The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

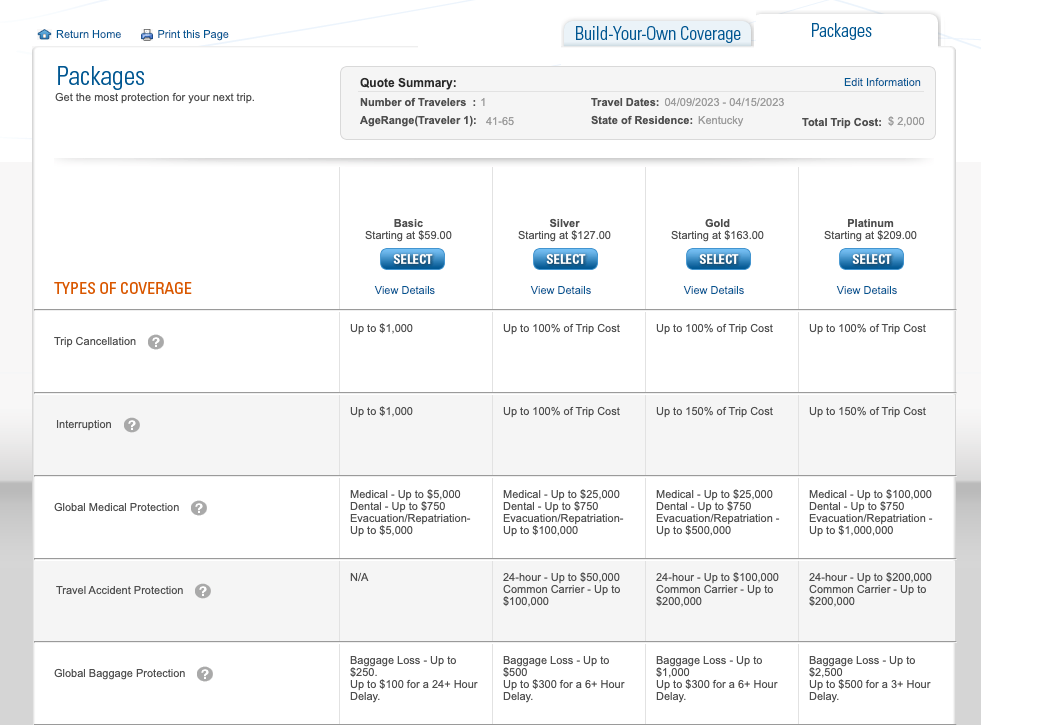

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

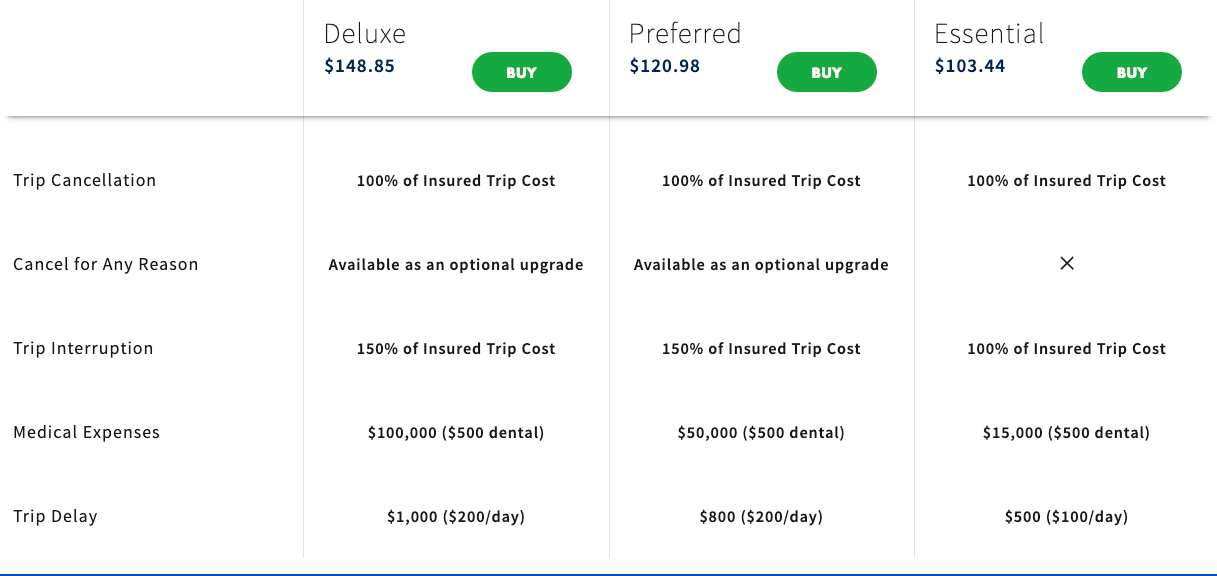

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

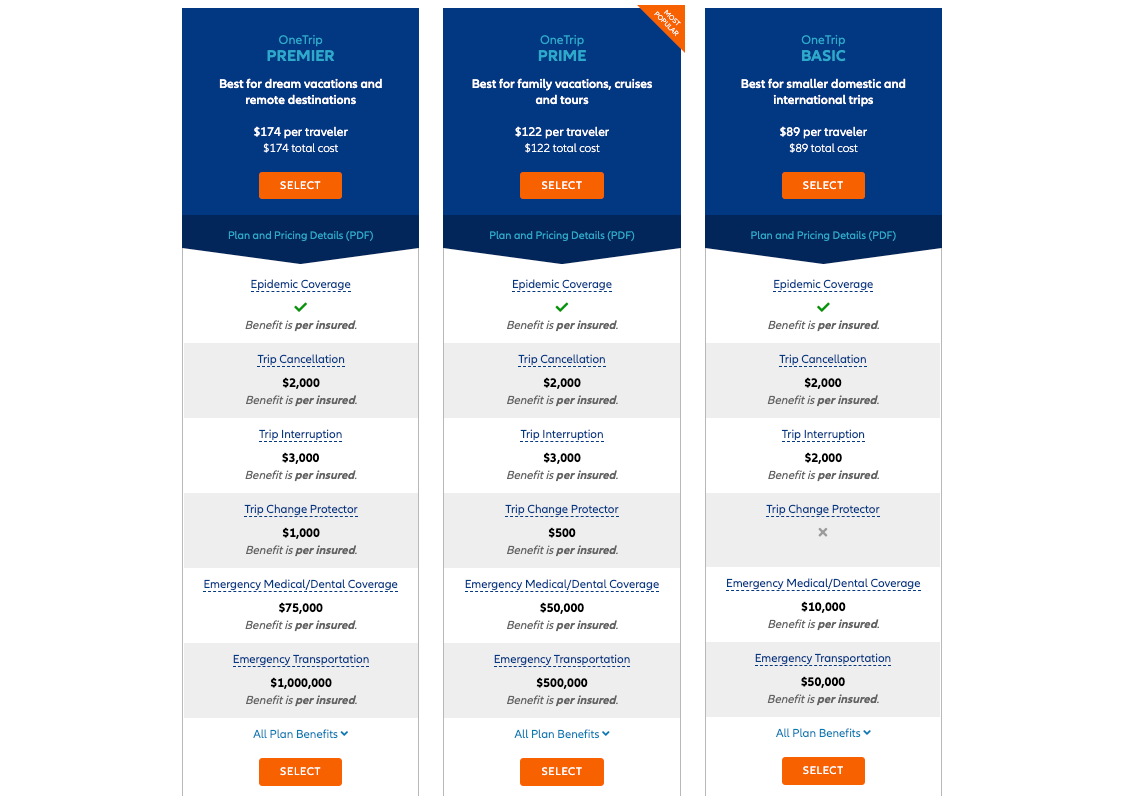

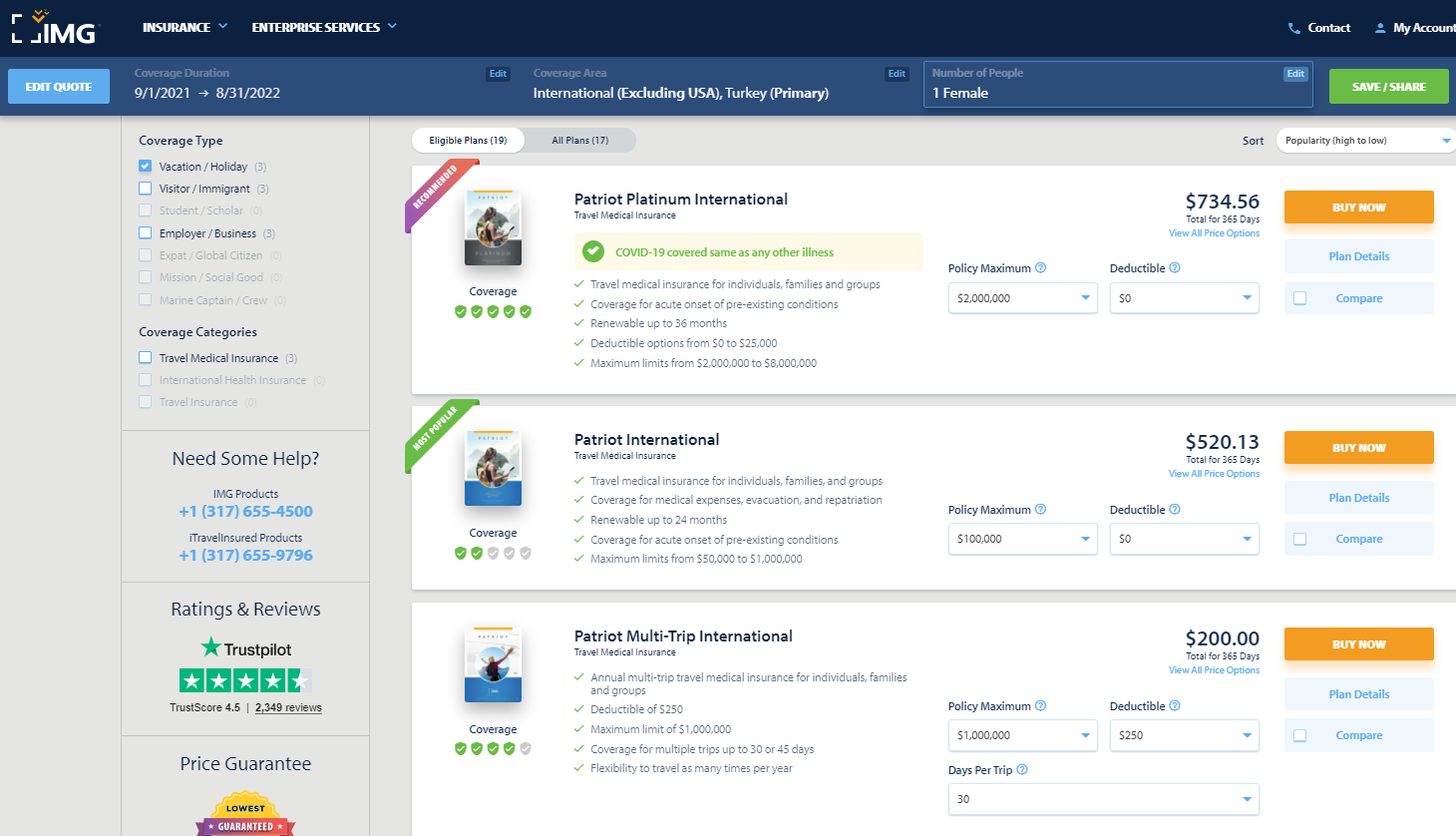

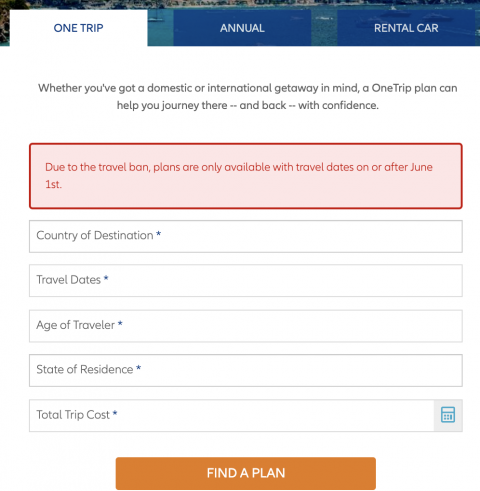

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

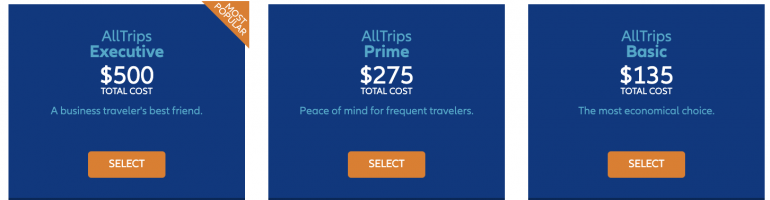

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

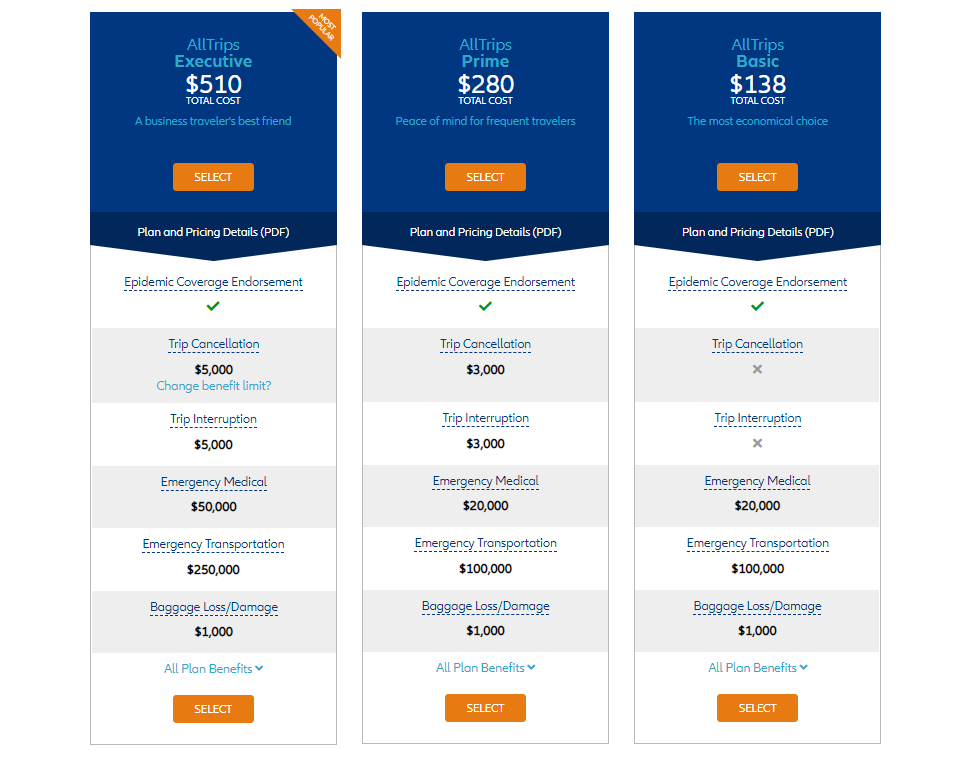

