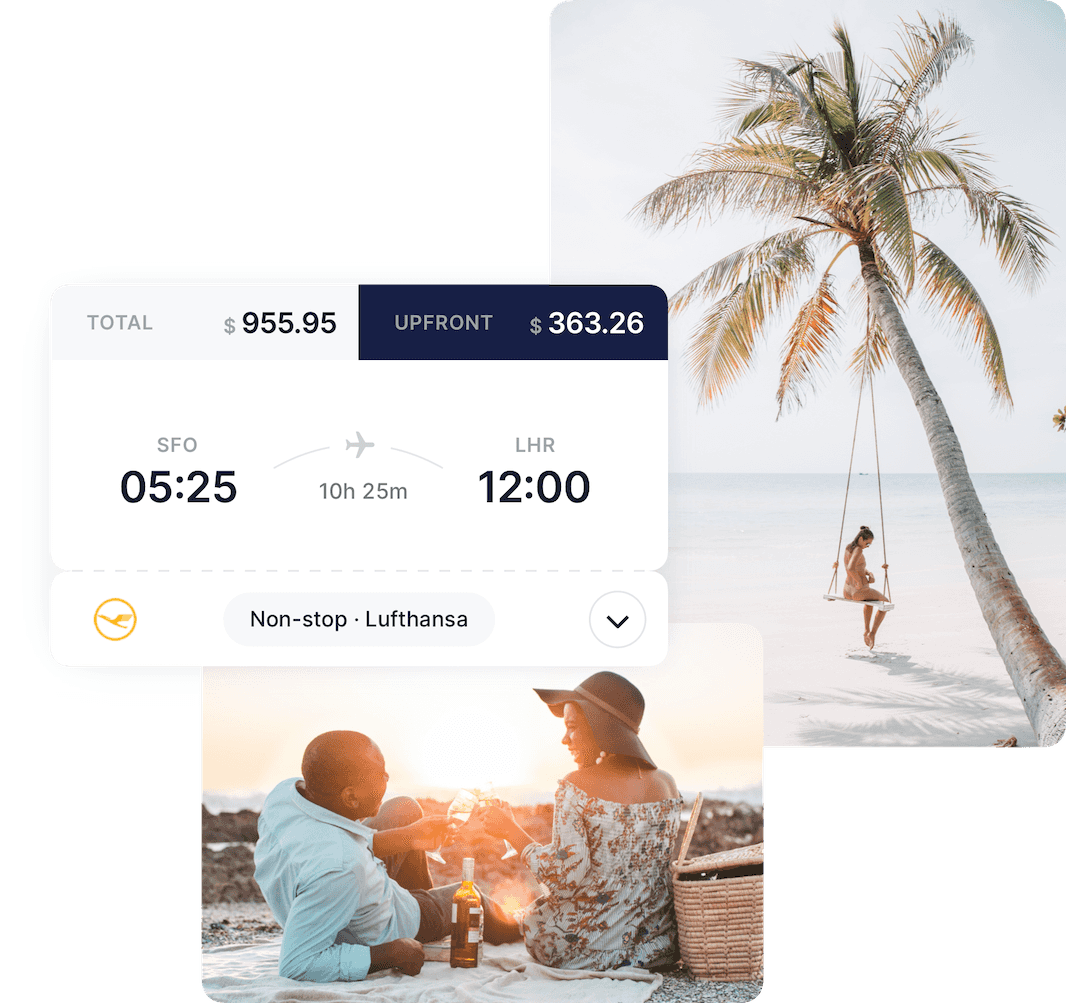

Uplift is the leader in Buy Now, Pay Later for travel .

When you pay monthly for a flight, a cruise, a hotel, or vacation package – you’re giving yourself the freedom to travel farther and explore more enjoyably. Millions of consumers choose Buy Now, Pay Later options for vacation and travel so that they can say “yes” to all those bucket-list items and pay over time.

Paying monthly with Uplift helps you avoid late fees or annual fees you may incur using a credit card. Not to mention you’ll never have to worry about prepayment penalties, debt traps, or compound interest using Uplift.

Whether you’re traveling for work, to visit family or friends, or simply taking that trip you’ve always been dreaming of, using Uplift to pay for flights in installments or spread the cost of your hotel into monthly payments is the perfect option.

Unlike other Buy Now, Pay Later companies, Uplift’s Customer Service Squad is available 24/7 and provides unparalleled service from purchase to final payment.

A few of our partners:

Uplift knows just how much thought, care, and planning goes into creating the most memorable experiences. Lump-sum costs shouldn’t hold you back from booking.

When it comes to paying monthly for your vacation purchases, rest easy knowing that Uplift is the original Buy Now, Pay Later for travel.

Take a look at what our valued travelers have been saying lately.

My daughter just moved from CA to TX and was not able to come home for Thanksgiving. I thought I would surprise her with a visit from myself, her brother and his wife. She will be very happy.

So excited this will be my first trip to Las Vegas an I can take it off my bucket list thanks to Uplift.

Was a great option to pre-book flights without having to pay the entire amount! We travel with a family of 5 so everything is always expensive!

Need more answers to your questions about Uplift? Start here.

Why choose Uplift?

Uplift gives you the freedom to purchase what you want now and pay with fixed monthly payments. Uplift is often a better alternative to credit cards because Uplift charges only simple interest while some credit cards charge interest on interest. Uplift also makes budgeting easy so you can manage your expenses over time rather than paying one large sum all at once.

What kind of products and services can I purchase using Uplift?

Uplift can be used to purchase a wide range of products and services from our travel partners and retailers. Click here to see a full list of our current partners who offer Uplift. Click here to see a full list of our current partners who offer Uplift.

Get the app

What is the advantage of using Uplift vs a credit card?

While some credit cards charge interest on interest, Uplift charges only simple interest. If you carry a balance on a credit card, it can be hard to understand what it will cost you. With Uplift, the cost is clear at the time of purchase, with simple interest, predictable payments, and no fees.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Ce site utilise des témoins de connexion. En continuant à naviguer sur le site, vous acceptez que nous utilisions des témoins.

Cookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

- Book a Flight

- Manage Reservations

- Explore Destinations

- Flight Schedules

- Track Checked Bags

- International Travel

- Flight Offers

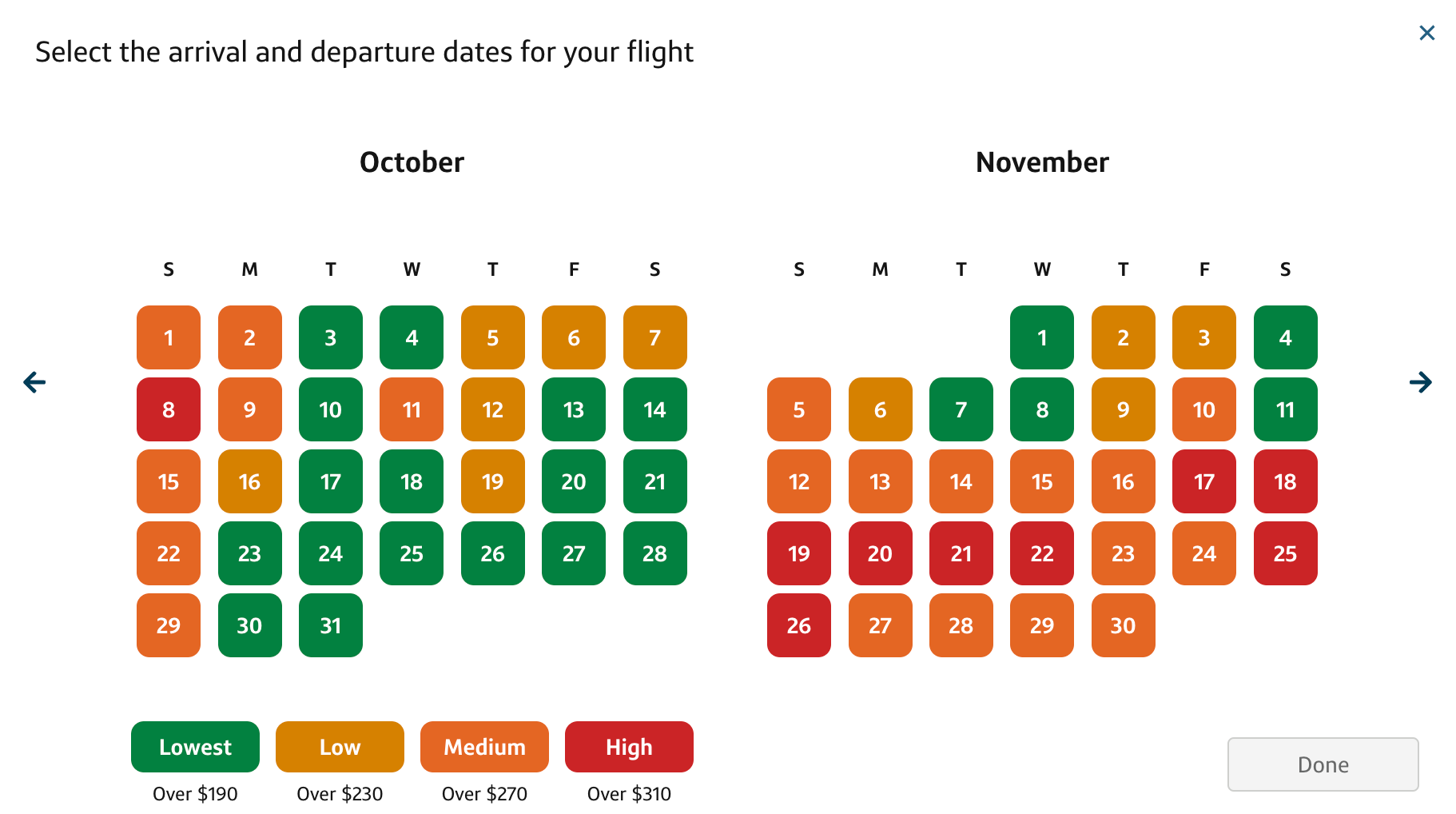

- Low Fare Calendar

- Upgrade My Flight

- Add EarlyBird Check-In

- Check Travel Funds

- Buy Carbon Offsets

- Flying with Southwest

- Book a Hotel

- Redeem Points for Hotels

- More Than Hotels

- Hotel Offers

- Best Rate Guarantee

- Rapid Rewards Partners

- Book a Vacation Package

- Manage My Vacation

- Vacation Package Offers

- Vacation Destinations

- Why Book With Us?

- FLIGHT STATUS

- CHANGE FLIGHT

How do I apply?

Shop for your items and add them to your cart like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a US resident, your Social Security number. If you're approved, finish checking out and you're done.

How are my loan offers determined?

We look at a number of factors, including your credit information, purchase details, and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button. We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com , click on the Accounts page, and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime by visiting pay.uplift.com .

I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

What is your Privacy Policy and Terms of Use?

Here is a link to our Privacy Policy and Terms of Use .

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $49 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders. Privacy Policy and Terms of Use .

Help Center

- Terms & Conditions

- Privacy Policy

- Do Not Sell/Share My Info

© 2024 Southwest Airlines Co. All Rights Reserved.

How Buy-now, Pay-later Services Work

Airlines and travel agencies partner with BNPL services like the travel-specific Uplift or the more broadly available Affirm to offer monthly payment options. Some take payments through PayPal Credit and/or Klarna. Learn about the differences between these services and how they work.

Affirm allows customers to pay monthly or every two weeks. Terms can last up to 48 months for the largest loans, but more typically, they last up to a year. Interest rates vary by person, ranging from 0% to 36% APR, and are determined at the time of sign-up. A down payment and credit check might be required when you apply for a loan.

To use Affirm, you will need a phone number to use as an account login. The service is available only in the U.S. and Canada. Once you've created your account and gotten approved for a loan amount, you can set up auto-pay or pay each month via the app or website. You can find a full list of Affirm's travel partners, including airlines and accommodations, on its website.

PayPal Credit

This is a monthly payment option provided by travel companies that take PayPal. Typically, you'll choose PayPal as your payment method, and once you sign into your PayPal account, you can choose PayPal Credit. As of 2023, the variable purchase APR is about 28% for new accounts, but you can avoid paying interest altogether if you pay the loan off within six months. Loan applications are subject to credit approval.

