© Copyright 1997- VnExpress.net, All rights reserved

2019 a y ear of new highs for Vietnam tourism

Vietnam’s tourism industry received a slew of prestigious awards and set new records in 2019., foreign tourist numbers a record high.

The number of foreign tourists reached an all-time high of 18 million in 2019, up 16.2 percent year-on-year. 14.3 million or 79 percent of the total were Asian visitors, up 19 percent.

China remained the largest source of tourists, accounting for 5.8 million (32 percent), followed by South Korea (4.3 million or 24 percent), Japan (952,000), and Taiwan (926,000).

The growth has been credited to the government’s visa waivers for nationals of potentially large tourism markets, the launch of a slew of new direct flights and increased nighttime activities like shopping and amusement.

World’s leading heritage destination

Vietnam surpassed competitors like Brazil, China, Egypt, and Greece to be named the world’s leading heritage destination for the first time at the World Travel Awards (WTA) in Oman in November.

The recognition vindicates the country's efforts to preserve its cultural heritage, the WTA stated.

The country is home to eight world heritage sites recognized by UNESCO: the Phong Nha-Ke Bang National Park, My Son Sanctuary, Hoi An ancient town, the Complex of Hue Monuments, Ha Long Bay, Trang An Landscape Complex, Thang Long Imperial Citadel, and the Ho Dynasty Citadel.

The heritage sites have repeatedly won global acclaim in recent years.

Launched in 1993 and heralded as the "travel industry's equivalent of the Oscars" by The Wall Street Journal , the WTA awards are based on votes by the public and travel professionals across the globe.

World’s best golf destination

For the first time, Vietnam received the World's Best Golf Destination award at the international World Golf Awards, a part of the World Travel Awards, held in the United Arab Emirates in October.

The country beat seven other nominees, Argentina, Canada, Jamaica, New Zealand, Oman, Portugal, and South Africa to win the prize. The World Golf Awards, the most prestigious in the golf tourism industry, have been given annually since 2014, based on votes by professionals and consumers.

According to the Vietnam Professional Golf Association, over 70,000 people played golf as a leisure sport in 2018, up from 10,000 in 2009. The country has more than 30 golf courses.

Asia’s leading culinary destination

Vietnam was crowned "Asia’s Leading Culinary Destination" at the World Travel Awards (WTA) for Asia and Oceania in October. It was the first time the country achieved this honor though Vietnamese cuisine has won considerable praise from international tourists and rave reviews from renowned travel magazines.

Graham Cooke, the founder of WTA, said Vietnamese cuisine has crossed the country’s borders and become one of the "must-try" experiences.

Google honors 400-year-old town Hoi An

Google Doodle in July 16 featured the ancient town of Hoi An on its homepage, making it the first Vietnamese destination to be honored thus. It was to mark the traditional Lantern Festival, held on the 14th day of each lunar month.

An image of Hoi An in central Vietnam with symbols of the Chua Cau (Pagoda Bridge) and colorful lanterns became Google’s logo for the day.

The Google Doodle commemorates holidays, events, achievements, and people.

Hoi An was recognized as a UNESCO world cultural heritage site in 1998 and has become one of the top holiday destinations in Vietnam, attracting over five million visitors this year, including more than four million foreigners.

The Pagoda Bridge, a national relic that appears on VND20,000 bills, has been an iconic landmark of the 400-year-old town. It was built in the early 17th century by Japanese traders who once made up a large part of the town’s population.

Colorful floating lanterns are also a distinct feature of Hoi An where lights are switched off during the lantern festival and the only light comes from the lanterns floated on the river.

Story by Nguyen Quy

- Tắt chia sẻ

2019: Eight landmark events for Vietnam

Tragedy and triumph in Vietnam: A 2019 pictorial flashback

Vietnamese cinema reels in the accolades in 2019

Vietnam Tourism Annual Report 2019 released

The Vietnam National Administration of Tourism (VNAT) has released the Vietnam Tourism Annual Report 2019 in both Vietnamese and English languages. The report reflects a busy year of the Vietnamese tourism sector with outstanding achievements, as the country served over 18 million foreign tourists – the highest number recorded, and 85 million domestic holiday-makers, earned 755 trillion VND (32.6 billion USD) from tourism services, and contributed 9.2 percent of GDP. It provides information about improving mechanisms, policies, transportation, accommodations and tourism promotion. It also recalls international awards that the tourism sector received last year. Of note, the 2019 report contains information about the application of technology in tourism development amid the fourth Industrial Revolution./. VNA/VNP

Ho Chi Minh City celebrates Vietnam Book Day

Vietnam becomes biggest rice supplier for Singapore

Vietnamese film wins highest award at Asian festival in Italy

ASEAN foreign ministers call for end to Myanmar violence

PM urges village elders, citizens to help preserve cultural heritage

Special music video promotes Vietnamese tourism

Southern tourism on right track

Most viewed.

Mekong Delta grapples with erosion, subsidence

Guidelines for foreigners entering Vietnam during COVID-19 prevention and control

Top 10 prestigious insurance firms in 2022 announced

Hanoi finalizes design of $375m Tran Hung Dao Bridge

Seven Vietnamese billionaires named on Forbes rich list

Read printed publications.

