Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Capital One Venture Rewards Card

Full List of Travel Insurance Benefits for the Capital One Venture Card [2024]

Senior Content Contributor

486 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3112 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![capital one travel travel insurance Full List of Travel Insurance Benefits for the Capital One Venture Card [2024]](https://upgradedpoints.com/wp-content/uploads/2022/08/Man-walking-in-airport-looking-at-flight-board.jpg?auto=webp&disable=upscale&width=1200)

Basic Card Information

Auto rental collision damage waiver, lost luggage reimbursement, roadside dispatch, travel accident insurance, travel and emergency assistance, no foreign transaction fees, other credit cards, travel insurance policies, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The Capital One Venture Rewards Credit Card remains one of the best travel rewards credit cards in the world. Even though this card has existed for many years, its relatively recent yet seemingly meteoric rise to the top of the rankings has been attributed to Capital One Miles’ new transfer partnerships with airlines and hotels.

In the past, the Capital One Venture card’s rewards could only be used for a fixed value for redemptions, such as statement credits and gift cards. Now, the card has the ability to help its cardholders achieve outsized value — it also has an impressive earning structure (especially if you’re into simplified rewards instead of bonus categories), a series of neat benefits, and, of course, travel insurance.

The Capital One Venture card offers great travel insurance, especially at its price point. In this guide, we’ll walk you through all of the travel insurance benefits offered by the Capital One Venture card.

Let’s get into it!

Travel insurance is just one of the suites of benefits offered by the Capital One Venture card . Before we dive deep into this card’s travel insurance coverage, let’s touch on the other reasons why you’d want this card in your wallet.

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- 2x miles per $1 on all other purchases

- Global Entry or TSA PreCheck application fee credit

- No foreign transaction fees ( rates & fees )

- Access to Capital One transfer partners

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

Financial Snapshot

- APR: 19.99% - 29.99% (Variable)

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Capital One Miles

- How To Find the 75k or 100k Bonus for the Capital One Venture

- Travel Insurance Benefits of the Capital One Venture

- Capital One Venture vs Venture X

- Capital One Venture Card vs. Capital One VentureOne Card [Detailed Comparison]

- Chase Sapphire Preferred vs Capital One Venture

- Best Capital One Credit Cards

- Best Travel Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Credit Card Sign Up Bonuses

- Best High Limit Credit Cards

- Capital One vs. Citi Credit Cards – Which Is Best? [2024]

- Recommended Minimum Requirements for Capital One Credit Cards

Travel Insurance Coverage

Travel insurance offered by your credit card is one of the most important ways you can protect yourself against unforeseen incidents, accidents, or other inconveniences while traveling.

Here’s what to expect.

Note: The information below has expired and is no longer available

The Capital One Venture card provides rental car insurance as a benefit for covered trips. As long as you decline the car rental agency’s collision damage coverage and use your card to pay for the rental, you’ll receive:

- Secondary coverage for collision damage and theft on U.S. domestic car rentals

- Primary coverage for collision damage and theft on international car rentals

There are a few requirements for this to kick in:

- Your name must be embossed on the credit card

- Only you as the primary renter and any additional drivers listed on your auto rental agreement are covered

- Your rental period must not exceed 15 consecutive days in the U.S. or 31 days outside of the U.S.

- Coverage is not available in Israel , Jamaica , the Republic of Ireland , or Northern Ireland

The benefit provides reimbursement for up to the value of the vehicle, but there are a few exclusions:

- Expensive or exotic automobiles

- Antique automobiles

Hot Tip: Remember, rental car insurance from credit cards does not offer liability coverage at all. That means if you are deemed at fault for the incident, you will be 100% liable for charges.

To get coverage, you need to put the entire car rental transaction on your Capital One Venture card and decline the rental company’s collision damage waiver. After that, you’re good to go!

Covered losses include:

- Physical damage and/or theft of the covered rental vehicle

- Valid loss-of-use charges imposed and substantiated by the auto rental company

- Reasonable and customary towing charges to the nearest qualified repair facility due to covered theft or damage

Here are some examples of exclusions :

- Injury of anyone or damage to anything inside or outside the rental vehicle

- Loss or theft of personal belongings

- Personal liability

- Theft or damage due to intentional acts, or due to the driver(s) being under the influence of alcohol, intoxicants, drugs, or due to contraband or illegal activities

- Wear and tear, gradual deterioration, or mechanical breakdown

- Damage due to off-road operation of the rental vehicle

Filing a Claim

To file an auto rental collision damage waiver claim, follow these steps:

- After the incident has occurred, report the theft or damage by calling the Benefit Administrator at 800-397-9010 (outside of the U.S., call collect at 303-967-1093). You must report it no later than 45 days after the incident.

- Your Benefit Administrator will advise on the next steps to file a claim.

- Collect all of your documentation, including accident report forms, auto rental agreements, repair estimates and itemized repair bills, police reports (if obtainable), and so on.

- All documents must be postmarked within 365 days of the date of theft or damage. Note that the completed claim form must be postmarked within 90 days after the theft or damage.

- Claims are typically processed within 15 days, and your Benefit Administrator will work with you to substantiate your claim.

Losing your luggage while traveling seems to be every traveler’s worst nightmare nowadays. And while lost luggage reimbursement doesn’t make up for the inconvenience of having to replace your clothes and toiletries in the event of a loss, it should soften the emotional and monetary blow.

With the Capital One Venture card, you can get lost luggage reimbursement. To qualify, you must pay for the entire cost of your plane ticket using your card and report the loss to the airline first.

You and your immediate family members, which include your spouse and legal dependent children under age 18 (or under age 25 if enrolled as a full-time student at an accredited institution) are covered.

Currently, you are covered for up to $3,000 per trip, per person. In New York, the coverage is limited to $2,000 per bag. This coverage is supplemental to any existing baggage insurance or reimbursement you may have from another source.

So if you lose $2,500 worth of luggage on an American Airlines flight and American Airlines reimburses you for $1,000, you could be eligible for the difference through this benefit, which would be $1,500.

To file a claim for lost luggage reimbursement, you’ll want to:

- Immediately notify the Common Carrier/airline to begin their claims process

- Call the Benefit Administrator at 800-757-1274 (outside the U.S., call collect at 804-673-6496) within 20 days from the date the luggage was lost or stolen.

- Your Benefit Administrator will send you a claim form. Follow all of the procedures to file a claim and furnish the appropriate documentation to complete your claim.

- Submit the claim with all necessary documentation within 90 days from the date the luggage was lost or stolen.

The Capital One Venture card offers Roadside Dispatch, which is a 24/7, pay-per-use program for roadside assistance.

You’ll pay a set price of $69.95 per service call, which includes:

- Standard Towing – up to 5 miles included

- Tire Changing – must have good, inflated spare

- Jump-starting

- Lockout Service (no key replacement)

- Fuel Delivery – up to 5 gallons (plus the cost of fuel)

- Standard Winching

All you need to do is call 800-847-2869 to make a service call!

The last thing you want to happen is for yourself or a loved one to be involved in a serious or life-threatening incident.

The Capital One Venture card offers travel accident insurance, which could cover you for up to $250,000 if there’s an accidental loss of life, limb, sight, speech, or hearing while flying on a common carrier.

To get this insurance, you’ll need to put the entire cost of the fare onto your Capital One Venture card. Note that terms, conditions, and exclusions apply. Refer to your Guide to Benefits for more details. Travel Accident Insurance is not guaranteed; it depends on the level of benefits you get at the time of application.

If you ever need to file a claim, you’ll want to follow these instructions:

- You’ll need to obtain a claim form within 20 days after the event occurrence by contacting the Claim Administrator via 855-830-3719.

- The Claim Administrator will send you the claim forms within 15 days.

- Within 90 days after the date of the loss, you’ll need to submit the completed claim form and all associated documentation.

It’s impossible to predict what will happen while you’re traveling, especially if you’re visiting a place you’ve never been before.

To help combat this uncertainty, the Capital One Venture card offers travel and emergency assistance services, which are available 24/7, 365 days per year.

These are offered to you, your spouse, and dependent children under the age of 22 years old.

These services are for assistance and referral only, which come at no additional charge. However, you will be responsible for any other services provided, including medical, legal, transportation, or cash advance services.

To use the travel and emergency assistance benefits, just call 800-397-9010 or 303-967-1093 if you’re outside the U.S.

Examples of services include:

- Emergency message service , which will record and relay emergency messages for travelers, immediate family members, or business associates.

- Medical referral assistance , which will provide medical monitoring, referral, and follow-up.

- Legal referral assistance , which can arrange contact with English-speaking attorneys, U.S. embassies, and consulates if detained by local authorities, or if you need legal assistance.

- Emergency transportation assistance which can help make necessary arrangements for emergency transportation home or the nearest medical facility.

- Emergency ticket replacement , which can help you get replacement tickets if your original carrier’s ticket is lost.

- Lost luggage locator service , which can help you find and arrange shipment of lost luggage through the common carrier’s procedures.

- Emergency translation service , which provides telephonic assistance in all major languages and helps find local interpreters if needed.

