We use cookies to ensure best experience for you

We use cookies and other tracking technologies to improve your browsing experience on our site, show personalize content and targeted ads, analyze site traffic, and understand where our audience is coming from. You can also read our privacy policy , We use cookies to ensure the best experience for you on our website.

- Leaders Speak

- Brand Solutions

- Standard Chartered launches co-branded travel credit card in partnership with EaseMyTrip

- ETTravelWorld

- Updated On Jul 20, 2022 at 01:17 PM IST

87% of Indian travellers expect airport lounge access as a premium card benefit: Collinson research

New research indicates that easing travel restrictions across Asia Pacific has increased international leisure travel, in spite of the remaining travel anxiety. According to the research, lounge access is regarded as a desirable benefit by Indian travellers as it acts as a promise for the safety of passengers.

- Published On Jul 20, 2022 at 11:36 AM IST

All Comments

By commenting, you agree to the Prohibited Content Policy

Find this Comment Offensive?

- Foul Language

- Inciting hatred against a certain community

- Out of Context / Spam

Join the community of 2M+ industry professionals

Subscribe to our newsletter to get latest insights & analysis., download ettravelworld app.

- Get Realtime updates

- Save your favourite articles

- travel card

- rikant pittie

- standard chartered bank

- standalone airlines

- credit cards & unsecured lending

- vinay misra

- domestic & international hotel bookings

- travel news

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

Review: Standard Chartered Journey Card

The StanChart Journey Card represents a major improvement over the hapless X Card in every way- though that's kind of a low bar!

Here’s The MileLion’s review of the Standard Chartered Journey Card, which has a pretty hardcore origin story.

Picture this- the year is 2019. You’re a bank with big plans to capture the affluent millennial segment. Do you:

- Design a card that not only attracts new customers, but offers enough value for them to stick around and become lifelong ones?

- Slap a 100,000 miles sign-up bonus on the bumper and railroad that sucker through to the market- renewals are a tomorrow problem!

It’s clear which option the bank decided on, and there’s nothing wrong with that approach, mind you, only that no one ever got down to thinking about renewal.

The story of how the premium metal Standard Chartered X Card eventually became the mass-market plastic Journey is a fascinating one— and you can read about it here — but it’s not the focus of this article.

Instead, the question before us is much simpler: should you get a Standard Chartered Journey Card?

Overview: SCB Journey Card

Let’s start this review by looking at the key features of the Standard Chartered Journey Card.

The Standard Chartered Journey Card is a direct replacement for the X Card, so even if you still hold a physical X Card, all your earn rates, benefits and fees will follow the Journey Card from 19 May 2023.

In other words, the Standard Chartered X Card no longer exists! However, for posterity’s sake, I’m preserving the legacy review, just so you understand how bad it had become.

Review: Standard Chartered X Card

How much must I earn to qualify for a SCB Journey Card?

How the mighty have fallen. Back when this was the Standard Chartered X Card, a minimum income of S$80,000 p.a. was required.

That’s now been cut to the MAS-mandated minimum of S$30,000 p.a.

How much is the SCB Journey Card’s annual fee?

The Standard Chartered Journey Card has an annual fee of S$194.40 for principal cardholders. You can either opt for a first year fee waiver, or pay the fee to receive 10,000 miles.

The annual fee is waived for up to five supplementary cards (it’s not clear what the fee is for the sixth onwards, but why would you want so many anyway?).

What sign-up bonus or gifts are available?

Standard chartered.

StanChart is running a welcome offer valid for applications submitted from 7 August to 30 September 2023 by new-to-bank cardholders, defined as those who:

- Do not currently hold a principal StanChart credit card, and

- Have not cancelled a principal StanChart credit card in the past 12 months

Cardholders can earn up to 45,000 bonus miles, broken down as follows:

Cardholders have the option of paying the first year’s S$194.40 annual fee to receive 10,000 bonus miles . This works out to a cost of 1.94 cents per mile, which is on the high side given cheaper alternatives for buying miles like CardUp and Citi PayAll.

Regardless of whether they pay the first year’s annual fee, cardholders will receive 35,000 bonus miles for spending at least S$3,000 in the first 60 days of approval. That’s the real headline here, as it represents an excellent return on your spend.

Bonus miles are on top of the StanChart Journey Card’s regular earn rates of 1.2-3 mpd, so assuming you spend the full S$3,000 on local, non-bonused transactions, you’re looking at an additional 3,600 miles (S$3,000 @ 1.2 mpd), for an overall haul of up to 48,600 miles.

New-to-bank customers who apply for a StanChart Journey Card via SingSaver by 21 September 2023 will be eligible to receive an extra S$120 in cash:

- S$100 cash : For approval (no minimum spend)

- S$20 cash : For spending at least S$500 and making a transaction of at least S$20 with Shopee, Lazada, Taobao, ezbuy, Qoo10, Carousell or Netflix within 30 days of approval

Since I imagine you’d be spending S$3,000 on this card to meet the sign-up bonus anyway, the S$500 minimum spend should be no deterrent. Also note that both the fee-paying and fee-waiver options are eligible for the extra S$120 cash.

Approval must be received within 14 days after 21 September 2023, and cash will be disbursed via PayNow within four months from the date of fulfilling the necessary criteria.

How many miles do I earn?

Sgd/fcy spend.

Standard Chartered Journey Card cardholders will earn:

- 3x 360° Rewards Points per S$1 spent locally (equivalent to 1.2 mpd )

- 5x 360° Rewards Points per S$1 spent overseas (equivalent to 2 mpd )

These aren’t the highest rates in the market, though it’s certainly not the lowest either.

All FCY transactions are subject to a 3.5% fee, which is the highest in the market (other banks max out at 3.25%).

This means that using your card overseas represents buying miles at 1.75 cents each .

However, the Standard Chartered Journey Card is offering a rebate of the usual 3.5% FCY transaction fee for overseas spend made and posted during:

- November 2023

- December 2023

No registration is required, and cashback will be credited according to the following timelines:

This is a great little promotion, insofar as it represents an opportunity to earn an uncapped 2 mpd overseas, with no FCY fees.

You can find the T&Cs of this offer here.

Bonus Spend

StanChart Journey Cardholders will earn 7.5 points per S$1 spent (3 mpd) on selected bonus categories, capped at S$1,000 per statement month.

The bonus categories are often confusing to cardholders, and it’s easy to see why. On Standard Chartered’s website, bonus categories are listed as:

- Transportation

- Food Deliveries

- Online Groceries

However, these are somewhat misleading labels. I’ve taken the liberty of reclassifying them based on the actual MCC ranges for greater clarity:

Do note that the examples are not exhaustive; all that matters is:

- the MCC falls within the approved range

- the transaction is online

- the transaction is in SGD

Any transactions beyond the S$1,000 monthly cap will earn 1.2 mpd.

