Update your browser

Be sure you have the most current version of your browser for the best experience on AAVacations.com. Browser requirements Opens in a new window

- Skip to global navigation

- Skip to content

- Skip to footer

Vacation package deals

Plan your getaway

- Save up to $150 on Caribbean vacation packages Book by May 15

Exclusive for AAdvantage® members

To book vacation packages through American Airlines Vacations, all travelers included in the package must be an AAdvantage® member. Not a member? Join now Opens in a new window

- Sign up for email offers Opens in a new window

- aa.com Opens in a new window

- Destinations

- AAdvantage®

AAdvantage login

Exclusive AAdvantage® experiences Verify AAdvantage® Number(s)

Tax exemptions

Tourism tax refunds.

You may be entitled to a refund of some taxes included in the price of your ticket if you meet the applicable criteria for exemptions and your itinerary involves:

- Travel between the U.S. and Mexico (including travel between Canada and Mexico via the U.S.)

- International travel to or from: Australia, Belize, Cayman Islands, Colombia, Greece, Hong Kong, Italy, Japan, Panama, Saint Lucia, Trinidad and Tobago, and the United Kingdom

All refund claims must be submitted within 12 months of ticket issuance.

Australia (AU) Passenger Movement Charge (PMC) Exemptions

- Infant under the age of two

- Children under the age of twelve at time of departure from Australia.

- For the purpose of the PMC, the External Territories will be regarded as part of Australia and end-to-end travel to them will not attract PMC liability

- Positioning crew - a passenger departing from Australia for the purpose of being a crew member of the same aircraft or another aircraft. This includes off-duty crew returning to their home base to later work as crew on another aircraft.

- Diplomatic and consular representatives of countries other than Australia

- Transfer/Transit passengers who both arrive and depart Australia by aircraft, only for the purpose of reaching their intended destination (e.g.: New Zealand ? Australia ? Singapore) without being immigration cleared are exempt for departure on the same calendar day

- Traditional inhabitant of Torres Strait Island or Papua New Guinea engaged in traditional activities.

- Foreign defense force personnel (and their families) departing Australia in military aircraft.

- Crew of an aircraft on duty including their spouse and children less than 18 years.

- Emergency passengers- passengers landing in Australia due to illness or bad weather conditions

- Passengers departing from Australia to Joint Petroleum Development Area for related activities

- Protective service officer on board for the security of the aircraft

- Single Journey Passenger - Passengers on fly/cruise/fly journeys which involve multiple departures from Australia only pay PMC for the first departure (the first operating carrier EX Australia is responsible for the PMC remittance). The journey must include a departure by ship. The second and subsequent departures are exempt as they have already paid the PMC for what can be characterized as a single journey.

Australia (UO) Goods and Services Tax (GST) Exemptions

- Domestic flights which have a connecting time of less than 24 hours to/from an international flight

- Domestic travel sold in conjunction with international air travel but on a separate ticket where the domestic ticket is referenced to the international ticket and the domestic ticket is issued prior to the commencement of the international journey.

- Where, subsequent to travel, a passenger can show that at the time of travel, they were NOT a resident of Australia for Australian income tax purposes and the ticket was purchased while the passenger was outside Australia. A refund may be available from the ticketing airline.

- Domestic travel ticketed outside of Australia.

- Infants under 2 years (On purely domestic travel within Australia, no separate ticket is issued for an infant).

Australia Passenger Service Charge (WY) Exemptions

- Infant under the age of two without a seat

- Airline crew on duty

- Transit/Transfer passengers not leaving the transit areas (i.e. passengers who remain airside), this includes passengers originating outside Australia who are in transit at an Australian port to another international port.

Belize Ticket Tax (BZ) Exemptions

- Children 2 years up to under 12

- Person whose visit to Belize is of less than twenty-four hours duration

- Person going out of Belize on official duty

Belize Airport Development Fee (BU) Exemptions

- Belizean citizens with a valid passport, Belizean resident card or a naturalization certificate

- Ministers of government, members of the national assembly, or members of the diplomatic and consular corps

- Military personnel

- Mayors of municipalities

- Official of international organizations

- Caribbean community secretariat personnel traveling on official business

- Minister and officials of other government visiting Belize at the invitation of the Belize government

- Public officers traveling on official business

- Approved scholarship holders leaving Belize to study abroad and sports and cultural groups representing Belize who been accredited by the government.

Belize Conservation Tax (FU) Exemptions

- Children under the age of 12

Belize Airport Departure Tax (FV) Exemptions

Belize international security fee (fw) exemptions, cayman islands terminal fee tax (gx) exemptions.

- Infant under the age of two years

Cayman Islands Departure Tax (KY) Exemptions

- All diplomats

- No stopover - Transit/Transfer passengers (24 hours).

Cayman Islands Passenger Facility Charge Tax (LZ) Exemptions

Cayman islands security tax (su) exemptions, china airport service charge (cn) exemptions, colombia airport tax (co)-international exemptions.

- Infant under the age of 2 years

- Within Colombia domestic to domestic transit passengers connecting within same day except via Bogota (BOG) where transit passengers are exempt up to six hours and via Cartagena (CTG) where transit passengers are exempt up to twelve hours. Passengers connecting between domestic - international or international - domestic are NOT exempt.

- International passengers connecting to international flights in Colombia and within 24 hours or less are exempted for intl to intl transfers only, except via Cartagena where transit passengers are exempt up to twelve hours, but passengers connecting flights domestic to international are not exempt

- Sports delegations accredited by the National Government

- Military flights

Colombia Resident Exit Tax (DG) Exemptions

- Children under the age of five

- International passengers connecting international flights in Colombia and within the 24 hours are exempted for International to International transfers only, but passengers connecting flights Domestic to International are NOT exempt.

- Government officials

- Foreign non-residents

- Sports delegations accredited by the national government

- Colombians residing abroad whose stay does not exceed 180 days in Colombia

- Students with government grants

Colombia Tourism Tax (JS) Exemptions

- Filipino overseas contract workers.

- Involuntary rerouting due to technical difficulties, weather conditions or other valid reasons

- Personnel from international organizations created through multilateral agreements to which Colombia has adhered.

- Senior passengers over 65 years old

- Students, scholarship holders, and investigator teachers duly accredited.

- Passengers arriving to Colombia on international flights and connecting with International flights within 24 hours or less

- Passengers arriving on International flights and connecting with Domestic flights or stopping in Colombia for more than 24 hours are NOT exempt

Colombia Sales Tax ? I.V.A (YS) Exemptions

- Tickets issued in San Andres Island ADZ (duty free zone)

- ID Tickets (100% discount)

- Tickets issued in Colombia which only cover itineraries abroad, regardless of place in the national territory where they are issued (any fares which allow to be issued separately).

- TO/FROM ACD/ACR/ADZ/BSC/CPB/GPI/JUO/LET/LPD/MVP/NQU/PVA/TCD/PDA/PCR

Greece Airport Development Tax (GR)?International Exemptions

- Air crew (operating and positioning)

- Transit/transfer passengers who continue their journey within 24 hours and their destination is different from the point of origin.

- Passengers whose flight is interrupted due to the inability of the aircraft to land at its destination

- Members of Greek (Club-Aeroclub) Air Sports Federation and the EU respectively members

Greece Departure Passenger Fee (F8) Exemptions (Not applicable to Athens)

- Airline crew on duty and positioning

- Direct transit passengers on board a flight at an en-route stop (arriving airport and departing from it on the same aircraft and remaining in the transit area)

- Passengers whose flight is interrupted due to the inability of their aircraft to land at its destination

Greece Security Charge (WQ) Exemptions

- No stopover - Direct transit passengers (same flight number and aircraft).

Greece Passenger Terminal Facilities Charge (WP)-International Exemptions

- No stopover - Direct transit passengers (same flight number and aircraft)

Hong Kong Air Passenger Departure Tax (HK) Exemptions

- Transfer passengers connecting on the same day.

- Military personnel, diplomats, officials of International organizations, government guests, heads of state/ministers

- Transit/Transfer passengers who schedule to arrive and depart from Hong Kong on the same day ('Day' means a calendar day, i.e. Local time 00:00 TO 23:59).

- All direct transit passengers and connecting airside transfer passengers who do not pass through immigration control.

Hong Kong Airport Construction Fee (G3) Exemptions

- Passengers on military, international organizations, state or charity flights

- Passengers on unscheduled landing (diversion) due to distress emergency adverse weather and/or aircraft technical problem.

