Suggested companies

Post Office Travel Money Card Reviews

Visit this website

Company activity See all

Write a review

Reviews 3.3.

Most relevant

Travel money card

Travel money card was very easy to use I love to use it when I’m traveling as a student.I have added the card to my Apple Pay and the card never failed me. Very reliable card and very simple to use for everyone I recommend.

Date of experience : June 26, 2024

The Post Office Travel Money Card is great. It’s very easy to use and was accepted everywhere during my holidays. I had no issue in using or topping up my card. The app is so easy to use too!

Reply from Post Office Travel Money Card

Hi Luigi, thank you for your great review and feedback, it really helps us. It's great to know that your enjoying your Travel Card. - Sarah

Travel money card was very easy to use…

Travel money card was very easy to use on my holidays. Very happy I got one before my holidays and was so easy to top up while I have been abroad.

Date of experience : June 10, 2024

Hi Arthur, thank you for your positive review and feedback its much appreciated. It’s really good to hear that you are enjoying your Travel Money Card’. -Sarah

Continuing problems with the App

As several other customers have reported I have been unable to add money to my account using the App on my phone. This happens with any credit card and is not restricted to one bank. I can top up using my computer but this is not useful when travelling and I would like an App that works for me. I have notified The Post Office a year ago and again earlier this month and been told the problem has been escalated by helpful folk on the phone. It is a competitive arena and there are other cards out there.

Date of experience : June 03, 2024

Written in response to the PO stopping…

Written in response to the PO stopping me using my money to gamble Your card is a rip off which I have not used for years. I note that you are happy ripping your customers off and and feel entitled to tell them how they may spend their money. If I actually used it your staggering impertinence in deciding how I should spend my money would ensure that I did not use it ever again. You have spurred me on - I shall be closing my account. I don't gamble but, next time ... there is a race meeting on, I shall go and gamble it all away I shall also ensure that I use the PO services as little as possible in the future My advice is to sack immediately all the staff involved in this nonsense BTW if you want a worthwhile travel card I strongly recommend Wise

Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion. As part of our responsibilities under the new consumer duty regulations, the Travel Money Card will block transactions related to gambling. This change is a protective measure aimed at preventing potential harm to our customers. The Post Office Travel Money Card is not intended for use in UK or for gambling. This policy ensures that customers are not exposed to financial harm by funding their Travel Money Card for gambling purposes in the UK. In addition, a UK ban on gambling with credit cards was announced on 1st January 2020 and went into effect on 14th April 2020. Post Office Travel Money Card customers continue to be able to load their Card using a credit card, but we cannot allow these funds to be used for gambling purposes. -Sarah

Problems with app

Have used Post Office travel card for a number of years and always found it very easy to top up on the app but for some reason this year i have been unable to top up with my long standing cooperative bank account. The bank say its the traders fault and the post office say its the banks fault. Please sort it out between you asap as can't give 5 stars!

Date of experience : June 18, 2024

HI Kim, I am sorry to hear this! We would like to understand more so we can help resolve this. Could you call us at 0207 937 0280 or email us at [email protected]. Thank you.

Awful 😞 can’t wait to get home as on my…

Awful 😞 can’t wait to get home as on my app I’ve no idea 🤷♀️ how much money I’ve spent after putting £700 on declined i would not recommend this card at all .. very disappointing indeed in Spain and can’t use a card you’ve put money on 🙃

Date of experience : June 21, 2024

Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion, we would like to understand more so we can help resolve this. Could you call us at 0207 937 0280 or email us at [email protected] to look into this further. Thanks - Katie

Scam Scam Scam

Probably the biggest scam I have came across ever, you may get a good enough rate on first transaction but be aware it’s the first and only time, better rates elsewhere, don’t do it, don’t be scammed, it’s a different rate when topping up card. Be warned don’t do it. No matter how they try to paint it or put lipstick on it, it’s a scam, over 2p difference in today’s “competitive” price. My advice is don’t touch with a barge pole. As of to their reply that was a blatant lie, update on the 23rd June 2024 there is more than 3p difference and adds up to a lot when buying over £1000 on a regular basis, why tell such lies, who is behind this deception???

Date of experience : June 17, 2024

Hi Robert thank you for your review. Our rates fluctuate daily but we do often have promotional rates for both new and existing customer. This may mean you get a better rate at purchase than you do on your next top up but may see a better rate when you top up in the future. We try to be as inclusive as possible and our rates are available on the app and online.

Easy and safe to use

I've started loading money on again for my girlfriend and myself holiday, its so easy to transfer money into American dollars from my bank. I have never had problems using it in shops, restaurants etc. in L.A. and the surrounding areas.

Date of experience : June 01, 2024

Hi Phil, thank you very much for your review!

Faulty card, 5 day wait refund

Tried to use my brand new travel card (which had been activated and in perfect condition) in the hotel on my first day on holiday, it declined after using the correct pin, tried tapping and declined, tried apple pay declined. Rang and was advised to try an ATM for a balance this was declined but post office staff told me the card wasn’t showing any declines. Asked them to transfer my funds back to my bank and told 3-5 working days! Would not advise a young one with limited funds to risk this service. I registered with Revolut and it’s great. Waiting game for rest of funds. Disgusting service when you are not at fault.

Hi Joanne we’re sorry to read that the Travel Money Card hasn’t met with your expectations, we would like to understand more so we can help resolve this. Could you call us at 0207 937 0280 or email us at [email protected]. Thank you.

Lovely staff

Lovely staff when dealing with my request and good advice on taking the card instead of cash

Date of experience : June 07, 2024

Hi James, thanks for sharing your thoughts with us, it's great to hear you were so happy with the service provided!

Just the job and rates are decent

Really easy to set up. Simple to use and rayes arent bad at all. Just what I need

Best travel card on the market.

I purchased a travel money card from my local post office. Excellent customer service. The benefits of the card and the accompanying app were fully explained. I registered the card after 10.30 the next day, downloaded the app and topped up the card all at home. Simple!!! Can be used contactless and comes with a pin. Used in bars, restaurants and hotels. No problem's. Card is secure as it's not attached to any of my bank accounts. Huge benefit is you can have up to 22 currencies added to the card. Plus the exchange rates are better than cash and secure.

