Do Cruise Ship Crew Pay Taxes?

You’re on the other side of the world, sailing in international waters, and so far from home you don’t even know which way around the world would be faster to fly to get there. You’re still working though and most places in the world income tax income. So, how does that work? Do cruise ship crew pay taxes?

There are so many questions floating around about cruise ship crew and a big one seems to be about whether or not cruise ship crew have to pay income taxes. Let’s talk about that.

First Off – Big Disclosure: I am not a lawyer, solicitor, tax advisor, or accountant. The information that follows is for general information purposes only. This information is based off of my experience, those experiences of people I know, and research. You should always ensure that you are paying the proper taxes for your home country/state/district. If you are unsure whether taxes are taken out of your pay talk to the cruise company you work, if you are unsure about how to go about paying/filing your taxes in your home country, speak to a licensed accountant.

Do Cruise Ship Crew Pay Taxes on their Wages?

Why yes, of course…

Actually, it’s more complicated than that (isn’t everything?). Cruise ships have crew members from all around the world. On any given cruise ship you will likely find crew members from 40+ countries. That’s not an exaggeration either, on the bigger ships you are likely to find even more than that. Keeping track of the tax requirements for employees from 40+ countries (just on one ship) would be incredibly challenging.

Just like in the rest of society, people are responsible for making sure they have paid their required taxes. While cruise ships are part of giant corporations, the crew members, those people working so hard to ensure that passengers have a great vacation – aren’t any different than people living in regular society. At the end of the day each crew member is responsible for making sure that they pay the appropriate taxes for their country/state/district.

Still though, it’s not quite as simple as that.

Do Cruise Lines Take Any Taxes Out Of Your Paycheck?

That answer is different depending on which cruise line you work for, where you are from, and even what contract type you have. Do cruise ship employees pay taxes? It’s about as complicated as Avril Lavigne was in the early 2000’s.

There Are Different Types of Contracts

Did you know that cruise ship employees aren’t always hired by the cruise line? There are a few different types of contracts out there. Primarily there are contracts where you are hired directly from the cruise line and those where you are hired through a recruitment agency or brand partner of some sort. Whether or not taxes get directly taken out isn’t entirely dependent on what contract type your on, but it can play a role in it. What country you are from can also play a role both in your contract type and in whether or not taxes are taken out. Confused yet?

If You’re From the US Working for a US Cruise Line

A lot of questions about whether or not cruise ship employees pay taxes come from people from the United States. I can’t speak for all cruise lines, but I worked for a cruise line that was a part of one of the biggest cruise corporations in the world. The company had headquarters in the United States and I am a US citizen. I was also hired directly by the cruise line and not a recruitment agency or brand partner.

In the United States when you file taxes you have to file a federal tax return and a state tax return (for most states, a few states do not have income taxes). When working for the cruise line they would withhold any federal taxes that I owed but not any state taxes. So, out of each paycheck there would be the typical federal deductions – including things like social security, but, there would be no state tax taken out.

As I am from Vermont – a state that taxes income – and the cruise line did not take any money out of my paycheck for state taxes, I am still responsible for paying my fair share as a Vermont resident. While working on the ship if I had moved and become a legal resident in a state that didn’t tax income I wouldn’t have owed additional money, but that wasn’t the case in my particular situation. At the end of the year I would get my W-2 from the cruise line and when I filed my taxes I would owe money to the state of Vermont.

So, while in this instance the cruise line is taking out some taxes from my paycheck, as with all crew members, as with all adults, I am still responsible for making sure I have paid my required taxes.

If You’re Not From the Same Country Your Company Is And You’re Hired Directly By Them

There is no one size fits all for how cruise ship workers pay their taxes. Most of the time if you are working onboard, are hired directly by the company, but aren’t from the same country that your company is headquartered out of you will have to handle paying all of your taxes and they will not withhold any towards your taxes.

This is not always strictly the case though as if your company has another branch or headquarters in another country you may be hired by that branch (still directly through the cruise line, but the side of the company that is the same country as you). In that case most likely they will withhold tax on each paycheck.

Most of the time though nothing will be withheld from your paycheck towards taxes though. At the end of each pay period you would be issued a pay-stub (of sorts, it may be a full page print out) detailing your earnings. You would then use this information when you file/report your income for the purpose of taxes with your government.

Important to Note: Many crew members are paid through direct deposit (the money is transferred directly into their bank account). There are some positions and contract types that are paid in cash. Yes, you read that correctly – they are paid in cold hard cash. Most people in these positions will find places like Western Union ashore to then transfer the money home. Bank Cards : In recent years cruise companies have partnered with various banks to have bank cards ( Brightwell is currently a popular choice) issued to crew members that their pay is loaded onto.

What If You’re On One of Those Other Contract Types?

All those other contract types – well, let’s say 99/100 times – you will not have any taxes withheld from your paycheck. So do cruise ship workers pay taxes? Each crew member is responsible for paying the taxes in their own country.

Interestingly, you can have people doing the same job that are on different contract types. One may have been hired through a recruitment agency (and from a country where the cruise line uses that recruitment agency), whereas another may have been hired directly through the cruise line (and most likely not from a country that has an agreement with a recruitment agency).

** As an Amazon Affiliate I may earn a commission on eligible purchases.

Does The Cruise Line Enforce Crew to Pay Their Taxes?

Not anymore than any other corporation enforces their employees to pay taxes. If you hire a contractor, say they are going to replace the roof on your house. You are employing them – they’re offering a service that you’re paying for – do you then make sure they file their taxes? No, you trust that they will pay the necessary taxes.

Crew members are kind of like the contractor fixing your roof. They do a job, the cruise line pays them for it, then the cruise ship workers pay the taxes on it. As members of society in general we assume that if people don’t pay their taxes then their respective governments will handle it. This is pretty much how it is for cruise line employees.

But, I’ve Heard About Crew Saying They Don’t Have to Pay Income Taxes So Is Working on a Cruise Ship Tax Free?

There are some countries where if you are outside of the country for more than half of the year you are not required to pay tax on your income.

Most people that work on cruise ships are away from their home country for half the year. For many that is literally one contract.

There are also some countries that don’t tax any income earned outside of the country (any foreign income).

Let’s strongly clarify something though:

Do you pay tax working on a cruise ship? You are responsible to file your taxes. Even if you live in a place that doesn’t require you to pay income tax if you are out of the country for a certain amount of time each year, and even if you are out of the country for more than that amount of time each year – even if you are from a country that doesn’t require you to pay tax on any foreign earned income –

You are still liable and responsible to properly report and file your taxes with your government.

You don’t get to determine that you aren’t required to pay your taxes, it’s the government that determines that when you file your taxes. If you don’t have to pay income taxes that particular year it really means that when you file your taxes the government says, “nope, you’re good, you aren’t required to pay X,Y, or Z”.

When this happens you get excited – thank the accountant you’re working with for filing everything correctly – and maybe enjoy an extra pint at the pub.

Want a bit more info on cruise ship pay? Check out this article from cruiseshipjobs.com .

Do Cruise Ship Crew Pay *Income* Taxes?

Yes, but it mostly depends on where you are from. Whether it is withheld out of their paycheck depends on where they are from; whether cruise ship workers have to pay taxes on their income earned while at sea depends on where they are from.

And, just like adults around the rest of the world – they’re responsible for filing their taxes and if what they owe hasn’t been withheld throughout the year then they’re responsible for paying.

Wondering about working on a cruise ship with a kid ? Here’s a run down of how that works.

Similar Posts

Accountability: September 2021

Ahh, September. What a magical month. It’s the beginning of fall foliage (aka lots of tourists in Vermont, but it’s also beautiful), the changing of seasons, and this time around going from pretty close to 24 hours a day with my husband to 111 days apart. Oh, it is the life we lead. Call it…

Accountability: February 2022

February has come to an end and what a month it has been. Have you ever had a time when you get lots of good news but it’s all really on the cusp of good news and you have to wait a bit for it to come to fruition? Well, that was February. I am…

Leave a Reply Cancel reply

Impartial training and careers advice

Call us: +441983 280 641

+441983 280 641

- Is working on a cruise ship tax free?