- Passengers on Technical Stop aircraft . A technical stop is defined as a stop most commonly used to refuel the aircraft, to make unexpected essential repairs or to respond to some emergency need to land the aircraft. No traffic is unloaded or loaded during a technical stop.

Hong Kong Airport Passenger Security Charge (I5) Exemptions

- Transit same plane through

Italy Security Bag Charge (EX) Exemptions-International FCO airport code

- Airline crew on duty (crew must go and return to base) as long as they hold a ticket issued by its carrier and shown at check-in confirming that they are traveling on duty.

- Direct transits - same flight number

Italy Council City Tax (HB) )-International Exemptions

- Italy - Transit from Domestic to Intra European Union

- Italy - Transit from Domestic to Extra European Union

Italy Embarkation Tax (IT)-International Exemptions

- Italy - Airline crew on duty (crew must go and return to base) as long as they hold a ticket issued by its carrier and shown at check-in confirming that they are traveling on duty.

Italy Passenger Service Charge (MJ) -International Exemptions

Italy security charge (vt) -international exemptions, japan passenger security service charge (oi) exemptions.

- Free tickets (for personal travel). Haneda (HND) only

- Free tickets (for company business travel). Haneda (HND) only

- ID Tickets (100% discount). Haneda (HND) only

- Involuntary rerouting due to technical difficulties, weather conditions or other valid reasons. Narita (NRT)

- Transit/Transfer to or from international flights operating on Japan domestic sectors within the same calender day at NRT

- Deportees NRT (deportee ? someone has been granted legal stay in a state for a finite period of time)

- Inadmissible passengers NRT (inadmissible ? someone has been or will be deemed as ineligible for legal entry into state upon the arrival)

- Infants under 2 years. Infant using a child fare ticket shall be considered as child and child rate applies. Infant using an adult fare ticket shall be considered as adult and adult rate applies. NRT

Japan Passenger Facilities Charge (SW) Exemptions

- National guests of foreign nations and accompanying personnel.

- Infants under age of two 2 years. Haneda (HND) only

- Involuntary rerouting, e.g. due to technical problems or weather conditions.

- Child (under age 12) using an adult fare ticket shall be considered as adult and adult rate applies

- Transit/transfer passengers to and from international flights when transit/transfer occurs within the same calendar day and at the same airport only. (The charge is not applicable even if passengers have entered the territory of Japan through Customs and Immigration area if a scheduled arrival of incoming flight at Chitose (CTS), Fukuoka (FUK), Ibaraki (IBR), Kansai International (KIX), Kokura (KKJ) and Chubu (NGO) Airports and a scheduled departure of outgoing international flight from Haneda, Kansai, Fukuoka or Nagoya airports are within the same calendar day)

- Same day transit to an international flight from a domestic Japan segment that is treated as part of the international flight. Passengers traveling from Sendai (SDJ) to Honolulu (HNL) via New Chitose (CTS) transit on HA441 and HA442.

- Persons evicted or denied landing in Japan by Immigration Control and Refugee Recognition Law (Law No. 319 of 4 October 1951).

- Transit/Transfer to or from international flights operating on Japan domestic sectors within the same calender day at NRT.

Mexico Excess Baggage Ticket Tax (MX) Exemptions

- Any portion of an international journey if ticket is sold outside Mexico. Baggage charges issued in Mexico for journeys not involving Mexico in the routing. Baggage charges issued in Mexico for any domestic portion of an international journey, if ticket is sold outside Mexico.

Mexico Tourism Tax (UK) Exemptions

- Mexican citizen (Passport)

- Resident of Mexico (permanent or temporary) holding a Mexico Visa

- Infants under the age of two without a seat

- No stopover - Transit/Transfer passengers (24 hours)

Mexico Departure Tax - TUA (XD) Exemptions

- Diplomats on reciprocal basis. (Functionaries of International Organizations holding a Laissez-Passer, official or diplomatic passport).

Mexico Transportation Tax - TUA (XO) Exemptions

- No exemptions

Panama Airport Departure Tax (FZ) Exemptions

- Transit/Transfer passengers (24 hours) International to International

Panama Airport Development Fee (F3) Exemptions

Panama value added tax (pa) exemptions.

- International Organizations duly accredited in the Republic of Panama purchasing airline tickets for official use.

Panama Facility Charge (PJ) Exemptions

- Air crew on duty

- Government Officials (provided a letter is issued by Autoridad Aeronautica Civil)

Saint Lucia Security Charge (IJ) Exemptions

Saint lucia airport service charge (ks) exemptions.

- Children 2 years up to under twelve

- The Governor-General, his/her spouse and children under the age of eighteen years when traveling with him/her.

- Member of Parliament his/her spouse and children under the age of eighteen years when traveling with him/her.

- Judges of the Eastern Caribbean Supreme Court

- Persons appointed by a minister or a permanent secretary to a ministry, traveling on government business

- Persons appointed by a minister to be guests of the government

- The official representative of the government of any country, his/her spouse and children under the age of eighteen years when traveling with him/her.

- Representatives of the United Nations organization or any other international or regional organization accorded diplomatic privileges in Saint Lucia or persons sent on missions on behalf of such organizations, their spouses and children under the age of eighteen years.

- Persons leaving Saint Lucia on the same day of arrival.

- Members of the protective services of Saint Lucia or any friendly country when traveling on official duty.

- Ministers or religious denominations which have a congregation in Saint Lucia and are registered with the Ministry with responsibility for the ecclesiastical affairs.

- Students who are Saint Lucian nationals, citizens or residents traveling abroad to educational institutions to pursue a course of study approved by the Ministry of Education.

- Persons repatriated or deported from Saint Lucia by the government or any law in force.

Saint Lucia Travel Tax (LC) Exemptions

- Infants under the age of two

- Children under the age of eighteen

- VSO Peace Corps

- Ministers of Religion

Trinidad and Tobago Concourse Fee - International (DD)

Trinidad and tobago passenger service charge (kt) exemptions.

- Persons 60 years of age and over, that are citizens or residents of Trinidad and Tobago

- Member of the Trinidad and Tobago defense Force or the armed forces of any country traveling on official duty

- Members of the crew of any aircraft

- In-transit passengers remaining in Trinidad and Tobago for a period not exceeding forty-eight hours

Trinidad and Tobago Value added Tax (TT) Exemptions

United kingdom (apd) air passenger duty (gb) exemptions.

- Passengers up to and including the age of 15 years traveling in economy cabin

- When connecting between flights. (Flights are considered connected when the time interval between arrival on a flight and departure on the next flight on the itinerary does not exceed 24 hours. (6 hours when arriving before 17:00 hours and departing on a domestic flight. When arriving at or after 17:00 hours and departing on a domestic flight by 10:00 hours the following day))

- Airline crew on duty within 72 hours.

- Civil Aviation Authority Employees traveling on official service.

- The Channel Islands (ACI/GCI/JER) are not part of the UK and do not apply APD (Air Passenger Duty) on departures from those airports.

- The Isle of Man (IOM) should be considered as part of the UK for assessing charges and exemptions, but any charge for departures from IOM itself (wherever travel originates) must not be included in the total GB tax.

- Travel from the Highlands and Islands airports (i.e. Barra, Benbecula, Campbeltown, Inverness, Islay, Kirkwall, Stornoway, Sumburgh, Tiree and Wick).

- When departures are scheduled on small aircraft. (Small aircraft are defined as those registered at less than 10 tonnes maximum takeoff weight and/or those not authorized to seat 20 or more passengers.)

United Kingdom Passenger Service Charge (UB) Exemptions

- Domestic to Domestic Transfer within 6 hours. Does not apply to FlyBe and BA flights.

- Airline staff carried free and to be engaged within 72 hours with regard to aircraft related engineering, safety, security or public hygiene matters.

- Airline staff positioning for or traveling as on board medical/unaccompanied minor escorts or couriers. Staff passengers traveling on ID tickets for privilege/duty purposes. The decision on whether to charge or exempt this category of passengers is subject to the ticketing airlines policy as agreed and appropriate under bilateral self-ticketing agreements.

If your travel is not complete and you meet the exception criteria, please contact us for assistance.

- Contact Reservations Opens in a new window

- Contact American Airlines Vacations Opens in a new window

If you've completed all travel and think you're entitled to a refund, please contact Refunds to submit a claim.

- Contact Refunds Opens in a new window

Airport lookup

Our system is having trouble.

Please try again or come back later.

Please tell us where the airport is located.