Uplift is the leading pay-over-time financing service in the travel space, partnering with cruise lines, hotel chains, airlines, and more. Once you have selected a product, like your flight, you are shown a per-month rate based on the price of the items in your shopping cart. When you get to the payment page and choose monthly payment as your option, you will be asked for some personal details, and once you click "check rate," you will be told whether you've been approved. Uplift offers an APR of 0% to 36% based on your credit. You won't be penalized for paying late or early, and you can set up autopay so the money comes out of your account automatically.

Klarna breaks up the price of your ticket into monthly payments or four equal payments to be made two weeks apart. Add the Klarna extension to your Chrome browser or download the app on your phone, then book your flight as usual, selecting Klarna at checkout. The first payment will be due upfront. Klarna offers an APR of 0% to about 30%.

Related Articles

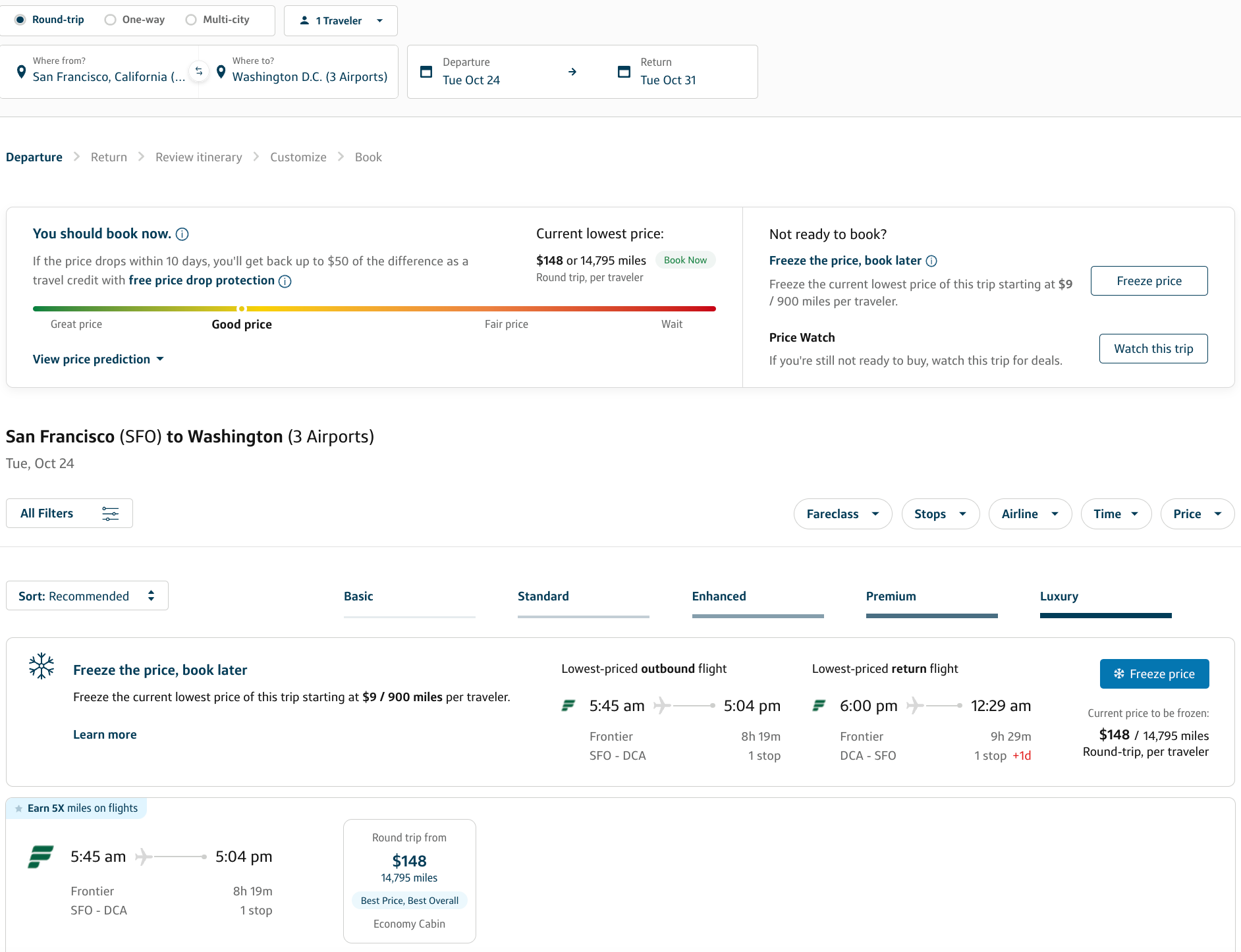

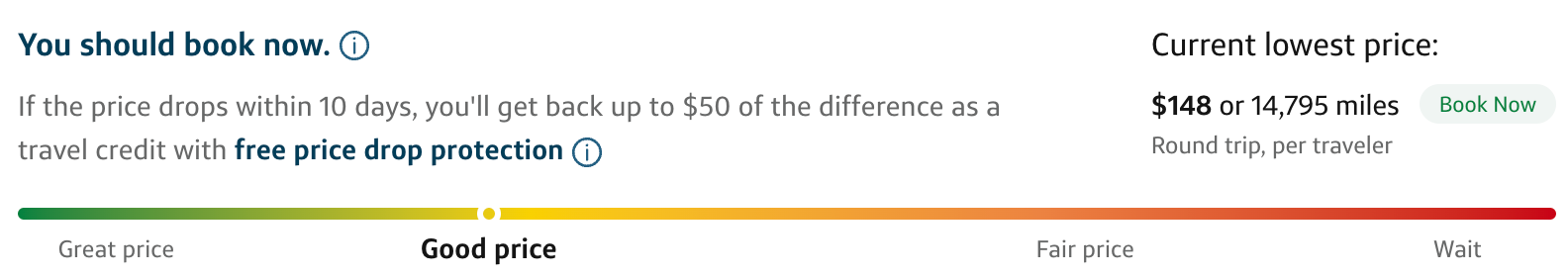

Buy now, pay later with KAYAK and Affirm

Don’t let budget get in your way – enjoy monthly installments for select flights, stays and rental cars booked on KAYAK.

What is Affirm?

Book today and pay over time.

Feel good about what you book and how you pay for it. With Affirm, you can make thoughtful purchases and pay over time while staying on budget. See here for additional details .

Affirm benefits

Quick and easy

Select Affirm as your payment method when booking and choose the payment plan that works for you.

No hidden fees

Affirm helps you break up payments with no fees or surprises, so you’ll know exactly how much you owe.

Real-time eligibility check

Answer a few questions to check your eligibility -or prequalify to see how much you can spend without affecting your credit score.

