- Customer Service

TD First Class SM Visa ® Signature Credit Card

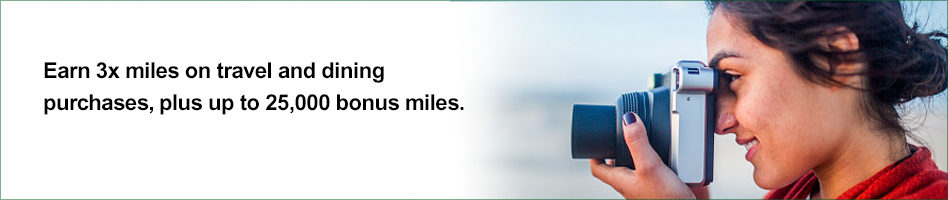

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

Bonus miles offer.

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

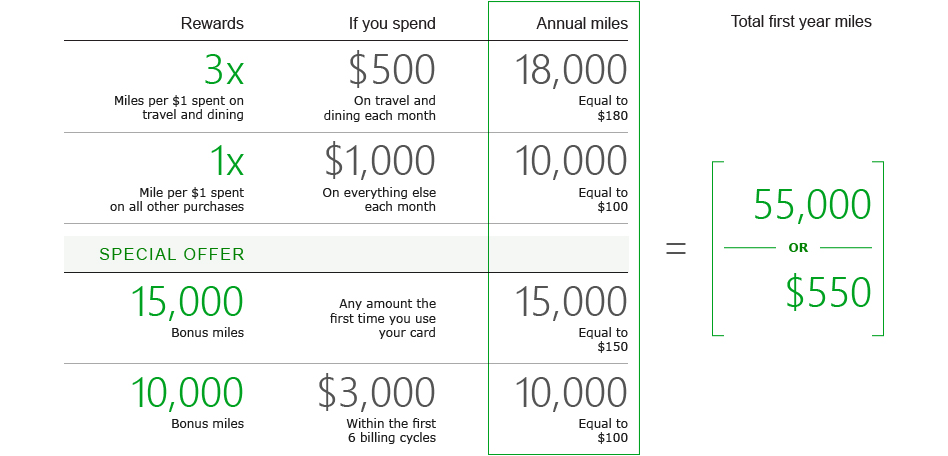

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

Earn unlimited points with every purchase, and triple the miles on travel

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

- Credit Cards

- TD First Class Travel Visa Infinite Card Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD First Class Travel® Visa Infinite* Card Review 2024

Updated: Mar 6, 2024, 3:51am

Fact Checked

Frequent travellers will find plenty of value in this card. Considering that it earns a minimum of 2 TD Rewards points on every dollar, it has flexible redemption options, plenty of insurance coverage, a travel credit of $100 when you book travel through Expedia ® for TD and a birthday bonus of up to 10,000 points, it easily earns its spot in your wallet.

- High earn rate for rewards with Expedia.

- Exclusive travel benefits.

- Expensive annual fee.

- Low annual net rewards earnings for average spenders.

Table of Contents

Introduction, quick facts, td first class travel visa infinite card rewards, td first class travel visa infinite card benefits, how the td first class travel visa infinite card stacks up, methodology, is the td first class travel visa infinite card right for you, advertising disclosure.

- Earn up to $800 in value†, including up to 100,000 TD Rewards Points, no Annual Fee for the first year† and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†

- Get an annual TD Travel Credit† of $100 when you book at Expedia® For TD.

- To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- This offer is not available for residents of Quebec.

- † Terms and conditions apply.

The TD First Class Travel Visa Infinite Card is considered to be one of Canada’s higher end travel credit cards, even though its annual fee makes it quite affordable. With easy earning potential, a flexible rewards program, and a generous insurance package, it’s definitely worth considering if you are a frequent traveller.

The travel perks and benefits aren’t quite as inclusive as other high-end credit cards. The absence of lounge access is a big one to note. Another downside is that the points cannot be converted into other rewards programs. That being said, for its price point, it’s quite competitive and still gives good value.

- Get an Annual Fee Rebate for the first year†. To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- Cardholders will earn points for every dollar spent with accelerated rates on groceries, restaurants, recurring bill payments and travel booked through Expedia® For TD.

- Cardholders will benefit from an annual $100 travel credit when they book travel through Expedia® For TD as well as an annual birthday bonus of up to 10,000 TD Rewards Points.

- Cardholders can redeem points for a range of options at any time as long as they have at least 200 TD points available.

Earning Rewards

Earning rewards with the TD First Class Travel Visa Infinite card is easy as you can earn on every purchase you make. Travel booked through Expedia For TD will earn you 8 TD rewards points per dollar spent. Eligible grocery and restaurant purchases will earn you 6 TD rewards points for every dollar spent. If you set up regularly recurring bill payments to your account you will earn 4 TD rewards points for every dollar spent. Meanwhile, all other purchases will earn 2 TD rewards points per dollar spent. Note that there is an annual spending cap of $25,000 for the accelerated categories. If you exceed the spending cap you will then earn 2 TD rewards points for every dollar spent.

Redeeming Rewards

Rewards can be redeemed at any point, in increments of 200 points. You can redeem them for options such as travel (you’ll get the best rewards value if you book through Expedia For TD), Amazon purchases, gift cards, cash credits, and education credits. Redeeming points is easy and the multiple rewards options are attractive. However, some other top-tier credit cards allow you to convert points to other programs like airline or hotel partners for more flexibility which this card is lacking.

Rewards Potential

Cardholders will get the best value for their points by booking travel through Expedia For TD. However, if you are someone who likes to book directly with hotels or airlines to get status points then it’s not the best rewards potential out there, since booking outside of Expedia For TD lowers the value of your points. With Expedia for TD, 200 points are equal to dollar. For travel booked outside of Expedia For TD, you need 250 points for that same dollar value.

That said, based on average Canadian spending, Forbes Advisor estimates this card could earn $127.34 in rewards value per year with Expedia and $111.67 with other travel partners (both calculations factor in the cost of the annual fee).

- Comprehensive travel insurance coverage.

- Discounts on car rentals with Avis and Budget Rent-A-Car.

- Link your card to Starbucks Rewards to earn 50% more TD points and Starbucks Rewards on Starbucks purchases.

Interest Rates

- Regular APR: 20.99%

- Cash Advance APR: 22.99%

- Foreign Transaction Fee: 2.50%

- Annual Fee: $139 (Get an annual fee rebate in the first year; account must be approved by June 3, 2024)

- Any other fees: Additional cardholder $50.00 (To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024)

TD First Class Travel ® Visa Infinite* Card vs. TD ® Aeroplan ® Visa Infinite* Privilege

While both travel cards, the TD Aeroplan Visa Infinite is a luxury travel card. The annual fee is a hefty $599, but it comes with considerably more perks and benefits. including lounge access and NEXUS card rebates. It also uses Aeroplan rewards rather than TD rewards. The TD Aeroplan Visa Infinite is a strong card, but it’s best for those who travel frequently and can offset the cost of the card with the included benefits.