3 mpd is not much of a draw, in and of itself, since you could earn 4-6 mpd on these categories with other cards.

When are 360° Rewards Points credited?

The base 3x/5x 360° Rewards Points for local/overseas spend are credited when your transaction posts, which generally takes 1-3 working days.

The bonus 4.5x 360° Rewards Points for local grocery, food delivery, and transport will be credited at the end of the statement period.

How are 360° Rewards Points calculated?

Here’s how you can work out the 360° Rewards Points earned on your Standard Chartered Journey Card.

This means the minimum spend required to earn points is S$0.17, whether in local or foreign currency.

For what it’s worth, SCB has a more forgiving rounding policy than banks like OCBC and UOB, which enables the Standard Chartered Journey Card to outperform ostensibly higher-earning cards for smaller transactions. An illustration is provided below.

If you’re an Excel geek, here’s the formulas you need to calculate points:

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

- General Spending Cards

- Specialised Spending Cards

What transactions aren’t eligible for 360° Rewards Points?

A full list of transactions that do not earn transactions can be found in the T&Cs.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Government Services

- GrabPay and YouTrip top-ups

- Insurance Premiums

For avoidance of doubt, CardUp transactions will earn points. Standard Chartered is also one of the rare few banks which still offers points for utilities payments, so enjoy it while it lasts.

What do I need to know about 360° Rewards Points?

360° Rewards Points earned on the Standard Chartered Journey Card never expire, so long as the card account remains active.

This is complicated, so bear with me.

If you are converting points to any programme other than KrisFlyer , 360° Rewards Points pool, end of story.

If you are converting points to KrisFlyer :

- Points earned Visa Infinite cards and the Journey card pool

- Points earned on non-Visa Infinite cards pool

In case you’re wondering why the Journey gets to party with the Visa Infinite cards, it’s purely a legacy reason. Remember, the former X Card was a Visa Infinite, so Standard Chartered could hardly “downgrade” all legacy X Card points by putting them on the same scheme as the non-Visa Infinite.

It used to be the case that all Standard Chartered points pooled, so a cardmember with a non-Visa Infinite card could apply for a Visa Infinite card to “enhance” the value of his non-Visa Infinite points (they enjoy a favourable conversion ratio, as you’ll see below). That is no longer possible.

Transfer Partners & Fees

Standard Chartered has 10 different airline and hotel transfer partners, one of the widest ranges in Singapore.

Transfers cost S$27 each, regardless of the number of points transferred.

Here’s the thing though: Standard Chartered has the most confusing rewards redemption system of any bank in Singapore, period. Yes, I’d go so far as to say that even Bank of China has it better.

Because of the way the system is set up, some people go away thinking:

- StanChart no longer offers transfers to KrisFlyer , or

- StanChart no longer offers transfers to anything but KrisFlyer

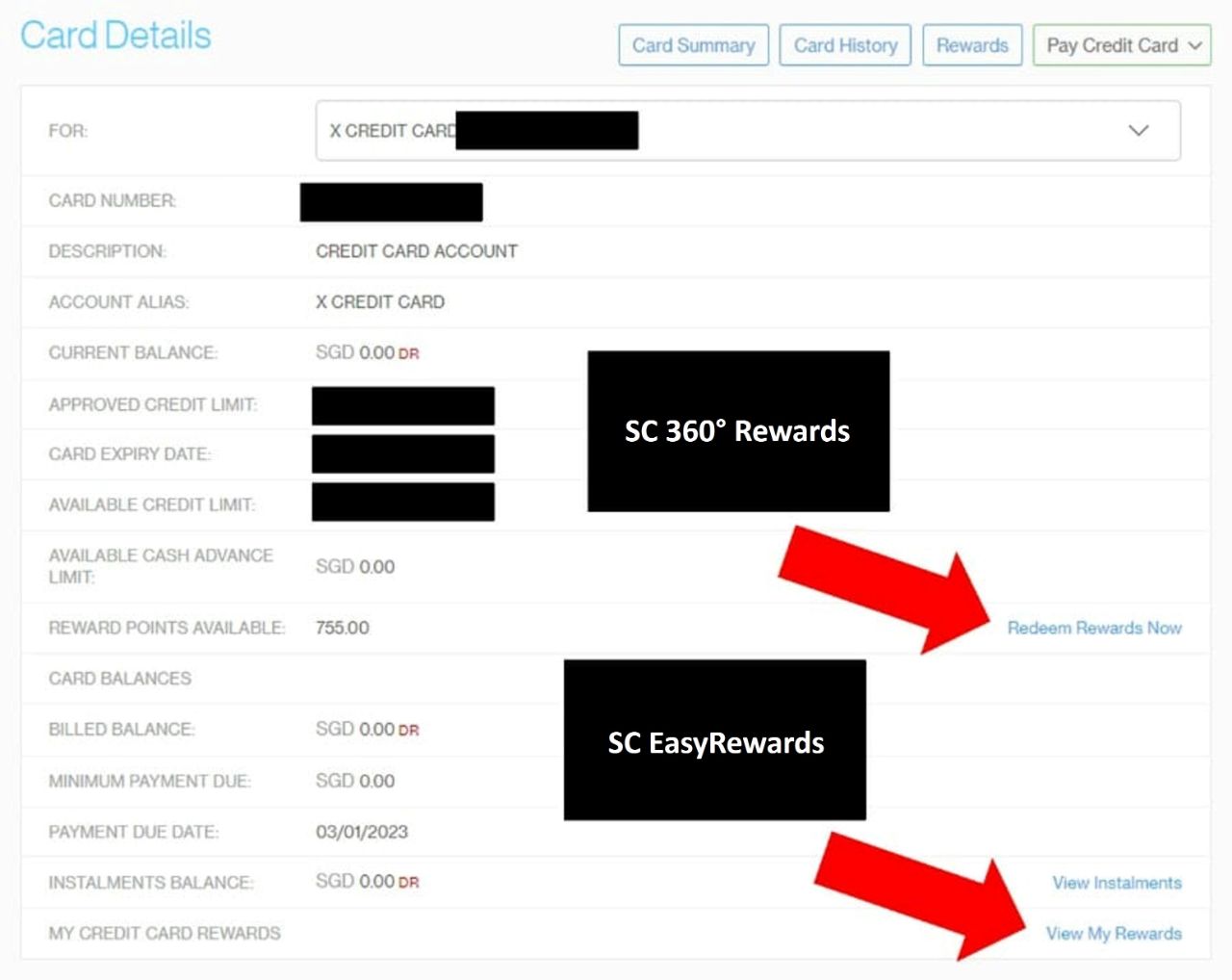

What’s going on is that StanChart has two different rewards portals:

- SC 360° Rewards (for redeeming KrisFlyer only)

- SC EasyRewards (for redeeming all other partners)

Both portals can be accessed through the desktop online banking platform.

