Online and mobile banking scheduled upgrade

Online and mobile banking will be unavailable on Saturday 18 May between 17:00 and 19:00 BST, and on Sunday 19 May between 00:00 and 06:00 BST. We apologise for any inconvenience this may cause. For anything urgent our customer service team will be available to support you during this time.

Our website doesn't support your browser so please upgrade.

Using your card abroad

Access your money worldwide, including local currency withdrawals and payments

Discover easier worldwide spending and payments when you open an Expat Bank Account.

Use your card worldwide

Enjoy the convenience of using your card wherever you see your card's logo. Fees apply.

- Use in any outlet that displays the Visa or Mastercard logo on your card

- ATM locator to help you find where you're able to use your visa debit or credit card abroad

- Fees apply and non-HSBC cash machines may also charge a fee[@cashwithdrawals]

Security while travelling

If you let us know you're away, we can manage your transactions more effectively while you're on holiday.

- We automatically monitor accounts for unusual foreign transactions

- We look out for possible fraud and declined transactions

- If you have a joint account you both need to notify us. For credit cards, only the primary cardholders needs to give us travel notifications

How to use your card abroad

Overseas usage fees .

Any non sterling transactions (including cash withdrawals) are converted to sterling by using the relevant payment scheme exchange rate applying on the day the conversion is made. We will deduct the payment and related transaction fees from your account once we receive details of the payment from the card scheme, at the latest the next working day.

Cost illustration (Visa)

Cost illustration of making a transaction abroad of EUR 100.00 using the Visa exchange rate on 6 June 2017 of 0.876855 = GBP 87.69 to which will be added the fees appropriate to your card and transaction.

See more information on the rate of exchange Visa used when converting your transaction.

Cost illustration (Mastercard)

Cost illustration of making a non-sterling transaction of EUR 100.00 using the Mastercard exchange rate on 5 June 2017 of 0.875944 = GBP 87.59 to which will be added the fees appropriate to your card and transaction.

See more information on the rate of exchange Mastercard used when converting your transaction.

You receive up to 56 days interest-free credit on credit card purchases if you pay your whole balance in full and on time. Please be aware that interest is charged from the date transactions are applied to your account until payment is received. There is no interest-free period on cash advances. Some cash machine operators may apply a direct charge for withdrawals from their cash machines and this will be advised on-screen at the time of withdrawal. ATM withdrawal limits are applicable.

You can use your card to make non-sterling cash withdrawals from self service machines operated by a third party and agree that the third party will perform the currency conversion for you. The applicable exchange rate, the amount of cash you will receive and the amount in sterling will be shown on the screen. The amount in sterling will be deducted from your account balance when we receive details of the payment from the self service machine operator, at the latest the next working day.

Travelling in the EEA

If you're travelling in the EEA[@eea], see how paying in local currency on your HSBC credit or debit card compares to the European Central Bank (ECB)'s latest foreign exchange rates .

Let us know when you're travelling

Tell us when you're away so we can manage your transactions more effectively.

- Tell us online using our online Live Chat service

- HSBC Premier customers call: +44 1534 616 313

- HSBC Advance customers call: +44 1534 616 212

Just so you know, we may monitor and record your communications with us. This is in the interest of security and to help us continually improve our service.

Start using your card abroad

Already with expat.

If you're already with HSBC Expat, simply activate your card to get started.

New to Expat?

You'll need to apply for an Expat Bank Account.

You might be interested in

Staying safe abroad.

Crisis24 security services offers international risk management for all Expat customers, covering everything from travel safety to identity theft.

Card support

Get help with all your card questions.

Guide to moving abroad

Read our 10-step guide to moving abroad to make sure you've got everything covered.

Additional information

Connect with us.

- Argentina

- Australia

- Brasil

- Česko

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- Nederland

- New Zealand

- Österreich

- Polska

- Portugal

- România

- Schweiz

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

HSBC Everyday Global Account Review

Learn about the HSBC Everyday Global Account in this review to help you decide whether this is the best card to use for your upcoming leisure or business travel

What is the HSBC Everyday Global Account?

The HSBC Everyday Global Account makes bringing cash overseas stress-free and simplifies your overseas purchases at home by allowing you to hold multiple currencies in the single debit account.

- Load and lock in the exchange rate of up to 10 currencies

- No additional overseas transaction or ATM fees

- Withdraw cash from any Visa ATM

The HSBC Everyday Global account bridges the gap between a debit card and a travel prepaid card. You can use your account for everyday buying at home, plus you won't have to worry about carrying lots of cash when you travel.

When you use your HSBC card, you're drawing money directly from your bank account when you make a purchase. It's designed for everyday money transactions and means you're not accumulating debt. And like a prepaid card, you can load the card with a set amount of money in the currencies you need even before you travel overseas.

In fact, you can load up to 10 currencies on your account including AUD, USD, EUR, SGD, NZD, JPY GBP, CAD, HKD and CNY (currency restrictions apply).

What if you want to take out cash while you're travelling? Well, you can without worrying about additional fees - this account comes with no account handling, overseas transaction, or international ATM fees.

If you need a new everyday spending account at home and you travel frequently to multiple overseas destinations, this account offers the convenience and flexibility you might need.

Pros and cons of using the HSBC Everyday Global Account

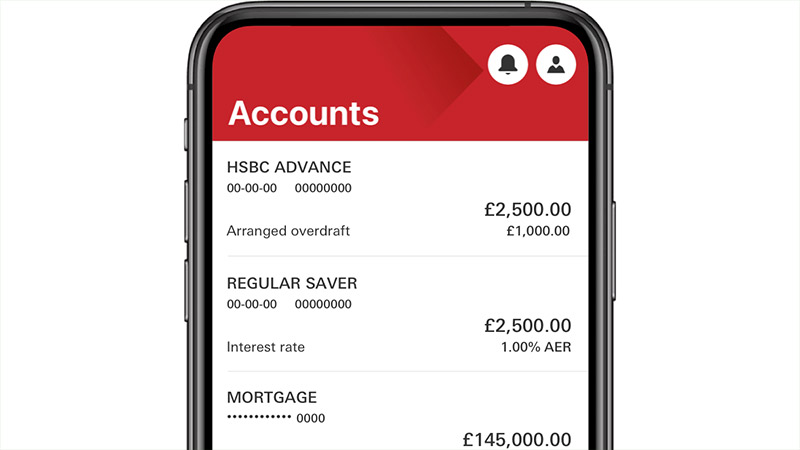

- Single Account for Multiple Currencies Manage multiple currencies in your one account online or using the HSBC mobile banking app.

- Lock in up-to-the-minute exchange rates Set your exchange rates using HSBC's real-time rates ahead of travel, so you don't have to worry about currency movements. Spend like a local overseas, using the local currency.

- $0 international ATM fees This is a huge benefit if you are travelling often and prefer to take out local cash from an ATM.

- Limited number of currencies. You can only pre-load and hold up to 10 currencies. Saying that, other currencies are still available for ATM cash withdrawals, with funds deducted from your AUD account at the current Visa exchange rate.

- Local Operator ATM fees. HSBC do not charge ATM fees, but local operators may charge extra fees or set limits. Check the ATM before using it.

- Complex FX exchange rates. You are charged two foreign exchange rates either the HSBC rate or the Visa rate in different scenarios.

Why consider the HSBC Everyday Global Account ?

If you're interested in linking your everyday transaction account to a travel card, this appears to be the only one in the market right now. Prepaid travel cards are more expensive, while most debit accounts don't let you hold foreign currency.

Although this account has no account keeping, foreign transaction or international ATM fees, like most banks, there are hidden fees in terms of HSBC's exchange rate margins.

Saying that, if you're good at planning and know your budget, HSBC's real-time exchange rates are slightly better than other banks, so you can lock in a good initial loading rate and save more than other prepaid travel cards. But always double check the rate you've being given against the market rate online - there may be even cheaper travel card options.

Read also: HSBC Review

Benefits of the HSBC Everyday Global Account

- Chip and PIN.

- Additional protection from Visa Zero Liability.

- Emergency card/cash available if stolen/lost.

Convenience

- Easy way to manage, spend and save on multiple currencies.

- No bank account required - set up the everyday debit account & access multiple currencies.

- Contactless payments via Apple Pay and Google Pay.

- Extra card for joint accounts.

- No ATM or foreign purchasing fees.

- Lock in exchange rate by loading funds to foreign currencies and avoid fluctuations.

- Unlimited transactions - no account fee and no minimum balance requirements.

Manage Your Money

- Reload and manage your funds easily online or on mobile phone app.

- Save or keep foreign currency on return for as long as you want.

- Control when you transfer between currencies.

- Unlimited real time currency exchange quotes between 8am Monday and 11.59pm Friday (excluding public & US holidays).

Fees and Limits of the HSBC Everyday Global Account

Transaction limits for hsbc everyday global account.

