Our History

The beginning.

In 1968, hospitality entrepreneur Ed Stephan and three Norwegian ship owners, Sigurd Skaugen, Anders Wilhemsen and Gotaas Larsen, created a cruise line to sail the Caribbean. The partners chose the name “Royal Caribbean” – with the connection to royalty signifying the high standards of service guests could expect from the new company. The first ship, Song of Norway , set sail on her maiden voyage from Miami on November 7, 1970, followed by two more ships in the next two years.

Influenced by the state-of-the-art Norwegian marine industry, the team built those first three ships for speed and fuel efficiency, with shallow drafts that could allow the ships to berth at small island quays. Impressed also by the Norwegian culture of ship safety, they made sure the vessels were designed for quick, efficient evacuation. Those early ships pioneered the wide, open-air decks and the round-cantilevered Viking Crown Lounges that made Royal ships stand apart from the crowd.

In the decades that followed, Royal Caribbean Group has continued as an industry innovator – from hotel and dining to entertainment, safety, technology and destination development

All those years ago, when Royal Caribbean was a start-up company, it looked the part. The trailer on Biscayne Boulevard that housed the business would fit in a single conference room in the Group’s current Miami headquarters, which has a clear view of that spot on the Boulevard.

Getting bigger has a lot of positives. But there are certain traits that helped us get where we are today and we will never lose. Chief among them is our entrepreneurial spirit. That is the force that drives us to innovate, to constantly strive to do better. Richard D. Fain, Chair of the Board, Royal Caribbean Group

Getting bigger carries the temptation to move slowly, take fewer chances. Royal Caribbean Group has always resisted that temptation. At the Group, growth fuels the penchant for trying new things and provides a larger landscape for conducting experiments. It means more opportunities for innovation — because great entrepreneurs know that breakout ideas are often the fast lane to success.

Entrepreneurial spirit is the state of mind that helps the Group see opportunity where others see only risk. It’s the state of mind that never thinks “good enough” is remotely good enough. It’s the state of mind that greets every new idea with the words “What if?” instead of “It won’t work.”

In 2020, Royal Caribbean Cruises Ltd. adopted a new moniker, Royal Caribbean Group, to reflect its status as a parent company of a diverse set of cruise lines as well as other business. The Group also sharpened its iconic crown and anchor logo, reflecting the company’s growth and evolution since its last refresh more than 20 years earlier.

Guests have come to expect the biggest, best and boldest from Royal Caribbean Group. And we aren’t going to let them down — ever.

Investor Relations

Global leadership.

About Royal Caribbean Group

Royal Caribbean Group (NYSE: RCL) is one of the leading cruise companies in the world with a global fleet of 65 ships traveling to more than 1,000 destinations around the world. Royal Caribbean Group is the owner and operator of three award-winning cruise brands: Royal Caribbean International , Celebrity Cruises , and Silversea Cruises, and it is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. Together, the brands have an additional 8 ships on order as of March 31, 2024. Learn more at www.royalcaribbeangroup.com or www.rclinvestor.com .

2024 Annual Shareholder Meeting

Date: May 29, 2024

Time: 9:00AM ET

Location: InterContinental Miami, 100 Chopin Plaza, Miami, Florida 33131

For record holders as of April 11, 2024

(click here for online voting and materials)

Sustainability Report

Safeguarding and Protecting the World’s Oceans and Destinations we Operate, and the Health and Well-Being of our Guests and Crew Members.

