Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AIG Travel Guard Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3126 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Core coverages, optional coverages for an additional fee, aig travel guard and covid-19, additional information — aig travel guard, to other travel insurance companies, to credit card travel insurance, the value of travel insurance comparison websites, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Purchasing insurance for your home, auto, or your life, can be complicated and time-consuming if you want to compare coverages and premium costs between companies. Fortunately, the process of purchasing travel insurance is quite simple , and you can secure immediate coverage within minutes.

It all starts with determining the coverages that most important to you, securing a quote, then making sure you’re purchasing from an established, highly-rated company. One such established travel insurance company is AIG Travel Guard .

With over 25 years of experience and high ratings from premier insurance financial rating company A.M. Best , AIG Travel Guard was named the best travel insurance company of 2020 by Forbes . Its Travel Guard Deluxe policy was also given a top 5-star rating by Forbes’ insurance analysts.

We’ll certainly discuss AIG Travel Guard’s policy offerings in our article today but we also want to discuss why you’d want to purchase travel insurance , whether travel insurance covers COVID-19, the process for obtaining a quote, and additional resources to help ensure you’re receiving good value.

Plus, if you’re wondering if you need to purchase travel insurance or whether you might have enough coverage elsewhere, you’ll want to read on.

While the primary reasons for purchasing travel insurance are to protect your economic investment and to cover unexpected additional expenses you might incur due to trip disruptions, purchasing travel insurance has another, more intangible, purpose.

Purchasing travel insurance can provide peace of mind prior to and during your trip as you won’t be worried that an unforeseen event will result in an economic loss. Knowing you have evacuation insurance when you’re traveling to a remote area on safari, for example, could be tremendously reassuring, even if you never use the coverage.

Here are some sample situations where travel insurance may provide coverage:

- Your sister is diagnosed with a life-threatening illness and you must cancel your trip

- You broke your ankle and will not be able to go on your skiing trip

- You become ill and cannot travel

- You or your traveling companion is terminated or involuntarily laid off from your job

- You are summoned to jury duty or other legal action such as requiring you to appear as a witness

If your trip is expensive, complicated, or you need medical coverage while traveling, a travel insurance policy is a must.

Bottom Line: In addition to protecting your trip investment and covering unexpected expenses due to trip disruptions, travel insurance can also provide peace of mind before and during your travels.

AIG Travel Guard — Coverages and Policy Options

There’s probably nothing more boring than listing insurance coverages but it’s important to know the types of coverages you can expect when purchasing an AIG Travel Guard policy.

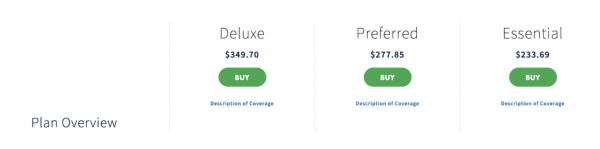

First, AIG Travel Guard offers 3 policy options for U.S. residents (not including NY residents), 3 separate options for NY residents, and 1 policy for Canadian residents.

- Tr avel Guard Essential

- Travel Guard Preferred

- Travel Guard Deluxe

- Travel Guard Essential Expanded — available to NY residents

- Travel Guard Protect Assist — available to NY residents

- Travel Guard Tour, Cruise, & Travel — available to NY residents

- Gold Trip Cancellation Policy — available to Canadian residents

Coverage options and limits will vary by policy, however, you can expect to find the core and optional coverages listed here.

Here are the types of coverages you’ll find offered on AIG Travel Guard policies and the applicable coverage limits for each type of policy.

There are also additional coverages that may be included at no extra charge, depending on the policy type selected. Terms and conditions apply.

- 1 child under 17 per covered adult is included for no extra charge

- Pre-existing conditions waiver

- Trip exchange coverage

- Single occupancy fee coverage

- Evacuation for a security reason

- Non-flight accidental and dismemberment insurance

- Worldwide travel and medical assistance services

You may secure any of the following add-on coverages by paying an additional fee.

- Cancel for Any Reason Insurance — covers trip cancellation for any reason

- Rental vehicle damage — coverage for collision damage when renting a vehicle

- Pet bundle coverage — pet care, medical expenses, and adds pet illness to trip cancellation benefit

- Adventure sports coverage — coverage for higher risk adventure activities

- Increased lodging expense bundle — increases the amount covered under travel inconvenience benefit

- Wedding bundle — coverage when a destination wedding is canceled

- Name a family member bundle — select a traveler to be covered as a family member

Hot Tip: For more information and tips on purchasing travel insurance, start here in our article on travel insurance basics .

Travel insurance , in general, is designed to protect you from financial loss due to unforeseen events that may cause you to cancel your trip, or to cover disruptions that could occur during your journey. It is not meant to cover voluntary trip cancellations due to fear of getting ill.

Voluntary cancellations, including those that are related to the fear of getting ill, are not covered on travel insurance policies. However, there is 1 option for obtaining coverage for voluntarily canceling your trip.

Cancel for Any Reason insurance (CFAR) is an optional coverage that can be added to select travel insurance policies allowing you to cancel your trip for any reason you deem necessary and be covered for partial reimbursement.

AIG Travel Guard offers CFAR coverage as an optional add-on to add to its Preferred and Deluxe plans , with these stipulations:

- Must be purchased within 15 days of the initial trip deposit

- The trip must be canceled more than 48 hours prior to departure

- The full cost of the trip must be insured for at the time of purchase

Cancel for Any Reason insurance does not cover the entire cost of the trip. In this case, to add CFAR insurance to the Deluxe and Preferred plans above, the additional premium would be $53.31 for coverage to cover up to 50% of the trip price. Additional options may be available to cover up to 75% of the cost of your trip.

The above prices are for a single trip 1-week in length for a traveler of 40 years of age at a cost of $3,000.

AIG Travel Guard policies, even without the CFAR insurance add-on, offer coverage for trip cancellations due to COVID-19 related illness and also medical coverage should a covered traveler become sick with COVID-19 during their travels. Terms and conditions apply.

