Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans . You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important , as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions , so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

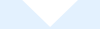

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

- Currency Card

- Travel Money

Compare Travel Money

Say no to airport bureaus, as featured in....

"for those ordering euros online, the best quotes, obtained at the same time by currency comparison website mytravelmoney.co.uk, were far better"

Trusted travel money comparison

- OPP Award Winner: Best Online Service 2012

- Best Exchange Rates Guaranteed

- 65+ currencies

Great product choice

- Save up to 10% versus airport

- Rates updated every 5 minutes

- Guaranteed best on the market rates

Independent & Impartial

- Travel companies compete. You win

- Impartial travel money reviews

- Thousands of live deals

Buy Holiday Money Online Today's Best Exchange Rates

Compare travel money with the UK’s leading holiday money comparison site. We are so confident we even offer a best exchange rates guarantee!

Don’t be held captive at airport bureaus and left paying a high price on your travel money! Compare holiday money with us today & see how much you can save.

- Turkish Lira

- Japanese Yen

- Hong Kong Dollar

- Swiss Franc

- Canadian Dollar

- New Zealand Dollar

@MyTravelMoneyUK

Follow us on twitter & get the latest great deals for your next trip

MyTravelMoney.co.uk News

4 things you must do on your gap year, 7 reasons why you should visit israel this december, 4 festive christmas destinations across the world, the top 5 most fabulous new year’s destinations, receive weekly travel tips, deals, freebies, special offers.

- How it works

Free Currency Card

Best euro rates guaranteed, trusted reviews.

The cheapest and easiest way to compare travel money deals.

"We have a passion, some may say obsession, for helping Brits find the best exchange rates on the market"

We are proud of being the UK’s leading website for comparing cheap currency deals. Our flagship independent travel money comparison will help you maximise your holiday and foreign currency requirements. Save up to 10%. Don’t let the airport bureaus cash in!

Don’t just take our word for it. Recently, we were awarded Best Online Service 2012 at the OPP Awards. We are quoted on a weekly basis in the national press, providing commentary for, amongst others: ThisisMoney, AOL, Guardian, The Times and Telegraph.

How it Works

Why settle for the first deal you stumble across? Shop around!

Bye bye airport bureaus. You’re party is over."

If you want the best euro exchange rates, simply enter the amount of euros (or up to 100 foreign currencies) you want to buy, the amount, and based on your requirements, we will dynamically find the best travel money deals based on multiple comparison filters. Why pay more on travel money if you don’t have to? It gives our team of money-saving, super savvy editors the greatest of pleasure helping you source the cheapest travel money and foreign currency suppliers.

Whether you want to use a travel money company who offers time saving home delivery of currency or airport pickup, we offer a raft of flexible options.

Manage your holiday budget abroad with a free travel money card

In addition to comparing holiday money, Prepaid travel money cards have proven to be an excellent tool to manage your holiday budget. The cards are typically FREE of charge and work by pre-loading foreign currency onto the card prior to departure. If you are going to the Eurozone countries, compare euro currency card options, and for the USA, take a look at our dollar currency card comparison.

Eliminate hefty ATM & Point of Sale charges abroad with a free travel money card.

Save 10% with today’s best euro rates

Compare travel money deals with MyTravelMoney.co.uk and save up to a whooping 10% with today’s best euro exchange rates + 65 other currencies. Our unique comparison platform screen scrapes the live rates of every major travel money supplier. Our research team do weekly mystery shops on euro currency rates.

We’re so sure you won’t find a better euro travel money deal, we offer a best rate guarantee! Happy searching for cheap deals on your travel money!

The home of cheap travel money deals, vetted by you!

"We give free reign for our product managers to innovate like crazy. You wanted reviews. We built them."

Our product managers and designers have stayed up late, drank copious amounts of coffee and worked hard to launch our new and updated travel money search. You can now compare travel money companies across a variety of filters, including: best exchange rates, fees, reviews, home delivery & collection.

You won’t find cheaper direct. Find a cheap travel money deal today.

Our unwavering ethos

Why do thousands of customers every day rely on us for the UK’s cheapest travel money deals & best exchange rates?

"Quite simply, we care about satisfying every visitor who visits our site."

We used to be like you. Frustrated. Spending hours on end searching for the best exchange rates when buying holiday money, only to come back confused and bored. That’s why we invested in a passionate and dynamic editorial team who search the travel money market to help you compare the best exchange rates from all the major players. Put simply, we’re here to showcase great deals and make your life simple.

It’s why we always work with the techies on bettering our product so you compare holiday money with consummate ease. The free tools, travel money saving tips and guides will ensure you and your family don’t get ripped off with poor exchange rates and high commission.

- Press centre

- Testimonials

- Privacy Policy

- Terms & Conditions

- Travel Money Widgets

- Travel Blogger University

- MyCurrencyTransfer.com

Popular Currencies

- Order Euros online

- Order US Dollars online

- Order Canadian Dollars online

- Order Australian Dollars online

- Order Thai Baht online

- Order Turkish Lira online

- Order Swiss Francs online

- Order Japanese Yen online

- Order New Zealand Dollars online

Popular Pages

- Travel Money Reviews

- Euro Currency Card

- Travel Money Survey 2012

- Buy Euros Online

- Travel Blog Awards 2012

- Travel Money Affiliates

- MyTravelMoney News

About MyTravelMoney

MyTravelMoney.co.uk is the UK’s leading travel money comparison website, with featured reviews, guides and information to bring you best deals.

- Home ›

- Travel Money ›

Compare euro travel money rates

Get the best euro exchange rate by comparing travel money deals from the UK's top foreign exchange providers

Best euro exchange rate

Over 340 million people use the euro every day according to the European Central Bank, making it the second most-traded currency in the world after US dollars. Twenty out of 27 EU Member States have adopted the euro as their official currency, and euros are used officially and unofficially in many non-EU countries and territories throughout Europe such as Monaco, San Marino, and Vatican City.