View And Download Reports

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this release relating to, among other things, our future performance estimates, forecasts and projections constitute forward-looking statements under the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to: statements regarding revenues, costs and financial results for 2020 and beyond. Words such as “anticipate,” “believe,” “could,” “driving,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “will,” “would,” “considering”, and similar expressions are intended to help identify forward-looking statements. Forward-looking statements reflect management’s current expectations, are based on judgments, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from the future results, performance or achievements expressed or implied in those forward-looking statements. Examples of these risks, uncertainties and other factors include, but are not limited to the following: the impact of the global incidence and spread of COVID-19, which has led to the temporary suspension of our operations and has had and will continue to have a material adverse impact on our business and results of operations, or other contagious illnesses on economic conditions and the travel industry in general and the financial position and operating results of our Company in particular, such as: the current and potential additional governmental and self-imposed travel restrictions, the current and potential extension of the suspension of cruises and new additional suspensions, guest cancellations; our ability to obtain sufficient financing, capital or revenues to satisfy liquidity needs, capital expenditures, debt repayments and other financing needs; the effectiveness of the actions we have taken to improve and address our liquidity needs; the impact of the economic and geopolitical environment on key aspects of our business, such as the demand for cruises, passenger spending, and operating costs; incidents or adverse publicity concerning our ships, port facilities, land destinations and/or passengers or the cruise vacation industry in general; concerns over safety, health and security of guests and crew; further impairments of our goodwill, long-lived assets, equity investments and notes receivable; an inability to source our crew or our provisions and supplies from certain places; the incurrence of COVID-19 and other contagious diseases on our ships and an increase in concern about the risk of illness on our ships or when traveling to or from our ships, all of which reduces demand; unavailability of ports of call; growing anti-tourism sentiments and environmental concerns; changes in US foreign travel policy; the uncertainties of conducting business internationally and expanding into new markets and new ventures; our ability to recruit, develop and retain high quality personnel; changes in operating and financing costs; our indebtedness, any additional indebtedness we may incur and restrictions in the agreements governing our indebtedness that limit our flexibility in operating our business, including the significant portion of assets that are collateral under these agreements; the impact of foreign currency exchange rates, interest rate and fuel price fluctuations; the settlement of conversions of our convertible notes, if any, in shares of our common stock or a combination of cash and shares of our common stock, which may result in substantial dilution for our existing shareholders; our expectation that we will not declare or pay dividends on our common stock for the near future; vacation industry competition and changes in industry capacity and overcapacity; the risks and costs associated with protecting our systems and maintaining integrity and security of our business information, as well as personal data of our guests, employees and others; the impact of new or changing legislation and regulations or governmental orders on our business; pending or threatened litigation, investigations and enforcement actions; the effects of weather, natural disasters and seasonality on our business; emergency ship repairs, including the related lost revenue; the impact of issues at shipyards, including ship delivery delays, ship cancellations or ship construction cost increases; shipyard unavailability; and the unavailability or cost of air service.

In addition, many of these risks and uncertainties are currently heightened by and will continue to be heightened by, or in the future may be heightened by, the COVID-19 pandemic. It is not possible to predict or identify all such risks.

More information about factors that could affect our operating results is included under the caption “Risk Factors” in our most recent quarterly report on Form 10-Q, as well as our other filings with the SEC, and the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent annual report on Form 10-K, copies of which may be obtained by visiting our Investor Relations website at www.rclinvestor.com or the SEC’s website at www.sec.gov . Undue reliance should not be placed on the forward-looking statements in this release, which are based on information available to us on the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Corporate Headquarters

Phone: 305-539-6000

Address: Royal Caribbean Group 1050 Caribbean Way Miami, FL 33132-2096

Investor Relations

Name: Michael McCarthy

Email: [email protected]

Fax: 305-539-0562

Corporate Communications

Royal Caribbean Group Email: [email protected]

Twitter: @NewsfromRCgroup

Royal Caribbean International Email: [email protected]

Celebrity Cruises Email: [email protected]

Consumer Web Sites

Royal Caribbean International http://www.royalcaribbean.com

Celebrity Cruises http://www.celebritycruises.com

Silversea Cruises https://www.silversea.com/

Azamara Club Cruises http://www.azamaraclubcruises.com

TUI Cruises http://tuicruises.com

Hapag-Lloyd Cruises https://www.hl-cruises.com/

Careers https://careers.royalcaribbeangroup.com/

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Student Loans

- Personal Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Royal caribbean cruises' (nyse:rcl) investors will be pleased with their notable 71% return over the last year.

