- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Use Southwest Travel Funds

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Southwest is one of the most popular airlines to fly in the U.S., partially because it offers a generous cancellation and flight change policy. However, depending upon the ticket you buy, you may receive travel funds instead of a cash refund in the event your flight plans change.

Here's how to use Southwest travel funds.

How do you get Southwest travel funds?

Thanks to its no-fee change/cancellation policy, Southwest provides a full refund or issues travel funds to your account. To benefit from this generous policy, you must cancel your flight at least 10 minutes before departure.

Here’s how to determine what kind of refund you’ll get:

You get a full refund to your original payment method when you book Anytime or Business Select tickets.

You get travel funds when you book Wanna Get Away or Wanna Get Away Plus tickets. If you use Rapid Rewards points, they will be returned to your Southwest account. Any refunded taxes will go to your travel funds.

Business Select and Anytime fares offer the most flexibility, but they also cost more than Wanna Get Away fares. Wanna Get Away fares, on the other hand, offer the lowest prices. But if you need to cancel or choose to rebook to a lower-priced flight , your only choice is to receive travel funds — cash refunds aren't on the table.

» Learn more: Southwest Rapid Rewards program: the complete guide

Where can you see your travel funds balance?

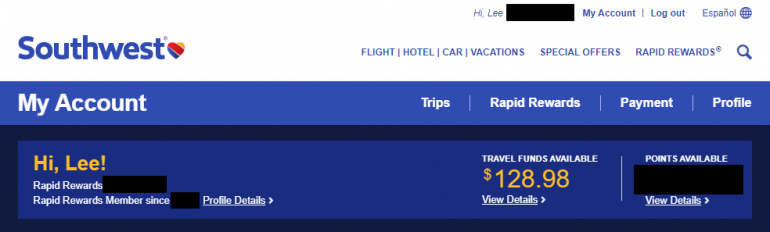

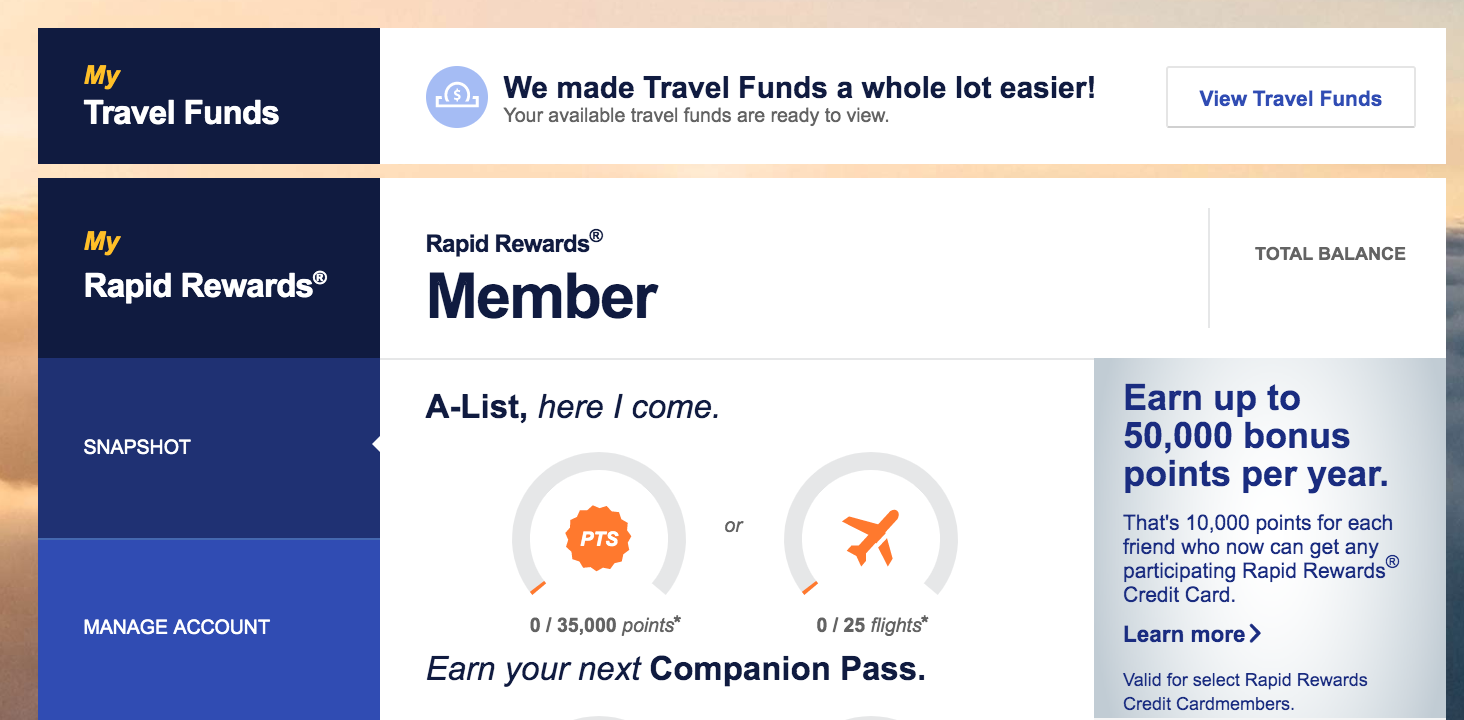

When you log in to your Rapid Rewards loyalty account, your travel funds appear at the top of the "My Account" screen.

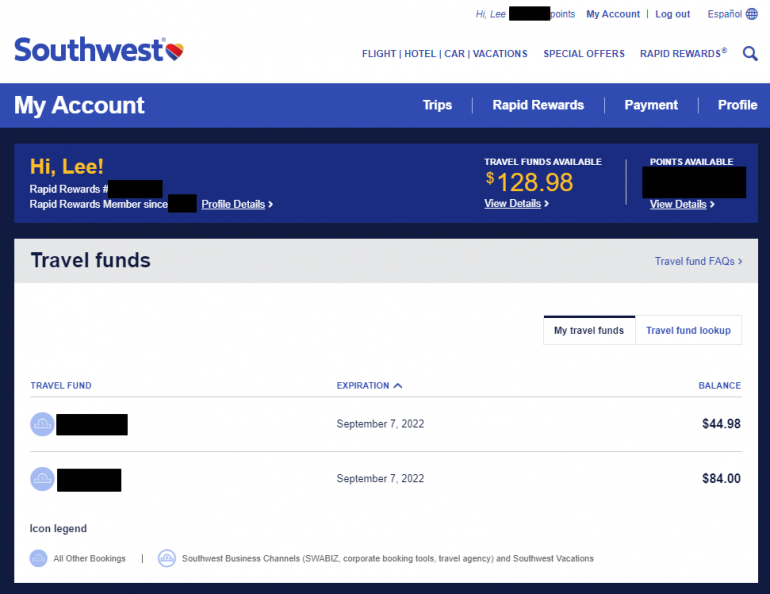

This shows the total available travel funds that you have, but it does not provide the details. You need to click on "View Details" to see the balance of the individual travel fund reservations. Here, you find the expiration date and balance for each reservation. As of July 28, 2022, any unexpired funds and any funds created from there on out will no longer expire. Southwest is updating their system, so for the time being, an expiration date of Dec. 31, 2040, will be displayed in the expiration field. Eventually, that field will go away altogether.

