Welcome to Online Banking

Sign in to online banking, help - client card or username.

Enter the 16-digit number from the card you use for debit and ATM transactions. If you don’t have a card, you can use the number you were given at the branch to access Online Banking.

If you have set up a username, you can enter it in this field to log in to Online Banking.

Help - Remember your client card or user name

Check this box if you’d like to save your Client Card number or username on this computer, so you don’t have to enter it again the next time you log in to Online Banking.

We don’t recommend this option if you’re using a public or shared computer.

If you delete the cookies on your computer, you’ll erase any saved Client Card numbers or usernames.

Help - RBC Security Guarantee

We’ll fully reimburse any unauthorized transactions made in RBC Royal Bank Online Banking.

New to Online Banking?

Discover Opens new tab what it can do for you.

Other Online Services Other Online Services RBC Direct Investing Dominion Securities Online RBC InvestEase Avion Rewards PH&N Investment Counsel RBC Royal Trust RBC Bank USA RBC Caribbean RBC Express RBC Global Trade Other Services

How can we help you.

Royal Bank of Canada Website, © 1995-2024

How to book a flight with RBC Avion Rewards points

One of the options for redeeming Avion Rewards credit cards is to use your points towards airfare anywhere in the world. Here’s how this works for a fixed-point exchange .

RBC Avion Rewards Points

There are several RBC Avion Rewards credit cards. The one used for this example is the RBC Visa Infinite Avion Card .

With this exceptional offer for the RBC Avion Visa Infinite Card, you can earn up to 55,000 Avion points:

- 35,000 Avion points on approval

- 20,000 Avion bonus points when you spend $5,000 in your first 6 months

You can use your Avion Rewards points for travel or redeem them with other loyalty programs such as :

- American Airlines AAdvantage

- British Airways Executive Club (and Qatar Airways Privilege Club)

- Cathay Pacific Asia Miles

- WestJet Rewards

For example, with the current welcome offer, you can get 55,000 British Airways Avios Points or 550 WestJet Dollars .

With the RBC Avion Visa Infinite Card, you earn 1 point per dollar and 1.25 points for travel purchases.

And you’ll benefit from a wide range of insurance coverage: Trip Cancellation and Interruption Insurance, Out-of-Province/Country Emergency Medical Insurance, Rental Vehicle Collision/Loss Damage Insurance, Mobile Device Insurance.

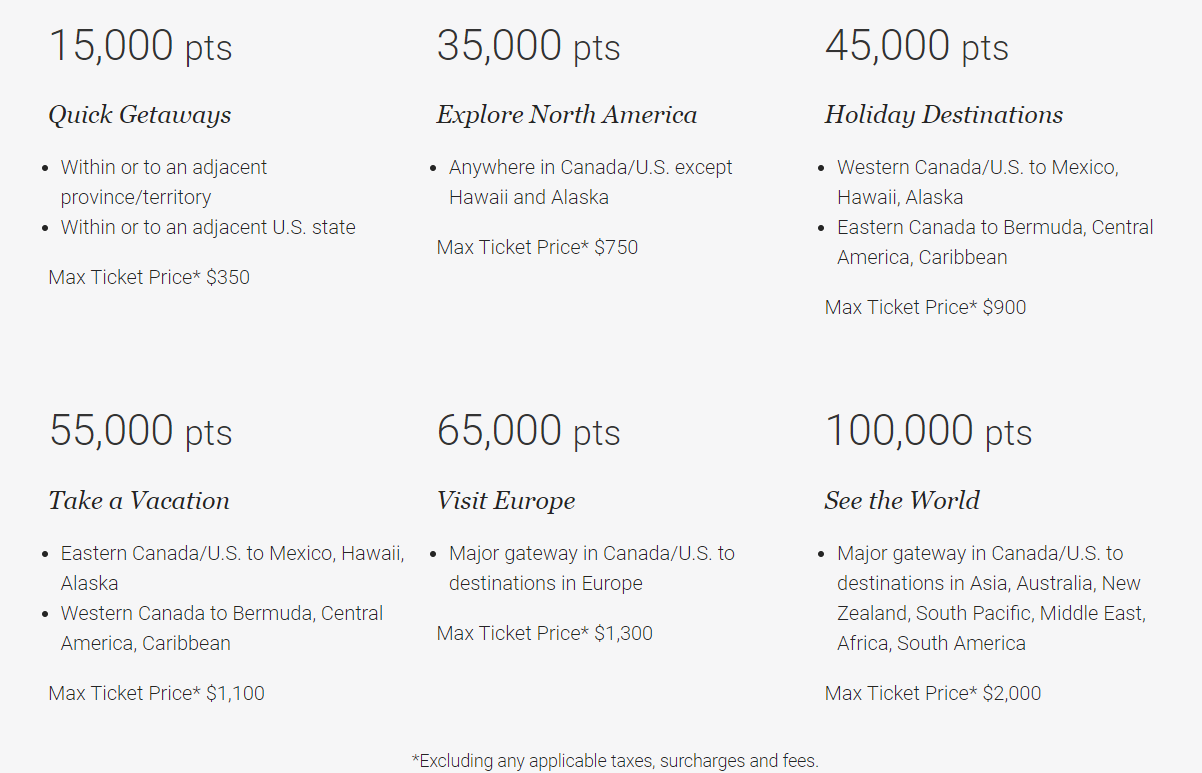

RBC Avion Rewards points can be used to travel anywhere in the world with a round-trip ticket. A one-way trip requires half as many Avion points. Here is the airfare table for a round-trip flight:

On average this equals about 2 cents per Avion point .

How to Book an Airline Ticket with RBC Avion Rewards Points

With 35,000 Avion points, I could afford a plane ticket to Canada or the United States.

From your RBC Online Banking profile, click on the blue Avion Rewards button.

Then, on the Trips page, click on Book a Trip .

Avion Rewards acts like a travel agency. Generally, the prices are the same as the ones found on the sites of the carriers and tour operators.

Its search tool allows you to use RBC Avion Rewards points to book :

- A car rental

- Hotel stays

- Or Vacation Packages

After entering your desired dates and destinations, the results will be displayed. On the left, there is a filter for options.

In this example, the non-stop and no change fee options are selected.

35,000 points can be redeemed on a flight costing up to $750.

In this example, I have chosen a higher class. This exceeds the $750, the remaining balance is added to the taxes and fees.

In my case, the same flight cost about $1,000 on the Air Canada website. This equates to 2.14 cents per point , ($750 divided by 35,000 points) which is excellent!

On the checkout page, RBC shows the points required to book this airline ticket. Any remaining point balance can be used to reduce the tax and fee balance.

For example, 90 points were used to lower the balance by 90 cents. The rest is to be paid with a credit card.

Enter the traveler’s information and make the payment.

An email from RBC Avion Rewards will be sent moments later to confirm. A few minutes later (or a few hours for some), the airline will send confirmation in a separate email. All the details will be there, including the reservation number.

How to Manage an Airline Ticket Purchased with RBC Avion Rewards Points

The booked trip can be found in the My Trips section of the RBC Avion Rewards portal. A link redirects you to the airline’s website.

You will be able to link this reservation to your frequent flyer profile. Here I entered my Aeroplan membership number.

Since I had taken the Comfort fare on Air Canada, I was able to choose a Prefered seat at no charge. This must be done directly on the Air Canada website.

Please note that to change or cancel a flight purchased through the RBC Avion Rewards portal, you must call the RBC Travel Centre directly at 1-877-636-2870.

The airline will not be able to do anything on their end and they will refer you to RBC. Any changes have a cost of $25 for each ticket .

There is also the option to chat with a virtual agent on the RBC site in the Help section.

In addition, if you have eUpgrades with Air Canada, you have the option to apply them at check-in 24 hours prior to your flight.

When your flight is completed, points and qualifications are deposited into your account based on the fare booked.

For example, the Comfort rate booked through RBC gave :

- Aeroplan Points

This counts towards your Aeroplan Status .

Here are other ways to use RBC Avion points .

Another way to redeem RBC Avion Rewards points for travel

Occasionally, the Avion Rewards site may experience technical difficulties or your flight may not appear in the search results.

At that time, call Avion Rewards Customer Service at 1-800-769-2512.

- Get an authorization number to book the flight you want (mandatory);

- Book your own flight directly on the desired airline’s website;

- Send an e-mail to [email protected] with your authorization number obtained earlier from Customer Service, your name, the number of tickets reserved, proof of purchase and itinerary details.

Avion Rewards will then deduct the required points from your RBC Rewards points account to credit the cost of your airline tickets, according to their airfare table.

All posts by Caroline Tremblay

Suggested Reading

Sign In to Avion Rewards

Sign in with:

If you have a personal credit card or deposit account, you need to enrol in RBC Online Banking to enjoy Avion Rewards. It’s easy and secure.

Sign in now to start shopping and saving

RBC client ? Sign in with: Eligible RBC clients enjoy bigger and better benefits from Avion Rewards. Check out the list of eligible products – if you have any of these, you’re in. Close

Don’t have Online Banking credentials?

