UN Tourism | Bringing the world closer

Secretary-general’s policy brief on tourism and covid-19, share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism and COVID-19 – unprecedented economic impacts

The Policy Brief provides an overview of the socio-economic impacts from the pandemic on tourism, including on the millions of livelihoods it sustains. It highlights the role tourism plays in advancing the Sustainable Development Goals, including its relationship with environmental goals and culture. The Brief calls on the urgency of mitigating the impacts on livelihoods, especially for women, youth and informal workers.

The crisis is an opportunity to rethink how tourism interacts with our societies, other economic sectors and our natural resources and ecosystems; to measure and manage it better; to ensure a fair distribution of its benefits and to advance the transition towards a carbon neutral and resilient tourism economy.

The brief provides recommendations in five priority areas to cushion the massive impacts on lives and economies and to rebuild a tourism with people at the center. It features examples of governments support to the sector, calls for a reopening that gives priority to the health and safety of the workers, travelers and host communities and provides a roadmap to transform tourism.

- Tourism is one of the world’s major economic sectors. It is the third-largest export category (after fuels and chemicals) and in 2019 accounted for 7% of global trade .

- For some countries, it can represent over 20% of their GDP and, overall, it is the third largest export sector of the global economy.

- Tourism is one of the sectors most affected by the Covid-19 pandemic, impacting economies, livelihoods, public services and opportunities on all continents. All parts of its vast value-chain have been affected.

- Export revenues from tourism could fall by $910 billion to $1.2 trillion in 2020. This will have a wider impact and could reduce global GDP by 1.5% to 2.8% .

- Tourism supports one in 10 jobs and provides livelihoods for many millions more in both developing and developed economies.

- In some Small Island Developing States (SIDS), tourism has accounted for as much as 80% of exports, while it also represents important shares of national economies in both developed and developing countries.

100 to 120 MILLON

direct tourism jobs at risk

Massive Impact on Livelihoods

- As many as 100 million direct tourism jobs are at risk , in addition to sectors associated with tourism such as labour-intensive accommodation and food services industries that provide employment for 144 million workers worldwide. Small businesses (which shoulder 80% of global tourism) are particularly vulnerable.

- Women, who make up 54% of the tourism workforce, youth and workers in the informal economy are among the most at-risk categories.

- No nation will be unaffected. Destinations most reliant on tourism for jobs and economic growth are likely to be hit hardest: SIDS, Least Developed Countries (LDCs) and African countries. In Africa, the sector represented 10% of all exports in 2019.

US$ 910 Billon to US$ 1.2 Trillon

in export from tourism - international visitors' spending

Preserving the Planet -- Mitigating Impacts on Nature and Culture

- The sudden fall in tourism cuts off funding for biodiversity conservation . Some 7% of world tourism relates to wildlife , a segment growing by 3% annually.

- This places jobs at risk and has already led to a rise in poaching, looting and in consumption of bushmeat , partly due to the decreased presence of tourists and staff.

- The impact on biodiversity and ecosystems is particularly critical in SIDS and LDCs. In many African destinations, wildlife accounts for up to 80% of visits, and in many SIDS, tourism revenues enable marine conservation efforts.

- Several examples of community involvement in nature tourism show how communities, including indigenous peoples, have been able to protect their cultural and natural heritage while creating wealth and improve their wellbeing. The impact of COVID-19 on tourism places further pressure on heritage conservation as well as on the cultural and social fabric of communities , particularly for indigenous people and ethnic groups.

- For instance, many intangible cultural heritage practices such as traditional festivals and gatherings have been halted or postponed , and with the closure of markets for handicrafts, products and other goods , indigenous women’s revenues have been particularly impacted.

- 90% of countries have closed World Heritage Sites, with immense socio-economic consequences for communities reliant on tourism. Further, 90% of museums closed and 13% may never reopen.

1.5% to 2.8 of global GDP

Five priorities for tourism’s restart.

The COVID-19 crisis is a watershed moment to align the effort of sustaining livelihoods dependent on tourism to the SDGs and ensuring a more resilient, inclusive, carbon neutral, and resource efficient future.

A roadmap to transform tourism needs to address five priority areas:

- Mitigate socio-economic impacts on livelihoods , particularly women’s employment and economic security.

- Boost competitiveness and build resilience , including through economic diversification, with promotion of domestic and regional tourism where possible, and facilitation of conducive business environment for micro, small and medium-sized enterprises (MSMEs).

- Advance innovation and digital transformation of tourism , including promotion of innovation and investment in digital skills, particularly for workers temporarily without jobs and for job seekers.

- Foster sustainability and green growth to shift towards a resilient, competitive, resource efficient and carbon-neutral tourism sector. Green investments for recovery could target protected areas, renewable energy, smart buildings and the circular economy, among other opportunities.

- Coordination and partnerships to restart and transform sector towards achieving SDGs , ensuring tourism’s restart and recovery puts people first and work together to ease and lift travel restrictions in a responsible and coordinated manner.

a lifelive for

SIDS, LDCs and many AFRICAN COUNTRIES

tourism represents over 30% of exports for the majority of SIDS and 80% for some

Moving Ahead Together

- As countries gradually lift travel restrictions and tourism slowly restarts in many parts of the world, health must continue to be a priority and coordinated heath protocols that protect workers, communities and travellers, while supporting companies and workers, must be firmly in place.

- Only through collective action and international cooperation will we be able to transform tourism, advance its contribution to the 2030 Agenda and its shift towards an inclusive and carbon neutral sector that harnesses innovation and digitalization, embraces local values and communities and creates decent job opportunities for all, leaving no one behind. We are stronger together.

RESOURCES FOR CONSEVATION

of natural and cultural heritage

Related links

- Policy Brief: Tourism and COVID-19

- The Impact of COVID-19 on Tourism

- António Guterres - Video

This is the impact of COVID-19 on the travel sector

A full recovery of the global tourism sector isn't expected until 2024. Image: UNSPLASH/Eva Darron

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} COVID-19 is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:.

- The tourism sector is one of the worst affected by the impacts of COVID-19.

