Niigata's Murakami City: Enjoy Fun Events, Sightseeing, and Local Cuisine!

We use cookies to improve our contents. Check the detail and update your settings here .

We use cookies to improve our services.

For more details, please click here .

- Change setting

- Food & Drink

- Accommodation

- Things To Do

- All the categories

Transportation

- Weather & Seasons

- Long-Term Stay

- Travel Tips

- Event Tickets

- About MATCHA

- Company Profile

- MATCHA Special Features

Rakuten Card Guide: English Support, Payments, Renewals, and More!

Rakuten Card is a credit card that international residents in Japan can easily apply for thanks to 24-hour English support. Read on for an informational guide on card renewals, payments, procedures when losing your card, and more!

Rakuten Card Facts

Rakuten Card is a widely used credit card in Japan with more than 21 million cardholders.

It's also favored by overseas students and international residents in Japan for its reward points earned by using your card. There is no annual fee.

Rakuten Card is provided by Rakuten Group, Inc. , an e-commerce giant in Japan. In recent years, Rakuten has gained popularity overseas through its sponsorship of FC Barcelona in the First Division of the Spanish Football League.

This article will give details on how to resolve issues that may occur when using the Rakuten Card , card renewals , and language support for international residents.

Easy Online Application! Apply for a Rakuten Card (Japanese)

Table of Contents

- 1. Rakuten Card’s English Support

- 2. How to Renew Your Rakuten Card

- 3. Payment Due Date and Methods

- 4. What to Do When Losing Your Card?

- 5. Cancellation/Utilizing the Rakuten Card in Japan

Rakuten Card’s English Support

Currently, the Rakuten Card application and Rakuten e-NAVI, a cardholder service website for checking your account, are only available in Japanese.

However, the customer call center provides English support for inquiries over the phone.

Contact the call center, and an English-speaking representative will return your call. Utilize this service if you’re not confident in using Japanese over the phone, or prefer assistance in English.

The customer call center accepts both domestic and international calls.

Contact numbers are listed below.

Domestic: 0570-66-6910 (Weekends and holidays included, 9:30-17:30) International: 81-92-474-6287 (Weekends and holidays included, 9:30-17:30 JST)

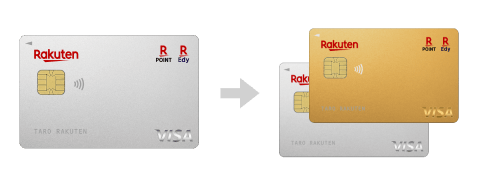

How to Renew Your Rakuten Card

Most people are concerned with credit card renewals. As a cardholder, there are no renewal or in-person contact procedures after your Rakuten Card has expired.

A new Rakuten Card will be sent to your registered address when your card is nearing its expiration date. This is typically mailed between the end of the month before your expiration month or the start of that same month.

Changes in your registration information, such as your mailing and e-mail address, can be done via Rakuten e-NAVI: the cardholder website.

Payment Due Date and Methods

The payment due date and payment method should be kept in mind when using your credit card.

Payment on the 27th of the Following Month

Rakuten Card’s statement period closes at the end of every month. The payment date for that period is by the 27th of the following month (if the 27th falls on a business holiday, then payment is due the next business day).

There are two payment methods available. You can choose to pay by bank transfer (automatic withdrawal) or at a convenience store .

1. Bank Transfer Payment

When paying by bank transfer, you need to register your bank account information on Rakuten e-NAVI during or after the credit card application process. You are not required to submit any documents.

As a precaution, bank transfer payments cannot be changed to convenience store payments once selected . Keep this in mind when choosing bank payments as your payment method.

2. Convenience Store Payment

If you opt for convenience store payments, you can use the information terminals installed in convenience stores to pay.

A ticket will be printed once you enter your payment number and phone number into the terminal. Take this ticket to the register to pay in cash.

Payment numbers are sent by e-mail when using your credit card. Information on your payment due date will also be included in the same e-mail. You will be responsible for completing your payment by that date.

Please be aware that once the payment due date passes, you cannot pay at a convenience store .

Convenience Stores with Payment Terminals

The convenience stores and terminals that support payments for Rakuten Card are listed below.

・ Lawson (Loppi) ・ FamilyMart (FamiPort) ・ MINISTOP (MINISTOP Loppi) ・ Seicomart (Club Station)

FamilyMart’s FamiPort is available in six languages: Japanese, Chinese, English, Korean, Portuguese, and Russian.

Conviniently make payments in your native language! Easy Online Application! Apply for a Rakuten Card (Japanese)

What to Do if You Lose Your Card?

It's important to know beforehand how to handle a lost credit card.

If your card is lost or stolen, please contact the designated phone line for lost or stolen cards to freeze your card . Contact Rakuten as soon as your card is missing to prevent any unauthorized usage.

The dedicated numbers for lost or stolen cards are listed below.

Domestic: 0120-86-6910 (24-hour reception) International: 81-92-474-9256 (24-hour reception)

If you are calling from overseas, a collect call can be made at the front desk of your hotel.

The process to reissue a new card is done via Rakuten e-NAVI. A new card generally takes between a week and ten days to be delivered to your registered address.

How to Cancel Rakuten Card

If you want to cancel your credit card, you must request a cancellation . Canceling a Rakuten Card is a simple procedure, so you won’t be hassled when you’re in a rush to fly home.

Contact the Rakuten Card customer call center with your credit card on hand. Simply tell a representative that you wish to cancel your card.

The customer call center numbers are listed below.

Domestic: 0570-66-6910 (Weekends and holidays included, 9:30-17:30) International: 81-92-474-6287 (Weekends and holidays included, 9:30-17:30)

English support is available around the clock, whether you’re in Japan or overseas. After contacting the call center, an English-speaking representative will return your call to assist you.

If you wish to cancel a Rakuten Premium Card or Rakuten Gold Card, then call the number printed on the back of your card (9:30-17:30).

Utilizing the Rakuten Card in Japan

On the fence about which credit card to apply for in Japan? Then consider choosing the Rakuten Card! It offers many services, including English support for inquiries and payments that can be made at convenience stores without a bank account.

Make your life in Japan more convenient by applying for the user-friendly Rakuten Card.

Getting A Credit Card In Japan: Guide And Foreigner-Friendly Suggestions

Rakuten Credit Card: How to Apply and Advantages

All Photos by Pixta

Related topics

Top articles.

Start planning your trip

Special Features

Popular Searches

Latest news.

Discover Kyoto's Elegant Geisha Culture at the Gion Kagai Art Museum

Showa Kinen Park Flower Festival 2024: Enjoy Nemophila, Tulips, and More!

A Must for Nature Lovers! Win a Free Stay at Unzen Amakusa National Park

A World of Light and Color! Van Gogh Alive in Japan 2024

Cherry Blossom Light-up in Tokyo! Yomiuri Land's Jewellumination

Japan's Public Holidays and Long Weekends in 2024

Aeon Mall Okinawa Rycom: A Shopping Mall Featuring a Resort Aura

Suica and Pasmo IC Cards: Prepaid Transportation Passes in Japan

Riding Taxis in Japan: The 6 Best Apps to Grab a Cab

How to Travel to Kyoto From Osaka: The Fastest and Cheapest Ways

New articles.

Torii (Shrine Gates) - Japanese Encyclopedia

Hiroshima: Year-Round Weather and What to Wear

The Only Way to Guarantee Great Photos at Shibuya Sky: Photography Plans by Capture My Japan

2024 is the Year of the Dragon. 10 Best "Dragon in the Chozuya" Shrines to Enjoy at the Shrines of Okayama

Umbrella Sky Events Near Tokyo: 4 Enchanting Installations in 2024

JavaScriptが無効の為、一部のコンテンツをご利用いただけません。JavaScriptの設定を有効にしてからご利用いただきますようお願いいたします。( 設定方法 )

- 楽天グループサービス一覧

よく検索されるキーワード

- カード申し込み・発行状況

- 楽天e-NAVIにログイン

年会費 11,000 円 (税込み)

楽天プレミアムカードの基本情報

ご利用における注意事項 こちらをクリックして必ずご確認ください.