Not an RBC client? Sign in with:

- Book Travel

- Credit Cards

How to Maximize the RBC Air Travel Redemption Schedule

RBC Avion Rewards is a flexible loyalty program that allows you to redeem points for travel, merchandise, gift cards, and more.

When it comes to redeeming Avion points for travel, you can transfer points to American Airlines AAdvantage , British Airways Executive Club , , Cathay Pacific Asia Miles , and WestJet Rewards , or you can choose to redeem Avion points for flights through the RBC Air Travel Redemption Schedule.

In This Post

What is the rbc air travel redemption schedule, how does the rbc air travel redemption schedule work, how to book flights with the rbc air travel redemption schedule.

The RBC Air Travel Redemption Schedule is one of the ways in which you can redeem RBC Avion points for travel.

Bookings are made through the Avion Rewards portal, which in turn, is powered by Expedia. Therefore, most, if not all, airlines available on Expedia are also accessible through Avion Rewards.

With the RBC Air Travel Redemption Schedule, you can redeem a fixed number of points to book flights to various destinations. However, it’s important to note that the fixed number of points only applies to a maximum ticket price, which we’ll discuss in detail below.

Note that this redemption option isn’t available to RBC ION Visa or RBC ION+ Visa cardholders, which earn “Avion Premium” points. Rather, the RBC Air Travel Redemption Schedule is only available with the highest-tier “Avion Elite” points, which can be earned on the following Avion credit cards:

It’s worth noting that you can transfer Avion Premium points earned on an RBC ION or RBC ION+ card into Avion Elite points, if you happen to have both an ION and an Avion credit card.

The 1:1 transfer can be completed in your Avion Rewards account, and it’s certainly worth considering, since Avion Elite points are more flexible than Avion Premium points.

With the RBC Air Travel Redemption Schedule, you can get a value of up to 2–2.3 cents per Avion point (all figures in CAD).

This is a solid redemption option, since you can redeem Avion points at a much lower rate of 1 cent per point on average – unless, of course, you transfer them to an airline program, which can extract even greater value.

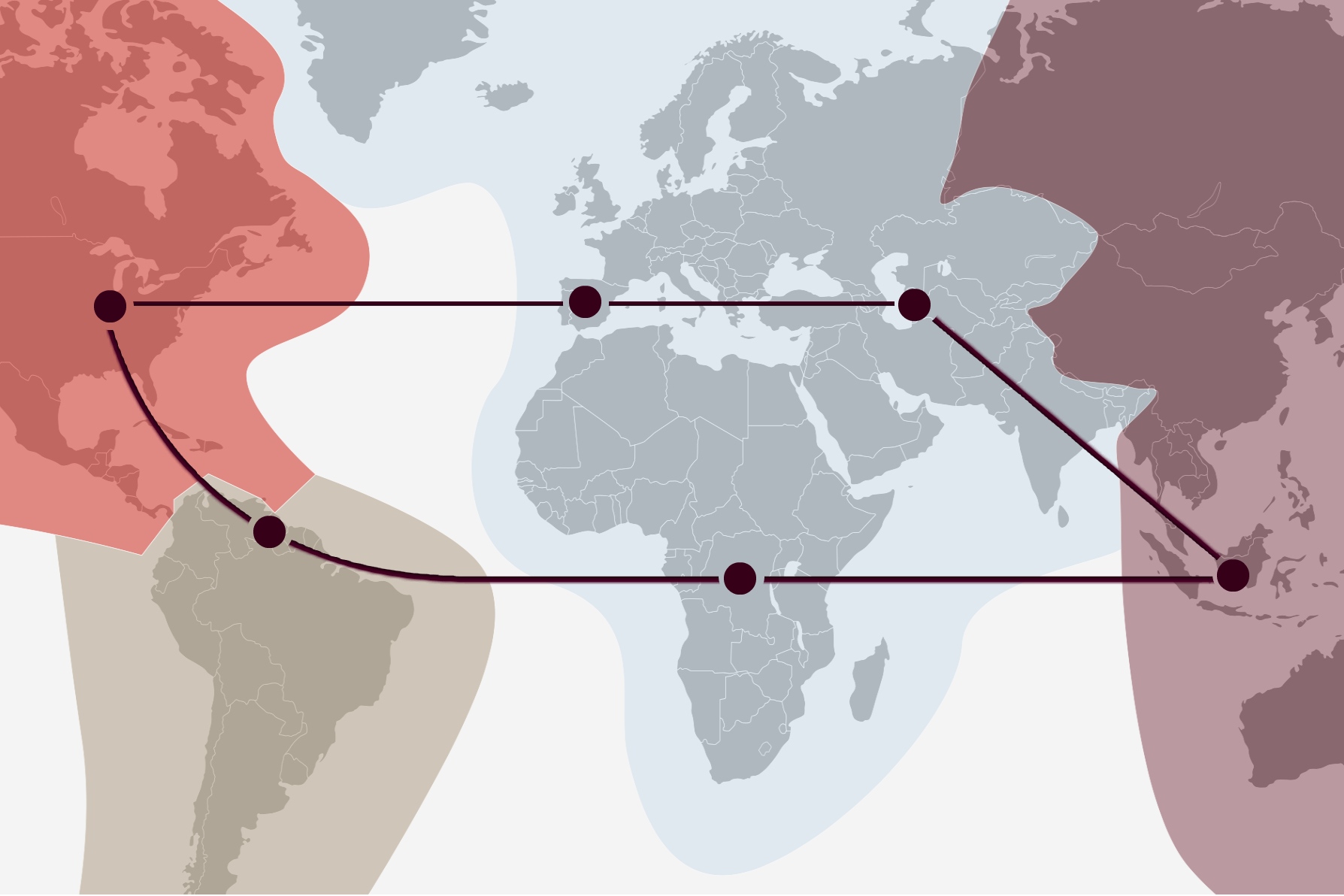

There are six different categories under the RBC Air Travel Redemption Schedule, with each one based on the flight’s origin and destination.

For example, if you’d like to book a short-haul flight under the Quick Getaways section, 15,000 Avion points will get you round-trip economy flights, with a base fare of up to $350.

You’ll need to pay the same 15,000 points if the base fare totals, say, $100, as you would if the base fare totals $350.

Therefore, you’ll get the best value from your points if you come as close to the maximum permitted ticket price in each category.

Just keep in mind that you’ll also have to cover the taxes and fees on the booking, which you can either pay for with cash, or redeem Avion points at a rate of 1 cent per point.

Furthermore, you can also exceed the maximum ticket price for any itinerary; however, you’ll have to pay the difference in cash, or use more Avion points at a rate of 1 cent per point.

If you’d rather book a one-way flight instead of a round-trip, the number of points required is halved.

The RBC Air Travel Redemption Schedule only applies to economy flights, and not for flights in any other class of service.

Quick Getaways

The shortest flight option on the RBC Air Travel Redemption Schedule, Quick Getaways, also happens to provide the most value per Avion point.

For flights within or to an adjacent Canadian province/territory, and within or to an adjacent US state, the pricing is as follows:

- 7,500 Avion points for a one-way ticket, with a maximum base fare of $175

- 15,000 Avion points for a round-trip ticket, with a maximum base fare of $350

At either 7,500 points for $175, or 15,000 points for $350, you’ll score a redemption rate of up to 2.33 cents per Avion point.

Some examples of other flight pairings available under Quick Getaways might include the following:

- Toronto and New York

- Winnipeg and Minneapolis

- Vancouver and Calgary

Unfortunately, airports in Alaska aren’t included under Quick Getaways, despite Alaska being adjacent to British Columbia and the Yukon.

Explore North America

For flights anywhere within the Canada and the US (excluding Hawaii and Alaska), which fall under the Explore North America section of the RBC Air Travel Redemption Schedule, the pricing is as follows:

- 17,500 Avion points for a one-way ticket, with a maximum base fare of $375

- 35,000 Avion points for a round-trip ticket, with a maximum base fare of $750

Either of the two options above yields a value of up to 2.14 cents per point.

With no distance limitations in this section, you could technically fly all the way from Yellowknife to Miami, and the ticket would still fall under the Explore North America category.

Holiday Destinations

Under the Holiday Destinations category of the RBC Air Travel Redemption Schedule, you may fly between the following areas:

- Western Canada/US and Mexico, Hawaii, or Alaska

- Eastern Canada/US and Bermuda, Central America, or the Caribbean

In Canada, the dividing line between Western and Eastern Canada is somewhere between Winnipeg, Manitoba, and Thunder Bay, Ontario – with Winnipeg being the start of Western Canada, and Thunder Bay being the start of Eastern Canada.

For this category, you may redeem Avion points as follows:

- 22,500 Avion point s for a one-way ticket, with a maximum base fare of $450

- 45,000 Avion points for a round-trip ticket, with a maximum base fare of $900

Redeeming Avion points this way yields a value of up to 2 cents per Avion point.

