Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- Income Travel Insurance: Is It a Good Deal?

- Covers pre-existing conditions

- Provides COVID-19 hospitalisation and evacuation coverage for certain countries

- Expensive, especially annual plans

- Low personal accident and medical benefits

Like many other insurers, NTUC Income offers three levels of travel insurance policies to cater to the tastes and budgets of all kinds of consumers. Ultimately, its plans tend to be priced quite close to the industry average and feature a medium degree of coverage in most areas with two main weak points. While Income's plans are priced fairly given the level of coverage provided, deal-seekers will not be particularly wowed. However, Income's travel insurance policies stand out because they are one of the only insurers in Singapore that cover pre-existing medical conditions.

Table of Contents

- Income Enhanced Travel Insurance: What You Need to Know

- Income Enhanced PreX Travel Insurance

Sports Coverage

Claims & contact information.

- Income Coverage & Benefits

NTUC Income Travel Insurance: What You Need to Know

NTUC Income's travel insurance plans are best for travellers who aren't price sensitive and want coverage for their pre-existing conditions. You can choose from 3 tiers of plans for both the Enhanced and Enhanced PreX plans: Classic, Deluxe and Preferred for the standard plans and PreX Basic, PreX Superior & PreX Prestige for the pre-ex coverage plans. We found that Income's single trip plans generally cost 15-30% below average compared to its competition, while its annual plans cost between average to 20% above average. For those prices, the coverage is more competitive when it comes to travel inconvenience benefits (cancellations, delays, luggage loss), but sinks to below average overseas medical and personal accident coverage.

NTUC Income offers the standard array of travel insurance benefits, ranging from medical and personal accident to trip inconvenience benefits like trip cancellation, postponement, delays and baggage loss. While most of the benefit limits are slightly below average, Income does boast above average limits for medical coverage in Singapore, trip delay and baggage loss coverage. However, these plans may fail to impress some types of travellers. For instance, Income's Basic plan provides average levels of coverage but won't impress budget travellers since its possible to find cheaper basic plans. The premium tier plan (Preferred) boasts above average coverage for a small amount of benefits, but won't stand out to travellers who equate premium-level plans with market beating coverage.

Income's annual policies cost above average for all 3 plans, so it won't be the best option for frequent travellers who are hoping to save on an annual travel insurance plan. However, as Income is the only insurer that is currently providing COVID-19 medical and hospitalisation coverage as long as you take the mandatory PCR test and test negative pre-departure and won't be travelling to a high-risk nation, it is the best option for travel during the COVID-19 period. Overall, Income's travel insurance plans are just enough for the average traveller and can provide sufficient additional coverage if that traveller needs coverage for pre-existing coverage. Otherwise, Income's Enhanced travel insurance plans may not sway budget travellers or travellers who like high levels of coverage.

Notable Exclusions

NTUC Income only covers pre-existing conditions if you purchase their Enhanced PreX plans. Besides that, the exclusions are pretty standard, including no cover for travelling for medical conditions, items lost or damaged while unattended, travelling to participate in professional or compensated sports, being a victim of war, riots, or rebellion and travelling against the advice of the Singapore Government.

NTUC Income Enhanced PreX Plans Travel Insurance

If you are not limited by budget and just want a plan that will give you ample protection for your pre-existing coverage, Income will be a good choice. However, budget travellers with pre-existing conditions may find Income to be an expensive option. We found that Income's PreX travel insurance plans cost around 3 times as much as Income's standard plans, making them quite expensive considering that Income isn't competitively priced to begin with. As one of the 3 insurers who provides extensive coverage for your pre-existing coverage, it settles somewhere in the middle, with MSIG's plans costing 10-22% less but Etiqa's Tiq plans costing around 15% more.

Besides the pricing, you should also consider the extent of Income's pre-existing coverage benefits. Its PreX plans also combine medical and emergency evacuation coverage under one limit, which brings down the value of these plans considerably (for instance, MSIG's PreX and Tiq's PreX plans have separate limits for medical and emergency evacuation, resulting in more coverage than Income). On the other hand, Income does let you claim for trip inconvenience (cancellations and postponement) due to your pre-existing conditions if you buy its Superior or Prestige plans, which can be a useful benefit for people who book their trips far in advance and have somewhat risky conditions. You should just be aware of the 50% copay you'll be responsible for should you use those benefits.

Income includes medical coverage for adventure and sports including skiing, scuba-diving, white water rafting and motorcycling. There's no golf coverage and no cover for extreme sports such as bungee jumping, skydiving and mountaineering.

Income lets you submit your claim online or via post. Both options require you to submit the proper documentation, which they list when you indicate the type of claim you want to submit. You should read the policy wording before buying the policy so you are aware of what you can and can't claim for.

Summary of NTUC Income Travel Insurance Benefits & Coverage

With so many options for travel insurance plans in Singapore, it's no wonder that picking the right one for your next business trip or holiday can seem like a daunting task. Below, we've compiled a summary of NTUC Income's premiums and coverage and how it compares to the industry average. If you'd like to learn more about how Income compares to other insurers, you can read our top picks for the best travel insurance plans in Singapore.

- Best Travel Insurance in Singapore

- Average Costs and Benefits of Travel Insurance

- How to Pick the Best Travel Insurance

Anastassia is a Senior Research Analyst at ValueChampion Singapore, evaluating insurance products for consumers based on quantitative and qualitative financial analysis. She holds degrees in Economics and International Business Management and her prior working experience includes work in the capital markets sector. Her analyses surrounding insurance, healthcare, international affairs and personal finance has been featured on AsiaOne, Business Insider, DW, Vice, Her World, Asia Insurance Review, the Australian Institute of International Affairs and more.

Our Top Travel Insurance

- Best Travel Insurance Promotions

- Best Annual Travel Insurance

- Best Travel Insurance for Sports

- Best Travel Insurance for Families & Groups

- Best Travel Insurance for Seniors

- Best Insurance Companies in Singapore

Keep up with our news and analysis.

Stay up to date.

