The best time to apply for these popular Citi credit cards, based on offer history

Editor's Note

Update: Some offers mentioned below are no longer available. View the current offers here .

If you're considering applying for a credit card, you're probably wondering whether the current sign-up bonus is worth it.

Welcome offers can change frequently, and it can be hard to know whether the current offer on a card provides the value you're looking for. There's no easy answer to precisely when is the best time to apply for a card, but it does help to know what a card has offered in the past when evaluating the current offer.

We've rounded up the offer history on the most popular cards from Citi to help you find the best time to apply for each card.

Best Citi credit card sign-up bonuses

The information for the the Citi Advantage Platinum Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Citi Premier® Card

The Citi Premier card earns 3 points per dollar on gas purchases, dining, groceries, and air and hotel travel. With its simplified model and array of airline transfer partners, the Citi Premier makes earning points for travel hassle-free.

*Bonus offer value is based on TPG's valuations and not provided by the credit card issuer.

When to apply for this card: When the bonus offer is 80,000 points or higher.

Learn more: Citi Premier credit card

Citi Custom Cash® Card

With the Citi Custom Cash, you'll earn 5% cash back on purchases in your top eligible spending category each billing cycle, up to the first $500 spent, and 1% cash back after that. You'll also earn unlimited 1% cash back on all other purchases. This card launched in mid-2021.

When to apply for this card: When the bonus offer is $200 cash back or higher.

Learn more: Citi Custom Cash credit card

Citi Double Cash® Card

The Citi Double Cash Card takes all of the stress and complication out of credit card rewards with a simple (yet lucrative) 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases and straightforward cash-back redemption options.

When to apply for this card: When there is any cash-back welcome offer.

Learn more: Citi Double Cash Card

Citi Rewards+® Card

Every purchase on the Citi Rewards+ Card rounds up to the nearest 10 points. Even a $2 coffee will earn 10 points, which can really stack up over time.

When to apply for this card: When the bonus offer is 20,000 points or higher.

Learn more: Citi Rewards+ credit card

Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

The Citi AAdvantage Platinum Select's perks include access to preferred boarding, no foreign transaction fees and a free checked bag on domestic flights, making it an excellent choice for anyone who flies American Airlines regularly.

The information for the Citi AAdvantage Platinum Select World Elite Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

When to apply for this card: When the bonus offer is higher than 50,000 miles.

Learn more: Citi AAdvantage Platinum Select credit card

Citi® / AAdvantage® Executive World Elite Mastercard®

The Citi AAdvantage Executive World Elite Mastercard is the elite card in the AAdvantage lineup. Recently, the card increased its perks as well as its annual fee. Cardholders enjoy a complimentary American Airlines Admirals Club membership, a value that alone more than makes up for the card's $595 annual fee, as well as the addition of up to $360 in annual statement credits for Lyft, Grubhub and eligible car rental purchases.

When to apply for this card: When the bonus offer is higher than 80,000 miles.

Learn more: Citi AAdvantage Executive World Elite Mastercard

Citi® / AAdvantage Business™ World Elite Mastercard®

The Citi AAdvantage Business World Elite Mastercard is excellent for businesses with employees who frequently fly American Airlines. Its perks include a free checked bag on domestic flights, preferred boarding and the potential to earn a companion certificate.

Learn more: Citi AAdvantage Business credit card

Bottom line

When you're considering applying for a Citi card — or any card — you'll want to determine whether its sign-up bonus provides substantial value.

Use our other offer history guides as a reference point as you evaluate the pros and cons of signing up for cards from the major issuers:

- The best time to apply for these popular travel credit cards

- The best time to apply for these popular American Express credit cards

- The best time to apply for these popular Capital One credit cards

- The best time to apply for these popular Chase credit cards

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

[Expired] Save $20 When You Spend $200 on Travel With New Citi Offer

Chris Hassan

Social Media & Brand Manager

218 Published Articles

Countries Visited: 24 U.S. States Visited: 26

Stella Shon

News Managing Editor

97 Published Articles 694 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

![citibank travel promo 2023 [Expired] Save $20 When You Spend $200 on Travel With New Citi Offer](https://upgradedpoints.com/wp-content/uploads/2023/05/New-York-Taxi-Cab-Image-Credit-Kai-Pilger-via-Pexels.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Citi offer: earn $20 back on travel purchases, about citi merchant offers, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Update: The offer mentioned below has expired and is no longer available.

If you have a Citi card, check your account for a targeted offer to earn $20 back on eligible travel purchases by June 24, 2023.

This offer came as a pop-up on the Citi mobile app, so log in on your account on desktop or mobile app if you can’t find it.

Although the offer is a bit limited, it should still be easy for many readers to get some cash-back.

Let’s take a look at the details.

Targeted Citi cardholders can get $20 back in a statement credit on eligible purchases.

This was a pop-up offer on the mobile app for my Citi Prestige ® Card , but cardholders may also find this offer in their email or even in their Citi Merchant Offers .

To earn the $20 statement credit, you must:

- Activate the offer

- Spend $200 on car rentals, limousines, taxis, travel agencies, or tour operators

- Purchases must post by June 24, 2023

Based on the wording, it appears that flights and hotels booked directly would not trigger the offer, while online travel agencies (OTAs) like Expedia might.

If you want to stack your savings, be sure to read our guide on how to use Expedia to find great deals on flights, hotels, vacation packages, and more.

Citi has been busy with its promotions lately, with the continued improvement of Citi Merchant Offers being the biggest addition.

This $20 travel offer is not technically a Citi Merchant Offer, despite having all of the characteristics of one. The only difference is that it is a bit more elusive to find — so don’t be too quick to dismiss any pop-ups!

Citi Merchant Offers can be found both on the Citi desktop website and mobile app in the offers section and include cash-back offers for travel, dining, shopping, and more.

Bottom line, this is a great little targeted offer for Citi cardholders.

Getting $20 back on travel expenses that you are already likely going to pay for is always nice. On a $200 charge, that’s 10% back — which is better than nothing.

However, it is a little disappointing that booking directly with a hotel or airline wouldn’t trigger the offer.

If you were targeted, don’t forget to activate the offer and use it by June 24, 2023!

The information for the Citi Prestige ® Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer.

Was this page helpful?

About Chris Hassan

Chris holds a B.S. in Hospitality and Tourism Management and managed social media for all Marriott properties in South America, making him a perfect fit for UP and its social media channels. He has a passion for making content catered toward family travelers.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![citibank travel promo 2023 [Expired] New Amex Offer: Spend $1,000, Get $300 Back With AmexTravel.com](https://upgradedpoints.com/wp-content/uploads/2022/02/Lufthansa-European-business-class-Prague-check-in-.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- All business 39

- Business Services 18

- Digital Marketing 12

- Dining & Entertainment 2

IHG Hotels & Resorts

Enjoy 20% off stays at IHG® properties across...

- All wedding 9

Four Seasons Hotel Singapore

Exclusive Wedding Packages

10% off BellyGood Wedding Packages

- All restaurants 279

- Hotel Dining 94

- Japanese 62

- Cafe and Delights 6

- International 6

Tarte by Cheryl Koh

S$8 off with. min spend of S$60

Cafe and Delights

Tai Cheong Bakery

S$1 off with every S$10 spend

- All hotels 15

Booking.com

Get up to 10% cashback on accommodation booki...