- Daily transfers and withdrawal limit are set at $10,000 for online transfers and $2,000 for ATM or EFTPOS transactions.

- Maximum load and BPAY/bank transfer amounts are set at $20,000.

- Please note that you may request to increase your transfer and withdrawal limits, however, it will be subject for review and approval.

- Your account will be marked as inactive after 6-months of you not using it.

All prices are in AUD

- Foreign Transaction Fee*: HSBC or VISA exchange rate

- Account Closure: $0

*Foreign currency conversion is charged in different scenarios using HSBC real-time or VISA exchange rates.

Australian Dollar (AUD)*, US Dollars (USD), Euro (EUR), British Pound (GBP), New Zealand Dollars (NZD), Japanese Yen (JPY), Canadian Dollar (CAD), Singapore Dollars (SGD), Hong Kong Dollars (HKD), Chinese Renminbi (RMB)

*Australian Dollar (AUD) is the control or default currency

Extra Tips and Tricks

Understand your exchange rate fees in different situations:, 1. pre-load a supported currency onto your card before travel.

If you decide to pre-load funds onto your card then your AUD* will be converted to any of the 10 supported currencies at the HSBC rate.

2. Exchanging for a supported local currency when you are purchasing

If you don't have local currency on your card while making a local currency purchase, the cash will automatically be taken from your AUD* account and converted at the HSBC rate.

3. Exchanging for a non-supported currency at the time of transacting

If you are transacting in a non-supported currency (one that you don't hold) like Thai Baht, or there are insufficient funds in that currency, then your AUD* will be converted at the Visa rate at the time of the transaction.

*Your AUD account is also known as your 'control currency', 'default currency' or 'main currency'.

Calculate HSBC's foreign currency exchange margin.

Compare HSBC's real-time exchange rate with the current online market rate when you load/reload foreign currencies onto your card. Also keep in mind that the final HSBC exchange rate offered can be different from the rates indicated. From our analysis, HSBC margins are slightly better than other banks.

Always pay using local currency.

Foreign retailers may seem nice by letting you pay in Australian dollars, but they may be hiding some sneaky margins in the exchange rates. With your Everyday Global Account you can spend in the local currency so make sure you do!

Find the cheapest ATMs.

Find out if ATMs charge additional fees and stick to the cheapest ATMs. The best idea is to take out all the cash you need in the one go.

Do everything online.

HSBC charges an extra $2.50 for staff-assisted Telephone Banking and $5.00 for branch withdrawals & transfers so do everything online for free.

How To Apply for the HSBC Everyday Global Account

1. set up your account.

- Set up your HSBC Everyday Global Account online in 5 easy steps or over the phone.

- You need to be 18 years plus and have an Australian residential address. Non-resident apply in-store.

- Make an initial load amount - max AUD$20,000.

2. Card is sent to your address

- Card is sent to your home address as per most debit cards.

3. Register

- Register your card online to manage your account.

4. Transfer Money/Load/Reload

- Transfer money to your account the same as any other debit card.

- Transfer currency from your main AUD account to other currencies, over the phone, online or via the HSBC app.

We have detected your browser is out of date. For more information, please see our Supported Browsers page.

How to notify HSBC that you’re traveling

Great news! Due to enhancements in our security measures:

- You no longer need to schedule a notification for your HSBC debit or credit card when traveling

- We may still send you a fraud alert if we see unusual activity on your account

For more information on how we protect your account, see Credit Cards Fraud Alert & Detection

I still need help

Fastest way

- Chat with us for assistance.

Other ways to get help

By telephone

- Contact Customer Service .

- Manage HSBC Credit Card

Connect with us

Please be aware of scammers that pretend to be from HSBC. Scammers may ask you for security codes over the phone or via text messages. They might try to contact you in the same text message thread that has legitimate messages from HSBC. Never share your log on credentials or authorisation codes with anyone, such as codes to register your device for mobile banking, to verify your identity, or to authorise a transaction. Contact us now if you are worried about fraud on your account, or to learn more about common types of fraud or scams.

- Online Banking

- HSBC Invest

Everyday Global Account

We’ve identified scams involving fake fixed income bonds, ESG bonds, and global currency reset products that are being offered to some customers. These are not real offers from HSBC. If you think you may have been the victim of a scam, are worried about fraud on your account, or are unsure about whether you are sending your money to a legitimate destination, please contact us immediately on 02 9005 8220 . You can also find more information on our fraud assistance page .

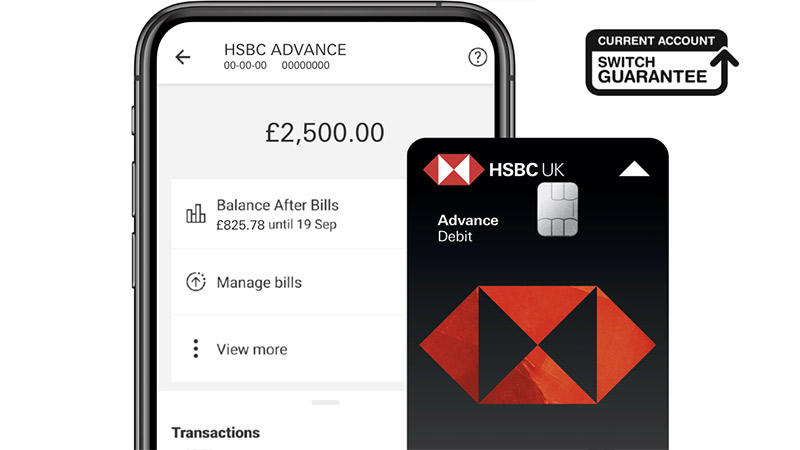

Easy banking at home and overseas

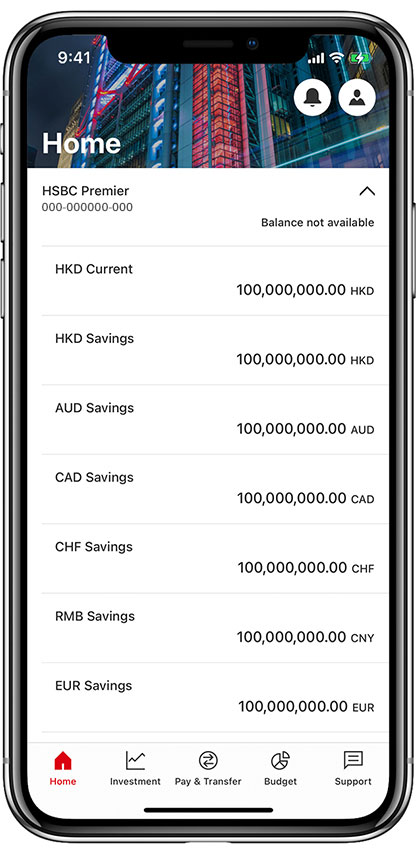

Our award-winning account makes it simple for you to hold, spend and send up to 10 foreign currencies in one place, with one Visa Debit card. You can also enjoy everyday benefits without any monthly fees.

Why open an Everyday Global Account?

Fee-free banking

No monthly account 1 , transaction or HSBC ATM fees 2

Everyday rewards

Up to 2% cashback 3 for tap and pay transactions under $100

One place, many currencies

Switch between 10 currencies easily on our HSBC Mobile Banking App

Easy money transfers

$0 HSBC fee to send money overseas

Features and benefits

In Australia

While at home in Australia, you can access these global rewards and features every day.

- $0 account 1 , transaction and HSBC ATM fees 2

- 2% cashback for purchases under $100 3

- Track your cashback in our HSBC Mobile Banking App

- Use Visa payWave, Google Pay™ and Apple Pay 4

To find out more about rewards you can earn every day, check out our HSBC Everyday Extras 5 FAQs .

Whilst overseas

Whether you're travelling or shopping online, you can enjoy these unique benefits with an Everyday Global Account.

- $0 overseas ATM fee 2

- $0 international transaction fees

- Our competitive Real Time Exchange Rates 6

- Transfer money online, anywhere in the world with no HSBC transfer fee.

- Currency switching on the HSBC Mobile Banking App

- Buy, transfer, hold and spend the following currencies: AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, and CNY (currency restrictions apply to CNY)

Award-winning everyday account

The HSBC Everyday Global Account is your one account for the world. It has been awarded Canstar’s 5-Star Rating for Outstanding Value – Transaction Account 2021 & 2022, Outstanding Value – Travel Debit Card 2018 - 2023 and Mozo’s Exceptional Everyday Account Award 2021 & 2022.

How to apply for an Everyday Global Account

New to hsbc.

Complete your application online in 5 easy steps today.

You can also apply for a joint account .

If you need additional support with your application, please call us on 1300 131 605 (Monday to Friday, 8:00am to 8:00pm AEST) or visit your local branch .

Already with HSBC?

Apply via online banking or the HSBC Mobile Banking App .

