We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

How does the Amex Platinum’s travel insurance work?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

American Express credit cards have emerged as one of the top card travel insurance options. After years of neglecting this aspect of their card benefits, they’re extremely competitive among other bank cards — particularly The Platinum Card® from American Express.

The Amex Platinum receives extra insurance less premium cards simply don’t have. Yes, it’s got a massive 100,000 point bonus after spending $6,000 in the first six months of account opening (read our post on common mistakes people make with Amex points to see how valuable they can be), but that’s a short-lived aspect of the card.

Let’s take a look at the Amex Platinum travel insurance — and learn how you can leverage the card for coverage on airfare, baggage, rental cars, and more. You can read our Amex Platinum review for a more well-rounded look at the card’s benefits.

Credit card travel protection benefits

When you pay for airfare with the best travel insurance credit cards , you can get automatic travel protection benefits at no extra charge. Chase and Amex offer fantastic features (while Citibank travel insurance is nonexistent, by the way).

Depending on the card, sometimes just paying the taxes and fees on an award flight will get you coverage. But the coverage you get can vary significantly by card. Enrollment required for select benefits.

Note: Amex stipulates that you must book with a “Common Carrier” to qualify for coverage. That just means you’ve booked an airline, a cruise ship, etc. You won’t be reimbursed if you book an under-the-table commute across Lake Okeechobee on your cousin’s fan boat.

Amex cards eligible for travel insurance

The best American Express cards are eligible for travel insurance. Here’s a table breaking down the most popular cards with the best coverage.

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express (similar name but quite different from the regular Platinum card — read our Amex Business Platinum review )

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant™ American Express® Card

- Hilton Honors American Express Aspire Card

The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Here’s a list of the most popular cards with benefits a tier below the most premium cards:

- American Express® Gold Card

- American Express® Business Gold Card

- American Express® Green Card

- Business Green Rewards

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- The Blue Business® Plus Credit Card from American Express

These cards don’t come with trip cancellation or interruption, and they have lower reimbursement caps for coverages like trip delay and baggage protection.

The Amex Platinum benefits are top of the food chain. Let’s get into the nitty-gritty.

Trip Interruption and Cancellation Insurance

With Amex Platinum Trip Cancellation Insurance, you’re are eligible for up to $10,000 per trip (with a maximum payout of $20,000 per 12-month period) for flight cancellations occurring due to a covered reason (such as inclement weather, jury duty, injury, illness, etc.). You must pay the full ticket with your card (award flight taxes and fees and Pay With Points tickets also eligible).

Trip Delay Insurance

If your trip is delayed more than six hours for a covered reason, you’ll get up to $500 for reasonable expenses (think meals, lodging, toiletries, etc.). Again, you must purchase your trip in full with your Amex Platinum — and paying taxes & fees on award flights or Pay With Points qualifies you for coverage.

Here are some examples of eligible reasons for which Amex will compensate you:

- Equipment failure (the plane wheels fall off, the engine won’t start, etc.)

- Inclement weather

- You lose your travel documents

- Your flight is hijacked

Note that this insurance is valid for round-trip flights only . However, the Amex Platinum benefits guide states:

The period of round-trip travel may consist of roundtrip, one-way, or combinations of roundtrip and one-way tickets with Common Carrier(s).

Rental Car Insurance

The Amex Platinum comes with secondary rental car insurance. That basically means that if your rental car is damaged or stolen, it’ll cover you for any expenses that remain after your personal insurance pays for everything that it covers. Or, if you purchased rental car insurance from the rental agency, Amex Platinum insurance will scoop up the remaining costs that it won’t cover.

However , you can enroll for free in the American Express Premium Car Rental Protection program , and that does offer primary rental car insurance. You’ll pay ~$25 (~$18 for California residents, ~$16 for Florida residents) per rental for up to 42 consecutive rental days (30 consecutive rental days for Washington State cardholders). If you’re renting for a few days, this is definitely worth purchasing.

Unless you’ve got any one of the best credit cards for car rentals . These come with primary rental car insurance for free.

Lost, Damaged, and Stolen Baggage Insurance

The Amex Platinum comes with various coverages in the event that your baggage is lost, stolen, or damaged by the common carrier:

- Up to $2,000 per person per trip for loss of checked baggage

- Up to $3,000 per person per trip for loss of carry-on baggage

- Up to $250 per person per trip for loss of high risk items (i.e. jewelry & electronics)

- Cap of $10,000 per trip for everyone on your itinerary.

High-risk items such as jewelry, electronic equipment, sports equipment, etc., are capped at $1,000 in total coverage. For things like cash, medical items, and contact lenses, you won’t be covered at all.

Delayed Baggage Insurance

Some cards will reimburse you in the event that your checked bags are delayed by more than six hours. If you arrive at your destination and your stuff doesn’t show up, you can go to the store and buy things to tide you over until your bag finally arrives (toiletries, clothes, and the like).

American Express completely ignores this fantastic feature. The Amex Platinum gives you none of this coverage. But read our post on the best credit card for baggage delay coverage to find a good one. This has saved me $500+ on a single trip in the past.

Premium Global Assist

When you are at least 100 miles from home, you can call the Amex Platinum Premium Global Assist to help solve pretty much any hardship. For example:

- You can call for help finding a lost item — including luggage. Amex will pester the airline until you are satisfied

- You can tell Amex to contact a friend or family member during your trip if you can’t reach them yourself

- If you lose your wallet, you can tell Amex to cancel all your credit cards

- If you need emergency evacuation, Amex will arrange everything

Note that Amex may be able to cover your emergency expenses and transportation if you’re in an area with sub-par treatment.

Plus, if you’re in the trenches of your trip planning, they can help you iron out the tedious details. They’ll help you understand travel etiquette in the country you’re visiting, if there are any shots that are required/recommended, and tell you if you need any special visas for your trip.

There are plenty of other things they can do, too. Their number is 1-800-345-2639.

FAQ: Things to consider with trip protection benefits

Because travel coverage is not the same across all cards, you’ll want to use the card that is best for your personal situation. Here are a few things that might factor into which card you use to pay for travel.

Will your airline elite status help if there’s a flight delay or cancellation?

Having airline elite status comes with perks that can help if you pay with a card like the Amex Platinum, which doesn’t have trip delay or cancellation insurance.