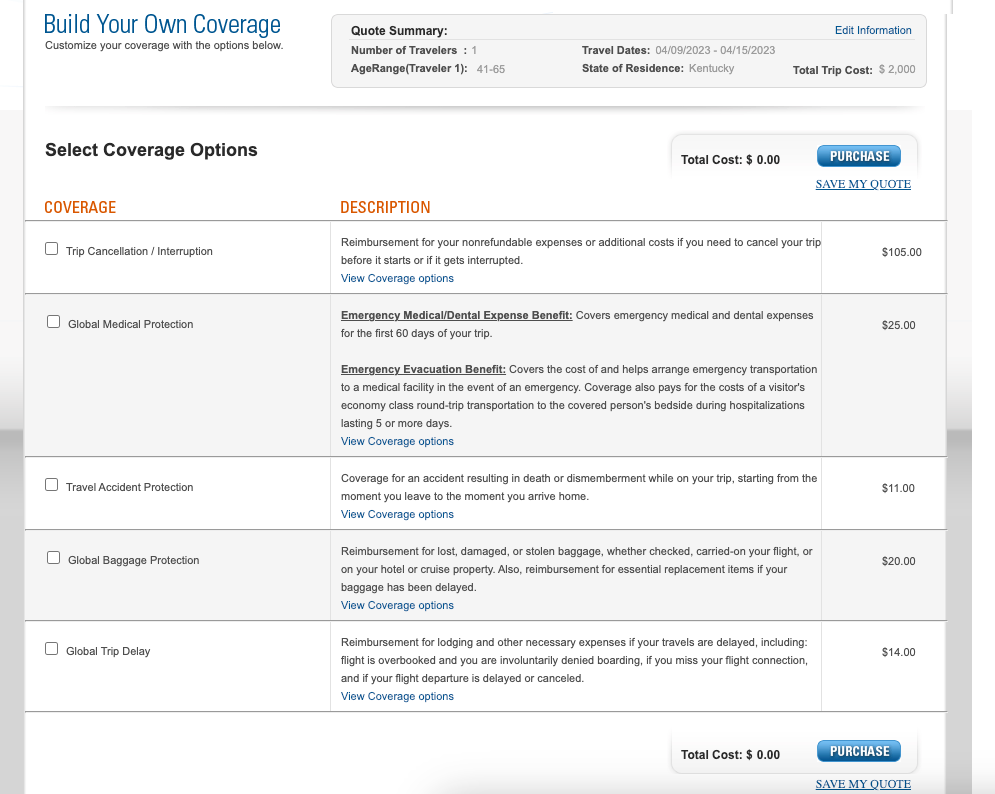

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

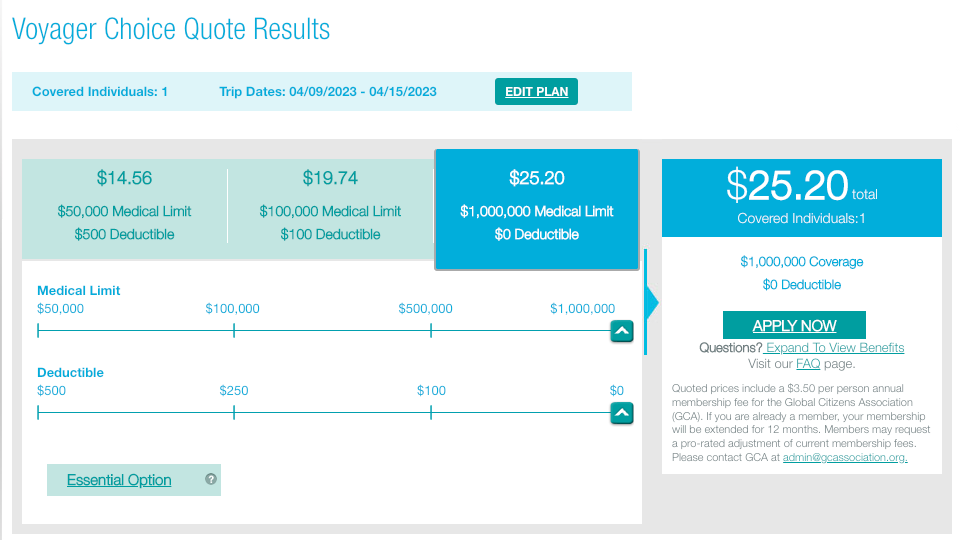

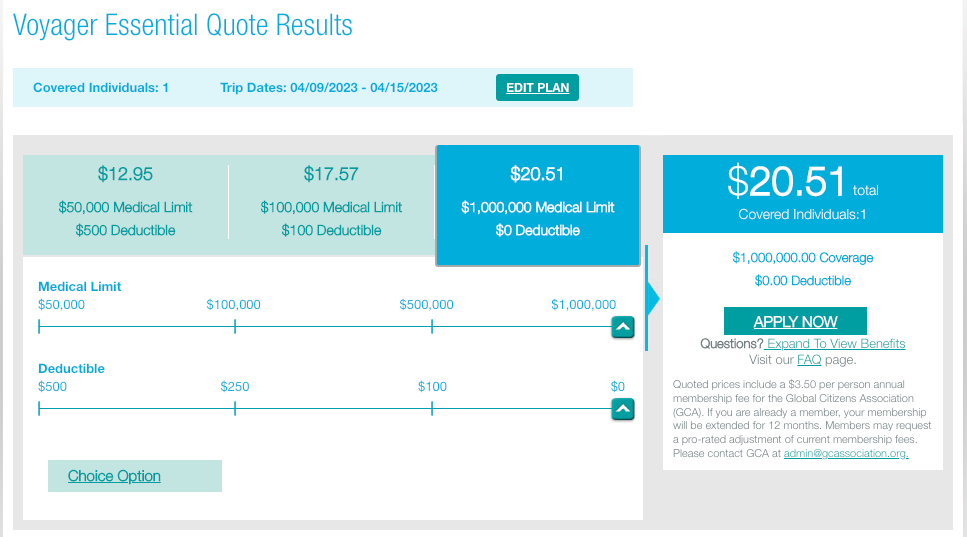

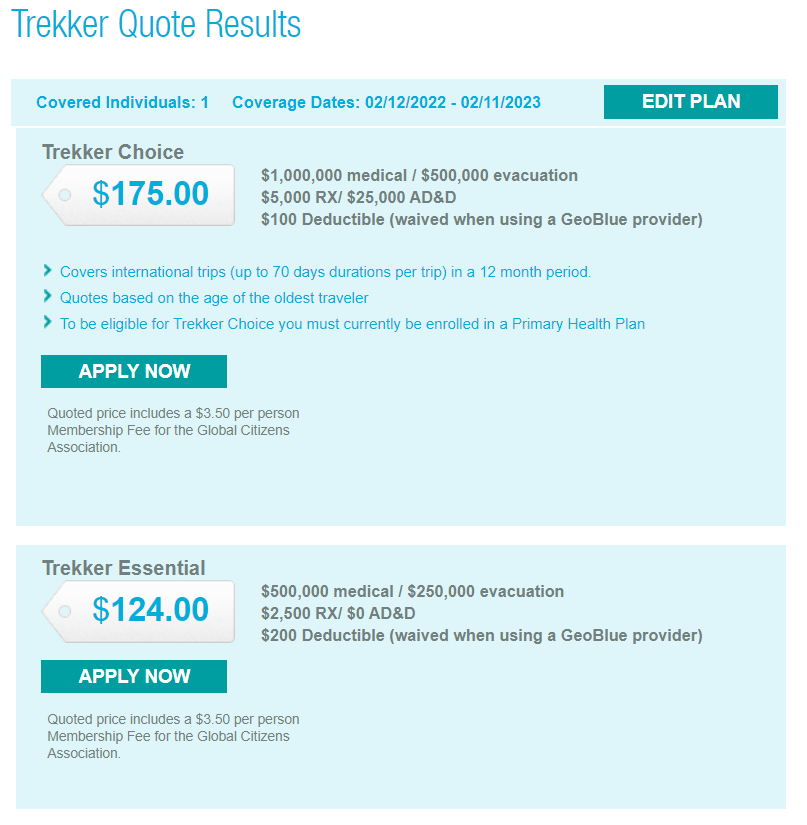

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

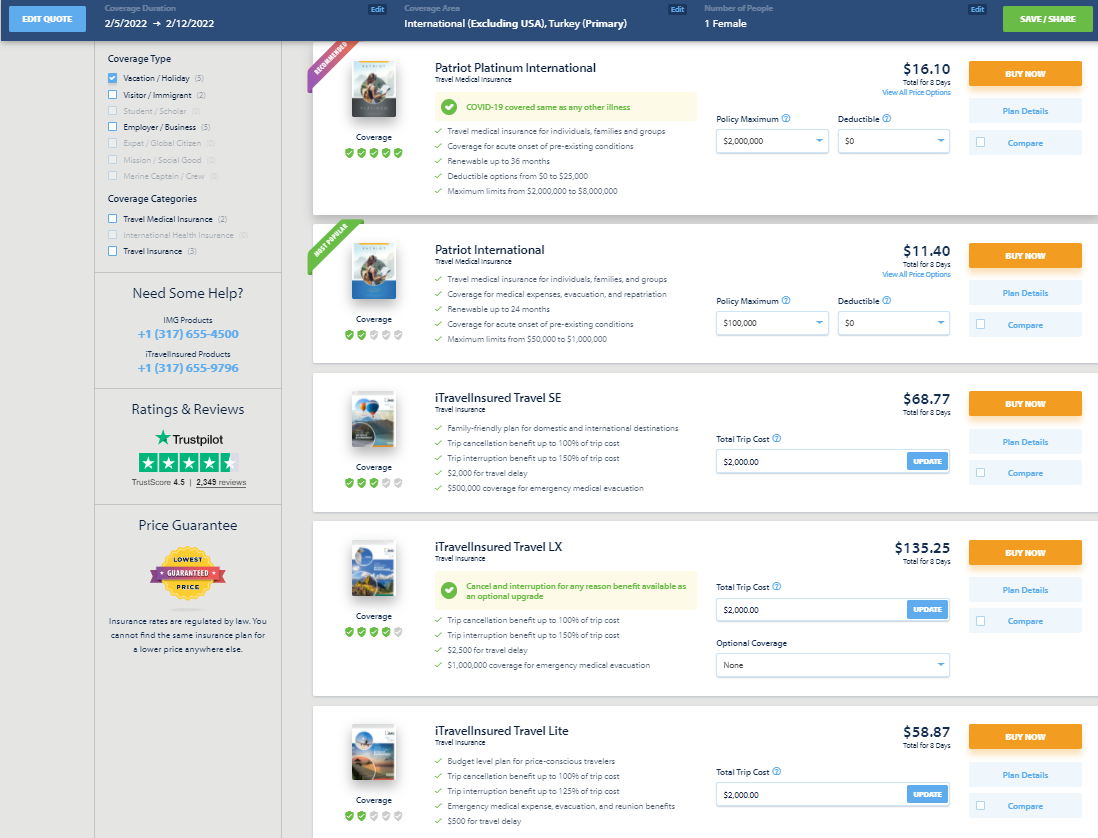

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

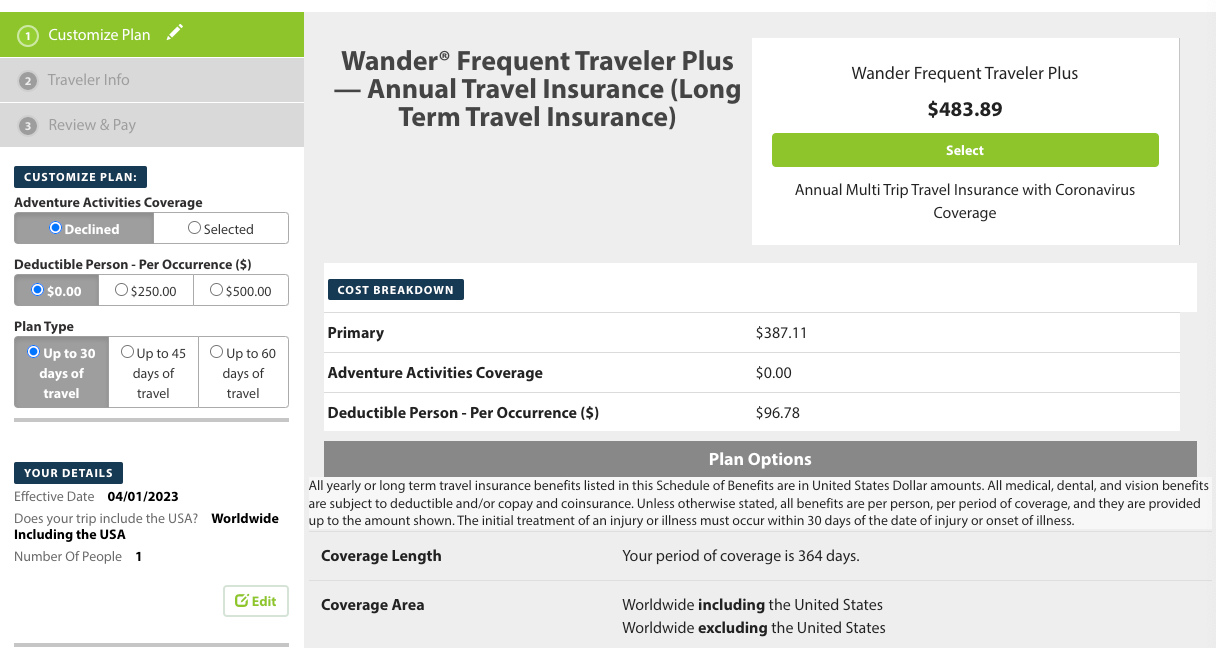

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

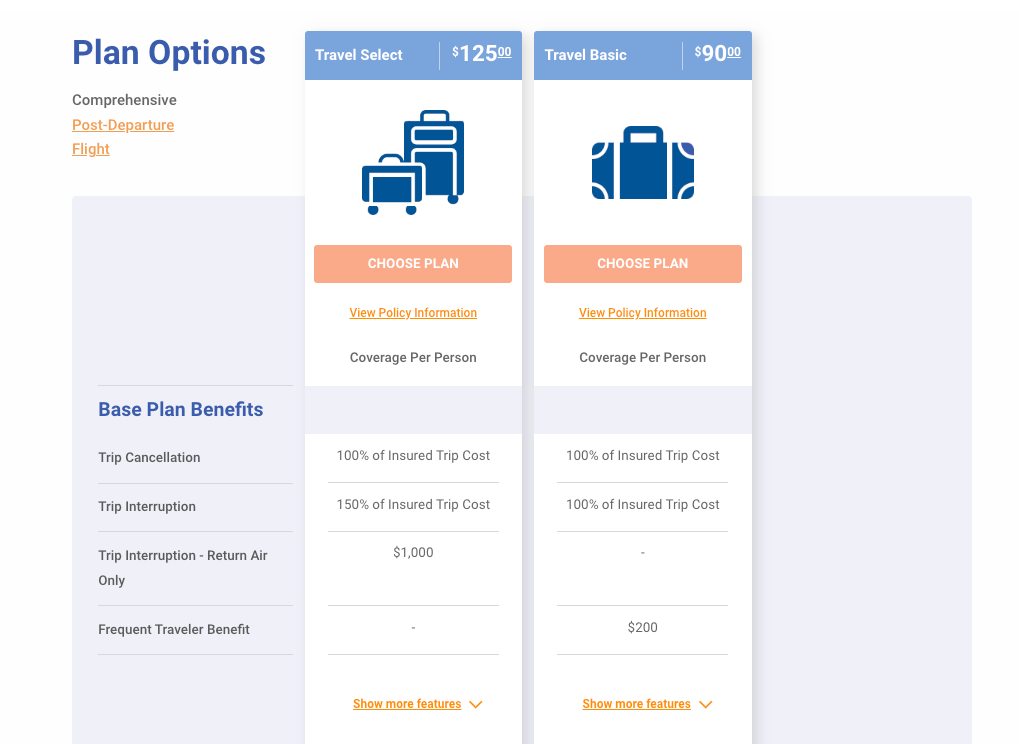

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