Register for online banking

Apply by phone or branch

- Find your nearest branch

Call us today

Call us on 1300 131 605 from Monday to Friday, 8am to 8pm (AEST)

Upgrade to HSBC Premier 7

Experience premium banking services, complete with your Premier Banking team, no monthly fee needed.

Important information

- Personal Banking Booklet (PDF, 1.50 MB) Personal Banking Booklet (PDF, 1.50 MB) For HSBC personal banking Download

- Transaction and Savings Accounts Terms (PDF, 1.10 MB) Transaction and Savings Accounts Terms (PDF, 1.10 MB) HSBC accounts Download

- Financial Services Guide (PDF, 906 KB) Financial Services Guide (PDF, 906 KB) Download

- User guide with illustrative examples (PDF, 3.9 MB) User guide with illustrative examples (PDF, 3.9 MB) Download

Terms & Conditions

This advertisement provides general advice only and doesn't take into account your objectives, financial situation or needs. Consider the Transaction and Savings Accounts Terms (PDF, 1.10 MB) and Financial Services Guide (PDF, 906 KB) before acquiring this product, available by calling 1300 308 008 , at your local branch or www.hsbc.com.au . Issued by HSBC Bank Australia Limited ABN 48 006 434 162. AFSL 232595.

2. Non-HSBC branded ATMs and HSBC Group ATMs in Argentina, France, Greece, Malta, Mexico and Turkiye may charge an ATM operator fee for withdrawals or balance enquiries at their ATMs.

3. You will earn 2% cashback on eligible purchases under $100 when you tap and pay with Visa payWave, Apple Pay or Google Pay™. This will be paid into your Everyday Global Account with the maximum cashback you can earn being $50 per calendar month. Eligible purchases must be made in Australian Dollars and where the merchant or its financial institution/ payment processor is registered in Australia. Purchases which are excluded for cashback include business, gambling and government transactions (including public transport). For the full exclusion list, refer to the Transaction and Savings Account Terms .

4. Terms and conditions apply to the use of Apple Pay and Google Pay TM .

5. HSBC Everyday Extras is a feature of the HSBC Everyday Global Account. You will be eligible for Everyday Extras if you deposit at least AUD2,000 into your HSBC Everyday Global Account before the last working business day of each calendar month. For more information refer to the Transaction and Savings Accounts Terms.

6. HSBC Real Time Exchange Rates will apply for transfers between HSBC Australia accounts when using HSBC Mobile and Online Banking. For Mobile Banking, HSBC Real Time Exchange Rates will apply for all international transfers.

For Online Banking, HSBC Real Time Exchange Rates will apply for AUD, USD, EUR, GBP, CNY, HKD, CAD, NZD, JPY, CHF, SGD, AED, DKK, MXN, NOK, SAR, SEK, THB and ZAR for international transfers within currency cut-off times .

When the FX market is closed on weekends (that is from the US market closing time on Friday to the Asia market opening time on Monday), the HSBC Real Time Exchange Rate will include additional weekend risk margin for the bank to cover risk of any market volatilities.

The HSBC Real Time Exchange Rate will not apply on currency holidays, on NSW and US public holidays.

For Online Banking, the HSBC Real Time Exchange Rate will not apply to transfers in currencies not listed above and to transfers outside of HSBC Australia entered after currency cut-off times. Instead, the HSBC Daily Exchange Rate , which is set and refreshed every 30 minutes daily from 7:00 AM to 7:00 PM (excluding weekends and NSW public holidays) will apply.

Future dated or recurring international transfers are not available on HSBC Mobile Banking.

For other future dated or recurring transactions via HSBC Mobile and Online Banking, the HSBC Daily Exchange Rate on the future date of the transaction will apply.

HSBC Real Time Exchange Rates will apply for Global Transfers between your HSBC Accounts. For transfers in unsupported currencies using Global Transfers, the receiving country's daily exchange rate will apply and currency cut-off times of the receiving country may also apply. For future dated transactions using Global Transfers, the HSBC Real Time Exchange Rate on the future date of the transaction will apply when the FX market is open.

FX transactions are subject to foreign exchange risk associated with exchange rate movements. HSBC accounts should not be used for speculative FX purposes.

7. Eligibility criteria for HSBC Premier applies and is set out in the HSBC Premier Service Guide

*The HSBC Everyday Global Account was awarded the Canstar 5-Star Rating for Outstanding Value – Transaction Account 2021 & 2022, Outstanding Value – Travel Debit Card 2018 – 2023 and Mozo's Exceptional Everyday Account Award 2021 & 2022.

Is the HSBC Global Money Account any good?

Our rating:

With the recent launch of HSBC’s Global Money Account we assess its features and see how it compares to the best travel debit cards for spending abroad, and the best euro account for UK residents .

The HSBC Global Money account is a multi-currency current account allowing the holder to send, spend and receive money abroad with no additional fees. Set to rival the likes of Revolut and Wise, the new account launched in October 2022, and is currently available to HSBC customers directly from the banking app.

How much does the Global Money Account cost?

The account is free to hold and there are no fees when making debit card payments, cash withdrawals, or sending money abroad. Delivery of the physical debit card is also free, as are any replacements or reissues.

How do I open a HSBC Global Money Account?

It can be opened within seconds from the HSBC banking app, and as an existing HSBC customer there is no credit check for doing so. Once open, you can allocate your own PIN for the card and add the card to ApplePay and GooglePay immediately. The card issued is a VISA card, so serves making it a nice complement to those with Mastercard’s such as those issued by Starling, or Halifax Clarity.

Unfortunately, the account is only available to existing HSBC current account holders. That doesn’t include First Direct customers (which is a HSBC brand), or those with a basic bank account from HSBC.

If you don’t have a HSBC account, you can instead try HSBC’s new Zing app .

Try HSBC's Zing app instead

HSBC's new Zing money app addresses all the drawbacks of the Global Money Account and is cheaper than Revolut and Wise

Use our link below, and once you spend £5 or more on your Zing Visa card, you'll be given a free £20 bonus.

But hurry, this offer is only available untli 31st May

Which currencies can I hold with the HSBC Global Money Account?

The Global Money Account allows the account hold to hold balances in 18 popular currencies. We’ve added the full list of currencies below.

- GBP – pound sterling

- USD – US dollar

- AUD – Australian dollar

- ZAR – South African rand

- PLN – Polish zloty

- CAD – Canadian dollar

- NZD – New Zealand dollar

- CHF – Swiss franc

- SEK – Swedish krona

- HKD – Hong Kong dollar

- AED – UAE dirham

- CZK – Czech koruna

- NOK – Norwegian krone

- DKK – Danish krone

- SGD – Singapore dollar

- JPY – Japanese yen

- CNH – Chinese yuan renminbi

What are the exchange rates and mark up?

Card transactions use the VISA daily rate for currency conversion. This would apply for example when you are spending in euro but do not hold enough of a euro balance in the account to pay for the item. The bank will then automatically covert from GBP using the VISA daily rate.

When manually converting balances from one currency to another within the account, HSBC will use its own rate. This is based on the interbank exchange rate plus a small mark up. Tests at the time of launch (October 2022) found the HSBC rate to be slightly better than that Wise, Revolut or Finneco across most major currencies.

Subsequently though, customers have found that HSBC’s exchange rates have fallen, and are now often worse than those mentioned above. This is something of a moving target, and your milage may vary.

Weekend premium

A premium of 1% applies when exchanging between currencies while the market is closed. This is typical with multi-currency accounts and the additional mark-up is to protect the banks from large swings in the exchange rate once the exchanges open again.

To put this into perspective, Revolut also applies a 1% surcharge on weekend exchanges across 15 major currencies, and a 2% surcharge on all others. Wise on the other hand continues to use the mid-market rate even at weekends.

We recently reviewed Atlantic Money, a dedicated UK based currency exchange app. It is more limited in terms of the currencies you can exchange, but was consistently cheaper than Wise, Revolut, and HSBC for larger currency conversions (those over £1,200). See our Atlantic Money Review for more.

Can I send and receive payments with the Global Money Account?

Currently you can send payments via the Global Money Account, in any currency you hold. Unfortunately for euro payments these are not SEPA instant payments so may take up to 24 hours before they show up in the recipient’s bank account. That may be subject to change in the future though as recent draft legislation by the EU Commission looks to force payment to providers to offer 24/7 instant payments . Think of it like Faster Payments in the UK.

You can’t receive payments just yet, but it is a feature that is supposedly coming soon, but more than 6 months since the account’s launch, there’s still no sign of it.

What are the HSBC Global Money Account ATM limits?

As ever with multicurrency accounts it’s not all about the foreign exchange rate. Sometimes the various transactional limits can make or break the account. The Global Money account has a daily ATM cash withdrawal limit of £500 (or equivalent foreign currency).

For those that are big cash spenders abroad, that limit beats Starling’s £300 a day, Chase’s £1,500 a month, and Revolut’s measly £200 a month.

International payment limits for transfers are capped at £50,000 or equivalent, so those wishing to make large purchase or transfers for example buying a home abroad, would need some forward planning.