PHOTO FOR SALE

Reimagining tourism: How Vietnam can accelerate travel recovery

This article is part of the ongoing Future of Vietnam series, which explores key topics that will shape the country’s future growth. Separate articles discuss Vietnam's post-COVID-19 economic recovery , its longer-term growth aspirations and ways for ecosystem players to win in Vietnam .

Download the Vietnamese translation (PDF – 2.4MB).

For most players in the travel industry , the idea of vacationers lounging on a beach thousands of miles from home or sailing the high seas seems like a distant memory. Globally, countries experienced a decline of 35 to 48 percent in tourism expenditures last year compared with 2019 . Vietnam, with its ten-month international border closure, has not been exempted.

Tourism contributes a significant share to Vietnam’s GDP, and the economy has relied on domestic travel to buoy the sector. Local tourism resumed shortly after the country ended its relatively brief lockdown—just in time for 2020’s summer holiday season. Our analysis shows that demand for domestic travel in Vietnam will continue to grow and will recover relatively fast because of growing domestic spending: vacationers who cannot yet travel abroad are redirecting their money locally, at a higher level than in 2019.

As Vietnam’s travel sector continues to evolve and as prospects of international travel become increasingly feasible with vaccination rollouts, travel and tourism players have to adapt to survive. This article gives an overview of the state of Vietnam’s tourism sector, looks ahead at how the industry is likely to recover, and maps out a way forward for the country’s travel and tourism companies.

The state of travel in Vietnam today: Staying afloat

Vietnam’s tourism sector relies heavily on international travel, which plunged last year. International flights dropped 80 percent in October 2020 from the same time period a year earlier (Exhibit 1). Hotels, in turn, filled only 30 percent of their rooms.

The sharp drop in foreign travelers has had an outsize impact on tourism expenditures—and Vietnam’s overall economy—because they spend significantly more than their local counterparts. In 2019, a year in which the tourism industry accounted for 12 percent of the country’s GDP, 1 “Total revenue from tourists in the period of 2008–2019,” Vietnam’s Ministry of Culture, Sports and Tourism, May 29, 2020, vietnamtourism.gov.vn. international travelers made up only 17 percent of overall tourists in Vietnam, yet accounted for more than half of all tourism spending—averaging $673 per traveler compared with $61 spent on average by domestic travelers (Exhibit 2). The tourism sector created 660,000 jobs between 2014 and 2019, 2 Global Economic Impact & Trends 2020 , World Travel and Tourism Council (WTTC), June 2020, wttc.org. and this sharp expenditure dive has also stunted the country’s food and beverage and retail industries.

As a return to pre-COVID-19 levels of international tourism may be far off, the travel sector’s short-term revival could depend on local tourism. In 2019, Vietnamese tourists spent $15.5 billion, of which $5.9 billion flowed overseas. The majority of tourists are unable to leave the country, so they are looking domestically to scratch their travel itch. Travel companies should therefore rise to the occasion and capture value from this opportunity.

Looking ahead: Vietnam’s tourism industry can recover by 2024 if it implements a zero-case-first approach

Even with favorable tailwinds driven by domestic tourism, Vietnam will be dependent on international markets, which represent around $12 billion in spending. The majority of Vietnam’s international tourists come from Asian countries, with those from China, Japan, South Korea, and Taiwan accounting for around 80 percent of Vietnam’s foreign tourism spending. Vietnam’s strong economic ties with these countries could lead to a relatively fast tourism-industry recovery compared with other key tourist destinations in Europe and North America (Exhibit 3).

To make the most of these ties, Vietnam has been pursuing a zero-case-first strategy since the start of the pandemic. This strategy is associated with markets in which COVID-19 transmission rates are low and—as a result—traveler confidence, at least on a domestic level, is relatively high.

By implementing the zero-case-first approach and taking into account Vietnam’s currently resilient local economy and proactive government campaigns, Vietnam’s tourism sector could recover to precrisis levels in 2024 (Exhibit 4).

Under this scenario, three paradigms are changing the way travel companies plan for Vietnam’s recovery:

- Shifts in tourism behavior could result in high-end domestic trips. With borders remaining closed for outbound travel, an increase in domestic luxury trips could occur as travelers reallocate their budgets. Of course, as noted above, the spending power of domestic tourists is weaker than that of foreign tourists, so this type of travel cannot completely fill the gap created by the lack of international travelers.

- Price cuts could be used to stimulate demand but aren’t sustainable for the long term. Many travel companies offered discounts in the immediate aftermath of the crisis in order to compete for business and stimulate demand. This may result in price dilution, especially for hotels across the country, and thus may not be a sustainable strategy for the long term.

- International travel bubbles have to be explored with caution. Currently, Vietnam has strict travel restrictions in place and allows only a select number of weekly international flights for travel by experts and diplomats, who are subject to mandatory quarantine on arrival. Vietnam needs to protect the status quo of having near-zero rates of COVID-19 cases and cannot risk opening its borders freely until herd immunity is reached, most likely through mass vaccinations. Thus, it could take some time before inbound foreign tourism returns at scale. In the meantime, there might be some opportunity to pursue more gradual and less risky measures. For instance, there have been discussions about establishing travel bubbles to allow travel between other countries with zero or near-zero transmissions, such as Australia, China, and Singapore. Travel companies should be prepared for two scenarios: one in which travel bubbles open up for inflows of international tourists, and the other in which domestic tourism remains the main driver of value.

