Cookies: We use cookies to improve your experience on this website. By continuing to browse our website, you are agreeing to use our site cookies. See our cookie policy for more information on cookies and how to manage them.

Privacy: You can see the full details of how we use your data in our Privacy Policy .

- TRAVEL INSURANCE

- CAR HIRE EXCESS INSURANCE

- PRE EXISTING MEDICAL CONDITIONS

- ANNUAL TRAVEL INSURANCE

- BACKPACKER TRAVEL INSURANCE

Flexible Travel Insurance from insurefor.com

During these unprecedented times, insurefor.com is creating policies to ensure they're flexible for their customers needs.

- - Medical Expenses Cover included for COVID19 while travelling

- - Now includes cover for travel where FCO advises against all but essential travel as a result of Coronavirus (COVID-19) for European Single Trip policies

- - Award winning customer service & flexible cover options

Join the 1,000's of people who protect themselves and trust insurefor.com with their travel every day

Established over 15 years ago, at insurefor.com we pride ourselves on providing great value, comprehensive insurance to all of our customers. We listen to your requirements and specialise in travel insurance plus medical cover and car hire excess insurance, so your travel plans are fully insured.

Flexible cover for our customers

As well as providing great value cover for our customers, we understand how important flexibility is in these unprecedented times. That's why we offer free amendments and a range of cover options to suit your plans.

An experienced insurer you can trust

insurefor.com is part of the ROCK Insurance Group, established in 2001. We're authorised and regulated by the Financial Conduct Authority. Over the past 18 years we have insured over 4.5 million people, received over 17,000 4 and 5 star reviews and won numerous awards for our customer service and claims experience.

Comprehensive protection

At insurefor.com we provide cover for the things that are important. This includes cover for Coronavirus (COVID-19) cover for cancellation before you travel and medical expenses and curtailment whilst you travel. Now includes cover for travel where FCO advises against all but essential travel as a result of Coronavirus (COVID-19) for European Single Trip policies.

Security and privacy

Your privacy is our priority, we work hard to make sure any information you give is kept secure.

With over 15 years’ specialist experience under our belts, insurefor.com provides a range of travel insurance for every kind of break imaginable, from business travellers to sun worshippers and even sports enthusiasts. Each policy can be tailored to add extras, such as winter sports insurance, which means that you don't pay for unnecessary cover if you don't need it, which helps to keep the costs down.

We offer you great quality UK, European and Worldwide cover, supported by great value family discounts.

And thanks to our exclusive gadget travel insurance, we can now provide cover for all those valuable things you like to take away with you, too. From mobile phones to mp3 players, games consoles for the kids to laptops and portable DVD players, you’d be surprised how the things we simply can’t live without these days soon add up.

Cheap Travel Insurance

Family is very important to us all, and we recognise that family holidays have the potential to be an expensive occasion. That is why our low cost family holiday insurance provides great cover for you and your loved ones.

insurefor.com's great value single trip travel insurance is perfect for a one-off trip, be it a city break, romantic getaway or a family holiday. With this insurance you have the freedom to specify where you are travelling, be it the UK, Europe or Australia. Our insurance gives you the flexibility to choose the number of days you will be on holiday up to a maximum of 365.

Our annual multi-trip travel insurance offers you year round cover at an affordable price, so you can go on as many trips as you wish with complete peace of mind. Our comprehensive cover offers many optional extras such as gadget cover or winter sports covering up to and including the age of 74.

We have introduced new Medical Screening cover , so if you have any pre-existing medical conditions, you can travel with peace of mind knowing that you really do have the right protection whilst on holiday. The process is quick, simple and within a matter of minutes provides you with a comprehensive quote.

For those individuals whose preferred travelling companion is their iPad or laptop, insurefor.com also provides optional extras to ensure a favourite gadget is also looked after whilst away from home. If however you are looking for specific insurance for your gadgets, try our sister website - www.gadgetbuddy.com where you can cover everything from mobile phones to ipads and sat-navs.

Our Cruise travel insurance ensures that you are covered for your cruise, whether you’re exploring the amazing fjords of Norway or adventuring around the Caribbean. Our policies cover you whilst you’re on board the ship, when enjoying activities and if you venture ashore during the course of your cruise.

At insurefor.com, our Winter Sports travel insurance provides you with complete cover on the slopes. Our policies provide protection for skiing and snowboarding, both on and off (guided) piste and a huge range of other winter sports activities. We offer insurance that gives you total peace of mind, covering not only you and your family, but also your equipment, giving you the freedom to relax and enjoy your holiday.

Cheap holiday insurance

At insurefor we understand that insurance is not something you want to have to spend a long time thinking about so we make it as easy for you as possible whilst driving costs down, the perfect combination to provide true peace of mind for a memorable holiday.

We cover those over the age of 65. Our Single Trip policies cover up to and including 84, and our Annual Multi-trip policies cover up to and including 74.

Please see our FAQ's

insurefor.com is a trading style of ROCK Insurance Services Limited who is authorised and regulated by the Financial Conduct Authority (FCA number 300317). Policies are underwritten by Euroins AD.

Suggested companies

Insurefor.com, staysure travel insurance.

ROCK Insurance Group Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.5.

17,075 total

Most relevant

Excellent Service no inconvenience to me

Was admitted in to hospital with a severe chest infection on my second day in Cyprus. Rock Insurance were amazing all the insurance for my hospital stay and aftercare was all sorted out without any problems. Will definitely used them again. Thank you 😊

Date of experience : 09 May 2024

Straight Forward

Always use rock, as unfortunately around 6 years ago, my wife fell ill abroad with Pneumonia and couldn't fly on return date. Everything was taken care of for a straight forward return home ☆☆☆☆☆

Date of experience : 08 January 2024

Finally found a reasonable one!

After two days of checking numerous companies and comparing prices I chose ROCK because they covered all the conditions I required and were still the cheapest. I don't know how this works but it suits me. I have not has to make any claim. and hope not to but so far would recommend

Date of experience : 16 January 2024

Additional cover

Easy process to add in details and wasn't over priced like some insurance companies. Had a problem initially trying to print off but this was quickly resolved. Would use them again.

Date of experience : 01 May 2024

Quick prompt action

Having had an unfortunate accident on holiday I was treated in a clinic on site at the hotel. The cost of which was around £4000 which I had to pay up front. On my return to the UK I contacted Rock Insurance and was treated most sympathetically by the advisor who led me through the claim procedure and put my mind at ease. There were no problems with the claim and I received a full refund minus the excess. I will certainly renew the policy when it comes due.

Date of experience : 05 January 2024

Such a user friendly form for booking a…

Such a user friendly form for booking a years travel insurance with this company. A really decent price too, especially for an older person

Date of experience : 11 January 2024

Purchased travel insurance with…

Purchased travel insurance with InsureFor.com We booked through compare the market and found the policy that suited our needs. Easy to book and fortunately we didn’t need to make a claim

Date of experience : 15 January 2024

Really easy and straight forward…

Really easy and straight forward despite me have a number of medical issues. Price was good for the cover given

Date of experience : 18 April 2024

We have purchased our travel …

We have purchased our travel insurance with you for years no complaints and will continue to use you again

Date of experience : 07 January 2024

All seems good

Booking via Compare the Market was very easy, and Rock Insurance seemed to be the best value. It's quite hard to comment further as the trip went okay with no issues so had no reason to contact the company, and therefore don't have any info other than making the actual booking.