For example, some airlines offer passengers with elite status free same-day standby flights, so if your flight is delayed, you could switch to another flight without having to worry about filing a claim for a trip delay.

Similarly, if your flight is canceled, having elite status might give you a higher priority to get a seat on the next available flight. But consider if you’re traveling to a remote destination or region with unpredictable weather that it’s wise to pay with best travel insurance credit cards . If all flights are delayed or canceled, you could end up paying out of pocket for hotel rooms and necessary expenses. Having a card that gets you reimbursed is a great benefit.

Did you book an expensive cruise or tour?

Having trip interruption or cancellation insurance from a credit card can come in handy should you have to cancel an expensive trip for an eligible reason. For example, let’s say you pay for a family cruise to Alaska, but are unable to go due to a last-minute illness. If you paid with the Amex Platinum, it’s possible to get a refund for your trip up to a certain limit.

I recommend reading the terms and conditions of your card’s trip protection benefits before paying for a vacation. It’s important to know who is covered, the claims process, and the reasons you’re eligible to get a refund.

Do you have third-party travel insurance?

Many purchase travel insurance through a third-party company to cover trip delays, cancellations, and other unforeseen events. You can often bundle these coverages with a supplemental medical travel policy, which can be helpful if you’re traveling outside the U.S.

There are great resources on the web to research travel insurance policies . Keep in mind, travel insurance plans and coverage amounts can differ widely — but purchasing a third-party plan can be helpful for folks who don’t pay for a trip with a card that comes with these benefits.

Bottom line

When you pay for a trip with Amex Platinum, you’ll receive trip delay insurance, as well as trip cancellation and interruption. These insurances make the card even more enticing to use for your travel, as you’ll earn 5x Amex Membership Rewards points on airfare purchased directly from airlines or from Amex Travel . Read our post on the best ways to use Amex points to see why that’s such a big deal.

This isn’t even counting the other great perks that come with the card, like Amex purchase protection and a gigantic welcome bonus worth potentially thousands in travel. Line this card’s virtues against the wall and it’s easy to see why the American Express Platinu m card is worth it .

Have you used any of the Amex Platinum travel insurance? I’d love to hear about your experience in the comments. And subscribe to our newsletter for more credit card travel techniques.

For rates and fees of the Amex Platinum, click here.

Joseph Hostetler

Joseph Hostetler is a full-time writer for Million Mile Secrets, covering miles and points tips and tricks, as well as helpful travel-related news and deals. He has also authored and edited for The Points Guy.

More Topics

Credit Cards

Join the Discussion!

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

4 Things to Know About AmEx Trip Cancellation Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

As a card issuer, American Express is well-known for its generous benefits. So whether you’re looking for statement credits , elevated earnings on dining or hotel elite status , AmEx probably has a card that’ll fit.

Among these perks is travel insurance, which can cover you when things go awry. But how does AmEx trip cancellation insurance work, and what does it cover? Let’s take a look.

1. What does American Express trip cancellation insurance cover?

AmEx has different levels of trip insurance depending on the card you hold. Its high-end cards, such as The Platinum Card® from American Express , provide the best benefits, including trip cancellation travel insurance . Terms apply.

Generally speaking, trip cancellation insurance from AmEx will cover your trip's prepaid, nonrefundable costs under eligible circumstances. The coverage maximum for reimbursement is $10,000 per trip and $20,000 per 12-month period. To be covered for trip cancellation, you’ll need to have paid the full amount of the trip with your eligible AmEx card or a combination of your card and other certificates, vouchers or miles.

Covered circumstances in which AmEx will reimburse you for trip cancellation include:

Accidental injury, sickness or loss of life concerning you, a traveling companion or a family member.

Inclement weather prevents you from traveling.

A change in military orders for either you or your spouse.

Hijacking or terrorist acts.

Jury duty or a subpoena if they cannot be postponed or waived.

If your dwelling becomes uninhabitable (e.g., your home catches fire).

Quarantine as imposed by a doctor.

» Learn more: How to find the best travel insurance

Finally, the trip must be round-trip, though the travel can consist of round-trip, one-way and open-jaw tickets . AmEx will reimburse more than your flight costs if you have a covered loss. Other types of purchases that AmEx will cover include:

Any other common carriers.

Common carriers are companies licensed to transport passengers across land, sea or air and require passengers to obtain a ticket before travel. This means rental cars, taxis, ride-share, and commuter travel services don’t qualify. However, tickets for regular bus lines, commercial airlines and standard rail lines do.

Be aware that AmEx’s trip cancellation insurance is secondary; it’ll pay out after other insurance and providers have made their payments.

» Learn more: How does credit card travel insurance work?

2. Which AmEx cards include trip cancellation insurance?

We’ve already mentioned The Platinum Card® from American Express as one that provides trip cancellation insurance, but there are plenty of others that do so as well.

These include both consumer and small business cards, such as the:

Business Centurion Card from American Express.

Centurion Card From American Express.

Delta SkyMiles® Reserve American Express Card .

Delta SkyMiles® Reserve Business American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant® American Express® Card .

The American Express Platinum Card for Schwab.

The Business Platinum Card® from American Express .

The Corporate Platinum Card.

The Platinum Card from American Express for Ameriprise Financial.

The Platinum Card from American Express for Goldman Sachs.

The Platinum Card from American Express for Morgan Stanley.

The Corporate Centurion Card from American Express.

Terms apply.

Other AmEx cards have different types of travel insurance , including trip delay reimbursement, rental car insurance and lost luggage compensation.

» Learn more: The best travel credit cards right now

3. Who is covered?

When using your eligible AmEx card to pay for your travel, you’re not the only person covered by trip cancellation insurance. These benefits likewise cover you, your family members and any traveling companions.

American Express defines family members as your domestic partner, spouse or unmarried child up to the age of 19 (or under the age of 26 if your child is a full-time college student). Traveling companions are those who have made advanced arrangements with you or your family to travel together.

» Learn more: Credit cards that provide travel insurance

4. How to file a claim

To file a claim for reimbursement through AmEx’s trip cancellation insurance coverage, you’ll need to notify your benefits administrator. This must be done within 60 days of the covered loss or you’ll run the risk of your claim not being honored.

To contact your benefits administrator and open a claim, call 844-933-0648.