Bottom Line: While trip cancellation, trip interruption, and emergency medical may offer some coverage for illness, you must purchase Cancel for Any Reason insurance to have coverage for canceling a trip due to the fear of getting ill. AIG Travel Guard offers this coverage on its Deluxe and Preferred plans.

Point-of-Sale Availability — In addition to offering travel insurance package policies directly to the public, AIG Travel Guard offers travel insurance products via several travel providers including airlines and various travel services. You’ll find the option to purchase Travel Guard protection during the checkout process with companies such as United Airlines or Frontier Airlines when purchasing a flight and when making a travel purchase via Costco Travel .

Call for Additional Quotes — While AIG Travel Guard does sell annual multi-trip policies, you must call to request a quote. Adventure sports coverage, medevac coverage, and rental vehicle damage coverage quotes are also available via phone.

15-Day Free Look Period — If you decide, after you have reviewed your purchased policy, that you do not want it, you may receive a full refund.

Cruise Insurance Option — AIG Travel Guard offers cruise insurance that includes cruise diversion and other applicable coverages.

Filing a claim — to initiate a claim, you can either call AIG Travel Guard at 866-478-8222 or access travelguard.com to begin the process. You will need your policy number handy. Once your claim is submitted, you can check the status at claims.travelguard.com/status .

How Does AIG Travel Guard Compare

First, know that when purchasing a policy from AIG Travel Guard, you’re buying from a highly-rated established insurance company. Here’s how the company stacks up in relative comparison with other travel insurance companies.

Comparing travel insurance policies can be complicated as coverage limits and prices vary widely. We looked at a 1-week trip to Mexico for a traveler 40 years of age and a total trip cost of $3,000 as criteria for obtaining a quote.

AIG Travel Guard’s Preferred plan, which prices out at around $200, aligns with the John Hancock Bronze policy above. Add in CFAR coverage, however, and the comparison costs are closer to AIG Travel Guard’s $254 premium for its Preferred level plan that also includes CFAR.

This 1 example uses the criteria of a specific trip for an individual traveler of a certain age and may not reflect the same relative premium costs as other comparisons.

Your own individual traveler information, the number of travelers, trip length, destination, state of residence, selected coverages, and the total cost of your trip will ultimately determine the premium cost. Our example is just a narrow snapshot comparison.

Bottom Line: Travel insurance policy coverages and costs vary dramatically. To ensure you’re receiving good value, determine the coverages that are most important to you, compare policy options, and purchase from a reliable company.

The travel insurance coverages that come complimentary on your credit cards are no substitute for a comprehensive travel insurance policy. With that being said, the coverage that comes with your credit card could be enough to cover some trips.

Here are some examples of trips where you may not need travel insurance and the coverage you have on your credit card could be sufficient.

- The trip consists of only a round trip domestic flight and hotel stay

- The trip is a road trip by car

- The trip does not include any non-refundable trip expenses

- The trip does not have several travel providers involved

- Your health insurance covers you while traveling and you are not worried about having additional medical coverage during your trip

Also, keep in mind that coverage offered on your credit card is generally secondary versus a primary travel insurance policy. This means you must first file a claim with other applicable insurance, including coverage with the airline or travel provider, for example, before the credit card coverage will kick in.

Bottom Line: If you have a significant investment at stake, several travel providers involved, or want medical coverage during your travels, you should purchase a comprehensive travel insurance policy for your trip and not depend on a credit card with travel insurance .

Travel insurance is widely available and competitive. You won’t have trouble purchasing some level of coverage regardless of your situation. Additionally, there are travel insurance comparison websites that make it easy to find a policy that fits and purchase coverage that is effective immediately.

These travel insurance comparison websites are each easy to use, have qualified people to assist, and all feature policies offered only by highly-rated companies.

Travelinsurance.com

- Instant coverage

- Simple format, easy to secure a quote quickly

- Guarantees the best price for the policy you’re purchasing

Squaremouth

- Features 20 companies with nearly 120 different policy options

- Its customer service team is award-winning

- You can access thousands of customer reviews

InsureMyTrip

- Educational content to assist you in understanding coverages

- Features 21 highly-rated companies

- Licensed agents can answer questions and assist with a claim

Bottom Line: Travel insurance comparison websites provide quick easy access to securing a quote, compare several high-rated travel insurance providers at once, and the benefit of receiving immediate coverage.

While airlines and travel providers have made significant changes to cancellation, refund, and exchange policies, it’s still important to consider purchasing travel insurance if you’re uncomfortable with the possibility of losing your trip investment or incurring unexpected expenses during your journey.

In addition, if you need medical insurance coverage during your trip, you won’t find that coverage on a credit card or with the airlines — you’ll need to purchase it.

The fact that AIG Travel Guard does not exclude COVID-19 related claims under certain coverages and offers a Cancel for Any Reason add-on is significant as not every travel insurance company can make that claim.

Also, if you have children traveling with you, you may find good value with AIG Travel Guard having those under 17 included for no extra charge (1 per premium-paying adult).

The bottom line when purchasing travel insurance from AIG Travel Guard is that if you can secure the coverages you need at a price you’re comfortable with and you’ll know you’re completing that transaction with a highly-rated established company.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

Is aig travel guard a good travel insurance company.

AIG Travel Guard is a highly-rated established travel insurance company. It is rated A by the prominent insurance financial rating company A.M. Best and has been in business for over 25 years.

It was also named the best travel insurance company of 2020 by Forbes.

Does AIG Travel Guard cover trip cancellation?

Yes, AIG Travel Guard will cover trip cancellations but only for covered reasons listed in the policy. Examples of situations that may be covered include becoming ill and having to cancel your trip, being called for jury duty or other covered legal obligation, or your home becomes uninhabitable.

Does AIG Travel Guard cover flight cancellations due to COVID?

AIG Travel Guard, like other travel insurance companies, does not cover canceling a flight due to the fear of getting ill. However, if you become ill from COVID-19 and have to cancel your trip, you may have coverage for trip cancellation, trip interruption, or emergency medical if should become ill during your trip.

How do I make a claim with AIG Travel Guard?

You can file a claim with AIG Travel Guard by calling 866-478-8222 Monday through Friday from 7 a.m. to 7 p.m. CST. You can also initiate a claim online at travelguard.com using your policy number and last name.