- All travel 48

- Tour/Sightseeing 15

- Car Rental 2

Qatar Airways

Up to 10% off | Promo code: CITIQR24

- All shopping 94

- Fashion & Beauty 22

- Home, Furnishings and Art 22

- Food & Grocery 11

- Marketplace 4

- Electronics & Technology 3

Citi x Mayer 2024 Offer

Electronics & Technology

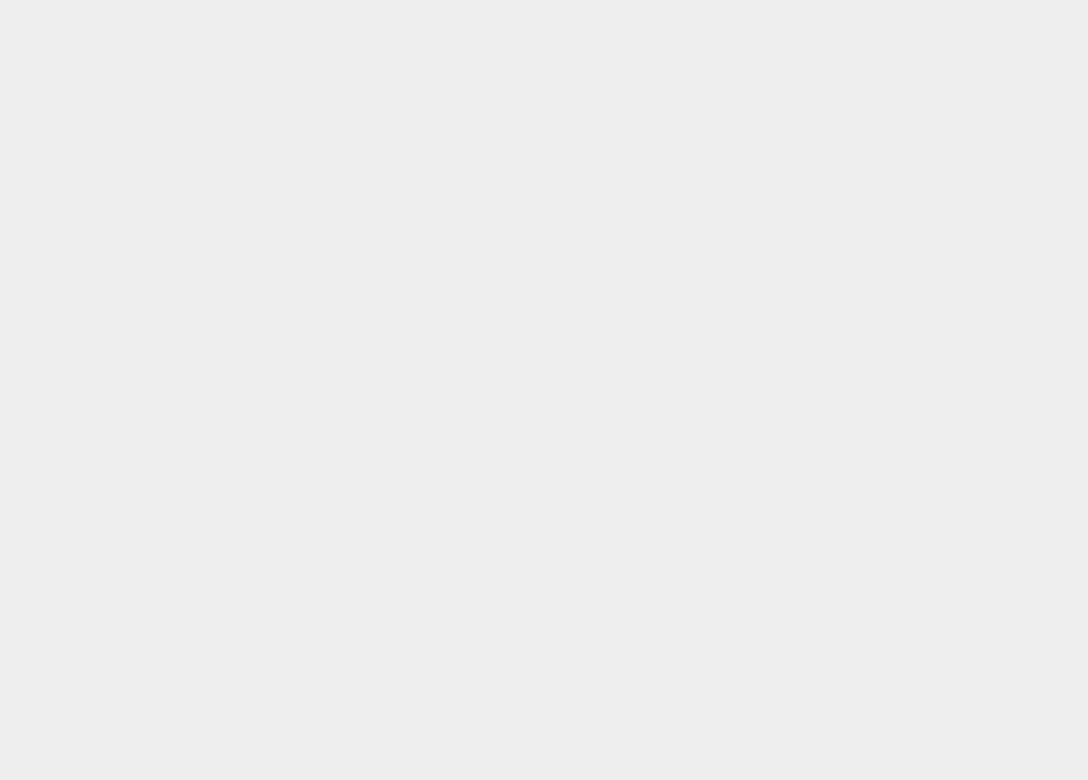

Citi x Stryv.co May 2024

- All lifestyle 21

- Entertainment 10

- Specialty 1

Citi x Browhaus Yearlong Promo 2024

Citi x Spa Esprit Yearlong Promo 2024

Citi Mastercard® Online Spend and Get

Book your travels with Citi Mastercard and go on bigger adventures! Redeem an American Tourister Flashflux Spinner 68/25 Luggage when you enrol and make a min. S$2,000 spend with your Citi Mastercard on the Singapore Airlines Website and/or SingaporeAir Mobile App from 1 March to 30 April 2024. Seize the chance to explore the world with unparalleled travel perks and privileges today. You’re always ahead when you travel with Citi. T&Cs apply.

Citi Mastercard - Singapore Airlines Online Spend and Get

Enrol and spend with your Citi Mastercard for your flight bookings on the Singapore Airlines Website and/or SingaporeAir Mobile App and you can redeem an American Tourister Flashflux Spinner 68/25 Luggage with min. S$2,000 spend. Enrol now by sending an SMS in the prescribed format CITISQSNG Last 4 digits of their eligible Citi Mastercard number (e.g. CITISQSNG 1234) to 72484 using your registered mobile number. Capped at first 1,000 eligible customers. Valid from 1 March to 30 April 2024.

Explore more ideas

Citi Gourmet Pleasures

Uncover the pleasures in life

Shop Smart, Save More with Citi

Unlock the joy of shopping

Citi Mastercard® Exclusives

Make every moment more rewarding

Tunglok Group of Restaurants

Exclusive Dining Promotions

Paradise Group Dining

Exclusive Dining Offers

Halal Eateries around singapore

Discover more exclusive deals at your fave halal food haunts

Embark on a gastronomic adventure

LES AMIS GROUP

Pamper Your Palate

OUE Restaurants

Travel Deals & Exclusives

Satisfy your wanderlust

Japanese Cuisine that delights your palate

Preferred language

- Bangkok, Thailand

- Sydney, Australia

- Tokyo, Japan

- Da Nang, Vietnam

- Hanoi, Vietnam

- Ho Chi Minh City, Vietnam

- Tien Giang, Vietnam

- Indonesia Bahasa

Which Citi Cards do you have?

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

5 Things to Know About Citi & Booking.com’s New Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Citi's new online travel booking platform allows customers to buy travel with cash or Citi ThankYou points . The portal is called Citi Travel with Booking.com and is managed by the online travel agency.

Now that the portal is live, Citi ThankYou points fans can earn and redeem points for travel and other merchandise in time for summer and beyond.

What to know about the Citi travel portal

1. you can book flights, hotels and car rentals.

The booking portal allows you to book all kinds of travel through the Citi website or mobile app. It includes car rentals, airlines and hotels (1.4 million hotels, to be exact, via Booking.com).

This can be a great way for you to pay for an upcoming trip with cash or to use your Citi ThankYou points to redeem for free or reduced-cost travel. Note that when redeeming your points for airline travel, you are eligible to earn frequent flyer miles. This is a smart money move to take advantage of your points while also growing your mileage balance .

However, when using Citi ThankYou points for hotel stays, you’re not eligible for earning hotel loyalty points or taking advantage of elite status benefits. This is because these hotel stays aren't booked directly through the hotel. Most hotel loyalty programs don’t provide points or perks when booking through third-party websites (including Booking.com, which is running this new Citi Travel platform).

Still, booking hotels via the Citi Travel portal is a good opportunity to redeem points for a stay at a hotel where you don’t have status or in a destination where you can’t earn or take advantage of status.

2. You can pay with points, cash or a combination

The new portal shows 1.4 million hotel reservation options because of its partnership with Booking.com. Plus, you can continue to pay entirely in cash, entirely in points or with a mix of cash and points.

This provides greater value for your points since you don't have to wait until you have enough for a particular redemption. Instead, you can use a combination and put any number of points in your account immediately to work for you.

3. You'll earn bonus points when booking

Between now and Dec. 31, 2025, new and existing cardholders can score bonus points for their travel reservations. Citi Rewards+® Card members earn 5x points when using their cards for hotel, car rentals and attractions booked through CitiTravel.com.