TD First Class Travel ® Visa Infinite* Card vs. Scotiabank Scene+ Visa Card for Students

Students studying away from home may consider a travel card like the TD First Class Travel Visa Infinite Card to help offset the cost of flights home. However, with the annual fee and rewards earning potential, you might be better off sticking to a $0 annual fee card geared towards student spending. The Scotiabank Scene+ Visa card for students allows you to earn points that can be used for day-to-day expenses like dining out, entertainment and even banking.

TD First Class Travel ® Visa Infinite* Card vs. TD ® Aeroplan ® Visa Platinum* Card

With an annual fee of $89, the TD Aeroplan Visa Platinum is a bit more affordable. The earn rates aren’t as high, but it’s also a different rewards program. While TD Rewards points are best with Expedia, Aeroplan points are best with Air Canada. So your choice between these two cards should depend on who you are most likely to book travel with to get the best value for your points.

When determining a rating for individual credit cards, the Forbes Advisor Canada editorial team factors in an exhaustive list of data points. With the TD First Class Travel ® Visa Infinite*, the scoring model used takes into account factors such as, but not limited to, rewards rates and categories, fees, welcome bonuses and other benefits and features. Keep in mind, what may be best for some people might not be right for you. Conduct informed research before deciding which cards will best help you achieve your financial goals.

The TD First Class Travel ® Visa Infinite* Card is a decent travel card . It’s easy to earn and redeem points and the suite of travel insurance is a huge perk. However, it has the best value for those who like to book their travel via Expedia. If you prefer to book directly with hotels or airlines or via other travel portals, then there are better travel credit cards out there where your rewards will go further.

Related : What is the best Canadian credit card

Frequently Asked Questions (FAQs)

Does the td first class travel visa infinite card have airline lounge access.

No, this card does not include airport lounge access .

Does the TD First Class Travel Visa Infinite Card have foreign exchange fees?

Yes, this credit card charges foreign exchange fees (or FX fees) at a rate of 2.5%. If you’re looking for a credit card without without foreign exchange fees , there are plenty available.

How many TD points do you need for a flight?

You need a minimum of 200 TD points to redeem them for rewards. If you book your flight through Expedia ® For TD the points value is 200 TD points per dollar.

Our partners are not responsible for anything reported by Forbes Advisor. To the best of our knowledge, everything is accurate at the time of publishing as of the date posted. For full information and details, please visit the advertiser’s website.

Hannah Logan is a Canadian freelancer writer and blogger who specializes in personal finance and travel. You can follow her adventures on her travel blog EatSleepBreatheTravel.com or find her on Instagram @hannahlogan21.

- Best Credit Cards

- Best Travel Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Cash Back Credit Cards

- Best Credit Cards for Bad Credit

- Best Aeroplan Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Balance Transfer Credit cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Student Credit Cards

- Best Secured Credit Cards in Canada

- Best Business Credit Cards

- Best of Instant Approval Credit Cards

- Best Prepaid Credit Cards

- Best No-Annual-Fee Credit Cards

- Best Low-Interest Credit Cards

- Best Neo Financial Credit Cards

- Best Visa Cards

- Best Air Miles Credit Cards

- TD Aeroplan Visa Infinite Privilege Review

- EQ Bank Card Review

- TD Aeroplan Visa Platinum Card Review

- Scotiabank Platinum American Express Card

- TD® Aeroplan® Visa Infinite* Card

- KOHO Prepaid Mastercard Review

- MBNA Rewards World Elite Mastercard

- MBNA True Line Mastercard Review

- The American Express Business Edge Card Review

- TD Rewards Visa Card Review

- RBC Avion Visa Infinite Review

- Scotiabank Gold American Express Card

- Neo Secured Credit Card Review

- Home Trust Secured Visa Review

- American Express Aeroplan Card Review

- Tangerine Money-Back Card Review

- TD Cash Back Visa Infinite

- TD Platinum Travel Visa Card Review

- Scotiabank Scene+ Visa Card

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

- Credit Card Expiration Dates: What You Need To Know

- What Is The Highest Limit Credit Card In Canada?

- What Is The Highest Credit Score Possible?

- Money transfer from Credit Card to the Bank

- How To Get Cash From A Credit Card At An ATM

- The Stack Mastercard Is No More

- How Is Your Credit Card Interest Calculated?

- How To Pay Your Mortgage With A Credit Card

- Does Applying For A Credit Card Hurt Your Credit?

- How To Check Your Credit Card Balance

- Cathay Pacific and Neo Financial Are Launching A Credit Card

- 4 Ways To Consolidate Credit Card Debt

- How To Get A Business Credit Card

- Canceling Credit Cards: Will I Get My Annual Fee Back?

- Can I Use A Personal Card For Business Expenses?

More from

Tim hortons credit card (tims card) review 2024, cibc costco mastercard review 2024: avid costco shoppers should not leave home without it, pc world elite mastercard review 2024, pc insiders world elite mastercard review 2024: earn the most pc optimum points in canada, cathay world elite mastercard review 2024: the only credit card in canada that earns asia miles, ja money card review 2024: earn cash back while learning about money management.

TD First Class Travel ® Visa Infinite* Card 🇨🇦

- 2X points on all purchases

- Premium Insurance

- Visa Infinite Benefits

Earn up to $800 in value † , including up to 100,000 TD Rewards Points , no Annual Fee for the first year † and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card †

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening † .

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points †

- Get an annual TD Travel Credit † of $100 when you book at Expedia® For TD.

- Get an annual fee rebate for the first year †

To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

Earn TD Reward Points on all the things you normally do, whether you use your card for groceries, dining, paying bills or booking travel. The rewards will add up quickly so you can enhance your travel experience or enjoy a wide variety of rewards.

- Earn 8 TD Rewards Points † for every $1 you spend when you book travel through Expedia® For TD †

- Earn 6 TD Rewards Points † for every $1 you spend on Groceries and Restaurants

- Earn 4 TD Rewards Points † for every $1 you spend on regularly recurring bill payments set up on your Account

- Earn 2 TD Rewards Points for every $1 you spend on other Purchases made using your Card † plus earn an annual Birthday Bonus † of up to 10,000 TD Rewards Points

Your Card also allows you to enjoy:

- An extensive suite of travel insurance coverages which helps you travel prepared

- No travel blackouts † , no seat restrictions † and no expiry † for your TD Rewards Points as long as your account is open and in good standing.

Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply. See more details .

Card Awards

Fees & conditions.

Per dollar of purchases

Travel Insurance

There may be a daily maximum amount depending on the type of fees paid

Other Insurance

With the TD First Class Travel® Visa Infinite* Card, you can earn up to 100,000 TD Points † and a first year annual fee rebate :

- Welcome Bonus of 20,000 TD Points when you make your first Purchase with your Card †

- A Birthday Bonus of up to 10,000 TD Rewards Points †

- Get an Annual Fee Rebate for the first year † .

With the TD First Class Travel® Visa Infinite* Card, you get:

- 8 TD Rewards Points † for every $1 you spend when you book travel through Expedia® For TD

- 6 TD Rewards Points † for every $1 you spend on Groceries and Restaurants

- 4 TD Rewards Points † for every $1 you spend on regularly recurring bill payments set up on your Account

- 2 TD Rewards Points † For every $1 you spend on other Purchases

This TD credit card is one of the best TD travel rewards cards.