What are the drawbacks and limitations?

The Global Money Account looks like a great travel companion for those with a HSBC account, but it’s not without its drawbacks.

Top ups and transfer not instantly available

Top ups and transfers into the account can take 24 hours before they are ready to use. That could leave you in bind if you run the balance down and forget to top up again before you next need to spend on the card. Whilst this is true with any additional account, banks such as Starling or Monzo that have free foreign spending baked in don’t run into the same issue.

We’d recommend having back up, such as Currensea (see our review) , in case you’re ever caught short.

Currensea acts as a layer on top your HSBC current account. Allowing you to spend in the foreign currency of your choice. It then direct debits your HSBC current account in pounds, to avoid charges. There’s a flat rate of 0.5% (50p per £100), making it much cheaper than using your HSBC current account debit card.

Can’t receive payments

You cannot receive foreign payments into the account. This is a big one for those with links abroad, who’d like an account receive foreign income. HSBC is working on it, but the account has been around for 8 months now, and there’s still no update on this.

Only accessible via the HSBC app

If you prefer to check your balance, reconcile your spending, or manage your account via online banking, then you’re out of luck. HSBC has limited access to the Global Money Account to App users only. There’s also no open banking, which means if use a third party budgeting tool such as Plum, you can’t link your account to it.

Should I get a HSBC Global Money Account?

Whether the HSBC Global Money account is worth it to you, all depends on your current circumstances. If you already bank with HSBC then even if you have a Wise, Revolut, or Finneco account, the Global Money Account could be a worthwhile addition, if only for streamlining the process of moving money around, or for the piece of mind that you’re dealing with a major UK bank with full FSCS protection.

If you aren’t already a HSBC customer, then it doesn’t really make sense to open a current account just to take advantage this Global Money Account, but since HSBC regularly runs current account switching offers , it might make sense for those who are already considering switching. In fact, in some instances it’s required in order to get the switching bonus.

While the exchange rates were some of the best around at launch, they can now be beaten. Added to that, the account is still missing some important features such as receiving foreign payments, and SEPA instant transfers. As such can’t match the likes of Revolut for versatility, or Atlantic Money for one off transfers.

Overall the Global Money Account is a step in the right direction. It will make a massive difference to those who’d normally just use their standard HSBC current account debit card when abroad, and help to retain customers who might otherwise use services from other multi-currency accounts.

Those who aren’t currently HSBC account holders, would be better served by Starling for general holiday spending , or Revolut for regular currency exchanges.

What should I get instead of the HSBCs Global Money account?

HSBC’s own Zing app is an alternative to the Global Money Account. Like the GMA, Zing allows uses to hold multiple different currencies within wallets in the app, and convert between them for low fees. It allows sending foreign payments, and unlike the GMA also accepts incoming foreign payments.

It offers a clean clear interface, and truly transparent pricing, and best yet is open to those without a HSBC current account.

Find out more in our HSBC Zing review

Other alternatives are the well known multi-currency accounts from Revolut (see our review) , and Wise . For those only needing to exchange and send money abroad, then Atlantic Money (see our review) , is a top alternative.

If you have a HSBC Global Money Account we’d love to hear your experience with it? Please comment below.

14 comments on “Is the HSBC Global Money Account any good?”

I am an HSBC customer and opened a Global Money account to pay the deposit on holiday accommodation in the Netherlands. Setting-up the account and using it was simple and my transaction was shown as completed. I was advised the transfer would take up to 3 working days but 13 working days on the money has not arrived in the accommodation provider’s account. I have queried this with HSBC (via telephone banking) 3 times so far and have been told transactions can take time. During my first call 2 weeks ago I was told a referral would be made for my transaction to be traced and this could take up to 5 working days. However, nothing heard so far and I am obviously concerned about what has happened to my money and the fact to secure the accommodation they have to receive my deposit (50% payment). Not sure how this will end but my experience has been a far from happy one.

I’m in the same situation , £1450 has disappeared and I keep getting the same rubbish answers over 4 wks now !!!!!! Very angry sometimes needs to be done asap. There hiding behind call centres

I am an existing HSBC customer. I opened a Global Money account recently to use for withdrawing cash when abroad for daily expenses when on holiday or business. My feedback is based on using it in Australia several weeks ago and the period between opening the account in the UK leading up to first use.

Pros: 1- Simple setting-up of account 2- Easy use as payment or debit card 3- Reasonable daily limit of £500 equivalent in foreign currency cash 4- Wide range of foreign currencies 5- Access through mobile App 6- Exchange in advance within the Global Money account to the target currency is possible 7- Transferring funds out is also easy to separate HSBC currency accounts

Cons: 1- Can only be used outside UK and cannot be used for withdrawing cash in foreign currency in the UK 2- The account requires 24 hours before credited funds in any currency are cleared for use or withdrawal 3- It requires separate HSBC accounts in foreign currencies to credit foreign currency into the Global Money account. 4- Only accessible through the mobile App and is not available on the main HSBC account website on desktops or laptops.

It would certainly be much more appealing if the cons are addressed and resolved. Despite these limitations, the advantages are clear and far outweigh the current negatives. It was easy and simple to use abroad. Based on my personal experience it is certainly better than Monzo, Citibank and Virgin Money comparable current products when used outside the UK.

Opened the global money account and bought USD. Months later I travelled to the US and for all transactions made HSBC charged me with Non-sterling fees when an operator confirmed to me that I can use my debit card as if I was in the UK…. Wouldn’t recommend it

I opened a global acc and transferred money overseas to an account that I have had for a number of years , 4 wks later nothing ? can only talk to a call centre ? no one knows where my money has gone £1450. I had a secure email 2 wks ago saying it was rejected ? and this issue would be sorted no later than 04 /05. nothing !!! I’ve. contacted hsbc and keep getting the same answer , don’t know !!! it’s a terrible set up and once my funds are returned ??? I will close this account for good !!!! Extremely in professional in every way ! Don’t open one !!

Mmm…doesnt look like a good product judging by the comments. I think I will just stick to drawing money out in the UK in euros and putting it in my pocket and traveling.. as I have for the last 30 years and everything has been okay.

This is a great currency wallet, in theory, but it falls short in certain ways. The big one is that, unlike the likes of Revolut, Monzo, Starling, etc, you can’t easily check what you’re spending as there is no push notification. You have to open the app, log in, navigate to the GMA and check in there to see if you’re being charged the correct amount. I don’t ever expect the HSBC app to reach the levels of usability of the newer fintechs, but this is fairly basic.

The other major sticking point is the “HSBC Exchange Rate”… Initially, this seems great, even compared to Revolut. I used it to exchange a large amount of GBP to EUR, but, they try to get you by making their margin much larger if you try to trade any more than £1000 in one go. So, after having traded an amount in £1000 increments, I now find that their rate has decreased by a further 300 bps over what it was initially. For example, if GBPEUR is currently 1.1600, I would be able to buy at around 1.1585. This no longer seems to be the case and the rate I am quoted is around 1.1555. This is a very bad rate indeed! I have already spoken to them about how this rate is supposed to be calculated, but no one at HSBC has the slightest clue, which I guess shouldn’t surprise anyone.

Spoke to HSBC directly about their exchange rate and I can confirm that it is entirely arbitrary and in their discretion to change whenever and however they like. They will actively try to limit your FX trading by increasing their spreads if you try to exchange any amount larger than £1000. Given that you cannot transfer money in yet either, I’d stick with the competitor’s offerings (Revolut or Wise).

I have used a Wise card for years and recently topped up a small amount from my HSBC account and the money never transferred having done so many times in the past. Many phone calls later it was because HSBC had blocked the transfer as ‘suspected’ fraud and it took a lot of convincing HSBC fraud to authorise my transfer. Days later a second top-up was blocked for the same reason and for reasons I still can’t fathom HSBC fraud asked me to visit my local branch to sort matters out. The branch never sorted it it out but I was told about their ‘Global Money’ account and persuaded to open one which I’m evaluating. My point here is that having used Wise for years and done many transfers from my HSBC account when HSBC launch a competitor card for Wise I suddenly start having problems!! Could the issues be connected?

The idea of the account was great. The biggest problem are exchange rates as it seems HSBC was too greedy to keep the promise of “great rates”. In my bank abroad I get Forex rates that can easily be 6-7,% better. I stopped using the account.

On a recent trip to France, the card was refused at several locations, but the amount was still deducted. In some cases it worked the second or third time of trying, but the account later showed that 2 or 3 deductions of the amount had been made, On another occasion the card was refused, so I paid with my credit card. Both accounts were charged. 3 months later, the problem is unresolved. It is very time consumining trying to contact HSBC Global and even then, no answer or offer of repayment.

You get account that promised a lot but typical HSBC style failed to deliver. Issues with card being denied for no reason, delays with credited funds and what renders the account useless are exchange rates. Way worse than any competition offers. The cherry on the cake is useless HSBC customer support that you can’t even get through.