Take a Vacation

The Take a Vacation category is the reverse of the Holiday Destinations category above, which allows for the following routing options:

- Eastern Canada/US and Mexico, Hawaii, or Alaska

- Western Canada/US and Bermuda, Central America, or the Caribbean

Since these routes are generally longer, you’ll need to redeem more Avion points, outlined as follows:

- 27,500 Avion points for a one-way ticket, with a maximum base fare of $550

- 55,000 Avion points for a round-trip ticket, with a maximum base fare of $1,100

Redeeming this way also yields a value of up to 2 cents per Avion point.

Visit Europe

Should you wish to book a trip to Europe, you may fly from any major airport in Canada or the US and redeem your points as follows:

- 32,500 Avion points for a one-way ticket, with a maximum base fare of $650

- 65,000 Avion points for a round-trip ticket, with a maximum base fare of $1,300

Interestingly, Hawaii and Alaska are also included under this category, and the redemption also works out to a value of up to 2 cents per Avion point .

See the World

Lastly, the See the World category includes all other destinations not covered by any other categories above.

Under this category, you may fly from Canada or the US to destinations in Asia, Australia, New Zealand, South Pacific, Middle East, Africa, and South America, for the following amounts of points:

- 50,000 Avion points for a one-way ticket, with a maximum base fare of $1,000

- 100,000 Avion points for a round-trip ticket, with a maximum base fare of $2,000

Similar to the last few categories, the redemption rate is up to 2 cents per Avion point.

To book a flight using the RBC Air Travel Redemption Schedule, you’ll first have to log into your RBC account, either on the RBC Avion website or through the Avion Rewards app.

As a reminder, you’ll need at least one of the eligible “Avion Elite” cards listed above to book flights with Avion Rewards directly.

Once you log in, select the “Travel” tab, and click “Book Travel”. From there, select “Flights”, and simply search for your desired flight route and dates.

As you search for your preferred flight, you’ll have the option to choose between “Fixed Points Pricing” and “Flexible Points Pricing”.

You’ll want to make sure “Fixed Points Pricing” is selected, since Flexible Points Pricing option will give you a flat redemption value of 1 cent per point (100 points = $1 CAD). If you don’t have enough points in your account to book a flight with the RBC Air Travel Redemption Schedule, you’ll only see the Flexible Points Pricing option.

From there, you’ll see the available flights, the number of points required, and the amount of taxes and fees you’ll have to pay. Once you’ve selected your preferred flight(s), simply complete the booking process.

If you’re having difficulty finding your desired flights, or if you can’t get online booking to work, you can always phone RBC Travel at (877) 636-2870.

One of the best features of the RBC Avion Rewards program is that you can use your points in multiple ways. The most valuable way to redeem your Avion points is for travel, since it offers the best value in terms of cents per point.

If you choose to redeem points through the RBC Air Travel Redemption Schedule, there are a few optimizations to keep in mind to make sure you’re getting the most out of your points.

Use the Full Base Fare Limit

To make the most of an RBC Air Travel Redemption Schedule booking, you should strive to reach the base fare limit in each category. This way, you’ll get the best return for your points.

In an ideal world, the best available flights for your trip would also max out the allowable base fare. Otherwise, it may not be worth booking flights with extra connections just to maximize your points, if a cheaper direct flight is available instead.

If you aren’t able to get close to the maximum allowed base fare, paying for the flight with cash, and saving your points for other redemptions, might make better sense.

For example, you can redeem 17,500 Avion points for a one-way ticket from Orlando to Toronto, with a maximum base fare of $375.

However, you might be able to find a cheap flight with a base fare of just $75 (CAD).

In this case, you’ll still be required to redeem the full 17,500 Avion points, and you’ll get a suboptimal redemption rate of 0.4 cents per point in the process, instead of the maximum of 2.14 cents per point if you used the full allowable base fare.

To determine the base fare for a flight, pay close attention to the breakdown of prices on the airline’s website. After selecting your flights, you should see a row that shows “Air transportation charges”, and another that displays the taxes, fees, and other charges.

In this area, keep an eye out for an option to view the full price breakdown. In the breakdown, the base fare is displayed under “Air transportation charges”, which is what your RBC Avion points will cover at a fixed rate through the RBC Air Travel Redemption Schedule.

When you search for the same flights on the RBC Avion Rewards platform, you’ll have to pay the full 17,500 points, even though it’s only covering the $75 base fare, and you’re still on the hook for the remaining taxes and fees.

In this case, you’re much better off just paying cash for the flight, and saving your Avion points for a more valuable redemption instead.

You could also book the same flight using Flexible Points Pricing, and it’d only cost 12,877 Avion points, and you wouldn’t have any out-of-pocket expenses. Just keep in mind that this results in a value of 1 cent per point, which is less than what you can otherwise get through the RBC Air Travel Redemption Schedule.

However, you’ll also want to make sure that the flight’s base fare isn’t too much more than the maximum allowed. Remember that you’ll be charged the excess amount in cash, or Avion points at a flat rate of 1 cent per point.

Book Positioning Flights

One of the realities of award travel is that there’s frankly much more award availability at US airports than you’d find in Canadian cities.

If you’re able to find an award flight that originates in the United States, you could use the RBC Air Travel Redemption Schedule to book your positioning flights between Canada and the US.

For example, if you need to catch a positioning flight from Ottawa to New York, from where you’ll depart on a long-haul flight booked with another loyalty program, you could easily book a one-way flight under the Quick Getaways category for only 7,500 points.

The flights you book don’t have to be direct, and as long as your origin and destination fall under the definition of the category, your redemption will qualify.

For instance, flying from Vancouver to Seattle with a stop in San Francisco will still qualify under Quick Getaways, since the origin and destination (British Columbia and Washington, in this case) are adjacent to each other.

Take Advantage of Flexibility

One of the best aspects of the RBC Air Travel Redemption Schedule is the flexibility it offers. You’re not restricted to a specific airline and its alliance, and you’re not constrained by airline award seat availability and blackout dates, either.

You might find the RBC Air Travel Redemption Schedule particularly useful for airlines that aren’t part of an alliance, and are otherwise difficult to book with points. Some examples of this might include Philippine Airlines, Caribbean Airlines, and Montreal-based Air Transat.

Furthermore, you could take advantage of the flexibility of the RBC Air Travel Redemption Schedule by using it in tandem with award seats in other programs, which are usually limited.

For example, let’s suppose you’d like to book a family of four on a summer trip from Toronto to Vancouver. Air Canada’s Aeroplan program has award availability at 12,600 points, but the number of seats available at that price is limited to three.

If you add a fourth passenger to the search, the cost moves up to 19,900 points, which is a considerable jump in price.

Instead, you could book three passengers at the lower cost of 12,600 Aeroplan points, and then look into using the RBC Air Travel Redemption Schedule to book the fourth seat using Avion points. This would also come in handy if you didn’t have enough Aeroplan points to cover the fourth passenger to begin with.

A flight from Toronto to Vancouver falls under the Explore North America category, which means it’ll cost 17,500 Avion points for a one-way flight, plus around $85 for taxes and fees.

Boost Your Avion Balance with the RBC ION+ Card

Despite its minimal monthly fee, the RBC ION+ Visa actually has the most competitive earning rates among RBC’s line-up.

With the RBC ION+ Visa, you’ll earn 3 Avion points per dollar spent on groceries, dining, food delivery, transit, gas, electric vehicle charging, streaming, and digital gaming. By contrast, you’ll only earn 1 Avion point per dollar spent on those categories with the higher-tier RBC Avion Visa Infinite .

- Earn 3,500 Avion Premium points upon approval †

- Plus, earn 3,500 Avion Premium points upon spending $500 in your first three months†

- Earn 3x points † on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming and digital subscriptions†

- Mobile device insurance †

- Monthly fee: $4 †

However, remember that you won’t get access to the RBC Air Travel Redemption Schedule with the ION+ card alone, since the card earns “Avion Premium” points, which can be redeemed for travel at a lower rate of 0.6 cents per point.

On the other hand, if you happen to have both an RBC ION+ Visa and an RBC Avion credit card that earns the higher-tier “Avion Elite” points, you can transfer “Avion Premium” points into “Avion Elite” points.

By doing so, you can redeem them at a higher value, either by transferring them to airline partners, or by making a booking on the Air Travel Redemption Schedule.

Therefore, you can get the best of both worlds by earning Avion Premium points on the RBC ION+ Visa, and then converting them into Avion Elite points, as long as you have an eligible Avion credit card, too.

The RBC Avion Rewards program provides a number of options for you to redeem your points towards travel. You can convert your Avion points to a partner airline, or you can redeem them through the RBC Air Travel Redemption Schedule.

While you can get great value by transferring Avion points to airline programs, there’s also great value to be found in the RBC Air Travel Redemption Schedule, potentially unlocking value of up to 2–2.3 cents per Avion point.

If you have a healthy balance of Avion points, be sure to consider the RBC Air Travel Redemption Schedule the next time you need to book a flight.