Quick and easy

Quick and easy, and travel insurance through Tesco went we got our travel money a bit cheaper too! Ideal. Only thing it’s limited coverage, so for example they don’t cover water sports. But still good anyway.

All Good for what we want!

Competitively priced for what we want. Easy process to finalise our requirements. Good all round.

Quick and easy to deal with spoke to a…

Quick and easy to deal with spoke to a real person who listened to what I had to say and understood quick settlement

Date of experience : 09 January 2024

Nopes nopes nopes

Nopes nopes nopes, Quick edit, got a phone call today to confince me to change the review while not willing to look into my case. When I said, I won't do anything about the review if nobdy looks into the case she said "I will leave a reply on your review" hope she does... As its great we can edit our reviews. After editing my review, she calles again... This time she was annoyed and spoke in a "teachers voice". As long as my case isn't dealt with in the proper way and you speak with some respect I won't change my extreme negative review.

Reply from ROCK Insurance Group

Dear customer, Thank you for your review, I am sorry you are unhappy with your recent encounter with Staysure. I did call you today to discuss your review but you were unwilling to discuss it with me. As you have provided no details regarding your issue and you were not willing to speak with me I am unable to assist you at this time. Once again, please accept my sincere apologies for the inconvenience and any frustration caused. Kind Regards Michelle EDIT - I called today to discuss the review and to get more information from you in order for me to look into it but you were not willing to speak with me. I was not trying to get you to change your review.

Quick easy good value for money

Quick easy good value for money. Did not need to use so cannot comment on service if needed on medical emergency

Very reasonable cost and…

Very reasonable cost and straightforward to set up. Thankfully we didn't need to make any form of claim so difficult to comment on quality of cover/claims handling.

Date of experience : 12 January 2024

Competitive price and easy to discuss nuances and renew policy with human being over telephone.

Competitive price and easy to discuss nuances by telephone and complete renewal this way rather than online. Would have given 5 stars if it was not for a glitch in payment a few days after renewal which meant having to resubmit payment details.

Date of experience : 11 December 2023

didn’t use the insurance so can only review how easy it was to find the website

Well I didn’t use the insurance on holiday i travel a lot and have never used my insurance it’s mainly just peace of mind so what can I say it was easy to find after browsing for the best prices thats it

We had medicines and medical conditions…

We had medicines and medical conditions to add to our travel insurance, but, everything went through with no issues. We have not been away yet so cannot speak about anything else.

Date of experience : 10 January 2024

Staff at the call center were very…

Staff at the call center were very helpful and sorted details of insurance cover out for us. We would use Rock insurance again.

- Policy documentation

- More Insurance

Annual insurance

Whether you’re into romantic weekend breaks in or you're a busy globe-trotting professional, our annual travel insurance allows you the flexibility to jet off whenever it suits you.

Cheap backpacker insurance is a vital part of your trip. Keep costs down, without cutting corners on your cover.

If you’re a regular on the slopes, you’ll need single trip or annual winter sport travel insurance.

Golf clubs, bags, fees – all covered in a click with our cheap golf holiday insurance.

If you’re a business traveller, you’ll want to make sure unforeseen problems cause the minimum of fuss.

- del.icio.us

- StumbleUpon

Suggested companies

Insurefor.com, staysure travel insurance.

ROCK Insurance Group Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.5.

17,075 total

Most relevant

Excellent Service no inconvenience to me

Was admitted in to hospital with a severe chest infection on my second day in Cyprus. Rock Insurance were amazing all the insurance for my hospital stay and aftercare was all sorted out without any problems. Will definitely used them again. Thank you 😊

Date of experience : May 09, 2024

Straight Forward

Always use rock, as unfortunately around 6 years ago, my wife fell ill abroad with Pneumonia and couldn't fly on return date. Everything was taken care of for a straight forward return home ☆☆☆☆☆

Date of experience : January 08, 2024

Finally found a reasonable one!

After two days of checking numerous companies and comparing prices I chose ROCK because they covered all the conditions I required and were still the cheapest. I don't know how this works but it suits me. I have not has to make any claim. and hope not to but so far would recommend

Date of experience : January 16, 2024

Additional cover

Easy process to add in details and wasn't over priced like some insurance companies. Had a problem initially trying to print off but this was quickly resolved. Would use them again.

Date of experience : May 01, 2024

Quick prompt action

Having had an unfortunate accident on holiday I was treated in a clinic on site at the hotel. The cost of which was around £4000 which I had to pay up front. On my return to the UK I contacted Rock Insurance and was treated most sympathetically by the advisor who led me through the claim procedure and put my mind at ease. There were no problems with the claim and I received a full refund minus the excess. I will certainly renew the policy when it comes due.

Date of experience : January 05, 2024

Such a user friendly form for booking a…

Such a user friendly form for booking a years travel insurance with this company. A really decent price too, especially for an older person

Date of experience : January 11, 2024

Purchased travel insurance with…

Purchased travel insurance with InsureFor.com We booked through compare the market and found the policy that suited our needs. Easy to book and fortunately we didn’t need to make a claim

Date of experience : January 15, 2024

Really easy and straight forward…

Really easy and straight forward despite me have a number of medical issues. Price was good for the cover given

Date of experience : April 18, 2024

We have purchased our travel …

We have purchased our travel insurance with you for years no complaints and will continue to use you again

Date of experience : January 07, 2024

All seems good

Booking via Compare the Market was very easy, and Rock Insurance seemed to be the best value. It's quite hard to comment further as the trip went okay with no issues so had no reason to contact the company, and therefore don't have any info other than making the actual booking.

Quick and easy

Quick and easy, and travel insurance through Tesco went we got our travel money a bit cheaper too! Ideal. Only thing it’s limited coverage, so for example they don’t cover water sports. But still good anyway.

All Good for what we want!

Competitively priced for what we want. Easy process to finalise our requirements. Good all round.

Quick and easy to deal with spoke to a…

Quick and easy to deal with spoke to a real person who listened to what I had to say and understood quick settlement

Date of experience : January 09, 2024

Nopes nopes nopes

Nopes nopes nopes, Quick edit, got a phone call today to confince me to change the review while not willing to look into my case. When I said, I won't do anything about the review if nobdy looks into the case she said "I will leave a reply on your review" hope she does... As its great we can edit our reviews. After editing my review, she calles again... This time she was annoyed and spoke in a "teachers voice". As long as my case isn't dealt with in the proper way and you speak with some respect I won't change my extreme negative review.

Reply from ROCK Insurance Group

Dear customer, Thank you for your review, I am sorry you are unhappy with your recent encounter with Staysure. I did call you today to discuss your review but you were unwilling to discuss it with me. As you have provided no details regarding your issue and you were not willing to speak with me I am unable to assist you at this time. Once again, please accept my sincere apologies for the inconvenience and any frustration caused. Kind Regards Michelle EDIT - I called today to discuss the review and to get more information from you in order for me to look into it but you were not willing to speak with me. I was not trying to get you to change your review.

Quick easy good value for money

Quick easy good value for money. Did not need to use so cannot comment on service if needed on medical emergency

Very reasonable cost and…

Very reasonable cost and straightforward to set up. Thankfully we didn't need to make any form of claim so difficult to comment on quality of cover/claims handling.