Once you have submitted a claim, you can check the status of your claim at claims.travelguard.com/status , using your claim number and last name.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of April 2024

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Travel insurance can help you protect the financial investment you made in your vacation when unexpected issues arise. Find the best travel insurance for the type of trip(s) you're taking and the coverages that matter most to you – from interruptions and misplaced belongings to illness and injury.

- Travelex Insurance Services: Best Overall

- Allianz Travel Insurance: Best for Trip Interruptions

- HTH Travel Insurance: Best for Groups

- Tin Leg: Best Cost

- AIG Travel Guard: Best for Families

- Nationwide Insurance: Best for Last-Minute Travel Insurance

- Seven Corners: Best for 24/7 Support When Traveling

- Generali Global Assistance: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best for Specialized Coverage

Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

Medical and trip cancellation maximum are not as high as some other companies

- 100% of the insured trip cost for trip cancellation; 150% for trip interruption

- Up to $1,000 in coverage for lost, damaged or stolen bags and personal items; $200 for luggage delays

- $750 in missed connection coverage

- $50,000 in emergency medical and dental coverage

- Up to $500,000 in emergency medical evacuation and repatriation coverage

SEE FULL REVIEW »

Annual and multitrip policies are available

Distinguishing between the company's 10 travel insurance plans can be challenging

- Up to $200,000 in trip cancellation coverage; $300,000 in trip interruption coverage

- $2,000 for lost, damaged or stolen luggage and personal effects; $600 for bag delays

- Up to $1,600 for travel delays

- Emergency medical coverage of up to $75,000

- Epidemic coverage

Generous coverage at the mid- and high-tier levels, and great group discounts

Preexisting conditions coverage is only available at mid- and high-tier plans

- 100% trip cancellation coverage (up to $50,000); 200% trip interruption coverage

- Up to $2,000 in coverage for baggage and personal effects; $400 in baggage delay coverage

- Up to $2,000 in coverage for trip delays; $1,000 for missed connections

- $500,000 in coverage per person for sickness and accidents

Variety of plans to choose from, including two budget-friendly policies and several more premium options

More limited coverage for baggage issues than other companies

- 100% trip cancellation protection; 150% trip interruption

- $500 per person for lost, stolen or damaged baggage and personal items

- Up to $2,000 per person in travel delay coverage ($150 per day); $100 per person for missed connections

- $100,000 per person in emergency medical coverage, including issues related to COVID-19

Travel insurance policy coverage is tailored to your specific trip

Information about policy coverage inclusions is not readily available without first obtaining a quote

- Trip cancellation coverage for up to 100% of your trip's cost; trip interruption coverage for up to 150% of the trip cost

- Up to $2,500 in coverage for lost, stolen or damaged baggage; $500 related to luggage delays

- Up to $1,000 in missed connection and trip delay coverage

- $100,000 in emergency medical coverage

Variety of plans to choose from and coverage available up to a day before you leave on your trip

Limited trip cancellation coverage even at the highest tier

- Trip cancellation coverage up to $30,000; trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- $2,000 for lost, damaged or stolen baggage; $600 for baggage delays

- Up to $2,000 for trip delays; missed connection and itinerary change coverage of $500 each

- $150,000 for emergency medical and dental issues

Customer service available 24/7 via text, Whatsapp, email and phone

Cancel for any reason coverage costs extra

- 100% trip cancellation coverage (up to between $30,000 and $100,000 depending on your state of residence); interruption coverage for up to 150% of the trip cost

- Lost, stolen or damaged baggage coverage up to $2,500; up to $600 for luggage delays

- Trip delay and missed connection coverage worth up to $1,500

- Emergency medical coverage worth up to between $250,000 and $500,000 (depending on where you live)

Generous emergency medical and emergency evacuation coverage

Coverage for those with preexisting conditions is only available on the Premium plan

- 100% reimbursement for trip cancellation; 175% reimbursement for trip interruption

- $2,000 in coverage for loss of baggage per person

- $1,000 per person in travel delay and missed connection coverage

- $250,000 in medical and dental coverage per person

In addition to single-trip plans, company offers specific road trip, adventure travel, flight and cruise insurance coverage

Coverage for missed connections or accidental death and dismemberment is not part of the most basic plan

- Trip cancellation coverage worth up to 100% of the trip cost; interruption coverage worth up to 150% of the trip cost

- $500 in coverage for lost, stolen or damaged bags and personal items; bag delay coverage worth $200

- Trip delay coverage worth up to $1,000; missed connection coverage worth up to $100

- Medical coverage worth up to $50,000

To help you better understand the costs associated with travel insurance, we requested quotes for a weeklong June 2024 trip to Spain for a solo traveler, a couple and a family. These rates should help you get a rough estimate for about how much you can expect to spend on travel insurance. For additional details on specific coverage from each travel insurance plan and to input your trip information for a quote, see our comparison table below.

Travel Insurance Types: Which One Is Right for You?

There are several types of travel insurance you'll want to evaluate before choosing the policy that's right for you. A few of the most popular types of travel insurance include:

COVID travel insurance Select insurance plans offer some or a combination of the following COVID-19-related protections: coverage for rapid or PCR testing; accommodations if you're required to quarantine during your trip if you test positive for coronavirus; health care; and trip cancellations due to you or a family member testing positive for COVID-19. Read more about the best COVID-19 travel insurance options .

Cancel for any reason insurance Cancel for any reason travel insurance works exactly how it sounds. This type of travel insurance lets you cancel your trip for any reason you want – even if your reason is that you simply decide you no longer want to go. Cancel for any reason travel insurance is typically an add-on you can purchase to go along with other types of travel insurance. For that reason, you will pay more to have this kind of coverage added to your policy.

Also note that this type of coverage typically only reimburses 50% to 80% of your nonrefundable prepaid travel expenses. You'll want to make sure you know exactly how much reimbursement you could qualify for before you invest in this type of policy. Compare the best cancel for any reason travel insurance options here .

International travel insurance Travel insurance is especially useful when traveling internationally, as it can provide medical coverage for emergencies (in some cases for COVID-19) when you're far from home. Depending which international travel insurance plan you choose, this type of travel insurance can also cover lost or delayed luggage, rental cars, travel interruptions or cancellations, and more.