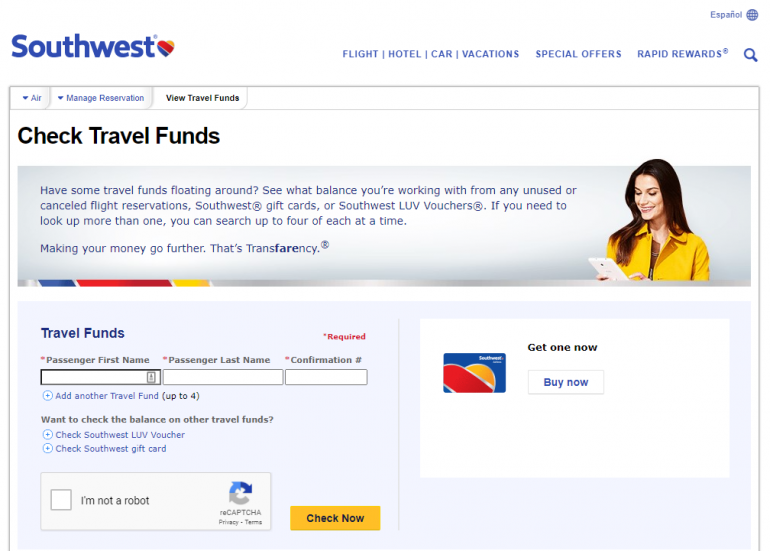

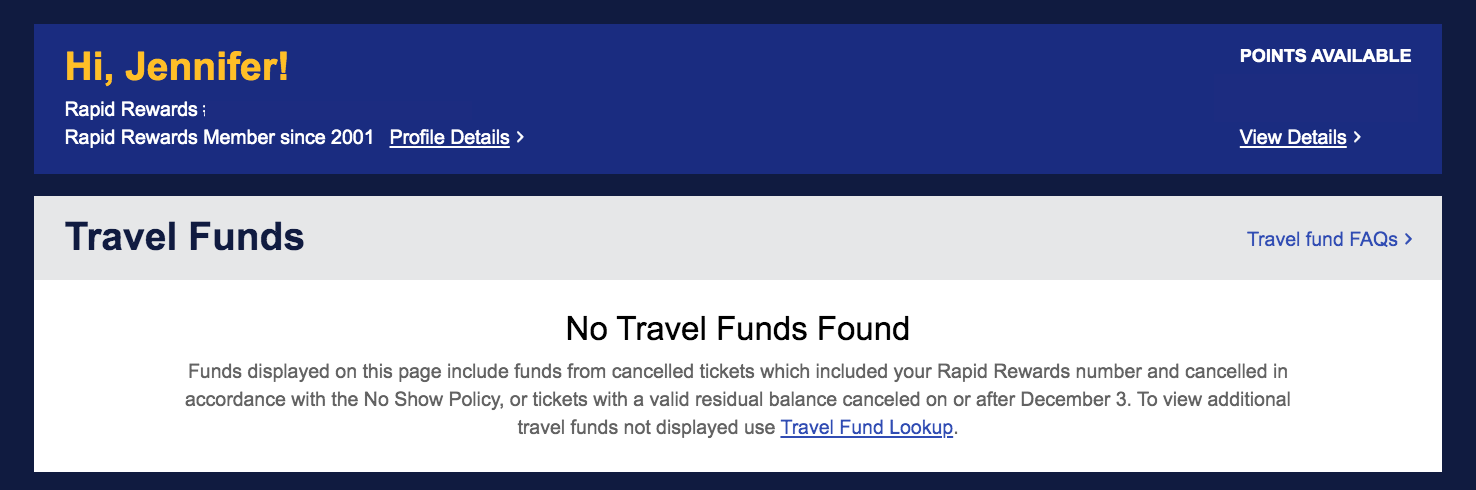

If you don't have a Southwest Airlines Rapid Rewards account, booked a flight that didn't have your loyalty number attached to it or have travel funds from a special purchase ticket, then you'll need to track them manually. Signing up for a Rapid Rewards account is free to do.

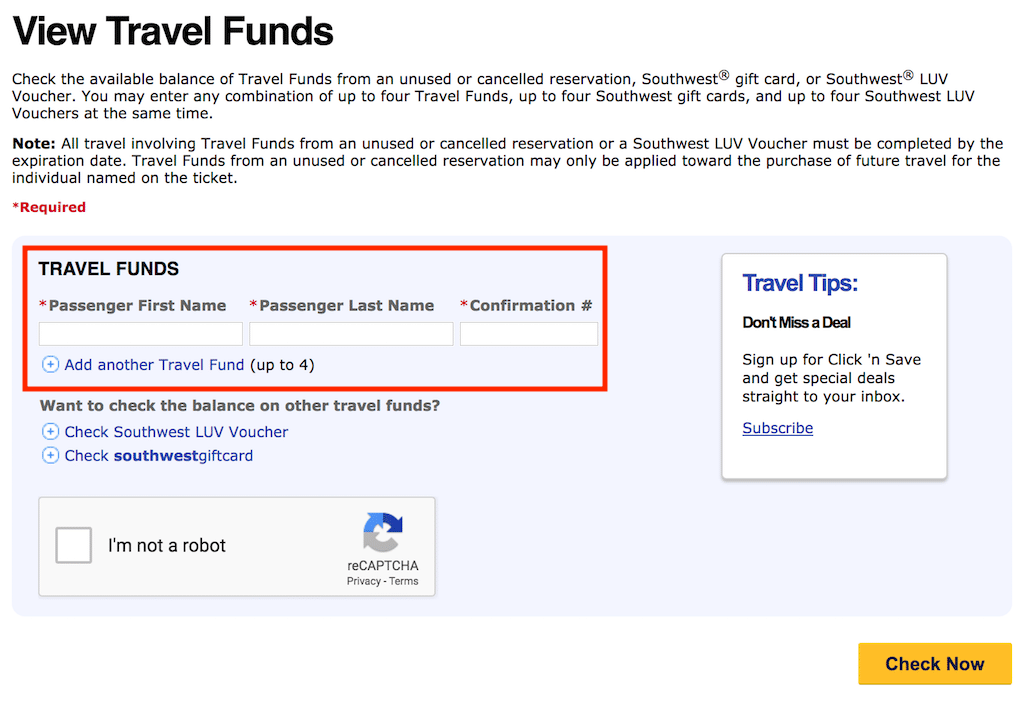

Unfortunately, you cannot manually add travel funds to your profile. To track your travel funds manually, visit the " Check Travel Funds " page on Southwest's website. You'll need to provide the passenger's first and last name plus the confirmation number from the reservation. On this page, you can also check the balance of Southwest LUV vouchers and gift cards.

» Learn more: Don't just redeem miles — redeem them wisely. Here's how

What can I do if my travel funds have expired?

While unexpired funds and newly created funds no longer have an expiration date as of July 28, 2022, what if you have travel funds that expired just before this change in policy? According to the Southwest Community message boards, your one hope is to call customer service within six months of the expiration and ask them to reinstate your travel funds as a LUV voucher. The LUV voucher will be good for another six months from the date of your call. Southwest charges $100 for this one-time extension and it comes out of your travel funds.

» Learn more: Southwest Airlines sweet spots

What can Southwest travel funds be used for?

Travel funds from Southwest can be used to book any available cash flight or to pay for the taxes and fees on award flights. They are treated like cash and can be used to pay for some or all of the amount owed. If you don't use all of the travel funds for the reservation, any remaining balance remains for future use.

» Learn more: Your guide to booking award flights on Southwest

Can I use Southwest travel fund for someone else?

Your travel funds can be transferred to someone else with a Rapid Rewards account if you bought a a Business Select , Anytime or Wanna Get Away Plus fare. That person would have to book their own flight using the travel fund, though. You won't be able to use your travel fund to book for someone else. Wanna Get Away fares are not eligible to transferred, so they can only be used by the ticketed passenger.

4 steps to book a flight with Southwest travel funds

Your travel funds can be used to book flights online, over the phone or at a Southwest Airlines ticket counter. For this illustration, we'll focus on booking a reservation online.

1. Have your original ticket confirmation number handy

Before booking a reservation, print out or write down the travel funds reservation number(s) that you'd like to use. Southwest's website does not allow you to choose from a list during booking.

2. Browse and select your flights

During the booking process, you'll select your travel dates, cities and times as normal.

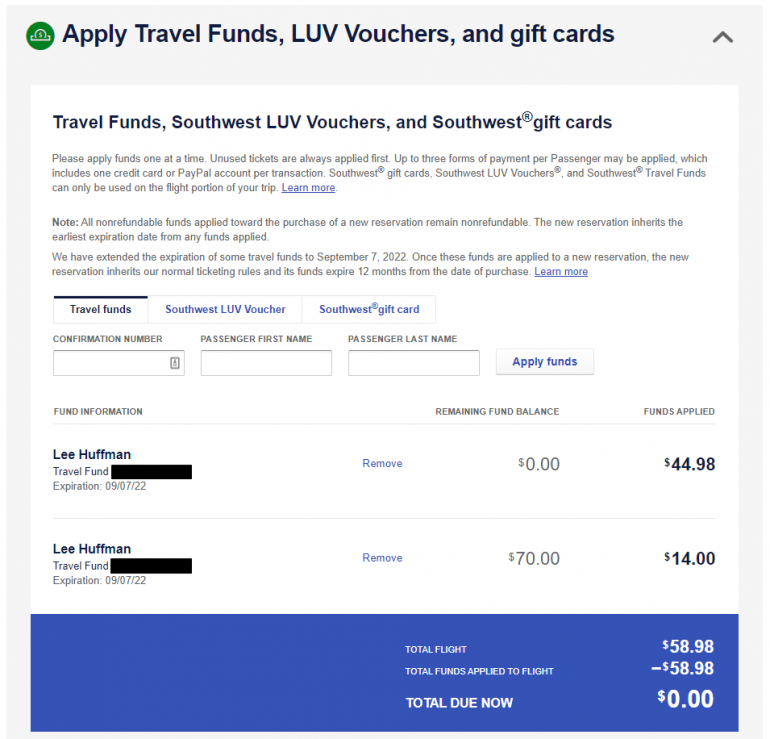

3. Apply your travel funds

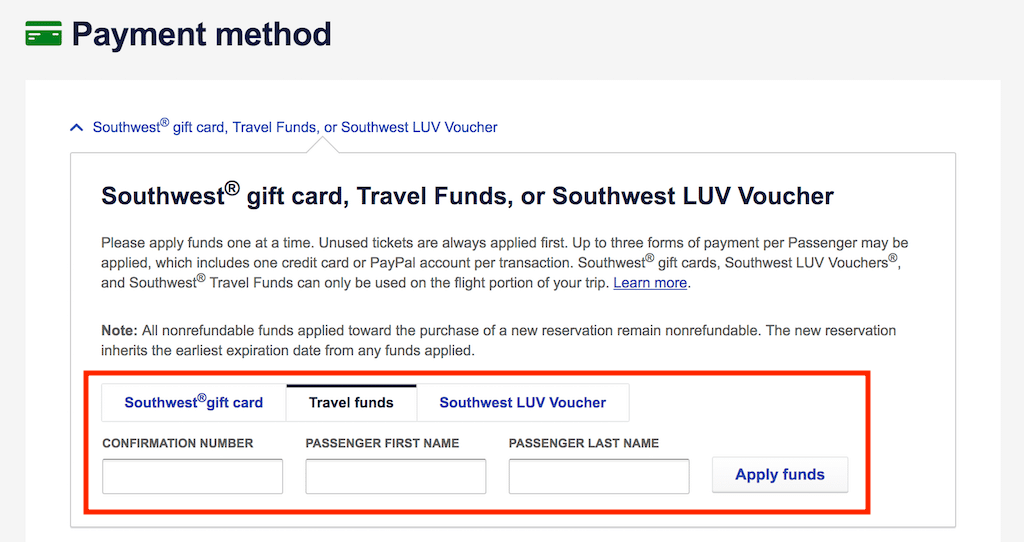

When you arrive at the "Passenger & Payment Info" page, click to expand the "Apply Travel Funds, LUV Vouchers and gift cards" section. Here is where you'll enter your travel funds' confirmation number and your first and last name before clicking "Apply funds." Then, continue the booking process as normal and pay any remaining balance owed with your preferred form of payment, such as the Southwest Rapid Rewards® Priority Credit Card .