You’ll also need to complete the cancellation procedures for your travel provider. For example, if you’ve booked a flight with, say, Delta Air Lines, you’ll want to navigate Delta’s website to be sure that your ticket has been appropriately canceled.

You’ll then need to furnish written proof of your loss within 180 days of its occurrence. Gather various paperwork, such as:

Copies of your common carrier and travel supplier receipts.

Your card statement showing that you used your AmEx card to pay for the trip.

A copy of the travel supplier’s cancellation policy.

Proof of your covered loss; this may include military orders, a note from your physician or jury duty.

AmEx might extend the deadline for documentation up to one year after your loss if it isn't possible for you to provide it in a timely manner.

AmEx may require other paperwork depending on your situation, but you'll want to coordinate with your benefits administrator to see if this is necessary.

» Learn more: Airline travel insurance versus your credit card's

Trip cancellation insurance from AmEx recapped

AmEx's high-end credit cards provide many benefits, including the protection of trip cancellation insurance. To be eligible for coverage, you'll need to use your card to pay for a covered trip. You'll also need to have a qualifying reason for cancellation.

AmEx will pay you up to $10,000 in losses for approved claims.

All information about the Business Centurion Card from American Express, Centurion Card From American Express, The American Express Platinum Card for Schwab, The Corporate Platinum Card, The Platinum Card from American Express for Ameriprise Financial, The Platinum Card from American Express for Goldman Sachs, The Platinum Card from American Express for Morgan Stanley and The Corporate Centurion Card from American Express has been collected independently by NerdWallet. These cards are no longer available through NerdWallet.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best SEO Services (2024 Rankings)

- Best Mass Texting Services 2024

- Best SEO Software 2024

- Best Email Marketing Software 2024

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies (June 2024)

- Best Car Insurance for New Drivers

- Cheap Same Day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

American Express Travel Insurance (2024 Guide)

This page features information related to American Express credit card travel insurance benefits. The information featured in this article was collected by the MarketWatch Guides team and has not been provided or reviewed by American Express.

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Kelly Larson is a senior editor with 14 years of experience creating and optimizing data-driven, reader-focused digital content. Kelly enjoys running and exploring the outdoors with his sons.

American Express offers free travel insurance benefits with many of its credit cards. These perks include trip cancellation, trip interruption, baggage delay and car rental collision coverage, which can protect you before and during your travels booked with a qualifying Amex card.

We at the MarketWatch Guides team will provide information on American Express travel insurance benefits as well as the provider’s standard travel insurance policies available for purchase. Carefully consider your options to decide if Amex’s free travel benefits suit your needs or if you should purchase additional travel insurance coverage for your trip.

Our Thoughts on American Express Travel Insurance

American Express offers complimentary travel benefits through qualifying Amex cards when you purchase trip expenses using your card. Benefits include trip cancellation, trip interruption, trip delay, baggage coverage, car rental and collision protection and global assist hotline services to cardholders, family members and traveling companions. American Express also offers standard travel insurance policies that non-cardholders can purchase.

We appreciate how American Express offers a unique travel benefit with car rental collision damage. Based on our research, this coverage isn’t typically included with a standard travel insurance policy. We also like how Amex’s Premium Global Assist Hotline may offer emergency medical transport and repatriation services at no cost to the cardholder. However, like most other credit cards, you will be subject to an annual fee that’s dependent on your card. In addition, not all Amex cards offer the same maximum amount of free travel benefits.

If you currently have an Amex card with travel insurance perks, we recommend comparing its travel coverage with standard plans offered by competitors. To help you choose the travel protection that best fits you, consider your unique needs when deciding on coverage.

American Express Travel Insurance vs. Amex Credit Card Complimentary Travel Insurance

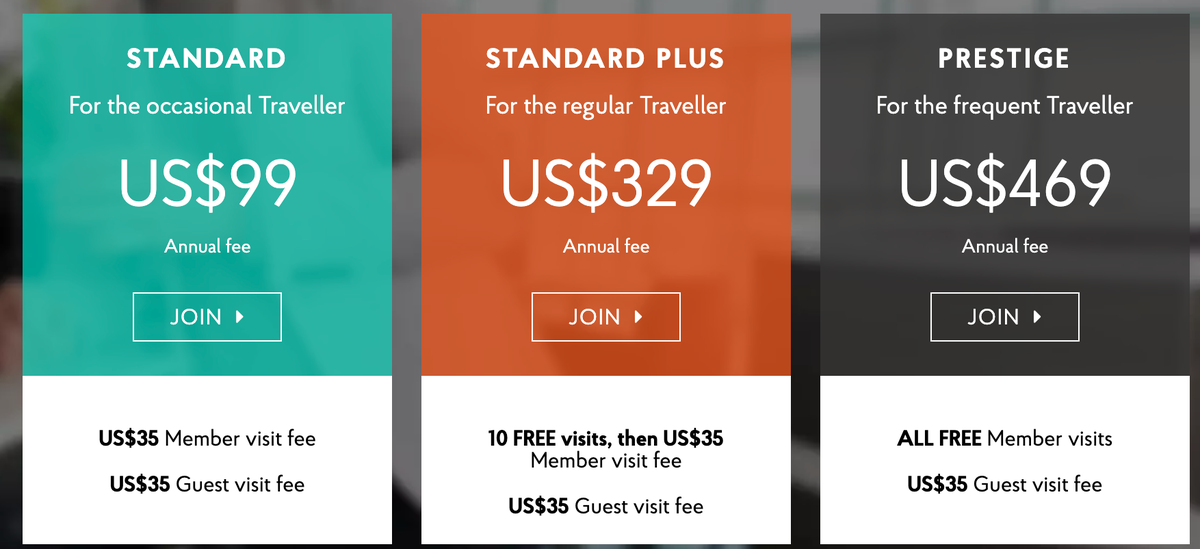

In addition to its complimentary travel insurance perks offered through various credit cards, American Express offers standalone policies for purchase. Note that you can purchase the company’s travel insurance policies even if you don’t have an American Express card. You’ll find four different plans and a custom plan option, making it easy to tailor coverage to suit a variety of travelers.