Cheap travel insurance If you want travel insurance but don't want to spend a lot of money, there are plenty of cheap travel insurance options that will offer at least some protections (and peace of mind). These are typically called a company's basic or standard plan; many travel insurance companies even allow you to customize your coverage, spending as little or as much as you want. Explore your options for the cheapest travel insurance here .

Trip cancellation, interruption and delay insurance Trip cancellation coverage can help you get reimbursement for prepaid travel expenses, such as your airfare and cruise fare, if your trip is ultimately canceled for a covered reason. Trip interruption insurance, on the other hand, kicks in to reimburse you if your trip is derailed after it starts. For instance, if you arrived at your destination and became gravely ill, it would cover the cost if you had to cut your trip short.

Trip delay insurance can help you qualify for reimbursement of any unexpected expenses you incur (think: lodging, transportation and food) in the event your trip is delayed for reasons beyond your control, such as your flight being canceled and rebooked for the next day. You will want to save your receipts to substantiate your claim if you have this coverage.

Lost, damaged, delayed or stolen bags or personal belongings Coverage for lost or stolen bags can come in handy if your checked luggage is lost by your airline or your luggage is delayed so long that you have to buy clothing and toiletries for your trip. This type of coverage can kick in to cover the cost to replace lost or stolen items you brought on your trip. It can also provide coverage for the baggage itself. It's even possible that your travel insurance policy will pay for your flight home if damages are caused to your residence and your belongings while you're away, forcing you to return home immediately.

Travel medical insurance If you find yourself sick or injured while you are on vacation, emergency medical coverage can pay for your medical expenses. With that in mind, however, you will need to find out whether the travel medical insurance you buy is primary or secondary. Where a primary policy can be used right away to cover medical bills incurred while you travel, secondary coverage only provides reimbursement after you have exhausted other medical policies you have.

You will also need to know how the travel medical coverage you purchase deals with any preexisting conditions you have, including whether you will have any coverage for preexisting conditions at all. Read more about the best travel medical insurance plans .

Evacuation insurance Imagine you break your leg while on the side of a mountain in some far-flung land without quality health care. Not only would you need travel medical insurance coverage in that case, but you would also need coverage for the exorbitant expense involved in getting you off the side of a mountain and flying you home where you can receive appropriate medical care.

Evacuation coverage can come in handy if you need it, but you will want to make sure any coverage you buy comes with incredibly high limits. According to Squaremouth, an emergency evacuation can easily cost $25,000 in North America and up to $50,000 in Europe, so the site typically suggests customers buy policies with $50,000 to $100,000 in emergency evacuation coverage.

Cruise insurance Travel delays; missed connections, tours or excursions; and cruise ship disablement (when a ship encounters a mechanical issue and is unable to continue on in the journey) are just a few examples why cruise insurance can be a useful protection if you've booked a cruise vacation. Learn more about the top cruise insurance plans here .

Credit card travel insurance It is not uncommon to find credit cards that include trip cancellation and interruption coverage , trip delay insurance, lost or delayed baggage coverage, travel accident insurance, and more. Cards that offer this coverage include popular options like the Chase Sapphire Reserve credit card , the Chase Sapphire Preferred credit card and The Platinum Card from American Express .

Note that owning a credit card with travel insurance protection is not enough for your coverage to count: To take advantage of credit card travel insurance, you must pay for prepaid travel expenses like your airfare, hotel stay or cruise with that specific credit card. Also, note that credit cards with travel insurance have their own list of exclusions to watch out for. Many also require cardholders to pay an annual fee.

Frequently Asked Questions

The best time to buy travel insurance is normally within a few weeks of booking your trip since you may qualify for lower pricing if you book early. Keep in mind, some travel insurance providers allow you to purchase plans until the day before you depart.

Many times, you are given the option to purchase travel insurance when you book your airfare, accommodations or vacation package. Travel insurance and travel protection are frequently offered as add-ons for your trip, meaning you can pay for your vacation and some level of travel insurance at the same time.

However, many people choose to wait to buy travel insurance until after their entire vacation is booked and paid for. This helps travelers tally up all the underlying costs associated with a trip, and then choose their travel insurance provider and the level of coverage they want.

Figuring out where to buy travel insurance may be confusing but you can easily research and purchase travel insurance online these days. Some consumers prefer to shop around with a specific provider, such as Allianz or Travelex, but you can also shop and compare policies with a travel insurance platform. Popular options include:

- TravelInsurance.com: TravelInsurance.com offers travel insurance options from more than a dozen vetted insurance providers. Users can read reviews on the various travel insurance providers to find out more about previous travelers' experiences with them. Squaremouth: With Squaremouth, you can enter your trip details and compare more than 90 travel insurance plans from 20-plus providers.

- InsureMyTrip: InsureMyTrip works similarly, letting you shop around and compare plans from more than 20 travel insurance providers in one place. InsureMyTrip also offers several guarantees, including a Best Price Guarantee, a Best Plan Guarantee and a Money-Back Guarantee that promises a full refund if you decide you no longer need the plan you purchased.

Protect your trip: Search, compare and buy the best travel insurance plans for the lowest price. Get a quote .

When you need to file a travel insurance claim, you should plan on explaining to your provider what happened to your trip and why you think your policy applies. If you planned to go on a Caribbean cruise, but your husband fell gravely ill the night before you were set to depart, you would need to explain that situation to your travel insurance company. Information you should share with your provider includes the details of why you're making a claim, who was involved and the exact circumstances of your loss.

Documentation is important, and your travel insurance provider will ask for proof of what happened. Required documentation for travel insurance typically includes any proof of a delay, receipts, copies of medical bills and more.

Most travel insurance companies let you file a claim using an online form, but some also allow you to file a claim by phone or via fax. Some travel insurance providers, such as Allianz and Travel Insured International, offer their own mobile apps you can use to buy policies and upload information or documents that substantiate your claim. In any case, you will need to provide the company with proof of your claim and the circumstances that caused it.

If your claim is initially denied, you may also need to answer some questions or submit some additional information that can highlight why you do, in fact, qualify.