Again, you may use your travel funds for cash fares or to pay the taxes and fees on award tickets.

Remember, travel funds from other passengers may not be applied to your ticket.

4. Get confirmation

Now that you've filled out all of the necessary information and remitted payment with your travel fund, you should see a confirmation email pop up in your inbox.

» Learn more: Is a Southwest credit card worth it?

Using Southwest travel funds

Southwest travel funds are typically created when you cancel or change a Wanna Get Away reservation. They are automatically added to your account when you attach your Rapid Rewards number to the reservation before it is canceled. These funds can be used to book cash or award travel, and any unused amount from your new reservation can be used on a future flight.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

UponArriving

Southwest Travel Funds (Expiration, How to use, Etc.) [2021]

Sometimes you need to cancel a flight or you just flat out miss a flight with Southwest. In those instances, all hope is not lost and all of your value is not lost either. That is because you will likely be issued Southwest travel funds (depending on the type of ticket that you purchased).

In this comprehensive article, I will show you everything you need to know about Southwest travel funds. I’ll discuss how you get them, how to use them, and important details like when they expire. I will also touch on gift cards and LUV vouchers for added clarification.

Table of Contents

What are Southwest travel funds?

Southwest travel funds are special funds that usually get issued when you are given a refunded credit for your Southwest flight. Southwest travel funds are different from gift card balances and Southwest LUV vouchers and I’ll discuss those below for added clarification.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Best Southwest credit cards

Southwest airlines rapid rewards premier card.

The Southwest Airlines Rapid Rewards Premier Card comes with the following benefits:

- No foreign transaction fees

- 6,000 anniversary points ( learn more )

- Earn 1,500 Tier-Qualifying Points for every $10,000 in purchases, up to 15,000 Tier-Qualifying Points each calendar year

- $99 Annual fee

Southwest Airlines Priority Card

The Southwest Airlines Priority Card comes with all of the benefits offered below:

- 2X Rapid Rewards on Southwest purchases

- 2X Rapid Rewards on hotel and car rental partner purchases.

- 1X Rapid Rewards on all other purchases

- $75 Southwest annual travel credit ( learn more )

- 7,500 anniversary points each year

- Four Upgraded Boardings per year when available.

- 20% back on in-flight drinks, WiFi, messaging, and movies

- Earn tier qualifying points towards A-list Status

- $149 annual fee applied to your first billing statement

How to get Southwest travel funds

Typically, you will get Southwest travel funds whenever you cancel a flight or you fail to show up for a flight (a “no show”).

One of the most common ways to get Southwest travel funds is to receive a credit for your canceled flight.

Southwest Airlines has one of the most generous cancellation policies out of any major airline in the US. They allow you to change your flights with no additional fee (up to 1 hour prior to departure) and allow you to cancel your flight up to 10 minutes prior to the departure time.

Anytime fare or a Business Select fare

If you purchased an Anytime fare or a Business Select fare then you can cancel up to 10 minutes prior to the departure time and receive a full refund. However, if you fail to cancel your flight you will be issued Southwest travel funds in place of that refund.

Wanna-Get-Away fare

If you purchased a Wanna-Get-Away fare you are not allowed to receive a full cash refund. Instead, you will receive Southwest travel funds whenever you cancel your ticket at least 10 minutes prior to departure. But keep in mind that if you fail to show up for your flight and don’t cancel your ticket at least 10 minutes prior to departure, you will not be issued any type of credit at anytime and you will lose all of your travel funds.

Award reservations

If you had an award reservation then your Rapid Rewards will be deposited back into your account. However, any taxes and fees associated with your reward travel reservation will be held for future use in the form of reusable travel funds under the name of the traveler(s).

Also keep in mind that if you purchase Southwest EarlyBird, that is a nonrefundable purchase and you will not receive travel funds for that. To find out more about Southwest EarlyBird click here .

2020 Coronavirus travel funds update

Extended expiration.

If you purchased a nonrefundable fare (such as a Wanna-Get-Away fare) for travel between March 1 and September 7, 2020 and you cancel your flight “in accordance with Southwest’s No Show Policy,” you will receive travel funds good through September 7, 2022.

However, once you use those travel funds for a purchase they will then expire one year from the date of purchase.

So for example if you redeemed travel funds on July 1, 2021 then those travel funds would expire July 1, 2022.

Travel funds with an expiration date of September 7, 2022, can be converted into Rapid Rewards points at the same rate you would be able to purchase a ticket with points today.

You must request to convert your travel fund by December 15, 2020.

Southwest gift cards

Southwest gift cards can be purchased from the Southwest website at anytime or you can purchase them via phone by calling Southwest Airlines at 1-800-IFLY-SWA (1-800-435-9792).

You can choose any amount between $10 dollars and $10,000 dollars so the range is quite extreme. (Orders exceeding $1,000 can be made by printing the Southwest gift card order form and following the directions provided.)

You can also choose to have these gift cards delivered via email, or you can have them sent via mail. But note that if you were getting them sent via the mail, you will have to pay the shipping fees. If you prefer, you can also expedite the shipping of these gift cards.

A Southwest gift card is NOT valid for the purchase of:

- Southwest Airlines Vacation Packages

- Rental cars

- Southwest Airlines Merchandise

- EarlyBird Check-In

- Additional Southwest gift cards

- In-flight purchases

Related: How much are Southwest points worth?

Southwest LUV Vouchers

Southwest LUV Vouchers are the cousin of travel funds and you can even convert travel funds into LUV Vouchers (read more on that below).

LUV Vouchers are valid as a form of payment toward future airfare only on Southwest Airlines through Southwest.com , toll-free Reservations 1-800-I-FLY-SWA (1-800-435-9792), or at any Southwest Airlines Ticket Counter.

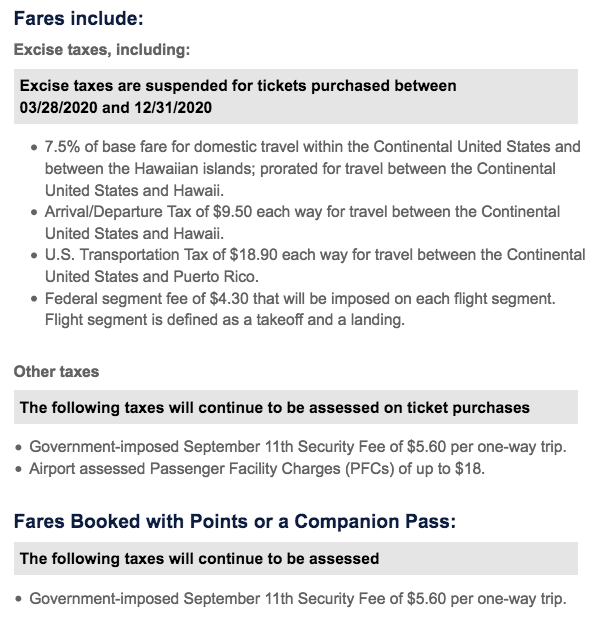

Southwest LUV Vouchers are not redeemable as:

- Payment toward Government-imposed segment fees

- Excise taxes

- Passenger Facility Charges

- September 11th Security Fees or

- Payment toward miscellaneous charges

- Southwest Airlines Group tickets

- Southwest Airlines Vacations packages

- or travel either wholly or in part on other air carriers.

When do Southwest travel funds expire?

Southwest travel funds will expire one year from the purchase date (booking date) of the original flight. This is a huge thing to know because some people assume that the expiration date is one year from the date of travel, which is not the case.

Southwest Airlines does not offer free extensions for the expiration date for travel funds. However, you still might be able to get them to extend the expiration date of your travel funds. This will likely come at a cost of though.

Travel funds expire date extension

Many people extend the expiration date for their travel funds after paying a $100 reinstatement fee. The travel funds are then converted into LUV vouchers when the reinstatement takes place.

You may only have 6 months to request the reinstatement and you must make your request after your travel funds expire. Also, the LUV voucher may only be valid for 6 months from issue so inquire about its expiration date.

Sometimes Southwest has reduced the value of the travel funds when they are reinstated so be on the lookout for that.

The good thing about getting a LUV voucher is that you should be able to use that for anybody. So in some instances, it could be very well worth it to pay $100 so that you can apply those funds to a different traveler.

