How to claim CRA medical travel expenses for 2023

The costs involved with traveling to receive medical attention can be significant when you factor in accommodation, meals, and related expenses.

Find out how to claim your CRA medical travel expenses.

IMPORTANT: All claims related to Medical Travel require documentation provided by the practitioner confirming your attendance (whether this be a receipt for services, or a letter signed by your service provider).

Claiming Mileage

There are two ways to claim transportation costs as a CRA travel medical expense but you have to travel at least 40 kilometers one way to obtain medical service that were not available locally.

Example: for trips to and from the hospital, clinic, or doctor’s office.

Record the distance of travel, calculate your mileage according to the province in which you reside. (2021 rates):

Example: 55¢ x 160km = $88.00; you may claim $88.00 as an eligible medical expense.

Vehicle expenses may be claimed as CRA medical travel expenses by submitting gas receipts for the date(s) of travel/service.

Claiming Meals, Accommodations and Parking

In addition to the transportation costs above, you may claim reasonable expenses during your trip for medical attention provided that you had to travel more than 80 kilometers to attend your appointment. The travel costs of one accompanying individual are also allowable, if it is deemed necessary to have a companion.

Meals can be claimed one of two ways: 1. Meal receipts can be submitted for reasonable costs for the patient and one attendant (alcoholic beverages will not be reimbursed) OR 2. A flat rate of $23 per meal may be claimed for the patient and one attendant up to a maximum of $69 per day per person.

Accommodations

Receipts must be enclosed for any reasonable accommodation fees that are being claimed (ie: hotel receipt). Coverage applies to the accommodations ONLY; telephone, movie charges and the like are not eligible for reimbursement.

Receipts must be enclosed for any parking lot fees incurred. Please refer to the CRA medical travel expenses website for further details

A farmer lives in rural Alberta. There is not much in the way of medical services, vision care, or therapeutic care, such as physiotherapy, available in this small town. Consequently, most treatment modalities require travelling to a center that has the appropriate medical facilities. The closest center is 44 kilometers from their home.

On a recent trip, they had chiropractic services performed and managed to visit the dentist for a check-up and teeth cleaning. They were eligible to be reimbursed for the cost of the travel between their home and where the services took place.

In Alberta, that amounts to 53 cents a kilometer – so they were also able to claim $46.64 for travel expenses (there and back). An alternative is to submit gas receipts for the dates of travel service.

On occasion, the same farmer requires a medical service that was only available on a timely basis in a major medical facility in the USA. This service was available in Canada but the wait time was over six months and the inconvenience to our customer as a result of their condition necessitated a faster remedy. They chose the US destination for the service.

As the travel distance now exceeded 80 Kilometers, in addition to the travel costs (economy class air fare), our customer can claim reimbursement for meals, accommodations, parking as well as the costs associated with a companion travelling with the patient if deemed necessary. An eligible travel expense claim of this magnitude represents a significant savings.

How to write off 100% your medical expenses

Are you an incorporated business owner with no arm's length employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with arm's length employees? Discover a tax deductible health and dental plan that has no premiums:

Write off 100% of your medical expenses

Are you an incorporated business owner with no employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with employees? Discover a tax deductible health and dental plan that has no premiums:

What's in this article

Subscribe to the blog

Discover more.

What is a health care spending account?

Health care spending accounts help business owners save on medical costs by turning after-tax...

By Alden Hui on December 8, 2020

What's covered in a Health Spending Account?

One of the great benefits of a Health Spending Account is the freedom it provides through an ...

By Alden Hui on October 15, 2019

7 Key Health Spending Account Rules that you should know

A Health Spending Account (HSA) is a tax-free benefit which allows small business owners and their...

By Alden Hui on April 25, 2019

This website stores cookies on your computer. To find out more about the cookies we use, see our Privacy Policy .

All provinces except Quebec use the Federal medical expense total to calculate the provincial medical expense tax credit, but the base amount threshold is different from the Federal for most provinces. See the tables of non-refundable tax credits for the base amounts and applicable tax credit rates for each province. See Quebec Medical Expense Tax Credit .

Medical Expenses for Other Eligible Dependants Line 33199, Provincial Line 58729

Note: Line 33199 was Line 331 prior to 2019, and Line 58729 was line 5872.

Income Tax Act s. 118.2(1)D

Medical expenses for other eligible dependants must have been paid within the same 12-month time period as line 33099 medical expenses (see above), and must have been paid by the individual claiming the expenses, or by the individual's legal representative .

Medical expenses may be claimed for amounts paid on behalf of a person who is dependent on the taxpayer for support (financially - i.e., you are paying medical expenses on their behalf), and who is

Medical expenses for other eligible dependants are claimed on line 33199 (line 331 prior to 2019) of the federal tax return. A separate calculation is done for each dependant. Only expenses in excess of the lesser of $2,635 for 2023 ($2,759 for 2024) or 3% of net income of the dependant can be claimed for the federal tax credit. The lowest tax rate is applied to the medical expenses to determine the amount of the tax credit. The 2011 Federal Budget removed the cap of $10,000 beginning in the 2011 taxation year.

Provincial Maximum Allowable Medical Expenses for Other Eligible Dependants

The provincial maximum allowable medical expenses for other eligible dependants was removed for 2011 for all provinces and territories except Ontario, BC, and Northwest Territories. It was removed for 2012 for BC. See the tables of non-refundable tax credits for the tax rates applicable to calculate the tax credit, and to see which provinces have a limit on the amount that can be claimed for each dependant.

More Than One Supporting Person for the Eligible Dependant

If more than one person supports the dependant , each supporting person can claim up to the maximum, where a maximum exists, as long as the total claimed by all supporting persons does not exceed the total medical costs for the dependant. This would make it advantageous to share high medical costs (such as nursing home costs ) among supporting persons. For example, the supporting persons could be husband and wife supporting a parent or grandparent, adult child who is still a student, or adult infirm child, or could be siblings supporting a parent or grandparent. The key is that each supporting person making a claim must have a receipt to support their claim.

TaxTips.ca Resources

Eligible Medical Expenses

Persons with Disabilities - links to all information on TaxTips.ca

Tables of Non-refundable Tax Credits for the base amounts and applicable tax credit rates for each province

Refundable Medical Expense Supplement

Quebec Medical Expense Tax Credit

Canada Revenue Agency (CRA) Resources

Split high medical costs for other eligible dependants among supporting persons in order to maximize the tax credit received.

You may be eligible for the refundable medical expense supplement .

When claiming medical expenses for a deceased person, it may help to adjust the prior year tax return to remove medical expenses regarding that person, and claim them on the year of death tax return.

