- Car Rentals

- Airport Transfers

- Attractions & Tours

- Flight + Hotel New

- Destinations

- Custom Trips

- Trip.com Rewards

Enjoy discount for global flights and hotels with designated Standard Chartered credit cards & Multi-Currency Mastercard debit card on Trip.com!

Terms and conditions (id: -).

SCBHK X Trip.com Hotel and Flight Offer (“Promotion”) - Terms and Conditions

- Promotion/Valid period (“Promotion period”): From 1st January to 31st December 2024

- Check-in date for hotels / Departure date for flights: From 1st January 2024 to 15th January 2025

- During the Promotion Period, customers who book hotels or flights at Trip.com with eligible credit cards and Multi-Currency Mastercard debit card via the designated link (https://hk.trip.com/sale/w/5691/scb-hk.html?locale=en_hk&curr=hkd&allianceid=3956009&sid=23767222) provided by Standard Chartered Bank (Hong Kong) Limited (“SCBHK”) are entitled to designated discounts for hotels or flights (“Offer”). The Offer is applicable to the prepaid room types of global hotels and the international flights. It is not applicable to China domestic flight and specific room types. The information displayed on the booking page is final. The Offer is also not applicable to flight and hotel products (“Flight + Hotel”), ticket and hotel packages and other specific products.

- The promo codes can be used on the mobile application of Trip.com (App), the desktop version website (PC) and the mobile version website (Traditional Chinese and English of the Hong Kong region).

- How to get the Offer: During the Promotion Period, (i) customers are entitled to 8% discount off (“Discount 1”) on the order of hotel upon booking hotel on the designated hotel booking page and entering the designated promo code “SCB2024H”. Discount 1 is applicable to room rates and taxes only. (ii) Customers are entitled to HK$50 off, HK$100, HK$150 and HK$200 off upon spending HK$2,000 to HK$3,999, HK$4,000 to HK$5,999, HK$6,000 to HK$7,999 and HK$8,000 or above (“Discount 2”) respectively on the order of flights upon booking flight on the designated flight booking page and entering the designated promo code “SCB2024F”. Discount 2 is applicable to adult flight ticket values only and is not applicable to taxes and other surcharges.

- Each order can be applied with one promo code only. Each order must be settled in Hong Kong Dollars (HK$) with the eligible Standard Chartered credit cards and Multi-Currency Mastercard Debit Card.

- The Discounts cannot be used in conjunction with other discounts, promotional offers, Trip coins and other offers.

- In case of cancelling the orders with promo code applied, the promo code(s) will be automatically returned to your account and can be used again during the Promotion Period. In case of cancelling the orders with promo code applied by contacting the customer services and requesting making changes, the promo code will no longer be valid.

- For hotels, the rate before discount refers to the original rate of the particular room type. The original rate my be different form the retail rate announced by the hotel. For flights, the rate before discounts refers to the original rate of the particular flight. The original rate may be different from the retail rate announced by the airline.

- Hotel cancellation and prepayment policy may vary depending on the room types. Please refer to the room policy during booking. Flight cancellation and prepayment policy may vary depending on the flight tickets. Please refer to the flight policy during booking.

- SCBHK and Trip.com are not liable for and will not indemnify for the failure of using the promo code as it has expired; is invalid or cancelled; its quota has been used up; fails to be used; or fails to be used due to technical factors; and any other possible reasons.

- SCBHK and Trip.com reserves the rights to take legal action in case of any illegal deeds or abuse.

- SCBHK and Trip.com reserves the rights to amend or cancel the Offer and the terms and conditions without prior notice.

- Trip.com reserves the rights for final decision.

- In case of discrepancy between the Chinese and English versions of these terms and conditions, the Chinese version shall prevail.

- Customer Support

- Service Guarantee

- More Service Info

- Website Feedback

- About Trip.com

- Terms & Conditions

- Privacy policy

- About Trip.com Group

Other Services

- Investor Relations

- List My Hotel

- Become a Supplier

Fincash » Debit Cards » Standard Chartered Debit Card

Table of Contents

1. Platinum Rewards Debit Card

2. priority infinite debit card, 3. business banking infinite debit card, 4. private infinite debit card, 5. platinum debit card, 6. mastercard platinum debit card, 7. premium cashback debit card, standard chartered debit card insurance, how to activate the standard chartered debit card, replace lost or stolen standard chartered debit card, standard chartered customer care, standard chartered bank debit card- benefits & rewards.

Standard Chartered PLC is a multinational Bank based in London, England. It is a renowned bank and a financial services company with a network of over 1,200 branches across 70+ countries worldwide. The bank acquires 90 per cent of its profits from Asia, Africa, and the Middle East.

When it comes to debit cards, Standard Chartered Bank offers a host of options to suit the various needs of the users. You can avail many reward points on shopping, dining, movies, travel, etc. Read on to know different types of Standard Chartered bank Debit Card .