- Prescription assistance and valuable document delivery arrangements which can help manage your prescription medication needs and transport critical documents that you left at your home or elsewhere.

- Pre-trip assistance which can help you learn about ATM locations, currency exchange rates, necessary immunizations, required passport visas, weather reports, and more in your destination before you leave.

Normally, foreign transaction fees on most credit cards are in the ballpark of 3%. But if you hold the Capital One Venture card, you won’t be hit with any foreign transaction fees at all ( rates & fees ).

So if you spend $1,000 on purchases while traveling abroad, you’d save $30 in fees!

How Coverage Compares

Now that we’ve highlighted all of the Capital One Venture card’s travel insurance coverages in detail let’s take a look at how it fares relative to other options.

We’ll start with other credit cards; after that, we’ll touch on travel insurance policies that are purchased outright.

Different credit card issuers like Chase and American Express offer unique sets of travel protections and benefits.

In this section, we’ll examine what other issuers offer. We’ll do our best to compare credit cards in the same tier as the Capital One Venture card.

The Chase Sapphire Preferred ® Card is the card that draws the most comparisons with the Capital One Venture card.

The Chase Sapphire Preferred card happens to offer elevated travel insurance benefits compared to the Capital One Venture card . To be specific, it offers:

- Trip cancellation and trip interruption coverage

- Trip delay reimbursement

- Baggage delay (plus lost and stolen baggage coverage)

- Primary rental car insurance

American Express

Although Amex doesn’t necessarily offer a card in the same tier, some compare the Capital One Venture card with the American Express ® Gold Card .

For a full breakdown of coverage by card, explore our Amex travel insurance benefits in-depth guide .

Because the Capital One Venture card doesn’t offer trip delay insurance, we give the slight edge to American Express cards.

Capital One

The Capital One Venture card’s travel insurance benefits pale in comparison to the Capital One Venture X Rewards Credit Card .

The Capital One Venture X card is a Visa Infinite card, so it offers a variety of other travel protections , such as:

- Trip interruption and cancellation insurance

That being said, the Capital One Venture X card also comes with a higher annual fee, so keep that in mind.

Citi credit cards generally don’t offer anything in the way of travel insurance, so the Capital One Venture card is significantly better.

Bank of America

Similar to Citi, Bank of America’s main cards for travel rewards generally don’t offer travel insurance or protections.

Travel insurance from your credit card will never be a full replacement for a comprehensive travel insurance policy, full stop.

That said, comprehensive travel insurance policies are often much pricier than you think (even though it can be worth it in an era of increasingly uncertain travel).

For example, if you have a $10,000 tour, it may cost $1,000 in travel insurance to fully cover that expense with a comprehensive travel insurance policy.

The best way to decide whether or not you want to purchase a separate travel insurance policy is to read through the benefits guide of your Capital One Venture card closely.

Depending on your risk appetite or tolerance, you might find it unnecessary to buy a travel insurance policy.

The Capital One Venture card offers a variety of travel protections to its cardholders. Thanks to this card, you can travel with significant peace of mind if something goes awry while traveling.

Remember that having travel insurance doesn’t guarantee you’ll get reimbursed when anything happens — you’ll need to confirm that the event that occurred is eligible for coverage. You’ll also need to follow the appropriate procedures at all times, including notifying your Benefit Administrator of all incidents in a timely fashion.

Overall, the Capital One Venture card provides decent travel insurance, but this will not replace a comprehensive travel insurance policy.

The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here .

Frequently Asked Questions

Does the capital one venture card have travel insurance.

Yes! The Capital One Venture card has terrific travel insurance benefits, including baggage insurance, travel accident insurance, and secondary rental car insurance.

Does the Capital One Venture card cover lost luggage?

Yes! The Capital One Venture card offers up to $3,000 in lost or stolen luggage insurance per covered trip. This also includes checked bags and carry-on bags.

Does the Capital One Venture card get you into airport lounges?

Right now, the Capital One Venture card offers 2 complimentary visits to Capital One Lounges or Plaza Premium Lounges every year. The Capital One Venture X card offers unlimited lounge access to Capital One Lounges, Plaza Premium Lounges, and a complimentary Priority Pass Select membership.

What are the benefits of the Capital One Venture card?

The Capital One Venture card earns up to 5x miles on purchases and offers a $100 Global Entry/TSA PreCheck application fee credit, 2 free visits to Capital One Lounges and Plaza Premium Lounges every year, Hertz Five Star status, excellent travel insurance including rental car coverage, no foreign transaction fees, and fee-free authorized users.

Was this page helpful?

About Stephen Au

Stephen is an established voice in the credit card space, with over 70 to his name. His work has been in publications like The Washington Post, and his Au Points and Awards Consulting Services is used by hundreds of clients.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![capital one travel travel insurance Citi Simplicity® Card — Review [2023]](https://upgradedpoints.com/wp-content/uploads/2019/11/Citi-Simplicity-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Everything you need to know about the Capital One travel portal

Editor's Note

Capital One's new travel portal, launched in 2021, has significantly improved since its beta release. It now allows Capital One credit cardholders , including those with the issuer's cash-back cards , to directly use their rewards for travel purchases. The portal also features updated flight search capabilities and the issuer's hotel programs: the Premier Collection and the Lifestyle Collection .

In this guide, we will explain what you need to know about the Capital One portal.

What is the Capital One travel portal?

Credit card issuers often provide bonus rewards when using their travel portals, but they can be frustrating due to poor customer service and user interfaces. However, Capital One differentiates itself by integrating technology from Hopper, a trusted app for predicting the lowest prices for flights and hotels. With access to vast amounts of data, Capital One claims a 95% accuracy rate in price predictions.

The portal also offers customer-friendly features like price drop protection, best price guarantee and price match with competitors. Suppose the portal advises you to book a flight. In that case, you will receive automatic price drop protection, ensuring a partial refund as a travel credit if the ticket price decreases within a specified time frame (generally up to $50 after booking).

Capital One has also addressed customer concerns by adding more support staff to reduce phone hold times. Three paid add-on features are available for users: cancel-for-any-reason (CFAR) coverage, price freeze protection and rapid rebooking .

CFAR coverage allows you to cancel your flight up to three hours before travel and receive back 70-90% of the ticket price. On the other hand, price freeze protection lets you pay a fee to lock in a price, protecting against sudden price increases. Rapid rebooking lets you select a same-day or next-day flight for up to $5,000 on any airline if your flight is delayed more than two hours or you risk not making your connection.

Here's a list of some top Capital One cards that offer access to Capital One Travel:

- Capital One Venture X Rewards Credit Card

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One SavorOne Cash Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One Spark Cash Plus

- Capital One Spark Miles for Business

You can access the portal through this link .

Related: Best Capital One credit cards

How to book flights through the Capital One travel portal

To book airfare using the Capital One travel portal, log into your account and hover over the "Flights" tab to search for one-way or round-trip flights. Enter your desired departure and arrival cities.