Revised: March 11, 2024

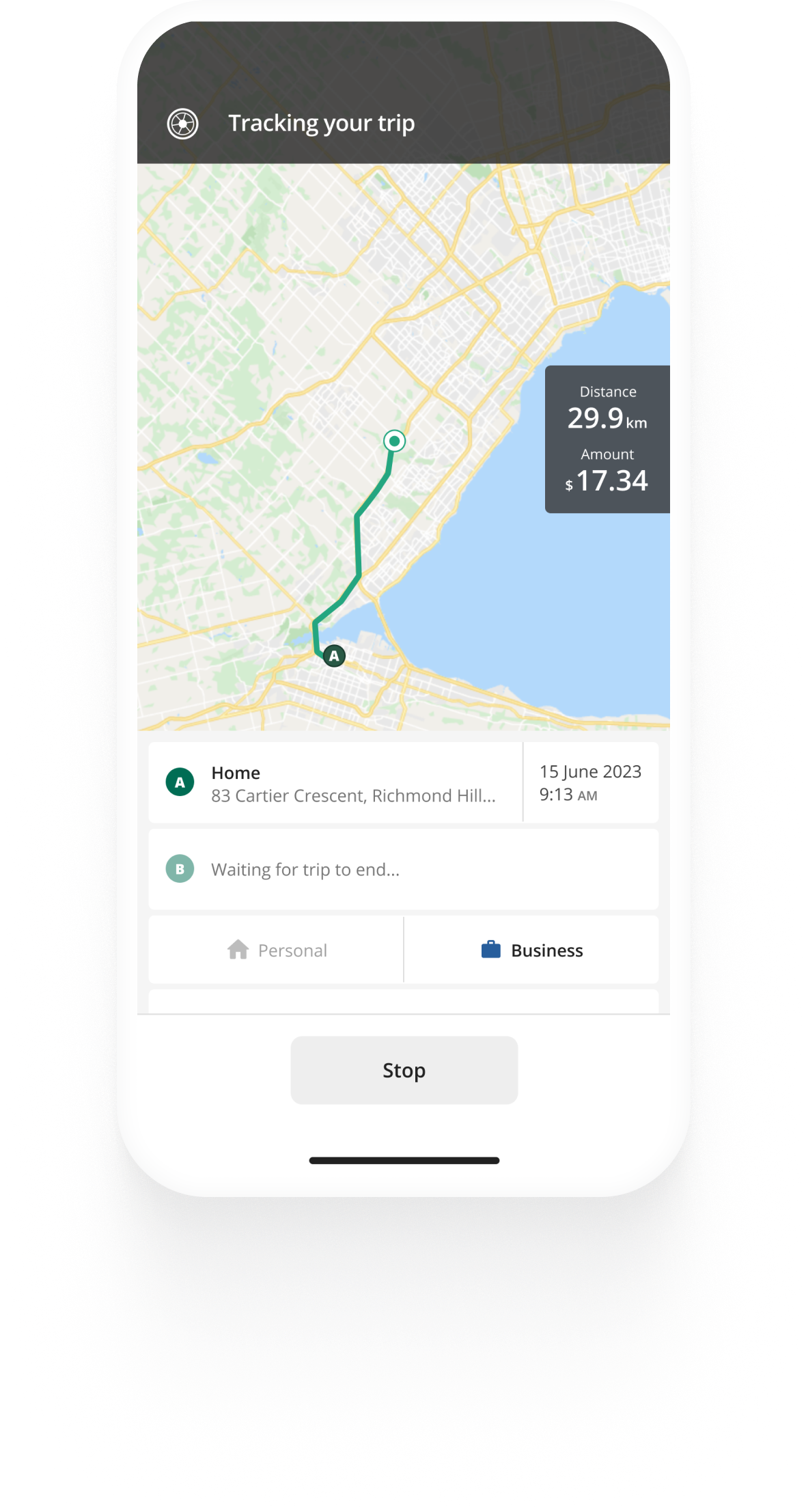

Track mileage automatically

Medical travel expenses, in this article, medical travel expenses you can claim, how to claim medical mileage from the cra.

You can claim a range of expenses for medical-related costs from the CRA. An important cost you can deduct on your tax return is medical travel expenses when you drive or use public transport to reach a medical centre that provides the medical care you need.

Track business driving with ease

Trusted by millions of drivers

You can claim medical mileage from the CRA if you travel over 40 kilometres in one direction in order to receive medical attention. In order for your mileage to qualify, you must observe the following rules from the CRA:

- You weren’t able to receive the medical care you needed near your home

- You took a reasonably direct route to the medical facility

- It was reasonable for you to travel to the specific medical facility in order to receive the needed medical service

You can claim mileage with your own car or a rented one, as well as any public transport costs such as bus, taxi and train fares if that was your mode of transportation.

The CRA provides two methods with which you can claim medical travel expenses - the simplified and detailed methods.

With the simplified method , you can use a flat per-kilometre rate to claim medical travel expenses. Each province and territory has a different cents per kilometre rate. With the detailed method, you can claim your actual medical travel expenses.

You can only use one method during a tax year.

If you use the simplified method for claiming medical travel expenses, it is highly recommended that you keep track of your medical mileage, as the CRA may ask for proof of your claim.

If you decide to use the detailed method in order to claim medical travel expenses, you will need to keep all receipts related to your medical mileage. These can include gas, fuel, oil, tyres, insurance, maintenance and repairs receipts for your vehicle, and bus, taxi and train tickets. You also need to keep track of your mileage, including your total mileage and mileage related to medical purposes.

If you use your vehicle to travel for medical purposes, you can find the percentage of medical mileage by dividing your medical travel by the total travel for the year. You will be able to claim a percentage of your fixed and variable costs to maintain and drive your vehicle equal to the percentage of medical travel you had during the year. For example, if 3% of your total kilometres were for medical purposes, you will be able to claim 3% of your vehicle expenses during the year.

Learn more about medical travel and other medical expenses you can claim and see the flat per-kilometre rates for the simplified method.

Do you also use your vehicle for work-related travel? See our CRA guide on mileage allowance and deductions where you’ll learn how to claim work-related travel and what records you need to keep.

How to automate your mileage logbook

Automate your logbook

Related posts, per diem allowance.

In Canada, Per diem often refers to a meal or travel allowance. The CRA doesn’t set fixed rates, so what is a fair rate, and what about tax?

CRA Mileage Rate 2024

The CRA announces 2024 rates for vehicle allowance: From January 1st, 2024, per kilometre rates will increase 2 cents over 2023.

iZEV Rebates in Canada

You can benefit from federal and provincial iZEV rebates when buying or leasing electric vehicles. See how much you can get per province.

Choose your Country or region

- Toronto Tax Lawyer

- Articling Program

- Canadian Tax Lawyers

- Case Results

- Case Studies

- Certified Specialists in Taxation

- Company Profile

- Leadership Team

- Articles & tips

- Canadian Accountant Articles

- Definitions

- Media Appearances

- News Releases

- Related Links

- CRA Tax Audits

- Unfiled Taxes

- Net Worth Audits

- Taxes Owing & Liens

- Tax Minimization

- CRA & Bitcoin Taxation

- Unreported Offshore Assets

- Unreported Offshore Income

- Unreported Foreign Pension

- Unreported Internet Income

- Unfiled GST/HST returns

- Individual & Family Income Tax Planning

- Succession Will, Estate and Tax Planning Ontario

- Tax Problems & Representation

- Tax Shelters

- Corporate Reorganizations

- Butterfly Transactions

- Incorporations

- Business Agreements

- Business Startup Planning

- Tax Consulting & Planning

- CEWS Tax Audit Services

- CERB Tax Audit Services

- CEBA Tax Audit Services

- Contact a Tax Lawyer

Medical Expense Credit for Travel

Published: March 9, 2020

Last Updated: April 17, 2020

The Income Tax Act (ITA) allows individuals to claim a medical expense tax credit in respect of travel expenses incurred when a patient requires medical treatment at least 80 kilometres away from their home. Therefore, you may be able to claim a deduction on your income tax return if you incurred reasonable travel expenses associated with transporting an individual from one locality to another in order to seek medical treatment.