Whatever you do, be honest and forthcoming with all the information in your claim. Also, be willing to provide more information or answer any questions when asked.

Travel insurance claims typically take four to six weeks to process once you file with your insurance company. However, with various flight delays and cancellations due to things like extreme weather and pilot shortages, more travelers have begun purchasing travel insurance, encountering trip issues and having to submit claims. The higher volume of claims submitted has resulted in slower turnaround times at some insurance companies.

The longer you take to file your travel insurance claim after a loss, the longer you will be waiting for reimbursement. Also note that, with many travel insurance providers, there is a time limit on how long you can submit claims after a trip. For example, with Allianz Travel Insurance and Travelex Insurance Services, you have 90 days from the date of your loss to file a claim.

You may be able to expedite the claim if you provide all the required information upfront, whereas the process could drag on longer than it needs to if you delay filing a claim or the company has to follow up with you to get more information.

Travel insurance is never required, and only you can decide whether or not it's right for you. Check out Is Travel Insurance Worth It? to see some common situations where it does (and doesn't) make sense.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Carry-on Luggage and Personal Item Size Limits (2024)

Amanda Norcross

Just like checked bags, carry-on luggage size restrictions can vary by airline.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

The Best Way to Renew a Passport in 2024

The proposed online passport renewal system is behind schedule.

The Best Carry-on Luggage of 2024

Erin Evans and Rachael Hood and Catriona Kendall and Amanda Norcross and Leilani Osmundson

Discover the best carry-on luggage for your unique travel style and needs.

- AIG Travel Guard Overview

- AIG Travel Guard Plans

AIG Travel Guard Cost

How to file a claim with aig travel guard, compare aig travel guard, aig travel guard frequently asked questions.

- Why You Should Trust Us

AIG Travel Guard Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

AIG Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits. If you're looking for travel insurance, consider Travel Guard .

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation coverage of up to 100% of the cost, for all three plan levels

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR covers up to 75% of total trip costs (maximum of $112,500 on some plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Medical coverage of up to $500,000 and evacuation of up to $1,000,000 per person

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes COVID coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Above average baggage loss and delay benefits

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical evacuation coverage

- con icon Two crossed lines that form an 'X'. Premiums may run slightly higher than competitors

Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits.

- Trip cancellation coverage for up to 100% of the trip cost

- Trip interruption coverage for up to 150% of the trip cost

- Preexisting medical conditions exclusions waiver must be purchased within 15 days of initial trip payment

- Annual travel insurance plan and Pack N' Go plan (for last-minute trips) available

AIG Travel Guard Travel Insurance Review

AIG Travel Guard is among the best travel insurance companies with impressive coverage limits, even with its basic plan, Travel Guard Essential. It's emergency medical evacuation coverage is particularly high, making Travel Guard a good choice for insuring cruises, as sea to land evacuations are often expensive.

Additionally, Travel Guard's Premium and Deluxe plans offer coverage that many of its competitors don't, such as its travel inconvenience coverage and ancillary evacuation coverage.

That said, Travel Guard is on the pricey side, compared with its competitors. While age is often a factor in your insurance premiums, Travel Guard tends to quote older travelers higher rates than its competitors. However, you often get what you pay for. In Travel Guard's case, you'll find that its coverage justifies its higher rates.

While great coverage is important, it's also crucial that an insurance company has a smooth claims process, which Travel Guard lacks, according to its customer reviews. Across 135 reviews on its Trustpilot page, AIG Travel Guard received an average of 1.2 stars, with 95% of reviewers giving the company one star. Surprisingly, AIG Travel Guard fares even worse with the Better Business Bureau, receiving an average of 1.08 stars out of five across 301 reviews.

Coverage Options Offered by AIG Travel Guard

AIG Travel Guard offers three primary plans: Travel Guard Essential, Travel Guard Preferred, and Travel Guard Deluxe. Each plan has different coverage limits and various types of protection.

Here's a look at what you'll get with each plan:

Depending on the policy you select, there are also additional coverages that my be included at no extra charge, like pre-existing conditions waiver, single occupancy fee coverage, worldwide travel and medical assistance services, and more. Be sure to check each policy closely to see what is and isn't covered.

Each of these plans also include coverage for one child under 17 as long as their travel costs are equal to or under the adult's cost. Additional coverages do not apply to the child.

AIG Travel Guard Pack N' Go Plan

In addition to these three primary plans, Travel Guard offers the Pack N' Go policy along with an Annual plan. This policy is for last-minute travelers who don't need trip cancellation coverage.

This plan includes:

- Trip interruption and trip delay ($200 per day maximum) up to $1,000

- Missed connection up to $500

- Baggage delay up to $200 and baggage coverage up to $1,000

- Medical expenses up to $25,000 and dental expenses up to $500

- Emergency evacuation and repatriation of remains up to $500,000.

AIG Travel Guard Annual Plan

Taking multiple trips throughout the year? Consider the Travel Guard Annual plan instead of purchasing a new policy for each adventure. This plan comes with coverage for:

- Trip interruption coverage up to $2,500

- Trip delay coverag e up to $1,500 ($150 per day maximum)

- Missed connection coverag e up to $500

- Baggage delay coverage up to $1,000 and lost/damaged baggage coverage up to $2,500

- Medical expenses coverage up to $50,000 and dental expenses up to $500

- Emergency evacuation coverage and repatriation of remains up to $500,000

- Accidental death and dismemberment coverage up to $50,000 and security evacuation up to $100,000

Additional Coverage Options from AIG Travel Guard

Like many other travel insurance providers, Travel Guard offers add-ons for an additional cost. These can be selected while you're purchasing your policy.

The availability of these add-ons depends on the policy you're buying. Note also that some are already included in the Preferred and Deluxe plans.

- Medical bundle — Increases coverage amounts for medical expenses and evacuation and adds hospital of choice and additional evacuation benefits.

- Security bundle — Provides various coverages for trip interruption or cancellation due to riot or civil disorder.

- Rental vehicle damage coverage — Reimburses a predetermined amount for physical damage to a rental car in the policy holder's name.