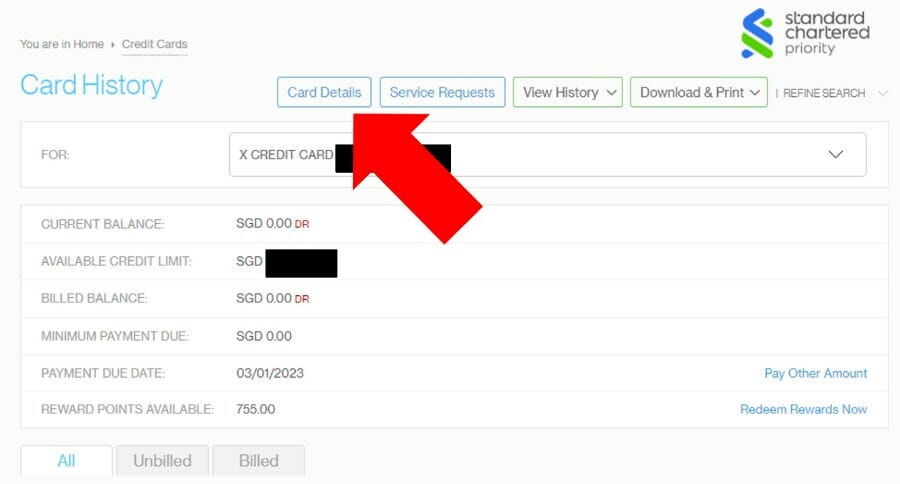

First, navigate to your credit card and click on the ‘Card Details’ button.

You’ll then see two options:

- Redeem Rewards Now (which brings you to SC 360° Rewards)

- View My Rewards (which brings you to SC EasyRewards)

You don’t need to tell me this is confusing. If you must use two different rewards portals, why not change the labels to make it clearer what’s found where?

Ah, StanChart. Never change.

Transfer Time

Conversions to KrisFlyer miles are generally completed within 1-3 working days. For other programmes, expect to wait up to 5 working days.

Other card perks

Two complimentary lounge visits.

Standard Chartered Journey Card cardholders enjoy two complimentary lounge visits per membership year, courtesy of Priority Pass. A guest fee of US$32 applies after the free visits have been exhausted, and this benefit is only available to the principal cardholder.

Here’s how this compares to other cards in its segment:

SC EasyBill

This isn’t a unique feature of the Standard Chartered Journey Card per se, but all StanChart cardholders can use SC EasyBill to pay the following bills:

- Individual Income & Property Tax

An admin fee of 1.9% applies, which is sometimes lowered for targeted customers.

To illustrate, suppose you have a S$10,000 income tax payment to make:

- After setting up the payment, StanChart will pay S$10,000 to IRAS on your behalf

- Your Journey Card will be charged S$10,190 (S$10,000 +1.9% admin fee)

- You’ll earn 12,000 miles (the admin fee does not earn miles)

- tl;dr: you’ve paid S$190 for 12,000 miles, or 1.58 cents apiece.

It’s not a terrible rate, but Citi PayAll offers much better rates during its regular promos, as well as a wider scope of payments.

Grab promo codes

From 19 May to 31 December 2023, Standard Chartered Journey Cardholders can enjoy a S$10 Grab transport promo code (SCCHANGI) for rides to and from Changi Airport, valid for the first 2,000 redemptions.

The code can be redeemed a maximum of once per cardholder.

The T&Cs of this offer can be found here.

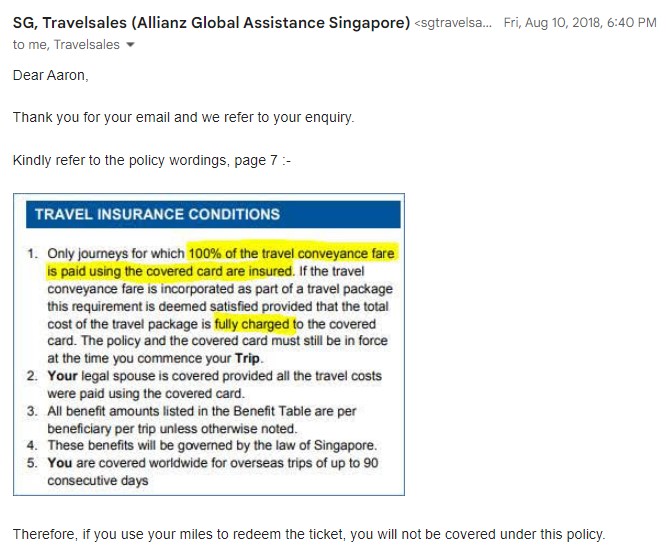

Complimentary travel insurance

Standard Chartered Journey Card cardholders enjoy complimentary travel insurance underwritten by Allianz, which is automatically activated when the full airfare is charged to the card. Allianz has previously clarified that coverage does not apply to award tickets, unfortunately.

Do note there is no coverage for trip cancellation and disruption, delayed flights, rental car excess, or personal liability. I personally would not feel comfortable without this, so I’d recommend you purchase additional coverage regardless.

Summary Review: SCB Journey Card

The Standard Chartered Journey Card is a massive improvement over the X Card, but really, that’s not saying much. After all, since when does cutting the annual fee by 70%, adding bonus categories and offering an FCY transaction fee waiver not make things better?

I think there’s nothing wrong with getting the Journey Card to enjoy the initial wave of launch offers— in fact, I’ve laid out a more detailed plan here — but my question is what happens in 2024 after those limited-time promotions cease (and if that isn’t X Card deja vu all over again, I don’t know what is).

Fortunately, it seems like it should be fairly easy to get an annual fee waiver for the Journey ( just like the X Card, incidentally!), so the bigger issue is whether you want to commit to earning points with yet another bank. Standard Chartered has a relatively large minimum conversion block of 10,000 miles for KrisFlyer, though it’s much smaller at 1,000 miles for its nine other partners.

Worth a punt in my book, assuming the hopelessly convoluted rewards system doesn’t make you scream.

- card review

- standard chartered

Similar Articles

Dbs adds cardup and ipaymy to rewards exclusion list (update: exclusion removed), complete faqs: uob lady’s savings account.

The Zero FCY fee is looking lucrative for my upcoming trip! Do you know if there are any other cards offering the same?

However, if you’re a new-to-bank customer, you can stack it with the extra 5 mpd offered during the first 30 days for a total of 8 mpd.