The conditions to deduct such travel expenses are as follows:

- Substantially equivalent medical services are not available in that locality

- The route travelled by the patient is, having regard to the circumstances, a reasonably direct route

- The patient travels to that place to obtain medical services for himself or herself and it is reasonable, having regard to the circumstances, for the patient to travel to that place to obtain those services.

For example, if you accompany your spouse to seek medical services 80 or more kilometers away from your home, you may deduct the travel expenses incurred as part of the transportation of your spouse. If you choose to stay with your spouse while your spouse receives medical treatment, you can also claim the travel expenses for the duration of your stay. In addition, when you accompany your spouse back home, you may also claim the costs associated with the return trip home. However, the travel expenses can only be claimed if your spouse could not receive substantially equivalent medical treatment near your home, the route traveled by you and your spouse was a reasonably direct route and it was reasonable for your spouse to travel to that particular location in order to obtain medical care.

According to information found on Canada Revenue Agency’s (“CRA’s”) website, CRA indicates that an individual may not claim the travel expenses associated with visiting a patient. In the above example, if you had accompanied your spouse to seek medical treatment and then returned back home, you may claim the costs associated with that trip. If you then visit your spouse while your spouse is receiving medical treatment, you may not claim the travel expenses associated with that visit.

The recent ruling of Woods J. in Jordan v. HMQ [2012-2088(IT)I] challenges this position that CRA took. In Jordan, the taxpayer’s spouse was required to travel from her home in Weyburn, Saskatchewan to Regina, Saskatchewan to receive medical treatment. The taxpayer accompanied his spouse on the trip from Weyburn to Regina and back to Weyburn when she finished treatment six months later. The Minister allowed the medical expense tax credit in respect of the one round trip which took place when the taxpayer accompanied his spouse to Regina and back to Weyburn. However, during the six months while the taxpayer’s spouse was located in Regina, the taxpayer made multiple trips from Weyburn to Regina to visit his spouse and assist with her recovery. The Minister disallowed the expenses associated with these trips.

Wood J. relied on Bell v. The Queen [2009 TCC 523] which states that of the provision of the Tax Act that permits the deduction “was aimed not simply at the cost of moving the patient, but at those additional expenses incurred by a patient, or the personal accompanying the patient, during the time between first leaving home to go to the place of medical treatment, and returning home after the treatment is completed”. Applying the principle in Bell, Wood J. found that there was no difference between living expenses incurred away from home (as in Bell), and the motor vehicle expenses incurred to travel back and forth between Weyburn and Regina, and thus allowed the taxpayer to claim the expenses he incurred while visiting his spouse.

If CRA is auditing you with respect to the deductions you have claimed for medical travel expenses or has denied those deductions, contact our experienced tax lawyers to find out more and schedule an initial consultation.

Related Post

Disclaimer:.

"This article provides information of a general nature only. It is only current at the posting date. It is not updated and it may no longer be current. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in the articles. If you have specific legal questions you should consult a lawyer."

About the Author

David j. rotfleisch.

David J. Rotfleisch, a leading Canadian tax lawyer, is not only a certified specialist in taxation but also a chartered professional accountant. Most recently, David is a pioneer in Canadian crypto taxation.

As of April 2020, he was one of 12 Ontario Certified Specialists In Taxation™.

Subscribe to our Newsletter

Looking for tax assistance.

Fill the form and we’ll get back to you.

Additional Areas Served

- Brampton Tax Lawyer

- Hamilton Tax Lawyer

- London Tax Lawyer

- Mississauga Tax Lawyer

- Montreal Tax Lawyer

- Ottawa Tax Lawyer

- Tax Lawyer Calgary

- Vancouver Tax Lawyer

- Winnipeg Tax Lawyer

- Edmonton Tax Lawyer

We are a Toronto tax law firm with a Canada wide full service income tax law practice.

Tax Solutions

- Tax Appeals

- Taxes Owning & Liens

Voluntary Disclosure

- Offshore Assets

- Offshore Income

- Offshore Pension

- Internet Income

Corporate Planning

- Tax Reorganizations

Get your CRA tax issue solved

Address: Rotfleisch & Samulovitch P.C. 2822 Danforth Avenue Toronto, Ontario M4C 1M1

416-367-4222 OR SCHEDULE ASSESSMENT

Copyright © 2024 Rotfleisch & Samulovitch Professional Corporation, Taxpage

Making a Claim for Medical Expense Travel Credits in Canada

by dellendo | Income Tax Return Preparation

Making a Claim for Medical Expense Travel Credits

Taxpayers can use the medical expense tax credit to offset taxes paid or owed. If you paid for healthcare, you may be allowed to deduct them from your taxes and benefits.

- Details of medical expenses

Medical Expense Tax Credit

- Eligible medical expenses

CRA Medical Expenses in Canada

Canada is the world second largest country. In addition to its immense size, some of the country’s most attractive places to reside are found in rural communities. Traveling long distances for medical care is a hassle, and it’s an issue if you live outside of a big city. If you have to travel for your treatment, you may be able to claim travel expenses on your tax return according to the Canadian government.

A range of costs incurred when traveling for medical treatment, as well as those incurred on behalf of your spouse or family, may be eligible for tax deductions. All reimbursements will cover travel, food, and housing costs for the patient and an escort, if needed. To help with tax season, let’s consider the allowable deductions and how to claim them.

How far must I travel to qualify for Medical Expense Travel Credits?

It is likely that you have spent a lot of money on parking at a hospital in the past, so be prepared for that expense. When traveling for medical treatment, parking charges are not deductible unless you travel more than 80 kilometers.

When submitting a claim to the CRA for transportation and travel expenses, it is necessary to meet the following requirements:

- In your neighborhood there were no comparable medical services.

- You avoided detours and followed the shortest route.

- It was appropriate for you to go to the place you did in order under the circumstances to acquire such medical care.

If you take public transportation to travel more than 40 kilometers (one way) for medical treatment, you may be entitled to claim the costs (eg. bus, train, or taxi fare). Even if you don’t use public transportation, you may be able to deduct the cost of your car.

If you traveled more than 80 kilometers (one way), you can deduct your automobile expenses, as well as your housing, meals, and parking fees, from your tax return.

If a medical professional has determined that you cannot travel without assistance, you may be able to claim reimbursement for expenses incurred by someone who traveled with you as a caretaker.

How does the CRA calculate vehicle costs?

If you need to drive to get medical attention, you can claim expenses such as gasoline, oil, license fees, insurance, maintenance and repair costs, and replacement parts on your tax return. Depreciation, provincial taxes, and loan charges are all considered tax-deductible expenses in the United States.

There are two techniques to determining automobile expenses: the complete methodology and the streamlined method. The comprehensive technique is the more thorough approach. If you select the detailed option, you will be required to keep track of the total amount of kilometers driven over a 12-month period. Assess the relationship between the overall cost of your vehicle and the number of kilometers travelled for medical treatment.