Your session expired

Any confirmed reservations have been saved, but you'll need to restart any searches in progress

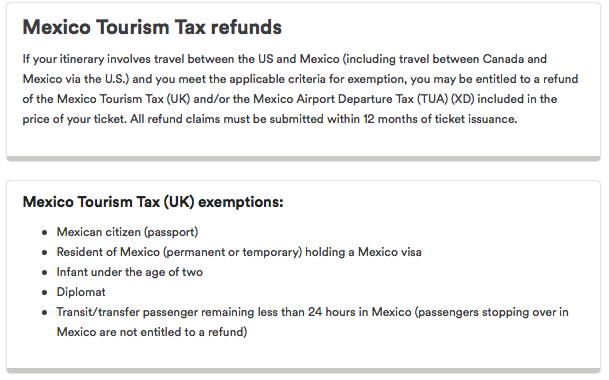

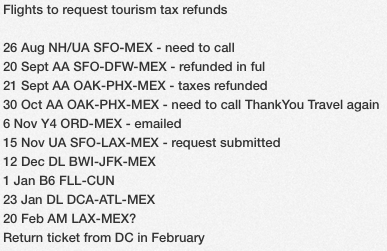

How to request Mexico Tourism Tax refunds for airline flights by citizens and residents

If you or someone you know has a Mexican passport or resident card, they might be leaving money on the table when they purchase airline tickets to/from/through Mexico.

When you purchase a plane ticket to Mexico, the fare has a tourism tax built in – similar to US customs and immigration fees. This fee goes toward the cost of immigration processing and the arrival / departure card required for foreign visitors. The fee is 390 Mexican Pesos, which is roughly $20 USD.

Screenshot from ITA Matrix showing the Mexico tourism tax – exchange rate as of December 18, 2016.

However, not everyone is required to pay this fee. If you have a Mexican passport or resident card, or are spending less than 24 hours in Mexico, you’re exempt from this tax. (Infants under 2 and diplomats are also exempt.) This is outlined (in Spanish) on this Mexican government FAQ page, question 16 .

Description of tax refund eligibility requirements on the Alaska Airlines website.

Mexican carriers typically know not to charge this fee to Mexican citizens based on the citizenship information you enter at the time of booking, but otherwise, there’s a good chance this fee will end up on your ticket even when it shouldn’t. (There’s actually a class action lawsuit pending against several US and Mexican airlines for this practice.) Fortunately, most airlines are pretty good about giving you a refund upon request.

Alaska Airlines Difficulty: EASY

I haven’t flown to Mexico on Alaska yet, since they don’t fly to Mexico City, but they were the first airline I found that documents the existence of this tax refund on their website . You can present your documentation to an airline representative at checkin to have a refund request submitted for you, or you can submit copies by mail or fax after travel is completed.

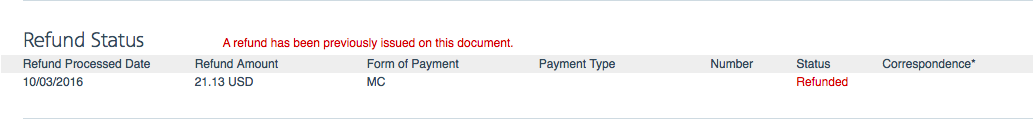

American Airlines Difficulty: EASY

American now has a page on their website about Mexico tourism tax refunds too. In the past, I used to submit refund requests via Twitter. Now, you can contact Reservations before your trip, or submit a refund request through their website after travel has been completed. The online refund request is very easy – I just selected ‘refund of taxes’ as the reason and uploaded a copy of my resident card, and the refund was back on my credit card within a few days.

Tax refund from American Airlines for a flight on September 21.

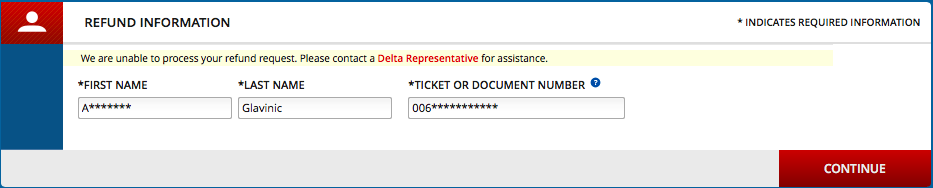

Delta Air Lines Difficulty: HARDER

Delta has information about tourism tax refunds buried on their Legal Notices page , and also on their “Pro” website for travel agents . The Legal Notices page directs you to their online refunds tool, but when I tried to submit a request for a refund for a previous flight, I got a big fat error message. Attempting to request a refund for an upcoming flight forces you to cancel the ticket first, which isn’t helpful either. I reached out to their Twitter team for assistance, but they told me to call the International Reservations Sales Team at 1-800-241-4141 for assistance. Stay tuned.

No luck requesting a refund from Delta online.

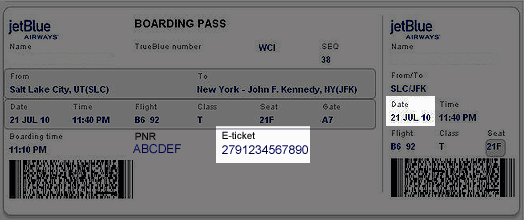

Jetblue Airways Difficulty: IMPOSSIBLE

JetBlue has an unnecessarily convoluted system for requesting tax refunds. In theory, it’s relatively simple: you show your receipt and your documents to Jetblue agents at checkin and they submit the refund request on your behalf. In practice, this is way harder than it sounds. Their Twitter team told me that you can’t just submit a copy of your e-ticket – you have to request a Comprobantes Fiscal Digital por Internet (CFDI) receipt through a third party website at least 48 hours but no more than 30 days after purchase.

This website (in Spanish) is buggy and full of inaccurate and conflicting information. For example, on the first page you have to enter your ticket number and date of purchase, but if you enter the actual date of purchase it doesn’t work. The site shows a sample boarding pass with the ticket number and departure date highlighted, but that doesn’t work either – their system doesn’t allow you to select dates in the future.

When I reached out to their Twitter team for help, they suggested entering the date I was requesting the receipt as the date of purchase (even though I bought the ticket last month) – that didn’t work either. Their Twitter team then directed me to email [email protected] , who couldn’t help with a receipt or refund, but sent me a $50 Jetblue voucher for my trouble.

Inaccurate sample ticket image from the JetBlue CFDI website

Southwest Airlines Difficulty: NOT SO BAD

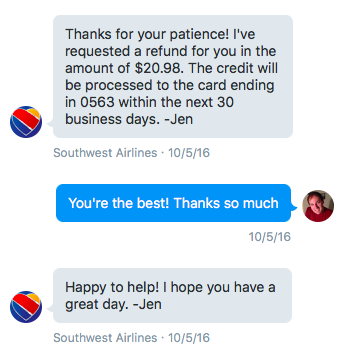

I’ve had good luck getting Southwest to refund tourism taxes via Twitter. Since Southwest tickets are so flexible, you have to wait until travel is completed to submit a refund request. Their Twitter team told me to fax a copy of my documents to their Refunds Department (972-656-2568) with my confirmation number. The first time I requested a refund, it took nearly two months – I submitted my documents on April 5, and didn’t receive a refund until the end of May. When I followed up with the Twitter team on May 20th, they said the Refunds department was still handling requests from March 21st. However, I submitted a request for a different ticket via Twitter on October 4th and was able to get a refund processed the next day without having to resubmit my documents.

Quick refund processing from @SouthwestAir on Twitter.

United Airlines Difficulty: EASY

United has also been great about processing refund requests via Twitter, on both award and paid tickets. Last time, they directed me to the United Refunds website , but when I told them I wasn’t sure which option to choose on the website, they processed my refund manually instead. (I suspect selecting “Contact United Refunds” would ultimately get you the same result).

Still not sure how to do this one by myself…but it might be possible.

Aeromexico Difficulty: EASY

The first time I traveled to Mexico, I had separate tickets from LAX to Mexico City and an onward connection (within 24 hours) from Mexico City to Santiago, Chile – which meant that I was exempt from both the tourism tax and Mexico City’s steep international departure tax. If I had booked that as a single ticket, those taxes would have been removed automatically, but their US refunds team (amusrefunds@ aeromexico .com) was able to process the refund quickly. That’s also the department for requesting tourism tax refunds based on citizenship or residency – just email them your ticket number and a copy of your passport or residency card.

All Nippon Airways (ANA) Difficulty: HARDER/TBD

I booked an ANA award ticket earlier this year that included a United segment from SFO to Mexico City. I reached out to ANA on Twitter and was directed to call them at 1-800-235-9262 for assistance. But I hate making phone calls, so I haven’t gotten around to it yet.