- Cancel for Any Reason Insurance (CFAR) — This is just what it sounds like. Cancel for any reason coverage will reimburse 75% of nonrefundable expenses when you cancel your trip for any reason, up to 48 hours before your scheduled departure. CFAR coverage is only available for Travel Guard's Deluxe and Preferred plans.

- Inconvenience bundle — Offers reimbursement for inconveniences like closed attractions, credit/debit card cancellation, hotel construction, and more.

- Pet bundle coverage — Daily travel benefit for boarding and medical expense coverage for illness or injury of dog or cat. Includes trip cancellation or interruption coverage if the pet is in critical condition or dies within seven days before the departure date.

- Adventure sports bundle — Removes the exclusions for adventure and extreme activities.

- Baggage bundle — Your baggage coverage with AIG becomes primary with increased coverage and baggage delay benefits.

- Wedding bundle — Provides trip cancellation coverage due to wedding cancellation (brides and grooms not covered).

- Name a family member bundle — One person can be named as a Family Member for the purpose of family member-related unforeseen event coverage.

How to Purchase and Manage Your AIG Policy

Getting a quote from AIG Travel Guard is quick and easy. Head to AIG website and enter basic information about the trip you're looking to cover. You'll get an instant quote for the insurance plans available for your trip, so it's easy to compare each option. Be prepared to provide information including:

- Your state of residence

- Date of birth

- The cost of your trip

- Travel dates

- Destination

- Method of travel

We ran a few simulations to offer examples of how much a Travel Guard policy might cost. You'll see that costs usually fall within 5-7% of the total trip cost, depending on the policy tier you choose.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following Travel Guard travel insurance quotes:

- Travel Guard Essential: $86.96

- Travel Guard Preferred: $152.01

- Travel Guard Deluxe: $188.59

Premiums for Travel Guard's various single trip plans are between 2.8% and 6.3%, well within, and even below, the average cost of travel insurance .

A 30-year-old traveler from California is heading to Japan for two weeks, costing $4,000. The Travel Guard travel insurance quotes are:

- Travel Guard Essential: $198.77

- Travel Guard Preferred: $240.39

- Travel Guard Deluxe: $305.04

Premiums for Travel Guard's various single trip plans are between 5% and 7.6%, within the average cost for travel insurance.

A couple of 65-years of age looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following Travel Guard quotes:

- Travel Guard Essential: $471.10

- Travel Guard Preferred: $618.22

- Travel Guard Deluxe: $834.78

Premiums for Travel Guard's various single trip plans are between 7.9% and 13.9%, which is significantly higher than the average cost. That said, travel insurance is often more expensive as you get older.

AIG Travel Guard Annual Plan Cost

Getting a quote for the annual plan requires much less information, only asking for the intended policy start date, your state of residence, and how many people you plan to insure. Quotes from AIG remained at $259 per traveler, regardless of state of residence and number of travelers.

Filing a claim with Travel Guard is a straightforward process. You'll need your policy number and can either go to travelguard.com or call Travel Guard at 866-478-8222 to start the claim. Once submitted, you can check the status of your claim at claims.travelguard.com/status.

See how AIG Travel Guard stacks up against the competition and find the right travel insurance policy for you.

AIG Travel Guard vs. Nationwide Travel Insurance

Nationwide is a household name when it comes to insurance providers and one of the largest and most-recognized insurance providers in the US. Similarly to Travel Guard , Nationwide makes it easy to find coverage by offering just two single-trip plans: the Essential and Prime plan.

In addition, Nationwide offers plans specifically designed for cruises along with annual trip insurance for those who travel a lot throughout the year.

The Nationwide Essential Plan comes with trip cancellation coverage of up to $10,000, up to $250,000 in emergency medical evacuation, up to $150 per day reimbursement for travel delays of 6+ hours, and coverage for delayed or lost baggage.

In comparison, the Travel Guard Essential plan covers trip cancellations with up to $100,0000 in coverage, up to $150,000 in emergency medical evacuation expenses, up to $100 per day ($500 total) for trip delays of 12+ hours, along with lost or delayed baggage coverage.

The high-tier Prime Plan from Nationwide offers even more coverage, including trip cancellation up to $30,000, trip interruption coverage up to 200% of the trip cost (maximum of $60,000), missed connection and itinerary change coverage of $500 each, $250 per day for trip delays of 6+ hours, and up to $1 million in coverage for emergency medical evacuation

AIG's highest-tier Deluxe plan comes with trip cancellation coverage of up to $150,000, up to $1,000,000 in emergency medical evacuation, up to $200 per day ($1,000 maximum) reimbursement for travel delays of 12+ hours, and coverage for delayed or lost baggage.

As you can see, it's hard to compare apples to apples when comparing the two different insurance providers. But it helps to know the specifics of the coverages that matter most to you.

Read our Nationwide travel insurance review here.

AIG Travel Guard vs. Allianz Travel Insurance

With Allianz Travel Insurance , you can choose from 10 different insurance plans to find one that suits your needs. Like Travel Guard , it offers one-off policies for specific trips and an annual travel insurance plan for those who take multiple trips a year. Similar to AIG, too, the different plans offer varying levels of coverage.

Allianz's most popular single-trip option is the OneTrip Prime plan. This plan offers trip cancellation coverage up to $100,000, trip interruption coverage up to $150,000, emergency medical coverage for $50,000, coverage for baggage loss, theft, or damage up to $1,000, and up to $800 in travel delay coverage.

The most similar plan from Travel Guard is the mid-tier Travel Guard Preferred plan, which which you'll get up to $150,000 in trip cancellation coverage, trip interruption coverage up to $225,000, $50,000 in emergency medical coverage, coverage for baggage loss, theft, or damage up to $1,000, and travel delay coverage of up to $800.

A variety of factors will determine the final cost of any of these travel insurance policies. However, when comparing quotes with the same factors, Allianz tends to be cheaper. Additionally, Travel Guard seems to be more sensitive to the traveler's age. However, it's best to compare quotes using your specific personal and trip details to determine which policy is the best for you.

Read our Allianz travel insurance review here.

AIG Travel Guard vs. Credit Card Travel Insurance

Before purchasing a travel insurance plan, take a look at the coverage offered through your travel rewards credit cards. Some of the basic coverages you're looking for, like rental car insurance, may already be available through credit card travel protection .