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. To wit, the Royal Caribbean Cruises Ltd. ( NYSE:RCL ) share price is 71% higher than it was a year ago, much better than the market return of around 22% (not including dividends) in the same period. So that should have shareholders smiling. And shareholders have also done well over the long term, with an increase of 57% in the last three years.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Royal Caribbean Cruises

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Royal Caribbean Cruises grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 38% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Royal Caribbean Cruises

A Different Perspective

It's nice to see that Royal Caribbean Cruises shareholders have received a total shareholder return of 71% over the last year. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Royal Caribbean Cruises (1 doesn't sit too well with us) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

NAICS Profile Page

Forgot your password?

Lost your password? Please enter your email address. You will receive mail with link to set new password.

Back to login

Privacy Overview

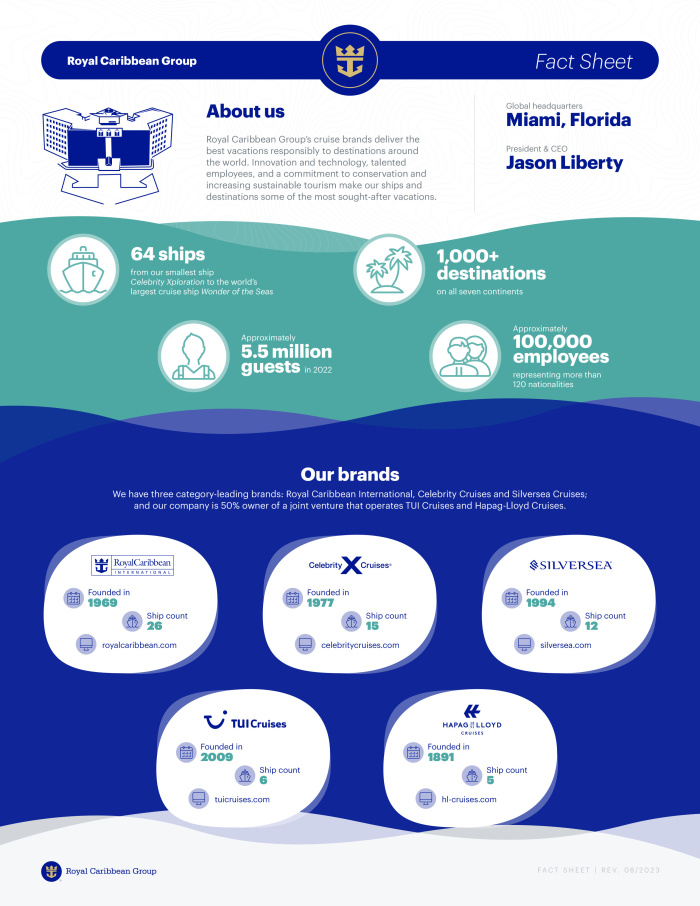

Infographics

Royal caribbean group company profile infographic.

Royal Caribbean Group Infographic

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

New to Zacks? Get started here.

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Management

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Image: Bigstock

Investors Heavily Search Royal Caribbean Cruises Ltd. (RCL): Here is What You Need to Know

Royal Caribbean ( RCL Quick Quote RCL - Free Report ) is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of the factors that might affect the near-term performance of the stock.

Shares of this cruise operator have returned +7.6% over the past month versus the Zacks S&P 500 composite's +3.2% change. The Zacks Leisure and Recreation Services industry, to which Royal Caribbean belongs, has gained 0.3% over this period. Now the key question is: Where could the stock be headed in the near term?

While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Rather than focusing on anything else, we at Zacks prioritize evaluating the change in a company's earnings projection. This is because we believe the fair value for its stock is determined by the present value of its future stream of earnings.

Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock's fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward. Because of this, empirical studies indicate a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

Royal Caribbean is expected to post earnings of $2.69 per share for the current quarter, representing a year-over-year change of +47.8%. Over the last 30 days, the Zacks Consensus Estimate has changed +0.6%.

