- Get 7 Days Free

Royal Caribbean Group RCL

Company report, royal caribbean's hardware and experiences continue to compel consumers to cruise.

Consumer interest in travel has maintained momentum for Royal Caribbean into 2024, continuing the robust demand and pricing trends in the business. The redeployment of the fleet was completed in mid-2022 and occupancy has returned to historical levels aiding a normalization of profits and cash flow. Royal Caribbean reported record pricing in 2023 (13% above 2019's level), with further growth anticipated in 2024, given robust advance booking patterns and price levels thanks to a healthy consumer appetite for travel. On the cost side, expenses should be better managed ahead as a result of optimized occupancy and ongoing productivity initiatives, aiding profitability.

Price vs Fair Value

Bulls say, bears say.

If consumer preference for experiences over things persists, yields could rise faster than we currently expect as demand rises.

Weakness in consumer spending spurred by an economic downturn could affect discretionary spending and cause pricing to soften intermittently.

Norwegian Cruise Line's stock looks very attractive for these reasons, analyst says

The suite life: celebrity cruises elevates 'the retreat' experience, norwegian cruise's stock rises as profit outlook raised for 2nd time in 3 weeks, celebrity cruises first-ever edge series alaska itineraries set sail, celebrity cruises' revolutionary ship celebrity apex® homeports in southampton for first-ever season from the uk, hard rock international, seminole gaming, royal caribbean international and celebrity cruises announce global partnership, bringing travel benefits across land and sea, royal caribbean sees record bookings as demand for experiences and travel grow, trading information, key statistics, company profile, competitors.

- Norwegian Cruise Line Holdings Ltd NCLH

- Wyndham Hotels & Resorts Inc Ordinary Shares WH

- Carnival Corp CCL

Financial Strength

Profitability, travel services industry comparables, sponsor center.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

Investors may trade in the Pre-Market (4:00-9:30 a.m. ET) and the After Hours Market (4:00-8:00 p.m. ET). Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices. Stock prices may also move more quickly in this environment. Investors who anticipate trading during these times are strongly advised to use limit orders.

- Data is delayed at least 15 minutes. Nasdaq.com will report pre-market and after hours trades.

- Pre-Market trade data will be posted from 4:15 a.m. ET to 7:30 a.m. ET of the following day.

- After Hours trades will be posted from 4:15 p.m. ET to 3:30 p.m. ET of the following day.

- Real-time Data is provided using Nasdaq Last Sale Data

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Link's cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com .

- After-Hours

- Press Releases

- Analyst Research

- Dividend History

- Historical Quotes

- Historical NOCP

- P/E & PEG Ratios

- Option Chain

- Institutional Holdings

- Insider Activity

- SEC Filings

- Revenue EPS

Symbol Search

Recently viewed.

Analyze your stocks, your way

Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data.

About Real-Time Quotes

Nasdaq provides NLS Volume, Previous Close, Today's High & Low, and the 52 week High & Low. The intraday chart, the last-five real-time quotes and sales data. Real-time stock quotes can be used to help inform investors when researching potential investment opportunities.

Related Pages

Trending stocks, trending etfs, trending indexes.

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

- Royal Caribbean Cruises-stock

- News for Royal Caribbean Cruises

Evaluating Royal Caribbean Gr: Insights From 12 Financial Analysts

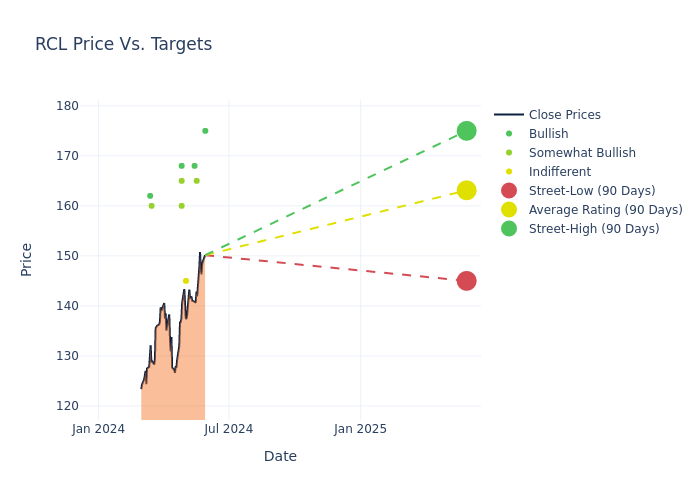

In the latest quarter, 12 analysts provided ratings for Royal Caribbean Gr (NYSE:RCL), showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

The 12-month price targets, analyzed by analysts, offer insights with an average target of $162.08, a high estimate of $175.00, and a low estimate of $145.00. This upward trend is apparent, with the current average reflecting a 6.98% increase from the previous average price target of $151.50.