- カード利用獲得ポイントの還元率が異なる ご利用先を見る

- 楽天ETCカードの詳細を見る

特典(期間限定ポイント含む)進呈には上限や条件があります。詳細は以下をご覧ください。

- 楽天市場ご利用分、楽天カード通常分、楽天カード特典分を合算したものとなります。 楽天市場ご利用分:商品ごとのお買い物金額(税抜き・クーポン利用後)100円につき1ポイント(通常ポイント)となります。 楽天カード通常分:楽天市場でのカードご利用額100円につき1ポイント(通常ポイント)となります。 楽天カード特典分:楽天市場でのカードご利用額(消費税・送料・ラッピング料除く)100円につき1ポイント(期間限定ポイント)となります。獲得ポイントには上限があります(楽天プレミアムカード・楽天ビジネスカード:5,000ポイント、その他のカード:1,000ポイント)

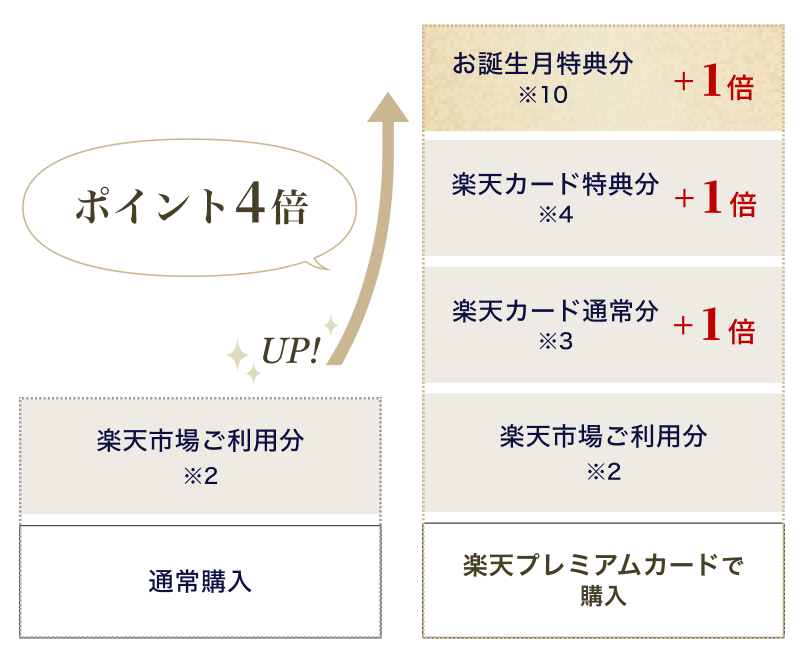

- お誕生月サービスは、楽天市場・楽天ブックスでの楽天ゴールドカード・楽天プレミアムカードご利用額100円につき1ポイント(通常ポイント)となります。獲得ポイントには上限があります(楽天ゴールドカード:月間2,000ポイント、楽天プレミアムカード:月間10,000ポイント)。

- 楽天市場コースを選んでいる場合に対象となります。楽天市場コース特典分は、楽天市場でのカードご利用額100円につき1ポイント(通常ポイント)となります。獲得ポイントには上限があります(月間10,000ポイント)。

- 楽天証券の楽天カードクレジット決済での 投信積立の詳細を見る

- 普通預金の金利優遇の商品詳細を見る 楽天銀行での楽天カードご利用代金 引き落としを見る

- 楽天ペイの楽天カードからの チャージ払いの詳細を見る

- 国内空港ラウンジの詳細を見る

- 海外空港ラウンジの詳細を見る

- 2025年 1月 1日(水)以降利用は年間5回まで無料と変更になります。それに伴いサービス提供方法も変更となりますので詳細は2024年夏以降にご案内いたします。

- 手荷物宅配サービスの詳細を見る

- 海外旅行傷害保険の詳細を見る

- 国内旅行傷害保険の詳細を見る

一部ポイント還元の対象外となる場合がございます。

楽天カード特典分は、楽天市場で開催中のSPU(スーパーポイントアッププログラム)の特典となります。特典進呈には上限や条件がございます。

楽天 プレミアムカードの 魅力

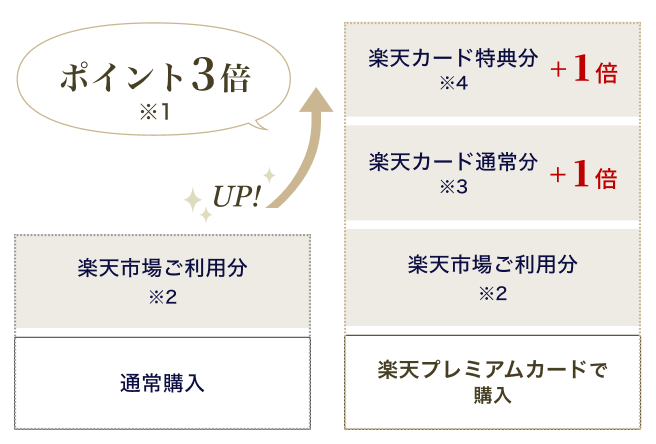

お得な ポイントサービス, 1 楽天市場のお買い物がお得に.

楽天プレミアムカードをお持ちの方は、楽天市場でお得にお買い物いただけます。

2 選べる 3 つのコース

楽天プレミアムカードをお持ちの方に、優待サービスをご用意しております。ご自身のライフスタイルに合わせてコースを1つお選びください。

お買い物でポイントを 貯めたい方におすすめ

毎週火曜日・木曜日のプレミアムカードデーに楽天市場でお買い物をするとポイント 最大4倍

旅行や出張にいくことが 多い方におすすめ

楽天プレミアムカードで楽天トラベルの決済をするとポイント 最大3倍

さらに海外旅行の際に便利な手荷物宅配サービスをご利用いただけます。

休日は家で映画や音楽を 楽しみたい方におすすめ

楽天プレミアムカードでRakuten TVまたは楽天ブックスの決済をするとポイント 最大3倍

楽天プレミアムカードをお持ちの方は、お誕生月に楽天市場・楽天ブックスをさらにお得にご利用いただけます。

4 楽天証券の還元率アップ

楽天プレミアムカードをお持ちの方は、 楽天証券で投信積立クレジット決済を行うと、ポイント還元率がアップします。

※ 代行手数料年率0.4%(税込み)未満の銘柄の場合

※ 楽天証券のページに遷移します

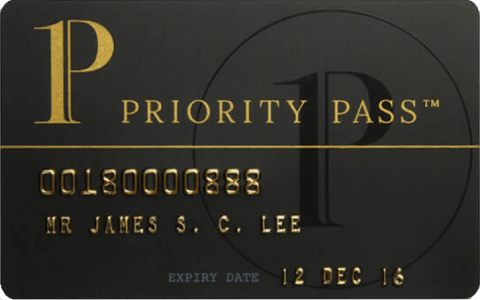

楽天プレミアムカード会員ご本人様は、プライオリティ・パス会員カードの発行を無料でお申し込みいただけます。

プライオリティ・パスは、楽天プレミアムカード到着後、別途お申し込みが必要となります。楽天カード会員様専用オンラインサービス「楽天e-NAVI」よりお申し込みください。同伴者様もご利用される場合は別途料金がかかります。同伴者様のご利用があった場合、後日楽天プレミアムカード会員ご本人様に同伴者料金としてお1人様1回につき3,300円(税込み)をご請求させていただきます。

プライオリティ・パス会員は、世界148カ国にある1,300カ所以上の空港ラウンジを無料でご利用いただけます。※2023年4月時点 会員制の落ち着いたラウンジにて、搭乗までの時間をストレス無く、有意義にお過ごしください。

※2025年1月1日(水)以降のご利用は年間5回まで無料と変更になります。それに伴いサービス提供方法も変更となりますので詳細は2024年夏以降にご案内いたします。

楽天プレミアムカードと当日航空券(もしくは半券)をご提示いただくと楽天プレミアムカード会員様は対象の国内空港ラウンジを無料でご利用いただけます。 急な出張も安心、くつろぎのひとときをお過ごしください。

3 楽天カード トラベルデスク

記憶に残る、少し贅沢な旅のお手伝いをします。 ニューヨーク・ホノルル・パリ・上海など世界44拠点(2023年10月1日時点)の現地デスクがお客様の旅をサポートいたします。

パスポート・カードの紛失や盗難、病気やケガなど

都市・観光情報など様々な情報のご紹介

レストラン・オプショナルツアーのご予約など

楽天プレミアムカードには、3種類の保険が自動的に付帯されております。 備えられる安心、守られている余裕。行き届いたサポート体制で、楽天プレミアムカード会員様のカードライフを支えます。

傷害死亡・後遺障害保険金最高5,000万円を補償。 ケガや病気、あるいは携行品の破損等、海外旅行における不慮の事故に対応します。

国内旅行中の事故や、ホテル・旅館内での火災事故等に対して傷害死亡・後遺障害保険金最高5,000万円まで補償いたします。

楽天プレミアムカードでご購入の商品(1個1万円以上)が購入日より90日以内に偶然な事故(破損、盗難、火災等)により損害を被った場合、最高300万円まで補償いたします。

