Uplift is the leader in Buy Now, Pay Later for travel .

When you pay monthly for a flight, a cruise, a hotel, or vacation package – you’re giving yourself the freedom to travel farther and explore more enjoyably. Millions of consumers choose Buy Now, Pay Later options for vacation and travel so that they can say “yes” to all those bucket-list items and pay over time.

Paying monthly with Uplift helps you avoid late fees or annual fees you may incur using a credit card. Not to mention you’ll never have to worry about prepayment penalties, debt traps, or compound interest using Uplift.

Whether you’re traveling for work, to visit family or friends, or simply taking that trip you’ve always been dreaming of, using Uplift to pay for flights in installments or spread the cost of your hotel into monthly payments is the perfect option.

Unlike other Buy Now, Pay Later companies, Uplift’s Customer Service Squad is available 24/7 and provides unparalleled service from purchase to final payment.

A few of our partners:

Uplift knows just how much thought, care, and planning goes into creating the most memorable experiences. Lump-sum costs shouldn’t hold you back from booking.

When it comes to paying monthly for your vacation purchases, rest easy knowing that Uplift is the original Buy Now, Pay Later for travel.

Take a look at what our valued travelers have been saying lately.

My daughter just moved from CA to TX and was not able to come home for Thanksgiving. I thought I would surprise her with a visit from myself, her brother and his wife. She will be very happy.

So excited this will be my first trip to Las Vegas an I can take it off my bucket list thanks to Uplift.

Was a great option to pre-book flights without having to pay the entire amount! We travel with a family of 5 so everything is always expensive!

Need more answers to your questions about Uplift? Start here.

Why choose Uplift?

Uplift gives you the freedom to purchase what you want now and pay with fixed monthly payments. Uplift is often a better alternative to credit cards because Uplift charges only simple interest while some credit cards charge interest on interest. Uplift also makes budgeting easy so you can manage your expenses over time rather than paying one large sum all at once.

What kind of products and services can I purchase using Uplift?

Uplift can be used to purchase a wide range of products and services from our travel partners and retailers. Click here to see a full list of our current partners who offer Uplift. Click here to see a full list of our current partners who offer Uplift.

Get the app

What is the advantage of using Uplift vs a credit card?

While some credit cards charge interest on interest, Uplift charges only simple interest. If you carry a balance on a credit card, it can be hard to understand what it will cost you. With Uplift, the cost is clear at the time of purchase, with simple interest, predictable payments, and no fees.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Ce site utilise des témoins de connexion. En continuant à naviguer sur le site, vous acceptez que nous utilisions des témoins.

Cookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Travel Tips

16 Airlines That Let You Book Flights Now and Pay Later

Planning a trip but don't want to pay for it all at once? These sites offer book-now, pay-later flights.

Orbon Alija/Getty Images

If you think a vacation is out of your reach, think again. Some airlines and online travel agencies have services that allow you to book a trip now and pay for it over time.

Affirm, PayPal, Uplift, and Klarna are among the book-now, pay-later services travel companies and airlines offer. Here, we break down the basics of these and airlines' own "BNPL" options so you can secure flights when the prices are lowest, even if you don't want to pay for them in full upfront.

Airlines Offering Book-now, Pay-later Flights

AeroMexico connects major U.S. cities to Latin American destinations like Guadalajara and Puerto Vallarta. The airline partners with Uplift to provide a monthly payment option. When you go to book a flight, you'll see an option to pay in monthly installments. Click through and you'll be asked for any personal information Uplift needs to process the loan.

You can also pay in installments through Klarna. Download the Klarna extension for Chrome or the app and you should see a pink "K" icon that will show you financing options. AeroMexico takes PayPal, which means you can use PayPal Credit to split up payments if you're approved.

Pay monthly for Air Canada flights and Air Canada Vacations packages with Uplift or PayPal Credit.

Alaska Airlines

Alaska Airlines partners with Uplift and Klarna to offer financing for flights.

Allegiant also uses Uplift and Klarna to provide payment plans. Select the Allegiant Pay option at checkout to choose financing through Uplift.

American Airlines

American Airlines offers several ways to buy now and pay later, including Klarna; PayPal Credit; Citi Flex Pay for select Citi cardholders; and Affirm, which has biweekly, monthly, and interest-free options but doesn't cover the cost of any flight extras, like luggage. American Airlines Vacations also gives you the option to pay monthly with Uplift.

Azul Airlines is a low-cost Brazilian airline that accepts payments through Uplift and PayPal.

Delta Air Lines

Delta offers PayPal Credit as a payment option, and you can pay using Affirm if you book your trip through Delta Vacations, a service for SkyMiles members that bundles flights, hotels, transportation, and activities.

One of the United Arab Emirates' two flag carriers, this airline partners with financing institutions Uplift and Klarna. You can also pay with PayPal Credit.

Frontier Airlines

Budget carrier Frontier Airlines lets you pay monthly installments through Uplift on purchases of $49 or more. If eligible, you will see the option at checkout. Frontier is also a Klarna retail partner.

KLM offers customers the option of holding a fare for 72 hours for a non-refundable fee. This is great if you find a fare that you want to book but need a few days to think about it. In addition, the airline takes PayPal Credit. This service is shown on the payment page as a "Bill Me Later" option, but directs you to your PayPal wallet.

Lufthansa has a list of payment methods on its website. Some monthly payment options are available specifically for residents of Brazil and Colombia. U.S. residents may pay monthly through PayPal Credit.

Porter Airlines

Porter , a Canadian airline, allows customers to use Uplift and PayPal to purchase flights across the U.S. and Canada.

Qatar Airways

Unless you're flying from Brazil, Brunei, or Kazakhstan, you can hold any Qatar Airways booking for up to 72 hours. How long prospective travelers can hold their Qatar flights depends on where they intend to fly to and from. The "Hold My Booking" option, available on the payment page, requires a non-refundable fee that doesn't go toward the price of your ticket. In most cases, you can also use PayPal Credit.

Southwest Airlines uses Uplift to break the cost of the flight up into fixed monthly payments. It also accepts PayPal Credit and Klarna.

Sunwing connects Canadian cities with destinations in Mexico and the Caribbean. You can pay for plane tickets in monthly installments through Uplift.

United Airlines

Use Uplift, PayPal Credit, or Klarna to pay for United Airlines flights in monthly installments. The company also has a program called FareLock that allows you to pay a fee to hold a fare for three, seven, or 14 days before paying for it in full. If you decide not to buy the ticket, you forfeit the fee. This service is offered only on itineraries wholly operated by United Airlines and/or United Express.

Online Travel Agencies Offering Monthly Payment Options

Alternative airlines.

Any ticket booked through Alternative Airlines can be paid for in weekly, biweekly, or monthly installments with Uplift. The online travel agency markets itineraries by more than 600 airlines, and Uplift financing can be used for all of them. You can also split payments through Klarna.

CheapOair.com

CheapOair uses Affirm to offer customers a monthly payment option.

Funjet Vacations

Funjet Vacations uses Uplift to offer monthly payments for its flights and vacation packages.

Priceline uses Affirm to handle monthly payments. Select the "monthly payments" option on the secure billing step of the booking process and choose from three-, six-, or 12-month options. Alternatively, break it up into four payments over six weeks using Klarna.

How Buy-now, Pay-later Services Work

Airlines and travel agencies partner with BNPL services like the travel-specific Uplift or the more broadly available Affirm to offer monthly payment options. Some take payments through PayPal Credit and/or Klarna. Learn about the differences between these services and how they work.

