+49 15678 241 600

+971 529 630 055

Hair transplant in istanbul, turkey, max grafts up to 6000 / incl. transfers + hotel + all extras, hollywood smile in turkey, breast surgery in the czech republic or in turkey, incl. hotel, night in the clinic + drugs + all extras, max grafts up to 6000 / incl. hotel + transfers + all extras, meditravel brings you to the best clinics for plastic and aesthetic surgeries.

- Hair transplant

- Breast augmentation

Hollywood Smile

Watch our video

Thanks to plastic surgeries many people feel better and look younger.

We organize medical trips to renowned clinics specializing in hair transplantation in Turkey, plastic surgery in the Czech Republic and Turkey, and dentistry in Turkey. Together with a team of experienced specialists and medical consultants, we advise and take care of patients at every stage of their journey to beauty – we guide them through the process of free online consultation, mediate in contact with the clinic, arrange all formalities, organize departures from every airport in the world, and provide translators at clinics and free online consultations during the recovery period.

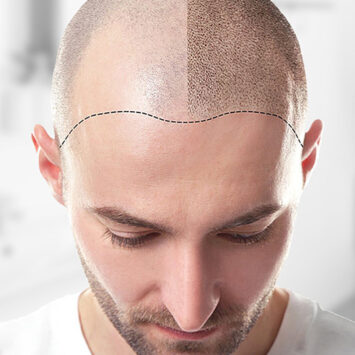

Hair transplant in Turkey

Hair transplantation in Turkey with Meditravel is a guarantee of the best treatment results and a low price – even 1/3 of the price in Poland. The operations that we help organize are performed by experienced surgeons from a reputable clinic. We perform hair transplant procedures without pain and scars, using the most modern micro FUE and DHI methods. We offer individual and group hair transplant trips with a guardian who accompanies patients during their travel and stay in Istanbul.

Our mission is to provide the highest level of service at affordable prices. We have been trusted by thousands of Poles, including stage stars, actors and well-known influencers. Hair transplantation in Turkey has many advantages, check the effects before and after the treatment of our patients and take advantage of the free online consultation. Choose the best specialists – take care of your appearance now, opting for a professional transplant.

Plastic surgeries abroad

We offer specialized treatments carried out, among others, in Prague and Istanbul. By deciding on plastic surgery with Meditravel, you have the guarantee that it will be performed by the best plastic surgeon while maintaining an affordable price of the procedure. Plastic surgeries are performed in renowned plastic surgery clinics in Turkey and the Czech Republic with the latest generation of equipment and the highest safety standards.

We offer such treatments as: breast augmentation, breast lifting, breast reduction, reaugumentation, rhinoplasty, septorinoplasty, liposuction, abdominoplasty, face lift, BBL, intimate surgeries, gynecomastia, upper and lower eyelids. On the other hand, operations performed in Turkey include professional hair transplantation in a specialist clinic. We provide Polish-speaking translators and a friendly atmosphere in each clinic.

With Meditravel you will fulfill your dreams

Choose your desired operation.

Hair transplant in one of the best clinics in Turkey. We offer operations with the latest sapphire micro FUE and DHI methods at very affordable prices - even 1/3 of the price in your home country. Possible are hair, beard and eyebrow transplants for men and women.

With Meditravel you can have your breast surgery in the best plastic surgery clinics in Prague and Istanbul. We offer breast augmentation with Mentor, Motiva and Polytech implants. Breast reduction and lift with or without enlargement is also possible.

from 2999 €

Start smiling and look like a star. Get your "Hollywood Smile" at a renown clinic in Istanbul. Veneers, implants and crowns are possible.

* Price excluding hotel, transfers and translator

20 veneers from € 4,799, hundreds of satisfied customers, why people trust us.

We work with several of the best clinics in the fields of hair transplant, plastic surgeries and dentistry. Just a short trip and you can get your desired look for a much lower price than in your home country. Meditravel organizes everything for you.

Flight and transfers

Luxury hotel, modern clinics, free online consultation, world class service, drugs and post-operative care, hair transplants, breast operations, nose corrections, liposuctions.

Take the first step!

Free consultation for you, see the difference with before and after pictures.

- Liposuction

before operation

after operation

Clinics we cooperate with.

Meditravel cooperates only with proven clinics for hair transplant, plastic surgery and dentistry. All have international accreditation and use the latest generation of medical equipment and devices. Each clinic has modern operating and postoperative rooms that ensure the safety of our patients. Thanks to the friendly atmosphere in the clinics, each patient can feel comfortable.

Clinicana Turkey

One of the best hair transplant clinics in the world. It is housed in a modern private hospital in Turkey, in the heart of Istanbul next to Taksim Square, and operates under the leadership of Dr. Soner Tatlıdede is a hair surgeon who has gained his experience in prestigious centers in Europe, the United States and Turkey. Clinicana has 6 modern operating rooms at its disposal. The hospital supports all branches of medicine, therefore Clinicana , as one of the few hair transplant clinics, can comprehensively consult the patient before the procedure and, if necessary, provide assistance during or after the procedure. The clinic meets international accreditations and has the most modern equipment.

Premier Clinic Czech Republic

The motto of the Premier Clinic is: “Only the best is enough for you.” Premier Clinic is a private premium medical facility in Prague operated under the leadership of the well-known plastic surgeon MU Dr. Lucie Zárubová and her team of doctors. The clinic is equipped with the most modern equipment, including two modern operating rooms with the possibility of mild low-flow anesthesia. Patients also have at their disposal fully equipped, monitored hotel-type recovery rooms with excellent gastronomy, a mini-bar and a discreet, free car park in the clinic building. The clinic is operated by the best Czech plastic surgeons with numerous specializations and extensive experience.

Instanbul Aesthetic Center Turkey

Istanbul Aesthetic Center is a Plastic Surgery Hospital located in the center of Istanbul , which was established to provide high-quality services using modern devices and a team of experienced doctors. The clinic constantly monitors all technological innovations and advances in the field of medicine in order to be able to provide patients with the highest standards of treatment. The clinic has modern operating theaters, standard and VIP recovery rooms , specially equipped with the comfort and convenience of patients in mind. There is also an intensive care unit in the clinic. The Istanbul Aesthetic Center clinic is well connected with the rest of the city, which makes it easy for patients and their companions to move around.

What our patients say about Meditravel

I recommend group trips with Meditravel. During the entire trip, a guardian was watching over our group, everything was buttoned up to the last button. For me, it was not only a trip for the procedure, but also a fun journey and adventure, and the effects of the treatment exceeded my expectations.

I have been a Meditravel client in the past year. I flew to Turkey for a hair transplant. My life has changed 180 degrees since then. Professional service, care and attention to detail are the advantages of Meditravel. Do not hesitate for a moment, just put yourself in the hands of professionals. You can check the effects on my youtube and instagram channel 🙂

Where to start ?! : D First of all, I felt super looked after by the Meditravel team, I didn't have to worry about ANYTHING! They take care of everything for you! From tickets to transfer etc etc! Everything in the clinic is professional, everything has been explained by the caregiver who can also be your translator 🙂 so if you don't know foreign languages, it's not a problem! I am very pleased with the course of the procedure and the results of the hair transplant.