You can deduct half the cost of your car on your tax return, for example, if you drive 10,000 kilometers in a year, with 5,000 kilometers of those being for medical treatment (which was more than 40 kilometers away).

You may easily calculate how many miles you traveled throughout the 12-month period in which you choose to seek medical attention by following this straightforward procedure. Calculate the distance traveled by multiplying the distance traveled by the provincial rate that is in effect. Tariffs vary by province or territory and are subject to change on a yearly basis. The document is available on the website of the Canada Revenue Agency.

Keep all of your receipts for future Canada Revenue Agency inspection applications, regardless of whether you choose a detailed or a simple approach (CRA).

What are the Accommodations Policies?

- To be eligible for payment for housing and food you must have covered more than 80 km for medical care.

- Receipts are based on accommodation claims and only stay costs, including taxes, are reimbursable. No additional price is included for items like room service, movies and telephone calls.

What is the process for claiming meals?

- You must have gone more than 80 kilometers to be eligible for food refunds from CRA. You have the possibility, as well as with car costs, to choose the detailed manner or the simplified method.

- You must keep track of the actual cost of each meal with the detailed way.

- You can deduct up to $17 for each meal up to $51 a day including sales tax and up to a maximum of $17 per meal for people who choose for the simpler option.

- Keep in mind whether you employ the detailed technique or the simplified method always to save receipts.

Travel Partners / Companions

You may be entitled to deduct the expenses of your spouse or common-law partner, as well as any other person who travels with you, as part of the tax credit for medical expenses if they accompany you on your journey. To include these charges, your doctor or other authorized practitioner must present you with a certificate showing that you were unable to travel alone at the time the incident happened.

When you meet certain qualifications, you may be able to cover the costs of transportation, lodging, and meals for your travel companion, depending on how far you traveled for medical care.

Travel outside of Canada’s borders

In addition to being able to claim expenditures incurred while out of the country, qualified medical expenses for traveling within Canada may also be reimbursed. Every single one of the following requirements must be met:

- Practitioners must have the legal right to practice in the country where they work. When it comes to hospitalizations, the institution must be either public or privately licensed private.

- The program requires that the health-care services you receive be unavailable in your neighborhood and that you travel to seek them.

Related Projects

Service title.

There is a common assumption that due to the universal healthcare system, Canadians don’t need to worry about medical costs. This assumption is untrue. Many Canadians have surprisingly steep medical bills, which is why the CRA lets Canadians claim eligible medical expenses as a credit on their taxes.

However, there are also non-eligible medical expenses. For this reason, it’s important for you to do your research on what you can claim for tax credit before claiming medical expenses.

Key Takeaways

- Eligible medical expenses must be recognized by a licensed healthcare provider.

- Expenses incurred are deductible up to $2,479 or 3% of your net income.

- Canada covers most medical expenses either as deductibles or under universal healthcare.

- Many non-eligible expenses have exceptions in certain situations.

- You may carry over expenses from the previous year as long as they were incurred within the past 12 months.

- You may claim travel expenses for treatments in some but not all cases.

- Tax credit only applies to medical expenses not covered by another health insurance plan.

Table of Contents

- CRA-Approved Medical Expenses Tax Deduction in Canada

Medical Expenses Not Eligible for Tax Deduction in Canada

- Simplify Your Tax Preparation with FreshBooks

- Frequently Asked Questions

17 CRA-Approved Medical Expenses Tax Deductions in Canada

Eligible expenses must be prescribed by a recognized medical practitioner, needed, and paid without reimbursement. There is also a threshold of $2,479 or 3% of your net income. Here are 17 medical expenses that are approved by the Canada Revenue Agency as tax-deductible:

1. Prescription Medications

Eligible prescription medications must be prescribed by a licensed practitioner. Over-the-counter medications do not qualify. Prescription supplements also do not qualify, with the exception of Vitamin B12. Medical cannabis may qualify if the patient has valid documentation stating the need and is registered with the licensed seller they’re purchasing from.

2. Medical Services

Eligible medical services vary based on province, so you should consult the Government of Canada website to verify which services qualify in your province. Eligible services may be reimbursed regardless of whether you received the treatment in or out of your home province or Canada. However, the out-of-province or country practitioner must be licensed in their jurisdiction.

3. Service Animals

Costs related to training and caring for a service animal may be eligible for tax credit in some cases. Emotional support and therapy animals do not qualify. Eligible service animals include those for:

- A physical impairment that restricts mobility

- Diabetes (for expenses incurred after 2013)

- Some psychiatric conditions in cases where the animal is trained to respond to psychiatric incidents, such as a PTSD flashback (for expenses incurred after 2017)

4. Medical Devices and Equipment

Most medical devices are eligible if they are prescribed by a licensed practitioner. Paid assistive devices are only eligible if prescribed. For example, television closed caption decoders purchased out of pocket without a prescription would not qualify, although they would if they were prescribed.

5. Vision Care

Any device that assists with vision correction is eligible for tax credit. This includes glasses, contact lenses, laser eye surgery, and other assistive vision devices such as prescription swimming goggles. The cost of both lenses and frames for glasses is refundable on your income tax return. Medical services to help correct vision, such as regular eye exams, are also claimable expenses.

6. Sexual Reassignment Surgery

Sexual reassignment surgery usually qualifies as a tax-deductible expense in Canada. However, the procedure must be performed by a licensed practitioner or hospital to qualify. You must also prove that the surgery is part of ongoing treatment for gender dysphoria disorder and not for cosmetic reasons. Other forms of gender-affirming care qualify as long as they meet these same qualifications. For instance, laser hair removal as part of gender dysphoria treatment would qualify, but purely cosmetic hair removal would not qualify.

7. Dental Services

Dental services are only eligible if the service is for a medical need. This would include any dental health procedures (such as cleaning or fillings), dentures, and any necessary medications related to a dental procedure. Cosmetic dental procedures do not qualify with the exception of braces.

8. Psychological Services

Psychological services are only eligible if they are recommended by a medical practitioner. If mental functions are severely impacted, you may qualify for the disability tax credit. To qualify, your mental impairment must render you unable to perform everyday tasks or perform them 3 times slower than the average for a person in your age range. This must be an issue 90% of the time for a period longer than 12 months and an impairment that does not improve with the use of psychiatric medication.

9. Nursing Care

Any amount paid for a licensed nurse is an eligible medical expense. This includes home care attendants who help individuals perform needed functions in their everyday lives. Deductible nurse expenses include the nurse’s salary, food preparation, housekeeping, health care, some grooming expenses, transportation, and activities.

10. Travel for Medical Treatment

Travel expenses for medical treatment are only eligible if you traveled further than 40 kilometers to receive treatment. However, you must prove that reasonable treatment was not available any closer to your home to receive a tax credit for the travel expense. You also must show that you chose the most direct route to your location and still exceeded 40 kilometers.

Lodging expenses and accommodation expenses are only deductible if you need to travel more than 80 kilometers for treatment. Proving that there were no reasonable options closer and that you took the most direct route is also required to deduct accommodation expenses for medical travel.