Air France / KLM Difficulty: IMPOSSIBLE

Last year, I booked two award tickets for my partner on Aeromexico using Flying Blue miles and was charged tourism tax on both tickets. I tried multiple times to reach out to Flying Blue, Air France / KLM, Delta (which handles some of their customer service in the US), and Aeromexico, both myself and through an agent at getservice.com . Air France told us to contact Aeromexico, and subsequent requests to contact either airline – even through executive channels – were met with complete silence. Ultimately, getservice recommended that I initiate a chargeback with my credit card company, and I also considered filing a complaint with the US Department of Transportation, but at that point the tickets were so old that I didn’t want to bother with it anymore.

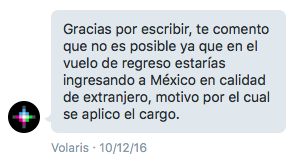

Volaris Difficulty: IMPOSSIBLE

The Volaris website asks you if you have a Mexican passport when you book your ticket, but since I have a US passport, there is no way to avoid being charged the fee automatically. I reached out to their Twitter team for advice, who incorrectly told me that since I have a foreign passport, I have to pay the fee regardless of my residency status.

I then reached out to the Volaris chat support team, who directed me to email Customer Relations at [email protected] . I’ve gone back and forth with them via email multiple times – they don’t seem to have a great grasp of how the law works, and in any case have decided that it’s my fault that the tax was charged because I selected “US Citizen” instead of “Mexican Citizen” at booking. Their policy (apparently) is that customers are completely responsible for whatever charges appear on the website at time of booking, and it sounds like they wouldn’t refund me even if I had a Mexican passport. Volaris told me that to avoid this fee in the future, I should just say that I am a Mexican citizen during the booking process. I ended up filing a chargeback on my Citi Prestige card, but since the amount was so small Citi just granted me a permanent credit without investigating.

“Thank you for writing, I inform you that [a refund] is not possible since on the return flight you would be entering Mexico as a foreigner, which is why the charge was applied.”

Final Thoughts

Frankly, this is an annoying process and requires quite a bit of record keeping and hassle. The savings definitely add up over time, due to the amount of travel that I do. The amount of money saved on taxes will more than cover the cost of my one-year temporary resident card. There’s relatively little information about this process online, so I’m hoping this article will help people save some time and money. I still have a few unresolved tax issues, but hopefully the refund process gets simpler, easier, and quicker in the future.

Source: http://travelwithgrant.boardingarea.com/

Yucatan Times

Ecuador brings the best of its culture and gastronomy to mérida, merida bets on improving air connectivity to attract tourists, you may also like, candidate alessandra rojo de la vega denounces shooting attack, triple execution shocks tulum, quintana roo, salbut yucatán fair 2024: san sebastián is ready for the gastronomic festival, lopez obrador visits yucatán without prior notice to the state government for second time, electrical network under “stress”: blackouts will continue on the peninsula, the amlo government will hire 1,200 additional cuban doctors.

Is there any way to ask for the refund if I don’t have the actual ticket anymore?

I bought my ticket trow Flight Hub for Air Transat. Do I have to contact Flight Hub or Air Transat? Tks

I love this page and the information. I hope you will like this also Why should you assistance for professional resume writers? .

I love this page and the information. I hope you will like this also The Perfect Time to Outsource Your HR Services .

Hello all. Julie William here, technical customer executive at Garmin Update GPS. If your device uses Garmin GPS, we recommend you update it regularly to ensure you get accurate directions. To update the GPS on your device, recommend the Garmin Express Software .

it is a more informative blog to read. thank you. Outplacement services can be provided by an employer as a way to support displaced employees and to smooth the transition to a new job, if you want to career transition, job search assistance then you can contact us

We have purchased airline tickets with Air Canada to return to Mexico in January 2024. Air Canada will not issue us with refunds for the Tourist tax we have paid. We are permanent residents of Mexico and have had no trouble receiving this refund over the past 10 years from other airlines (Flair, Delta, Westjet). We wonder if there is anyone who has had any luck getting this refund back from Air Canada?

Leave a Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Our Company

Lorem ipsum dolor sit amet, consect etur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis.

- 01 Central Park, US, New York City

- Phone: (012) 345 6789

- Email: [email protected]

- Support: [email protected]

About Links

- Advertise With Us

- Media Relations

- Corporate Information

- Apps & Products

Useful Links

- Privacy Policy

- Terms of Use

- Closed Captioning Policy

- Accessibility Statement

- Personal Information

- Data Tracking

- Register New Account

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Accept

Keep me signed in until I sign out

Forgot your password?

A new password will be emailed to you.

Have received a new password? Login here

Are you sure want to unlock this post?

Are you sure want to cancel subscription.

Mexico Solved

Mexico Tax Refund: All You Need To Know

Navigating Mexico’s tax refund system can feel like a salsa dance you haven’t learned the steps to yet.

But fret not, expats!

This guide will be your rhythm to ensure you don’t miss a beat.

Tax Number In Mexico: An Expats Guide

- Mexico’s Income Tax: A Simple Guide for Expats

- Tax Return Software in Mexico: A Simple Guide

Similar Posts

Mexico Tax System: How It Works

Merging into the Mexico tax system can seem as intricate as a Mariachi melody, right? Fear Not! We’ve got your covered! Our guide is crafted to navigate you through the complexities of taxes in Mexico with the ease of a seasoned expat. Whether you’re settling down or investing in this vibrant country, understanding the local…

Navigating the fiscal seas of a new country can be a voyage fraught with mystifying terminologies and bewildering bureaucracies. Yet, here at MexicoSolved.com, we chart the uncharted, de-mystify the mystifying, and simplify the intricate! Dive in as we explore the ins and outs of acquiring a tax number in Mexico What Is The Tax Number…

Tax Consulting In Mexico: An Expats Guide

Decoding tax laws in Mexico is a bit like trying to order a taco with every topping – it’s complex, but oh-so-rewarding when done right! If you’re an expat feeling lost in the salsa of Mexican tax codes, you’ve come to the right spot. Let’s dive in! What Is A Tax Consultant? A tax consultant…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Why Did We Choose Mexico?

- Products & Resources

- Testimonials

Airline Mexico Tourism Tax Refund Due to Residents

Mexico Tourism Tax Refund

If you are a Temporary/Permanent Resident of Mexico and travel by air to, from and through Mexico , you might be eligible for a refund of the Mexican Tourism Tax included in the price of your ticket–usually in the $25.00 to $30.00 USD range-within 12 months of the ticket issuance.

Each airline has their own procedural requirements for applying for the refund so you will want to check with your carrier for their specifications, but w hether traveling as an individual, a couple or a family, those total amounts can really add up and it is absolutely worth taking the time to apply for!

I recently went through the process with both Alaska & Delta Airlines and will walk you through my experience with each. I hope the information is helpful and paves the way for you to get your refund(s)!

Alaska Airline

With Alaska Airline we used to simply request a tourism tax refund form the ticket agent when checking in, fill it out right then and there and then receive the refund within a couple of weeks. But the last few times we have flown Alaska, we were instructed to apply online.

I got onto Alaska’s online chat and the agent instructed me to do one of the following (I did both for good measure):

1. Fax to #206-392-7587:

- Passenger’s Name as Appears on Ticket

- Confirmation Number

- Ticket number

- Copy of Both Front and Back of Mexico Permanent Resident Card

2. Mail All of The Above Documentation to:

Alaska Airline Refunds Department P.O Box 68900 Seattle, WA 98168

I was told to expect the refund in 7 to 10 business days and did in fact receive it within this timeframe.

Last Summer’s Alaska Airline Round Trip from Puerto Vallarta to San Diego (times 4!)

Total Refund: $116.08 USD

Delta Airline

For delta airline, i was first directed to fill out a form online, but the system wouldn’t accept my ticket number and prompted me to call their 1-800-847-0578 number. the agent took all of my information (full name, ticket number) and then, while still on the line, sent me an email asking me to reply with attached copies of the front and back of our mexican permanent resident cards., easy peasy we received the refund to the credit card used for the purchase within seven business days., our recent delta airline round trip from puerto vallarta to salt lake city (times 4) .

Total Refund: $115.60 USD

According to both Alaska and Delta , there are also other circumstances (citizens, diplomats, infants under age of two, transit/transfer passengers) in which a Mexican Tourism Tax Refund is given.

Again, please check directly with your own individual carrier for their specifications.

I hope this information has been useful and puts a few dollars back into your pocket to be used for more fun, tacos, tequila and adventures !

Do you have any experience or helpful suggestions to getting your Mexican Tourism Tax Refund ?