The coverage you have on your credit card couple be sufficient if, for example, you're taking a road trip by car and you don't have any non-refundable trip expenses. It could also be enough if your health insurance covers you while you travel and you aren't overly worried about incurring additional medical expenses during your trip.

It's also worth remembering that credit card coverage is usually secondary versus the primary coverage you'd get with a travel insurance policy. Meaning you'll have to file a claim with the other applicable insurance (like through the airline travel provider) before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Depending on the single trip plan you choose, AIG Travel Guard offers $15,000-$100,000 in emergency medical expense coverage.

All three of Travel Guard's single trip policies offer pre-existing condition waivers as long as you purchase your policy within 15 days of your initial trip payment.

Travel Guard is the name used for AIG's travel insurance products, but AIG also offers other insurance products, like AIG Life Insurance .

Your coverage depends on the policy you buy, but all policies will cover (up to a specified limit) trip cancellation, interruption, delay, emergency medical expenses, lost and delayed baggage, and emergency evacuation.

Yes, Travel Guard plans cover trip cancellation and interruption due to illness, injury, or death of a family member. If your trip is delayed or canceled due to inclement weather, that's covered too. AIG Travel Guard's is also among the best CFAR travel insurance companies.

Why You Should Trust Us: How We Reviewed AIG Travel Guard

The policy that's best for you will be the one that offers the right amount and type of coverage, fits your budget, and is easy to use if you ever need it.

In reviewing Travel Guard , we looked at the company's travel insurance offerings and compared them to plans offered by the top travel insurance companies in the space. Factors considered included things like coverage options, claim limits, what's covered, available add-ons, and typical insurance policy costs. We also considered buyer preferences.

Read more about how Business Insider rates insurance providers .

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Thu. Apr 25th, 2024

Top 5 Travel Insurance With Covid-19 Coverage In Singapore 2023

By Mary Alavanza

SINGAPORE: The COVID-19 cases in Singapore have more than doubled from Sept 17-23, as reported by the Ministry of Health last Monday, October 2. Now, if you are a traveller, this can be alarming. To protect yourself while travelling, here are the best travel insurance plans with COVID-19 coverage in Singapore in 2023.

Top 5 travel insurance with COVID-19 coverage

Here are some top picks if you want to enjoy your travel while keeping safe:

1. AIG Travel Guard Direct – Supreme

- Overseas Medical Expenses: S$2,500,000

- Travel Cancelation / Postponement: S$15,000

- Loss/Damage of Personal Baggage: S$10,000

- Premium: S$77

AIG Travel Guard Direct – Supreme is a very flexible travel insurance plan. It’s great if you want lots of coverage for COVID-19-related expenses, with up to S$2,500,000 for medical costs overseas. It also gives you good protection if your trip gets cancelled or you lose your baggage. So, if you want a travel insurance plan that adapts to your needs , this one is a smart choice.

AIG Travel Guard Direct – Supreme COVID-19 Protection:

- Trip Postponement: Up to S$1,500

- Trip Cancellation: Up to S$7,500

- Disruption During Trip: Up to S$7,500

- Medical Expenses: Up to S$250,000

- Emergency Repatriation: Up to S$250,000

- Overseas Quarantine Allowance: S$1,400

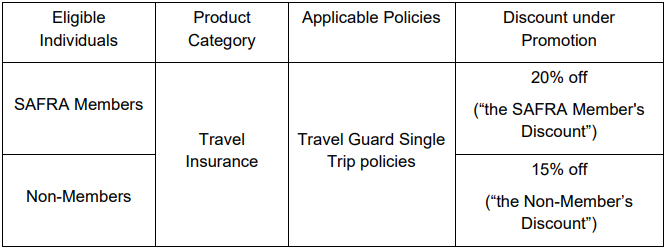

AIG Travel Guard Direct – Supreme Promotions:

Valid until October 31, 2023

- Apply through MoneySmart and use producer code 030138.

- Faster cash redemption with Apple AirTag or up to S$50 cash via PayNow.

- Up to S$20 iShopChangi e-vouchers.

- Receive an Eskimo Global 1GB eSIM for convenient connectivity in 80+ countries.

2. MSIG TravelEasy Premier

- Overseas Medical Expenses: S$1,000,000

- Trip Cancellation: S$15,000

- Loss/Damage of Baggage: S$7,500

- Premium: S$44.40 (40% Off, from S$74)

MSIG TravelEasy Premier offers strong COVID-19 coverage with overseas medical expenses of S$1,000,000, making it a reliable option for medical protection during the pandemic . It also includes significant coverage for trip cancellation and baggage, and the discounted premium adds to its value.

MSIG TravelEasy Premier COVID-19 Protection:

- Postponement Before Trip: Up to S$3,000

- Disruption During Trip: Up to S$3,000

- Emergency Repatriation: Up to S$1,000,000

- COVID-19 Related Trip Cancellation: Up to S$5,000

- COVID-19 Overseas Medical Expenses: Up to S$250,000

- COVID-19 Trip Curtailment: Up to S$5,000

- COVID-19 Quarantine Benefits: S$100

MSIG TravelEasy Premier Promotions:

- Apply through MoneySmart and receive over S$35,000 worth of gifts when you submit your claim by November 1, 2023.

- Faster cash redemption is available.

- Enjoy cash rewards and iShopChangi vouchers with minimum premiums.

- Get discounts on MSIG Single Trip and Annual Trip Travel Insurance plans.

- Participate in the Wowza Travel Bonanza Lucky Draw for a chance to win exciting prizes.

- Use iShopChangi e-vouchers for duty-free shopping.

- Receive a convenient Eskimo Global 1GB eSIM for international connectivity.

- Japan Merchant Vouchers available with TravelEasy® policies to Area B (valid until October 31, 2023).

3. Starr TraveLead Comprehensive Gold

- Premium: S$30.42 (35% off, from S$46.80)

Starr TraveLead Comprehensive Gold is your top pick for extensive travel insurance. With broad coverage, including overseas medical expenses, trip cancellations, and baggage protection, it ensures worry-free travel. Plus, enjoy enticing discounts and perks, making it a valuable choice for your travel safety .