Date of experience : May 16, 2024

Hi Stella, Thank you for your fantastic review! I hope you continue to enjoy your Travel Money Card on future holidays.

It’s impossible to top up through the…

It’s impossible to top up through the app. You have to go online which is annoying. The daily withdrawal limit of £450 is also a nuisance. WISE card is much more user friendly and cheaper - you even get 3 free withdrawals a month.

Date of experience : June 15, 2024

Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion, we would like to understand more so we can help resolve this. Could you call us at 0207 937 0280 or email us at [email protected] Sarah, Thanks

It was a lot better doing this on the computer, simple and not time consuming. However on the phone through the app was hard as it would accept my payments at all

Date of experience : May 27, 2024

Hi there, thank you for your review! Apologies to hear you had some bother with the app, if you run into any more issues please contact us on 0207 937 0280 or email us at [email protected],uk and we can advise further. Thank you

Account security is HIGH RISK.

Account security is HIGH RISK. Having used the card for a long time I had used it for many transactions. It became very clear that there was fraudulent transaction amounting to £800. Post Office failed to protect the account sufficiently. They are refusing to cover the loss and are hiding behind the small-print. They are happy to take your fees, but not so good at protecting you. AVOID AT ALL COSTS!

Date of experience : June 05, 2024

Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations. We would like to understand more so we can help resolve this. Could you call us at 0207 937 0280 or email us at [email protected]. Thanks

No fees and easy to use

The Travel Money Card was so easy to use and having the physical card as well as the app meant my husband and I could pay for things from the same account when needed. There are no transaction fees as there are with most bank cards used overseas so would definitely recommend and use next time we go abroad.

Date of experience : March 02, 2024

Than you so much for your great review, it really helps us! We hope yo continue to enjoy your Travel Money Card on future trips

I wouldn't go on holiday without it!

I've had my Post Office Travel Money Card for years and carry all my holiday spending money on it. Its so easy to use and I've always been able to access cash if I've needed it, from an ATM. The App makes everything easy to manage and I can transfer from my bank whenever I need to because who sticks to budget when they're on holiday?! 😅

Date of experience : March 05, 2024

Thank you so much for your great review and feedback, it really helps us. It's really good to hear that you have been using your Travel Money card for so long with us, so thanks again and we hope that you continue to enjoy it for many more years!

Coop Bank customers should avoid this product. Since April the post office have not…

Since April the post office have not been able to transfer money from the Coop bank to Travel Cards once people are abroad. I bought my card in May when this was already a problem Using a Coop bank account. I am now abroad and having to use my daughters account to top my travel card up. Lousy service and too late to buy another proper product.

Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion. Could you call us at 0207 937 0280 or email us at [email protected]

Did everything they said it would do in…

Did everything they said it would do in the time they said. Can't ask for more

Date of experience : June 22, 2024

How does a post office travel money card work?

The Post Office offers a prepaid multi-currency travel card allowing you to hold 23 different currencies. But be careful as there are hidden fees.

The Post Office offers one simple plan, their basic Post Office Travel Money Card. While the travel money card is free to get, there is a minimum load amount of £50 of whichever of the 23 currencies you choose.

Terms such as fee-free, no commission, and zero charges are used a lot by travel money providers, and the Post Office is no different when it comes to marketing their card, which offers 0% commission. But as with most others, there is often a hidden fee under the bonnet. After all, how else would a provider make any money?

It’s worth noting that if you use your Post Office travel money card to withdraw cash abroad, you will be charged at the point of loading your desired currency (the FX mark-up rate), you will then be charged a minimum of £1.50 per ATM withdrawal on top of this. So withdrawing £100 worth of currency could cost around £5.20.

Read our full Post Office travel card review here

What fees does the Post Office charge?

What's an alternative to a Post Office travel money card?

A new solution, only offered by Currensea, the UK's best rated travel debit card. Currensea connects via Open Banking to your existing debit card and is accepted anywhere which accepts MasterCard. Plus, Currensea use the best live interbank exchange rate for 16 separate currencies (which is what the banks use between them), this guarantees that you'll receive the best current exchange rate every time you use your card. Plus there are no hidden fees and charges like the Post Office and its even free to get and use.

No video selected

Select a video type in the sidebar.

See how much you can save using a Currensea travel debit card

Save in 180 currencies vs high street banks or any prepaid travel card..

Find out more

Savings calculator

Using your currensea card whilst on a beach holiday in spain for a week. currensea will save you money against all the major high street banks, travel and prepaid cards*, 5 things to consider before choosing a travel money card, 1. what’s the rate.

Prepaid cards offer a huge range of rates that might not be as good as the rate offered by your bank. Whilst almost all providers say no fees, the fee is often hidden in the exchange rate.

2. Does your travel money card offer protection?

Some cards are covered by section 75 protection, but not all, it’s worth checking the T&Cs before you sign-up to ensure that all your purchases will be covered by some kind of chargeback protection.

3. Can you get back unused currency?

Once your holiday has finished you’re unlikely to want to leave any leftover currency on your travel money card. Make sure that you can easily get your money back, without incurring further fees.

4. Are there any hidden fees?

Check for any fees, prepaid cards generally have more hidden fees than credit or debit cards. Make sure that you keep an eye out for fees such as application and replacement fees, transaction fees, and inactivity charges.

5. Are there any limitations to where you can use the different types of cards?

All providers say that they can be used wherever you see the Visa or Mastercard logo but there are some big exceptions that may impact your choice. If you want to pay at a petrol station, hire a car, or pay on a cruise - generally, you can only use a Credit, Debit, or Currensea’s travel debit card - prepaid travel cards are often not accepted.

Why is Currensea better than a travel card?

We link with your current bank account via open banking to make saving money simple. you can find out more about open banking here.