引受保険会社:楽天損害保険株式会社

お客様が安心・快適にご利用いただくために、様々なサービスをご用意いたしております。

カード利用お知らせメール

メールでご利用状況をいち早くご案内。不正利用の早期発見につながります。

24時間体制で不審なカード利用を監視・検知しています。

ネットショッピングにおける「なりすまし」などの被害を未然に防ぎます。

カード紛失・盗難時における不正利用の損害金額を補償します。

楽天カードをお持ちでない方は新しく楽天プレミアムカードをお申し込みいただけます。

新規入会&利用で 5,000 ポイント

ポイント(期間限定ポイント含む)の進呈には条件がございます。

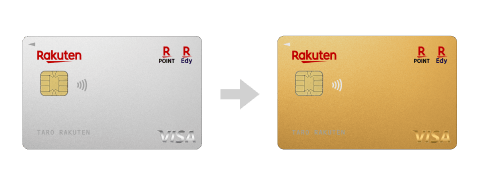

すでに楽天カードをお持ちの方は、 お持ちの楽天カードから切り替えで楽天プレミアムカードをお申し込みいただけます。

楽天プレミアムカードへ切り替えで 3,000 ポイント

2枚目のカードのお申し込み

すでに楽天カードをお持ちの方は、 お手持ちのカードに加えて2枚目に楽天プレミアムカードをお申し込みいただけます。

2枚目に楽天プレミアムカードを作成で 3,000 ポイント

ポイント未利用時の倍率です。

楽天市場ご利用分は、商品ごとのお買い物金額(税抜き・クーポン利用後)100円につき1ポイント(通常ポイント)となります。

楽天カード通常分は、楽天市場でのカードご利用額100円につき1ポイント(通常ポイント)となります。

楽天カード特典分は、楽天市場でのカードご利用額(消費税・送料・ラッピング料除く)100円につき1ポイント(期間限定ポイント)となります。

楽天カードご利用通常ポイントおよび楽天カードご利用特典ポイントはカード決済分のお買い物のみがポイントアップ対象となります。 「楽天市場ご利用分」「楽天カード特典分」は、楽天市場で開催中のSPU(スーパーポイントアッププログラム)の特典となります。特典(期間限定ポイント含む)進呈には上限や条件があります。

楽天市場コース特典分は、楽天市場でのカードご利用額100円につき1ポイント(通常ポイント)となります。獲得ポイントには上限があります(月間10,000ポイント)。

楽天トラベルご利用分は、楽天トラベルよりポイント進呈されます。詳細は楽天トラベルのホームページよりご確認ください。

トラベルコース特典分は、楽天トラベルでの楽天プレミアムカードでのオンライン決済が必要となります。獲得ポイントには上限があります(月間10,000ポイント)。

Rakuten TV or 楽天ブックスご利用分は、Rakuten TV・楽天ブックスよりポイント進呈されます。詳細は各ホームページよりご確認ください。

エンタメコース特典分は、Rakuten TVもしくは楽天ブックスでのカードご利用額100円につき1ポイント(通常ポイント)となります。獲得ポイントには上限があります(月間10,000ポイント)。

お誕生月サービスは、楽天市場・楽天ブックスでの楽天プレミアムカードご利用額100円につき1ポイント(通常ポイント)となります。獲得ポイントには上限があります(月間10,000ポイント)。

楽天市場ご利用分 ※2

楽天カード通常分 ※3

楽天カード特典分 ※4

市場コース特典分 ※5

楽天トラベルご利用分 ※6

トラベルコース特典分 ※7

Rakuten TV or 楽天ブックスご利用分 ※8

エンタメコース特典分 ※9

Popular among foreigners! Explanation of types of Rakuten Credit Cards, how to make one, and tips for screening.

- Lifestyle Support

- Financial Services and Mobile Communications

The Rakuten Credit Card is a very popular credit card among Japanese and non-Japanese alike. Issued by the Internet giant Rakuten, the credit card is easy to apply for online and has a reputation for a relatively smooth application process.

In this article, we will explain why Rakuten Credit Cards are so popular and introduce three attractive features of Rakuten Credit Cards. We also provide a comparison of the eight different Rakuten credit cards and tips on how to pass the screening process.

For foreign residents in Japan, it is very important to make good use of credit cards to improve their quality of life. Please read this article to find the best Rakuten credit card for you.

▼ Goandup Picks Click here for recommended articles!

- This page introduces services for foreigners who wish to study in Japan or improve their Japanese language skills to learn Japanese online.

- We introduce an online community where foreigners living in Japan can exchange information and interact with each other to support their life in Japan.

- This section introduces study abroad support services that provide comprehensive support to foreigners who wish to study in Japan, from preparation for study abroad to living in Japan.

- How to purchase a prepaid SIM and suitable SIM cards for foreigners.

- We introduce how to select and recommend pocket Wi-Fi products that can be used conveniently in Japan.

- This site provides foreigners who want to work in Japan with comprehensive information on how to find a job, recommended job sites, and other information necessary to find a job.

【 Three Reasons for the Popularity of the 】 Rakuten Credit Card

The Rakuten Credit Card is attractive because you can apply online, receive your card quickly, and earn free Rakuten points.

1. you can apply online

Rakuten Credit Card can be applied for online, so it is easy for foreigners who are not fluent in Japanese to apply. Another convenient feature of the online application is that you do not need a stamp.

2. fast delivery of cards

It takes about one week to receive your Rakuten Credit Card after you have applied for it. It usually takes about two weeks to receive the credit card, so the time required to receive the credit card is quite short.

3. free award Rakuten points will be given

When you apply for Rakuten Credit Card, you will receive 5000 free Rakuten points. It is recommended to check the official website regularly, as campaigns sometimes increase the number of points to 8,000 points, for example.

【8 types of 】 recommended Rakuten credit cards

There are many types of Rakuten credit cards, so you may be wondering which one you should choose. Here we will explain the main Rakuten Credit Cards.

1. Rakuten Card

Rakuten Card is the most orthodox card and is easy to use for everyone. It is recommended for all foreigners.

To learn more about Rakuten Card and apply for a card, please contact us. click here Oh my god!!!

2. Rakuten PINK Card

Rakuten PINK Card is a credit card for women and is recommended for female foreigners. If you enter the customized service for 330 yen per month, you can use coupons and insurance services for women.

To learn more about Rakuten PINK Card and apply for it click here Oh my god!!!

3. Rakuten Gold Card

Rakuten Gold Card is a credit card ranked higher than Rakuten Card. It is recommended for foreigners who frequently fly or drive, as it offers free use of airport lounges twice a year and no annual fee for the ETC card.

To learn more about Rakuten Gold Card and apply for it click here Oh my god!!!

4. Rakuten Premium Card

Rakuten Premium Card is a credit card ranked higher than Gold Card. It is recommended for foreigners who travel frequently, as it offers free airport lounge access and travel accident insurance.

To learn more about Rakuten Premium Card and apply for it click here Oh my god!!!

5. Rakuten Bank Card

Rakuten Bank Card is a Rakuten Card that can also be used as a Rakuten Bank cash card. It is recommended for foreigners who have an account with Rakuten Bank.

To learn more about Rakuten Bank Card and to apply click here Oh my god!!!

6. Rakuten ANA Mileage Club Card

Rakuten ANA Mileage Club Card is a credit card for frequent ANA flyers, allowing you to earn ANA miles and eliminating the need to check-in at the airport counter.

To learn more about Rakuten ANA Mileage Club Card and apply for the card click here Oh my god!!!

7. Rakuten Card Academy

Rakuten Card Academy is a student-only credit card recommended for international students. It is convenient because it automatically switches to the regular Rakuten Card when you graduate from school.

To learn more about Rakuten Card Academy and to apply click here Oh my god!!!

8. alpen group Rakuten Card

Alpen Group Rakuten Card is a credit card affiliated with Alpen Group, a famous sporting goods company. It is recommended for foreigners who love sports, as it offers benefits such as Alpen points.

To learn more about the Alpen Group Rakuten Card and apply for it click here Oh my god!!!

Comparison chart of cards by type

How to make and apply for rakuten credit card.

To apply for Rakuten Credit Card, access the application page on Rakuten's website, enter the required information, and complete the identification verification process.

Foreign residents will always be asked to identify themselves, so be sure to have your residence card or other identification ready. You must also identify yourself to the delivery person when you receive your card.

How to apply for Rakuten Credit Card

- Access Rakuten's application page

- Select a card type

- Enter your address and other personal information

- Enter your income and workplace information.

- Choose to add Rakuten Edy

- Enter your bank account

- Identification.

- Awaiting Review

- Receive a card

4 tips to pass the Rakuten Credit Card screening

There are a few tips to keep in mind to pass the Rakuten Credit Card screening.