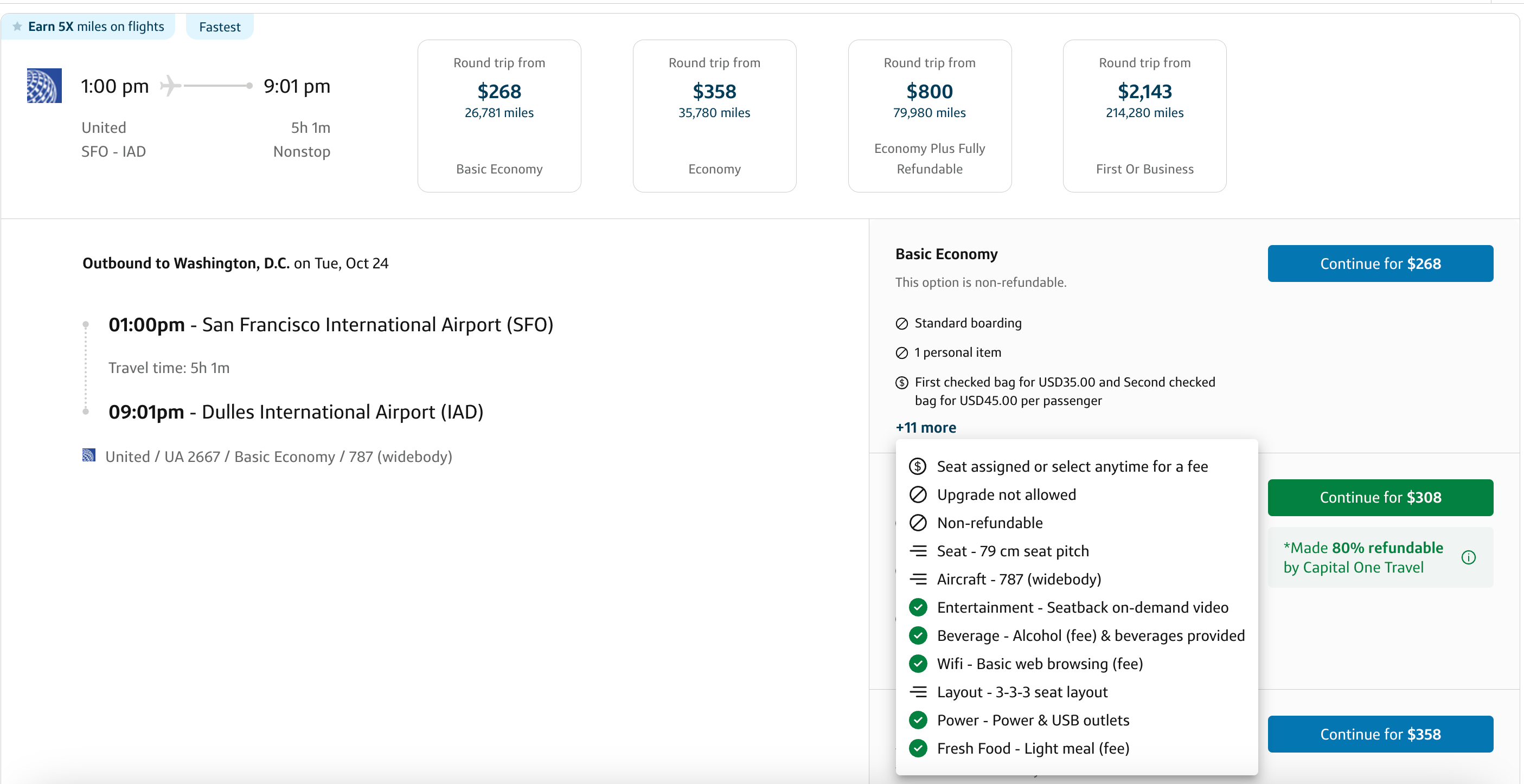

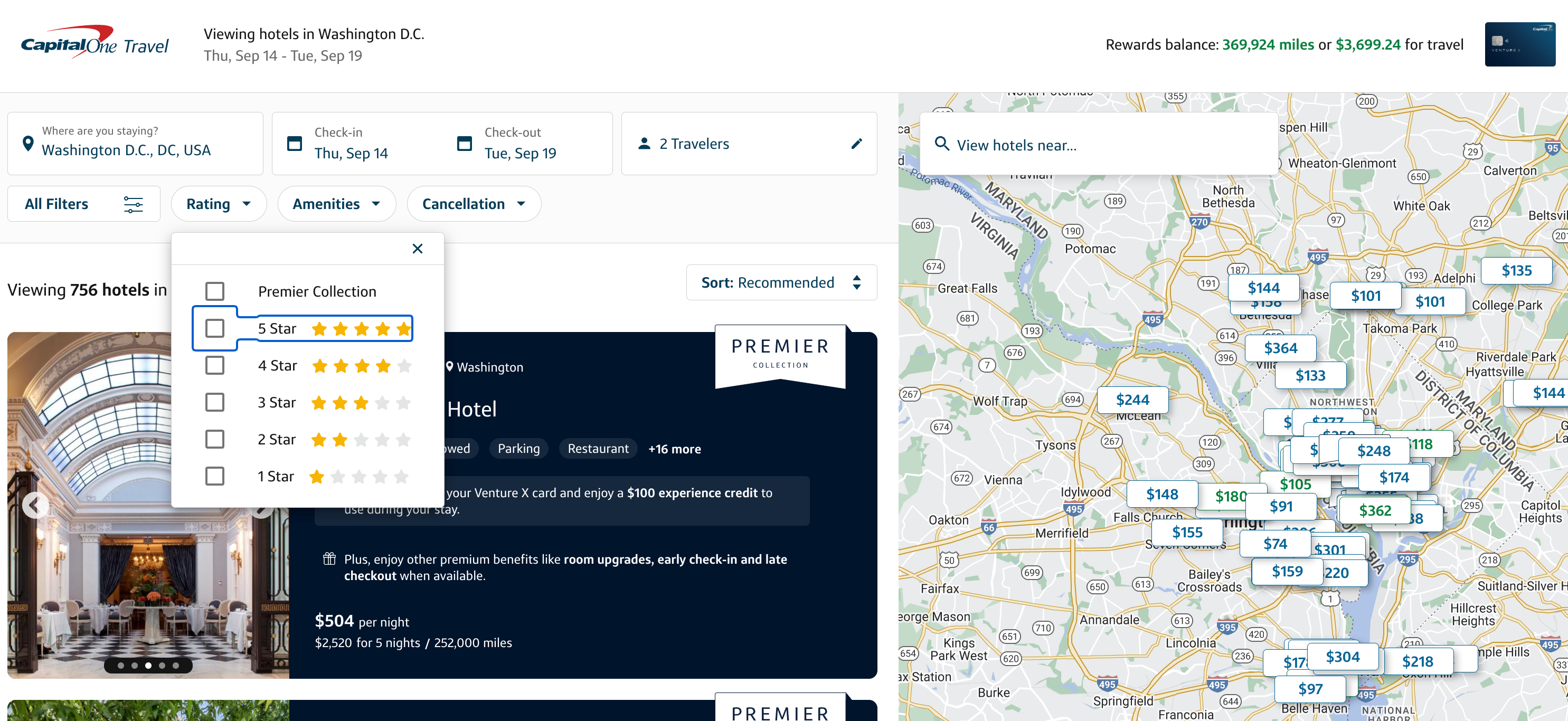

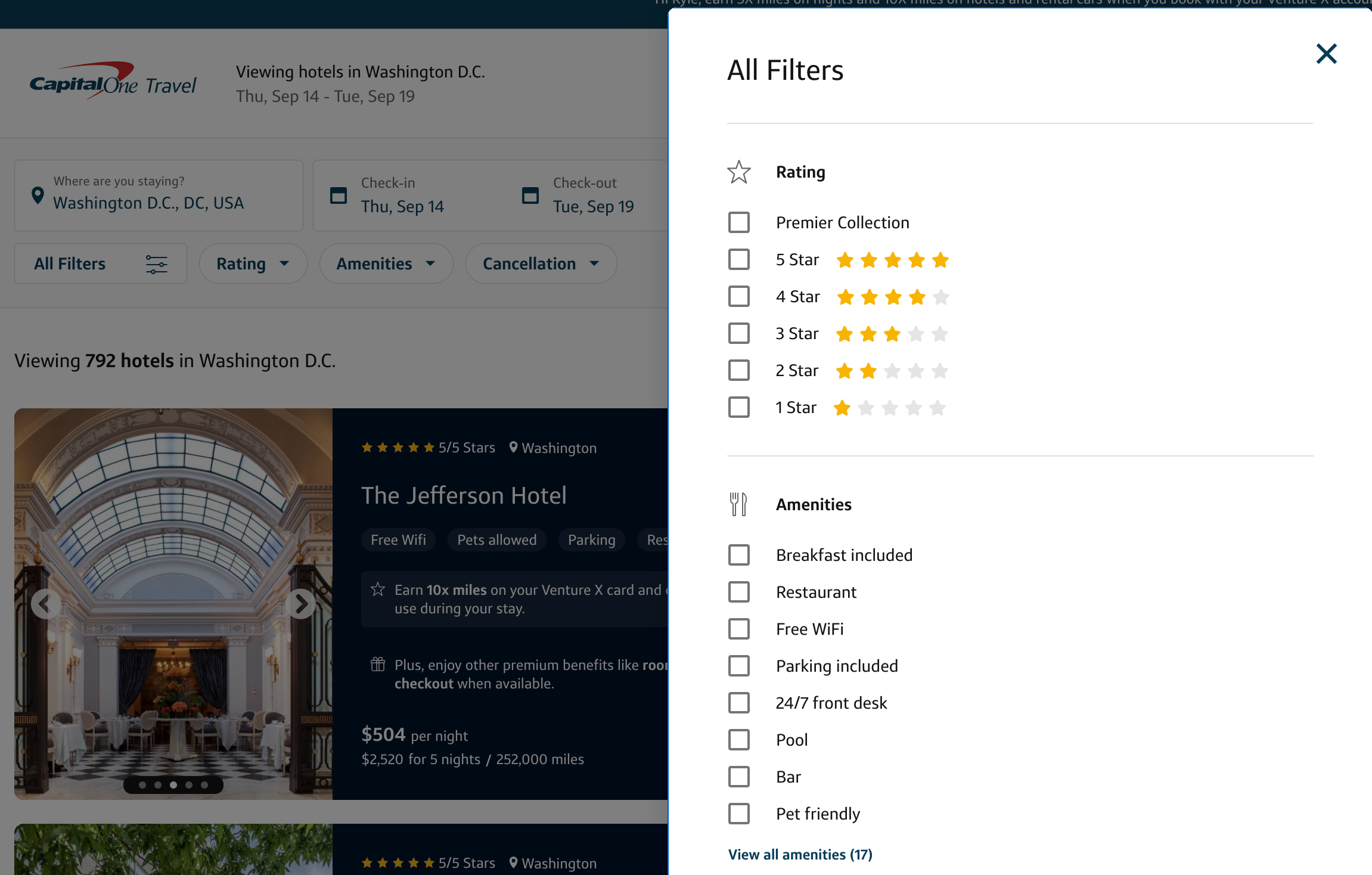

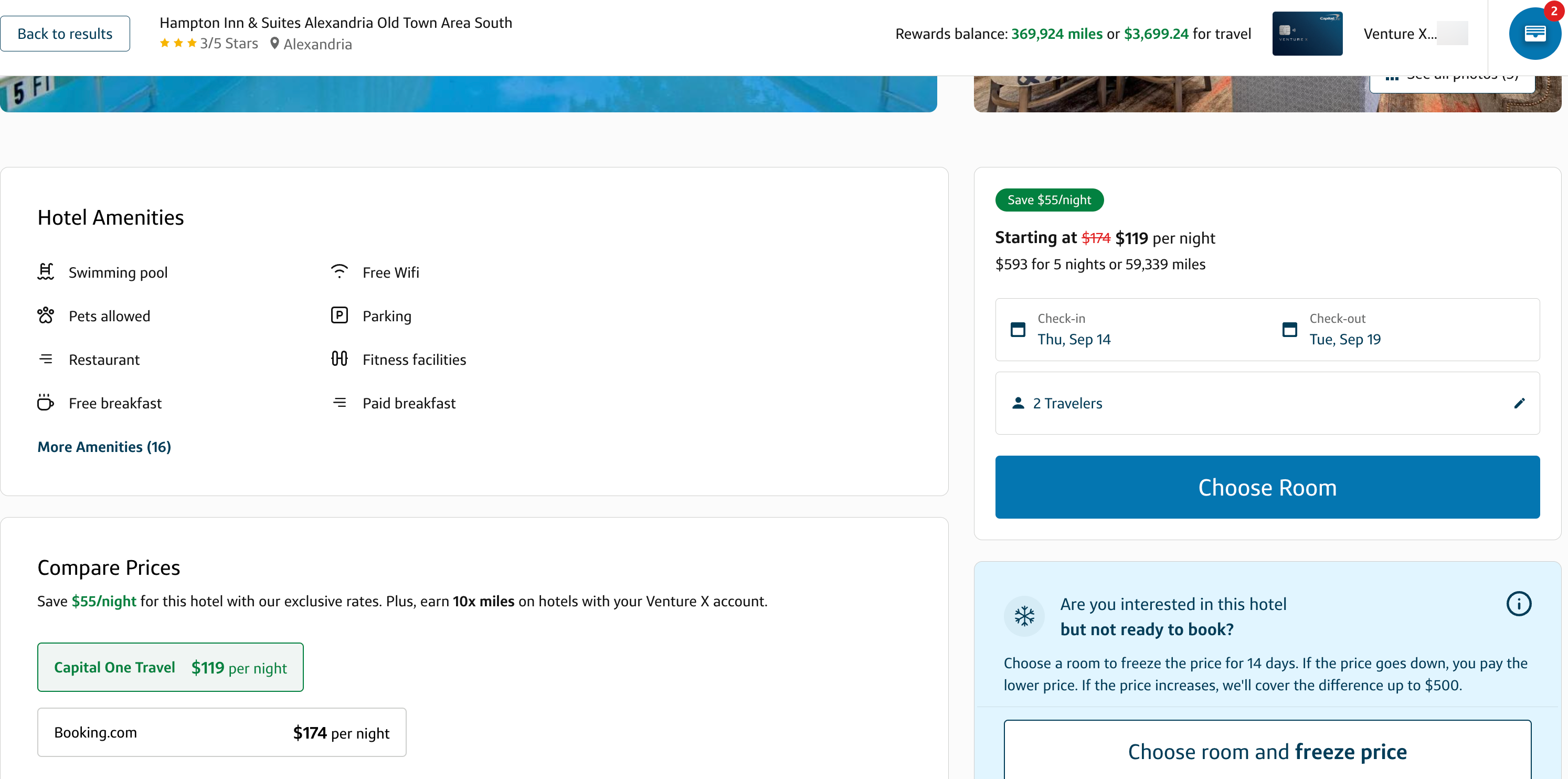

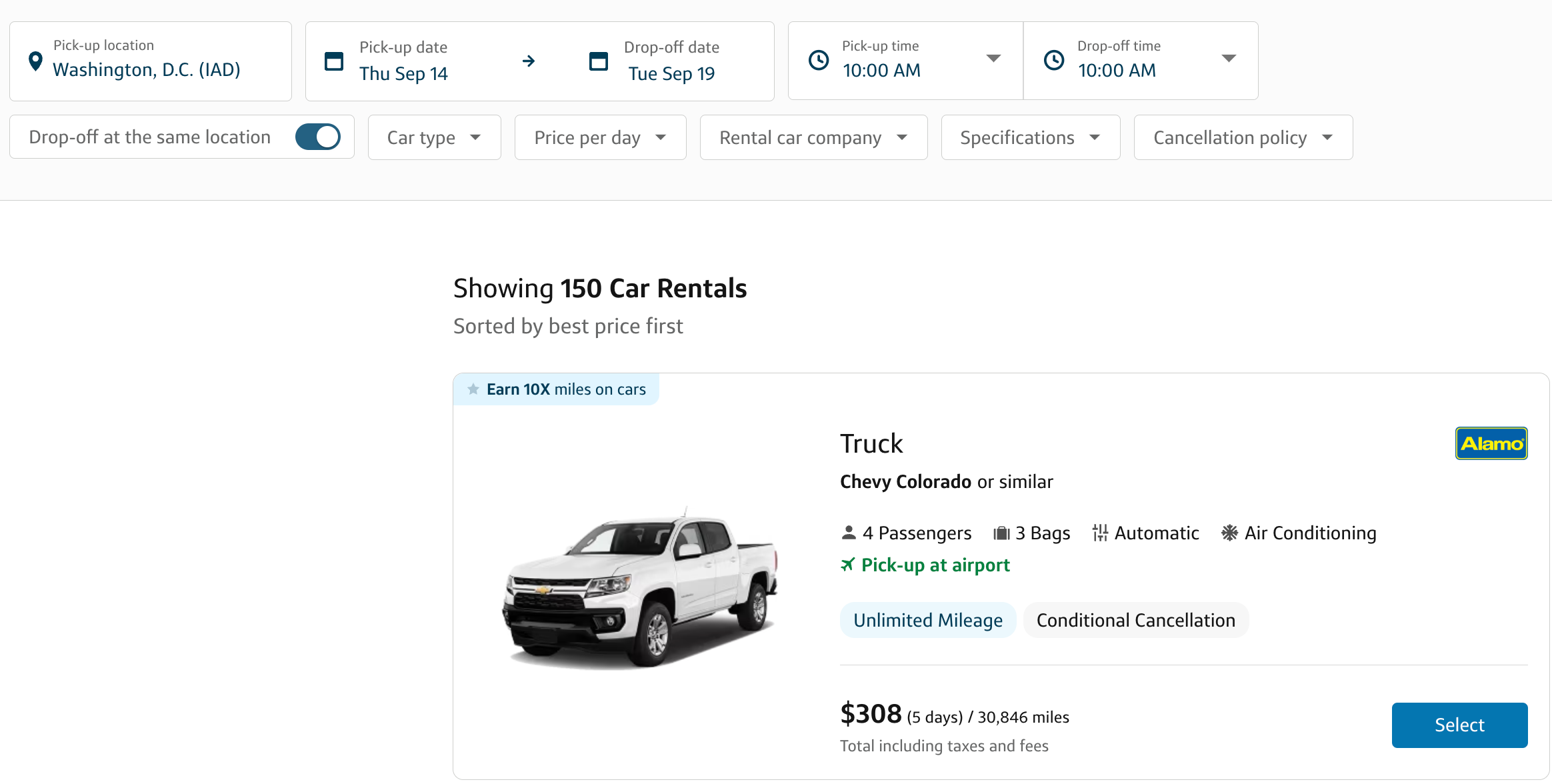

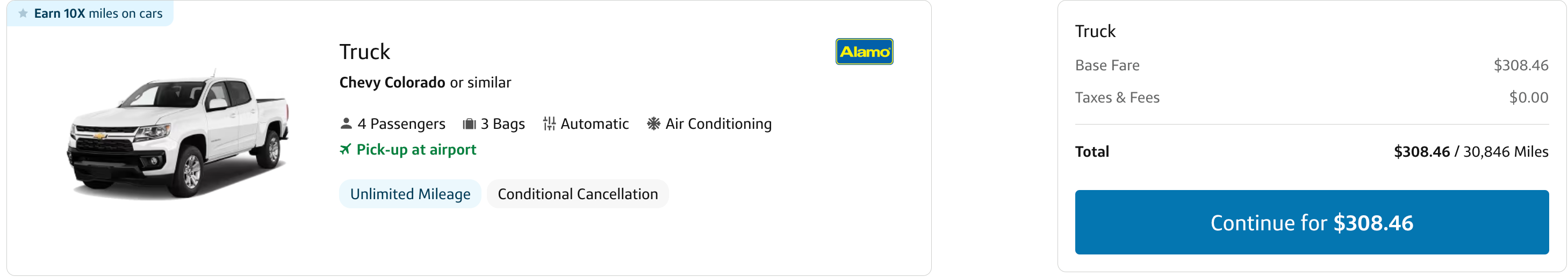

Images below are for illustrative purposes only

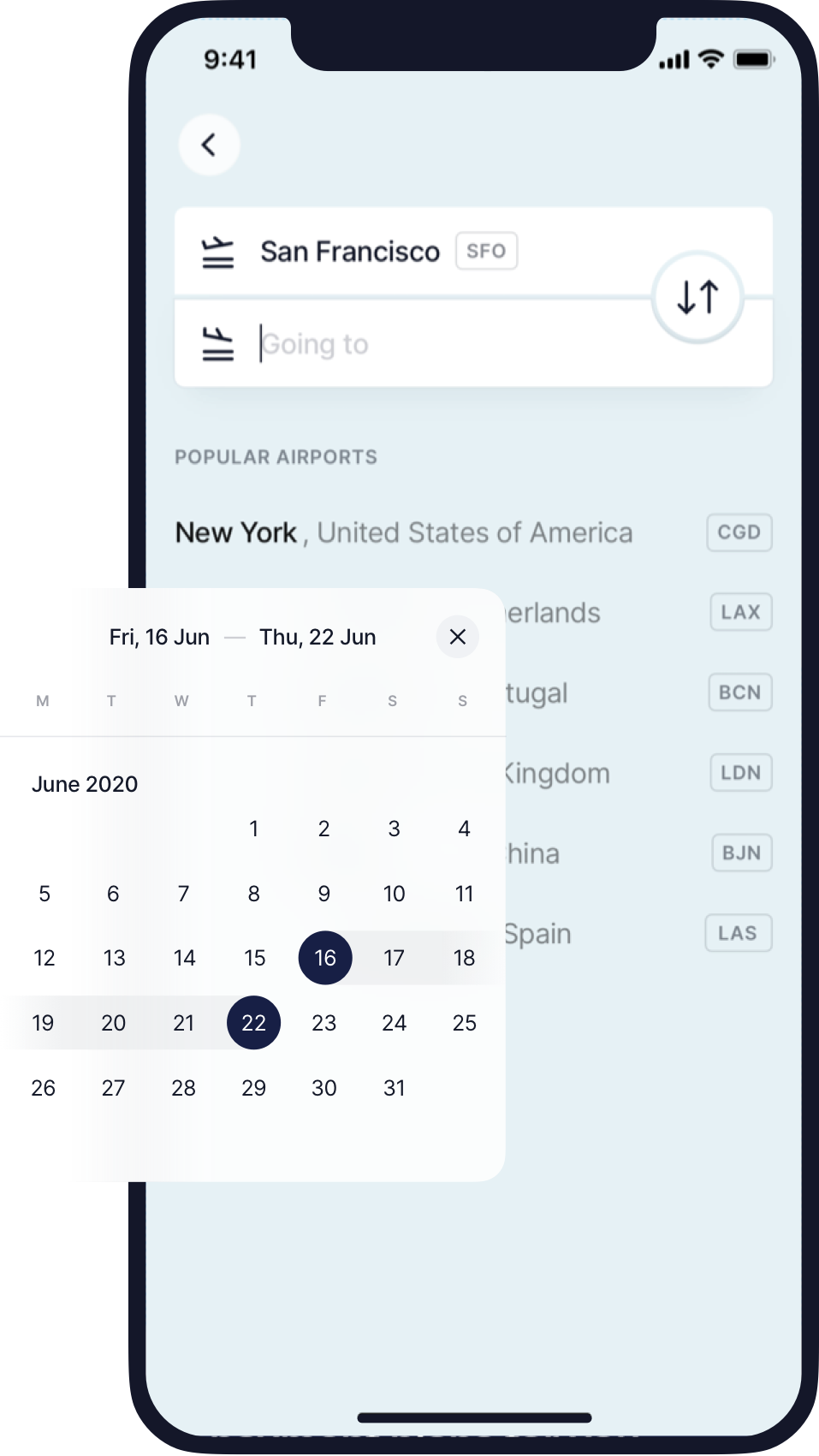

How to use Affirm on KAYAK

Step 1 – look for the kayak logo **.

Once you find the flight, stay or rental car perfect for you, look for the KAYAK logo when choosing which provider to book with.

**Applicable bookings may be labeled with “Instant booking” and/or a thunderbolt icon.

Step 2 – Select “Affirm” as your method of payment

When choosing your payment option, select Affirm as the method of payment for your booking.

Step 3 – Check your eligibility on Affirm

Simply enter your mobile number to confirm your account and answer a few questions to check your eligibility. Don’t stress–this won’t affect your credit score.

Step 4 – Compare your payment plan options

Quickly and easily compare the payment plan options available for your booking.

Step 5 – Review your final payment plan

Review the payment options for your booking and complete your reservation by paying with Affirm.

Rates from 10–36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check, may not be available everywhere, and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. See affirm.com/licenses for important info on state licenses and notifications.

Search now and pay with Affirm

Frequently asked questions.

Yes! There’s no penalty for paying early.

You can make or schedule payments at affirm.com or in the Affirm app for iOS or Android. Affirm will send you email and text reminders before payments are due.

No—your credit score won’t be affected when you create an Affirm account or check your eligibility. If you decide to buy with Affirm, this may impact your credit score. You can find more information in Affirm’s Help Center.

Yes, your travel booking must be $150 or greater.

For any cancellation or change requests, please reach out directly to the merchant via customer support service number provided in your booking confirmation emails.

Yes, you’ll need a mobile phone number from the U.S. or U.S. territories. This helps Affirm verify it’s really you who is creating your account and signing in.

You can visit their website at affirm.com .

California consumers have the right to opt out of the sale * of their personal information. For more information on how we securely process personal information, please see our Privacy Policy .

Do not sell my info ON

* The definition of "sale" under the California Consumer Privacy Act is applicable only to California consumers.

Update your browser

Be sure you have the most current version of your browser for the best experience on AAVacations.com. Browser requirements Opens in a new window

- Skip to global navigation

- Skip to content

- Skip to footer

- Sign up for email offers Opens in a new window

- aa.com Opens in a new window

- Destinations

- AAdvantage®

AAdvantage login

Exclusive AAdvantage® experiences Verify AAdvantage® Number(s)

Enjoy now. Pay over time.

Spread the cost of your trip over low monthly payments.

Experience Buyer's Joy Feel good about what you book and how you pay for it. With Uplift, you can make thoughtful purchases and pay for them in bite-sized installments while keeping yourself on a budget.

Low monthly payments Budget-friendly loan options

Easy application Quick decision

Surprise-free No late fees or prepayment penalties

Easy AutoPay No payment dates to remember

- Select Uplift at checkout Add purchases to your cart just like you normally would. When you are ready to check out, choose Uplift as your form of payment.

- Quick & easy Provide a few pieces of information and receive a quick decision.

- Enjoy now Enjoy your trip now and pay for it over time with low monthly installments.

Find vacations

Frequently Asked Questions

- What is Uplift?