4. It pays to understand how reservations work

When making a reservation through an online travel agency like Booking.com (even under the Citi ThankYou rewards branding), you’ll have to contact the agency about any travel changes or disruptions. It is the travel agency that handles changes instead of the airlines, hotels and other travel partners that you booked travel with.

Citi says that their agents are available 24/7, and that there will be a dedicated Booking.com-backed customer support team for Citi cardholders. Still, some people may find it frustrating that they cannot deal directly with the travel provider since this is a third-party travel agency reservation. Just be aware of this limitation when making any reservation through an online travel agency.

If you want to change or cancel a flight , for example, you’ll have to contact the Citi-dedicated customer service, not the airline.

5. You can redeem points for other purchases, too

You can redeem Citi ThankYou points at other partners, too, including CVS, Choice Hotels and Wyndham Hotels & Resorts among others. There are 180 redemption partners.

The new Citi ThankYou travel portal, recapped

This new portal provides a new option for earning and redeeming Citi ThankYou points with the assistance of Booking.com. The goal is to make it easier to benefit from your points and rack up more when using your Citi credit cards.

The more options the better, we say. When you know the restrictions for using your points and can benefit from the perks of using them, Citi ThankYou points offer exceptional value .

The information related to Citi Prestige® Card has been collected by NerdWallet and has not been reviewed or provided by the issuer or provider of this product or service.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

- Credit Cards

- View All Credit Cards

- See If You're Pre-Selected

- Balance Transfer Credit Cards

- 0% Intro APR Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Travel Credit Cards

- Retail Store Cards

- Small Business Credit Cards

Quick Links

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- Small Business Banking

- Personal Loans

- Overdraft Line of Credit

- Home Lending

- Refinance Your Home

- Use Your Home Equity

- Small Business Lending

- Investing Overview

- Self-Directed Investing

- Guided Investing

- Working with an Advisor

- Wealth Management

- Citigold ® Private Client

- Citi Priority

- Open an Account

Notificación importante

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.

Please be advised that verbal and written communications from Citi may be in English as we may not be able to provide servicing related communications in all languages. These communications may include, but are not limited to, account agreements, statements and disclosures, change in terms or fees; or any servicing of your account. If you need assistance in a language other than English, please contact us as we have language services that may be of assistance to you.

CITI TRAVEL with Booking.com

Citi travel℠: your first stop to your next destination.

Please note that Citi's travel provider has changed to Rocket Travel as of March 19th, 2023. Here are your servicing options:

For all bookings made before March 19th, 2023 :

- To change or cancel your booking: call 1-833-737-1369. For TTY: Use 711 or other Relay Service

- To rebook using Delta Airlines credits, visit Delta.com and log in using your credit card number, Skymiles account number or contact information.

- To book new travel : visit the Citi Travel portal or call 1-833-737-1288 (U.S. Toll-Free, for TTY: Use 711 or other Relay Service)

For new bookings, earn ThankYou Points when you pay for part, or all, of your trip with your eligible Citi Card through Citi Travel, your booking destination. Plus, you can redeem your points towards even more adventures through the Citi Travel portal. With customizable options and booking right from your Citi Mobile ® App for eligible cardholders, the way to go is now way easier.

Access to over 1.4 million hotel and resort options

Competitive prices when booking flights, hotels, cars and attractions, 24/7 customer service support for your booking needs.

Citi Travel℠ is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

To provide you with extra security, we may need to ask for more information before you can use the feature you selected.

Just a moment, please...

Get Citibank information on the countries & jurisdictions we serve

You are leaving a Citi Website and going to a third party site. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta. Si necesita ayuda en un idioma distinto al inglés, por favor, comuníquese con nosotros, ya que tenemos servicios de idiomas que podrían serle útiles.

Share Your Screen With A Phone Representative

During your call, you may be asked to share your screen for a faster, more efficient experience. If you agree, the phone representative you're speaking with will give you a Service Code to enter below.

If you need assistance from a Citi representative, contact us via chat or phone

- ATM / Branch

- Open an Account

- View All Credit Cards

- 0% Intro APR Credit Cards

- Balance Transfer Credit Cards

- Cash Back Credit Cards

- Rewards Credit Cards

- See If You're Pre-Selected

- Small Business Credit Cards

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- Small Business Banking

- Personal Loans & Lines of Credit

- Home Equity

- Small Business Lending

- Investing with Citi

- Self Directed Trading

- Credit Cards

- Credit Knowledge Center

- Understanding Credit Cards

- What are the Costco Visa travel benefits

What are the Travel Benefits of the Costco Anywhere Visa® Card by Citi?

Exclusively for Costco members, the Costco Anywhere Visa Card by Citi offers cash back on all purchases and additional cash back on categories such as eligible gas and EV charging, restaurants and eligible travel and purchases from Costco and Costco.com. Cardholders also enjoy access to Citi Entertainment ® .

These benefits and more can make the Costco Anywhere Visa a great card for travel. Let’s look at how it works.

Cash back rewards on travel

Cardholders earn unlimited 3% cash back at restaurants and eligible travel purchases. This can include airfare, hotel stays, car rentals, travel agencies, cruises and Costco travel.

Cardholders can also make the most of road trips and vacation car rentals with 4% cash back on eligible gas and EV charging transactions for the first $7,000 every year. After the first $7,000, cardholders continue to earn 1% cash back in these categories.

Other travel benefits

Cardholders can also get access to services and benefits like:

- Travel and emergency assistance

- Worldwide car rental insurance

- Travel accident insurance

- Roadside assistance dispatch service

- Zero foreign transaction fees 1

Terms, conditions and exclusions apply, please see here for more information.

These services and benefits help take the stress out of travel so you can enjoy a worry-free, relaxing vacation.

Access to Citi Entertainment

Citi Entertainment opens the door to popular experiences, such as concerts, sporting events and dining.

With the Costco Anywhere Visa Card by Citi, cardmembers can get special access to purchase tickets to thousands of events, including presale tickets and exclusive experiences for some of the most anticipated concerts, sporting events and dining experiences.

Whether you want to attend a local event while on vacation or plan a trip around a concert, your Costco Anywhere Visa® Card by Citi can enhance your travel with special entertainment experiences.

1 Important Pricing & Information

Disclosure : This article is for educational purposes. It is not intended to provide legal, investment, or financial advice and is not a substitute for professional advice. It does not indicate the availability of any Citi product or service. For advice about your specific circumstances, you should consult a qualified professional.

Additional Resources

Insights and Tools

Utilize these resources to help you assess your current finances & plan for the future.

FICO® Score

Learn how FICO® Scores are determined, why they matter and more.

Review financial terms & definitions to help you better understand credit & finances.

- Consumer: 1-800-347-4934

- Consumer TTY: 711

- Business: 1-866-422-3091

- Business TTY: 711

- Lost/Stolen: 1-800-950-5114

- Lost/Stolen TTY: 711

Terms & Conditions

- Card Member Agreement

- Notice At Collection

- Do Not Sell or Share My Personal Information

Copyright © 2023 Citigroup Inc

Important Information

- Seasonal Promotions

- Credit Cards

- Ready Credit

- Investments

You have selected: Credit Cards

Win the experience of a lifetime for football fans

Thank you for your participation and extend our warmest congratulations. All winners will be notified by our Citiphone officer and instructions on how to redeem their prize will be sent to them via an electronic mailer. Terms and Conditions apply.

Explore now >

Top-up and receive cash rewards today (For Citigold Private Client or Citigold relationships)!