Types of Standard Chartered Debit Card

- Earn 10 reward points for every Rs. 100 spent on entertainment, groceries, supermarket, telecom and utility bills. Collect up to a maximum of 1, 000 reward points per month

- Enjoy higher withdrawal and spending limit of Rs. 2,00,000 per day

- Get access to Visa’s comprehensive Global Customer Assistance Service (GCAS) for travel overseas

- As this Standard Chartered bank debit card is a contactless card, you can enjoy faster checkouts over transactions across the globe

- Enjoy secure online transactions using 3D OTP verification

- It gives instant payment solutions like UPI, Bharat QR, Bharat Pill Payment solutions (BBPS) and Samsung Pay

- Enjoy 50% off (up to Rs. 300) on BookMyShow

- Get four complimentary domestic airport lounge access, every quarter

- In case of lost debit card, get access to Visa’s comprehensive Global Customer Assistance Service (GCAS) for travel overseas

- Enjoy cashless transactions across the globe with extra features on this standard chartered bank debit card

- Get instant payment solutions like UPI, Bharat QR, Bharat Pill Payment solutions (BBPS) and Samsung Pay

Looking for Debit Card? Get Best Debit Cards Online Disclaimer: By submitting this form I authorize Fincash.com to call/SMS/email me about its products and I accept the terms of Privacy Policy and Terms & Conditions. Processing... Apply Now

- Earn 3x reward points for every Rs. 100 spent on all categories

- Get access to four complimentary domestic airport lounge every quarter

- Avail access to VISA’sGCAS whenever you travel abroad

- Enjoy cashless transactions across the globe

- This Standard Chartered debit card provides real-time discounts on dining and health. Get extended lifestyle privileges for additional benefits

- Earn 2x reward points for every Rs. 100 spent on all categories like dining, movies, shopping, etc.

- Avail 50% off (up to Rs. 300) on movie ticket bookings at BookMyShow

- Enjoy access to four complimentary domestic airport lounge every quarter

- Get access to VISA’s comprehensive GCAS whenever you travel abroad

- Take complete benefits of cashless transactions across the globe

- Earn 1 reward point for every Rs. 100 spent on all categories like dining, movies

- Get high withdrawal and spending limit of Rs. 2,00,000 per day

- Avail access to Visa’s comprehensive Global Customer Assistance Service (GCAS) whenever you travel abroad meant for lost debit card

- Enjoy cashless transactions across the globe.

- Avail high withdrawal and spending limit of Rs. 1,00,000 per day

- On spending more than Rs. 750, enjoy 5% cashback on dining, shopping, etc.

- In case of a lost debit card, get access to VISA’s GCAS for travel overseas

- premium Cashback Debit Card comes with instant payment solutions like UPI, Bharat QR, Bharat Pill Payment solutions (BBPS) and Samsung Pay

Standard Chartered provides air insurance and purchase protection up to a certain limit.

Here are the debit cards along with insurance cover:

Go to the website, and select debit card activation-

- Provide your mobile number

- Fill in the necessary details on the website

- Click on Submit

For assistance, Call 24-hour customer care hotline number 1300 888 888 / (603) 7711 8888.

The bank has provided helpline numbers for those customers who have lost their debit card. Customers can notify the bank if any suspicious activity is spotted or if the card is stolen or lost.

You can replace stolen and lost debit card with these 4 steps:

- Log in to their website and click Online Banking

- Select “Help & Services”

- Go to “Card Management” and select “Replace Card”

- Select the card to be replaced and follow instructions on the screen to place a request for a new card

The bank has listed various numbers that provide 24* 7 assistance to its customers.

Here are the premium banking helpline numbers:

You can also email: [email protected]

Also, you can write to the bank at the following address: Standard Chartered Bank, Customer Care Unit, 19 Rajaji Salai, Chennai, 600 001.

Standard Chartered bank debit cards offer a top-notch lifestyle with great benefits for all your requirements. Avail the benefits by applying for a debit card today.

You Might Also Like

SBI Debit Cards- Check Benefits & Rewards Of SBI Debit Cards

Top Axis Bank Debit Cards- Benefits & Rewards To Enjoy!

Best Indusind Bank Debit Card 2024 - Benefits & Rewards

Best Citi Bank Debit Cards 2024- Check Benefits & Rewards!

Standard Chartered Credit Card - Key Features & Rewards

Best ICICI Debit Cards - Bundle Of Benefits & Rewards!

HDFC Debit Card- Check Exciting Rewards & Benefits!

Top Kotak Debit Cards 2024- Check Benefits & Rewards!