Uplift gives you the freedom to book travel now and pay over time with simple fixed installments. Some plans include interest while some are interest-free. When you're ready to check out, just select "Uplift" as your payment method, complete a short application and receive quick decision. Choose the terms of your payment plan, finish checking out and enjoy your purchase. Then, pay over time with simple, no-surprise monthly payments.

- How do I apply for installment payments through Uplift?

Shop for your items and add them to your cart just like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a U.S. resident, your Social Security Number. If you're approved, finish checking out and you're done.

- How are my loan term offers determined?

We look at a number of factors, including your credit information, purchase details and more.

- How do I make installment payments?

You can make a payment anytime at pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button.

We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com, click on the Accounts page and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime at pay.uplift.com.

Make installment payments Opens in a new window

- I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

- What is your Privacy Policy and Terms of Use?

Privacy Policy Opens in a new window

Terms of Use Opens in a new window

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $300 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders.

Uplift lenders Opens in a new window

Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

Airport lookup

Our system is having trouble.

Please try again or come back later.

Please tell us where the airport is located.

Your session expired

Any confirmed reservations have been saved, but you'll need to restart any searches in progress

Members save 10% or more on over 100,000 hotels worldwide when you’re signed in

Vacation deposit and payment plans.

- Things to do

I only need accommodations for part of my trip

What are the benefits of vacation payment plans?

Paying for your vacation in instalments can help you spread the costs and also gives you the option to plan a vacation you wouldn’t otherwise be able to afford. By booking in advance and choosing a trip payment plan you’ll give yourself plenty of time to pay for the vacation of your dreams. It can also come in handy when paying for a group booking, giving you extra time to round up money from other members of your party.

Can I book now and pay later with Expedia?

With Expedia you can filter your vacation search results by payment type, to see what options are on offer. If you know you need to spread the costs, go straight to our latest book now, pay later deals . With this option you can reserve your accommodation ahead of time, and cancel or modify your booking with no extra fees, should your plans change.

How can I find great deals on vacation packages?

To grab the best deal on your next vacation, book your accommodation, flight, and car rental as an Expedia bundle . Search the latest deals to see what’s on offer and then choose to pay monthly for your vacation on checkout.

Does Expedia have a flexible cancellation policy?

Find free cancellation and pay later options by filtering your search results by payment type, so you can rest assured that your vacation is fully flexible. Cancellation policies differ between vacation packages, so it’s always best to check at the time of booking.

Why should I book a vacation payment plan with Expedia?

At Expedia we give you easy access to a huge selection of the best vacation packages. You can then use our advanced filter options to build your ideal vacation and book it in just a few clicks. With access to loads of book now, pay later deals, as well as vacations with payment instalments , we can help you secure the vacation of your dreams.

Save with our bundle deals!

Car, Stay, Flight... book everything you need for your perfect weekend getaway with Expedia and save!

Vacation rental

Apartments, Villas, Cabins... we have everything you need!