Affirm allows customers to pay monthly or every two weeks. Terms can last up to 48 months for the largest loans, but more typically, they last up to a year. Interest rates vary by person, ranging from 0% to 36% APR, and are determined at the time of sign-up. A down payment and credit check might be required when you apply for a loan.

To use Affirm, you will need a phone number to use as an account login. The service is available only in the U.S. and Canada. Once you've created your account and gotten approved for a loan amount, you can set up auto-pay or pay each month via the app or website. You can find a full list of Affirm's travel partners, including airlines and accommodations, on its website.

PayPal Credit

This is a monthly payment option provided by travel companies that take PayPal. Typically, you'll choose PayPal as your payment method, and once you sign into your PayPal account, you can choose PayPal Credit. As of 2023, the variable purchase APR is about 28% for new accounts, but you can avoid paying interest altogether if you pay the loan off within six months. Loan applications are subject to credit approval.

Uplift is the leading pay-over-time financing service in the travel space, partnering with cruise lines, hotel chains, airlines, and more. Once you have selected a product, like your flight, you are shown a per-month rate based on the price of the items in your shopping cart. When you get to the payment page and choose monthly payment as your option, you will be asked for some personal details, and once you click "check rate," you will be told whether you've been approved. Uplift offers an APR of 0% to 36% based on your credit. You won't be penalized for paying late or early, and you can set up autopay so the money comes out of your account automatically.

Klarna breaks up the price of your ticket into monthly payments or four equal payments to be made two weeks apart. Add the Klarna extension to your Chrome browser or download the app on your phone, then book your flight as usual, selecting Klarna at checkout. The first payment will be due upfront. Klarna offers an APR of 0% to about 30%.

Related Articles

A guide to using buy now, pay later for travel

PayPal Editorial Staff

January 5, 2024

Planning a vacation? Buy now, pay later (BNPL) may be offered as a payment option when booking flights, hotels, or other travel accommodations.

Discover how BNPL options work for travel, from potential pros and cons to responsible practices and strategies if considering using it.

What is buy now, pay later for travel?

Buy now, pay later is an installment option that allows people to split up purchases into several smaller payments over weeks or months. It can typically be used for several types of purchases, from big-ticket items like electronics and furniture to travel expenses like hotels and airfares.

If BNPL is an available payment option for an airline, hotel, or travel retailer, individuals can opt for a payment plan at checkout. Normally, they would select the BNPL provider and apply in the checkout, but some providers may redirect applicants to their website to create an account and apply. Typically, applicants receive a near-instant decision, which may mean those looking to use buy now, pay later for travel can book their travel or vacation without a significant delay.

Depending on the BNPL provider , there may be interest fees and other charges, though some providers may offer plans with no interest. Be sure to review any terms before applying.

While application and approval requirements may vary depending on provider, here’s a breakdown of the general eligibility requirements and approval process:

- Meet the eligibility requirements: These can vary based on the provider. People typically need to be at least 18 years old and provide personal details like their social security number and home address. Some BNPL providers may also assess income, payment history, and credit score.

- Agree to the terms: Individuals must agree to the terms and conditions of a BNPL plan, including an installment schedule and any associated fees or interest charges.

- Receive a decision and book travel: People usually receive a BNPL approval decision in seconds. If approved, they can book their travel using BNPL as their payment method.

Potential benefits of using buy now, pay later for travel

Before using buy now, pay later for a trip, consider the potential advantages:

- Flexibility: BNPL may offer flexibility to spread the cost of a trip over time, allowing travelers to manage their budget and avoid a significant upfront expense.

- Interest-free options: Some BNPL services may provide interest-free payment plans. For example, PayPal’s Pay in 4 allows people to split eligible purchases into four interest-free, bi-weekly installments. 1

- Accessibility: Buy now, pay later may help make travel accessible to those with limited credit histories or low credit scores.

Potential downsides of using buy now, pay later for travel

There are some potential disadvantages to using buy now, pay later for travel expenses. Some examples include:

- Interest and fees: Some BNPL providers may charge interest or fees if travelers miss payments or choose longer repayment terms, potentially increasing the overall cost of their trip.

- Overspending: While BNPL offers flexibility, it can also lead to overspending if travelers don't carefully budget for their installment payments. It also may tempt some to book more expensive trips than they can comfortably afford.

- Credit impact: Although certain buy now, pay later providers may not conduct hard credit checks initially, missed payments or defaults may negatively impact credit scores in the long run.

- Limited booking options: Not all travel providers or agencies accept BNPL as a payment option.

Using buy now, pay later for travel responsibly

Here are some factors to consider when signing up for a BNPL plan for travel:

- Budget and plan: Establish a personal budget for travel plans that includes not only the upfront trip cost but also the future installment payments to ensure the overall expense remains manageable and within budget.

- Read the fine print: Carefully read and understand the terms and conditions. Pay close attention to any interest rates, fees for missed payments, and the total cost of a trip when opting for BNPL.

- Responsible spending: Avoid the temptation to overspend just because BNPL offers flexibility. It’s important to only buy on credit responsibly .

- Ensure timely payments : Commit to making payments on schedule to avoid late fees or interest charges. Setting up automatic payments can help prevent missed deadlines.

Using BNPL for travel may offer convenience and flexibility for those looking to travel or book a vacation, but it should be done with careful consideration. Be sure to consider any fees or interest that may apply and keep track of when payments need to be made.

Learn about PayPal Pay Later .

BNPL for travel FAQ

What is buy now, pay later.

Buy now, pay later is a type of short-term financing method that allows people to split a purchase into several smaller installments over weeks or months. Some BNPL plans may be interest free, while others may include interest and fees.

Can buy now, pay later be used for flights?

Buy now, pay later can often be used for flights. Many airlines and travel booking platforms offer BNPL as a payment option at checkout. Travelers should budget and plan their payments accordingly before committing to a payment plan.

Can I book a vacation with buy now, pay later?

Individuals may be able to book a vacation using buy now, pay later. BNPL options are increasingly available for vacation planning, including flights, accommodations, and activities. Travelers can opt for BNPL at checkout and split the total cost into smaller installments. However, be sure to budget carefully and be aware of any potential interest or fees.

It all starts in the app

Save cash back offers from top brands. Plus send money, track packages, and more.

Scan the code or enter your number to get the app.

Related content

We use cookies to improve your experience on our site. May we use marketing cookies to show you personalized ads? Manage all cookies

Book a flight for only a fraction upfront

Purchase your flight in installments before your departure date.

Elisa Ticket $1,100.00 Purchased @ $407.00 upfront

Jessica Ticket $820.00 Purchased @ $303.40 upfront

Patrick & Sarah Ticket $1,500.00 Purchased @ $555.00 upfront

Los Angeles

Dan Ticket $402.00 Purchased @ $148.74 upfront

How it works

The easy and convenient way to lift off

Submit your ticket

Find a flight from your favorite travel site, take and upload a screenshot of your flight details.

Book your flight for a fraction of the cost upfront and pay the remaining balance in installments before your departure date.

Receive e-ticket

Receive your e-ticket after your last payment. Pack light.

Why people love us

Price protection.

Book with us and we'll secure your airfare in advance when prices are cheaper. Protect yourself from price hikes no one likes.

No hidden fees. No credit checks

Pay a one time service fee for each booking. No credit checks. We don't believe your credit score is the best representation of you.

Flexible and guaranteed

Now you have the option to not pay the full cost upfront for your ticket. With Airfordable you pay for your flight for a fraction upfront and the rest in installments before you travel. You will receive your e-ticket once the final payment is made. No gimmicks. No hassle.