Date of experience : January 12, 2024

Competitive price and easy to discuss nuances and renew policy with human being over telephone.

Competitive price and easy to discuss nuances by telephone and complete renewal this way rather than online. Would have given 5 stars if it was not for a glitch in payment a few days after renewal which meant having to resubmit payment details.

Date of experience : December 11, 2023

didn’t use the insurance so can only review how easy it was to find the website

Well I didn’t use the insurance on holiday i travel a lot and have never used my insurance it’s mainly just peace of mind so what can I say it was easy to find after browsing for the best prices thats it

We had medicines and medical conditions…

We had medicines and medical conditions to add to our travel insurance, but, everything went through with no issues. We have not been away yet so cannot speak about anything else.

Date of experience : January 10, 2024

Staff at the call center were very…

Staff at the call center were very helpful and sorted details of insurance cover out for us. We would use Rock insurance again.

You are using an outdated browser. Please upgrade your browser to improve your experience.

No results found

Try adjusting your search to see more results.

If you are unsure whether this review should be removed, please see our policy on reporting reviews .

A company can partner with Smart Money People and invite their verified customers to leave a review. When they do this it’s labelled as "Verified source" on the Smart Money People website.

There are a number of automated invitation techniques available to businesses. All of which are trusted and ensure that only verified customers can leave reviews through them.

ROCK Insurance: Travel Insurance reviews

No new 5 star reviews, 100% increase in 1 star reviews, latest highest rating:.

Latest lowest rating:

About the Travel Insurance

Our ROCK Insurance Travel Insurance reviews can help you to find out what life as a ROCK Insurance customer is really like. And if you have experience of using this product, why not write your review on Smart Money People today?

Review ROCK Insurance: Travel Insurance now

Rock insurance travel insurance reviews ( 9 ), could not extend travel insurance, my experience with rock travel insurance as axa partner.

decent cover for holidays

Showing 4 of 9

Do you have a different ROCK Insurance product?

There's still more to see!

Join smart money people.

Keep up to date on ratings of your favourite businesses. Find out about our awards and write new reviews with ease

News, guides and insight from our team

Looking back at the Building Societies Annual Conference 2024

Is the industry ready for the final Consumer Duty deadline?

British bank awards winners 2024

.png)

Savings accounts: Are you losing out by being loyal?

Travel Insurance

Compare our holiday cover for your next big adventure. Discount available for Clubcard members.

Learn more about our policies and get a quote to cover you for things like medical expenses, cancelling or cutting your trip short and baggage or valuables.

Tesco Bank Travel Insurance is arranged and administered by Rock Insurance Services Limited and underwritten by Inter Partner Assistance S.A.

Travel Insurance you can trust

- Choose from Economy or our 5 Star Defaqto rated Standard and Premier cover Single and Annual Multi Trip policies. Choose from Economy or our 5 Star Defaqto rated Standard and Premier cover Single and Annual Multi Trip policies.

- Cover for medical expenses and 24/7 Emergency Medical Assistance is provided with all our cover levels. Monetary limits, excesses and exclusions apply. Cover for medical expenses and 24/7 Emergency Medical Assistance is provided with all our cover levels. Monetary limits, excesses and exclusions apply.

Standard and Premier cover

Types of trip cover

Single trip.

Only plan on one holiday in the next 12 months? Buy cover for the length of your trip only and have protection from cancellation from the moment you buy.

Annual Multi Trip

If you plan on taking two or more trips in the next 12 months, Annual Multi Trip cover can offer greater convenience than Single Trip cover.

Designed for longer trips abroad up to 18 months, often to multiple countries. You may find this type of cover is right for you if you’re planning a gap year or career break.

The power to get holiday cover for less

Clubcard members get a 10% discount when you buy direct. Discount doesn’t apply to Later Life cover or add-ons. Just enter your Clubcard number when you get your quote.

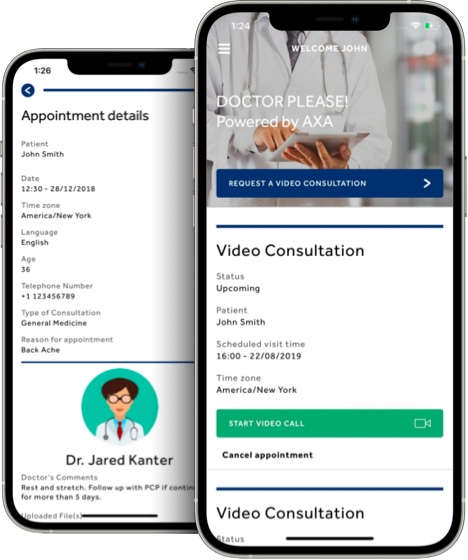

Get access to a doctor virtually

Available with our Single Trip and Annual Multi Trip policies, choose Premier cover and you'll have access to an English speaking GP on the phone or via an app. This comes as standard for our Backpacker and Later Life products.

COVID-19 cover includes

- If you have to cancel or cut short your trip as a result of contracting COVID-19. If you have to cancel or cut short your trip as a result of contracting COVID-19.

- Medical treatment if you contract COVID-19 abroad. Medical treatment if you contract COVID-19 abroad.

- If you’ve got to return home early because the region you’re in goes into lockdown. If you’ve got to return home early because the region you’re in goes into lockdown.

Remember to check the latest Foreign, Commonwealth & Development Office (FCDO) and local authorities travel advice before you go. We don't include cover for cancellation where the FCDO or local authorities advise against travel. For full details of the COVID-19 cover provided on our policies take a look at the policy booklets . Monetary limits, excesses and exclusions apply.

Quick answers to common questions

Getting set up

Just applied for Travel Insurance? Here's what you might need to get started.

Managing your policy

Some of our commonly asked questions about Travel Insurance.

Something's not right

Not sure about something on your policy? We're here to help.

Getting started with holiday cover

Travel insurance glossary and jargon buster

Do I need travel insurance?

What it covers and why it might be handy to have it

What type of travel insurance should I get?

Some key things you might need to know when picking a policy

Help for existing customers

If you’re an existing customer you can find information, ways to get in touch with us or start a claim here.

Important information

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

If you purchased or renewed your Travel Insurance policy on or after 13 December 2023, your policy documents are below.

If you purchased or renewed your Travel Insurance policy before 13 December 2023, your policy documents are below.

The Insurance Product Information Documents summarise the key features, benefits and exclusions of cover.

The Insurance Product Information Documents summarise the key features, benefits and exclusions of our additional cover.

Gadget Cover Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

Car Hire Document

How we collect and use your personal data.

Tesco Personal Finance PLC (trading as Tesco Bank) acts as an intermediary for this policy. Tesco Bank Travel Insurance is arranged and administered by Rock Insurance Services Limited and underwritten by Inter Partner Assistance S.A. Gadget Cover is underwritten by AmTrust Europe Limited (AmTrust). You can find out more about how ROCK will process and share your data in their Privacy Notice.

ROCK will share some of your information with Tesco Bank as set out in their privacy notice and you can find out more about how Tesco Bank will then process that data in our Privacy Policy .

ROCK will also share data with IPA UK so that they can underwrite your policy and if you make a claim. You can find out more about how IPA UK will process your data in the ‘Data Protection Notice and Fraud’ section of the Policy Wording document and by visiting the AXA Assistance website and AmTrust Europe website.