- Earn 35,000 RBC Avion points † when you get approved for the card

- Plus, earn 20,000 RBC Avion points † upon spending $5,000 in the first six months

- Earn 1.25x RBC Avion points † on qualifying travel purchases

- Transfer RBC Avion points to British Airways Executive Club and other frequent flyer programs for premium flights †

- Redeem Avion points for flights with the RBC Air Travel Redemption Schedule †

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120 †

How much commission do you make off your RBC links? I read your blog religiously and don’t bother with the other Canadian ones.

Imagine my surprise and annoyance when after applying for my and P2’s Avion Visa Infinite that I learn GCR was offering $100 back!!! Even some blogs are offering $100 back in their own way to people that apply through them.

Either you guys missed it, but the more I read this blog, I suspect you just wanted to keep the extra money for yourselves. Shame on me for forgetting to check GCR and shame on you for withholding info like that just to make a buck.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Prince of Travel is Canada’s leading resource for using frequent flyer miles, credit card points, and loyalty programs to travel the world at a fraction of the price.

Join our Sunday newsletter below to get weekly updates delivered straight to your inbox.

Have a question? Just ask.

Business Platinum Card from American Express

120,000 MR points

American Express Aeroplan Reserve Card

85,000 Aeroplan points

American Express Platinum Card

100,000 MR points

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 85,000 Aeroplan points†

Latest News

Head-to-Head: Amex Bonvoy Card vs. Amex Bonvoy Business Card

Guides Apr 17, 2024

Hilton Honors Summer 2024 Global Promotion: Earn Double Points

Deals Apr 17, 2024

Lufthansa to Debut Allegris Business Class on Canadian Routes

News Apr 16, 2024

Recent Discussion

Rbc changes earning rates on the rbc® british airways visa infinite†, how to use air canada same-day airport changes, american express referral program: refer friends, earn points, christopher, mbna rewards world elite® mastercard®, looking ahead to 2024 in the miles & points landscape, prince of travel elites.

Points Consulting

15 good uses of RBC Avion Rewards points

- Post author: Andrew D'Amours

- Post published: April 27, 2023

- Post category: Travel rewards Canada / Using rewards

- Post comments: 0 Comments

RBC Avion Rewards points are pretty much the only ones among all of Canada’s travel rewards currencies that even try to compete with Amex points in terms of ways to use them for outsized value and transfer partner options (and ease of earning a lot of points). Let’s start with the basics, but we’ll have much more content about this currency!

We’ll look at 15 good uses for those RBC Avion Rewards points.

Basics of RBC Rewards points

The RBC Avion Visa Infinite Card is currently offering its regular welcome bonus. It’s already one of the most popular cards in Canada, as the main card for the country’s largest bank.

Basically, you’ll earn 35,000 RBC Avion Rewards points with no minimum spend requirement to reach, so it’s perfect as a 2nd card to apply for on the same day as a 1st one with a minimum spend requirement and a bigger bonus.

You can get this welcome bonus even if you’ve had this card before; that’s the beauty of all cards that aren’t issued by Amex (often there’s a minimum wait period; but not with RBC). And that’s why you can get a literally infinite amount of free rewards to travel more for less! Save your spot for our free webinar on travel rewards for beginners to learn more!

You can read all the details on our RBC Avion Visa Infinite Card page , and on our review (which includes a video presentation if you prefer that format).

We’ll also have a lot more content, tips, and guides on all the major programs (including RBC, Amex, Aeroplan, Avios, Marriott, etc.) very soon.

How to use RBC Avion Rewards points

With other RBC cards, the RBC Avion Rewards points you get work differently. So we’ll just focus on the RBC Avion Rewards “Elite” points that are relevant here, as the RBC Avion Visa Infinite Card ‘s welcome bonus is by far the most valuable among RBC cards.

RBC Avion Rewards points can be used as both of the 2 only types of rewards use options that exist: uses that are more valuable (less simple) or uses that are more simple (less valuable).

So we will divide the article into the 4 different ways that RBC Avion points can work:

- Transfer to Avios (12 good uses)

- Transfer to WestJet Rewards and others (1 good use)

- Reward flights with the RBC price chart (1 good use)

- Travel credit to erase almost any travel expense (1 good use)

1. Transfer to Avios (12 good uses)

The Avios program is far from being as simple as the ubiquitous airline rewards program in Canada (the Aeroplan program ), but depending on your travel preferences, it can be very valuable too.

We’ve put together an article that lists 12 good uses of Avios points .

Note that 60,000 RBC Avion points = 60,000 Avios points (1 to 1 transfer rate). The increased welcome bonus on the RBC Avion Visa Infinite Card that is offered regularly gives you those 60,000 points ( sign up to get an alert when it returns).

But usually, RBC has a transfer bonus promo with at least a 30% bonus every year. That means you get 30% more Avios points when transferring RBC points, giving you 30% more free travel! And 30% more value than our Flytrippers Valuation for the RBC Avion Visa Infinite Card ‘s welcome bonus. That’s even more amazing!

This option can give you up to 9 one-way short-distance flights in some countries, or 4 one-way flights to/from Miami from Toronto or Montreal for example.

But with Avios, you’ll have much fewer options compared to Aeroplan. So you’re better off choosing the cards with amazing offers that earn Aeroplan points or American Express points if you want airline rewards (the most valuable type of rewards) but prefer some that are simpler than Avios points.

2. Transfer to WestJet Rewards and others (1 good use)

Okay, there is more than 1 good use with the other airline partner programs, but it’s really a lot rarer that it’s a good value. So we’ll say 1 good use for now: for a sweet spot with other partners.

The 3 other RBC airline program partners are:

- WestJet Rewards (1 to 1 transfer rate)

- Cathay Pacific Asia Miles (1 to 1 transfer rate)

- American Airlines AAdvantage (1 to 0.7 transfer rate)

We’ll discuss it in more detail in our RBC Avion Rewards program guide soon , but the main appeal used to be for those who often fly WestJet. But now, their program is so bad that the RBC points option #4 below is probably more valuable even for WestJet flights.

(The WestJet RBC World Elite Mastercard also has an increased offer and the WestJet RBC Mastercard is a no-fee option, if you really like WestJet — we’ll cover those cards later since the welcome bonus is hundreds of dollars lower than the RBC Avion Visa Infinite Card and the other incredible offers right now !)

The Asia Miles program can be interesting, especially since it is also a transfer partner with the Amex Membership Rewards program and the HSBC Rewards program . So it’s easy to earn many Asia Miles. But it’s a program with sweet spots that are even more specific than Avios, which I’ll cover soon to keep this post shorter today.

Finally, the American AAdvantage program has a much less appealing transfer rate for starters. And the program is not great, as is the case with most US airline programs. That said, I did make my 1st AAdvantage redemption in 15+ years in the world of travel rewards… and it was literally one of the most valuable redemptions I’ve ever made. I was glad to have RBC Avion points to transfer to AAdvantage!

3. Reward flights with the RBC price chart (1 good use)

We’re now at the first of the 2 uses of RBC points that don’t involve transferring to another program.

I’ll do a separate article for you soon, but basically, the RBC award chart has only one good use: when airline tickets are very expensive in cash .

The thing is the price chart will give you a ticket for a fixed number of points, regardless of the cash price (with a maximum price though).

It’s harder to maximize than airline partner programs, at least for those who don’t normally buy expensive flights. And it’s much more restrictive: you have to book flights only departing from Canada or the USA. However, RBC does allow you to book one-ways at least (compared to the Amex price chart that only allows roundtrips for example).

Here is the full RBC price chart for roundtrip reward flights (directly through the RBC program instead of having to transfer points).

(One-ways simply cost half the amount of points with half the maximum price too!)

So for example, let’s say you use your 60,000 RBC Avion points for 4 roundtrip flights that cost 15,000 points… you could “save” $1400 ($350 x 4)!

That would give a great value of 2.3 ¢ per point (and the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus would be worth $1280 instead of ≈ $780 at our always conservative Flytrippers Valuation).

However, that means you’d be paying for very, very expensive tickets. So it’s just a good use if you were really going to pay a lot of money for those flights (if you didn’t have any flexibility for example). And when the plane ticket’s base fare is as close as possible to the maximum ticket price in the RBC price chart.

When used this way, RBC points only cover the base fare, so not the taxes and some other fees. The maximum ticket price in the price chart is also only for the base fare (the same as the Amex price chart for reward flights ).

Remember that what’s important is not how much you pay out of pocket, but how much you SAVE in total, at least if you know how to do the math and if you want to get the most value with your rewards.

So the RBC price chart can still be interesting if you have to go somewhere and the flights are very expensive. For example, if you are going to a European destination that is very expensive for your dates, that can easily cost $1600, especially if you’re not in Toronto or Montreal (which is sad considering we often spot deals to Europe in the $400s roundtrip).

With 65,000 RBC Avion points (the 5,000 missing after the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus are pretty easy to earn), you could save $1300, a great use on paper. But it’s not a good use if the alternative is a flight to Europe paid with cash that has just a $300 base fare.