If you're travelling to Europe, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best euro exchange rate by comparing a wide range of UK travel money suppliers who have euros in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Compare before you buy

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Order online

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

The best euro exchange rate right now is 1.1547 from Travel FX . This is based on a comparison of 17 currency suppliers and assumes you were buying £750 worth of euros for home delivery.

The best euro exchange rates are usually offered by online travel money companies who have lower operating costs than traditional 'bricks and mortar' stores, and can therefore offer better currency deals than their high street counterparts.

For supermarkets and companies who sell travel money online and on the high street, it's generally cheaper to place your order online and collect it from the store rather than turning up out of the blue and ordering over the counter. Many stores set their 'walk-in' exchange rates lower than their online rates because they can. By ordering online you're guaranteed to get the online rate and you can collect your order from the store as usual.

Euro rate trend

Over the past 30 days, the Euro rate is up 0.11% from 1.1547 on 29 Mar to 1.156 today. This means one pound will buy more Euros today than it would have a month ago. Right now, £750 is worth approximately €867.00 which is €0.97 more than you'd have got on 29 Mar.

These are the average Euro rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to Euro currency chart .

Timing is key if you want to maximise your euros, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the euro rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the euro rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their euros as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your euros sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better euro rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your euros first before you collect them from the store so you benefit from the supplier's better online rate.

Euro banknotes and coins

Euros are governed and issued by the European Central Bank which is based in Frankfurt, but the actual production of euro banknotes and coins is handled by various national banks throughout the Eurozone. Spain and Greece are responsible for printing €5 and €10 banknotes, Germany prints €100 notes, and the other EU member states are responsible for printing €20 and €50 notes.

One euro (€) can be subdivided into 100 cents (c). There are seven denominations of euro banknotes in circulation: €5, €10, €20, €50 and €100 which are frequently used, plus €200 and €500 notes which are no longer printed but are still in circulation and remain legal tender. The designs printed on each banknote are intended to be symbolic of the European Union's identity and unity, as well as highlighting the diversity and richness of different European cultures. The front of each banknote features architectural styles from different periods in Europe's history, including Classical, Gothic, Renaissance and modern, while the reverse side features bridges that represent communication and cooperation between the different countries within the European Union.

Euro coins are available in eight denominations: 1c, 2c, 5c, 10c, 20c, 50c, €1 and €2. Each EU member state is responsible for minting its own coins, and can choose their own design for the 'tails' side. For example, German coins feature the 'Bundesadler' or Federal Eagle which has been the German coat of arms since 1950, while French coins depict Marianne; an important symbol of French national identity. Next time you've got a handful of euro coins, take a look at the tails side and see if you can guess which EU country they came from!

There's no evidence to suggest that you'll get a better deal if you buy your euros in Europe. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your euros in Europe:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy euros when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in Europe

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Twenty out of 27 EU member states have adoped the euro as their official currency. These are: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

The following European countries and territories who are not part of the EU also use the euro as their official currency: Andorra, Kosovo, Monaco, Montenegro, San Marino and Vatican City, French Guiana and Martinique, the Azores, Canary Islands, and Madeira.

Tips for saving money while visiting Europe

The most budget-friendly destinations in Europe are generally those located in the east such as Latvia, Lithuania and Estonia. In contrast: Luxembourg, Ireland and France usually top the list as some of the most expensive holiday destinations. Regardless of where you're planning to visit, you can save money during your trip by following some simple tips:

- Research your accommodation: Hotels can be expensive, so one way of saving money is to look for more budget-friendly accommodation such as hostels, holiday rentals, or even campsites. AirBnB can be an affordable option too, especially if you rent a room instead of an entire apartment; and you'll get to experience what it's like to live like a local. Salud!

- Use public transport: Make the most of any metro systems, buses, or trams to get around instead of relying on private taxis or rental cars. Many European countries also offer national and regional travel passes for public transport which can work out significantly cheaper than buying individual tickets.

- Eat like a local: Opt for local restaurants or street food vendors that offer authentic cuisine at lower prices. Avoid dining at expensive tourist restaurants, and try cooking your own meals if your accommodation has a kitchen. Not only is this a great way to save money, but it can also be a fun cultural experience to shop around in European supermarkets and cook with local ingredients.

- Plan your itinerary: Look out for free attractions such as museums, parks, churches and historical sites, and plan your itinerary around these. Many cities in Europe also offer free walking tours which can be a great way to get an overview of a new location while learning about its culture and history.

- Find discount vouchers: Many tourist attractions and activities offer discount vouchers and codes that can save you money on entry fees and other perks. Look for vouchers online; sign up to newsletters and follow the social media accounts of places you're planning to visit.

- Take cash: Using cash will help you to stick to a budget more easily than paying by card, and you'll also avoid foreign transaction fees. If you do take a card with you, look out for ATMs that are affiliated with your UK bank to avoid ATM fees, and if you're asked whether you want to pay in pounds or euros - always choose euros. If you pay in pounds the merchant can set their own exchange rate which won't be in your favour.

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Compare travel money

Choosing the right place to buy your holiday cash can make a huge difference to the overall cost of your trip. We compare the best rates from high-street cash providers, prepaid travel cards and travel debit cards to show you the best deals.

Which currency do you need?

Click on a tile to compare travel money providers for that currency.

What is travel money?

Travel money is the foreign currency you take on holiday with you in order to purchase things abroad.

Traditionally, you would buy travel money at a bureau de change. They would quote an exchange rate for a given currency and that would determine the price in pounds.

These days, you can get travel money ordered directly to your house and you can buy travel debit cards .

Where is the best place to get travel money?

The best travel money rates are found online. You can shop around for the best deals on multiple websites, comparing exchange rates, delivery fees and promotional offers.

If you would rather buy your currency in person, high-street supermarkets such as Sainsbury's, ASDA and Tesco often have currency exchanges inside their stores. It's always worth visiting a few different stores to get a sense of who is offering the best rates.

Should I use cash or a travel card? We always recommend taking a card with you on holiday rather than lots and lots of cash. More often than not, the best exchange rates are found on travel cards, making them the cheapest way to spend money abroad. For instance, with a Starling card you get the Mastercard exchange rate with zero fees, and with a Wise card you get the market exchange rate.