For the current fiscal year, the consensus earnings estimate of $10.96 points to a change of +61.9% from the prior year. Over the last 30 days, this estimate has changed +0.5%.

For the next fiscal year, the consensus earnings estimate of $12.59 indicates a change of +14.9% from what Royal Caribbean is expected to report a year ago. Over the past month, the estimate has changed +3.1%.

With an impressive externally audited track record , our proprietary stock rating tool -- the Zacks Rank -- is a more conclusive indicator of a stock's near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates , has resulted in a Zacks Rank #1 (Strong Buy) for Royal Caribbean.

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Due to inactivity, you will be signed out in approximately:

- Favorites & Watchlist Find a Cruise Cruise Deals Cruise Ships Destinations Manage My Cruise FAQ Perfect Day at CocoCay Weekend Cruises Crown & Anchor Society Cruising Guides Gift Cards Contact Us Royal Caribbean Group

- Back to Main Menu

- Search Cruises " id="rciHeaderSideNavSubmenu-2-1" class="headerSidenav__link" href="/cruises" target="_self"> Search Cruises

- Cruise Deals

- Weekend Cruises

- Last Minute Cruises

- Family Cruises

- 2024-2025 Cruises

- All Cruise Ships " id="rciHeaderSideNavSubmenu-4-1" class="headerSidenav__link" href="/cruise-ships" target="_self"> All Cruise Ships

- Cruise Dining

- Onboard Activities

- Cruise Rooms

- The Cruise Experience

- All Cruise Destinations " id="rciHeaderSideNavSubmenu-5-1" class="headerSidenav__link" href="/cruise-destinations" target="_self"> All Cruise Destinations

- Cruise Ports

- Shore Excursions

- Perfect Day at CocoCay

- Caribbean Cruises

- Bahamas Cruises

- Alaska Cruises

- European Cruises

- Mediterranean Cruises

- Royal Destinations

- Cruise Planner

- Make a Payment

- Check-In for My Cruise

- Beverage Packages

- Shore Excursions

- Update Guest Information

- Book a Flight

- Dining Packages

- Royal Gifts

- Required Travel Documents

- Transportation

- Book a Hotel

- Redeem Cruise Credit

- All FAQs " id="rciHeaderSideNavSubmenu-7-1" class="headerSidenav__link" href="/faq" target="_self"> All FAQs

- Boarding Requirements

- Future Cruise Credit

- Travel Documents

- Check-in & Boarding Pass

- Transportation

- Perfect Day at CocoCay

- Post-Cruise Inquiries

- Royal Caribbean

- Celebrity Cruises

Beat the Clock & Save

Up to $650 onboard credit.

PERFECT DAY AT COCOCAY

WEEKEND GETAWAYS

STARTING FROM

CARIBBEAN CRUISES

europe cruises

ALASKA CRUISES

FIRST-TIME CRUISER: EVERYTHING YOU NEED TO KNOW

Discover why cruising is the ultimate vacation and unlock insider tips and tricks. Start your journey now!

EXPLORE MORE

NEWEST. BOLDEST. BEST.

There are so many ways to conquer your bucket list while we await the arrival of the next Icon Class ship, Star of the Seas℠. From the game changing Oasis Class to the Icon of Vacations℠, explore our newest, best ships.

UTOPIA OF THE SEAS

PORT CANAVERAL

STAR OF THE SEAS

ICON OF THE SEAS

WONDER OF THE SEAS

ODYSSEY OF THE SEAS

FORT LAUDERDALE

SYMPHONY OF THE SEAS

CAPE LIBERTY

up to $650 onboard credit

{{error.text}} {{error.link.label}}

LAST CALL ON CRUISE DEALS

Score big savings on last minute cruises

GREAT CRUISES NEAR ME

You don’t have to travel far for an incredible vacation. cruise from a port near you to top-rated vacation destinations in the tropics and beyond. no matter where in the world you’re sailing from, you’ll find plenty of deals on epic itineraries sailing right from your backyard..