Six actions to jump-start Vietnam’s tourism recovery

As travel companies reimagine their pathways to recovery, it is important to address the risks and anxieties related to COVID-19, while also solving for the pain points and trends that existed before the crisis. Below are six steps that Vietnam, and other countries operating in a zero-case-first market approach, can take as they embark on this road to recovery.

Focus on domestic travelers

Local demand can be revitalized by focusing on emerging destinations with the joint cooperation of local governments, online travel agencies, attractions, hotels, and airlines. Outdoor tourism that involves sunshine, beaches, mountains, and nature were among the top choices for Vietnamese travelers after the lockdown was lifted in mid-May last year, and airports at the two big travel hubs of Ho Chi Minh City and Hanoi were busy. To further tap into the domestic opportunity, operators will have to focus on affordability while striving to maintain high-quality products and experience.

Consider new pricing models to rebuild demand

Rebuilding demand and propelling volume, through discounts and presales, are key tactics during the early stages of recovery, especially for high-end operators that will not be able to tap into international demand for some time. However, the crisis has also forced operators to set aside their existing commercial playbooks. Historical booking patterns and trends normally used as key reference points for price optimization and yield management may no longer be as relevant. In this context of depleted demand, the paradox is that while price cuts are necessary, they could also be dangerous. In this light, companies can also explore opportunities to bundle products—which can offer upselling and cross-selling opportunities—as well as diversify their revenue stream and enhance premium product and pricing.

Five-star hotels in Hanoi and Ho Chi Minh City, for example, can provide full “staycation” packages for families, complete with home pickup by luxury car, a suite, and discounts on food and drinks. Tourism companies and hotels could work together to provide end-to-end travel packages that include flights, train tickets, limousine and bus services, and accommodations. Other companies could capitalize on booming demand for luxury and outdoor activities, such as yacht tours or farm stays.

As demand grows and confidence increases, operators will naturally be inclined to revert to a more dynamic pricing model, based on indicators such as hotel occupancy and domestic-air-travel passenger numbers—and how they grow toward achieving prepandemic levels. That will then give companies an opportunity to refine optimal pricing mechanisms, especially around key domestic holidays such as Tet (the Vietnamese New Year). This is not something that all countries are getting right. Many hotels in Germany , for example, missed pricing or revenue-management opportunities when demand for summer travel reemerged last year.

In the future, dynamic pricing models and the revenue-management function will need to be revisited, based on three new axioms: traveler segments will not be the same for a long period of time and will be a stronger and more diverse domestic mix; demand elasticities will be different, with health concerns playing a more influential role in decision making; and demand will remain very volatile, as observed in Vietnam during the Tet holiday this year, when a small spike in COVID-19 cases led to a big drop in bookings and travel demand throughout the country.

The time for digital (really) is now

Even before the pandemic, consumer reliance on digital for travel-related bookings had been growing. In 2018, online travel activity made up 19 percent of the total tours and activity market size. The pandemic has made the adoption of mobile and digital tools even more essential. Strategic collaborations—such as online travel agencies providing ticket-booking services via instant messaging and social-media platforms—could offer an opportunity for increased market penetration.

At the same time, travel companies should revamp their online touchpoints and experiences to improve customer experience. This is already starting to happen: the website of the Vietnam National Administration of Tourism (VNAT) has virtual tours for its most popular destinations, and some tour guides have organized real-time online tours for international customers. In addition, a commercial titled, “Why not Vietnam” aired on CNN in October 2020 to drive international traffic to the website, and on the domestic level, a reality show with the same name offered up weekly online travel photo contests to engage viewers.

Furthermore, companies could also think about placing digital tools in new places within the customer journey. They must recognize that factors promoting customer loyalty may have changed; near-term uncertainty may mean, for example, that the ability to cancel a reservation matters more than brand choice or price. Taking this into account, companies could empower customers to build their own itineraries using connected digital tools that make it easier for them to modify or cancel their plans. Solutions and policies that provide choice and control will help build the long-term trust and confidence necessary to get travelers back on the road and in the air.

Lay the groundwork for inbound demand

To capture early outbound demand, travel players could benefit from tracking the development of travel bubbles. This is especially relevant for Vietnam, as the majority of tourists to Vietnam are from nearby regions with strong economic ties and relatively low transmission rates. As stated earlier in this article, our analysis finds that nearby countries such as China, Malaysia, and Thailand could provide inbound expenditure growth of at least the CAGR between 2020 and 2025 (Exhibit 3).

In this context, travel companies will need to be flexible and nimble to capture early international-travel demand—and should be prepared to implement strict health and safety protocols that fulfill the stipulations of both domestic and destination security policies. That said, betting on travel bubbles cannot in itself be a strategy in the short term, as international arrivals are expected to remain low in 2021, and foreign demand will not return to 2019 levels before 2025.

Reinvent the traveler’s experience beyond accommodation—and ‘redistribute’ tourism investments toward unconventional and more diverse destinations

Globally, travelers are personalizing their trips through destination adventures. Tourism spending is shifting away from accommodation to activities—a trend that holds true for Vietnam. According to a report released by the General Statistics Office of Vietnam, Vietnamese travelers have allocated smaller budgets for accommodation in the past few years, accounting for approximately 15 percent of travel expenditures in 2019, down from 23 percent in 2011.