Why you can trust Exiap to compare travel money

Over 100,000 monthly users use Exiap, saving thousands by finding and comparing exchange rates and fees for their next holiday. All it takes is a few taps or clicks to compare and select the lowest fees and rates available.

Frequently Asked Questions

You can compare travel money for the following currencies on Exiap: Bulgarian Lev , Chinese Yuan , Croatian Kuna , Czech Koruna , Danish Krone , Euros , Icelandic Krona , Indonesian Rupiah , Japanese Yen , Korean Won , Malaysian Ringgit , Norwegian Krone , Polish Zloty , Romanian Leu , South African Rand , Swedish Krona , Thai Baht , Turkish Lira and Vietnamese Dong .

We rank the best travel money providers for major currencies such as Euros and Lira based on their exchange rates and fees.

The provider that gets you the most foreign currency for your pound sterling comes top of our comparison table - period!

To get the best rates in physical currency exchanges, make sure you get quotes from a few different exchanges. Show the best quote to the exchange with the second-best quote and ask if they can beat it.

You have a few options with leftover travel cash: 1) Store it away for a future holiday 2) Take it to an exchange to convert it back into GBP

If you choose the latter option, you may be hit by 'buy-back rates'. These are the rates offered by exchanges to take back unused Euros, Lira and other foreign currencies. Often then are much worse than what you originally bought the currency for.

That's why we always recommend using a travel card. You can convert back and forth between pounds and foreign currencies at the market exchange rate, meaning you don't get punished for not spending all your travel cash!

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Compare Travel Money Exchange Rates

Order travel money online and get the best rate on your foreign currency. Whether you are looking for euros, dollars, or one of the many currencies our top travel money providers offer, we will always find you the best rate when you buy currency.

Best Travel Money Rates

✔ We compare exchange rates from all the UK's top travel money providers.

✔ We search out the best rates for Euros, Dollars, and over 80+ other popular foreign currencies.

✔ We list all the best online travel money suppliers that can deliver currency to your door.

✔ We help you to save money by getting the best exchange rate today!

✔ Our clever algorithm not only finds the best exchange rates but the amounts we show you include delivery cost and any other charges meaning the price you see is the price you pay.

Why buy currency online?

If you are one of the millions of jetsetters of the UK or just love getting away on the occasional holiday, buying your currency online is a great way of saving money. Knowing where to get your travel money can be daunting; finding out where to get the best exchange rate can seem like an intimidating task. That’s where we come in! Compare Travel Cash compare exchange rates from all the UK's top travel money providers. Our rates include all the fees so there are no hidden surprises.

Buying currency online is the best way to make sure you get the best exchange rate. You more often than not get a better deal buying currency online than you do on the high street and almost definitely better than buying currency in the airport.

Get the best Exchange Rate on your Travel Money

We can help you save money and get the best deal when buying currency. Every few minutes we compare the exchange rates of foreign currencies from all over the globe, so whether you want Euros, Dollars, Lira, Koruna, Rand, and many more currencies, we have you covered. Researching today's best exchange rates from the UK's best travel money providers to show you the best deals and offers in one place.

TOURIST EXCHANGE RATES FAQ

The tourist rate or holiday money exchange rate is the rate at which foreign currency is sold to consumers. Basically, it's the rate foreign currency is sold in exchange for local currency. For example, if you were heading to Spain, you would exchange your pounds to euros using the tourist rate.

The exchange rate used by banks and big financial institutions is different and called the interbank rate, this changes continually throughout the day. Travel money suppliers make their money on the difference between the interbank rate and the tourist rate, this is why it is so important to compare travel money rates to get the most up to date information and today's best rates.

Most of our travel money providers offer 0% commission when you buy currency online. Historically the older fashioned bureau de change and banks would charge the exchange rate + commission + handling fees which made things super complicated when trying to work out the cheapest way to buy holiday money. With modern technology and the ability to update currency exchange rates anywhere in the world instantly, travel money suppliers consolidate any charges into the tourist exchange rate they offer you. Basically they make their money on the difference between the interbank rate and the exchange rate they offer you.

All of the travel money prices we quote include any fees and commissions, including delivery to your home!

Hundreds of customers buy travel money through online travel money providers sites every day and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transferring money to any company.

Compare Travel Cash undertake comprehensive checks on all of our online travel money providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

All of the travel money prices we quote include all the charges including any commissions, fees, and delivery charges. The exchange fee we quote is the price you will pay. No hidden charges.

Every few minutes Compare Travel Cash updates the rates to bring you the most up to date information and the latest best rates for travel money.

Most of the world's currencies are bought and sold by banks and financial institutions based on flexible exchange rates, meaning their prices fluctuate continuously based on the supply and demand in the foreign exchange market. High demand for a currency or a shortage in its supply will cause an increase in price. If that all sounds very technical, there's no need to worry, we do all the research for you so you always know you are getting the best rate and latest information when you buy currency online.

Many of our online travel money providers update their rates almost instantly inline with the market. Those who don't update their currency exchange rates so regularly do not tend to offer the best rates for currency exchange as they have to factor in enough of a margin to cover the fluctuations.

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

Compare the Best Holiday Money Rates in the UK in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

In the United Kingdom, online travel money orders from Compare the Market, MoneySuperMarket, and even Post Office Travel Money are extremely popular for getting travel money for your next holiday abroad. However, there are hidden fees involved that we will detail in this guide.

Whether you’re travelling for business or pleasure, we’ll answer all the questions you have on buying foreign currency in the UK and help you find the best ways to make your money go further. While travel debit cards with no international transaction fees such as Starling Bank and travel money cards such as Revolut have a slight technical difference, we will explain why these two options are the best way get holiday money in the UK in 2024.

UK Holiday Money Comparison: 4 Best Currency Exchange Rates

- 01. Top Choice: Multi-currency travel money card scroll down

- 02. Recommended: Travel debit card scroll down

- 03. Optional: Travel money pick-up or delivery scroll down

- 04. Worst Case: High-street or bureaux de change scroll down

- 05. Our top 5 exchange rate tips for UK travel money scroll down

Compare Holiday Money in the UK

Compare holiday money in the uk: 4 ways to order.