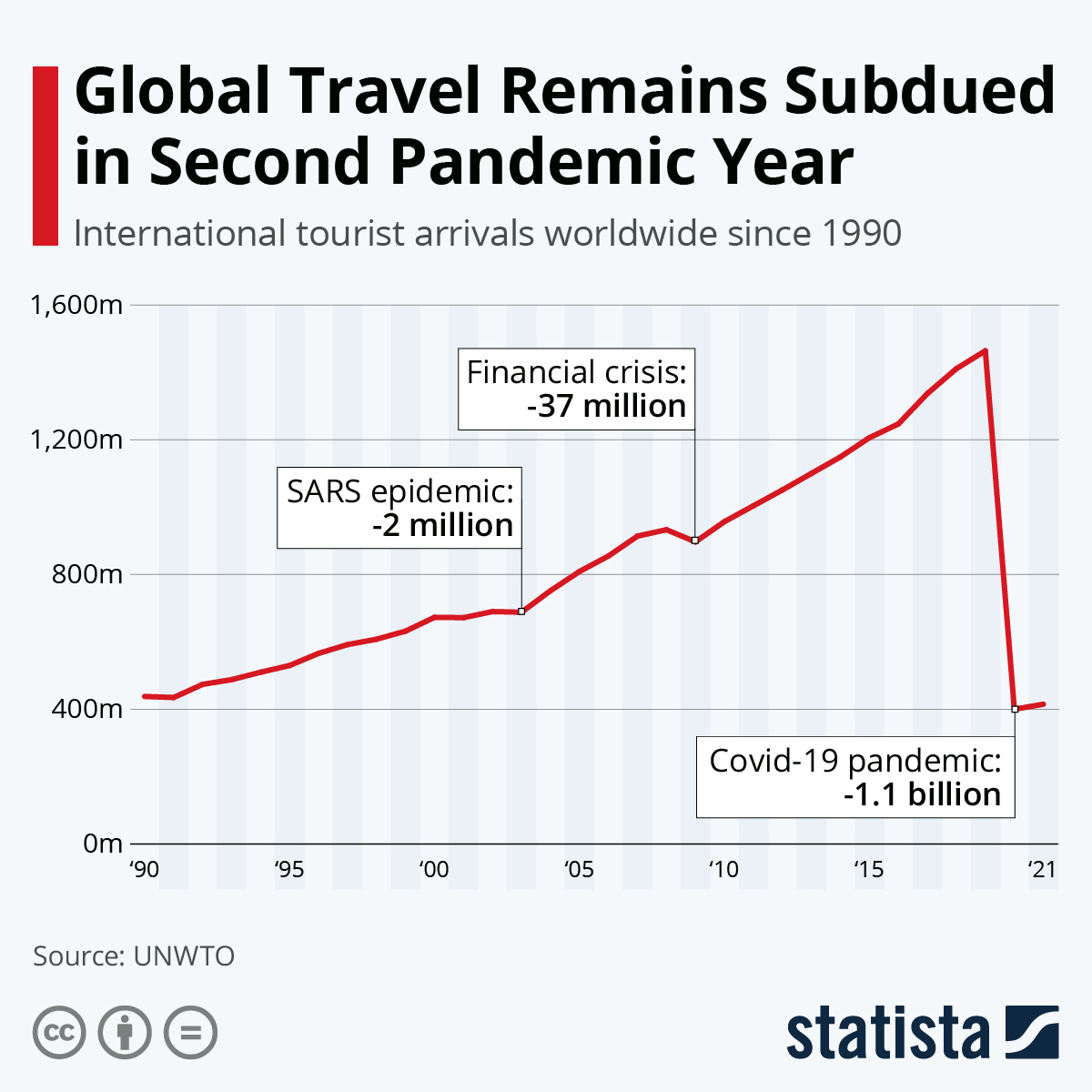

- International arrivals have increased by just 4% in the second year of the pandemic; with 1 billion fewer arrivals when compared to pre-pandemic levels.

- 63% of experts from the World Tourism Organization (UNWTO) believe the sector won't fully recover until 2024.

While few industries have been spared by the impact of the COVID-19 pandemic, even fewer have been hit as hard as the tourism sector . As 2021 drew to a close with severe limitations to travel still in place, the World Tourism Organization (UNWTO) reported that international tourist arrivals increased by just 4 percent last year, remaining 72 percent below 2019 levels. That equates to more than 1 billion fewer international arrivals compared to pre-pandemic levels, keeping the industry at levels last seen in the late 1980s.

Prior to the coronavirus outbreak, the global tourism sector had seen almost uninterrupted growth for decades. Since 1980, the number of international arrivals skyrocketed from 277 million to nearly 1.5 billion in 2019. As our chart shows, the two largest crises of the past decades, the SARS epidemic of 2003 and the global financial crisis of 2009, were minor bumps in the road compared to the COVID-19 pandemic.

Looking ahead, most experts no longer expect a full recovery until until 2024 or later. While the UNWTO Panel of Experts is confident to see an uptick in travel activity this year, just 4 percent of the surveyed experts expect a full recovery in 2022. Roughly one third of respondents believe that international arrivals will return to pre-pandemic levels in 2023, while 63 percent think it will take even longer than that. UNWTO scenarios predict that international tourist arrivals could grow between 30 and 78 percent in 2022 compared to 2021. While that sounds like a significant improvement, it would still be more than 50 percent below pre-pandemic levels.

Have you read?

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} business travel won’t be more sustainable post-covid unless companies take action, a travel boom is looming. but is the industry ready, how virtual tourism can rebuild travel for a post-pandemic world, don't miss any update on this topic.

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Health and Healthcare Systems .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

How midwife mentors are making it safer for women to give birth in remote, fragile areas

Anna Cecilia Frellsen

May 9, 2024

From Athens to Dhaka: how chief heat officers are battling the heat

Angeli Mehta

May 8, 2024

How a pair of reading glasses could increase your income

Emma Charlton

Nigeria is rolling out Men5CV, a ‘revolutionary’ meningitis vaccine

5 conditions that highlight the women’s health gap

Kate Whiting

May 3, 2024

How philanthropy is empowering India's mental health sector

Kiran Mazumdar-Shaw

May 2, 2024

- Share full article

Advertisement

Supported by

A Year Without Travel

How Bad Was 2020 for Tourism? Look at the Numbers.

The dramatic effects of the coronavirus pandemic on the travel industry and beyond are made clear in six charts.

By Stephen Hiltner and Lalena Fisher

Numbers alone cannot capture the scope of the losses that have mounted in the wake of the coronavirus pandemic. Data sets are crude tools for plumbing the depth of human suffering , or the immensity of our collective grief .

But numbers can help us comprehend the scale of certain losses — particularly in the travel industry , which in 2020 experienced a staggering collapse.

Around the world, international arrivals are estimated to have dropped to 381 million in 2020, down from 1.461 billion in 2019 — a 74 percent decline . In countries whose economies are heavily reliant on tourism , the precipitous drop in visitors was, and remains, devastating.

According to recent figures from the United Nations World Tourism Organization, the decline in international travel in 2020 resulted in an estimated loss of $1.3 trillion in global export revenues. As the agency notes, this figure is more than 11 times the loss that occurred in 2009 as a result of the global economic crisis.

The following charts — which address changes in international arrivals, emissions, air travel, the cruise industry and car travel — offer a broad overview of the effects of the coronavirus pandemic within the travel industry and beyond.

International arrivals in tourism-dependent economies

Macau, a top gambling destination, is highly dependent on travelers, as measured by the share

of its G.D.P. that is generated by tourism. Its international visitor numbers plummeted in 2020:

ARRIVALS IN 2020

The following countries are also among the world’s most dependent on travel, in terms of both their

G.D.P. and their international tourism receipts as a percent of total exports:

U.S. Virgin Islands

The Bahamas

Antigua and Barbuda

Saint Lucia

Cook Islands

0.5 million

Macau, a gambling destination, is dependent on travelers,

as measured by the share of its G.D.P. that is generated by

tourism. Its international visitor numbers plummeted in 2020:

The following countries are also among the world’s most

dependent on travel, in terms of both their G.D.P. and their

international tourism receipts as a percent of total exports:

Before the pandemic, tourism accounted for one out of every 10 jobs around the world. In many places, though, travel plays an even greater role in the local economy.

Consider the Maldives, where in recent years international tourism has accounted for around two-thirds of the country’s G.D.P. , when considering direct and indirect contributions.

As lockdowns fell into place worldwide, international arrivals in the Maldives plunged; from April through September of 2020, they were down 97 percent compared to the same period in 2019. Throughout all of 2020, arrivals were down by more than 67 percent compared with 2019. (Arrival numbers slowly improved after the country reopened in July; the government, eager to promote tourism and mitigate losses, lured travelers with marketing campaigns and even courted influencers with paid junkets .)

Similar developments played out in places such as Macau, Aruba and the Bahamas: shutdowns in February and March, followed by incremental increases later in the year.

The economic effect of travel-related declines has been stunning. In Macau, for example, the G.D.P. contracted by more than 50 percent in 2020.

And the effects could be long-lasting; in some areas, travel is not expected to return to pre-pandemic levels until 2024.

Travelers passing through T.S.A. airport security checkpoints

The pandemic upended commercial aviation. One way to visualize the effect of lockdowns on air travel is to consider the number of passengers screened on a daily basis at Transportation Security Administration checkpoints.

Traveler screenings plunged in March before hitting a low point on April 14, when 87,534 passengers were screened — a 96 percent decline as compared with the same date in 2019.

Numbers have risen relatively steadily since then, though today the screening figures still sit at less than half of what they were a year earlier.

According to the International Air Transport Association, an airline trade group, global passenger traffic in 2020 fell by 65.9 percent as compared to 2019, the largest year-on-year decline in aviation history.

Daily carbon dioxide emissions from aviation

3.0 million metric tons

Another way to visualize the drop-off in air travel last year is to consider the amount of carbon dioxide (CO2) emitted by aircraft around the world.

According to figures from Carbon Monitor , an international initiative that provides estimates of daily CO2 emissions, worldwide emissions from aviation fell by nearly 50 percent last year — to around 500 million metric tons of CO2, down from around 1 billion metric tons in 2019. (Those numbers are expected to rebound, though the timing will depend largely on how long corporate and international travel remain sidelined .)

All told, CO2 emissions from fossil fuels dropped by 2.6 billion metric tons in 2020, a 7 percent reduction from 2019, driven in large part by transportation declines.