Amex complimentary travel insurance benefits are best for travelers who already hold an American Express card, as they come at no extra cost to cardholders. Depending on your specific Amex card, benefits can include baggage, car rental loss and damage, trip delay, trip cancellation, trip interruption and emergency hotline benefits. Some cards, such as the Platinum and Centurion Card, may offer all available benefits. Other Amex cards may only provide one or two. Unlike Amex’s standalone travel insurance policies, its baked-in benefits for cardholders don’t include emergency medical coverage.

How To Qualify for American Express Travel Insurance

Qualifying for American Express travel insurance benefits as an Amex card member is simple. However, you will need to visit the American Express retail and travel benefits page to learn if your exact card offers any travel insurance benefits. Various personal, business and corporate Amex cards qualify for travel insurance benefits, which we’ll detail further in this article.

If you own an Amex card with travel insurance benefits, you must book any nonrefundable travel expenses using your Amex card to qualify for reimbursement. Travelers eligible for these benefits include cardholders, family members and traveling companions who purchase a covered trip using an eligible card. If you’d like more coverage than American Express offers through its travel insurance benefits, the company provides “top-up options,” which are additional coverage limits available for purchase.

If you don’t own an Amex card, you can still apply for travel coverage through Amex Travel Insurance. You can get a free policy quote online through the American Express webpage or by calling customer service and speaking with a representative.

How Does Amex Travel Insurance Work?

American Express travel insurance benefits provide various protections for qualifying cardholders, offering coverage for trip cancellation, baggage delay, car rental collision and more. Amex cardholders also receive 24/7 Global Assist Hotline or Premium Global Assist Hotline services, which provide travel and emergency assistance services if you need help during covered travels.

American Express notes that it doesn’t administer all travel benefits associated with qualifying Amex cards. New Hampshire Insurance Company, an AIG Company, covers trip delay, cancellation and interruption benefits. AMEX Assurance Company, a subsidiary of American Express, provides car rental loss, damage coverage and baggage insurance. American Express states that coverage is subject to certain terms, conditions and limitations, with coverage considered secondary to any primary coverages you may have through other companies associated with your travels.

American Express Credit Card Travel Insurance Benefits

Many American Express credit cards come with various travel insurance benefits when you book and pay for your trip expenses using your Amex card. Unlike the travel insurance policies sold through American Express, these benefits are accessible to cardholders for qualifying trips.

The following sections offer a closer look at these coverages, including what they entail, monetary limits and which Amex cards offer each coverage.

Trip Cancellation and Interruption

Trip cancellation and trip interruption insurance can reimburse you for prepaid, non-refundable travel expenses in two scenarios: if you need to cancel your trip for a reason covered under your policy, and if you need to cut your vacation short and return home for a covered situation. This benefit applies to all eligible travelers if you pay for your travel expenses (including flights and cruises ) using a qualifying Amex card. Note that if you book a trip with Amex Membership Reward Points, you’ll also be eligible for reimbursement.

The maximum reimbursement for trip cancellations and interruptions is the same across all Amex cards with this travel benefit. You’ll receive up to $10,000 per covered trip and $20,000 per eligible card per 12 consecutive months. American Express considers this coverage secondary, meaning any other applicable insurance or benefits provided through your travel supplier will apply before Amex coverage.

American Express lists accidental injuries, illnesses, acts of terrorism, unpostponable jury duty, military orders and more to be covered reasons for trip cancellation or interruption. We encourage you to carefully read through your Amex card’s specific policy terms to ensure you understand what scenarios are included and excluded from coverage.

The following Amex cards offer trip cancellation and trip interruption benefits:

- Centurion ® Card from American Express

- The Platinum Card ®

- Corporate Platinum Card ®

- The American Express Platinum Card ® for Schwab

- The Platinum Card ® from American Express for Goldman Sachs

- The Platinum Card ® from American Express for Morgan Stanley

- Delta SkyMiles ® Reserve Credit Card

- HIlton Honors American Express Aspire Card

- Marriott Bonvoy Brilliant ™ American Express ® Card

- Business Centurion ® Card from American Express

- Business Platinum Card ®

- Delta SkyMiles ® Reserve for Business Credit Card

- The Corporate Centurion ® Card from American Express

Trip delay insurance coverage provides protection when your plane, bus, train or other type of transport experiences a delay. This benefit can extend to hotel rooms, meals and other necessities while you wait for your travels to resume. Covered delays accepted by American Express include delays caused by weather, lost or stolen passports, carrier equipment failure and more. Intentional acts by the traveler are excluded from this coverage.

There are 20 different Amex cards that offer trip delay insurance. American Express determines reimbursement rates by the Amex card you hold, but the allotted claims frequency remains the same across all applicable cards — two claims per 12-month period. You must notify the administrator of your claim within 60 days of your covered loss. Cards that provide $500 per covered trip and a delay threshold requirement of six hours include:

- Hilton Honors American Express Aspire Card

Cards that provide $300 per covered trip and a delay threshold requirement of 12 hours include:

- Marriott Bonvoy Bevy ™ American Express ® Card

- American Express ® Gold Card

- American Express ® Green Card

- Platinum Delta SkyMiles ® Credit Card

- American Express ® Business Gold Card

- Platinum Delta SkyMiles ® Business Credit Card

Baggage Delay or Loss

Baggage coverage can reimburse you for items in your travel bags if they are lost, stolen, damaged or delayed during transit. Most travel insurance companies offer plans that include this coverage, but coverage limits vary between providers. If you plan on traveling with expensive items in your luggage, you may want to consider a baggage insurance policy with high delay and loss limits.

Each Amex card offering baggage delay or loss coverage has a combined maximum payout of $3,000 per person. Carry-on baggage, checked luggage and high-end items may have different maximum limits depending on your Amex card. Regardless of your card and its limits, you must file a claim within 30 days of baggage loss.

Car Rental Collision Damage

Car rental collision damage coverage is a unique protection, as not all travel insurance providers offer it. It can cover any damage from a collision or theft incurred on a rental vehicle if you pay for the entire rental using your Amex card. Note that you need to forgo the car rental insurance offered by the rental company. Over 60 different Amex cards offer car rental loss and damage insurance, with varying reimbursement maximums depending on your card.

American Express offers two tiers of car rental loss and damage insurance: Tier 1 offers $50,000 in total coverage, and Tier 2 offers $75,000. This Amex travel benefit also provides accidental death and dismemberment, accidental injury and car rental personal property coverage for Tier 2 cards. Exclusions include drivers not named “authorized drivers” on your rental agreement, rentals lasting longer than 30 days and more.