Thanks to travel debit cards and the innovation of multi-currency accounts , there are now few advantages to ordering travel money in the UK from a travel money provider (which you might find from a place like MoneySuperMarket).

Travel money exchanges in the UK have been useful to get physical bills of foreign cash before your flight. However, its almost always cheaper to simply get cash at an ATM while on your holiday abroad. Furthermore, most retails and merchants these days accept card payments. There are travel cards that waive foreign transaction fees too — and they lower your risk of loss or theft when travelling with large amounts of cash.

In this list below, we compare four methods to get travel money if you are in the UK. Let's jump in:

1. Get a Multi-Currency Card For Overseas Travel Money

When typical travel money providers sell you foreign currency, they apply a weaker exchange rate than the real mid-market rate . This markup is known as an exchange rate margin , which they pocket as a profit. As we go down the list, we will see this hidden fee get more and more costly.

The Wise Multi-Currency Account and Revolut are our recommendations for the best way to get travel money in the UK because they both offer the best exchange rates on the market.

Revolut is our top choice for travel money in the UK because it charges zero fees for first £1,000 per month that you exchange. The platform works entirely by desktop or smartphone, and they send you a debit card to access your travel money. After the fair usage limit, Revolut charges 1% of the total for Standard plan customers. If you upgrade to their Premium, Metal, or Ultra plans, then you the fair usage limit will be completely lifted.

What's just as impressive is Revolut's exchange rate fees. While markups vary by currency and increase on the weekends, the average markup is a minuscule 0.2%. For euros (€), the most popular currency used for travel money in the UK, Revolut sometimes applies an exchange rate that is actually stronger than the European Central Bank's mid-market rate. This means that you may gain when you exchange your GBP to EUR for your next holiday in the Eurozone.*

You can use Revolut's debit card to use at ATMs for local cash. As a Standard customer, you'd get £200 month of fee-free withdrawals.

*The GBP to EUR exchange rate shown in the image above is not guaranteed. The image was taken on 28/07/2023.

Learn more: Read our in-depth Revolut review or visit their website .

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Wise Account

The power of the Wise multi-currency account comes from never charging hidden exchange rate margin fees. No matter which foreign currency you want, Wise will always apply the real mid-market exchange rate to your British pounds. Instead, it charges a transparent service fee that ranges from 0.3% to around 2% depending on the currency.

The Wise account lets you exchange, hold, and spend over 50 foreign currencies with its debit card. It even comes with checking account details for 10 countries, including a UK sort code, US account number, EU IBAN, and more. This means you can receive money locally from those countries with direct debits, SEPA payments, and other methods.

For holiday cash, you can use the Wise debit card for 2 free ATM withdrawals for a total of £200 per month.

Learn more: Read our in-depth Wise review or visit their website .

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

2. Get a Travel Debit Card That Waives Foreign Transaction Fees

While multi-currency cards like Revolut and Wise allow you to directly use the local currency to pay for goods on your travels, UK debit and credit cards use your GBP holdings. When you use a card issued by Visa, for example, Visa will covert the British pounds in your bank account into the local currency of your holiday destination.

The Visa and Mastercard currency conversion rates are very low (around 0.2%-0.5%), making debit and credit cards a viable option. You can track the Visa exchange rate here and the MasterCard exchange rate here . Just make sure to find cards that charge no international transaction fees . These fees, also called "foreign transaction fees", are a much higher percentage and add up very quickly.

Starling Bank

Starling Bank stands out as one of the premier debit cards for international travel for customers in the UK, thanks to its absence of foreign transaction fees. If you solely have their GBP account, your Starling Bank card will apply the live exchange rate used by MasterCard, which closely aligns with the mid-market exchange rate. Moreover, Starling Bank provides EUR accounts for no additional cost, making it an ideal choice for traveling to countries that accept euros. In such instances, your Starling Bank debit card will access these account balances, allowing it to be recognised as a local Eurozone card.

One of the most compelling features of Starling Bank is its complete exemption from ATM fees, both domestically and internationally. Irrespective of the amount of cash withdrawn or the frequency of withdrawals, Starling Bank never imposes any fees for ATM transactions. While third-party fees may still apply, as determined by the ATM owner, this travel benefit solidifies Starling Bank's position as the top debit card for international travel for UK residents and citizens.

More info: Read our in-depth Starling Bank review or visit their website .

- Service & Quality 8.5

- Fees & Exchange Rates 10

- Customer Satisfaction 9.3

3. Order Online and Collect From a Travel Money Provider

Many businesses, including specialist currency providers and supermarkets, allow you to order your travel money online. This is normally known as a “Click and Collect” service. You can then visit a local store and pick up your foreign currency. Depending on the provider, your money could be ready the same day or you might need to visit a few days later to give them a chance to prepare your transaction.

With some services, you’ll pay online, while others will allow you to pay when you pick up your travel money. You will normally need to take the debit or credit card you used to buy the currency and may also need to take another form of identification with you.

A “Click and Collect” service typically charges a £5 - £10 fixed fee and a 2% - 5% exchange rate margin.

Have Travel Money Delivered to Your Home

One convenient way to get travel money is to order it online and have it delivered to your home address. You can order through a currency exchange provider’s website, pay for your order and let them know where you would like it delivered.

You should receive your travel money in a couple of business days, and most providers recommend ordering currency for delivery at least three working days before you’re due to travel. For security reasons, most providers will only send your travel money to the address associated with your debit or credit card, and somebody will need to be available to pay for the delivery. Depending on the amount you’re ordering, you may need to pay a fee for home delivery.

Pick Up at a UK Travel Money Provider

Many chains offer a pick-up service, and in some cities, you’ll find independent operators. This is cheaper than the delivery option because the provider will not charge you a delivery fee. There are multiple ways to pay for foreign currency at a local provider including credit cards, debit cards and cash.

We have a complete guide to the best bureaux de change in London .