>> where is the 5 mpd found in the offer?

this is a leftover from a previous sign-up offer. will get it updated, thanks!

one more question – it states “transactions made and posted” . my hotel check out is 31st October which i will pay on that day. will this qualify or no?

it is impossible to tell when a transaction will be posted, so depends on your luck

Is the first year free waiver applicable to existing SC customers too? Not very clear from the T&Cs but it seems only for new customers

I have applied for SC Journey and wanted to go for the 35k miles signup offer with minimum $3k spend. Used CardUp to pay my income tax to reach to $3k minimum spend but the transaction was deemed invalid unfortunately. SC agent themselves are unclear with the requirement, I checked with them to clarify that I did indeed meet the requirements, which they have confirmed, but to be met with disappointment when the miles did not arrive at the promised date

contact cardup for assistance.

see this post: https://t.me/milelion/875466

I have one question about sign-up gift (which is still being offered in 2024). If I did cancel a SC credit card previously ~10 years ago and I did enjoy sign-up gift then (I recalled is $200 cash) – if I sign-up SC Journey card now, will I get the full welcome miles or will be knocked off by previous $200 cash (in equivalent form of miles/points)? My understanding is if today the welcome gift is $300 cash, then only $100 will be credited after offsetting $200 previous gift. But I am not sure how it works when the welcome … Read more »

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

- New Prepaid SIM

- International Roaming

- Switch Prepaid to Postpaid

- Port to Airtel Prepaid

- Buy New Connection

- Port to Airtel

- Free Sim Delivery

- Buy New DTH Connection

- Upgrade Box

- Buy Second DTH connection

- View Account

- Get New Account

AIRTEL BLACK

Airtel finance.

- Credit Card

AIRTEL BLACK NEW

10 best credit cards for international travel.

Travelling abroad can be an exciting and enriching experience, but managing expenses in foreign currencies can often be a hassle. Hence, choosing the right credit card can help simplify your travels, save money, and provide added benefits such as rewards and insurance. In other words, investing in a credit card for international travel can be a smart choice, especially if you don’t want to get into the hassle of carrying cash in hand of different currencies when traveling abroad.

In this guide, we’ll explore the 10 best credit cards for international travel that are perfect for Indian travellers. These cards not only offer great perks but also come with low or no foreign transaction fees, making them the ideal choice for your next trip.

Also Read: What is a Lifetime Free Credit Card

1. Airtel Axis Bank Credit Card

Along with high credit limits and low interest rates, the Airtel Axis Bank Credit Card offers some amazing offers for international travellers such as complimentary Airport Lounge Access, best deals on international spending, and a lot more. Additionally, you don’t have to worry about strict or stringent eligibility criteria while applying for a credit card. With basic eligibility criteria, such as age limit cardholders (18-70 years of age), Indian citizenship, a good credit score, and more, you can apply for the credit card using your internet devices.

2. SBI Elite Credit Card

The SBI Elite Credit Card is another excellent option for those who travel overseas frequently. It offers 2 reward points for every ₹100 spent internationally and complimentary access to international and domestic airport lounges. This card also provides free membership and discounts on various international spending, making it one of the best credit cards for overseas travel.

3. ICICI Bank Sapphiro Credit Card

The ICICI Bank Sapphiro Credit Card is designed for the sophisticated traveller. It offers low foreign transaction fees and complimentary access to airport lounges globally. You also earn reward points on all international spends, making it a fantastic card for worldwide travel. Additionally, this card provides comprehensive travel insurance coverage.

4. American Express Platinum Travel Credit Card

The American Express Platinum Travel Credit Card is renowned for its travel benefits. It offers membership rewards points that can be redeemed for travel vouchers. You also get access to premium airport lounges and travel insurance coverage. Despite its slightly higher fees, the extensive benefits make it one of the best cards for international travel.

Also Read: How to Activate Your Credit Card

5. Axis Bank Miles & More World Credit Card

The Axis Bank Miles & More World Credit Card is a great option for those who fly frequently with partner airlines. You earn miles on every spend, which can be redeemed for flights and upgrades. The card also offers access to airport lounges and travel insurance, making it ideal for frequent flyers. It’s a top contender among credit cards with no foreign currency conversion fee.

6. Citibank PremierMiles Credit Card

The Citibank PremierMiles Credit Card is perfect for travellers looking for flexibility. You earn miles on every spend, which can be redeemed for flights with any airline. The card also offers low foreign exchange fees and complimentary access to airport lounges. This makes it one of the best credit cards for worldwide travel.

7. YES FIRST Preferred Credit Card

The YES FIRST Preferred Credit Card offers reward points on international spending and access to several airport lounges globally. You can also enjoy 4 complimentary International (Outside India) Aiport lounge visits per calendar year. Additionally, It also comes with comprehensive travel insurance and low foreign currency conversion fees. This card is excellent for those who want to enjoy premium travel benefits without high costs.

8. IndusInd Bank Pinnacle Credit Card

The IndusInd Bank Pinnacle Credit Card is designed for luxury travellers. It offers reward points on all international spends, access to premium airport lounges, and complimentary travel insurance. The low foreign transaction fees make it an attractive option for those looking to minimise costs while travelling abroad.

9. HSBC Premier MasterCard Credit Card

The HSBC Premier MasterCard Credit Card is another strong contender for international travel. It offers reward points on every spend, access to airport lounges worldwide, and travel insurance. The card also has no foreign currency conversion fee, making it one of the best credit cards for overseas travel.

10. Standard Chartered Ultimate Credit Card

The Standard Chartered Ultimate Credit Card offers unlimited reward points on all international spends, access to premium airport lounges, and comprehensive travel insurance. With low foreign exchange fees, it’s a great choice for those who want to enjoy exclusive travel benefits.

Also Read: Make UPI payments through Credit Cards

How To Apply For The Airtel Axis Bank Credit Card?

To apply for the Airtel Axis Bank Credit Card, customers can easily register using the Airtel Thanks App. Here’s how:

- Download the Airtel Thanks App: Available on both Android and iOS platforms, download and install the Airtel Thanks app on your smartphone. Alternatively, you can also visit the Airtel website to register your application.

- Log in or Sign Up: If you already have an Airtel account, you will need to log in using your credentials. If not, sign up for a new account.

- Navigate to the Credit Card Section: In the app, go to the ‘financial services’ section and select the Airtel Axis Bank Credit Card.

- Fill in the Details: Complete the application form with your personal and financial details.

- Submit the Application: After filling in the required information, submit your application. You may need to upload certain documents for verification.

- Approval and Delivery: Once your application is approved, the credit card will be delivered to your registered address.

Choosing the best credit card for international travel depends on your specific needs and preferences. Whether you prioritise reward points, low foreign transaction fees, or access to airport lounges, there’s a card out there that suits your requirements. Meanwhile, the Airtel Axis Bank Credit Card provides an easy application process through the Airtel Thanks App, making it a convenient choice for tech-savvy travellers.

By selecting the right credit card, you can make your international travel more enjoyable and cost-effective. So, review these options carefully and choose the one that best fits your travel lifestyle. Safe travels!

You might also like

What is the Credit Card settlement process?

How to Get Cashback on Credit Card Bill Payment?