In January 2020, I did liposuction with Meditravel. It was the best decision that changed my life for the better and stripped me of my complexes. I recommend Meditravel for comprehensive service, kind and professional help at every stage and putting me in the hands of the best surgeon who literally made a miracle. Thank you with all my heart.

9 months after the breast augmentation surgery 🙂 Professional service from meditravel ❤️ before, during and after the operation. They literally took care of everything 🙂 Better results than I imagined. I wish I had delayed my decision for so long. I recommend!

Thank you for professionally arranging my trip to Istanbul for a hair transplant. Everything went smoothly. I was in touch with a Meditravel consultant all the time, and in the clinic I was provided with Polish-speaking care. Upon arrival, a driver was waiting for me at the airport. I was nowhere alone. Even for tourist purposes, I was provided with journeys. The clinic is a very modern and clean facility equipped with the latest equipment. Experienced doctors and medical staff work there. The effect of the treatment exceeded my expectations.

Two years have passed since the Meditravel hair transplant. The effect is amazing, the hair is thick and strong, I took a good step by choosing Meditravel. I was convinced of the choice by a large number of effects presented on the website. Very pleasant and friendly service, every detail was discussed during the online consultation. Care during your stay in Istanbul at a very high level. The effect after the transplant is simply amazing. I heartily recommend.

Blog - Do you want to know more?

Learn more about the surgeries.

Hair transplant with DHI method

- 16 March 2020

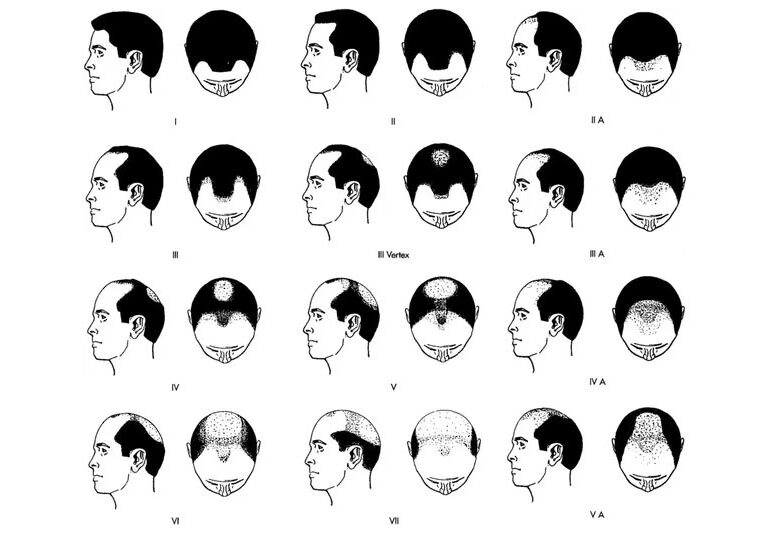

Norwood scale

- 25 January 2020

How to prepare for a breast surgery?

- 14 July 2021

What are the effects of hair transplant?

- 28 June 2021

Many international travelers carry medicines with them to treat acute or chronic health problems. However, each country has its own laws related to medicines. Medicines that are commonly prescribed or available over the counter in the United States might be unlicensed or considered controlled substances in other countries. While rules vary by country, there can be serious consequences if you violate the laws at your destination. The consequences may include:

- Authorities taking away your medicine

- Penalties, including jail or prison time

Before Travel

Check with your destination’s embassy and embassies of countries that you have layovers in to make sure your medicines are permitted.

- Many countries allow a 30-day supply of certain medicines, but also require the traveler to carry a prescription or a medical certificate from their health care provider.

- If your medicine is not allowed at your destination, talk with your health care provider about alternatives and have them write a letter describing your condition and the treatment plan.

- You may also want to check the International Narcotics Control Board website that provides general information about narcotics and controlled substances, for countries that have information available, for travelers.

Check CDC’s destination pages for travel health information . Check CDC’s webpage for your destination to see what vaccines or medicines you may need and what diseases or health risks are a concern at your destination.

Make an appointment with your healthcare provider or a travel health specialist that takes place at least one month before you leave. They can help you get destination-specific vaccines, medicines, and information. Discussing your health concerns, itinerary, and planned activities with your provider allows them to give more specific advice and recommendations.

- If you plan to be gone for more than 30 days, talk to your health care provider about how you can get enough medicine for your trip. Some insurance companies will only pay for a 30-day supply at a time.

- If you are a traveling to a different time zone, ask your health care provider about any changes to taking your medicine. Medicines should be taken according to the time since your last dose, not the local time of day.

- Find out how to safely store your medicine while traveling and check whether it needs refrigeration. Keep in mind that extreme temperatures can reduce the effectiveness of many medicines.

Prepare a travel health kit with items you may need, especially those items that may be difficult to find at your destination. Include your prescription and over-the-counter medicines in your travel health kit and take enough to last your entire trip, plus extra in case of travel delays. Pack medications in a carry on in case your luggage is lost or delayed.

- Keep medicines in their original, labeled containers. Ensure that they are clearly labeled with your full name, health care provider’s name, generic and brand name, and exact dosage.

- Bring copies of all written prescriptions, including the generic names for medicines. Leave a copy of your prescriptions at home with a friend or relative in case you lose your copy or need an emergency refill.

- Ask your prescribing health care provider for a note if you use controlled substances, or injectable medicines, such as EpiPens and insulin.

Buying Medicine Abroad

Counterfeit drugs are common in some countries, so only use medicine you bring from home and make sure to pack enough for the duration of your trip, plus extra in case of travel delays. If you must buy drugs during your trip in an emergency, see CDC’s Counterfeit Drugs page.

More Information

- CDC Yellow Book: Avoiding Poorly Regulated Medicines

- Travel Smartly with Prescription Medications (US Department of State)

- Traveling with Prescription Medications (US Food and Drug Administration)

File Formats Help:

- Adobe PDF file

- Microsoft PowerPoint file

- Microsoft Word file

- Microsoft Excel file

- Audio/Video file

- Apple Quicktime file

- RealPlayer file

- Zip Archive file

Exit Notification / Disclaimer Policy

- The Centers for Disease Control and Prevention (CDC) cannot attest to the accuracy of a non-federal website.

- Linking to a non-federal website does not constitute an endorsement by CDC or any of its employees of the sponsors or the information and products presented on the website.

- You will be subject to the destination website's privacy policy when you follow the link.

- CDC is not responsible for Section 508 compliance (accessibility) on other federal or private website.