Decoding Analyst Ratings: A Detailed Look

The standing of Royal Caribbean Gr among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Royal Caribbean Gr. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Royal Caribbean Gr compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Royal Caribbean Gr's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Royal Caribbean Gr's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Royal Caribbean Gr analyst ratings.

Get to Know Royal Caribbean Gr Better

Royal Caribbean is the world's second-largest cruise company, operating 65 ships across five global and partner brands in the cruise vacation industry, with eight more ships on order. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in the first quarter of 2021.

Royal Caribbean Gr's Financial Performance

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Royal Caribbean Gr's remarkable performance in 3 months is evident. As of 31 March, 2024, the company achieved an impressive revenue growth rate of 29.18% . This signifies a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Royal Caribbean Gr's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 9.66%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 7.29%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Royal Caribbean Gr's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.02%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 4.11 , Royal Caribbean Gr adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Royal Caribbean Cruises News MORE

Related stocks.

- Stock Market Overview

- Market Momentum

- Market Performance

- Top 100 Stocks

- Today's Price Surprises

- New Highs & Lows

- Economic Overview

- Earnings Within 7 Days

- Earnings & Dividends

- Stock Screener

- Today's Top Stock Pick

- All Top Stock Picks

- Percent Change

- Price Change

- Range Change

- Gap Up & Gap Down

- Five Day Gainers

- Pre-Market Trading

- Post-Market Trading

- Volume Leaders

- Price Volume Leaders

- Volume Advances

- Trading Liquidity

- Market Indices

- S&P Indices

- S&P Sectors

- Dow Jones Indices

- Nasdaq Indices

- Russell Indices

- Volatility Indices

- Commodities Indices

- US Sectors Indices

- World Indices

- New Recommendations

- Top Stocks to Own

- Top Signal Strength

- Top Signal Direction

- Stock Signal Upgrades

- Stock Market Sectors

- Major Markets Heat Map

- Industry Rankings

- Industry Heat Map

- Industry Performance

- Stocks by Grouping

- Options Market Overview

- Unusual Options Activity

- IV Rank and IV Percentile

- Most Active Options

- Unusual Options Volume

- Highest Implied Volatility

- %Change in Volatility

- Options Volume Leaders

- Change in Open Interest

- %Chg in Open Interest

- Upcoming Earnings

- Options Strategy Indexes

- Options Price History

- Options Flow

- Options Calculator

- Options Time & Sales

- Options Screener

- Long Call Screener

- Long Put Screener

- Covered Calls

- Married Put

- Collar Spread

- Bull Call Debit Spreads

- Bear Call Credit Spreads

- Bear Put Debit Spreads

- Bull Put Credit Spreads

- Long Call Calendar

- Long Put Calendar

- Bull Call Debit Diagonal

- Bear Call Credit Diagonal

- Bear Put Debit Diagonal

- Bull Put Credit Diagonal

- Short Straddle

- Long Straddle

- Short Strangle

- Long Strangle

- Long Call Butterfly

- Short Call Butterfly

- Long Put Butterfly

- Short Put Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Short Iron Condor