No new bank account needed

Forget having to set-up and manage multiple accounts

No need to top-up or pre-pay

Remove the hassle and inconvenience of pre-loading another card

No ATM fees

Pay no ATM fees if you withdraw under £500

Your account is secure with Currensea

Authorised by the Financial Conduct Authority

Freeze your card anytime at the click of the button via the app

All purchases protected by Mastercard Chargeback Protection

Our connected banks

We work with all the major uk high-street banks.

Currensea pricing plans

Our plans are simple and transparent. we give you the best live exchange rate so you can spend in confidence, without the hidden fees..

Saves 85 % on bank charges*

Across card spend & ATM withdrawals

2% FX rate over £500pm

Send £100 - £20,000 per transfer

Spend notifications, set spend limits & freeze/unfreeze card

Mastercard chargeback protection

Get the best live interbank exchange rates

Convert savings into air miles

Mastercard travel debit card

Saves 100 % on bank charges*

1% FX rate over £500pm

Access our latest offers for Premium travel debit card users

Including Hertz Gold Plus Rewards with complimentary Five Star Status and a 20% worldwide discount with Avis

Complimentary night's stay when booking a trip of 4 nights or more

£ 120 /year

1% FX rate over £750pm

Send £100 - £20,000 per transfer

Mastercard World Elite travel debit card

Access our latest offers for Elite travel debit card users

Exclusive membership to Avis President's club and Hertz's President's Circle

Enjoy 4 nights for the price of 3 and other exclusive benefits with 'Elite I Prefer Member Status'

24/7 travel concierge giving you truly luxurious benefits

LoungeKey TM warmly welcomes you to access 1100+ airport lounges

Explore 3,000+ locations with extravagant benefits incl complimentary breakfast, room upgrades and much more

Tap to Pay With Google Pay ™

Get all the benefits of your Currensea travel debit card conveniently on your phone. Just add a card to Google Wallet™ to get started.

No hidden fees

No weekend charges, non-sterling transaction fees, foreign currency purchase fees, internet purchase fees or dormant card fees.

So, how does Currensea make its money?

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Get competitive rates and 0% commission for your holiday cash

Foreign currency

Find our best exchange rates online and enjoy 0% commission on over 60 currencies. And you can choose collection from your nearest branch or delivery to your home

Go cashless with our prepaid Mastercard®. Take advantage of contactless payment, load up to 22 currencies and manage everything with our app, making travel simple and secure

Order travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

Why get your holiday cash from Post Office?

- Order online, buy in branch, or choose delivery to your home or local branch

- 100% refund guarantee* if your holiday’s cancelled, at the same exchange rate, excluding bank and delivery charges. Just send your receipts and evidence of cancellation to us within 28 days of purchase. *T&Cs apply

- Order euros or US dollars to collect in branch in as little as 2 hours

Euros and US dollars in 2 hours

Click and collect euros and US dollars in 2 hours. Terms and conditions apply

Today’s online rates

Rate correct as of 27/06/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Need some help?

Travel money card lost or stolen.

Please immediately call: 020 7937 0280

Available 24/7

Travel money help and support

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Other related services

Travelling abroad? These tips will help you get sorted with your foreign ...

We all look forward to our holidays. Unfortunately, though, more and more ...

From European hotspots to far-flung destinations, UK travellers are making ...

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Our annual survey of European ski resorts compares local prices for adults and ...

The nation needs a holiday. And, with the summer season already underway, new ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Going on holiday is an exciting time for families. To make sure it stays fun, ...

Eastern Europe leads the way for the best value city breaks this year. And ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Post Office Travel Card Review

Travelling is one of the most exciting and liberating experiences out there. Whether you’re jetting off to a far-off destination or just exploring your own country, having the right travel card can make the whole experience easier and more enjoyable.

Are you planning a trip? If so, you may be wondering if the Post Office Travel Money Card is a good option for you. In this article, we’ll take a close look at the Post Office Travel Money Card, how it works, and what you need to know before using it.

By the end of this guide, you’ll have all the information you need to make an informed decision about whether or not the Post Office Travel Money Card is right for your next trip.

Table of Contents

Benefits of Having a Travel Card

First and foremost, travel cards are an excellent way to earn miles and points. This can be incredibly valuable if you are a frequent traveller or want to visit somewhere far off where you’ll have to pay high airfare. Plus, you can use these miles and points to book travel, hotels, flights, vacation packages, and more.

Another major advantage of travel cards is their versatility. As you travel, you’ll have the ability to withdraw cash from ATMs using your card, pay for purchases using your card, and even get roadside assistance on select cards. You’ll also have access to excellent trip cancellation and travel insurance.

Plus, travel cards are typically easier to qualify for than other types of credit cards. This is because many companies view travel cards as a “safe” type of credit. However, having a travel card can also help to improve your credit score.

Post Office Travel Cards: What Are They?

The Post Office Travel card is a Mastercard prepaid card, which can be loaded with a choice of 23 currencies. ATMs are available in more than 200 countries where you can spend and withdraw money.

You can load your account with any currency before travelling and then use it abroad without having to convert your currency.

Post Office Travel offers a contactless card that can be accessed through its app.

Post Office Travel Cards Benefits and Features

Here’s a quick look at the Post Office Travel card’s main features and benefits:

- Payments for low-value items can be made quickly and conveniently using contactless technology

- Compatible with Apple Pay and Google Pay

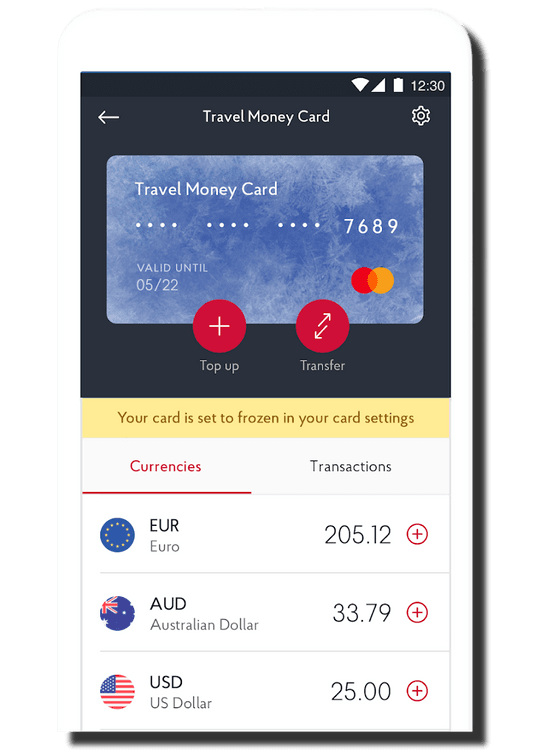

- With the Travel app, you can manage your card, top it up, transfer currencies, as well as freeze it.