Have you recently finished school and are unsure what step to take next? Or perhaps you are about to graduate and are looking for a varied and exciting career?

Or maybe you just feel like you’re in the wrong job and are after a change. Whatever your reason for considering working on a cruise ship, you’ve probably got a number of questions buzzing in your brain, from where to begin your job search to what type of positions are available and even if you need to pay tax when you work on the ocean.

Well, if you’ve got questions, we’ve got the answers – so read on to discover our answers to your ultimate financial questions about life on board a cruise ship.

Is working on a cruise ship right for me?

First things first, you might be wondering whether or not working on a cruise ship is right for you. Well, if you want to travel to amazing places, meet awesome people, and get paid for doing so, then working on a cruise ship could be perfect for you.

Working on a cruise ship is great fun, and it also provides the opportunity to pick up a whole host of transferable skills for your future. Plus, with so many different types of jobs available on board, whatever you’re interested in, you’re sure to find a role that works for you. But what about tax?

Your questions about tax whilst working on a cruise ship answered

So, do I have to pay tax?

“ Do you pay tax when working at sea ?” is one of the questions we are asked the most here at Flying Fish. And we’re happy to say that as a general rule of thumb, the answer is, no. When you work onboard a ship, you are actually exempt from paying UK income tax, as long as you meet the qualifying criteria and fill in your tax return correctly!

When you work as a seafarer, you are paid without any tax or national insurance being deducted. This is because cruise ships and other vessels employ their crew from all over the world, so it is up to each individual seafarer to declare their income to their country.

So, whilst you most likely won’t have to pay any tax due to a legislation known as the Seafarers’ Earning Deduction (more on that below!), HMRC will still expect you to declare your income by completing a seafarers’ self-assessment tax return .

What is a seafarers’ self-assessment tax return?

When you work on board a cruise ship – or any other vessel – you will be classed as a seafarer and will need to complete a seafarers’ tax return in order to declare your income to HMRC so they can calculate the amount of tax you owe (if any!).

Although the Seafarers’ Earning Deduction means your earnings will most likely be exempt from income tax, you must still complete your tax return if you’re going to avoid any nasty penalties. Discover how to complete your tax return in this helpful blog .

Am I eligible for SED if I work on a cruise ship?

If you work on board a cruise ship, are employed by the vessel, and are a resident of the UK, you may not need to pay tax on your earnings.

The three basic rules to qualify for SED are that you must have spent more than 183 days outside of the UK during a 365-day period, your qualifying period has at least one voyage that begins and ends at a foreign port, and that you are employed to work on a ship. You won’t qualify for the deduction if you are a Crown employee (for example, a Royal Navy sailor), not a UK resident, or if you are self-employed.

Find out everything you need to know about the Seafarers’ Earning Deduction and how to claim it in this ultimate guide to SED .

What do I need to apply for SED?

In order to complete your seafarers’ self-assessment tax return and apply for SED, you’ll need to submit the following records to HMRC:

- Photocopy from your discharge book

- If not shown in your discharge book, proof of a foreign port

- Boarding cards if you flew out to join your vessel earlier than the date shown in your discharge book, the same with returning back to the UK

- Details of any courses or holidays abroad, such as flight tickets, boarding cards, accommodation receipts, or visa/credit cards receipts

- P60/P45 from any PAYE employment during the tax year

- Wage slips or bank statements showing the gross amounts received

- Employment contract

How can Flying Fish help with my tax?

If you’re worried about completing your seafarers tax return or are confused with all the information out there, we can take the weight off your shoulders. The Flying Fish seafarers’ tax service is available for just £210, and we’ll complete and file your tax return for you – so you can enjoy your career at sea, completely stress free!

Get ready to sail away into the sunset with Flying Fish

We hope that answers all your questions on paying tax when you work on a cruise ship!

In addition to tax advice, here at Flying Fish we also offer a range of specialist courses to help you set sail into your dream job.

The SCTW Basic Safety Training Course is a requirement for all crew who want to work at sea on all commercial vessels, including cruise ships, ferries, and Superyachts – so be sure to sign up for our six-day training course and kick-start your cruise ship career here .

Related articles

- Seafarers Tax

5 ways to ensure your SED claim is rock solid

The Seafarers’ Earnings Deduction, often referred to as the SED, is a tax legislation that enables seafarers to claim back their UK income tax. It a...

Do I need to pay off my Student loan if I work on a Superyacht?

Good question! First, let me say that the information below is aimed at people who have studied in the UK and took out a Student Loan to cover course ...

Have I got the right experience to work in yachting?

If you’re thinking about working on board a Superyacht, we share the skills and experience you need and how to get into the yachting industry in thi...

- Cruise News

Fact Check: Do Cruise Lines Pay US Taxes?

Ashley Kosciolek

- June 15, 2020

As many states prepare to reopen after three months of self-isolation and social distancing, cruisers are finding the travel itch a bit difficult to scratch.

Whether or not cruise lines will return to service this summer is still up in the air, but as the mainstream media’s cruise line finger-pointing dies down, we’d like to continue dispelling some of the wild misreporting that’s been happening since February.

This second installment of Cruise Radio’s “Fact Check” series will address whether cruise lines — which largely source customers from North America — do, in fact, pay taxes in the United States and, if so, how much and to whom.

Do Cruise Lines Pay Taxes in the U.S.?

The short answer is yes, but there’s a bit more to it. Provisions under the U.S. Internal Revenue Code allow foreign corporations — like cruise lines — to do business in America without being taxed federally, as long as they are registered in countries that have reciprocal agreements with the U.S.

A big misunderstanding is the manner in which international shipping is handled under the tax code is not a “tax shelter.” It is how international shipping – long before there was a cruise industry – has been taxed. It is memorialized in numerous treaties that the U.S. has with other countries. Countries have not been able to find an equitable way to tax shipping that traverses international boundaries constantly.

READ MORE: How Much Are Port Fees and Taxes?

So to put it simply, the agreement is, “You don’t tax our ships and we won’t tax yours.”

It’s a mutual policy that equally benefits U.S. corporations that are, in return, able to do business internationally without being taxed in those countries.

Carnival Corp. — which operates Carnival Cruise Line, Princess Cruises, Holland America Line, Costa Cruises, Cunard Line and Seabourn Cruises — is registered in Panama; Royal Caribbean Cruises, Ltd. — operating Royal Caribbean International, Celebrity Cruises, Azamara Cruises and Silversea Cruises — is registered in Liberia; and Norwegian Cruise Line Holdings — which comprises Norwegian Cruise Line, Regent Seven Seas Cruises and Oceania Cruises — is registered in Bermuda.

A representative from Carnival Corp. told Cruise Radio that, in addition to the taxes it paid to the U.S. Federal Government in 2019, the corporation shelled out an additional $600 million in port taxes and fees directly to port cities in the United States.

According to the Internal Revenue Service (IRS), Panama, Liberia and Bermuda are all countries that have reciprocal tax agreements with the U.S. , so none of the aforementioned cruise lines pay federal taxes in the U.S.

However, they do pay docking fees to the U.S. ports they visit. They also pay per-passenger head taxes that range from about $5 to $15 per person in certain ports; on a midsize ship carrying 3,000 passengers, that amounts to between $15,000 and $45,000 per port call.

Further, cruise lines are subject to state income taxes, as well as various other taxes, such as a 33% tax on all gambling revenue generated while in Alaska waters.

Additionally, more than 420,000 U.S.-based employees or people associated with cruise industry pay federal and state income taxes.

How much do cruise lines pay in taxes?