Receive cash rewards of up to S$30,000 # when you deposit fresh funds and/or transfer in investment assets between 1 January to 29 February 2024. # T&Cs apply .

Learn More >

Top-up and receive cash rewards today (For Citi Plus relationships)!

Receive cash rewards of up to S$910 * when you deposit fresh funds between 1 January to 29 February 2024. * T&Cs apply .

Travel Smart with Citi for stress-free travel

We’ve connected all our travel products, tools and services to bring you smarter, stress-free travel. Take advantage of our travel deals and offerings before you head off and make the most of our products while you're away. We have something for every stage of your trip, so all you need to do is figure out #WhereToNextWithCiti?

20% cash back on Deliveroo orders

- Exclusively for Citi Cash Back Cardmembers

- Enjoy 20% cash back when you order your favorite meals from Deliveroo

- Valid till 19 August 2018

Lazada Birthday Exclusive : LiveUp members will enjoy 10% rebate at Lazada.sg instead of 8% rebate with their Citi Credit Cards from 24 April 2018 to 26 April 2018.

Tap & go TM using your Citi Credit & Debit Mastercard ® on Buses and Trains

- You can now tap & go TM to pay for your bus and train rides with your Citi Credit & Debit Mastercard!

- Also enjoy the convenience of tap & go TM on your smartphone. Add your Citi Credit & Debit Mastercard to your Apple Pay, Google Pay and Samsung Pay today.

- Valid from 11 April 2019 to 11 May 2019. Capped at S$10 per Cardmember.

Terms and Conditions Apply

Frequently Asked Questions

Citi Credit Cards Daily Spend & Get Promotion

- Enjoy additional rewards on your daily spend like food deliveries, grocery purchases and more.

- Simply enrol today and shop at selected merchants.

Citi World Privileges

- Get deals and discounts locally and in over 90 countries, from travel, dining to shopping.

- Find deals near you now and save deals you love for next time.

Browse offers now

Citi Mastercard ® Spend and Get 2.0 Promotion

- Get a S$150 Shopee voucher * when you spend with your eligible Citi Mastercard Credit Card(s) from 22 Aug to 21 Oct 2022. * T&Cs apply.

- Enrolment cap has been reached.

- Enrollment capacity reached*

- Enroll today! Limited enrolment slots*

Find out more

Citi Cash Back Christmas Special

- Enjoy 8% cash back on your favourite festive treats at Bakeries (including Bengawan Solo, Breadtalk, Paris Baguette) and Confectionery Stores (including Candy Empire, Candylicious, Garrett Popcorn)

- Valid till 31 December 2018

LiveUp Members Promotion

- LiveUp members get 8% rebate on Join LiveUp Lazada.sg purchases with Citi Credit Cards (Capped at $30 per calendar month)

- LiveUp members get 8% rebate on Redmart.com purchases with Citi Credit Cards (Capped at $30 per calendar month)

- Rebate will be in the form of a credit to the LiveUp members’ LiveUp account

- Valid till 30 April 2019.

Join LiveUp

Online shopping deals

- Offers all year round at your favourite online brands like Lazada, RedMart, Shopee, Qoo10, Foodpanda.

20% cash back on foodpanda orders

- Enjoy 20% cash back when you order your favourite meals from foodpanda

- Valid till 30 April 2018

Refer Your Friend and Get S$150

- S$150 cash back is yours, when your friend signs up for a Citibank Credit Card. Terms and conditions apply.

Refer Your Friend here

$120 Cashback Credit Card Promo!

- Spend and get up to S$120 Cash Back when you apply for a Citibank Credit Card!

- Valid till June 2018

Citibank Gourmet Pleasures

- Citibank Gourmet Pleasures presents you the best dining deals at over 1,000 locations.

Business Privileges Programme

- Enjoy exclusive discounts and offerings for the whole year across a wide range of merchants in Travel and Entertainment, as well as Non-Travel and Entertainment categories

Welcome offer on your Citi Quick Cash on Ready Credit Promotions

Enjoy interest rates from as low as 3.45% p.a today (EIR 6.5% p.a.) Applicable to new Citi Credit Card or Citibank Ready Credit account holders only.

- For new Citibank customers applying for Citibank Ready Credit

- Eligible for new Citibank customers who apply for instalment loan with Citibank Ready Credit account with $1,000 minimum loan amount will enjoy 4.55% p.a. (EIR 8.5% p.a.)

- Plus, get your loan in our hour!

Citibank 1 Hour Loan Approval Terms and Conditions

Welcome offer on your Ready Credit with Balance Transfer!

- Get welcome offer of 0% interest rate for 6 months with 1.58% service fee (EIR 3.65% p.a.) on Citibank Ready Credit.

- Eligible for new Citibank customers who apply for Citibank Ready Credit account with S$500 minimum loan amount

Receive up to S$2,000* cash when you refer a friend to Citigold or Citigold Private Client

It's now easier to share the Citi experience and get rewarded with a referral invitation code.

- Receive S$500 * cash reward for each successful Citigold referral

- Receive S$2,000 * cash reward for each successful Citigold Private Client referral

- Be the first 100 eligible first-time referrers to enjoy the additional One-Time Bonus Referral Reward of S$388 *

* Citi Client Referral Programme Terms and Conditions apply

Receive cash rewards of up to S$80,000 # when you deposit fresh funds and/or transfer in investment assets between 1 April and 31 May 2024. # T&Cs apply .

Exclusive SGD Time Deposit Promotions

For New-To-Bank and existing clients with Citigold Private Client relationship: • Enjoy up to 3.30% # p.a. on a 3-month SGD Time Deposit or up to 3.10% # p.a. on a 6-month SGD Time Deposit with new funds placement of S$250,000 to S$3 million. # T&Cs apply

For New-To-Bank and existing clients with Citigold relationship: • Enjoy up to 3.20% ^ p.a. on a 3-month SGD Time Deposit or up to 3.00% ^ p.a. on a 6-month SGD Time Deposit with new funds placement of S$250,000 to S$3 million. ^ T&Cs apply

For New-To-Bank and existing with Citi Priority, Citibanking or Cit Plus relationship: • Enjoy 2.50% * p.a. on a 3-month and 6-month SGD Time Deposit with new funds placement of S$50,000 to S$3 million. * T&Cs apply

For New-To-Bank and existing clients with Citigold Private Client relationship: • Enjoy up to 3.50% # p.a. on a 3-month SGD Time Deposit or up to 3.45% # p.a. on a 6-month SGD Time Deposit with new funds placement of S$250,000 to S$3 million. # T&Cs apply

For New-To-Bank and existing clients with Citigold relationship: • Enjoy up to 3.40% ^ p.a. on a 3-month SGD Time Deposit or up to 3.35% ^ p.a. on a 6-month SGD Time Deposit with new funds placement of S$250,000 to S$3 million. ^ T&Cs apply

For New-To-Bank and existing with Citi Priority, Citibanking or Cit Plus relationship: • Enjoy 3.20% * p.a. on a 3-month SGD Time Deposit or 3.15% * p.a. on a 6-month SGD Time Deposit with new funds placement of S$50,000 to S$3 million. * T&Cs apply

^ Citibank SGD Time Deposit Promotion terms and conditions apply. Applicable to all clients of Citigold Private Client .