- Long Iron Condor

- Long Call Condor

- Long Put Condor

- Short Call Condor

- Short Put Condor

- ETF Market Overview

- Popular ETFs

- Top 100 ETFs

- Top Dividend ETFs

- ETF Screener

- Top ETFs to Own

- ETFs Signal Upgrades

- Performance

- Funds Screener

- Futures Market Overview

- Long Term Trends

- Highs & Lows

- Futures Market Map

- Performance Leaders

- Most Active Futures

- Prices by Exchange

- Commodities Prices

- Mini & Micro Futures

- Trading Guide

- Historical Performance

- Commitment of Traders

- Legacy Report

- Disaggregated Report

- Financial TFF Report

- Contract Specifications

- Futures Expirations

- First Notice Dates

- Options Expirations

- Economic Calendar

- Cash Markets Overview

- Corn Indexes

- Soybean Indexes

- Yield Forecast Indexes

- Euro Futures Overview

- Power Futures

- Carbon Futures

- European Trading Guide

- Forex Market Overview

- Forex Market Map

- Currency Converter

- Crypto Market Overview

- Market Capitalizations

- Bitcoin Futures

- Popular Cross Rates

- Australian Dollar

- British Pound

- Canadian Dollar

- Japanese Yen

- Swiss Franc

- Metals Rates

- All Forex Markets

- Popular Coins

- Bitcoin-Cash

- Today’s Investing Ideas

- Top Performing Stocks

- Top Trending Tickers

- Barchart Screeners

- Insider Trading Activity

- Politician Insider Trading

- Chart of the Day

- Top Stock Pick

- Futures Trading Guide

- Biotechnology Stocks

- Blockchain Stocks

- Bullish Moving Averages

- Candlestick Patterns

- Cannabis Stocks

- Cathie Wood Stocks

- Clean Energy Stocks

- Cybersecurity Stocks

- Dividend Stocks

- eMACD Buy Signals

- Gold Stocks

- Hot Penny Stocks

- Power Infrastructure

- REIT Stocks

- SPAC Stocks

- Top Stocks Under $10

- TTM Squeeze

- Warren Buffett Stocks

- World Markets

- Markets Today

- Barchart News

- Contributors

- Alan Brugler

- Andrew Hecht

- Angie Setzer

- Darin Newsom

- Gavin McMaster

- Jim Van Meerten

- Josh Enomoto

- Oleksandr Pylypenko

- Rich Asplund

- Rick Orford

- All Authors

- All Commodities

- Food & Beverage

- All Financials

- Interest Rates

- Stock Market

- Top Stories

- All Press Releases

- My Watchlist

- My Portfolio

- Investor Portfolio

- Symbol Notes

- Alert Center

- Alert Templates

- Custom Views

- Chart Templates

- Compare Stocks

- Daily Prices Download

- Historical Data Download

- Watchlist Emails

- Portfolio Emails

- Investor Portfolio Emails

- Screener Emails

- End-of-Day My Charts

- End-of-Day Reports

- Organize Watchlists

- Organize Portfolios

- Organize Investor Portfolios

- Organize Screeners

- Organize My Charts

- Site Preferences

- Author Followings

- Upcoming Webinars

- Archived Webinars

- Popular Webinars

- Market on Close

- Market on Close Archive

- Site Education

- Free Newsletters

- Technical Indicators

- Barchart Trading Signals

- Time & Sales Conditions

- Barchart Special Symbols

- Barchart Data Fields

- Barchart Premier

- Barchart Plus

- Membership Comparison

- Barchart for Excel

- Create Free Account

- Price Overview

- Performance Report

- Interactive Chart

- Snapshot Chart

- Barchart Opinion

- Trading Strategies

- Top Trade Alerts

- Technical Analysis

- Trader's Cheat Sheet

- Price History

- Historical Data

- Options Prices

- Volatility & Greeks

- Options Overview History

- Put/Call Ratio

- Protection Strategies

- Vertical Spreads

- Horizontal Spreads

- Straddles & Strangles

- Butterfly Spreads

- Condor Strategies

- News & Headlines

- Key Statistics

- SEC Filings

- Competitors

- Stock Comparison

- Insider Trades

- Earnings Estimates

- Analyst Ratings

- Financial Summary

- Income Statement

- Balance Sheet

Royal Caribbean Cruises Ltd (RCL)

Want to use this as your default charts setting, switch the market flag, want streaming chart updates, need more chart options, free barchart webinar.

Carnival, Royal Caribbean Shares Are Moving Higher: What's Going On?

C ruise line stocks Carnival Corp (NYSE:CCL) and Royal Caribbean Cruises Ltd (NYSE:RCL) are moving Monday in the wake of Norwegian Cruise Line Holdings Ltd (NYSE:NCLH), which saw shares pop after the company raised its 2024 guidance and set new 2026 financial targets .