1. longer period of stay is more advantageous

You can apply for a visa if your period of stay is at least 3 months, but those who stay longer are more likely to be screened. It is important to apply when you have some leeway in your period of stay.

2. it is more advantageous not to have a cash advance

It is easier to pass without a cash advance because it requires a review of income and other factors.

3.JCB is said to have a strict screening process.

You can choose from VISA, Mastercard, American Express, and JCB (depending on the type of card), but JCB is a Japanese brand and is said to have a tougher screening process. If you have no particular preference, it is safe to avoid JCB.

4. do not apply for more than one card at the same time

If you apply for several cards besides Rakuten at the same time, you may be considered suspicious and fail the screening process. Card companies share information, so you cannot apply for cards from other companies without Rakuten's knowledge.

Useful information and support for living in Japan

Living in Japan is fascinating, but it is not uncommon to face many challenges due to language barriers and cultural differences. For example, you may encounter difficulties in all aspects of life, from using keigo (honorific expressions) in everyday and business situations, to difficulties in finding housing, using public services, preparing for the JLPT exam, and even meeting new friends and loved ones.

At such times, Goandup Salon will be your reliable partner!

Our community provides support and information to help foreign residents in Japan to make their life in Japan richer and more comfortable.

- Japanese Language Study will meet the needs of all levels, from daily conversation to the use of keigo in business situations, to efficient Japanese language learning methods and preparation for the JLPT exam.

- living aspect of the program provides concrete advice and information on how to establish a foundation for living in Japan, including explanations of Japanese culture and rules, finding housing, and how to contract public services and living infrastructure.

- Jobs & Careers Regarding the "what if" section, we can help you find a job, change jobs, and understand Japanese business etiquette and workplace culture, which are key to a successful career in the workplace.

- Travel & Dining Guide will introduce you to hidden gems in Japan, must-try gourmet information, and other unique local attractions to help you experience Japan more deeply.

If you have any questions or concerns about life in Japan, Goandup Salon is here to help you! We will wholeheartedly support you to make your life in Japan smoother and more enjoyable.

For more information, click here ▼

Goandup Salon" community for foreigners living in Japan

The Rakuten Credit Card is easy to apply for online, easy to get approved, and offers many great benefits. By making good use of your Rakuten Card, you can make your life in Japan more convenient and affluent. You can also find the best card that suits your lifestyle from the eight types introduced here.

If you don't have Rakuten Card yet, why don't you take this opportunity to apply for it? Why don't you start a comfortable credit life with Rakuten Card?

Finally, we have prepared an article with information on how foreigners can make good use of credit cards in Japan.

◆ Five Japanese credit cards for foreigners! And tips on how to pass the screening process. ◆ How can foreigners get a credit card in Japan? ◆ How to make it easier for foreigners to get credit cards in Japan ◆ The Complete Guide to Japanese Debit Cards for Foreigners!

These articles provide detailed information on recommended credit cards other than Rakuten Card, the procedures for foreigners to obtain a card, and tips to make it easier to pass the screening process. We also provide information on convenient debit cards for foreigners who have difficulty in getting a credit card, so please check them out.

Credit and debit cards are strong allies for foreigners during their stay in Japan. Please refer to these articles to make your life in Japan comfortable and fulfilling.

We, "Goandup", will continue to promote the charm of Japan to the world.

If you found this article useful or enjoyable in any way, we would appreciate your support to fund our operations., we would appreciate donations of any amount via the paypal link below. ▶️ paypal.me/goandup, related articles.

Introducing Japanese unlimited data SIM cards recommended for foreigners!

5 recommended share houses for foreigners in Sapporo, Hokkaido!

- Housing Search and Real Estate Information

No worries for foreigners! 20 English-speaking dentists in Tokyo's 23 wards

- Public Services and Living Infrastructure

How to rent an apartment in Tokyo for foreigners! Includes rent rates!

Explanation of the process and fees when a visa consultant is hired to apply for a visa.

- Visa and Residency Guide

Summary of how foreigners can obtain a "Volunteer Visa" to stay in Japan

martin-dm/ Getty Images

Advertiser Disclosure

Best credit cards for travel insurance

From trip cancellation to baggage delay and rental car protection, these cards have you covered

Published: August 17, 2022

Author: Aaron Broverman

Author: Lee Huffman

Editor: Brady Porche

How we Choose

The best credit cards for travel insurance offer valuable travel benefits that protect you when problems happen on your trip. Your ideal card should include a generous welcome bonus, strong earning power and attractive benefits that you’ll actually use.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

Over the last year, travel has had its share of challenges. And, that’s especially true for airline travel, which has been plagued with delays and cancellations due to a perfect storm of increased demand, problems with staffing and other challenges.

When you fly, these types of interruptions can derail your entire vacation, making for a frustrating experience. But the good news is that there are credit cards that offer travel protections to cover expenses when your flight is delayed, interrupted or canceled. They may even cover certain expenses if your checked bag is lost or damaged. These perks can be pretty useful if you’re a regular traveler.

To help you get started, here’s a look at the best credit cards for travel insurance based on the features that are most important to you, as well as tips on how to choose the perfect option for your travel and spending style.

Chase Sapphire Reserve: Best travel insurance coverage amounts

Travel benefits rundown : Auto rental collision damage waiver; baggage delay insurance; emergency evacuation and transportation services; lost luggage reimbursement; roadside assistance; travel accident insurance; travel and emergency assistance services; trip cancellation/interruption insurance; trip delay reimbursement

Why we picked it : The Chase Sapphire Reserve card offers some of the top coverage amounts among travel credit cards. Your trip is covered against cancellation or interruption up to $10,000 per person and $20,000 per trip, and when your trip is delayed more than six hours, you and your family are covered up to $500 per ticket. And in terms of baggage, you’ll receive lost baggage reimbursement of up to $3,000 per passenger per trip, even when your luggage is damaged, and baggage delay insurance for delays of more than six hours (up to $100 a day for five days).

The Reserve also offers emergency evacuation and transportation services for up to $100,000 if you or a member of your immediate family becomes sick or injured, as well as travel accident insurance of up to $1,000,000. And when you rent a car, you’ll receive primary rental car insurance for up to $75,000 against theft or damage to the vehicle.

- Generous travel protections

- $300 annual travel credit

- Priority Pass Select airport lounge access

- Up to $100 in credits toward Global Entry or TSA PreCheck

- $550 annual fee

- Lower sign-up bonus compared to similar premium cards (60,000 points when you spend $4,000 in your first three months)

Who should apply : If you’re a frequent traveler, can deal with the $550 annual fee and want access to a variety of solid travel insurances, this card is hard to beat. Plus, you’ll get stellar rewards rates on travel through Chase Ultimate Rewards as well as on general travel purchases. For a full list of perks, be sure to read through our Chase Sapphire Reserve card benefits guide .

Who should skip : There are similar travel cards with slightly fewer offerings but much lower annual fees, such as the Sapphire Reserve’s sister card — the Chase Sapphire Preferred Card, highlighted below. If you don’t anticipate spending enough to offset the Reserve’s annual fee (or use enough of its added statement credits), you might look elsewhere.

Chase Sapphire Preferred: Best travel insurance coverage for a low annual fee

Travel benefits rundown : Auto rental collision damage waiver; baggage delay insurance; lost luggage reimbursement; roadside dispatch; travel accident insurance; travel and emergency assistance services; trip cancellation/interruption insurance; trip delay reimbursement

Why we picked it : At first glance, it appears that the Sapphire Reserve and Preferred offer the same travel insurance coverages (minus emergency evacuation and transportation, which is only offered by the Reserve). But where they differ is in timing and coverage amounts — through which the Reserve offers better coverage.

The Chase Sapphire Preferred Card charges one of the lowest annual fees ($95) of all the cards on this list, but you still receive some stellar travel insurance perks. The collision damage waiver for rental cars carries no country exclusion like many other credit cards (though you’ll receive coverage for up to the cash value of the vehicle), and you get many of the same benefits as the Sapphire Reserve.

Here’s a look at other travel insurance differences between the Preferred and Reserve:

- Travel accident insurance goes up $1,000,000 for the Reserve and up to $500,000 for the Preferred.

- Trip delay reimbursement starts at delays of six hours or more for the Reserve and 12 hours or more for the Preferred (or if an overnight stay is required). Both cards cover you and your family up to $500 per ticket for unreimbursed expenses.

- Roadside assistance with the Reserve covers you for up to $50 per incident four times a year, whereas you’ll need to pay for any services when using the Preferred’s Roadside Dispatch perk.