- TD Best Credit Cards - April 2024

- Best Travel Credit Cards - April 2024

- Best Visa Credit Cards - April 2024

- Canada's Best Credit Card Offers - April 2024

- Expedia For TD: How To Redeem TD Rewards Points?

Alternative Cards

- Great Welcome Offer

- Air Canada Benefits

- NEXUS Credit

- Card Details

Earn up to $1,200 in value † , including up to 50,000 Aeroplan points † (enough for a round trip to New York City † ) and additional travel benefits. Account must be approved by June 3, 2024.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card †

- Earn 20,000 Aeroplan points when you spend $6,000 within 180 days of Account opening †

- Plus, earn a one-time anniversary bonus of 20,000 Aeroplan points when you spend $10,000 within 12 months of Account opening †

- Enroll for NEXUS and once every 48 months get an application fee rebate †

- Plus, share free first checked bags with up to 8 travel companions †

- Earn 1.5 points † for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations ® ) made with your card

- Earn 1 point † for every $1 spent on all other Purchases made with your Card

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore (www.aeroplan.com/estore).

- Your Aeroplan Points do not expire as long as you are a TD ® Aeroplan ® Visa Infinite* Cardholder in good standing.

- Earn big rewards on the little things : Earn 50% more Aeroplan Points and 50% more Stars at participating Starbucks ® stores. Simply link your TD Aeroplan Visa Infinite Card to your Starbucks ® Rewards account. Conditions apply.

- Earn Aeroplan Points on your everyday purchases

- Redeem your points for travel and more.

- Take advantage of an extensive suite of travel insurance † .

- Travel lightly through the airport and save on baggage fees † : Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lb) when your travel originates on an Air Canada flight.

- Complimentary Visa Infinite Concierge † : On-call 24 hours a day, seven days a week, the Visa Infinite Concierge can help with any Cardholder request — big or small, to help you get the most out of life whenever you travel, shop and use your Card.

- Visa Infinite Luxury Hotel Collection † : Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 of the world’s most intriguing properties.

† Terms and conditions apply.

- Primary card $139

- Additional card $75

- Individual $60,000

- Household $100,000

- Purchase Rates 20.99 % 20.99 % (QC)

- Cash Advance Rates 22.99 % 20.99 % (QC)

- Balance Transfer Rates 22.99 % 20.99 % (QC)

- Best Aeroplan Credit Cards - April 2024

- Groceries 1.5 Aeroplan Points

- Gas 1.5 Aeroplan Points

- Air Canada 1.5 Aeroplan Points

- Year 1 $1,425

- Year 2+ $425

- Annual Credit

- VIP Lounges

- Travel credit

- 4.5X points on grocery and restaurants purchases†

- Purchase Insurance

Earn up to $370 in value † , including up to 50,000 TD Rewards Points † and no Annual Fee for the first year † . Conditions apply. Account must be approved by September 3, 2024.

- Welcome Bonus of 15,000 TD Rewards Points when you make your first Purchase with your Card † .

- 35,000 TD Rewards Points when you spend $1,000 within 90 days of Account opening † .

To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

- Earn 6 TD Rewards Points † for every $1 you spend when you book travel through Expedia ® For TD † .

- Earn 4.5 TD Rewards Points for every $1 you spend on Groceries and Restaurants † .

- Earn 3 TD Rewards Points for every $1 you spend on regularly recurring bill payments set up on your Account † .

- Earn 1.5 TD Rewards Points For every $1 you spend on other Purchases made using your Card † .

- Flexibility to redeem your TD Rewards Points on a wide variety of rewards at Expedia® For TD, Starbucks ® and more.

- Booking your travel through Expedia ® For TD † to maximize the TD Rewards Points you can earn on your travel purchases.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply. See more details.

†Terms and conditions apply.

- Primary card $89

- Additional card $35

- Individual $0

- Household $0

- Groceries 4.5 TD Rewards Points

- Dining and Food delivery 4.5 TD Rewards Points

- Recurring Payments 3 TD Rewards Points

- Year 1 $647

- Year 2+ $219

- 3% cash back on groceries and gas

Earn up to $500 in value † , including 10% in Cash Back Dollars in the first 3 months on Bonus Eligible Purchases up to a total spend of $3,500 † . Conditions apply. Account must be approved by June 3, 2024.

- Bonus Eligible Purchases are Gas Purchases, Grocery Purchases & Pre-authorized payments, until a total collective spend of $3,500 of such purchases have been made † .

To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by June 4, 2024.

- Earn 3% in Cash Back Dollars on eligible grocery Purchases and gas Purchases † , and on regularly recurring bill payments † set up on your account

- Earn 1% Cash Back Dollars on all other Purchases made with your Card †

- Earn Cash Back Dollars on every eligible purchase.

- Redeem your Cash Back Dollars to help pay down your Account balance whenever you please – the choice is yours! †

- Your Cash Back Dollars never expire as long as your account is open and in good standing

- Emergency Road Services with Deluxe TD Auto Club Membership

- Complimentary Visa Infinite * Concierge service † available 24/7

- Mobile Device Insurance †

- Additional card $50

- Best Cash Back Credit Cards in Canada - April 2024

- Groceries 3 %

- Recurring Payments 3 %

- Year 1 $969

- Year 2+ $341

This browser is not supported. Please use another browser to view this site.

- Credit cards

- Newcomers to Canada

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage payment calculator

- Income property

- Renovations + maintenance

- Compound interest calculator

- Household finances

- Find a Qualified Advisor Tool

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- A Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- Making sense of the markets

- Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Winston Sih and Courtney Reilly-Larke on March 31, 2022 Estimated reading time: 6 minutes

TD First Class Travel Visa Infinite Card review

This premium TD card lets travellers redeem flexible rewards through a partnership with Expedia.

With a plethora of travel-focused credit cards on the market, the TD First Class Travel Visa Infinite Card may not be the obvious choice—especially considering how many Aeroplan cards TD currently has on its roster. That said, the TD First Class Travel Visa Infinite Card is worth considering. Why? It boasts a flexible redemption program and a partnership with Expedia. Cardholders get access to Expedia For TD online portal to redeem rewards for flights, hotels and car rentals on expediafortd.com.

Add to that comprehensive insurance coverage and generous earn rates and the TD First Class Travel Visa Infinite Card becomes a solid choice for avid travellers.

TD First Class Travel Visa Infinite Card

- Annual fee: $139 (annual fee rebate—conditions apply to qualify)

- Earn rates: Up to 8 TD Rewards points per $1 on travel; 6 points per $1 on groceries and restaurants; 4 points per $1 on recurring bills; and 2 points per $1 on all other purchases

- Welcome offer: You can earn up to $800 in value, including up to 100,000 TD Rewards Points and no Annual Fee for the first year. Conditions apply. Account must be approved by June 3, 2024. Plus, you get an annual birthday bonus of 10% of your previous year’s points (up to 10,000 points).