4. Visit a High Street Bank or Bureaux de Change

Exchanging money at high street bank or a currency exchange bureaux at an airport is usually the least favourable option for travellers. These establishments typically impose fixed service fees of £10 or more. Moreover, their exchange rates are often not transparent, leaving customers unaware of the actual margin being applied to their transactions. We have seen the markup charged by airports to exceed a staggering 17% or more, leading to substantial losses when converting money.

Be careful when confronted with banks or bureaux advertising "no fee" exchanges, as this often means that they are incorporating hidden exchange rate margins into their services. While these options may serve as a last resort during emergencies at airports, they are generally ill-advised to get travel money in the UK.

To ensure optimal value for your travel money, we highly recommend obtaining a travel debit card or multi-currency account with transparent and competitive rates.

Holiday Money Comparison

Have a look at our travel money comparison chart to find some of the best foreign currency exchange rates offered in the UK.

Last updated: 28/07/2023

Top 5 Exchange Rate Tips For Travel Money in the UK

Here are our essential facts to consider when doing travel money comparison in the UK for your next holiday:

- Cards Over Travel Cash: The right travel money cards consistently offers better rates than travel cash.

- Watch Out for Credit Card Fees: Credit cards charge extra fees to buy travel money on sites like MoneySuperMarket and Compare the Market.

- Avoid International Transaction Fees: It's worth the effort to find a debit card that waives foreign transaction fees for spending abroad.

- Minimise Cash Holding: If you use travel money, pick up your cash as soon as you can since there may be limited protection for your funds.

- Avoid Airport Currency Exchange: Refrain from changing cash at the airport, as rates are often the worst available on the market.

Here are our travel money comparison highlights for the UK:

- Revolut : Get a GBP and EUR account, plus hold and exchange over 20 foreign currencies with no fees for the first £1,000 per month.

- Starling Bank : Get a free GBP and EUR bank account and access both currencies with the Starling debit card, which waives all foreign transaction fees and charges no ATM withdrawal fees.

Travel Money Comparison UK FAQs

Yes. Here at Monito, we make it easy to compare providers so your money goes further. Our easy-to-use comparison tool help you compare travel money solutions, from click and collect services to the best multi-currency cards to spend money abroad without the hidden fees. We also provide in-depth reviews of travel money services , so you can understand their fees, exchange rates, how easy they are to use, what their customers think, mobile apps and much more.

When you’re deciding how to get your foreign currency, there are several areas you might want to take into account:

- Fees: These can come as fixed fees, commissions, percentage fees, delivery fees, credit card fees or ongoing fees

- Exchange rates: The foreign currency exchange rate will impact how much travel money you get, and can vary significantly between providers

- Services: the types of service a travel money provider offers, for example: Click and Collect, home delivery, local currency exchange or multi-currency cards

- Speed: How quickly you will receive your travel money

- Convenience: How easy it is to get your travel money

- Customer reviews: What other people think of the travel money provider

- Mobile apps: Whether the provider has a useful mobile app for ordering travel money on-the-go

- Credibility and security: The steps the travel provider takes to protect your personal and financial information

The types of fees you’ll need to pay do depend on the currency exchange business that you use. Typical types of fees include:

A travel money provider may charge you a fixed fee to exchange currency. On larger amounts, these fixed fees won’t make a big difference, but if you’re exchanging smaller amounts, they can take a bite out of how much you’ll receive.

Commissions and percentage fees

Some providers will charge a percentage of the total amount you exchange. This may be a more economical fee if you’re sending smaller amounts, but can quickly add up if you’re sending more.

Delivery fees

If you’re having travel money delivered to your home, then a U.K. travel money provider may charge you for this service. You’ll normally be charged if you order under a certain amount, typically if you exchange less than £500.

Ongoing fees

Certain premium services offered by traditional and mobile banks may charge a monthly fee for services, including a multi-currency card.

Credit card fees

If you pay for travel money with a credit card, it’s possible that your credit card provider will charge you extra since these types of transactions are often considered as “cash advances.” This could be charged as a percentage of the amount and may also result in additional interest. Check with your credit card company to understand what their fees are. If you want to avoid these fees, you could fund your transaction with cash, a debit card or a bank transfer.

Overseas ATM/cash machine fees

If you withdraw money at an overseas cash machine, you may be charged additional fees. These might be charged whether you’re using your U.K. bank or credit card or a multi-currency card.

For example:

- Eurochange U.K. charges £1.50 per cash machine transaction

- Debenhams charges €2 per cash machine transaction

- Tesco Bank charges £1.50 per cash machine transaction

- Monese charges two percent of the transaction amount after a certain limit

Note that these fees are often in addition to fees charged by the cash machine operator.

Many U.K. travel money providers make most of their money on the difference between the exchange rate they offer to customers and the interbank exchange rate. The interbank rate is also known as the base, mid-market or standard exchange rate, which is the midpoint between the buying and the selling prices of the two currencies.

Here are some examples of what that difference can mean in terms of how much you’ll pay in “hidden” exchange rate markups and fees.

Debenhams travel money: Exchanging 1,000 U.K. pounds into Philippine pesos

- Base exchange rate, 1,000 GBP converts to 65,138 PHP

- Debenhams Travel Money exchange rate, 1000 GBP converts to 59,058 PHP

- The Debenhams Travel Money exchange rate is 9.4 percent more expensive, or around 94 GBP in exchange rate fees

Tesco travel money: Exchanging 1,000 U.K. pounds into Australian dollars

- Base exchange rate, 1,000 GBP converts to 1,862 AUD

- Tesco Bank Travel Money online exchange rate, 1,000 GBP converts to 1,819 AUD

- The Tesco Bank Travel Money exchange rate is 2.3 percent more expensive, or around 23 GBP in exchange rate fees

Eurochange U.K.: Exchanging 500 U.K. pounds into South African rand

- Base exchange rate, 1,000 GBP converts to 19,138 ZAR

- Eurochange UK exchange rate, 1,000 GBP converts to 18,396 ZAR

- The eurochange UK exchange rate is 3.9 percent more expensive, or around 38 GBP in exchange rate fees

We’ve seen markups of between two percent and 18 percent from travel money providers. That’s why it’s always worth comparing holiday money solutions before your trip.