CRUises from

STARTING FROM

CRUISES FROM

JOIN THE COUNTDOWN

Sign up to receive information about our special offers and deals. You can unsubscribe at any time. For more details about how we use your information, view our Privacy Policy .

GIVE THE GIFT OF ADVENTURE

New Gift Cards Now Available

THIS IS A DAY UNLIKE ANY OTHER

TAKE ADVENTURE TO NEW HEIGHTS

Everyone deserves a vacation. you’ll find endless opportunities to make the most of every moment — like game-changing activities, world-class dining, show-stopping entertainment, and plenty of ways to unwind in the sun.

ULTIMATE WORLD CRUISE

SOUTHERN CARIBBEAN

ALASKA WHALE WATCHING & WILDLIFE

THE MOST EXCITING CRUISE DESTINATIONS AND AWARD-WINNING SHIPS

Unlock some of the most incredible travel destinations . Get on island time and unwind on some of the best beaches in the world, venture deep into the rainforests, and snorkel the most vibrant reefs on a Caribbean or Bahamas cruise getaway with the whole family.

Earn your wilderness badge as you cruise between the Alaska glaciers, pan for gold in prospecting towns, and trek across the rugged tundra on an Alaska vacation . And savor a burst of flavors throughout culture-rich ports in the Mediterranean , the British Isles, Scandinavia and beyond on an unforgettable cruise through Europe . No matter where in the world you choose to wander, cruises can take you deep into top-rated cruise ports and off-the-beaten-path gems, so you can experience each one like a local.

It all starts with the boldest cruise ships at sea — and ours have won awards for everything from world class dining and spectacular entertainment, to record-setting onboard thrills and groundbreaking innovation. Whether you’re traveling solo or vacationing with the whole extended family, you’ll have all kinds of ahh-inducing cruise rooms to choose from, like affordable connecting staterooms that are perfect for groups, romantic rooms for couples craving rejuvenation and relaxation, and even a thrill-filled Ultimate Family Suite with a private game room and in-suite slide.

Previewing: Promo Dashboard Campaigns

My Personas

Code: ∅.

Royal Caribbean Cruises Headquarters & Corporate Office

Royal Caribbean Group, formerly known as Royal Caribbean Cruises Ltd., is an American global cruise holding company incorporated in Liberia and based in Miami, Florida, US. It is the world’s second-largest cruise line operator, after Carnival Corporation & plc.

Travel & Tourism

Corporate Phone Number

305-539-6000

Customer Support Phone Number

800-256-6649

Headquartered Address

https://www.royalcaribbean.com/

This website is built to provide the most important contact information about the Corporate Offices & Headquarters including Royal Caribbean Cruises Address, Corporate Number and more.

Related Articles

Lion Country Safari Headquarters & Corporate Office

Talentify.io Headquarters & Corporate Office

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

Investors Heavily Search Royal Caribbean Cruises Ltd. (RCL): Here is What You Need to Know

May 30, 2024 — 09:00 am EDT

Written by Zacks Equity Research for Zacks ->

Royal Caribbean (RCL) is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of the factors that might affect the near-term performance of the stock.

Shares of this cruise operator have returned +7.6% over the past month versus the Zacks S&P 500 composite's +3.2% change. The Zacks Leisure and Recreation Services industry, to which Royal Caribbean belongs, has gained 0.3% over this period. Now the key question is: Where could the stock be headed in the near term?

While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Rather than focusing on anything else, we at Zacks prioritize evaluating the change in a company's earnings projection. This is because we believe the fair value for its stock is determined by the present value of its future stream of earnings.

Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock's fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward. Because of this, empirical studies indicate a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

Royal Caribbean is expected to post earnings of $2.69 per share for the current quarter, representing a year-over-year change of +47.8%. Over the last 30 days, the Zacks Consensus Estimate has changed +0.6%.