- Annual income requirement: Personal income of $60,000 or household income of $100,000

- Point value: 1 TD Rewards point = $0.005 when redeemed for travel via Expedia For TD or $0.004 when redeemed through other providers and websites

- Recommended credit score for approval: 725 or higher

- Interest rates: 20.99% on purchases, 22.99% on cash advances, 22.99% on balance transfers

The TD First Class Travel Visa Infinite Card

- Three things you need to know about the TD First Class Travel Visa Infinite Card

- How to redeem your TD Rewards

- What are the best ways to benefit from this card?

Are there any drawbacks to the TD First Class Travel Visa Infinite Card?

4 things to know about the td first class travel visa infinite card, 1. the you earn points under the td rewards program.

T he TD points system is easier to understand than the point system for the bank ’ s Aeroplan credit cards. Your Point values stay the same no matter where you ’ re flying, so it ’ s easy to work out how much they ’ re worth. Plus, TD Points can be redeemed on any airline, not just Air Canada or Star Alliance Partners. While Aeroplan Miles are valuable, if you prefer simplicity the TD First Class Travel Visa Infinite Card might be more up your alley.

2. Your points go farther when you book with ExpediaForTD.com

If you already use Expedia to book your travel, this card is a savvy choice. When you book travel online through Expedia For TD, you earn 8 TD points per $1.

3. The card comes with a generous welcome bonus

You can earn up to $800 in value, including up to 100,000 TD Rewards Points and no Annual Fee for the first year. Conditions apply. Account must be approved by June 3, 2024.. Plus, earn a birthday bonus of up to 10,000 rewards points (conditions apply). You can also receive a $100 TD travel credit when you spend at least $500 at Expedia for TD.

4. You’ll get great travel insurance

The TD First Class Travel Visa Infinite Card comes with up to $2 million of travel medical insurance coverage for the first 21 days of a trip. Trip cancellation, trip interruption, common carrier travel accident insurance, travel assistance services, flight delay insurance, auto rental collision insurance, and delayed and lost baggage insurance round out the card’s benefits. For a premium rewards card, The TD First Class ’ s insurance is fairly standard, however; so, if you ’ re looking for more comprehensive credit card insurance , you could consider a card like the National Bank World Elite Mastercard, * which comes with up to $5 million in out-of-province-of-residence medical/hospital insurance for trips up to 60 days (if you ’ re under 54).

How to redeem your TD Points:

You can redeem your TD Points for travel in two ways. The best—and most valuable—way is through the Expedia For TD online portal, where you can redeem 200 TD points per $1 in travel credit (0.5%) and pay the balance of the cost (if any) using your credit card (you’ll also earn Points on this spend).

Your other redemption choice is the “Book Any Way” option, which lets you book via other travel websites; however, your bookings can cost up to 25% more if you go this route. When using “Book Any Way” you’ll redeem at 250 TD points per $1 (0.4%) applied as a statement credit on your first $1,200 in travel purchases and 200 TD points per $1 (0.5%) for your travel purchases over $1,200. In comparison, with Expedia For TD, you’ll get a better and more consistent return of 0.5% on all your travel spending.

In both cases, the TD First Class Travel Visa Infinite Card allows you to redeem for any seat on any airline. Additionally, you can redeem points for rewards in small increments (minimum 200), so this means you don’t need to build up a large pool of points before you’re able to apply them towards travel.

Finally, through the TD Rewards site, you can shop for items such as a Vitamix blender, a Dyson vacuum or gift cards. However, you won’t get the same value as you would booking travel. For example, a $50 gift card at Best Buy will cost you 20,000 TD points, whereas you can use the same amount of points for $100 in travel on the Expedia For TD portal.

How to optimize the TD First Class Travel Visa Infinite Card

Ultimately, your best bet is to redeem points for travel from ExpediaForTD.com . Generally, prices on the website are similar to those on the main Expedia website, and you’ll be able to redeem at the rate of 200 points per $1. If you redeem points for travel outside of the TD portal, your points can lose up to 25% in value; however this could be a smarter route if you find a really good deal on another travel portal.

If you do find a better hotel or flight deal elsewhere, you have the option to price match, but there are some restrictions: you must have booked within the last 24 hours; your travel plans must be at least 48 hours away; and travel dates, and flight and hotel classes must all be the same to submit a claim.

Does the TD First Class Travel Visa Infinite Card have travel insurance?

With this card you’ll get an extensive suite of travel insurance coverage, for big and small emergencies. For frequent travellers and those who cross the border often, this is a must. The card includes travel medical insurance of up to $2 million of coverage for the first 21 days. (If you or your spouse are over 65 or older, you’re only covered for the first four days of your trip.) You’ll also get up to $1,500 of trip cancellation insurance with this card up to a maximum of $5,000 for all insured persons. For trip interruption insurance, you get $5,000 per insured person, up to $25,000 for all the insured people on the same trip.

You’ll also get common carrier travel accident insurance, emergency travel assistant services and delayed/lost baggage insurance (up to $1,000 per insured person if your baggage is delayed for more than six hours or gets lost ultimately).

There is a minimum personal income requirement of $60,000 or a household income of $100,000. However, this is a common requirement for many cards in the same category.

Other cards offer more incentive to spend in categories like groceries, dining and entertainment. The TD First Class Travel Visa Infinite Card only offers three times the Points earn on travel booked through the Expedia For TD portal (4.5%)—everything else is at the base three TD points per $1 (1.5%) rate. To compare, the Scotiabank Gold American Express has a five-times Points accelerator on restaurants and groceries (5% per dollar).

Finally, the TD First Class Travel Visa Infinite Card doesn’t offer airport lounge access , and you’ll be charged foreign transaction fees . So, if you like to use airport lounges, or you often find yourself shopping in a foreign currency, you may want to consider a card that offers those perks.

Bottom line

TD’s unique partnership with Expedia, accelerated earn rates and incremental points redemption structure make the TD First Class Travel Visa Infinite Card a worthwhile consideration as a travel credit card . However, the biggest boost in earning points you’ll get with this card is by booking with ExpediaForTD.com. If you don’t want to be locked into booking that way, you may want to explore other travel card options.

More on credit cards :

- Canada’s best travel cards 2022

- Canada’s best credit cards for gas

- Canada’s best credit cards for grocery purchases 2022

- Best cash back credit cards

What does the * mean?

Affiliate (monetized) links can sometimes result in a payment to MoneySense (owned by Ratehub Inc.), which helps our website stay free to our users. If a link has an asterisk (*) or is labelled as “Featured,” it is an affiliate link. If a link is labelled as “Sponsored,” it is a paid placement, which may or may not have an affiliate link. Our editorial content will never be influenced by these links. We are committed to looking at all available products in the market. Where a product ranks in our article, and whether or not it’s included in the first place, is never driven by compensation. For more details, read our MoneySense Monetization policy .

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Comments Cancel reply

Your email address will not be published. Required fields are marked *

One of the TD First Class Infinite VISA Benefits List include : “ Earn 3 points per $1 on everything spent “ Could you clarify why on my recent Bill Statement, showed $5 earned for 1,178 points Wouldn’t 1,178 points translate into 1178 divided by 3 ?