In 2019, Carnival Corp. paid $71 million in taxes on $3.06 billion in income. In the same year, Royal Caribbean Cruises, Ltd. paid $25.5 million in taxes on $1.8 billion in income , and Norwegian Cruise Line Holdings paid $18.9 million in taxes on more than $911 million in income.

That works out to a tax rate of 2.32% for Carnival Corp., 1.4% for Royal Caribbean Cruises, Ltd . and 2.07% for Norwegian Cruise Line Holdings.

According to PricewaterhouseCoopers , the federal tax rate for foreign corporations that are not tax-exempt is 21%; when combined with state and local taxes, that rate goes up to 25.75% for non-tax-exempt foreign corporations.

Did cruise lines ask for a bailout from the U.S. Federal Government?

No. Despite many media outlets’ gleeful announcements that the cruise industry was excluded from U.S. bailouts, what they haven’t mentioned is that the cruise lines never asked to be included in the first place.

According to the Cruise Lines International Association (CLIA), the organization that collectively represents passenger cruise lines, the lines and their parent companies did not request federal assistance.

Although all three of the major cruise line parent companies were able to secure enough non-government funding to sustain themselves for the short term, they all imposed some variation of layoffs, furloughs and/or salary cuts on their employees .

It’s also important to recognize that cruise lines aren’t the only ones benefitting from U.S. tax law loopholes.

Many profitable Fortune 500 companies — including International Business Machines (IBM), Amazon, Molson Coors, Netflix, Apple and even General Motors, which did receive a government bailout in 2008 — also avoid paying federal taxes, according to a 2019 report by the Institute on Taxation and Economic Policy (ITEP).

Want more cruise line fact-checking?

Take a peek at our first installment, which addresses cleanliness standards on cruise ships , and stay tuned to Cruise Radio for additional coverage.

Recent Posts

Cruise passenger dead after going overboard near norway, parents miss cruise ship, teen sails on without them, carnival quietly removes benefit from vifp loyalty program, disney cruise ship passenger arrested at port everglades, share this post, related posts.

World Cruise Delayed Again by Failed Inspection, Passengers Left Waiting

Juneau, Alaska Strikes Deal with Cruise Lines on Passenger Limits

Bringing you 15 years of cruise industry experience. Cruise Radio prioritizes well-balanced cruise news coverage and accurate reporting, paired with ship reviews and tips.

Quick links

Cruise Radio, LLC © Copyright 2009-2024 | Website Designed By Insider Perks, Inc

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

- Follow Cruise Jobs on Facebook

- Follow Cruise Jobs on Instagram

Free emails with tips and advice on how to get a job on-board a cruise ship.

Tax Free Income

- Connie Motz

- 26 September 2010

The allure of the tax free income offered by cruise line employment is almost too much for job seekers to resist. But before you get too excited, it might 'pay' to conduct a little research into your country of residence and any maritime laws that may apply in regards to income.

In most cases, it's the responsibility of the individual worker to report any monies earned as income to their respective governments as declared by law. But in many cases, when a cruise ship employee works outside of his or her own country onboard a vessel where the employment contract is six months or more in duration, any income earned by that employee is not taxable by their country of origin.

Here are some examples of tax free income laws:

If you are an Australian citizen, you are required by law to pay tax on any foreign income earned. The Australian Government does provide an Exempt Foreign Employment Income policy (23AG), however, strict conditions apply regarding the type of employment and the policy does not generally apply to cruise line employment.

Canadian citizens are required to report all of their income regardless of the country of origin of that income and are expected to pay income tax accordingly. Technically, there is an Overseas Employment Tax Credit (IT-497R4) available, however, this tax credit only applies if the employee is working for a Canadian company overseas and within certain industries specified.

United Kingdom

When a person receives an income above the provided personal allowance, and is a resident of the UK or is based in the country for tax purposes, he or she is required to pay tax regardless of whether a part of that work is carried out abroad or overseas, such as the case of cruise ship employees.

Read more about UK Income Tax for employees on-board cruise ships .

United States of America

All U.S. citizens working for a U.S. based cruise line such as Norwegian Cruise Lines or Carnival Cruise Lines, will automatically have income tax deducted from their paychecks as per federal and state laws. Depending on individual circumstances, regulations within the Internal Revenue Service (IRS) Foreign Earned Income and Housing Exclusions/Deductions (Publication 54) may apply.

If you're concerned about whether or not you'll be able to earn tax free income while working onboard a cruise ship and since laws can be confusing, it's best to consult a professional certified accountant who will provide you with tax advice and an interpretation of the law in regards to your own specific overseas employment situation.

Cruise Ship Central

Essential information to enjoy your cruise.

Do Cruise Ship Residents Need to Pay Taxes?

Living on a cruise ship may sound like a dream come true, but have you ever wondered if the residents aboard these floating paradises need to pay taxes? It’s a question that has piqued the curiosity of many, and in this article, I will explore the intriguing world of cruise ship residency and shed some light on the tax implications for those who choose to call these luxurious vessels their home. From international laws to individual circumstances, let’s unravel the mystery surrounding the tax responsibilities of cruise ship residents.

Table of Contents

Living on a cruise ship may seem like a dream come true for many. The idea of sailing the seas, exploring new destinations, and enjoying all the amenities and activities that a cruise ship has to offer is incredibly appealing. However, when it comes to taxes, things can get a bit more complicated. In this article, I will explore the topic of cruise ship residency and whether or not residents need to pay taxes.

Introduction to Cruise Ship Residency

Cruise ship residency refers to the practice of living on a cruise ship for an extended period of time. Instead of owning or renting a traditional home, individuals choose to make a cruise ship their permanent residence. This lifestyle allows for a unique blend of travel, adventure, and luxury.

Definition of Cruise Ship Residency

Cruise ship residency is not recognized as an official residency by most countries. Instead, it is usually considered as a temporary or transient status. While cruise ship residents may spend a significant amount of time on the ship, their legal residency is still typically tied to a land-based address.

Advantages and Disadvantages of Living on a Cruise Ship

Living on a cruise ship certainly has its perks. Residents have access to a wide array of amenities, including restaurants, entertainment venues, fitness centers, and pools. They also get to travel to different destinations without the hassle of packing and unpacking.

However, there are also some disadvantages to consider. Limited space and privacy, the need to constantly adapt to new surroundings, and the potential for seasickness are just a few of the challenges that cruise ship residents may face.

Increasing Popularity of Cruise Ship Residency

In recent years, there has been a growing interest in cruise ship residency. Some individuals, particularly retirees, are drawn to the idea of an all-inclusive lifestyle with minimal responsibilities. The appeal of exploring new places and forging new social connections has contributed to the rise in popularity of this unique form of residency.

Residency Status for Tax Purposes

Determining residency status is crucial when it comes to taxation. Your residency status determines which country’s tax laws apply to you and whether or not you are required to pay taxes. However, for cruise ship residents, establishing a clear residency status can be challenging.

Importance of Residency Status

Residency status is important because it determines your tax obligations, including the reporting of worldwide income, eligibility for tax credits and deductions, and the need to file tax returns. It is essential to understand the rules and regulations surrounding residency status to ensure compliance with tax laws.

Different Residency Definitions

Each country has its own criteria for determining residency status. Common factors include the number of days spent in the country, the purpose of the visit, and ties to the country such as property ownership or family connections. It is important to consult with a tax professional or refer to the specific tax laws of the country in question to determine residency status.

Impact of Residency on Tax Obligations

Residency status significantly impacts your tax obligations. For example, if you are considered a resident of a particular country, you may be required to report and pay taxes on your worldwide income. Non-residents, on the other hand, may only need to report income earned within the country’s borders. Understanding your residency status is essential for determining your tax obligations as a cruise ship resident.

Determining Factors for Tax Obligations

Determining your tax obligations as a cruise ship resident relies on several key factors. These factors help to establish your presence in a particular country and whether or not you are liable for paying taxes.