- SavingsPlus

- Explore Funds

- Mutual Fund Basics

- Financial Planning

- Mutual Fund Companies

- Best Performing Mutual Funds

- Best Liquid Funds

- Top 10 SIP Mutual Funds

- Top Balanced Funds

- Best ELSS Funds

- Best Equity Mutual Funds

- Best Large Cap Funds

- Best Ultra Short Term Funds

- Best Index Funds

- Tax Calculator

- Growth of Lumpsum

- Growth of SIP

- Retirement Planning

- Higher Education

- Marriage Expense

- Buy Vehicle

- Any Other Goal

- Building Trust

- Why Fincash

- Our Partners

- Media Center

- Corporate Solution

AMFI Registration No. 112358 | CIN: U74999MH2016PTC282153

- Privacy Policy

- Terms & Conditions

- Disclaimers

© 2024 Shepard Technologies Private Limited. All Rights Reserved

Best Debit Cards in Singapore

By irvin yap.

Hey there! I’m exploring the best debit cards in Singapore for 2023. Did you know that the statistic shows that 93.5% of Singaporeans that above 15 age have debit over credit cards? That’s huge, right?

In Singapore, debit cards play a crucial role in the everyday financial lives of residents. They offer a convenient, secure way to make transactions without carrying cash. They are widely accepted for in-store and online purchases, often with benefits like cashback and rewards.

The security of a debit card is the same as a credit card. Debit cards are directly linked to the user’s bank account, allowing immediate access to funds and ensuring spending is limited to available balances, which helps manage budgets more effectively. Unlike credit cards, credit cards may cause you to overspend and create debt.

I will share the best debit card Singapore 2023 according to my research and experiences. With this guidance, you will understand debit cards and find your best debit card Singapore 2023.

Table of Contents

Debit Card is Better Than Credit Card: Key Reasons

When managing finances in Singapore, choosing the best debit card can be smarter than opting for a credit card. Here’s why:

- Spending Within Means: The best debit card Singapore offers ensures you spend the money you already have. This prevents the risk of accruing debt, a common issue with credit cards.

- Better Budget Management: Using a debit card helps in maintaining a budget. You’re more conscious of your balance, leading to more prudent spending decisions.

- No Interest Rates: Unlike credit cards, no interest is charged on debit card purchases. This makes them cost-effective for everyday use.

- Cashback and Rewards: Opting for the best cashback debit card Singapore provides can offer similar rewards to credit cards, like cashback on purchases, without the risk of high interest or overspending.

- Suitability for Students: The best debit card for students in Singapore is tailored to the needs of the younger demographic. It’s a great tool for students to learn financial responsibility without the risk of accumulating debt.

- Travel Benefits: Frequent travellers can benefit from the best travel debit card Singapore boasts. These cards often come with lower foreign transaction fees and other travel-related benefits, making them more suitable than credit cards for international use.

- Wider Acceptance and Convenience: Debit cards are widely accepted locally and globally. They offer the same convenience as credit cards regarding online and in-store purchases.

- Lower Fees and Charges: Debit cards generally come with lower annual fees than credit cards, making them a cost-effective option for many.

Debit cards offer a safer, more budget-friendly alternative to credit cards, especially for those who prefer to avoid debts and manage their finances more effectively.

Read also: Best Credit Cards in Singapore

Compare Best Debit Cards in Singapore

Note: The ranking above are not listed in order

What to Consider When Choosing A Debit Card?

When selecting a debit card in Singapore, several factors are crucial:

- Fees and Charges: Look for cards with low or no annual fees, and consider other charges like ATM withdrawal fees.

- Rewards and Cashback: Some cards, like the best cashback debit card Singapore, offer rewards or cashback on purchases. This can be a great way to earn while you spend.

- Foreign Transaction Fees: For travellers, the best travel debit card Singapore should have low foreign transaction fees. This is important for those who travel frequently or shop online from international retailers.

- ATM Network and Accessibility: Consider the availability and accessibility of ATMs, especially if you travel or withdraw cash frequently.

- Spending Limits: Some debit cards have daily spending limits. Ensure the limit aligns with your spending habits.

- Online and Mobile Banking Features: Look for cards that offer robust online and mobile banking features for convenience.

- Eligibility Criteria: Some cards, like the best debit card for students Singapore, are tailored for specific groups like students and might have special benefits or lower requirements.

- Security Features: Consider the security measures in place, like SMS alerts for transactions and the ability to freeze the card via an app.

- Customer Support: Good customer service is crucial for handling any issues.

- Linked Accounts and Services: Some debit cards are linked to savings or current accounts, which might offer additional benefits or interest.

The best debit card in Singapore depends on individual needs and lifestyle. These factors will help you choose a card that best suits your financial habits and goals.

Popular Debit Cards for Daily Use

1. DBS Visa Debit Card – Best for Travel

Special Highlight

The DBS Visa Debit Card is particularly valued for its travel-friendly features. It stands out in Singaporean as a robust option for frequent travel abroad. Offering the convenience of multi-currency transactions without additional fees simplifies spending in various countries. This card is a practical choice for globetrotters seeking a seamless financial experience during international adventures.