- Comparable travel insurance benefits without a large annual fee

- 80,000-point welcome bonus when you spend $4,000 in three months (for a reasonable annual fee)

- $50 annual statement credit when booking hotels through Chase

- 10 percent anniversary points bonus

- No airport lounge access or access to multiple travel-related statement credits

- Less elevated travel insurance perks compared to the Reserve

Who should apply : If you’re interested in a travel card with solid travel insurance benefits but can’t quite justify the Reserve’s high annual fee, you’ll do well with the Sapphire Preferred. Similarly, the card offers ongoing rewards on general travel and travel through Chase. For more information, you can read through our Chase Sapphire Preferred benefits guide .

Who should skip : The Sapphire Preferred is really only worth skipping if you’re looking for more elevated travel insurance perks, ongoing rewards or statement credits . Otherwise, it’s a great option.

The Platinum Card from American Express: Best range of travel insurance benefits

Travel benefits rundown : Travel assistance (including lost luggage reimbursement and legal assistance); travel inconvenience or delay insurance (including missed flights and luggage delays); trip cancellation and interruption insurance; travel accident insurance; car rental loss and damage insurance; various travel medical coverages (including emergency medical transportation, emergency medical services, emergency dental treatment and prescription expenses)

Why we picked it : The Platinum Card® from American Express comes with a pretty comprehensive travel insurance package if you can handle its hefty $695 annual fee. It also comes with many of the same travel insurance benefits as the rest of the American Express travel card slate, but its benefits , in particular, are so significant that they’re worth a spot on this list.

Enjoy travel assistance that includes help tracking down lost luggage and, in the event it’s not found, get reimbursed for up to $1,200 per trip. This coverage also includes up to $10,000 per trip for legal assistance. With travel inconvenience insurance — including missed departures, connections and luggage delays — get up to $250 per person for additional travel and food and up to $1,000 for baggage delays of four hours or more. Further, secondary trip cancellation and interruption insurance covers up to $10,000 per trip and $20,000 per year, travel accident insurance covers up to $500,000 and car rental loss and damage insurance covers up to the repair cost or value of the car.

To round out the Amex’s Platinum’s premium travel insurance benefits, in the event of an emergency, you’ll receive: $100,000 for medical transportation, $250,000 for medical services, $1,000 for dental treatment and $1,000 for prescriptions.

- Extensive list of travel insurance benefits and annual statement credits

- Global Lounge Collection access, including the Centurion Lounge, Delta Sky Clubs, Priority Pass Select lounges and more

- Exceptional 80,000-point welcome bonus when you spend $6,000 in your first six months

- Automatic hotel elite status

- Limited ongoing rewards categories if you spend quite a bit outside of travel

- Very high $695 annual fee

Who should apply : If you’re looking for the best of the best in terms of a travel rewards card, the Amex Platinum is hard to beat. Be sure, of course, that you can either afford to pay its high annual fee or would spend enough and use enough of its statement credits to offset the yearly cost. For more information on all that this premium American Express card has to offer, read our Amex Platinum benefits guide .

Who should skip : The Amex Platinum has a lot going on, and if you’re not interested in taking advantage of its many, many benefits (Global Entry or TSA PreCheck credit, Clear credit, hotel and airline credits, Uber, Walmart+, digital entertainment credits and more), you may be better off with a lower-fee travel card with slightly less robust travel insurance perks.

Capital One Venture X: Best for adding authorized users

Travel benefits rundown : Auto rental collision damage waiver; trip cancellation and interruption insurance; travel and emergency assistance services; trip delay reimbursement; travel accident insurance; lost luggage reimbursement

Why we picked it : With the Capital One Venture X Rewards Credit Card , you can add up to four authorized users at no additional charge. These authorized users have access to the same trip protections, lounge access and other benefits as the primary cardholder — making it our pick for the best option for authorized user access.

The Venture X offers numerous travel protections, including an auto rental collision damage waiver of up to the cash value of the car (or up to $75,000 for new cars), trip cancellation and interruption insurance of up to $2,000 per person, travel accident insurance of up to $1,000,000, lost luggage reimbursement of up to $3,000 per trip for common carrier tickets, trip delay reimbursement of up to $500 per ticket when a trip is delayed for six hours or more (or requires an overnight stay), and travel and emergency assistance services (though you’ll need to pay any associated fees out of pocket).

- Reasonable annual fee given its ongoing rewards, welcome bonus and statement credit opportunities

- Ability to add up to four authorized users at no cost

- 75,000-mile welcome bonus after spending $4,000 in your first three months

- Cellphone protection

- Travel bonus categories limited to the Capital One Travel portal

- Not as many travel-related statement credits compared to other premium travel cards

Who should apply : If you’re looking for a premium travel card with quality travel insurance benefits and a few statement credits, but without an incredibly high annual fee, the Venture X could be the right choice for you. Other Capital One Venture X benefits include an annual travel statement credit, a Global Entry or TSA PreCheck credit and access to Priority Pass and Capital One lounges.

Who should skip : If you aren’t keen on booking a majority of your travel through the Capital One portal, you may look elsewhere. This card offers 10X miles on hotel and rental cars booked through the portal, 5X miles on flights booked through the portal and just 2X miles on all other purchases.

Bank of America Premium Rewards: Best for large bank balances

Travel benefits rundown : Trip delay reimbursement; trip cancellation/interruption insurance; baggage delay insurance; lost luggage reimbursement; travel and emergency assistance services; emergency evacuation and transportation coverage; auto rental collision damage waiver; roadside dispatch

Why we picked it : Travelers who maintain large bank balances can earn up to 75 percent more rewards with the Bank of America® Premium Rewards® credit card thanks to Bank of America’s Preferred Rewards program. In addition to travel insurance protections, you’ll earn 2X points on travel and dining and 1.5X points on everything else. With the 75 percent maximum bonus, your earning power grows up to 3.5X and 2.625X, respectively.

In terms of travel insurance benefits, you’ll receive trip delay reimbursement of up to $500 per ticket when a trip is delayed for more than 12 hours, trip cancellation/interruption insurance of up to $2,500 for non-refundable tickets and baggage delay insurance of up to $100 per day for five days when baggage has been delayed for six or more hours. You’ll also get lost luggage reimbursement, travel and emergency assistance services, emergency evacuation and transportation coverage, an auto rental collision damage waiver and roadside dispatch, as noted above.

- Monthly bonus for large banking balances via the Preferred Rewards program

- Airline incidental and Global Entry or TSA PreCheck credits

- 50,000-point welcome bonus when you spend $3,000 in your first 90 days

- Relatively low $95 annual fee

- Requires larger deposit balances to get maximum value from Preferred Rewards program

- No airline or hotel transfer partners

- Lack of more premium travel benefits

Who should apply : If you’re already a Bank of America banking customer and are looking to boost your card’s rewards rates, owning the Bank of America Premium Rewards card is a great way to do so. Plus, you’ll get access to some pretty valuable travel insurance benefits. For more information, consider reading through our Bank of America Premium Rewards card benefits guide .

Who should skip : If you don’t carry at least a $20,000 balance within a Bank of America account, getting this card for the Preferred Rewards program points boost really isn’t worth it. Instead, consider looking toward the Sapphire Preferred, as it offers comparable travel insurance benefits, but with higher ongoing rewards rates and a bigger first-year bonus.

Comparing the best credit cards for travel insurance

Types of travel insurance coverage on credit cards.

Rewards credit cards offer valuable travel insurance protections that can help you save money and protect your travel plans. Benefits vary by card, but the most common types of credit card travel insurance benefits include:

- Trip cancellation/interruption insurance : This coverage reimburses travelers for prepaid, non-refundable travel expenses when a trip is canceled or cut short by sickness, severe weather or other covered situations.

- Trip delay reimbursement : When travel is delayed by a set number of hours or requires an overnight stay, trip delay reimbursement covers unreimbursed expenses. Qualifying expenses can include meals and lodging, for example.

- Lost luggage reimbursement : When your checked or carry-on luggage is damaged or lost by the airline, this coverage reimburses travelers for replacing clothing, toiletries, luggage and more.

- Auto rental collision damage waiver : This waiver protects the cardholder when the rental car is damaged or stolen. Coverage is primary or secondary, and it does not cover damage to other property or injuries to people inside or outside the vehicle.

- Emergency evacuation and transportation : If you or an immediate family member becomes injured or sick during a trip and requires emergency evacuation, this benefit covers medical expenses and transportation.

How to choose a credit card for travel insurance

With so many travel credit cards offering travel insurance benefits, some consumers may have difficulty picking the right one. Here are a few factors you should consider before applying:

- Travel protection limits. How much does the card reimburse or cover in case your travel plans are affected? And how many people are included?

- Travel protection exclusions. How long do you have to wait before the card’s benefits can be used?

- Welcome bonus. Does the card offer an attractive welcome bonus, and can you meet the minimum spending requirements within the allotted time frame?