If so, I would love to hear about it in the comments section below.

Thank you! ¡Gracias!

Katie O’Grady

Others articles on this topic:

How to Get a Refund of The Mexico Tourism Tax by TEX MEX EXPATS

How to request mexico tourism tax refunds for airline flights by citizens and residents by yucatan times, *please protect yourself and your loved ones with an expat travel insurance policy & carbon monoxide detectors.

By checking this box I consent to the use of my information provided for email marketing purposes. Privacy Notice

Tagged as: Airline Tourism Tax , Mexico Tourism Tax Refund

Thanks for info, Katie! Did not know. I’ll ask for refund on next trip.

You are more than welcome. Remember that you can apply for up to a year from the date of the ticket’s issuance (of course double check with your airline), so get working on pulling those records up! Well worth the time in my book!

Saludos, Katie 🙂

Hi Katie! I was very curious and intrigued about this…but I don’t see that line (Mexican tourism tax) on any of my old tickets…is it only on certain airlines? Thanks and hope all well with your familty 🙂

Hi Linda! Yes, I too had to do some digging with a few of the flight receipts, but they were there! On several I had to click on the hyperlink that read “other taxes”. Which airline(s) do you usually fly with? If you have all of your flight records from 12 months within the date of the ticket issuance, and you are a PR of Mexico, you should qualify. See if the airline has an online chat feature or customer service number you can call. My experience was that not “all” representatives where well-informed so it took a little persistence and patience but for 300 dollars, I say well worth it! Good Luck! Katie 🙂

Leave a Comment

Sign me up for the newsletter!

Next post: Traveling from Puerto Vallarta to San Diego during COVID-19 (with Kids)!

Previous post: The Blessing Of The Horses, San Miguel de Allende (A Cowgirl’s Dream!)

sanmigueltimes

Unwto welcomes sustainable tourism collaboration with guanajuato, san miguel’s city council plans to raise public transportation fares, you may also like, maximize your time on your next trip to san miguel de allende, san miguel de allende’s quebrada street: a vibrant part of the city, pet shop boys celebrate 40th anniversary of their classic hit “west end girls”, deaths due to high temperatures are recorded throughout mexico, happy mother’s day in mexico, michelin guide: the best gastronomic event in the world will take place in mexico, leave a comment.

Save my name, email, and website in this browser for the next time I comment.

Our Company

News website that serves the English-speaking community in San Miguel with information and advertising services that exceed their expectations.

- 01 Central Park, US, New York City

- Phone: (012) 345 6789

- Email: [email protected]

- Support: [email protected]

About Links

- Advertise With Us

- Media Relations

- Corporate Information

- Apps & Products

Useful Links

- Privacy Policy

- Terms of Use

- Closed Captioning Policy

- Accessibility Statement

- Personal Information

- Data Tracking

- Register New Account

@2024 All Right Reserved by San Miguel Times

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Accept

Keep me signed in until I sign out

Forgot your password?

A new password will be emailed to you.

Have received a new password? Login here

Are you sure want to unlock this post?

Are you sure want to cancel subscription.

Travel with Grant

Transforming your frequent flyer miles into free trips around the world.

How to Request Mexico Tourism Tax Refunds for Mexican Citizens, Residents & Transiting Visitors [UPDATED September 2017]

Originally Posted in January 2017 – Updated with new data points in September 2017!

Buenos dias!

If you or someone you know has a Mexican passport or resident card, they might be leaving money on the table when they purchase airline tickets to/from/through Mexico.

When you purchase a plane ticket to Mexico, the fare has a tourism tax built in – similar to US customs and immigration fees. This fee goes toward the cost of immigration processing and the arrival / departure card required for foreign visitors. The fee is 500 Mexican Pesos, which is roughly $28 USD. (The fee increased from 390 pesos at some point in 2017). On your ticket receipt you may see this referred to as UK (the IATA code for this tax) or DNR (the Spanish abbreviation).

Screenshot from ITA Matrix showing the Mexico tourism tax – tax and exchange rate as of December 18, 2016.

However, not everyone is required to pay this fee. If you have a Mexican passport or resident card, or are spending less than 24 hours in Mexico, you’re exempt from this tax. (Infants under 2 and diplomats are also exempt.) This is outlined (in Spanish) on this Mexican government FAQ page, question 16 .

Description of tax refund eligibility requirements on the Alaska Airlines website.

Mexican carriers typically know not to charge this fee to Mexican citizens based on the citizenship information you enter at the time of booking, but otherwise, there’s a good chance this fee will end up on your ticket even when it shouldn’t. (There’s actually a class action lawsuit pending against several US and Mexican airlines for this practice.) Fortunately, most airlines are pretty good about giving you a refund upon request.

Alaska Airlines Difficulty: MEDIUM

Alaska was the first airline I found that documents the existence of this tax refund on their website . You can present your documentation to an airline representative at checkin to have a refund request submitted for you, or you can submit copies by mail or fax after travel is completed. After my trip on Alaska’s inaugural flight from San Francisco to Mexico City , I sent a fax with the ticket numbers and IDs and received an email about two days later letting me know the refund had been processed.

American Airlines Difficulty: EASY

American now has a page on their website about Mexico tourism tax refunds too. In the past, I used to submit refund requests via Twitter. Now, you can contact Reservations before your trip, or submit a refund request through their website after travel has been completed. The online refund request is very easy – I just selected ‘refund of taxes’ as the reason and uploaded a copy of my resident card, and the refund was back on my credit card within a few days.

Tax refund from American Airlines for a flight on September 21, 2016.

Delta Air Lines Difficulty: MEDIUM

Delta has information about tourism tax refunds buried on their Legal Notices page , and also on their “Pro” website for travel agents . The Legal Notices page directs you to their online refunds tool, but when I tried to submit a request for a refund for a previous flight, I got a big fat error message. Attempting to request a refund for an upcoming flight forces you to cancel the ticket first, which isn’t helpful either. I reached out to their Twitter team for assistance, but they told me to call the International Reservations Sales Team at 1-800-241-4141 for assistance.

Update: I sent a fax with ticket numbers and ID copies to Delta’s Passenger Refunds department at 404-715-9256 and received an email about two days later saying that the refunds had been processed to the original forms of payment.

No luck requesting a refund from Delta online.

Jetblue Airways Difficulty: IMPOSSIBLE

JetBlue has an unnecessarily convoluted system for requesting tax refunds. In theory, it’s relatively simple: you show your receipt and your documents to Jetblue agents at checkin and they submit the refund request on your behalf. In practice, this is way harder than it sounds. Their Twitter team told me that you can’t just submit a copy of your e-ticket – you have to request a Comprobantes Fiscal Digital por Internet (CFDI) receipt through a third party website at least 48 hours but no more than 30 days after purchase.

This website (in Spanish) is buggy and full of inaccurate and conflicting information. For example, on the first page you have to enter your ticket number and date of purchase, but if you enter the actual date of purchase it doesn’t work. The site shows a sample boarding pass with the ticket number and departure date highlighted, but that doesn’t work either – their system doesn’t allow you to select dates in the future.

When I reached out to their Twitter team for help, they suggested entering the date I was requesting the receipt as the date of purchase (even though I bought the ticket last month) – that didn’t work either. Their Twitter team then directed me to email [email protected], who couldn’t help with a receipt or refund, but sent me a $50 Jetblue voucher for my trouble.

Inaccurate sample ticket image from the JetBlue CFDI website

Southwest Airlines Difficulty: NOT SO BAD

I’ve had good luck getting Southwest to refund tourism taxes via Twitter. Since Southwest tickets are so flexible, you have to wait until travel is completed to submit a refund request. Their Twitter team told me to fax a copy of my documents to their Refunds Department (972-656-2568) with my confirmation number. The first time I requested a refund, it took nearly two months – I submitted my documents on April 5, and didn’t receive a refund until the end of May. When I followed up with the Twitter team on May 20th, they said the Refunds department was still handling requests from March 21st. However, I submitted a request for a different ticket via Twitter on October 4th and was able to get a refund processed the next day without having to resubmit my documents.

Quick refund processing from @SouthwestAir on Twitter.

Spirit Airlines Difficulty: EASY

Bill reported in the comments that he was able to obtain a refund easily by sending an email to customer service, presumably with the relevant ticket numbers/record locator(s) and a copy of the necessary documents.

United Airlines Difficulty: EASY

I used to use Twitter to get tax refunds from United, but now I just use the United Refunds website . Select the “Contact United Refunds” option, fill out the form with your ticket details, and upload a copy of your resident card or passport; you’ll get an email in a few days informing you that the refund has been processed. As a bonus, United automatically removes the taxes from roundtrip itineraries originating in Mexico.