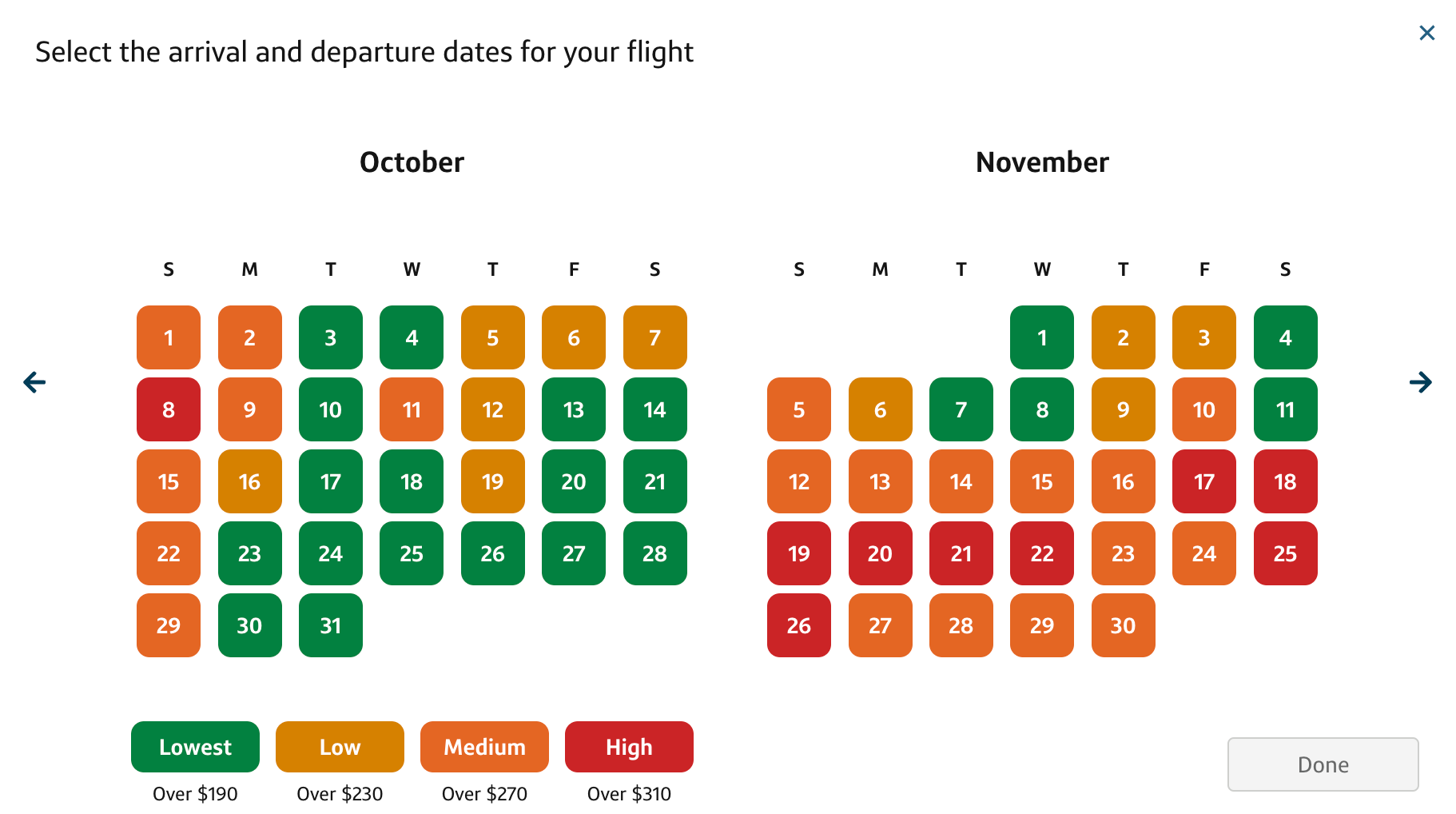

When selecting departure and return dates, it's not just a matter of merely selecting the convenient dates for you. Capital One brings in Hopper's familiar, color-coded interface, allowing you to see which dates offer the lowest prices in economy class.

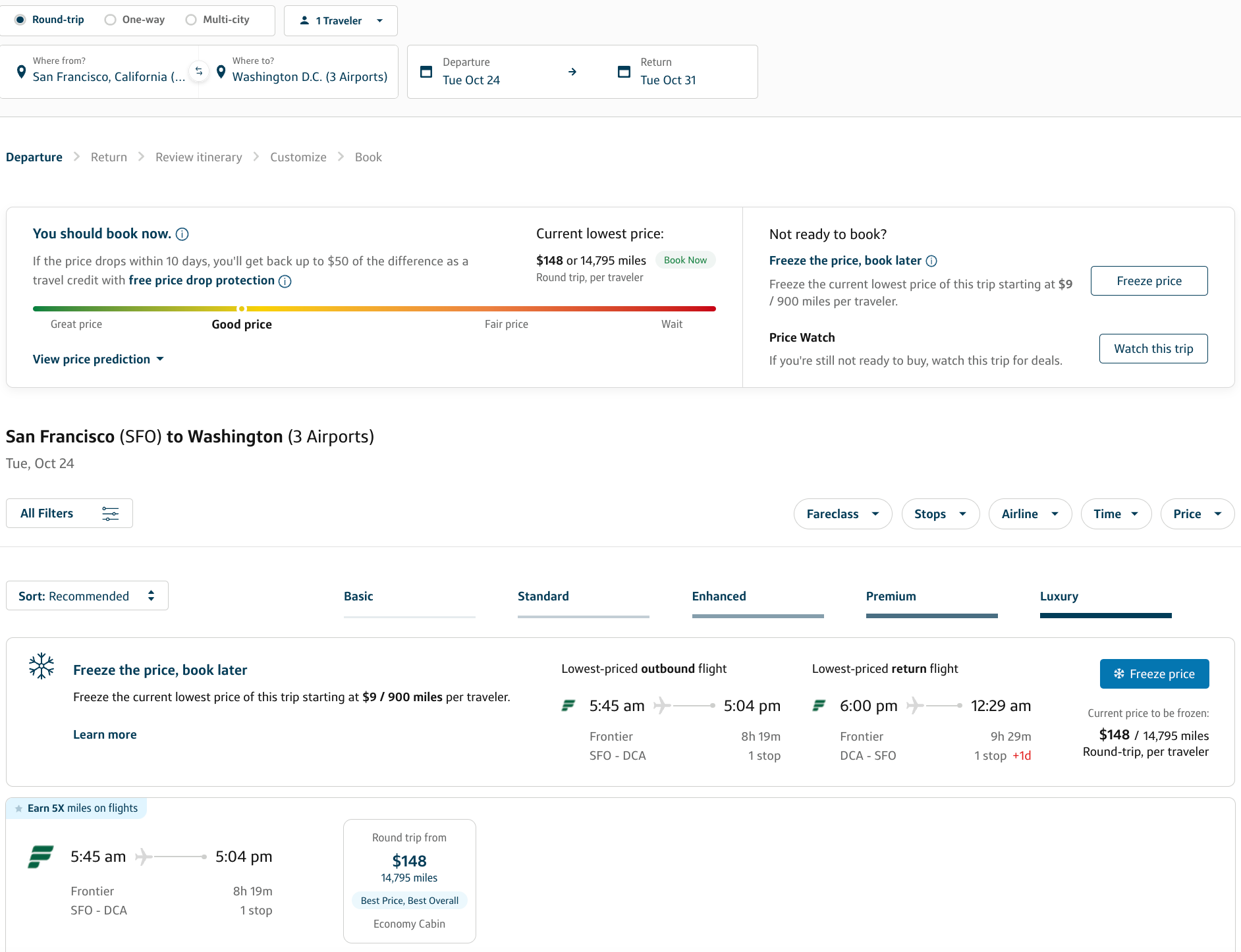

You'll see Capital One's booking recommendation and flight options on the next screen.

From the results page, you can narrow the parameters by:

- Fare class (cabin)

Then, you can sort your results by:

- Recommended

- Price (low to high)

- Departure time (earliest to latest)

- Arrival time (earliest to latest)

- Stops (least to most)

- Duration (shortest to longest)

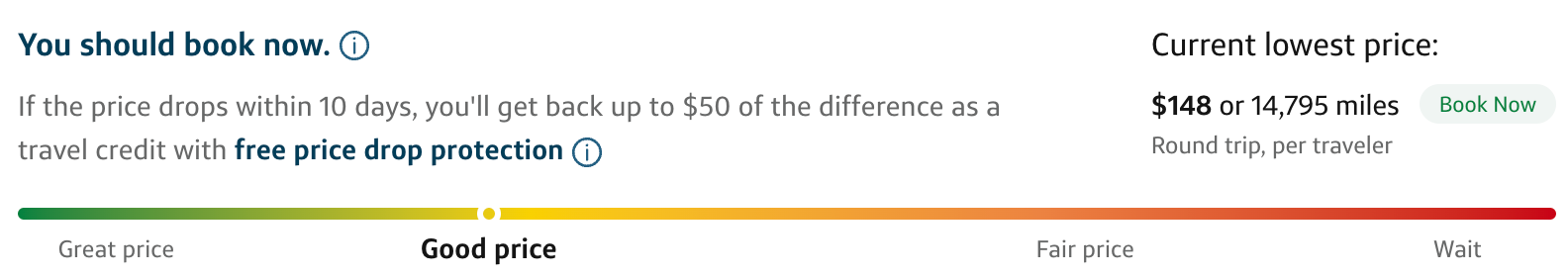

There are a few other interesting features worth mentioning. Above all the options, you can see the price prediction tool come into effect with clear messaging on whether or not it's a good time to book.

If the site's algorithms advise you to book, that will trigger free price drop protection. You'll get back up to $50 of the difference as a future travel credit if you book now and the price drops in the specified time period (10 days in the above example).

If you're not ready, you can press "Watch This Trip" to receive emails about the best time to book whenever better prices become available. Unfortunately, this feature applies to the route and date, not the specific flight(s) you want to watch — though you can exclude basic economy and connecting flights.