Find the Best Travel Insurance & Avoid Costly Surprises

- 22 Top-Rated Providers

- Side-by-Side Comparison

- 3 Million+ Travelers Insured

Standard Single Trip Policies

- The most popular and comprehensive travel insurance plan

- Covers cancellations, medical emergencies, delays, and luggage

- Protection from the time you purchase to the date you return

Annual / Multi Trip Policies

- Cost-effective option for travelers taking multiple trips a year

- Includes common medical, delay, and luggage benefits

- May require add-ons from trip cancellation or interruption

Cruise Insurance Policies

- Offers comprehensive trip protection on land and at sea

- Includes high travel medical insurance coverage limits

- Protects against hurricanes, inclement weather, and more

Adventure & Sports Policies

- Essential for travelers partaking in high-risk activities

- Provides protection for lost or delayed sports equipment

- Strong coverage for cancellations and medical emergencies

Compare and Save in Minutes

Whether you’re heading abroad or staying local, we make it easy to find the best travel insurance plan for your next adventure. No bias. No hidden fees. Just the best trip protection quotes from the country’s leading providers.

Tell us some basic information about your next trip. We’ll use these details to help narrow your search and show the plans that best fit your needs.

Easily see how plans from the best travel insurance providers compete on cost and coverage. Use filters and sort results to uncover the right plan for you.

Get peace of mind at the lowest possible price. We partner with leading providers to offer you the best policies at the best value, guaranteed.

Why Trust Squaremouth?

When selecting a travel insurance provider, it's crucial to compare options. Obtain quotes from three to five insurers to ensure the best coverage and value. While it may seem time-consuming, this process can result in significant savings.

That's why we're here – over the past two decades, our industry-leading comparison engine has helped millions of travelers find highly-rated insurance plans and protect their trip expenses.

Our industry-leading comparison platform , enriched by customer reviews, displays unbiased results based on your specific trip details. If you run into any trouble, our multi-award-winning customer service team is just a phone call away.

- Helped more than 3 million travelers

- 20+ years serving the travel community

- Intuitive & user-friendly comparison engine

- More plans and top-rated providers than the competition

- Prices are regulated by law; you won't find a lower price anywhere else

- Multi award-winning customer service team

- 140,000+ customer reviews

Save With Squaremouth

Squaremouth has helped more than 3 million travelers find the best policy for their trip.

Key Travel Insurance Benefits

Most trip insurance policies are comprehensive, including coverage for cancellations, medical emergencies, travel delays, and lost luggage, among other benefits.

What Coverage is the Most Important?

Squaremouth customer reviews.

More than 99% of customers would recommend Squaremouth to others. Read what a few of them had to say about their recent experience buying travel insurance.

Great Experience!

"The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others."

Savannah from NC 03/26/2024

Great Coverage and Price

"Getting a travel insurance quote online was easy. We have used Squaremouth before and have been pleased each time. It's peace of mind for our travel needs."

Rhonda from IN 03/20/2024

Easy to Use!

"I always use Squaremouth simply because it is so easy to use and offers plans that are affordable to me."

Emily from AZ 03/08/2024

Very pleased!

"They give great service, and the website is so easy to navigate to find just the right insurance plan. I always appreciate working with them."

Don from UT 03/07/2024

The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others.

Featured Articles

Our topic experts keep a constant pulse on the travel industry so we can provide the most current information and recommendations based on today's traveler needs.

What Type of Insurance Do I Need?

Plans can range in terms of cost and coverage, so it’s important to identify your specific needs before comparing options. Discover the different types of travel insurance policies you should consider for your upcoming trip.

How to Buy Travel Insurance on Squaremouth

If you’re new to Squaremouth, this quick guide can help you identify your needs, start your first quote, and compare your results. If you need additional help, our customer service team is just a phone call away.

Travel Insurance FAQs

Here are some of the most frequently asked questions from travelers like you.

Is Travel Insurance Mandatory for International Travel?

While rare, some countries or organized tours may require proof of travel insurance that lasts for the duration of your trip. Our Destination Center is a good starting point to learn about entry requirements and travel insurance recommendations.

While it is typically not mandatory, travelers should consider buying insurance if they want to protect themselves financially from unforeseen events that may impact their travel plans. Many Americans and U.S. residents purchase travel insurance when planning international or high cost trips. View our list of the top international travel insurance providers .

What Does Travel Insurance Cover?

Comprehensive travel insurance is designed to cover common disruptions that may impact a trip. Most policies will provide coverage for trip cancellations , medical emergencies , travel delays , missed connections , accidental death and dismemberment , and lost luggage . Travelers that experience financial loss as a result of a covered disruption may be eligible for reimbursement through their insurance policy.

How Much Does Travel Insurance Cost?

In general, a comprehensive policy with Trip Cancellation typically costs between 5% and 10% of the total trip cost. The cost of a policy depends on four primary factors: trip cost, traveler age, trip length, and coverage amounts. A policy without an insured trip cost will be significantly less expensive. We recommend comparing plans from multiple providers to find the best priced plan for your trip.

What Should I Look for When Comparing Travel Insurance?

There’s no one-size-fits-all policy when it comes to travel insurance. When comparing plans, you should consider the following:

- Benefits: Travel insurance benefits outline what situations are covered under each plan. Make sure each plan you’re considering includes coverage for what’s important to you.

- Coverage Limits: Plans will set limits to how much reimbursement you’re eligible for, and can vary significantly. Higher coverage limits can result in less out of pocket expenses in the event of a claim.

- Exclusions: Travel insurance companies will list specific activities, equipment, and scenarios that are not covered by their plans in the event of a claim.

- Premium: Higher priced insurance products do not always equate to better coverage. We recommend choosing the most affordable plan that offers the travel protection you need.

- Provider Reputation: All providers on Squaremouth have been carefully vetted and offer 24-Hour Assistance services. Customers are also encouraged to share honest reviews about their experience before, during, and after their trips.

Does Travel Medical Insurance Cover International Trips?

In many cases, primary health care plans, such as Medicare or a policy you have through your employer, are not accepted overseas. If you’re not covered, you may be responsible for unforeseen medical expenses if you get sick or injured while traveling.

To avoid out-of-pocket expenses if you need medical care in the event of an emergency, many travelers opt for travel medical insurance. These plans can cover the cost of treating unexpected medical conditions incurred during your international trip.

Are Pre-Existing Conditions Covered by Travel Insurance?

Coverage for pre-existing conditions varies among travel insurance policies. While many plans won’t offer coverage for existing injuries or illnesses, some plans may offer Pre-Existing Condition waivers if certain conditions are met, such as purchasing the policy within a specified time frame from booking the trip.

Will My Policy Cover Trip Cancellations?

Yes, many comprehensive travel insurance policies cover trip cancellations under specified circumstances, such as sudden illness, injury, or death of the insured or a family member, natural disasters, or unexpected work obligations. Most policies that include the Trip Cancellation benefit offer 100% reimbursement for all prepaid, non-refundable trip costs.

What’s the Difference Between Single-Trip and Annual Travel Insurance?

Single-trip travel insurance covers a specific journey for a set duration, offering protection for that trip only. This is the most popular type of travel insurance among Squaremouth users. In contrast, Annual Travel Insurance provides coverage for multiple trips within a year. Annual plans can be cost-effective for frequent travelers and less of a hassle than purchasing multiple single-trip plans.