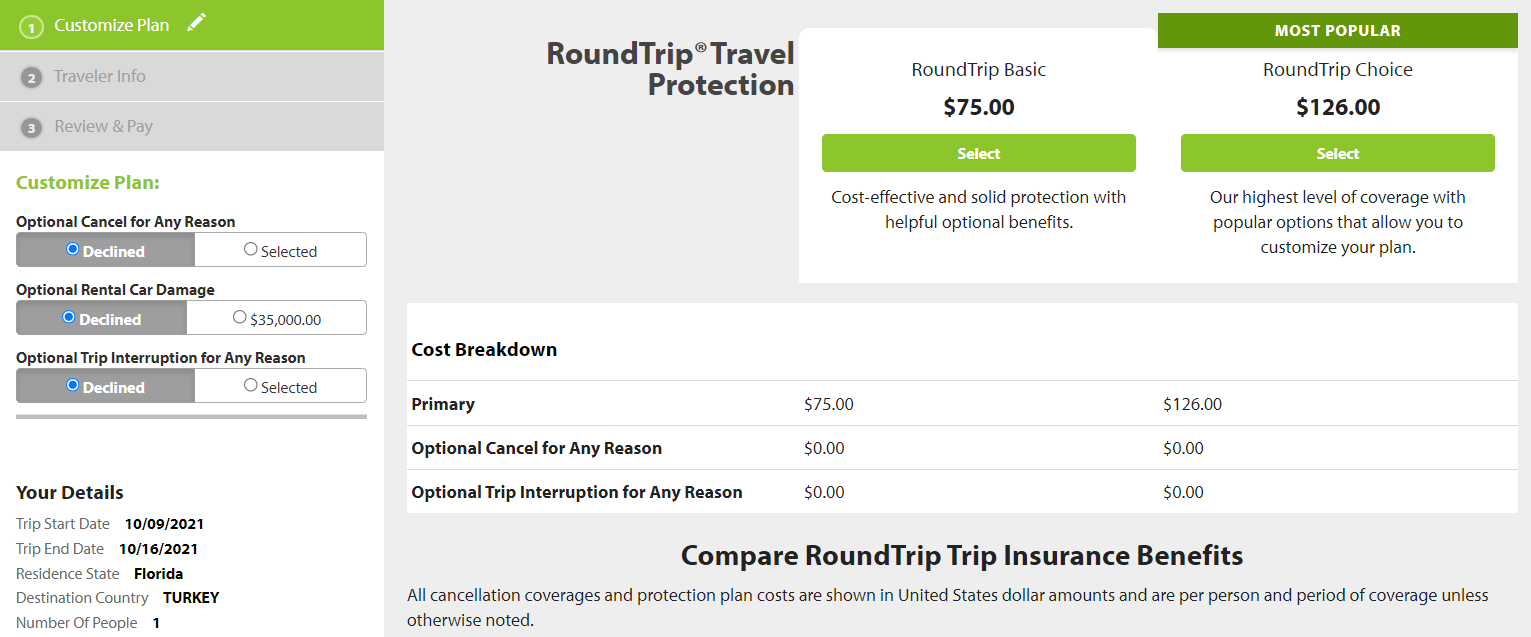

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

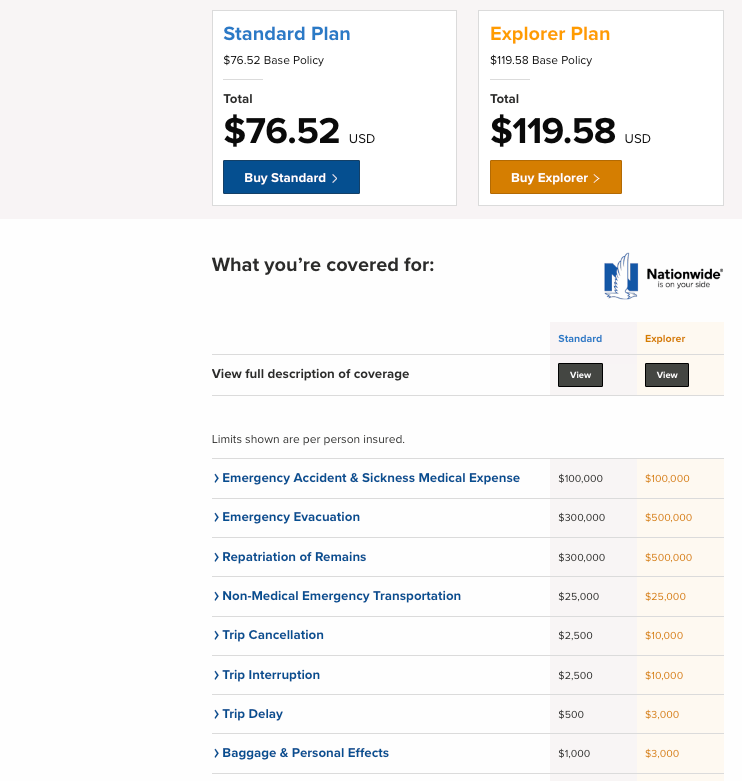

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Search Search Please fill out this field.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

- Life Insurance

- Companies A-E

Delta Life Insurance Company Review

Simple whole life policies, but watch out for high levels of complaints

:max_bytes(150000):strip_icc():format(webp)/KTretina3-853e8118a7474ca89b325465f58f5520.jpg)

Delta Life Insurance

The Delta Life Insurance Company specializes in basic whole life policies with relatively low coverage amounts. While it does offer some useful benefits, the company has received substantially more customer complaints than is typical for a company of its size. It also requested that AM Best no longer include it in the evaluation process, so its financial stability has not been evaluated. With those drawbacks in mind, you should consider the many other companies that offer similar policies that have better reputations for service and financial strength.