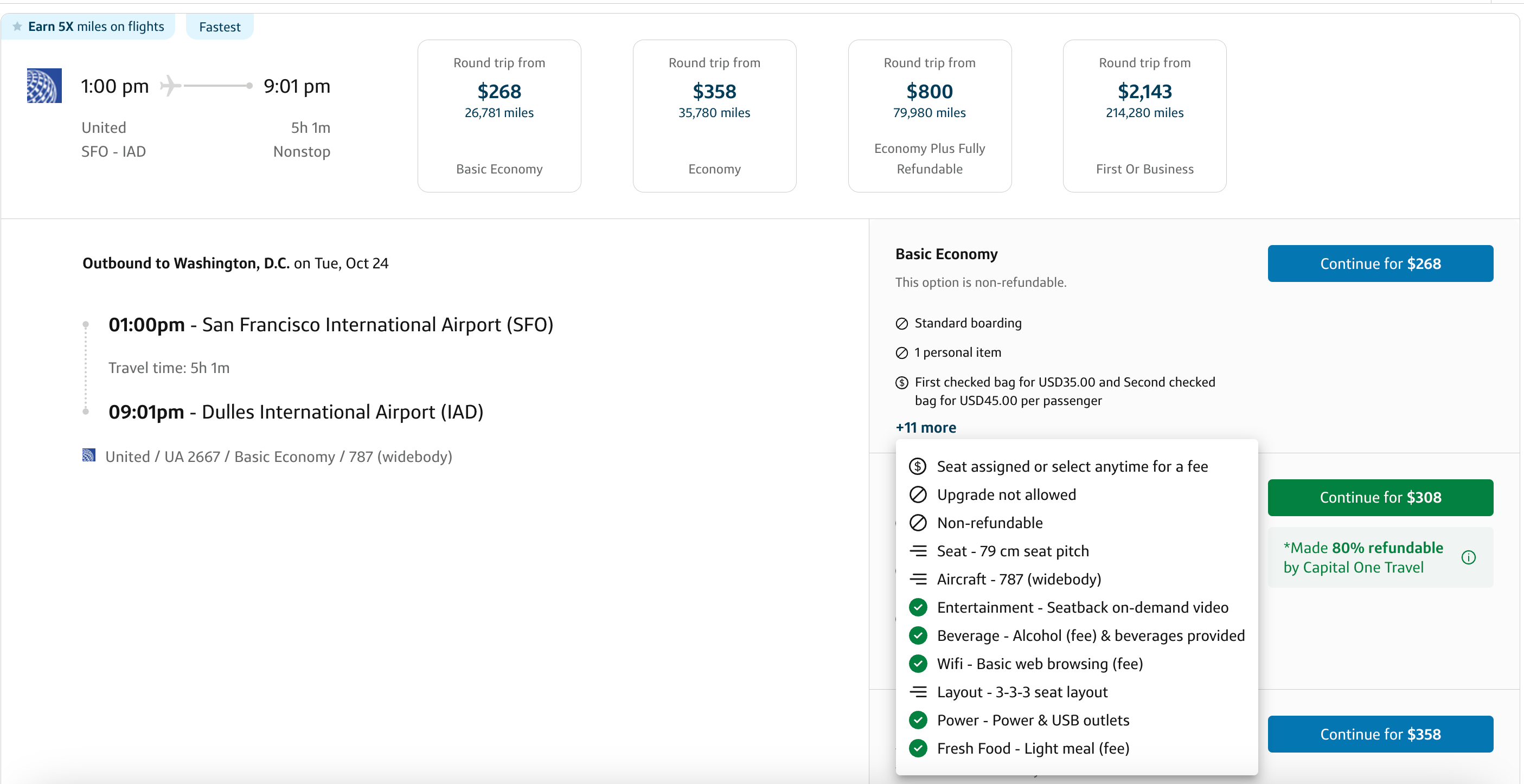

Pay attention to the fare class when booking flights. Basic economy differs between airlines. For example, United Airlines does not allow full-size carry-on bags, but Delta Air Lines does. Additionally, cancellation policies vary across fare classes.

Capital One has tried to standardize fare classes across all airlines on its platform, making it easier for users. When searching through Capital One Travel, you'll see the following labels:

- Basic : The best-priced options are often basic fares with restrictive policies and few amenities.

- Standard : Typically, main and economy fares include amenities like carry-on bags and seat selection.

- Enhanced : These fares include more legroom, priority boarding, and free beverages and snacks.

- Premium : These fares include cradled or reclined seats, priority boarding, and premium snacks and beverages.

- Luxury : These fares feature reclined seats with personalized services and premium meals. Priority boarding is also included.

After selecting your desired flight, Capital One Travel provides an extensive overview of what to expect during your journey. This includes detailed information on seat measurements, aircraft layout and onboard amenities like power outlets, fresh food options and whether lounge access is included. These comprehensive details surpass what you typically find on other travel portals or even when booking directly with airlines.

The payment side is quick and easy too. Enter the traveler information, with fields for frequent flyer numbers and Known Traveler Numbers (for instance, your TSA PreCheck number).

As a holder of the Capital One Venture card , I can apply my miles at a rate of 1 cent each toward the purchase. However, if you want to save your miles for later, press "Do not apply my rewards." You can use your credit card to pay for your reservation instead.

Note that the Capital One Venture X card offers 5 miles per dollar spent on flights booked through Capital One Travel.

Other options available in the booking process include purchasing the abovementioned add-ons: CFAR and price freeze. The price for these features will vary, depending on factors like your trip cost, how far in advance you're booking, whether the price is rated as "low" or "high," and other elements.

Related: Everything you need to know about Capital One's new rapid rebooking feature

How to book hotels through the Capital One travel portal

There are fewer distinctive features when booking your hotels through the Capital One travel portal, but the process is similar to the above.

To find a hotel, hover over the "Hotels" tab on the landing page and enter your destination, dates and number of travelers. Unlike flight bookings, there is no color-coded calendar for prices.