Instead of spending on luxury accommodations, travelers are saving money for destination experiences. Many tourists are booking activities before they travel, which suggests the in-destination experience has a bigger impact in the overall tourist decision-making process. Many adventure activities, such as cave discovery, highland hiking, isolated island stays, water sports, and food festivals have become the main reason for travelers to visit a destination in the first place.

In Vietnam, examples of efforts aimed at developing a distinct experience—rather than specific infrastructures—have emerged recently, such as the development of Ho Chi Minh City’s “night economy,” and diversified marketing from the Binh Duong province to spotlight its festivals as main attractions. VNAT is also participating in this effort, specifically making farm stays in mountainous areas an axis for the development of more indigenous experiences. Meanwhile, other regions are also marketing unique experiences: Dalat is promoting its hiking and camping attractions, Mui Ne its golf and water sports, and Ninh Binh and Phong Nha-Ke Bang their nature activities.

Local operators, who often lag behind big travel companies in terms of resources but are more agile in organizing personalized activities, can leverage increasingly popular online players to connect directly with customers and provide these options. International online travel agencies such as TripAdvisor, as well as closer-to-home players such as Traveloka and Triip.me, have been building dedicated “experience” platforms to inspire users and allow them to choose the most suitable tours by providing a range of attractive options for destination adventures. Tourism companies could shift their efforts away from building resorts and selling sightseeing tickets to designing exceptional activities and leverage these platforms to take advantage of travel-experience trends.

Reimagine government’s role in tourism

In most countries, reinventing the tourism industry will involve industry professionals working in concert with industry groups and governments . Vietnamese tourism administrators have an exciting opportunity to reimagine their roles and lead the sector through recovery and beyond—first, by boosting domestic demand to make up for lost income from international travelers, and second, by promoting Vietnam’s image as a country that has managed the pandemic fairly well. To do this, three things should occur:

- In the short term, government and industry associations need to ensure the survival of operators. The government can experiment with new and sustainable financing options such as hotel revenue pooling, in which a subset of hotels operating at higher occupancy rates share revenue with others. This would allow hotels to optimize variable costs and reduce the need for government stimulus plans.

- In the midterm, government-backed digital and analytic transformation is necessary, especially to level the playing field for small and medium-sized enterprises, which made up more than 50 percent of travel suppliers in 2018. Encouraging and helping local operators adjust to the demand for online travel services is critical to help them stay competitive. Government can play a vital role as a matchmaker, connecting suppliers to distributors and intermediaries to create packages attractive to a specific segment of tourists, and then use tourist engagement to provide further analytical insights to travel intermediaries. This ability allows online travel agents to diversify their offerings by providing more experiences off the beaten track. The Singapore Tourism Analytics Network (STAN) and the Tourism Exchange Australia (TXA) platforms are examples of how this mechanism can work at scale.

- Finally, Vietnam has a solid opportunity to boost its stature as an adventure destination. Governments and industry associations can leverage the overall momentum of the country, as well as the expected return of international travel, to boost demand. Our analysis finds that in the Asia–Pacific region, adventure remains the leading travel trend searched by travelers, so Vietnam is well positioned to leverage this trend. Similarly, investments are also expected to shift away from mega development projects, such as Phu Quoc and Nha Trang, toward small- and medium-scale projects and cities that offer specialized offerings like sports tourism, medical tourism, and even agricultural tourism.

Travel players in Vietnam can seek to accelerate the industry’s recovery by capturing emerging growth opportunities domestically as they gradually rebuild international travelers’ confidence. Our six steps should set the stakeholders in Vietnam’s travel industry in the right direction and help them thrive in the tourism economy of the future .

Margaux Constantin is a partner in McKinsey’s Dubai office; Matthieu Francois is an associate partner in the Ho Chi Minh City office, where Thao Le is a consultant.

The authors wish to thank Celine Birkl, Bruce Delteil, and Alex Le for their contributions to the article.

Explore a career with us

Related articles.

Indonesia’s Traveloka finds strength in local markets amid the pandemic

COVID-19 tourism spend recovery in numbers

Six golden rules for ecosystem players to win in Vietnam

- Thang Long - Hanoi

- Overseas Vietnamese

- Most Recent

- Most Popular

- Mobile Version

- Party building

- Dien Bien Phu Victory 70 years on

- Human rights

- Patriotic emulation

- Green transition

- Digital transformation

- Climate change

- Post-pandemic recovery

Vietnam welcomes record number of foreign visitors in 2019

Related News

Vietnam promotes tourism at indonesia’s festival, hcm city kicks off tourism stimulus programme, night tourism a billion-dollar opportunity ready to be exploited.

The number showed a year-on-year rise of 16.2 percent. Tourists from Asia made up 79.9 percent of the total, up 19.1 percent, Europe up 6.4 percent, America up 7.7 percent, and Africa 12.2 percent.

The Vietnam National Administration of Tourism said the country served 85 million domestic holidaymakers in the year, increasing over 6 percent.

In 2019, Vietnam was honoured with global prestigious prizes such as the World Golf Awards , the World Travel Awards , and the Asia’s Best Destination .

Vietnam’s tourism competitiveness has continuously improved, standing 63th among 140 economies in the World Economic Forum ranking.