Car Rentals

Hit the road with one of our car rental deals

- All Inclusive Vacation Ideas

- Vacation Deals & Tips

- Top Vacation Destinations

- Best Travel Destinations by Month

Top Destinations

- Bali Vacation Packages

- Banff Vacation Packages

- Dubai Vacation Packages

- European Vacation Packages

- Hawaii Vacation Packages

- Iceland Vacation Packages

- Jamaica Vacation Packages

- Las Vegas Vacation Packages

- Los Cabos Vacation Packages

- Montreal Vacation Packages

- New York Vacation Packages

- Paris Vacation Packages

- Switzerland Vacation Packages

- Thailand Vacation Packages

- Toronto Vacation Packages

- Vancouver Vacation Packages

Other Destinations

- Lake Louise Vacations

- Whistler Vacations

- Mont-Tremblant Vacations

- Fernie Vacations

- Blue Mountain Vacations

- Golden Vacations

- Big White Vacations

- Vermilion Crossing Vacations

- Revelstoke Vacations

- Cranbrook Vacations

- Kamloops Vacations

- Cancun Vacations

- Tulum Vacations

- Cabo San Lucas Vacations

- Santo Domingo Vacations

- Punta Cana Vacations

- La Romana Vacations

- Samana Vacations

- Puerto Plata Vacations

- Kingston Vacations

- Montego Bay Vacations

- Negril Vacations

- Ocho Rios Vacations

- Bridgetown Vacations

- Christ Church Vacations

- Nassau Vacations

- Fort-de-France Vacations

- George Town Vacations

Top Regions

- Canada Vacation Packages

- Newfoundland and Labrador Vacation Packages

- Prince Edward Island Vacation Packages

- Nova Scotia Vacation Packages

- New Brunswick Vacation Packages

- Quebec Vacation Packages

- Ontario Vacation Packages

- Manitoba Vacation Packages

- Saskatchewan Vacation Packages

- Alberta Vacation Packages

- British Columbia Vacation Packages

- Nunavut Vacation Packages

- Northwest Territories Vacation Packages

- Yukon Vacation Packages

Other Countries

- United States Vacations

- Bahamas Vacations

- Mexico Vacations

- Costa Rica Vacations

- Maldives Vacations

- Dominican Republic Vacations

- U.S. Virgin Islands Vacations

- Puerto Rico Vacations

- Aruba Vacations

- Bora Bora Vacations

- Turks and Caicos Vacations

- Caribbean Vacations

- Japan Vacations

- Greece Vacations

- UAE Vacations

- Italy Vacations

We'll Be Right Back!

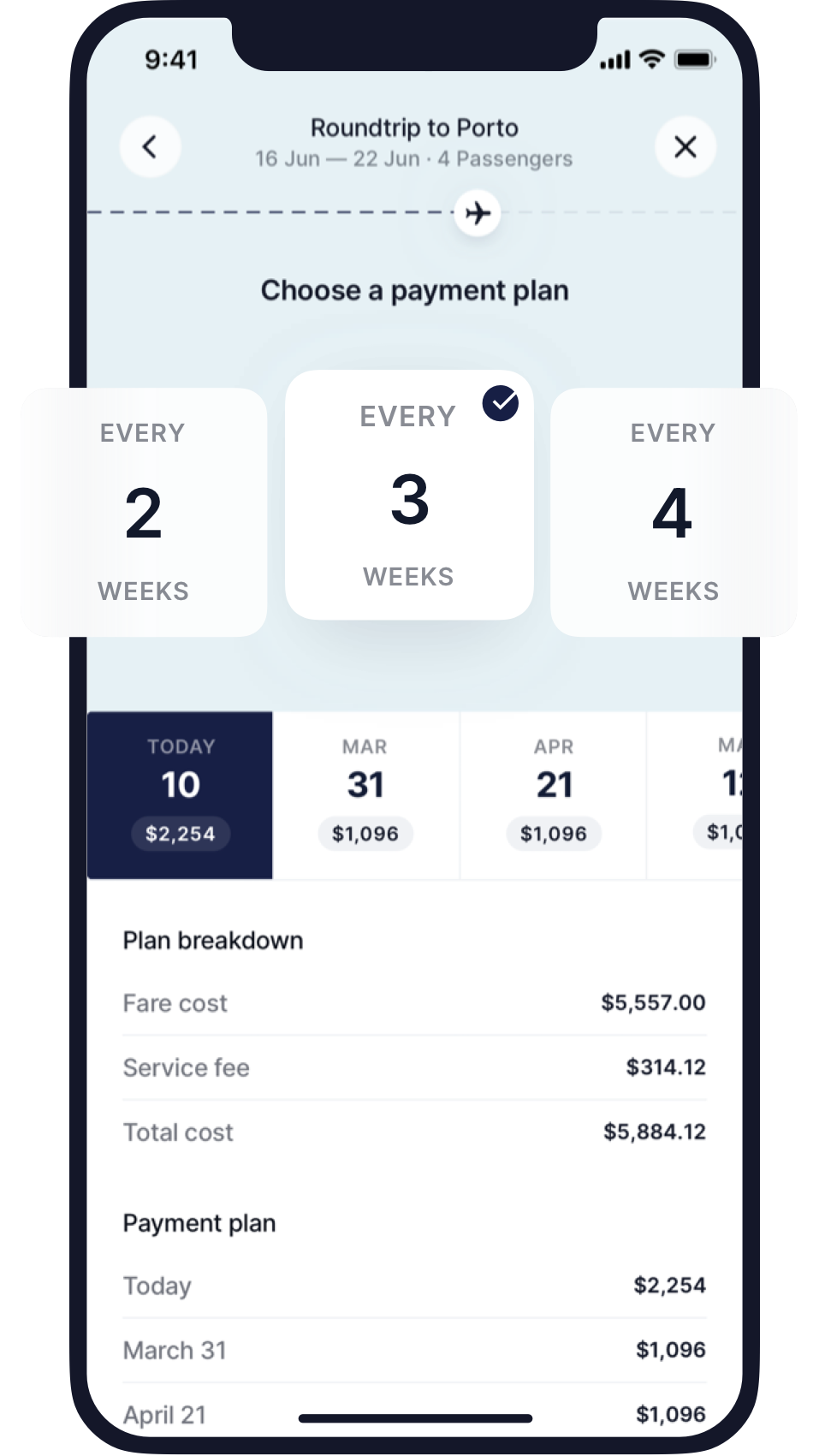

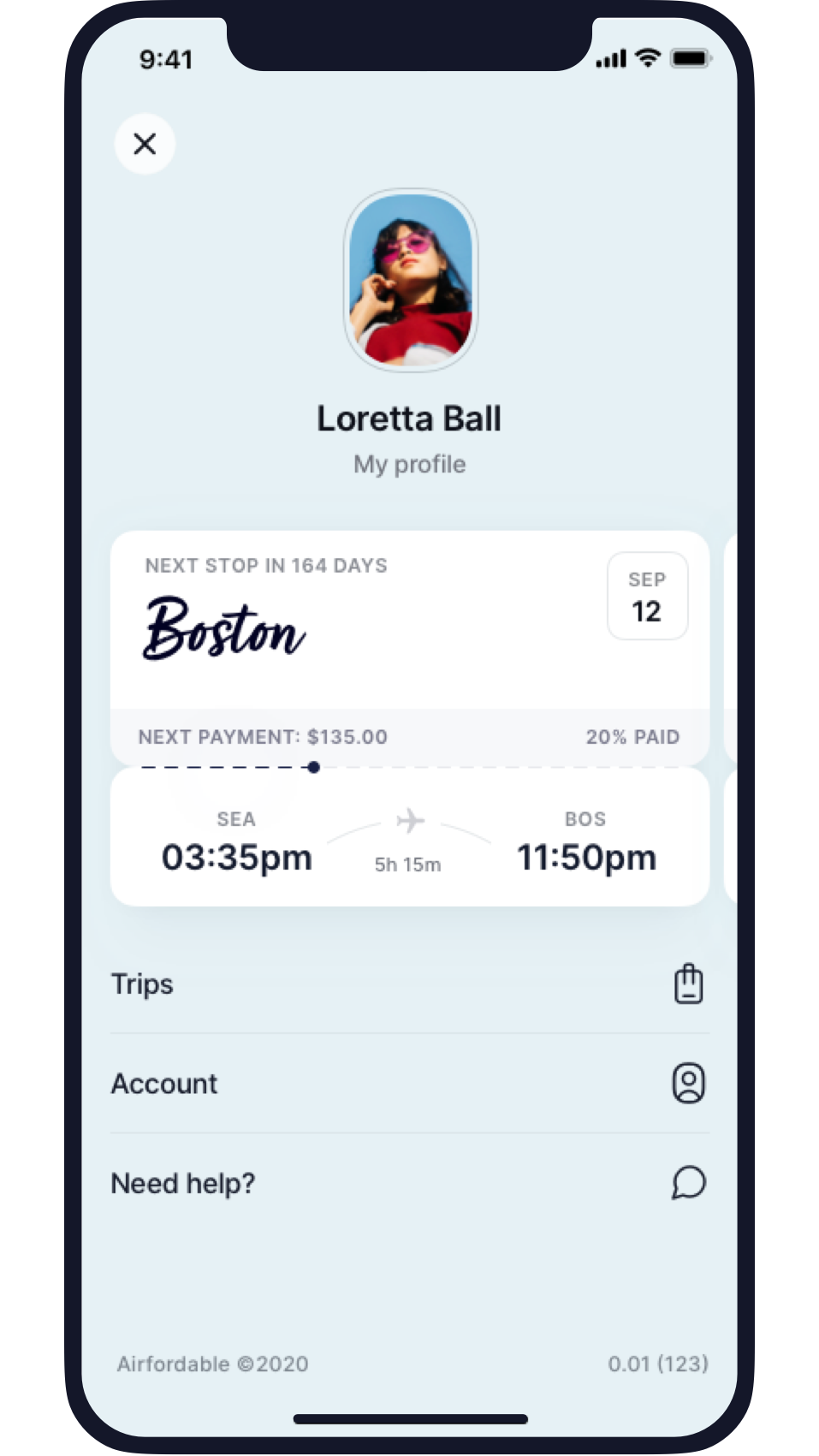

NEW: Book your hotel with Airfordable! 🏨 Download our app to get started now.

Get Started!

Your flight for only a fraction upfront

Get an estimate.

How much is your ticket?

Your upfront payment now is

And the rest in installments

No credit check, no interest

Just a transparent one-time service fee

Flexible payment plan

Choose the plan that works for you

Lock in your fare now

Don't miss out on a great deal

24/7 customer support

Focus on the fun of travel - not the stress

Scan to download

Accessible. Flexible. Easy. And done!

Fraction upfront

Book your flight for a fraction now, pay the rest later

Payment options

Pick what works best for your wallet

Progress tracking

Track all your payments and trips in one place

Discover the Airfordable difference

Planning your trip doesn’t need to feel like a chore. We put in the work so you don’t have to!

Book your favorite airlines

Complete control over your payment schedule

Manage multiple trips

Airfordable is the way to go!

Trusted by 500,000+ satisfied travelers, each with their unique stories and incredible adventures to share. Read real Airfordable traveler reviews.

What makes us different

No hidden fees. No credit checks

Pay a one time service fee for each booking. No credit checks. We don't believe your credit score is the best representation of you.

Price protection

When you book with us, you can secure your airfare well in advance when prices are cheaper. Protect yourself from the notorious airline price hikes no one likes.

Amazing community

Our travelers are a diverse group looking for creative ways to travel and budget. Airfordable is the bond that brings them together.

In good hands

The Airfordable team's sole mission is to help you travel more, but in an easy and financially responsible way. We're here for you.

Flexible and guaranteed

Pay only a fraction upfront for your flights. You will receive your e-ticket once the final payment is made. No gimmicks. No hassle. Just accessible travel for your needs.

Safe and secure

Every interaction with Airfordable uses bank-level security and encryption. Your sensitive data is safe with us.

Great support at your fingertips

Dealing with airlines can be a hassle. Our team does the legwork for you, so you can focus on the fun — not the stress.

Available 24/7

We're always here to help you, day or night, with any support you need to book your perfect trip.

Reach us by email

Have a question, comment, or review? Our team can always be reached by email at [email protected].

Talk to support

Our in-app chat will send you directly to a member of our team for the one-on-one support you need.

Approved by the press

“Airfordable's value comes at the intersection of volatile ticket prices.... By locking in a ticket price up front, users can benefit by securing a better price on airfare while demand stays low and the date of departure is still far away.”

“A service like Airfordable could mean the difference between someone being able to take a trip or not – turning it into a priceless service.”

“The best part about Airfordable is that your ticket is paid off before your trip, so you don’t have to deal with debt once you return home. For someone who doesn’t want to miss out on a trip to see family and friends, a vacation or a life milestone, this can be a really great service.”