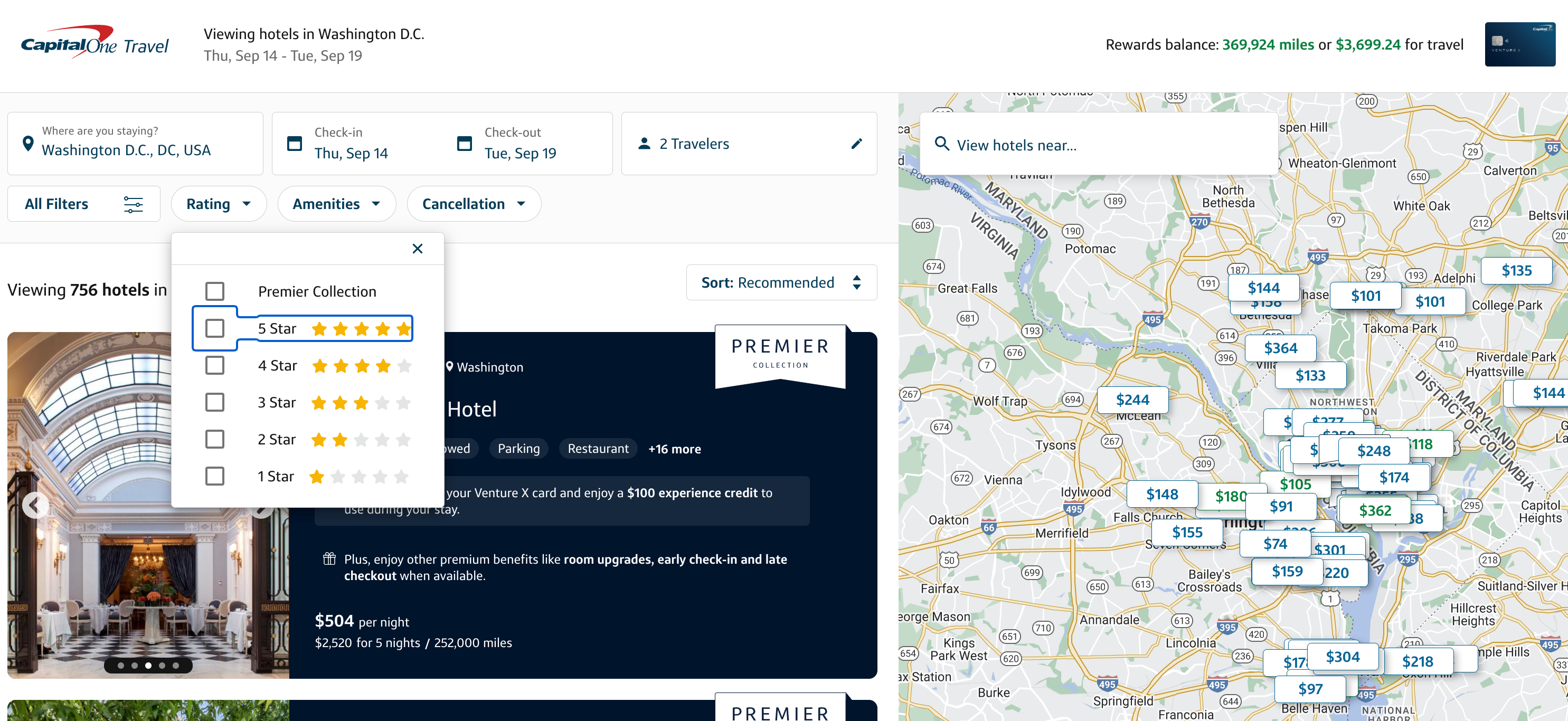

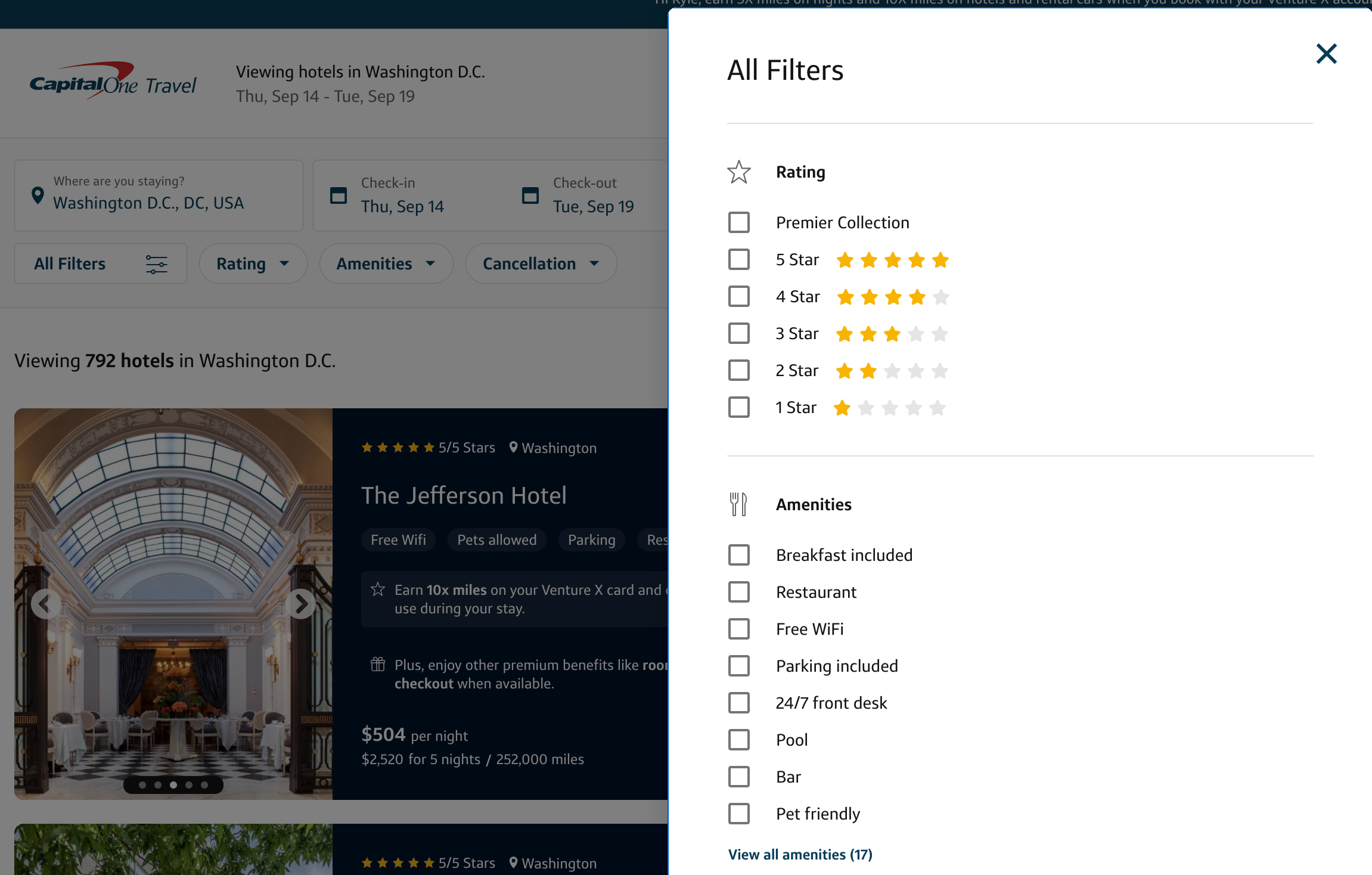

You'll then see a list and map format with various options. Filter your search by rating and price per night. Sort the listings by recommended, price (low to high) or star rating (high to low).

If your city has Premier Collection hotels, those options will appear toward the top. These hotels include benefits like an on-property "experience credit" of up to $100, daily breakfast for two people and complimentary Wi-Fi. Access is limited to those with premium credit cards from Capital One: Capital One Venture X Rewards Credit Card and Capital One Venture X Business (a business credit card formerly known as the Spark Travel Elite card).

If you click "All filters," you can sort by the amenities that matter to you or even look up specific properties.

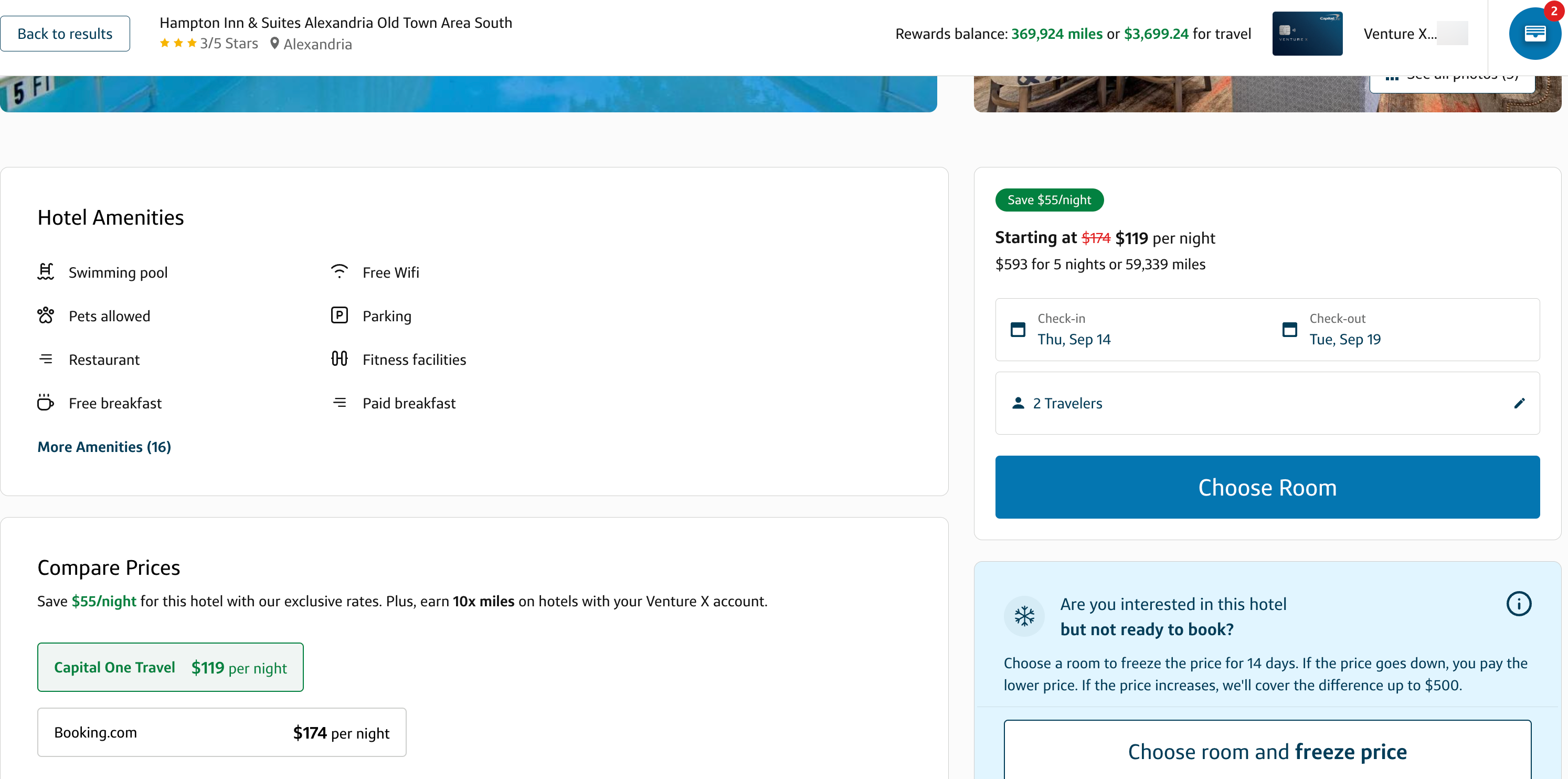

While the search features are more limited than booking flights, you'll get a detailed description of each hotel and can find out about amenities, rates, location and cancellation policy.

The payment process for booking hotels is the same as for flights. You can redeem your Capital One miles for the trip or pay with your card.

Paying with your card may be the better option here, as multiple cards offer bonuses on hotels booked through Capital One Travel:

- Venture X: 10 miles per dollar spent

- Venture, VentureOne and Spark Miles: 5 miles per dollar spent

- SavorOne, Quicksilver and Spark Cash Plus: 5% cash back

However, if you book hotels in a major loyalty program — like Marriott Bonvoy or Hilton Honors — through Capital One Travel, you likely won't receive points. You also won't enjoy any elite status perks.