- Pros & Cons

- Key Takeaways

- Company Overview

Multiple riders available

Coverage for special circumstances included with some plans

Extremely high number of complaints

Not rated by AM Best

Limited policy information available

- The Delta Life Insurance Company was founded in 1958 and is based in Atlanta, Georgia.

- It sells basic whole life policies that are geared toward households with modest incomes.

- Coverage amounts are $25,000 or less.

- The company is only licensed in Georgia, Mississippi, and South Carolina.

- It’s not rated by AM Best and it has received far more complaints than the industry standard.

The Delta Life Insurance Company was founded in 1958. Based in Atlanta, Georgia, the company is a relatively small insurer. It has just 250 employees and it generates about $75 million in sales.

Today, the company sells basic whole life insurance policies that are geared to people with modest incomes. Its plans are sold through independent agents who work on commission.

The Delta Life Insurance Company primarily markets its life insurance products to residents of Georgia, but it is licensed to sell life insurance in three states: Georgia, Mississippi, and South Carolina.

In addition to life insurance, Delta also sells property and casualty insurance through its subsidiary, Delta Fire and Casualty.

Pros Explained

Cons explained, available plans, available riders, customer service, complaint index, third-party ratings, cancellation policy, competition, methodology.

The Delta Life Insurance Company is not one of our top-rated life insurance companies. You can review our list of the best life insurance companies for what we think are better options.

- Multiple riders available: When you purchase a policy from Delta Life Insurance Company, you can add optional riders to your plan. Delta does have multiple riders to choose from, including child term, accidental death, and waiver of premium riders.

- Coverage for special circumstances included with some plans: With some of Delta’s plans, coverage is included for special circumstances. For example, some plans include added benefits if you experience loss of eyesight or limbs, are killed in an accident while on a common carrier, or die in an accident.

- Extremely high number of complaints: The Delta Life Insurance Company has received an extremely high number of consumer complaints. Its complaint ratio was 14 times as high as the industry standard.

- Not rated by AM Best: Most life insurance companies are evaluated and rated by AM Best, a credit rating agency. The agency issues its opinions on the financial stability of insurers. In 2008, AM Best downgraded Delta’s rating. That same year, the company requested that it be removed from AM Best’s evaluation process and it hasn’t been rated since.

- Limited policy information available: Delta publishes very little information about its policies online. Besides basic brochures that explain the plan options, it doesn’t offer any information about its rates or cancellation policies. For details, you must contact a Delta insurance agent.

In 2021, the Delta Life Insurance Company collected $15 million in annual premiums. To put that in perspective, consider that Northwestern Mutual—the largest writer of individual life insurance based on direct premiums written—had annual premiums totaling $17.7 billion for its individual life insurance segment.

The Delta Life Insurance Company caters its products to households with modest incomes. It only sells whole life policies, and its coverage amounts are relatively low. With whole life policies, you get coverage for your entire lifetime, so you don’t have to worry about your plan expiring as long as you pay all of your premiums on time. Whole life policies can also build cash value over time, and Delta offers four policy options:

Classic Preferred Series

The Classic Preferred Series is a whole life policy for non-smokers in good health. Its rates are lower than you’d get with other policies and it includes accidental death and waiver of premium benefits. This plan is available to people 74 or younger. The maximum policy amount is $25,000.

Graded Policy

If you are not in the best health, you may be able to qualify for life insurance by purchasing the Delta Graded Policy option. With this policy, the benefits are graded for the first few years, meaning it will pay out a smaller benefit if you pass away.

One Parent Family Policy

The One Parent Family Policy is specifically designed for single parents. It includes accidental death coverage, as well as benefits if you lose your eyesight or limbs. It also pays an added benefit if you die in an accident while you’re a fare-paying passenger on a common carrier.

10 Pay/20 Pay Whole Life

With the 10 Pay/20 Pay plan, you can make payments for either 10 or 20 years. After that, you no longer have to pay premiums, but your policy remains in effect.

The 10 Pay plan is only available to people ages 25 or younger, making it a good option if you’re a parent buying a policy on behalf of a child. The 20 Pay plan is available to anyone 65 or younger. The maximum coverage amount is $20,000.

As with other insurance companies, the Delta Life Insurance Company offers some endorsements, also known as riders, that you can use to adjust your coverage. Insurance riders allow you to access your benefits while living, purchase insurance for a family member, or get an added benefit under special circumstances.

Delta offers the following riders:

Accidental Death Benefit

Included in the One Parent Family and Classic Preferred Series policies, the accidental death benefit provides your beneficiaries with a larger death benefit if you die as a result of an accident.

Child Insurance

An optional rider, you can add the children’s insurance rider to your policy to get life insurance for your children. You can purchase term life coverage for your child and when they turn 22, they can convert the policy to whole life coverage and get up to five times the face amount.

Common Carrier Accidental Death

The common carrier accidental death rider is included in the One Parent Family policy. If you die while on a common carrier as a fare-paying passenger, your beneficiaries will receive a death benefit that is three times the face amount. This rider expires once you turn 70.

Loss of Eyesight or Limbs

If you lose your eyesight or limbs, additional benefits will be paid directly to you. Your premiums will also be waived and your policy will remain in force. This rider expires when you turn 70.

Waiver of Premium

The waiver of premium rider can be beneficial if you become disabled and are unable to work. The rider will waive the premiums but keep your policy active. This benefit expires when you turn 60.

To get any details about Delta’s policies, cancellation terms, or pricing, you must contact an insurance agent. Delta’s agents work on commission and they have a financial incentive to sell policies to you. Make sure you do your homework to ensure you only buy the life insurance plan that is right for you.

The Delta Life Insurance Company’s website is very barebones, and it doesn’t allow policyholders to make payments, start a claim, or download forms online. If you need to make any changes to your policy or want to make a payment, you must contact your agent.

If you have general questions, you can contact Delta by calling 404-231-2111. If you have questions related to claims, you can call the general customer service line or email [email protected] .

When you’re shopping for an insurance policy, checking out what existing customers have to say about insurers is a good idea. An excellent resource is the National Association of Insurance Commissioners (NAIC).

The NAIC collects all complaints that consumers submit and uses them to determine companies’ complaint ratios—a measure of how many complaints each company received relative to their share of the insurance market. The industry standard is 1.0, so a company with a ratio above that number received more complaints than expected.

With that guideline in mind, Delta’s complaint ratio is extraordinarily high. In 2020, the Delta Life Insurance Company’s complaint ratio was 14.72 for its individual life insurance segment—substantially worse than the industry standard. In fact, its ratio was 14 times as high as expected for a company of its size.

For the past three years, Delta’s complaint ratio was much higher than the industry standard.

Most major insurance companies are evaluated and rated by AM Best, a credit rating agency that issues its opinions on insurers’ financial stability.

However, Delta Life Insurance has not been rated by AM Best in years. In 2008, AM Best downgraded Delta’s Financial Strength Rating to B- (Fair). That same year, the company requested that it be removed from AM Best’s interactive rating process, so the company has been given an NR-4 (Not Rated—Company Request) distinction ever since.

As a small regional insurer, Delta was not included in the J.D. Power 2020 U.S. Individual Life Insurance Study. The study evaluated and ranked the largest life insurers in the country based on available plans, prices, and customer service.

While Delta doesn’t publicly post details about its cancellation policies, all insurance companies must honor "free look" periods. Generally lasting 10 days, free look periods give you time to review your policy and cancel it if you change your mind. If you cancel your policy within the free look period, you’ll get a full refund of all the premiums and fees you paid.

Once the free look period expires, you can cancel your policy but you may have to pay fees. Contact your Delta agent for information about policy surrender charges and cancellation processes.

The Delta Life Insurance Company doesn’t list typical policy rates, nor does it have an online quote tool. To get information about its premiums, you have to work with an insurance agent.

As with other insurance companies, Delta requires you to select either “male” or “female” when getting a quote or applying for a life insurance policy. Being nonbinary doesn’t disqualify you from getting life insurance , but you should be aware that most insurance companies haven’t updated their underwriting processes to reflect a current awareness of gender issues.

Delta Life Insurance Company offers few plan options and has low coverage amounts. Also, it has received a high number of complaints over the past few years and it hasn’t been evaluated by AM Best recently.

If you’re looking for a company that has a better reputation for its customer service, financial stability, and policies, consider Northwestern Mutual. It’s the largest individual life insurance company based on direct premiums written and it’s our choice for the best whole life insurance insurer.

Northwestern Mutual has 12 different policy options, including whole, term, universal, and variable universal life plans. It has multiple riders you can add to your policy to customize your plan, and the company has a much stronger reputation within the insurance industry than Delta.