I have this card, but rarely use except for buying something on a trip to get the insurance coverage. The issue I have is I like to book my travel through web sites like tripcentral.ca (better for packages), VRBO (for condo rentals) and booking.com (much better selection), so only end up rarely using Expedia for TD and end up getting 1.2% back on my purchases, unless I want to wait until I have over $1,200 of points and then buy a major trip, getting 1.5% on the part over $1,200.

So, its pretty good and the insurance is good, but its not as great for travel as they like to claim.

I have had this card for about 2 years now and I am so dessapointed with it. I will stop using it from now on and I will tell everybody I know NOT to get this card or anything related to TD Bank. I changed to this card because they assured me I have full trip coverage with it so I booked my last vacation with it and considering that I did not get what I wanted on my trip they will take some responsibilities and give me some refund after my claim was with them for 8 months. They kept asking me for documents that I provided every time they asked and at the end they kept asking for documents I already submitted three times before. TD is a disgrace for Canadians. I wish the government take actions and do a deep audit on these guys. I will slowly withdraw everything I have with TD to go to another bank. Anything is better than this. Please people, do not do anything with this bank and definitely nothing with this credit card. I am been having issues with this bank since 2008 and it’s time to move on to a better service.

This is the all lying I have issues with that I lost my luggage on my way back home and my flight cut and delayed for 5 months they don’t cover anything’s this massage is for the Visa highly in-charge manager if you guys don’t find me solution I have to take legal step and say bye to TD my whole family since they denied my claim it’s really really broke my heart. I was really trust them never ever again.

I want to redeem my points from my business travel which I have accumulated as I switched to the rewards cash card now .How do I do this June 15,2022

This card is excellent and works well if you are looking to use it for travel specifically. I find it comes in handy when even needing a car rental or a hotel stay on the fly.

We have this card and use it often, we had enough points to use it for 5 hotels on our roadtrip last spring (booked them through expedia). I guess it all depends on what you plan to do. We often go on little roadtrips to Canmore, Banff or Jasper and use it to stay there as well so it really saves us for accommodations. Also not having to get separate car insurance for rental cars is a big plus.

I just got back from Cuba. Unfortunately my flight from Ottawa to Cuba was delayed by 4 hours. And from Cuba to Ottawa for 14 hours. I want to be reimbursed because I bought a ride on my The TD First Class Travel Visa Infinite. Please give me the contact information to whom to apply for compensation. Thank you,

I have First Travel Visa card. My trip is more than 21 days. How can I get travel insurance for the days after first 21 days?

This is incorrect. the $100 travel credit is only for hotels and vacation rentals ALONG with flights. Not if your travel consists only of flights. It is a Hotel credit and NOT a travel flight credit. Beware! This credit card is absolutely useless.

Related Articles

How to beat inflation: First, tackle lifestyle creep

Managing lifestyle creep is challenging financially and psychologically, especially with inflation. Expert strategies keep day-to-day spending in check.

Save money, save the planet: Our favourite products and strategies for eco-friendly living

MoneySense celebrates Earth Day by sharing our editors’ top tips for reducing waste, saving money and shrinking our environmental...

Real Estate

Home buyers’ alert: Terms you may not know, but should

Understanding industry jargon can make you a better real estate investor.

Making sense of the markets this week: April 21, 2024

Capital gains tax inclusion rate will increase (for some), Netflix chills, U.S. bank earnings solid, and will the loonie...

How will the changes to capital gains in Canada affect tech sector?

Tech industry warns that the budget's capital gains proposals could cause “irreparable harm.”

Federal Budget 2024: How it will affect Canadians’ finances and taxes

Learn how the federal government’s 2024 budget can affect you and your money.

6 phishing scams targeting young Canadians (and how not to fall for them)

Gen Z isn’t immune to phishing scams. Find out the most common schemes targeting young Canadians and how to...

How much income do I need to qualify for a mortgage in Canada?

Credit Cards

The best no foreign transaction fee credit cards in Canada for 2024

Cards that waive or refund the fee for foreign currency charges are few and far between—but if you’re a...

Auto Insurance

How to deal with the rising costs of auto insurance due to car theft

Insurance is high on frequently stolen vehicles. Here’s how to reduce your premiums.

TD First Class Travel® Visa Infinite* Card review

Welcome Offer Ends Jun 3, 2024

Earn up to $800 in value†, including up to 100,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by June 3, 2024.

- Rates & Fees

8 Points Earn 8 TD Rewards Points for every $1 you spend through ExpediaForTD†

6 Points Earn 6 TD Rewards Points for every $1 you spend on groceries and restaurants.†

4 Points Earn 4 TD Rewards Points for every $1 you spend on recurring bill payments.†

2 Points Earn 2 TD Rewards points for every $1 you spend using your card.†

10% Bonus Points Each year, received a birthday bonus equal to 10% of the total number of points earned over the 12 preceding months.†

$100 Get an annual TD Travel Credit when you book at Expedia For TD†

USD The annual fee is in USD

$139 Annual Fee Annual fee is in USD. First additional cardholder is $50, subsequent cardholders are $0.

20.99% Purchase APR APR for purchases 20.99%†

22.99% Cash Advance APR APR for cash advances 22.99%†

22.99% Balance Transfer Rate APR for balance transfers 22.99%†

Good Recommended Credit Score

$60,000 Required Annual Personal Income

$100,000 Required Annual Household Income

By Money.ca & Scott Birke

Updated: March 27, 2024

Play article

( mins)

( )

This offer is not available for residents of Quebec.

The TD First Class Travel® Visa Infinite* Card stands out among travel credit cards for its nice welcome bonus, strong rewards rate on all purchases, and particularly massive earn rate for purchases via through Expedia® For TD†. It also offers substantial long-term value for those who have a TD All-Inclusive Banking Plan, as that membership rebates the card’s annual fees for the primary cardholder and an Authorized User.

Unfortunately the card leaves a bit to be desired due to its relative lack of auxiliary travel features. This could underwhelm some travelers but may be forgivable for those who are just focused on getting as many free flights and hotel nights as possible.

Pros and Cons of the TD First Class Travel® Visa Infinite* Card

Major combined value for the welcome bonus (up to $800†)

Good base earn rate on all purchases

Huge earn rate when you book travel through Expedia® For TD†

Very flexible redemption options

$100 TD Travel Credit†

Visa Infinite Benefits

Great savings on annual fees for accountholders of TD’s All-Inclusive Banking Plan

Does not provide free lounge access

Charges foreign transaction fees

Welcome bonus

Earn up to $800 in value † , including up to 100,000 TD Rewards Points, no Annual Fee for the first year † and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card † .

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening † .

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points † .

- Get an annual TD Travel Credit † of $100 when you book at Expedia ® For TD.

- Get an Annual Fee Rebate for the first year † .

To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

Earning TD Points

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†

- Earn 2 TD Rewards Points For every $1 you spend on other purchases made using your card†

Points don’t expire as long as your account is active, and the card has no caps on the total amount of TD Points that can be earned.

Redeeming TD Points

Though there are a number of redemption options with TD Points, you get the best value when redeeming for travel via one of two methods:

Book Any Way†

The Book Any Way† redemption path allows you to charge eligible travel expenses to your credit card and then retroactively redeem your points for those expenses within 90 days of the expense date. Travel expenses may include but are not limited to:

- Air travel taxes

- Baggage fees

- Airport parking and shuttles

- Car rentals

- Local commuter transport, like trains, buses or subways

- Travel attractions and entertainment

Each point redeemed via Book Any Way† is worth $0.004 for the first $1,200 of any redemption and $0.005 for the remainder of any redemption above $1,200.