For the current fiscal year, the consensus earnings estimate of $10.96 points to a change of +61.9% from the prior year. Over the last 30 days, this estimate has changed +0.5%.

For the next fiscal year, the consensus earnings estimate of $12.59 indicates a change of +14.9% from what Royal Caribbean is expected to report a year ago. Over the past month, the estimate has changed +3.1%.

With an impressive externally audited track record , our proprietary stock rating tool -- the Zacks Rank -- is a more conclusive indicator of a stock's near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates , has resulted in a Zacks Rank #1 (Strong Buy) for Royal Caribbean.

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Projected Revenue Growth

Even though a company's earnings growth is arguably the best indicator of its financial health, nothing much happens if it cannot raise its revenues. It's almost impossible for a company to grow its earnings without growing its revenue for long periods. Therefore, knowing a company's potential revenue growth is crucial.

In the case of Royal Caribbean, the consensus sales estimate of $3.98 billion for the current quarter points to a year-over-year change of +13%. The $16.21 billion and $17.63 billion estimates for the current and next fiscal years indicate changes of +16.6% and +8.8%, respectively.

Last Reported Results and Surprise History

Royal Caribbean reported revenues of $3.73 billion in the last reported quarter, representing a year-over-year change of +29.2%. EPS of $1.77 for the same period compares with -$0.23 a year ago.

Compared to the Zacks Consensus Estimate of $3.68 billion, the reported revenues represent a surprise of +1.24%. The EPS surprise was +35.11%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates three times over this period.

No investment decision can be efficient without considering a stock's valuation. Whether a stock's current price rightly reflects the intrinsic value of the underlying business and the company's growth prospects is an essential determinant of its future price performance.

Comparing the current value of a company's valuation multiples, such as its price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), to its own historical values helps ascertain whether its stock is fairly valued, overvalued, or undervalued, whereas comparing the company relative to its peers on these parameters gives a good sense of how reasonable its stock price is.

As part of the Zacks Style Scores system, the Zacks Value Style Score (which evaluates both traditional and unconventional valuation metrics) organizes stocks into five groups ranging from A to F (A is better than B; B is better than C; and so on), making it helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Royal Caribbean is graded B on this front, indicating that it is trading at a discount to its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Royal Caribbean. However, its Zacks Rank #1 does suggest that it may outperform the broader market in the near term.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Stocks mentioned

More related articles.

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Investors Heavily Search Royal Caribbean Cruises Ltd. (RCL): Here is What You Need to Know

Shares of this cruise operator have returned +7.6% over the past month versus the Zacks S&P 500 composite's +3.2% change. The Zacks Leisure and Recreation Services industry, to which Royal Caribbean belongs, has gained 0.3% over this period. Now the key question is: Where could the stock be headed in the near term?

While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Rather than focusing on anything else, we at Zacks prioritize evaluating the change in a company's earnings projection. This is because we believe the fair value for its stock is determined by the present value of its future stream of earnings.

Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock's fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward. Because of this, empirical studies indicate a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

Royal Caribbean is expected to post earnings of $2.69 per share for the current quarter, representing a year-over-year change of +47.8%. Over the last 30 days, the Zacks Consensus Estimate has changed +0.6%.

For the current fiscal year, the consensus earnings estimate of $10.96 points to a change of +61.9% from the prior year. Over the last 30 days, this estimate has changed +0.5%.

For the next fiscal year, the consensus earnings estimate of $12.59 indicates a change of +14.9% from what Royal Caribbean is expected to report a year ago. Over the past month, the estimate has changed +3.1%.

With an impressive externally audited track record, our proprietary stock rating tool -- the Zacks Rank -- is a more conclusive indicator of a stock's near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #1 (Strong Buy) for Royal Caribbean.

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Projected Revenue Growth

Even though a company's earnings growth is arguably the best indicator of its financial health, nothing much happens if it cannot raise its revenues. It's almost impossible for a company to grow its earnings without growing its revenue for long periods. Therefore, knowing a company's potential revenue growth is crucial.