“Airfare is usually cheaper when you buy further in advance, but what if you haven't planned for a trip, or saved up the cash yet? One new solution is Airfordable.”

- Things to do

Explore > Company > News > Book your flight and hotel now, pay later

Book your flight and hotel now, pay later

We are always looking ahead at new payment options and technologies to help alleviate the stress of booking your dream vacation. Are you on a tight budget, or perhaps you just prefer to pay for big purchases over time? Great news, we now have you covered!

Expedia recognizes there’s no one-size-fits-all approach to budgeting for vacation so next time you’ve caught the wanderlust bug or need to get home for Christmas but are struggling to pay for those flight and hotel reservations upfront, you can now breathe a sigh of relief. We’ve recently expanded our partnership with online lender Affirm to give you the flexibility of spreading out the cost of your flight and hotel package booking over numerous payments instead of paying the full amount of your trip upfront.

Our team is incredibly passionate about making travel accessible for all—everyone deserves a vacation! We’ve received positive feedback from our customers who have used Affirm to book and pay for hotels on Expedia , and now we are excited to bring this payment offering to Expedia customers shopping for flight and hotel packages as well.

Ready to take advantage of more payment flexibility when you travel? Here’s how you can use Affirm on Expedia to book your next hotel and flight package.

1) Visit expedia.com , search for and select a flight and hotel.

Upon selecting your package, select the Monthly Payments tab .

2) Click on “Continue to Affirm”

3) Create an account or sign in to Affirm

You will be transferred to a secure Affirm sign-in page. Shoppers apply using top-of-mind information about themselves and receive a real-time decision at checkout.

4) Complete your reservation with Affirm

Now you’re ready to jet set!

Expedia also offers exclusive Book Now, Pay Later hotel deals , so there’s no reason to let the cost of accommodation keep you from your travel plans.

What’s holding you back? Plan and book your next dream vacation today!

More Articles With Company

Vrbo just got better

Book your dream trip now, pay later with affirm.

Your next getaway is closer than you think. Find vacation homes offering Affirm as a payment option.

I am traveling with pets

If checked, only properties that allow pets will be shown

Introducing a new way to pay

With a unique selection of 2+ million whole homes all over the world, finding the perfect place for your family to get away together is easy. And now paying at your own pace with Affirm gives everyone more options - choose between 3 to 24 monthly payments. You’ll also get access to 24/7 support and our Book with Confidence Guarantee free with every booking. So go for it. Your together awaits. Affirm is available on select properties. Look for the Affirm logo on eligible listings.

Rates from 0–36% APR. For example, a $700 purchase might cost $63.18/mo over 12 months at 15% APR. As low as 0% APR promotion runs 5/1/2023 to 5/14/2023 or until funds are expended, whichever occurs first. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. See affirm.com/licenses for important info on state licenses and notifications.

Top vacation destinations

Carousel cards.

Miramar Beach

14,389 vacation rentals

5,953 vacation rentals

Hilton Head Island

8,314 vacation rentals

Panama City Beach

16,154 vacation rentals

Gulf Shores

12,499 vacation rentals

8,011 vacation rentals

8,265 vacation rentals

4,598 vacation rentals

4,840 vacation rentals

15,252 vacation rentals

Top picks in Miramar Beach

Photo gallery for tops`l beach manor 701 | 2 bed, 2 bath.

Tops`l Beach Manor 701 | 2 Bed, 2 Bath

Photo gallery for location, luxury, gulf front resort condo..

LOCATION, LUXURY, GULF FRONT RESORT CONDO.

Photo gallery for great town home tons of amenities.

Great Town Home!!! Tons of Amenities!

Photo gallery for 300 ft. to beach & over- looking pool 2 bed, 2.5 bath, 1250 sf..

300 ft. To Beach & Over- Looking Pool! 2 bed, 2.5 bath, 1250 sf.

Photo gallery for the pool house - gulf view, heated indoor pool, walk to the beach + dining.

The Pool House - Gulf View, Heated Indoor Pool, Walk to the Beach + Dining!

Photo gallery for ocean front views indoor & outdoor pool great location.

Ocean Front Views! Indoor & Outdoor Pool! Great Location!

Top picks in charleston, photo gallery for serene cottage with beautiful garden and heated pool.

Serene Cottage with Beautiful Garden and Heated Pool

Photo gallery for grand historic home, spacious, downtown, piazza and garden (lic.#op2018-00320).

Grand historic home, spacious, downtown, piazza and garden (Lic.#OP2018-00320)

Photo gallery for spend the weekend aboard your own private yacht in historic charleston.

Spend The Weekend Aboard Your Own Private Yacht In Historic Charleston

Photo gallery for walk to upper king st. historic downtown charleston retreat. free off-street parking for 2 cars.

Walk to Upper King St. Historic downtown Charleston retreat. Free Off-street parking for 2 cars!

Photo gallery for the manor 93.5 a by guesthouse charleston – new luxury home in downtown charleston.

The Manor 93.5 A by Guesthouse Charleston – New Luxury Home in Downtown Charleston

Photo gallery for new close to downtown charleston and beaches.

NEW! Close To Downtown Charleston And Beaches!

Top picks in hilton head island, photo gallery for 14 laughing gull - friday to friday bookings sea pines luxury oceanfront.

14 Laughing Gull - FRIDAY TO FRIDAY BOOKINGS! SEA PINES LUXURY OCEANFRONT!

Photo gallery for tennis villa f20 - close to beach.

Tennis Villa F20 - Close to Beach

Photo gallery for brand new as seen on hgtv deluxe beachfront villa w beautiful ocean front views.

Brand New As seen on HGTV! Deluxe Beachfront Villa W Beautiful Ocean Front Views

Photo gallery for hilton head family condo w/ community pool & bikes.

Hilton Head Family Condo w/ Community Pool & Bikes

Photo gallery for oceanfront, 50 yards from the beach and even less to the pool. newly renovated.

Oceanfront, 50 yards from the beach and even less to the pool. Newly Renovated

Photo gallery for seaside villa 376 - spectacular ocean views.

Seaside Villa 376 - Spectacular Ocean Views

Top picks in panama city beach, photo gallery for "30a my way" | named vrbo's vacation home of the year 2023.

"30a My Way" | Named Vrbo's Vacation Home of the Year 2023!

Photo gallery for newly remodeled 500 feet to beach.

Newly Remodeled!! 500 Feet to Beach!!

Photo gallery for affordable cozy beachfront free beach chair service.

Affordable Cozy Beachfront! Free Beach Chair Service!

Photo gallery for newly remodeled two bedroom two bath 500 feet to beach.

Newly Remodeled Two bedroom Two bath! 500 Feet to Beach!

Photo gallery for "burnt bottom" private beach boardwalk + pool.

"Burnt Bottom" Private Beach Boardwalk + Pool

Photo gallery for beautiful beachfront condo in panama city beach fl.

Beautiful Beachfront Condo in Panama City Beach FL

Top picks in gulf shores, photo gallery for luxurious private gulf front home, heated pool, elevator & cancellation policy.

Luxurious Private Gulf Front Home, Heated Pool, Elevator & cancellation policy

Photo gallery for waterfront home with wifi, sun deck, screened porch & private beach access.

Waterfront home with WiFi, sun deck, screened porch & private beach access

Photo gallery for waterfront condo with pool, full kitchen & beach access - snowbird-friendly.

Waterfront condo with pool, full kitchen & beach access - snowbird-friendly

Photo gallery for brand new coastal modern home, 9br/8.5 ba, pool, steps from the beach, sleeps 28.

Brand New Coastal Modern Home, 9BR/8.5 BA, Pool, Steps From the Beach, Sleeps 28

Photo gallery for beach cottage - amazing beach location walk to the beach.

Beach Cottage - Amazing Beach Location! Walk to the beach!

Photo gallery for heated pool. 3rd floor. ocean house ii book now.

Heated Pool. 3rd floor. Ocean House II Book now!

Top picks in clearwater, photo gallery for my clearwater beach house.

My Clearwater Beach House

Photo gallery for large vacation home with private lazy river and outdoor kitchen.

Large Vacation Home with private Lazy River and Outdoor Kitchen

Photo gallery for new 2br condo - minutes from clearwater beach.

New 2br Condo - Minutes from Clearwater Beach

Photo gallery for apartment located near clearwater beach pool access.

Apartment located near Clearwater beach! Pool access!

Photo gallery for charming 3-bedroom bungalow in clearwater's north beach steps to the water.

Charming 3-bedroom Bungalow in Clearwater's North Beach! Steps to the Water!

Photo gallery for beautiful new home minutes away from beach.

Beautiful new home minutes away from beach

Does vrbo offer book now pay, later vacations.

Yes, you can pay for your short-term home with Vrbo Affirm vacation payment plans. Once you've found your dream place to stay, select “monthly payments” at checkout. You'll be able to spread the cost over 3, 6, or 12 months, giving you the financial flexibility to pay for your vacation over time. This means you'll have the freedom to jet off on the escape you've been dreaming of all year. Vrbo's vacations with payment installments include all types of homes, from trendy townhouses to cozy mountain lodges and spacious beachfront homes.

How can I use Affirm's book now pay, later vacations?

To take advantage of Affirm's vacation payment plans, choose your favorite short-term rental and select “monthly payments” on the checkout page. Then, click “Continue to Affirm” and type in your details to get a real-time decision in seconds. It'll show you the total cost to pay for your vacation over time, with payment options for 3, 6, and 12 months. Pick the one that works for you and let the countdown begin—your dream vacation home is booked.

Is there a credit check to use Affirm's book now, pay later vacations?

Yes, there'll be a credit check if you want to pay for your vacation over time. But don't worry, it has no impact on your credit score and you'll get a real-time decision within a few seconds. To perform the check, you'll need to enter a few brief details.

What types of homes can I book by payment plans?

All types of homes are eligible for Vrbo's book now, pay later vacations. From luxury beachfront villas in Florida to rustic mountain lodges in the Rockies, you can pay for dream vacation rentals in 3, 6, or 12 monthly installments. These payment options make your escape more accessible than ever before. Whether it's a family reunion in Colorado's quaint mountain towns or a group getaway to the West Coast, you can now pay for your vacation over time.

Can I book my family escape with Affirm's vacation payment plans?

Yes, you can book your family vacations with payment installments thanks to Affirm at Vrbo. Take your pick from thousands of spacious homes and select the “monthly payment” tab at checkout. It'll then guide you through the quick and easy steps to access payment options for 3, 6, or 12 monthly installments. Whether it's a spacious villa in Orlando to relax between visiting the theme parks or a trendy townhouse as a base to explore New York, pay for your vacation over time on Vrbo.

What are the benefits of Affirm's book now, pay later vacations?

Thanks to Affirm's vacation payment plans, you can book the dream home you wouldn't otherwise be able to afford in 2024. Think luxury beachfront condos on the West Coast, trendy apartments in Vegas, or quaint cottages in the Great Smoky Mountains. Payment options include 3, 6, or 12 monthly installments, and there are no hidden fees. This means you'll see the final cost before booking. You can even set up automatic payments through the Affirm app—helpful if things slip your mind sometimes. But you don't have to, and there are no late payment fees, either.

Are there any additional fees or interest charges for book now, pay later vacations?

There are no additional fees with Affirm's book now, pay later vacations, meaning what you see is what you pay. Before booking, you'll be able to view the final cost of your vacation payment plan. While most credit cards charge a complicated compound interest, with Vrbo Affirm you'll pay simple interest on your vacations with payment installments.

How can I find travel deals for book now, pay later vacations?

To score deals on vacation payment plans in 2024, try to be flexible with your dates. If you're traveling during popular dates, such as national holidays, it's a good idea to book early. This way, you'll guarantee your first choice of home and you may get a better rate. There could also be early booking deals, too. For off-peak dates, you can sometimes land great last-minute offers.

More vacation ideas

- Key West vacation rentals

- Maui vacation rentals

- Nashville vacation rentals

- Charleston vacation rentals

- Branson vacation rentals

- New Orleans vacation rentals

- Asheville vacation rentals

- Breckenridge vacation rentals

- Lake of the Ozarks vacation rentals

- Marathon vacation rentals

- Sedona vacation rentals

- Savannah vacation rentals

- Nantucket vacation rentals

- St. Simons Island vacation rentals

- Santa Barbara vacation rentals

- Jackson vacation rentals

- Hot Springs vacation rentals

- Martha's Vineyard vacation rentals

- Estes Park vacation rentals

- New Hampshire vacation rentals

- Other vacation rentals destinations

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

'buy now, pay later' can help fund your next trip but here's what you need to know about these loans, cnbc select walks you through what you need to know if you're considering a point-of-sale loan to finance your next trip.