Featured Travel Insurance Companies

- Allianz Travel Insurance

- FWD Travel Insurance

- Direct Asia Travel Insurance

- Etiqa Travel Insurance

- Aviva Travel Insurance

- HL Assurance Travel Insurance

- Wise Traveller Travel Insurance

Travel Insurance Basics

- What is Travel Insurance

- Why You Need Travel Insurance

- Average Cost and Benefits of Travel Insurance

- Average Cost of a Staycation

- Average Cost of a Vacation

- Who Should Get Annual Travel Insurance

- Airline Travel Insurance vs. Traditional Travel Insurance

- Travel Insurance and Terrorism Coverage

- Travel Insurance and Haze Coverage

- Travel Insurance and Zika Coverage

- Travel Insurance and Overbooked Flight Coverage

- Travel Insurance and Trip Cancellation Coverage

- How to Successfully File an Insurance Claim

Other Financial Products for Travellers

- Best Air Miles Credit Cards

- Best Credit Cards for Complimentary Lounge Access

- Best Credit Cards for Overseas Spending

Related Articles

- Best Year-End Travel Destinations to Beat the Crowd

- Travel Diaries: 5 Safest Travel Destinations in the World

- Travel Essentials Checklist For Your Family Vacation

- How To Survive and Thrive as a Solo Traveller

- How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- Best Frequent Flyer Plans to Upgrade Your Travels in 2023

- Travel Insurance

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

Travel Insurance Singapore Guide (2024): Must-Knows for Choosing the Best Travel Insurance

Travelling is a favourite Singaporean pastime. A national sport, if you will. But while we all love travel and wanderlust, most of us don’t give much thought to buying travel insurance .

Buying travel insurance in Singapore is something a lot of us take for granted. Few of us bother to buy travel insurance ahead of time, and even fewer compare policies to find the best travel insurance in Singapore .

Here is everything you should look out for before buying travel insurance in Singapore.

Key features to look out for in travel insurance

- What does travel insurance cover?

- How to choose travel insurance

- Travel insurance prices

- Best travel insurance in Singapore

- Common mistakes when buying travel insurance

- Travelling with pre-existing health conditions

- When should I buy travel insurance?

- Single trip or annual travel insurance?

- Compare travel insurance before buying

1. What does travel insurance cover you for?

A good travel insurance policy covers you for a whole series of situations, from the small inconveniences to the most terrible.

Trust me, you never want to be in a situation that you’re not covered for.

It could be a minor inconvenience, like having your luggage delayed and being forced to spend at least one night in the same clothes you wore on the entire flight. Or it could be a serious medical emergency, like getting stung badly by jellyfish in the middle of a remote island adventure and needing immediate medical attention.

These days, almost all travel insurance in Singapore automatically includes COVID-19 coverage. That means, you’ll be able to claim from your travel insurance if you get Covid-19 while travelling .

You should also have coverage for everything from lost and delayed luggage, flight delays and cancellations, all the way to medical treatment, medical evacuation and even repatriation in case of serious illness and death. All these different situations have different claim limits, of course.

Travel insurance also covers things like reimbursing deposits if your travel agent goes bust, if your credit card is used fraudulently overseas, or if you damage your rental car . Some policies even pay you if you are kidnapped while overseas! And the best part is that travel insurance is relatively cheap and convenient to buy.

Back to top

2. How to choose travel insurance

With so many different benefits in a travel insurance plan, it can be tough to decide if a particular travel insurance plan is worth your money. You should look out for how much you are reimbursed for common travel hiccups.

- Find a travel insurance that covers flight delays and cancellations: Flight delays happen more often than you realise. They can be extremely inconvenient, especially if it ends up causing you to miss your connecting flight. Ensure that your policy covers you for a decent period of time. For example, if your flight is delayed, some policies pay you $100 for every 6 consecutive hours of delay. There’s usually a cap of around $200-$500, but if you want more coverage DirectAsia Voyager 150 pays out up to $1,000 for travel delay.

Total Premium

DirectAsia Voyager 150

[ Score a Rolex, Apple iPhone, MVST Luggage & More! | FLASH DEAL] • Enjoy 40% off your policy premium • Receive up to S$25 via PayNow and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$19,600 worth of gifts to be given away: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Apple iPhone 15 Pro 128GB (worth S$1,664.25) • 5x MVST TREK Aluminium Large Suitcase (worth S$790) • 1x Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$589) and many more! Increase your chances of winning when you refer friends today. T&Cs apply PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

Key Features

Additional coverage for Travel Insurance - Sports equipment, Maid and COVID-19. Extreme Sports add-on only available for Annual Plans.

Kids go free – up to four kids travel for free with a Family policy only (2 adults)

Matching kids limits – children enjoy the same coverage limits as adults

Emergency Dental – Accidental Dental treatment can be costly, so it is covered under the main medical expenses coverage which is higher than a separate dental benefit

Optional COVID-19 coverage on trip cancellation, medical expense, and emergency evacuation. Only for Single Trip.

- Lost or delayed baggage: Make sure your policy covers you well for such situations. Many policies pay $100 for every 6 consecutive hours your baggage is delayed, including Bubblegum Travel Insurance which pays up to $3,000 for lost or damaged baggage. Don’t forget to also pay attention to the maximum amount you’re covered for.

Bubblegum Travel Insurance

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy 10% off your policy premium. • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$25 via PayNow and up to S$20 iShopChangi e-vouchers with eligible premiums spent. T&Cs apply. PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

Bubblegum offers just 1 affordable plan to suit all your travel needs to maximise your savings

Overseas medical expenses up to $150,000 SGD (Covid-19 sub-limit of $65,000 included)

24-Hour global Emergency Assistance services including Emergency Medical Evacuation and Repatriation

Covid-19 trip related cancellation/curtailment up to $600 SGD included

Adventurous activities like scuba diving and hot air ballooning are covered with no limit on depth or height.

- Medical coverage overseas: Since you can never predict what might happen on your trip, it literally pays to be safe than sorry. A good travel insurance policy covers you for at least $200,000 for overseas medical coverage and unlimited coverage for emergency medical evacuation and repatriation. One value-for-money insurance policy that fits the bill is Starr TraveLead Comprehensive Bronze .

Starr TraveLead Comprehensive Bronze

[ Score a Rolex, Apple iPhone, MVST Luggage & More! | FLASH DEAL] • Enjoy 50% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$50 via PayNow OR 1 x Apple AirTag (worth S$45.40) and up to S$20 iShopChangi e-vouchers with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$19,600 worth of gifts to be given away: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Apple iPhone 15 Pro 128GB (worth S$1,664.25) • 5x MVST TREK Aluminium Large Suitcase (worth S$790) • 1x Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$589) and many more! Increase your chances of winning when you refer friends today. T&Cs apply PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

For Cruise to nowhere insurance: Find out more here

Personalise your travel insurance-Flexible coverage allows you to create a travel insurance plan with different types of coverage and addon that can adapt to your needs

Overseas Covid-19 related medical expenses of up to $15,000 SGD included (Excluding China).