In Italy we have used this card to pay for bills and shopping etc with no issues. Today we find that withdrawals from atms here is now subject to a 5 euro fee at certain banks atms.

Maybe the free atm selling point is now history.

Free ATM withdrawals typically means the bank issuing the card doesn’t charge you. Highstreet banks in the UK often charge their customers for using their cards abroad to withdraw cash.

What you are seeing the the owners of the cash machines in Italy charging a fee. This is unfortunately very common throughout the EU (regardless of who you bank with), and in the US and Caribbean where is can be as much as $10 each time you withdraw.

The trick is knowing which ATMs don’t charge, but the problem is they change quite often. For example Bank Inter in Spain never used to charge, but it was bought by another bank, which then implemented charges.

Good luck with your travels.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Money in your inbox

Join thousands of like-minded money savers and receive money saving hints, tips, and offers, direct to your inbox.

By entering your email address you agree to our Terms of Use and Privacy Policy and consent to receive emails from from Money Saving Answers.

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

The top 5 travel debit cards in 2024.

Debit cards make paying easier, but which is the best debit card for travelling overseas?

Using travel money cards overseas is extremely handy for paying for shopping, taxis, corner shops and withdrawing cash at ATMs.

It's a great option as long your bank does not charge fees for foreign transactions or ATM withdrawals.

So, how do you find out where to get the best travel debit cards?

To save you time, we've compared a large number of debit cards for overseas travellers to help you make the right decision.

The Best Travel Debit Cards:

Wise travel card.

- Revolut Australia Card

Macquarie Transaction Account Debit Card

- HSBC Global Everyday Account Debit Card

ING Orange Everyday Account Debit Card

Revolut Card Offer

Sign up and get a $15 top-up . For new customers only, T&Cs apply .

Best Exchange Rate

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is great for frequent travellers as it offers over 40 currencies at the inter-market exchange rate, which is the cheapest rate globally. In addition you can buy goods online from overseas with no transaction fee plus get the best exchange rate. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Our Wise Travel Card Review

Revolut - Low Fees

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

- No monthly fees

- No foreign transaction fee

- No ATM fees in Australia

- No ATM fees overseas

- Contactless limit with no PIN up to $200 per transaction

- Joint accounts available

- Discounts of up to 10% on eGift cards to use at over 50 leading retailers

- Simple and easy to work out costs for account

- Can be used in Australia as an EFTPOS card

- Instant transfers can be made using PayID and OSKO

- Works with Apple Pay, Google Pay, Fitbit and Garmin

- Available to 14 year olds and older

- Easily lock and unlock your card in the app if your card is lost or stolen

- Multi award winning account including Mozo Best Everyday Savings for 2021

- $2,000 daily limit for ATM withdrawals

- Exchange rates are MasterCard exchange rates, which are normally 2% - 6%+ the market rate

- Added security with a mobile app that sends actionable push notifications for you to approve or deny online transactions and account activity

- Tools for spending each time you make a transaction, it’s automatically categorised into groups such as groceries, travel, leisure or technology. In addition you can see how you're spending at a glance and over time.

There's a lot to love about the Macquarie Bank Transaction account debit card starting with no fees, no foreign transaction fees, no ATM fees in Australia or overseas. In addition the only fee you will pay is the currency conversion charged by Mastercard.

The debit card works in Australia and the contactless limit is $200, which is super handy. It also works with Apple Pay, Google Pay, Fitbit and Garmin. Finally it has tools to help you track your spending, can be given to teenagers over 14 and is easy to lock or unlock your card through the app if lost or stolen.

HSBC Everyday Global Debit Card

- No initial card or closure fees

- No monthly or account fees

- No international ATM fees

- No cross currency conversion fees

- Lock in very competitive exchange rates before travel

- No maximum balance

- Earn 2% cashback

- 10 Currencies can be loaded are AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, CNY (currency restrictions apply to CNY)

- Awarded 5 gold stars by CANSTAR in 2021 for Outstanding Value

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with Visa pay wave, Apple Pay or Google Pay for purchases under $100. With a maximum of $50 cash back per month. In addition you need to deposit $2,000 or more into your Everyday Global Account each calendar month.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Debit Card is a good option to take travelling and to spend money in Australia with no international transaction fees, international ATM fees and monthly fees. In addition there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

Finally it is one of the only travel cards that offers Chinese Yuan. To avoid ATM fees you need to find HSBC branches in Australia and only use ATMs overseas with a VISA or VISA Plus logo.

- No ATM fees

- No account keeping fees

- Can be used in Australia with no additional costs

- No fees for paying via bank transfer or Bpay

- Transfer limits can be set by user

- As long as you you deposit at least $1000 and make at least 5 payments each month ING will waive international transaction fees and refund overseas ATM withdrawal fees

- Can be used in all countries

- Can be used in Australia to buy goods overseas and not pay international transaction fees

- Works with Apple Pay and Google Pay

- Visa currency conversion rates apply, which are normally 4% above market

The ING Orange Everyday Account Debit Card is a good card for most Australians travelling overseas for ATM access, with no fees. It also allows you to to buy goods online without an international transaction fee.

Furthermore you can use it in Australia for free and there are no fees to get your initial card, for account keeping or to top up your card. A word of caution however, if you travel overseas for longer than 1 month, you still need to deposit at least $1,000 and make at least 5 payments each month to get the rebates.

Learn more about the best travel money, credit and prepaid cards for travel

Prepaid Travel Card

Best Travel Card

Credit Card

The difference between a debit card and a travel card is that you preload a travel card with foreign currency before you leave. The exchange rate is set for your time overseas. Most preloaded currency cards have 10 different currencies on them for you to choose from.

A debit card only has Australian dollars in it. You pay a currency conversion fee every time you make an online overseas purchase or pay with your debit card overseas.

Using a debit card overseas is similar to how you use it in Australia and you wave your card over the charging device. You might be asked to key in your pin, which will be the same pin as you use in Australia. It is always advisable to let your bank know you are travelling overseas as they might block the transaction.

A travel card is better for currency exchange rates and a debit card is better for convenience. Both are equally good for security. A travel card has a cheaper currency exchange rate around 2% however a debit card is more expensive at around 4%. A debit card can be used in Australia once your travels are over and if you choose Macquarie , Up Bank , Citibank , HSBC or ING you will not pay for foreign transaction fees.

A good travel debit card will save you lots of money and does not charge monthly or account keeping fees. It does not charge a foreign transaction fee or fees to withdraw cash from ATMs in Australia or abroad. It has good security and is easy to transfer funds into when overseas.

You can use most Australian debit cards overseas, if you advise your bank you are travelling overseas in advance. In some cases you can not use your Australian debit card overseas, so it is best to check before you depart Australia.

The first thing to look for are no foreign transaction fees, these can be between 3-5%. Second, you need to look for a debit card that does not charge for overseas ATM withdrawals, as these can be $5 per transaction plus 3%. Therefore a cash withdrawal of $300 will withdraw $314 from your account.

Third, you need to look for a debit card with no monthly fees or account keeping fees. Finally you need to choose a debit card with good security and is easy to transfer money into while you are travelling overseas.

The pros of using a debit card overseas is that they are very convenient as you can use them when you return to Australia to pay for everyday items like groceries and fuel. They are generally accepted in most places around the world especially if they are linked to Visa or Mastercard.

The cons of using a debit card overseas is that they can get expensive if you choose one with foreign transaction fees, monthly fees and fees for withdrawing cash from ATMs.

Luckily the days of having to call an international number to report a stolen or lost card are gone. In most cases you should be able to notify your bank through the mobile app your debit card has been lost or stolen and they will deactivate your debit card immediately to stop unauthorised spending.

If you choose a Macquarie , Up Bank , Citibank , HSBC or ING debit card then you will not have any ongoing fees with an overseas debit card. If you choose the Commonwealth World, the NAB Platinum or Westpac Choice debit card you will have ongoing monthly fees.

It's simple. To move money to your debit card overseas, you login into the account you want to transfer money from and transfer your Australian dollars to the bank account that is linked to your debit card overseas. If your bank uses OSKO or Pay ID this should happen immediately, even if you are overseas at the time.

According to NerdWallet Mastercard gives the best currency conversion rates globally, giving better rates 70% of the time. This includes the major traded currencies such as the US dollar , Euro, Great British Pound , Australian dollar, Japanese yen , Hong Kong dollars, Canadian dollars , Singapore dollars , Swiss francs and New Zealand dollars . However Visa does give better currency conversion rate for Thai baht , Hungarian forint, Icelandic Krona and Tunisian dinar.

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

HSBC Mastercard® Debit Card

Earn up to 20% cash rebate when you spend in Japan/ mainland China!

Get rebate on suica, didi or mainland china alipay with every dollar spent on your hsbc mastercard® debit card terms and conditions apply..