- Earning power. Review the card’s ongoing rewards rates to determine if they align with how you spend.

- Other card perks. What other perks does the card offer beyond travel protections? If it offers statement credits or discounts that you likely won’t use, there’s likely a cheaper option for you.

- Annual fee. Are the card’s features, benefits and earning power worth the annual fee?

- Authorized users. Does the card allow authorized users — and if it does, how much does it cost to add them?

Bottom line

There are many credit cards that can cover you in the event your next trip gets pushed back or ruined altogether. While the best travel credit cards with travel insurance all offer similar protections, the benefits or terms vary by card.

Besides the travel protections offered, be sure to compare benefits, earning power and annual fees to find the card that best fits your lifestyle and travel plans.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Aaron Broverman has been covering personal finance for over a decade for Creditcards.com starting with its former sister site Creditcards.com Canada. His personal finance work has also appeared on Yahoo, Money Under 30 and Bankrate.

Lee Huffman spent 18 years as a financial planner and corporate finance manager before quitting his corporate job to write full time. He contributes to CreditCards.com and has been writing about early retirement, credit cards, travel, insurance and other personal finance topics since 2012. He enjoys showing people how to travel more, spend less and live better through the power of travel rewards.

On this page

- Types of travel insurance coverage

- Best travel insurance coverage amounts

- Best travel insurance coverage for a low annual fee

- Best range of travel insurance benefits

- Best for adding authorized users

- Best for large bank balances

- Comparing cards for travel insurance

- How to choose a card

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

Best business credit cards with a 0% intro APR

Plenty of business cards offer generous introductory APRs on new purchases, offering increased payment flexibility for small business owners. Here are some of our favorites.

Best travel credit cards for beginners

It’s a great time to plan your post-pandemic vacation and get your first travel credit card. But which card should it be?

Best credit cards for expedited airport security screening

Best flat-rate cash back credit cards

Best credit card combinations for everyday spending

Best credit cards for grocery shopping in 2023

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

- COLUMN ALL PLEASURE LIFE WORK VISA MANNER OTHERS SEMINAR TOPICS

[2022 Version] Rakuten Card Application Process

This post is also available in 日本語

Credit cards issued overseas cannot be used for settlement in Japan. Rakuten Card is a card issued in Japan. If you are over the age of 18 and resident in Japan, you can apply for a card even if you are a foreign national or foreign student. It is said that the screening is relatively easy to pass too. It is easy to collect points that can be used with the Rakuten Group, and the card is very popular with people living in Japan.

On this occasion, therefore, I shall introduce how to apply for and make a Rakuten card. Please read this in conjunction with previous articles on this topic.

Articles related to the Rakuten Card

- What is the “Rakuten Card” a popular credit card in Japan?

- Characteristics of the Rakuten Premium Card and Comparison with the Rakuten Card

- Which Rakuten Card is Better? Introduction and Recommendations

- Procedure for applying for and making a Rakuten Card

Flow from applying for the Rakuten Card to receiving rewards on joining

- Prepare information required in advance

- Applying from a PC or smartphone Once you pass the entry screening, your card shall be issued and sent to you

- Receive the card

- Receive entry rewards(new member rewards and rewards on usage).

Preparation for applying for the Rakuten card

Personal identification documents(residence card, special permanent resident certificate).

Confirm the below.

- Expiry date has not been exceeded

- Current address is registered

- Name described on the ID confirmation documents Unless you apply as described on this document, you may fail the screening

Japanese bank account information

A Japanese bank account opened by the applicant is required to register for an account from which the withdrawal can take place. Prepare your “cash card or bankbook” to confirm the account number and branch number.

Requires an email address that can be immediately verified and a phone number where person in question can be contacted.

Applying for the Rakuten card

Use your computer or smartphone to apply at the URL below. If you want to increase your credit limit, and are a working adult, we recommend applying for the Rakuten Premium Card. If you are a student, we recommend applying for the Rakuten Card Academy.

Rakuten Card

Points to note

- No. 1 in Customer Satisfaction for 13 consecutive years*2021 Japanese Customer Satisfaction Index Survey Credit Card Industry

- Shopping at Rakuten market gives three times the points reward!! * Privileges are subject to limits and conditions.

- Card with e-money “Edy” loaded

- Includes “Anshin” function to respond to problems

Campaign “New Member & Usage Points Present!”

Rakuten Premium Card

- Free Priority Pass with access to airport lounges throughout the world!

- Shopping at Rakuten market gives five times the points reward!!

- Automatically added overseas and domestic travel insurance!

- No Rakuten ETC card annual fees!

- Six times point return when shopping at Rakuten Market in your birthday month!

Rakuten Card Academy

- Able to use “Rakuten Gakuwari” (automatically applied for students until the age of 25)

- High level of point return when used for Rakuten Books or Rakuten Travel

- Usage limit of “Up to 300,000 yen” prevents overuse

- After graduation, you automatically switch to the “Rakuten card”

Below, we shall describe how you should apply if you are not a Rakuten member, using the “Rakuten Card” screen. (By becoming a Rakuten Member before applying, it becomes possible to save the information you entered during this process.)

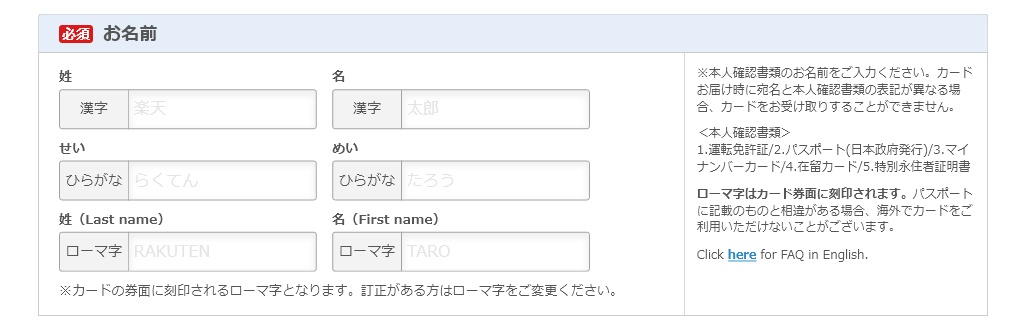

Enter basic information

Select the brand and card design you wish to use. The design you can select changes according to the brand you choose.

Enter your name. Enter the same information in Kanji as is found on your identification document. You may omit any middle names you have only if the name is too long to type. For hiragana, enter furigana in hiragana. Romaji is the notation that will be printed on the face of the card. If this matches the information on your passport, you can relax knowing that the card will be usable overseas.

Enter your gender/date of birth/telephone number 1/email address. The “mobile phone/smartphone” field in the e-mail address is the e-mail address issued by your mobile carrier. If you use a Google (@gmail.com) or Apple (@icloud.com) address, enter it in the email address field for the computer, even if you normally use that address on your cell phone or smartphone.

Answer the following items:

- Select whether or not you would like to receive notification messages from Rakuten Card and Rakuten Points Card。

- Address Make sure that you enter your current address in Japanese characters. If the characters do not fit, you should omit the apartment name rather than the room number.

- Family information Select your family structure

- Number of people in the household Select the number of persons living in the same household, whether living separately or together. (The person concerned is counted as one person.)

- Residential situation Reply regarding your status in the house you currently live in, that is whether you own, rent, or live in a dormitory.

- Years of residence

- Payment of housing loan or rent Select whether or not this applies not only to you or to the other people living in the same household as you as well.

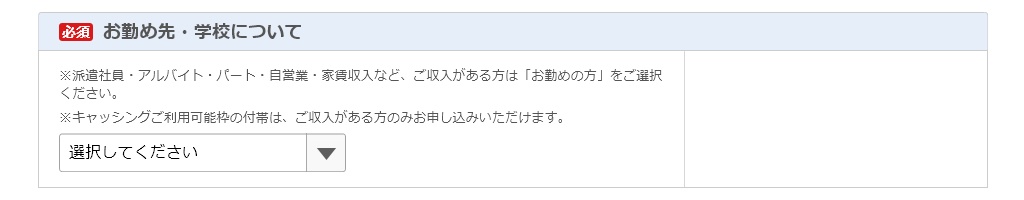

Enter your place of work or school.

If you have any income from any type of employment, such as full-time, temporary, or part-time, select “Employed” and enter your annual income including tax. Select “Student” in case of an international student. (Several questions may be added for this item, depending on the selections you make.)