No sublimit or restriction on outpatient expenses and number of visits

24 hours Global Emergency Assistance Services help you when you need it most, connecting you with medical treatment and transportation

Seamless and Cashless claims via PayNow

Covers travel expenses for sending back an unattended child during the hospitalisation of the insured person

Please note that travelling to Russia and Ukraine is not covered in Starr’s insurance with immediate effect.

- Travel insurance with COVID-19 coverage: Ideally, your policy should offer coverage for a range of COVID-19 expenses you might encounter during your travels (and even before you fly!). Look out for the travel insurance policies’ coverage for trip cancellation and postponement and medical expenses due to Covid-19. Overseas quarantine cash allowance is an added bonus. For example, AIG Travel Guard® Direct – Enhanced covers $100 per day for 14 days if you’re quarantined overseas due to COVID-19.

AIG Travel Guard® Direct - Enhanced

[GIVEAWAY | Receive your rewards as fast as 30 days*] • Enjoy 10% off your policy premium. • Get up to S$20 iShopChangi e-voucher with eligible premiums spent. • Additionally, receive an Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply. PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

Voted TripZilla's Best Travel Insurance (Single Trip).

Up to S$250,000 in overseas COVID-19 related medical coverage if you are diagnosed with COVID-19 overseas.

Overseas quarantine allowance of up to S$100 per day per person for up to 14 days if you test positive for COVID-19 overseas and are unexpectedly placed into mandatory quarantine.

Up to S$1,500 if you are diagnosed with COVID-19 and have to postpone your trip.

Up to S$7,500 in curtailment costs if you are diagnosed with COVID-19 while travelling and need to return to Singapore earlier than planned.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

Purchase your travel insurance with confidence and enjoy unlimited flexibility with AIG's Travel Guard® Direct

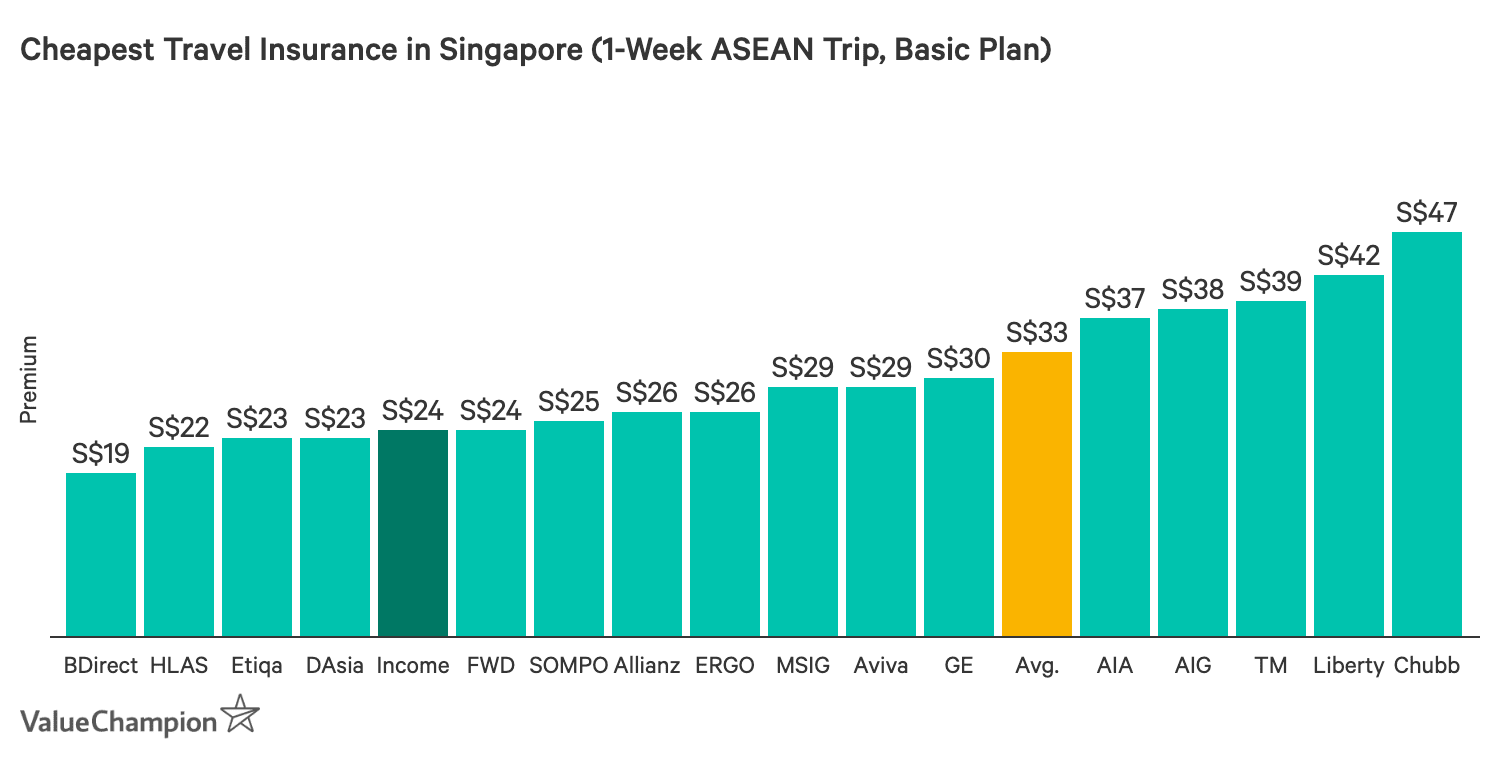

3. Travel insurance prices in Singapore

Travel insurance in Singapore is very price-sensitive, and sometimes insurers can compete to shave off even $1 from their premiums to make their policies more enticing (yay for us!).

One way to get a cheaper plan is to see which insurers offer regional travel insurance . If you are only travelling to Thailand, for example, it is usually cheaper to get a policy that covers only SEA or ASEAN countries, rather than a worldwide coverage policy .

However, price is not the only factor—especially since cheap insurance policies often mean significantly less coverage. Buying travel insurance is not like buying a “warehouse sale” LV bag in Chatuchak Market. You don’t just shop around, look for the stall owner with the weakest bargaining skills, and haggle the price down as low as can get.

Look at other aspects of the policy when buying travel insurance . There are many other factors to consider—for example, how much coverage you’re eligible for, and how quickly your claims can be processed. Make sure that you don’t have to wait till the next blue moon before you can see the results of your claims.