If your funds have already expired, then I highly suggest that you call and inquire about all of the above possibilities. If the phone representative is not willing to budge, then I suggest that you try calling back later and speaking with another representative.

Note that it is possible that the policies regarding reinstated travel funds are subject to change at anytime so always be prepared for alternative measures!

What about gift cards and vouchers?

Unlike Southwest travel funds, the gift cards do not expire.

However, Southwest LUV Vouchers must be redeemed and all travel completed by the expiration date indicated. If applied in conjunction with any other accepted form(s) of payment, the earliest expiration date of all payments applies.

Southwest will often grant extensions for LUV vouchers but will usually refuse an extension if that LUV voucher was received as a result of getting an extension from your travel funds expiration date. However, if you were given a LUV voucher because of some sort of customer service issue, then you will likely be granted at least one extension for the expiration date.

How to check/view your Southwest travel funds

If you would like to check the status of your Southwest travel funds then simply log-in to your Southwest account and then click on “My Account.” You will then see “My travel funds” at the top and you’ll just need to click on “View Travel Funds.”

You can also do so by clicking here. You will need to have your confirmation number and the passengers first and last name. On that website, you can also check the balance of your Southwest gift card and vouchers.

If you do not have your flight details, you might run into some resistance because Southwest does state that you need this information to look up your travel funds:

Customers calling Southwest to request a refund or to research travel funds for a specific ticket must provide their confirmation number, ticket number or flight information (date, origin and destination).

How to use and apply Southwest travel funds

It is very simple to use your Southwest travel funds.

When you are getting ready to complete the booking of your flight, you should see a button on the checkout screen under the Payment method window for Travel Funds. You will want to click that and then enter in the confirmation number and passenger name from the reservation of the canceled or unused flight.

Keep in mind that the passenger name must match the name of the traveler on the new flight perfectly. You cannot use Southwest travel funds for someone else. You also cannot transfer your travel funds to someone else.

As Southwest states:

Travel Funds from an unused or cancelled reservation may only be applied toward the purchase of future travel for the individual named on the ticket.

But keep in mind the possible exception where you convert your travel funds into LUV vouchers. That route comes with a cost and some risk, but if it works out it can be a way to get around the transferability rule.

Southwest travel funds FAQ

If you do not know your confirmation number, then try to search your inbox for Southwest emails. You should have been given an email at the time of booking containing your confirmation number. The subject line will usually state “Your reservation is confirmed.” You might also be able to locate the confirmation number by logging into your Southwest account and clicking on your past activity which you find under “My Trips.” If all else fails then consider calling the following phone number: 1-800-435-9792 (1-800 I FLY SWA).

You should note that you can only use these funds for airfare or for Southwest vacation packages. They cannot be applied for other purchases like in-flight purchases, Southwest Earlybird, and other random airline incidentals.

A lot of people don’t have use for their travel funds and they want to know if they can convert the travel funds into cash money. The answer to this question is no. If Southwest allowed customers to do that, it would honestly defeat the entire purpose of issuing travel credits in the first place so it is understandable that they do not allow this.

It is possible that when you go to apply your Southwest travel funds that they will not work. If that is the case, then I suggest calling up Southwest right away and explaining to them that you believe that you have travel funds that should be applied and that they are not working during the checkout process.

If you would like to check the status of your Southwest travel funds then simply log-in to your Southwest account and then click on “My Account.” You will then see “My travel funds” at the top and you’ll just need to click on “View Travel Funds.”

When you are getting ready to complete the booking of your flight, you should see a button on the checkout screen under the Payment method window for Travel Funds. Click that and then enter in the confirmation number and passenger name from the reservation of the canceled or unused flight.

Southwest is one of the most generous airlines when it comes to changing flights and canceling your flights. Receiving Southwest travel funds for your cancellations and no show instances can be a great way to not miss out on a lot value. Just make sure that you stay on top of tracking the expiration date for your funds so that you properly use them in time.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo . He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio .

23 comments

Hi, I tried to get my travel funds reinstated within the 6months period(by deducting 100), but they were not ready to do it, I have an other travel funds which is about to expire, I booked something and cancelled due to the corona virus scare, though I explained my situation about it, they were not ready to do it.I have been traveling via southwest from past 10 years, even though they were not ready to do it.They would have updated the funds on the app long back.Its so confusing with so many promotional emails from southwest.

So just to make sure, did you make your request after your travel funds expired or before?

I have 2 travel funds, one of them got expired in dec2019, and the other one is expiring on march 22nd 2020.So I requested for both.

The southwest site says you CAN use travel funds for southwest vacations. https://www.southwestvacations.com/deals/benefits-of-booking-southwest-vacations?clk=GSUBNAV-VAC-WHYBK&intcmp=GSUBNAV-VAC-WHYBK

Thanks for that. I’ve updated the article to clarify.

Question that may be very pertinent to this. I had small amount of travel funds to use ($20) which were expiring on 8/15/20. I just applied those to a new flight I just purchased last month (say 2/15/20). With the COVID-19 situation prices continue to drop and I noticed the new flight now is $34 less so I changed to get that $34 credit.

However, now when I look at my Travel funds, I do see the $34, but the expiry date is 8/15/20 (not 2/14/21 which is what I was expecting). It appears since I used that old Travel fund of $20, it is now applying that original expiry date to my new Travel funds. Is this how it should work? I could not find anything on this but it is important to know. It may not be worth to use those small travel fund amounts if they are expiring soon since any future larger credit you may get won’t have a long life.

I would be surprised that SWA would do this (the ticket I bought on 2/15 was $200 – so saying that when I applied that $20 travel fund to it, making that original ticket date be the new expiration date seems silly).

I have the same issue. On 2/20/2020 I booked a flight for this coming weekend using a credit card and a small travel fund balance that was set to expire on 7/16/2020. I’ve now cancelled that flight for obvious reasons, but the website shows the full amount (not the just the amount on the original travel fund) expires on 7/16/2020. Is this a glitch, or by design? If it’s supposed to work like that, then like the other poster wrote, be careful if you book a flight using a combination of travel funds and credit card…if you cancel that flight, you won’t get a full year credit on the amount you paid by credit card…

I recently (March 13,2020) had to make a change in travel. I did not have a computer access and call wait times were in excess of 90 minutes. I COULD NOT use my travel funds on the SOUTHWEST Android app. That is such a huge limitation. I could not load a desktop site on my phone.

Travelers should be aware of the limitation in using Travel Funds is ONLY AVAILABLE via the FULL SOUTHWEST.COM desktop site. Not their mobile app.

Southwest “should” fix this arbitrary limitation.

Excellent information! I canceled my trip last week due to the virus. I had purchased two tickets. When I book my next flight, I will obviously use the travel funds for my ticket. Will I be able to use those travel funds for the other person’s ticket…….she had a ticket on the canceled flight? I tried to call the airline for this question, but the wait time was long.

Travel funds are credited back to the passenger name on the original ticket. No one may use that credit except the original passenger. So if you bought three tickets for three different passengers, then each passenger will have a separate credit listed under their Specific name And under that confirmation code.

If you have travel funds that expire June 1, 2020 to you have to actually fly by June 1, 2020 or just book your next trip by then?

I was wondering the same thing. Have you found out the answer to this yet?

I am wondering that same thing. If my travel funds expire in April 2021, can I use them for a flight in June 2021?

I need to use my “credit” by March 13, 2021 from a cancelled flight. Can i book a ticket for later in the year or do I actually have to fly by March 13?

I do not understand why if I pay for tickets for other family members and they can’t be used, why I can not get the voucher back in my account? It really just doesn’t seem fair!

I purchased tickets for travel for my wife and me to fly to Hawaii last October. Due to personal reasons we could not go at that time. I promised my wife I would take her this past spring but due to the Covid outbreak you are not allowed to travel to Hawaii without quarantining for 2 weeks. My funds expire in October 2020 so basically I will lose my money unless I use the funds for other travel which I do not want to do until the Covid risk lessens. We are elderly and have other health problems so SWA is basically telling us to travel somewhere we don’t need or want to go and in the process risk our lives. What an airline!! By the way I have taken over 700 flights on SWA over the years and have been a loyal customer. As a result I will fly SWA as little as possible in the future. This will be easier now as all the other major airlines have done away with their change fees as well.

does using travel funds for a southwest flight count as a qualifying revenue flight. there are promos that require a revenue flight

I canceled over 10 upcoming flights on Southwest in mid-March just as the pandemic travel restrictions were starting in CA (I also canceled many more on 3 other airlines — I fly a couple times a week). I then went to transfer the credits to points and couldn’t find the cancelation notice (even though I wrote down when I canceled). I was told that the funds were “stuck” and therefore even though they had documentation of cancelation, I had to call corporate to have them establish the credit. I called corporate but after holding for 30 minutes, I didn’t have time to complete the transfer (but the person assured me the cancelation was in the record and would be issued when I called back). When I called back I was placed on hold for about 30 minutes and they told me that they didn’t see that I had canceled and would only issue credit for no-show (due to COVID) but the funds had to be used in a couple months (before my job will allow me to travel). Is there anything you advise?

Thank you for this great information. My question is about using SW travel funds by the expiration date, does “using” mean booking travel or travel by that date?

We have funds that expire in Sept. 2021. I plan to book flights next week for travel in Dec. 2021.