What Happened With NCLH: Norwegian Cruise Line announced a new strategy Monday in connection with its Investor Day. The company’s new “Charting The Course” strategy includes a refreshed vision, strategic initiatives and three-year financial and sustainability targets geared at enhancing shareholder returns. Norwegian shares were up nearly 7% at last check.

Norwegian Cruise Line raised its full-year 2024 net yield growth expectations from 6..4% to 7.2%. Norwegian also raised its full-year 2024 adjusted EBITDA expectations from $2.25 billion to $2.3 billion and full-year adjusted earnings guidance from $1.32 to $1.42 per share versus estimates of $1.35 per share, according to Benzinga Pro .

Norwegian Cruise Line also introduced new 2026 targets including adjusted earnings of approximately $2.45 per share, adjusted operational EBITDA margin of approximately 39%, a reduction of net leverage to the mid-four turn levels and record adjusted ROIC of 12%.

“We have continued to see very strong demand and record bookings. We are now thrilled to launch this financial plan by setting long term targets with increased 2024 guidance, putting ourselves on solid footing to enhance shareholder value in the coming years,” said Mark Kempa , CFO at Norwegian Cruise Line Holdings.

On Friday, Wells Fargo analyst Daniel Politzer maintained Carnival with an Overweight rating and raised the price target from $22 to $23. Politzer also maintained Royal Caribbean with an Overweight and raised the price target from $159 to $165.

Check This Out: Benzinga’s ‘Stock Whisper’ Index: 5 Stocks Investors Secretly Monitor But Don’t Talk About Yet

CCL, RCL Price Action: At publication time, Carnival shares were up 4.33% at $15.65 and Royal Caribbean shares were up 2.59% at $145.68, according to Benzinga Pro .

Photo: postcardtrip from Pixabay.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This article Carnival, Royal Caribbean Shares Are Moving Higher: What's Going On? originally appeared on Benzinga.com .

Limited Time Deal Gets You Pro at Half-Price

Get The Market's Most Powerful Trading Tools — 50% Off Pro Memorial Day Sale

Exclusive News, Scanners, and Chat Power Pro Users to Win More

The Market's Most Powerful Trading Tools — 50% OFF Limited Time

- Get Benzinga Pro

- Data & APIs

- Our Services

- News Earnings Guidance Dividends M&A Buybacks Legal Interviews Management Offerings IPOs Insider Trades Biotech/FDA Politics Government Healthcare

- Markets Pre-Market After Hours Movers ETFs Forex Cannabis Commodities Binary Options Bonds Futures CME Group Global Economics Previews Small-Cap Real Estate Cryptocurrency Penny Stocks Digital Securities Volatility

- Ratings Analyst Color Downgrades Upgrades Initiations Price Target

- Ideas Trade Ideas Covey Trade Ideas Long Ideas Short Ideas Technicals From The Press Jim Cramer Rumors Best Stocks & ETFs Best Penny Stocks Best S&P 500 ETFs Best Swing Trade Stocks Best Blue Chip Stocks Best High-Volume Penny Stocks Best Small Cap ETFs Best Stocks to Day Trade Best REITs

- Money Investing Cryptocurrency Mortgage Insurance Yield Personal Finance Forex Startup Investing Real Estate Investing Credit Cards

- Cannabis Cannabis Conference News Earnings Interviews Deals Regulations Psychedelics

Why Is Norwegian Cruise Line Stock Shooting Higher Today?

Zinger key points.

- Mizuho analyst Ben Chaiken upgrades the stock from Neutral to Buy.

- Ben Chaiken raises the price target from $21 to $24.

Norwegian Cruise Line Holdings Ltd NCLH shares are trading higher after Mizuho Securities analyst Ben Chaiken upgraded the shares from Neutral to Buy and raised the price target from $21 to $24.

According to the analyst, valuation has completely reset after about 2 years of significant relative underperformance.

NCLH is streamlining its business like cost cutting, which should drive upside to near term/medium-term estimates, said the analyst.

In the context of a very favorable industry backdrop, the analyst sees upside to yields from NCLH optimizing its fleet itineraries, with a longer-term yield tailwind from further build-out of its private island portfolio.