To give you an idea, I’ve used airline reward programs for dozens and dozens of flights in the past 10 years, and I have used the bank price charts only once (it was with RBC during the Christmas holidays this year because flights during the holidays are expensive).

I usually don’t buy expensive flights so it’s less beneficial for me. And when I do buy expensive flights, I’m flexible, so airline points are a lot more valuable.

In short, the value you can get with the RBC price chart really depends on your personal situation and how good you are at finding cheap flights. As is always the case in the world of travel, you have to compare!

4. Travel credit to erase any travel expense (1 good use)

Finally, the only option that has a fixed value… isn’t really a good use at all in fact.

It’s a “good” use only if you want to keep it simple and are willing to get a lot less value in return, as so many people are.

Instead of being worth ≈ $780, the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus is worth a flat $480 net if you use it like this. Because as a travel credit, 60,000 RBC Avion points = a $600 credit.

But it’s much simpler: you can apply the points to any travel expense.

It’s always going to be worth 1¢ per point. Any travel use. Very simple.

That’s why the other options are about 50% more valuable… but even $480 for free is pretty good!

With this option, you don’t have to think anything through, you don’t have to maximize anything, you don’t have to take any specific flights… it’s really as simple as it gets.

Well, almost as simple as it gets. There is one restriction: you need to book on the RBC Avion website (you cannot book on other websites as you can with other rewards programs).

If you want to use points for any travel expense, you really shouldn’t “waste” valuable points like RBC Avion points anyway (unless you’re never going to use them for more valuable flight redemptions, in that case of course take the points instead of not taking them).

Instead, use points that cannot give you more value AND can be used by booking on any website! Like Scene+ points (the Scotiabank Gold American Express Card ), BMO Rewards points (the BMO eclipse Visa Infinite Card ), or AIR MILES miles (the BMO AIR MILES World Elite MasterCard ).

Or points that can be used by booking on any website without losing too much value. Like TD Rewards points (the TD First Class Travel Visa Infinite Card ) or HSBC Rewards points (if you already have some).

The RBC Avion Visa Infinite Card is a great option to get points of the more valuable type. These examples may give you a good idea of what you could do with the welcome bonus, while you wait for our more comprehensive guides.

Have any questions about RBC Avion Rewards points? Ask me in the comments below.

Want to be the first to get our free travel rewards course and all our content, sign up for our travel rewards newsletter.

See the deals we spot: Cheap flights

Explore awesome destinations : Travel inspiration

Learn pro tricks : Travel tips

Discover free travel: Travel rewards

Featured image: Beach (photo credit: Nico David)

Share this post to help us help more people travel more for less:

Andrew D'Amours

Leave a reply cancel reply.

How to redeem Avion Rewards points for financial rewards

When logged into RBC Rewards, if you look under the Shop & Redeem menu, you’ll see there’s an option to use your points for RBC financial rewards. Assuming you have financial products with RBC, you can use your points for the following:

- Add to your existing investments

- Mortgage payments

- Repayment to your line of credit.

It takes 12,000 RBC points to get $100 in financial products which gives you a value of .83 cents per point. At first glance that may seem like a lot, but think about the long term. With mortgage and line of credit payments, you’re basically paying off your loan earlier which you immediately save on the interest. If you’re adding to your investments, you can take advantage of compound interest which could make your redemption very valuable in the long run.

If you use your points for a financial reward that’s put towards your RRSP , you could also get a tax break. Putting in your TFSA would allow you to invest with tax free gains. It’s a win-win situation, but you won’t see the reward for many many years.

Redeeming Avion Rewards points for merchandise, statement credits, and charitable donations

The final three redemption options for your RBC Rewards points are merchandise, statement credits, and charitable donations. Although the RBC Rewards merchandise catalogue is quite large and there are some quality products available, the number of additional points required for the value is not worth it at all. I would advise avoiding using your points for merchandise. That said, there are occasionally discounts on merchandise redemptions, so sometimes the transactions aren’t a terrible deal.

Using your points for a statement credit is an even lower value. It takes 17,200 points to get $100 off your statement. That means your points would be worth .58 cents per point. Unless you’re facing financial difficulties, you’re better off redeeming your points for anything else.

RBC Avion points transfer partners

I love programs that let you convert points to other loyalty programs since it adds flexibility and value. Avion Rewards has one of the most extensive and valuable lists of conversion partners when it comes to Canada’s bank travel reward programs. American Express Membership Rewards is better, in my opinion, but RBC Rewards isn’t far behind.

Here is the list of programs you can convert Avion points to, but note that except WestJet Rewards, only Avion cardholders can transfer their points to the following partners:

- WestJet Rewards : 1,000 RBC points = $10 WestJet dollars

- Hudson’s Bay Rewards : 1,000 RBC points = 2,000 HBC Rewards points (worth $10 at Hudson’s Bay)

If you are an Avion cardholder you can also benefit from these conversion options:

- American Airlines : 10,000 RBC points = 7,000 AAdvantage miles

- Cathay Pacific Asia Miles : 10,000 RBC Points = 10,000 Asia Miles

- British Airways : 10,000 RBC points = 10,000 Avios miles

It’s hard to put an exact value on airline miles since there are so many variables, but generally speaking, their value is around a minimum of 1.5¢ per mile for economy tickets. Often you can get double the value if you’re booking in business class. That said, WestJet Rewards uses a dollar system, so they have a fixed value.

It’s a good idea to log into RBC Rewards often since they have many redemption promotions throughout the year, which boost your points’ value. In addition, RBC Rewards had a few transfer bonuses (10% to 30% bonus points) for Westjet, Asia Miles, British Airways Avios Miles, and American Airlines AAdvantage Miles. That meant you got extra value when transferring your points to a partner.

Of particular interest is how you can transfer your points to WestJet dollars. Nothing stops you from holding an RBC Avion card and the RBC WestJet World Elite Mastercard. Both cards come with good sign up bonuses so you could quickly rack up those WestJet dollars. For example, the RBC Avion card typically has a welcome bonus of 15,000 points which can be transferred to WestJet for $150 WestJet dollars. The WestJet RBC World Elite Mastercard’s standard bonus is $250 and a companion voucher. When you combine the two, you’ll have $400 in WestJet dollars without having to spend much. No purchase is required to get the bonus with the Avion card, and you only need one purchase with the WestJet Card.

Do RBC Rewards points expire?

There’s a lot of conflicting information out there about when RBC Rewards points expire. I have confirmed that RBC Avion points don’t expire as long as you have an active eligible RBC Royal Bank credit card. If you cancel your card, you have 90 days to redeem them before losing them. The first-in, first-out rule you may have read about online is an old outdated article. RBC really needs to delete that page. If you’re unsure when your points expire, you could always call customer service to confirm.

How RBC Avion compares to others

RBC Avion Rewards is easily one of the best travel loyalty programs of Canada’s big five banks. There are many reasons why I rank RBC Rewards so high, including:

- No blackout dates

- No minimum number of points to redeem

- A fixed points flight program

- Many transfer partners to convert points to

- Many promotions for redemptions

- Value of points

In my opinion, RBC Rewards is only second to American Express Membership Rewards . American Express holds the first place because RBC Rewards lacks an option to book travel on your own (you can only book through their portal) and because RBC Rewards credit cards don’t really have any increased earn rates which limit how fast you can earn points. You can also read my reviews of CIBC Rewards , BMO Rewards , TD Rewards and Scene+ to see how RBC Rewards compares.

How to earn RBC Avion Rewards

To earn RBC Rewards, you must have a credit card account that earns you RBC Rewards. As you can imagine, the easiest ways to earn points are via credit card sign up bonuses and everyday purchases you make on your RBC Rewards credit card. Currently, there are six personal credit cards and two business credit cards that will earn you RBC Rewards points. To make things a bit complicated, RBC Rewards has two tiers of RBC Rewards points: regular and Avion RBC Rewards points. Points from an Avion account have more redemption options, and these options are the most valuable ones. With this in mind, the RBC Visa Infinite Avion card is arguably the best card to earn Avion points and is one of the best RBC credit cards .

RBC Avion Visa Infinite Card

- $120 annual fee

- 35,000 Avion points on approval

- 20,000 Bonus points when you spend $5,000 in the first 6 months

- Earn 1.25 Avion points for every $1 spent on travel purchases

- Earn 1 Avion point per $1 on all other purchases

- Comprehensive travel insurance

- Mobile device insurance up to $1,500

The sign up bonus for new cardholders is typically 15,000 points which isn’t much compared to some of the best travel credit cards in Canada . That said, the RBC Visa Infinite Avion Card often has promotions where the welcome bonus is 25,000 – 35,000 points, and the annual fee for the first year is waived. Whenever a promo like that comes around, it’s worth signing up for the card.