I too have the very same question…Seems it has been asked a lot on here and no one gets an answer. I sure hope to get an answer to this soon too.

So here’s the rub on travel funds, they expire 1 year after the booking date, not the travel date. But when you want to redeem them, the redemption date is the travel date, not the booking date. This is just pure evil!

Whoa! I am facing the similar issues that I read in this comment section. Really they have very conveniently kept hidden loopholes that would be experienced only by the customer who has to face such a situation. And very cleverly SW sneaks away gulping our hard earned money by luring you can have travel funds to use for future travel! Even though I pay with my credit card the travel fund could be used by only the passenger in whose name I bought the ticket. Why on earth the passenger who has enjoyed my buying ticket will get free travel funds to use but I can not use it if he/she is not flying and I need to fly for my own business to take care. Well, this time I had to cancel and rebook the tickets 4-5 times and in that rebooking I had to change my travel route that saved me and my husband more that $ 300 dollars for each of us. My husband is suffering with diabetes as well as lung cavity formed due to bacterial infection making him immunocompromised. Due to this corona/omicron fear he does not want to risk his life. Our travel funds are expiring on June 29, 2022. I spent several hours calling SW airline customer service, wait time 72 hours!, also tried calling through Southwest Credit card that I used to buy our tickets and from there trying to get some help with travel funds extension, no human available making me listening FREE MUSIC for infinite time. Why there is no e-mail facility to get in touch with them? No where on the entire site you can use e-mail contact except using the form the site want me to fill in. And unfortunately my issue is not among the reasons the page shows, I can not use e-mail route! Do you have any update about COVID 19 some modification in using travel funds beyond the expiration time limit? I would appreciate some feedback.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Privacy Overview

/static-assets/statics-12975/images/financebuzz.png)

Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

15 Legit Ways to Make Extra Cash

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

6 Smart Strategies to Save Money on Car Insurance

How to easily redeem your southwest flight credits.

Thanks to Southwest’s generous cancellation policy, you might have flight credits waiting to be used.

/images/2019/09/06/how_to_redeem_your_southwest_travel_funds_for_flights.jpg)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

To redeem your Southwest flight credits, you can use them to book any available cash flight or to pay for the taxes and fees on award flights. One of the places you can check your flight credits is the Southwest website.

Southwest flight credits are a form of flight credits that you might receive from one of the features we love most about Southwest Airlines. This feature is the ability to cancel a flight and receive the unused funds in the form of flight credit.

Let's explore how to make the best use of your Southwest flight credits and how to check the credits available to you.

Key takeaways

What are southwest flight credits, how to use southwest flight credits, how to make the most of your southwest flight credits, southwest flight credits faq.

- Southwest flight credits are funds toward future flights that you can earn when you cancel a Southwest reservation up to 10 minutes before the scheduled flight departure.

- You can redeem your Southwest flight credits through the Southwest website, mobile app, phone, or at a Southwest ticket counter. They can cover cash flights as well as taxes and fees associated with rewards travel.

- Southwest flight credits don’t expire, so you don’t have to worry about losing them if you don’t use them.

- Southwest allows you to transfer flight credits to someone else if your canceled fare was a Business Select, Anytime, or Wanna Get Away Plus fare.

Southwest flight credits are essentially travel funds you can apply toward future flights. They aren't the same thing as airline miles you earn from one of the air carrier's co-branded Chase credit cards . A passenger earns these flight credits when they cancel a Southwest reservation up to 10 minutes before the flight is scheduled to take off.

You can redeem your flight credits by going to the Southwest website at Southwest.com, by phone, through the mobile app, or at a Southwest ticket counter for future flights. You can reach Southwest customer service at 1-800-I-FLY-SWA (1-800-435-9792).

You can also use Southwest flight credits to cover any taxes and fees associated with rewards travel. And since Southwest doesn’t charge cancellation fees, the entire cost of your canceled ticket can be put toward your next flight; you’ll pay only if there’s a fare difference.

Do Southwest flight credits expire?

Southwest flight credits no longer expire. Southwest has eliminated expiration dates on all Southwest flight credits unexpired on or created on or after July 28, 20222.

Keep in mind that other forms of Southwest travel funds, such as gift cards or LUV vouchers, might have expiration dates. The expiration date is typically listed on the card or travel voucher, or you can check the expiration date online.

Can I transfer Southwest flight credits?

Southwest allows you to transfer flight credits to someone else in certain cases. This feature is available for customers who buy their flights using the Wanna Get Away Plus fare, as well as the Anytime or Business Select fares.

Both the sender and the receiver of the flight credit must be Rapid Rewards Members. To access the transferable flight credits associated with your Rapid Rewards account, you need to log in to your account and select “My Account” from the menu options at the top of the page for desktop or scroll down to “My Travel Funds” at the bottom of the page for mobile and the Southwest app.

Next, select “Payment” from the menu options within your account. Any available transferable flight Credits and flight credits in your account should be listed.

Other types of Southwest travel funds

Keep in mind that you can also receive other forms of travel funds from Southwest, this includes:

- Southwest gift cards you received or bought

- Southwest LUV vouchers you received for inconveniences on past trips

These can be used similarly to Southwest flight credits, but different rules may apply.

To use your Southwest flight credit, follow these steps:

- Access your flight credits: You can do this through My Account by selecting the Payment tab on southwest.com or “Check Travel Funds” on mobile.

- Write down your original ticket confirmation number: You might need this when making your new reservation.

- Browse and select your new flight: Search for the flight you’d like to take to begin the booking process.

- Apply your flight credit: You should see an option to apply a flight credit or other travel funds in the payment section. You can do so by entering the confirmation number associated with the flight credit.

- Make sure you got a confirmation: After applying your flight credit and completing your booking, you should receive a confirmation of your payment and new booking.

You can also call Southwest or visit a ticket counter to redeem your unused funds.

Sometimes, your Southwest flight credits won’t be enough to cover the cost of your flight. This can be frustrating, especially if you weren’t planning to travel and just want to make use of your funds. But with Southwest Rapid Rewards, you’ll always earn bonus points toward future travel when you have to make a purchase.

If your Southwest flight credits aren’t enough to cover the cost of your upcoming flight, consider using a Southwest credit card to cover the difference. Chase is the credit card issuer for the Southwest credit cards, but you'll earn Southwest rewards, not Chase Ultimate Rewards. You’ll rack up some serious Southwest points and perks through one of these credit cards , which are known for being some of the best airline credit cards .

For example, a Southwest credit card can even help you earn the Companion Pass faster, which lets you take a travel companion with you for free on all your Southwest flights, excluding taxes and fees. You can also use flight credits in conjunction with Rapid Rewards points or with a Southwest gift card.

Southwest’s cancellation policy is extremely generous and is just one of the reasons we love the airline . Even though their cards are some of the best travel credit cards , you’ll need to be aware of the rules associated with redeeming your Southwest flight credits and keep track of any information you’ll need to access your funds. With these tips in mind, you can worry less about canceling flights because of a travel disaster and start putting your funds toward your next travel adventure.

How many Southwest travel funds can I use?

You can use up to three forms of payment per Southwest transaction, including travel funds and vouchers. As long as your travel funds are valid for the flight date and passenger(s) in question, you can apply as many as three separate vouchers to the same purchase.

It’s important to note that because Southwest only allows up to three forms of payment per transaction, your combined vouchers must cover the entire cost of the flight(s), including fees and taxes. If you don’t have enough flight credits to pay the entire balance — or are using LUV vouchers, which require taxes and fees to be paid separately — you’ll be limited to using two vouchers. In that case, you will need to use an alternate form of payment, like a travel credit card, for the balance.

Can I use my flight credits on the Southwest app?

Yes, you can use flight credits (as well as LUV vouchers and Southwest gift cards) when booking a flight through the Southwest mobile app.

As with all other Southwest booking platforms, you are limited to a total of three payment options per booking. If you are using multiple flight credits or LUV vouchers to book a flight, you’ll need to ensure they cover the full cost (airfare plus any government fees, taxes, or charges).

Otherwise, the maximum number of flight credits or vouchers you can use per booking is two. That is so you can cover the difference with a credit card or other payment method without exceeding the three-payment-method maximum.

Should I convert my Southwest flight credits to points?

If you have Southwest flight credits, you’ll have the option to convert travel funds into Southwest Rapid Rewards points . Depending on how you plan to use those funds, this may or may not be a good idea.

If you plan to book a flight prior to your funds’ expiration, converting might not make sense. In many cases, you could lose money on the funds-to-points conversion, which gives you less flight for your money.

However, there are some cases in which converting might be the right idea. This is the case if:

- You have existing Rapid Rewards points but are slightly short of how many you need to book the desired flight. Converting funds to points would give you a large enough balance to book the trip you want.

- You book flights for your family, friends, or other groups. The flight credits are linked to your name and can be used only for your own flights. Rapid Rewards points can be transferred, shared, or used to book flights for others.

How do I extend my Southwest flight credits?

Southwest flight credits that were created on or after July 28, 2022, never expire, so you no longer have to worry about extending your flight credits.

Can I transfer my Southwest flight credits to someone else?

Yes, Southwest enables you to transfer flight credits to someone else as long as your fare type is a Wanna Get Away Plus, Anytime, or Business Select. Also, keep in mind that both you and the receiver of the flight credit must be Rapid Rewards Members.