Starr TraveLead Comprehensive Gold COVID-19 Protection:

- Emergency Repatriation: Unlimited

- COVID-19 Related Trip Cancellation: S$500

- COVID-19 Overseas Medical Expenses: S$65,000

- COVID-19 Trip Curtailment: S$500

Starr TraveLead Comprehensive Gold Promotions:

Valid from October 1-12, 2023

- Apply through MoneySmart to be eligible

- Stand a chance to receive over S$35,000 worth of gifts when you submit your claim by 13th October 2023

- Faster cash redemption is available

- Enjoy cash rewards and iShopChangi vouchers with a minimum premium after discounts

- Use promo code MSVTL35 to get 35% off Starr Single and Annual Trip Travel Insurance plans

- Participate in the Wowza Travel Bonanza Lucky Draw for a chance to win exciting prizes

- Use iShopChangi e-vouchers with no minimum spend

- Receive a convenient Eskimo Global 1GB eSIM for international connectivity to over 80+ countries.

4. FWD First

- Premium: S$18 (40% Off, from S$30)

FWD First provides solid COVID-19 coverage with overseas medical expenses of S$1,000,000, ensuring adequate protection during international travel. It also offers good coverage for trip cancellation and baggage loss at an affordable premium, making it a cost-effective choice .

FWD First COVID-19 Protection:

- Cancellation Before Trip: S$5,000

- Disruption During Trip: S$5,000

- Medical Expenses: Up to S$200,000

- Emergency Repatriation: Up to S$200,000

- Hospitalisation Allowance: S$100 per day

- Overseas Quarantine Allowance: S$50 per day

- Hospitalisation After Trip: S$100 per day

FWD First Promotions:

Valid from October 4-31, 2023

- Exclusive offers when you apply through MoneySmart

- Stand a chance to win over S$35,000 in gifts when you submit your claim by 1st November 2023

- Get S$10 iShopChangi Voucher (no minimum spend) with a minimum premium of S$65 after any FWD discount

- Receive S$20 iShopChangi Voucher (no minimum spend) with any FWD Annual Trip plans purchased

- Enjoy limited-time discounts with promo code FWDDAY23

- Participate in the Wowza Travel Bonanza Lucky Draw

- Fast delivery of Eskimo Global 1GB eSIM for global connectivity (No claim form required).

5. Bubblegum Travel Insurance

- Overseas Medical Expenses: S$150,000

- Trip Cancellation: S$5,000

- Loss/Damage of Personal Baggage: S$3,000

- Premium: S$27.29 (10% off, from S$30.32)

Bubblegum Travel Insurance provides a hassle-free and convenient travel insurance solution. Offering overseas medical coverage, trip cancellation, and baggage protection, it’s a straightforward choice for worry-free travel.

Bubblegum Travel Insurance COVID-19 Protection:

- COVID-19 Related Trip Cancellation: Up to S$600

- COVID-19 Overseas Medical Expenses: Up to S$65,000

- COVID-19 Trip Curtailment: Up to S$600

Bubblegum Travel Insurance Promotions:

Valid from October 1-31, 2023

- Stand a chance to win exciting rewards when you submit your claim by 1st November 2023

- Get up to S$15 Cash via PayNow and S$10 iShopChangi Voucher (no minimum spend) with a minimum premium of S$80 after any Bubblegum discount

- Receive up to S$25 Cash via PayNow and S$20 iShopChangi Voucher (no minimum spend) with a minimum premium of S$120 after any Bubblegum discount

- Enjoy a 10% discount with promo code MSTI10

In these times when COVID-19 is rising again, having the right travel insurance with COVID-19 coverage is your best safeguard for worry-free travel.

Read also:

How to Minimize Car Insurance Premiums When Working From Home in Singapore

How To Invest & Buy Insurance Without Sacrificing Your Starbucks Coffee Or Mala Hotpot

Related Post

Discover the best place to stay and experience siem reap in cambodia, hidden gems of batu pahat: 6 top spots to explore & enjoy, explore ayer hitam in johor: what more can this ceramic town offer, singapore stocks declined on thursday—sti dipped by 1.1%, singapore smes show worrying decline in cybersecurity awareness, new survey finds, singaporean youths embrace independent travel before turning 18, new flexible work guidelines aim to guide, not mandate: snef clarifies.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Forms Centre

- Self-Service

Beware of phishing scams. For more information, please visit our Safety Tips page.

The GST rate will increase to 9% on 1 January 2024. Visit this page for more information.

Travel Guard ®

Now with COVID-19 Cover

TRAVEL GUARD

Travel alerts.

Please be advised that the military conflict between Russia and Ukraine may impact travel insurance coverages and benefits, and AIG’s ability to provide certain travel-related assistance services, for travel to, from or within the affected areas.

Now with COVID-19 cover

Travel Guard is now enhanced with COVID-19 coverage. Better coverage, same great service and experience.

As you look forward to travelling again, you can travel confidently with AIG's Travel Guard for your next getaway.

Our wholly owned assistance centers are equipped to assist you 24 hours a day, 7 days a week.

QUICK QUOTE

Single trip coverage.

The maximum length of each insured trip is 182 days.

ANNUAL COVERAGE

The Insured Policyholder(s) will be covered for an unlimited number of trips made during the Policy Period. The maximum length of each insured trip is 90 days

POLICY TYPE

The policy type shows which people are insured under the policy. You can choose from either Individual or Family cover.

If you choose Individual cover this policy insures you only.

If you choose Family cover this policy insures you and/or your spouse and/or your children.

• Under a Per Trip policy, the family must depart from and return to Singapore on the same itinerary together as a family for cover to apply.

• Under an Annual Multi-Trip policy, cover will apply to you or your spouse whilst travelling separately of each other; however your children must be accompanied by you and/or your spouse for the entire trip for cover to apply.

GROUP/ COUPLE

Select this option if you have individuals travelling together on the same dates and to the same destination.

For group/ couple up to a maximum of 50 individual policies on the same transaction.

Zone 1 Destinations

Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand, Vietnam

Zone 2 Destinations