Yes. Many providers will put an upper limit on how much you can exchange in a single transaction or over time. You can find details of these limits in our in-depth reviews.

Typically, yes. A reputable currency exchange business should be licensed and authorized by the Financial Conduct Authority. They should also have separate business operational accounts and accounts for processing foreign money exchange. All of the providers we feature on our website are licensed and authorized. You can find out more about other providers by reading our in-depth reviews.

It’s very unusual for something to go wrong with a currency exchange transaction. Your financial protection depends on how you pay for your travel money. If you pay via cash, you’ll likely get your foreign currency immediately. If you pay by bank transfer, you’re not normally protected. If you pay by debit card, you’re protected from fraud and non-receipt. The most complete protection comes if you use a credit card to fund your transaction, although that comes with other issues like higher fees. We recommend paying for most travel money with a debit card.

In many cases, you can sell your remaining foreign currency notes back to your travel money provider. Most providers indicate on their website how to return money to them. Note that you may get back less than what you sent, as the buyback rates are not as good as the selling exchange rates.

Something else that’s worth pointing out is the exchange rates offered by bureaux de change. These exchange rates often have a much higher markup than click and collect or home delivery exchange rates. Typically, bureaux de change will have different rates for buying and selling currencies, so make sure you’re comparing like with like. In most cases, we recommend a click and collect or home delivery service so you get better exchange rates.

You can learn about exchange rates and fees at London bureaux de change here .

You can open an account with multiple providers in order to have backup cards and multiple limits (with 1x Wise card and 1x Revolut, you can withdraw 2x €200 for free at an ATM abroad for example). If you're not travelling alone, you can open multiple accounts with the same provider, so both you and your partner can have your own card for example.

Order your card in advance (at least two weeks) to make sure you receive it before your holidays. If you’re too late, some services offer a paid express delivery option (£19.99 for a Standard Revolut card for example).

From the United Kingdom? Revolut is not licensed as a bank in the UK. The content found on this page relating to its products and services is not intended exclusively for a UK readership and may therefore contain inaccuracies from the perspective of UK customers.

References Used In This Guide

1. Travel Money . MoneySuperMarket. Accessed 28 July 2023. 2. Travel Money . Post Office UK. Accessed 28 July 2023. 3. Travel Money. MoneySavingExpert. Accessed 28 July 2023. 4. UK Pricing. Revolut. Accessed 28 July 2023.

Travel Money Comparison UK Tips

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Cheap Holiday Money At Your Fingertips

Find The Best Travel Money Rates

Our rates are updated hourly and sorted by the best currency exchange rates at the moment of inquiry. We pride ourselves on being one of the industry’s most comprehensive and accurate sites, but we recommend double-checking the rates before placing an order.

Best Travel Money Rates Provider (Wise):

Additional providers:.

* This is a comparison of more than 30 recommended travel money providers (doesn’t include other companies which have been included in some of the comparison tables on the site but have not made it into our “recommended” list).

* We do not guarantee the accuracy of quotes, but you can go ahead and check us out. If the provider is offering a different quote than what we featured, go and check other providers (sometimes the rates fluctuate heavily which causes some discrepancies but it’s rare). We feel this holiday money rate comparison is more accurate than most.

* Customer rating component is taken from CompareHolidayMoney with their permission.

View our Per Currency Comparison of top travel money providers:

Pound to Euro

Pound to Dollar

Pound to “Aussie” Dollar

Pound to Canadian Dollar

Pound to Turkish Lira

Pound to Costa Rican Colon

Pound to “Kiwi” Dollar

Pound to Sri Lankan Rupee

Pound to Indian Rupee

Pound to Thai Baht

Finding the best travel money provider

With travel money, finding the best travel money provider for your needs could be complicated. For once, the amount of currency required impacts the rates you are getting. Additionally, some providers are cheaper for particular currency pairs and more expensive for others. Finally, some people value rates, while others care about quality of service and reliability (and are willing to pay more for it).

This is why we have established CompareTravelMoney.net, to provide travellers with all the information they require to make a sober choice. For each currency, we have a separate list of recommended providers with specific rates which apply to the amount you are willing to exchange.

Websites like ours don’t charge money off clients (you will not get better rates by approaching them yourself; on the contrary). We only take a small fee for each client we refer over to a travel money company. In fact, we encourage competitiveness in the niche, and as a whole, what we do helps people get better and better rates each year for their currency.

Happy Travels!

Be sure to read through our About Us and Terms and Conditions . We have covered international money transfers for bank account transfers in a separate guide, but we are unable to present rates from these companies.

Sunday 28th. April 2024

Follow us on twitter keep an eye on the latest rates & get the latest deals.

Travel Money Finder

Make the most of your travel money, search & compare the best uk foreign currency exchange rates, impartial results from multiple suppliers, up to 80 currencies tracked.

Rates Watch

Sun. 28th. April 2024 1:20pm

GOV.UK Travel Advice

Popular Currencies

Best value bureaux.

Prepaid Currency Cards

Currencies Information

Compare Travel Money Exchange Rates

Making sure you find the best exchange rate should be a priority when planning any trip abroad. The process of comparing travel money rates can be confusing for some, so here are the main things to keep in mind.

What is the exchange rate?

The exchange rate is the way to calculate how much of one currency you will get in exchange for your own money. For example, an exchange rate of 1 would mean that for every one pound sterling, you would get one euro. A rate of 1.2 would mean that for every pound, you would get 1.20 euros. When comparing holiday money providers, look for the exchange rate which gives the highest pound-to-euro or pound-to-dollar rates.

The exchange rate is not a fixed rate. It can vary from day to day, and even from hour to hour. That is why it’s important to shop around and compare travel money quotes from a range of providers to be sure you are getting the most for your money.

What currency do I need?

If you are leaving the UK, you will need to exchange your pounds for the currency used in your destination. UK currency is often referred to as GBP (Great Britain Pounds) for currency exchange.