In 2020, the country strives to welcome approximately 20.5 million international tourists, and 90 million domestic ones. The tourism sector aims to gross over 830 trillion VND (35.9 billion USD) in revenue./.

Hanoi’s tourism revival further strengthened

VNA launches special news website on Dien Bien Phu Victory

Prime Minister pays tribute to legendary founders of Vietnam

Quang Nam launches big tourism stimulation programme

Prime Minister meets Apple CEO

You should also see.

PM asks Lang Son to fully tap development resources

Construction starts on final sub-project of North-South Expressway

Quang Ninh aims to become international tourism hub

Infographic Power capacity from renewable energy sources by 2030

Ninh Binh listed among world’s top 10 free-crowd wonders

Agro-forestry-fisheries products nearly double in Q1

Hung Kings’ Commemoration Day - Vietnam’s long-held tradition

Real estate market thrives, entities ready to re-enter market

CNN names Vietnamese dumpling among world’s tastiest

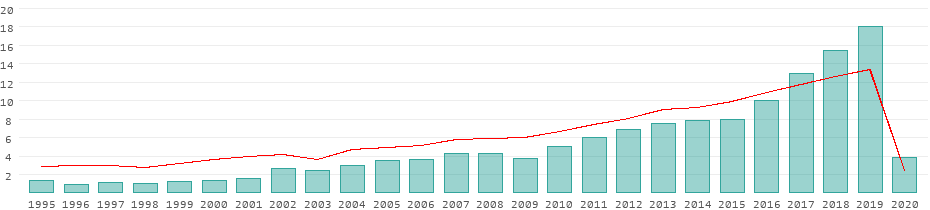

Tourism in Vietnam

Development of the tourism sector in vietnam from 1995 to 2020.

Revenues from tourism

All data for Vietnam in detail

- Culture – Society

- Science – Technology

- Human Rights

- Border and territory

- 3D exhibitions

- Photo and video contest

- Destinations

- National Awards for External Information

- Young parliamentarians

- Data about Vietnam

- Ninth time – 2023

- Press Release

- Grand Prix of Binh Dinh-Vietnam

Viet Nam Tourism Annual Report 2019

Author: Ministry of Culture, Sports and Tourism – Viet Nam National Administration of Tourism Publisher: VNA publishing house Year: 2019 Pages: 64 Language: English

Cùng chủ đề

Những quy định luật pháp quốc tế và nỗ lực của việt nam trong việc gỡ thẻ vàng iuu.

Nội dung Cẩm nang truyền thông quảng bá hình ảnh VN ra nước ngoài

Nội dung dự kiến đưa vào cuốn sách việt nam thường niên 2023, xây dựng và phát triển nền đối ngoại, ngoại giao việt nam, truyện cười dân gian việt nam – tiếng pháp, truyện cười dân gian việt nam – tiếng đức, truyện cười dân gian việt nam – tiếng anh.

- Vietnam Chatbot

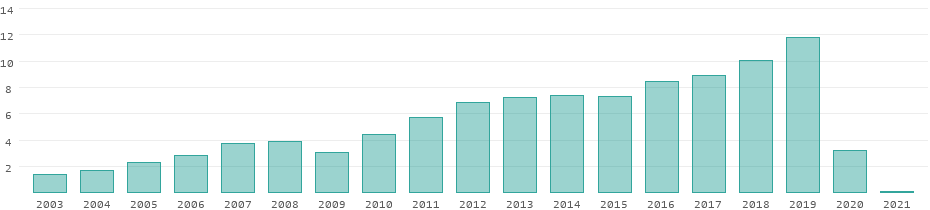

International tourism, number of arrivals - Viet Nam

Selected Countries and Economies

All countries and economies.

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

GENERAL STATISTICS OFFICE

- Development history

- Functions and duties

- Organizational structure

- National Accounts

- Banking, insurance and State budget

- Agriculture, Forestry and Fishery

- Investment and Construction

- Enterprises

- Trade and Services

- Health, Culture, Sport, Living standards, Social order, Safety and Environment

- Administrative unit, Land and Climate

- Population and houses census

- Rural, agricultural and fishery census

- Economic census

Vietnam Tourism 2021: Needs determination and effort to overcome difficulties

In 2020, Viet Nam’s tourism suffered extremely heavy losses due to the impact of the Covid-19 epidemic. After many years of continuous impressive growth, in 2020, for the first time, Viet Nam recorded a sharp decline in the number of domestic and international tourists due to the Covid-19 epidemic. The total number of tourists served by accommodation, food and beverage service establishments in 2020 reached 97.3 million VND, a decrease of 44% over the previous year; a number of tourists served by travel agencies was 3.7 million, down 80.1%. International arrival to Viet Nam decreased 78.7% year on year, gained only 3.8 million arrivals. The sharp decline in the number of domestic and international tourists has led to a significant decline in revenue for accommodation, food and beverage service, estimated at 61.8 trillion VND, down by 43.2 percent.