- Spend in up to 11 foreign currencies without extra fees

- Up to 3% cashback on local contactless transactions

- Widely accepted globally

- Supports Visa payWave for contactless payments

Eligibility

- Must be a DBS/POSB account holder

Additional Benefits

- Enhanced fraud protection

- Access to DBS/POSB’s extensive ATM network

- Compatibility with mobile wallets for digital payments

- Dedicated customer support for international banking queries

This card’s focus on travel-related benefits aligns it closely with the best travel debit card Singapore category, offering a blend of convenience, security, and rewards that cater to the needs of modern travellers.

2. OCBC Yes! Debit Card – Best for Spending and Rewards

The OCBC Yes! Debit Card is a standout option for those who seek rewards on their daily expenditures. It’s particularly known for its cashback and rewards program, making it an attractive choice for savvy spenders who want to maximize their returns on routine purchases. This card is ideal for those who frequent specific merchants and utilize the card’s reward structure effectively.

- Cashback on everyday purchases

- Contactless payments

- Wide merchant acceptance

- Available to OCBC account holders

- Exclusive deals and discounts with partner merchants

- Online banking facilities

- Enhanced security features

The OCBC Yes! Debit Card aligns well with the needs of those looking for a versatile spending tool in Singapore, offering a blend of rewards and convenience.

3. UOB One Debit Card – Best for Cashback

The UOB One Debit Card is highly regarded for its exceptional cashback benefits, making it a top choice for those who prioritize savings while spending. It’s especially beneficial for those with a high transaction frequency, as the card offers attractive cashback rates, making everyday spending more rewarding.

- High cashback rates on various spends

- Contactless payment options

- Wide acceptance both locally and internationally

- Available to UOB account holders

- Discounts and deals with partner merchants

- Access to UOB’s extensive ATM network

- Integration with UOB’s mobile banking app for easy account management

The UOB One Debit Card stands out in the Singapore market as the best cashback debit card Singapore, offering substantial savings through its cashback program on everyday expenses.

4. HSBC Everyday Global Debit Card – Best for Global Use and Travel

The HSBC Everyday Global Debit Card is tailored for those who travel frequently or engage in international transactions. Its multi-currency capabilities stand out, allowing users to transact in various currencies without incurring high conversion fees, making it an ideal choice for globe-trotters and online shoppers buying from international websites.

- Multi-currency transactions without extra fees

- Global acceptance for ease in international spending

- Contactless payments for convenience

- Must be an HSBC account holder

- Competitive exchange rates

- Access to HSBC’s global ATM network

- Security features like fraud protection

The HSBC Everyday Global Debit Card aligns well with the best travel debit card Singapore category, offering various features that cater to international spending needs.

5. Standard Chartered Business Debit Card – Best for Business Transactions and Management

The Standard Chartered Business Debit Card is designed for business owners and professionals. This card stands out for its capacity to simplify business-related financial transactions, offering enhanced control and convenience. It’s an excellent tool for managing company expenses, streamlining accounting processes, and keeping track of business spending.

- Tailored for business transactions

- Enhanced expenditure tracking

- Global acceptance of business travel needs

- Available to Standard Chartered business account holders

- Access to exclusive business-related offers and privileges

- Integration with business banking services for streamlined financial management

The Standard Chartered Business Debit Card is an efficient solution for business professionals in Singapore, offering specialized features that cater to the unique financial needs of businesses.

6. Citibank Debit Mastercard – Best for Global Accessibility

The Citibank Debit Mastercard is renowned for its global acceptance and convenience. This card is particularly beneficial for individuals seeking a seamless spending experience locally and internationally. It stands out for its ease of use in various shopping and travel transactions, making it a reliable choice for those who value accessibility and flexibility in their financial tools.

- Wide acceptance at numerous locations worldwide

- Contactless payment functionality

- Compatibility with various digital wallets

- Available to Citibank account holders

- Access to Citibank’s global ATM network

- Exclusive deals and promotions with partner merchants

This card is a versatile option within the best debit card Singapore landscape, catering to various spending needs and preferences.

7. NTUC Plus! Visa Debit Card – Best for Shopping and Grocery Discounts

The NTUC Plus! Visa Debit Card is tailored for individuals who frequently shop at NTUC FairPrice stores and affiliated outlets. It offers substantial discounts and savings on everyday grocery purchases, making it an excellent choice for households looking to maximize their budget in daily shopping.

- Discounts at NTUC FairPrice, Unity, and Warehouse Club stores

- Contactless payment technology

- Visa network global acceptance

- NTUC Union membership is required

- Linkage to NTUC membership for more rewards

- Exclusive promotional offers at various retail partners

The NTUC Plus! Visa Debit Card is a practical choice for Singaporeans who prioritize savings on groceries and everyday purchases, fitting well within the best debit card Singapore category for shoppers.