Global Assist and Premium Global Assist Hotlines

American Express provides Global Assist and Premium Global Assist Hotlines to 73 different cards. Each type of assistance is available 24/7 to cardholders, but the assistance you qualify for depends on your card.

Global Assist Hotline services can help you prepare for your trip before leaving by offering information on customs, foreign exchange rates, passport and visa information and more. You can also benefit from lost passport or travel document replacement assistance, translation services, medical assistance and more. Note that while these services are free of charge, charges associated with third-party referrals will be your responsibility as a cardholder.

The American Express Premium Global Assist Hotline offers the same services as Global Assist, with a few extra perks. While Global Assist will provide administrative services for emergency medical transportation and repatriation of mortal remains, Premium Global Assist may offer the actual services — at no cost to the cardholder — depending on eligibility. It can also assist with medical financial coordination, which standard Global Assist doesn’t offer.

To qualify for Global Assist and Premium Global Assist benefits, you must be a cardmember in good standing with a trip originating from your U.S. billing address within the past 90 days. In addition, you must be traveling more than 100 miles from your home address. If you’re traveling to Cuba, Iran, Syria, North Korea or Crimea, you are ineligible for these assistance services.

Cards that provide Premium Global Assist include:

- Platinum Card ® from American Express

- Business Platinum Card ®

- Corporate Centurion ® Card from American Express

- Corporate Platinum ® Card

American Express Travel Insurance Plans

Amex cardholders and non-cardholders alike can purchase Amex Travel Insurance plans. Similar to standard plans from providers like Seven Corners and Trawick International , these plans cover emergency medical services, trip cancellations, trip interruptions, lost or delayed baggage and more. Some coverages are also offered through Amex travel benefits, while others are unique to the company’s travel insurance policies.

Purchasing a plan is straightforward — you can either use the quote tool provided on the American Express website or contact a customer service representative for assistance. When shopping, you’ll have your choice of four plans — Basic, Silver, Gold and Platinum — in addition to a custom plan option. The next few sections provide more information on the coverage provided through American Express travel insurance policies.

Global Medical Protection

Global medical protection provides medical, dental, evacuation and repatriation coverage up to a fixed amount. Emergency medical and dental coverage is valid for the first 60 days of your trip. Emergency evacuation benefits cover the cost and help arrange emergency transportation to a capable medical facility. It also covers the cost of a visitor’s transport to a covered person’s bedside if hospitalization lasts more than five days.

Travel Accident Protection

Travel accident protection provides coverage for an accident resulting in death or dismemberment at any point during your trip, from the moment you leave home to the moment you arrive back. This coverage isn’t available with the American Express Basic travel insurance plan but comes with a Silver, Gold or Platinum plan.

24-Hour Travel Assistance

This benefit comes with every travel insurance policy purchased through American Express. It provides worldwide access to a 14-hour hotline that offers travel support before and during your trip. American Express also provides this benefit through Amex prepaid, reloadable cards.

Benefits Included With Amex Credit Card Coverage

Several coverages provided through an American Express Travel Insurance plan are also perks with qualifying Amex credit cards. However, coverage limits will vary. Whether you purchase a policy or use your Amex travel perks, it’s important to understand the limitations and restrictions outlined for each coverage.

Trip cancellation and interruption benefits can reimburse nonrefundable expenses if you need to cancel your trip before it starts or if it’s interrupted for a covered reason outlined in your policy. Coverage limits for each plan are as follows:

- Basic : Up to $1,000 in trip cancellation and interruption coverage

- Silver : Up to 100% of trip costs for cancellation and interruption coverage

- Gold : Up to 100% of trip costs for cancellation and 150% for interruption coverage

- Platinum : Up to 100% of trip costs for cancellation and 150% for interruption coverage

Global Baggage Protection

Global baggage protection offers reimbursement for lost, damaged or stolen baggage. This applies to checked baggage, carry-on baggage, or baggage on your hotel or cruise property. If your baggage is delayed, you can receive reimbursement for essential items you need replaced. Coverage limits for each plan include:

- Basic : Up to $250 for baggage loss and up to $100 for a 24-hour delay

- Silver : Up to $500 for baggage loss and up to $300 for a 6-hour delay

- Gold : Up to $1,000 for baggage loss and up to $300 for a 6-hour delay

- Platinum : Up to $2,500 for baggage loss and up to $500 for a 3-hour delay

Global Trip Delay

Global trip delay coverage protects delayed travel, covering lodging, meals and other necessary expenses. Covered travel scenarios include overbooked flights, missed flight connections and delayed or canceled flights . Included coverage limits are:

- Basic : Not included

- Silver : Up to $150 per day, maximum of $500 per trip

- Gold : Up to $150 per day, maximum of $750 per trip

- Platinum : Up to $300 per day, maximum of $1,000 per trip

How To File a Travel Insurance Claim With American Express

If you’ve purchased an American Express Travel Insurance policy and need to file a claim, you can contact your administrator in three ways. You can use the claims phone number or address found in your Certificate of Insurance/Policy or the claims portal through the American Express website. If you cannot locate your Certificate of Insurance or Policy, you can email the company to request an additional copy.

During your travels, keep track of any receipts, police reports, medical bills and other documents you might need to provide in the event of a claim. The exact documents required will depend on the benefit for which you’re filing a claim. American Express directs policyholders to your Certificate of Insurance/Policy for specific information. Still, it also notes that the company’s claims department will share the documents needed to validate your claim. Note that American Express outlines specific time requirements for filing a claim within your policy, with requirements varying by coverage.

Should You Get an American Express Credit Card For Travel Insurance?

Signing up for an American Express credit card for travel insurance benefits is a personal decision, but it’s not your only option. You can purchase a policy through American Express Travel Insurance or another standard insurer, such as Travelex or Faye , without taking on the responsibility of a new credit card. Benefits offered through Amex travel perks or their standard travel insurance policies may not suit your coverage needs, as the company lacks cancel for any reason (CFAR) coverage and other protections provided by other insurers.

If you already have an Amex card and feel the travel perks provided satisfy your needs, booking your vacation with your card is all you need to do to enjoy these benefits. However, whether you have an American Express card or another card with travel insurance perks, we encourage you to gather multiple quotes while considering your travel needs, budget and expectations before purchasing a policy.