Yearly revenues of three of the biggest cruise lines

$20 billion

ROYAL CARIBBEAN

Few industries played as central and public a role in the early months of the coronavirus pandemic as did the major cruise lines — beginning with the outbreak aboard the Diamond Princess .

In a scathing rebuke of the industry issued in July, the Centers for Disease Control and Prevention blamed cruise companies for widespread transmission of the virus, pointing to 99 outbreaks aboard 123 cruise ships in U.S. waters alone.

While precise passenger data for 2020 is not yet available, the publicly disclosed revenues — which include ticket sales and onboard purchases — from three of the largest cruise lines offer a dramatic narrative: strong revenues in the early months of 2020, followed by a steep decline.

Third-quarter revenues for Carnival Corporation, the industry’s biggest player, showed a year-to-year decline of 99.5 percent — to $31 million in 2020, down from $6.5 billion in 2019.

The outlook remains bleak for the early months of 2021: For now, most cruise lines have canceled all sailings into May or June.

Long-distance car travel, before and during the pandemic

Driving trips at least 50 miles from home, with stays of two hours or more, based on a daily index from

mobile location data.

Trips at least 50 miles from home, with stays of two hours

or more, based on a daily index from mobile location data.

Air travel, both international and domestic, was markedly curtailed by the pandemic. But how was car travel affected?

One way to measure the change is to look at the Daily Travel Index compiled by Arrivalist , a company that uses mobile location data to measure consumer road trips of 50 miles or more in all 50 U.S. states.

The figures tell the story of a rebound that’s slightly stronger than that of air travel: a sharp drop in March and April, as state and local restrictions fell into place , followed by a gradual rise to around 80 percent of 2019 levels.

Difference in visits to four popular national parks, 2019 to 2020

1.0 MILLION

GREAT SMOKY

GRAND CANYON

CUYAHOGA VALLEY

YELLOWSTONE

1.0 million

Another way to consider car travel in 2020 — and domestic travel in the U.S. more broadly — is to look at the visitation numbers for America’s national parks.

Over all, national park visitation decreased by 28 percent in 2020 — to 237 million visitors, down from 327.5 million in 2019, largely because of temporary park closures and pandemic-related capacity restrictions.

The caveat, though, is that several parks saw record numbers of visitors in the second half of the year, as a wave of travel-starved tourists began looking for safe and responsible forms of recreation.

Consider the figures for recreational visits at Yellowstone National Park. After a shutdown in April, monthly visitation at the park quickly rose above 2019 levels. The months of September and October of 2020 were both the busiest on record, with numbers in October surpassing the previous monthly record by 43 percent .

Some national parks located near cities served as convenient recreational escapes throughout the pandemic. At Cuyahoga Valley National Park, 2020 numbers exceeded 2019 numbers from March through December. At Great Smoky Mountains National Park, numbers surged after a 46-day closure in the spring and partial closures through August; between June and December, the park saw one million additional visits compared to the same time period in 2019.

Stephen Hiltner is an editor on the Travel desk. You can follow his work on Instagram and Twitter . More about Stephen Hiltner

Come Sail Away

Love them or hate them, cruises can provide a unique perspective on travel..

Cruise Ship Surprises: Here are five unexpected features on ships , some of which you hopefully won’t discover on your own.

Icon of the Seas: Our reporter joined thousands of passengers on the inaugural sailing of Royal Caribbean’s Icon of the Seas . The most surprising thing she found? Some actual peace and quiet .

Th ree-Year Cruise, Unraveled: The Life at Sea cruise was supposed to be the ultimate bucket-list experience : 382 port calls over 1,095 days. Here’s why those who signed up are seeking fraud charges instead.

TikTok’s Favorite New ‘Reality Show’: People on social media have turned the unwitting passengers of a nine-month world cruise into “cast members” overnight.

Dipping Their Toes: Younger generations of travelers are venturing onto ships for the first time . Many are saving money.

Cult Cruisers: These devoted cruise fanatics, most of them retirees, have one main goal: to almost never touch dry land .

Reimagining the $9 trillion tourism economy—what will it take?

Tourism made up 10 percent of global GDP in 2019 and was worth almost $9 trillion, 1 See “Economic impact reports,” World Travel & Tourism Council (WTTC), wttc.org. making the sector nearly three times larger than agriculture. However, the tourism value chain of suppliers and intermediaries has always been fragmented, with limited coordination among the small and medium-size enterprises (SMEs) that make up a large portion of the sector. Governments have generally played a limited role in the industry, with partial oversight and light-touch management.

COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024. This puts as many as 120 million jobs at risk. 2 “International tourist numbers could fall 60-80% in 2020, UNWTO reports,” World Tourism Organization, May 7, 2020, unwto.org.

Reopening tourism-related businesses and managing their recovery in a way that is safe, attractive for tourists, and economically viable will require coordination at a level not seen before. The public sector may be best placed to oversee this process in the context of the fragmented SME ecosystem, large state-owned enterprises controlling entry points, and the increasing impact of health-related agencies. As borders start reopening and interest in leisure rebounds in some regions , governments could take the opportunity to rethink their role within tourism, thereby potentially both assisting in the sector’s recovery and strengthening it in the long term.

In this article, we suggest four ways in which governments can reimagine their role in the tourism sector in the context of COVID-19.

1. Streamlining public–private interfaces through a tourism nerve center

Before COVID-19, most tourism ministries and authorities focused on destination marketing, industry promotions, and research. Many are now dealing with a raft of new regulations, stimulus programs, and protocols. They are also dealing with uncertainty around demand forecasting, and the decisions they make around which assets—such as airports—to reopen will have a major impact on the safety of tourists and sector employees.

Coordination between the public and private sectors in tourism was already complex prior to COVID-19. In the United Kingdom, for example, tourism falls within the remit of two departments—the Department for Business, Energy, and Industrial Strategy (BEIS) and the Department for Digital, Culture, Media & Sport (DCMS)—which interact with other government agencies and the private sector at several points. Complex coordination structures often make clarity and consistency difficult. These issues are exacerbated by the degree of coordination that will be required by the tourism sector in the aftermath of the crisis, both across government agencies (for example, between the ministries responsible for transport, tourism, and health), and between the government and private-sector players (such as for implementing protocols, syncing financial aid, and reopening assets).

Concentrating crucial leadership into a central nerve center is a crisis management response many organizations have deployed in similar situations. Tourism nerve centers, which bring together public, private, and semi-private players into project teams to address five themes, could provide an active collaboration framework that is particularly suited to the diverse stakeholders within the tourism sector (Exhibit 1).

We analyzed stimulus packages across 24 economies, 3 Australia, Bahrain, Belgium, Canada, Egypt, Finland, France, Germany, Hong Kong, Indonesia, Israel, Italy, Kenya, Malaysia, New Zealand, Peru, Philippines, Singapore, South Africa, South Korea, Spain, Switzerland, Thailand, and the United Kingdom. which totaled nearly $100 billion in funds dedicated directly to the tourism sector, and close to $300 billion including cross-sector packages with a heavy tourism footprint. This stimulus was generally provided by multiple entities and government departments, and few countries had a single integrated view on beneficiaries and losers. We conducted surveys on how effective the public-sector response has been and found that two-thirds of tourism players were either unaware of the measures taken by government or felt they did not have sufficient impact. Given uncertainty about the timing and speed of the tourism recovery, obtaining quick feedback and redeploying funds will be critical to ensuring that stimulus packages have maximum impact.

2. Experimenting with new financing mechanisms

Most of the $100 billion stimulus that we analyzed was structured as grants, debt relief, and aid to SMEs and airlines. New Zealand has offered an NZ $15,000 (US $10,000) grant per SME to cover wages, for example, while Singapore has instituted an 8 percent cash grant on the gross monthly wages of local employees. Japan has waived the debt of small companies where income dropped more than 20 percent. In Germany, companies can use state-sponsored work-sharing schemes for up to six months, and the government provides an income replacement rate of 60 percent.