- You can choose from 23 different currencies and top it up whenever you need it

- Accepted everywhere Mastercard is accepted

- Call centre assistance is available 24/7

- Whenever there is currency left over, it can be transferred into another currency by using the wallet-to-wallet feature

- If you use a local currency supported by your card to spend abroad, there are no fees

Post Office Travel Card Costs

Travel money cards from the Post Office cost nothing to order and no fees apply when you pay for purchases using the currency you hold. Provided your available balance is in a currency accepted by the card, you can shop, dine, and drink without any charges.

When using your card in a country that doesn’t support the currency of your card, you will have to pay a 3% foreign transaction fee. Using your card in Brazil, for example, will result in a 3% foreign transaction fee since the Brazilian Real isn’t a supported currency.

Despite the card’s currency support, you’ll still have to pay ATM withdrawal fees. Each currency has a different ATM fee.

An example would be:

- Euro – 2 Euros

- Canadian Dollar – 3 Canadian Dollars

- US Dollar – 2.5 United States Dollars

- Swiss Franc – 2.5 Switzerland Francs

- Australian Dollar – 3 Australian Dollars

- Pound Sterling – 1.5 Pounds Sterling plus 1.5% commission

Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

Exchange Rates

Exchange rates fluctuate based on the demand for currencies at the Post Office. Thus, you’ll receive a particular amount of travel money depending on the current exchange rate.

For travel money cards, you can get exchange rates at Post Office branches and on the website. Be sure to remember that rates may differ whether you are purchasing online, by phone, or in person.

In addition to the margin, the exchange rate at the Post Office will probably include a markup. When you search for the rate on Google or currency websites, you’ll most likely get an accurate one. Consequently, a margin will reduce the amount you receive when exchanging EUR, USD, or another currency.

A Post Office Travel Money company profits by offering its customers a better rate than the base rate. U.K. pounds are converted into U.S. dollars at a rate of 1.23 dollars per pound, for example.

If you exchange £400 through Post Office Travel Money, you can get 1.18 USD per pound. In this case, there is a difference of £16 or 4%. Exchange rates are better when you exchange large sums of money .

Exchange Rates for In-Branch Travel Money

According to the Post Office, in-branch exchange rates are determined by many factors, including branch location, competitor pricing, convenience, etc. The company will always strive to offer the best possible rate within these parameters. Online orders/distribution is the cheapest method for many retailers, as they can use centralised packing costs. Because of this, online exchange rates are always better than branch rates.

Comparing Post Office Travel Money Rates to Other Providers

There are several new services that it’s worth comparing directly to Post Office Travel Money.

Online-Only Banks

There have been several purely mobile banks launched in recent years both in the UK and across Europe. With services like Monzo, N26, Revolut, Monese, or Bunq, consumers can access a wide range of banking options.

Each of these modern financial institutions provides services such as money transfer agencies and international travel cards, and it makes sense to compare them with Post Office Travel Money.

For example, Monzo facilitates international money transfers through the popular exchange company Wise. For example, when sending a thousand pounds to a Swedish account using Monzo/Wise, the recipient receives 12,103 Swedish crowns versus 11,546 with Western Union, a difference of around 5%.

Other Currency Providers

It may also be possible to transfer money at a better rate in some countries. Using Xendpay, you could send 500 pounds to Saudi Arabia, and the beneficiary would receive 2,289 Saudi Riyals instead of 2,158 Saudi Riyals with Post Office Travel Money.

Supported Currencies

Prepaid travel cards from Post Office can be loaded with any of the following 23 currencies:

- CAD – Canadian dollar

- JPY – Japanese yen

- USD – US dollar

- AUD – Australian dollar

- CHF – Swiss franc

- AED – UAE dirham

- CNY – Chinese yuan

- DKK – Danish kroner

- PLN – Polish zloty

- CZK – Czech koruna

- ZAR – South African rand

- GBP – Pound sterling

- TRY – Turkish lira

- HKD – Hong Kong dollar

- THB – Thai baht

- HRK – Croatian kuna

- SGD – Singapore dollar

- HUF – Hungarian forint

- SEK – Swedish kronor

- SAR – Saudi riyal

- NOK – Norwegian krone

- NZD – New Zealand dollar

Sending Money With the UK Post Office

Many Post Office branches and their website offer Post Office Travel Money. They offer convenient and quick foreign exchange services. They are useful for local currency exchanges because they are so widely available. Post Office services like international money transfers and travel cards offer additional options for sending and spending overseas.

How to Get and Use a Post Office Travel Card?

Post Office travel cards are only available to UK residents over 18 years old.

Ordering Your Card

To order a Post Office Travel card, you can do one of three things:

- You can order through the Post Office Travel app

- Visit the Post Office website to apply online

- Get your card at your local Post Office. It will be necessary to bring photo identification, like a passport or driver’s licence

Your card should be available immediately if you apply at a branch. Your card will be delivered within two to three days after you apply online or via the app.

Card Activation

It’s necessary to activate your travel card before you can use it. You’ll find detailed instructions in your welcome letter.

Using Your Card

ATMs and online sites that accept MasterCard accept Post Office travel cards, too. If you are buying something in person, you’ll need your PIN to verify your purchase and possibly your signature if the Chip and PIN system is not widely available in the country.

In some countries, contactless payments are also allowed for small amounts, although the rules and limitations vary.

According to its terms and conditions, you should not use your Post Office card in certain situations.