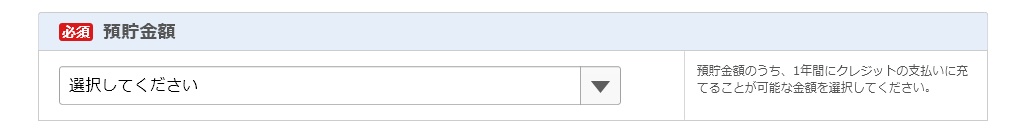

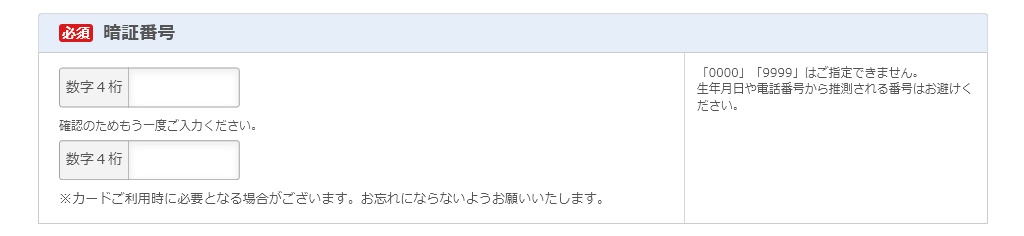

Enter the balance of your savings account. Honestly enter the amount of savings in the Japanese bank account that you have opened.。

Answer in regard to the following items.

- Billing address

- Purpose of use for the card after membership When used for regular shopping, you should choose “Use for regular shopping, etc.”

- Amount loaned from other companies Enter the amount honestly.

- Equipped with Edy function Prepaid electronic money functions are available free of charge, so you should apply for any you are interested in. You can also set the auto-charge feature.

- Notifications from Rakuten Edy

Enter the account from which to pay the amount used.

You can only register accounts with the name you use to apply for your card.

Set your pin code. Enter a 4-digit number you will not easily forget. You cannot enter “0000” or “9999”. Avoid using numbers that are easy to guess, such as date of birth or telephone number.

This completes the entry of basic information. Click the <Next> button and proceed to “Enter workplace information”.

Entering workplace information

If you select “Worker” in basic information

- Workplace name

- Name of prefecture where workplace located

- Workplace telephone number Do not enter your number, but rather enter a fixed telephone number for the workplace.

- Number of years worked

- Industry type

- Confirmation of driver’s license, etc.

If you select “Student” in basic information

- School or college name

Once you have entered the workplace information, click the “Next” button, and move to “Enter Rakuten member registration information”.

Enter Rakuten member registration information

The email address you entered in basic information shall become your Rakuten member user ID.

Set your Rakuten member password! Enter your desired string that is “6 characters or more” in “half-sized alphanumeric characters”.

Once you have set whether to receive Rakuten member news or not, you will need to confirm whether the displayed “Rakuten member registration information” is correct or not. The automatically displayed information is the information entered as basic information. If there are any mistakes, click the <Return to Basic Information Input>button, and correct your basic information.

If there is no problem, click the <Next> button and move to “Enter Rakuten Member Registration Information”.

Enter your payment account information.

Enter the account information for the financial institution selected in basic information.

- Name of financial institution

- Branch number

- Account number

Once you have finished inputting, click the <Confirm entered content> button. When the “Confirm Account Information” screen appears, check the information and, if everything is correct, click the “Apply to Financial Institution” button. You will be taken to the automatic account transfer application page on the financial institution’s website. (Please note that if you close the Rakuten Card site during the financial institution site procedure, or if the procedure takes too long, you will have to start over from the beginning.)

Family Card

Once you complete the card application, you can also choose a family card. If you want to use this, enter the names of family members in the application instead of your own.

Membership screening and card issue

Once all the information has been entered, you will receive a “Notification of Application Receipt” e-mail.

You can check the status of your membership screening and card issuance at the following URL Enter the “Card Application Receipt ID, your date of birth, and the last 4 digits of your phone number” in the body of the e-mail, and click the <Check Issuance Status> button. https://apply.card.rakuten.co.jp/status/input.xhtml

Receive your Rakuten card

If the membership screening is successful, the card will be issued and delivered in approximately one week.

The credit card will be delivered by mail requiring personal identification (specified matter transmission type) by Japan Post or by Sagawa Express with receiver confirmation support. Only the person who applied for the card can receive the card. When your card is delivered, be sure to check the “email just before delivery” that comes before it arrives.

When receiving, you must also present a photo identification document, so please have your Residence Card or Special Permanent Resident Certificate handy.

Receiving entry rewards (new entry rewards and card usage rewards)

When you receive your Rakuten Card, receive your reward points. You can use each point as 1 yen.

Entry rewards

You will receive these points when you apply for and join in Rakuten Card for the first time. These are normal points so there is no expiry date. Please note that to receive this service, you must register with Rakuten e-NAVI, the online service for Rakuten Card members only.

3,000 reward points for card usage

If you apply for Rakuten Card for the first time and meet the following two conditions after entry, you will automatically receive these points around the end of the following month. These are time-limited points so they have an expiration date. Be sure to use them before they expire!

- Using the card for the first time Use the card by the end of the month following the “date of application” for the card (not eligible for cash advances)

- Account Transfer Settings Complete the account transfer setup by the 25th of the second month following the “date of application” for the card.

Additionally, check the information on the website carefully, as brand campaigns may also be running.

Rakuten Card entry screening

To make the screening process as easy as possible, we have outlined the key points you need to know.

- Apply with the name described on your personal identification

- For “Purpose of use after entry,” select only “Use for everyday purchases, etc.

- Set cashing to 0 yen

- Do not apply for automatic revolving payment service

- If you fail the screening once, you can apply again after six months have passed Longer stays, more stable income, and longer periods of service are useful when applying.

If you have problems

If you face problems when applying, such as difficulties with the Japanese language screen, the process does not work properly, or you are unable to receive your card because you are not home, contact the contact center. An English-speaking representative will call you back.

【Contact Center】 Tel. 0570-66-6910 / 092-474-6287 (9:30-17:30) Press “0#” when you hear the voice guidance.

【FAQ in English】 https://support.rakuten-card.jp/category/show/531?site_domain=guest

Applying for a credit card can be hard work. If you are not fluent in Japanese, you may feel uneasy about the process. Rakuten Card, though, tends to be more accessible than other cards. There is also a contact center that provides assistance in English. If you need a card issued in Japan, you should definitely try applying.

- Advantages and Disadvantages of Making a Second Rakuten Card

- Types of Tea Often Drunk in Japan and Their Characteristics

- What is a yukata? Explanation of their features, how to wear them, and how they differ from a kimono

- Types of Sushi and Its History

- [Explained by a Legal Professional]Basics of Residence Cards

Related posts

Recent Posts

Living in JAPAN

RetireJapan

Personal Finance for Residents of Japan

Skip to content

- RetireJapan Board index Public Insurance

Travel insurance with a credit card

Post by Viralriver » Wed Aug 03, 2022 3:55 am

Re: Travel insurance with a credit card

Post by TokyoWart » Wed Aug 03, 2022 4:37 am

Post by captainspoke » Wed Aug 03, 2022 5:38 am

Viralriver wrote: ↑ Wed Aug 03, 2022 3:55 am ... she booked it using her credit card, I'm unsure of whether or not my credit card's travel insurance would cover me. ...

Post by zeroshiki » Wed Aug 03, 2022 7:22 am

Post by RetireJapan » Wed Aug 03, 2022 7:41 am

Post by adamu » Wed Aug 03, 2022 1:32 pm

Viralriver wrote: ↑ Wed Aug 03, 2022 3:55 am Rakuten premium card.

zeroshiki wrote: ↑ Wed Aug 03, 2022 7:22 am Rakuten Card is on-use

Post by goran » Wed Aug 03, 2022 11:39 pm

adamu wrote: ↑ Wed Aug 03, 2022 1:32 pm It's technically automatic, but with conditions. Note that premium has the ¥1 travel to airport option, the regular card requires you book via a travel agent . Yeah, I don't understand it either.

Post by TokyoBoglehead » Thu Aug 04, 2022 12:18 am

Return to “Insurance”

- ↳ General

- ↳ RetireJapan for Dummies

- ↳ Case Studies/Asking for Advice

- ↳ Spending and Frugality

- ↳ Stock market investing

- ↳ Legacy NISA (~2023)

- ↳ New NISA (2024~)

- ↳ iDeCo

- ↳ Banking

- ↳ Robo-advisors

- ↳ Real Estate

- ↳ Taxes

- ↳ Pension

- ↳ Inheritance/Estates

- ↳ Insurance

- ↳ RetireJapan

- ↳ Small Business/Self-employment

- ↳ Children/Family

- ↳ US citizens and green card holders

- ↳ Local groups and meetups

- ↳ Promo codes and affiliate links

- RetireJapan Board index

- All times are UTC

Powered by phpBB ® Forum Software © phpBB Limited

Privacy | Terms

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Faye Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be a worthwhile investment, especially if you’re worried about unexpected costs during your trip. There are a ton of different travel insurance companies out there, so finding one that suits your needs can be a struggle. That’s why we’ve done the work for you.