Expedia® For TD

Points can alternatively be redeemed† for flights, hotels, vacation packages and rental cars via ExpediaForTD.com. Redeeming with this method yields a flat value of $0.005 per point. The site will indicate the dollar value of the TD points you have on hand, and then you apply those points to your travel purchase when checking out.

Aside from the high value in earning and redeeming† rewards via ExpediaForTD.com, the platform also provides a nice price guarantee feature: If you find a cheaper Flight + Hotel package within 24 hours of booking or a cheaper hotel rate up to 48 hours before check-in, Expedia will refund the difference between what you paid and the lower rate you found.

Other redemption paths

TD Points can also be redeemed for the following, though the value you get per point tends to be lower than what you get for the above two travel redemption methods.

- Amazon’s Shop with Points†: Select your TD card as your method of payment at Amazon.ca checkout , then automatically apply points toward your purchase. 10K TD Points can be redeemed for $33 (value of $0.0033 per point) and can be redeemed for Amazon.ca purchases either in part or in full.

- TD’s Shop the Mall†: Redeem points for clothing, electronics and computers from retailers like Roots, Zara, and the Body Shop.

- TD’s Shop the Catalogue†: Redeem points for merchandise including clothing, games, furniture, and appliances.

- Gift cards† at retailers like Bed Bath & Beyond, Best Buy, Canadian Tire, and more.

- Cash statement credit† for your TD card account. This requires a minimum 10K points to redeem. The first 10,000-point minimum is worth $0.005 per point and then each additional 400 points is worth $1 (0.0025 per point).

- Education credit† via HigherEdPoints.com. Credits must be purchased in minimum 62,500 points/$250 credit increments, for a redemption value of $0.004 per point.

Insurance and protections

The card’s suite of travel insurance, car rental insurance, and purchase coverage is adequate, though not the best in the field for its price point.

Compared to competing Canadian travel credit cards with a comparable annual fee, some notable weaknesses in the above suite of travel insurance include the relatively brief coverage periods of Travel Medical Insurance†; low-ish maximums for Trip Cancellation payouts†. A comparative strength of the TD First Class Travel® Visa Infinite* Card is its Trip Interruption coverage†, which is very generous.

You can check out our guide to credit card travel insurance to learn more about the different types of coverage listed above, and to review other Canadian travel credit cards that might have stronger travel insurance benefits.

Fees, rates and eligibility requirements

The card’s $60,000 individual and $100,000 household annual income requirements are reasonable for a travel credit card with rewards earn rates at this level, as are the $139 annual fee for the primary cardholder and $50 annual fee for each additional authorized user. Other fees and interest rates are also standard, with a 20.99% purchase interest rate; 22.99% balance transfer rate; 22.99% cash advance rate; and 2.5% foreign transaction fee.

One very unusual card benefit is the possibility of getting both the primary cardholder’s $139 annual fee and an additional authorized user’s $50 annual fee fully rebated every year.† This feature is available to new cardholders who are also members of TD’s All-Inclusive Banking Plan. It’s rare for Canadian banks to really reward clients that bundle together multiple products, and it’s an incentive that other financial institutions might do well to take note of.

How does it compare to competing travel cards?

When compared to competing travel credit cards with comparable annual fees, the TD First Class Travel® Visa Infinite* Card strengths and weaknesses are clear:

Its sign-up bonus eclipses the competition, which gives it an immediate punch of value. It’s also something of a no-brainer card for those who have TD’s All-Inclusive Banking Plan, as the annual fee rebate† effectively makes the card free to use year after year.

It’s less ideal for those who are unlikely to spend a significant amount at through Expedia® For TD. The foreign transaction fees, lack of free airport lounge access and middling travel insurance package might ultimately make it a better card for those who do a significant amount of domestic travel; those who frequently find themselves overseas might consider a different travel credit card with more globetrotter-friendly perks, such as:

Scotiabank Gold American Express® card

No foreign transaction fees, earns 6X Scene points for each $1 CAD on all eligible purchases at Sobeys and eligible grocers¹, 5X Scene+ points for every $1 CAD spent on other eligible groceries and 3X Scene+ points for every $1 CAD spent on gas, and has an all-encompassing travel insurance package.

BMO Ascend™ World Elite®* Mastercard®*

Includes complimentary membership in Mastercard Travel Pass provided by DragonPass,* with four annual complimentary passes. That’s a ~$128 USD value that renews every year*. Plus the up to 60,000-point sign-up bonus* and first year annual fee waiver* is still competitive with the TD card’s sign-up bonus.

*Terms and conditions apply

Drawback: There are increased earn rates but you earn only 1 point for every $1 spent everywhere else where they do not apply.* You can learn more about this card by reading our complete BMO Ascend™ World Elite®* Mastercard®* review .

What is the difference between TD Points and TD Rewards Points?

There is no meaningful difference beyond the different names.

Do I need to notify TD when travelling?

Most banks, including TD, no longer require international travel notifications, though TD does continue to monitor its clients’ credit card activity whether they are inside or outside Canada.

What is Expedia for TD?

Expedia® For TD is a partnership between Toronto-Dominion Bank and the online travel agency Expedia. Booking travel with Expedia® For TD yields the best value possible for your TD Points, though it is a less flexible and more limited redemption method than the Book Any Way† method.

About our authors: faces of finance

The Money.ca Editorial Team is a group of passionate financial experts, seasoned journalists, and content creators who are deeply committed to providing unbiased, relevant, and accurate financial information. With years of combined industry experience, our team is dedicated to maintaining the highest journalistic standards and delivering informative and engaging content. From personal finance and investing to retirement planning and business finance, we cover a broad range of topics to suit the financial needs of our diverse readership. You can trust the Money.ca Editorial Team to empower you with the knowledge and tools necessary to make wise financial decisions.

These articles do not include bylines, as they are intended to provide information about the company or have been written by an internal team at Money.ca, rather than stories by individual writers or contributors. Bylines are used for all other articles.

Scott Birke is a finance editor and writer with an interest in credit cards, investing, saving money and personal finance. Scott joined Wise Publishing from Finder, and his byline has appeared in the National Post, Mountain Life and Rock and Ice. When he's not trying to help Money.ca readers save money by comparing better financial products, he can be found riding his snowboard or mountain bike or listening to his small (but growing) vinyl collection.

Latest Articles

As inflation cools, Macklem says different countries will cut rates at own pace

S&P/TSX composite closes up nearly 100 points, U.S. stock markets mixed

Most actively traded companies on the toronto stock exchange.