11. Healthcare Premiums

Premiums paid toward a private health services plan may be eligible as long as 90% of the premiums go toward eligible medical expenses as specified by the Canada Revenue Agency. For instance, if ineligible cosmetic procedures take up more than 90% of the cost of your health insurance premiums, paying into those premiums wouldn’t qualify.

12. Fertility Services

Medical expenses paid to help a patient conceive a child are eligible for tax deductions. The service must be performed or overseen by a public or licensed private health centre to qualify. Expenses paid toward a surrogate mother or sperm/ova/embryo donor are eligible if incurred after 2022 and as long as the surrogate/donor is from Canada. An example of such an expense would be paying for medical exams for a surrogate mother. Freezing one’s sperm or ova with the intent of conceiving a child in the future also qualifies for deductions.

13. Mobility Aids

Walking aids, standing devices, wheelchairs, and crutches all qualify for a tax credit. Modified vehicles designed to allow a person with physical impairments to drive also qualify with a prescription. 20% of the fees paid for a van used to transport a person in a wheelchair can also be reimbursed. However, this amount has a limit of $5,000 with the exception of Ontario where the limit is $7,703.

14. Therapeutic Services

The cost of personalized therapy for a person who qualifies for the disability tax credit is eligible. Rehabilitative therapy also qualifies as an eligible medical expense. Therapy must be prescribed and delivered by a licensed psychologist, doctor, or nurse depending on the nature of the mental or physical impairment.

15. Home Renovations

Renovation expenses qualify if the renovations are to increase the mobility of a person in their own home, making them eligible for the home accessibility tax credit . They cannot be done with the expectation that the renovations will increase the value of the property. Examples may include buying and installing wheelchair ramps, lowering cabinets, or enlarging doorways. This applies to costs related to modifying an existing home or building a new house.

16. Certain Education and Training Costs

Some training costs to help an abled person care for a disabled family member may be eligible if the disabled person is unable to function without the family member’s support. Tutoring services for a person with a severe learning disability may also qualify. Tutoring must be in addition to primary schooling and certified as needed by a medical practitioner.

The cost of purchasing a wig may be eligible for tax credit if the person buying the wig is experiencing abnormal hair loss due to an illness, accident, or medical treatment. A licensed medical professional must verify in writing that the wig is being purchased by a person in this situation.

Don’t miss deducting any of your eligible medical expenses on your next tax return. Watch the video below to see how you can simplify your tax preparation process with FreshBooks.

The Canada Revenue Agency specifies non-deductible medical expenses as anything that is not a medical need as verified by a healthcare provider. You also cannot claim medical expenses that are reimbursed by other means.

Non-Prescription Medications

Any over-the-counter medications such as non-prescription painkillers, antacids, or antihistamines do not qualify. This is true even if the non-prescription medication is to help manage a chronic illness or disability. Over-the-counter medications recommended by a physician also do not count without an official prescription.

Cosmetic Surgery

Any form of cosmetic or “plastic” surgery does not qualify if the procedure is purely for cosmetic purposes. There is an exception if the cosmetic surgery was performed under compassionate grounds. For example, prosthetic breasts may qualify for a person who received a mastectomy due to breast cancer treatment.

Health Club Memberships

Health club memberships including gym, fitness, and recreational centres do not qualify as eligible medical expenses. Some services offered at such a facility may qualify in some cases. For instance, physical therapy performed by a licensed physiotherapist at a health club may qualify, depending on the circumstances.

Vitamins and Supplements

With the exception of Vitamin B12, vitamins, and supplements do not qualify as a deductible expense, even if prescribed by a licensed physician. This also includes supplements other than Vitamin B12 that require a prescription to purchase.

Birth Control

Non-prescription contraception is not a qualifying medical expense. However, birth control pills prescribed by a medical practitioner do qualify as a deductible expense. In this situation, the contraceptive medication must be prescribed with the intent of improving the life of someone with a medical condition that can be treated or better managed with birth control pills.

The province of British Columbia recently made birth control free through BC Medical. While this is technically not a tax deduction, it is worth noting as this particular expense may receive more coverage in the future.

Abortion is legal in all Canadian provinces, and historically this was an ineligible medical expense. However, as of March 2023 , the Canadian government announced that abortion costs will be partially covered under universal healthcare.

Specialized Food

With the exception of gluten-free food, specialty foods for people with dietary restrictions do not qualify as a deductible expense. This includes organic food, sugar-free food, and allergen-free food. People who wish to claim medical expenses on gluten-free food must provide written proof from a medical professional that they need gluten-free food for a medical condition, such as Celiac disease.

Weight Loss Programs

Weight loss programs are not a tax-deductible expense in Canada. This is true even if weight loss is recommended by medical practitioners. This also applies to weight loss supplements. Many weight loss programs and supplements are unregulated, which is why they cannot be officially claimed for a tax credit.

Cosmetic Dentistry

With the exception of orthodontic procedures like braces and teeth straightening, cosmetic dentistry is not eligible as a deductible expense. This includes teeth whitening, veneers, and dental implant devices that are purely for cosmetic purposes. Eligible orthodontic procedures can be claimed for yourself, your common-law partner, or any dependent child under 18.

Hair Replacement or Removal

Hair replacements and hair transplant surgeries are classified as cosmetic procedures. For this reason, they do not qualify for tax credits. This also applies to hair growth serums or supplements. Hair removal procedures are not usually eligible. However, electrolysis or laser hair removal performed by a licensed medical professional does qualify for the tax credit.

Veterinary Expenses

Tax-deductible medical expenses must be for yourself or a human dependent. Veterinary expenses do not qualify, except in some cases for a service animal. In this case, the service animal is considered a medical necessity for a human, and the animal’s ability to perform is considered part of the human’s healthcare needs. Pet insurance options for non-service animals are available in Canada. However, these are not covered by federal tax under universal healthcare.

Medical Expenses Already Reimbursed

Medical tax credit is intended for unreimbursed medical expenses. Costs that have been reimbursed by other means do not qualify for tax credit. This includes those reimbursed by health insurance premiums, private health services, and employer medical benefits. If your health insurance plan reimbursed only part of your expenses, you may still be eligible for tax credit on the remainder in some situations.

Medical Expenses Claimed in Previous Years

You can only claim expenses for yourself, your spouse or common-law partner, or any dependent children within 12 months of the current tax year. You may claim some expenses from the previous tax year as long as they were not claimed during that tax season. For example, while filing your 2024 tax return, you may only include expenses from 2023 if they were not already claimed on your 2023 return.

Simplify Your Tax Preparation With FreshBooks

FreshBooks stands out as one of the top accounting software tools for any small business owner. However, freelancers and self-employed individuals can also use Freshbooks to keep all of their expenses in order. Claim all your eligible medical expenses this tax season by using FreshBooks to keep track of everything you’re entitled to deduct from your taxes.

Sign up for your free trial today to see how much easier filing your income tax return could be. Try FreshBooks free !

Medical costs aren’t the only tax deductions Canadians can claim. Learn more about tax write-offs for small businesses in Canada before you file your next return.

FAQs About Medical Expense Tax Deduction in Canada

All procedures performed for medical or reconstructive purposes and reasonable travel expenses to receive treatment may be covered for you by the Canadian government. Here are the answers to some commonly asked questions about medical-related tax deductions.