Southwest flight credits: bottom line

If you've had canceled flights with Southwest, you might be sitting on a list of valuable Southwest flight credits. These credits are a flexible way to book future travel, covering both cash flights and the taxes and fees on award flights. The best part? They don't expire, giving you the freedom to plan your next adventure on your own schedule.

Generous Welcome Bonus

Southwest rapid rewards ® plus credit card.

/images/2022/07/19/southwest-rapid-rewards-plus-credit-card.jpg)

FinanceBuzz writers and editors score cards based on a number of objective features as well as our expert editorial assessment. Our partners do not influence how we rate products.

Current Offer

- Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening

Rewards Rate

2X points on Southwest purchases and Rapid Rewards hotel and car rental partners; on local transit and commuting, including rideshare; and on internet, cable, phone services, and select streaming; plus 1X points on all other purchases

- Earn 2X points on Southwest purchases and Rapid Rewards hotel and car rental partners; on local transit and commuting, including rideshare; and on internet, cable, phone services, and select streaming

- Redeem points for flights, gift cards, and more

- 3,000 bonus points after cardmember anniversary

- Plus, 2 EarlyBird Check-Ins per year

- Has annual fee

- Has foreign transaction fee

- Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- 3,000 anniversary points each year.

- Earn 2X points on Southwest® purchases.

- Earn 2X points on local transit and commuting, including rideshare.

- Earn 2X points on internet, cable, and phone services; select streaming.

- 2 EarlyBird Check-In® each year.

- Earn 1 point for every $1 spent on all other purchases.

- Member FDIC

/authors/lindsay_frankel_updated.png)

Author Details

Lindsay Frankel

/authors/yahia-barakah-financebuzz.jpg)

Yahia Barakah, CEPF

- Credit Cards

- Best Credit Cards

- Side Hustles

- Savings Accounts

- Pay Off Debt

- Travel Credit Cards

Southwest's new enhancement to tracking Travel Funds

Although Southwest Airlines makes canceling and changing a flight easy, its technology hasn't always been customer-friendly when it came to keeping track of refund vouchers. Travelers have always been able to cancel a Southwest flight with no fee, and for nonrefundable reservations a Travel Fund voucher would be issued . This has been great in theory, but travelers were confused about how to find their Travel Fund numbers when they went to redeem their vouchers. Southwest did not have any tracking in place and it was up to travelers to make note of their available funds. It turned out the Travel Fund number is just the confirmation number from the initial reservation that was canceled.

That all changed for flights canceled on or after Dec. 3, 2019. According to Deals We Like , Southwest will now keep track of your Southwest Travel Funds for you. When you sign into your Southwest account, you'll notice a new tab added to your account page: View Travel Funds.

Related: The best Southwest credit cards of 2019

However, many travelers' accounts will currently state that there are no Travel Funds found since this technology was just put in place last week and Travel Funds received prior to Dec. 3, 2019 still need to be tracked manually. You can still check your balance on Southwest's Travel Fund lookup page . As of now, there is no way to add them to the account tracker.

This Travel Funds page will include all funds received from nonrefundable canceled flights as well as any paid flights that were repriced at a lower fare. Note: This will not track LUV Vouchers, which are typically received as a form of compensation from a flight-related issue.

Related: How to reprice a flight when the fare decreases

When you go to pay for your flight, you'll still have to manually enter your Travel Fund information. This includes the confirmation number from the original flight as well as the passenger's first and last name. Keep in mind that Travel Funds, unlike LUV Vouchers, aren't transferrable.

Travel Funds expire 12 months from the date the original flight was booked — not from when the flight was canceled and the Travel Funds issued. This expiration date is also a "must-fly-by date" not a "book-by date." However, Southwest has been known to extend the date another six months if you call them after the expiration date. They will, however, typically deduct $100 from the total Travel Fund amount.

Also know that when combining a Travel Fund with another form of payment, if you cancel the latest reservation, the entire amount paid will inherit the earliest expiration date. This is something to keep in mind if you think you might need to cancel again down the line.

Related: Southwest Travel Fund reader mistake story

Bottom line

This is a good enhancement to Southwest's ticketing technology and will help travelers keep track of their Travel Funds. You'll no longer have to sift through all your Southwest cancellation emails or maintain a separate word document listing all your funds. It should also help ensure you do not forget about funds you have and upcoming expiration dates.

Related: Battle of the Airlines: Why I think Southwest Airlines is the best

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Southwest Gift Cards, Flight Credits & LUV Vouchers [Everything You Need To Know]

Katie Seemann

Senior Content Contributor and News Editor

349 Published Articles 54 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3233 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![southwest.com travel funds Southwest Gift Cards, Flight Credits & LUV Vouchers [Everything You Need To Know]](https://upgradedpoints.com/wp-content/uploads/2018/08/SWAMedia12303-source.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Southwest gift cards, using southwest gift cards, southwest flight credits, southwest luv vouchers, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Southwest Airlines offers lots of customer-friendly policies, including free checked baggage and the ability to change your flight with no fee. Plus, Southwest’s frequent flyer program, Rapid Rewards, is straightforward and simple to use.

However, one thing that can get a little confusing with Southwest is all the different forms of payment — there are gift cards, Flight Credits (formerly called Travel Funds), and LUV Vouchers.

While these might all seem similar, they have very different rules. Specifically, Flight Credits and LUV Vouchers can get a little tricky to use if you aren’t sure how.

In this post, we’ll go over each of these so you know exactly how to use Southwest gift cards, Flight Credits, and LUV Vouchers successfully!

Where To Buy Southwest Gift Cards

Southwest gift cards can be purchased online and at many retailers including:

- Giant Eagle

How To Purchase a Southwest Gift Card on Southwest.com

- On the next page, click Buy a gift card .

- Fill in the amount and quantity you would like to purchase. Gift cards can be purchased in any amount from $25 to $1,000. If you’re purchasing multiple cards, they will all have the same value, however, the total value of the purchase can’t exceed $1,000.

- Fill in either the recipient’s email or physical address, depending on your shipping method. You can add a gift message or leave this area blank.

- Click the yellow Payment button at the bottom right-hand side of the screen to continue to payment options.

- Verify your details, enter your payment information, and click the yellow Purchase button to complete the transaction.

Hot Tip: Buying a gift card through Southwest.com counts as a travel purchase , so be sure to use a credit card that offers bonus points on travel. The Chase Sapphire Preferred ® Card earns 2x points on travel, while the Ink Business Preferred ® Credit Card earns 3x points! Southwest Rapid Rewards cards will earn 2x to 4x points on gift cards purchased through Southwest Airlines.

Purchasing a Large Volume of Gift Cards Online

Purchases of gift cards on Southwest.com are limited to $1,000 per transaction . If you would like to purchase multiple gift cards and will exceed the $1,000 limit, you can use the Corporate & Volume Sales order form .

- Go to Southwest.com and scroll to the very bottom of the page. Under Southwest Products , click on Southwest gift card .

How To Earn Tons of Points Buying Gift Cards

Whether buying a gift card for yourself or as a gift for someone else, they can be a great way to rack up tons of Southwest Rapid Rewards points ! The key is using the right credit card at the right retailer.

Here are a couple of strategies that will help you maximize your points-earning when purchasing Southwest gift cards:

- Use the Ink Business Cash ® Credit Card at office supply stores to earn 5x points.

- Use the Chase Freedom Flex℠ at Sam’s Club during a warehouse store bonus period — you’ll earn 5x points , and will be purchasing the gift cards at a slight discount. Watch for other Freedom Flex card bonus categories that include stores that sell gift cards.

- Use your Chase Sapphire Reserve ® to purchase gift cards through Southwest.com for 3x points.

- Keep an eye on Amex Offers and Chase Offers . You can often find discounts or offers for bonus points on stores that sell gift cards.

Southwest gift cards can only be used for flights (including taxes and fees) purchased directly through Southwest Airlines — either online, by phone at 800-435-9792 (800-I-FLY-SWA), or at a Southwest ticket counter.

Hot Tip: There are no fees to purchase Southwest gift cards. They never expire and are fully transferable.

Flights purchased with Southwest gift cards are non-refundable . If your travel is not taken or the flight is canceled, the funds will be held as a Flight Credit to be used on a future flight. Thankfully, Flight Credits don’t have an expiration date.

How To Use a Southwest Gift Card Online

Using a gift card to purchase a flight online doesn’t really differ much from purchasing a flight with a credit card.

- Go to Southwest.com and search for a flight as you normally would.

- Once you get to the Passenger and Payment Info page, scroll to the middle of the page where you’ll see Payment Method .

Hot Tip: You can use 3 forms of payment, including Southwest gift cards, LUV Vouchers, and Flight Credits, per person on each reservation.

What Can You Buy With a Southwest Gift Card?

Southwest gift cards are good for the purchase of flights booked directly with Southwest . You can use gift cards online, over the phone, or in person at a Southwest ticket counter. Gift cards can also be applied to taxes and fees associated with your ticket.

The list of things you can’t use gift cards on is a little longer! The following are items you can not pay for with a Southwest gift card :

- Additional Southwest gift cards

- EarlyBird Check-In

- Inflight purchases

- Oversized and excess baggage fees

- Partner hotel and rental cars

- Purchases through a travel agent

- Southwest Airlines group desk purchases

- Southwest Airlines group tickets

- Southwest Airlines merchandise

- Southwest Airlines vacation packages

- Unaccompanied minor service charge

- Upgraded boarding at the airport

Bottom Line: Southwest gift cards can be applied to your flight cost plus any taxes and fees associated with your flight.