Physical Presence Test

The physical presence test is a common method used to determine tax obligations. It typically involves counting the number of days spent in a specific country within a given tax year. Different countries may have different requirements for how many days must be spent within their borders for tax residency purposes.

Substantial Presence Test

The substantial presence test is another tool used to determine tax obligations. It takes into account both the number of days spent in a country and the overall presence over a three-year period. This test aims to determine whether an individual has a significant presence in a country and is therefore subject to its tax laws.

Tax Treaties and International Agreements

Tax treaties and international agreements between countries can also impact tax obligations for cruise ship residents. These agreements often outline specific provisions for individuals who may be subject to taxation in multiple countries. It is important to review the relevant tax treaties and agreements to understand how they may impact your tax situation.

Residency Rules for Different Countries

Tax regulations for cruise ship residents vary depending on the country. Here, we will explore the residency rules and tax requirements for residents of the United States, Canada, and the European Union.

Tax Regulations for United States Residents

For residents of the United States, tax residency is primarily determined by the number of days spent within the country. The Internal Revenue Service (IRS) requires U.S. citizens and resident aliens to report their worldwide income, regardless of where they live. However, there are certain exclusions and deductions available for income earned overseas.

Tax Laws for Canadian Residents

In Canada, residency is determined by several factors such as the length and frequency of visits to the country, residential ties, social ties, and economic ties. Residents of Canada are generally required to report their worldwide income, including income earned on a cruise ship, to the Canada Revenue Agency (CRA).

Tax Requirements for European Union Residents

The tax requirements for residents of European Union (EU) member states can vary depending on the country. Some EU countries adopt the physical presence test, while others may consider factors such as the purpose of the visit or the individual’s intention to establish a permanent home in the country.

Taxation of Earnings while on Cruise Ships

Cruise ship residents may earn income through various means while onboard the ship. Understanding how these earnings are taxed is essential for complying with tax laws.

Income Sourced within the Cruise Ship Industry

If you are employed directly by a cruise ship company, the income you earn while working onboard is considered sourced within the cruise ship industry. This income is typically subject to income tax and should be reported accordingly.

Taxation Laws for Earnings from Cruise Ship Employment

The taxation of earnings from cruise ship employment can be complex. It may depend on factors such as your residency status, the country in which the ship is registered, and any applicable tax treaties. Consulting with a tax professional is recommended to ensure compliance with tax laws and to understand any potential tax credits or deductions that may be available.

Taxation of Income from Onshore Activities

While living on a cruise ship, residents may engage in onshore activities to supplement their income. Understanding the tax implications of these activities is important for remaining in compliance with tax laws.

Tax Considerations for Onshore Work while Living on a Cruise Ship

Income earned from onshore work is generally subject to taxation and should be reported accordingly. It is important to keep thorough records of any income earned from onshore activities and consult with a tax professional to determine the appropriate reporting and tax obligations.

Tax Exemptions for Income Earned Offshore

Some countries offer tax exemptions for income earned offshore, particularly if the income is not sourced within the country’s borders. However, the availability of these exemptions may depend on your residency status, the specific country’s tax laws, and any applicable tax treaties. It is important to research and understand the tax laws and exemptions of the country in which you reside as a cruise ship resident.

Tax Benefits for Cruise Ship Employees

Cruise ship employees may be eligible for certain tax benefits offered by cruise ship companies. These benefits can help reduce tax obligations and increase the overall financial well-being of employees.

Employee Benefits Offered by Cruise Ship Companies

Cruise ship companies often provide employee benefits such as accommodation, meals, healthcare, and transportation. These benefits can greatly enhance the quality of life for cruise ship employees and may be provided tax-free or with certain tax advantages.

Tax Implications of Employee Benefits

While some employee benefits may be provided tax-free, others may be subject to taxation. It is important to understand the tax implications of these benefits and consult with a tax professional to ensure compliance with tax laws and to take advantage of any available tax deductions or credits.

Tax Exemptions for Long-Term Cruise Ship Residents

Long-term cruise ship residents may be eligible for certain tax exemptions and incentives. These exemptions can help reduce or eliminate tax obligations, providing additional financial benefits.

Criteria for Qualifying as a Long-Term Cruise Ship Resident

Each country has its own criteria for determining long-term residency. Some countries require a specific minimum number of days to be spent within their borders, while others consider factors such as intent to establish a permanent home or ties to the country. It is important to research and understand the specific criteria for long-term residency in the country in which you reside as a cruise ship resident.

Tax Exemptions and Incentives for Long-Term Residents

Long-term cruise ship residents may be eligible for various tax exemptions and incentives. These can include exemptions on certain types of income, deductions for living expenses, or reduced tax rates. It is important to consult with a tax professional or refer to the specific tax laws of the country in question to understand the available exemptions and incentives for long-term residents.

Common Tax Issues for Cruise Ship Residents

Cruise ship residents may encounter several common tax issues. These issues can range from determining residency status and reporting income accurately to understanding tax obligations in multiple countries.

Some common tax issues for cruise ship residents include:

- Determining the correct residency status.

- Understanding and complying with reporting requirements for global income.

- Navigating tax laws and obligations in multiple countries.

- Determining the tax treatment of employee benefits.

- Identifying and utilizing available tax credits and deductions.

To navigate these tax issues effectively, it is highly recommended to consult with a tax professional who specializes in international taxation and understands the specific challenges faced by cruise ship residents.

Reporting Requirements for Cruise Ship Residents

Cruise ship residents are generally required to meet certain reporting obligations. These obligations ensure transparency and compliance with tax laws.

Tax Filing Obligations

Depending on your residency status and the country in which you reside, you may be required to file tax returns. Filing obligations can vary in terms of frequency and complexity, so it is essential to understand the specific requirements of your country of residence.

Forms and Schedules for Reporting Income

Cruise ship residents may need to use specific forms and schedules when reporting their income. These forms and schedules are designed to capture relevant information about worldwide income, deductions, and any tax credits or exemptions for which one may be eligible. It is important to consult with a tax professional to determine the appropriate forms and schedules to use when filing your tax returns.

Recordkeeping Requirements

Maintaining accurate and thorough records is essential for cruise ship residents. This includes keeping receipts, employment contracts, and bank statements, as well as documenting travel dates and destinations. Adequate recordkeeping is crucial for accurately reporting income and ensuring compliance with tax laws.

In conclusion, cruise ship residents may need to pay taxes depending on their residency status, the country in which they reside, and the specific tax laws of that country. Determining residency status, understanding tax obligations and exemptions, and meeting reporting requirements are all essential for cruise ship residents. Consulting with a tax professional who specializes in international taxation is highly recommended to navigate these complexities effectively and ensure compliance with tax laws.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Follow us on Facebook

- Follow us on Twitter

- Follow us on YouTube

- Follow us on Pinterest

- Connect with us on LinkedIn

- Subscribe to our blog

- Cool and Unique Jobs (Check them out!)

- Take a Gap Year!

- Alaska Fishing Industry

- On-Demand Delivery Jobs

- Wine Industry Jobs

- Nursing Jobs (High Demand)

- Truck Driving Jobs (High Demand)

- Security Mercenary Jobs

- Becoming a Male Model

- Drone Operator Jobs

- Jobs in the Renewable Energy Industry

- On-Demand Odd Jobs

- Distillery Jobs

- Beach Resort Jobs

- Tour / Travel Gigs

- Pet Sitting Jobs

- Land Tour Section

- Animal Jobs Section

- Working Abroad

- Shared Economy Jobs Section

- Cicerone, Beer Sommelier Jobs

- Teaching / Tutoring / Coaching Gigs

- Backpacking Trip Leader Jobs

Cruise Line Employee Pay, Benefits, and other Compensation

Pay is a big factor for cruise ship employees. If you’ve found yourself wondering how much you can earn and how much you can save while working on a cruise ship, you’re not alone. Here we discuss in greater detail some of the earning potential and pay-related issues that cruise ship employees commonly ask about.