The earn rate of 1.25 points per $1 spent on travel is decent, while the 1 RBC Reward point earned per dollar spent on all other purchases, including bill payments, is pretty common. Here’s something that many people don’t realize. You don’t need to make any purchases to get the bonus. The terms and conditions say you get it after the first statement.

Another little-known trick is that you can switch from the RBC WestJet World Elite Mastercard to the RBC Visa Infinite Avion Card and vice versa. This is useful if you’re not able to maximize your points and want to try something new. That said, be sure to use up your points before you make any changes.

The RBC Visa Infinite Avion Card also provides good travel insurance when travelling outside Canada. Not only do you get travel medical, but you’ll also be covered for trip cancellation/interruption, delayed and lost baggage, hotel/motel burglary and more. Obviously, some exclusions apply, so read the certificate of insurance for complete terms.

Link to your Petro-Points card

RBC has a deal in place with Petro-Canada where you can save 3 cents per litre at Petr-Canada, 20% extra Petro-Points, and 20% extra RBC Rewards points.

To be eligible, you just need to add your Petro-Points number to your RBC online banking account. You would link your Petro-Points card to all of your eligible RBC debit or credit cards.

Final thoughts

Avion Rewards is one of the best bank travel rewards programs . The RBC Visa Infinite Avion card may not give you the best signup bonus or have the highest earn rate, but there’s no denying that once you have the points, they’re easy to use. There are no blackout dates and no minimum points required to make a redemption, so you’ll never run into any issues using your points. If you’re a fan of RBC, check out my RBC InvestEase review and find out how you can reduce your investment management fees.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

97 Comments

Can you explain more on the comprehensive cancellation insurance for traveling? For flight

What I mean is you get travel medical, trip accident, trip cancellation, lost luggage, etc. You cAN READ THE FULL DETAILS HERE.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-infinite-avion/rbc-visa-infinite-avion-certificate-of-insurance.pdf

Barry choi, What about outright flight cancellation by company with no booking possibility ? this happened to me 5 years ago and Avion card could not do anything!

When saying trip cancellation … talking from whom??

What do you mean by company with no booking possibility? With fight cancellation, it only applies to reasons that are outlined in your insurance policy.

When should I pay for a flight as opposed to redeeming points. I want to go to Vancouver – Honolulu -L.A. – Vancouver. Points 45000 plus $266 Cash $960 Plse advise and thx,Lawrence

45,000 Rewards points would be worth $450 + $266 for taxes = $716. Since the value of your redemption via the fixed travel program is $960, you come out ahead using the fixed program.

How much is 28906 rbcrewards point please

10,000 points = $100 so you have $289 at the base value. Your points are worth more if you use the RBC Rewards Air Travel Redemption Schedule

Hi. I have 10500 pts and I purchased my ticket for $2000 whose base fair is $1400. What’s the best way to go with the schedule?

You need 15,000 points to make a claim within or to an adjacent Province/Territory/U.S. State. That fare has a maximum base price of $350 so you can’t use the fixed redemption schedule.

you could just 10,000 points to redeem $100.

Sorry Barry. I have 105000 points. I missed a zero. Can you please update your response?

If you’ve already paid for your ticket, you can’t use the air redemption schedule. Assuming you didn’t 100K points gets you a flight from any major gateway in Canada/U.S. to destinations in Asia, Australia, New Zealand, South Pacific, Middle East, Africa, South America

Hi Barry, thanks for the article and for all the Q&A work as well !!

I’m looking at making the switch to Amex. I have 160k reward points I’ve saved up over the years. Looking to cash out or use these points up somehow with the best value. Appears as tho 10,000 points for $100 value is about the best offer from RBC rewards? Also, do you know if these points expire if I got rid of my RBC Avion card?

Yup, 10K points for $100 is indeed the best value. You lose all your points if you cancel your card. Your best bet would be to transfer your points to WestJet Dollars or hotels.com giftcards as they have good value.

I product switched to the RBC British Airways Visa almost 4 months ago. My account has remained in good standing however, I haven’t received the welcome bonus of 15k points yet. I have called RBC multiple times and each time I have been told that BA awards the points but when I speak to BA, they say that RBC needs to award the points. Do you have any idea who should be awarding the points? Thanks in advance for any help you can provide.

In theory, it should be BA that actually issues the points but RBC would have to authorize it.

I would advise escalating the case with RBC first to see if that resolves anything.

If I wish to use my Avion Rewards points to pay off my credit card bill, is it straight 100 points/per every $1?

No, it takes 172 points to claim $1 in statement credit so you’re devaluing your points quite a bit if you were to go that route.

Is this card best to earn miles to book a points first class flight from Vancouver to Tokyo?

I just noticed RBC is offering 50% more points if converted to Avios, does the same offer ever happen with AA points?

The 50% bonus is quite rare. I’ve never seen it with AA.

Is it worth it to convert your Avion points to BA Avios given the 50% bonus on until Dec 15th? I live in Vancouver and typically fly to Hawaii in Winter and Europe in summer. Your insight is much appreciated.

If you plan on using those BA points, then yes, it’s a great deal. That said, I’m not sure which airlines you can use BA Avios points to get you from Vancouver to Hawaii.

Hi, is it worth buying the air Canada gift cards at a 10% discount? Are they easy to use and are there any hidden charges / rules to these we should know about?

Buying the gift cards gives you a guaranteed discount of 10%, but you might get better value if you used your points on the fixed travel program. It’s honestly a personal choice but I imagine you wouldn’t have any issues with using the gift cards. As far as I know there are no additional charges or rules, but read the fine print before you commit.

Do my RBC rewards expire at any point

Not as long as you have a credit card account that earns you RBC Rewards active with them that’s in good standing.

RBC Reward points expire after 3 years on a First In, First out basis.

That is incorrect. If you refer to handbook, the first page states that RBC points don’t expire.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-platinum-avion/rbc-visa-platinum-avion-benefits-guide.pdf

The reference to points expiring after 3 years is old and should have been removed from the website.

my mistake, you are correct. I believe my knowledge was outdated.

I just logged into my RBC Rewards and I see that I have a – 69K point balance. How is it possible to end up with a negative reward points balance?? I have never even used my rewards and forgot that it was even available. Any help would be appreciated.

You’d have to check with RBC about that

Do you think it is worth keeping the RBC Infinite Avion card beyond the first year? Is it worth the $120 per annum annual fee considering that I am also paying fees for amex gold card and BMO cash back card?

Thanks for your insight

Hi Viviene,

I personally wouldn’t keep three credit cards with annual fees. Of the three cards you mentioned, I’d probably drop the BMO cash back card but that’s because I prefer travel points. Who do you bank with? Do they waive the fee for any cards?

I bank with BMO but it’s a joint account and the waiver goes towards my partner’s BMO MC world elite card. I figure the cashback we get each year more than pays for the annual fee.

What does RBC Avion offer that justifies its fee? It seems as if it would take a long time to build up any significant number of points.

Well it’s really for you to decide based on your spending. E.g. if you moved all the spending from your cash back card to the RBC card, you could more in points for flights than what the annual fee would cost you. I think the RBC Rewards fixed flight travel chart offers good value especially if you’re looking at short haul flights. However, that may be redundant since you have the Amex Gold which also has a fixed points program.

How would you compared the two fixed points program? I tend to focus on transferring my Amex points to Avios and haven’t really looked at the Amex fixed points program. I also feel that the Amex Gold has more to offer than the RBC card in terms of travel insurance and flexibility on how to use points. But I may be wrong….

Both programs have their sweet spots. Amex is arguably better since you have more transfer partners. The Amex Gold has a slightly higher earn rate on travel. but RBC Rewards has occasional promos where if you transfer your points to BA, you get 25 or 50% more points.

I do agree that the Gold Amex is a better overall card.

Is there anyway I can browse through options for say a vacation package, that would be qualified for if I had 150000 points? For example my 150000 points would allow me to go to Cayo Largo Cuba, or Puerto Plata Dominican Republic or Cozumel Mexico…you get the idea.

It doesn’t give you an option to search for results based on X points. All really allows you to do is search by price from low to high after you’ve selected a country.

I have always been a fan of the RBC Avion program until today when I tried to change a departing flight and was told that all the flights I chose were “not available” although there were clearly seats for sale on both the airline website AND Expedia. RBC only offered a few very poor flight options. I thought “any flight” meant “any flight”. I have never encountered this before. We ended up buying new flights from the airline after spending over 30 minutes on hold, suffering through a painfully frustrating conversation with an agent and draining the battery on my phone.

I’m going to bail on Avion after learning that they recognize an Air Canada fuel surcharge of 570$ per ticket to europe in a time of extended, sustained low fuel prices. It was going to cost me 1100$= in fees when flights can be purchased outright for just over 1600$.

Value lost due to poor decisions at Avion….. adios!

That’s Air Canada’s fault, not Avion.

How long does it take to convert RBC points into Asia Miles? Is it instantaneous or do you have to wait 6-8weeks?