Get discounts on your restaurant bills with a credit card

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Best travel credit cards of June 2024

- • Credit card strategy

- • Credit card comparisons

Bankrate expert Garrett Yarbrough strives to make navigating credit cards and credit building smooth sailing for his readers. After regularly featuring his credit card, credit monitoring and identity theft analysis on NextAdvisor.com, he joined the CreditCards.com and Bankrate teams as a staff writer to develop product reviews and comprehensive credit card guides focused on cash back, credit scores and card offers.

- • Rewards credit cards

- • Travel credit cards

Nouri Zarrugh is a writer and editor for CreditCards.com and Bankrate, focusing on product news, guides and reviews. His areas of expertise include credit card strategy, rewards programs, point valuation and credit scores, and his stories on building credit have been cited by Mic.com, LifeHacker, People.com and more. Through his thorough card reviews and product comparisons, Nouri strives to demystify personal finance topics and credit card terms and conditions to help readers save money and protect their credit score.

- • Credit cards

- • Personal finance

Stephanie Zito is a professional traveler, self-employed humanitarian consultant and collector of credit card points. She shares savvy travel tips that she’s learned firsthand circling the globe for more than 25 years. She’s a backpacker, expect and premium traveler who’s visited more than 130 countries and all seven continents. Her life motto is “See the world, change the world, have fun doing it!” and her mission is to inspire others along the journey.

The listings that appear on the website are from credit card companies from which Bankrate receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all credit card companies or all available credit card offers. Here's an explanation for how we make money.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Travel credit cards help you earn valuable points and miles on your purchases. For maximum value, some cards earn rewards not only on travel, but also everyday purchases like dining, groceries and gas. You can redeem these rewards for free or discounted flights, hotel stays or to cover other travel-related expenses.

The best travel cards also come with additional features. Even no-annual-fee travel cards are likely to offer perks like sign-up bonuses, intro APR offers and travel insurance. But for top-of-the-line benefits like airport lounge access, elite status and travel credits, expect to pay an annual fee.

View card list

Table of contents

Why choose bankrate.

We helped over 150,000 users compare travel cards in 2023

We evaluated and compared over 40 travel rewards perks

Over 47 years of experience helping people make smart financial decisions

The Bankrate Promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards .

Bankrate's Best Travel Credit Cards of June 2024

- Best starter travel card: Chase Sapphire Preferred® Card

- Best for flat-rate rewards: Capital One Venture Rewards Credit Card

- Best for luxury travel: The Platinum Card® from American Express

- Best for no annual fee: Capital One VentureOne Rewards Credit Card ( See Rates & Fees )

- Best for foodies: American Express® Gold Card

- Best for everyday spending: Citi Strata Premier℠ Card

- Best for intro APR: Bank of America® Travel Rewards credit card

- Best for point values: Chase Sapphire Reserve®

- Best for practical perks: Capital One Venture X Rewards Credit Card

- Best for pairing: Chase Freedom Unlimited®

- Best for hotel bookings: Wells Fargo Autograph Journey℠ Card

- Best no-annual-fee hotel card: Hilton Honors American Express Card

- Best luxury hotel card: Marriott Bonvoy Brilliant® American Express® Card

- Best for transfer partners: Bilt Mastercard®

- Best for gas: Wells Fargo Autograph℠ Card

- Best for companion tickets: Delta SkyMiles® Platinum American Express Card

- Best starter airline card: Southwest Rapid Rewards® Plus Credit Card

- Best for expedited security screening: Bank of America® Premium Rewards® credit card

- Best for first-year value: Discover it® Miles

- Best for fair credit: Credit One Bank Wander® Card

- What to know about travel credit cards

- Tips for choosing the best travel card

Travel credit card perks

How do credit card points and miles work.

- Expert advice on travel cards

How we assess the best travel credit cards

- Frequently asked questions

- Ask the experts

Credit range

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

0 ? 'Showing ' + filterMatchedProductTiles + ' results' : ' '">

Sorry, no cards match these filters

You can still get a personalized list of cards that fit your credit profile in just a few minutes.

You might also consider these cards

Card categories

Best starter travel card

Chase Sapphire Preferred® Card

Bankrate score

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

Intro offer

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

We calculate this number by multiplying the card's intro offer by Bankrate's valuation of this issuer's rewards program , showing you how much your points or miles are worth in dollars.

Rewards rate

5x on travel purchased through Chase Travel℠. 3x on dining, select streaming services and online groceries. 2x on all other travel purchases. 1x on all other purchases.

Regular APR

- 5x 5x on travel purchased through Chase Travel℠.

- 3x 3x on dining, select streaming services and online groceries.

- 2x 2x on all other travel purchases.

- 1x 1x on all other purchases.

What we love: This popular card comes loaded with features that can make it easy even for occasional travelers to offset the modest $95 annual fee without eating into hard-earned rewards. Plus, its rewards program is one of the best, giving you some of the most valuable travel redemptions — through both Chase and transfer partners — and Chase card pairing opportunities if you want to build your card portfolio eventually. Learn more: Why expert Margaret Weck loves using the Chase Sapphire Preferred Alternatives: If you’re looking for an even simpler travel card, the Capital One Venture Rewards Credit Card is a terrific option. Its flat rewards rate makes it easy to know exactly how much you’ll earn with every purchase and though it can’t match the Sapphire Preferred’s redemption flexibility, it offers more redemption options than the typical travel rewards card.

- You earn Ultimate Rewards points with this card — some of the most valuable and flexible rewards around, especially if you pair it with Chase’s cash back cards in the future.

- The card touts significant long-term benefits like anniversary bonus points and travel credits, as well as travel protections like trip cancellation insurance and a car rental collision damage waiver.

- Doesn’t offer airline- or hotel-specific perks like free checked bags, elite status or free night stays.

- The sign-up bonus is decent, but the card has previously offered higher, chart-topping bonus points.

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Best for flat-rate rewards

Capital One Venture Rewards Credit Card

New Venture cardholders can earn 75,000 miles once they spend $4,000 on purchases within 3 months from account opening

5 Miles per dollar on hotels and rental cars booked through Capital One Travel 2 Miles per dollar on every purchase, every day

2 Miles - 5 Miles

- 5 Miles 5 Miles per dollar on hotels and rental cars booked through Capital One Travel

- 2 Miles 2 Miles per dollar on every purchase, every day

What we love: It’s a great option for travelers looking for a straightforward rewards program and flexible redemption options. You'll earn unlimited miles on all eligible spending and can redeem not only for travel bookings, but also as a statement credit to cover travel purchases made in the past 90 days. Learn more: Why expert Jacqueline DeMarco loves the Capital One Venture Rewards Credit Card Alternatives: The Chase Sapphire Preferred® Card offers a higher rewards rate in some everyday spending categories and potentially more valuable points. Chase points are worth 1.25 cents each if you redeem for travel through Chase, while Capital One miles are only worth 1 cent each when you redeem for travel. Plus, Chase rewards are more helpful for occasional travelers since you can redeem as cash back at 1-cent-per-point value.