When it comes to planning your next vacation , travel expenses can quickly add up — even if you managed to save a little cash ahead of time. You might be tempted to choose the 'buy now, pay later' option that's offered at checkout on many travel websites, including Carnival or Expedia.

These point-of-sale loans are seductive to consumers who don't want to pay for their vacations with one lump-sum payment, allowing people to make payments over a fixed period of time, sometimes without high interest rates.

But is using the 'buy now, pay later' option to pay for your flights or hotel stays too good to be true?

CNBC Select explores some of the benefits and drawbacks of using 'buy now, pay later' for travel.

What we'll cover

What are point-of-sale loans, how do point-of-sale loans work, should you use point-of-sale loans for travel, bottom line.

'Buy now, pay later' providers (also known as point-of-sale loans) offer consumers the option to sign up for a payment plan either when they're buying something on a retailer's website or directly through the loan provider's website ahead of purchase

Point-of-sale loans give consumers the ability to make installment payments over a fixed period of time until they completely pay off their purchase. This means that you'll make payments toward your purchases bi-monthly or monthly depending on the plan and/ or provider.

These payments can typically be automated by providing your debit card or bank account information. While many providers boast 0% interest rates, some point-of-sale loans can have interest rates upwards of 30%, higher than the APRs on many credit cards.

Some of the most popular providers are Afterpay , Affirm , Klarna and Uplift . Klarna offers point-of-sale loans, some with 0% APR, that allow you to make four payments every two weeks and require a deposit at checkout, while Afterpay allows you to pay over six weeks. Afterpay, Uplift, Klarna and Affirm also offer consumers longer payment periods of up to one, two or even three years.

When you purchase a flight or an item, you're given different financing options at checkout, such as the opportunity to pay with a credit card, gift card or point-of-sale loan . You'll be redirected to the POS provider website where you can enter your personal information.

Some companies won't perform a credit check while others will perform either a soft or hard credit inquiry . Soft credit checks don't negatively impact your credit score , but hard inquiries will temporarily decrease your score. Based on the information you enter, you'll either be approved or denied for the loan.

Afterpay doesn't do any credit checks while Klarna does soft and hard credit checks, depending on the loan.

The impact a point-of-sale one has on your credit score depends on whether the provider reports your payment history to the credit bureaus . For example, Affirm only reports your credit history to Experian for some loans and not others. For the loans that Affirm does report to Experian, your payment history, the length of your credit history with Affirm, the amount of your loan and your late payments can all show up on your credit report.

Make sure to read the terms and conditions of your POS loan to see if your negative payment history is reported to the credit bureaus.

Travel expenses might seem like the perfect opportunity to use a point-of-sale loan because it's oftentimes a big purchase that you might not have the immediate cash on hand to cover.

Klarna, Afterpay, Affirm and Uplift all offer 'buy now, pay later' option for certain travel partners. Affirm has partnerships with Delta Vacations, Priceline, StubHub and Alternative Airlines, a flight booking website. Uplift is exclusively focused on providing point-of-sale loans for travel, with around 200 travel partners , including United Airlines, Kayak , Southwest Airlines and Royal Caribbean.

Uplift will help you cover transactions costing anywhere from $100 to $25,000. Interest rates range from 7% to 30%, but there are a few travel partners such as Carnival Cruise Line and Atlantis that have a 0% APR, according to Tom Botts, chief commercial officer at Uplift. The average APR for an Uplift point-of-sale loan is 15%, which is similar to the average APR for credit cards .

"We use a variety of factors to determine eligibility," Botts says. "Interest rates are based on a number of factors including credit history, transaction amount and time to travel."

Uplift also only performs a soft credit check which won't negatively impact your credit score.

If you're able to secure a loan with 0% APR and make your payments on time, a point-of-sale loan could be a good choice for funding a trip. But if those monthly payments won't easily fit within your budget, be wary of a POS loan and read the fine print beforehand to determine how much you'll end up paying in interest.

For example, if you use Affirm to finance your purchases on Alternative Airlines , you can only get a 0% APR on your point-of-sale loan if you buy a flight that costs less than $500. If your ticket costs more than $500 , you could incur an interest rate of up to 30%, depending on your creditworthiness.

If you spend $1,000 on a flight and choose a 12-month payment plan with Affirm, you'll have to cough up nearly $100 in interest if you have a 20% APR on your loan. One perk of using Affirm over a credit card is that you'll have a longer payment period (of 3, 6, 12 or 18 months) which helps to spread the expenses over time into more manageable payments. And with an installment loan from Affirm or Uplift, the interest doesn't compound month over month, so your payment stays the same over the loan's term.

But a big drawback of using point-of-sale loans for travel is having to deal with unexpected problems, like trip cancellations or delays, says Priya Malani, the CEO and founder of Stash Wealth.

"If a trip is canceled or delayed with unexpected fees, your loan is still due. You're on the hook for the agreed upon total. Even though you may have checked out in one fluid process, you're still working with two separate entities — the travel provider and the POS loan provider," Malani says.

When it comes to funding your resort stay in Cancun or your flight to the Maldives, there are other options for financing your trip.

Travel rewards credit cards offer higher rewards rates for money spent on travel and the points you earn can go toward booking flights or hotels. While travel credit cards typically come with an annual fee, some offer a 0% introductory period, so you won't have to worry about high interest rates kicking in for 12 months or longer. If you go the 0% APR route, make sure you set up a repayment plan and pay the minimum each month so you don't end up paying late fees or big interest charges.

The Chase Sapphire Preferred® Card is currently offering a welcome bonus offer where new cardholders can earn 60,000 points after they spend $4,000 on purchases in the first three months from account opening. Points can be redeemed for $750 worth of travel when booked through Chase Travel℠.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

The Capital One Venture Rewards Credit Card is also a solid choice but comes with a smaller welcome bonus and higher rewards rate than the Preferred, giving 2X miles per dollar on every purchase and a welcome offer of 75,000 bonus miles if you spend $4,000 within three months of account opening.

Capital One Venture Rewards Credit Card

5 Miles per dollar on hotel and rental cars booked through Capital One Travel, 2X miles per dollar on every other purchase

Earn 75,000 bonus miles once you spend $4,000 on purchases within 3 months from account opening

N/A for purchases and balance transfers

19.99% - 29.99% (Variable)

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Travel cards also often come with additional perks such as car rental insurance, trip cancellation insurance and purchase protection. You won't get any of these perks when you use a POS loan for travel.

If you worry about putting a big expense on your credit card or you're only eligible for a POS loan with high APR, you should also consider creating a travel fund instead.

By saving your money in a high-yield savings account , you'll be earning more (thanks to compound interest ) than you would be if you put your money in either a checking account or a traditional savings account. Creating a separate fund for travel can also give you a money goal to strive for and setting up automatic monthly transfers can help you avoid spending money on other short-term, more frivolous purchases.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Point-of-sale loans are attractive because of how easy they are to use — you simply provide some basic information about yourself to the loan provider before checking out and you can instantaneously get a loan that will allow you to spread the cost of your trip over a few months. If you're not diligent about reading the fine print, however, there can be a lot of caveats to using the 'buy now, pay later' option, including high interest rates and late fees.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of buy now, pay later loan products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- This checking account earns 8% APY — with a catch Andreina Rodriguez

- Are safe driving discounts worth it? Ryley Amond

- Capital One announces new lounge for New York's JFK Airport Senitra Horbrook

Book now, pay later

Vacation financing through Affirm is available for U.S. stays with a total rent of at least $250. Select "Pay later with Affirm"* at checkout.

How Affirm works

See if you’re eligible by providing some basic information. You’ll get a real-time decision (and your credit score won’t be affected).

Know exactly what you’ll owe before you commit. No hidden costs, no surprises.

Choose to pay in installments over 3, 6, 12, or 18 months*—even after the date of your trip.

Your trip, your way

When you finance your vacation with Affirm, your payment schedule is just one of the things you won't have to worry about.

Our professional property management includes 24/7 guest support, premium cleaning, and seamless check-in for your most relaxing vacation yet.

Sign up for emails

Curated tips & inspiration for your next vacation.

Choose from thousands of places to stay

Affirm travel FAQ

Who is eligible to apply for affirm financing on a vacasa stay.

While Affirm requires you to be at least 18 years old, you must be at least 21 to book a Vacasa home. (Some of our homes and destinations require a higher minimum age to rent the property—you'll see that specified on the property listing, if applicable.)

You must also be a U.S. resident booking a home within the U.S.

Does Affirm do a credit check, and how does it impact my credit score?

If you choose to pay with Affirm, we ask for some basic personal information to see if you're eligible. You'll get a real-time decision on whether you prequalify for a vacation loan. This process includes a quick credit check—but it does not affect your credit score.

How do I make my payments?

After you complete your Vacasa trip purchase, look out for an email directly from Affirm about your vacation payment plan. You can make secure payments on Affirm's website, or through their app. Visit Affirm's help center for more details on making loan payments.

Can I amend my order after my purchase has been processed?

If you need to adjust your reservation after purchase, you can do so in your Trip Manager . For any changes that come with additional fees (such as adding pets or pool heat), you'll need to pay for those with a credit card. Those charges cannot be added to your existing loan through Affirm.

And, if you end up needing to change dates or cancel your reservation, good news—trips paid for with Affirm still fall under our worry-free booking policy . You'll also see your change and cancellation options in your Trip Manager.

Can you make payments on a trip to Hawaii?

Yes, you can. We offer vacation payment plans through Affirm on U.S. stays, including those in Hawaii (as long as the rent totals at least $250).

Where to next?

Rates from 0–36% APR. For example, a $700 purchase might cost $63.18/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders . Options depend on your purchase amount, and a down payment may be required. See affirm.com/licenses for important info on state licenses and notifications.

A guide to using buy now, pay later for travel

PayPal Editorial Staff

January 5, 2024

Planning a vacation? Buy now, pay later (BNPL) may be offered as a payment option when booking flights, hotels, or other travel accommodations.

Discover how BNPL options work for travel, from potential pros and cons to responsible practices and strategies if considering using it.

What is buy now, pay later for travel?

Buy now, pay later is an installment option that allows people to split up purchases into several smaller payments over weeks or months. It can typically be used for several types of purchases, from big-ticket items like electronics and furniture to travel expenses like hotels and airfares.

If BNPL is an available payment option for an airline, hotel, or travel retailer, individuals can opt for a payment plan at checkout. Normally, they would select the BNPL provider and apply in the checkout, but some providers may redirect applicants to their website to create an account and apply. Typically, applicants receive a near-instant decision, which may mean those looking to use buy now, pay later for travel can book their travel or vacation without a significant delay.

Depending on the BNPL provider , there may be interest fees and other charges, though some providers may offer plans with no interest. Be sure to review any terms before applying.

While application and approval requirements may vary depending on provider, here’s a breakdown of the general eligibility requirements and approval process:

- Meet the eligibility requirements: These can vary based on the provider. People typically need to be at least 18 years old and provide personal details like their social security number and home address. Some BNPL providers may also assess income, payment history, and credit score.

- Agree to the terms: Individuals must agree to the terms and conditions of a BNPL plan, including an installment schedule and any associated fees or interest charges.

- Receive a decision and book travel: People usually receive a BNPL approval decision in seconds. If approved, they can book their travel using BNPL as their payment method.

Potential benefits of using buy now, pay later for travel

Before using buy now, pay later for a trip, consider the potential advantages:

- Flexibility: BNPL may offer flexibility to spread the cost of a trip over time, allowing travelers to manage their budget and avoid a significant upfront expense.

- Interest-free options: Some BNPL services may provide interest-free payment plans. For example, PayPal’s Pay in 4 allows people to split eligible purchases into four interest-free, bi-weekly installments. 1

- Accessibility: Buy now, pay later may help make travel accessible to those with limited credit histories or low credit scores.

Potential downsides of using buy now, pay later for travel

There are some potential disadvantages to using buy now, pay later for travel expenses. Some examples include:

- Interest and fees: Some BNPL providers may charge interest or fees if travelers miss payments or choose longer repayment terms, potentially increasing the overall cost of their trip.