Our forecasts indicate that it will take four to seven years for tourism demand to return to 2019 levels, which means that overcapacity will be the new normal in the medium term. This prolonged period of low demand means that the way tourism is financed needs to change. The aforementioned types of policies are expensive and will be difficult for governments to sustain over multiple years. They also might not go far enough. A recent Organisation for Economic Co-operation and Development (OECD) survey of SMEs in the tourism sector suggested more than half would not survive the next few months, and the failure of businesses on anything like this scale would put the recovery far behind even the most conservative forecasts. 4 See Tourism policy responses to the coronavirus (COVID-19), OECD, June 2020, oecd.org. Governments and the private sector should be investigating new, innovative financing measures.

Revenue-pooling structures for hotels

One option would be the creation of revenue-pooling structures, which could help asset owners and operators, especially SMEs, to manage variable costs and losses moving forward. Hotels competing for the same segment in the same district, such as a beach strip, could have an incentive to pool revenues and losses while operating at reduced capacity. Instead of having all hotels operating at 20 to 40 percent occupancy, a subset of hotels could operate at a higher occupancy rate and share the revenue with the remainder. This would allow hotels to optimize variable costs and reduce the need for government stimulus. Non-operating hotels could channel stimulus funds into refurbishments or other investment, which would boost the destination’s attractiveness. Governments will need to be the intermediary between businesses through auditing or escrow accounts in this model.

Joint equity funds for small and medium-size enterprises

Government-backed equity funds could also be used to deploy private capital to help ensure that tourism-related SMEs survive the crisis (Exhibit 2). This principle underpins the European Commission’s temporary framework for recapitalization of state-aided enterprises, which provided an estimated €1.9 trillion in aid to the EU economy between March and May 2020. 5 See “State aid: Commission expands temporary framework to recapitalisation and subordinated debt measures to further support the economy in the context of the coronavirus outbreak,” European Commission, May 8, 2020, ec.europa.eu. Applying such a mechanism to SMEs would require creating an appropriate equity-holding structure, or securitizing equity stakes in multiple SMEs at once, reducing the overall risk profile for the investor. In addition, developing a standardized valuation methodology would avoid lengthy due diligence processes on each asset. Governments that do not have the resources to co-invest could limit their role to setting up those structures and opening them to potential private investors.

3. Ensuring transparent, consistent communication on protocols

The return of tourism demand requires that travelers and tourism-sector employees feel—and are—safe. Although international organizations such as the International Air Transport Association (IATA), and the World Travel & Tourism Council (WTTC) have developed a set of guidelines to serve as a baseline, local regulators are layering additional measures on top. This leads to low levels of harmonization regarding regulations imposed by local governments.

Our surveys of traveler confidence in the United States suggests anxiety remains high, and authorities and destination managers must work to ensure travelers know about, and feel reassured by, protocols put in place for their protection. Our latest survey of traveler sentiment in China suggests a significant gap between how confident travelers would like to feel and how confident they actually feel; actual confidence in safety is much lower than the expected level asked a month before.

One reason for this low level of confidence is confusion over the safety measures that are currently in place. Communication is therefore key to bolstering demand. Experience in Europe indicates that prompt, transparent, consistent communications from public agencies have had a similar impact on traveler demand as CEO announcements have on stock prices. Clear, credible announcements regarding the removal of travel restrictions have already led to increased air-travel searches and bookings. In the week that governments announced the removal of travel bans to a number of European summer destinations, for example, outbound air travel web search volumes recently exceeded precrisis levels by more than 20 percent in some countries.

The case of Greece helps illustrate the importance of clear and consistent communication. Greece was one of the first EU countries to announce the date of, and conditions and protocols for, border reopening. Since that announcement, Greece’s disease incidence has remained steady and there have been no changes to the announced protocols. The result: our joint research with trivago shows that Greece is now among the top five summer destinations for German travelers for the first time. In July and August, Greece will reach inbound airline ticketing levels that are approximately 50 percent of that achieved in the same period last year. This exceeds the rate in most other European summer destinations, including Croatia (35 percent), Portugal (around 30 percent), and Spain (around 40 percent). 6 Based on IATA Air Travel Pulse by McKinsey. In contrast, some destinations that have had inconsistent communications around the time frame of reopening have shown net cancellations of flights for June and July. Even for the high seasons toward the end of the year, inbound air travel ticketing barely reaches 30 percent of 2019 volumes.

Digital solutions can be an effective tool to bridge communication and to create consistency on protocols between governments and the private sector. In China, the health QR code system, which reflects past travel history and contact with infected people, is being widely used during the reopening stage. Travelers have to show their green, government-issued QR code before entering airports, hotels, and attractions. The code is also required for preflight check-in and, at certain destination airports, after landing.

4. Enabling a digital and analytics transformation within the tourism sector

Data sources and forecasts have shifted, and proliferated, in the crisis. Last year’s demand prediction models are no longer relevant, leaving many destinations struggling to understand how demand will evolve, and therefore how to manage supply. Uncertainty over the speed and shape of the recovery means that segmentation and marketing budgets, historically reassessed every few years, now need to be updated every few months. The tourism sector needs to undergo an analytics transformation to enable the coordination of marketing budgets, sector promotions, and calendars of events, and to ensure that products are marketed to the right population segment at the right time.

Governments have an opportunity to reimagine their roles in providing data infrastructure and capabilities to the tourism sector, and to investigate new and innovative operating models. This was already underway in some destinations before COVID-19. Singapore, for example, made heavy investments in its data and analytics stack over the past decade through the Singapore Tourism Analytics Network (STAN), which provided tourism players with visitor arrival statistics, passenger profiling, spending data, revenue data, and extensive customer-experience surveys. During the COVID-19 pandemic, real-time data on leading travel indicators and “nowcasts” (forecasts for the coming weeks and months) could be invaluable to inform the decisions of both public-sector and private-sector entities.

This analytics transformation will also help to address the digital gap that was evident in tourism even before the crisis. Digital services are vital for travelers: in 2019, more than 40 percent of US travelers used mobile devices to book their trips. 7 Global Digital Traveler Research 2019, Travelport, marketing.cloud.travelport.com; “Mobile travel trends 2019 in the words of industry experts,” blog entry by David MacHale, December 11, 2018, blog.digital.travelport.com. In Europe and the United States, as many as 60 percent of travel bookings are digital, and online travel agents can have a market share as high as 50 percent, particularly for smaller independent hotels. 8 Sean O’Neill, “Coronavirus upheaval prompts independent hotels to look at management company startups,” Skift, May 11, 2020, skift.com. COVID-19 is likely to accelerate the shift to digital as travelers look for flexibility and booking lead times shorten: more than 90 percent of recent trips in China were booked within seven days of the trip itself. Many tourism businesses have struggled to keep pace with changing consumer preferences around digital. In particular, many tourism SMEs have not been fully able to integrate new digital capabilities in the way that larger businesses have, with barriers including language issues, and low levels of digital fluency. The commission rates on existing platforms, which range from 10 percent for larger hotel brands to 25 percent for independent hotels, also make it difficult for SMEs to compete in the digital space.

Governments are well-positioned to overcome the digital gap within the sector and to level the playing field for SMEs. The Tourism Exchange Australia (TXA) platform, which was created by the Australian government, is an example of enabling at scale. It acts as a matchmaker, connecting suppliers with distributors and intermediaries to create packages attractive to a specific segment of tourists, then uses tourist engagement to provide further analytical insights to travel intermediaries (Exhibit 3). This mechanism allows online travel agents to diversify their offerings by providing more experiences away from the beaten track, which both adds to Australia’s destination attractiveness, and gives small suppliers better access to customers.

Governments that seize the opportunity to reimagine tourism operations and oversight will be well positioned to steer their national tourism industries safely into—and set them up to thrive within—the next normal.

Download the article in Arabic (513KB)

Margaux Constantin is an associate partner in McKinsey’s Dubai office, Steve Saxon is a partner in the Shanghai office, and Jackey Yu is an associate partner in the Hong Kong office.

The authors wish to thank Hugo Espirito Santo, Urs Binggeli, Jonathan Steinbach, Yassir Zouaoui, Rebecca Stone, and Ninan Chacko for their contributions to this article.

Explore a career with us

Related articles.

Make it better, not just safer: The opportunity to reinvent travel

Hospitality and COVID-19: How long until ‘no vacancy’ for US hotels?