The pay you can earn by working on a cruise ship is largely determined by your position. There are, however, a number of other factors that can contribute to your earnings. The size of the ship, the type of ship, the clientele, the cruise liner, tips earned and your job experience will all affect your earning potential. How much you earn will also depend on whether or not your pay is salary or commission-based. Each of these factors should be taken into account when trying to forecast the money you can earn or save by working in the cruise industry.

As a paid cruise ship employee you will have to pay all the income taxes you would normally pay working at a land-based job. Keep in mind though, that there are some big differences to land-based jobs. For example, in most cases, on a cruise ship, your cabin is free. Additionally, for the duration of your contract you will likely have no grocery bills, and in many cases, uniforms are provided by the cruise line. Some companies will even pay laundry expenses. This means that it is possible to bank nearly all your earnings, especially if you don’t have too many land-based expenses.

“I would have saved virtually everything, but I had a lot of shore -based bills, like a car and student loan payments. Before you go, definitely get rid of expenses you don’t need while on board, like car and rent payments. Practically everything was paid for, we really didn’t have any living worries at all. No cooking, no laundry, and our rooms were cleaned for us every day; we even got free dry-cleaning. We did have to pay our room steward ten dollars per week, and that was pretty much it. Of course, alcohol and restaurant stuff is really expensive on the ship. For instance, a beer cost almost four bucks, so if you go over your bar allowance (which I always did), it can cost you a lot.”

A gift shop employee offers this insight:

“I managed to save some money during my six-month contract since I had no expenses and my commissions [tips] started adding up. I could have saved a lot more, though, if I hadn’t done so much shopping in the different ports of call that I went to. Unfortunately, we visited Hawaii right before the end of my contract, and I really spent a lot of money there. I knew someone who worked in a gift shop on a ship and came back after ten months with $12,000 in the bank, but most people don’t make close to this much. Commissions varied a lot, and the most I ever got was $800 a month. A lot of it depends on what kind of passengers you have. Our line was kind of a budget one that offered lower prices. We jokingly called it ‘K-Mart Cruises.’ The passengers tended to be cheap, but that’s not true on all lines. Some of them are really upscale.”

It is true that compensation can vary greatly from cruise line to cruise line. However, on large lines, staff and entry-level positions such as aerobics instructors, youth counselors, junior purser , disc jockeys, and hosts, will receive an industry-standard wage around $1,200-$1,500 per month. Casino workers, waiters, and bartenders depend heavily on tips, which can sometimes double salaries.

Positions such as these tend to be in high demand because of the increased earning potential, and not surprisingly, are harder to procure.

Raises are relatively rare for people who remain the cruise staff, although wages will increase with experience on some ships. Wages increase dramatically when a staff member takes on a new position like that of a cruise director or assistant cruise director. In positions like these, cruise ship employees can make as much as $4,500 a month. Keep in mind though, that these positions are very competitive. One of the top-earning positions onboard is that of a cruise director, a position that can command as much as $80,000 per year! Although, the average cruise ship director salary is $50,000 annually. Of course, competition for these positions can be fierce, with many qualified applicants competing for only two or three positions per ship.

So what can you expect to make? The majority of positions are based on an hourly wage and most employment opportunities on a cruise ship earn $1,200-$1,500 a month. There are though, a large number of positions that can make as much as $2,500 a month equating to $13 an hour. Because work weeks on a cruise ship are typically longer than your typical work week, a cruise ship employee can expect to work over 45 hours in a week on average. Some cruise ship employees will work closer to 60. While this may seem long and arduous, the earning potential of all those hours worked is an excellent payoff.

Again, earnings will vary depending on the cruise line you are contracted with, but in general, you can expect to at least secure a comfortable existence while on board, and have money in your pocket when you depart. Most cruise ship employees do.

Almost every cruise line offers a cruise discount for employees who have been with the company for over a year. Taking your family on a cruise for as little as $15 a day can add up to thousands of dollars in saved vacation expenses, and give your family the chance to see places they might not be able to otherwise experience. While you probably won’t become a million by going to sea , it is possible to enrich your life with a healthy sum of money, and, perhaps more importantly, fond memories.

- Subcribe to our blog

Do cruise ship employees pay US taxes?

Faqs about taxes for cruise ship employees:, 1. are there any tax benefits for cruise ship employees, 2. how much income can i exclude using the feie, 3. what is the fica tax, 4. who qualifies for fica tax exemptions, 5. do non-us citizens working on cruise ships pay us taxes, 6. can i claim deductions for expenses related to my work on a cruise ship, 7. how do i file my us tax return as a cruise ship employee, 8. can i receive a tax refund as a cruise ship employee, 9. are there any penalties for not paying taxes as a cruise ship employee, 10. can i still contribute to social security while working on a cruise ship, 11. can i deduct my travel expenses to and from the cruise ship, 12. how can i ensure i am compliant with us tax laws as a cruise ship employee.

Yes, cruise ship employees do pay US taxes. However, the taxation process for cruise ship employees can be quite complex and can vary depending on a range of factors, including the individual’s citizenship, the cruise line they work for, and the duration of their employment. In general, if you are a US citizen or a permanent resident, you are required to pay taxes on your worldwide income, including earnings from working on a cruise ship.

The Internal Revenue Service (IRS) considers cruise ship employees as working abroad, and therefore, they may qualify for certain tax benefits, such as the Foreign Earned Income Exclusion (FEIE) or the Foreign Housing Exclusion (FHE). These exclusions allow individuals to exclude a certain amount of their foreign earned income from being taxed. For the tax year 2021, the FEIE amount is $108,700.

Additionally, cruise ship employees may also have to pay Social Security and Medicare taxes, known as the Federal Insurance Contributions Act (FICA) taxes. However, there are certain exceptions and exemptions available for individuals who perform services on foreign-flagged vessels, which may reduce their FICA tax liability.

It is important for cruise ship employees to consult with a tax professional or seek guidance from the IRS to ensure they meet their tax obligations and take advantage of any available deductions or credits.

Yes, cruise ship employees may qualify for tax benefits such as the Foreign Earned Income Exclusion (FEIE) or the Foreign Housing Exclusion (FHE). These exclusions allow individuals to exclude a certain amount of their foreign earned income from being taxed.

For the tax year 2021, the FEIE amount is $108,700. This means you can exclude up to $108,700 of your foreign earned income from being taxed.

The Federal Insurance Contributions Act (FICA) tax consists of Social Security and Medicare taxes. Cruise ship employees may have to pay FICA taxes, unless they qualify for certain exceptions and exemptions.

Cruise ship employees who perform services on foreign-flagged vessels may qualify for FICA tax exemptions. It is important to understand the specific rules and conditions for these exemptions, as they can vary depending on the individual’s situation.

Non-US citizens working on cruise ships may still be subject to US taxes, depending on various factors such as the country they are from, the cruise line they work for, and the length of their employment. It is advisable for non-US citizens to consult with a tax professional to determine their specific tax obligations.

Yes, as a cruise ship employee, you may be eligible to claim deductions for certain work-related expenses, such as uniforms, equipment, or travel expenses. It is recommended to keep detailed records of these expenses and consult with a tax professional to ensure you are claiming all eligible deductions.

Cruise ship employees can file their US tax return using Form 1040 or Form 1040NR, depending on their residency status. It is recommended to seek guidance from a tax professional or use tax preparation software specifically designed for international workers.

Yes, it is possible for cruise ship employees to receive a tax refund if they have paid more in taxes than their actual tax liability. This typically happens if they qualify for certain deductions, credits, or exclusions.

Failure to pay taxes or comply with tax obligations can result in penalties imposed by the IRS. It is important to fulfill all tax obligations and seek professional advice if you are unsure about the requirements.