Thanks for visiting! GoodRx is not available outside of the United States. If you are trying to access this site from the United States and believe you have received this message in error, please reach out to [email protected] and let us know.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

Travel Medical Insurance Plans

- Trip Cancellation Insurance

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Best Travel Insurance for Seniors

- Evacuation Insurance Plans

- International Life Insurance for US Citizens Living Abroad

- The Importance of a Life Insurance Review for Expats

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Health Insurance Plan

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

Trawick Safe Travels USA

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

Travel health insurance will cover the costs of getting medical attention in case of an emergency abroad. Plans also include medical evacuation, repatriation, trip interruption, and more. This type of coverage is necessary when you’re going outside your country for periods of up to a year or more. Even if you have a domestic medical plan, there is no guarantee that it will be accepted abroad.

Learn more about travel medical policies in this article and get to know which plans for traveling abroad fit your needs.

What is International Travel Health Insurance?

When traveling outside your home country, buying medical insurance as part of your international travel plan is vital to protect yourself against accidents or illnesses. Even if you have private medical insurance issued in your home country, it will most likely not cover you on your trip abroad. And even if it does, there is a chance that the coverage will be insufficient to provide the care you might need during your trip.

What Does Travelers' Medical Insurance Cover?

Depending on the plan you choose, your travel insurance policy can offer:

- Freedom to seek treatment with a hospital or doctor of your choice

- Maximum limits from $50,000 to up to $8,000,000

- 24/7 access to an emergency assistance medical hotline to speak with medical experts

- Deductible options from $0 to up to $25,000

- Renewable for up to 36 months

- Other benefits like travel delay/cancellation, baggage loss/delay

- Universal Rx pharmacy discount savings

- Repatriation and emergency evacuation

Is Travel Health Insurance Worth It?

The best travel medical insurance plans combine the benefits of travel insurance plans with additional health and medical coverage. Whenever you travel to another country, it is a necessity to have the right international plan that will cover you in case the unexpected happens.

Recommended Medical Travel Insurance Plans

We offer great options to cover you and your family during travel abroad. The Atlas plan is an affordable policy for travelers from most countries. GeoBlue's Voyager plan is a comprehensive plan tailored to US citizens. The Trawick Safe Travels plan includes comprehensive coverage for trip cancellation, trip interruption, emergency medical, and post-departure travel coverage, among other benefits. Trawick's Safe Travel USA is designed specifically for foreigners visiting the USA .

Pro Tip: Visit our Travel Insurance Guide to find which type of plan is best for your situation.

Recommended Plan for US Citizens Traveling Abroad

GeoBlue's Voyager Travel Insurance plan is designed specifically for US citizens traveling abroad. The benefits are excellent while remaining a very affordable option. Most importantly, the customer service is outstanding, which is essential when you need to reach someone in a medical emergency.

GeoBlue Voyager Plan

- For U.S. citizens up to age 95

- Includes pregnancy coverage, baggage loss, trip interruption & more

- 24/7/365 service and assistance

Option for All International Travelers

Trawick offers a great plan for all other nationalities traveling abroad to any country in the world. Coverage options are global, benefits are comprehensive, and they have a range of coverage levels to meet all budgets.

Safe Travels International

- Desinged for non-U.S. citizens traveling outside their home country (excluding the U.S.)

- Coverage for an unexpected recurrence of a Pre-Existing Condition

- Coverage from 5 days to 364 days - extensions are available

Recommended Plan for International Visitors to the US

Safe Travels USA from Trawick is the best plan option for international citizens visiting the United States. In addition to those listed above, benefits include limited coverage for wellness visits and "acute onset of pre-existing conditions".

- Desinged for non-U.S. citizens traveling to the U.S. and addiitonal countries

- Includes comprehensive medical, evacuation, & repatriation coverage

Affordable Plans with Great Coverage and Benefits

Our suggested plan based on affordability, benefits, and service is the Atlas Travel Insurance Plan. Don't be fooled by the price - the benefits are very comparable to those offered by more expensive insurers.

- Emergency medical, evacuation, repatriation benefits

- Choose between the basic and more extensive coverage

- Meets Schengen visa insurance requirements

- 24/7 worldwide travel and emergency medical assistance

Or See for Yourself: Compare Travel Medical Insurance Plans

Frequently Asked Questions

How much does travel health insurance cost.

You can see in the table below that plans can cost from as low as $0.80 per day to as high as $5 a day , sometimes more. Monthly rates, ranging from $40 to $60, are also available, sometimes providing better value. How much an international travel health insurance plan costs will depend on the length of the trip, your age, medical limits, complications, and the deductible you choose by the time you purchase the plan.

Emergency medical plans for travelers are surprisingly affordable. The average cost of an international travel medical insurance plan is $2 per day. It is very affordable compared to the high cost of medical care should something go wrong on your trip.

Plans are often of a sort duration, within the travel period you have indicated, so the risks are less for insurers. As a result, medical insurance costs for traveling abroad are also significantly lower. Travel health policies also do not cover trip cancellations , so their premiums are lower than usual.

Costs and Benefits of a Travel Medical Insurance Plan

The cost of your plan will cover several benefits, all under one policy. For the low price listed here, you get emergency medical coverage abroad, trip interruption benefits, repatriation, medical evacuation, 24/7 travel assistance, and coverage for lost or stolen items. Some plans include personal liability coverage, natural disasters, political evacuation, and more.

How Optional Coverage Adds to the Cost of Your Policy

Many plans offer additional optional benefits for an additional cost. For example, you can add coverage for adventure trips, mountaineering, or Accidental Death and Disability (AD&D). Each additional benefit will increase the price of your plan. In general, the increase in premiums is affordable and worth the added expense if you feel you need that additional coverage.

What Are the Different Levels of Health Insurance for Traveling Abroad?

There are various levels of international travel health insurance plans from some of today’s leading insurers. These plans can range from very basic emergency health coverage to comprehensive health care, including prescriptions, medical evacuation, and insurance for high-risk activities.

- The most basic level of travel insurance covers emergency medical needs while you’re away from home. If you fall ill or get injured while traveling, this type of policy will usually cover your treatment. Some plans let you add higher maximums for medical coverage so you can get care for significant medical expenses.

- You can add features to your policy like prescription plans, repatriation, emergency evacuation, and coverage for pre-existing conditions. Depending on the plan, some of these might already be covered.

- You can also add riders for so-called “extreme sports,” which cover you if you want to paraglide, climb mountains, or do zipline tours in the jungle.

- Yet another type of travel insurance is trip cancellation, which pays you back if your vacation is interrupted or called off for a set list of reasons. A more expensive version of this is called Cancel For Any Reason or CFAR, which reimburses your trip costs if you suddenly can’t go for a reason that’s not otherwise covered. These plans include medical coverage, but you should check how much and whether you need more.

Among our most popular plans for US citizens is the GeoBlue Voyager Plan , which allows travelers to customize their coverage with different medical maximums and deductibles. You can be confident that your coverage, benefits, and service will be excellent.