Frequently Asked Questions

Does american express travel insurance cover family members.

Yes, American Express travel benefits can provide coverage for cardholders, family members and traveling companions who purchase a covered trip using an eligible card. American Express Travel Insurance policies cover travelers enrolled when you buy your plan.

How long do you have to claim American Express travel insurance?

American Express outlines specific time requirements for filing a claim within your policy, but these time requirements vary by coverage type. Consult your policy documents or contact a customer service representative for more information on claim time constraints.

What trip cancellation reasons are covered?

Trip cancellation reasons covered under an American Express Travel Insurance policy include unexpected sickness or injury of the covered person or family member, adverse weather conditions, natural disasters, labor disputes or strikes affecting travel services, or the unexpected job termination of a covered person.

Do I need separate travel insurance if I have a credit card?

If you have a credit card offering travel insurance benefits and are satisfied with the coverage, you may not need a separate travel insurance policy. However, if you’d prefer higher coverage limits or specialty protections like CFAR coverage or an adventure sports waiver, it may be worth gathering quotes from reputable travel insurance providers.

Methodology: Our System for Rating Travel Insurance

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

Amex Platinum card review: High annual fee with loads of perks

Editor's note: This is a recurring post, regularly updated with new information and offers.

The Platinum Card® from American Express overview

The Platinum Card® from American Express is one of the top premium travel rewards cards on the market. As a cardmember, you'll earn valuable Membership Rewards points, receive over $1,500 in annual statement credits (as long as you can take advantage of them) as well as access to an extensive network of airport lounges worldwide. Card rating*: ⭐⭐⭐⭐½

* Card rating is based on the opinion of TPG's editors and is not influenced by the card issuer.

Nowadays, it seems every bank, airline and hotel offers a premium travel rewards card . But for a long time, The Platinum Card from American Express was the only premium rewards card on the market. With its sleek design and hefty metal weight, there was a bit of prestige attached to being an Amex Platinum cardholder.

That still exists, even though a few competitors in the luxury card category have emerged in recent years, including the Chase Sapphire Reserve® and the Capital One Venture X Rewards Credit Card . When you stack them up against one another, the Amex Platinum shines in ways the others don't. Then again, it falls flat in some areas, too.

The Amex Platinum has undergone significant changes in recent years and carries a steep $695 annual fee (see rates and fees ) — one of the highest on the market. That's why people often ask whether the Amex Platinum is still worth the annual fee , even with the new perks.

The recommended credit score for this card is above 690 and it ranks as one of the best travel cards , but that doesn't mean it's right for every traveler.

Let's dig into the details and benefits to see whether having the Amex Platinum in your wallet makes sense for you.

Amex Platinum pros and cons

Amex platinum welcome offer.

The current welcome bonus for the Amex Platinum is 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership. This is slightly above the standard welcome offer we have seen.

THE POINTS GUY

According to TPG's latest monthly valuations , Amex Membership Rewards points are worth 2 cents each, making this bonus worth $1,600. That's nearly three times the card's $695 annual fee.

Amex sometimes offers up to 150,000 points to targeted individuals through other channels — like the CardMatch tool , so it's worth checking out if you're targeted. Just remember that offers are subject to change at any time and are not necessarily available to everyone.

Related: How to redeem Membership Rewards points for maximum value

Amex Platinum benefits

What truly sets The Platinum Card from American Express apart is the fact that it confers so many valuable best perks and travel benefits. Let's take a look:

- Up to $200 in statement credits annually for incidental fees charged by one airline you select*

- Up to a $200 annual hotel credit , in the form of a statement credit, on prepaid Amex Fine Hotels + Resorts or The Hotel Collection bookings with Amex Travel when you pay with your Amex Platinum (Hotel Collection stays require a two-night minimum)*

- Up to $200 annually in Uber Cash , valid on Uber rides and Uber Eats orders in the U.S. (split into monthly $15 credits plus a $20 bonus in December)*

- Up to $189 in statement credits to cover your Clear Plus annual membership *

- Up to $240 in annual digital entertainment credit — with the exception of SiriusXM, which will be removed effective May 8 and no longer be eligible for this benefit — disbursed as up to $20 monthly statement credits when you pay for eligible purchases with the Amex Platinum at eligible partners*

- Up to $300 in annual Equinox credit on Equinox gym and Equinox+ app memberships (subject to auto-renewal)*

- Up to a $155 statement credit that covers the cost of a monthly Walmart+ membership when paying with the Amex Platinum (on one membership, subject to auto-renewal); Plus Up excluded.

- A $100 statement credit for Global Entry every four years or an up to $85 fee credit for TSA PreCheck every 4½ years (depending on which application fee is charged to your card first)

- Up to a $100 annual Saks Fifth Avenue credit , split into two up to $50 statement credits between January and June, then July through December*

- Access to the American Express Global Lounge Collection , including Centurion Lounges , Priority Pass lounges, Airspace lounges, Escape lounges, Plaza Premium lounges and Delta Sky Clubs (when traveling on same-day Delta flights; Effective February 1, 2025: Eligible Platinum Card Members will receive 10 Visits per Eligible Platinum Card per year to the Delta Sky Club or to Grab and Go when traveling on a same-day Delta-operated flight)*

- Complimentary Gold status with Hilton Honors and Marriott Bonvoy *

- Complimentary car rental status : Hertz Gold Plus Rewards President's Circle, Avis Preferred Plus and National Emerald Club Executive*

- Access to Amex Fine Hotels + Resorts and The Hotel Collection

- If your trip is delayed by more than six hours because of a covered reason, you may be eligible to be reimbursed up to $500 per covered trip for reasonable additional expenses**

- If you need to cancel or interrupt your trip because of a covered reason, you may be eligible for reimbursement of up to $10,000 per covered trip**

- Extended warranty benefit extends eligible manufacturer's warranties of five years or less by up to one additional year***

- Purchase protection protects recent purchases against theft, accidental damage or loss for up to 90 days from the purchase date***

- Terms apply to the benefits listed

Even if you can use just a handful of these perks, it's easy to cover most (or all) of the Amex Platinum's annual fee.