4. Which travel insurance to buy in Singapore?

Like anything else you purchase, the best travel insurance is what gives you the most value for money. Say you are only travelling to Thailand for a weekend shopping trip, for example. You’re probably travelling light and don’t need more than $3,000 coverage for loss of baggage, even if you can pay just $3 more for significantly more coverage. Save that $3 and treat yourself to all the Thai milk tea you can drink!

As we said earlier, you shouldn’t be so stingy and only buy the cheapest. The cheapest may have lots of terms and conditions when it comes to claims . For example, an insurer might not cover delayed luggage if it is only delayed returning to Singapore. If this is the only inconvenience you face in your entire trip, you might be understandably upset that it’s not claimable.

The important thing is to read the terms and conditions of your preferred policy carefully and make sure you’re not caught unawares. This is especially important when it comes to medical pre-existing conditions.

5. Common mistakes when buying travel insurance

How many of us actually know how to go about buying a good travel insurance that is suitable for our needs? Here are five common mistakes to avoid when buying travel insurance:

- Buying the most “convenient” travel insurance : Do you just buy the first travel insurance you see on Google? It is important to read the details of the coverage provided to see if they are adequate for your needs or to cover the risks of the destination you’re travelling to, eg. medical coverage and loss of personal belongings.

- Buying travel insurance at the last minute : Do you often buy your travel insurance when waiting to board your flight or while making your way to the airport? Yes, better late than never. However, you should be aware that some of the benefits of the travel insurance are applicable (eg. natural disasters , airline strike, tour agency bankruptcy) if you buy travel insurance ahead of your trip.

- Not buying travel insurance for the entire length of your trip : Should you purchase travel insurance only for the days you are actually overseas? No. You should include flights to and from your holiday destination. In the event of baggage delays, loss or damage, or overbooking of flights, you’d then be able to make a claim. For long haul trips, do remember to cater for the +1 or +2 days that it takes for your flight to reach Singapore.

- Not reading your travel insurance policy : Not all travel insurances are created equal. In fact, the policy document and terms of coverage makes for rather interesting reading. Do go through the policy document for what’s included and excluded, claim limits, and what you gotta do in order to make a claim.

- Assuming travel insurance is “one size fits all” : If your holiday includes adventurous elements like skydiving or scuba diving, check to ensure that the travel insurance you are considering covers these activities. MSIG TravelEasy Elite covers a whole range of activities, including sky diving, hot air ballon rides, and bungee jumping. Alternatively, check to ensure that adventurous activities are not excluded from the claims.

MSIG TravelEasy Elite

[ Score a Rolex, Apple iPhone, MVST Luggage & More! | MoneySmart Exclusive] • Enjoy up to 40% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$45 via PayNow OR 1 x Apple AirTag (worth S$45.40) and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$19,600 worth of gifts to be given away: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Apple iPhone 15 Pro 128GB (worth S$1,664.25) • 5x MVST TREK Aluminium Large Suitcase (worth S$790) • 1x Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$589) and many more! Increase your chances of winning when you refer friends today. T&Cs apply PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

COVID-19 coverage of up to $300,000 medical cover and up to $5,000 travel inconvenience benefit for your trip protection.

Stay protected and enjoy a wide range of adventurous activities from sky diving, scuba diving, white-water rafting to winter sports like dog sledding, tobogganing, sledging and ice-skating.

Get covered across all TravelEasy Plan types with a high limit of S$1,000,000 for emergency medical evacuation & repatriation

MSIG provides cover for insolvency of licensed travel agencies registered with the Singapore Tourism Board (includes NATAS registered travel agencies)

6. Will pre-existing conditions affect my travel insurance?

One of the biggest travel insurance stories in 2017 was when a Singaporean man had a heart attack in Tokyo and fell into a coma. The medical costs alone cost $120,000 and bringing him back to Singapore via medical evacuation would cost another $120,000.

Because the man had been diagnosed with heart failure in 2012, his insurer considered it a pre-existing condition and therefore no claim was possible. Currently, one insurer that covers pre-existing conditions is MSIG TravelEasy Pre-Ex travel insurance.

MSIG TravelEasy Pre-Ex Standard

7. When should I buy travel insurance?

There are many, many things that can go wrong when you’re travelling. Half of these things could happen even before you leave the country!

Waiting to buy your travel insurance policy on the day you travel (or worse, after you’ve already crossed into international waters) puts you at risk for travel inconveniences big and small like delays or postponement.

A good travel insurance policy also covers you for your entire trip being cancelled unexpectedly.

You should buy a travel insurance online as soon as you’ve planned your trip. Getting your travel policy as early as possible does not make you “ kiasu ”. It makes you smart.

This is because you’ll want to maximise the coverage you can get from the policy. For example, if you haven’t bought a policy yet and the travel agency you’re booking with closes down a week before your travel, you won’t be able to claim anything. The same goes for flight delays and flight cancellations.

There is no penalty for buying travel insurance earlier, except maybe missing out on promotions that often happen around the travel season. But what’s the point of saving a few dollars and risk losing hundreds due to cancelled flights and hotel deposits?

8. Buy single trip or annual travel insurance?

In the past, it made more sense to buy single trip travel insurance plans when you leave Singapore. That’s because in the past, most people only travel once or twice a year. With the greater nomad and remote working culture … and travels over long weekend, though? It might actually be more convenient to buy an annual plan for your travel insurance.

A good gauge to determine whether to choose between a single trip plan and an annual plan is to ask yourself if you’re going to be travelling more than 3 times a year . And we’re not just talking about weekend getaways either!

Whether you’re just going across the Causeway or travelling further overseas for work, an annual plan definitely makes more sense to your wallet.

Depending on how often you travel and how far you travel, it might be worthwhile to consider buying annual travel insurance .

If you are a frequent traveller, you not only save money by buying an annual policy, but you’ll never have to spend time buying insurance every time you fly overseas. Of course, just like single trip travel insurance, you should still compare the various policies online before you commit.

Annual travel insurance has a flat premium and covers you for an entire year of travel. It usually costs about $200-$300 a year, so only buy it it you are a frequent traveller. That is, it only makes sense if you are going to travel overseas more than 7-8 times a year, at least.

9. Why should I compare travel insurance before buying it?

Comparing allows you to choose the best travel insurance policy for your needs. You’ll be able to see at a glance what coverage policies have for various situations, such as medical costs, and compensation levels for lost, delayed and damaged baggage.