Major water users in southern Alberta agree to curb consumption in face of drought

Lululemon cutting over 100 jobs in Washington distribution centre closure

TC Energy reduces pressure on pipeline segment as rupture investigation continues

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

- $139 annual fee – First year free

- Earn 20,000 TD Rewards points after your first purchase

- 80,000 additional points when you spend $5,000 in the first 180 days

- Annual $100 travel credit (accommodations & vacation packages)

- Birthday bonus of up to 10,000 points

- Earn 8 points per $1 spent when you book on Expedia for TD

- Earn 6 points per $1 spent on groceries and dining

- Earn 4 points per $1 spent on recurring bills

- Earn 3 per $1 spent on all other purchases

Welcome bonus and earn rate

The TD First Class Visa Infinite Card is one of TD’s most popular cards. The welcome bonus is typically quite generous and hovers between 80,000 – 145,000 TD Rewards points. The welcome bonus is comparable to cards on my list of the best travel credit cards in Canada .

As for the earn rate, you’ll get 8 points per dollar spent on Expedia for TD purchases. 6 points per dollar spent on groceries and dining. 4 points per dollar spend on recurring bills and 3 points on all other purchases.

To give you some perspective, when using TD Rewards points on Expedia for TD purchases, 1 point is worth $0.50. That means the base earn rate gets you 1.5% back in travel rewards, which is quite good.

Although the card has an annual fee of $139, it’s usually waived for the first year. You can also get the annual fee waived every year if you have a TD All-inclusive bank account.

Benefits and perks

If you’re reading my TD First Class Travel Visa Infinite Card review, then you’ll want to know about all the benefits. What’s interesting is that this card recently had an update and now comes with some pretty fun perks.

$100 annual travel credit

When you book accommodations or vacation packages on Expedia for TD worth at least $500, you’ll get a $100 credit back on your credit card. This is a pretty unique benefit that puts money back in your pocket, but it does not apply to all travel categories. In addition, this benefit only applies to individual bookings and is not cumulative.

10% birthday bonus

One unique perk is the birthday bonus worth up to 10,000 TD Rewards points. To earn this bonus, TD will give you 10% of the points you’ve earned in the year leading up to your birthday. Welcome bonuses don’t count. For example, if you earned 93,000 TD Rewards points in the year leading up to your birthday, you’d earn 9,300 extra TD Rewards points on your birthday.

Save on rental cars

Cardholders get at least 10% off the base rate when renting vehicles in Canada and the U.S at Avis or Budget and paying with your TD Aeroplan Visa Infinite Card. If you’re travelling internationally, you’ll save at least 5% at participating locations.

Travel insurance

- Travel medical – $2,000,000 for 21 days / 4 days if you’re 65 or older

- Trip cancellation – up to $1,500 per person / $5,000 total

- Trip interruption – up to $5,000 per person / $25,000 total

- Flight/trip delay insurance – $500 per person – 4 hours

- Delayed and lost baggage – up to $1,000 / 6 hours

- Auto rental collision/loss damage – 48 consecutive days / $65,000

- Hotel/motel burglary insurance – $2,500

- Common carrier travel accident – $500,000

The travel insurance included is competitive and comparable to my list of the best credit cards with travel insurance , but it does lack two major types of travel insurance.

The 21 days of travel medical insurance is pretty good, but like many other credit cards, it only gives 4 days if you’re 65 or older. You’ll obviously need more coverage if you fall into that age range.

Note that was this card, you only need to charge 75% of your trip costs for your flight/trip delay and hotel/motel burglary insurance to apply. However, for trip cancellation and auto rental collision, you need to charge 100% of the cost to your card.

Mobile device insurance

Many people aren’t aware that the TD First Class Travel Visa Infinite Card comes with mobile device insurance. When you charge at least 75% of the total device or monthly plan cost to your card, you’ll be insured for up to $1,000. That said, like other mobile device insurance plans, depreciation applies when making a claim. Both cellular phones and tablets count as mobile devices.

Purchase insurance

- Purchase security – 90 days

- Extended warranty – Up to 1 additional year

The purchase security insurance covers your good from theft, loss, and damage for 90 days. With extended warranty, you your warranty doubled up to one additional year.

Visa Infinite benefits

- Concierge service – The Visa Infinite Concierge is available 24/7 and can help you secure concert tickets, make dinner reservations and more.

- Luxury Hotel Collection – You’ll get exclusive benefits such as resort credits and room upgrades when booking accommodations through the Visa Luxury Hotel Collection.

- Dining Series – Get access to some culinary events, such as celebrity chef meetups and tasting menus.

- Wine Country program – Your Visa Infinite Card gets you discounts and free wine tastings at participating wineries in British Columbia, Ontario and Sonoma Valley.

- Entertainment access – Throughout the year, cardholders get invites and exclusive access to the Toronto International Film Festival.

- Troon Golf – Troon Rewards Silver Status is given to cardholders. With your status, you’ll get 10% off green fees, merchandise and lessons.

How to redeem your points

TD Rewards allows you to book travel in multiple ways, giving you more options. Given the flexibility, many people love TD Rewards. However, your points will have a different value depending on how you redeem them.

Expedia for TD

Expedia for TD is TD’s main travel redemption option. 200 TD Rewards points get you $1 off Expedia for TD travel bookings. This essentially makes one TD Reward point worth .5 cents. Expedia for TD is nearly identical to Expedia.ca. That means you’ll get access to a large inventory of flights, hotels, car rentals, all-inclusive packages and attraction tickets.

To redeem TD Rewards points on Expedia for TD, you have to log in to TD Rewards and click on the Expedia for TD link. When you’re ready to pay, you’ll be given the option to use your TD Rewards points. Generally, Expedia has very competitive prices.

Booking on your own

TD Rewards points can also be used to offset travel expenses you charge directly to your TD First Class Travel Visa. The redemption rate is 250 points = $1 (or a value of .4 cents per point). That means you get 20% less value than using your points on Expedia for TD. That said, when you make a travel purchase on your own that’s more than $1,200 in value, any amount that’s $1,201 or above would have a redemption value of 200 points for $1.

Even though you get less value by booking on your own, there are a few reasons to consider this option. The first reason is that you are not restricted to what is available on Expedia for TD, so you can use points for bookings on Airbnb or booking.com. The second reason why booking on your own travel is handy is that most hotel chains will require that you book directly with them to enable loyalty membership status and perks.

TD First Class Travel Visa Infinite Card eligibility

- You’re a Canadian citizen, or you’re a permanent resident

- You’re at least the age of majority in the province or territory where you reside

- You have a minimum annual personal gross income of $60,000 or a household income of $100,000

As a Visa Infinite card, there are very specific eligibility requirements. Even though there’s no formal credit score requirement listed, you’ll likely need your credit score to be at least 700 to be approved. That’s because a credit score of at least that number would put you in good standing or higher.

How the TD First Class Visa Infinite compares

As a mid-tier travel rewards credit card, the TD First Class Travel Visa Infinite Card has a lot of competition. Not only does it compete with other bank credit cards, but there are also airline credit cards worth looking at too.

TD First Class Visa Infinite Card vs. Scotiabank Passport Visa Infinite Card

The Scotiabank Passport Visa Infinite Card is a very popular travel credit card since it gives you get six free annual airport lounge passes and has no foreign transaction fees. The earning rate of this card is similar to what TD offers. The overall insurance package offered by TD is slightly better.