Atlas Travel Insurance is a comprehensive travel medical policy that includes hospitalization and doctor coverage. It also includes coverage for lost luggage. You can customize the policy to include optional coverage for extreme sports .

The Patriot Platinum Insurance provides optional coverage for extra riders, including personal belongings and and extreme sports. This is perhaps the best medical policy for traveling abroad because it provides world-class coverage and access to the best service and assistance for traveling outside your home country.

You can review the list we made of the Best Travel Insurance Companies to get a better idea of which provider to choose.

For long-term travelers, expats, or individuals moving abroad for a year or longer, an international medical insurance plan might be a better option. These plans provide more comprehensive medical benefits but lack some of the coverage offered in travel health plans, such as trip interruption.

What Is the Cheapest Travel Medical Insurance Plan?

We offer a variety of medical plans for traveling abroad, and they come at a range of different price points.

When it comes to medical coverage, the best value travel insurance plan is one that covers specific benefits you need at a price you can afford. Some inexpensive plans do not cover the most important benefits or cover them with limited value. Other low-cost policies provide considerable travelers' medical insurance coverage, but their service is not as good, so it will be frustrating to use it in emergencies.

International Citizens Insurance has filtered the best insurance providers that offer affordable plans with good coverage and excellent service. For the most affordable and reliable plans, we recommend the following options:

How Do I Purchase an International Travel Medical Policy?

Applying for a travel health plan is easy. Just answer a few questions about yourself and the planned trip to get the initial quote. From there, you can refine the plan and see how much the travelers' medical insurance will cost by selecting and deselecting different benefits and their maximum coverage amounts. You can also tweak the deductibles, optional add-on features, and other portions of the policy, if possible.

Use our Plan Picker to get started!

When you are satisfied with the quote after adjusting the cost and benefits of the plan, you can proceed with the online application and pay for the plan using your credit card. A confirmation email will be sent along with policy documentation and relevant contact details should you need emergency medical assistance on your next trip.

We have listed some of the best medical insurance for international travel. Just follow the links on each one to learn more about the plan.

Do These Plans Cover My Visa Requirements?

In most cases, they do. The short term medical insurance plans we offer are designed to meet, and even exceed, most visa requirements of most countries. We also have plans that can meet Schengen Visa Insurance requirements.

Before traveling to a country, check the visa requirements to ensure you purchase the maximum benefit and deductible amounts required. Most countries require at least $50,000 of coverage in medical benefits, along with a specific deductible amount.

Check the visa requirements for the country you are traveling to, and then when purchasing your policy, you can select the level and benefits that meet those requirements.

Read More: Insurance for Your Travel Visa

Can You Buy Just Travel Medical Insurance?

Yes, definitely.

International travel medical insurance plans are designed to cover emergency medical expenses should you get sick or injured while traveling abroad. Suppose you are in an accident and need medical care. In that case, these plans are designed to help you find a doctor, get you treated in the best facilities available, cover necessary medical prescriptions, and provide continuous care.

Note: These plans will typically not cover any pre-existing conditions you might have. Before you sign up for a policy, check the part pertaining to pre-existing conditions to clarify any questions or concerns regarding that portion.

Your policy may not cover treatment for accidents or illnesses that occur while participating in certain dangerous activities. Some plans offer adventure sports coverage as an optional add-on. If you plan to partake in hazardous activities or sports events that pose a high risk of getting injured, it is best to get this add-on on top of your base-level coverage.

Some policies, known as trip cancellation plans , also cover the cost of your trip if you have to cancel, and are typically more expensive. If you only want coverage for medical emergencies, a travel medical plan is right for you.

Not sure where to start? Use our Pick a Plan tool.

How Does International Travel Medical Insurance Compare to Trip Insurance?

With the wide variety in names and coverage of travel, trip, and medical plans, it can be confusing to select which one is the most appropriate for your needs. Different service providers offer several levels of coverage, so a travel insurance plan provided by one insurer could be completely different from those offered by competitors.

Trip insurance is a short-term solution that covers trip cancellation, protection, and limited emergency medical coverage. This type of policy is usually available only for up to 62 days.

A travel health insurance plan is more comprehensive. It provides increased medical coverage from what a regular trip or travel insurance policy does. This type of policy is best for travel periods lasting from 5 days up to a year.

If you are considering longer-term coverage or more comprehensive medical benefits, read these guides to help you see the available options:

- Expatriate Insurance or Travel Insurance: What is the Difference?

- Overseas Health Insurance Coverage

Do I Need to Buy Health Insurance for Traveling Abroad?

Travel health insurance is a short-term solution for those who are traveling outside their home country anywhere between 5 days and a year. Whether it is for business or pleasure purposes, getting adequate coverage is an essential part of ensuring safe travels.

Having a health plan at home will not guarantee you coverage when you travel to other countries. And usually, if it does provide coverage, it will be limited and will not cover the most important areas that need to be addressed.

The plans we offer can work for a broad range of traveling individuals, including international vacationers, immigrants, relatives visiting from overseas, and foreign au pairs and nannies.

The best part about global travel health insurance policies is that they are available to all nationalities traveling abroad.

Which Countries Require Travel Medical Insurance to Enter?

Most countries that were requiring medical travel insurance with COVID-19 coverage at the height of the pandemic are no longer requiring it. However, it is still highly recommended. (Read our guide for more specific details on the latest travel insurance requirements.) Double-check all requirements before booking your travel policy. Below is a list of countries that still require travel medical insurance as of December 2023.

- Saudi Arabia

- the Czech Republic

- Liechtenstein

- the Netherlands

- Switzerland

Recommended Travel Medical Plan Options for US Citizens

The following rate tables below show the cost per day for U.S. citizens traveling outside of the U.S.

GeoBlue Voyager Choice

IMG Patriot International

WorldTrips Atlas International

Trawick Safe Travels Outbound

Rates were last updated on March 4, 2024

Recommended Travel Medical Plan Options for All Nationalities

The following rate tables below show the cost per day for international (non-U.S.) citizens traveling abroad, including trips to the U.S.

The plans, IMG Patriot America, WorldTrips Atlas America and Seven Corners Travel Medical, provide coverage worldwide, including inside the U.S. and outside the U.S.

Trawick Safe Travels USA only provides coverage inside the U.S.

IMG Patriot America

WorldTrips Atlas America

Seven Corners Travel Medical Plus

Pro Tip: Visit our Plan Picker to find the best plan at the right price for your trip.

How Much Travel Medical Insurance Do I Need?

It depends on where you’re going, what your home coverage is like, and what you plan to get up to!

- For shorter trips, you can probably get away with less coverage. But if you’re traveling extensively, you might think about a more thorough policy. If you are taking several trips throughout the year, consider annual travel insurance so you’re always covered.

- How’s your health? If you have conditions that need regular treatment or medications, make sure your policy is up to the level of care you need while abroad. Most plans will exclude coverage for pre-existing conditions, so be aware of that.