But of course, comparing travel insurance in Singapore allows you to see that the cheapest travel insurance policy may not be the best. This is because the cheaper policies usually have significantly less coverage, naturally. While that may be a good thing for some travellers – there’s no need to get a $1,000 coverage for lost luggage if you’re only bringing the bare minimum to a staycation in Bangkok, for example.

ALSO READ: Best Travel Insurance in Singapore: AIG vs AXA vs FWD vs NTUC

Are you headed overseas? Compare the cheapest travel insurance here .

Related Articles

Comparing Digital Multi-Currency Accounts: Wise, YouTrip, Revolut, and Others

10 Money Changers in Singapore with the Best Rates

10 Data Roaming Plans in Singapore—Which is Most Worth It? (2024)

9 Best Credit Cards in Singapore for Overseas Spending (2024)

How to Pay in China Like a Local: 2024 Guide for Foreigners and Tourists

FWD Premium

Med. Coverage (Overseas)

Trip Cancellation

Loss/Damage of Baggage

Total Premium Total Premium S$18.13 25% Off

MoneySmart Exclusive:

[ Score up to $35,000 ] All eligible customers are guaranteed to receive an S$20 iShopChangi e-voucher* ! Additionally, receive an Eskimo Global 1GB eSIM* worth USD7 (no min. premium required)! T&Cs apply On top of that, apply and be automatically enrolled in our Wowza Travel Bonanza and score the latest Apple gadgets, Samsonite Spinner and more! T&Cs apply.

Valid until 15 Dec 2023

More Details

Key Features

Enjoy cashless medical outpatient treatment in Singapore, access to emergency assistance and your travel policy documents through the FWD SG app!

Add on coverage for COVID-19 available for both Single & Annual Trips for travel period of 90 days or less.

Optional add on coverage available when your trip is cancelled for any reason for Single Trips. (To be purchased within 7 days of your initial trip deposit for your trip).

See all plan details

One great advantage of NTUC Income’s travel insurance is the high trip cancellation coverage ranging from $5,000 to $15,000. Other travel insurance providers might not be so generous. For instance, Great Eastern is offering $2,000 to $15,000, while AIG offers $2,500 to $15,000.

Great Eastern TravelSmart Premier Classic

Loss of Baggage

Comprehensive worldwide protection with extensive medical coverage

Extended to coverage for travel inconveniences and medical expense due to COVID-19

One way coverage is availble to your destination

Adventurous activities benefit - Complimentary benefits at no extra cost

Coverage for Emergency Dental Treatment, Traditional Chinese Medical (TCM) and Chiropractor treatments

Protect against pregnancy-related conditions while you are overseas

Most Flexible Plan

AIG Travel Guard® Direct - Supreme

Overseas Medical Expenses

Travel Cancelation / Postponement

Loss/Damage of Personal Baggage

[Receive your cash as fast as 30 days*] All eligible customers are guaranteed up to S$70 in Cash (via PayNow) and rewards*! Additionally, receive an Eskimo Global 1GB eSIM* worth USD7 (no min. premium required)! T&Cs apply.

Valid until 31 Dec 2023

Voted TripZilla's Best Travel Insurance (Single Trip).

Up to S$250,000 in overseas COVID-19 related medical coverage if you are diagnosed with COVID-19 overseas.

Overseas quarantine allowance of up to S$100 per day per person for up to 14 days if you test positive for COVID-19 overseas and are unexpectedly placed into mandatory quarantine.

Up to S$1,500 if you are diagnosed with COVID-19 and have to postpone your trip.

Up to S$7,500 in curtailment costs if you are diagnosed with COVID-19 while travelling and need to return to Singapore earlier than planned.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

Purchase your travel insurance with confidence and enjoy unlimited flexibility with AIG's Travel Guard® Direct

3. NTUC Travel Insurance Pre-Existing Conditions

NTUC Income is one of the few insurers in Singapore that provide comprehensive travel insurance plans that cover pre-existing medical conditions , such as asthma, eczema, diabetes, high blood pressure, even heart disease. The other two that cover pre-existing conditions are MSIG travel insurance and Etiqa travel insurance .

The most obvious difference between a Pre-Ex travel insurance plan and a regular travel insurance plan is, of course, price. The cheapest NTUC PreX plan costs over twice the price of a regular NTUC travel insurance plan!

For those who have major health problems, you don’t have much of a choice. There’s no point buying a cheap normal insurance with no coverage for you at all because you definitely will not be able to claim medical expenses, evacuation costs or travel delays linked to a flare-up of your condition.

It is especially worth the money if your condition is either life-threatening or very expensive to treat overseas.

However, if you have a condition that’s pure suffering not immediately life-threatening, such as eczema, then it is your choice whether you want to spend more on Pre-Ex travel insurance for better coverage.

It’s important to look at the coverage limits if you’re seriously considering pre-existing travel insurance. Why? If you’re travelling to somewhere with really expensive healthcare, like Europe or the US, you might want to upgrade to the Enhanced PreX Prestige plan.

NTUC Enhanced PreX Travel Insurance Premiums and Coverage:

Is NTUC’s travel insurance for pre-existing medical conditions any good? For one, NTUC PreX travel insurance covers COVID-19 while MSIG Pre-Ex and Etiqa Pre-Ex don’t cover you for COVID-19. So, if you want both pre-existing medical conditions and COVID-19 coverage in your travel insurance, NTUC Enhanced PreX is your only choice.

Even though NTUC Pre-Ex travel insurance offers you COVID-19 coverage, the downside is that they’ve lowered the medical benefits you get if you’re aged 70 and above.

For example, for those aged 70 and above NTUC PreX’s overseas medical and emergency medical evacuation coverage share a total claim limit of $500,000 for its basic plan tier (as opposed to up to $250,000 in overseas medical expenses and $500,000 in medical evacuation coverage for under 70s).

By comparison, MSIG Pre-Ex basic offers $250,000 / $50,000 medical (below 70 / above 70) and $1,000,000 evacuation regardless of age, while Etiqa Pre-Ex basic offers $200,000 medical and $1,000,000 evacuation and repatriation of mortal remains.

Otherwise, NTUC PreX’s miscellaneous trip cancellation and baggage delay benefits are pretty good.

4. NTUC Travel Insurance COVID-19 Coverage

Whether you buy an NTUC Travel Insurance Standard or an NTUC Enhanced PreX Travel Insurance plan, you’ll be relieved to know that all NTUC travel insurance plans automatically come with COVID-19 coverage.