Here's how TPG director of content Nick Ewen describes it:

"I have no use for some benefits of the Amex Platinum, and others (like Walmart+) I utilize just because they're there. However, I always max out the digital entertainment credit ($240). I also easily use all $200 in Uber credits and all $200 in airline statement credits annually. In other words, just three of these perks put $640 back in my pocket every year. As a result, I think of it as paying $55 for all of the other benefits on the card — and that makes it a no brainer to keep in my pocket."

Your exact situation may vary, but crunch the numbers to see how much real-life value you can get from the card.

* Enrollment is required for select benefits.

**Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

***Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

Related: How to maximize benefits with the Amex Platinum

Earning points on the Amex Platinum

With the Amex Platinum, you'll earn 5 points per dollar on airfare purchased directly with the airlines or through the Amex Travel portal (on up to $500,000 of airfare purchases per calendar year). Plus, you'll earn 5 points per dollar on prepaid hotels booked with Amex Travel .

These 5-point categories are an excellent way to earn lots of Membership Rewards points. Based on TPG valuations , earning 5 points per dollar provides a 10% return.

All other purchases earn just 1 point per dollar, but Platinum cardmembers are eligible for targeted Amex Offers that could boost earning rates at various merchants (including Amazon ).

Related: The ultimate guide to saving money with Amex Offers

Redeeming points on the Amex Platinum

Membership Rewards points are one of the most valuable and flexible loyalty currencies ever created for redeeming points. The best way to maximize your points is to transfer them to one of their loyalty program partners.

You can also use your Membership Rewards points to book travel directly through American Express Travel. But if the personal Amex Platinum is the only Amex card in your inventory, using points for airfare and hotel redemptions this way won't get you amazing value.

You'll get only 1 cent per point when you redeem the points directly for airfare at Amex Travel and less than 1 cent per point when redeeming for hotel rooms.

From my experience, 9 out of 10 times, you should never redeem Membership Rewards points for flights through American Express Travel, as you will get much better value utilizing transfer partners .

However, suppose you also have The Business Platinum Card® from American Express . In that case, you'll get one of the very best direct point redemptions available . This results from the 35% points rebate for first- and business-class flights on any airline plus economy flights on your selected airline (up to 1 million bonus points back per calendar year).

Related: Here are 9 of our favorite ways to use Amex Membership Rewards points

Transferring points on the Amex Platinum

Each Membership Rewards point is worth 2 cents, thanks largely to the program's airline and hotel transfer partners . Those include at least one helpful option in each major airline alliance ( SkyTeam , Star Alliance and Oneworld ).

Transferring your points to the right airline or hotel program is usually the best way to maximize your Membership Rewards points value.

Here's how TPG senior editor Matt Moffitt likes to transfer and redeem his Membership Rewards points:

"I look out for transfer bonuses to maximize my points to book long-haul business-class flights. I often transfer to Iberia Plus for lie-flat seats to Madrid. Sometimes, I'll transfer to Qantas Frequent Flyer to secure hard-to-find business- or first-class flights back to Australia."

Which cards compete with the Amex Platinum?

Some other compelling premium credit cards go head-to-head with the Amex Platinum:

- If you want a slightly lower annual fee: Try the Chase Sapphire Reserve , which comes in at a $550 annual fee but offers a $300 travel credit and some of the best travel protections available . However, it can't beat the Amex Platinum when it comes to perks such as lounge access and hotel benefits. For more information, read our full review of the Chase Sapphire Reserve .

- If you want a much lower annual fee: Capital One's premium rewards card, the Capital One Venture X Rewards Credit Card , packs a punch and comes with a more affordable $395 annual fee (see rates and fees ). The Venture X is potentially more lucrative than the Amex Platinum when it comes to earning, accruing 10 miles per dollar on hotels and car rentals booked via Capital One Travel, 5 miles per dollar on flights booked via Capital One Travel and an unlimited 2 miles per dollar on everything else. For more information, read our full review of the Venture X .

For additional options, check out our full list of the best cards for travel rewards and lounge access .

Read more: The best premium credit cards: A side-by-side comparison

Bottom line

If you can take full advantage of more than $1,500 in annual statement credits yearly, The Platinum Card from American Express is one of the most compelling rewards cards, especially if you travel enough to make the hotel statuses and lounge benefits useful or shop enough to get substantial value from the shopping protections .

The Amex Platinum's $695 annual fee is steep, but the various annual credits can recoup the entire cost (and more), even before considering the card's other perks.

Apply here: The Platinum Card from American Express

Check the CardMatch tool to see if you're targeted for a 150,000-point Platinum Card offer (after meeting minimum spending requirements). These offers are subject to change at any time.

For rates and fees of the Amex Platinum, click here .

- Best Overall

- Best for No-Annual-Fee

Best for Independent Hotel Purchases

- Best for Beginners

- Best for Everyday Spending

- Best for Students

- Best Premium Travel Card for Affordability

- Best for Dining and Groceries

- Best for Travel Insurance

- Best for Luxury Travel Benefits

- Why You Should Trust Us

Best Travel Credit Cards of June 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Wells Fargo Autograph Journey℠ Visa® Card, Citi Strata Premier℠ Card, Bank of America® Travel Rewards Credit Card for Students. The details for these products have not been reviewed or provided by the issuer.

- Best overall travel credit card : Chase Sapphire Preferred® Card

- Best travel credit card for beginners : Capital One Venture Rewards Credit Card

- Best no-annual-fee travel credit card : Capital One VentureOne Rewards Credit Card ( rates and fees )

- Best for spending at hotels : Wells Fargo Autograph Journey℠ Visa® Card

- Best for travel rewards on everyday spending : Citi Strata Premier℠ Card

- Best travel card for students : Bank of America® Travel Rewards Credit Card for Students

- Most affordable premium travel credit card : Capital One Venture X Rewards Credit Card

- Best travel credit card for earning travel credit on dining and groceries : American Express® Gold Card

- Best premium card for travel bonus categories : Chase Sapphire Reserve®

- Best for luxury travel benefits and airport lounge access : The Platinum Card® from American Express

Introduction to Travel Credit Cards

Whether you're just dipping your toe into the world of rewards credit cards or you've already flown thousands of miles on points alone, we can tell you: There's a travel credit card for everyone. There's a card if you're looking for free flights, if you're hoping for free hotel stays, or if you're just doing whatever it takes to realize your dream of an overwater bungalow. There are even no-annual-fee travel credit cards that won't cost you anything to keep.