What's the Process for Filing a Travel Insurance Claim?

To file a trip insurance claim, follow these steps:

- Contact your insurer: Notify them as soon as possible about the incident.

- Gather documentation: Collect relevant documents, such as police reports, medical records, or receipts for expenses incurred.

- Complete the claim form: Fill out the insurer's claim form with accurate details.

- Submit supporting documents: Attach all required documents to substantiate your claim.

- Keep records: Maintain copies of all submissions and correspondence for your records.

- Follow up: Stay in touch with the insurer for updates on your claim status.

- Be honest and thorough: Provide clear and truthful information to expedite the process.

Remember, the process may vary by insurer, so review your policy or contact your insurance provider for specific instructions. Learn more about what can be covered and how to file a travel insurance claim .

Where Can I Buy Travel Insurance?

Travelers can purchase travel insurance directly from providers, through a comparison site like Squaremouth, or directly through a travel supplier when booking. Credit cards and travel agents are other sources to consider. Travel insurance prices are regulated by law, meaning the price of one specific policy must be the same regardless of where it is sold, whether it’s purchased from Squaremouth or directly from the provider.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Faye Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be a worthwhile investment, especially if you’re worried about unexpected costs during your trip. There are a ton of different travel insurance companies out there, so finding one that suits your needs can be a struggle. That’s why we’ve done the work for you.

Let’s take a look at travel insurance provider Faye to see what type of plans the company offers, the coverage levels you can expect and whether Faye travel insurance is right for you.

About Faye travel insurance

Faye is the brand name for customizable travel protection plans offered by a company called Zenner Inc. Its website notes that it specializes in quick reimbursements, which can be a big draw for travelers. Policies issued by Faye are underwritten by the United States Fire Insurance Company.

» Learn more: How to pick between travel insurance providers

Faye insurance plans

Unlike many other travel insurance companies , Faye offers only one plan.

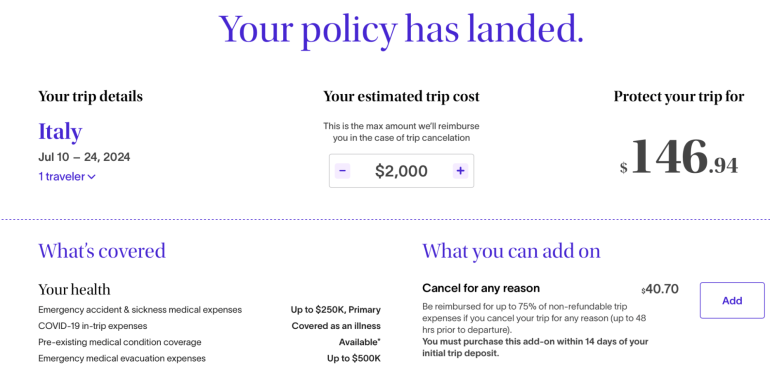

To find out what types of coverage Faye travel insurance plans include, we generated a quote for a 44-year-old woman from Arizona who was traveling to Italy for two weeks. Her total trip cost came in at $2,000.

Here’s what Faye provides:

This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis .

The plan is comprehensive and includes coverage you don’t typically see, such as reimbursement for lost credit cards and a payment for being inconvenienced.

Faye also offers a number of customizations; there are different add-ons from which to choose, all of which vary in price. More on your options in the next section.

» Learn more: How travel insurance for domestic vacations works

Plan add-ons

If you'd like to customize your Faye travel insurance plan to meet your needs more specifically, you can add on extra coverage for more money.

» Learn more: How does travel insurance work?

What isn’t covered by Faye

Even if you purchase a very comprehensive travel insurance policy, there are still situations where you’re not covered.

These include:

Bad weather, including hurricanes, if the policy was purchased after the storm was named.

Intentionally self-inflicted injuries or suicide.

Expenses incurred while under the influence of drugs or alcohol.

High-risk sports for which you are paid.

Psychological disorders, unless you’re hospitalized.

War and acts of war.

Illegal acts.

Piloting or learning to pilot or acting as crew of an aircraft.

To find the full list of exclusions for your specific policy, be sure to review your plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

How to choose a Faye plan online

Purchasing a Faye travel insurance plan online is simple. You’ll first want to head to the company’s website to generate a quote.

You’ll need to input information like your age, where you live, where you’re going and how long you’re going to be away. Once you’ve got that all entered in, you’ll be taken to the results page.

Here, you’ll be able to see what plan options you have available, as well as what add-ons there are to pick.

After you’ve selected the coverage you’d like, you’ll need to go through the online checkout process.

» Learn more: Is travel insurance worth it?

Which Faye plan is best for me?

Although Faye has just one base plan available for purchase, it has plenty of different add-ons from which to choose. Faye sorts its bundles and add-ons according to the trip you’re taking, so you may see your bundled offer vary from time to time.

For tentative plans . Choosing to add on a Cancel For Any Reason (CFAR) policy can provide peace of mind if your travel plans aren’t solid. With the ability to get up to 75% of your money back, you’ll just want to make sure you’re canceling at least 48 hours in advance.

For pet owners . Not many travel insurance companies include coverage for your pets , especially not when it comes to vet bills. With a low overall cost, this add-on can make a huge difference if you end up delayed on your return.

For those wanting to customize everything . Faye’s base plan allows customers to create tons of different customizations according to their travel needs. Even though it’s costly, it makes up for it with wholly comprehensive coverage.

Faye’s travel insurance offerings may suit your needs, but before purchasing a plan, take a look in your wallet. Many different travel credit cards offer complimentary travel insurance , which can include benefits such as trip cancellation reimbursement, rental car insurance and more.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Six Travel Mistakes to Avoid

No travel medical insurance? Unnecessary luggage and hotel fees? Here are the biggest travel mistakes people make and how you can avoid them.

- Newsletter sign up Newsletter

Even the most seasoned tourists can make travel mistakes when planning a vacation. Some blunders can be minor infractions, but others can cost travelers a lot of money and heartache.

But there are steps you can take to avoid travel mistakes. Here are six slip ups that travelers may make this year, plus tips on how to avoid them.

1. Overlooking travel medical insurance

Christopher Elliott , a consumer advocate and founder of the nonprofit Elliott Advocacy , says many people don’t consider purchasing travel medical insurance . “People often think nothing bad will happen before or on their vacation, but then they get injured overseas and need to go to the hospital, and the next thing they’re looking at is a $10,000 hospital bill.” Indeed, nearly one in four Americans report they’ve experienced a medical issue while traveling abroad, according to a 2023 survey sponsored by GeoBlue, an international health insurance company.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Unfortunately, most U.S. healthcare plans — including employer group plans, Medicare and Affordable Care Act plans — offer limited or no medical coverage outside the U.S.

How to avoid: One solution is to purchase a travel medical insurance policy, a type of insurance that provides coverage for a range of medical emergencies while traveling abroad, from minor injuries to major events like heart attacks and strokes, to medical evacuation and emergency transport in the case of severe emergencies.

The average travel medical insurance plan costs $89, according to Squaremouth , a travel insurance comparison website. Squaremouth advises international travelers to obtain a policy that provides a minimum of $50,000 in emergency medical coverage and at least $100,000 in medical evacuation coverage.