8. Bank of China Great Wall International Debit Card – Best for Travel

The Bank of China Great Wall International Debit Card is an excellent choice for those who frequently travel or transact internationally. This card stands out for its global acceptance and ease of use across different currencies, making it a convenient option for international travellers and shoppers.

- No annual fee

- Multi-currency transaction capabilities

- Global acceptance and usage

- Available to Bank of China account holders

- Access to exclusive global offers and promotions

- Enhanced security features for international use

The Bank of China Great Wall International Debit Card offers essential features for international use, positioning it as a strong contender within the best debit card and travel debit card categories in Singapore.

9. Maybank Platinum Debit Card – Best for Students

The Maybank Platinum Debit Card is particularly favoured for its comprehensive reward program. It is designed for individuals seeking to maximise local spending rewards. This card offers a blend of cashback and reward points on various transactions, making it an attractive choice for those who prioritize earning rewards on their everyday expenditures in Singapore.

- Attractive rewards program

- Cashback on specific categories

- Extensive local merchant network

- Available to Maybank account holders

- Exclusive discounts and deals at partner merchants

- Enhanced security features for safe transactions

The Maybank Platinum Debit Card, with its focus on rewards and local spending, can be categorized as the best debit card for students in Singapore. Its offers of cashback and special rewards help students save their costs and earn some extra benefits to strengthen the experiences of each transaction on their spending.

10. CIMB FastSaver Account Debit Card – Best for Savings and High-Interest Earnings

The CIMB FastSaver Account Debit Card suits individuals who are focused on savings and earning interest. This card is linked to the CIMB FastSaver account, known for its attractive interest rates, making it an excellent choice for those looking to grow their savings effortlessly.

- High-interest rates when linked to FastSaver account

- Wide ATM network access

- No minimum spending requirements

- Must hold a CIMB FastSaver account

- Online banking convenience

- No annual fees

- Easy fund transfers and bill payments

This card is a solid option within the best debit card Singapore category, especially for those prioritizing savings and interest accrual on their deposits.

Debit Cards with the Best Rewards

In Singapore’s dynamic financial scene, finding a debit card with the best rewards can significantly enhance your spending. Certain cards stand out for their unique reward structures among many options.

1. UOB One Debit Card

The UOB One Debit Card is noteworthy for its lucrative cashback offers, making it a top contender for Singapore’s best cashback debit card. It caters to a broad range of spending habits, offering substantial cashback on daily expenses. This makes it particularly appealing to those prioritising savings on everyday purchases.

2. CIMB FastSaver Account Debit Card

Furthermore, the CIMB FastSaver Account Debit Card is an excellent choice for those looking to earn rewards through savings. This card is linked to the CIMB FastSaver account, which offers attractive interest rates. It’s an ideal option for individuals focused on growing their savings while enjoying the convenience of a debit card.

Debit Cards for Online Shopping

1. NTUC Plus! Visa Debit Card

In the realm of online shopping in Singapore, selecting the right debit card is crucial for maximizing benefits and convenience. The NTUC Plus! Visa Debit Card is a noteworthy option, especially for those who frequently shop online for groceries and household items.

This card offers exclusive discounts at NTUC FairPrice, Unity, and Warehouse Club stores, making it an excellent choice for budget-conscious shoppers. Its cashback features and rewards program, coupled with the convenience of online shopping, position it well within the best debit card Singapore category.

For those looking to combine everyday grocery shopping with the benefits of online purchasing, the NTUC Plus! Visa Debit Card presents an attractive package of rewards and savings.

Debit Cards for Travellers

1. HSBC Everyday Global Debit Card

For travellers in Singapore, choosing a debit card that caters to their specific needs while on the move is essential. The HSBC Everyday Global Debit Card stands out in this regard. It is specifically designed for globetrotters, offering the flexibility of multi-currency transactions without additional fees.

This feature is particularly valuable for those who travel across different countries, as it eliminates the hassle of currency conversion charges. Additionally, globally, the card’s wide acceptance ensures that travellers can use it conveniently, no matter where they are.

With its traveller-friendly features, the HSBC Everyday Global Debit Card aligns perfectly with the best travel debit card Singapore cluster, making it an ideal choice for Singaporeans who are frequent travellers.

Debit Cards for Students and Young Adults

1. Maybank Platinum Debit Card

In Singapore, students and young adults have specific financial needs, and choosing the right debit card can make a significant difference. The Maybank Platinum Debit Card is an excellent choice in this segment.

Tailored to suit the lifestyles of younger individuals, it offers a mix of rewards and practicality. This card provides a rewards program that accumulates points for every spend, which can be redeemed for various rewards. Its wide acceptance and security features make it a reliable option for daily use and online purchases.