• Enjoy 12-month SGD Time Deposit rate at 3.40% p.a. *

• Enjoy 3-month USD Time Deposit rate at 4.30% p.a. ^

• Enjoy 12-month USD Time Deposit rate at 4.70% p.a. ^

To enjoy the offers,

1. Placement amount must be in fresh funds only.

2. Have a minimum Assets under Management (AUM) of S$250,000 and S$1,500,000 for customers of Citigold and Citigold Private Client respectively.

3. Have investments or insurance holdings with us during the Promotion Period (for existing customers).

4. Have completed an Investment Risk Profile with your Relationship manager (for new customers).

* SGD Time Deposit Promotion terms and conditions apply.

^ USD Time Deposit Promotion terms and conditions apply.

Citi MaxiGain Savings Account

- Do less, earn more interest.

- Get 1.5%p.a. on your savings with the new Citi MaxiGain Savings Account

Citibank InterestPlus Savings Account

- Get 2.5% p.a. bonus interest.

Citibank Foreign Currency FX Time Deposit Promotion

- Enjoy 1-month USD Time Deposit at 6.50% p.a. *

- Enjoy 1-month CNH Time Deposit at 4.50% p.a. *

- Enjoy 1-month AUD Time Deposit at 5.50% p.a. *

* Citibank Foreign Currency FX Time Deposit Promotion terms and conditions apply.

Time Deposit Investment Bundle Promotion

Enjoy this exclusive suite of Time Deposit offers.

- SGD 6-Month Time Deposit rate of 1.78% p.a.

- SGD 3-Month Time Deposit Investment Bundle rate of 2.88% p.a.

- Attractive Foreign Currency Time Deposit rates

- Exclusive Investment Time Deposit Bundles

- Offers end on 28 February 2019.

Citi Top Up Promotion

- Get up to S$12,000 cash reward when you bring in fresh funds or investment assets.

Get up to S$55 cashback with your Citibank Debit Mastercard

- Get up to S$11,500 cash rewards by simply transferring in your investment holdings with us.

- From now until 31 August 2021, you can receive up to S$55* in cash rebates when you spend online and make foreign currency transactions. So if you haven’t already done so, activate your card to enjoy amazing rewards.

- T&Cs apply.

Citibank Global Wallet Promotion

- Activate Citibank Global Wallet and get up to 10% cashback on your foreign currency spend

Get Started

Terms and Conditions

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured. For more information, please visit www.sdic.org.sg .

The promotions, products and services mentioned in this website are not offered to individuals resident in the European Union, European Economic Area, Switzerland, Guernsey and Jersey, Monaco, San Marino, Vatican, The Isle of Man, the UK, Brazil, New Zealand, Jamaica, Ecuador or Sri Lanka. This website is not, and should not be construed as, an offer, invitation or solicitation to buy or sell any of the promotions, products and services mentioned therein to such individuals.

AIA #GiftofCare

- From now until 31 May 2020, AIA offers you AIA #GiftofCare, which comprises insurance coverage and teleconsultations. Simply register now to enjoy this offer. No purchase is required with limited applications on a first-come-first-served basis only. Terms and conditions apply.

Full disclaimers apply .

Complimentary insurance coverage against COVID-19 from AIA

- AIA will provide eligible customers with S$1,000 hospitalisation income benefit and S$25,000 death benefit against COVID-19 from now till 31 December 2021 or 30 days after the Disease Outbreak Response System Condition (DORSCON) level has officially stepped down to green – whichever is earlier. Terms and conditions apply.

- All eligible customers will automatically benefit from this free coverage. No action required.

Citi-AIA 10 th Anniversary Insurance Time Deposit Promotion

- Get up to 10.00% p.a. on a 2-month SGD or USD Time Deposit with purchase of any eligible AIA insurance plan through us.

MAKE AN APPOINTMENT >

Terms and conditions apply

Citi-AIA 10 th Anniversary Celebration Campaign

Purchase any eligible AIA insurance plan through us and receive vouchers worth up to:

- S$1,500 for Citigold Private Client Customers

- S$750 for Citigold, Citi Priority, Citibanking and Citi Plus Customers

What's more, if you had already bought an AIA life insurance policy through us that remains in-force, receive a Loyalty gift (Gadget worth up to S$1,664.25) on your next purchase of eligible AIA insurance plan through us.

Citi-AIA Power Up Promotion

- Get up to S$2,000 worth of vouchers with purchase of any eligible AIA insurance plan.

Citi-AIA ECM Rewards Promotion

- If you had already bought an AIA life insurance policy through us that remains in force, receive up to S$4,000 worth of vouchers on your next purchase of any eligible AIA insurance plan through us.

Citi-AIA Booster Rewards Promotion

Purchase any eligible AIA Insurance plan through us and receive vouchers worth up to:

- S$3,000 for Citigold Private Client Customers

- S$1,500 for Citigold, Citi Priority, Citibanking and Citi Plus Customers

Important Insurance Disclaimers

AIA Life Confident Campaign 2018

- Enjoy up to 30% off First Year Premium on eligible life insurance plans

Investment-Time Deposit Bundle Promotions

- Enjoy preferential SGD and FCY Time Deposit Investment Bundles

Learn More about SGD Investment-Time Deposit Bundle Promotion

- Receive up to S$201,000 cash rewards when you top up your balances, transfer in your investment holdings or invest with us.

- Activate Citibank Global Wallet and get up to 10% cashback on your foreign currency spend 4

Citibank Online Brokerage Promotion

- Enjoy complimentary buy trades on the US and HK markets with eligible new accounts.

- - Citi Priority customers enjoy 1 month of free buy trades

- - Citigold customers enjoy 2 months of free buy trades

- - Citigold Private Client customers enjoy 3 months of free buy trades

Citibank Online Investment Funds

- Enjoy lower sales charge of up to 1.5% when you subscribe to selected Investment Funds through Citibank Online.

Commission-free buy trades for new brokerage accounts

- Enjoy 6-month commission-free buy trades online for U.S. and Hong Kong markets when you open a new Citibank Brokerage account.

Citibank Brokerage

- Receive up to S$300* cashback when you trade online with Citibank Brokerage. *Offer is valid from 1 Jan to 29 Feb 2024.

Citibank Online Foreign Exchange

- Receive S$50* GrabGifts voucher when you perform FX conversions through Citi eFX or Citibank Global Wallet. *Applicable to top 100 customers with the highest total volume of FX conversions performed through Citi eFX or Citibank Global Wallet. Offer is valid from 1 Apr to 30 Jun 2024.

Citibank Online Unit Trust

- Enjoy lower sales charge of up to 1.5% when you subscribe through Citibank Online or Citi Mobile® App.

Citi 2023 eFX CNY Promotion

- Get S$168 cash rebates with 8 successful FX transactions via Citi eFX from 22 January to 5 February 2023. and hold a Citibank Credit Card.

Disclaimers

Contents on this webpage are for general information only, and should not be relied upon as advice. The information provided does not have regard to any individual’s investment objectives, financial situation or particular needs. This webpage and its contents are not an offer nor solicitation to purchase, nor endorsement or recommendation of, any products or services by Citibank Singapore Limited, its related entities and their respective directors, agents and employees (together "Citigroup").