- If you’re going somewhere with a high level of medical care easily available, you probably don’t need medical evacuation or repatriation. Consider adding it if you’re going into the wilderness, staying somewhere rural and far from care, or making an adventure trip.

- Speaking of, what are you planning to do on your vacation? You might be surprised by some things insurance companies consider “extreme sports.” If you’re planning anything outdoorsy, check if your activity requires special coverage.

- Some countries require a travel policy to get a visa. For instance, the Schengen visa requires a minimum of $50,000 in medical coverage. Check the visa rules for the place you’re traveling to.

Different Types of Health Plans for Travelers

Here at International Citizens Insurance, we provide a wide range of travel health plans from some of the leading insurers. Among our most popular plans are the Atlas and Patriot Plans, which have different levels to choose from, each designed to suit the needs of various travelers.

Atlas Travel Insurance is a comprehensive policy that includes hospitalization and doctor coverage. It can also include insurance on lost luggage. You can customize the policy to include optional coverage for extreme sports .

With Patriot Platinum Insurance , you can get coverage for extra riders and extreme sports when you add them. This is one of the best travel medical insurance plans for traveling abroad, providing world-class coverage and access to the best service and assistance for traveling outside your home country.

Annual, Multi-Trip Travel Insurance Plans for Frequent Travelers

International coverage for travel is available as a single-trip plan that covers a specific trip for a specified number of days.

But a multi-trip or annual travel insurance plan can cover all trips outside your home country during the year. This is usually valid for a year and up to a certain number of days per trip. This is a more cost-effective medical insurance for traveling abroad, especially if you are a frequent traveler.

If you are looking for one of the best travel health insurance policies we offer, consider the GeoBlue Trekker annual travel insurance plan. See the link below for more details on the policy and how you can get a quote before your purchase online.

Annual Plan for any Nationality

Seven Corners Travel Medical Annual Multi-Trip

- Buy annually and travel as often as you want.

- Choose from 30-, 45-, and 60-day trip lengths.

- Emergency medical evacuation benefit of $1,000,000.

GeoBlue Trekker Plan for US citizens

Trekker MultiTrip Travel Insurance

- Up to $500,000 for sickness and accidents

- $500,000 medical evacuation benefit

- Unlimited Trips Outside the U.S. for trips up to 70 days

Buy One of Our Recommended Travel Medical Plans

Atlas Travel Insurance: Learn More | Free Quote / Apply (Best for All Nationalities Traveling Abroad)

GeoBlue Travel Insurance: Learn More | Free Quote / Apply (Best for US Citizens Abroad)

A message from the Center for Disease Control : Severe illness or injury abroad may result in a financial burden on you and your family. Although planning for every possible contingency is impossible, travelers can reduce the cost of a medical emergency by considering the purchase of 3 types of insurance for their trip: trip insurance, travel health insurance, and medical evacuation insurance. These insurance policies can be purchased before a trip to provide coverage in the event of an illness or injury and may be of particular importance to individuals with chronic medical conditions. Basic accident or travel insurance may even be required for travelers to certain destinations.

Author: Joe Cronin , Founder and President of International Citizens Insurance . Mr. Cronin, a former expat, is an authority in the areas of international travel, and global health, life, and travel insurance, with expertise in advising individuals and groups on benefits for today's global workforce. Follow him on LinkedIn or Twitter .

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Travel Medical Insurance: Emergency Coverage While You Travel Internationally

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is travel health insurance?

Travel insurance vs. travel medical insurance, what does travel medical insurance cover, different types of travel medical insurance plans, how to purchase travel medical insurance, credit cards with travel medical insurance, who needs travel health insurance, how much does travel medical insurance cost, medical only travel insurance, how do i use my travel health insurance, what else you need to know, final thoughts on international medical insurance plans.

Travel medical insurance provides protection against unexpected illnesses or injuries during travel abroad.

Premium travel credit cards may offer limited coverage, making stand-alone travel medical insurance necessary.

In case of a medical emergency, contact the insurer, pay expenses and file a reimbursement claim.

Primary vs. secondary coverage: Primary allows direct claims, secondary requires filing with primary first.

If you’re looking for a policy that protects you in the event of an unexpected illness or injury while traveling abroad, then you need to learn about stand-alone travel medical insurance. This type of insurance can be provided by the benefits of certain premium travel credit cards , but the coverages can be both limiting and low in value.

Emergency medical coverage is included within some comprehensive travel insurance policies but can also be purchased on its own. Even if you have a primary U.S. insurance plan, including Medicaid or Medicare, odds are it will help very little (or often not at all) while out of the country.

Checking all the different sources of information can get confusing, and it's easy to misunderstand what type of medical insurance you have when traveling or accidentally duplicate your coverage by purchasing a policy when you already have those benefits covered from another source. Here’s everything you need to know about travel medical insurance so you can choose the best option for your trip.

Travel medical insurance provides reimbursement for emergency medical expenses, including medical evacuations, while you’re traveling. These policies do not provide coverage for routine expenses.

So, if you break your leg while you're on vacation internationally, emergency medical coverage will protect you. However, if you decide to get a teeth cleaning while you’re abroad, you will not be covered. Travel medical insurance is meant to protect you in case of emergency.

Expats, frequent business travelers or individuals who spend significant periods of time living outside the U.S. can purchase a comprehensive travel health insurance policy meant for long-term travelers (more on this below). These policies offer routine medical coverage for those living abroad (generally for one year or longer) rather than vacationers. Long-term international travel health insurance policies should not be confused with travel medical insurance.

Travel medical insurance products and comprehensive policies may also include coverage for family members who are traveling with you, or coverage for a family member to visit you if you become hospitalized. The definition of "family" can vary, but it commonly includes your spouse, children, siblings, parents, grandparents and more. So if your travel companion gets sick or injured during the trip, trip cancellation benefits may kick in. Or if you get hospitalized in a foreign country, the insurer could pay for a flight and hotel accommodations for a designated family member to visit you.

Although natural disasters that impact your plans are usually covered, travel medical insurance policies often exclude pandemics from coverage or those countries that have a ‘Level 4 Do Not Travel’ advisory issued by the U.S. Department of State . If U.S. citizens travel to those countries, travel medical insurance services may not be available. It's important to check the fine print of your policy to determine what may or may not be covered.

A comprehensive travel insurance policy will include more protections than stand-alone travel medical insurance.

Travel medical insurance plans will have protections related to emergency medical events, while comprehensive trip insurance policies cover everything from medical care to trip cancellations.

Here are how those differences generally shake out.

With travel medical insurance, there are no trip cancellation benefits, so the cost of the trip is irrelevant. This makes the policy cheaper compared to purchasing comprehensive travel insurance, where you’ll need to include the entire nonrefundable cost of your vacation when calculating your quote.

Although travel medical plans can include coverage for benefits like trip interruption, the covered amounts will usually be limited.