Particularly for students beginning to manage their finances independently, the Maybank Platinum Debit Card stands as a strong contender within the best debit card for students in the Singapore category, offering benefits that align with their unique spending habits and financial learning curve.

Premium Debit Cards

1. Citibank Debit Mastercard

Singapore’s financial landscape offers a range of premium debit cards, each designed to cater to the upscale market segment. The Citibank Debit Mastercard exemplifies this category, providing users with premium features.

This card offers global acceptance, Ideal for individuals seeking a blend of luxury and functionality, making it perfect for international travel and online shopping.

Its enhanced security features, exclusive deals, and promotions stand out, aligning with the best travel debit card Singapore cluster. This card caters to those who desire a high-end banking experience coupled with the convenience and safety of a debit card.

How to Apply for a Debit Card

Step 1: determine your needs.

Before choosing a debit card, assess your financial habits and needs. Consider whether you’re seeking cashback, travel perks, or student-friendly features.

Are you a frequent shopper, traveller, or student managing a tight budget? Identifying your primary spending patterns and what you value most in a debit card – rewards, low fees, or specific benefits – is essential.

This understanding will guide your choice, ensuring your card aligns with your lifestyle and financial goals.

Step 2: Research Options

Once you’ve identified your needs, research various debit cards available in Singapore. Explore their features, benefits, and fees. Look for cards that offer rewards and benefits that match your lifestyle, such as the best cashback debit card in Singapore for shoppers or the best travel debit card Singapore for frequent travellers.

Consider factors like annual fees, rewards programs, and user reviews. Comparing these features across different banks and their offerings will help you find a card that meets your requirements and offers the best value for your spending habits.

Step 3: Check Eligibility

After narrowing down your choices, check the eligibility criteria for the debit cards you’re interested in. Each card has specific requirements set by the issuing bank.

These often include age restrictions, minimum income levels, or, in the case of student cards, proof of enrollment in an educational institution. Some cards also require you to have an existing account with the bank.

Ensuring you meet these prerequisites is vital before proceeding with your application, as it saves time and increases the likelihood of your application being approved.

Step 4: Gather Necessary Documents

For a smooth application process, gather all necessary documents beforehand. You’ll need a valid identification document like a National Registration Identity Card (NRIC) or passport.

Additional documents such as an Employment Pass or Student Pass might be required if you’re a foreigner. Proof of address, often a utility bill or bank statement, is usually needed.

For income verification, recent payslips or bank statements are standard. Students should have their student ID or proof of enrollment ready. These documents will expedite the application process for your chosen debit card.

Step 5: Apply Online or In-Person

Once you have all your documents, apply for the online or in-person debit card. Online applications can be done on the bank’s website, offering convenience and speed.

For in-person applications, visit your chosen bank’s nearest branch. This option can be beneficial if you prefer face-to-face assistance or have specific questions.

Both methods require completing an application form and submitting the necessary documents. Choose the method that best suits your comfort and convenience.

Step 6: Await Approval

After submitting your application, the next step is to wait for approval. The processing time can vary depending on the bank and the completeness of your application.

Banks typically review the provided information to ensure eligibility and compliance with their criteria. During this period, you might be contacted for additional information or clarification.

Approval times can range from a few days to a couple of weeks. Patience is key during this phase, as the bank carries out necessary checks to approve your debit card application.

Step 7: Activate the Card

Once your application is approved and you receive your debit card, the next step is activation. This is a crucial security measure. Activation can be done through various methods, such as calling a designated phone number, using an ATM, or through the bank’s online banking platform.

Follow the instructions provided with your card. Activation verifies your identity and enables the card to be used. Ensure you complete this step before attempting transactions with your new debit card.

Step 8: Set Up Online Banking

After activating your debit card, set up online banking to manage your account efficiently. This can usually be done through the bank’s website or mobile app.

You must create a username and password and provide additional verification details. Online banking allows you to check balances, view transactions, transfer funds, and pay bills conveniently.

Applying for a debit card in Singapore is a systematic process that starts with understanding your financial needs and preferences. It involves thorough research of available options, checking eligibility criteria, and preparing necessary documentation.

The application process, whether online or in-person, is followed by a waiting period for approval. Once the card is received, activation and online banking are essential final steps. The right debit card can significantly streamline your financial transactions, offering convenience, security, and benefits tailored to your lifestyle.

Frequently Asked Questions

Which singapore debit card has no foreign transaction fee.

The HSBC Everyday Global Debit Card is known for having no foreign transaction fees, making it ideal for international use.

Are there any debit cards in Singapore that offer rewards or cashback?

Yes, the UOB One Debit Card and OCBC FRANK Debit Card are popular for offering rewards and cashback on various transactions.

What should I look for in a debit card if I travel frequently?