TD First Class Visa Infinite Card vs. American Express Gold Rewards Card

Another great mid-tier travel card is the American Express Gold Rewards Card . Although the card has an annual fee of $250, you get an annual $100 travel credit and a Priority Pass Membership with four free annual Plaza Premium airport lounge passes. What makes this card stand out is the fact that you earn American Express Membership Rewards points. These points can be transferred to Aeroplan at a 1:1 ratio.

TD First Class Visa Infinite Card vs. TD Aeroplan Visa Infinite Card

If your goal is to travel for less, then the TD Aeroplan Visa Infinite Card should also be considered. With this card, you’ll earn Aeroplan points on all eligible purchases. This is relevant because Aeroplan is Air Canada’s loyalty program and one point can easily be worth between 1.5 – 2 cents each. In addition, by having this card, you get your first checked bag free and preferred pricing on Aeroplan redemptions.

Final thoughts

My TD First Class Travel Visa Infinite Card review is positive. It’s an ideal card for people in the following situations:

- You want to save on travel – TD Rewards points are highly flexible and best used via Expedia for TD.

- You bank with TD – If you have an All-Inclusive Banking Plan, the annual fee is waived for this card.

- You want insurance – The included travel and purchase insurance with this card is excellent.

Although Expedia for TD may not be the best rewards program out there, it’s easy to understand and there are no blackout dates. Plus, the overall insurance package you get with this card is excellent. That said, the earn rate for this card is not as good as other cards out there.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

Hi Barry! Thanks for another great post. I currently use the AMEX cobalt as my everyday card and wanted to get a supplementary card to use when AMEX is not accepted. I currently have an All-Inclusive banking plan with TD, which would waive the annual fee for the TD First Class Travel Visa Infinite Card & the TD Aeroplan Visa Infinite Card. Which one would you recommend between the two?

Hey Sylvia.

It sort of depends on your goals. If you got the TD Aeroplan VI card, you could pool the points with your Cobalt since those points can be converted to Aeroplan. The TDFCTVI is good if need to make non-Aeroplan bookings such as car rentals or hotel bookings.

You state the following: “Note that was this card, you only need to charge 75% of your trip costs for your travel insurance to be valid.” However, my review of the wording indicates that under Trip Cancellation, you must charge the full cost of your trip to the card to get coverage. This is under the definition of Covered Trip.

You’re right. the 75% only applies to hotel/motel burglary and trip delay.

Calculating rewards with the new and improved TD First Class Travel makes it a good competitor to the Aeroplan card. I feel like it’s hard to get a good value with Aeroplan (2 cpp). More than often international travel gives around 1.4 cpp making the First Class card more valuable (if booking something via Expedia to get the $100 credit that is. Am I missing something? Would the Aventura or RBC Avion otherwise be better?

Hey Philippe,

I haven’t had too much trouble finding Aeroplan value between 1.8 – 2 CPP. Then again, I booked most of my travel before there was crazy demand.

Aventura and Avion both have a fixed travel program where you can get a higher CPP, but I personally find Aeroplan to be more valuable. I typically try to collect American Express Membership Rewards points and then transfer them to whatever program gives me good value when I need to make a redemption.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

Home » TD First Class Travel Visa Infinite Card: Up to 115,000 bonus points + no annual fee in the 1st year

TD First Class Travel Visa Infinite Card: Up to 115,000 bonus points + no annual fee in the 1st year

A new increased welcome bonus offer of up to 115,000 points is now available on the TD First Class Travel ® Visa Infinite* Card . In addition to the bonus points, newly approved cardholders receive a first year annual fee rebate on the primary and first additional card added to the account. This new offer is available until January 3, 2024.

TD First Class Visa Infinite Welcome Bonus

The new increased welcome bonus of up to 115,000 points on the TD First Class Travel Visa Infinite Card is broken down as follows:

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 95,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†

- Get an annual TD Travel Credit† of $100 when you book at Expedia® For TD.

- Get a free 12 month† Uber One membership (that’s $120 in value†).

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by January 4, 2024.

This new welcome bonus is relatively easy to achieve. you’ll earn 20,000 points right away on your first purchase and then an additional 95,000 if you spend $5,000 over the course of six months . That works out to an average of $833.34 in monthly spending over those 6 months which should be easy enough for those whose income makes them eligible to get this card ($60,000 personal / $100,000 household) .

Value in the Welcome Bonus

Here are just a few examples of what those 115,000 points can get you in terms of rewards:

- $575 worth of travel when you redeem via ExpediaForTD

- $460 worth of travel when you redeem for any travel that you book yourself and charge on the card

- $460 worth of education payments when you redeem your TD Rewards points via HigherEdPoints . ($460 is an example of the potential value as you have to redeem in 62,500 point increments for HigherEdPoints)

- $287.50 in gift cards or statement credits.

Annual Fee Waiver

With this current welcome bonus you do get a first year annual fee waiver and after that the card’s annual fee is $139.

If you are a TD All-Inclusive account holder, you’ll continue to receive a full rebate of the Annual Fee for the Primary Cardholder and the First Additional Cardholder as well.

Card Highlights:

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†.

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†

- Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card† plus earn an annual Birthday Bonus† of up to 10,000 TD Rewards Points

- Your TD Points don’t expire as long as you are a TD First Class Travel Visa Infinite* Cardholder

- An annual TD Travel Credit† of $100 when you book at Expedia® For TD.

- TD Rewards Birthday bonus† that helps you celebrate in style.

- An extensive suite of travel insurance coverage which helps you travel prepared

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply. See more details.

Wrapping it up

TD’s new card offers for the fall and early winter have been released and they include this excellent increased offer for the TD First Class Visa Infinite Card. The welcome bonus provides up to 115,000 TD Rewards points which are worth up to $575 in travel value. Thanks to also having no annual fee in the first year this new bonus moves the card into the top 5 for this month in terms of welcome bonus value.

Click here to learn more about and/or to apply for the card

† Terms and Conditions apply.

Sponsored advertising. The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

This offer is not available for residents of Quebec. For Quebec residents, please click here .

Want to learn more? Have a question? Join our Facebook group to ask the Rewards Canada community!

Be sure to subscribe to the Rewards Canada News email newsletter so that you don’t miss out on any loyalty program news and offers! You can subscribe to the newsletter here

CREDIT CARDS

Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website. We may receive compensation for the products and services you obtain through links on our site.

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

- Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

TD First Class Travel vs TD Aeroplan: How to Choose

The main difference between TD First Class Travel and TD Aeroplan is the rewards system. Aeroplan is Air Canada’s reward program, while the TD First Class Travel card is tied to TD Rewards Points. Thinking about where you shop and how you like to redeem your points can help you decide which of these cards is the better fit.

What is TD Aeroplan?

What is td first class travel.

- TD First Class Travel vs. TD Aeroplan: Which is better?

- TD First Class Travel cards

- TD Aeroplan cards

TD Aeroplan is the name given to a group of TD credit cards that earn Aeroplan points . You can use the points to buy things like flights, hotel rooms, car rentals, merchandise and more via Air Canada’s Aeroplan redemption platform.

TD offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite .

- TD Aeroplan Visa Platinum.

- TD Aeroplan Visa Infinite Privilege.

- TD Aeroplan Visa Business.