Safe, secure and guaranteed

Every interaction with Airfordable uses bank-level security and encryption. Sensitive data is safe with Airfordable.

Amazing community

Our travelers are diverse and smart spenders looking for creative ways to travel. Airfordable is the bond that brings them together.

In good hands

Airfordable is a humane technology company whose sole mission is to help you travel more, but in an easy and financially responsible way.

Join the AF community

Over 10,000 travelers look to Airfordable for traveling in a responsible and systematic way

Elaine Jane Abesames

I'm really happy to have found Airfordable! They offer flexible installments which I love! It's truly a dream come true! Thank you for helping me book my dream vacation to the Bahamas!!!

I was able to book a flight to Madrid, Spain for me and my girlfriend this summer through Airfordable. Being that this is my first Euro trip, I'm super excited.

Autumn Dowis

I chose to book with Airfordable because it was simple, quick, easy, and affordable of course! As a full-time college student who also works full-time, Airfordable helped to ease the burden of a large up-front payment.

Catrina Banks

I decided to utilize Airfordable, because it gave me the opportunity to lock in the price on plane tickets while making payments that was convenient for my family. This was the best decision that I could have made!!

Frequently asked questions

Below are a few questions you might be itching to ask. If you don’t find what you’re looking for, email us at [email protected]

What is Airfordable?

Airfordable allows you to book a flight for a fraction of the cost upfront and pay the remaining balance in installments before your departure date.

Does Airfordable check my credit?

No. You are so much more than your credit score, so we don’t turn you into a three digit number.

Do you charge a service fee?

Yes, we do. Airfordable charges a one-time service fee. Sign in and use the installment calculator to determine your fee.

What happens if the price changes after I book?

Our crystal ball hasn’t arrived yet. Until it does, we cannot predict any price changes. With Airfordable, you are paying to protect your airfare from increasing in price which can be a lot more costly than price drops.

Airfordable

Fly the smart way.

Airfordable is on a mission to democratize travel

7 Million+ miles and counting...

- Book a Flight

- Manage Reservations

- Explore Destinations

- Flight Schedules

- Track Checked Bags

- International Travel

- Flight Offers

- Low Fare Calendar

- Upgrade My Flight

- Add EarlyBird Check-In

- Check Travel Funds

- Buy Carbon Offsets

- Flying with Southwest

- Book a Hotel

- Redeem Points for Hotels

- More Than Hotels

- Hotel Offers

- Best Rate Guarantee

- Rapid Rewards Partners

- Book a Vacation Package

- Manage My Vacation

- Vacation Package Offers

- Vacation Destinations

- Why Book With Us?

- Book a Cruise

- Manage My Cruise

- Cruise Offers

- FLIGHT STATUS

- CHANGE FLIGHT

How do I apply?

Shop for your items and add them to your cart like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a US resident, your Social Security number. If you're approved, finish checking out and you're done.

How are my loan offers determined?

We look at a number of factors, including your credit information, purchase details, and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button. We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com , click on the Accounts page, and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime by visiting pay.uplift.com .

I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

What is your Privacy Policy and Terms of Use?

Here is a link to our Privacy Policy and Terms of Use .

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $49 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders. Privacy Policy and Terms of Use .

Help Center

- Terms & Conditions

- Privacy Policy

- Do Not Sell/Share My Info

© 2024 Southwest Airlines Co. All Rights Reserved.

The 10 Best Payment Plans for Vacations

Vacations are a time to have fun, sit back, and relax. It’s a great way to let off steam that comes with the monotony of life. The only possible drawback I can think of? The meticulous planning and finances.

The good thing is, there’s an alternative. The “Book Now Pay Later” vacation payment plans option is increasingly becoming popular and for good reason!

Imagine this scenario: You need a vacation badly. You’re burnt out from working and the distinction between your work and private life has disappeared, but you don’t have enough in savings to fund your vacay. Should you wave that badly needed vacation goodbye?

Not quite. This is where payment plans come into play. Payment plan offers range from interest-free policies to low down payments and easy monthly installments.

Even if you can’t afford a vacation right now, you can still take the leap. Your dream of exploring the City of Light? Vacationing in the Maldives? Payment plans put them all within reach.

The benefits of using payment plans for vacation packages abound. With so many options in the tour and travel market, it can get a little overwhelming. Don’t fear, this article has you covered.

Top Vacation Payment Plans

1. expedia .

With their Uplift payment program , you can book a trip today and set easy monthly instalments that fit your budget. You don’t have to pay an arm and a leg every month. These monthly payments can be tailored to your budget allowing you to travel before your loan is paid off in its entirety. Southwest are a particularly good choice if you are looking for all-inclusive vacations with hundreds of resorts to choose from.

- They have customizable monthly payments.

- They offer an easy application process.

- There are no charges in the monthly payments, no late fees, and no prepayment penalties.

- Large range of all-inclusive vacations and resorts (including Mexico and Caribbean)

- Canceled flights are refunded as Southwest Airlines air credit which can be limiting.

- Canceled land travel, tours, and accommodations are refunded in the form of travel credit from Southwest Vacations.

3. Funjet (Best for All-Inclusive Packages)

Funjet has a great payment plan if you want to travel and save money at the same time. With a simple downpayment, you can secure the best deals at great rates.

You’ll have to make your vacation reservation six weeks in advance with deposit options available at checkout. You can schedule a final payment or make multiple payments at zero interest.

- Cancel any time for any reason. There are no pesky rebooking fees.

- Reserve a vacation for as little as $50.

- Reservations are subject to change.

- Deposit options are not available if you’re traveling during a holiday.

4. Luxury Escapes

Luxury Escapes’ Latitude Financing Payment plan offers a 12-month interest-free period. You’ll pay monthly installments, but after the 12-month promotional period, you’ll be charged a pretty hefty 24.99% interest rate.

Luxury Escapes offers flexible booking dates. That means you can book a limited-time deal for a certain property now and rebook it for a different date later.

- They have a seven-day refund guarantee.

- There are no hidden costs.

- If your preferred date is unavailable, you can’t get a refund. Make sure to read the terms and conditions carefully.

5. Contiki

A small layaway deposit of $99 will lock in your travel dates. Contiki accepts Visa, Mastercard, and American Express. They can accommodate all types of installment plans : weekly, monthly, two payments of 50% each – you name it, you got it. You just have to make the entire payment 45 days before departure. That’s it.

- There are no interest charges and no fees.

- They offer flexible payment plans.

- The Freedom Guarantee ensures you can reschedule travel dates, swap the tour type, or choose a different region to travel in altogether. You can avoid cancellation fees with this feature.

- Cancellation fees as high as 50% if cancellation is done within one to seven days before departure and 100% if done on the day of departure.

6. United Vacations (Best for Layaway Vacation Packages)

With United Vacations, you can finance your trip through Uplift . United have a layaway vacation option which allows you to lay down an initial $250 deposit and pay the rest at least 45 days before the departure date. The best part? You can use multiple credit cards to fund your trip.

- If you get the vacation protection package, you won’t have to deal with cancellation fees. You have the flexibility to change or cancel the plan as needed.

- You can book your entire trip through United Vacations from hotels, flights, car rentals to resorts, airport transfers, and excursion experiences.

- Airfare is non-refundable. If your flight was canceled, they’ll give you credit you can use within a year as long as your tickets were booked through American Airlines. If not, policies vary from carrier to carrier.