You won’t find the COVID-19 coverage table in the usual NTUC travel insurance policy wording. Instead, there’s a separate NTUC travel insurance COVID-19 policy wording document that you should refer to.

NTUC travel insurance’s COVID-19 coverage and benefits:

Few of us really scrutinise the individual coverage limits on our travel insurance, trusting that they do cover the bare essentials.

The good news is that NTUC travel insurance’s COVID-19 extension is simple, and adequate. Take COVID-19 overseas medical coverage for example, NTUC offers $150,000 while MSIG’ basic plan offers $75,000. Then, there’s overseas COVID-19 quarantine cash allowance, which NTUC gives $100 per day, up to $1,400, but Etiqa’s basic plan offers $100 per day, up to $500 only.

5. NTUC Travel Insurance: Extreme Sports

Since our last review in July 2022, NTUC has updated its Travel Insurance policy to include more c ommon vacation activities like scuba diving and skiing. Nevertheless, extreme thrill seekers may want to go for a more lenient insurance provider such as Direct Asia travel insurance , which properly covers extreme sports and martial arts.

To be honest, NTUC Travel Insurance is adequate if you’re looking to snorkel or join a guided tour group with a licensed outdoor adventure operator. But if you’re a hardcore adrenaline junkie…you might want to look around instead.

6. NTUC vs MSIG vs Etiqa Travel Insurance

If you’re considering NTUC travel insurance, you should be comparing it against established household insurance providers such as MSIG and Etiqa.

All 3 insurers, NTUC, MSIG, and Etiqa offer COVID-19 coverage in their travel insurance plans automatically. Other plans that include automatic COVID-19 coverage include Starr TraveLead Comprehensive, Bubblegum Travel Insurance, Singlife Travel Insurance and DBS Chubb Travel Insurance.

In terms of overseas medical expenses, MSIG offers comparable coverage to NTUC’s travel insurance. When it comes to other travel and logistics-related coverage such as trip cancellation and baggage loss, NTUC and MSIG travel insurance plans’ coverage are also pretty much on par.

All things considered, NTUC and MSIG travel insurance plans are shockingly similar and competitive. A key difference is emergency medical evacuation coverage for people aged 70 and over–NTUC travel insurance parks that under the overseas medical expense limit.

7. NTUC vs FWD Travel Insurance

When you pit NTUC travel insurance against one of the most popular “budget” travel insurance providers, FWD, you’ll realise that the travel insurance offerings are very similar and competitive.

Between NTUC travel insurance and FWD travel insurance, coverage is actually largely on par if you’re considering a basic travel insurance plan with COVID-19 coverage. However, FWD’s prices are lower even if you purchase the COVID-19 add-on.

8. NTUC Travel Insurance vs Other Travel Insurers

At a glance, here’s how NTUC Income’s travel insurance stacks up compared to the other major travel insurers in Singapore.

9. NTUC Travel Insurance Promo

Even though many Singaporeans probably don’t mind paying more for NTUC travel insurance just because it’s a household brand name, their travel insurance plans are actually pretty expensive.

However, with ongoing promotions like the current 45% discount promo, it can be value for money. All standard per-trip plans qualify for the promo. For example, if you wanted to go temple-hopping for a week in Myanmar, the cheapest Classic plan would cost just $33.55 after the discount. Here are the premiums you’ll be paying with the current 45% discount promo:

In addition, Income is offering an additional 15% off Enhanced PreX per-trip plans with complimentary personal accident coverage for 6 months.

10. NTUC Travel Insurance Claim

If you follow insurance threads on forums or even talk to your friends about insurance claims over kopi , you might have gotten wind of NTUC Income’s bad claims reputation .

Unfortunately, online forums such as Hardwarezone and Reddit are full of similar stories from users claiming that their NTUC insurance claims were slow, long-drawn-out and plagued with difficulties. According to the users’ NTUC claim experiences, there was a lot of emphasis on the need for original invoices to be submitted.

To be fair, between these nasty stories, you’ll also find users who managed to claim from NTUC insurance smoothly and received their cheques in the mail.

So, how do you make a claim? Your first port of call should be to get in touch with NTUC Income ASAP.

NTUC Travel Insurance Emergency hotline: Call the NTUC emergency assistance hotline at +65 6788 6616

Here’s where it gets confusing. You have to identify the type of claim that you’re making and the “correct” way to submit it. Super important: all claims must be made within 30 days of the event or incident.

NTUC Travel insurance online claims: Submit NTUC travel insurance claims online with supporting documents such as invoice, flight itinerary, police report, etc. through their website. You can do so for the following benefits:

Trip cancellation

Trip shortening

Travel delay

Baggage delay

Loss and damage of baggage or personal belongings

NTUC Hard copy claims: For medical expenses, you need to fill in the NTUC travel insurance claim form and drop off the hard copy form with the supporting documents such as hospital bill, medical report, boarding pass, etc. at an NTUC Income branch.

NTUC Email claims: For claims that do not involve travel inconveniences (see above) and medical expenses (see above), you’ll need to fill in the NTUC travel insurance claim form digitally, and email it together with your supporting documents to [email protected]. Include your travel policy number in the subject line.

NTUC Claims settlement time: If there is no dispute, NTUC Income will settle your claims within 10 working days or longer during high-volume travel periods like school holidays.

11. Conclusion: Should I buy NTUC Travel Insurance?

NTUC travel insurance isn’t the absolute cheapest around, but their regular travel insurance plans are very affordable and value for money when there’s a 45% promotion going on.

However, just because it’s a brand name doesn’t mean that their coverage is the highest in town, especially when you compare it with newcomers like FWD. That’s not a problem for most travellers though, unless you’re going to a super expensive country or encounter some unusual scenario.

For most Singaporeans who just want to eat, chill and relax on holiday, NTUC travel insurance is more than adequate especially as it also provides COVID-19 coverage. However, daredevils should take note that it does not cover more thrilling activities like mountaineering and other extreme sports.

If you have a pre-existing medical condition , NTUC Enhanced PreX is one of the very few travel insurance options suitable for you. It is pricey for sure, but probably worth the money if you have a life-threatening condition like asthma or heart disease. Make sure that the plan is sufficient to cover your overseas expenses and/or evacuation.

Still looking for travel insurance? Compare the best travel insurance in Singapore here .

The post NTUC Income Travel Insurance Review: COVID-19 Coverage, Pre-existing Conditions, Premiums appeared first on the MoneySmart blog .

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans , Insurance and Credit Cards on our site now!