What is the medical expenses tax deduction?

The medical expenses tax deduction in Canada is a non-refundable tax credit Canadians can claim on their personal tax return. This credit is called the Medical Expense Tax Credit (METC). Because it is a non-refundable tax credit, you can subtract it from your tax owed as long as it does not bring your balance above 0.

It’s easy to track and calculate your Medical Expense Tax Credit (METC) with FreshBooks. Our accounting software lets you easily track all of your expenses in one centralized location to give you a clear picture of what you may receive from your medical expense tax credit.

Are medical expenses tax deductible in Canada?

Most medical expenses are tax deductible or covered by universal healthcare in Canada. Exceptions include cosmetic, veterinary, and non-prescription services. These services may still be covered in some cases.

FreshBooks can help you keep track of all your tax deductible medical costs. This way, you won’t forget to claim anything you’re entitled to at the end of this tax year.

How much medical expense can I claim on my taxes?

The maximum amount of medical expenses for tax deduction in Canada is either 3% of your net income or $2,479, whichever is lower. For example, if 3% of your net income is $1,200, you can claim $1,200, but if 3% of your net income is $3,000, you can only claim $2,479.

Can I carry over medical expenses for taxes?

You can carry over medical expenses for taxes if they were incurred within 12 months of the end of the current tax year. However, you need to be sure that they were not claimed by you or anyone else in the previous tax season before adding them to your current return. By tracking claims with FreshBooks, you can be sure that you’re not repeating claims this tax season.

Do I have to attach medical receipts to my tax return?

You will need to attach your medical receipts to your tax return if you’re filing your return on paper. If you’re filing electronically, you should keep your receipts but you won’t need to attach them.

To keep your records organized, you can store financial data on your medical receipts using FreshBooks. This will help you easily retain records of all eligible medical expenses for tax deductions.

How do you calculate medical expense tax deductions?

First, determine whether 3% of your net income is lower than $2,479. Then, take the lowest marginal tax rate in your province plus the federal tax rate and multiply it by the minimum threshold. Here’s how that will look as a formula:

- Medical Expenses – 3% or $2,479 = X

- X (Provincial Rate + 0.15) = Medical Expense Tax Credit

Note: 0.15 was chosen because 15% is the lowest marginal tax rate at the federal government level.

More Useful Resources

- Disability Tax Credit

- Home Accessibility Tax Credit

Kristen Slavin, CPA

About the author

1000 more rows at the bottom Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

Snowbird Advisor Insurance

COVID-19 Travel Insurance Coverage Options - UPDATE LEARN MORE

The Insurance Specialists for Snowbirds, Boomers and Seniors

Reduce the cost of your travel medical insurance by claiming a tax credit.

Canadian travellers may be eligible to get some money back for travel medical insurance premiums

Travel insurance can be expensive, particularly if you travel for extended periods of time, have pre-existing health conditions, or are a more mature traveller.

Fortunately, Canadian travellers may be eligible to recoup some of the cost of your travel medical insurance premium by claiming it for a CRA Medical Expense Tax Credit on your income tax return.

Medical Expense Tax Credits allow you to reduce your income tax liability by claiming travel medical insurance premiums and other eligible medical expenses on your tax return and meeting certain eligibility requirements.

Make sure you speak to your accountant to get professional advice on claiming your travel medical insurance premium as a Medical Expense Tax Credit:

In the meantime, here are a few things to keep in mind about Medical Expense Tax Credits:

- Only travel medical insurance is eligible to be claimed. Other types of travel insurance like trip cancellation/interruption insurance and baggage insurance are not eligible for Medical Expense Tax Credits. If you have an all-inclusive travel insurance policy that covers medical, cancellation/interruption and baggage, only the amount related to the medical portion of your premium is eligible for the credit. If you purchased your policy from Snowbird Advisor Insurance , you can find your total premium in the confirmation package you received at the time you purchased your policy .

- You’ll need a copy of your travel medical insurance receipt/confirmation to prove to CRA how much your premium cost and that your insurance policy was eligible for a tax credit.

- You can claim other eligible medical expenses you incur inside and outside Canada, as long as you were not reimbursed for those expenses (i.e. under an insurance plan).

- Only medical expenses that exceed a minimum dollar value threshold prescribed by the government are eligible for the tax credit.

- Any tax credit you receive won’t be for the full amount of your eligible expenses, as the government only allows you recoup a percentage of your expenses.

The bottom line is that while you won’t be able to recoup the full amount of your travel medical insurance premiums by claiming them on your tax return, it can still be a fast and easy way to save some money.

You can learn more about Medical Expense Tax Credits here.

Disclaimer: The material provided in the Snowbird Advisor Insurance Learning Centre is for informational purposes only and does NOT constitute insurance, legal, financial or other advice, and should not be relied on as such. If you require such advice, you should speak with a qualified professional to assist you.

Travel Insurance:

Manulife coverage is underwritten by The Manufacturers Life Insurance Company and First North American Insurance Company , a wholly-owned subsidiary of Manulife, PO Box 670, Stn. Waterloo, Waterloo, ON N2J 4B8.* Manulife and the Block design are trademarks of The Manufacturers Life Insurance Company and are used by it and its affiliates under license.

Blue Cross coverage is underwritten by Canassurance Hospital Service Association and/or Canassurance Insurance Company .*

* Certain terms, conditions, limitations, and exclusions apply, see policies for details. Some products may not be available in all provinces.

Home & Auto Insurance:

Home and Auto insurance is arranged by Canadian Insurance Alliance (2018) Inc. o/a HUB SmartCoverage (all rights reserved) and is underwritten by a number of Canadian insurers.

For more than 20 years, HUB SmartCoverage has worked with some of the largest insurance companies in Canada, servicing the home and auto insurance needs of Canadians in Alberta, Ontario and the Atlantic provinces, as well as providing residents of British Columbia with home insurance solutions.

Eligible medical expenses and credits for your tax return

Last updated: Mar. 10, 2023

The list of medical and disability tax credits and deductions is longer than most Canadian taxpayers realize and it’s not difficult to miss an eligible expense or credit.

The Income Tax Act offers a wide range of tax credits and deductions to persons who are ill or disabled, or support a relative with such infirmities. It’s important to understand these credits and deductions so you can claim them on your tax return and reduce the amount of tax you pay.

If you’re ill or disabled – or help support an ill or disabled dependant- you need to be aware of the following credits and deductions:

Disability Tax Credit

Taxpayers with severe and prolonged mental or physical impairment can claim a disability amount of $8,870 (2022 amount), which equates to a federal tax credit of $1,330.50.

To qualify, the impairment must be certified by a medical doctor, nurse practitioner (or other eligible practitioner, depending on the impairment) on form T2201.

Applications may be completed by these professionals on either the online digital form or paper form . The impairment must have lasted, or be expected to last, at least a year. If you or a family member may be eligible for this, please discuss with your medical practitioner to apply to CRA.

Medical Expense Credit

Once over a threshold amount, you and/or your spouse can claim medical expenses for yourself, each other, and dependent children who were under the age of 18 years old at the end of the tax year. If you supported other family members, who relied on you for financial assistance, you may be able to claim medical expenses paid on their behalf as well (i.e. parents, grandparents, siblings, cousins, etc.).