Cruise ship employees may still be required to contribute to Social Security, depending on their employment contract and the cruise line they work for. However, there may be exceptions and exemptions available for individuals who perform services on foreign-flagged vessels.

Depending on your specific circumstances, you may be eligible to deduct travel expenses related to your work on a cruise ship. It is recommended to consult with a tax professional to understand the rules and requirements for claiming such deductions.

To ensure compliance with US tax laws, it is advisable for cruise ship employees to seek guidance from tax professionals who specialize in international taxation. They can assist in understanding your tax obligations, maximizing deductions, and filing accurate tax returns. Additionally, keeping detailed records of income and expenses related to your work on a cruise ship can help support your compliance efforts.

Please note that tax laws and regulations can change, and it is essential to keep abreast of any updates or changes that may affect your specific tax situation.

About The Author

Kevin Johnson

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Will the Cruise Industry Navigate Around the Minimum Tax?—Part 1

The cruise industry is in the process of recovering from Covid-19. Royal Caribbean Cruises Ltd., a Liberian corporation that is publicly traded and is the world’s second-largest cruise ship operator, reported financial accounting income of approximately $2 billion in 2019. The company reported a $6 billion financial accounting loss in 2020, a $5 billion financial accounting loss in 2021, and a $3 billion annualized financial accounting loss in the first half of 2022. But in a September 2022 8-K filing, Royal Caribbean reported that its bookings have exceeded 2019 levels since its Covid-19 restrictions were eased in August.

Section 883

Royal Caribbean’s 202110-K acknowledges that the company and several of its principal subsidiaries, which also are incorporated in Liberia, are, in connection with operating cruises between US and foreign ports, engaged in a trade or business in the US and deriving US source income. The 10-K observes that Section 883 generally provides corporations a statutory exclusion from gross income and, as a practical matter, provides a US corporate income tax and US corporate branch tax exemption, for the shipping income of foreign corporations whose country of incorporation provides US corporate shipowners a reciprocal exemption.

Specifically, Section 883 provides that qualifying shipping income “shall not be included in gross income of a foreign corporation, and shall be exempt from taxation under this [income tax] subtitle.” Conversely, IRS Rev. Rul. 80-147 and Treas. Reg. 1.883-1(j) imply that expenses attributable to such exempt income are not deductible and cannot create a US net operating loss carryforward against effectively connected non-exempt, non-shipping income.

The IRS, relying on an exchange of diplomatic notes between Liberia and the US, concluded in Rev. Rul. 2008-17 that Liberia is such a reciprocating country. Accordingly, for regular US corporate income tax purposes, Royal Caribbean and its financial-accounting-consolidated Liberian subsidiaries appear to have relatively little US effectively connected income or loss from their shipping activities.

Royal Caribbean’s 10-K notes that the Treasury Regulations—namely Treas. Reg. 1.883-1(h)(2) —disqualify certain income from the Section 883 tax exemption. Such disqualified income includes providing tours of the city of Miami before or after cruises end there.

Corporate Alternative Minimum Tax

Beginning in 2023, the Inflation Reduction Act of 2022 can impose a US corporate minimum income tax on certain foreign-parented corporate groups whose average worldwide adjusted financial statement income exceeds $1 billion.

However, CAMT only applies in a limited fashion to such foreign-parented groups. Section 56A(c) states that in determining the amount of a foreign corporation’s AFSI, “the principles of Section 882 shall apply.” CAMT generally only applies to a foreign-parented group if the group’s AFSI is at least $100 million, considering the application of limitation of Section 56A(c)(4) to foreign corporate members of the group. A foreign-parented group, even one with worldwide AFSI exceeding $1 billion, must have a minimum of $100 million in AFSI to be subjected to CAMT, excluding US net income of foreign group members excluded under the principles of Section 882 and 56A(c)(4).

If a foreign-parented group, apparently including Royal Caribbean, has more than $1 billion of worldwide AFSI, it will not be subject to CAMT if the group’s income that is not exempted under Section 56A(c)(4), such as non-exempt income described in Treas. Reg 1.883-1(h)(2), is less than $100 million. Even if such a group has $1 billion of worldwide AFSI and at least $100 million in Section 56A(c)(4)-limited AFSI, the AFSI tax base of the CAMT is limited by Section 56A(c)(4).

The cruise industry faces some ambiguity on the interaction of Section 883 with Section 56A(c)(4). For example, several of Royal Caribbean’s cruises sail from Fort Lauderdale, Miami, or Port Canaveral, Fla., to Nassau, Bahamas, and then return to Florida. Under Section 863(c)(3) , 50% of the passenger revenue of such cruises is treated as US source effectively connected income described in Section 882. See TAM 9348001 . However, Section 883 can exempt this 50% from regular US corporate income tax and branch profits tax. For purposes of the $100 million AFSI threshold, and the CAMT tax base if such $100 million is exceeded, would AFSI include 100%, 50%, or none of such Florida–Bahamas cruise income?

Section 59(k)(2)(A) treats Section 56A(c)(4) as inapplicable to foreign-parented groups only to determine whether the $1 billion worldwide AFSI threshold is met, not to determine whether the $100 million threshold is met or, if so, what the CAMT tax base is. Therefore, it seems that the IRS could not include 100% of Royal Caribbean’s Florida–Bahamas round trip passenger income in AFSI in determining whether the $100 million threshold is met or, if so, what the CAMT tax base is.

With respect to inclusion of 50% of Royal Caribbean’s Florida–Bahamas round trip passenger income in AFSI, the situation is less clear. As noted, Section 56A(c)(4) states that “in the case of a foreign corporation, to determine [AFSI], the principles of Section 882 shall apply.” Some IRS rulings are unclear on the question, which was academic before the enactment of the CAMT, as to whether such reciprocally exempt shipping income should be viewed as effectively connected income under the principles of Section 882 but excludable under the independent application of Section 883, or as excludable from Section 882 consideration in the first instance. Compare Rev. Rul. 87-15 —which states that “[a] portion of [the shipping company’s] income [is] effectively connected with a United States trade or business....Such income, however, is exempt from United States tax under the reciprocal shipping exemption of Section 883(a)(1)”—with PLR 8129051 , in which the IRS National Office notes, without adverse comment, that the shipping company concluded that its revenue was excluded from its “gross income under Section 882(b) by reason of the ‘reciprocal exemption’ provisions of Section 883(a)(1).”

Under the cruise-line-unfavorable view that Section 56A(c)(4) only incorporates the exceptions in Section 882 and not those in Section 883, the 50% of the passenger net revenue characterized as effectively connected income could be includable in AFSI. In the short term, the application by Section 59A of a three-year average in determining applicable corporation status, and the allowance to applicable corporations by Section 56A(d) of an unlimited carryforward of post-2019 financial statement losses to offset up to 80% of current year AFSI, could reduce the CAMT exposure to Royal Caribbean and other cruise lines, whose businesses were harmed by Covid-19 between 2020 and 2022. Under the cruise-line-favorable view that Section 56A(c)(4) also incorporates the exceptions in Section 883, 0% would be includable in AFSI.

Some cruise lines companies, such as Royal Caribbean, have ship-owning subsidiaries that lease the ships to affiliates who operate the cruises. These ship-owning subsidiaries apply Section 883 to avoid being subject to the otherwise applicable Section 887 4% gross transportation tax on their US non-effectively connected source income. The analogous issue exists as to whether such income is exempted from inclusion in AFSI under Section 56A(c)(4). Another analogous issue exists as to whether any shipping or other income that is exempt from US corporate income tax and US transportation tax under the terms of an income tax treaty is likewise excepted by Section 56A(c)(4).