Let’s take a look at travel insurance provider Faye to see what type of plans the company offers, the coverage levels you can expect and whether Faye travel insurance is right for you.

About Faye travel insurance

Faye is the brand name for customizable travel protection plans offered by a company called Zenner Inc. Its website notes that it specializes in quick reimbursements, which can be a big draw for travelers. Policies issued by Faye are underwritten by the United States Fire Insurance Company.

» Learn more: How to pick between travel insurance providers

Faye insurance plans

Unlike many other travel insurance companies , Faye offers only one plan.

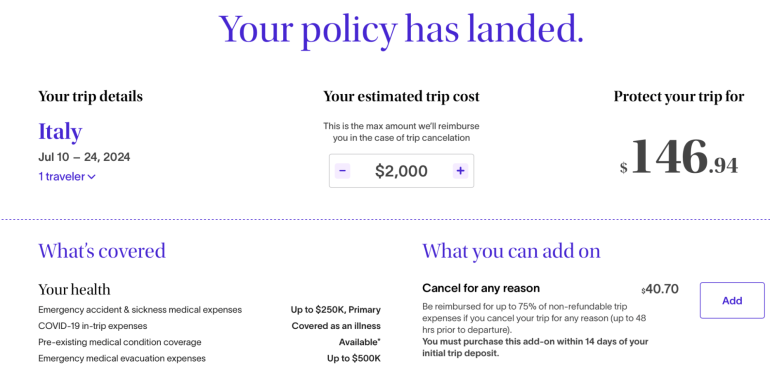

To find out what types of coverage Faye travel insurance plans include, we generated a quote for a 44-year-old woman from Arizona who was traveling to Italy for two weeks. Her total trip cost came in at $2,000.

Here’s what Faye provides:

This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis .

The plan is comprehensive and includes coverage you don’t typically see, such as reimbursement for lost credit cards and a payment for being inconvenienced.

Faye also offers a number of customizations; there are different add-ons from which to choose, all of which vary in price. More on your options in the next section.

» Learn more: How travel insurance for domestic vacations works

Plan add-ons

If you'd like to customize your Faye travel insurance plan to meet your needs more specifically, you can add on extra coverage for more money.

» Learn more: How does travel insurance work?

What isn’t covered by Faye

Even if you purchase a very comprehensive travel insurance policy, there are still situations where you’re not covered.

These include:

Bad weather, including hurricanes, if the policy was purchased after the storm was named.

Intentionally self-inflicted injuries or suicide.

Expenses incurred while under the influence of drugs or alcohol.

High-risk sports for which you are paid.

Psychological disorders, unless you’re hospitalized.

War and acts of war.

Illegal acts.

Piloting or learning to pilot or acting as crew of an aircraft.

To find the full list of exclusions for your specific policy, be sure to review your plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

How to choose a Faye plan online

Purchasing a Faye travel insurance plan online is simple. You’ll first want to head to the company’s website to generate a quote.

You’ll need to input information like your age, where you live, where you’re going and how long you’re going to be away. Once you’ve got that all entered in, you’ll be taken to the results page.

Here, you’ll be able to see what plan options you have available, as well as what add-ons there are to pick.

After you’ve selected the coverage you’d like, you’ll need to go through the online checkout process.

» Learn more: Is travel insurance worth it?

Which Faye plan is best for me?

Although Faye has just one base plan available for purchase, it has plenty of different add-ons from which to choose. Faye sorts its bundles and add-ons according to the trip you’re taking, so you may see your bundled offer vary from time to time.

For tentative plans . Choosing to add on a Cancel For Any Reason (CFAR) policy can provide peace of mind if your travel plans aren’t solid. With the ability to get up to 75% of your money back, you’ll just want to make sure you’re canceling at least 48 hours in advance.

For pet owners . Not many travel insurance companies include coverage for your pets , especially not when it comes to vet bills. With a low overall cost, this add-on can make a huge difference if you end up delayed on your return.

For those wanting to customize everything . Faye’s base plan allows customers to create tons of different customizations according to their travel needs. Even though it’s costly, it makes up for it with wholly comprehensive coverage.

Faye’s travel insurance offerings may suit your needs, but before purchasing a plan, take a look in your wallet. Many different travel credit cards offer complimentary travel insurance , which can include benefits such as trip cancellation reimbursement, rental car insurance and more.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Introduction to TravelSafe Travel Insurance

- Coverage Options

- Purchasing and Managing a Policy

- Customer Service and Support

Compare TravelSafe Travel Insurance

- Why You Should Trust Us

TravelSafe Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

TravelSafe Insurance is a travel insurance company owned by the Chester Perfetto Agency, which provides a wide array of travel insurance options such as health, life, and auto insurance. TravelSafe can cover longer trips than many of its competitors, but charges high rates. It's also known for its golf-specific coverage.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to 120 days' coverage available for travelers ages 79 and under (30 days for 80+)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $2,500 per person for missed connections over three hours or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay coverage of up to $150 per person per day kicks in after six hours or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Policy can be purchased by U.S. citizens living abroad

- con icon Two crossed lines that form an 'X'. Medical coverage ceiling of $100,000 may be low for some travelers' needs.

- con icon Two crossed lines that form an 'X'. Claims reviews from customers say performance is not always the best

- A well-rounded insurance plan for travelers who are concerned about missing connections for cruise-related travel

- Classic and Basic travel insurance plans

- GolfSafe travel insurance plans provide coverage for you and your equipment

- Travel medical insurance through partner Trawick International

Among the companies included in our guide on the best CFAR travel insurance , TravelSafe offers thick insulation against the unpredictability of travel. The trips that TravelSafe can insure are on the higher end of the industry, covering trips lasting up to 150 days and costing up to $100,000. TravelSafe's Classic plan also offers coverage for people who are up to 100 years old.

One standout feature of TravelSafe is that all of its plans offer primary coverage, so you can file immediately with TravelSafe instead of going through your health insurance provider first, even with TravelSafe's Basic plan. Many travel insurance companies only provide primary coverage with their higher-tiered plans.

That said, TravelSafe's Basic plan costs more than many travel insurance companies' most expensive plans. This brings up the issue of cost. While its plans are technically within the bounds of the average cost of travel insurance, TravelSafe certainly stretches those limits, and it's certainly more expensive than many of the best travel insurance companies.

Ultimately, TravelSafe is best for travelers taking an expensive trip who can afford expensive insurance.

Coverage Options from TravelSafe

TravelSafe has two main policies for those seeking travel insurance: travel insurance for stateside and international travelers and travel insurance for those who are planning golf trips. For each policy type, travelers can choose between classic and basic coverage. And golfers can choose between GolfSafe Secure and GolfSafe Secure Plus.

Here's how the three TravelSafe travel insurance plans stack up in terms of what's included and coverage limits:

TravelSafe also offers specific golf insurance plans, which is something incredibly unique among travel insurance companies. If you're an avid golfer, purchasing golfing insurance will cover things like lost holes, something regular travel insurance won't. TravelSafe's golf insurance plan benefits are as follows:

Additional coverage options from TravelSafe

TravelSafe offers several optional coverages for its travelers:

Rental car damage and theft coverage: Available for both Basic and Classic plans, this add-on covers up to $35,000 per covered vehicle.

Business and sports equipment rental: Also available for both TravelSafe plans, your rental equipment is covered for up to $1,000.

CFAR coverage: Only available for Classic+, you'll receive 75% of your nonrefundable trip costs. You must purchase your policy within 21 days of your initial trip deposit.

TravelSafe Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for TravelSafe plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate TravelSafe coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following travel insurance quotes:

- Basic: $112

- Classic: $147

- Classic (Plus): $274

Premiums for TravelSafe plans are between 3.7% and 9.1% of the trip's cost, within and above the average cost of travel insurance.

TravelSafe provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- Basic: $153

- Classic: $202

- Classic (Plus): $377

Once again, premiums for TravelSafe plans are between 3.8% and 6.3% of the trip's cost, within the expected range of travel insurance costs.

A Texas family consisting of two 40-year-old parents with a 10-year-old and 4-year-old on a two-week trip to Australia for $20,000:

- Basic: $512

- Classic: $676

- Classic (Plus): $1,616

TravelSafe plans cost between 2.6% and 8.1% of the trip's cost, below and within the average cost of travel insurance.

A 65-year-old couple looking to escape New Jersey for Mexico for two weeks with a trip cost of $6,000 would have the following quotes:

- Basic: $472

- Classic: $582

- Classic (Plus): $952