From now on, whether you're shopping at home or travelling abroad, staying in control of your global currencies has never been easier. With a card built around 12 major currencies, you can shop online, make purchases, and withdraw cash at HSBC Group ATMs around the world, with zero fees.

* You need to have an integrated account to apply .

Why you'll want it

Easy access to major currencies, $0 fees for all your purchases, free cash withdrawals worldwide, earn on every purchase.

- Supplementary Debit Card for your loved ones A supplementary card gives your loved ones the benefits of multi-currency and fee-free privileges.

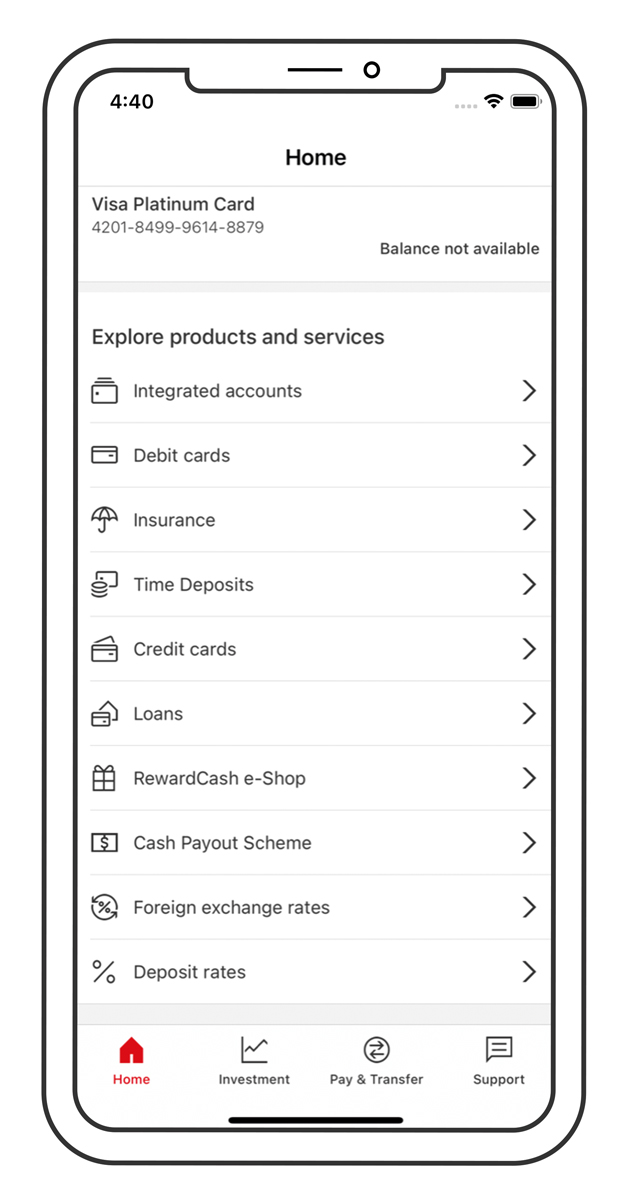

How to get your card ready

Get your card on mobile

If you're already an integrated account holder, get your debit card application processed instantly on the HSBC HK Mobile Banking app. Simply select "Explore products and services" after you log on to the app.

Alternatively, you're welcome to contact us directly to apply for your card.

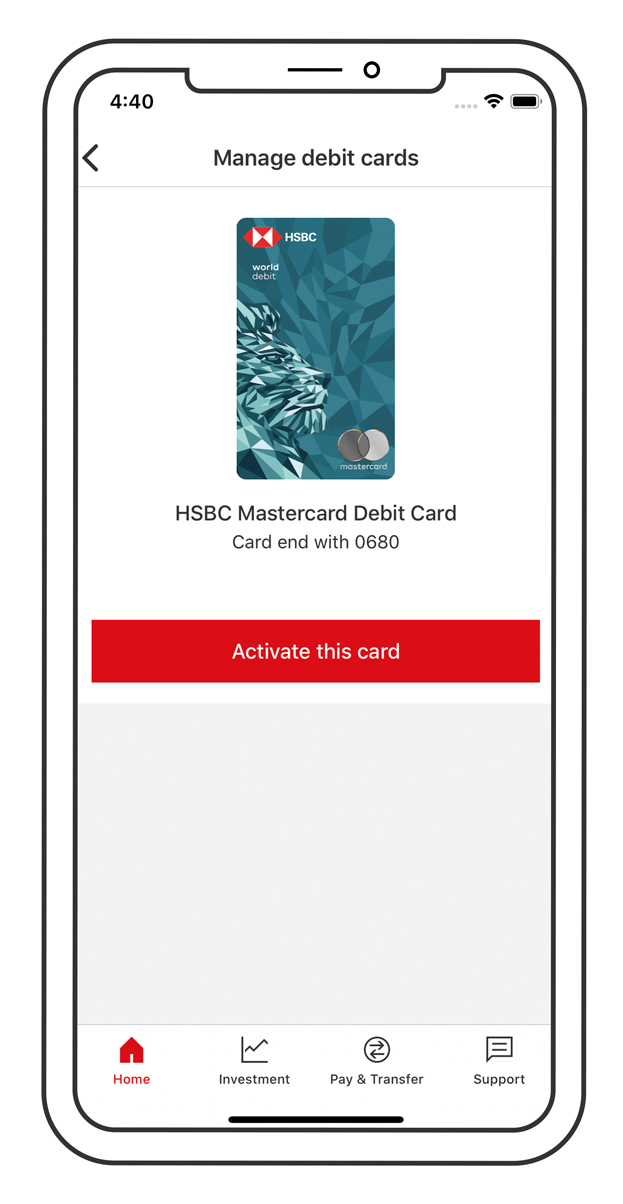

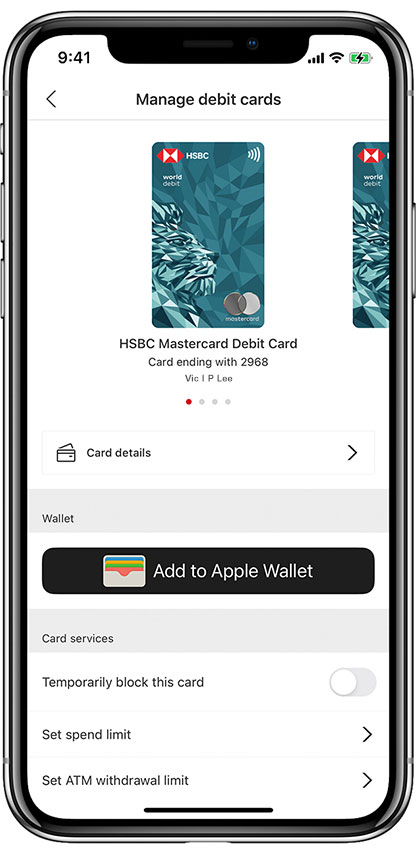

Activate your card 3

Once your physical card arrives, you can activate it by entering your card expiration date on the "Manage Debit Cards" page on the HSBC HK Mobile Banking app.

How to receive your card PIN (Personal Identification Number)

You no longer need to wait for your PIN to arrive by mail. Simply call the Interactive Voice Response (IVR) hotline on (852) 3163 0633 and set up your own card PIN after activating your debit card. It’s fast and simple!

Eligibility

Hsbc integrated account holders.

Enjoy all the benefits of having a multi-currency card today.

Not an integrated account holder yet?

If you're opening a new HSBC Premier or HSBC One account, you may request for the HSBC Mastercard® Debit Card at the same time. 1

Apply for an HSBC Premier Account:

- More details

Apply for an HSBC One Account:

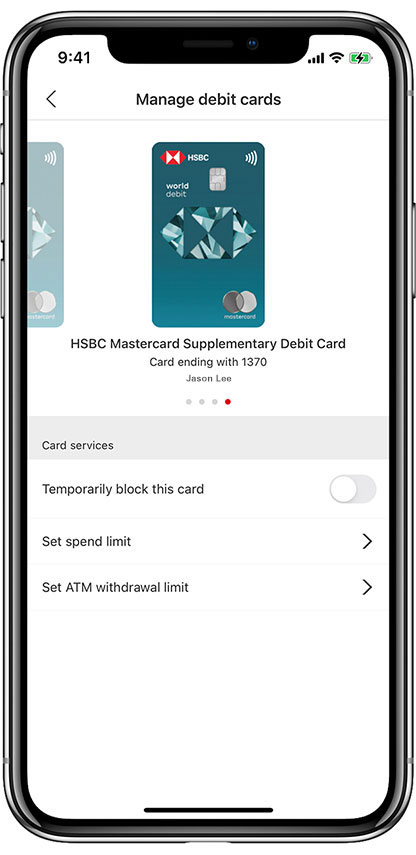

Apply for a Supplementary Debit Card for your loved ones

A truly international multi-currency Debit Card for your loved ones, no matter where they go around the world.

- Features & Benefits

- Are you eligible?

- How do I apply?