Look for cards with low or no foreign transaction fees, wide global acceptance, and travel-related benefits. For example, the HSBC Everyday Global Debit Card offers multi-currency transactions without extra fees.

Can I use my Singapore debit card overseas, and what are the associated fees?

Yes, you can use Singapore debit cards overseas, but be aware of foreign transaction fees and currency conversion charges, which vary by card and bank.

Is there a minimum age requirement to apply for a debit card in Singapore?

Yes, the typical minimum age requirement is 16 years, but it can vary depending on the bank’s policies.

Financial Disclaimer:

The information provided herein is for general informational purposes only. It is not intended as financial, legal, or professional advice. While efforts have been made to ensure accuracy and up-to-dateness, the content may not reflect current legal or regulatory standards or developments. Individual circumstances vary, and users should seek personalized advice from qualified professionals if necessary. The author or publisher of this content does not accept responsibility for any losses or damages arising from the use, reliance on, or actions taken based on the information contained in this material.

Irvin Yap is a skilled writer focused on personal finance and insurance in Singapore. Known for simplifying complex topics, his...

- Latest News

- Emergencies

- Ask the Law

- GN Fun Drive

- Visa+Immigration

- Phone+Internet

- Reader Queries

- Safety+Security

- Banking & Insurance

- Dubai Airshow

- Corporate Tax

- Top Destinations

- Corporate News

- Electronics

- Home and Kitchen

- Consumables

- Saving and Investment

- Budget Living

- Expert Columns

- Community Tips

- Cryptocurrency

- Cooking and Cuisines

- Guide to Cooking

- Art & People

- Friday Partner

- Daily Crossword

- Word Search

- Philippines

- Australia-New Zealand

- Corrections

- Special Reports

- Pregnancy & Baby

- Learning & Play

- Child Health

- For Mums & Dads

- UAE Success Stories

- Live the Luxury

- Culture and History

- Staying Connected

- Entertainment

- Live Scores

- Point Table

- Top Scorers

- Photos & Videos

- Course Reviews

- Learn to Play

- South Indian

- Arab Celebs

- Health+Fitness

- Gitex Global 2023

- Best Of Bollywood

- Special Features

- Investing in the Future

- Know Plan Go

- Gratuity Calculator

- Notifications

- Prayer Times

Standard Chartered UAE and Visa launch multi-currency account for international payments

Business banking & insurance.

- Travel & Tourism

The account will be linked to the Visa Multi-Currency Debit Card

Dubai: Standard Chartered UAE Sunday announced the launch of a Multi-Currency Account (MCA), in partnership with Visa, a leading global payments technology company, offering customers access to 14 various currency accounts.

The account will be linked to the Visa Multi-Currency Debit Card, giving clients the ability to create transactions across multiple currencies to use for travel, online shopping, investment, and remittance. Integrated within the bank’s existing i-banking and mobile banking platforms, the multi-currency account is a functionality that is being enabled on Standard Chartered’s Current and Savings products (covering both Islamic banking and conventional) that will allow clients access to 14 currency accounts.

The bank’s latest innovative solution is designed to ease the daily cashless transactional needs of customers, regardless of where they are in the world. The card enables consumers to load 14 currencies used by UAE residents. These currencies include: AED (UAE Dirham), USD (US Dollar), GBP (British Pound Sterling), EUR (Euro), CHF (Swiss Franc), AUD (Australian Dollar), SGD (Singapore Dollar), CAD (Canadian Dollar), HKD (Hong Kong Dollar), JPY (Japanese Yen), NOK (Norwegian Krone), NZD (New Zealand Dollar), SEK (Swedish Krona) and ZAR (South African Rand).

“The ethos behind the Multi-Currency Account is to give our customers a simplified and secure platform for international spending. Customer experience is at the heart of everything we do and by fully integrating this latest product offering into our digital platforms, we are providing our clients peace of mind to spend and transfer money no matter where they are in the world,” said Rola Abu Manneh, Chief Executive Officer for Standard Chartered UAE.

To enable this feature, customers with a Standard Chartered Current Account, Salary Account or Saadiq Current Account can proceed via i-Banking or SC Mobile. The versatile feature enables customers to make retail transactions in foreign currency and overseas cash withdrawal without incurring any additional charges.

“The SCB Visa Multi-currency Debit card is a perfect example of innovation meeting market needs and ultimately creating tangible value for our consumers. The international nature of the UAE consumer means whether they are traveling, shopping online, investing globally or sending money back home, they are constantly dealing with multiple currencies and simplifying this experience is vital. We are very pleased that we have been able to partner with Standard Chartered to make this market first a reality," said Dr Saeeda Jaffar, Group General Manager for the GCC, Visa.

In order to fund the account, customers must select a foreign currency from the available currencies displayed on Standard Chartered’s digital platforms and transfer funds in that selected currency from an already existing account to the eligible account. The fund transfer amount will be converted at a rate offered by the Bank on a timely basis.