7. JetBlue Vacations

JetBlue’s annual percentage rate ranges from a huge 10.99% to 25.99% for a loan term of 12 to 18 months. Their partnership with MarcusPay enables them to offer top-tier package getaways.

If you want lower rates and longer terms, you’ll need to have excellent credit scores. Additionally, rates are generally higher for longer-term loans.

- They don’t require a deposit upfront.

- If you find the same package for a cheaper price within 24 hours of booking, they’ll match it and refund the difference.

- JetBlue Vacation charges a $200 cancellation fee per person plus additional penalties charged by the hotels.

8. G Adventures

Deposits for layaway vacations start at $250. If you’re unsure about a specific tour but don’t want to let the opportunity pass you by, they have a “holding an option” tool that lets you reserve a spot for 48 hours without paying a pretty penny.

The best part? If you ever have to cancel a trip, change it, or push it back, you’re not forced to use it within a year or two. It’s good for life. You can pay the full balance close to your departure date.

- They have small groups per trip. This helps you form a closer connection to the places and people you visit on your travels.

- They offer lifetime deposits.

- “Optional” activities cost you an additional fee if you decide to purchase. If you don’t want to factor in any additional costs to your budget, you can pass on these.

- Depending on the trip, guides can be a hit or miss.

9. Intrepid Travel

Intrepid Travel provides exemplary flexibility in changing travel plans. There are no change fees as long as you notify them about the changes at least 21 days in advance. You have the flexibility to choose an entirely new trip or pick new travel dates.

You only need to secure your trip with a deposit and you can pay the rest in installments whenever you like. Just make sure you’ve paid for the trip in full at least 21 days before you’re scheduled to depart.

- There are no interest and rebooking fees.

- You can hold your trip for up to 5 days without paying a deposit.

- If you’re traveling solo, you’ll have to pay a mandatory single supplement fee for certain trip types.

10. Priceline

Priceline.com comes through with terrific ways to save on travel. As long as you know how to look for deals, you’ll hit pay dirt.

Check out Priceline’s Express Deal which can save you anywhere between 10% to 40% off flights. The catch? You don’t know what time your flights will depart. It can be a red-eye for all you know.

- Priceline offers significantly lower prices.

- You can place bids for a lower price. If you get it, it’s a win. If you don’t, you lose nothing.

- Once the fee is charged, you don’t get a refund if you change your mind.

- You can’t reserve a room for more than 2 people.

Most popular destinations for vacation payment plans

If you are looking for inspiration for your next vacation then we’ve chosen 5 of the most popular destinations which are available to finance with installments.

Bonus Trip – Disney World Payment Plan

If you’re looking for family vacation payment plans then one of the best is the Disney World payment plan , we’ve written about it before and it’s a great choice if you have kids. Family vacations can be expensive and instalments are a great way to spread the cost. With Disney you can book your vacation and choose how often you want to pay. The payment plans are extremely flexible allowing you to look forward to your next family vacation without the stress of a huge amount leaving your bank account.

Wrapping It All Up

Payment plans for vacations are probably the best thing for people who don’t mind taking a chance and are flexible in their travel itineraries. With plans offering 0% interest rates and easy installments, who wouldn’t want to travel the world?

Before you settle on a payment plan, read the fine print. There are multiple “book now, pay later” options available on the market, but some have better deals than others. Always explore your options and take your time in making a decision. Most, if not all travel plans, are non-refundable. Click wisely.

Can you use Afterpay for vacations?

Yes. You can currently use Afterypay for hotels and accommodations via the website Agoda.com. Agoda is a reputable travel company and is part of the Priceline group.

Can you use Affirm for travel?

Yes. There are multiple travel companies which accept Affirm at checkout. These companies currently include Expedia, Priceline, Delta Vacations and CheapOair.

Can you finance vacations with Klarna?

Yes. It is possible to book vacations with Klarna using their ‘Pay in 4’ option which allows you to split your vacation payments into 4 payments using the Klarna app.

Related Posts

Can you buy a gift card with Afterpay?

Pay later apps like Klarna

Buy Now Pay Later Gift Cards

Pay Monthly Cruises

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Living Not So Fabulously

- Decoding Retirement

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Klarna partners with uatp to tap the $1 trillion air travel industry.

The partnership brings together a globally recognized BNPL provider with the most trusted name in travel payments

WASHINGTON , Sept. 10, 2024 /PRNewswire/ -- UATP , the global payment network that enables organizations to simplify payment processes and expand their payment capabilities, has announced a new partnership with Klarna, the AI-powered global payments network. The partnership allows airlines to offer Klarna's flexible payment services, including interest-free Buy Now Pay Later, providing customers with more flexible payment options for travel products and services.

UATP's collaboration with Klarna represents the convergence of two highly successful payment technology companies, with mutual benefits on the horizon. Klarna gains immediate access to UATP's vast base of airlines and travel agencies and is a preferred BNPL partner for EU and APAC.

The $1 trillion air travel sector is a key growth opportunity for Klarna because credit cards account for 70% of retail travel payments. This leads to high costs for airlines, who spend $20bn a year on payment processing, and massive interest payments for consumers. Wherever Klarna is available on a travel site, consumer adoption is very high: the total value of travel booked through Klarna has increased by 50% in the past year.

For UATP, integrating Klarna further strengthens the payment network's support for BNPL options. Offering a variety of BNPL choices helps UATP merchants tap into a global BNPL market estimated at $14.55 billion this year and is expected to grow at a CAGR of 26.50% to reach $60.47 billion by 2030.

The Convenience and Ease of BNPL from a Trusted Provider

"BNPL is an essential payment option for travel merchants to provide their customers. It offers flexibility and convenience to encourage travelers to complete transactions and boost conversion rates," says Zach Ornelas , SVP of Global Sales for UATP. "But to reap the full benefits of having this payment option, merchants need a BNPL partner that their customers know and trust. Klarna is that partner."

Klarna offers consumers a choice of ways to pay including immediate payments, short-term, interest-free BNPL and longer-term financing. Globally, about 30% of the payments Klarna processes are immediate payment.

Klarna's BNPL is a short-term, interest-free credit service with no fees when paid on time. Klarna underwrites every transaction based on strict eligibility assessments and boasts a 99% repayment rate globally. This model provides consumers with a transparent and predictable repayment structure, making it easier to manage their finances without accumulating interest.

A Speedy and Complementary Expansion into the Travel Vertical

By leveraging UATP's existing connections and expertise in alternative forms of payment, the partnership between UATP and Klarna enables airlines and other travel merchants on the UATP network to introduce BNPL more quickly, eliminating resource-intensive implementation work and lowering the cost per transaction. It also allows Klarna to quickly access the travel merchants connected to the UATP network, expanding their exposure to the travel vertical and enhancing their growth opportunities in this sector.

"Travel is perfect for interest-free buy now, pay later, allowing travelers worldwide to spread the cost of their trips and without getting stuck paying sky-high credit card interest rates," says Erin Jaeger , Head of North America , Klarna, "This agreement with UATP means we can quickly bring these benefits to many more airlines and tap into the huge growth opportunity which the $1 trillion travel industry represents for us.""

The UATP and Klarna partnership is expected to go live in Q3 of 2024. For more information about UATP and its partnership with Klarna, please contact Wendy Ward at [email protected] .

ABOUT UATP UATP is the global payment network simplifying payments in complex industries. We make it easy for businesses to make or accept any type of payment; open new markets, drive growth and reduce costs for Issuers, Merchants, vendors, agents, aggregators and more. UATP is continually innovating to connect companies to new forms of payment (AFPs), and our easy-to-use data tools, DataStream ® and DataMine ® , provide comprehensive account details to Issuers and Corporate Account Holders. Our team has decades of experience with the ever-changing payments landscape, and our reliable and proven technology ensures our global customers get more from every payments experience. Learn more at uatp.com.