The analyst felt the market was not properly encompassing the significant capex drag and impact

on the balance sheet from future ship orders.

The analyst, at this point, believes the risk/impact is fully reflected in valuation with NCLH trading at a 1x discount relative to Royal Caribbean Cruises Ltd RCL on ’25 estimates.

NCLH recently held an investor day that the analyst believes coherently outlined a path to substantially higher earnings .

The analyst’s $24 target price is based on a 9x ’25 EBITDA estimate of ~$2.6 billion.

However, valuation is now at a discount, and the analyst believes fundamentals are inflecting, which creates a compelling setup for the stock.

Price Action : NCLH shares are trading higher by 3.81% at $16.61 at the last check Tuesday.

Photo via Wikimedia Commons

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Shareholder Benefits

This exclusive benefit offer is reserved solely for shareholders owning a minimum of 100 shares of Royal Caribbean Group (NYSE: RCL) at time of sailing.

$1,000 Onboard Credit per Stateroom on a World Cruise

$250 Onboard Credit per Stateroom on Sailings of 14 or more nights.

$100 Onboard Credit per Stateroom on Sailings of 6-13 nights.

$50 Onboard Credit per Stateroom on Sailings of 5 nights or less.

- Applicable on any eligible Royal Caribbean International, Celebrity Cruises or Silversea Cruises sailing.

- Excludes any charter or Galapagos sailings.

To complete your Shareholder Onboard Credit Offer Request electronically click here .

You can complete your Shareholder Onboard Credit Request for Silversea Cruises here .

Requests should be received in our office approximately 2-3 weeks prior to your sail date.

The benefit is only available for the stateroom in which the shareholder (with a minimum of 100 shares) is sailing. Onboard credit is applied on a per stateroom basis, double occupancy. Only one shareholder credit per stateroom on any one sailing. If shares are held jointly, 100 shares are required for each onboard credit request on any one sailing.

Yes, you may request this benefit multiple times-as often as you sail on Royal Caribbean International, Celebrity Cruises or Silversea Cruises. (excludes any charter or Galapagos sailings)

Benefit is non-transferable and not available to employees of Royal Caribbean Group or its subsidiaries and affiliates. Benefit cannot be redeemed for chartered sailings, any Galapagos sailings or complimentary sailings.

No. Benefit is non-transferable. Only the stateroom that the shareholder is traveling in will be eligible for the onboard credit.

Shareholder benefit offer applies to bookings made on or after June 1, 2023. Onboard credit is applied on a per stateroom basis; double occupancy, one shareholder credit per stateroom, and one credit per shareholder per sailing. If you are requesting shareholder onboard credit for two or more separate staterooms and shares are held jointly, a minimum of 100 shares per stateroom booked must be held. Single guests paying 200% of applicable fare receive full onboard credit value. Onboard credit may not be used for onboard service charges or pre-purchased activities. Any unused credit after the final night of the sailing shall be forfeited and is not redeemable for cash. Notwithstanding the foregoing, World Cruise onboard credit benefit may be used for shore excursions and, if unused, may be refunded upon request to the shareholder’s original form of payment. Benefit is non-transferable and not available to employees of Royal Caribbean Group or its subsidiaries and affiliates. Benefit cannot be redeemed for chartered sailings, complimentary sailings or Galapagos sailings. The shareholder must own the Royal Caribbean Group (NYSE: RCL) stock at time of sailing. Onboard credit is calculated in US dollars except on sailings where the onboard currency used is a foreign currency (in which case the onboard credit will be converted at a currency exchange rate determined by the cruise line). Onboard credit amount is credited to shareholder’s stateroom folio at time of sailing. Other terms and conditions may apply. Prices and offers are subject to availability and change without notice, capacity controlled, and may be withdrawn at any time.

You can download the Shareholder Benefits PDF here .

You can complete your Shareholder Onboard Credit Offer Request electronically here .