Facing the accumulated difficulties, the tourism industry has made efforts to implement many solutions to remove difficulties for businesses and workers; proposed to the Government and the Prime Minister solutions to support the recovery of business activities such as land tax, electricity prices, reduced or free sightseeing at many destinations. In addition, many businesses also promptly changed from exploiting international markets to focus on domestic tourism, thereby becoming a salvage solution in the epidemic period. The tourism industry has twice launched the stimulating tourism demand program: The first time in May 2020 with the theme “Vietnamese people travel in Vietnam” and the second time in September 2020 with the theme “Viet Nam tourism – a safe and attractive destination”. These programs have received a positive response from localities, businesses and people, created a new movement trend, spread the inspiration to discover a safe and attractive destination in Viet Nam. These programs have brought practical contributions to the economic recovery process: Many domestic tourists have been experienced and explored Vietnam’s top tourist destinations and many unknown places for the first time at a fairly average cost. Entertainment facilities, shopping activities are activated; travel businesses are re-opened, thereby creating jobs for a certain number of workers… Although the revival of tourism may not be enough to boost the operation of the whole country but it can keep small businesses active and stimulate the local economy, reducing negative impacts of the epidemic on the economy until international tourism is active again.

Influenced by the Covid-19 epidemic, the accommodation, food, beverage and travel services have also been heavily affected. In January 2021, the revenue of accommodation, food, beverage services was estimated at 48.7 trillion VND, down 4.1% compared to the same period last year, of which accommodation revenue was estimated at 4.5. trillion, down 15%; travel revenue was estimated at 1.6 trillion VND, down 62.2%, of which Hanoi’s revenue decreased by 45.6%; Can Tho decreased by 50.1%; Da Nang decreased 68.2%; Ho Chi Minh city by 69.9%; Quang Nam decreased 91.3%; Khanh Hoa decreased 95%.

The Covid-19 in the world continues to be complicated, forecasts for the global tourism picture in the first months of 2021 still have not shown bright signs. The domestic market still plays a crucial role, the international tourism market needs longer time to recover even when the epidemic ends. Therefore, Viet Nam tourism has also prepared to enter the new year 2021 with determination and efforts to find a suitable direction. In 2021, the tourism industry has defined the motto ” Link, Act and Develop”, which continues to focus on restoring and developing domestic tourism. To overcome difficulties in this context as well as development orientations for the coming years, Viet Nam tourism needs to focus on a number of issues such as: Restructuring the tourist market in a sustainable and effective direction; targeting high-quality, long-stay, high-spending customers; developing new products and services, linking to diversify and improve product quality suitable to each market segment; promoting public-private cooperation, regional links between localities and destinations in tourism development cooperation; digital transformation in tourism development, especially in management, business, market research, marketing and selling tourism products.

- Data and statistics

Travel, Tourism & Hospitality

Revenue of the travel & tourism industry in Vietnam 2019-2028

Revenue of the travel & tourism market in vietnam from 2019 to 2028 (in million u.s. dollars).

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

Definition:

The Travel & Tourism market encompasses a diverse range of accommodation services catering to the needs and preferences of travelers. This dynamic market includes package holidays, hotel accommodations, private vacation rentals, camping experiences, and cruises.

The market consists of five further markets.

- The Cruises market covers multi-day vacation trips on a cruise ship. The Cruises market encompasses exclusively passenger ticket revenues.

- The Vacation Rentals market comprises of private accommodation bookings which includes private holiday homes and houses as well as short-term rental of private rooms or flats.

- The Hotels market includes stays in hotels and professionally run guest houses.

- The Package Holidays market comprises of travel deals that normally contain travel and accommodation sold for one price, although optional further provisions can be included such as catering and tourist services.

- The Camping market includes bookings at camping sites for pitches using tents, campervans, or trailers. These can be associated with big chains or privately managed campsites.

Additional Information:

The main performance indicators of the Travel & Tourism market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues and users for the above-mentioned markets. Users represent the aggregated number of guests. Each user is only counted once per year. Additional definitions for each market can be found within the respective market pages.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

Prominent players in this sector include online travel agencies (OTAs) like Expedia and Opodo, as well as tour operators such as TUI. Specialized platforms like Hotels.com, Booking.com, and Airbnb facilitate the online booking of hotels and private accommodations, contributing significantly to the market's vibrancy.

For further information on the data displayed, refer to the info button right next to each box.

Other statistics on the topic Online travel market in Vietnam

- Direct GDP contribution of the tourism sector in Vietnam 2015-2021

Leisure Travel

- Most used online travel agencies Vietnam 2023

- Leading online travel agencies by awareness Vietnam 2021

Accommodation

- COVID-19 impact on hotel occupancy rate in Vietnam 2019-H1 2020

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

Statistics on " Online travel market in Vietnam "

- Online travel market size worldwide 2017-2028

- Online travel market scale APAC 2023, by country

- Consumer goods e-commerce spending in Vietnam 2023, by category

- GMV of online travel sector in Vietnam 2019-2025

- Online revenue share of the travel & tourism market in Vietnam 2019-2028

- Revenue of the travel & tourism industry in Vietnam 2019-2028

- Revenue per user of travel & tourism in Vietnam 2019-2028

- Online travel agency usage Vietnam 2023

- Travel frequency among online booking users Vietnam 2021

- Purposes of using an online travel agency Vietnam 2023

- Timing of purchasing travel tickets via an online travel agency Vietnam 2023

- Timing of booking accommodation via an online travel agency Vietnam 2023

- Devices used for booking tickets or services via an online travel agency Vietnam 2023

- Top-of-mind online travel agencies among users Vietnam 2021

- Preferences of using travel agency versus online booking for hotels Vietnam 2021