How To Check Your Gift Card Balance

Southwest Flight Credits, formerly called Travel Funds, are what you get if you cancel a flight or change a flight to a lower-priced itinerary . Flight Credits only exist digitally — you won’t get a card, certificate, or voucher for these funds.

They can be redeemed through Southwest.com , over the phone, and at Southwest Airlines ticket counter locations.

Flight Credits are tied to your original itinerary. For example, let’s say you cancel flight #1212 and receive a Flight Credit for the price you paid. When you go to book a new flight, you will need to pull up your Flight Credit using the confirmation number from flight #1212.

Hot Tip: As of July 28, 2022, Southwest Flight Credits no longer expire . Any Flight Credits issued on or after this date and any Flight Credits that were set to expire on or after this date now do not expire at all.

How To Use a Southwest Flight Credit on Southwest.com

- Once you get to the Passenger and Payment Info page, scroll to the middle of the page, where you will see Payment Method .

- Look for the section that says Apply Flight Credits, LUV Vouchers, and Southwest gift cards .

Hot Tip: Southwest Flight Credits that are created from a Wanna Get Away fare are not transferable. Southwest Flight Credits that are created from a Wanna Get Away Plus fare are transferable.

How To Check the Balance of Your Southwest Flight Credits

You can easily see what Flight Credits you have in your Rapid Rewards account. After logging into your Southwest account, click on My Account in the upper right-hand corner. Then you’ll see an at-a-glance look at the total Flight Credits you have (they are labeled as Travel Funds here).

To see the details of your available Flight Credits, click on View Details . You’ll see a list of your available Flight Credits along with the confirmation number that you’ll need to redeem them.

Bottom Line: Flight Credits are what you’ll get if you cancel a flight or change a flight to a lower-priced itinerary. These credits don’t expire.

So now that you’re up to speed on Southwest gift cards and Flight Credits, let’s talk about LUV Vouchers!

What’s a LUV Voucher, you ask? It’s a voucher you’ll get as compensation for a delayed flight, missing baggage, or volunteering to get bumped from a flight.

If you receive your LUV Voucher at the airport you may still get a paper copy.

However, you’re more likely to receive an email with your LUV Voucher information.

Southwest LUV Vouchers are valid at Southwest.com , by calling 800-I-FLY-SWA, or at any Southwest Airlines ticket counter. You’ll need the voucher number and security code (confirmation) to complete a purchase.

Your travel must be completed by the voucher’s expiration date (usually 6 months to 1 year from the date of issue). The LUV Voucher can be applied toward your flight cost, but NOT any taxes or fees associated with your ticket.

Hot Tip: If you have a physical Southwest LUV Voucher, take a photo of it! This ensures you’ll still be able to use it even if you lose the paper voucher.

How To Use a Southwest LUV Voucher on Southwest.com

- Look for the section that says Apply Flight Credits, LUV Vouchers, and Southwest gift cards . Then all you need to do is enter your LUV Voucher number and security code.

Hot Tip: You can use up to 3 forms of payment per person per reservation. This can include any combination of gift cards, Flight Credits, and LUV Vouchers plus 1 credit card or PayPal account per transaction.

How To Check the Balance of Your LUV Voucher

Checking your LUV Voucher balance on Southwest.com is easy, but it’s a bit tricky to find. You can click here or follow the instructions below.

Hot Tip: If you cancel a flight that you paid for with a LUV Voucher, that balance will be refunded in the form of a Flight Credit.

Southwest Airlines offers 3 distinct forms of payment that require a little know-how to use: gift cards, Flight Credits, and LUV Vouchers. All 3 can be used to purchase Southwest flights online, over the phone, or at a ticket counter . However, they all have different rules as far as expiration dates, what they can be applied to, and who can use them.

Luckily, these rules stem from Southwest’s customer-friendly policies — including holding Flight Credits from a canceled flight for future use, and even occasionally rewarding you with LUV Vouchers if something goes wrong. Thankfully, once you know the basics, you will be the master of your Rapid Rewards account in no time!

The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Where can i buy a southwest gift card.

Southwest gift cards can be purchased on Southwest.com and at many other retailers including Amazon, Best Buy, grocery stores, Sam’s Club, Staples, Target, Walgreens, and Walmart.

How many Southwest gift cards can be used at once?

Southwest accepts up to 3 forms of payment per person on a reservation, including gift cards. For a 2-person reservation, you could use up to 6 gift cards.

Do Southwest gift cards expire?

No, Southwest gift cards do not have expiration dates nor will they devalue over time. However, LUV Vouchers do carry expiration dates.

LUV Vouchers generally expire 6 to 12 months from the date of issue. The expiration date will be printed on the voucher or included in the email.

Can I buy a Southwest gift card with points?

Yes, you can purchase a Southwest gift card using Rapid Rewards points on the Southwest Rapid Rewards website , however, it’s not a great way to get the most value from your points. A $50 gift card costs 9,400 Rapid Rewards points.

Can my Southwest gift card be replaced?

No, a Southwest gift card cannot be replaced if lost, stolen, or damaged.

What are Southwest Flight Credits?

Flight Credits (formerly Travel Funds) are credits that are issued to you if you cancel a flight or change your flight to a less expensive itinerary. They are held digitally, so you won’t receive a physical voucher. You need to know the confirmation number from your original flight to access Flight Credits.

What is a Southwest LUV Voucher?

A LUV Voucher is what you might receive if Southwest is offering compensation for a disrupted flight, lost baggage, or volunteering to take a later flight. You’ll receive a paper voucher or an email with the voucher number and security code.

Are LUV Vouchers transferable?

Yes, LUV Vouchers can be used to purchase a flight for anyone, not just the person who owns the voucher.

Are Soutwhest Flight Credits transferable?

If your Flight Credits were generated from a Wanna Get Away Plus fare, they are transferable. If they were generated from a Wanna Get Away fare, they are not transferable.

What's the difference between Flight Credits and Travel Funds?

There’s no difference between Southwest Flight Credits and Travel Funds. Flight Credits is the new name for Travel Funds.

When do Southwest Flight Credits expire?

As of July 28, 2022, Southwest Flight Credits don’t expire. Any Flight Credits created on or after this day and any Flight Credits that had an original expiration date on or after this day will not expire.

Was this page helpful?

About Katie Seemann

Katie has been in the points and miles game since 2015 and started her own blog in 2016. She’s been freelance writing since then and her work has been featured in publications like Travel + Leisure, Forbes Advisor, and Fortune Recommends.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Kiplinger Readers' Choice Awards 2024: Travel Rewards Credit Cards

The Kiplinger Readers’ Choice Awards celebrate the best travel rewards credit cards.

- Newsletter sign up Newsletter

Kiplinger Readers' Choice Awards Categories

About the Kiplinger Readers’ Choice Awards

The Kiplinger Readers’ Choice Awards aim to recognize and celebrate the best products and services in the personal finance arena. We asked you, our Kiplinger community, to help us name the products and services you think have delivered excellent value in the past year.

The survey results, which we’re sharing here in our second annual Readers’ Choice Awards, offer valuable insight into which providers shine when it comes to your everyday interactions and experiences with them. Our Awards recognize excellence in everything from credit cards, banks and brokers to insurers, tax software and financial apps. For each category, we’ve listed an overall winner that earned the highest score. We’ve also highlighted other products and services that earned above-average scores for various criteria we asked readers to assess.

By voting, our community has helped us form our guide to the very best financial products. These are the products and companies that you think stand out from the crowd.

Kiplinger Readers' Choice Awards: Travel Rewards Credit Cards

These cards provide the greatest value to frequent travelers, who can redeem points or miles for flights, hotel reservations, car rentals and more. Some come with perks such as rental car insurance and access to airport lounges. Readers judged travel rewards credit cards on the strength of customer service, how likely they would be to recommend the card to others and how satisfied they are overall with the card.

OVERALL WINNER: Capital One Venture X

Outstanding for:

- Customer service

- Most recommended

- Overall satisfaction

This card handily beats the competition for delivering many of the benefits you would expect from a premium travel card but with a relatively low annual fee of $395. “The annual fee pays for itself if you do almost any travel,” wrote one reader.

Earn 10 miles per dollar spent on hotels and rental cars booked through Capital One Travel , five miles per dollar for flights reserved through Capital One Travel, and two miles per dollar on all other spending. Cardholders also get a $300 annual credit toward travel bookings through Capital One, a bonus of 10,000 miles on each yearly account anniversary, reimbursement of the application fee for expedited airport security screening with Global Entry or TSA PreCheck, and free access to three lounge networks: Capital One’s airport lounges, Priority Pass and Plaza Premium.

Chase Sapphire Preferred

This travel card wins honors for each aspect readers judged. One respondent wrote that it offers the “best benefits, like primary car rental insurance and travel insurance.”

Chase Sapphire Preferred, which has a $95 annual fee, offers five Chase Ultimate Rewards points per dollar on travel that you purchase through Chase Travel (two points per dollar on other travel spending); three points per dollar on restaurants, online grocery purchases and select streaming services; and one point per dollar on other spending. You can transfer points to the card’s travel transfer partners, including Southwest Airlines Rapid Rewards, United MileagePlus, Marriott Bonvoy and World of Hyatt. Or redeem points for travel bookings through Chase, among other options.