The post NTUC Income Travel Insurance Review: COVID-19 Coverage, Pre-existing Conditions, Premiums appeared first on MoneySmart Blog .

Original article: NTUC Income Travel Insurance Review: COVID-19 Coverage, Pre-existing Conditions, Premiums .

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Latest stories

Her middle school security guard held her captive for 10 years. now tanya kach is revealing how she survived a decade locked upstairs.

Tanya Kach was 14 years old when she vanished in 1996. A decade later, she was found at her middle school security guard’s home, where she was being kept captive. Now, with the help of fellow kidnapping survivor Elizabeth Smart, she’s telling her story. Andrea Cavallier reports

Woman Caught Smuggling 350 Nintendo Switch Games In Her Bra

A nervous woman with a large bust size was stopped at an airport in China after officials grew suspicious. They inspected her and discovered she was allegedly trying to smuggle 350 Nintendo Switch carts out of the country by stuffing them into her bra.

Taylor Swift publicly praises boyfriend Travis Kelce amid separation

Taylor Swift took to Instagram to heap praise on her NFL boyfriend, Travis Kelce

Anwar Ibrahim’s clarification over Singapore teachers proposal highlights importance of clear communication

Government messages should be carefully thought out and clearly articulated to prevent confusion, and eliminate ambiguity. The post Anwar Ibrahim’s clarification over Singapore teachers proposal highlights importance of clear communication appeared first on Twentytwo13.

Emily Ratajkowski just showed us the cool-girl way to wear crochet

The podcast host's latest 'fit is a summer classic reimagined

Julia Fox bares all in wired pearl strapless bra complete with baby pink ribbons

Julia Fox has shared two photos to Instagram of her nailing the naked trend, wearing a wired pearl strapless bra complete with baby pink ribbons.

Innocent elderly woman knocked out cold at LA airport when she lands in middle of a road-rage fight

The woman was rushed to the hospital in critical condition

Kate Middleton Arrives at Trooping the Colour with Family: See the First Look Photo

The Princess of Wales is making her first public appearance in six months after announcing her cancer diagnosis in March

Putin’s nuclear arsenal is crumbling. Ukraine can take it out for good

It’s high time that the West’s more timid leaders understood that the nuclear threats coming out of Moscow are all “bluff and bluster”, aimed at them and their wobbling lips.

Prince Louis Busts Some Moves, Effortlessly Overshadows Mom Kate

LONDON—It is no easy to task to overshadow the most famous woman in the world, especially when she is making a feverishly awaited return to public view after a six month absence.But Prince William and Kate Middleton’s youngest child, Prince Louis, 6, managed it, Saturday—and didn’t even resort to pulling one of his famous funny faces, apart from the odd yawn.Instead, the adorable young prince broke the internet by breaking into a boogie while watching a military marching band at Trooping the Col

Sunak defends Biden after he ‘wandered off’ at G7 event

Rishi Sunak has denied claims Joe Biden “wandered off” at a G7 event.

Ukraine's use of a Patriot missile system to down Russia's prized A-50 spy plane was 'historic,' said a US air defense officer

Ukraine used a US-made Patriot missile system to down a Russian A-50 spy plane in January, a senior US officer confirmed.

Boeing finds new flaws in 787 jets: sources

STORY: Boeing has found more quality problems on its jets. Reuters sources say the issues this time concern its 787 widebody planes. They say the aerospace giant has found hundreds of incorrectly tightened fasteners on some undelivered aircraft. The sources say the problem was discovered at plant in South Carolina, with the fasteners found to have been tightened from the wrong end. There is no immediate concern about flight safety, but one source says Boeing is trying to understand how the problem arose - and how much work it must do to remedy the issue.The company confirmed the checks to Reuters, and said there would be no impact on deliveries. Even so, it’s another concern for investors after a series of quality control issues at the company. Some of its big-selling 737 MAX jets were grounded for a time earlier this year after a midair blowout on one of the planes. The Federal Aviation Administration has blocked a plan to raise output of the model, while Boeing takes steps to ensure manufacturing quality. Regulators said they were aware of the new concerns regarding the 787, and would work with the company to determine appropriate action. Boeing shares are down around 30% this year amid all the problems.

American tourist dies in hot tub electrocution at a Mexican resort

Bystanders said they couldn’t rescue the couple because of the electrical current

Blake Lively Embraced the Exposed Bra Trend in a Sheer Micro-Minidress

With the buttons left undone.

Donald Trump said Joan Rivers voted for him in 2016. She died in 2014

‘I know one thing: she voted for me, according to what she said,’ claimed the former president

Russian soldiers surrender after failed raid on chemical factory

Dozens of Russian soldiers surrendered to Ukrainian forces after a failed raid on a chemical factory in the northern town of Vovchansk, in the Kharkiv region.

PC had sex with vulnerable woman he met on duty

Shamraze Arshad contacted the woman hours after she had been admitted to hospital.

Kim Kardashian’s Skims to open five stores throughout the US

Skims was founded in 2019 by Kim Kardashian and entrepreneur Jens Grede

‘I talk to a lot of presidents’: Serena Williams gets testy when asked about Trump after being named on regular call list

‘I spoke to every president since I’ve been alive, including Ronald Reagan, I’ll have you know,’ former tennis star says

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

IMAGES

COMMENTS

With Income's Travel Insurance, you are protected for travel delay of up to 120 hours[2] for any reason[3]. Up to $2,000[2] baggage delay coverage. ... Be holding a valid Singapore identification document (NRIC, employment pass, work permit, long-term visit pass or student pass)

Travel Insurance. Get coverage for travel inconveniences and medical expenses (including pre-existing medical conditions and COVID-19) on your next holiday. ... Covers one round trip back to Singapore. Yearly policy. Covers multiple round trips back to Singapore over a 12-month period from the coverage start date. ... Back to Income homepage.

Enjoy your holiday with great savings! Travel with a peace of mind with 60% off on your Per-trip Travel Insurance plans! Stay protected with Income's Travel Insurance and enjoy the following coverage more than most insurers 1: 🧳 Up to $2,000 2 baggage delay coverage. Up to $2,000 2 travel delay coverage. 📕 Up to $8,000 2 coverage for ...

Travel Insurance ; Overseas Study Protection Plan ; Home, Maid & Lifestyle. ... Limit for extra expenses to return to Singapore: 1,000: 2,000: 3,000: Co-payment for claims due to pre-existing medical conditions: NA 2: NA 2: NA 2: ... Download My Income app to manage your Income insurance matters conveniently.