The threshold amount is 3% of income or, if your income exceeds $82,633, a flat $2,479 for the 2022 tax year. Once over the threshold amount for the year, you can recover about 15¢ for each dollar you spend on qualifying expenses. It’s usually best to combine all family medical expenses on one return, and for the lower-income (and thus lower-threshold) spouse to make the claim. Of course, that spouse must owe enough tax to use up the credit.

When preparing taxes and claiming medical expenses, you can pick any 12-month period ending during the year. This allows you to plan for the credit based on when you have had, or expect to have, large medical expenses.

The list of qualifying medical expenses is extensive and includes:

- Payments for non-insured health care services received from physicians, dentists, psychologists, and many others.

- Prescription drugs and prescription eyeglasses.

- Premiums for private health insurance plans such as drug, dental and out-of-country coverage (even if you pay the premiums through payroll deductions by your employer).

- Traveling expenses if you need to travel more than 40 km for medical services. In addition, you may claim food and lodging expenses if you have to go more than 80 km. This is an important one for farm families.

- Attendant care, and care in a nursing home or other institution.

- Various medical devices such as hearing aids, wheelchairs, and dialysis machines.

- Guide dogs and expenses for maintaining them.

- Certain home renovation and moving expenses incurred to accommodate a disabled person.

Refundable Medical Supplement

Worth up to $1,316 for 2022, this refundable tax credit is available to working individuals (who make above $3,841 in 2022), with high medical expenses and adjusted family incomes of no more than $55,449. In a tax context, “refundable” means you get it even if your income is below the taxable threshold. The amount is reduced by family net income greater than $29,129 (in 2022).

This lesser-known credit can be claimed in addition to the medical expense tax credit and is commonly missed as a refundable credit on tax returns. For obvious reasons, many farm families qualify, as do students and others whose income happens to be low in years when their medical expenses are high.

Attendant Care Credit

If you can claim the disability tax credit, you may be eligible to include some or all of the costs of an attendant needed to help you earn certain income or go to school. Alternatively, you can claim attendant expenses as a medical expense if you have no “earned” income.

Disability Credit Transfer

Disabled individuals who cannot take advantage of all or part of this credit can transfer it to a spouse or other qualifying person who supports them.

Disability Credit Supplement

In addition to the $8,870 disability amount that can be transferred from an individual, you can claim a supplement of $5,174 for eligible disabled children under 18 at the end of the year. This claim is reduced by childcare or attendant care expenses claimed for the disabled child.

Infirm Dependant Credit

You can claim this credit for certain relatives who are 18 years or older before the end of the year if they are dependent on you because of a mental or physical infirmity. While the individual does not need to live with you or qualify for the disability tax credit, his/her infirmity must create dependence on you for a considerable period of time.

The amount available for the credit is reduced on a dollar-for-dollar basis by the dependent’s income over a certain threshold.

Family Caregiver Amount Tax Credits

This credit is available if you live with and provide in-home care for a dependent with a physical or mental impairment (for example, a parent or grandparent 65 or older). Other relatives who are dependent because of a mental or physical infirmity may also be eligible.

This credit is subject to certain income thresholds, and if the dependent has income over a certain amount, no amount may be claimed.

Childcare Deduction Amount

Beyond the medical expense tax credit, the childcare deduction amount is increased , when the individual being cared for is had an impairment in physical or mental function and is dependent on you for care.

You or your spouse might have paid someone to look after your child who had a mental or physical infirmity. If you incurred these expenses so one of you could earn income or go to school, you can deduct them – up to $8,000 for a child (depending on the child’s age) who does not qualify for the disability amount and up to $11,000 for a child who does qualify.

How to claim medical expenses and credits

For the 2022 tax year, you can claim only eligible medical expenses on your tax return if:

- you, or your spouse or common-law partner paid for the medical expenses in any 12-month period ending in 2022 (for example May 2021 to May 2022)

- and they were not claimed in 2021

Generally, you can claim all amounts paid, even if they were not paid in Canada. However, you must exclude the portion that you have been or will be reimbursed for through an employer health insurance program, for example.

You claim medical expenses on line 33099 or 33199 of your T1 tax return.

Click here to learn seven simple ways to organize your receipts.

What if I missed claiming medical expenses or credits?

If you’ve realized that you missed claiming eligible medical expenses in the past, you may have options to resubmit your returns for those tax years. The Canada Revenue Agency (CRA) generally allows you to make changes to your return up to 3 years after you filed it.

You will use CRA My Account and make a request to change your return. You may be required to submit a CRA Form T1-ADJ (Adjustment Request) and submit a request in writing, along with all supporting documentation to your designated CRA Tax Centre.

If the 3-year period has expired, CRA may still allow changes to your tax returns under the “Taxpayer Relief Provisions” in Information Circular IC 07-1.

The bottom line here is that rules relating to medical tax credits and expenses are both complex and confusing. It’s best to have your tax advisor analyze your particular situation and determine the claim and/or mix of claims that gives you the best tax advantage.

Free Download: Year-End Tax Planning Strategies for Your Small Business

Many small business owners wait until spring to start thinking about their taxes, but this simple act of waiting could cost them thousands.

Fall is actually the best time to start think about your taxes. It allows you to get organized and assess what actions you can take before the end of the tax year to lower your future business or corporate income taxes.

Consider this toolkit your roadmap to help you get organized, reduce your tax burden, and keep more money in your pocket.

With more than 70 years of Canadian tax experience, we offer unlimited tax preparation help, support and tax advice for Canadian business owners. For one flat fee. Our tax experts will run the numbers to create a custom tax return that helps minimize headaches and maximize your tax savings.

Leave your unique tax situation to us. We’ll get you every dollar you deserve. Book online or call us at 1-800-265-1002.

- Barrie & Central Ontario

- London & Southwestern Ontario

- Smiths Falls & Eastern Ontario

- Sudbury & North Central Ontario

Atlantic Canada

- Nova Scotia, New Brunswick, PEI

- Calgary, Southern Alberta & East Kootenays

- Edmonton & Northeastern Alberta

- Grande Prairie, Northwestern Alberta & Peace River Valley

British Columbia

- Kelowna & Southern BC

Saskatchewan

- Regina & Southern Saskatchewan

- Saskatoon & Central Saskatchewan

- Winnipeg, Brandon, Rural Manitoba & Northwestern Ontario

Member Services

- 1-800-265-1002

- Contact/Locations

Announcements

- News Release

- Credits & Deductions

- Income & Investments

- CRA Tax Updates

- Getting Organized

- Family & Children

- Homes & Rental Properties

- Medical & Disability

- Expats & Non-Residents

- Employment & Employees

- Foreign Income & Property

- Self-Employed & Freelance

- Small Business

- Unemployment

- After you File

What Are Some Out-of-Country Travel Deductions for Taxpayers?

The Canada Revenue Agency (CRA) offers a range of out-of-country travel deductions to offset the expenses involved with international journeys. Only certain travel expenses qualify. In most cases, your trip must be for medical or business purposes to claim a deduction.

Employment Travel Expenses

Taxpayers who are required to travel for work may claim food, beverage and lodging expenses on their income tax returns..