Email us at [email protected]

For Silversea Cruises Email us at [email protected]

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this release relating to, among other things, our future performance estimates, forecasts and projections constitute forward-looking statements under the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to: statements regarding revenues, costs and financial results for 2020 and beyond. Words such as “anticipate,” “believe,” “could,” “driving,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “will,” “would,” “considering”, and similar expressions are intended to help identify forward-looking statements. Forward-looking statements reflect management’s current expectations, are based on judgments, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from the future results, performance or achievements expressed or implied in those forward-looking statements. Examples of these risks, uncertainties and other factors include, but are not limited to the following: the impact of the global incidence and spread of COVID-19, which has led to the temporary suspension of our operations and has had and will continue to have a material adverse impact on our business and results of operations, or other contagious illnesses on economic conditions and the travel industry in general and the financial position and operating results of our Company in particular, such as: the current and potential additional governmental and self-imposed travel restrictions, the current and potential extension of the suspension of cruises and new additional suspensions, guest cancellations; our ability to obtain sufficient financing, capital or revenues to satisfy liquidity needs, capital expenditures, debt repayments and other financing needs; the effectiveness of the actions we have taken to improve and address our liquidity needs; the impact of the economic and geopolitical environment on key aspects of our business, such as the demand for cruises, passenger spending, and operating costs; incidents or adverse publicity concerning our ships, port facilities, land destinations and/or passengers or the cruise vacation industry in general; concerns over safety, health and security of guests and crew; further impairments of our goodwill, long-lived assets, equity investments and notes receivable; an inability to source our crew or our provisions and supplies from certain places; the incurrence of COVID-19 and other contagious diseases on our ships and an increase in concern about the risk of illness on our ships or when traveling to or from our ships, all of which reduces demand; unavailability of ports of call; growing anti-tourism sentiments and environmental concerns; changes in US foreign travel policy; the uncertainties of conducting business internationally and expanding into new markets and new ventures; our ability to recruit, develop and retain high quality personnel; changes in operating and financing costs; our indebtedness, any additional indebtedness we may incur and restrictions in the agreements governing our indebtedness that limit our flexibility in operating our business, including the significant portion of assets that are collateral under these agreements; the impact of foreign currency exchange rates, interest rate and fuel price fluctuations; the settlement of conversions of our convertible notes, if any, in shares of our common stock or a combination of cash and shares of our common stock, which may result in substantial dilution for our existing shareholders; our expectation that we will not declare or pay dividends on our common stock for the near future; vacation industry competition and changes in industry capacity and overcapacity; the risks and costs associated with protecting our systems and maintaining integrity and security of our business information, as well as personal data of our guests, employees and others; the impact of new or changing legislation and regulations or governmental orders on our business; pending or threatened litigation, investigations and enforcement actions; the effects of weather, natural disasters and seasonality on our business; emergency ship repairs, including the related lost revenue; the impact of issues at shipyards, including ship delivery delays, ship cancellations or ship construction cost increases; shipyard unavailability; and the unavailability or cost of air service.

In addition, many of these risks and uncertainties are currently heightened by and will continue to be heightened by, or in the future may be heightened by, the COVID-19 pandemic. It is not possible to predict or identify all such risks.

More information about factors that could affect our operating results is included under the caption “Risk Factors” in our most recent quarterly report on Form 10-Q, as well as our other filings with the SEC, and the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent annual report on Form 10-K, copies of which may be obtained by visiting our Investor Relations website at www.rclinvestor.com or the SEC’s website at www.sec.gov . Undue reliance should not be placed on the forward-looking statements in this release, which are based on information available to us on the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

IMAGES

COMMENTS

Find the latest Royal Caribbean Cruises Ltd. (RCL) stock quote, history, news and other vital information to help you with your stock trading and investing.

The latest Royal Caribbean Cruises stock prices, stock quotes, news, and RCL history to help you invest and trade smarter. ... Royal Caribbean Cruises Ltd. Stock , RCL. 150.24 +1.83 +1.23% 03:59: ...

Discover real-time Royal Caribbean Cruises Ltd. Common Stock (RCL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Stay ahead with Nasdaq.

Get the latest Royal Caribbean Cruises Ltd (RCL) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

RCL | Complete Royal Caribbean Group stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. ... Norwegian Cruise Line Holdings Ltd. 2.76%: $6.86B ...

A high-level overview of Royal Caribbean Cruises Ltd. (RCL) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.

Find the latest Royal Caribbean Cruises Ltd. (RCL) stock quote, history, news and other vital information to help you with your stock trading and investing.