A new approach in tracking travel demand

The COVID-19 travel shock hit tourism-dependent economies hard

- Download the paper here

Subscribe to the Hutchins Roundup and Newsletter

Gian maria milesi-ferretti gian maria milesi-ferretti senior fellow - economic studies , the hutchins center on fiscal and monetary policy.

August 12, 2021

The COVID crisis has led to a collapse in international travel. According to the World Tourism Organization , international tourist arrivals declined globally by 73 percent in 2020, with 1 billion fewer travelers compared to 2019, putting in jeopardy between 100 and 120 million direct tourism jobs. This has led to massive losses in international revenues for tourism-dependent economies: specifically, a collapse in exports of travel services (money spent by nonresident visitors in a country) and a decline in exports of transport services (such as airline revenues from tickets sold to nonresidents).

This “travel shock” is continuing in 2021, as restrictions to international travel persist—tourist arrivals for January-May 2021 are down a further 65 percent from the same period in 2020, and there is substantial uncertainty on the nature and timing of a tourism recovery.

We study the economic impact of the international travel shock during 2020, particularly the severity of the hit to countries very dependent on tourism. Our main result is that on a cross-country basis, the share of tourism activities in GDP is the single most important predictor of the growth shortfall in 2020 triggered by the COVID-19 crisis (relative to pre-pandemic IMF forecasts), even when compared to measures of the severity of the pandemic. For instance, Grenada and Macao had very few recorded COVID cases in relation to their population size and no COVID-related deaths in 2020—yet their GDP contracted by 13 percent and 56 percent, respectively.

International tourism destinations and tourism sources

Countries that rely heavily on tourism, and in particular international travelers, tend to be small, have GDP per capita in the middle-income and high-income range, and are preponderately net debtors. Many are small island economies—Jamaica and St. Lucia in the Caribbean, Cyprus and Malta in the Mediterranean, the Maldives and Seychelles in the Indian Ocean, or Fiji and Samoa in the Pacific. Prior to the COVID pandemic, median annual net revenues from international tourism (spending by foreign tourists in the country minus tourism spending by domestic residents overseas) in these island economies were about one quarter of GDP, with peaks around 50 percent of GDP, such as Aruba and the Maldives.

But there are larger economies heavily reliant on international tourism. For instance, in Croatia average net international tourism revenues from 2015-2019 exceeded 15 percent of GDP, 8 percent in the Dominican Republic and Thailand, 7 percent in Greece, and 5 percent in Portugal. The most extreme example is Macao, where net revenues from international travel and tourism were around 68 percent of GDP during 2015-19. Even in dollar terms, Macao’s net revenues from tourism were the fourth highest in the world, after the U.S., Spain, and Thailand.

In contrast, for countries that are net importers of travel and tourism services—that is, countries whose residents travel widely abroad relative to foreign travelers visiting the country—the importance of such spending is generally much smaller as a share of GDP. In absolute terms, the largest importer of travel services is China (over $200 billion, or 1.7 percent of GDP on average during 2015-19), followed by Germany and Russia. The GDP impact for these economies of a sharp reduction in tourism outlays overseas is hence relatively contained, but it can have very large implications on the smaller economies their tourists travel to—a prime example being Macao for Chinese travelers.

How did tourism-dependent economies cope with the disappearance of a large share of their international revenues in 2020? They were forced to borrow more from abroad (technically, their current account deficit widened, or their surplus shrank), but also reduced net international spending in other categories. Imports of goods declined (reflecting both a contraction in domestic demand and a decline in tourism inputs such as imported food and energy) and payments to foreign creditors were lower, reflecting the decline in returns for foreign-owned hotel infrastructure.

The growth shock

We then examine whether countries more dependent on tourism suffered a bigger shock to economic activity in 2020 than other countries, measuring this shock as the difference between growth outcomes in 2020 and IMF growth forecasts as of January 2020, just prior to the pandemic. Our measure of the overall importance of tourism is the share of GDP accounted for by tourism-related activity over the 5 years preceding the pandemic, assembled by the World Travel and Tourism Council and disseminated by the World Bank . This measure takes into account the importance of domestic tourism as well as international tourism.

Among the 40 countries with the largest share of tourism in GDP, the median size of growth shortfall compared to pre-COVID projections was around 11 percent, as against 6 percent for countries less dependent on tourism. For instance, in the tourism-dependent group, Greece, which was expected to grow by 2.3 percent in 2020, shrunk by over 8 percent, while in the other group, Germany, which was expected to grow by around 1 percent, shrunk by 4.8 percent. The scatter plot of Figure 2 provides more striking visual evidence of a negative correlation (-0.72) between tourism dependence and the growth shock in 2020.

Of course, many other factors may have affected differences in performance across economies—for instance, the intensity of the pandemic as well as the stringency of the associated lockdowns. We therefore build a simple statistical model that relates the “growth shock” in 2020 to these factors alongside our tourism variable, and also takes into account other potentially relevant country characteristics, such as the level of development, the composition of output, and country size. The message: the dependence on tourism is a key explanatory variable of the growth shock in 2020. For instance, the analysis suggests that going from the share of tourism in GDP of Canada (around 6 percent) to the one of Mexico (around 16 percent) would reduce growth in 2020 by around 2.5 percentage points. If we instead go from the tourism share of Canada to the one of Jamaica (where the share of tourism in GDP approaches one third), growth would be lower by over 6 percentage points.

Measures of the severity of the pandemic, the intensity of lockdowns, the level of development, and the sectoral composition of GDP (value added accounted for by manufacturing and agriculture) also matter, but quantitatively less so than tourism. And results are not driven by very small economies; tourism is still a key explanatory variable of the 2020 growth shock even if we restrict our sample to large economies. Among tourism-dependent economies, we also find evidence that those relying more heavily on international tourism experienced a more severe hit to economic activity when compared to those relying more on domestic tourism.

Given data availability at the time of writing, the evidence we provided is limited to 2020. The outlook for international tourism in 2021, if anything, is worse, though with increasing vaccine coverage the tide could turn next year. The crisis poses particularly daunting challenges to smaller tourist destinations, given limited possibilities for diversification. In many cases, particularly among emerging and developing economies, these challenges are compounded by high starting levels of domestic and external indebtedness, which can limit the space for an aggressive fiscal response. Helping these countries cope with the challenges posed by the pandemic and restoring viable public and external finances will require support from the international community.

Read the full paper here.

Related Content

February 18, 2021

Eldah Onsomu, Boaz Munga, Violet Nyabaro

July 28, 2021

Célia Belin

May 21, 2021

The author thanks Manuel Alcala Kovalski and Jimena Ruiz Castro for their excellent research assistance.

Economic Studies

The Hutchins Center on Fiscal and Monetary Policy

Tedros Adhanom-Ghebreyesus

May 9, 2024

Robin Brooks

Emily Gustafsson-Wright, Elyse Painter

May 8, 2024

COVID-19 impact on tourism could deal $4 trillion blow to global economy: UN report

Facebook Twitter Print Email

The impact of the COVID-19 pandemic on tourism could result in a more than $4 trillion loss to the global economy, UN trade and development body UNCTAD said on Wednesday in a report issued jointly with the UN World Tourism Organization ( UNWTO ).

The estimate is based on losses caused by the pandemic’s direct impact on tourism and the ripple effect on related sectors, and is worse than previously expected.

𝗕𝗿𝗲𝗮𝗸𝗶𝗻𝗴. @ UNCTAD and @ UNWTO have published an update on the effects of #COVID19’s impact on tourism. The crash in international tourist arrivals since the pandemic started could cost the world economy $4 trillion by the end of 2021. https://t.co/b3NJ4CDTwD pic.twitter.com/FbfiupmRoB UNCTAD UNCTAD

Last July, UNCTAD estimated that the standstill in international tourism would cost the global economy between $1.2 trillion and $3.3 trillion.