Accepted as a form of payment for corporate business travel worldwide by airlines, travel agencies and Amtrak ® ; UATP accounts are issued by: Aeromexico; Air Canada (TSE: AC); Air China; Air New Zealand (ANZFF.PK); Air Niugini; American Airlines (NASDAQ: AAL); APG Airlines; Austrian Airlines; Avianca Airlines; BCD Travel; China Eastern Airlines (NYSE: CEA); Delta Air Lines (NYSE: DAL); EL AL Israel Airlines; Etihad Airways; Fareportal; Frontier Airlines; GOL Linhas Aereas inteligentes S.A. (NYSE: GOL and Bovespa: GOLL4); Hahn Air; High Point Travel; Japan Airlines (9201:JP); JetBlue Airways; LATAM Airlines; Link Airways; Qantas Airways (QUBSF.PK); Shandong Airlines; Sichuan Airlines; Southwest Airlines; Sun Country Airlines; TUIfly GmbH; Turkish Airlines (ISE: THYAO); United Airlines (NASDQAQ: UAL) and WestJet. AirPlus International issues the UATP-based Company Account for Lufthansa German Airlines.

About Klarna Since 2005 Klarna has been on a mission to accelerate commerce with consumer needs at the heart of it. With over 150 million global active users and 2 million transactions per day, Klarna's fair, sustainable and AI-powered payment and shopping solutions are revolutionizing the way people shop and pay online, empowering consumers to shop smarter with greater confidence and convenience. More than 500,000 global retailers integrate Klarna's innovative technology and marketing solutions to drive growth and loyalty, including H&M, Saks, Sephora, Macy's, Ikea, Expedia Group, Nike and Airbnb.

Klarna is a founder-led company backed by Sequoia Capital and a broad base of internationally distinguished investors and institutions including Bestseller, Commonwealth Bank of Australia , Mubadala Investment Company, Silver Lake , Dragoneer, GIC, BlackRock, Wellcome Trust, CPP Investments and Atomico. For more information, visit Klarna.com

View original content to download multimedia: https://www.prnewswire.com/news-releases/klarna-partners-with-uatp-to-tap-the-1-trillion-air-travel-industry-302242245.html

SOURCE UATP

- Travel Advisories |

- Contact Us |

- MyTravelGov |

Find U.S. Embassies & Consulates

Travel.state.gov, congressional liaison, special issuance agency, u.s. passports, international travel, intercountry adoption, international parental child abduction, records and authentications, popular links, travel advisories, mytravelgov, stay connected, legal resources, legal information, info for u.s. law enforcement, replace or certify documents.

Get a Passport

Renew or Replace a Passport

Get My Passport Fast

Prepare to Apply

Passport Help

Legal Matters

Prepare to Apply for a Passport Homepage

Share this page:

Passport Forms

What Form Should I use?

Get Your Processing Time

Passport Fees

Passport Photos

Citizenship Evidence

Photo Identification

Where to Apply

Applying with a Disability

Expand the boxes on this page to see how much you need to pay for a passport, and what types of payment to use. You can also use our fee calculator to figure out the cost of your passport. The fees you pay depend on:

- If you want a passport book, passport card, or both documents

- How fast you need your passport, and

- Where you apply

What fees should I pay?

I'm applying for the first time as an adult (16 and older).

You will need to pay both an application fee and an acceptance fee. Pay the acceptance fee to the facility which takes your application, and the application fee to the U.S. Department of State.

Our Apply in Person page has more information on how to submit your application.

I'm an adult (16 and older) and I'm renewing my passport

Pay an application fee to the U.S. Department of State.

Adults (16 and older) may be able to renew their passport.

- Renewing by Mail : Steps to mail your application to us

- Renew Online : Steps to submit your application online, if you are eligible

My child is under 16 and I'm applying for their passport

You will need to pay both an application fee and an acceptance fee. Pay the acceptance fee to the facility which takes your child's application, and the application fee to the U.S. Department of State.

All children must apply in person. Our Children Under 16 page has more information on how to apply.

I'm changing or correcting my passport

I need to rush my passport or pay for a special service.

Add these fees to your total application fee. Include the amount in your check or money order which you make payable to the U.S. Department of State.

Passport fee calculator

Answer a few questions and we'll calculate your passport fees..

Where do you currently reside?

Check with your local U.S. embassy or consulate for information on how to apply for a passport.

Do you still have the passport in your possession?

Note: If you want to renew both a valid passport book and passport card, you must submit both documents. For example, if you can submit a passport book, but you lost your passport card, you cannot renew the passport card. If you want to renew either a valid book or a card, you must submit the specific document you want to renew.

Is the passport damaged or mutilated?

Do you know the issuance date of your passport?

Do you know if your passport is still valid?

What is the Issuance Date of your passport? (MM/DD/YYYY)

Have you reported it lost or stolen to Passport Services?

Are you replacing a "Limited Validity" Passport?

Was your passport issued domestically or overseas?

What was the validity of your limited passport?

Was your passport limited due to an ongoing change of your gender marker or a naturalization certificate replacement?

What is the Issuance Date of your Limited Validity Passport? (MM/DD/YYYY)

Do you require any changes or corrections to what is currently printed on your passport?

Select all that apply:

Do you have an original or certified copy of your marriage certificate or the government-issued document demonstrating your legal name change under federal or state law?

Passport Options

Passport type, passport type: book, passport type: card, passport type: book & card, change/correct passport, renew passport, processing method, processing method: standard, processing method: expedited, processing method: expedited at agency, processing method: overseas processing.

* To be eligible, you must make an appointment and provide proof of international travel.

If you have a life-or-death emergency or other need for urgent travel abroad, the passport agency or center will do everything possible to issue a U.S. passport in time for your trip.

Total Payable to Department of State

Total Payable to Department of State - Information.

- list example

Acceptance Facility Fee

Acceptance Facility Fee - Information.

We accept different forms of payment

Applying at a passport acceptance facility (post office, government office, library).

Go to our Apply In Person page to find the steps to apply.

You will need to pay both an application fee and an acceptance fee. Pay the application fee to the U.S. Department of State, and the acceptance fee to the facility which takes your application.

To pay for the application and special services such as expediting your application:

- Submit a check (personal, certified, cashier's, traveler's) or money order payable to "U.S. Department of State"

To pay the separate acceptance fee:

- Personal checks and money orders

- Credit cards. The facility may add a surcharge to cover the cost of the credit card transaction.

- Cash. You must provide the exact amount.

If you are renewing by mail :

- Send us a check (personal, certified, cashier's, traveler's) or money order payable to "U.S. Department of State"

- When renewing by mail from Canada, you must pay by check or money order payable in U.S. dollars through a U.S. bank.

If you are renewing online :

- Use a credit card or debit card

Applying or Renewing at a Passport Agency

Go to our Passport Agency and Center page for steps on how to apply at one of our 26 locations across the country.

We prefer that you pay with:

- Credit cards : Visa, Mastercard, American Express, and Discover

- Debit cards (or prepaid cards that are not linked to a line of credit or bank account): Visa or Mastercard

- Contactless payments such as Apple Pay, Google Pay or Samsung Pay

We also accept checks, money orders, and cash. Make checks and money orders payable to the "U.S. Department of State."