Investment products are not bank deposits or obligations of or guaranteed by Citibank Singapore Limited, Citigroup, Inc or any of their affiliates or subsidiaries unless specifically stated. Investment products are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in investment and/or treasury products denominated in non-local currency should be aware of the risks of exchange rate fluctuations that may cause a loss of principal when foreign currency is converted back to the investors' home currency. The information on this webpage does not constitute the distribution of any information or the making of any offer of solicitation by anyone in any jurisdiction in which such distribution or offer is not authorised or to any person to whom it is unlawful to distribute such document or to make any offer or solicitation.

Investment Funds listed on Citibank Online or the Citi Mobile® App do not take in to account the investment objectives or financial situation of any particular person. Prior to entering in to a transaction, prospective investors should consult with their own legal, tax, financial, accounting and such other advisors to the extent they consider necessary, and make their own investment, hedging and trading decisions (including decisions regarding the suitability of the transaction) based on their own judgment and advice from those advisors. Investors should also read the relevant prospectus / offer documents (which are available upon request at branches of Citibank Singapore Limited) before investing in any Investment Funds. All applications for Investment Funds are subject to Terms and Conditions specific and must be made on the application forms accompanying the prospectus or otherwise prescribed by the issuer.

Investment products are not available to U.S. persons and may not be available in all jurisdictions.

Securities investments are not bank deposits and involve risks, including the possible loss of the principal amount invested. The price of securities can and does fluctuate; sometimes dramatically, and that any individual security may experience upward or downward movements, and may even become valueless. Therefore it is as likely that losses will be incurred rather than profit made as a result of buying and selling securities. This is the risk that customers should be prepared to accept. Investors investing in securities denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Citibank is not recommending the Citibank Brokerage Account or giving any advice in relation to customers' securities investments. Customers will take complete responsibility for any losses resulting from their trading strategy. Interested investors should seek the advice of their financial advisors, as appropriate. In the event that you choose not to seek advice from a financial advisor, you should carefully consider whether securities investments are suitable for you in light of your investment objectives, financial means and risk profile.

Citibank full disclaimers, terms and conditions apply to individual products and banking services.

Time Deposit Investment Bundle

- Enjoy exclusive 3-month SGD Time Deposit rate of 2.5% p.a. when you invest with us.

Citibank Home Loan referral programme

Refer a friend and receive up to S$1,000 shopping vouchers.

Choose the mortgage package that suits your refinancing needs!

Receive SMEG Retro-Style Kettle & Toaster* when you refinance your home loan with us.

*T&Cs apply.

Terms and conditions apply, click here or speak to a Citi Personal Banker or Relationship Manger for more information.

3 Except 5-year premium term policies.

This Promotion is organized by AIA Singapore Private Limited (Reg. No. 201106386R) ("AIA"). Terms and conditions apply, click here or speak to a Citi Personal Banker or Relationship Manager for more information.

Important Insurance Disclaimers: The insurance plans are underwritten by AIA Singapore Private Limited (Reg. No. 201106386R) ("AIA") and distributed by Citibank Singapore Limited. All insurance applications are subject to AIA's underwriting and acceptance. Please refer to full disclaimers applicable to relevant product(s) and/or service(s).

- Best for Everyday Spending

- Best for Flat-Rate Cash Rewards

- Best for Rotating Cash Back Categories Label

- Best for Families

- Best for Groceries, Dining, and Entertainment

- Best for Self-Care and Pet Card

- Why You Should Trust Us

Best Cash Back Credit Cards of June 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Wells Fargo Attune℠ Card, Capital One Savor Cash Rewards Credit Card†, Chase Freedom Flex℠, U.S. Bank Cash+® Visa Signature® Card. The details for these products have not been reviewed or provided by the issuer.

- Best cash back credit card for everyday spending : Chase Freedom Unlimited®

- Best cash back credit card for flat-rate cash rewards : Wells Fargo Active Cash® Card

- Best cash back credit card for rotating cash back categories : Discover it® Cash Back

- Best cash back card for families : Blue Cash Preferred® Card from American Express

- Best cash back credit card for groceries, dining, and entertainment : Capital One SavorOne Cash Rewards Credit Card

- Best cash back credit card for self-care and pet care : Wells Fargo Attune℠ Card

Introduction to Cash Back Credit Cards

Cash-back credit cards are among some of the most popular card types, returning anywhere from 1% to 10% cash back on all kinds of purchases — and often without an annual fee. For folks who are just getting into credit card rewards, or who want to keep things simple, cash-back credit cards are a good choice since they don't require much work to use.

Best Cash Back Credit Card Comparison

Earn 5% cash back on Chase travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

0% intro APR on purchases and balance transfers for the first 15 months

20.49% - 29.24% Variable

Earn an additional 1.5% cash back on everything you buy

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Solid flat cash-back rate

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can combine cash-back rewards with Ultimate Rewards points if you have an eligible card

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee

- con icon Two crossed lines that form an 'X'. Some other cards offer a higher rate of cash back on certain types of purchases

The Chase Freedom Unlimited® is a great choice for credit card beginners and experts alike. With no annual fee and a high earnings rate, it's worth considering as an everyday card — and it's even better when you pair it with an annual-fee Chase card like the Chase Sapphire Reserve®.

- Intro Offer: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

- Earn unlimited 2% cash rewards on purchases.

0% intro APR on purchases and qualifying balance transfers for 15 months from account opening

20.24%, 25.24%, or 29.99% variable

Earn $200 cash rewards bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good welcome bonus for a $0 annual fee card

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Straightforward 2% cash rewards on purchases with no categories to track

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong benefits including cell phone protection, Visa Signature perks, and an intro APR on purchases and qualifying balance transfers

- con icon Two crossed lines that form an 'X'. If you've opened a Wells Fargo card in the past six months, you may not qualify for an additional Wells Fargo credit card

- con icon Two crossed lines that form an 'X'. Foreign transaction fees

The Wells Fargo Active Cash® Card is definitely worth considering if you want to earn a strong rate of cash rewards on purchases without rotating categories or earning caps and with no annual fee. It's got a solid welcome bonus and intro APR offer, which puts it high on our list of the best zero-interest credit cards.

- Select "Apply Now" to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

- 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. 20.24%, 25.24%, or 29.99% Variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5.

- $0 annual fee.

- No categories to track or remember and cash rewards don't expire as long as your account remains open.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Earn unlimited 1% cash back on all other purchases automatically.

0% intro APR for 15 months on purchases and balance transfers

18.24% - 28.24% Variable

Earn Unlimited Cashback Match™

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. From April 1 to June 30, 2024, you can earn 5% cash back at gas stations & electric vehicle charging stations, home improvement stores, and public transit on up to $1,500 in purchases after enrollment, then 1%

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Discover will match your cash back earned at the end of your first account year

- con icon Two crossed lines that form an 'X'. Cap on how much bonus cash back you can earn each quarter

- con icon Two crossed lines that form an 'X'. If the quarterly categories aren't convenient for you, you can earn more cash back with a different card

The Discover it® Cash Back is one of the best credit cards that offers 5% back on popular rotating categories up to a spending limit. Your rewards are matched by Discover after the first 12 months, and the card has no annual fee.

- Intro Offer: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 18.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

Earn 6% cash back on purchases at U.S. supermarkets (up to $6,000 per year, then 1%). Earn 6% cash back on select U.S. streaming subscriptions. Earn 3% cash back on transit (including taxis, rideshare, parking, tolls, trains, buses, and more). Earn 3% cash back on gas at U.S. gas stations. Earn 1% cash back on all other purchases. Cash back is received as Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout.