Some of them include:

- Tolls on the road

- Petrol pumps with self-service

- Deposits for car rentals or hotels

- Airline or cruise ship transactions

Adding Money to Your Card

With the Post Office Travel app, you can add money to your card easily. Additionally, you can add money at a local branch or on the Post Office website.

Buying Back Currencies

Having unused currency on your card gives you a few options. You may be able to withdraw cash at your local Post Office branch or ATM, but there may be a fee.

Wallet-to-wallet transfers are also available in the app. You can transfer unused balances from one currency to another. In preparation for your next trip to Europe, you can convert unused USD into EUR.

Each currency listed above can be topped up for between fifty pounds and five thousand pounds on your card. Your card can hold up to ten thousand pounds, as well as carry out transactions of up to thirty thousand pounds annually.

Different currencies have different limitations on cash withdrawals. For example, in a single transaction, you may withdraw up to 450 euros or 500 dollars.

App Overview

On Google Play and the App Store, you can download the Post Office Travel app for free. With the app, you can activate and order your card, check your balance, add money to it, and more.

In addition to transferring leftover currency between wallets, it’s possible to convert it to another currency you prefer by using the new wallet-to-wallet feature.

Furthermore, you can book airport parking, purchase travel insurance through the app, and use other features.

Contacting the Post Office

If you need assistance, you may reach the contact centre by dialling 0344 335 0109 in the United Kingdom or 0044 20 7937 0280 from abroad. Customer service is available each day of the week at any time of the day.

In addition, you can reach Customer Services at the Post Office in the following ways:

- Postal mail at PO Box 3232, Cumbernauld, G67 1YU, Post Office Travel Card

- Send an email to [email protected]

Post Office Travel Card: FAQs

Here are some common travel card problems you might encounter.

When I lose or damage a card, what do I do?

Post Office currency cards are easy to replace if lost or damaged. Your card will be blocked, and another one will be sent to you. App users can also freeze their cards.

How should I deal with a declined or blocked card?

The first thing you need to do is ensure that you have enough money in your account via the app. If you don’t have enough money in your account to purchase your item, call the customer care centre.

If I forget my PIN, what should I do?

Call the customer service centre if you cannot remember your travel money card PIN. If you need a new one, they can issue it for you.

My card is about to expire. What should I do?

A new card should automatically be sent to you. You can call the contact centre if it hasn’t arrived after the expiration date, and they’ll issue you another.

Post Office Prepaid Travel Card Summary

Travel cards from the Post Office are handy if you want to keep your money safe while you’re away from home. The convenience of not carrying cash around with you and not having to change money during your trip will make your trip much more enjoyable.

Because it’s a contactless card, you can pay in local currencies quickly and easily. This helps you budget because you can only spend what’s on it.

If you travel frequently or take multi-destination holidays, the card is convenient since you can store 23 currencies on it. A card that supports a variety of currencies might be more useful if you love exploring far-flung areas.

The exchange rate is a drawback to take into account. Post Office rates may be competitive (compared to airport exchange rates, for example), but they will likely include a margin or markup. ATMs also charge fees when you use your card.

Comparing other travel money cards could help you find a better deal, so make sure to shop around.

by Matt Woodley

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

Post Office Travel Card review

The Post Office Travel Card is a prepaid travel card you can load in cash or online, to switch to the currency you need for spending and withdrawals. It’s not linked to your regular bank account, and can be managed from your smartphone, for secure spending across 23 currencies.

Before you order a Post Office Travel Card check out this full review - we’ll look at what the card can do , how to order your card and how much it’ll cost .

And to help you compare we’ll also touch on Post Office Travel Card alternatives like Wise and Starling, which may offer cheaper and more flexible options for taking travel money abroad.

TL;DR - it's a solid prepaid card

- The card supports most major currencies for holidays, including Euros (Europe), Lira (Turkey) and UAE Dirhams (Dubai)

- Several top-up methods , with the option of doing so online or in-store

- Only convert what you want to spend; good for holiday budgeting

However, there are some downsides.

- There are better exchange rates available with other travel cards

- You'll get a worse exchange rate (a.k.a "buy-back rates") when converting leftover foreign currency to pounds

Find out more about the card on the Post Office website or click the button below to purchase a card. Order a card

Not sure yet? Continue reading to decide whether this is the right prepaid card for you.

What's in this guide?

What is the post office travel money card, how does it work.

- Fees & limits

How do I get a Post Office Travel Money Card?

What happens when the card expires, what are the alternatives.

The Post Office Travel Money Card is a prepaid card you can top up in cash or from your bank account, in any of 23 supported currencies.

Once you have funds on your card you can use it as you would a regular debit card, for contactless and mobile payments, and cash withdrawals. There’s no fee to spend currencies you hold on your card, although other transaction fees do apply depending on how you use the account.

Use your Post Office card to buy travel money before you head off on holiday, or top up as you go online.

As pictured, you can also manage, view and freeze your card in the Post Office app for security.

- Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies

- If you choose to top up in GBP and convert later, you’ll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP

- Exchange rates are shown in the Post Office app, and may include a markup on the market exchange rate - but rates often improve if you top up more

- It’s free to spend currencies you hold. You can also spend unsupported currencies, but a foreign transaction fee of 3% will apply

It’s worth noting that the Post Office exchange rates are shown in the Post Office app before you convert your funds. They may include a markup, which is an extra fee added into the rate applied to switch to the currency you need.

Another thing worth noting is that the exchange rate gets better for higher top up amounts - meaning you’ll pay a smaller markup the more you add to your card.

Using a markup is pretty common but does make it tricky to see what you’re really paying for your foreign currency transactions.

Spending limits and card fees

Before you order a Post Office Travel Card it’s good to know a bit about the fees and limits that apply to card usage.

When you transact with your Post Office Travel Money Card, there are also fees to pay.

While these do vary slightly by currency, they’re roughly similar.

It’s easy to get your Post Office Travel Card online or in person by calling into a Post Office near you. Here’s what you’ll need to do.