In 2021, Northwestern Mutual’s complaint ratio for the individual life insurance segment was just 0.03, better than the industry standard. And in 2021, AM Best affirmed the company’s A++ (Superior) Financial Strength Rating, the highest rating possible.

While the Delta Life Insurance Company markets itself to modest-income households, it may not be the best choice for you if you’re looking for affordable coverage. It has an extremely high complaint ratio and hasn’t been evaluated by the credit rating agencies in years. There are many other companies that offer basic policies with affordable face amounts with better reputations for service and financial transparency.

Our reviews of life insurance companies are based on a quantitative methodology that analyzes each insurer on their stability and reliability, customer service, claims experience, diversity of product lines, and cost. We compare the terms of each type of policy offered—including available coverage amounts, optional riders, and premium payment options—with those of other major life insurance companies. Lastly, we look at how the company is rated by third-party organizations to determine its reliability and overall reputation.

NAIC. " Complaint Index - Delta Life Insurance Company ."

AM Best. " AM Best Downgrades and Withdraws Ratings of Delta Life; Affirms and Withdraws Ratings of Delta Fire & Casualty ."

NAIC. " Complaint Index - Northwestern Mutual ."

Insurance Information Institute. " Facts + Statistics: Life Insurance ."

J.D. Power. " Life Insurance Customer Satisfaction Flatlines Despite Pandemic Fears, J.D. Power Finds ."

AM Best. " AM Best Affirms Credit Ratings of The Northwestern Mutual Life Insurance Company and Its Subsidiary ."

:max_bytes(150000):strip_icc():format(webp)/Baltimore_Life_Recirc-569847f2b16648358b71fa5cccf1bd26.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Financial Indicator

- Investors' Corner

- Customer Service

- Company Profile

- Values, Vision & Goal

- Board of Directors

- Audit Committee

- Nomination & Remuneration Committee

- Executive Committee

- Risk Management Committee

- Policyholder Protection & Compliance Committee

- Corporate Chronicle

- Ordinary Life Insurance

- Gono Grameen Bima

- Group Life Insurance

- Health Insurance

Overseas Mediclaim Policy

- Gono Grameen

- Ordinary Life

- Policy Enquiry

- Pay Premium

- Premium Certificate For Income Tax Rebate

- Forms Download

- Overseas Mediclaim Policy Check

- Conference Hall Booking

- Delta Life Insurance

(Travel Health Insurance)

This is a distinctive “Short Term Health Insurance Policy” issued to Bangladeshi Nationals as well as resident Foreigners living in Bangladesh who intend to travel abroad for Official, Business, or Holiday trip. It is also a pre-requisite for Visa application of developed countries especially schengen states.

Requisites for taking out an "Overseas Mediclaim Policy"

- “Proposal Form” duly filled in and signed by the traveler. (click to “Form Download”)

- Premium Rate Chart Schengen & Non Schengen

- Terms and Conditions

- “Photocopy of Passport” – the first page that contains details about passport holder.

Basic Information about "Overseas Mediclaim Policy"

- Policy has to be taken before traveling abroad.

- Policy is issued only to Bangladeshi Nationals & Resident Foreigners.

- Policy Premium depends on “Age of Proposer” and “Duration of Trip”.

- Any “Alteration”, should be made before “Policy Commencement Date”.

- Emergency medical treatment of illness & accident

- Transport and repatriation in case of illness & accident

- Repatriation of mortal remains.

- Pre-existing medical condition.

- Mental Illness and Suicide,

- Pregnancy & Child Birth.

- Euro 30,000 for visit to Schengen Countries (without any deductible).

- US$ 50,000 for visit to Non-Schengen Countries (with deductible of US $100)

- US$ 1,00,000 (with deductible of US $100)

Few Other Important Aspects of Overseas Mediclaim Policy

- "Proposal Form" may be downloaded from our website.

- Physical presence or photograph of proposer is not required to take out a policy.

- One stop service for policy issue at 11th floor of Delta Life Tower.

- Only about an hour is required to issue an Overseas Mediclaim Policy.

- Policy is issued to Individuals from the age of 6 months up to 79 years.

- Policy from Delta Life Insurance is universally accepted by all Embassies.

For more Information please contact our customer care service desk or your nearest Delta Life office.

Premium Calculator

- Personal Info

- Select Policy

- Calculate Premium

Please provide your personal info to get started.

Six Travel Mistakes to Avoid

No travel medical insurance? Unnecessary luggage and hotel fees? Here are the biggest travel mistakes people make and how you can avoid them.

- Newsletter sign up Newsletter

Even the most seasoned tourists can make travel mistakes when planning a vacation. Some blunders can be minor infractions, but others can cost travelers a lot of money and heartache.

But there are steps you can take to avoid travel mistakes. Here are six slip ups that travelers may make this year, plus tips on how to avoid them.

1. Overlooking travel medical insurance

Christopher Elliott , a consumer advocate and founder of the nonprofit Elliott Advocacy , says many people don’t consider purchasing travel medical insurance . “People often think nothing bad will happen before or on their vacation, but then they get injured overseas and need to go to the hospital, and the next thing they’re looking at is a $10,000 hospital bill.” Indeed, nearly one in four Americans report they’ve experienced a medical issue while traveling abroad, according to a 2023 survey sponsored by GeoBlue, an international health insurance company.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Unfortunately, most U.S. healthcare plans — including employer group plans, Medicare and Affordable Care Act plans — offer limited or no medical coverage outside the U.S.

How to avoid: One solution is to purchase a travel medical insurance policy, a type of insurance that provides coverage for a range of medical emergencies while traveling abroad, from minor injuries to major events like heart attacks and strokes, to medical evacuation and emergency transport in the case of severe emergencies.

The average travel medical insurance plan costs $89, according to Squaremouth , a travel insurance comparison website. Squaremouth advises international travelers to obtain a policy that provides a minimum of $50,000 in emergency medical coverage and at least $100,000 in medical evacuation coverage.

Note: Some travel insurance policies include emergency medical coverage and medical evacuation coverage up to certain limits.

2. Getting hit with unnecessary luggage fees

You may have heard that a number of airlines — including American Airlines , Delta , and JetBlue Airways — recently raised their prices for checked bags. But one thing a lot of travelers aren’t aware of, Elliott says, is that some are now charging customers more if they check a bag at the airport versus paying to check a bag in advance. For instance, JetBlue customers flying within the U.S., Latin America, the Caribbean and Canada can save up to $20 on their first two checked bags ($10 savings per bag) when they add them to their flight reservation at least 24 hours before departure.

How to avoid: Make sure to pay ahead of time for any bags that you plan to check.

3. Incurring hidden hotel fees

Wi-Fi fees, early check-in fees, gym fees—hotels today charge guests no shortage of extra fees and surcharges . It’s a widespread problem: In an April 2023 survey by Consumer Reports , nearly four out of 10 (37%) U.S. adults said they had experienced a hidden or unexpected hotel fee in the previous two years.

How to avoid: Many hotels offer to reduce or, in some cases, waive certain fees to guests who join their loyalty program, which is free in most cases. Also, sometimes simply asking an employee at check-in to waive certain fees could do the trick.

4. Not utilizing a key search feature on Airbnb

Like hotels, Airbnb rental property owners often tack on extra fees, such as cleaning fees, fees for additional guests beyond a certain number, and service fees. These additional costs can add hundreds of dollars to your bill.

How to avoid: Elliott praised Airbnb for introducing a feature in December 2022 that allows guests to view a stay’s total costs, before taxes, when searching for rental properties. But he says there’s a caveat: “If you’re in the U.S., you need to change a setting in order to see the full rate when you search for rentals.”

To enable the feature, click the slider on the upper right of the search page that says, “Display total before taxes.”

5. Paying full price for a rental car

First, the good news: “The rental vehicle shortage has improved,” Elliott says. That’s resulted in a stabilization of rates, with rental car prices recently averaging $42 a day, up only 3% from last year, according to a report from the travel search company Hopper. The bad news? Renting a car is still more expensive than it was before the pandemic, especially for travelers who pay full freight.

How to avoid: There are several ways you can avoid paying full price. Big-box stores such as Costco , BJ’s and Sam’s Club provide their members discounts on certain rental cars. AARP and AAA also offer their members discounted rates. ( AARP members save up to 30% on base rates at Avis and Budget Rent A Car; AAA members save up to 20% on Hertz rentals). In addition, a number of credit card companies offer certain cardholders rental car discounts when they book a vehicle from specific rental car companies.

You may also be able to nab a lower rate by prepaying when you book a reservation. And, some rental car companies offer limited-mileage plans at a lower cost, which could be a good option if you’re planning to take just a short trip.

Tip: See if your credit card offers rental car insurance before you pay for insurance from a rental car company.

6. Encountering sky-high hotel rates because of Taylor Swift’s European tour

When Taylor Swift performs a concert, sometimes tens of thousands of out-of-town fans descend on the city, causing hotel prices to spike. Consider: the median rate for a standard hotel room during an Eras Tour date in Europe this year is projected to jump by 44%, with average hotel room prices in Warsaw surging a staggering 154% during her tour date there, according to a recent study by Lighthouse , a travel and hospitality research company.

How to avoid: The simplest approach for Europe-bound travelers in 2024, Elliott says, is to avoid traveling to a destination during a Taylor Swift tour date in that city. “When Taylor Swift comes to town all of the hotels sell out, and it becomes very difficult to find a reasonably priced hotel,” he says.