Aeromexico Difficulty: EASY

The first time I traveled to Mexico, I had separate tickets from LAX to Mexico City and an onward connection (within 24 hours) from Mexico City to Santiago, Chile – which meant that I was exempt from both the tourism tax and Mexico City’s steep international departure tax. If I had booked that as a single ticket, those taxes would have been removed automatically, but their US refunds team (amusrefunds@ aeromexico .com) was able to process the refund quickly. That’s also the department for requesting tourism tax refunds based on citizenship or residency – just email them your ticket number and a copy of your passport or residency card. Note: From the comments, others have reported difficulty with Aeromexico. YMMV.

All Nippon Airways (ANA) Difficulty: HARDER/TBD

I booked an ANA award ticket earlier this year that included a United segment from SFO to Mexico City. I reached out to ANA on Twitter and was directed to call them at 1-800-235-9262 for assistance. But I hate making phone calls, so I haven’t gotten around to it yet.

Air France / KLM Difficulty: IMPOSSIBLE

Last year, I booked two award tickets for my partner on Aeromexico using Flying Blue miles and was charged tourism tax on both tickets. I tried multiple times to reach out to Flying Blue, Air France / KLM, Delta (which handles some of their customer service in the US), and Aeromexico, both myself and through an agent at getservice.com . Air France told us to contact Aeromexico, and subsequent requests to contact either airline – even through executive channels – were met with complete silence. Ultimately, getservice recommended that I initiate a chargeback with my credit card company, and I also considered filing a complaint with the US Department of Transportation, but at that point the tickets were so old that I didn’t want to bother with it anymore.

Air Transat Difficulty: IMPOSSIBLE

Isabelle in the comments reports that despite reaching out by both phone and Twitter, Air Transat just pointed her to the fiscal receipt request page on their website and said that she would have to request a refund from the Mexican government.

Volaris Difficulty: IMPOSSIBLE

The Volaris website asks you if you have a Mexican passport when you book your ticket, but since I have a US passport, there is no way to avoid being charged the fee automatically. I reached out to their Twitter team for advice, who incorrectly told me that since I have a foreign passport, I have to pay the fee regardless of my residency status.

I then reached out to the Volaris chat support team, who directed me to email Customer Relations at [email protected]. I’ve gone back and forth with them via email multiple times – they don’t seem to have a great grasp of how the law works, and in any case have decided that it’s my fault that the tax was charged because I selected “US Citizen” instead of “Mexican Citizen” at booking. Their policy (apparently) is that customers are completely responsible for whatever charges appear on the website at time of booking, and it sounds like they wouldn’t refund me even if I had a Mexican passport. Volaris told me that to avoid this fee in the future, I should just say that I am a Mexican citizen during the booking process. I ended up filing a chargeback on my Citi Prestige card, but since the amount was so small Citi just granted me a permanent credit without investigating.

“Thank you for writing, I inform you that [a refund] is not possible since on the return flight you would be entering Mexico as a foreigner, which is why the charge was applied.”

Frankly, this is an annoying process and requires quite a bit of record keeping and hassle. The savings definitely add up over time, due to the amount of travel that I do. The amount of money saved on taxes will more than cover the cost of my one-year temporary resident card. There’s relatively little information about this process online, so I’m hoping this article will help people save some time and money. I still have a few unresolved tax issues, but hopefully the refund process gets simpler, easier, and quicker in the future.

Check Out These Related Posts:

73 thoughts on “ how to request mexico tourism tax refunds for mexican citizens, residents & transiting visitors [updated september 2017] ”.

Can you ask for reimbursement after the flight was taken? Thks

Hi Jorge, yes several of these were reimbursed after the flight was taken. (In fact, some airlines like Southwest require it.) Was there a specific airline you’re curious about?

Thanks! Yes, Aeromexico to be exact.. You just drop an email requesting the refund with the tix and passport info?

That should work! Let me know how it goes.

Here is a big no from Aeromexico they don’t care … Southwest takes two months

Dear Mr. Sang:

Thank you for taking the time to contact us.

Receive an apology for the delay in the response.

It is important to state taxes are not paid to Aeromexico, those are pays to government; therefore cannot be refunded.

Also it is important to acknowledge you that we only keep records for our flights and reservation for a yearlong.

Best regards,

That’s really disappointing – thanks for the data point.

Sorry, but NOT easy at all with AeroMexico. We E-mailed them a copy of the ticket, passport and Residency card, and they told us you have to have joint citizenship – contrary to what it clearly states on the government web site. We have now E-mailed them a copy of the government’s remarks to see how they will respond. Very disappointing, AeroMexico!

Sorry to hear that! Let me know if you have more luck with a second representative.

Is a mexican passport required to go on a flight to mexico from the airline volaris? Because I am Mexican American and I already bought tickets for my family. Although I have a USA passport.

Not at all – you can use any passport to travel on them, they just ask if you have a Mexican passport so they can adjust the taxes accordingly.

Did you ever manage to get the refund from Delta? I’m trying to do it with them now and I’m going round in circles!

No I still haven’t tried. Let me know if you have any luck.

I spoke to them over the phone and by email, over the phone was a bit more of a challenge as the guy genuinely had no idea what I was talking about but he went out of his way to find out. APPARENTLY we were never charged it in the first place so they couldn’t refund it. It was actually quite painless and they were very good at responding to the emails!

Hi Rebecca! I was able to get a refund from Delta via fax. Updated information in the post :)

Great news Tonei! I’ve got an upcoming flight with Jetblue next month. Not holding my breath as have never been able to get in back in the past, but it’s worth a shot right ;)

I have residency in Mexico, and I’m legally not required to pay this tax. However, on the Volaris booking, there’s no option to select residency, just passport country. For my family, this means we pay an extra $100 that we shouldn’t have to pay. I’ve seen one other place online where people just say “Select Mexico!”. I don’t want to get stranded at the airport however. Anyone actually tried this?

That’s the same thing Volaris’ own reps told me to do – as far as I can tell, the only thing that option does is toggle the tourism tax. I haven’t flown Volaris in a while though, so I haven’t personally tried it.

From my experience with Volaris, it also toggles the ability to pay using anything but a México-based payment method. Of course it may have changed since I last tried it!

Good catch! I think last time I bought a Volaris ticket I ended up using PayPal to circumvent that restriction.

You are right. When we have booked on Air Canada there is nothing to state country of residence – just passport. As there are no longer Visa restrictions for Canada, I shall be using my Mexican passport from now on to avoid ther tax But this won’t be available to my husband who has permanent residency in Mexico.

Has anyone had any experience getting the Mexico Tourist Tax Refund from Spirit Airlines? I appreciate any advice or assistance. Thanks! Bill

I haven’t flown Spirit internationally – good luck, and let me know how it goes!

FOLLOW-UP—SPIRIT AIRLINES

My wife and I have Residente Permanente from when we lived in Mexico. I applied for the Mexican Tourist Tax Refund from Spirit. We got an almost immediate response from Spirit. Jorge in their customer service department was extremely helpful in crediting the refund to us. A lot of people like to pick on Spirit but I find them transparent in their advertising.

Nice! Glad to hear that this worked out so easily.

Hello Bill, Could you please give me details about how you proceed with Spirit? I have a claim with them and they said they have never refunded this Mexican tourism tax. By the way, I possess an Mexican permanent residence as well. Many thanks in advance for your response

Hi, This is what I received from the Spirit Team regarding my request: “Please be advised that any refund requests for government taxes paid for at the airport should be requested at the airport directly before boarding the flight. Otherwise, it may not be granted. We strongly encourage you to coordinate with our team members at the airport ticket counter for further help” In other words, they didn’t provide me with any procedure to request my Mexican tax refund due to my last flight with Spirit on December 2017. Any other suggestion to get this refund are more than welcome. Thanks

I contacted them and they processed the refund

With Air Transat, seem impossible. I contact them by phone & twitter. Both send me to this link. They said they cannot refound it, it need to be done by the mexican governement. https://webportal.edicomgroup.com/customers/airtransat/pasaje/consulta-ticket-cfdi-airtransat.html

https://webportal.edicomgroup.com/EdiwinViewer00/ayuda/FormAyuda.jsp?tipocliente=anonimo&idioma=ES&dominio=ATA870429CZ5

I am trying now to get a refound from Interjet. First thing their billing doesnt explain if we got charge for it or not.