- Head to the Post Office website

- Select "Order Your Card >"

- Top up in your preferred currency - there’s a minimum top up of 50 GBP, through to a maximum of 5,000 GBP

- Input personal details following the prompts

- Delivery of your card will take 2-3 days by post

- Head to your local Post Office branch

- Show a valid form of ID (driving licence, passport or EEA ID card)

- Apply in branch and load your card

The expiry date for your card will be printed on the back of the card - usually it’s valid for 3 years from the point you order it.

Once your card has expired you’ll pay a monthly inactivity fee of £2 per month if you don’t redeem your balance within 12 months of the card expiring. This fee continues until there’s no remaining balance, at which point your account will be closed.

If you’re not sure whether the Post Office Card is right for you, check out a few alternatives to see which gives you the best balance of cost and convenience.

The Wise card allows you to hold and exchange 50+ currencies, and spend in 170+ countries. It's a fully-fledged debit card, meaning it works at home just as well as it does abroad.

There’s no markup on the exchange rate, and they are super transparent about the fees (usually around 0.4% for foreign spending) they'll charge you.

Starling card

The Starling debit card is a good option for international spending as there are no foreign transaction fees and no ATM fees .

You can sign up entirely online for an account with no monthly fees which you can manage from your phone, with instant notifications and a whole range of banking features. Get a Starling Card

Frequently Asked Questions

Post Office is a trusted institution and will keep customer funds safe according to all applicable legal requirements.

When it comes to travel money, the Post Office works in partnership with First Rate Exchange Services, which is a registered business and holds a Money Services Business License in the UK.

You can hold up to 23 different currencies:

- Australian dollars

- Canadian dollars

- New Zealand dollars

- Croatian kuna

- Turkish lira

- South African rand

- Swiss francs

- Polish zloty

- Pounds sterling

- Chinese yuan

- Czech koruna

- Danish kroner

- Hong Kong dollars

- Hungarian forint

- Japanese yen

- Norwegian krone

- Saudi riyal

- Singapore dollar

- Swedish kronor

- About Antique Wolrd

- Antique News

- Cards & Envelopes

The Post Office Travel Money Card Review: Key Features, Rates and Fees

If you’re heading overseas, a travel card could be a handy solution for covering your spending. They tend to be cheaper to use than your ordinary bank debit card, and can even offer better exchange rates compared to buying currency.

- A Complete Guide to Sending Celebration of Life Thank-You Cards

- How to Send Mail Overnight

- Pop Up Chick Card for Easter

- DIY Gift Card Envelope: Easy 5 Minute Craft

- Hallmark Aims to Inspire People to Connect with Loved Ones This Holiday Season with Signature Cards

There are lots of travel cards out there, but here we’re going to focus on the Post Office Travel card. We’ll run through what it is and how it works, along with fees, exchange rates, supported currencies and how to apply for one.

You are watching: The Post Office Travel Money Card Review: Key Features, Rates and Fees

And while you’re comparing spending options ahead of your trip, make sure to check out the Wise card. This international card can be used in 175 countries worldwide, automatically converting your pounds to the local currency at the mid-market rate. There’s only a small fee to pay for the conversion¹, or it’s free if you already have the currency in your Wise account.

But for now, let’s focus on the Post Office travel card.

¹ Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

What is the Post Office travel card?

The Post Office Travel card is a prepaid Mastercard that you can load up with up to 23 currencies. You can use it for spending and ATM withdrawals in over 200 countries, in 36 million locations².

Simply top up with your chosen currency before you travel, then spend overseas without needing to convert currency.

The card is contactless and can be managed using the Post Office Travel app.

Key features and benefits

Here’s your quick at-a-glance guide to the main features and benefits of the Post Office Travel card ²:

- Contactless for making fast and convenient low-value transactions

- Available with Google Pay and Apple Pay

- Manage, top up, transfer between currencies and freeze your card using the Travel app

- Reload whenever you need to, with up to 23 currencies available

- Can be used wherever Mastercard is accepted

- 24/7 call centre help is available if you need it

- Wallet-to-wallet feature – where you can transfer any leftover currency to a new currency of your choice

- No charges when you spend abroad using an available balance of a local currency supported by the card (although there are some fees to know about – we’ll look at those next).

Post Office travel card fees and charges

Post Office travel cards are free to order and there are no charges for paying retailers in the currencies held on your travel money card. So, you can spend in shops, bars and restaurants without any charge – as long as you’re paying with an available balance of a currency supported by the card².

If you do use your card in a country with a local currency that isn’t supported by the card, you’ll be charged a cross-border fee of 3%². For example, if you go to Brazil and use your card at a local restaurant, you’ll be charged the cross-border fee of 3% as Brazilian real isn’t supported by the card.

You’ll also be charged for withdrawing cash from any ATM, even in currencies supported by the card. These ATM fees vary depending on the currency used. For example ²:

- Euro – 2 EUR

- US Dollar – 2.5 USD

- Australian Dollar – 3 AUD

- Pound Sterling – 1.5 GBP + commission of 1.5%

- Swiss Franc – 2.5 CHF

- Canadian Dollar – 3 CAD.

One last thing to note on the subject of fees. All Post Office Travel cards are valid for up to 3 years. Exactly 12 months after your card expires, you’ll start to be charged a monthly maintenance fee of £2².

Here is also a list of the European countries that charge the highest ATM fees.

Exchange rates

The Post Office offers exchange rates that move up and down according to the demand for currencies. So, the exact amount of travel money you’ll receive on your travel card will depend on the rate at the time of your purchase.

You can check the Post Office exchange rates on its website, travel money card app and branches. Keep in mind though that rates may vary whether you’re buying online, via phone or in-store.

The Post Office exchange rate is also likely to include a margin or mark-up on the mid-market rate. This is the rate you’ll find on Google or currency sites like XE.com, and is generally considered to be a fair rate. A margin added on top of this makes the rate worse for you, so you’ll get less EUR, USD or whatever other currency you’re exchanging.

Read more : Personalised Birthday Cards

Wise only ever uses the mid-market exchange rate, with no mark-ups or margins. This means that your pounds go further, wherever you’re travelling to.