$0 intro for the first year, then $95

0% intro APR for 12 months on purchases and balance transfers from the date of account opening

19.24% - 29.99% Variable

Earn a $250 statement credit

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous bonus rewards, especially at U.S. supermarkets

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. One of a small handful of credit cards that offer bonus rewards on select streaming services

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Intro APR offer

- con icon Two crossed lines that form an 'X'. Unlike many other cash-back cards, it charges an annual fee

- con icon Two crossed lines that form an 'X'. If you spend more than $6,000 at US supermarkets each year, you'll want to use another card once you reach that cap

The Amex Blue Cash Preferred is one of the best cash-back cards, particularly for consumers who spend a lot of money at U.S. supermarkets, use streaming services, or have lots of commuting and gas expenses. The annual fee is worth it if your typical spending lines up with the card's bonus categories.

- Earn a $250 statement credit after you spend $3,000 in eligible purchases on your new Card within the first 6 months.

- $0 intro annual fee for the first year, then $95.

- Buy Now, Pay Later: Enjoy $0 intro plan fees when you use Plan It® to split up large purchases into monthly installments. Pay $0 intro plan fees on plans created during the first 12 months from the date of account opening. Plans created after that will have a monthly plan fee up to 1.33% of each eligible purchase amount moved into a plan based on the plan duration, the APR that would otherwise apply to the purchase, and other factors.

- Low Intro APR: 0% on purchases and balance transfers for 12 months from the date of account opening. After that, your APR will be a variable APR of 19.24% - 29.99%.

- 6% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%).

- 6% Cash Back on select U.S. streaming subscriptions.

- 3% Cash Back at U.S. gas stations.

- 3% Cash Back on transit (including taxis/rideshare, parking, tolls, trains, buses and more).

- 1% Cash Back on other purchases.

- Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit on Amazon.com at checkout.

- $84 Disney Bundle Credit: With your enrolled Blue Cash Preferred Card, spend $9.99 or more each month on an auto-renewing Disney Bundle subscription, to receive a monthly statement credit of $7. Valid only at Disney Plus.com, Hulu.com or Plus.espn.com in the U.S.

- Terms Apply.

Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024. Earn 8% cash back on Capital One Entertainment purchases. Earn 5% cash back on hotels and rental cars booked through Capital One Travel (terms apply). Earn 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®). Earn 1% cash back on all other purchases.

0% intro APR on purchases and balance transfers for 15 months (3% fee for the first 15 months, then 4% at a promotional APR that Capital One may offer you at any other time)

19.99% - 29.99% Variable

Earn $200 cash back

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Bonus cash back on dining, entertainment, and grocery store purchases

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Long intro APR period for purchases and balance transfers

- con icon Two crossed lines that form an 'X'. Other cards earn more cash back in certain bonus categories

- con icon Two crossed lines that form an 'X'. Not the highest sign-up bonus among cash-back cards

The Capital One SavorOne Cash Rewards Credit Card offers a good welcome bonus and excellent return rates that can earn you cash back on common expenses like dining, groceries (excluding superstores like Walmart and Target), streaming, and entertainment — plus there's no annual fee to worry about.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

- 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

- No foreign transaction fee

- No annual fee

Earn unlimited 4% cash rewards on select self-care, planet-friendly, and sports, recreation, and entertainment purchases. Earn 1% cash rewards on other purchases.

0% intro APR for 12 months from account opening on purchases

Earn a $100 cash rewards bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High cashback rate on common expenses including gyms, spas, pet care, concert tickets, and public transit

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cellphone protection

- con icon Two crossed lines that form an 'X'. Limited reward redemption beyond cash back

Best Cash Back Credit Card Reviews

Cash back credit cards make it easy to rack up rewards by offering simple redemption opportunities: Either convert your cards into a statement credit toward your card's outstanding balance, or use them for travel redemptions or other exciting prizes and rewards. The best cash back credit cards offer bonus categories, introductory 0% APR for balance transfers and new purchases, or additional value on everyday transactions.

These are the top options available in 2024, according to Business Insider's team of personal finance experts.

Best Cash Back Card for Everyday Spending

If you're looking for a card that combines strong bonus categories with decent flat-rate rewards on non-bonus spending, the Chase Freedom Unlimited® could fit the bill. It offers 5% cash back (5x points) on travel purchased through Chase Travel, 3% cash back (3x points) on dining and drugstore purchases, and 1.5% cash back (1.5x points) on everything else.

The Chase Freedom Unlimited® has no annual fee and offers a 0% intro APR on purchases and balance transfers for the first 15 months. After that, there's a 20.49% - 29.24% Variable. If you have a major purchase ahead of you, that introductory offer can be useful.

If you also have an annual-fee Chase Ultimate Rewards card like the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® , or Ink Business Preferred® Credit Card , you can pool your points from the two cards. Then, you'll be able to transfer the whole body of points to Chase's airline and hotel partners or use them to book travel through Chase with a bonus.

Plus, the Chase Freedom Unlimited® has a substantial welcome offer: additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year).

Read our Chase Freedom Unlimited® review

Best Cash Back Card for Flat-Rate Cash Rewards

Not only does the Wells Fargo Active Cash® Card rank highly in this guide, but it also tops our list of the best 2% cash back credit cards . It earns a flat rewards rate on everything — 2% cash rewards on purchases, with no bonus categories to keep track of. Our guide to earning and redeeming Wells Fargo Rewards details all the ways to use your cash rewards from this card.

It offers a substantial welcome bonus for a no-annual-fee card: $200 cash rewards bonus after spending $500 in purchases in the first three months from account opening. In addition, new cardholders get a 0% intro APR on purchases and qualifying balance transfers for 15 months from account opening (followed by a 20.24%, 25.24%, or 29.99% variable APR). That's super useful if you have large expenses you want to pay off over time.

The Wells Fargo Active Cash® Card comes with a good array of benefits, which include cell phone protection, roadside dispatch, travel emergency assistance, and access to the Visa Signature® Concierge. However, it does charge foreign transaction fees, so if you're traveling outside the US, you'll want to pack a different card.

Read our Wells Fargo Active Cash® Card review

Best Cash Back Card for Rotating Cash Back Categories

If you prefer a card that earns straight cash back, not points, and like the idea of rotating bonus categories, the Discover it® Cash Back could be a great fit. You can earn 5% cash back in popular rotating quarterly bonus categories when you activate, on up to $1,500 in combined spending (then 1%). You'll also earn 1% back everywhere else (from April 1 to June 30, 2024, earn 5% cash back at gas stations & electric vehicle charging stations, home improvement stores, and public transit on up to $1,500 in purchases after enrollment, then 1%).

Instead of a regular welcome bonus, Discover rewards new cardholders in a different way. After the first 12 months, it will match all of the rewards you earn from the card through the Discover Cashback Match program. That means you can effectively earn up to 10% back in your first year — and if you're a big spender, this can pay off handsomely.

Read our Discover it® Cash Back review

Best Cash Back Card for Families

If you're looking for an American Express cash back card, especially if you have a large family that spends a lot on groceries, streaming, and commuting, the Blue Cash Preferred® Card from American Express is an excellent option. It offers a 0% intro APR for 12 months on purchases and balance transfers from the date of account opening, before switching to a 19.24% - 29.99% Variable APR.