The majority of European countries have adopted the euro as their currency, with a few notable exceptions. If you are planning a trip to a country within the eurozone, it’s essential to check the GBP/EUR exchange rate to determine how much money you can exchange. Remember, the exchange rate can fluctuate, so it’s always a good idea to keep an eye on it both before and during your trip.

Travel money is available in every currency. Make sure you are searching for the correct exchange rate though, as more than one country uses the currency of the same name. Dollars are used in the USA, Canada and Australia, to name a few, and each will have a different rate!

How to get the best exchange rate on holiday currency?

Many factors affect the exchange rate on any given day. The amount of currency you will get for your pound will vary depending on which provider you buy it from, where you buy it – either online or on the high street, and even the physical location of the provider. This variability is crucial for those dealing in foreign exchange, be it for academic, personal, or professional reasons.

Money exchange companies located in or near popular tourist attractions tend to offer lower exchange rates. This is why you might be advised to steer clear of buying your currency at the airport. The captive market can mean providers get away with much lower rates!

Online or high street travel money?

Most high street banks and Post Offices offer currency exchange. However, generally, better deals are found with online providers.

Travel money fees

As well as the exchange rate, you will need to consider fees when choosing a travel money provider. Travel money providers charge a fee for converting currency. By comparing the rates from several providers, you can find the lowest fee.

Be aware though that the provider with the lowest fee might not always be offering the best exchange rate! This is where online comparison can help. You can see at a glance how much holiday money your pounds will buy and choose the best for you.

How much money should I exchange?

No one can tell you exactly how much money to exchange. Everyone’s needs are different, depending on whether you’re travelling for business or pleasure.

Most holiday money companies will have a maximum limit on the amount you can exchange. In most cases, this will be around £2500, although some providers allow transactions of up to £7,500. If you are travelling for business or buying from suppliers abroad, exchanging a larger amount could be more cost-effective once fees are taken into account.

How do I get my travel money?

This will depend on where you buy it from. High street providers usually offer the choice to pick up your holiday money from a local branch or deliver it directly to your home. There’s usually a small additional fee of up to £10 or free home delivery.

Travel money FAQs

Am i protected.

The best protection is to buy your currency from an authorised by the FCA provider or reputable and established broker. If your provider folds before you take delivery of your travel money, you will not be protected. Make sure you collect or arrange delivery of your funds as soon as possible after purchasing to avoid being left out of pocket.

How to find the best exchange rate?

How much holiday money you will be able to buy can vary hugely from day to day . The best way to get the most for your money is to shop around and compare travel money quotes from as wide a range of providers as possible. It doesn’t have to be time-consuming when done online and could save you money.

Do I have to order travel money in advance?

When you choose to buy your currency is completely up to you. Buying in advance can allow you to take advantage of a good exchange rate or deal, and gives the greatest flexibility on how to collect/deliver your cash.

Can I use my credit card for travel currency?

Yes. You can pay for your holiday money with either a credit or debit card. Be aware that using a credit card will incur fees from both the card provider AND the currency provider, so might not be the cheapest way to get your holiday money.

Why use online travel money comparison sites?

Online travel money sites usually offer better exchange rates than high street providers. This is because of the increased competition online. The other benefit of an online currency comparison is that you can see rates from many different providers at a glance, all in one place.

Royal Mail strikes are expected in November.

We advise all our customers to order their travel money this month to reduce any inconvenience caused from any upcoming delays or backlogs next month.

Compare Exchange Rates

- Currency Converter

- Convert British Pounds To Australian Dollars

- Convert British Pounds To Euro

- Convert British Pounds to Japanese Yen

- Convert British Pounds To Turkish Lira

- Convert British Pounds To US Dollars

- Convert Australian Dollars To British Pounds

- Convert Euro To British Pounds

- Convert Japanese Yen To British Pounds

- Convert Turkish Lira To British Pounds

- Convert US Dollars To British Pounds

Order Travel Money & Foreign Currency Online for the best rates.

How are we cheaper and transparent?

Most banks and bureau de change add on various margins to the exchange rate that customers are not aware of making it harder for you to compare exchange rates on offer. We have gone one step further. To offer you low-cost exchange rates on your travel money whilst giving you to access to the live interbank exchange rate at the point of when you transact for complete transparency. Compare our currency exchange rates and see how much you could save. You can buy Turkish Lira here .

TOP RATED COMPANY ON TRUSTPILOT

Ranked 1st of 96 on Review Centre

- Travel Money

I have British Pounds

1 GBP = Your exchange rate

1 GBP = Real exchange rate

- Transfer Type

- Low cost transfer - 369.39 GBP fee Send money from your bank account

- Advanced transfer - 369.39 GBP fee Send from your GBP account outside the UK

The more you order the lower the fee

I want to buy

Featured in

Most bureau de changes, banks and currency brokers will state no commission or fee free but in reality, these are hidden within the rate of exchange. When you cannot see the interbank exchange rate it becomes harder to compare which is the best value? We're changing this to offer a fully transparent marketplace where there are no hidden fees and you have access to the live interbank exchange rate before you transact.

The Currency Club is re-writing the script!

We evaluate the euro-to-pound exchange rates offered by most of the UK's largest travel money companies. Our sophisticated algorithms help you sell Euros for Pounds and make sure you receive the most accurate buy-back rates for euros and can discover who is providing the best euro-to-pound exchange rates. And, if you need any detailed consultation on the exchange rate, our team will provide the same. Moreover, visit our website and learn the essential information regarding Euro/Pound exchange.

Have you got any leftover cash from your recent vacation? We can buy back foreign currency from you. At our bureaux de change, you can convert money into GBP. In whatever denomination that we sell, we will buy back.

Follow these simple steps:

To locate the closest branch, use our branch finder and choose "foreign currency."

Come with your cash, and we'll buy everything from you.

We're pleased to repay you for the holiday money you purchased from us if your trip is cancelled.

You're finally done!

This is how you can buy back currency . Transfers are pretty simple. Just follow a few simple steps, and you can exchange them to get the cash back.