Currencies supported

You can load your Post Office prepaid travel card with funds in any of these 23 currencies²:

- EUR – Euro

- USD – US dollar

- AUD – Australian dollar

- AED – UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish kroner

- GBP – Pound sterling

- HKD – Hong Kong dollar

- HRK – Croatian kuna

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish kronor

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

You can top up your card with between £50 and £5,000 in any of the currencies listed above. The maximum you can hold is £10,000, plus you can load and spend up to £30,000 on your card each year².

Cash withdrawal limits vary from currency to currency. For example, you can withdraw a maximum of €450 euros or $500 US dollars² in a single transaction.

App overview

The Post Office Travel app is free to download from the Google Play and Apple App stores. You can use it to order and activate your card, monitor your balance and top up with currencies. Using the new wallet-to-wallet feature, you can also transfer leftover currency to other currencies of your choice in just a few taps.

You can also buy Post Office travel insurance, book airport parking and access other features through the app.

How good is the Post Office prepaid travel card?

The Post Office travel card is handy to have if you’re travelling and want to keep your money safe. You won’t need to carry cash around with you, or have to take time out of your trip to change currency.

Paying in local currencies is quick and easy, especially as it’s a contactless card. Plus, you can only spend what’s on it, so this can help you to budget.

As you can store 23 currencies on it, the card is convenient if you travel regularly or are taking multi-destination holidays. If you love visiting far-flung places, however, you might need a card that supports more currencies.

One drawback to consider is the exchange rate. While rates may be competitive (compared to changing money at the airport, for example), the Post Office is likely to include a margin or mark-up on the mid-market rate. There are also charges for using your card at an ATM.

So, it’s important to shop around and compare other travel money cards, as some could offer you a better deal.

Take the Wise card, for example. With this contactless international card, you can spend in 175 countries and manage over 50 currencies in your Wise account. There are no ATM fees¹ for withdrawing up to £200 a month (2 or less withdrawals) and you’ll get the mid-market exchange rate on every transaction. Note, that Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks.

The Wise card will automatically convert your money to the local currency at the mid-market rate when you spend, for just a small conversion fee¹.

How to get and use a Post Office travel card

You can only get a travel card from the Post Office if you’re aged over 18 and a resident of the UK.

Ordering your card

There are three ways to order a Post Office Travel card:

- Download the Post Office Travel app and place an order there.

- Apply online at the Post Office website.

- Pop into a local Post Office branch to apply for a card. You’ll need to take a form of photo ID with you, such as a passport or UK driving licence.

If you’re applying in a branch, you should be able to pick up your card there and then. For applications made online or in the app, you’ll need to wait 2-3 days for your card to be delivered.

Card activation

You’ll need to activate your travel card before you can use it.

Read more : Write a postcard of about 50 words about your holiday in a city

You’ll be given instructions on how to do this in the welcome letter delivered along with your new card.

Using your card

You can use your Post Office travel card anywhere that accepts MasterCard, online and at ATMs³.

If you’re buying something in person, you’ll need to enter your PIN. If you’re in a country where Chip & PIN isn’t as widely available (such as the USA), you may be asked to sign to verify your purchase instead.

You can also make contactless payments for small amounts, although different countries have different rules and limits for this.

The Post Office’s terms and conditions list a handful of situations in which you shouldn’t use your card. These include the following³:

- Self-service petrol pumps

- Car hire or hotel check-in deposits

- Transactions on planes or cruise ships.

How to top up your card

The easiest way to top up your Post Office Travel card is using the app. If you prefer, you can also top up at the Post Office website or in a local branch³.

Buying back currencies

If you have unused currency on your card, there are a couple of options available. You may be able to withdraw it at a local Post Office branch or ATM, although fees may apply³.

Alternatively, you can use the new wallet-to-wallet feature in the app³. This lets you transfer unused balance in one currency over to another. For example, you can transfer unused USD to EUR, ready for your next trip to Europe.

How to contact the Post Office about your card

You can call the contact centre on 0344 335 0109 when you’re in the UK or +44 (0) 20 7937 0280 when you’re overseas³. Lines are open 24 hours a day, seven days a week.

You can also contact the Post Office Travel Card Customer Services department via the following methods³:

- By post at Post Office Travel card, PO Box 3232, Cumbernauld, G67 1YU

- By email at [email protected].

Post Office Travel Card: troubleshooting tips

Here’s how to deal with some common problems you might have with your travel card.

How do I report a lost or damaged card?

If you lose your Post Office currency card or discover that it’s damaged, just phone the contact centre. They’ll block it and send you another. You can also freeze your card using the app.

What should I do if my card is declined or blocked?

Firstly, check your account via the app to make sure you have enough money in it. If you have enough to pay for your item or have less than you should have in your account, call the contact centre.

What if I’ve forgotten my PIN?

If you can’t remember your travel money card PIN, phone the contact centre. They can issue you with a new one.

What happens when my card expires?

You should receive a new card automatically³. If it hasn’t arrived after the expiry date, call the contact centre and they’ll issue you with one.

And that’s pretty much it – everything you need to know about the Post Office Travel card. It’s handy if you don’t want to carry cash around or exchange currency while on holiday. And you can use it in multiple countries, as it supports 23 currencies. The app is another great feature, letting you top up and manage your money on the move.

But just remember to compare exchange rates and fees (especially for those all-important ATM withdrawals) before choosing a travel card for your trip – as you could be getting a better deal elsewhere.

Sources used:

- Wise – terms and conditions & pricing

- Post Office – Travel Money Card

- Post Office Travel card – Terms and Conditions

Source: https://antiquewolrd.com Categories: Cards & Envelopes

Join Lenon Blur

I am a JOIN LENON BLUR - world-leading expert, and I am the admin of Antiqueworld with many years of experience researching antiques and postal publications. I hope to provide the audience with the most accurate and informative information.

- Bahasa Indonesia

- Eastern Europe

- Moscow Oblast

Elektrostal

Elektrostal Localisation : Country Russia , Oblast Moscow Oblast . Available Information : Geographical coordinates , Population, Area, Altitude, Weather and Hotel . Nearby cities and villages : Noginsk , Pavlovsky Posad and Staraya Kupavna .