- Carries solid perks given its low annual fee, including expedited airport purchase security and hotel experience credits, lost luggage reimbursement and more.

- Zero foreign transaction fees make this an excellent choice for international travelers.

- You can’t offset the annual fee with annual travel credits or bonuses alone as you can with some rival cards.

- The card’s sign-up bonus carries a high spending requirement, so it may be tough to earn if you don’t have large purchases on the horizon.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

Best for luxury travel

The Platinum Card® from American Express

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year. Earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- 5X Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year.

- 5X Earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

What we love: Luxury travelers and big spenders will appreciate the bevy of travel benefits, including annual statement credits worth around $1,700, elite hotel loyalty status and access to perhaps the most comprehensive airport lounge access available with a credit card. Learn more: Why expert Holly Johnson loves the Platinum Card® from American Express Alternatives: The Capital One Venture X Rewards Credit Card offers a taste of luxury at a lower cost than many premium travel cards. You can unlock a generous rewards rate on both travel and general purchases, complimentary access to popular airport lounge memberships and valuable annual travel credits and anniversary miles.

- Comes with a generous welcome offer and a longer time period to earn it compared to most rewards cards.

- A robust line-up of airline and hotel partners and related perks make this card truly valuable for travelers.

- The $695 annual fee may not be worth it if you don’t spend much on travel frequently or can’t take full advantage of the card’s luxury — and often niche — perks.

- Redeeming and maximizing the card’s credit and benefits requires some legwork and can be a bit confusing.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Best for no annual fee

Capital One VentureOne Rewards Credit Card

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

5 Miles per dollar on hotels and rental cars booked through Capital One Travel 1.25 Miles per dollar on every purchase, every day

1.25 Miles - 5 Miles

- 1.25 Miles 1.25 Miles per dollar on every purchase, every day

What we love: This card offers some of the same advantages as the Capital One Venture, without the burden of an annual fee. It gives you the chance to earn flat-rate miles on your everyday spending and the option to transfer miles to over 15 loyalty program partners to even cover travel purchases outside Capital One — a unique level of redemption flexibility for a starter travel card. Learn more: Reasons to get the VentureOne Rewards Card Alternatives: A general-purpose flat-rate credit card that offers 2X points or 2 percent cash back on all purchases may bring more value if you don’t travel often and aren’t ready to upgrade to a travel rewards credit card with an annual fee. However, the Discover it® Miles earns a flat-rate 1.5X miles that can also be redeemed for cash back at 1-cent per mile, which is unusual for travel rewards.

- The welcome offer is generous for a no-annual-fee travel credit card.

- Booking hotel stays and rental cars through Capital One Travel nets you an impressive 5X miles.

- Unlike several no-annual-fee travel cards, redeeming for non-travel purchases waters down your rewards’ value.

- Capital One has no major U.S. carrier in its line-up of travel partners.

- $0 annual fee and no foreign transaction fees

- Earn unlimited 1.25X miles on every purchase, every day

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

Best for foodies

American Express® Gold Card

Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S. Earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X). Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- 4X Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S.

- 4X Earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- 3X Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

What we love: Few credit cards are more rewarding for traveling foodies than the American Express Gold Card. Both the food-related annual credits and the rewards rates at restaurants, U.S. supermarkets and on flights booked directly with airlines or via the Amex travel portal are some of the best on the market. In fact, the up to $240 in credits each year alone nearly make up for the annual fee. Learn more: Why the Amex Gold is worth the annual fee Alternatives: If the Amex Gold Card’s annual fee sounds high, consider the Chase Sapphire Preferred® Card . It carries key travel perks, high travel and dining rewards rates, and a much lower annual fee.

- This card features one of the best rewards return rates available on dining, groceries and food deliveries.

- There is no preset spending limit, so you can enjoy extended purchasing power, and you also have the option to pay off purchases with Pay Over Time if necessary.

- Although the card touts a solid collection of travel perks, it doesn’t include popular premium card perks like airport lounge access or trip cancellation/interruption insurance.

- Only eligible airfare earns more than 1X points, while rival cards often earn similar (or higher) reward rates on hotel stays and other travel purchases as well.

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

Best for everyday spending

Citi Strata Premier℠ Card

- Earn 70,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com

Earn 10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com. Earn 3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations. Earn 1 Point per $1 spent on all other purchases

- 10X Earn 10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

- 3X Earn 3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations.

- 1X Earn 1 Point per $1 spent on all other purchases

What we love: This card’s high rewards rate in everyday bonus categories makes it an especially good choice for occasional travelers and people looking for a standalone rewards card. Its practical bonus categories mean you can earn rewards quickly, even if you don’t actually spend a ton on travel. Alternatives: As long as you don’t mind buying groceries online, the Chase Sapphire Preferred® Card could be an even more lucrative everyday rewards card. That’s thanks mostly to its high point redemption value (1.25 cents per point when you use points to book travel with Chase, versus just 1 cent per point when you book with Citi using the Strata Premier).

- It’s one of the only travel cards that offers a high rewards rate on groceries, dining and gas, so it should work well whether it’s your standalone card or just one part of your card stack.

- Its annual hotel benefit carries enough value to potentially offset the annual fee on its own.

- The annual hotel benefit, though generous, isn’t very flexible: You’ll only get the $100 discount if you book a single hotel stay of $500 or more (excluding taxes and fees) through CitiTravel.com.

- Based on Bankrate’s latest point and mile valuations, Citi ThankYou rewards carry a lower average redemption value than Chase, Amex and Capital One rewards.

- Earn 10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

- Earn 3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations.

- Earn 1 Point per $1 spent on all other purchases

- $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking.

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

Best for intro APR

Bank of America® Travel Rewards credit card

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 1.5X Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

What we love: This entry-level travel card keeps things simple for occasional travelers. It offers simple flat-rate rewards and lets you redeem for a broad mix of travel options not typically available on many travel cards, such as cash back toward purchases with travel agencies, zoos, art galleries and more. It’s even more valuable if you’re a Bank of America customer and can qualify for a rewards boost through the Bank of America Preferred Rewards® program. Learn more: Is the Bank of America Travel Rewards card worth it? Alternatives: The Capital One VentureOne Rewards Credit Card is another great starter travel card, but, unlike many cards in this category, it lets you transfer your miles to airline and hotel partners, potentially for a higher redemption value.

- Its easy-to-earn sign-up bonus and intro APR offers give this card good short-term value.

- No annual fees or foreign transaction fees sweeten this offer.

- It only offers 1.5X points on purchases, and you can’t transfer points can’t to airline partners for more rewards value, so it may not be as lucrative as competing cards.