Related: The best hotels in San Francisco for a golden getaway

How to book rental cars through the Capital One travel portal

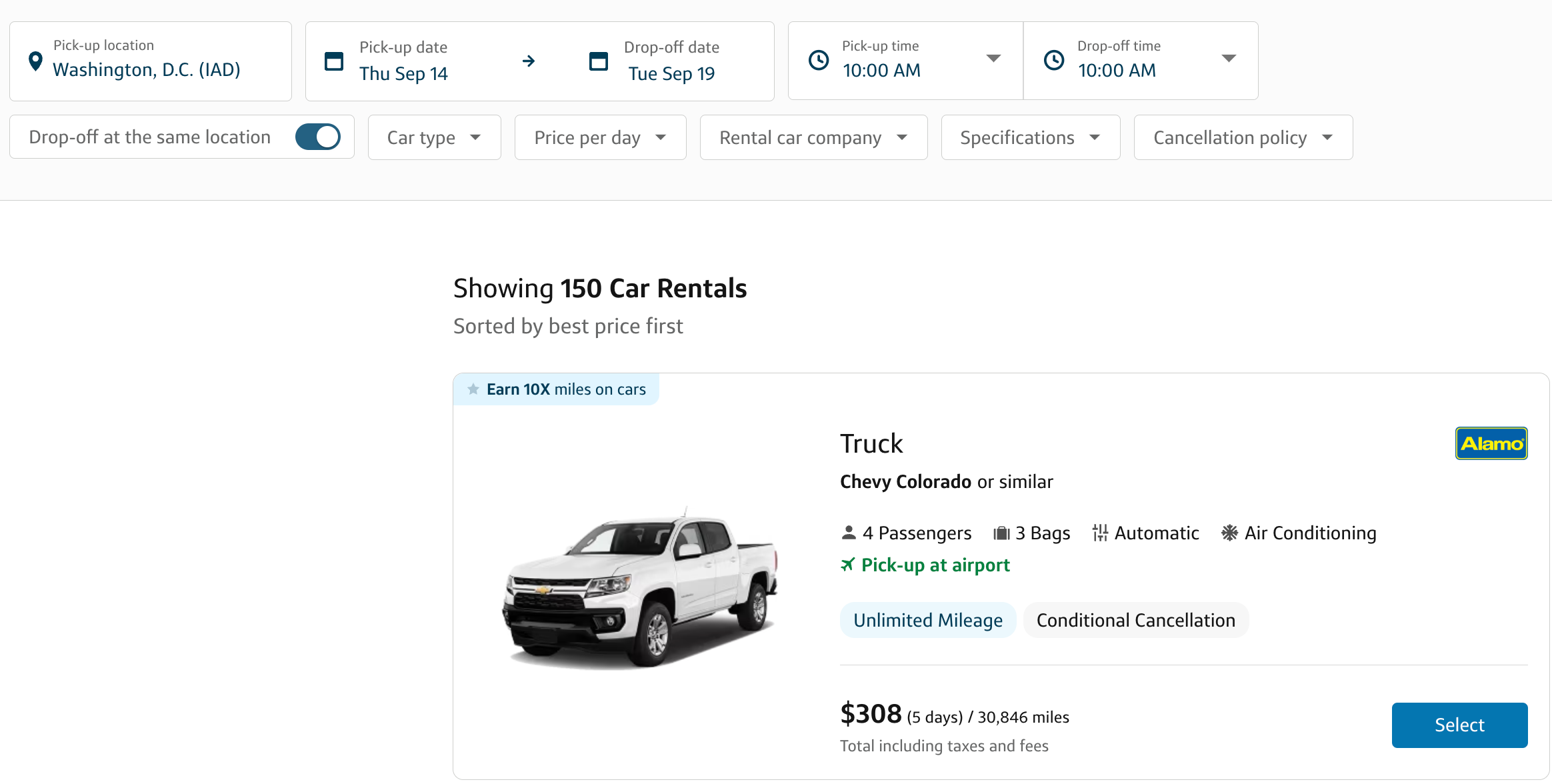

The process for rental cars is straightforward. Click "Car Rentals" at the top and enter your search criteria. You'll receive a list of options that can be filtered by car type, price per day, rental car company and specifications.

You can then reserve the car in a few clicks, with clear information about pick-up and drop-off.

With some rental car agencies — Hertz, Thrifty and Dollar — you can add your rewards number to the booking and likely enjoy the associated benefits. The option to add your loyalty number generally won't appear for other companies.

This is particularly appealing for Venture X cardholders , as you can earn 10 miles per dollar spent on rental car bookings and still enjoy the complimentary Hertz President's Circle status* that's included on the card.

Note that these car rentals earn rewards at the same rate as hotels booked through Capital One Travel:

*Upon enrollment eligible cardholders will maintain Hertz President's Circle status through Dec. 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g., at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

Related: Stacking rental car perks with Hertz and the Venture X

Further things to consider about the Capital One travel portal

Capital One Travel packs a punch for cardholders, but there are a few additional things to remember.

First, consider checking alternative platforms like Google Flights for better prices or alternate routings before booking with Capital One. Credit card portals sometimes have higher prices and don't always show all available flight options. Be sure you're not paying more for the same itinerary.

Additionally, if you're planning on using your Venture miles or Spark miles at a rate of 1 cent apiece , you should always book directly with the travel provider (whether it's an airline, hotel or car rental company). Then, use the miles to cover that purchase. This ensures you get all of the benefits of booking directly while using your rewards at exactly the same redemption value.

Also, with 18 transfer partners , Capital One offers a range of options for transferring your miles at a 1:1 ratio. Before booking through the portal, compare prices against Capital One transfer programs. For instance, a $150 United flight can cost 15,000 Capital One miles through the portal or just 7,500 Avianca LifeMiles (plus minimal taxes and fees). In this instance, it makes more sense to transfer your Capital One miles to Avianca LifeMiles.

As noted, hotel and car rental reservations through Capital One Travel likely won't be eligible for perks in a given loyalty program. If your elite status is important, it's advisable to book directly with major chain hotels and most car rentals. However, if you're booking independently owned hotels or elite status isn't a concern, the Capital One travel portal may be a better option.

Finally, remember that Venture X cardholders enjoy $300 in annual credits for bookings made via Capital One Travel. Unlike the $300 credit on the Chase Sapphire Reserve , this only applies to purchases made through the portal. As a result, even if you'd rather book flights, hotels or car rentals directly with travel providers, you should still spend at least $300 on your Venture X through Capital One travel each year.

Related: 7 tips to help keep an airline from losing your luggage

Bottom line

Capital One has made significant advancements in the travel space, including improved transfer partners, the introduction of a premium card and the opening of its flagship lounge in Dallas Fort Worth International Airport (DFW).

The Capital One travel portal offers a user-friendly interface. With its detailed pricing and fare class information, you might consider especially using it for flight bookings. Additional features like CFAR coverage, price drop protection, rapid rebooking and price freeze add value for cardholders.

You can also earn bonus rewards for many Capital One Travel purchases across most of the issuer's card portfolio, making it a great option as you plan upcoming trips.

Additional reporting by Stella Shon.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Capital one's new travel portal includes cancel-for-any-reason coverage and price protection tools, capital one's new travel portal will debut packed with money-saving benefits..

The offers below may no longer be available.

Capital One unveiled the details of their brand new travel booking portal — Capital One Travel. It's a unique platform to book travel using your Capital One credit card , whether you are booking with miles or cash.

This news comes as the bank recently announced upgraded travel benefits, including new transfer partners for Capital One miles and opening three Capital One airport lounges.

Now, Capital One is delivering an all-in-one travel portal where consumers can book flights, hotels and car rentals — and also access several exciting features to save money on travel and make booking a hassle-free experience.

Capital One Travel's new features

American Express and Chase are famous for their travel rewards credit cards , along with their travel portals where you can use their respective points. Now, Capital One has built its own proprietary portal with a slew of unique features.

However, this portal is still in 'beta' and is not yet accessible to Capital One cardholders. The live version will be rolling out to Capital One Venture Rewards Credit Card, Capital One VentureOne Rewards Credit Card, Capital One Spark Miles for Business, Capital One Spark Miles Select for Business and Capital One Walmart Rewards® Mastercard® cardholders in the coming weeks.

The portal will include these features when it first launches:

- Price prediction technology: Earlier this year, Capital One announced a partnership with Hopper, a tech company with airfare price prediction technology. Using historical data, this tool will predict when flights are at their highest or lowest price. This can help inform the timing of when you should purchase a flight if you want to get it for the best price.

- Price drop protection: If a flight price is found lower than the one you paid, Capital One will offer a refund for the difference. This can be a huge money saver for consumers who regularly travel, and the best part is that it's automatically refunded.

- Price match guarantee: If you find a better price for a flight, hotel or rental car on another site within 24 hours of booking, Capital One Travel will refund the difference.

Later this year Capital One will add these benefits to its travel portal:

- Integrated travel insurance to 'cancel for any reason' : For a small fee, consumers can book their travel with a 'cancel for any reason' clause. This is typically a premium if you are to purchase a traditional travel insurance policy . You can cancel a flight for any reason 24 hours before departure and get 80% of your ticket cost back.

- Freeze your price: If you find a price you like, but aren't fully ready to book, you have the option to freeze the price and complete the purchase at a later time. Capital One will cover the difference if the flight price is higher than when you instituted the freeze; if the price has dropped, you will be able to purchase it at the lower price. There will be a small fee for this feature.

Lastly, sustainable travel has become a priority for many who are hitting the road. Booking.com's 2021 Sustainable Travel Report revealed that 61% of travelers stated the pandemic has influenced them to want to travel more sustainably. In response, Capital One is launching a partnership with Eden Reforestation to plant four trees for every flight, hotel, or rental car booking in order to help with forest restoration.