- Preferences of booking package travel in Vietnam 2021

- Preferences of using travel agency versus online booking for flights Vietnam 2021

- Factors influencing online travel agency choices Vietnam 2021

- Change in international tourist arrivals in Vietnam 2023, by means of transport

- Intention to spend on big-ticket items Vietnam 2022, by category

- Consumer goods e-commerce spending growth in Vietnam 2023, by category

Other statistics that may interest you Online travel market in Vietnam

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Online travel market scale APAC 2023, by country

- Premium Statistic Direct GDP contribution of the tourism sector in Vietnam 2015-2021

- Premium Statistic Consumer goods e-commerce spending in Vietnam 2023, by category

- Premium Statistic GMV of online travel sector in Vietnam 2019-2025

Key indicators

- Premium Statistic Online revenue share of the travel & tourism market in Vietnam 2019-2028

- Premium Statistic Revenue of the travel & tourism industry in Vietnam 2019-2028

- Premium Statistic Revenue per user of travel & tourism in Vietnam 2019-2028

Usage of OTAs

- Premium Statistic Online travel agency usage Vietnam 2023

- Premium Statistic Travel frequency among online booking users Vietnam 2021

- Premium Statistic Purposes of using an online travel agency Vietnam 2023

- Premium Statistic Timing of purchasing travel tickets via an online travel agency Vietnam 2023

- Premium Statistic Timing of booking accommodation via an online travel agency Vietnam 2023

- Premium Statistic Devices used for booking tickets or services via an online travel agency Vietnam 2023

Leading OTAs

- Premium Statistic Most used online travel agencies Vietnam 2023

- Premium Statistic Leading online travel agencies by awareness Vietnam 2021

- Premium Statistic Top-of-mind online travel agencies among users Vietnam 2021

Consumer preferences

- Premium Statistic Preferences of using travel agency versus online booking for hotels Vietnam 2021

- Premium Statistic Preferences of booking package travel in Vietnam 2021

- Premium Statistic Preferences of using travel agency versus online booking for flights Vietnam 2021

- Premium Statistic Factors influencing online travel agency choices Vietnam 2021

Impacts of COVID-19

- Premium Statistic Change in international tourist arrivals in Vietnam 2023, by means of transport

- Premium Statistic COVID-19 impact on hotel occupancy rate in Vietnam 2019-H1 2020

- Premium Statistic Intention to spend on big-ticket items Vietnam 2022, by category

- Premium Statistic Consumer goods e-commerce spending growth in Vietnam 2023, by category

Further related statistics

- Basic Statistic Travel and tourism industry: share of total economy employment in the UK 2000-2013

- Basic Statistic Travel and tourism industry: share of total economy GDP in the UK 2000-2013

- Premium Statistic Share of travel trips in the Middle East by frequency 2018

- Premium Statistic Share of Arab expats travel trips in GCC by destination 2018

- Premium Statistic Leading travel companies that comes to mind to Saudi Arabian residents by brands 2018

- Premium Statistic Share of business travel trip searches in the Middle East by executor 2018

- Premium Statistic Share of payments for travel activities in Egypt by method 2018

- Premium Statistic Share of travel trips in GCC by frequency 2018

- Premium Statistic Share of domestic travel trips in the Middle East by payment method 2018

- Premium Statistic Leading travel companies that comes to mind to Oman residents by brands 2018

- Premium Statistic Share of business travel trip payments in the Middle East by method 2018

- Premium Statistic Share of payments for travel transportation in Egypt by method 2018

- Premium Statistic Share of domestic travel trips in the Middle East by frequency 2018

- Premium Statistic Share of domestic travel trips in the Middle East by reason 2018

- Premium Statistic Leading travel companies that comes to mind to Kuwaiti residents by brands 2018

- Premium Statistic Frequently purchased products e-commerce sites COVID 19 Malaysia 2020 by age group

- Basic Statistic Interest in tourist activities of French visitors to UK 2014

- Premium Statistic Frequency of online purchases during COVID-19 pandemic Malaysia 2020 by age group

Further Content: You might find this interesting as well

- Travel and tourism industry: share of total economy employment in the UK 2000-2013

- Travel and tourism industry: share of total economy GDP in the UK 2000-2013

- Share of travel trips in the Middle East by frequency 2018

- Share of Arab expats travel trips in GCC by destination 2018

- Leading travel companies that comes to mind to Saudi Arabian residents by brands 2018

- Share of business travel trip searches in the Middle East by executor 2018

- Share of payments for travel activities in Egypt by method 2018

- Share of travel trips in GCC by frequency 2018

- Share of domestic travel trips in the Middle East by payment method 2018

- Leading travel companies that comes to mind to Oman residents by brands 2018

- Share of business travel trip payments in the Middle East by method 2018

- Share of payments for travel transportation in Egypt by method 2018

- Share of domestic travel trips in the Middle East by frequency 2018

- Share of domestic travel trips in the Middle East by reason 2018

- Leading travel companies that comes to mind to Kuwaiti residents by brands 2018

- Frequently purchased products e-commerce sites COVID 19 Malaysia 2020 by age group

- Interest in tourist activities of French visitors to UK 2014

- Frequency of online purchases during COVID-19 pandemic Malaysia 2020 by age group

IMAGES

COMMENTS

The Vietnam National Administration of Tourism (VNAT) has released the Vietnam Tourism Annual Report 2019 in both Vietnamese and English languages.