» Learn more: How to find the best travel insurance

You will be reimbursed for unplanned, emergency medical costs that you incur during your trip. We reviewed several travel medical insurance plans on InsureMyTrip and found that they offer the following protections:

Since we reviewed several policies in the chart above, these limits show a wide range.

» Learn more: Does travel insurance cover medical expenses? Kinda.

Both the type of trip and type of coverage determine which travel medical policy makes the most sense. You’ll need to become familiar with four terms: primary coverage, secondary coverage, single trip and multi-trip.

Primary vs. secondary coverage

Travel medical insurance plans will refer to medical coverage as primary or secondary.

Primary means that you can submit a claim to your travel medical insurance company before submitting to any other insurer.

When the policy is secondary , you will need to submit your claim to your primary insurance provider before you can submit a claim to the travel insurance provider.

For example, say you break your leg on vacation and have to go to the emergency room right away. If your travel health insurance is primary, you can pay your medical bill with your credit card and then submit a claim directly to the travel insurer.

However, if your travel medical coverage is secondary, you will first have to submit this claim to your U.S.-based medical insurer even though they may deny the claim (because the policies limit coverage abroad). You may even be required to include the refusal notice from your primary insurance along with your claim to your secondary travel health insurer.

Single-trip vs. multi-trip

Whether you’re a frequent traveler or go on vacation only once a year, you can choose a policy that is tailored to your travel needs. You can purchase either single- or multi-trip coverage, and it's important to know the difference between the two types.

Single-trip medical travel insurance: You leave home, travel internationally and return home. You can visit as many countries as you like while traveling, but when you return home, the coverage ends. These plans are purchased for each trip, whether you’re gone for four days or four weeks.

Multi-trip coverage: You can leave, travel and return home as many times as you want during the covered period. You can, for example, leave home, travel to France for a week, return home for a month, travel to Panama for three weeks and return home. The coverage continues no matter how many times you return home as long as each trip does not exceed the allowable period (usually 30 to 90 days). These plans must be purchased on an annual basis, and they require you to have health insurance in the United States.

Multi-trip coverage makes sense (and is usually more cost effective) if you travel frequently and do not want to purchase a single policy each time you go on an international trip. However, if you do not have medical insurance in the U.S., you will not be covered under multi-trip plans.

Do I need to have primary health insurance in the U.S. to be eligible for travel medical insurance?

The answer to this question is: maybe. It depends on the type of coverage you have. If your single-trip plan refers to your medical coverage as primary, you don’t need another health insurance policy. However, if the coverage provided under your single-trip plan is secondary, then you must have primary health insurance.

As noted above, all multi-trip plans require that you have primary medical insurance coverage in the U.S.

» Learn more: What to do if you get sick while traveling overseas

You can search for medical travel policies on insurance comparison sites like Squaremouth (a NerdWallet partner), InsureMyTrip or Travel Guard . Policies differ by state, and availability may change during or after the pandemic, so verify that the state you reside in offers travel medical insurance in light of coronavirus.

You might already have some travel medical insurance from an existing credit card in your wallet. If your limits are sufficient for your risk tolerance, you might forego purchasing a separate travel medical insurance policy or plan.

Let's take a look at the Chase Sapphire Reserve® coverage, for example. It offers emergency medical coverage up to $2,500 (maximum $10,000 per trip) with a $50 deductible. This card has an annual fee of $550 .

In contrast, the policies we've discussed above, offer medical coverage from $50,000 to $2,000,000. That's significantly more coverage from the third-party option.

So if you want a higher limit — even if you have a premium travel credit card with existing medical coverage — purchasing a complementary plan may make sense.

This can be especially true if you are traveling in a country with expensive healthcare, will be traveling in remote or rural areas, or will be participating in higher-risk adventures.

Credit card travel medical insurance coverage doesn't always include pre-existing conditions. Check your terms.

If that $550 annual fee makes you cringe, consider the Chase Sapphire Reserve® 's 'little sibling' card, the Chase Sapphire Preferred® Card has similar, but fewer, benefits but for a more moderate annual fee of $95 . It offers identical travel medical insurance.

Chase Sapphire Preferred® Card

If you plan on traveling and your existing medical insurance will not cover you in the country you are traveling to, buying a travel medical insurance plan could make sense. You could either purchase a comprehensive travel insurance policy or one that only provides medical coverage.

Purchasing a policy strictly for travel medical insurance is a good idea for those who want emergency coverage while traveling but:

Have a premium travel card that already provides trip cancellation and trip delay coverage the individual deems sufficient.

Do not need trip cancellation, trip delay or the other benefits provided by a comprehensive policy because the traveler will remain in one location for a while and is not worried about a canceled trip.

If you do not have a travel card with trip cancellation benefits and you also want emergency medical coverage, then you’re better off with a comprehensive travel insurance policy.

The cost of the policy varies based on a number of factors including:

The country you’re going to.

The state you’re from.

Coverage provided.

NerdWallet conducted a full analysis of medical travel insurance costs and found that it’s typically 7% of your overall trip cost. For example, travel insurance will cost you an additional $140 (roughly) for a $2,000 trip.

Here's a closer look at medical benefits provided by some standalone travel insurance providers. Note that these plans typically include other non-medical only travel insurance benefits.

Travelex: Travel Select

The Travel Select plan from Travelex breaks its medical travel insurance into two separate categories:

Emergency medical expense : $50,000 (with a dental coverage sublimit of $500).

Emergency medical evacuation and repatriation of remains : $500,000 (with an escort coverage limit of $25,000).

If you purchase the plan within 15 days of the initial trip payment, your coverage will also include a pre-existing medical condition exclusion waiver.

Seven Corners Trip Protection Choice

The Seven Corners Trip Protection Choice plan includes more coverage than its Basic counterpart.

Emergency accident and sickness medical expense: Up to $500,000 Primary Coverage.

Emergency dental: Up to $750.

Medical evacuation and repatriation of remains: Up to $1 million. This includes emergency medical evacuation, medical repatriation and repatriation of remains coverage.

If you encounter a medical emergency while traveling, contact your travel insurance provider about how to proceed.

You will likely need to pay for your medical expenses using your credit card and subsequently file a claim for reimbursement with the insurer.

Some coverage (e.g., emergency evacuation) may need to be arranged by your travel medical insurance provider to be eligible for reimbursement.

In all instances, it's best to contact your insurance provider before making any arrangements or paying any bills.

Terminology

Similar to your regular health insurance, travel medical coverage also comes with limits, exclusions and deductibles.

Exclusions are specific events that are excluded from coverage. For example, some plans may exclude coverage for activities (e.g., skydiving) that are deemed risky. Check the policy to make sure that the activities you plan to partake in are not excluded.

Limits are monetary caps on coverage. For example, the policy may cover emergency dental treatment but only up to $500 worth. Anything over that maximum you would be responsible for paying.