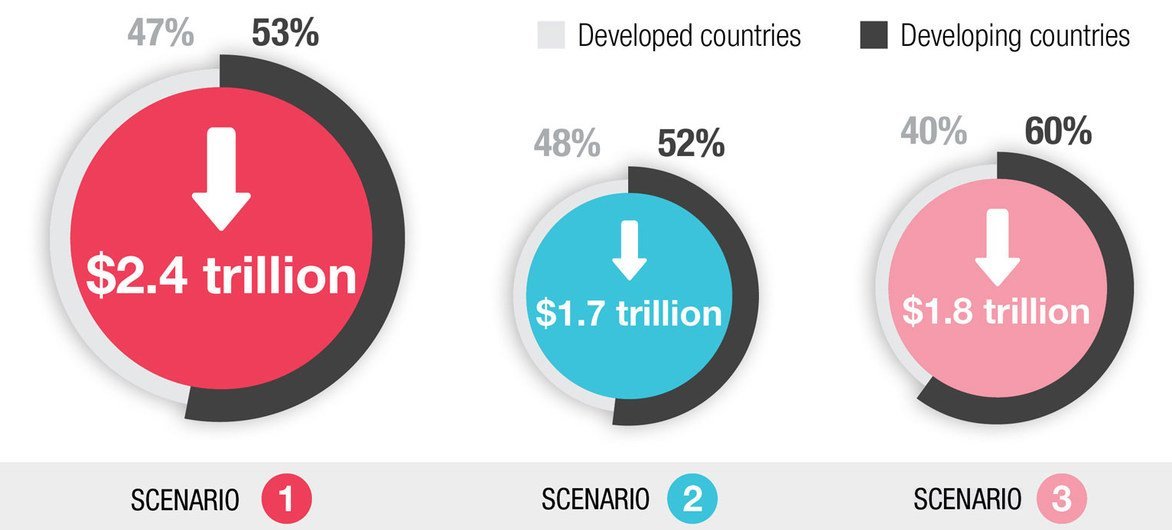

The steep drop in tourist arrivals worldwide in 2020 resulted in a $2.4 trillion economic hit, the report said, and a similar figure is expected this year depending on the uptake in COVID-19 vaccines.

Global vaccination plan crucial

“The world needs a global vaccination effort that will protect workers, mitigate adverse social effects and make strategic decisions regarding tourism, taking potential structural changes into account,” said Isabelle Durant, the UNCTAD Acting Secretary-General.

“Tourism is a lifeline for millions, and advancing vaccination to protect communities and support tourism’s safe restart is critical to the recovery of jobs and generation of much-needed resources, especially in developing countries, many of which are highly dependent on international tourism,” the UNWTO Secretary-General Zurab Pololikashvili added.

Developing countries hit hard

International tourist arrivals declined by about 1 billion, or 73 per cent, last year, while in the first quarter of 2021 the drop was around 88 per cent, the report said.

Developing countries have borne the brunt of the pandemic’s impact on tourism, with estimated reductions in arrivals of between 60 per cent and 80 per cent.

They have also been hurt by vaccine inequity. The agencies said the “asymmetric roll-out” of COVID-19 vaccines has magnified the economic blow to the tourism sector in these nations, as they could account for up to 60 per cent of global GDP losses.

Rebound amid losses

It is expected that tourism will recover faster in countries with high vaccination rates, such as France, Germany, the United Kingdom and the United States.

However, international tourist arrivals will not return to pre-pandemic levels until 2023 or later, due to barriers such as travel restrictions, slow containment of the virus, low traveller confidence and a poor economic environment.

While a tourism rebound is anticipated in the second half of this year, the report expects a loss of between $1.7 trillion and $2.4 trillion in 2021, based on simulations which exclude stimulation programmes and similar policies.

As tourism falls world GDP takes a hit in 2021

Likely outcomes

The authors outline three possible scenarios for the tourism sector this year, with the most pessimistic reflecting a 75 per cent reduction in international arrivals.

This scenario sees a drop in global tourist receipts of nearly $950 billion, which would cause a loss in real GDP of $2.4 trillion, while the second reflects a 63 per cent reduction in international tourist arrivals.

The third considers varying rates of domestic and regional tourism. It assumes a 75 per cent reduction in tourism in countries where vaccine rates are low, and 37 per cent reduction in countries with relatively high vaccination levels, mainly developed countries and some smaller economies.

National Geographic content straight to your inbox—sign up for our popular newsletters here

- CORONAVIRUS COVERAGE

How hard will the coronavirus hit the travel industry?

The COVID-19 pandemic brings travel to a standstill, causing massive job and revenue losses. Will there be light at the end of the tunnel?

A nearly empty American Airlines flight prepares for takeoff March 18, 2020. Airlines, along with the rest of the travel industry, are facing an uncertain future caused by the coronavirus pandemic.

In the wake of the coronavirus pandemic, few industries have fallen as far and as fast as tourism. The technological revolution that brought us closer together by making travel and tourism easy and affordable—a revolution that fueled one billion trips a year—is helpless in halting a virus that demands we shelter in place.

Taking a snapshot of tourism losses is difficult, as the data changes as quickly as the virus spreads. If the pandemic continues for several more months, the World Travel and Tourism Council , the trade group representing major global travel companies, projects a global loss of 75 million jobs and $2.1 trillion in revenue. Losses come daily; as of April 2, British Airways is reportedly poised to suspend 36,000 staffers .

An employee at Dayton International Airport picks up a single bag on the jetway bridge March 18, 2020. Airlines project losses of at least $250 billion due to travel restrictions from COVID-19.

Gloria Guevara, the CEO of WTTC, is lobbying governments to offer support to travel companies saying these potential job losses are “bringing real and profound worry to millions of families around the world.”

These photos capture a world paused by coronavirus.

America’s travel industry is among the hardest hit. The U.S. Travel Association projects a loss of 4.6 million jobs through May, a figure likely to increase. U.S. weekly jobless claims skyrocketed to a stunning 6.6 million , doubling in a week and by far the biggest spike in half a century. Tourism decline is a driving reason for job losses in states including Nevada, where Las Vegas casinos and jumbo hotels have gone dark.

On March 29, in an attempt to contain the virus in America, President Donald Trump extended national limits on travel, work, and gatherings of more than 10 people for at least another month—and perhaps into June. Summer vacations could be on hold. “This is the worst time of the year for this to happen,” says Isabel Hill, director of the Commerce Department’s National Tourism Office . “This is the season—spring and summer—when the travel and tourism [industry] makes a significant amount of [its] revenue.”

“The impact on travel is six or seven times greater than the 9/11 attacks,” says Roger Dow, president and CEO of the U.S. Travel Association, which encourages travel to and within the country and represents an industry that generates $2.6 trillion in economic output and supports 15.8 million jobs in the U.S.

Airports including Cologne Bonn in Germany are mostly shut down. The global tourism industry is facing massive job and revenue losses.

With so much at stake, Congress passed a $2 trillion stimulus that couldn’t have come at a more urgent time. The focus is to help those unemployed and to support businesses large and small. But questions remain: Will the aid package be enough as the country slides into a recession, and what does it mean for travelers?

Not saving for a rainy day

Much of the tourism industry built its financial strategy around a trouble-free future, planning for eternal blue skies: open borders; high tourism demand, an $8 trillion industry that defies the ups and downs of the market.

On average, international carriers, including Delta and United Airlines, had less than two months of cash on hand to cover expenses before the coronavirus hit, according to the International Air Transport Association (IATA). In contrast, Apple has enough cash to cover six years of expenses.

With much of its fleet grounded, the airlines’ projected revenue losses could climb to more than $250 billion. That’s at least twice the $113 billion in losses the IATI predicted three weeks ago , before countries started shutting down borders.

Airlines for America (A4A), the trade group representing American and JetBlue among others, as well as UPS and Fedex, say its member companies will lose $87 billion in revenue this year and have already begun borrowing.

Aid packages to the rescue?

Airlines could benefit from several provisions of the stimulus: $425 billion from the Federal Reserve for distressed industries; $75 billion in loans, and $25 billion in direct grants, with the government taking a stake in the companies. Much of the money is conditional—it can’t be used for corporations to buy back stock, a practice that led many companies to be short of cash.

The bailout comes on the heels of a $100 million bill Congress passed weeks before, which provides increased unemployment insurance, paid sick leave, extended food assistance, and free testing for the virus.

“This [aid package] is important and we want [the recovery] to speed up,” says Dow. “Most of the travel industry [consists of] small, mom-and-pop businesses. With small business loans we can help keep their doors open.” The emergency small business loans will be available through June and would be forgiven if companies have to keep their employees on the payroll.