It usually takes 4-5 days for the transfer to Asia Miles

I have around 200k in avion points. I am trying to figure out the best option for using them as we are moving to Europe for a year. I looked into the flights but almost 1/2 goes to the taxes, etc. I was wondering if it was best to use them while we are there for short trips. So, what would be the best value? (ie rental car, hotels, ?), anything else?

Points for flights to Europe are typically of low value due to the fees. Using them within Europe is also not a good value since you wouldn’t be able to use the fixed travel program. You could use the RBC travel portal when you’re abroad and book points at 10,000 points = $100 in travel.

Alternatively, you could convert your points to WestJet dollars at a 1:1 ratio. On occasion, there are promos where you can convert to hotels.com giftcards which can be a good value.

Hi Barry, we have ~250,000 RBC Avion points and I’m trying to maximize getting to FCO (Rome) this summer from YYZ (Toronto.) We also have 90,000 in Aeroplan.

Traveling with a 15 month old so really wanted to optimize for lie-down seats. But they are pricey. ($8000 for two seats on AC’s direct flights.)

Can you suggest a way to optimize our points to make it work?

Flying from Toronto to Europe is one of the worst redemptions regardless of the program due to high airport taxes. With Aeroplan, you need 110K points for a return business flight so that won’t really work.

For RBC, I don’t think you can use your points for business so that doesn’t really help.

The best value I can think of right now and this is honestly not the greatest solution is to consider transferring your points to WJD. If you have the WestJet World Elite Mastercard, you can use the companion voucher for premium economy. I just booked two flights from YYZ to LGW for $2400. Of course, you would still need to get a flight to Rome and you’d only be redeeming your points at a 1% value.

IMO, you’re better off paying cash for this route and saving your points for later.

Help. We have 175000 Avion points. Looking to use them from YVR to LHR. If I use the points for 3 fares return it looks like another $700 each on top !!!! With Aur Canada. Flights in September are approximately $700 each return. Can you give any advice. I have not checked if BA charges the same.

Flights to Europe are a terrible value due to the high taxes. You’re better off saving your points for a different redemption.

Is it possible to use Avion points to pay for an upgrade on an already booked flight? Is it worth it? Looking at this for a flight from Houston to Auckland on Air New Zealand.

You’d have to call and ask. You definitely can’t do upgrades via the RBC Travel portal.

Is there a time limit to redeem accumulated points? And I wld like to purchase a gift card for electronics?

Your points don’t expire as long as you have an active RBC credit card that’s in good standing.

I am a bit lost with car rental points… if my rental was $800.00 how many points would I need

That falls under travel so it would cost you 80,000 points.

Barry, Can RBC Avion Visa Infinite cardholders redeem for a Premium Economy class seat instead of Economy class? Thanks!

RBC Rewards is a full service travel agency so you can book premium economy, but it’ll cost you more points. It’s unlikely you’d be able to book premium under the Air Travel Redemption Schedule since the price would exceed the maximum base price.

Barry, RBC Avion Visa Infinite redemption schedule From Canada to Hong Kong: 100,000 points. Maximum ticket price: $2,000.

Normally the Air Canada Premium Economy ticket from Canada to Hong Kong costs close to (less than) $2,000. It’s not worth to redeem Economy class, which is about $1,000 or less. That’s why I would like to know whether I can redeem Premium Economy class or not.

As long as the base ticket price is below $2,000, you should be able to redeem a premium economy flight using your RBC Rewards points.

Hi Barry, I’m totally torn between Scotia Passport and RBC AVion? Which one do you really prefer if we plan on going US visits and Asian Countries as well?

Both cards a bit different. The Scotiabank card is a good all-in-one card since it has no forex fees, but the RBC Avion has a fixed points travel chart which can be of good value. Since you’re based in Canada, Air Canada/Aeroplan cards are good for US travel thanks to the new Buddy Pass. WestJet companion vouchers can also be handy.

Barry, early thanks for answering my question. I am contemplating on utilizing approx. 111,000 Avion points for Best Western gift cards. I presume the gift cards are in Canadian funds? Travel contemplated is in the U.S. once the ban is lifted. How is the difference in currency handled by U.S. based Best Westerns?

The gift cards are only worth it if you’re getting an equal value to your RBC Avion points. E.g. 1,000 points = $10. Yes, the cards would come in CAD. If you use them outside of Canada, you would be subject to the exchange rate at the hotel which will definitely have a markup.

Avion $350 air fare fee for interprovincial travel is useless to many Canadians outside the Upper / Lower Canada belt. Many interprovincial one way tickets are $350 or more. I’ve amassed nearly a million dollars over the years on my Avion card, and travel with my family of 6, using the points. I always have to wait for airlines to post sale prices before I can use the points, because their reward amount is set too low. Its not a cheap card either. I’ve never complained, but its been the same price system for over 10 years. Hello! Inflation!

Paying the taxes on flights is also a bummer. I’ve often just bought sale priced flights with cash, because the Avion rewards taxes where close to half the flight cash amount. Didn’t see the point in wasting them.

How do I book a business class seat? We’d like to go back to Europe next year and want to fly business class. I have over 300,000 points with Avion.

Two years ago we booked two business class seats after transferring points to British Airlines, What a nightmare!

I swore that I’d move to another point card to get better service, connections, etc.

Please help.

RBC has a travel rewards portal where you’d book your flights and then redeem your points.

Aeroplan is a lot easier these days, it’s worth considering switching to a card that earns you Aeroplan points.

We have 215000 points with RBC and travel to Mexico, US and are thinking of going from Edmonton to Amsterdam and returning to Edmonton from Rome. What are the best way to use our points. Is transferring points to Westjet a better deal than buying Westjet gift cards .

To maximize your value, you should use the RBC Air Trave Redemption schedule – https://www.rbcrewards.com/#!/travel/redemptionSchedule

It’ll cost 65,000 points to get to Europe with a max ticket value of $1,300. That works out to 2 cents a point which is double the normal value.

Ad for WJD, it’s a better value to transfer your points directly instead of buying gift cards

Any luck with product switching lately and receiving the welcome bonus of 15,000 points for Avion Infinite?

Darn. Seems to still work for WJ MC. Perhaps makes sense to PS to a no AF card and then cycle back.

I recently “purchased” airline tickets using Avion points. Unfortunately I mistakenly selected the Flexible Points Pricing and as a result ended up using roughly twice as many points as would have been needed under the Fixed Points Pricing. The difference is somewhere around 35,000 points. I requested that Avion reverse this mistake but was advised that it was their policy to not allow such a change. I requested to talk to a manager, but they basically advised that this wasn’t going to happen (they told me it would take 6 weeks). Any advice.

Unfortunately, it’s unlikely they’ll reverse the charges. This happens with all points programs.

Hi Barry… I have over 1 Mil points… and on flight can I upgrade to Exec or 1st Class with my points ?? I don’t see it anywhere when i am looking at the booking … Any ideas. Thanks Mike

In the RBC Avion travel portal, you should be able to choose premium economy or business class seats for your flights.

What are the pros & cons of flex points vs flexible points booking w Avion? How do I know which we should use?

All rbc rewards and avion rewards points can be used on any travel purchase made through the RBC travel portal.

I have been reading your awesome feedback from Avion customers! I recently tried to receive information from the RBC Rewards program call centre and it was horrific – unprofessional and unknowledgeable agents, transferring me first to Expedia and then to Air Canada. They wore me down. I then went online and read reviews on the performance of the program – from what I saw, every customer who had to make a change on their travel booking experienced exactly the frustration I did.. Has this program gone down hill in recent years on their customer service assistance?

The program itself is fine, but I imagine every travel operator is experiencing customer service issues. I guess the real problem is knowing who to call. If you book travel through the Avion travel portal, technically speaking, you will go through them to make changes even if you booked an Air Canada flight.

Hi Barry, I’m unsure whether to use my avion infinite Visa card to pay a Europe bike tour purchase as the surcharge is 4 percent or pay with an e-transfer. The foreign currency rate I’m billed at was 1.49. I look forward to your response. Also, if I pay with an e-transfer will I have any travel protection? Thanks in advance! Barbara

Hey Barbara,

A 4% surcharge is quite a bit. That said, an e-transfer may come with fees too. I personally would just choose what’s cheaper. That said, if you don’t pay with your credit card, you don’t get any protection if you need to cancel your tour for a qualifying reason.

Hi Barry, Thank you for your responses. I really appreciate it! Barbara

Regarding financial rewards, more specifically applying a credit to an existing RBC mortgage: is the cash value going to be considered a lump sum payment or something else? I ask this because the options to pay down a mortgage faster are limited to double-up payments upon each scheduled payment, and one lump sum payment (aka prepayment) of up to 10% of the initial principal per year. I already used my yearly lump sum and I’m concerned that I wouldn’t be allowed to redeem my Avion points towards my mortgage or I may be allowed to do so, but I could be issued a penalty for not following the rules. I couldn’t find anything online about what the value of the points redeemed is considered to be.

Hey Stephanie,

If I had to guess, it would count as a prepayment. You’d have to call them to find out for sure.