A deductible is an amount you need to pay before your policy will reimburse. For example, if you have a policy with a $250 deductible and you submit claims for eligible expenses totaling $400, the insurer will reimburse you only $150. Policies can often be customized to increase or decrease the deductible.

The lower the deductible, the more expensive the policy and vice versa.

Long-term travel medical insurance options for expats

Individuals who live or work abroad and spend a considerable portion of the year living outside the U.S. are eligible for a travel health insurance plan that provides coverage for routine medical care. These policies are different from travel medical insurance, which is meant to cover only emergencies.

Long-term international travel health insurance plans usually have higher limits than travel medical insurance policies and are available on a long-term basis only (one year or more).

The policies are only available for one year or longer and have high maximum limits of $1,000,000 to $8,000,000. The plans are customizable and allow you to receive worldwide medical treatment.

For the most part, your U.S.-based medical insurance provider will not cover your medical treatment when you’re abroad. If you want peace of mind while you’re on a trip away from your home country, a travel medical insurance plan is your best bet.

Anytime before your trip begins.

Generally, the emergency medical insurance coverage on credit cards offers fewer protections and lower limits than a stand-alone policy. For example, the Chase Sapphire Reserve® offers emergency medical coverage up to $2,500 with a $50 deductible. The policies we looked at above offered medical coverage from $50,000 to $2,000,000. If you want a higher limit, you may want to purchase a travel medical insurance policy.

It depends on the type of coverage you’re looking for. Generally, if you’re only concerned with emergency medical benefits and don’t need trip cancellation, trip delay, rental car coverage or any of the other benefits provided by a comprehensive travel insurance plan, a medical plan should be enough for you. There is no one-size-fits-all answer, and your particular circumstances determine which policy is most suitable.

Yes. Travelers can purchase medical-only travel insurance coverage, and on the bright side, this type of plan is often more affordable than comprehensive policies. In 2023, travelers spent an average of $96 on medical-only travel insurance, versus over $400 on average for comprehensive plans, according to Squaremouth.

Generally, the emergency medical insurance coverage on credit cards offers fewer protections and lower limits than a stand-alone policy. For example, the

Chase Sapphire Reserve®

offers emergency medical coverage up to $2,500 with a $50 deductible. The policies we looked at above offered medical coverage from $50,000 to $2,000,000. If you want a higher limit, you may want to purchase a travel medical insurance policy.

Travel health insurance can protect you if you experience an unexpected medical emergency during a trip. Although this is a topic no one wants to think about, it's important to know your options.

Depending on the coverage you’re looking for, you can either pick a stand-alone medical policy or get a comprehensive travel insurance one. Deciding what policy is best depends on your situation and any additional protections you may already have through your premium travel credit card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Best overall

- Best for exotic trips

- Best for trip interruption

- Best for medical-only coverage

- Best for family coverage

- Best for long trips

- Why You Should Trust Us

Best International Travel Insurance for June 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're planning your next vacation or trip out of the country, be sure to factor in travel insurance. Unexpected medical emergencies when traveling can drain your bank account, especially when you're traveling internationally. The best travel insurance companies for international travel can step in to provide you with peace of mind and financial protection while you're abroad.

Best International Travel Insurance

- Best overall: Allianz Travel Insurance

- Best for exotic travel: World Nomads Travel Insurance

- Best for trip interruption coverage: C&F Travel Insured

Best for medical-only coverage: GeoBlue Travel Insurance

- Best for families: Travelex Travel Insurance

- Best for long-term travel: Seven Corners Travel Insurance

How we rate the best international travel insurance »

Compare the Best International Travel Insurance Companies

As a general rule, the most important coverage to have in a foreign country is travel medical insurance , as most US health insurance policies don't cover you while you're abroad. Without travel medical coverage, a medical emergency in a foreign country can cost you. You'll want trip cancellation and interruption coverage if your trip is particularly expensive. And if you're traveling for an extended period of time, you'll want to ensure that your policy is extendable.

Here are our picks for the best travel insurance companies for international travel.

Best overall: Allianz

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz Travel Insurance offers the ultimate customizable coverage for international trips, whether you're a frequent jetsetter or an occasional traveler. You can choose from an a la carte of single or multi-trip plans, as well as add-ons, including rental car damage, cancel for any reason (CFAR) , adventure sport, and business travel coverage. And with affordable pricing compared to competitors, Allianz is a budget-friendly choice for your international travel insurance needs.

The icing on the cake is Allyz TravelSmart, Allianz's highly-rated mobile app, which has an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store. So, you can rest easy knowing that you can access your policy and file claims anywhere in the world without a hassle.

Read our Allianz Travel Insurance review here.

Best for exotic trips: World Nomads

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

World Nomads Travel Insurance offers coverage for over 150 specific activities, so you can focus on the adventure without worrying about gaps in your coverage.

You can select its budget-friendly standard plan, starting at $79. Or if you're an adrenaline junkie seeking more thrills, you can opt for the World Nomads' Explorer plan for $120, which includes extra sports like skydiving, scuba diving, and heli-skiing. And World Nomads offers 24/7 assistance, so you can confidently travel abroad, knowing that help is just a phone call away.

Read our World Nomads Travel Insurance review here.

Best for trip interruption: C&F Travel Insured

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 2 major plans including CFAR coverage on the more expensive option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancellation for job loss included as a covered reason for trip cancellation/interruption (does not require CFAR coverage to qualify)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Frequent traveler reward included in both policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1 million in medical evacuation coverage available

- con icon Two crossed lines that form an 'X'. Medical coverage is only $100,000

- con icon Two crossed lines that form an 'X'. Reviews on claims processing indicate ongoing issues

- C&F's Travel Insured policies allow travelers customize travel insurance to fit their specific needs. Frequent travelers may benefit from purchasing an annual travel insurance plan, then adding on CFAR coverage for any portions of travel that may incur greater risk.

C&F Travel Insured offers 100% coverage for trip cancellation, up to 150% for trip interruption, and reimbursement for up to 75% of your non-refundable travel costs with select plans. This means you don't have to worry about losing your hard-earned money on non-refundable travel costs if your trip ends prematurely.

Travel Insured also stands out for its extensive "reasons for cancellation" coverage. Unlike many insurers, the company covers hurricane warnings from the National Oceanic and Atmospheric Administration (NOAA).

Read our C&F Travel Insured review here.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. A subsidary of Blue Cross Blue Shield

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers strong medical plans as long as you have a regular health insurance plan, but it doesn't have to be through Blue Cross

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers long-term and multi-trip travel protection

- con icon Two crossed lines that form an 'X'. Multiple complaints about claims not being paid or being denied

- con icon Two crossed lines that form an 'X'. Does not provide some of the more comprehensive coverage like CFAR insurance

- con icon Two crossed lines that form an 'X'. Buyers who do get claims paid may need to file multiple claim forms

GeoBlue Travel Insurance offers policies that covers emergency medical treatments when you're abroad. While GeoBlue lacks trip cancellation coverage, that allows it to charge lower premiums than the other companies on this list.