- Overspending: While BNPL offers flexibility, it can also lead to overspending if travelers don't carefully budget for their installment payments. It also may tempt some to book more expensive trips than they can comfortably afford.

- Credit impact: Although certain buy now, pay later providers may not conduct hard credit checks initially, missed payments or defaults may negatively impact credit scores in the long run.

- Limited booking options: Not all travel providers or agencies accept BNPL as a payment option.

Using buy now, pay later for travel responsibly

Here are some factors to consider when signing up for a BNPL plan for travel:

- Budget and plan: Establish a personal budget for travel plans that includes not only the upfront trip cost but also the future installment payments to ensure the overall expense remains manageable and within budget.

- Read the fine print: Carefully read and understand the terms and conditions. Pay close attention to any interest rates, fees for missed payments, and the total cost of a trip when opting for BNPL.

- Responsible spending: Avoid the temptation to overspend just because BNPL offers flexibility. It’s important to only buy on credit responsibly .

- Ensure timely payments : Commit to making payments on schedule to avoid late fees or interest charges. Setting up automatic payments can help prevent missed deadlines.

Using BNPL for travel may offer convenience and flexibility for those looking to travel or book a vacation, but it should be done with careful consideration. Be sure to consider any fees or interest that may apply and keep track of when payments need to be made.

Learn about PayPal Pay Later .

BNPL for travel FAQ

What is buy now, pay later.

Buy now, pay later is a type of short-term financing method that allows people to split a purchase into several smaller installments over weeks or months. Some BNPL plans may be interest free, while others may include interest and fees.

Can buy now, pay later be used for flights?

Buy now, pay later can often be used for flights. Many airlines and travel booking platforms offer BNPL as a payment option at checkout. Travelers should budget and plan their payments accordingly before committing to a payment plan.

Can I book a vacation with buy now, pay later?

Individuals may be able to book a vacation using buy now, pay later. BNPL options are increasingly available for vacation planning, including flights, accommodations, and activities. Travelers can opt for BNPL at checkout and split the total cost into smaller installments. However, be sure to budget carefully and be aware of any potential interest or fees.

Was this content helpful?

We use cookies to improve your experience on our site. May we use marketing cookies to show you personalized ads? Manage all cookies

Should You Use Buy Now, Pay Later for Travel?

BNPL brings financial flexibility to travel bookings, but paying for travel in installments could be risky.

Should You Use BNPL for Travel?

Getty Images

Plan how you’ll make the payments before hopping onboard.

Buy now, pay later financing options offer a flexible alternative to traditional payment methods when you make a purchase – including travel purchases. Whether traveling for family obligations or jetting off on a fabulous vacation, BNPL may offer the option to book travel without making a full upfront payment. But while BNPL can offer flexibility, it isn’t without risk.

Read on to understand the benefits, drawbacks and factors you should consider before using BNPL to book travel.

What Is Buy Now, Pay Later?

BNPL is an alternative to credit cards and loans . It’s popular for travel expenses such as flights, hotels and vacation packages. BNPL can offer convenience and flexibility, particularly for costly trips that might be difficult to pay upfront, but you should exercise caution.

“Participating online and in-person retailers offer (BNPL) at checkout,” says Rod Griffin, senior director of public education and advocacy for credit bureau Experian. “You can think of BNPL similar to a layaway plan, where you pay a merchant for a purchase over time rather than immediately upfront. Unlike a layaway, though, with BNPL, you get your items right away.“

Using BNPL, you can make a purchase and spread your expense into installment payments . That allows you to buy products or services – such as travel – immediately without making a full payment. BNPL is often interest-free as long as you stay on top of installment payments.

How to Secure a $30,000 Personal Loan

Matthew Reitz July 28, 2023

How Buy Now, Pay Later Services Work

BNPL services are typically available at checkout when you book travel. For example, you might see the option to use BNPL when you book a flight instead of entering a credit card number .

At checkout, the BNPL service will provide loan information, including the number of payments, how much you’ll pay and your interest rate , if there is one. Some BNPL services use a credit check, but BNPL often doesn’t require a hard credit check unless you opt for extended terms or make a particularly large purchase.

You’ll make the first payment if approved, and your travel will be booked. The remaining balance will be split into equal installments. If you’ve opted for auto-pay, the installment amounts will be automatically charged to your payment method when each payment comes due.

Personal Loans for Debt Consolidation:

Factors to Consider Before Opting for Buy Now, Pay Later

Before you opt for BNPL, plan how you’ll make your payments. While BNPL can make paying for travel easier, installment payments could pressure other financial obligations. Can your budget handle the installment payments along with other commitments?

“The first thing to ask yourself is can you pay back the loan on time and in full?” says personal finance and travel expert Barry Choi. “Next, you should be aware that BNPL may encourage you to spend more because the entire balance isn't due right away.”

Some BNPL services offer interest-free installment plans, but you may have to pay interest or fees if you miss a payment.

“BNPL plans have widely varying payment structures, so it's important to read the terms carefully,” says Griffin. “Treat them like you would any loan agreement and look for information on payment terms, potential interest and late fees, and whether those payments or fees will be reported to the national credit reporting companies like Experian.”

Interest-Free Buy Now, Pay Later Installment Plans

An interest-free BNPL plan allows you to split your purchase into equal installments with no interest charges. BNPL installment plans may have no credit check . That can give you an alternative if you’re worried about getting approved for a credit card or loan to finance a travel purchase.

But there’s a catch: The repayment terms are often very short – for example, a down payment and three biweekly payments. Also, you might pay fees if it takes longer to repay the loan or if you miss a payment.

For example, you might be offered four interest-free payments, but if you opt to pay over six, 12 or 24 months instead, you’ll pay interest. It’s key to read the terms and conditions before signing the dotted line. And if you miss a scheduled installment payment, you should expect a late payment fee. You might also have to pay interest.

6 Best Loans for Moving or Relocating

Dawn Papandrea Aug. 8, 2023

Benefits and Drawbacks of Buy Now, Pay Later for Travel Expenses

- Payment flexibility: You can spread out travel costs in installments so it’s easier on your budget.

- Interest-free options: You may have the option of getting an interest-free installment plan.

- Quick approvals: BNPL applications and approvals are generally fast, so you can get approved and book your trip.

“The main benefit of BNPL is that you can pay for your purchases over time without potentially paying interest,” says Choi. “This can help people who are facing a temporary cash flow crunch.”

- Late fees and interest: If you miss a payment or extend the installment period, you might have to pay late fees or interest.

- Credit impact: Missing a payment or defaulting on BNPL could negatively impact your credit score if the account goes to collections. But BNPL generally doesn’t help you build credit as traditional credit cards or loans can.

- Overspending risk: Breaking payments into smaller installments might make you feel that you can afford to spend more than you can handle.

“Generally, consumers are better off avoiding BNPL services since it may encourage them to spend more or buy things they don't need,” says Choi. “That said, BNPL can be helpful in some situations. For example, you need to purchase something immediately for an emergency and don't have a credit card.”

Alternatives to Buy Now, Pay Later

- Savings: Setting aside money in a travel fund enables you to pay for your trip without using credit.

- Rewards credit cards : You could pay for travel with points and miles earned with a rewards credit card.

- Personal loans : If you have good credit, a personal loan might offer better terms than BNPL.

- Delaying purchases: If you can’t afford travel without debt, hold off until it’s in your budget.

“To responsibly use BNPL services, you should be prepared to make all your payments on time to avoid fees, keep enough funds in your bank to avoid overdraft payments and assess the cost of the purchase and your overall budget to avoid overextending,” says Griffin. “It can be very easy to take on multiple BNPL accounts. You can quickly find yourself with more debt than you realized you were taking on and difficulty repaying the debts you owe.“

6 Best Vacation Loans

Dawn Papandrea June 17, 2024

Tags: money , Travel , credit cards , loans

Personal Loan Articles

Personal Loans Advice

Personal Loan Categories

Personal Loan Lenders

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

You May Also Like

How much loan can you borrow.

Jerry Brown June 17, 2024

What Is a Credit-Builder Loan?

Bob Musinski and Melanie Lockert June 14, 2024

How the Fed Impacts Personal Loans

Kim Porter June 12, 2024

2024 Home Improvement Survey

Erika Giovanetti June 12, 2024

CFPB Sets Protections for BNPL

Jerry Brown May 30, 2024

3 Ways to Leverage 'Buy Now, Pay Later' for Your Dream Vacation

T aking a vacation is pricey, and with inflation soaring over the past few years, the average cost of a domestic trip -- not including airfare -- is $1,584 right now. When you add flight costs or the price of paying for other family members to join you, a dream vacation can easily feel out of reach.

High travel costs are causing some Americans to opt for buy now, pay later (BNPL) options when putting their vacations into their online shopping carts. BNPL plans are essentially loans you apply for when booking your travel that allow you to pay for your trip over time.

Many BNPL companies charge interest rates ranging between 7% to 30% for the loan, but some may have lower special offers. As such, using a BNPL to fund your dream vacation may not always be the best option for your personal finances . But if you score a reasonable rate -- some can be as low as 0% -- there could be a few ways to leverage this option for your dream vacation.

1. Buy your plane tickets

The ticket-purchasing website Alternative Airlines says on its website that you can book flights on more than 650 airlines and use a BNPL service to pay for them.

The website partners with 10 BNPL companies, including PayPal Credit, Affirm, Klarna, and Afterpay, allowing you to make payments on your ticket weekly, bi-weekly, or monthly. Some buy now, pay later companies on the site even offer interest-free payment plans.

2. Book your hotel

Lodging is one of the most expensive parts of any dream vacation, which is why some people choose to pay for it using an installment plan rather than all at once.

There are a couple of different payment methods you can choose from when booking a hotel with BNPL, including a no-interest option through some online travel booking websites. For example, Expedia allows you to reserve some hotel rooms without charging you, and you only pay for the room when you arrive at the hotel.

The company's Book Now Pay Later option won't charge you any interest, making it a better option than some BNPL companies. Expedia says that some hotels may also offer free cancellation, which can come in handy if your travel plans unexpectedly change.

Another option for travelers is to book their hotel and pay for it using a buy now, pay later service like Uplift. The company conducted a survey showing that 48% of travelers are likely to use BNPL for hotels, and 43% of travelers upgraded their hotel options and amenities when doing so.

3. Book the full vacation

Nearly all online vacation booking sites offer the option to pay for your full vacation over a series of installments with a BNPL service. This allows you to spread out the cost of a pricey vacation over time, making it easier to manage the large expense.

But it's good to remember that the more you spend on your vacation, the more you'll owe, depending on your BNPL interest rate. The Consumer Financial Protection Bureau says BNPL late fees are on the rise too, and that in some cases, late fees can make buy now, pay later payment options more expensive than using a credit card.

It's worth mentioning that some vacations allow you to pay in installments without charging any interest. Disney is well known for allowing people to book their entire vacation with just $200 down and then spread out payments leading up to the vacation, paying as much as they want for each payment. The last remaining payment is then due 30 days before you arrive at your hotel.

Keep this in mind when using BNPL

While there can be responsible ways to use BNPL to book your dream vacation, pay attention to the details. If you qualify for a 0% interest rate, then it may not be a bad option. But if you have to pay an interest rate, you're much better off budgeting and saving ahead of time for your vacation.

Also, make sure you'll be able to make your payments on time to avoid late fees. Your dream vacation will likely cost enough already -- there's no need to add fees on top of it.

Alert: highest cash back card we've seen now has 0% intro APR until 2025

If you're using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick , which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our experts even use it personally. Click here to read our full review for free and apply in just 2 minutes.

Read our free review

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Chris Neiger has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends PayPal. The Motley Fool recommends the following options: short December 2023 $67.50 puts on PayPal. The Motley Fool has a disclosure policy .

Worldwide vacations

Get the best savings right to your inbox..

Sign up to receive emails about upcoming sales, promotions and exclusive offers.

Please enter a valid email address.

There was a problem saving your email address.

Popular destinations

Dominican republic, this week's promotions, splash into savings, zoetry wellness & spa resorts, the u.s. savings event, riu hotels & resorts, steal of a deal, vacation deals, partner offers.

Meet Me in the Mediterranean

Puerto Vallarta Tourism

North Atlantic Europe Vacations Sale

Marriott bonvoy, vacation with confidence.

Lowest airfares

Exclusive Perks