FWD Travel Insurance. $33 - $57 (Add $11 - 22 for COVID-19 coverage) - Overseas medical expenses: $200,000 - $1,000,000. - Trip cancellation: $7,500 - $15,000. - Trip cancellation or disruption: $5,000. - Overseas quarantine allowance: $50/day up to 14 days. - Medical expenses (Singapore or overseas): $200,000. Tiq by Etiqa ...

Browse more insurance products available online. Get the protection you need now! Achieve protection goals with Income today! What we recommend. Secure your financial future for you and your loved ones against life's unknowns. ... Download My Income app to manage your Income insurance matters conveniently.

Income travel insurance medical coverage. At $250,000 to $1,000,000, Income's Travel Insurance overseas medical coverage is generous compared to some of its competitors such as Sompo Travel Insurance's $200,000 to $400,000 overseas medical limit.. However, do note that for adults aged 70 years and older, the coverage for medical expenses overseas, emergency medical evacuation, and sending ...

NTUC Income Travel Insurance Standard Plan Pricing and Coverage. Plan type. Classic. Deluxe. Preferred. Overseas medical expenses. S$300,000. S$300,000. S$350,000. ... 6 Best Senior Travel Insurance for Elderly in Singapore Best Travel Insurance For Camera Equipment: Up to S$1,000 Coverage Starr Cruise to Nowhere Travel Insurance Review ...

Make quick online changes to your Travel Insurance policy, such as changing travel dates and destinations, remove travellers or edit traveller details and plans. Income Insurance Travel Insurance Self-Service Online Portal

Income's travel insurance policy is the one of the few in Singapore that provides coverage for pre-existing medical conditions. 3.6/5.0. ValueChampion Rating. Personal Accident Coverage. Trip Delay Coverage. Baggage Delay Coverage. Pros. Covers pre-existing conditions. Provides COVID-19 hospitalisation and evacuation coverage for certain countries.

It can also ensure you meet Singapore's travel requirements. Travel insurance with Covid-19 medical coverage is required for all travelers entering Singapore. "You must have at least $30,000 ...

Travel insurance in Singapore is very price-sensitive, and sometimes insurers can compete to shave off even $1 from their premiums to make their policies more enticing (yay for us!). ... Income's Travel Insurance Review (2024): COVID-19 Coverage, Pre-existing Conditions, Promotions, Premiums.

Brave the unknown with comprehensive coverage from Income's Travel Insurance. Explore unconventional destinations, try exotic cuisines, or take on thrilling adventures with confidence knowing you are well-protected! Get up to $15,000 coverage for overseas transport and accommodation expenses [1]. Get up to $1,000,000 medical expenses coverage ...

Travel insurance. Get comprehensive coverage for your upcoming trip with our Pre-existing Medical Conditions benefit, COVID-19 enhanced add-on, Cancel For Any Reason add-on, and more. From S$14 for a 3-day Single trip, Individual, ASEAN. Check your price.

Allianz Travel Insurance: Best for Enjoying High Medical Coverage. If you want to get a plan with medical coverage, Allianz is a great travel insurance plan to go for. Just by getting the most basic tiered bronze plan, you'd be getting S$250,000 in coverage (for travellers ages 69 years and below).

Get coverage for travel delays and cancellations, medical expenses (including pre-existing medical conditions and COVID-19) on your holidays. Buy Online Now.

One great advantage of NTUC Income's travel insurance is the high trip cancellation coverage ranging from $5,000 to $15,000. Other travel insurance providers might not be so generous. For instance, is offering $2,000 to $15,000, while offers $2,500 to $15,000. Great Eastern logo. Great Eastern TravelSmart Premier Classic.

Across all Travel Easy plan types, emergency medical evacuation and repatriation is at a high limit of $1,000,000. Don't allow yourself to be stranded when your travel operator goes bankrupt overnight! Our travel insurance provides cover for insolvency of licensed travel agencies registered with the Singapore Tourism Board (includes NATAS ...

Travel Lite. Our plan includes cover for accidental death & disability, overseas medical expenses and more. 24/7 Emergency travel assistance. Rental vehicle excess¹. S$500. Loss or damage of baggage & personal belongings². S$3,000. Accidental death & disability3. S$50,000.

Income Insurance Limited (Income) is one of the leading composite insurers in Singapore, offering life, health and general insurance. Established in 1970 as the only insurance co-operative in Singapore to plug a social need for insurance, Income is now a public non-listed company limited by shares, which continues to serve the protection ...

SOMPO Travel Insurance (Superior) Lowest price in Singapore. S$ 24.00. Buy arrow_right_alt. S$ 48.0050% off. Exclusive cashless outpatient services in Japan. Extensive rental vehicle coverage. High baggage delay coverage. S$ 10,000.

Travel insurance for foreigners in Singapore can be found from specific insurers such as NTUC Income, FWD, Etiqa, Sompo, Allianz, AXA and AIG. ... Using SingSaver, you can compare travel insurance online in Singapore, ensuring you find a policy within your budget that covers all your needs, including travel insurance with COVID coverage and ...

The insurance savings plan that gives you up to 4% p.a.* return on your first S$10,000. Save, earn and be insured all in one app. *Terms & Conditions apply. Learn More. REWARDS.

A: Yes, for delay of every full six hours in a row while overseas you will receive a cash benefit of $200 for adult (s) and $50 for child (ren) in accordance to the premium you have paid. For delay after you arrive in Singapore, you will receive a flat cash benefit of $200 for adult (s) and $50 for child (ren).

Single Trip: Get a 40% discount when you use the promo code TSP40S.Valid till 30 June 2024. T&Cs apply. Discount is only valid for Elite and Classic plans. Also receive: 4 miles per S$1 spend on your premium. Valid till 1 July 2024. Travel Miles Campaign and Additional 2 Miles Travel Giveaway. T&Cs apply.

05 June 2024 SINGAPORE - Income Insurance Limited (Income Insurance) today released its 2023 Sustainability Report, which highlights a clear focus on delivering positive social impact through its refreshed sustainability strategy, 'Resilience for All'.The strategy reflects its ambition to foster resilience as a core benefit to society through its actions, products and services.

June 14, 2024 at 3:17 AM PDT. Listen. 1:08. Allianz SE and Singapore-based Income Insurance Ltd. are in talks about a possible tie-up, people familiar with the matter said. A deal could involve ...

Palm Beach, Florida. Metro: Miami-Fort Laudendale-Pompano Beach. County: Palm Beach. 2024 Home Value: $11,590,488. Average Household Income: $365,991