- Checks: personal, certified, cashiers, and travelers

- Money orders: U.S. Postal, international, and currency exchanges

- Cash: must provide the exact amount

Requesting a Refund for Expedited Service

Service Commitment

If you paid the $60 fee for expedited service when you applied and you did not receive expedited service, you may be eligible to request a refund of this fee. We cannot refund any other passport fees or your travel expenses if you miss your trip.

Non-Refundable Fees

We cannot refund the passport application fee and the execution fee. By law, we collect both fees and keep them even if a passport is not issued.

Learn more about refunds on our Refund of Expedited Passport Fee page.

External Link

You are about to leave travel.state.gov for an external website that is not maintained by the U.S. Department of State.

Links to external websites are provided as a convenience and should not be construed as an endorsement by the U.S. Department of State of the views or products contained therein. If you wish to remain on travel.state.gov, click the "cancel" message.

You are about to visit:

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

- Payment options

Travel credit

Understanding travel credit options.

We offer different types of travel credit: Trip Credit, Flight Credit, and Travel Vouchers. Each type of travel credit has its own terms and conditions, so be sure to read them carefully before redeeming your credit. Keep in mind, travel credits can only be used to book flights, and can’t be used to pay for extras like seats or bags.

Types of travel credit

*Can’t be used for extras like seats or bags.

**For Trip Credit issued on or after April 2, 2024, AAdvantage® members have 12 months to use their Trip Credit when canceling their trip on aa.com or the American app and their AAdvantage® number is included in their reservation. Non-AAdvantage® members have 6 months.

***When booked on aa.com, Flight Credit can only be applied to flights within the U.S., Puerto Rico, and the U.S. Virgin Islands. (U.S. currency only)

Ready to book a trip?

Book a trip with your Trip Credit

Find your trip to use your Flight Credit

- Contact Reservations

How to find and redeem your travel credit

If you received a travel credit, you can use it to book your next trip. Here's how to find and redeem your Trip Credit and Flight Credit.

Trip Credit

If you're an AAdvantage ® member, most Trip Credits will appear in your AAdvantage ® account.

For Trip Credit issued on or after April 2, 2024, AAdvantage ® members have 12 months to use their Trip Credit when canceling their trip on aa.com or the American app and their AAdvantage ® number is included in their reservation. Non-AAdvantage ® members have 6 months.

Log in to your account

Step 1: Find your Trip Credit email

- Look for an email from American Airlines with the subject line ‘Your Trip Credit.’

- Your Trip Credit number is a 13-digit number that begins with ‘00115.’

Keep in mind there are separate ticket numbers for add-ons like seats, upgrades, and bags.

Step 2: Book and add your Trip Credit

- Go to aa.com and book your new flight.

- On the payment screen, select ‘Trip Credit.’

- Follow the prompts to pay using your Trip Credit.

- You may use a credit card to pay any remaining balance.

General rules

- Trip Credit is non-refundable, non-transferable, non-returnable, may not be redeemed for cash, check or credit (except where required by law) and has no implied warranties, including warranties of merchantability or fitness.

- Trip Credit is void if bought, sold or bartered, advertised for sale or used for commercial or promotional purposes.

- We won’t replace Trip Credit if lost or stolen. This may include inadvertent deletion, forwarding or access of the email containing your Trip Credit number. Please guard the Trip Credit number as you would cash.

- Except where prohibited by law, we reserve the right to refuse, void, cancel, reject or hold for review any Trip Credit mistakenly issued in an incorrect denomination or issued or obtained, directly or indirectly, in connection with fraudulent actions, fraudulent claims, compensation abuse or in connection with any violation of these terms and conditions.

Expiration and validity

- Valid until 11:59 p.m. (CT) on the date listed on the Trip Credit, and we won't reissue it past the expiration date.

- We won't accept invalid or expired Trip Credit.

- We won’t accept Trip Credit with an invalid number or if we are unable to locate it within the American Airlines systems.

- To receive Trip Credit, your original ticket must be canceled before the departure of the first flight (or the ticket loses any remaining value and cannot be used for future travel).

Redemption and usage

- You may redeem Trip Credit on aa.com or by contacting Reservations. Trip Credit is not redeemable through any other channels, including airport ticket counters or travel agencies.

- When contacting Reservations, tell the agent you have Trip Credit and you want to use it to book your travel.

- Trip Credit is redeemable toward air travel on flights operated by American, American Eagle ® or flights marketed by American (designated with an AA*). You can’t use Trip Credit for payment of air travel on any other airline on aa.com.

- Contact Reservations to use Trip Credit for qualifying one world ® or other airline partner itineraries.

- Trip Credit is redeemable toward the base air fare and directly associated taxes, fees and charges collected as part of the fare calculation.

- You may not use Trip Credit for products and / or services sold separate from the fare price or for taxes, fees or charges in connection with AAdvantage ® award travel, American Airlines Vacations℠ or any other non-flight products and / or services sold by American.

- You may only use non-taxable Trip Credit for single-passenger reservations on aa.com.

- Contact Reservations to use Trip Credit for more than 9 passengers.

- The recipient of Trip Credit can use it to pay for travel for themselves or others.

- You may redeem up to 8 Trip Credits in a single transaction on aa.com or through Reservations.

- If the ticket price is greater than the value of the Trip Credit, you may pay the difference only with a credit card accepted by American.

- If the ticket price is less than the value of the Trip Credit, we’ll issue any remaining value on a new Trip Credit, delivered via email to the passenger ticketed on the Trip Credit redemption. You may choose to have the new Trip Credit email sent to your email address and then use the remaining value on a new reservation for yourself or someone else.

- You may not combine Trip Credit with the value of an existing ticket to pay for a new ticket.

Flight Credit

If you're an AAdvantage ® member and had your account number listed in your reservation before cancellation, you can log in to your account and view available Flight Credit in your AAdvantage ® account.

Step 1: Find your canceled trip or confirmation email

- You'll need your 6-character confirmation code and 13-digit ticket number.

- American tickets have a 13-digit number that begins with '001'.

Step 2: View your canceled trip

- Go to aa.com and choose ‘Manage trips / Check-in’

- Choose ‘View canceled trips’ and enter your trip details.

- You’ll find your Flight Credit details on the ‘Your trip’ page.

Step 3: Rebook and add Flight Credit

- Go to aa.com and find your new flight.

- On the payment screen, choose ‘Add Flight Credit.’

- Enter the ticket number from your canceled trip and apply the credit.

Book a trip with your Flight Credit

- Flight Credit is non-refundable, non-transferable, non-returnable, may not be redeemed for cash, check or credit (except where required by law) and has no implied warranties, including warranties of merchantability or fitness.

- Flight Credit is void if bought, sold or bartered, advertised for sale or used for commercial or promotional purposes.

- We won’t replace Flight Credit if lost or stolen. This may include inadvertent deletion, forwarding or access of the email containing your Flight Credit number. Please guard the Flight Credit number as you would cash.

- Except where prohibited by law, we reserve the right to refuse, void, cancel, reject or hold for review any Flight Credit mistakenly issued in an incorrect denomination or issued or obtained, directly or indirectly, in connection with fraudulent actions, fraudulent claims, compensation abuse or in connection with any violation of these terms and conditions.

- Flight Credit is valid for 1 year from the date the ticket was issued. We will not extend or reissue once it expires.

- If you don't show for your flight, your ticket will no longer be valid or eligible for any credit.

- We won't accept invalid or expired Flight Credit.

- You may redeem Flight Credit on aa.com, in person at the airport or by contacting Reservations.