Note: Some travel insurance policies include emergency medical coverage and medical evacuation coverage up to certain limits.

2. Getting hit with unnecessary luggage fees

You may have heard that a number of airlines — including American Airlines , Delta , and JetBlue Airways — recently raised their prices for checked bags. But one thing a lot of travelers aren’t aware of, Elliott says, is that some are now charging customers more if they check a bag at the airport versus paying to check a bag in advance. For instance, JetBlue customers flying within the U.S., Latin America, the Caribbean and Canada can save up to $20 on their first two checked bags ($10 savings per bag) when they add them to their flight reservation at least 24 hours before departure.

How to avoid: Make sure to pay ahead of time for any bags that you plan to check.

3. Incurring hidden hotel fees

Wi-Fi fees, early check-in fees, gym fees—hotels today charge guests no shortage of extra fees and surcharges . It’s a widespread problem: In an April 2023 survey by Consumer Reports , nearly four out of 10 (37%) U.S. adults said they had experienced a hidden or unexpected hotel fee in the previous two years.

How to avoid: Many hotels offer to reduce or, in some cases, waive certain fees to guests who join their loyalty program, which is free in most cases. Also, sometimes simply asking an employee at check-in to waive certain fees could do the trick.

4. Not utilizing a key search feature on Airbnb

Like hotels, Airbnb rental property owners often tack on extra fees, such as cleaning fees, fees for additional guests beyond a certain number, and service fees. These additional costs can add hundreds of dollars to your bill.

How to avoid: Elliott praised Airbnb for introducing a feature in December 2022 that allows guests to view a stay’s total costs, before taxes, when searching for rental properties. But he says there’s a caveat: “If you’re in the U.S., you need to change a setting in order to see the full rate when you search for rentals.”

To enable the feature, click the slider on the upper right of the search page that says, “Display total before taxes.”

5. Paying full price for a rental car

First, the good news: “The rental vehicle shortage has improved,” Elliott says. That’s resulted in a stabilization of rates, with rental car prices recently averaging $42 a day, up only 3% from last year, according to a report from the travel search company Hopper. The bad news? Renting a car is still more expensive than it was before the pandemic, especially for travelers who pay full freight.

How to avoid: There are several ways you can avoid paying full price. Big-box stores such as Costco , BJ’s and Sam’s Club provide their members discounts on certain rental cars. AARP and AAA also offer their members discounted rates. ( AARP members save up to 30% on base rates at Avis and Budget Rent A Car; AAA members save up to 20% on Hertz rentals). In addition, a number of credit card companies offer certain cardholders rental car discounts when they book a vehicle from specific rental car companies.

You may also be able to nab a lower rate by prepaying when you book a reservation. And, some rental car companies offer limited-mileage plans at a lower cost, which could be a good option if you’re planning to take just a short trip.

Tip: See if your credit card offers rental car insurance before you pay for insurance from a rental car company.

6. Encountering sky-high hotel rates because of Taylor Swift’s European tour

When Taylor Swift performs a concert, sometimes tens of thousands of out-of-town fans descend on the city, causing hotel prices to spike. Consider: the median rate for a standard hotel room during an Eras Tour date in Europe this year is projected to jump by 44%, with average hotel room prices in Warsaw surging a staggering 154% during her tour date there, according to a recent study by Lighthouse , a travel and hospitality research company.

How to avoid: The simplest approach for Europe-bound travelers in 2024, Elliott says, is to avoid traveling to a destination during a Taylor Swift tour date in that city. “When Taylor Swift comes to town all of the hotels sell out, and it becomes very difficult to find a reasonably priced hotel,” he says.

Related Content

- 24 Best Travel Websites to Find Deals and Save You Money

- Five Ways to a Cheap Last-Minute Vacation

- Best Travel Rewards Cards May 2024

To continue reading this article please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Daniel Bortz is a freelance writer based in Arlington, Va. His work has been published by The New York Times, The Washington Post, Consumer Reports, Newsweek, and Money magazine, among others.

Social Security just expanded access to Supplemental Security Income (SSI) benefits and reduced the administrative burden for low-income households.

By Erin Bendig Published 14 May 24

To plan smart for retirement, estimate your Social Security benefits years before you'll need the money. Here's how to do it.

By Kathryn Pomroy Published 14 May 24

Starbucks is offering exclusive in-app offers every Monday and Friday in May.

By Donna LeValley Published 13 May 24

Everest, Inc. author Will Cockrell discusses why high-net-worth people flock to climb Mount Everest.

By Alexandra Svokos Published 11 May 24

A new poll shows a vast majority of Americans believe now is a bad time to buy a house, in the worst low in Gallup's history.

By Alexandra Svokos Published 10 May 24

Scammers are targeting college graduates with fake job ads, according to the FTC.

Shop early and honor mothers everywhere with great deals from Walmart, Amazon, Etsy, Applebee's, Pandora and oh, so many more.

By Kathryn Pomroy Published 9 May 24

Celebrate Teacher Appreciation Week through May 10 with deals from Scholastic, Microsoft, AT&T, Verizon and more.

A new Gallup poll shows Americans are still concerned about having enough money for retirement, but there are some changes from last year.

By Alexandra Svokos Last updated 6 May 24

Jobs Report Slower jobs growth and easing wage pressures are good news for rate cuts.

By Dan Burrows Published 3 May 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

FinanceBuzz

8 Reasons It’s Worth It To Buy Travel Insurance (And 6 Times To Skip It)

Posted: July 12, 2023 | Last updated: April 7, 2024

Life is full of unexpected events and complications, and that doesn’t stop just because you’re traveling. If anything, travel may have even more surprises than your day-to-day life at home.

Travel insurance can help you avoid wasting money if you have to cancel a trip due to illness, need medical coverage while you’re traveling, or send you home for medical reasons.

However, it may not always be necessary and can sometimes be a waste of money. Keep reading to learn when you should and shouldn’t opt for travel insurance.

Compare the best travel credit cards for nearly free travel

Safety net for international travel

The number one reason people buy travel insurance is to cover an expensive trip. And if you’re traveling overseas, chances are your travels will cost a lot of money.

In addition, there are potential complications when it comes to international travel, from losing luggage during connecting flights, missed or canceled flights, sickness, and more.

And if something catastrophic happens in a foreign country, travel insurance provides evacuation so you can get home safely.

Want to learn how to build wealth like the 1%? Sign up for Worthy to get ideas and advice delivered to your inbox.

Medical coverage

Getting sick or injured is unpleasant enough when you’re in the comfort of your home, but it’s a new beast entirely when you’re abroad.

Generally, you can expect basic medical expenses to be covered through your travel plan, often including dental. Medicare will not cover medical expenses in a foreign country. If you’re traveling overseas, travel insurance for potential medical costs is worthwhile.

Cover rental car mishaps

Renting a car is a great way to get around when traveling because you can explore a place on your own. Using taxis or ride-share services may cost more money. However, even the best drivers make mistakes, and no one can protect themselves from reckless drivers.

Your U.S. car insurance won’t cover you when driving in a foreign country. So choosing the car-rental insurance option when you buy travel insurance may be a good move.

Be aware that most travel insurance rental-car plans cover collisions and may not cover medical expenses, damages to other cars or property, or personal property damage or loss.