GeoBlue plans can cover medical expenses up to $1 million with several multi-trip annual plans available. It offers coinsurance plans for trips within the U.S. and 100% coverage for international trips. It also has a network of clinics in 180 countries, streamlining the claims process. It's worth noting that coverage for pre-existing conditions comes with additional costs.

Read our GeoBlue Travel Insurance review here.

Best for family coverage: Travelex Travel Insurance

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Options to cover sports equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Option to increase medical coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Can cancel up to 48 hours before travel when CFAR option is purchased

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable coverage for budget-conscious travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes generous baggage delay, loss and trip delay coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Optional "adventure sports" bundle available for riskier activities

- con icon Two crossed lines that form an 'X'. Only two insurance plans to choose from

- con icon Two crossed lines that form an 'X'. Medical coverage maximum is low at up to $50,000 per person

- con icon Two crossed lines that form an 'X'. Pricier than some competitors with lower coverage ceilings

- con icon Two crossed lines that form an 'X'. Some competitors offer higher medical emergency coverage

Travelex travel insurance is one of the largest travel insurance providers in the US providing domestic and international coverage options. It offers a basic, select, and America option. Read on to learn more.

- Optional CFAR insurance available with the Travel Select plan

- Trip delay insurance starting at $500 with the Travel Basic plan

- Emergency medical and dental coverage starting at $15,000

Travelex Travel Insurance offers coverage for your whole crew, perfect for when you're planning a family trip. Its family plan insures all your children 17 and under at no additional cost. The travel insurance provider also offers add-ons like adventure sports and car rental collision coverage to protect your family under any circumstance. Got pets? With Travelex's Travel Select plan, you can also get coverage for your furry friend's emergency medical and transportation expenses.

Read our Travelex Travel Insurance review here.

Best for long trips: Seven Corners

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse coverage options such as CFAR, optional sports equipment coverage, etc.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Available in all 50 states

- con icon Two crossed lines that form an 'X'. Prices are higher than many competitors

- con icon Two crossed lines that form an 'X'. Reviews around claims processing are mixed

- Trip cancellation insurance of up to 100% of the trip cost

- Trip interruption insurance of up to 150% of the trip cost

- Cancel for any reason (CFAR) insurance available

Seven Corners Travel Insurance offers specialized coverage that the standard short-term travel insurance policy won't provide, which is helpful if you're embarking on a long-term trip. You can choose from several plans, including the Annual Multi-Trip plan, which provides medical coverage for multiple international trips for up to 364 days. This policy also offers COVID-19 medical and evacuation coverage up to $1 million.

You also get the added benefit of incidental expense coverage. This policy will cover remote health-related services and information, treatment of injury or illness, and live consultations via telecommunication.

Read our Seven Corners Travel Insurance review here.

How to Find the Right International Travel Insurance Company

Different travelers and trips require different types of insurance coverage. So, consider these tips if you're in the market to insure your trip.

Determine your needs

Your needs for travel insurance will depend on the type of trip you're taking. You'll need to consider your destination and what you'll be doing there, either business, leisure, or adventure traveling. Policies covering adventure sports and activities will cost more. Longer, more expensive trips will also cost more.

Research the reputation of the company

When researching a company, you'll want to closely review the description of services. You'll want to see how claims are handled, any exceptions, and limitations.

You'll also want to look at the company's customer reviews on sites like Trustpilot, BBB, and Squaremouth, as this will provide insight on the quality of customer service and the claims process. You should also take note of whether companies respond to customer reviews.

Compare prices

You can get quotes through a company's website or travel insurance aggregators like InsureMyTrip and VisitorsCoverage. You'll need to be prepared to provide the following information about your trip:

- Trip destination(s)

- Travel dates

- Number of travelers

- Traveler(s) age/birthday

- State of residence

- Total trip cost

For companies that offer travel medical insurance, you'll also want to play around with the deductible options, as they can affect your policy premium.

Understanding International Travel Insurance Coverage Options

Travel insurance can be confusing, but we're here to simplify it for you. We'll break down the industry's jargon to help you understand what travel insurance covers to help you decide what your policy needs. Bear in mind that exclusions and limitations for your age and destination may apply.

Finding the Best Price for International Travel Insurance

Your policy cost will depend on several factors, such as the length of your trip, destination, coverage limits, and age. Typically, a comprehensive policy includes travel cancellation coverage costs between 5% and 10% of your total trip cost.

If you're planning an international trip that costs $4,500, you can expect to pay anywhere from $225 to $450 for your policy. Comparing quotes from multiple providers can help you find a budget-friendly travel insurance policy that meets your needs.

Why You Should Trust Us: How We Reviewed International Travel Insurance Companies

We ranked and assigned superlatives to the best travel insurance companies based on our insurance rating methodology . It focuses on several key factors, including:

- Policy types: We analyzed company offerings such as coverage levels, exclusions, and policy upgrades, taking note of providers that offer a range of travel-related issues beyond the standard coverages.

- Affordability: We recognize that cheap premiums don't necessarily equate to sufficient coverage. So, we seek providers that offer competitive rates with comprehensive policies and quality customer service. We also call out any discounts or special offers available.

- Flexibility: Travel insurance isn't one-size-fits-all. We highlight providers that offer a wide array of coverage options, including single-trip, multi-trip, and long-term policies.

- Claims handling: The claims process should be pain-free for policyholders. We seek providers that offer a streamlined process via online claims filing and a track record of handling claims fairly and efficiently.

- Quality customer service: Good customer service is as important as affordability and flexibility. We highlight companies that offer 24/7 assistance and have a strong record of customer service responsiveness.

We consult user feedback and reviews to determine how each company fares in each category. We also check the provider's financial rating and volume of complaints via third-party rating agencies.

Read more about how Business Insider rates insurance products here.

International Travel Insurance FAQs

The best insurance policy depends on your individual situation, including your destination and budget. However, popular options include Allianz Travel Insurance, World Nomads, and Travel Guard.

You should pay attention to any limitations regarding covered cancellations, pre-existing conditions, and adventure activities. For example, if you're worried you may have to cancel a trip for work reasons, ensure that you've worked at your company long enough to qualify for cancellation coverage, as that is a condition with some insurers. You should also see if your destination has any travel advisories, as that can affect your policy.

Typically, your regular health insurance won't cover you out of the country, so you'll want to make sure your travel insurance has adequate medical emergency coverage. Depending on your travel plans, you may want to purchase add-ons, such as adventure sports coverage, if you're planning on doing anything adventurous like bungee jumping.

Travel insurance is worth the price for international travel because they're generally more expensive, so you have more to lose. Additionally, your regular health insurance won't cover you in other countries, so without travel insurance, you'll end up paying out of pocket for any emergency medical care you receive out of the US.