A source of optimism to the cruise line industry is that in former Treas. Reg. Sections 1.56-1(b)(6)(ii)(B) and 1.56(g)-1(m)(4), dealing with the analogous repealed corporate alternative minimum tax on book income and adjusted current earnings preferences, the Treasury favorably excluded earnings of a foreign shipping company attributable to its Section 883 or treaty income that was exempt from regular US corporate income tax.

Part 2 of this article will consider whether the OECD Pillar Two minimum tax can apply to cruise line income.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Author Information

Alan S. Lederman is a shareholder at Gunster, Yoakley & Stewart, P.A. in Fort Lauderdale, Fla.

We’d love to hear your smart, original take: Write for Us

Learn more about Bloomberg Tax or Log In to keep reading:

Learn about bloomberg tax.

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools.

This is the announcement bar for Poornima to test the Close Button. It will expire May 31 2024.

- Pre-Cruise FAQ

- Onboard FAQ

- Post-Cruise FAQ

- Cruisetours FAQ

- Special Offers Sign Up

- Cruise Deals

You have been logged out

Your window will update in 5 secs

Onboard Employment FAQ

Are you interested in joining the thousands of worldwide employees who are proud to be part of the Princess Cruises family? We are committed to being an employer of choice and understand that our Consummate Hosts need to be supported, empowered, and recognized.

We also understand that working at sea can be a challenging new opportunity. Here are answers to some essential questions you might have when considering cruise ship employment.

- What are the requirements to work onboard?

What is a C1/D visa?

How do i get a medical certificate, which ship will i be assigned to, how do i get to and from the ship i am assigned to, do i need travel insurance, how long will i be onboard, can i get off and go home during the contract, will i have my own room, what is the power voltage in my cabin, can i drink alcohol onboard, is there a drug policy, is there a curfew, can i bring a family member or friend onboard, will i have access to guest areas and amenities during my time off, once onboard, how do i stay in touch with my friends and family back home, can i have mail delivered to the ship, is there an atm onboard to use, will i have to pay taxes, can i send money home from onboard, how do i pay for items onboard, how do i do laundry, what if i miss the ship in port, what happens if i get sick while working onboard, can i visit the ports while working onboard, how do i apply to work onboard, what are the requirements for onboard employment.

While specific position requirements depend on the job you are interested in, there are some essential requirements that all crew must meet to work onboard:

- Be 21 years of age or older

- Be able to pass a criminal background check

- Hold a valid passport

- Have a US C1/D visa (if you are not a Canadian or US citizen/resident)

- Have a Princess-specific pre-employment medical exam certificate

- Meet the English fluency requirements relevant to your position

Also known as a seaman's visa, some nationalities need this to work onboard a ship and travel to certain countries. This visa normally lasts between two and five years. You will be required to make an appointment at your nearest US Embassy to gain this visa; all paperwork for the appointment will be supplied by your manning agency.

This extensive examination is at the employee's expense and can be conducted through one of Princess's recommended medical facilities—you'll be advised which one is closest to you. Once this is completed and approved by our corporate Medical department, you are cleared to travel and work onboard.

Shipboard employees are scheduled to vessels based on operational need. This means you could be assigned to any one of our vessels in the fleet depending on where a position is open at the time you are travel-ready. After your first assignment, we will be able to provide details about the next assignment after your leave period.

At the beginning of each contract Princess Cruises will provide flights from your designated airport to your assigned ship. At the completion of your contract, Princess will arrange for your travel back home as well. It is your responsibility to get to the airport from your home, but from there we will provide any necessary accommodations and/or transportation to and from the ship.

While you are covered medically in Los Angeles and onboard the vessel, we suggest you purchase basic travel insurance to cover the cost of lost luggage or injuries that could result from shoreside activities.

Contract lengths vary by position but range between four and ten months. After each contract you will receive approximately 60 days of vacation before your next assignment. Your daily work schedule while onboard will depend on your particular position, but you can expect to work seven days a week and anywhere between 10-13 hours per day.

Time off during the contract is not permitted. In case of family emergencies, Princess Cruises does understand that additional time at home may be needed and does accommodate these requests on a case-by-case basis.

Accommodations vary depending on the ship and position. Those in non-management positions generally share a cabin with one to three other roommates whereas those in most management positions are entitled to a single cabin. Cabins include a storage space, TV, and DVD player.

All vessels have 120v US power and some vessels also have 220v European power.

Yes, alcohol is available for purchase during time off. However, Princess Cruises has a strict alcohol limit and at no time can a crew member be intoxicated.

Princess has a zero-tolerance drug policy. All crew are subject to random and reasonable-suspicion drug testing. Violation of these policies will result in termination.

There is no set curfew. However, crew who are out late should be respectful of other crew members and guests nearby.

Crew members who meet specific length-of-service criteria have the option of requesting "relatives travel," a benefit that allows family members to sail onboard for a limited period of time. Some restrictions may apply.

While some officer-level positions do allow restricted access to guest areas, most facilities are for guests only. However, we have a variety of crew-only facilities, such as a crew pool, whirlpool, gym, bar, and Crew Club, which is a communal room where you can gather to watch movies, play games, sing karaoke, and much more!

Postal mail services are available while onboard. You will also have access to computers in the crew training areas. Wi-fi Internet is also available in the crew areas if you choose to bring your own laptop or tablet. Princess offers discounted rates for phone and Internet cards so you can stay in touch with those at home. But remember that satellite capabilities are sometimes limited while the ship is at sea.

You will be provided with mailing addresses for ports where mail can best be delivered.

There is an ATM in the guest areas; an ATM charge will apply. You can also cash checks in the Crew Office onboard to get cash.

US citizens will have federal taxes automatically deducted and may be required to pay state taxes, if applicable. All other nationalities are responsible for filing their own tax forms upon returning to their home countries (as they are self-employed).

You can wire money via the Crew Purser's office. Details are available onboard and rates may vary.

You will be provided with a bar account number, which is your personal number for the duration of your contract onboard each ship. As the entire vessel is cashless, even for guests, you will provide your account number at the bars, salon, and shops in guest areas. In the Crew Bar you can purchase a CrewCard and add money onto it for purchases. At the end of every month you will be required to settle your account.

There are crew laundry facilities where the washers and dryers are free of charge—you just provide the soap. You can also use the dry cleaning onboard, but there is a nominal cost.

Crew members who miss the ship should contact the ship's Agent who will be at the port (the address and phone number are always in the Princess Patter, a daily newsletter for our guests). The Port Agent will arrange transportation to the ship's next port of call. However, it is the responsibility of crew to pay these transportation costs. Crew may be disciplined for the offense and could be terminated. Depending on the port all crew members are required to be back onboard half an hour to an hour prior to sailing time.

While onboard, all crew are medically covered and can visit the Medical Clinic for health concerns. If you need to be medically disembarked during your contract, Princess will provide transportation to a land-based medical facility and repatriate you back home.

If you are not scheduled to work during the time the ship is in port, you can disembark the ship with your supervisor’s approval. Occasionally, there are crew-specific activities or tours to participate in.

Safety requirements dictate that a certain number of crew members be present on each vessel at all times. As such, there may occasionally be times when, although not scheduled to work, you will be required to remain onboard while the ship is in port.

Princess Cruises recruits globally through authorized hiring partners. Find a hiring partner located near you.

Once you contact the authorized hiring partner, you can get answers to questions regarding the application process and which positions are currently open in your region.

- Port Overview

- Transportation to the Port

- Uber & Lyft to the Port

- Dropping Off at the Port

- Cruise Parking

- Cruise Hotels

- Hotels with Parking Deals

- Uber & Lyft to the Ports

- Things to Do

- Cozumel Taxi Rates

- Free Things to Do

- Restaurants Near the Cruise Port

- Hotels & Resorts With Day Passes

- Closest Beaches to the Cruise Port

- Tips For Visiting

- Shore Excursions

- Cruise Parking Discounts

- Hotels with Shuttles

- Which Airport Should I Use?