I contact them by twitter, no helpfull. By email they send me this: “Agradecemos los minutos que nos otorga de su día para el envió de este mensaje, es importante considerar que a pesar de ser residente el impuesto de salida es mandatorio por cuestiones migratorias razón por la cual este no es rembolsable, sin embargo, requerimos que pueda señalarnos que impuesto expone ya que hay diversos impuestos que ya esta precargados en su compra. ” Basicaly they don’t event know if we got charge & say it’s mandatory to pay the DNR. Wil see what happen whit that & uptade.

Update, what a complicated thing with Interjet. By email they said to contact by phone. After spending an hour on the phone with them, they come to the conclusion that we have not been charge. On the confirmation of purchase there is no description of impuestos. At first they did not understand what I was talking about but at the end apparently we don’t have that charge & they cannot send me a detail or proof of that. Will see the day of the flight!

I did reach out to INM too about that & the official name of that taxe is DNR. This was the response I got from them: 28/08/2017 5:14 pm Instituto Nacional de Migración Buen Día En atención a su consulta Le comento, el DNR es el derecho que deben de pagar los extranjeros cuando ingresan a México bajo la condición de estancia de visitante sin permiso para realizar actividades remuneradas (turista), por vía aérea, terrestre o marítima. Actualmente es de $500 por persona. Si la estancia de los extranjeros es menor a 7 días en territorio mexicano, no se paga el DNR. Saludos Cordiales

It’s the number 16: https://www.gob.mx/inm/articulos/preguntas-frecuentes-del-programa-paisano

Does anyone know how to file the tax return from Mexico after the fight was taken? I was trying to file the tax return in the airport ,but I’ve been told they do not have one in terminal 4 which they only have it in terminal 3 and 2 , and they told me that I can’t go to the other terminals but I can file it on the airplane which later on the flight attendant told me they do not have it on the plane

They may have thought you were trying to get a sales tax refund for purchasing items in the country…as far as i know the only way to get this tax refunded is through the airline, typically their refunds department.

Any experience with LAN? Have a transit in MEX on separate tickets with the tax collected by LAN.

Nope – but let me know how it goes!

I sent by USPS mail to Alaska Airlines at their address in Seattle a written letter with three past flights, including flight numbers, dates, and e-ticket numbers. Received a credit on my (Alaska Airlines/BofA) credit card about 3 weeks later.

Hey Tonei, Any ideas for Virgin Atlantic, I just asked them on their instant chat and the poor girl had no idea what I was talking about! I only just got the ticket today so I’ve got plenty of time to figure it out!

I would try their social media team first, and if they can’t help email or fax their refunds department. Let me know how it goes!

I just had a look at the fare breakdown on the ticket and it doesn’t even list the Tourism Tax (UK) as one of the taxes included in the total.. It’s got the TUA but not the UK which is interesting… This is the price breakdown that they provide! Base Fare Carrier-imposed Surcharge (YQ) Mexico – Transportation Tax – IVA (XO) United Kingdom – Air Passenger Duty (APD) (GB) Mexico – Airport Departure Tax – TUA (XD) United Kingdom – Passenger Service Charge (UB)

What’s your routing?

Cancun-London-Cancun Direct Flights both ways.. and I booked using the details from my UK passport, not the Mexican one!

I’ve send an email to Aeromexico (to the email address mentioned in the article), but Aeromexico wants the tour operator to refund it. This is nonsense, right? According to Mexican law, the airlines are the ones obliged to refund the tourist tax, right? Any advice on how to request the tourism tax back from AeroMexico? Thank you! Yvonne

Great article! I’m glad to hear there is a lawsuit pending. I have residency status in Mexico, but fly to the US for business at least 6 times per year. My carrier is United, and after going through a huge merry-go-round with them trying to get them to waive this tax when I fly, I’ve finally given up! No one there seems to understand what I’m talking about, and I have been told many different things by many different people there. At one point I was told that there was no way to remove it or refund it since I was booking on-line. So then I tried to book with a phone call and have it waived at that point, and got transferred around to different departments, speaking with people who had no understanding of what I was referring to, to eventually be told that everyone except for diplomats pays that tourism tax! This is why, just now, booking with American Airlines I am very pleased to see the notification for a possible refund. Hope the other airlines catch up soon!

That’s really disappointing to hear! I’ve had nothing but positive experiences with united on this front – they don’t charge the tax on round trip tickets originating in Mexico, and when I have had a ticket that included the tax, a request through their online refunds form with a copy of my resident card has been quickly resolved.

I just booked a United ticket online today and the Mexican tourism tax is there. I called them and the “supervisor” said I had to be a Mexican citizen for a refund. I am a resident with a residency card. My last two flights have the tax on them and I cannot get them removed apparently. Also, they do have a refund site but you have to choose a dropdown menu reason and this is not one of the choices. FYI.

Hi Derrick,

Customer service tends to be pretty clueless. Try submitting a request with the “E-Ticket refund” option – I think that I’ve had success with that in the past. If that doesn’t work, you could also try sending them a fax or a request by mail – unfortunately it looks like they’ve removed the option to contact them via email.

1-872-825-9364

United Airlines

United Refunds

P.O. Box 4607, Dept. NHCRF

Houston, TX 77253-3046

Thank you. I called back and persisted on the matter with someone in international flights for a good 30min and think it will work. It is a battle for 500 pesos but it can add up. It definitely isn’t automatic leaving out of Mexico and back. I will use the above idea to avoid the call and see how it goes.

As you can see from their reply to my request for a refund, Aeromexico is stone-walling still if one doesn’t have a Mexican Passport. Residency Card doesn’t qualify, even tho Mexican regulations accept it.

Dear Mr. Dailey,

Thank you for contacting us.

Our requirement to process Mexican Tourism tax refund is a valid Mexican passport, if you do not have it please contact [email protected] .

Any question, please do not hesitate in contact us.

Kind Regards,

De: Robert Dailey Enviado: miércoles, 6 de junio de 2018 18:10 Para: AM US Refunds Asunto: Fwd: Refund Mex air tax

Dear Sirs, Note my attached ticket # AM 8139978598 and copy of my Mexican Temporary Resident card. These were requested by you after receiving my attached previous email. Thanks for your kind consideratioin. RH Dailey

It seems like I got lucky with Aeromexico my first time – my experience with their customer service hasn’t been great, so at this point I try to avoid booking through them if possible for flights arriving in Mexico (often it’s possible to book Delta codeshares for a similar price, and their customer service is much better).

Fingers crossed that escalating it and pointing to the regulation may help – i ultimately gave up on my last Aeromexico ticket because i was tired of fighting with them. Alternately, you may be able to do a chargeback on your credit card for the amount of the tax.

It is taking 150+ days now to get a TR in QRoo Mexico… can I get refunded for each flight in/out to get permission to leave the country again to continue the TR process?

I’m not 100% sure – but definitely worth a shot, depending on the airline you may be able to just provide them with a copy of the visa issued by the Mexican embassy, or perhaps a copy of your permission de salir y regresar with the letter showing that your application is in progress. (And so dsorry it’s taking this long!)

Tonei I’ve got 4 refunds cooking- with AM, Delta, American and SWA. The experience with AM has been laughable, surreal, and hard to believe. I think they just aren’t making refunds, and making excuses to nix the requests. They can’t really be as ignorant as they profess [eg, only Mex. passport holders are eligible, etc]. Anyway, I look at all of this as part of my miles/points hobby and a learning experience. If I lived in the real world instead of being retired, I couldn’t possibly be able to rationally pursue such rabbit warrens… If I can, I’ll let you know of any successes. Don’t hold your collective breaths.

I booked a flight with Volaris today and when I selected U.S. passport there was a blue line that popped up: “People from other countries and without a residence should pay a fee on the counter.” In addition, I was charged $40 per ticket in taxes but only $4 in fees. So I think they’ve begun to make you pay at the counter when you check in.

Aeromexico now says that they have paid the taxes to the government and you must request reimbursement from the government not them. I went through about 4 emails and a copy of the government website rules to no avail. So it seems their level has risen to impossible now. American airlines was great and fast.

Exactly my experience with AM

Pingback: How to get a refund of the Mexican Tourism tax on your Mexico flights - TexMexExpats

SUCCESS PROCEDURES WITH SOUTHWEST AIRLINES

SEND YOUR SWA REFUND REQUEST TO: [email protected] SEND: your name; confirmation no.; ticket no., Residency documentation.