Currently, the card offers a welcome bonus of a $250 statement credit after you spend $3,000 in eligible purchases on your new card within the first six months from account opening. It also comes with a handful of travel and shopping protections, including car rental insurance, return protection, purchase protection, and extended warranty.

Keep in mind there's an annual fee of $0 intro for the first year, then $95, so you'll want to be sure you spend enough to justify paying it. If you prefer a no-annual-fee Amex cash-back card, check out the Blue Cash Everyday® Card from American Express instead.

The Blue Cash Preferred® Card from American Express offers the highest rewards rate available for grocery spending, although there is a $6,000 annual spending cap on that 6% rate. After that, you earn 1% (cash back is received in the form of Reward Dollars that can be redeemed as statement credits or at Amazon.com checkout). Otherwise, the card earns 6% back on select U.S. streaming subscriptions, 3% back at U.S. gas stations and on transit, and 1% back on all other purchases.

Read our Blue Cash Preferred® Card from American Express review

Best Cash Back Card for Groceries, Dining, and Entertainment

The Capital One SavorOne Cash Rewards Credit Card seems almost custom-made for folks who like to get out and experience life to the fullest. If you're a foodie, love attending concerts and sporting events, or even enjoy entertaining at home, this card can help you earn a lot of rewards for your spending.

Cardholders earn 3% cash back on dining, at grocery stores (excluding superstores like Walmart and Target), entertainment, and popular streaming services, and 1% cash back on all other purchases. The Capital One SavorOne Cash Rewards Credit Card also offers 5% cash back on hotels and car rentals booked through the Capital One Travel portal.

The welcome bonus is generous, too: $200 cash back after you spend $500 on purchases within three months from account opening. And if you've got big purchases coming up, a 0% intro APR on purchases and balance transfers for 15 months (3% fee for the first 15 months, then 4% at a promotional APR that Capital One may offer you at any other time) (followed by a 19.99% - 29.99% Variable APR) can make it easier to spread out your payments ( rates and fees ).

This card offers a handful of good benefits, including extended warranty***, travel accident insurance***, and travel emergency assistance services***. As with all other Capital One credit cards , you won't pay foreign transaction fees on international purchases, so it's great to use when you're out globetrotting.

Also, if you don't think your credit score is good enough to qualify for the regular version of the card, and you're currently enrolled in college, you could apply for the student version of the card to convert to the regular version after graduation.

Read our Capital One SavorOne Cash Rewards Credit Card review

Best Cash Back Card for Self-Care and Pet Care (Gyms, Spas, Pet Care)

The brand-new Wells Fargo Attune℠ Card is perfect for people who prioritize fitness, self-care, pet care, live shows and other ticketed experiences, and environmentally friendly choices. This no-annual-fee card earns 4% cash back on select purchases in self-care, planet-friendly, and entertainment categories such as gyms and fitness expenses, spas, pet care and grooming, concert tickets, public transit, some thrift stores, EV charging stations, and similar purchases.

New cardholders can also take advantage of two introductory offers: $100 cash rewards bonus when you spend $500 in purchases in the first three months from account opening, and 0% intro APR for 12 months from account opening on purchases (then 20.24%, 25.24%, or 29.99% variable APR).

Read more in our Wells Fargo Attune card review .

What You Should Know About Cash Back Credit Cards

Cash back credit cards can be an easy way to break into the world of credit card rewards. They come in a few different types:

- Flat rate — These cards earn the same rate of cash back on all purchases. For example, the Chase Freedom Unlimited® earns 1.5% back on most spending (the Freedom Unlimited also offers bonus cash back on eligible travel, dining, and drugstore purchases).

- Select bonus categories — Many other cash back cards offer bonus cash back (more than 1%) on select spending categories. For example, with the Capital One Savor Cash Rewards Credit Card† , you'll earn 4% back on dining, streaming services, and entertainment, and 3% back at grocery stores (excluding superstores like Walmart and Target).

- Rotating categories — A few cards, including the Chase Freedom Flex℠ , offer bonus cash back on a selection of spending categories that changes every quarter of the year. These cards have a cap on how much bonus cash back you can earn each quarter — with the Chase Freedom Flex℠, you'll earn 5% back on up to $1,500 in combined purchases each quarter (then 1%).

- Some cards are starting to offer yet a fourth format for delivering cash back rewards: pick your own bonus categories from a list of options. These cards include the Bank of America® Customized Cash Rewards Credit Card and the U.S. Bank Cash+® Visa Signature® Card .

If you're willing to juggle multiple credit card accounts, there's value in having both cash back and points-earning cards. If you prefer a single-card strategy, evaluate your goals and consider how much you're willing to pay in annual fees to make the best decision for your situation.

If you're trying to put money back in your wallet, our top recommendations are to transfer your cash back to a bank account or use it to reduce the amount owed on your credit card statement.

On the other hand, if you're hoping to earn rewards that you can redeem for travel, a card that earns points is more up your alley. Our points-earning picks for the best rewards credit cards earn either Amex Membership Rewards points, Chase Ultimate Rewards points, Citi ThankYou Rewards points, or Capital One miles. You can transfer all of these currencies to travel partners and redeem them for things like free flights. (Note that while Capital One calls its rewards currency "miles," they aren't miles with a given airline program.)

How to Use a Cash Back Credit Card

To use a cash back credit card, you'll want to remember that it won't be worth it if you're paying interest or late fees. It's important to pay your balance in full each month, make payments on time, and only spend what you can afford.

Cash back cards vary greatly in their return rates — you can earn anywhere from 1% to 6% back. Even better, many cash back cards have no annual fee , so you don't have to pay for the privilege of earning rewards.

If you're new to rewards credit cards and aren't interested in earning travel points or miles, a cash back card is the best option for you. With cash back cards, 1% back will always be 1 cent back, no matter what, and you can use your cash back to lower your monthly bill or transfer it to your checking account, among other options.

The best cash back credit card for you depends on your spending habits and if you prefer a flat rate of cash back on all spending or earning bonus cash back on specific types of purchases. Flat-rate cash back cards are best for those who don't want to keep track of multiple bonus categories and just want a simple earning structure.

But if you really want to maximize your rewards earning, choosing a card that earns bonus cash back in categories where you spend a lot — like groceries, dining, or gas — can make a huge difference in your rate of return.

How to Choose a Cash Back Credit Card

To choose the best cash back credit card for you, you'll want to look for a few things:

- The cash back rate for your common spending categories . Extra cash back for gas isn't much use if you don't drive. Consider how you intend to use this card, and look at the rate for those spending categories.

- How you redeem your cash back . Make sure you're clear on what you're earning. Is it statement credit? Cash? Points? If points, can they be combined with or transferred to other cards you have, or brands you like?

- The annual fee . An annual fee may make or break your choice. Are you willing to pay one? And more importantly, can you afford it comfortably — or will it be effectively wiped out by the cash back you'll earn in a year?

We don't mention the APR because the rate only applies if you're carrying a balance on your credit card. We recommend applying for a cash back credit card intending to pay off the balance in full each month. For other categories of credit cards, like balance transfer cards, the APR might be a more important consideration.

If this all sounds too complicated, you can't go wrong by using the Wells Fargo Active Cash® Card, which has no annual fee and a flat earning rate of 2% cash rewards on purchases.