- Transportation to the Ports

- Dropping Off at the Ports

- Fort Lauderdale Airport to Miami

- Inexpensive Hotels

- Hotels near the Port

- Hotels With Shuttles

- Budget Hotels

- Carnival Tips

- Drink Packages

- Specialty Restaurants

- Faster to the Fun

- More Articles

- CocoCay Tips

- Norwegian Tips

- Great Stirrup Cay

- Harvest Caye

- How to Get the Best Cruise Deal

- Best Time to Book a Cruise

- Best Websites to Book a Cruise

- Cruises Under $300

- Cruises Under $500

- Spring Break Cruise Deals

- Summer Cruise Deals

- Alaskan Cruise Deals

- 107 Cruise Secrets & Tips

- Tips for First-Time Cruisers

- What to Pack for a Cruise

- What to Pack (Alaska)

- Packing Checklist

- Cruising with Kids

- Passports & Birth Certificates

- Bringing Alcohol

- Cruising with a Disability

- Duty-Free Shopping

- Cruise Travel Insurance

- Things to Do on a Cruise Ship

- What Not to Do on a Ship

- News & Articles

Answered: How Much Money Do Crew Members on a Cruise Earn?

If you’re like many passengers, no matter what the crew members aboard a cruise ship earn, you still might not think it’s enough. One constant in cruising is an overall appreciation for the hard work that crew do to provide passengers with a great vacation.

The crew that you encounter on the cruise — such as the cabin stewards, dining staff and more — have jobs that are unlike what many of us have ever experienced.

For one, crew members work lengthy shifts. It’s not unusual, for instance, to see your cabin steward making his or her first rounds early in the morning and then doing another round to tidy up rooms late in the evening. And this pace happens day in and day out across all sorts of positions.

Not only is the work hard, but the crew is also doing it far from home. You’ll notice that large portions of the crew are from places like the Philippines, India, and China, among many other countries. Often, they are literally from places halfway around the world while families and friends are still back home.

And that distance isn’t just a factor for a few weeks. Crew operate under contracts that last for months. That means they can often stay and work on the ships for six months at a time before returning home.

To be sure, working on a cruise ship isn’t for everyone. Yet many do it for the opportunity to earn a living making more than what they would back home while also seeing parts of the world that many others never get the chance to visit.

So exactly how much do workers on a cruise ship earn?

“Median Employee” Earning Disclosure Required

First, there is no set rate that every person working on a cruise ship earns. Different positions on the ship will make different amounts. And on a modern cruise ship there are dozens if not hundreds of different roles, from the captain of the ship to kitchen staff.

That means there is no set compensation list for every cruise line that shows what different positions make (at least publicly).

But we do have the next best thing…

Major cruise lines like Carnival, Princess, Royal Caribbean, Celebrity, and Norwegian are actually part of larger public companies that trade on major stock exchanges. As a result, the parent companies are subject to certain SEC filing requirements.

Along with quarterly and annual reports, part of that requirement is a “Pay Ratio Disclosure” as part of the Dodd-Frank reform. Here, a company must detail the ratio of pay for a company CEO compared to the “median employee.”

That gives us not only a glimpse into how much the top brass at the company makes in total, but also what those who work on the ship earn as well.

How Much the Crew Makes on a Cruise

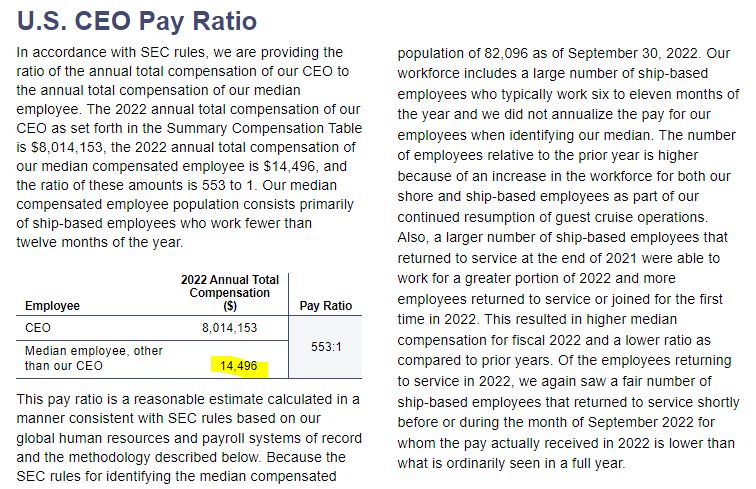

There are three major cruise companies that trade on public exchanges: Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings. Each shares the “median employee” wages via the CEO Pay Ratio disclosure in its filings.

Carnival Corporation includes lines like Carnival, Princess, Costa, and others. In 2022, the cruise company reported that its median employee earned $14,496 in total compensation. With a CEO total compensation of over $8 million, that comes to a pay ratio of 553:1.

Royal Caribbean Group includes names like Royal Caribbean, Celebrity, and more. In 2022, the company stated that its median employee earned $15,264 . Given total compensation to the CEO of $10.7 million, the pay ratio comes in at 705:1.

Finally, Norwegian Cruise Line Holdings , which includes NCL, Oceania and Regent Seven Seas filed that its total compensation for 2022 was $24,484 . Meanwhile, that company’s CEO took home compensation of more than $21 million. That is a pay ratio of 866:1.

For comparison, hotel company Hilton Worldwide Holdings reports a median employee compensation of $43,702 compared to over $23.5 million in compensation for the CEO. That’s a ratio of 539:1.

And according to the Economic Policy Institute, the average CEO-to-worker ratio reached 399:1 in 2021 , a new high.

Some More Things to Know About The Crew’s Compensation

There is little argument that if you want to get rich, then working on a cruise ship likely isn’t the path. That said, there is some context with these figures that bears mentioning.

First, as mentioned, the crew are internationally sourced, often from places where the cost of living is significantly lower than what we see in the United States. That can make the earnings — though low by American standards — more attractive.

Second, this compensation figure is based on what the “median employee” was paid over the course of the year. However, many employees do not work the entire year . According to Carnival Corporation’s disclosure, “our workforce includes a large number of ship-based employees who typically work six to eleven months of the year and we did not annualize the pay for our employees when identifying our median.”

Finally, when working on the ship, cruise crew are also provided with some benefits like room and board that aren’t usually included in regular jobs. As Norwegian stated, “our shipboard employees receive certain accommodations that are not typically provided to shoreside employees including housing and meals while on the ship and medical care for any injuries or illnesses that occur while in the service of the ship. These accommodations are free of cost to each shipboard employee.”

Even with that, however, there’s no doubt that by American standards, shipboard crew work extremely hard and for wages that many of us would not be willing to take.

And while the cruise lines make clear that this compensation figure includes wages and gratuities billed to passengers, they do not include any extra money paid to crew directly by guests . So the next time you’re feeling generous on a cruise, the crew would likely be happy to accept any extra gratuity.

Popular: 39 Useful Things to Pack (17 You Wouldn't Think Of)

Read next: park & cruise hotels for every port in america, popular: 107 best cruise tips, secrets, tricks, and freebies.

This is a typical crap article from cruise ship apologists. So really most people don’t get a good wage and saying maybe Americans won’t work for this, but they do. Relying on tips is a cop out. These hardworking people should be paid for every hour they work. I wouldn’t trust a metric 400-600:1! ; it’s a nonsense number. They pick overseas workers as they know they will just do the work.

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Carnival Cruise Casino Guide: What to Know Before You Play

Everything to know about interior cruise cabins (read before booking), 5 easy ways to get to the los angeles and long beach cruise ports, hotels with cruise shuttles for every major port in america, 107 best cruise tips, tricks, secrets, and freebies, 39 useful things to pack for your cruise (including 17 you’d never think of).

- Privacy Policy

- Terms & Conditions

- Ask a Cruise Question

Federal Income Tax