Related Content

- 24 Best Travel Websites to Find Deals and Save You Money

- Five Ways to a Cheap Last-Minute Vacation

- Best Travel Rewards Cards May 2024

To continue reading this article please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Daniel Bortz is a freelance writer based in Arlington, Va. His work has been published by The New York Times, The Washington Post, Consumer Reports, Newsweek, and Money magazine, among others.

The Justice Department is investigating Tesla for potential securities and wire fraud, according to media reports.

By Joey Solitro Published 8 May 24

Uber Technologies reported an unexpected first-quarter loss, sending shares lower Wednesday. Here's what you need to know.

A new Gallup poll shows Americans are still concerned about having enough money for retirement, but there are some changes from last year.

By Alexandra Svokos Last updated 6 May 24

Jobs Report Slower jobs growth and easing wage pressures are good news for rate cuts.

By Dan Burrows Published 3 May 24

Federal Reserve The Federal Reserve struck a dovish pose even as it kept interest rates unchanged for a sixth straight meeting.

By Dan Burrows Published 1 May 24

Investors of all kinds are eagerly awaiting news from the Federal Reserve meeting. Here is live updates and commentary from Kiplinger experts.

Philips agreed to a $1.1 billion settlement over CPAP and ventilator machines.

By Alexandra Svokos Published 30 April 24

A proposed bill could change how the Social Security COLA is calculated, resulting in higher benefits for retirees.

By Erin Bendig Published 30 April 24

Many of the tactics used to increase longevity in "blue zones" are attainable, and as people age longer, habits and financial planning need to adapt accordingly.

By Quincy Williamson Published 24 April 24

Want to keep working, just not as hard? A phased retirement may just be the answer.

By Kimberly Lankford Published 23 April 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Best travel insurance plans for 2024: a unique and comprehensive list for travelers from international citizens insurance.

Including the Best Plans for Seniors, Global Nomads, Visitors to the USA, Pets, Adventure Sports Addicts and More

BOSTON, MA / ACCESSWIRE / May 2, 2024 / International Citizens Insurance, a leading international insurance broker, has announced the best travel insurance plans for 2024 summer travel. As the cost of airfare and hotels continues to rise along with the increase in flight delays and cruise cancellations, this list could not have come at a better time for travelers looking to protect their travel plans and their finances.

"This summer's travel season promises a high level of demand, increasing costs, and a strong potential for travel disruptions due to political unrest, weather, and other factors," said Joe Cronin, President of International Citizens Insurance. "Our clients want travel insurance they can trust to help them if they suffer a cancellation, a medical emergency, lost luggage, a natural disaster, or have to change plans due to unforeseen events. With this list, they will be able to find the best overall travel insurers as well as the right plans for their individual needs."

International Citizens Insurance judged each company and plan on six key criteria: the user-friendliness of their site, the ease of policy purchase, the number of countries plans are offered in, how extensive the benefits are, the ease of making a claim and the quality of the company's customer service. The most trusted insurers include WorldTrips , who made history as one of the first insurers to offer plans for purchase over the internet; GeoBlue Travel Insurance , which supports seniors with coverage for people up to 84 years old; and Trawick International, which offers coverage for over 500 adventure sports activities.

To help customers find the best insurance for their specific needs, International Citizens Insurance has also identified the best insurance for several use cases, including Cancel for Any Reason (CFAR) insurance, travel medical plans, and insurance with coverage for pets. International Citizens Insurance has also identified the best plans for clients with special needs, including seniors, missionaries and volunteers, U.S. citizens abroad, and digital nomads.

In today's unpredictable world, travel insurance has become the most essential accessory for any international traveler. Travelers want trip cancellation insurance to protect their trip and travel medical insurance plans to protect their health. But with so many companies out there, which ones can you trust?

Learn more about the best travel insurance companies at https://www.internationalinsurance.com/travel-insurance/best-companies.php .

About International Citizens Insurance

International Citizens Insurance is the insurance division of International Citizens Group. We provide educational content, reviews, and unique comparison engines that enable travelers and expatriates to research, quote, compare, and purchase global life, travel, and international health insurance from various carriers.

Contact Information

Joe Cronin President [email protected] 617-500-6738

Andrew Blomberg Vice President, Global Group Benefits [email protected] (339) 221-5190

SOURCE: International Citizens Insurance

View the original press release on newswire.com.

Recommended Stories

Analyst adjusts nvidia stock price target ahead of earnings.

This is what could happen next to Nvidia shares.

Here's the Income and Net Worth You Need to Reach the Top 50% of American Households

Americans can improve their net worth through prudent budgeting and smart investments.

Don't Sit On Losses: How This Simple Rule Spared Investors From Meta's 77% Crash

The 7% sell rule is one of the tools nimble individual investors have that larger funds which hold large positions among a wide range of stocks may not.

Novavax Stock Surges 120% on $1.4 Billion Deal With Sanofi

Novavax the pharmaceutical company that last year warned that falling sales of its Covid-19 vaccine could put it out of business, said it reached a $1.4 billion deal with French company Sanofi to commercialize its existing treatment and develop a new one. Shares spiked 120% in premarket trading to $10.02. Sanofi agreed to pay $500 million upfront and spend another $700 million when the company hits development, regulatory and launch milestones, Novavax said in a statement Friday.

TSMC’s April Sales Jump 60% on Sustained Demand for AI Chips

(Bloomberg) -- Taiwan Semiconductor Manufacturing Co. saw April sales jump 60% to NT$236 billion ($7.3 billion) as sustained artificial intelligence demand was helped by the beginnings of a recovery in consumer electronics.Most Read from BloombergBiden Set to Hit China EVs, Strategic Sectors With TariffsAckman Scolded Over DEI Views at Closed-Door Milken SessionApple Apologizes for iPad Pro Ad, Scraps Plan to Air It on TVMarjorie Taylor Greene Finally Got What She Deserved: DefeatNovavax Soars o

Forget About ‘Timing the Market': Schwab Research Reveals the Optimal Way to Invest

Can investors realistically time the market to maximize returns, especially over the long term? According to a recent study from Charles Schwab, perfect market timing is practically impossible. The firm’s research showed that most investors are better off investing as soon as possible using a buy-and-hold strategy rather than trying to predict short-term peaks and […] The post Forget About ‘Timing the Market’: Schwab Research Reveals the Optimal Way to Invest appeared first on SmartReads by Smar

Warren Buffett said he could make a 50% return on $1 million and predicted higher taxes. Here are 14 Q&A nuggets.

Warren Buffett teased a potential Canada bet, predicted Berkshire would surpass $200 billion in cash this quarter, and shrugged off dollar worries.

Tesla to Spend More Than $500 Million to Expand Supercharger Network, Musk Says. The Stock Rises.

CEO Elon Musk says the electric-vehicle company will be spending “well over” $500 million to expand its Supercharger network.

Energy Transfer Is Getting a Big Acquisition-Fueled Earnings Boost

Acquisitions are driving stronger-than-expected growth this year.

Meet the Stock-Split Stock That Makes Up 23% of Billionaire Bill Ackman's $11 Billion Portfolio

Just because a stock pick is obvious doesn't mean it's wrong.

- Motor Comprehensive plans that provide you with a sense of comfort and safety on the road

- Medical Medical services that will be with you for the rest of your life with a wide medical network

- Home A homeowner or a tenant, safeguard your home and belongings against various types of danger

- Life Three life-long programs divided into two categories: saving and protection

- Travel Peace of mind is one of the most significant reasons to purchase travel insurance

- Employee Benefits Improve your employee benefits with attractive medical and life insurance plans

- Fleet Insurance The best and most efficient option for companies that own a large number of vehicles

- General Insurance Insurance plans that cover organizations against any unexpected incidents that may cause severe losses

- Marine Insurance Cover your shipments against material loss or damage transported by sea, air, or land

Life Insurance

If you are one of those who plan for the future, you should also be one of those who think about life insurance plans and programs that provide you and your loved ones with financial protection in the event that something happens to you, God forbid, and help you save and invest so that you and your loved ones can enjoy peace of mind.

Life insurance plans and programs enable you to enjoy all the moments of your life while providing future financial care for you and your loved ones, whether when your children embark on their higher education journey, or when you retire so that all of you can maintain your usual lifestyle.

Why Delta Life Insurance?

Delta life insurance.

Delta Insurance is distinguished by the diversity of its life insurance programs that accompany you throughout your life. Delta offers standard life insurance protection plans that secure your family, but has also developed programs that help you bear the costs of living after retirement, and the costs of your children's university education.

Therefore, Delta Insurance has developed three specialized programs that fall into two categories: savings and protection. You can purchase these programs in one annual installment or several installments throughout the year, depending on what suits your needs. Most importantly, all savings programs offer customers three main benefits: savings, earnings, and protection.

A recent Forbes study confirmed that a large percentage of people are very worried that their loved ones will not be able to cover even the normal monthly expenses if they are no longer present in their lives.

What makes Delta Life Insurance products unique?

- Competitive prices

- Dedicated customer service and account managers

- Quick execution and completion of processes

- A team with specialized certifications

- Flexibility in dealing with consumers

- Quick digital operations

- Quick payments settlement

Is life insurance expensive?