Information

Find all the information of Elektrostal or click on the section of your choice in the left menu.

- Update data

Elektrostal Demography

Information on the people and the population of Elektrostal.

Elektrostal Geography

Geographic Information regarding City of Elektrostal .

Elektrostal Distance

Distance (in kilometers) between Elektrostal and the biggest cities of Russia.

Elektrostal Map

Locate simply the city of Elektrostal through the card, map and satellite image of the city.

Elektrostal Nearby cities and villages

Elektrostal weather.

Weather forecast for the next coming days and current time of Elektrostal.

Elektrostal Sunrise and sunset

Find below the times of sunrise and sunset calculated 7 days to Elektrostal.

Elektrostal Hotel

Our team has selected for you a list of hotel in Elektrostal classified by value for money. Book your hotel room at the best price.

Elektrostal Nearby

Below is a list of activities and point of interest in Elektrostal and its surroundings.

Elektrostal Page

- Information /Russian-Federation--Moscow-Oblast--Elektrostal#info

- Demography /Russian-Federation--Moscow-Oblast--Elektrostal#demo

- Geography /Russian-Federation--Moscow-Oblast--Elektrostal#geo

- Distance /Russian-Federation--Moscow-Oblast--Elektrostal#dist1

- Map /Russian-Federation--Moscow-Oblast--Elektrostal#map

- Nearby cities and villages /Russian-Federation--Moscow-Oblast--Elektrostal#dist2

- Weather /Russian-Federation--Moscow-Oblast--Elektrostal#weather

- Sunrise and sunset /Russian-Federation--Moscow-Oblast--Elektrostal#sun

- Hotel /Russian-Federation--Moscow-Oblast--Elektrostal#hotel

- Nearby /Russian-Federation--Moscow-Oblast--Elektrostal#around

- Page /Russian-Federation--Moscow-Oblast--Elektrostal#page

- Terms of Use

- Copyright © 2024 DB-City - All rights reserved

- Change Ad Consent Do not sell my data

IMAGES

COMMENTS

Post Office Travel Money Card provides you with an easy way to take your travel money abroad. Its prepaid, reloadable, contactless and not linked to a bank a...

How To Transfer Money Back From Post Office Travel Card? Are you a frequent traveler who uses the Post Office Travel Card? Have you ever wondered what to do ...

From buying travel money and travel insurance to applying for a pre-paid Travel Money Card, there's nowhere else these essentials can be sorted so easily, al...

Struggling with a malfunctioning Post Office Travel Card? Watch our video for expert tips on troubleshooting and getting your travel card back in action. Fro...

How To Activate Post Office Travel Card (What Is Post Office Travel Money Card?). In this video tutorial I will show how to activate Post Office Travel Card....

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features NFL Sunday Ticket Press Copyright ...

There are three ways that you able to obtain a Travel Money Card, each very simple. Via our travel app: you can order and store up to three Travel Money Cards in our free travel app. Delivery will take 2-3 working days. Online: follow our application process to order your card online. Your card will take 2-3 working days to be delivered.

Call us 24/7. Please call our Travel Money card team immediately on: 0207 937 0280. We'll cancel your card and work out the best way to replace it.

Post Office Travel Money Card is a type of prepaid currency card. You can load it with up to 22 different currencies to use on your travels. These guides look closer at this type of holiday money and how to make it work best for you.

The Post Office Travel Card offers a safe and convenient way to manage your money while traveling. It is a prepaid card that can be loaded with up to £2,500 in a single transaction and is ...

Have used Post Office travel card for a number of years and always found it very easy to top up on the app but for some reason this year i have been unable to top up with my long standing cooperative bank account. The bank say its the traders fault and the post office say its the banks fault. Please sort it out between you asap as can't give 5 ...

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial ...

The Post Office offers a prepaid multi-currency travel card allowing you to hold 23 different currencies. But be careful as there are hidden fees. The Post Office offers one simple plan, their basic Post Office Travel Money Card. While the travel money card is free to get, there is a minimum load amount of £50 of whichever of the 23 currencies ...

New-look travel app out now. Our revamped travel app's out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user ...

Australian Dollar - 3 Australian Dollars. Pound Sterling - 1.5 Pounds Sterling plus 1.5% commission. Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

The Post Office Travel Money Card is a prepaid card you can top up in cash or from your bank account, in any of 23 supported currencies. Once you have funds on your card you can use it as you would a regular debit card, for contactless and mobile payments, and cash withdrawals. There's no fee to spend currencies you hold on your card ...

Pound Sterling - 1.5 GBP + commission of 1.5%. Swiss Franc - 2.5 CHF. Canadian Dollar - 3 CAD. One last thing to note on the subject of fees. All Post Office Travel cards are valid for up to 3 years. Exactly 12 months after your card expires, you'll start to be charged a monthly maintenance fee of £2².

Loading Euro Cash on to a Travel Card. ac1992 Posts: 1 Newbie. 1 August 2023 at 2:36PM. So I bought some euros, as the exchange rate was good, to load on to my Post Office Travel Card. After the euros arrived I went to the post office to load them on and was advised that they cannot do this, and they can only load GBP on to the card which will ...

596K subscribers in the vexillology community. A subreddit for those who enjoy learning about flags, their place in society past and present, and…

Elektrostal is a city in Moscow Oblast, Russia, located 58 kilometers east of Moscow. Elektrostal has about 158,000 residents. Mapcarta, the open map.

Elektrostal Geography. Geographic Information regarding City of Elektrostal. Elektrostal Geographical coordinates. Latitude: 55.8, Longitude: 38.45. 55° 48′ 0″ North, 38° 27′ 0″ East. Elektrostal Area. 4,951 hectares. 49.51 km² (19.12 sq mi) Elektrostal Altitude.

In 1938, it was granted town status. [citation needed]Administrative and municipal status. Within the framework of administrative divisions, it is incorporated as Elektrostal City Under Oblast Jurisdiction—an administrative unit with the status equal to that of the districts. As a municipal division, Elektrostal City Under Oblast Jurisdiction is incorporated as Elektrostal Urban Okrug.