The lodging sector— which has suffered as much as transport , with companies such as Marriott losing as much as 75 percent in revenue—is also a big recipient of the bailout. Hotels (and restaurants) can benefit from the $350 billion lending program for small businesses and from a small adjustment to a federal tax law that could save them as much as $15 billion.

Cruise industry at sea

But cruise companies face an uphill battle to recover. Cruises have become beleaguered poster children of the pandemic as news stories chronicle the plight of ships carrying infected passengers. At press time, Holland America’s Zaandam and Rotterdam ships were finally granted permission to disembark at Port Everglades in Fort Lauderdale, Florida, after the Coast Guard balked at allowing them to dock. On March 8, the Center for Disease Control and the State Department told Americans to stop taking cruises and published a detailed explanation why those ships increase the virus’s “risk and impact.”

Cruise lines have become the face of the pandemic, as news articles chronicle the plight of ships carrying infected passengers searching for ports.

The cruising industry faces an uphill battle to recovery. Because many cruise companies are incorporated overseas, they don’t qualify for U.S. aid money.

The effect on the cruise business has been swift. Companies have lost $750 million in revenue since January, according to reports. Shares of the big fish—Royal Caribbean, Carnival, and Norwegian—have dropped by 60 to 70 percent. Future losses will mount, and it’s likely that sailings will be postponed at least until July or August.

Unlike the airlines and hotels, cruise companies aren’t eligible for the $500 billion in aid because they don’t count as American enterprises. Major companies locate their primary headquarters overseas, with ships flagged and incorporated in other nations. This means they pay almost no federal taxes and avoid many U.S. regulations.

This photographer returned from a remote island to a world paused by a pandemic.

The cruising industry faces more hurdles in the future. “Governments may have an increased interest in illness reporting and sanitation inspections,” which means more regulations, says Ross Klein, a Canadian academic at the Memorial University of Newfoundland who studies the sector.

A sign of things to come

But there is a glimmer of hope. China, where the pandemic began, offers a glimpse into the future. Now that the pandemic is reportedly under control there and restrictions are being lifted, there are early signs of recovery.

Hotel bookings in China have increased by 40 percent the first week in March, according to Bloomberg, while peak daily flights rose 230 percent from the previous (albeit disastrous) month. Arne Sorenson, CEO of Marriott, says he’s seen initial improvement in his company’s properties in China.

China’s domestic tourism market is gigantic and supports some five billion trips a year. In several surveys the domestic industry says it’s planning for a recovery of 70 percent over the next six months, according to Dr. Wolfgang George Arlt, director of the China Outbound Tourism Research Institute . But that recovery largely rests on domestic tourism, with China severely limiting foreign visitors to insure the virus doesn’t resurface.

The United States—the new epicenter of the pandemic—isn’t following China’s trajectory, so the comparison may be more hopeful than realistic. Still, the U.S. Travel Association’s Dow remains optimistic. “Over the long term we will return and come back to business as usual,” he predicts. “People have short memories and there will be a pent up desire to travel.”

Economists, though, are warning that few industries—let alone travel—will return to normal anytime soon.

Related Topics

- CORONAVIRUS

You May Also Like

How new flights to Akureyri are opening up northern Iceland

Rights on Flights: the new campaign seeking to make air travel more accessible

For hungry minds.

How to overcome a fear of flying: five courses that tackle it

How to make travel more accessible to the blind

New tools offer peace of mind for pandemic travel

This airline is now weighing passengers — but why?

Is it safe to go there? The U.S. travel advisory system, explained

- Environment

History & Culture

- History & Culture

- History Magazine

- Gory Details

- Mind, Body, Wonder

- Paid Content

- Terms of Use

- Privacy Policy

- Your US State Privacy Rights

- Children's Online Privacy Policy

- Interest-Based Ads

- About Nielsen Measurement

- Do Not Sell or Share My Personal Information

- Nat Geo Home

- Attend a Live Event

- Book a Trip

- Inspire Your Kids

- Shop Nat Geo

- Visit the D.C. Museum

- Learn About Our Impact

- Support Our Mission

- Advertise With Us

- Customer Service

- Renew Subscription

- Manage Your Subscription

- Work at Nat Geo

- Sign Up for Our Newsletters

- Contribute to Protect the Planet

Copyright © 1996-2015 National Geographic Society Copyright © 2015-2024 National Geographic Partners, LLC. All rights reserved

- Skip to main content

- Skip to "About this site"

Language selection

- Français

- Search and menus

StatCan COVID-19: Data to Insights for a Better Canada Impact of COVID-19 on the tourism sector, second quarter of 2021

Archived content.

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please " contact us " to request a format other than those available.

This page has been archived on the Web.

by Stephanie Tam , Shivani Sood and Chris Johnston

Text begins

In March 2020, the government imposed travel restrictions and border closures aimed at containing COVID-19, which brought travel to and from Canada to a near standstill. Note In fact, in this month, the number of international arrivals to Canada from other countries fell by 54.2% from February 2020, the largest single monthly drop since 1972. Note Most hotels were empty: by the first week of April 2020, the hotel occupancy rate was below 20% across Canada. Note

To reduce the spread of COVID-19, the Canadian government closed its international border to non-Canadian citizens and permanent residents, with the exception of US citizens. Shortly following this, the Canada–US border was closed to non-essential travel, and various restrictions on non-essential travel to and from Canada were in place for the remainder of 2020 and continued into 2021. Some restrictions affected domestic travel of Canadians as well, such as the closure of various provincial and territorial borders, restrictions placed on travel between regions of a province or territory, and limitations of non-essential travel. With the persistence of the pandemic affecting many parts of the world, restrictions were tightened and further extended into 2021. As of May 2021, restrictions on non-essential travel into Canada remained, as did the mandatory 14-day quarantine period for Canadians returning from abroad.

These travel restrictions have a direct impact on businesses, particularly those in the tourism sector, which was one of the hardest hit by government interventions. In 2020, tourism Note gross domestic product (GDP) was down 47.9% annually, while economy-wide, GDP fell at a much slower pace (-5.4%). This contributed to a decline in tourism's share of GDP , which fell from 2.0% in 2019 to 1.1% in 2020. Tourism spending was almost cut in half (-48.1%) in 2020. Note

Under these circumstances, many businesses in the tourism industry have had to reduce their hours, or close temporarily or permanently, which led to laying off employees. In 2020, tourism activities generated about 530,000 jobs. Note Tourism jobs fell 28.7% annually in 2020, with most of the drop occurring in the second quarter. All tourism categories were down in 2020, with food and beverage services (-32.3%) and accommodation (-35.2%) contributing most to the overall decline. Tourism's share of employment fell from 3.8% in 2019 to 3.0% in 2020. Note

By the second quarter of 2021, the Canadian economy had experienced just over a full year of COVID-19. From the beginning of April to early May, Statistics Canada conducted the Canadian Survey on Business Conditions to better understand the ongoing effects of the pandemic on businesses and business expectations moving forward. This article provides insights on those expectations, as well as on the challenges and uncertainties faced by businesses in the tourism sector. For the purposes of this article, the tourism sector is composed of various industries including those in accommodation and food services; arts, entertainment and recreation; and transportation. Note Based on the results of this survey, businesses in the tourism sector expect profitability and sales to decline in the short term, but have a somewhat positive future outlook in the long term. A significant proportion of these businesses experienced a decline of 40% or more in revenue in 2020 compared with 2019 and over three-quarters were approved for or received some form of funding because of the pandemic.

Overwhelming majority of businesses in the tourism sector reported lower revenue in 2020 compared with 2019

As of December 2020, businesses in the tourism sector accounted for 7.7% of all employer businesses in Canada, of which the vast majority (98.0%) were small businesses with less than 100 employees. Note

Over four-fifths (84.3%) of businesses in the tourism sector experienced a decrease in revenue in 2020 compared with three-fifths (60.5%) of all businesses. Almost half (44.9%) of businesses in the tourism sector experienced a decline of 40% or more in revenue in 2020, with those in Northwest Territories (52.4%), Prince Edward Island (51.6%), and Manitoba (51.3%) most likely to see this level of loss. Relatively few businesses in the tourism sector had unchanged revenues (6.3%) or saw their revenues increase (8.3%) in 2020 compared with 2019. In contrast, just under one-fifth (19.2%) of all businesses experienced a decline in revenue of 40% or more in 2020, over one-fifth (20.7%) saw revenues unchanged and nearly one-fifth (18.1%) saw revenues increase.