7 Nearly Secret Things to Do If You Fly Southwest

Pre-existing conditions often aren’t covered

Unfortunately, as with many health insurance plans, travel insurance often won’t cover pre-existing conditions. Travel health insurance is usually meant for unforeseen illnesses or injuries instead of complications due to an existing medical issue.

Even travel insurance companies that cover pre-existing issues often only cover physical maladies and exclude mental conditions and typical pregnancy-related symptoms and complications.

Protect lost luggage

A big fear for travelers is losing their luggage, either having it not arrive at the destination or stolen during their trip. Most airlines will offer reimbursement for luggage they lose, but it can take quite a while for this to process.

Travel insurance will cover the cost of replacing your clothing and other items while you wait for your luggage to be located and can also cover theft and damage.

Cover valuable items and gear

You should consider buying travel insurance if you’re traveling with valuables, including expensive jewelry, art, or even pricey sporting or adventure gear.

You’ll need to talk to the insurance agency specifically about covering your valuables, as they may need to be insured separately. Depending on your homeowners insurance policy, your jewelry may be covered even when you travel.

Sporting goods, including golf clubs, will not be covered by your homeowners insurance if you’re traveling, so you will need travel insurance to replace them if they’re lost, damaged, or stolen.

Pay no interest until nearly 2025 with these credit cards

Emergencies happen

While we do our best to prepare for the worst-case scenario, we can’t stop life from happening. Things like medical emergencies, a death in the family, or other catastrophes can halt your travel plans.

If you have travel insurance, rescheduling or cancellation fees will be covered, allowing you to deal with the emergency at your own pace. You won’t have to worry about losing the money spent on the trip and subsequent fees.

Natural disaster coverage

Are you planning a fall trip to the Gulf Coast or Florida? Consider your travel destination and the time of year you're going.

If you’re visiting someplace prone to natural disasters, especially seasonal occurrences like tornadoes, hurricanes, wildfires, and such, travel insurance can help you recoup your money should these events interrupt your travel plans.

Similarly, if a natural disaster occurs during your trip, often, insurance will pay to move you to a more secure location.

Extreme adventures may not be covered

Your insurance will most likely cover typical travel-related injuries but don't expect your medical bills to be covered if your itinerary involves extreme adventures or dangerous exploits.

Surfing, sailing, kayaking, bungee jumping, scuba diving, skiing, snowboarding, and other extreme sports do not fall into everyday illnesses or injuries. For these activities, consider getting a specific plan for adventure activities.

Earn up to 5% cash back when you shop with these leading credit cards

Shaky travel companies

If you booked your trip through a travel company and it goes bankrupt, travel insurance may provide a safety net to ensure you get your money back.

Airlines, cruise ships, travel companies, and other travel-related businesses suffered during the pandemic, and many may not be on solid financial ground yet.

This may not be covered in a basic insurance plan, so make sure your agent adds financial default coverage if you are concerned about the health of your travel provider.

In the situation any company or organization closes or is otherwise inoperable during your trip, you’ll be covered.

Now let’s look at times you may not need travel insurance.

Your credit card offers travel protections

Before purchasing travel insurance, consider which credit card you have. Many of the top credit cards offer travel protections.

Some protections you may already have include lost luggage, rental car insurance, trip delay, and trip interruption or cancellation.

Credit card programs often don’t cover medical or other interruptions, so consider your priorities before choosing this option.

You have a domestic trip

If you’re traveling within the U.S. and its territories, travel insurance may not be necessary. For example, you won’t need medical coverage as your health insurance should be honored nationwide.

Domestic travel is also usually much less expensive. If you’re taking a cheap, last-minute, or nonstop flight and staying at an inexpensive hotel or rental, the cost of travel insurance may not be worth it.

One exception might be a family trip to Disney World. The estimate for a trip for a family of four in 2023 is more than $6,000, so travel insurance might be money well spent in this case.

5 Signs You’re Doing Better Financially Than the Average American

Don’t add expense to cheap trips

Not all travel is planned. Whether traveling for work, a family emergency, or just a last-minute vacation, you likely don’t need insurance in these circumstances. Odds are, you’re packing light, and both your flight and hotel are relatively inexpensive.

In these scenarios, the things insurance covers won’t be relevant, including baggage loss, flight cancellations, hotel issues, and so on.

Not only will these costs likely be minimal, but they can be disputed with your airline or hotel, although it may take a little while to get your money back.

The airline has a flexible rebooking policy

If you’re buying travel insurance to cover the cost of rescheduling a flight, you’re better off purchasing a refundable ticket at a higher price. And some airlines have more flexible policies now.

Many airlines allow last-minute ticket changes and will even help you reschedule your flight within a specific timeframe. The timeframe and policy vary by airline, and you may be subject to a nominal cancellation or rebooking fee, but it will be significantly less than insurance.

Insurance will not cover political unrest

One emergency situation insurance probably won’t cover is war or political unrest. If you’re visiting a location with political tensions and your trip is canceled as a result, don’t expect your insurance to cover the costs.

Insurance companies generally follow the travel advisories the U.S. State Department issued for medical and political situations.

Similarly, insurance won't cover these costs if you have to leave your trip early for safety concerns. Consider your destination's political environment before booking your travel or buying insurance.

9 Things You Must Do Before The Next Recession

Your hotel may cover cancellations

Many hotel cancellation policies have tiers depending on the booking you make. For example, some may have free cancellation within a specific period, while others charge different rates for rooms booked as non-refundable or partially refundable.

If your sole reason for purchasing insurance is hotel flexibility, consult with the hotel before you book. They may have a policy as flexible as your insurance or can work with you should something unexpected arise.

Penalty-free cancellations for major hotels tend to be around 24-48 hours prior to arrival.

Bottom line

Travel insurance may be pricey, but it’s a lifesaver in many situations. However, in others, it’s overkill and a waste of money.

Every travel situation is different, so consider your specific needs when purchasing. And, if you want more money to cover your insurance, consider these ways to make extra cash for travel funds.

More from FinanceBuzz:

- 7 things to do if you’re barely scraping by financially.

- 12 legit ways to earn extra cash.

- Can you retire early? Take this quiz and find out.

- 9 simple ways to make up to an extra $200/day

More for You

Caitlin Clark breaks unbelievable WNBA record in her debut with the Indiana Fever

NATO makes strong statement on Ukraine

7 Phrases a Harvard-Trained Psychologist Says Indicate Low Emotional Intelligence--and How to Do Better

I'm an employment lawyer. Here are the first 3 questions to ask HR if you're laid off or fired.

12 Strange Facts About Redheads You Never Knew

7 Ways People Destroy the Value of Their Homes, According to a Real Estate Agent

7 CDs You Probably Owned, Threw Out and Now Are Worth Bank

Map reveals best places to live in the US if nuclear war breaks out

20 times TV shows made noticeable continuity errors in the plot

3 teams who were absolutely screwed by the NFL schedule, and 3 who weren’t

If you and your partner use any of these 5 phrases regularly, your relationship is stronger than most

Britain says it is developing a radio-wave weapon that can take out a swarm of drones for just $0.12 a shot

These Richest Black Actresses Are Breaking Barriers in Hollywood

Here is the true value of having a fully paid-off home in America — especially when you're heading into retirement

Cheese Recall Map Shows Multiple States Impacted: 'Discard it Immediately'

Taylor Swift's Eras Tour Kicks Off Its European Leg in Paris: Photos From the Opening Show

Controversial Netflix show watched almost 14 million times despite backlash

This common trait is a red flag of a toxic boss, says ex-IBM CEO: 'I used to think it was a great skill'

The Greatest Creature Feature Movies of All Time

The 7 things people with nice-smelling homes never do, according to cleaning pros

More From Forbes

Is travel insurance refundable here’s everything you need to know.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Sometimes, travel insurance is refundable. Here's when you can get your money back.