- Open a supplementary card for your loved ones / children aged 12 or above in a few easy steps on the HSBC HK Mobile Banking app. Supplementary cardholders don't need to visit a branch or hold a bank account

- Provide for the spending needs of your loved ones in any currencies, hassle-free. Simply maintain HKD or respective foreign currency funds in your Integrated Account and your supplementary cardholders can use them directly, with no foreign currency transaction fees

- Worried about over-spending? You can control how much supplementary cardholders spend by setting spending rules via the HSBC HK Mobile Banking app

- Keep updated on supplementary card spending with real-time spend and withdrawal notifications

- Earn 0.4% cash rebates every time your loved ones spend on their supplementary cards

- There are no annual fees, no foreign currency transaction fees, and no ATM cash withdrawal fees when using HSBC Group’s ATMs worldwide

- Apply for up to six supplementary debit cards per principal debit card, if you have a big family

- You must hold an HSBC Mastercard® Debit Card to apply for a supplementary card for your family and friends

- Supplementary card applicants must be aged 12 or above

- Log on to the HSBC HK Mobile Banking app

- Select 'Debit cards' under 'Explore products and services' on the Homepage

- Click on 'Start application'

Remember to have the information and contact details of supplementary cardholders before you apply. These include date of birth, identity document number, mobile phone number and email address.

If your supplementary cardholder does not hold an account with HSBC yet, you need to upload his/her identity document .

Features & Benefits

Are you eligible , how do i apply , what else should i know .

How can I manage my supplementary card through the HSBC HK Mobile Banking app?

Your HSBC Mastercard® Supplementary Debit Card allows you to always stay in control. As a principal cardholder, you can manage supplementary cards from the 'Manage debit cards' page on the HSBC HK Mobile Banking app.

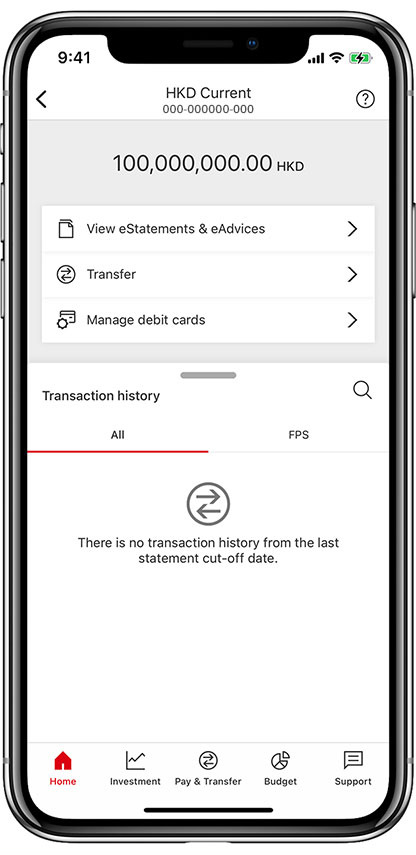

Step 1: Log on to the HSBC HK Mobile Banking app and click on any sub-account of the integrated account with principal card.

Step 2: Click on 'Manage debit cards'.

Step 3: The Mastercard® principal card will be shown.

Step 4: Swipe to the left from the card face to see your supplementary card(s).

What limits can I set for HSBC Mastercard® Supplementary Debit Card?

As a principal cardholder, you can set the following limits:

- Monthly spend limit (covers purchases made via Mastercard® and EPS network)

- Daily local ATM cash withdrawal limit

- Daily overseas ATM cash withdrawal limit

Will my supplementary cardholder know my account balance?

Your privacy matters a lot to us. Supplementary cardholders have access to a limited set of banking / ATM services, and balance enquiries are blocked for them.

What do I do when I receive the supplementary card?

You can follow three simple steps to get started:

- Once you receive the HSBC Mastercard® Supplementary Debit Card, pass it to your supplementary debit cardholder

- Advise your supplementary cardholder to activate the card and set the PIN by calling 3163 0633. A one-time password will be sent to him/her for verification. You will be notified by email and SMS once the activation is successful

- After card activation, you can change the spend and withdrawal limits of the card conveniently via the HSBC HK Mobile Banking app. Just log on > tap on any accounts linked to the card > 'Manage debit cards'. Remember to tell your supplementary cardholder about the limits you set (but just in case you forget, we will also notify the supplementary cardholder every time you change the limit)

What should I know if I am a supplementary cardholder?

Getting Started

- If you hold an HSBC Mastercard® Supplementary Debit Card, you can activate the card and set up the PIN by calling 3163 0633. A one-time password will be sent to your mobile number for verification

- You can then start enjoying the benefits of the fee-free multi-currency spending experience! Remind your principal cardholder to keep sufficient funds in his/her account, just in case

- For your convenience, you can also add the card to your mobile wallet!

Using the card

- You can use the card at any merchants worldwide that accept Mastercard® for purchases or via local EPS network. Please ask your principal cardholder about the limits he/she set for the card before using it

- You can withdraw cash from HSBC Group’s ATM network for free. If you withdraw from non-HSBC Group ATMs, fees may apply. Refer to our tariffs for details. Again, please check what withdrawal limits have been set by the principal cardholder

- Remember – each time you spend or withdraw with the card, we will notify you and the principal cardholder. You will also be notified every time the spending / withdrawal limit set by the principal cardholder is changed. You can find out the remaining monthly spending limit from the spend notification we send you after every transaction

Just in case…

Needing some card services? In most cases, you'll have to ask your principal cardholder. These services include:

- Check card information / status

- Check transaction history

- Replace card

- Change card limits

- Request a new PIN (except first PIN set-up)

- Dispute a transaction

- Change of personal particulars e.g. phone number and email address

- Cancel card

However, you will still be able to raise requests related to the security of your card. They are:

- Activate your card

- Block your card

- Report lost card (you need to ask your principal cardholder for a replacement card request)

Get your card in seconds with the HSBC HK App 2

What else should I know

If you still hold a hsbc jade mastercard® debit card.

Click here to view details

1. You can choose the HSBC Mastercard® Debit Card and/or the HSBC UnionPay ATM Card upon opening your new integrated account.

2. You need to have an integrated account to apply.

- Apple, the Apple logo, iPhone, iPad, iPod touch, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc.

- Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

- QR Code is a registered trademark of Denso Wave Incorporated.

- The screen displays are for reference and illustration purposes only.

- Terms and Conditions apply.

3. By activating this card, you agree to the Debit Card Terms and Conditions and accept the preset daily spending limit as printed on the card mailer. Once the card is activated, if you'd prefer to lower your spending limit, you can adjust it anytime from the 'Manage debit cards' screen on your HSBC HK app or call our hotline as printed on the back of your card.

Risk Disclosure:

- Currency conversion risk - The value of your foreign currency and RMB deposit will be subject to the risk of exchange rate fluctuation. If you choose to convert your foreign currency and RMB deposit to other currencies at an exchange rate that is less favourable than the exchange rate in which you made your original conversion to that foreign currency and RMB, you may suffer loss in principal.

If Your Debit Card Expires While You’re Traveling, Do These 7 Things

T raveling can be an exciting adventure, full of new experiences and memories to cherish. However, it can quickly turn into a stressful situation if you find your debit card has expired. Being far from home without immediate access to your funds can be worrisome, but don’t panic. Here are some important steps to take if your debit card expires while you are on vacation.

Read More: 6 Genius Things All Wealthy People Do With Their Money

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

1. Contact Your Bank Immediately

The moment you realize your debit card has expired, contact your bank or card issuer. Most banks have international toll-free numbers specifically for travelers who have issues with their debit cards. Inform them about your situation and verify your identity. Banks are familiar with handling these situations and can quickly help you find a solution.

2. Request an Emergency Card Replacement

Ask if your bank can expedite a new debit card to your current location. Many banks offer an emergency card replacement service for travelers. While this might come with a fee, it’s worth the peace of mind. Provide a secure and verifiable address, like your hotel, where the card can be delivered.

3. Use Digital Wallet Services

In today’s digital age, accessing your funds without needing the physical debit card is often possible. If your bank supports it, you can add your debit card to a digital wallet like Apple Pay , Google Pay or Samsung Pay. This way, you can continue to make purchases and pay for services with your smartphone or a smartwatch.

4. Explore Wire Transfer Options

If getting a replacement card is not feasible, consider having money wired to you. You can use wire transfer services like Western Union or MoneyGram to receive cash without needing a debit card. You’ll need to provide identification and the transaction details, but it’s a reliable way to access your money.

5. Use Other Cards

Always travel with more than one form of payment. If you have a credit card or another debit card , now is the time to use it. This reduces the inconvenience of having a single expired card and ensures you’re not stranded without access to your funds.

6. Withdraw Funds Through a Partner Bank

Some banks have international partnerships with other banks. In such cases, you might be able to withdraw cash directly from a partner bank’s branch. You’ll need to present your passport and possibly answer security questions, but it’s an effective way to access your money.