In the case of Royal Caribbean, the consensus sales estimate of $3.98 billion for the current quarter points to a year-over-year change of +13%. The $16.21 billion and $17.63 billion estimates for the current and next fiscal years indicate changes of +16.6% and +8.8%, respectively.

Last Reported Results and Surprise History

Royal Caribbean reported revenues of $3.73 billion in the last reported quarter, representing a year-over-year change of +29.2%. EPS of $1.77 for the same period compares with -$0.23 a year ago.

Compared to the Zacks Consensus Estimate of $3.68 billion, the reported revenues represent a surprise of +1.24%. The EPS surprise was +35.11%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates three times over this period.

No investment decision can be efficient without considering a stock's valuation. Whether a stock's current price rightly reflects the intrinsic value of the underlying business and the company's growth prospects is an essential determinant of its future price performance.

Comparing the current value of a company's valuation multiples, such as its price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), to its own historical values helps ascertain whether its stock is fairly valued, overvalued, or undervalued, whereas comparing the company relative to its peers on these parameters gives a good sense of how reasonable its stock price is.

As part of the Zacks Style Scores system, the Zacks Value Style Score (which evaluates both traditional and unconventional valuation metrics) organizes stocks into five groups ranging from A to F (A is better than B; B is better than C; and so on), making it helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Royal Caribbean is graded B on this front, indicating that it is trading at a discount to its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Royal Caribbean. However, its Zacks Rank #1 does suggest that it may outperform the broader market in the near term.

Zacks Investment Research

IMAGES

VIDEO

COMMENTS

Royal Caribbean Cruises Ltd. is a global cruise vacation company that operates Royal Caribbean International, Celebrity Cruises, Pullmantur, Azamara Cruises and CDF Croisieres de France. The company has a combined total of 37 ships in service and seven under construction.

Royal Caribbean Cruises Ltd is a company that operates in the Leisure, Travel & Tourism industry. It employs 21-50 people and has $5M-$10M of revenue. The company is headquartered in Miami, Florida. Read More. Royal Caribbean Cruises's Social Media. Is this data correct?

Royal Caribbean Cruises. Hospitality · United States · <25 Employees. Royal Caribbean Cruises Ltd is a company that operates in the Leisure, Travel & Tourism industry. It employs 11-20 people and has $1M-$5M of revenue. The company is headquartered in the United States. Read More. View Company Info for Free

Royal Caribbean Group, formerly known as Royal Caribbean Cruises Ltd., is a global cruise holding company incorporated in Liberia and based in Miam i, Florida. It is the world's second-largest cruise line operator, after Carnival Corporation & plc. ... Search ZoomInfo's database of 106M+ companies and 140M+ professionals to find your next lead ...

Royal Caribbean Employee Directory. Royal Caribbean corporate office is located in 1050 Caribbean Way # B, Miami, Florida, 33132, United States and has 5,359 employees. royal caribbean cruises ltd.

Director since 2011. Donald Thompson. Director since 2015. Rebecca Yeung. Director since 2023. Arne Alexander Wilhelmsen. Director since 2003. Our history. In 1968, hospitality entrepreneur Ed Stephan and three Norwegian ship owners, Sigurd Skaugen, Anders Wilhemsen and Gotaas Larsen, created a cruise line to sail the Caribbean.

Royal Caribbean Group is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. Together, our brands operate a global fleet of 60 ships traveling to more than 800 ...

Royal Caribbean International has been delivering innovation at sea since its launch in 1969. Each successive class of ships is a record-breaking architectural marvel that revolutionizes vacations with the latest technology. Today, the cruise line continues to dial up the guest experience for adventurous travelers, offering bold onboard thrills ...

In 2020, Royal Caribbean Cruises Ltd. adopted a new moniker, Royal Caribbean Group, to reflect its status as a parent company of a diverse set of cruise lines as well as other business. The Group also sharpened its iconic crown and anchor logo, reflecting the company's growth and evolution since its last refresh more than 20 years earlier.