- When contacting Reservations, tell the agent you have Flight Credit and you want to use it to book your travel.

- The recipient of Flight Credit can use it to pay for travel for themselves only.

- Flight Credit is redeemable toward air travel on flights marketed and operated by American, by American Eagle ® carriers or on flights marketed and sold by American but operated by one of American’s codeshare or one world ® partners (i.e. flights designated with an AA*).

- Flight Credit is redeemable toward initial booking, the base air fare and directly associated taxes, fees and charges collected as part of the fare calculation.

- You may only redeem 1 Flight Credit for single-passenger trips on aa.com or through Reservations. In order to redeem up to 2 Flight Credits in a single transaction, you must contact Reservations.

- If the ticket price is greater than the value of the Flight Credit, you may pay the difference only with a credit card accepted by American.

- If the ticket price is less than the value of the Flight Credit, you can only use the value of Flight Credit needed for the current booking while remaining value will be issued as travel credit for future reservations.

- You may not use Flight Credit for products and / or services sold separately from the fare price or for taxes, fees or charges in connection with AAdvantage ® award travel, American Airlines Vacations℠ products or services or any other non-flight products and / or services sold by American.

Electronic Travel Voucher

- eVouchers are provided for U.S. customers only.

- eVouchers are non-refundable, non-transferable, non-returnable, may not be redeemed for cash, check or credit (except where required by law) and have no implied warranties, including warranties of merchantability or fitness.

- eVouchers are void if bought, sold or bartered, advertised for sale, or used for commercial or promotional purposes.

- We won’t replace eVouchers if lost or stolen. This may include inadvertent deletion, forwarding or access of the email containing your eVoucher number. Please guard the eVoucher number and PIN as you would cash.

- Except where prohibited by law, we reserve the right to refuse, void, cancel, reject or hold for review any eVouchers mistakenly issued in an incorrect denomination, or issued or obtained, directly or indirectly, in connection with fraudulent actions, fraudulent claims, compensation abuse or in connection with any violation of these terms and conditions.

- eVouchers are valid for 1 year from the date of issue, and we won’t reissue them past the expiration date.

- We’re not responsible for honoring invalid or expired eVouchers.

- We won’t accept an eVoucher with an invalid number or if we are unable to locate it within the American Airlines systems.

- You may redeem eVouchers only on aa.com or by contacting Reservations. eVouchers are not redeemable through any other channels, including airport ticket counters or travel agencies.

- eVouchers are redeemable toward air travel on flights operated by American, American Eagle ® , one world ® partners or on flights marketed by American (designated with an AA*). You can’t use eVouchers for payment of air travel on any other airline.

- Flights sold or originating outside the U.S., Puerto Rico or U.S. Virgin Islands or operated by other carriers are not eligible.

- eVouchers are redeemable toward the base air fare and directly associated taxes, fees and charges collected as part of the fare calculation.

- You may not use eVouchers for products and / or services sold separate from the fare price or for taxes, fees or charges in connection with AAdvantage ® award travel, American Airlines Vacations℠ or any other non-flight products and / or services sold by American.

- The eVoucher recipient can use it to pay for travel for themselves or others.

- You may redeem up to 8 eVouchers in a single transaction.

- If the ticket price is greater than the value of the eVoucher(s), you may only pay the difference with a credit, debit or charge card with a billing address in the U.S., Puerto Rico or U.S. Virgin Islands.

- If the ticket price is less than the value of the eVoucher(s), the unused amount will remain on the eVoucher until it reaches zero, at which time the eVoucher will be deactivated.

- You may not combine eVouchers with the value of an existing ticket to pay for a new ticket.

You may also like...

- American Airlines Gift Card Opens another site in a new window that may not meet accessibility guidelines.

- Reservations and tickets FAQs

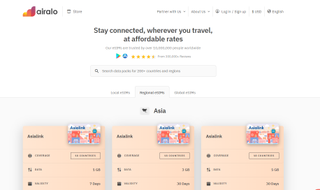

Best eSIMs for Asia in 2024

Sub-regional plans included

Best eSIM overall

- Best for unlimited data

- Best for Asian network coverage

- Best for pay-as-you-go

- Best for Southeast Asia

- eSIMs for Asia FAQs

eSIMs have become more popular with travelers because of their ubiquitousness and convenience. Gone are the days of paying expensive roaming fees or getting new physical SIM cards whenever you visit another country. Instead, you can activate an eSIM and access cellular networks in multiple countries.

Asia is the second-most visited continent, with hundreds of millions of tourists visiting everywhere from China to Malaysia, South Korea, Singapore, India, and many others. As a visitor, you’ll likely need an eSIM, and we’ve created this guide to help you pick the best one. We tested many eSIM providers and chose the few that provide the best service across Asia.

The best eSIMs for Asia in 2024 in full:

Why you can trust TechRadar We spend hours testing every product or service we review, so you can be sure you’re buying the best. Find out more about how we test.

Our expert review:

Specifications

Reasons to buy, reasons to avoid.

Airalo is an eSIM provider with excellent network coverage. Its widespread coverage, exceptional customer service, and reasonably priced data plans have helped Airalo amass 10 million+ users worldwide.

This eSIM provider offers an Asialink package that works in 18 Asian countries: Bangladesh, Cambodia, China, Hong Kong, India, Indonesia, Japan, Laos, Macao, Malaysia, Pakistan, Philippines, Singapore, South Korea, Sri Lanka, Taiwan, Thailand, and Vietnam. You can travel to these countries with your Asialink eSIM and enjoy a superfast internet connection.

Airalo offers different pricing plans, including $5 for 1 GB for 7 days, $13 for 3 GB for 30 days, $20 for 5 GB for 30 days, $37 for 10 GB for 30 days, $100 for 50 GB for 90 days; and $185 for 100 GB for 180 days. The main drawback is that none of these plans include a phone number to make calls and receive SMS. However, you can still call via VoIP apps like WhatsApp and Line.

Read our full Airalo review.

- ^ Back to the top

Best eSIM for unlimited data

Holafly is an eSIM provider that offers excellent network coverage in supported countries, which include South Korea, Japan, Cambodia, Singapore, Vietnam, Thailand, Taiwan, Singapore, Malaysia, Indonesia, Philippines, and Laos. You can observe that Holafly offers coverage in 12 Asian countries, compared to Airalo’s 18 countries. However, Holafly shines above Airalo by offering unlimited data to its customers.

Flexible pricing is a major advantage of choosing Holafly. There are no standard data fees– it depends on how many days you select. For example, unlimited data for 7 days costs 34 euros ($37), and 30 days costs 83 euros ($90). Holafly is undoubtedly expensive, but the tradeoff is enjoying unlimited data, unlike most other eSIM packages with capped data plans.

Holafly offers data-only plans without phone numbers for calling. Most eSIM providers don’t offer phone numbers because of the complicated regulations and infrastructure required to do so. The exception is when your eSIM is from a telecoms firm that has already laid the groundwork for issuing phone numbers.

Purchasing a Holafly plan is easy. After payment, you'll receive a QR code in your email. Scan this code to activate your plan and enjoy unlimited data. Use code TECHRADAR to get 5% off.

Read our full Holafly review.

Best eSIM for Asian network coverage

Yesim offers affordable plans and robust network coverage. It offers sub-regional plans for Southeast Asia (Australia, Indonesia, Malaysia, New Zealand, Philippines, Singapore, Thailand, and Vietnam); Asia Pacific (Cambodia, China, Hong Kong, India, Indonesia, Japan, Macao, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Taiwan, Thailand, and Vietnam); and Central Asia (Armenia, Georgia, Kazakhstan, Kyrgyzstan, Russia, and Uzbekistan).