The name of Turkey's currency is Turkish Lira. In the years 2005 to 2008, it was referred to as the New Turkey Lira. However, starting in 2009, the word "New" was omitted, and the currency was once more referred to as the Turkish Lira.

The Turkish Lira was a steady currency before its current value decline, primarily due to the pandemic.

You can get the best exchange rate for Turkish Lira on our website. We will compare prices in your area to provide you with the best possible deal.

With us, you can buy or sell Turkish Lira without paying any additional fees. The fees imposed for currency exchange differ amongst exchange companies. However, free software to exchange currencies will allow you to save money.

The official currency of the United States of America (USA), which has the largest economy in the world, is the US dollar. Given the USA's robust economy, it is not surprising that the USD is one of the strongest currencies in the world. As a result, the most common currency used for transactions worldwide is the US dollar, which is regarded as the standard. According to a recent Bank of International Settlements survey, the US dollar accounted for 88% of all foreign exchange transactions.

Contact us if you want to get the best exchange rate for USD . US Dollar exchange rates fluctuate throughout the day due to the high level of volatility in the currency exchange market. You can check the current exchange rates for the US dollar online and place an order to buy or sell US dollars at those prices.

You may buy and sell foreign money online with The Currency Club at real-time, transparent exchange rates. We have one of the best buy-back exchange rates . Compare the best exchange rates offered by hundreds of money changers in your area for more than 40 different currencies. Get your travel money quickly, easily, and affordable by ordering your foreign currency online at our best rates. With our range of currency brokers, check buy-back rates for euros, dollars, and more.

The best exchange rates can be found by comparing them.

View charges at a glance.

Apply right away

These rates are available only when you pay online - rates in branch will differ

Last updated on

Source: compareholidaymoney.com

*We capture the exchange rates being offered by airports and high street providers once a month and calculate what spread they are taking off the live interbank rate. We then compare that to what rates we are offering to calculate the savings you can make if you use us.

*Your potential saving has been calculated using our exchange rate and the most expensive provider's rate in the market at a given point in time.

What will you do with the savings you make on your travel money?

transacted £1 Billion

since company inception

currencies traded

How does it work?

Select the currency you wish to buy

Log in to your account or visit the home page and select the currency like change Swedish Krona to GBP and confirm the amount you wish to buy

Confirm your exchange rate

Our rates move with the market, once you confirm your order you fix your rate, go here for the best exchange rate for Turkish lira .

Select a delivery date

Royal Mail will require a signature from someone in the property at the time of delivery

Pay via bank transfer or credit, debit cards. We can only dispatch currency once we have received cleared funds

Confirmation and tracking information

We shall email you a dispatch notification once your currency is on its way to you and this mail will include your tracking details.

Delivery of currency

We use Royal Mail Special Delivery which is a fully insured and secure home delivery service

Frequently asked questions

How do i place an order with the currency club.

All orders are placed online via the website. Simply go to our homepage and complete the steps on the currency converter. Then follow the onscreen instructions. To check whether you have successfully placed the order, log in and check your Order History. Please not that all updates regarding your order shall be sent to your electronically via email so be sure to check your inbox.

If you are having trouble to order euros online with us , please do not hesitate to contact our customer services team.

Will I receive confirmation that my order has been accepted?

Yes. On successful completion of an order, you will receive an order acknowledgment email that we have received your currency order, followed by and Order Confirmation that we have received payment against your order. So, convert your pound to Indian rupee, today .

Are there any minimum and maximum limits per transaction?

The minimum order amount with The Currency Club is £100 worth of currency and the maximum is £7500 per order per day for home delivery. Please note that we can also handle larger requirements so please email us on [email protected] or ring us for further information on 020 7723 7000. So, keep these details handy when you sell US dollars with us .

I haven't received any email confirmation after placing my order, what should I do?

This shouldn't usually happen as the system is fully automated.

Firstly, try logging into your account. If you are facing an issue it could be that you have entered your email address incorrectly during the registration process. We can easily fix this if you call into our team.

If your email address has been entered correctly, check your junk/spam folder. Please make sure you add thecurrencyclub.co.uk to your safe senders list so you receive all communication from us regarding your order.

Why has my order been cancelled?

Orders can be cancelled due to a variety of reasons. An order can be cancelled automatically by the system if you have selected the low cost service and we do not receive payment in a timely fashion. It can also be cancelled if the card billing address does not match the delivery address or if we have run out of stock of the currency you have ordered. So, when you sell UAE dirham to GBP online , make sure you are completing all the steps properly.

New Service!

Cheaper, faster, easier international currency transfers.

Our members comments

Travel Blogger

Despite the proliferation of businesses taking their wares to the internet, most are simply doing the same old retail 'thing' but in another format.The Currency Club is different. The service is straightforward, accurate, excellent value and does not bombard the customer with pointless visual and virtual noises in the process. A company that does a straightforward job in a way that far exceeds the experience of the high street.Highly, recommended.

First time i've ordered currency online and was unsure at first. But the currency club had one of the best rates with free next day delivery. When i had a query i received a response within the hour! Fantastic service and will definitely use again!

What can I say, not only an incredibly easy transaction selling my dollars(I received payment on the same day TCC got them through the post from me) but i had actually made a mistake and was called to say i was owed $98 worth more than i'd stated on the form.I am most greatful for the honesty, it made my day to think that, even though i was really non the wiser, this company cares.Can i give 6 star review? Most definitely I will use them again...

First time i've used The Currency Club and it won't be last.Excellent service, very good rates both for the purchase and the "buy-back". would highly recommend.

A page for us to share with you our thoughts on everything to do with with foreign exchange and much more. From new product launches and widgets to political announcements, market insights and even where to head on your next holiday look no further, you'll find it all here.

September 2020

An update during the Covid-19 crisis..

These are really challenging times for everyone around the globe as we are bombarded with tragic news stories and adjust to a new "normal".

December 2020

Message from the CEO

The Currency Club's mission has always been to reduce the cost of foreign exchange for everyone. We launched our business ten years ago with this intention,and we deliberately focused on the retail travel money sector..

Guide to send money abroad cheaply