Peter Hoagland always checks to see if his travel insurance is refundable. That's because anything can happen between the time you book your vacation and when you leave — and because travel insurance isn't always refundable.

During the pandemic, he discovered that the hard way. He had to cancel a trip and asked for his money back from the insurance company. It refused.

"Since then, I always read the fine print on the policy," he says.

The refundability of travel insurance has always been an open question. Some countries and U.S. states regulate refundability. Travel insurance companies put refundability details in the fine print of the policy. And, as Hoagland found out, there are always exceptions.

Like the pandemic, when refund policies were all over the map. Some insurance companies adhered to their published policies. Others offered a credit that could be reused within a year, which was minimally useful because the pandemic was still happening a year later. Others quietly gave their customers a refund.

Hoagland says he fought for his money. Eventually, he contacted a manager at his travel insurance company.

"That produced a quick result," he says. "I got my money back."

iOS 17.5—Apple Issues Update Now Warning To All iPhone Users

Biden vs trump 2024 election polls trump leads biden by 1 point latest survey shows, ios 17 5 iphone update now live with important new features.

But let's face it: Getting a refund for travel insurance can be difficult. There are times when insurance is always refundable because it's required by law. There are times when it's sometimes refundable. And there are times when it's almost never refundable. But even then, there may be a way to recover some — or all — of the value of your policy.

Getting a refund for travel insurance can be a challenge

If you have a travel insurance policy and would like to get a refund, it might be easier said than done, say experts.

"While travel insurance is regulated like auto and home insurance, it’s often less standardized," says Stuart Winchester, CEO of Marble, a digital wallet for your insurance. "So first off, it’s important to check the fine print of your specific policy. Don’t assume it’s like the last one you got."

Even when you have something in writing, a refund can require some serious negotiating skills.

"Getting a refund for travel insurance can be complicated and frustrating," says Peter Hamdy, the managing director of a tour operator in Auckland, New Zealand. He's asked for a refund on policies numerous times and says that despite what travel insurance companies may tell you, there are no hard-and-fast rules when it comes to getting a refund on your policy.

"Some situations can warrant a refund," he says. "It depends on your policy."

What does a typical refundability clause look like? For example, the World Explorer Guardian from Insured Nomads notes that it's refundable only during the 10-day review period from the date of delivery or 15 days from the date of delivery if mailed, provided you have not already departed on your trip and you have not incurred any claimable losses during that time. If you depart on your trip before the expiration of the review period, the review period ends and the policy can't be refunded.

"We go a bit further with our World Explorer Travel Medical plans," notes Andrew Jernigan, CEO of Insured Nomads. "If no claims have been filed then we can refund the unused portion of the policy if you cut your trip short.”

When can you get a refund for travel insurance?

Here are the most common cases where travel insurance can be refunded:

- If you cancel during the "free look" period required by the government. Most states require what's called a "free look" period of anywhere from 10 to 14 days. "During this period, travelers can review the purchase and make sure it fits their needs," explains James Nuttall, general manager of Insubuy . "If it does not, they can cancel it for any reason and get a full refund, no questions asked, so long as you haven’t departed yet.

- If you cancel during the travel insurance company grace period. Many insurance companies also have a grace period for refunds (usually, they are the same as the "free look" although some grace periods can be longer). "If you’re outside your grace period, which typically lasts one to two weeks after signing, you’re contractually obliged to pay your premiums," says David Ciccarelli, CEO of the vacation rental site Lake . "Still, it doesn’t hurt to ask your company for a refund or alternative options if you’re outside your grace window. You might not get a yes, but it could lead to some cost savings or better solutions."

- When someone else cancels your trip. "For instance, if your cruise is canceled due to low river tide, you are not at fault and would typically receive a full refund or credit for a future sailing, thus eliminating the need for the travel insurance policy," explains Rhonda Abedsalam vice president of travel insurance for AXA Assistance US.

- If you die. Typically, the policy would be refunded to your next of kin. Generally, you can also ask for a refund if your travel companion dies before your trip.

Remember, it depends on where you buy your insurance

The refundability of your insurance can depend on where you purchased it. Commercial policies bought from a cruise or tour company are generally canceled and refunded if you cancel the trip far enough in advance of your departure date.

"The travel insurance cancellation provisions are generally tied to the cancellation provisions for the cruise or tour," explains Dan Skilken, president of TripInsurance.com . "After you have paid the last deposits on the cruise and are close enough to departure that they will not provide a refund on the cruise, they generally will also not provide a refund on the travel insurance. But if you cancel early enough to get all or most of your deposit back, you will also get your travel insurance premium refunded."

If you’ve purchased retail travel insurance from a third-party provider or comparison website, you can often get a refund if you can show receipts proving that you received a full refund of all trip deposits and have not had any cancellation penalties or taken any travel credits when you canceled your trip.

That's because retail travel insurance is sold for a specific traveler and for a specific trip. If you have proof of a complete refund and have not received travel credits, then you no longer have what's called an "insurable interest" in the trip. The insurance company must cancel and refund your premium in full, says Skilken.

Insider tip: If the insurance company refuses, just tell them you have proof that you no longer have an insurable interest in the trip. You have to have an insurable interest in a trip to own a travel insurance policy.

Your agent may be able to help you get a refund

You may also be able to lean on the agent who sold you the policy. For example, all policies on Squaremouth come with a money-back guarantee.

"The purpose of this benefit is to give travelers extra time to review their policy documentation to be sure it’s the best policy for their coverage needs," says spokeswoman Jenna Hummer. At Squaremouth, the money-back period typically lasts between 10 and 14 days, which is in line with the mandated "free look" period.

However, I have also seen agents negotiate with travel insurance companies for a more generous refund period in case of extenuating circumstances. There's no guarantee that you'll get it, but it's worth asking — and one reason to work with a third party.

Agents can also help you avoid this problem. Susan Sherren, who runs Couture Trips , a travel agency, notes that American Airlines Vacation Packages offers a predeparture protection insurance plan, which allows cancellation for any reason before the outbound departing flight time. Other restrictions apply, she adds.

"More flexibility will often cost you more," she says. "But having the flexibility is a great way to sleep well at night."

Can't get a refund? Look for other kinds of flexibility from your travel insurance company

Even if your travel insurance company says no to a refund, it doesn't necessarily mean you've lost the value of your policy.

"If a travel supplier changes or cancels your trip, you should be able to change your travel insurance policy to match the new dates of your trip or even cover a new trip, sometimes up to two years into the future," says Daniel Durazo, director of external communications at Allianz Partners USA .

Pro tip: Be sure to change the dates of your travel insurance policy before the departure date of your current itinerary. You can do that online or by calling your agent. Once the policy's effective date has passed, making any changes or initiating a refund or credit becomes much more difficult.

Don't forget to do your due diligence