This eSIM provider offers different data plans, ranging from 1 GB to 20 GB, valid for 30 days. We like that all its plans are valid for 30 days, unlike some rivals, which have plans valid for as low as 7 days.

Like the other eSIM providers mentioned so far, Yesim requires no documentation. You can purchase a package online and activate your eSIM immediately after payment. All it takes is scanning the QR code sent to your email address.

Best eSIM for pay-as-you-go

4. BNE eSIM

The BNE eSIM is an excellent option for Asian travelers. It notably offers pay-as-you-go plans, i.e., data plans that don’t have a fixed expiring date. This pay-as-you-go option makes BNE eSIM suitable for people who expect to spend a long time in Asia. You can also buy 30-day plans if you plan to stay in Asia for a short time.

BNE offers data plans between 1 GB and 20 GB. The pay-as-you-go option costs slightly more than the fixed 30-day option. For instance, the 10 GB plan costs $26 for 30 days but $40 for the pay-as-you-go option.

You don't need documentation to buy an eSIM from BNE; you can activate your eSIM immediately after payment. BNE's data plans cover 17 Asian countries: Bangladesh, China, Hong Kong, India, Indonesia, Israel, Japan, Kazakhstan, South Korea, Malaysia, Pakistan, Philippines, Singapore, Sri Lanka, Taiwan, Thailand, and Vietnam.

Best eSIM for Southeast Asia

5. Maya Mobile

Maya Mobile is a U.S.-based eSIM provider that offers global network coverage. You can buy a Maya eSIM and enjoy superfast internet access across Asia. Maya has network-sharing agreements with at least 2 domestic networks in most Southeast Asian nations.

You can buy a Maya eSIM without documentation. After payment, you'll scan the QR code sent to your email address to activate the eSIM. Alternatively, you can reserve a data plan for a future date, which will be activated automatically.

Maya offers unlimited data plans but with a catch. There's a daily limit to how much data you can use with 4G or 5G (up to 5 GB). Once you reach that limit, you can only browse at LTE speeds. Another drawback is that Maya’s most affordable plan doesn’t support Wi-Fi hotspot sharing.

This eSIM provider works in the following Asian countries: China, Hong Kong, Indonesia, Malaysia, the Philippines, Singapore, Taiwan, Thailand, and Vietnam.

Best eSIMs for Asia FAQs

What is an esim .

eSIM is an abbreviation for embedded SIM. It is a digital version of a SIM card embedded directly into your smartphone, rather than the physical SIM cards you can remove or replace anytime. An eSIM allows you to activate a cellular connection from a carrier without swapping any physical SIM. All the configurations take place on your phone, so you can connect to new networks without hassles.

eSIMs offer many advantages, including storing multiple network profiles on a single device and seamlessly switching between cellular networks when you travel. An eSIM is also more secure than traditional SIM cards; the eSIM remains embedded in the phone if it gets missing, making tracking the location more feasible. In contrast, someone can remove a physical SIM from a stolen or missing phone, making it almost impossible to track.

Why do I need an eSIM when visiting Asia?

Asia has 48 countries with over 4.8 billion people between them. Each country has its mobile carriers, and a standard SIM card that works in one country won’t work in another except you’re a roaming package. The issue is that roaming packages have steep costs, which leaves eSIMs as the cost-effective solution.

You can buy and activate an eSIM outside of the country you want to visit. Once you reach your desired country, you can use the activated eSIM to surf the web.

eSIM providers don’t usually own telecom networks. Instead, they tap into the infrastructure of existing mobile carriers across different countries. They’ve negotiated network-sharing agreements that allow eSIM owners to tap into domestic networks when they visit new countries.

For instance, you live in Denmark and want to visit Thailand. You can buy an eSIM and activate it while in Denmark. When you get to Thailand, you can use the eSIM to surf the web or make calls (if your eSIM provider offers this option). An eSIM is much more convenient than going to a physical outlet in Thailand to get a new SIM card to access a cellular connection.

Is my phone eSIM-compatible?

eSIMs became popular in 2018 after Apple released the first eSIM-only iPhone to U.S. customers. Since then, many other smartphone makers have joined the train, and virtually all new high-end smartphones now have eSIMs. All iPhones XR and above are eSIM-compatible, and the same applies to Samsung Galaxy Note 20 or Galaxy S20 and above.

Follow these steps to check if your smartphone has an eSIM slot:

For iPhones

- Open Settings > Cellular.

- Look for the Add eSIM button. This button’s presence means your iPhone is eSIM-compatible. If you can’t find this button, the iPhone is incompatible with eSIMs.

For Android phones

- Launch the Settings app.

- Select About Phone.

- Look for SIM Status or something similar (it varies depending on your smartphone).

- Look for any mention of eSIM or Embedded SIM. If you find it, your Android device is compatible. Otherwise, it is not compatible.

If you're unsure about compatibility, check your smartphone manufacturer’s website. eSIM compatibility will likely be mentioned in your smartphone’s technical specifications.

Considerations for choosing an eSIM

1. Location

eSIM providers offer different plans for different countries. The provider you’ll choose depends on the countries in Asia you want to visit. For example, if you plan to visit China, India, Thailand, and Singapore, look for an eSIM provider that offers network coverage in these four countries. The good news is that you can find an eSIM plan covering Asia.

2. Validity

How long will your data subscription last? eSIM providers offer plans lasting 7 days, 13 days, 20 days, 30 days, etc. Some even provide annual or non-expiring data plans. The plan to choose depends on the duration of your trip. If you expect to stay in Asia for a long time, it’s advisable to select a plan that’s valid for as long as possible.

3. Data usage

You must consider browsing habits when choosing an eSIM plan. If you’re a heavy internet user who streams movies or plays games online, you should be eyeing the largest data plans from your eSIM provider. But if you just need data for mundane tasks like texting and audio calling, you can pick a smaller data plan.

If the large data plans seem too costly, you can pick a smaller one and restrict heavy internet tasks to Wi-Fi when you reach your destination.

4. Customer service

Can you contact customer support if you have any eSIM issues? Ideally, the eSIM provider should have a support team you can contact via email, phone, or live chat to lodge complaints. Excellent customer service gives you peace of mind, knowing you can always get help when required.

Of course, it’s essential to choose a plan you can afford. Compare similar data or phone plans from different eSIM providers for a fair price. The idea is to purchase a plan that gives a good bang for your buck.

6. Coverage

Research what networks your eSIM provider uses in each country you plan to visit. It’s better to choose an eSIM provider compatible with multiple networks instead of one. This way, you’re assured of getting coverage even in less populated areas.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Stefan has always been a lover of tech. He graduated with an MSc in geological engineering but soon discovered he had a knack for writing instead. So he decided to combine his newfound and life-long passions to become a technology writer. As a freelance content writer, Stefan can break down complex technological topics, making them easily digestible for the lay audience.

Department of Energy to overhaul supercomputing with $23 million investment in emerging US tech

The next outage will impact your end users

5 Severance season 2 questions I want to know before the hit Apple TV Plus sci-fi show returns

Most Popular

- 2 PS5 Technical Presentation live - are we about to see the PS5 Pro?

- 3 Department of Energy to overhaul supercomputing with $23 million investment in emerging US tech

- 4 This is what it'll be like to test your ears with AirPods Pro 2's new hearing test

- 5 OpenAI claims to have topped a million business users

- National Security