Over one-quarter (28.9%) of businesses in the tourism sector reported expenses staying the same in 2020 compared with 2019. However, 14.8% of tourism businesses reported an increase of 20% or more in expenses in 2020.

Despite the reduced demand in the tourism sector in 2020 compared with 2019, the proportion of sales made online grew slightly year over year. In 2020, two-fifths (39.7%) of businesses in the tourism sector reported at least some sales were made online, compared with under one-third (31.9%) in 2019.

Many businesses in the tourism sector anticipate losses to continue into the near future

Although travel has edged up each month since the record low in March 2020, travel has still remained far below 2019 levels. For example, following three consecutive years of positive growth, international travel to and from Canada declined 73%, from 96.8 million travellers in 2019 to 25.9 million in 2020. Additionally, travellers to Canada from both the United States and overseas countries were down 93.0% in December 2020 compared with December 2019. Similarly, the number of Canadian residents returning from abroad was down 91.3% year over year. Note

Nearly half of businesses in the tourism sector expected the rising cost of inputs (43.5%) and attracting new or returning customers (39.2%) to be obstacles over the next three months. Note Additionally, travel restrictions were an obstacle expected for two-fifths (39.4%) of tourism businesses, and over one-third (37.8%) expected government regulations to be an obstacle over the coming three months.

Nearly half (47.3%) of businesses in the tourism sector expected their profitability would decrease over the next three months, a higher proportion than all businesses (37.1%). Nearly two-fifths (38.4%) of tourism businesses expected profitability to remain the same, while 12.4% expected their profitability to increase.

Furthermore, nearly two-fifths (38.3%) of businesses in tourism expected lower sales over the next three months, higher than the proportion of all businesses (25.7%). Over one-third (36.4%) of businesses in the tourism sector expected sales to stay about the same.

Future outlook of businesses in the tourism sector are mostly positive in the long term

As provinces and territories begin moving towards final phases in vaccination distribution plans, vaccines have been increasingly administered to the general population and will continue into the summer. Despite the challenges businesses in the tourism sector are currently facing, in the long term, the majority of these businesses were either somewhat (50.3%) or very optimistic (15.4%) about the future outlook of their business over the next 12 months. However, nearly one-fifth (18.0%) reported that their future outlook was not optimistic, while 16.2% were undecided.

At their current level of revenue and expenditures, over half (54.2%) of businesses in the tourism sector reported that they could continue to operate for 12 months or more before considering closure or bankruptcy. However, one-quarter (25.5%) of businesses in the tourism sector were unsure, and 20.3% said they could continue to operate for less than 12 months before considering closure or bankruptcy. At the same time, 1.0% of businesses in the tourism sector plan to close in the next 12 months.

Nearly half (46.0%) of businesses in tourism can continue to operate at their current level of revenue and expenditures for 12 months or more before considering laying off staff. Just over one-third (34.4%) of businesses in the tourism sector reported they could continue to operate for less than 12 months before considering laying off staff, while less than one-fifth (19.7%) did not know how long they could continue to operate.

More businesses in the tourism sector cannot take on more debt

Over one-fifth (21.4%) of businesses in the tourism sector reported that they could take on more debt, similar to the proportion of all businesses (23.0%). Conversely, one-quarter (25.1%) of businesses in the tourism sector reported that they did not have the ability to take on more debt. One-third (33.3%) of tourism businesses reported they did not need to take on more debt, compared with over two-fifths (42.9%) of all businesses.

Of all businesses and businesses in the tourism sector that could not take on more debt, the most commonly reported reason was the lack of confidence or uncertainty in future sales. Businesses in the tourism sector were more likely to report this reason (72.3%), in comparison to all businesses (56.2%).

The majority (62.4%) of businesses in the tourism sector reported that they had the cash or liquid assets required to operate for the next three months, compared with over three-quarters (75.0%) of all businesses.

Maintaining sufficient cash flow or managing debt was an obstacle expected over the next three months by nearly two-fifths (39.3%) of businesses in the tourism sector, whereas one-fifth (22.2%) of all businesses expected the same.

In response to the challenges experienced by businesses due to the pandemic, various government programs focusing on funding or credit were made available to support businesses. The vast majority (86.9%) of businesses in the tourism industry were approved for or received some form of funding or credit because of the COVID-19 pandemic compared with under three-quarters (73.2%) of all businesses.

Of businesses in the tourism sector that did not access any COVID-19 related funding or credit, nearly two-thirds (65.6%) stated that it was because funding or credit was not needed.

Methodology

From April 1 to May 6, representatives from businesses across Canada were invited to take part in an online questionnaire about how COVID-19 is affecting their business and business expectations moving forward. The Canadian Survey on Business Conditions uses a stratified random sample of business establishments with employees classified by geography, industry sector, and size. An estimation of proportions is done using calibrated weights to calculate the population totals in the domains of interest. The total sample size for this iteration of the survey is 34,169 and results are based on responses from a total of 16,937 businesses, 2,731 of which were in the tourism sector. The total sample size for the last iteration of the survey is 32,400 and results are based on responses from a total of 15,431 businesses, 2,487 of which were in the tourism sector.

Statistics Canada. (2021). Canadian Survey on Business Conditions, first quarter of 2021.

Statistics Canada. (2021). Canadian Survey on Business Conditions, second quarter of 2021.

More information

Note of appreciation.

Canada owes the success of its statistical system to a long-standing partnership between Statistics Canada, the citizens of Canada, its businesses, governments and other institutions. Accurate and timely statistical information could not be produced without their continued co-operation and goodwill.

Standards of service to the public

Statistics Canada is committed to serving its clients in a prompt, reliable and courteous manner. To this end, the Agency has developed standards of service which its employees observe in serving its clients.

Published by authority of the Minister responsible for Statistics Canada.

© Her Majesty the Queen in Right of Canada as represented by the Minister of Industry, 2021

Use of this publication is governed by the Statistics Canada Open Licence Agreement .

Catalogue no. 45-28-0001

Frequency: Occasional

Strategic Approach to Thermal Tourism During and After Covid-19

- Conference paper

- First Online: 28 April 2024

- Cite this conference paper

- Dália Liberato ORCID: orcid.org/0000-0003-0513-6444 3 , 4 ,

- Joana A. Quintela ORCID: orcid.org/0000-0002-4475-2744 5 ,

- Paulo Neto 6 ,

- Pedro Liberato ORCID: orcid.org/0000-0003-2908-1599 3 , 4 ,

- Filipa Brandão ORCID: orcid.org/0000-0002-9323-4572 7 &

- Elga Costa 8 , 9

Part of the book series: Springer Proceedings in Business and Economics ((SPBE))

Included in the following conference series:

- International Conference of the International Association of Cultural and Digital Tourism

19 Accesses

Health and wellness have become important motives for consumption, attracting the researchers’ interest. One of the current challenges in academic research and in the wellness tourism industry is the conceptual development related to the key term wellness. In recent years in Europe, classical thermalism, focused essentially on the “cure” dimension, has been replaced by modern thermalism, which is particularly based on the “wellness” dimension, and the offer is more focused on preventive therapeutic motivations, combined with recreational and tourism aspects. Although the pandemic period led to the stagnation of tourism businesses, health tourism capitalized on the opportunity and developed successfully from the impact of the pandemic. The main objective of this work is to understand the challenges and strategies of the sector during and after Covid-19, namely whether the impact of the pandemic confirmed the need to reassess products and services, with complementary and composite offers that combine nature, sports, and nutrition, among others. A qualitative methodology approach was used to answer this objective, drawing on semi-structured interviews. The results report the challenges that Covid-19 represented to the sector, regarding the expenses increasing with disease prevention and equipment maintenance, the lack of investment, and the decrease in wellness products consumption.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Anaya-Aguilar, R., Gemar, G., & Anaya-Aguilar, C. (2021). Challenges of spa tourism in Andalusia: Experts’ proposed solutions. International Journal of Environmental Research and Public Health, 18 (4), 1829. https://doi.org/10.3390/ijerph18041829

Article Google Scholar