Find the most up-to-date statistics and facts on tourism industry in Vietnam. ... Premium Statistic Revenue per user of travel & tourism in Vietnam 2019-2028 ...

In 2019, Viet Nam, for the first time, welcomed 18 million international visitors, a year-on-year increase of 16.2%. The top 10 source markets contributed 15,2 million visitors, occupying 84.3% of the total. Figure 1.1. Number and growth of international visitors from leading source markets, 2019.

The Vietnam National Administration of Tourism (VNAT) has released the Vietnam Tourism Annual Report 2019 in both Vietnamese and English languages. VNA Tuesday, September 29, 2020 10:41.

Tourism in Vietnam is a component of the modern Vietnamese economy. ... Tourism statistics International visitors. Data source: Ministry of Culture, Sport & Tourism. Year ... In 2019, the tourism industry accounts for 12% of the country's GDP, international visitors only 17% but more than half: on average, each foreign tourist spends US$673 ...

Vietnam tourism statistics for 2019 was 11,830,000,000.00, a 17.36% increase from 2018. Vietnam tourism statistics for 2018 was 10,080,000,000.00, a 13.39% increase from 2017. Vietnam tourism statistics for 2017 was 8,890,000,000.00, a 4.59% increase from 2016. Download Historical Data Save as Image.

Foreign tourist numbers a record high. Foreign tourists on Bui Vien pedestrian street, one of Saigon's most popular hangouts. Photo by VnExpress/Quynh Tran. The number of foreign tourists reached an all-time high of 18 million in 2019, up 16.2 percent year-on-year. 14.3 million or 79 percent of the total were Asian visitors, up 19 percent.

01/11/2023. Author: Ministry of Culture, Sports and Tourism - Viet Nam National Administration of Tourism Publisher: VNA publishing house Year: 2019 Pages: 64 Language: English.

29/09/2020. The Vietnam National Administration of Tourism (VNAT) has released the Vietnam Tourism Annual Report 2019 in both Vietnamese and English languages. The report reflects a busy year of the Vietnamese tourism sector with outstanding achievements, as the country served over 18 million foreign tourists - the highest number recorded ...

International tourism, expenditures (current US$) - Vietnam. World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0. LineBarMap. Also Show Share Details. Label. 2005 - 2020.

In 2019, a year in which the tourism industry accounted for 12 percent of the country's GDP, 1 "Total revenue from tourists in the period of 2008-2019," Vietnam's Ministry of Culture, ... According to a report released by the General Statistics Office of Vietnam, Vietnamese travelers have allocated smaller budgets for accommodation in ...

In 2020, the country strives to welcome approximately 20.5 million international tourists, and 90 million domestic ones. The tourism sector aims to gross over 830 trillion VND (35.9 billion USD ...

Within 18 years, the country's dependence on tourism has decreased slightly. Before the outbreak of the COVID-19 pandemic, sales were $11.83 billion billion, 3.5 percent of gross national product. In 2020, tourist receipts plummeted due to the COVID-19 pandemic. Of the $11.83 billion billion (2019), only $3.23 billion billion remained.

Viet Nam Tourism Annual Report 2019. Author: Ministry of Culture, Sports and Tourism - Viet Nam National Administration of Tourism. Publisher: VNA publishing house. Year: 2019.

(TITC) - According to the General Statistics Office of Vietnam, the number of international visitors to Vietnam in May 2022 obtained 172.9 thousand arrivals, an increase of 70.6% compared to the last month and 12.8 times higher than the same period last year. In the first 5 months of the year, international visitors to Vietnam reached 365.3 thousand arrivals, 4.5 times higher than the same ...

World Bank Data

In 2020, Viet Nam's tourism suffered extremely heavy losses due to the impact of the Covid-19 epidemic. After many years of continuous impressive growth, in 2020, for the first time, Viet Nam recorded a sharp decline in the number of domestic and international tourists due to the Covid-19 epidemic. The total number of

In 2019, Vietnam witnessed a remarkable ... the Vietnam National Administration of Tourism (VNAT) and the General Statistics Office. Forecasting 2022, 4 38 of Vietnam (GSO). The collected data on Vietnam's tourism include (1) the monthly number of international tourists to Vietnam, from January 2008 to December 2020; (2) the annual ...

According to Vietnam's General Statistics Office, in 2019, the total number of international arrivals reached 18 million, a 16.2% increase from the previous year, while domestic tourists reached ...

Vietnam tourism 2018 in numbers - Viet Nam National Authority of Tourism. (TITC)- In 2018, Vietnam tourism continued its sustainable growth in inbound and domestic visitors and tourism receipts.

Basic Statistic Foreign tourism spending Vietnam 2019-2021; Further related statistics. 10 Premium Statistic ... General Statistics Office of Vietnam, Number of people traveling abroad in Vietnam ...

The revenue in the travel & tourism market in Vietnam was forecast to continuously increase between 2024 and 2028 by in total 890.6 million U.S. dollars (+24.42 percent). After the eighth ...

ベトナムは、2019年水準を上回る直行便数の回復、インセンティブツアーの催行等の影響も あり、訪日外客数は67,400人(対2019年同月比140.8%※)であった。 ホーチミン~成田間の増便などもあり、日本への直行便数は2019年同月を上回っている。