- The top tiers of the Bank of America Preferred Rewards® program may be out of reach for many cardholders.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 19.24% - 29.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Best for point values

Chase Sapphire Reserve®

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

Earn 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠. Earn 5x total points on flights through Chase Travel℠. Earn 3x points on other travel and dining. Earn 1 point per $1 spent on all other purchases.

- 10x Earn 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠.

- 5x Earn 5x total points on flights through Chase Travel℠.

- 3x Earn 3x points on other travel and dining.

- 1x Earn 1 point per $1 spent on all other purchases.

What we love: Rewards-savvy travelers will be hard-pressed to find a card with better rewards potential than the Sapphire Reserve. Points are worth 50 percent more through Chase Travel, and potentially more with the right transfer partner. It’s a stellar partner for Chase’s cash back cards and stacks on even more value with enough perks to recoup the annual fee without relying on hard-earned rewards. Learn more: Why expert Holly Johnson loves the Chase Sapphire Reserve Card Alternatives: The Capital One Venture X Rewards Credit Card offers some of the same key perks as the Sapphire Reserve at a much lower cost. Along with a generous rewards rate on both Capital One Travel and general purchases, the card boasts valuable, practical benefits like competitive airport lounge access , up to $300 in annual Capital One Travel credits and 10,000 bonus miles every year on your account anniversary.

- You can kickstart your rewards bank with one of the most valuable sign-up bonuses on the market.

- Its top-tier benefits include up to $300 in annual travel statement credits, Priority Pass airport lounge access, exhaustive travel protections and stand-out partner perks.

- The card’s cost could be a deterrent for some new cardholders, especially if they plan on encountering adding multiple authorized users.

- You won’t get as many luxury hotel and airport lounge perks with this card as you would with some of its rivals.

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

Best for practical perks

Capital One Venture X Rewards Credit Card

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

10 Miles per dollar on hotels and rental cars booked through Capital One Travel 5 Miles per dollar on flights booked through Capital One Travel 2 Miles per dollar on every purchase, every day

2 Miles - 10 Miles

- 10 Miles 10 Miles per dollar on hotels and rental cars booked through Capital One Travel

- 5 Miles 5 Miles per dollar on flights booked through Capital One Travel

What we love: This is the perfect middleground for travelers who want the practical benefits from luxury travel cards without dealing with bloated features and an annual fee upwards of $500. It offers complimentary lounge access, high-earning bonus rewards categories, anniversary credits and bonus miles, which can easily make the card worth it for frequent travelers. Learn more: Capital One Venture X Benefits Guide Alternatives: If a higher annual fee is no issue, consider The Platinum Card® from American Express. It’s a top choice for frequent travelers thanks to its impressive welcome offer and luxury perks like annual travel credits, lounge access and hotel elite status. However, the Chase Sapphire Reserve® may be better if your luxury travel experience calls for racking up more rewards.

- Offers anniversary bonus miles and a chance to earn credits worth hundreds of dollars starting at your first account anniversary.

- Comes with complimentary lounge access at over 1,300 lounges for you and two guests per visit.

- To earn the anniversary credit, travel must be booked through the Capital One Travel portal. That’s not as flexible as some other cards, which offer credits that cover any travel purchases, regardless of how you book.

- Lacks some perks found on other premium travel cards like airline or hotel elite status, which can get you benefits like free checked bags or room upgrades.

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

Best for pairing

Chase Freedom Unlimited®

Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That's 6.5% on travel purchased through Chase Travel, 4.5% on dining and drugstores, and 3% on all other purchases.

Enjoy 5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service 1.5% on all other purchases

- 5% Enjoy 5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service

- 1.5% 1.5% on all other purchases

What we love: Not only does it earn 1.5 percent cash back on general spending, but it also has a bonus cash back rate for drugstores and dining at restaurants. And if you pair it with one or two premium Chase travel cards, you could pool your rewards for better travel redemption value. Learn more: Why I love the Chase Freedom Unlimited Alternatives: If you want to take advantage of even more rewarding cash back categories and remain in the Chase family, consider the Chase Freedom Flex℠ .

- You can pool rewards with other Chase cards to maximize your earnings.

- The additional rewards rate offer can add even more cash back to your pocket for the first year.

- The welcome offer isn’t as competitive as other cards’ offers.

- Maximizing rewards with this and other Chase cards can get complicated for people who like simple rewards programs.

- Intro Offer: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

Best for hotel bookings

Wells Fargo Autograph Journey℠ Card

- Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip.

Earn unlimited 5X points on hotels Earn unlimited 4X points on airlines Earn unlimited 3X points on other travel and restaurants Earn 1X points on other purchases

- 5X Earn unlimited 5X points on hotels

- 4X Earn unlimited 4X points on airlines

- 3X Earn unlimited 3X points on other travel and restaurants

- 1X Earn 1X points on other purchases

What we love: It offers a great rewards rate on hotel bookings and gives you a chance to earn a $50 annual statement credit with a $50 minimum airline purchase. Add in a solid rate on airline purchases, other travel and restaurants and this card carries great value as a standalone mid-tier card for occasional travelers. Alternatives: If you want to earn travel rewards but don’t actually spend much on hotels and airfare, the lower-tier Wells Fargo Autograph℠ Card is also worth a look. Though it earns also rewards on travel, it boasts a great mix of other practical everyday categories (including gas stations).

- You can transfer points to Wells Fargo’s new list of airline and hotel partners, including popular programs like British Airways Executive Club, Choice Privileges and more, which could boost the redemption value of your rewards.

- The $50 annual statement credit offsets more than half the card’s $95 annual fee and should be a cinch to earn if you fly at least once per year.

- Wells Fargo only offers one other card that earns travel rewards (the Autograph), and there is some category overlap between the two, so they may not be as lucrative as some competing card stacks.

- The card doesn’t carry some popular travel perks available on other mid-tier travel cards, such as credits for expedited airport security screening or rideshares.

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points on other purchases.

- $95 annual fee.

- Book your travel with the Autograph Journey Card and enjoy Travel Accident Insurance, Lost Baggage Reimbursement, Trip Cancellation and Interruption Protection and Auto Rental Collision Damage Waiver.

- Earn a $50 annual statement credit with $50 minimum airline purchase.

- Up to $1,000 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

Best no-annual-fee hotel card

Hilton Honors American Express Card

- Earn 70,000 Hilton Honors Bonus Points plus a Free Night Reward after you spend $2,000 in purchases on the Hilton Honors American Express Card in the first 6 months of Card Membership. Offer Ends 7/31/2024.

Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with hotels and resorts within the Hilton portfolio. Earn 5X Points per dollar on purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations. Earn 3X Points for all other eligible purchases on your Card.

- 7X Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with hotels and resorts within the Hilton portfolio.

- 5X Earn 5X Points per dollar on purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

- 3X Earn 3X Points for all other eligible purchases on your Card.