7. Precautionary Measures for the Future

To avoid a situation like this in the future, make a note of your card’s expiration date before you leave on vacation. Most banks send out new cards a few weeks before the old one expires, so ensure your address is up-to-date. Additionally, consider setting up travel alerts on your account and inform your bank of your travel plans. That way, you’ll cut down any risk of fraud alerts or blocks issued on your account.

If your debit card stops working while you’re traveling, it can be a hassle, but it’s not a huge disaster. If you act quickly and check out other options, you can still get to your money and have an enjoyable and relaxing time on your trip. Make sure to have a second way to pay ready and the phone number for your bank with you, just in case you need it while you’re on the go.

Editor's note: This article was produced via automated technology and then fine-tuned and verified for accuracy by a member of GOBankingRates' editorial team.

This article originally appeared on GOBankingRates.com : If Your Debit Card Expires While You’re Traveling, Do These 7 Things

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy

Online banking for credit cards

Take control of your account, at home or on the go.

Whether it's paying your bills, managing your accounts and limits, reviewing your transactions or resetting your PIN, you can do it all on your schedule with online banking.

Download the app

Get the HSBC India Mobile Banking app

Simple, convenient and secure way to bank.

Features that help you bank on your schedule

- Get real-time transactions updates Keep track of your credit card and account transactions in real time no matter where you are.

- Pay your bills from wherever you are Pay your utility bills, such as electricity, gas, water and broadband, online from home, office or wherever you can connect.

- Go paperless View and access your bank statements online. It's convenient for you and better for the environment.

- Reset your PIN Manage your PIN online in just a few simple steps to keep your account and credit cards secure.

- Manage transaction limits Adjust your local and international transaction limits easily from wherever you are, be it home, office or on the go.

How to get started

Take charge of your account and credit cards

Download the HSBC India Mobile Banking app from the App Store or Google Play .

Tap 'not registered for online banking'

Open the app and tap 'not registered for online banking' to start your online banking registration process.

Keep your information ready

Use your PAN card, email address or phone banking number and your date of birth to register.

Set your 6-digit PIN

Set your 6-digit PIN and get started.

Frequently asked questions

How can i reset my credit card pin using the hsbc india mobile banking app .

Follow the instructions below to reset your credit card PIN:

- Log on to the app

- Select your credit card

- Tap 'manage cards'

- Select 'reset credit card PIN'

- Submit the request

How to manage domestic and international transaction limit?

Follow the instructions below to manage domestic and international transaction limit:

- Log on to HSBC India Mobile Banking app

- Tap on 'manage cards'

- Select 'set transaction type control'

- Update the desired domestic or international limit

- Select 'save' to submit the request

You might also be interested in

Bill payments.

Paying your bills is now faster, simpler and easier with our enhanced bill payment system.

eStatements

Securely view and download your statements through online banking or the app.

How does a credit card work?

Our step-by-step guide on how credit cards work and how to make the most out of them.

HSBC India mobile banking app

Easily manage your bank accounts and credit cards on our app.

Connect with us

Can You Get a Wooden Credit Card?

Alternative and eco-friendly card options are on the way, but wooden cards aren't likely to dominate.

Getty Images | iStockphoto

Some eco-friendly credit card ideas include recycled plastics, alternative materials or going cardless.

Key Takeaways

- Billions of credit cards end up in landfills, but some card issuers are working to incorporate sustainable and recyclable materials into new cards.

- It's getting easier and less expensive for card issuers to switch to more sustainable materials, such as recycled plastics.

- Some companies have been experimenting with greener card designs, including wooden cards and cards made from non-food corn.

Plastic and credit cards are practically synonymous – as in, "I was short on cash, so I whipped out my plastic and bought it." In fact, researchers estimate that there are over 26 billion plastic credit cards in circulation today, the majority of which are made from first-use "virgin" plastics like PVC. Because these cards do not break down and decompose, they will ultimately add to ever-growing landfills.

Why don't companies just switch to more sustainable materials like wooden credit cards? Although one eco-conscious company, Treecard, actually created a wooden debit card, the trend hasn't caught on in the credit world.

"The primary form of card is a polymer card," says Tom Szaky, founder and CEO of TerraCycle, a Trenton, New Jersey-based recycling company. Among the company's initiatives, TerraCycle partners with Mastercard in the UK to recycle credit cards. He says that something like wooden cards won't draw attention away from the classic plastic design. Not only is plastic durable and flexible, he says, but legacy card-reading machines and systems were built with plastic in mind.

"The real answer is there should not be a card at all," says Szaky. But we're not yet at the point in which the world is ready for fully cardless payments, he adds. In the meantime, his company and others are looking for ways to make the credit card industry more sustainable.

Learn more about the impact of plastic credit cards, greener card solutions and how far away we may be from going cardless.

The Impact of Plastic Cards

What's to become of those 26 billion credit cards in circulation? Because of the tiny metal pieces inside, recycling a credit card doesn't really work, although companies like TerraCycle are trying to change that. In a pilot program in the UK in partnership with Mastercard and select HSBC bank branches, TerraCycle has advanced shredding machines that shred cards into 265 tiny pieces. Then TerraCycle is able to separate the plastic and metal waste and reform it into pellets and powders that can be reused. The company is aiming to bring that technology to the U.S. soon.

For now, while the vast majority of old cards wind up in landfills, payment networks and card issuers are beginning to address the plastic issue. In a major announcement, Mastercard will require any newly produced cards in its network to be made from sustainable materials starting in 2028. "This will likely be a catalyst for the space," says Josh Hatcher, senior graphic designer at Vericast Card Solutions.

Some issuers have already committed to similar goals. For instance, all Bank of America credit and debit card products are now made from at least 80% recycled plastic. Another issuer, U.S. Bank, announced in late 2023 that it will use recycled materials for all new cards in its Altitude Go line. And the American Express® Green Card is made from 70% reclaimed plastic.

Eco-Friendly Credit Card Ideas

In order for card issuers to make major changes to their card designs, it has to be practical, but it is getting easier and less expensive, says David Shipper, strategic advisor in the retail banking and payments practice at Datos Insights. "There are more sustainable card material options than ever before, and the quality of these products is much better than in years past," he says. "This allows the bank or credit union to promote their efforts to be more eco-friendly."

Some of the options include:

Recycled Plastics

Card companies that commit to using a high percentage of recycled plastics (such as rPVC, rPET, or PLA) can make a big impact. And where that recycled plastic comes from matters as well. "What's exciting is not just moving from virgin to recycled, but to start looking at using high-risk materials like ocean plastic," Szaky says. That means sourcing the plastic from waste found in oceans. "When card companies push this, it's nice to see," he says.

Alternative Materials

Some companies have been experimenting with greener card designs, such as Treecard's wooden card. Another example is Bank of New Hampshire, which uses 84% polylactic acid, or PLA, for its debit cards. PLA is a bio-sourced, renewable material made from non-food corn. It is biodegradable within six months.

Going Cardless

Research firm eMarketer said it expects that more than two-thirds of smartphone users will use a mobile wallet by the end of 2024. But even many early adopter mobile wallet users still carry their plastic credit cards since that has always been the primary connection between them and their bank, says Shipper. "Consumers like the security of having a physical card," he adds, noting that we are likely a decade away from being cardless.

Businesses are getting ready, however. According to the J.D. Power 2024 U.S. Merchant Services Satisfaction Study , 88% of small businesses accept digital wallets compared with the 94% that accept cards, narrowing the gap.

"Using some form of verification like your phone or some biometric to pay – that's the future," says Szaky. He points out that China has been using biometrics for years, but the U.S. will take longer to get there. "Legacy systems will need time to rationalize."

Are Metal Credit Cards Sustainable?

Metal credit cards have been around for some time, but they are mostly reserved for high-end cardholders. "Metal is significantly more expensive than plastic, which is why it is mainly used in upscale and exclusive cards," says Hatcher. "For that reason alone, I do not foresee many cards in the market switching from plastic to metal."

Metal cards are also not a great choice for the environment. "Production of metal cards requires significantly more energy than is required to produce a PVC card," according to Mastercard's whitepaper, "A Guide to Issuing Sustainable Cards," “thus any metal card has a higher energy footprint than a PVC card and cannot be endorsed from a sustainability perspective."

For now, the best option will be recycled PVC card material, which is available at a lower cost and is more easy to source, says Shipper.

How Consumers Can Make a Difference

Moving away from a first-use plastic credit card world will take time, but there are small changes that consumers can make that might help.

- Opt out of junk mail. Szaky points out that some card issuers use fake plastic credit cards in their promotional mailers. Opting out can help prevent some of that waste. Just go to optoutprescreen.com or call 888-5-OPT-OUT (1-888-567-8688).

- Return your expired metal cards. Metal cards cannot be shredded or cut up, but most issuers will send you a prepaid envelope to send the card back for recycling. If they don't do so automatically, call and ask.