Compare the Top Travel Credit Cards

Earn 5x on travel purchased through Chase Travel℠. Earn 3x on dining, select streaming services and online groceries. Earn 2x on all other travel purchases. Earn 1x on all other purchases.

21.49% - 28.49% Variable

Earn 75,000 bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High intro bonus offer starts you off with lots of points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel coverage

- con icon Two crossed lines that form an 'X'. Doesn't offer a Global Entry/TSA PreCheck application fee credit

If you're new to travel rewards credit cards or just don't want to pay hundreds in annual fees, the Chase Sapphire Preferred® Card is a smart choice. It earns bonus points on a wide variety of travel and dining purchases and offers strong travel and purchase coverage, including primary car rental insurance.

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel. Earn unlimited 1.25X miles on every purchase.

0% intro APR on purchases and balance transfers for 15 months (intro fee of 3% for the first 15 months, then 4% of the amount of each balance transfer at a promotional APR that Capital One may offer you at any other time)

19.99% - 29.99% Variable

Earn 20,000 miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee or foreign transaction fees

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Versatile rewards

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 1.25 miles per dollar on all purchases with no bonus categories to track

- con icon Two crossed lines that form an 'X'. Lower earning rate than some other no-annual-fee rewards cards

- con icon Two crossed lines that form an 'X'. Limited benefits

The VentureOne Rewards Card is a slimmed-down version of the popular Capital One Venture Rewards Credit Card. It's one of the few no-annual-fee cards on the market that gives you the option to redeem miles for cash back or transfer them to travel partners.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase-or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

Earn unlimited 5x points per dollar on hotels. Earn 4x points on airlines. Earn 3x points on other travel and dining. Earn 1x on other purchases.

21.24%, 26.24%, or 29.99% Variable

Earn 60,000 bonus rewards points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation and lost baggage protection

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Airline and hotel transfer partners available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Welcome bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous cellphone protection

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Low annual fee

- con icon Two crossed lines that form an 'X'. Transfer partner network not as diverse or robust as competitors

The Wells Fargo Autograph Journey℠ Visa® Card is a true travel credit card, with benefits that rival many of the best travel rewards credit cards currently on the market. This card has a low annual fee on par with that of popular competing credit cards and Wells Fargo's newly announced Points Transfer program allows cardholders to juice maximum value from every point they earn.

Earn 5x miles per dollar on hotels and rental cars booked through Capital One Travel. Earn unlimited 2x miles on every purchase.

19.99% - 29.99% variable

Earn 75,000 miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No bonus categories to keep track of

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes up to a $100 statement credit for Global Entry or TSA PreCheck

- con icon Two crossed lines that form an 'X'. Other credit cards offer higher rewards in certain categories of spending

If you want an easy, no-fuss travel rewards credit card, the Capital One Venture Rewards Credit Card is a great fit. For a moderate annual fee, it offers plenty of value, useful benefits, and a substantial welcome bonus.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

Earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked through CitiTravel.com. Earn 3X points per $1 on air travel and other hotel purchases, at restaurants, supermarkets, gas stations and EV charging stations. Earn 1X point per $1 on all other purchases.

21.24% - 29.24% variable

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 3x points on most travel, restaurants, gas/EV charging, and supermarkets

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 10x points on hotels, rental cars, and attractions booked via Citi Travel

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. $100 annual hotel credit on a single stay of $500 or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No foreign transaction fees

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay/interruption benefits and lost/damaged baggage coverage

- con icon Two crossed lines that form an 'X'. Has an annual fee

- con icon Two crossed lines that form an 'X'. Citi Travel rates often are higher than retail cost of travel

Earn unlimited 1.5 points per dollar on purchases.

- 0% intro APR for your first 18 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account

17.99% - 27.99% Variable

25,000 online bonus points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous welcome bonus for a student credit card

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earns flexible points you can use toward a wide variety of travel purchases

- con icon Two crossed lines that form an 'X'. Other travel rewards cards have higher earning rates

- con icon Two crossed lines that form an 'X'. Few travel-related benefits compared to other travel cards

A good student credit card should offer rewards and useful benefits to those with limited credit history and the Bank of America® Travel Rewards Credit Card for Students hits several of those notes. However, while the card is marketed to students, those without established credit may have difficulty getting approved.

- The information related to the Bank of America® Travel Rewards Credit Card for Students has been collected by Business Insider and has not been reviewed by the issuer.

- 25,000 online bonus points after spending $1,000 in purchases in the first 90 days from account opening (redeemed as a $250 statement credit toward travel and dining purchases)

- Unlimited 1.5 points for every $1 spent on all purchases everywhere, no expiration on points

- No annual fee or foreign transaction fees

Earn unlimited 10 miles per dollar on hotels and rental cars booked through Capital One Travel. Earn 5 miles per dollar on flights booked through Capital One Travel. Earn unlimited 2 miles on all other purchases.

Earn 75,000 bonus miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Excellent welcome bonus and miles earning

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Premium perks including airport lounge access and credits for certain purchases

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Visa Infinite benefits including travel and shopping protections

- con icon Two crossed lines that form an 'X'. High annual fee

- con icon Two crossed lines that form an 'X'. Annual travel credits only apply to Capital One Travel purchases

The Capital One Venture X Rewards Credit Card is one of the best credit cards for frequent travelers, with top-notch benefits and a wide range of built-in protections. It comes with a generous welcome bonus and credits that can help offset the annual fee — which is much lower than similar premium cards.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

Earn 4X Membership Rewards® points at Restaurants, plus takeout and delivery in the U.S. Earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X). Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com. Earn 1X Membership Rewards® points on all other purchases.

See Pay Over Time APR

Earn 60,000 Membership Rewards® points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Great rewards for dining and for shopping at US supermarkets

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Monthly statement credit for eligible dining purchases recoups some of the annual fee

- con icon Two crossed lines that form an 'X'. Underwhelming welcome bonus

Foodies and travelers alike will appreciate the American Express Gold's generous welcome bonus and Membership Rewards points earning. Its Uber Cash credits are useful for rides and Uber Eats, and monthly dining credits with participating merchants like GrubHub and Seamless are easy to use.

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Terms Apply.

Earn 5x points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1x point per $1 spent on all other purchases.