What we love: This card earns rewards in a terrific mix of everyday bonus categories, so it should be easy to rack up Hilton points even if you don’t spend a ton on hotel bookings. Since it charges no annual fee and provides a few Hilton Honors benefits like Silver status, it’s also a great fit if you’re new to hotel cards and want a single no-annual-fee option instead of juggling multiple rewards cards. Learn more: Why expert Holly Johnson loves the Hilton Honors American Express Card Alternatives: The American Express® Green Card could be more flexible since it lets you earn and redeem rewards on a much wider variety of travel purchases, including airfare and bookings with several hotel brands, not just Hilton. You can transfer points to the Hilton Honors program as well, but the Hilton Honors American Express Surpass® Card may be better if you prefer upgraded Hilton-specific rewards, loyalty status and other perks.

- Comes with automatic Silver Elite status, which includes a free fifth award night when you book at least four consecutive nights with points.

- Earns rewards in three of the average person’s biggest spending categories, making it a terrific standalone option for earning Hilton points.

- A higher-tier Hilton card would earn more on Hilton bookings and could be more lucrative for frequent guests, even with an annual fee.

- You can only redeem points with Hilton and its partners, which limits the rewards value you earn on the everyday categories compared to a general-purpose cards’ rewards.

- Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with hotels and resorts within the Hilton portfolio.

- Earn 5X Points per dollar on purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

- Earn 3X Points for all other eligible purchases on your Card.

- Enjoy complimentary Hilton Honors™ Silver status with your Card. Plus, spend $20,000 on eligible purchases on your Card in a calendar year and you can earn an upgrade to Hilton Honors™ Gold status through the end of the next calendar year.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- No Annual Fee.

Best luxury hotel card

Marriott Bonvoy Brilliant® American Express® Card

- Earn 95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

Earn 6X Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy® 3X points at restaurants worldwide and on flights booked directly with airlines 2X points on all other eligible purchases

- 6X Earn 6X Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy®

- 3X 3X points at restaurants worldwide and on flights booked directly with airlines

- 2X 2X points on all other eligible purchases

What we love: Frequent Marriott guests looking for luxury card-level perks and elite status should be able to justify this premium card. Along with a terrific rewards rate on Marriott bookings and an annual free night award, you could enjoy generous annual credits for restaurant purchases and Marriott property stays, airport lounge access, elite night credits and more. Learn more: Best Marriott credit cards Alternatives: If you’re looking for top-tier travel perks but want the flexibility to earn and redeem rewards for stays at any hotel chain, consider an elite travel card from Chase or Amex, which can come with generous travel benefits, airport lounge access and the ability to transfer points to Marriott. The Capital One Venture X Rewards Credit Card is another lucrative alternative.

- Outperforms other Marriott cards with its boosted rewards on travel-related categories and 21X points at Marriott Bonvoy hotels, thanks to the automatic Platinum Elite status.

- It’s one of the only hotel cards that includes complimentary Priority Pass lounge access, top travel protections and credits for expedited airport security screening.

- Unlocking some of the card’s best perks — like Five Suite Night Awards — requires a $60,000 annual spend, which may be tough to reach even for frequent Marriott guests.

- Unless luxury perks are at the top of your wishlist, the annual fee may not be worth it and a lower-tier hotel card may offer more value overall.

- $300 Brilliant Dining Credit: Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card at restaurants worldwide.

- With Marriott Bonvoy Platinum Elite status, you can receive room upgrades, including enhanced views or suites, when available at select properties and booked with a Qualifying Rate.

- Earn 6X Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy®. 3X points at restaurants worldwide and on flights booked directly with airlines. 2X points on all other eligible purchases.

- Free Night Award: Receive 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy points) at hotels participating in Marriott Bonvoy®. Certain hotels have resort fees.

- Each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant® American Express® Card, you will be eligible to select a Brilliant Earned Choice Award benefit. You can only earn one Earned Choice Award per calendar year. See https://www.choice-benefit.marriott.com/brilliant for Award options.

- $100 Marriott Bonvoy Property Credit: Enjoy your stay. Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card.

- Fee Credit for Global Entry or TSA PreCheck®: Receive either a statement credit every 4 years after you apply for Global Entry ($100) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant® American Express® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- Each calendar year with your Marriott Bonvoy Brilliant® American Express® Card you can receive 25 Elite Night Credits toward the next level of Marriott Bonvoy® Elite status. Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express. Terms apply.

- Enroll in Priority Pass™ Select, which offers unlimited airport lounge visits to over 1,200 lounges in over 130 countries, regardless of which carrier or class you are flying. This allows you to relax before or between flights. You can enjoy snacks, drinks, and internet access in a quiet, comfortable location.

- No Foreign Transaction Fees on international purchases.

- With Cell Phone Protection, you can be reimbursed, the lesser of, your repair or replacement costs following damage, such as a cracked screen, or theft for a maximum of $800 per claim when your cell phone line is listed on a wireless bill and the prior month's wireless bill was paid by an Eligible Card Account. A $50 deductible will apply to each approved claim with a limit of 2 approved claims per 12-month period. Additional terms and conditions apply. Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- $650 Annual Fee.

Best for transfer partners

Bilt Mastercard®

Intro offer is not available for this Wells Fargo credit card.

3x points on dining 2x points on travel 1x points on other purchases Earn up to 1x points on rent payments without the transaction fee, up to 100,000 points each calendar year. When you make at least 5 posted transactions in a statement period using your Bilt Mastercard, you'll earn points on rent and qualifying net purchases.

1X Points - 3X Points

- 3X Points 3x points on dining

- 2X Points 2x points on travel

- 1X Points 1x points on other purchases

- 1X Points Earn up to 1x points on rent payments without the transaction fee, up to 100,000 points each calendar year. When you make at least 5 posted transactions in a statement period using your Bilt Mastercard, you'll earn points on rent and qualifying net purchases.

What we love: Not only is this card is a terrific choice for renters since it earns rewards and waives transaction fees when using it to pay rent, it’s also great for rewards strategists considering the extremely robust travel rewards program. You can earn rewards on travel and dining and your points carry a high value whether you redeem through the Bilt travel portal or one of the many airline and hotel transfer partners. Alternatives: If you like the Bilt card’s travel rewards program but don’t see yourself renting long term, consider the Chase Sapphire Preferred® Card. It earns generously on both travel and dining and also boasts high-value points and transfer partners. If the way you pay rent doesn’t incur credit card payment fees, a flat-rate card may also be worth weighing.

- It’s the only card that helps you avoid the fees typically associated with paying rent with a credit card.

- Offers a solid collection of travel perks for a no-annual-fee card, including trip cancellation and interruption protection, trip delay reimbursement and other high-level travel protections.

- You can only use rewards to cover rent, toward a future home down payment or for travel and shopping. Cash back isn’t an option.