Find the latest Royal Caribbean Cruises Ltd. (RCL) stock quote, history, news and other vital information to help you with your stock trading and investing.

See the latest Royal Caribbean stock price (NYSE: RCL), related news, valuation, dividends and more to help you make your investing decisions.

Stock analysis for Royal Caribbean Cruises Ltd (RCL:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

Royal Caribbean Cruises Ltd. Common Stock (RCL) Real-time Stock Quotes - Nasdaq offers real-time quotes & market activity data for US and global markets.

About RCL. Royal Caribbean Cruises Ltd. operates as a cruise company worldwide. The company operates cruises under the Royal Caribbean International, Celebrity Cruises, and Silversea Cruises brands, which comprise a range of itineraries. As of February 21, 2024, it operated 65 ships.

Royal Caribbean Group (NYSE: RCL) is one of the leading cruise companies in the world with a global fleet of 65 ships traveling to more than 1,000 destinations around the world. Royal Caribbean Group is the owner and operator of three award-winning cruise brands: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises, and it is ...

RCL New York Stock Exchange • NLS real time price • CURRENCY IN USD • Hotels & Entertainment Services. ROYAL CARIBBEAN CRUISES LTD. (RCL) Compare. ROYAL CARIBBEAN CRUISES LTD. 146.31 ...

3 Reasons Royal Caribbean Is the Best Cruise Line Stock Motley Fool - Thu May 2, 10:15AM CDT. All three cruise lines are cheaper than you think, but one name stands out as the clear leader. RCL : 141.74 (+0.04%) NCLH : 16.20 (+0.68%) CCL : 14.56 (+1.82%) More news for this symbol.

RCL New York Stock Exchange • delayed by 15 minutes • CURRENCY IN USD • Hotels & Entertainment Services. ROYAL CARIBBEAN CRUISES LTD. (RCL) Compare. ROYAL CARIBBEAN CRUISES LTD. 148.43 ...

Royal Caribbean is the world's second-largest cruise company, operating 65 ships across five global and partner brands in the cruise vacation industry, with eight more ships on order.

Shares of Royal Caribbean Cruises Ltd. (NYSE:RCL - Get Free Report) have received an average recommendation of "Moderate Buy" from the fifteen ratings firms that are currently covering the company, Marketbeat Ratings reports.Two equities research analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company.

Customizable interactive chart for Royal Caribbean Cruises Ltd with latest real-time price quote, charts, latest news, technical analysis and opinions. ... Royal Caribbean Cruises Ltd (RCL) Royal Caribbean Cruises Ltd ... Stock Market Overview Market Momentum Market Performance Top 100 Stocks Today's Price Surprises New Highs & Lows Economic ...

Royal Caribbean Cruises is displaying some positive trends. The data shows that returns on capital have increased substantially over the last five years to 13%. The amount of capital employed has ...

Get the latest Royal Caribbean Cruises Ltd (RCL) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

Nomura Asset Management Co. Ltd. raised its stake in Royal Caribbean Cruises Ltd. (NYSE:RCL - Free Report) by 9.5% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC.The institutional investor owned 64,348 shares of the company's stock after buying an additional 5,586 shares during the quarter.

Franklin Resources Inc. grew its holdings in shares of Royal Caribbean Cruises Ltd. (NYSE:RCL - Free Report) by 12.0% in the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission.The firm owned 166,632 shares of the company's stock after buying an additional 17,815 shares during the quarter.

Royal Caribbean is the world's second-largest cruise company, operating 65 ships across five global and partner brands in the cruise vacation industry, with eight more ships on order.

Cruise line stocks Carnival Corp (NYSE:CCL) and Royal Caribbean Cruises Ltd (NYSE:RCL) are moving Monday in the wake of Norwegian Cruise Line Holdings Ltd (NYSE:NCLH), which saw shares pop after ...

The analyst, at this point, believes the risk/impact is fully reflected in valuation with NCLH trading at a 1x discount relative to Royal Caribbean Cruises Ltd RCL on '25 estimates. NCLH ...

The shareholder must own the Royal Caribbean Group (NYSE: RCL) stock at time of sailing. Onboard credit is calculated in US dollars except on sailings where the onboard currency used is a foreign currency (in which case the onboard credit will be converted at a currency exchange rate determined by the cruise line).