In order to qualify :

- You must have paid for your own trip, AND

- Your employer must not have reimbursed you.

To assure the CRA you and your employer have this type of arrangement, have your employer fill out a Form T2200 (Declaration of Conditions of Employment) and keep that form with your financial records.

You may claim 50 percent of your food and beverage costs only if your trip exceeds 12 hours in length . However, if your food and beverage costs are unreasonably excessive, the CRA requires you to base your claim on a more reasonable amount. For example, if you spend $10 on lunch, you may claim $5 as a travel expense. However, if you spend $1,000 on dinner and you could have had a reasonably comparable dining experience for $300, you may not claim $500. Instead, you may only claim $150.

Travel Expenses for International Medical Services

- If you must travel out of the country to receive medical care, you may write off your travel expenses for that international journey.

- If your doctor certifies in writing that you need an attendant to help you travel, you may also deduct your attendant’s traveling expenses.

In order to qualify:

- The medical services you receive must not be readily available near your home, AND

- You must travel at least 80 kilometres away from your home.

Public transportation vs driving

- If public transit is available, such as buses, trains or airplanes, to take you to your destination, you may write off the cost of your ticket .

- However, you may write off the cost of driving yourself only if public transit is not available .

Travel Medical Insurance

Whether you are traveling for medical procedures, business purposes or just entertainment, you may write off the cost of your travel medical insurance premiums. If you buy a comprehensive travel insurance policy , you may only deduct the portion of the policy’s premium related to travel medical insurance.

You may not deduct premiums for trip cancellation or other types of travel insurance.

- CRA: Travelling Expenses for Salaried Employees

Related articles

Facts every canadian needs to know about filing coupled tax returns, advising the canada revenue agency of a name change, married tax returns in canada.

COMMENTS

The Canada Revenue Agency (CRA) has approved Form T2201 for Dali. Dali pays their 43-year-old neighbour, Marge, $14,000 each year to look after them full-time. Dali can claim the amounts they pay Marge for attendant care as a medical expense. ... If you have travel expenses related to medical services and you also qualify for northern residents ...

To claim transportation and travel expenses with the CRA, the following conditions must be met: If you traveled at least 40 km (one way) to get medical services, you can claim the cost of public transportation (ex. bus, train, or taxi fare). If public transportation isn't available, you may be able to claim vehicle expenses.

Record the distance of travel, calculate your mileage according to the province in which you reside. (2021 rates): Example: 55¢ x 160km = $88.00; you may claim $88.00 as an eligible medical expense. Method 2. Vehicle expenses may be claimed as CRA medical travel expenses by submitting gas receipts for the date (s) of travel/service.

travel expenses outside of Canada, when a person is required to travel 80 km or more one way from their home to get medical services outside of Canada, which are eligible medical expenses - the expenses include transportation, travel, accommodations, meals and parking. costs of the following devices (Income Tax Act s. 118.2 (2) (i))

For example, if you travelled 5,000 kilometres in your car during the 12 month period, and 40 percent was for medical expenses, you are allowed to claim 2,000 kilometres (40 percent) of your travelling costs on your tax return. Documenting Travel Expenses - Simplified Method. You can also document your travel expenses using the simplified method.

In this article. CRA rules on medical travel. Medical travel if you travel more than 40 kilometres. Medical travel over 80 kilometres in Canada and abroad. CRA Medical travel rates 2023. Medical travel rates 2022. FAQ. If you need to receive medical care, you may be able to deduct medical travel expenses for your medical mileage. The deductions ...

Medical expenses for other eligible dependants are claimed on line 33199 (line 331 prior to 2019) of the federal tax return. A separate calculation is done for each dependant. Only expenses in excess of the lesser of $2,635 for 2023 ($2,759 for 2024) or 3% of net income of the dependant can be claimed for the federal tax credit.

Meal expenses. If you choose the detailed method to calculate meal expenses, you must keep your receipts and claim the actual amount that you spent. If you choose the simplified method, claim in Canadian or US funds a flat rate of $23 per meal, to a maximum of $69 per day (sales tax included) per person, without receipts.

Medical travel expenses you can claim. You can claim medical mileage from the CRA if you travel over 40 kilometres in one direction in order to receive medical attention. In order for your mileage to qualify, you must observe the following rules from the CRA: You can claim mileage with your own car or a rented one, as well as any public ...

The Income Tax Act (ITA) allows individuals to claim a medical expense tax credit in respect of travel expenses incurred when a patient requires medical treatment at least 80 kilometres away from their home. Therefore, you may be able to claim a deduction on your income tax return if you incurred reasonable travel expenses associated with ...

The. medical expense tax credit is non-refundable tax credit that you can use to. reduce the tax that you paid or may have to pay. If you paid for healthcare expenses, you may be able to claim them as eligible medical expenses on your income tax and benefit return.

If you have to travel for your treatment, you may be able to claim travel expenses on your tax return according to the Canadian government. A range of costs incurred when traveling for medical treatment, as well as those incurred on behalf of your spouse or family, may be eligible for tax deductions. All reimbursements will cover travel, food ...

The maximum amount of medical expenses for tax deduction in Canada is either 3% of your net income or $2,479, whichever is lower. For example, if 3% of your net income is $1,200, you can claim $1,200, but if 3% of your net income is $3,000, you can only claim $2,479.

You'll need a copy of your travel medical insurance receipt/confirmation to prove to CRA how much your premium cost and that your insurance policy was eligible for a tax credit. You can claim other eligible medical expenses you incur inside and outside Canada, as long as you were not reimbursed for those expenses (i.e. under an insurance plan).

Taxpayers with severe and prolonged mental or physical impairment can claim a disability amount of $8,870 (2022 amount), which equates to a federal tax credit of $1,330.50. To qualify, the impairment must be certified by a medical doctor, nurse practitioner (or other eligible practitioner, depending on the impairment) on form T2201.

travel expenses Generally, you can claim all amounts paid, even if they were not paid in Canada. You can only claim the part of an eligible expense for which you have not been or will not be reimbursed. How to claim medical expenses You can claim medical expenses on line 33099 or 33199 of your tax return under Step 5 - Federal tax.

Medical expense claims are made using line 330 or 331 on Schedule 1 of your tax return. For starters, you can claim amounts spent by you, or your spouse or common-law partner, for the following individuals, on line 330: You, or your spouse or common-law partner. Any children born in 2001 or later, belonging to you or your spouse.

The deadline is April 30. The Canada Revenue Agency (CRA) offers a range of out-of-country travel deductions to offset the expenses involved with international journeys. Only certain travel expenses qualify. In most cases, your trip must be for medical or business purposes to claim a deduction.

Meal expenses. If you choose the detailed method to calculate meal expenses, you must keep your receipts and claim the actual amount that you spent. If you choose the simplified method , claim in Canadian or US funds a flat rate of $23/meal, to a maximum of $69/day (sales tax included) per person, without receipts.

Situation: You reimburse travel expenses for your employee's spouse or common-law partner on a business trip taken by your employee. If the allowance or reimbursement is not taxable, you do not need to do any calculations. Do not continue to next step. If the allowance or reimbursement is taxable, continue to: Step 5 - Calculate the value to ...