Chase Sapphire Reserve

Chase’s premium credit card, which charges a $550 annual fee, provides benefits including a $300 yearly statement credit for travel purchases, membership with Priority Pass Select for airport lounge access, credit of up to $100 every four years for a Global Entry, TSA PreCheck or NEXUS application fee, and perks such as room upgrades at certain luxury hotels. “This card pays for itself,” one reader says.

Cardholders also get 10 points per dollar spent on hotels and car rentals purchased through Chase’s Ultimate Rewards portal and five points per dollar for flights booked through Chase Travel . These rewards kick in after you’ve spent $300 on travel. You also earn three points per dollar at restaurants and on other travel worldwide. As with Sapphire Preferred, you can transfer points to travel partners or redeem them for travel bookings.

American Express Gold

Earn four points per dollar spent at U.S. supermarkets (on up to $25,000 spent per year; one point per dollar thereafter). Cardholders also earn four points per dollar on dining or food delivery, three points on air travel, and one point on other spending. The most lucrative way to redeem points is for airfare booked through Amex Travel or as transfers to hotel or airline partner programs. The annual fee is $250.

Capital One Venture Rewards

Cardholders, who pay a $95 annual fee, get five miles per dollar on hotels and rental cars booked through Capital One Travel and two miles per dollar on all other spending. Redeem miles for statement credits on travel purchases or travel bookings through Capital One, or transfer miles to partner airline and hotel loyalty programs.

“The website makes it easy to use rewards benefits to cover travel purchases,” one reader says. An additional perk: Reimbursement of the application fee for TSA PreCheck or Global Entry.

The Platinum Card from American Express

Readers especially appreciate this card for its excellent customer service. “You can always talk to a human who can help,” says one respondent. “In 30+ years, I have found that American Express always has my back!” says another.

Frequent travelers can offset the card’s $695 annual fee by taking advantage of its bountiful perks and valuable points structure. Travelers enjoy access to a range of airport lounges, including Amex’s Centurion lounges as well as those in the Airspace, Delta Sky Club, Escape, Plaza Premium and Priority Pass Select networks. “The lounge access is hard to beat,” says one survey respondent.

You get up to $100 in application-fee reimbursement for TSA PreCheck or Global Entry, too. Plus, get yearly credits of up to $200 for incidental fees with one airline you choose, $200 for select hotel bookings through Amex, and $189 for membership with the CLEAR airport security screening program.

Cardholders earn extra points on various purchases, including five Membership Rewards points per dollar for flights booked with airlines or through Amex Travel (on up to $500,000 spent per year) and on prepaid hotel bookings through Amex. Exchanging points for flights booked through Amex or for certain gift cards are among the most favorable redemption options.

- Wealth Managers

- Donor-Advised Funds

- Cash Back Credit Cards

- Airline Rewards Credit Card Programs

- Hotel Rewards Credit Card Programs

- National Banks

- Internet Banks

- Full-Service Brokers

- Tax Software

- Auto Insurance Companies

- Peer-to-Peer Payment Services

- Homeowners Insurance Companies

To continue reading this article please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Ellen writes and edits personal finance stories, especially on credit cards and related products. She also covers the nexus between sustainability and personal finance. She was a manager and sustainability analyst at Calvert Investments for 15 years, focusing on climate change and consumer staples. She served on the sustainability councils of several Fortune 500 companies and led corporate engagements. Before joining Calvert, Ellen was a program officer for Winrock International, managing loans to alternative energy projects in Latin America. She earned a master’s from the U.C. Berkeley in international relations and Latin America.

- Lisa Gerstner Editor, Kiplinger Personal Finance magazine

- Emma Patch Staff Writer, Kiplinger's Personal Finance

A look at how to assess and sell collectibles that you keep, including jewelry, coins, sports memorabilia and more.

By Emma Patch Published 29 May 24

Concerned about RMDs? Worried about outliving your retirement savings? A qualified longevity annuity contract defers some RMDs and guarantees lifetime income.

By Ken Nuss Published 29 May 24

Kiplinger Readers' Choice Awards The results are in for the 2024 Kiplinger Readers’ Choice Awards — celebrating the best products and services in personal finance.

By Lisa Gerstner Published 28 May 24

Kiplinger Readers' Choice Awards The winners of the Kiplinger Readers’ Choice Awards' best peer-to-peer payment services category. Our awards celebrate the very best products and services in personal finance.

By Ellen Kennedy Published 28 May 24

Kiplinger Readers' Choice Awards These are the winners of the Kiplinger Readers’ Choice Awards' best full-service brokers category. Our awards celebrate the very best products and services in personal finance.

By Emma Patch Published 28 May 24

Kiplinger Readers' Choice Awards The results of the Kiplinger Readers’ Choice Awards' best tax software category. Our awards celebrate the very best products and services in personal finance.

Kiplinger Readers' Choice Awards The results of the Kiplinger Readers’ Choice Awards' best homeowners insurance company category. Our awards celebrate the very best products and services in personal finance.

Kiplinger Readers' Choice Awards The results of the Kiplinger Readers’ Choice Awards' best auto insurance company category. Our awards celebrate the very best products and services in personal finance.

Kiplinger Readers' Choice Awards The Kiplinger Readers’ Choice Awards celebrate the best products and services in personal finance.

Kiplinger Readers' Choice Awards The winners of the Kiplinger Readers’ Choice Awards' best internet banks category. Our awards celebrate the very best products and services in personal finance.

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

Southwest Airlines Community

- Discussion Forum

- Travel Policies

- Travel Funds

- Subscribe to RSS Feed

- Mark Post as New

- Mark Post as Read

- Float this Post for Current User

- Printer Friendly Page

06-15-2020 04:33 PM

- Mark as New

- Get Direct Link

- Report Inappropriate Content

Solved! Go to Solution.

- Back to Board

- Previous Post

06-15-2020 05:13 PM - edited 06-15-2020 06:20 PM

06-15-2020 11:45 PM

06-16-2020 06:57 PM

06-17-2020 12:16 AM

06-18-2020 02:50 PM

06-18-2020 04:15 PM

06-19-2020 01:41 AM

06-18-2020 04:41 PM - edited 06-18-2020 06:02 PM

06-18-2020 11:55 PM - edited 06-18-2020 11:55 PM

- « Previous

- Next »

A Guide to Navigate Southwest Cancellations

Re: cancelling a wanna get away plus reservation, cancellation woes, viva las vegas las vegas ranks most popular 2024 destination for gen z, survey finds, using different pay options, quick links, community champions.

Customer Service | FAQ

Save big on travel each week. Sign up

Connect with us

Discussion Forum and Stories

About Southwest

- Investor Relations

- Southwest Citizenship

- Southwest ® The Magazine

- Advertise with Southwest

- Supplier Information

Flying Southwest

- Why Fly Southwest?

- International Travel

- Airport Information

- Popular Routes

- Tarmac Delay Plan

- Contract of Carriage

- Flight Schedules

Southwest Products

- EarlyBird Check-in ®

- Business Select ®

- Southwest ® gift card

- Southwest Vacations

- WiFi & Inflight Entertainment

- Corporate Travel & Groups

- Charter Services

- Southwest ® The Store

Customer Service

- Customer Commitments

- Baggage Policies

- Special Assistance

- Customers of Size

- Traveling with Infants

- Traveling with Pets

- Purchasing & Refunds

- Lost and Found

Indicates external site which may or may not meet accessibility guidelines.

© 2019 Southwest Airlines Co. All Rights Reserved. Use of the Southwest websites and our Company Information constitutes acceptance of our Terms and Conditions . Privacy Policy

All prices displayed on this web page are in dollars of the United States of America.

- Southwest Airlines Business Travel logo and link Southwest Corporate Travel

- Southwest Airlines Cargo logo logo and link Southwest Cargo

How Southwest Business Is Simplifying Corporate Air Travel Management

Southwest Business + Skift

May 29th, 2024 at 10:00 AM EDT

As business travel approaches pre-pandemic levels, Southwest Business is streamlining corporate air travel management. By enhancing booking systems, introducing a self-service portal, and maintaining dedicated support, Southwest aims to ensure flexibility and efficiency for travel managers and travelers alike.

Southwest Business

This sponsored content was created in collaboration with a Skift partner.

Business travel is back — well, almost. According to Skift Research , business travel will reach 95 percent of its pre-pandemic levels by the end of 2024. This resurgence marks a significant recovery for corporate travel, which had been lagging behind leisure travel.

In this resurgent landscape, travel managers have become more critical than ever in streamlining the air booking process, ensuring it aligns with company policies while seeking solutions that simplify management tasks and maintain compliance.

Southwest Airlines has continued to expand its services within the business travel sector to help travel managers achieve their goals, offering enhanced capabilities to book, modify, and manage flights through multiple distribution channels, including global distribution systems (GDS), direct connect application programming interfaces (API), and its own proprietary booking platform, SWABIZ.

“Anticipating the growth in business travel this year allowed us to move forward with many key enhancements to enable travel managers to manage their Southwest travel programs better,” said Ryan Green, executive vice president and chief commercial officer at Southwest Business. “Our goal is to make business travel simple and easy for everyone involved — and for travel managers, that starts by offering flexible self-service options, customizable programs, and robust tools to simplify program management.”