Too old to travel. So thinking of using my Avion points to buy RBC merchandise. How can I see what is available if I don’t do any banking transactions on a computer?

You need to go to the RBC Avion website to see what items are available for redemption – https://www.avionrewards.com/index.html

On the web site that I see, the first thing that they want is your Visa number. And that is exactly why we don’t do money matters on line.

Avion Rewards is a credit card rewards program. Using your credit card number is how you log in.

Hello I redeemed 130,000 points for a flights to Barcelona from Toronto and had to cancel. What is the value of these points so that I can make a travel insurance claim

That’s a value of $1,300.

Hi Barry, Thought you might be interested in my experience being transitioned from HSBC World Elite MC to RBC Avion Visa. Since I don’t have anything that spells out the fees, conversion rate, etc. I called the RBC conversion team. They are waiving the $120 annual fee for the first year and that’s it. Although the HSBC card did not charge the 2.5% foreign conversion fee, the RBC card does. The extra points which HSBC gave for travel expenses are likewise not available with the RBC card. It seems to me that if I wanted this card I would be better off applying for it and getting the bonus. Very disappointing.

You should have received paperwork about the details of your new card. HSBC World Elite MC holders being switched the Avion Visa Infinite will still get no FX fees on their card.

You’re correct about losing the travel credit after the first year.

The Avion card is a clear downgrade, I mention a few other options in this article – https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-hsbc-clients-may-not-love-their-new-rbc-credit-cards-but-rbcs-avion/

Thanks Barry. I don’t subscribe to the Globe but I assume you suggested the Scotiabank Passport Visa as an alternative. I don’t want to take up your time with all this but I applied for the Scotia card and it developed into a real mess. I’m still trying to find out what happened, currently waiting to hear back from their Escalated Customer Concern team.

I suggested a few.

The Amex Cobalt for high earn rate, Rogers Mastercard for Costco (if you use Rogers), and Platinum for high end travel benefits. If you want no FX, the Scotiabank card is indeed good, but I like the EQ Bank card cuz it has no fees.

I’ll def check into the EQ card, thanks again.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

- Book a Flight

- Manage Reservations

- Explore Destinations

- Flight Schedules

- Track Checked Bags

- International Travel

- Flight Offers

- Low Fare Calendar

- Upgrade My Flight

- Add EarlyBird Check-In

- Check Travel Funds

- Buy Carbon Offsets

- Flying with Southwest

- Book a Hotel

- Redeem Points for Hotels

- More Than Hotels

- Hotel Offers

- Best Rate Guarantee

- Rapid Rewards Partners

- Book a Vacation Package

- Manage My Vacation

- Vacation Package Offers

- Vacation Destinations

- Why Book With Us?

- FLIGHT STATUS

- CHANGE FLIGHT

Enter code SAVE25NOW in the Promo Code box when booking. Offer is valid only for continental U.S. flights. The 25 percent promotion code savings are valid for one-way or round trip Wanna Get Away® and Wanna Get Away Plus® fares booked with Rapid Rewards points during the Booking Period, flown during the Travel Period, and are applied before taxes and fees. Seats and days are limited. Savings are reflected in the price when entering the multiuse code SAVE25NOW in the Promo Code box on Southwest.com and swabiz.com. This discount is only available through Southwest.com and swabiz.com. Discount is valid on new reservations only. Discount will apply only for flights booked during the Booking Period and flown on the dates within the Travel Period. If one segment of the trip is outside the Travel Period and one is within the Travel Period, only the portion of travel falling within the Travel Period will be discounted. Changes made to the itinerary after purchase will eliminate qualification for this promotion. The discount is only valid with the provided promotion code and is not combinable with other promotion codes or fares. All reward travel is subject to taxes, fees, and other government or airport-imposed charges of at least $5.60 per one-way trip. Applicable taxes, fees, and other government or airport-imposed charges can vary significantly based on your arrival and departure destination. The payment of any taxes, fees, and other government or airport-imposed charges is the responsibility of the Passenger and must be paid at the time reward travel is booked with a credit card, flight credit, or Southwest gift card. When traveling on reward travel, you will receive all fare product features except for earning Rapid Rewards points. Any change in itinerary may result in an increase in points used. Points bookings are subject to change until ticketed. If you cancel your reservation at least ten (10) minutes prior to the scheduled departure of your flight, any remaining unused points will be returned to your Rapid Rewards account. All Rapid Rewards rules and regulations apply and can be found at Southwest.com/rrterms . Offer is not redeemable for cash, and may not be used in conjunction with other special offers, or toward the purchase of a gift card or previously booked flight, or changed to a previously booked flight. Discount is not valid on group travel, Southwest Vacations®, and government fares.

Help Center

- Terms & Conditions

- Privacy Policy

- Do Not Sell/Share My Info

© 2024 Southwest Airlines Co. All Rights Reserved.

- Fantasy Baseball

- Fantasy Football

- Pro Pick'em

- College Pick'em

- Fantasy Plus

- Fantasy Basketball

- Fantasy Hockey

- Men's Bracket Mayhem

- Women's Bracket Mayhem

- Download the App

- 76ers beat Heat, earn playoff spot

- Jontay Porter receives lifetime ban

- Caitlin Clark's massive Nike deal

- Real Madrid ousts Man City in UCL

- Kraft warned Falcons about Belichick

2024 RBC Heritage full field: Scottie Scheffler and Masters rivals in Hilton Head

It's another big week for the PGA Tour as top players will compete in the RBC Heritage, the fifth signature event of the season.

Masters champion Scottie Scheffler highlights the 69-player field. He is joined by Augusta rivals Ludvig Åberg, Max Homa and Collin Morikawa.

Two eligible players are skipping this week: last year's FedExCup champion, Viktor Hovland, who missed the cut at the Masters following second-round 81, and Hideki Matsuyama, who tied for 38th in Augusta. Here's a look at the initial full field, per the PGA Tour:

Field for RBC Heritage pic.twitter.com/07eNRaUwR5 — PGA TOUR Communications (@PGATOURComms) April 15, 2024

Sponsor Exemptions Kevin Kisner Shane Lowry Webb Simpson Gary Woodland — PGA TOUR Communications (@PGATOURComms) April 15, 2024

Recommended Stories

Masters: amen corner dooms max homa, ludvig åberg and collin morikawa.

Augusta National’s famed stretch of golf holes turned into a nightmare for a trio of contenders.

Masters: Scottie Scheffler claims second green jacket in emphatic fashion

At 27, Scottie Scheffler joins of an exclusive club of two-time Masters winners.

2024 Masters payouts: How much did Scottie Scheffler earn for his win at Augusta National?

The Masters has a record $20 million purse this year.

Masters: Viktor Hovland withdraws from next week’s RBC Heritage after missing cut at Augusta National

Viktor Hovland had two doubles and a triple on Friday, and he missed the cut at the Masters for the first time in his career

Masters posts lowest ratings since COVID-era tournaments

Not even the the Masters is immune to golf's declining viewership.

2024 Masters final-round tee times: Scottie Scheffler holds lead over Collin Morikawa at Augusta National

Scottie Scheffler and Collin Morikawa will head out in the final group on Sunday at the Masters.

3 guarantees: Death, taxes and Scottie Scheffler at the Masters

Augusta National is famous for its final-round pressure, and no one handles it better than Scottie Scheffler.

2024 Masters third round tee times: Bryson DeChambeau, Max Homa set for final group on Moving Day

Bryson DeChambeau, Max Homa and Scottie Scheffler hold a three-way tie for the lead at the midway point of the Masters.

2024 Masters: What is the cut line at Augusta National?

How does the cut line work at The Masters? Here are the full details.

Masters: Scottie Scheffler underprepared for parenthood but in contention for a 2nd green jacket

The world No. 1 is just one stroke back after Round 1 of the Masters.

Masters betting: Scottie Scheffler's low odds to win aren't scaring off bettors

Scheffler is +400 to win his second green jacket and is getting nearly 20% of the money at BetMGM.

Masters betting: Scottie Scheffler is the overwhelming favorite to win his second green jacket

The 2022 Masters winner hasn't finished lower than second in any of his last three starts.

Masters: Opening round likely to be delayed as heavy rain, storms expected at Augusta National

After Thursday, the weather for the rest of the weekend should be perfect in Augusta.

2024 Masters tee times: Scottie Scheffler, Rory McIlroy lead marquee pairing; Tiger Woods set for Thursday afternoon

Tee times are out for the opening days of the Masters, and big names abound.

NBA play-in: Coby White's 42 points lead Bulls' offensive explosion to end Hawks' season

Coby White continued a career season with a career game for the Bulls in the play-in tournament.

Angels reliever Robert Stephenson ruled out for the season with elbow injury

Robert Stephenson was pulled from the mound just four pitches into his appearance with their Triple-A affiliate on Saturday.

NCAA to approve new rules allowing athletes to transfer multiple times and still be immediately eligible

As long as they are academically eligible, the NCAA will no longer limit how many times athletes can transfer schools without penalty.