Kudos for SWA!!! I’ve attached their procedure, and if one follows it closely,…success will follow: But, be aware: 1] You must send them front & BACK your resident card. 2] Your boarding pass is a good way to show you have travelled, and it has the confirmation no. on it. 3] However, the required 10 digit ticket number does not appear on the boarding pass. It is a) at the end of your original email confirmation [along with the breakdown of fees and taxes with the Mex. Tourist Tax clearly marked], and b) also surprisingly on your credit card statement that you used for payment. I emailed the required info [see below], and within 2 weeks received an approval; the refund is made to the credit card used in ticket purchase. I currently have refund requests in to Delta, American and United, and I’ll report my results as I get them. I have just finished with an unsuccessful prolonged refund attempt with Aeromexico. I won’t torture you, dear reader, with the blow by blow. It was Sysiphean & futile. But, I recently gave them one more chance, and resubmitted a new request. NOTE; it failed! I hope this info is correct and helpful. If I’m in error on any of this, kindly so inform me. Thanks.

IMG_0279.jpg

A RAY OF HOPE WITH AEROMEXICO FLIGHT REFUNDS!!

You can get the refund on Aeromexico flights ONLY if the flight was a partner miles/points award written by Delta, NOT if the flight was obtained from Aeromexico. The award CANNOT be obtained on-line from Delta; the refund site is there, but has been non-functional forever [the Delta agent confirmed this]. One must do it by phone, as follows: phone 800-847-0578, [Delta] and ask for “refunds dept”; you’ll be transferred. You’ll be asked for your ticket number [on boarding pass and your purchasing credit card statement] and your Mex. Resident card no. [on its back] plus personal identifying info. You will be on hold for quite some time while the agent confers with several other depts. You will, finally, be given a reference no. and email, and a positive response will come by email in a week or two. Others on the internet have reported success with this methodology. Don’t bother trying to get this refund from Aeromexico. It’s a fools errand.

Nicely done! I should clarify in the post that it’s always the ticketing airline that you need to deal with – in examples like this where you have an Aeromexico flight on a Delta ticket, since Delta is the ones that collected the money, they’re the ones responsible for issuing the refund.

Can you update your United information. They still charge me the tourism tax when my round trip ticket originates in Mexico and ends there .great information I appreciate this article!!

Are you booking directly on united.com? I just tried booking a ticket MEX-IAH roundtrip and it didn’t have the tax attached. I wasn’t signed in to my MileagePlus profile, either.

https://www.dropbox.com/s/1xdnz3s7nb5ad3y/Screenshot%202018-11-29%2000.24.46.png?dl=0

I just purchased a ticket to Mexico for my wife, who is Mexican, and myself, and once I put in her nationality, it took around $20 off the ticket price. No refund request needed, I ended up at this site because I was trying to figure out what that meant exactly.

This is a bit off topic but do you know if every airlines already include the DNR in their airfare? I was about to book with Volaris because it had the cheapest price but when I chose my nationality the DNR fee was added automatically but at Aeromexico or Delta, the airfare didn’t change at the time of payment so I’m not sure if they include this fee automatically in the airfare. Do you have any idea about this?

Yes, most airlines include it by default – the only exceptions I know of are Volaris (if you mark that you’re a Mexican citizen) and United (for round trips originating in Mexico).

Thank you so so much :))

I’m on the phone with JetBlue trying to get this issue resolved. They told me that we have to go through this process in person with the gate attendant at the airport before boarding the flight and they’d file whatever form is needed on our behalf.

I actually found out about this tax when we purchased our last tickets through American Airlines because once you put in your nationality, they subtract the amount of the tax from the total amount due, which lowers the total ticket price.

Thanks for that info! I always found it challenging to get people at JetBlue who had any idea what I was talking about or how to deal with it.

Do you have another link for Jet Blue? The one in the article isn’t working for me. I asked a representative and they told me I had to go about the reimbursement directly with “Mexico.” As if that is not a very vague concept… haha

Pingback: Mexico increases tourist tax on your Mexico flights; How do you get a refund - The Mazatlán Post

So what happens if I’m a us citizen and I put I have a mexican passport to get out from paying the tourism tax. Do I have to pay at the counter? Will they find out?

Same question here…. Still dont know what to do now! :(

I’ve just been doing the phone dance with AeroMexico. I am a Mexican permanent resident, and as others have reported AM says they only reimburse for citizens. This is clearly different to the Mexican federal law. They actually told me that Mexican law doesn’t apply to foreign citizens. I might try quoting that next time I pass through immigration / get stopped by the police / walk out of a shop without paying!

https://www.gob.mx/inm/articulos/preguntas-frecuentes-del-programa-paisano

But, I think it isn’t worth the effort. If you have a choice, book through Delta on a codeshare. Their process is straightforward.

Pingback: The Era of Visa-Free Living in Mexico is Over

Got something to say? Cancel reply

Documenting Tourism Tax for Travel from the U.S. to Mexico

Delta and Aeromexico will continue to collect the Tourism Tax (UK Tax) for tickets on DL006 and AM139 ticket stock issued on/after July 1, 2021, for travel that originates from the United States to Mexico. As a reminder, this tax is part of the fare auto-price.

This Tourism Tax may be waived for citizens of Mexico. To waive the UK tax, Travel Agents will need to add the traveler’s Mexican-issued Passport Number in an OSI in the traveler’s PNR. A few examples are provided below:

Amadeus: OS AM MEXICAN PAX ID NUMBER XXX/P2

Sabre: OSI AM MEXICAN MEX ID NUMBER -1.2

Please note: OSI formats may differ per GDS. Please contact your GDS Help Desk if you have a question regarding OSI formats.

Travel Agencies may be held responsible and subject to a debit memo for the Tourism Tax amount and ADM charges in the event the tax is not included on the ticket or the OSI information is not included on the PNR, if waiving the tax for Mexican citizens.

If you have any questions or require more information, please contact Global Sales Support or Delta Reservations for assistance.

- About this Site

- Website Feedback

- TODAY’S TOP FARES

- WEEKEND DEALS

- SEARCH FARES FROM A CITY

- SEARCH FARES TO A CITY

- SEE CHEAPEST MONTH TO FLY

- SEARCH & COMPARE FLIGHT DEALS

- SET UP FARE PRICE ALERTS

- ALL AIRLINE DEALS

- ALASKA DEALS

- AMERICAN AIRLINE DEALS

- DELTA DEALS

- JETBLUE DEALS

- SOUTHWEST DEALS

- UNITED DEALS

- ALASKA AIRLINES

- ALLEGIANT AIR

- AMERICAN AIRLINES

- DELTA AIRLINES

- FRONTIER AIRLINES

- HAWAIIAN AIRLINES

- SOUTHWEST AIRLINES

- SPIRIT AIRLINES

- SUN COUNTRY AIRLINES

- UNITED AIRLINES

- AIRLINE BAGGAGE FEES

- AIRLINE CODES GUIDE

- SEE ALL BLOG POSTS

- RECENT FARE SALES

- TRAVEL TIPS & ADVICE

- TRAVEL GEAR

- SEE MY ALERTS

- MY ALERTS Get Money-Saving Alerts Sign Into Your Account Get Alerts By proceeding, you agree to our Privacy and Cookies Statement and Terms of Use Or Sign In

- SEARCH HOTEL DEALS BY DESTINATION

- SEARCH FAVORITE HOTEL BRANDS

- SET UP ALERTS

How to Avoid Mexico’s Tourism Tax for Short Visits

See recent posts by Peter Thornton

When flying from the U.S. to Mexico, your airfare will include a Tourism Tax, which is approximately $30 USD per ticket. For those who live near the southern border, there is a way to avoid this tax when visiting Mexico for a week or less, even when flying to beach resorts in southern Mexico.

Cross the Border by Land and Fly from Mexico’s Border Airports

While you may not have considered it before, flying from one of Mexico’s airports near the U.S. border to destinations throughout Mexico is an excellent way to save money on airfare since domestic flights within Mexico tend to be much cheaper than flights departing from the U.S. where hefty international taxes are imposed.

Plus, if you’re visiting Mexico for seven days or less, U.S. citizens don’t need to pay Mexico’s Tourist Tax when entering via a land border crossing.

Which Major Airports in Mexico Are Near the U.S. Border?

- Tijuana International Airport (near San Diego, CA)

- Mexicali International Airport (near El Centro / Calexico, CA)

- Ciudad Juárez International Airport (near El Paso, TX)

There are a few other commercial airports near the border, but these are the largest border airports that offer several more nonstop flight options around Mexico compared to nearby airports in the U.S. You’ll save both time and money when flying from these airports to destinations throughout Mexico.

Related: Passport Book vs. Passport Card: Which Do I Need?

How to Get to Tijuana Airport from the U.S.

Cross border express (cbx).