You are the one who makes that decision! Delta creates your life insurance plan depending on the amount of money and coverage you require, as well as the duration you desire. The younger and healthier you are, the less expensive your insurance will be.

Delta Baraem

Education is our priority.

Delta Nomow

Save for the future.

Term Life Insurance

Delta Insurance has developed a university education program that aims to reduce the financial burden on parents of educating their children based on the agreed university tuition, following an extensive study of the increasing costs of education year after year, and the efforts of all parents to secure a better education for their children.

The Delta Baraem education program has been specifically designed for you, with numerous additional insurance benefits, to assist and support you in preparing for one of the most significant events in your children's lives.

Features of Delta Baraem

- An investment savings program for children's university education at a specific age and based on the period specified by you

- Simple and regular installments in a flexible manner that contribute to your commitment to regular and long-term savings, paid monthly, or quarterly, or semi-annually, or annually

- Minimum guaranteed return of 3.5% on the dinar

- The flexibility of getting your plan in United States Dollars with a minimum guaranteed return of 2%

- The flexibility of obtaining university tuition fees as a single payment or 7 equal yearly installments

- In the event of the policyholder's death or permanent total disability, Delta Insurance takes care of the child's school education for the remaining years and university education in due course

- The possibility of getting an additional benefit doubling the amount of university tuition, paid to the beneficiaries once upon death of the policyholder, and once upon policy maturity, in addition to the annual schooling fees for the remaining years of school education

- The possibility of modifying the contract terms and conditions upon anniversary

In exchange for a small additional premium, you can secure your family and loved ones with an additional amount, equal to the university tuition fees agreed on that is paid in full, in case of death to cover the initial living costs, in addition to the schooling and university tuitions agreed on in the insurance contract.

Delta Insurance has designed a retirement savings and investment program to provide you with a financial cushion you can rely on as an additional source of income after your retirement that assists you in fulfilling your retirement plans.

You can get a pleasant retirement with Delta Nomow, which allows you and your family to continue living your lifestyle, and in installments that suit you and your way of living.

Features of Delta Nomow

- An investment savings program that lets you save for your retirement, paid on your preferred retirement age, either as annuities or a single payment

- Flexibility in tailoring the coverage that suits you and setting the appropriate premium for your retirement plan

- Delta Insurance will pay the agreed life insurance amount and waiver the premium in the event of the policyholder's death or permanent total disability, in addition to the cash available in the investment wallet at that point in time

- The ability to top up your wallet by depositing additional amounts at any time

The single premium program affiliated with Delta Nomow enables you to pay the investment amount in one installment and get it paid back after a specific period of time based on your preference.

A simple life insurance program!

Losing a family member is difficult on all levels. The family faces the emotional burdens of loss, but it also becomes considerably more difficult to meet everyday expenses. Delta Aman ensures that your family get the financial security they need.

Losing a family member is difficult on all levels. The family faces the emotional burdens of loss, but it also becomes considerably more difficult to meet everyday expenses.

A life insurance plan allows you to worry less and is the first step in helping you plan for the financial security of your family and loved ones.

Delta Aman is an insurance contract between you and Delta Insurance in which you agree to pay a premium for a specific period in exchange for us agreeing to pay a predetermined sum to the beneficiaries in the case of death within the insurance period.

You can choose the exact period that will be covered to suit important events, such as paying off a personal loan or a mortgage.

You can also choose the benefit of added protection in the event of complete disability, critical illness, or death.

Features of Delta Aman

- Competitive rates with simple installments

- Flexible plans with client-defined standards

- Coverage can be extended to include disability and critical illness

Payments for this insurance plan are made over a certain time period ranging from 5 to 20 years, based on an agreement between you and Delta Insurance.

Get your plan today!

Are there insurance programs that i can benefit from upon retirement.

Delta Insurance has created six specialized savings schemes that offer three major benefits: savings, earnings, and life insurance (protection).

How can I ensure that the beneficiaries will get private life insurance if anything unfortunate happens?

A life insurance policy is a legally binding agreement between an insurance company and a consumer.

Is a life insurance policy expensive?

It is primarily up to you based on the amount you choose, the coverage you want, and the time you require.

Is there a program where I may get help paying for my children's education?

"Delta Baraem" is the program developed by Delta specifically to support you in reducing the financial burdens resulting from the education of your children in the future, whether it is school or university costs.

Other products you might be interested in

Travel Insurance

Peace of mind is one of the most significant reasons to purchase travel insurance.

Medical Insurance

Medical services that will be with you for the rest of your life with a wide medical network.

Motor Insurance

Comprehensive plans that provide you with a sense of comfort and safety on the road.

Understanding What Travel Insurance Covers

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠. The details for these products have not been reviewed or provided by the issuer.

- Travel insurance is intended to cover risks and financial losses associated with traveling.

- Coverage can include trip cancellation, baggage protection, medical care, and emergency evacuation.

- When filing a claim, be specific and comprehensive in your documentation to ease the process.

Whether it's a trip across the world or a trip across the state, having travel insurance provides major relief if things go awry. Flight delays, lost baggage, illness, injuries, and other unforeseen events can disrupt even the best-laid plans. With a major disruption comes the potential for unanticipated expenses.

Travel insurance and the coverage it offers can help keep you protected and save you money in the long run.

Overview of Travel Insurance Coverage

Travel insurance policies protect travelers from financial losses should something go wrong during their trip. You can customize which coverages you want to include, and there are several to choose from.

"Common types of coverage include trip cancellation, trip interruption, baggage protection, coverage for medical care if you get sick or hurt during your trip, and emergency medical evacuation," says Angela Borden, a travel insurance expert and product strategist for travel insurance company Seven Corners.

Travel insurance plans offer nonrefundable payments and other trip-related expenses. While monetary compensation is a primary benefit, there is another valuable perk of travel insurance. It can provide peace of mind.

What does travel insurance cover?

Your specific travel insurance plan (and its terms and conditions) will determine the minutia and specifics of what is covered. As with most other forms of insurance, a general rule of thumb is the more you spend, the better your coverage.

"Travel insurance can be confusing, so it's best to research a reputable company that specializes in travel insurance and has a long history of successfully helping travelers all over the world," says Borden.

Trip cancellation and interruptions

A travel insurance policy can reimburse you for a prepaid, nonrefundable trip if it is canceled for a covered event, such as a natural disaster or a global pandemic.

Trip interruption insurance covers you if you're already on your trip and you get sick, there's a natural disaster, or something else happens. Make sure to check with your travel insurance providers to discuss any inclusions, coverage, and more.

Travel delays and missed connections

Travel delay insurance coverage provides reimbursement for any expenses you incur when you experience a delay in transit over a minimum time. Reimbursements can include hotels, airfare, food, and other related expenses.

Medical emergencies and evacuations

Typically, US healthcare plans are not accepted in other countries. So travel insurance with medical coverage can be particularly beneficial when you are abroad. Medical coverage can also help with locating doctors and healthcare facilities.

Medical transportation coverage will also pay for emergency evacuation expenses such as airlifts and medically-equipped flights back to the US. Out of pocket, these expenses can easily amount to tens of thousands of dollars. Certain plans may even transport you to a hospital of choice for care.

Travel insurance generally does not include coverage for pre-existing conditions. That said, you can obtain a pre-existing condition waiver, which we will talk about later.

Baggage and personal belongings

Most airlines will reimburse travelers for lost or destroyed baggage, but be prepared for limitations. Travel insurance plans will typically cover stolen items, such as those stolen out of a hotel room. This may not include expensive jewelry, antiques, or heirloom items. Typically, airlines have a few days to recover your bag.

In the meantime, you can make a claim to pay for items like certain toiletries and other items you need to pick up. If your bag is truly lost or you don't get it for an extended period, you can file a true lost baggage claim.

What does credit card travel insurance cover?

A major perk on several travel credit cards is embedded credit card travel insurance . Typically, you will need to use the specific card for the transaction (at least with partial payment) for travel coverage to kick in.

Each card has specific rules on what exactly is covered. But one of the industry leaders is the $550-per-year Chase Sapphire Reserve credit card. Here's a snapshot of what is covered with this specific card:

- Baggage delay: up to $100 reimbursed per day for up to five days if a passenger carrier delays your baggage by more than six hours.

- Lost and damaged baggage: up to $3,000 per passenger per trip, but only up to $500 per passenger for jewelry and watches and up to $500 per passenger for cameras and other electronic equipment.

- Trip delay reimbursement: up to $500 per ticket if you're delayed more than six hours or require an overnight stay.

- Trip cancellation and interruption protection: up to $10,000 per person and $20,000 per trip for prepaid, nonrefundable travel expenses.

- Medical evacuation benefit: up to $100,000 for necessary emergency evacuation and transportation when on a trip of five to 60 days and traveling more than 100 miles from home.

- Travel accident insurance: accidental death or dismemberment coverage of up to $100,000 (up to $1,000,000 for common carrier travel).

- Emergency medical and dental benefits: up to $2,500 for medical expenses (subject to a $50 deductible) when on a trip arranged by a travel agency and traveling more than 100 miles from home.

- Rental car coverage: primary coverage for damages caused by theft or collision up to $75,000 on rentals of 31 days or fewer