Compared to other bank's travel portals, Capital One Travel will provide a very unique and potentially valuable tool. The other travel booking platforms do not include nearly any of the same purchase protections or travel insurance policies.

And with transfer bonuses becoming more lucrative for consumers who earn transferable points, there is often less incentive to use a bank's travel portal. But with Capital One's new product, travelers have more tools to try and get the best price for their upcoming adventure.

Best Capital One credit cards

If the new Capital One Travel portal is intriguing, consider applying for one of the many Capital One credit cards.

Here are their current cards and their welcome offers:

- Capital One Venture Rewards Credit Card: 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

- Capital One VentureOne Rewards Credit Card: 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening

- Capital One SavorOne Cash Rewards Credit Card: A one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Capital One Savor Cash Rewards Credit Card: A one-time $300 cash bonus once you spend $3,000 on purchases within the first 3 months from account opening

- Capital One Quicksilver Cash Rewards Credit Card: A one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Capital One Spark Miles for Business: 50,000 miles bonus once you spend $4,500 in the first 3 months from account opening.

Bottom line

Booking through a credit card's travel portal has several upsides, mainly the ability to earn and burn your miles all in one place. But the new benefits of the Capital One Travel portal make the card issuer stand out from other bank's booking platforms.

- 5 things to avoid if you’re applying for a mortgage Kelsey Neubauer

- Best sole proprietorship business credit cards Jason Stauffer

- This is the best budgeting app to help investors track their money Jasmin Suknanan

Should You Use a Credit Card Travel Portal?

Unlock the details of credit card travel portals and learn how to maximize your benefits.

Using a Credit Card Travel Portal

Getty Images

Using a credit card portal to book travel could help you save money and help you earn more points or redeem travel credits.

Key Takeaways

- Credit card travel portals search across multiple travel options, giving you the power to compare prices.

- You can use your credit card or rewards to book travel with your credit card issuer's travel portal.

- Some cards may offer travel credits and benefits when you book using the associated travel portal.

You have many options for booking travel, whether you want to book directly with airlines and hotels, use an online travel agency or book with your credit card's travel portal. Using a credit card travel portal may allow you to take advantage of cardholder benefits and credits and give you additional choices for your booking.

Understand how to use credit card travel portals to save money on your next trip and maybe get some elevated perks along the way – but also recognize when it doesn't make sense.

What Are Credit Card Travel Portals?

Similar to online travel agencies, such as Expedia or Booking.com, credit card travel portals are online travel booking platforms. Cardholders can use credit card travel portals to browse and book travel options, including flights, hotels, rental cars and experiences using your credit card or rewards.

Credit card travel portals include:

- American Express Travel.

- Capital One Travel.

- Chase Travel.

- Citi Travel.

Some credit cards offer cardholder savings or perks when you book travel using the issuer's credit card portal, such as travel credits or cardholder privileges, including free breakfast or late checkout.

How Credit Card Travel Portals Stack Up

When you use a credit card travel portal, the amount and method of payment may be the deciding factors in how you book. Using a credit card travel portal to book travel can save you money, but not always.

We compared a midweek economy flight from Los Angeles to New York and a weeklong stay at a three-star hotel in Manhattan. In some cases, credit card travel portals were competitive, but Expedia had the lowest overall price for flight and hotel costs on this test trip.

Still, this is just one example, and travel prices can fluctuate depending on how you book. It's always a good idea to compare all of your options.

Benefits of Credit Card Travel Portals

Booking your travel with a credit card travel portal can help you earn more points or redeem travel credits. Some examples:

- Cardholders of the Capital One Venture X Rewards Credit Card get a $300 annual travel credit for bookings through the Capital One Travel site. When booking on the Capital One Travel site, cardholders earn unlimited 10 miles per dollar on hotels and rental cars and 5 miles per dollar on flights. ( See Rates and Fees )

- With The Platinum Card ® from American Express , cardholders get a $200 annual hotel credit for prepaid Fine Hotels + Resorts or The Hotel Collection bookings with American Express Travel and earn five points per dollar on flights and prepaid hotels booked with American Express Travel. ( See Rates and Fees )

- Chase Sapphire Preferred ® Card holders get a $50 annual Chase Travel hotel credit and earn five points per dollar on Chase Travel purchases.

"Using the travel credits is huge," says JT Genter, editor in chief of rewards and travel tracking tool AwardWallet. "Card issuers are leaning more towards those only being accessible through the portal."

Credit card travel portal bookings may help your points go further, too. "Because I have a Chase Sapphire Preferred Card, when I use the (Chase) portal to book travel, my points get an extra 25% bump," says Chip Chinery, personal finance blogger at Chip's Money Tips. For example, you'd only pay 100,000 points for a flight or hotel that would require 125,000 Chase Ultimate Rewards points to book without the points boost.

Helpful features can add up to savings on credit card travel portals. For example, Capital One Travel offers a price match guarantee. Genter used the Capital One Travel price match feature on a flight from Cairo to Marrakech, Morocco. Although he booked with Capital One Travel, an online travel agency had a better price. He was able to price match with Capital One Travel to get a travel credit.

Genter points out that cardholders of The Platinum Card from American Express can take advantage of the International Airline Program for potential savings on international flights in first, business or premium economy.

You may also get benefits for booking with credit card travel portals, particularly when booking hotels. For example:

- Cardholders of The Platinum Card from American Express get elite benefits at participating hotels, including early check-in, room upgrades, breakfast for two, a $100 experience credit, complimentary Wi-Fi and guaranteed 4 p.m. check-out.

- If you have a Chase Sapphire Reserve ® , you can book The Edit properties through Chase Travel and receive benefits, including daily breakfast for two, a $100 on-property credit, room upgrades, early check-in and late check-out and complimentary Wi-Fi.

Drawbacks of Credit Card Travel Portals

Travel credits and on-property perks are compelling reasons to use a credit card travel portal. However, it pays to compare pricing among your card's portal, direct booking or an online travel agency, because the lowest-priced option depends on the trip you're taking. Also, you may forfeit some benefits, as credit card travel portals are third-party bookings.

With a third-party booking, you'll have less flexibility in customer service and cancellation than you would if you booked directly. For example, if you're dealing with a delayed flight and need service from the airline, you may be directed to the travel portal customer service. You may have limited options for cancellation and how you get your money or rewards back.

Another major point to consider with third-party bookings: You generally won't be able to earn points or miles with the airline or hotel, though you can earn points with your card. Additionally, you may not be able to use elite benefits for any status you hold. For example, if you have Hilton Honors status that entitles you to a daily food and beverage credit, you're not likely to get it when you book a stay with your credit card travel portal.

When to Use a Credit Card Travel Portal

Booking travel with a credit card travel portal can make sense in some scenarios. For instance:

- You want to compare your travel options across multiple airlines or hotels in the portal.

- You have a travel credit available that can only be redeemed through the issuer's travel portal.

- You have rewards you want to redeem on the portal, and booking this way offers a good redemption value.

- You want to take advantage of benefits, such as elite hotel perks that you can get when using a credit card travel portal.

- Your booking options on the portal are priced lower compared with other options.

- Booking on the portal earns elevated rewards, and the prices and benefits are comparable to those of other booking options.

"It makes sense if you want to take advantage of the credits but also to earn bonus points," says Genter. "And sometimes, they have promotions such as hyper-targeted offers."

Tags: credit cards

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Cheapest travel insurance of April 2024

Mandy Sleight

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:52 a.m. UTC April 11, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best cheap travel insurance company of 2024 based on our in-depth analysis of the cheapest travel insurance plans. Its Atlas Journey Preferred and Atlas Journey Premier plans offer affordable travel insurance with high limits for emergency medical and evacuation benefits bundled with good coverage for trip delays, travel inconvenience and missed connections.

Cheapest travel insurance of 2024

Why trust our travel insurance experts

Our team of travel insurance experts analyzes hundreds of insurance products and thousands of data points to help you find the best travel insurance for your next trip. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Best cheap travel insurance

Top-scoring plans

Average cost, medical limit per person, medical evacuation limit per person, why it’s the best.

WorldTrips tops our rating of the cheapest travel insurance with two plans:

- Atlas Journey Preferred is the cheaper travel insurance plan of the two, with $100,000 per person in emergency medical benefits as secondary coverage and an optional upgrade to primary coverage. It’s also our pick for the best travel insurance for cruises .

- Atlas Journey Premier costs a little more but gives you $150,000 in travel medical insurance with primary coverage . This is a good option if health insurance for international travel is a priority.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier offers $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan offers travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Cheap travel insurance for cruises

Travel insured.

Top-scoring plan

Travel Insured offers cheap travel insurance for cruises and its Worldwide Trip Protector plan gets 4 stars in our rating of the best cruise travel insurance .

- Worldwide Trip Protector offers $1 million in emergency evacuation coverage per person and a rare $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits, which means you won’t have to file medical claims with your health insurance first.