In fiscal 2016, Royal Caribbean Cruises Ltd. reported net income of $1.31 billion. The company is publicly traded on the New York Stock Exchange (NYSE:RCL). Our Ships. Quantum Class Quantum of the Seas In service: November 2, 2014 168,666 tons 4,180 guests* Anthem of the Seas In service: April 22, 2015

Royal Caribbean Group, formerly known as Royal Caribbean Cruises Ltd., is a global cruise holding company incorporated in Liberia and based in Miami, Florida.It is the world's second-largest cruise line operator, after Carnival Corporation & plc.As of March 2024, Royal Caribbean Group fully owns three cruise lines: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises with 65 ...

Royal Caribbean Group (NYSE: RCL) is one of the leading cruise companies in the world with a global fleet of 65 ships traveling to more than 1,000 destinations around the world. Royal Caribbean Group is the owner and operator of three award-winning cruise brands: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises, and it is ...

Royal Caribbean Group is the owner and operator of three award winning cruise brands: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises and it is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. Together, the brands have an additional 10 ships on order as of December 31, 2022.

Royal Caribbean Group is the owner and operator of three award winning cruise brands: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises and it is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. Together, the brands have an additional 10 ships on order as of March, 31, 2023.

Corporate Headquarters. Phone: 305-539-6000. Address: Royal Caribbean Group 1050 Caribbean Way Miami, FL 33132-2096

We are here to help with reservations, Crown & Anchor memberships and general questions.

To wit, the Royal Caribbean Cruises Ltd. share price is 71% higher than it was a year ago, much better than the market return of around 22% (not including dividends) in the same period. So that ...

Unique Site ID: 60-584-4232: Company Name: Royal Caribbean Cruises Ltd: Tradestyle: ROYAL CARIBBEAN: Top Contact: Restricted: Title: Restricted: Street Address:

Royal Caribbean Group Infographic. Health and safety protocols, guest conduct rules, and regional travel restrictions vary by ship and destination, and are subject to change without notice. Due to evolving health protocols, imagery and messaging may not accurately reflect onboard and destination experiences, offerings, features, or itineraries.

Suite 2001, 20/F, Tower 1, The Gateway, Harbour City, Tsim Sha Tsui, Hong Kong

Royal Caribbean International has been delivering innovation at sea since its launch in 1969. Each successive class of ships is a record-breaking architectural marvel that revolutionises holidays with the latest technology. Today, the cruise line continues to dial up the guest experience for adventurous travellers, offering bold onboard thrills ...

What are the top things to know after I have booked a Royal Caribbean cruise? When should I arrive at the port terminal to board my cruise ship? Can I book back-to-back cruises at this time? If I test positive for COVID-19 right before my cruise or on the cruise, what is your refund policy and what associated costs are covered?

Royal Caribbean reported revenues of $3.73 billion in the last reported quarter, representing a year-over-year change of +29.2%. EPS of $1.77 for the same period compares with -$0.23 a year ago.

THE MOST EXCITING CRUISE DESTINATIONS AND AWARD-WINNING SHIPS Unlock some of the most incredible travel destinations.Get on island time and unwind on some of the best beaches in the world, venture deep into the rainforests, and snorkel the most vibrant reefs on a Caribbean or Bahamas cruise getaway with the whole family.. Earn your wilderness badge as you cruise between the Alaska glaciers ...

Royal Caribbean Cruises Headquarters & Corporate Office. Royal Caribbean ...

The $16.21 billion and $17.63 billion estimates for the current and next fiscal years indicate changes of +16.6% and +8.8%, respectively. Last Reported Results and Surprise History. Royal ...

Royal Caribbean RCL is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of the factors that might affect the near-term performance of the stock. Shares of this cruise operator have returned +7.6% over the past month versus the Zacks S&P 500 composite's +3.2% change.