- Cheap trip insurance for cruises.

- Offers a rare $150,000 for non-medical evacuation.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person only available for cruises and tours.

Best cheap travel insurance for families

Travelex has the best cheap travel insurance for families because kids age 17 are covered by your policy for free when they’re traveling with you.

- Free coverage for children 17 and under on the same policy.

- $2,000 travel delay coverage per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Only $50,000 per person emergency medical coverage.

- Baggage delay coverage is only $200 and requires a 12-hour delay.

Best cheap travel insurance for seniors

Evacuation limit per person

Nationwide has the best cheap travel insurance for seniors — its Prime plan gets 4 stars in our best senior travel insurance rating. However, Nationwide’s Cruise Choice plan ranks higher in our best cheap travel insurance rating.

- Cruise Choice has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion. It also has a missed connections benefit of $1,500 per person after only a 3-hour delay, for cruises or tours. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Coverage for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” (CFAR) upgrade available.

- Missed connection coverage of $1,500 per person is only for tours and cruises, after a 3-hour delay.

Best cheap travel insurance for add-on options

AIG offers the best cheap travel insurance for add-on options because the Travel Guard Preferred plan allows you to customize your policy with a host of optional upgrades.

- Travel Guard Preferred upgrades include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings. There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million.

- Bundle upgrades allow you to customize your affordable travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best cheap travel insurance for missed connections

TravelSafe has the best cheap travel insurance for missed connections because coverage is not limited to cruises and tours, as it is with many policies.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of the best cheap travel insurance plans.

- No “interruption for any reason” coverage available.

- Weak baggage delay coverage of $250 per person after 12 hours.

Cheapest travel insurance comparison

How much does the cheapest travel insurance cost?

The cheapest travel insurance in our rating is $334. This is for a WorldTrips Atlas Journey Preferred travel insurance plan, based on the average of seven quotes for travelers of various ages to international destinations with a range of trip values.

Factors that determine travel insurance cost

There are several factors that determine the cost of travel insurance, including:

- Age and number of travelers being insured.

- Trip length.

- Total trip cost.

- The travel insurance plan you choose.

- The travel insurance company.

- Any add-ons, features or upgraded benefits you include in the travel insurance plan.

Expert tip: “In general, travelers can expect to pay anywhere from 4% to 10% of their total prepaid, non-refundable trip costs,” said Suzanne Morrow, CEO of InsureMyTrip.

Is buying the cheapest travel insurance a good idea?

Choosing cheaper travel insurance without paying attention to what a plan covers and excludes could leave you underinsured for your trip. Comparing travel insurance plans side-by-side can help ensure you get enough coverage to protect yourself financially in an emergency for the best price.

For example, compare these two Travelex travel insurance plans:

- Travel Basic is cheaper but it only provides up to $15,000 for emergency medical expense coverage. You’ll also have to pay extra for coverage for children.

- Travel Select will cost you a bit more but it covers up to $50,000 in medical expenses and includes coverage for kids aged 17 and younger traveling with you. It also offers upgrades such additional medical coverage, “cancel for any reason” (CFAR) coverage and an adventure sports rider that may be a good fit for your trip.

Reasons to consider paying more for travel insurance

Make sure you understand what you’re giving up if you buy the cheapest travel insurance. Here are a few reasons you may consider paying a little extra for better coverage.

- Emergency medical. The best travel medical insurance offers primary coverage for emergency medical benefits. Travel insurance with primary coverage can cost more than secondary coverage but will save you from having to file a claim with your health insurance company before filing a travel insurance claim.

- Emergency evacuation. If you’re traveling to a remote location or planning a boat excursion on your trip, look at travel insurance with a high medical evacuation insurance limit. If you are injured while traveling, transportation to the nearest adequate medical facility could cost in the tens to hundreds of thousands. It may make sense to pay more for travel insurance with robust emergency evacuation coverage.

- Flexibility. To maximize your trip flexibility, you might consider upgrading your travel insurance to “ cancel for any reason” (CFAR) coverage . This will increase the cost of your travel insurance but allow you to cancel your trip for any reason — not just those listed in your policy. The catch is that you’ll need to cancel at least 48 hours before your trip and will only be reimbursed 50% or 75% of your trip expenses, depending on the plan.

- Upgrades. Many travel insurance plans have optional extras like car rental collision and adventure sports (which may otherwise be excluded from coverage). These will cost you extra but may give you the coverage you need.

How to find the cheapest travel insurance

The best way to find the cheapest travel insurance is to determine what you’re looking for in a travel insurance policy and compare plans that meet your needs.

“Travel insurance isn’t one-size-fits-all. Every trip is different, and every traveler has different needs, wants and concerns. This is why comparison is key,” said Morrow.

Consider the following factors when comparing cheap travel insurance plans.

- How often you’re traveling. A single-trip policy may be the most cost-effective if you’re only going on a single trip this year. But a multi-trip travel insurance plan may be cheaper if you’re going on multiple international trips throughout the year. Annual travel insurance policies cover you for a whole year as long as each trip doesn’t exceed a certain number of days, usually 30 to 90 days.

- Credit card has travel insurance benefits. The best credit cards offer perks and benefits, and many offer travel insurance-specific benefits. The coverage types and benefit limits can vary, and you must put the entire trip cost on the credit card to use the coverage. If your trip costs more than the coverage limit on your card, you can supplement the rest with a cheaper travel insurance plan.

- The coverage you need. When looking for the best travel insurance option at the most affordable price, only buy extras and upgrades you really need. A basic plan may only provide up to $500 in baggage insurance, but if you only plan to take $300 worth of clothes and accessories, you don’t need to pay more for higher coverage limits.

Is cheap travel insurance worth it?

Cheap travel insurance can be worth it, as long as you understand the plan limitations and exclusions. Taking the time to read your policy, especially the fine print, well before your trip can ensure there won’t be any surprises about what’s covered once your journey begins.

“If a traveler is looking for coverage for travel delays, cancellations, interruptions, medical and baggage — a comprehensive travel insurance policy will provide the most bang for their buck,” said Morrow. But if you’re on a tight budget and are only worried about emergency medical care and evacuation coverage while traveling abroad, stand-alone options are cheaper.

Before buying travel insurance, you should also consider what your health insurance will cover.

“Most domestic health insurance plans, including Medicare, will not cover medical bills abroad,” said Morrow. Even if you’re staying stateside, you may find value in an affordable travel insurance plan with medical coverage if you have a high-deductible health plan (HDHP).

A cheap travel insurance plan is better than none at all if you end up in a situation that would have covered some or all of your prepaid, nonrefundable trip expenses.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance . From those top-scoring travel insurance plans, we chose the most affordable for our rating of the cheapest travel insurance.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Cheapest travel insurance FAQs

When buying travel insurance, cheapest is not always the best. The most affordable travel insurance plans typically offer fewer coverages with lower policy limits and few or no optional upgrades. Add up your total nonrefundable trip costs and compare travel insurance plans and available features that cover your travel expenses. This strategy can help you find the cheapest travel insurance policy that best protects you from financial loss if an unforeseen circumstance arises.

Get the coverage you need: Best travel insurance of 2024

According to our analysis, WorldTrips , Travel Insured International and Travelex offer the best cheap travel insurance. Policy coverage types and limits can vary by each travel insurance provider, so the best way to get the cheapest travel insurance plan is to compare several policies and companies to find the right fit for your budget.

A good rate for travel insurance depends on your budget and coverage needs. The most comprehensive travel insurance plan is usually not the cheapest. But cheap trip insurance may not have enough coverage or the types of coverage you want. Comparing different levels of coverage and how much they cost can help you find the best cheap insurance for travel.

The average cost of travel insurance is between 5% to 6% of your total travel expenses for one trip, according to our analysis of rates. However, you may find cheaper travel insurance if you opt for a plan with fewer benefits or lower coverage limits. How much you pay for travel insurance will also depend on the number of travelers covered, their ages, the length of the trip and any upgrades you add to your plan.

Travel insurance covers nonrefundable, prepaid trip costs — up to the policy coverage limits — when your trip is interrupted or canceled for a covered reason outlined in your plan documents. Even the cheapest travel insurance policies usually provide coverage for:

- Medical emergencies.

- Trip delays.

- Trip interruption.

- Trip cancellation.

- Lost, stolen or damaged luggage.

However, if you’re looking to save on travel insurance, you can shop for a policy that only has travel medical insurance and does not include benefits for trip cancellation .

Even when you buy cheap travel insurance, you can often use upgrade options to customize your policy to meet your specific needs.

Some common travel insurance add-ons you may want to consider include:

- Rental car damage coverage.

- Medical bundle.

- Security bundle.

- Accidental death and dismemberment coverage.

- Adventure sports bundle.

- Pet bundle.

- Wedding bundle.

- “Cancel for work reasons” coverage.

- “Interruption for any reason” (IFAR) coverage.

- “Cancel for any reason” (CFAR) coverage .

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

10 worst US airports for flight cancellations last week

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travel Insurance Mandy Sleight

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

Best no annual fee travel credit cards of April 2024