More From Banking

December rate cut, a 'reasonable prediction': Fed exec

Dh13.8b in new savings via bank deposits during Q1

UAE banks' liquid assets reach Dh786.6b in Q1-2024

UAE's gold reserves see 12.6% year-on-year growth

UAE residents enjoy visa-free entry to 10 destinations

Dubai is the airport of the world, says Sheikh Mohammed

Moving to Sharjah? 3-year rent freeze attracts tenants

Tourism returns to Europe, with crowding at hotspots

Delhi airport launches fast-track immigration clearance

GST rate changes in India: What you need to know

Daku given 2-game ban for offensive chants at euro 2024, t20 wc: jordan, buttler star as england thrash usa, saudi arabia says 1,301 deaths during hajj 2024, watch: dubai’s burj khalifa lights up for olympic day, qatar's ooredoo inks middle east ai deal with nvidia.

Get Breaking News Alerts From Gulf News

We’ll send you latest news updates through the day. You can manage them any time by clicking on the notification icon.

- FLIGHT+HOTEL

- More Charters Book private charters here Cruise Book cruise here Gift Card Buy giftcards here Offers Check Best latest offers

- Afghanistan +93

- Albania +355

- Algeria +213

- American Samoa +1684

- Andorra +376

- Angola +244

- Anguilla +1264

- Antigua and Barbuda +1268

- Argentina +54

- Armenia +374

- Australia +61

- Austria +43

- Azerbaijan +994

- Bahamas +1242

- Bahrain +973

- Bangladesh +880

- Barbados +1246

- Belarus +375

- Belgium +32

- Belize +501

- Bermuda +1441

- Bhutan +975

- Bolivia +591

- Bosnia and Herzegovina +387

- Botswana +267

- Brunei Darussalam +673

- Bulgaria +359

- Burkina Faso +226

- Burundi +257

- Cambodia +855

- Cameroon +237

- Cape Verde +238

- Cayman Islands +1345

- Central African Republic +236

- Colombia +57

- Comoros +269

- Congo (DRC) +243

- Congo (Republic) +242

- Cook Islands +682

- Costa Rica +506

- Côte d'Ivoire +225

- Croatia +385

- Cyprus +357

- Czech Republic +420

- Denmark +45

- Djibouti +253

- Dominica +1767

- Dominican Republic +1809

- Ecuador +593

- El Salvador +503

- Equatorial Guinea +240

- Eritrea +291

- Estonia +372

- Ethiopia +251

- Faroe Islands +298

- Finland +358

- French Polynesia +689

- Gambia +220

- Georgia +995

- Germany +49

- Gibraltar +350

- Greenland +299

- Grenada +1473

- Guadeloupe +590

- Guatemala +502

- Guernsey +44

- Guinea +224

- Guinea-Bissau +245

- Guyana +592

- Honduras +504

- Hong Kong +852

- Hungary +36

- Iceland +354

- Indonesia +62

- Ireland +353

- Isle of Man +44

- Israel +972

- Jamaica +1876

- Jordan +962

- Kazakhstan +7

- Kiribati +686

- Kuwait +965

- Kyrgyzstan +996

- Latvia +371

- Lebanon +961

- Lesotho +266

- Liberia +231

- Liechtenstein +423

- Lithuania +370

- Luxembourg +352

- Macedonia +389

- Madagascar +261

- Malawi +265

- Malaysia +60

- Maldives +960

- Marshall Islands +692

- Martinique +596

- Mauritania +222

- Mauritius +230

- Micronesia +691

- Moldova +373

- Monaco +377

- Mongolia +976

- Montenegro +382

- Montserrat +1664

- Morocco +212

- Mozambique +258

- Myanmar (Burma) +95

- Namibia +264

- Netherlands +31

- New Caledonia +687

- New Zealand +64

- Nicaragua +505

- Nigeria +234

- North Korea +850

- Pakistan +92

- Palestinian Territory +970

- Panama +507

- Papua New Guinea +675

- Paraguay +595

- Philippines +63

- Portugal +351

- Puerto Rico +1787

- Réunion +262

- Romania +40

- Russian Federation +7

- Rwanda +250

- Saint Kitts and Nevis +1869

- Saint Lucia +1758

- Saint Vincent and the Grenadines +1784

- San Marino +378

- São Tomé and PrÃncipe +239

- Saudi Arabia +966

- Senegal +221

- Serbia +381

- Seychelles +248

- Sierra Leone +232

- Singapore +65

- Slovakia +421

- Slovenia +386

- Solomon Islands +677

- Somalia +252

- South Africa +27

- South Korea +82

- Sri Lanka +94

- Suriname +597

- Swaziland +268

- Switzerland +41

- Syrian Arab Republic +963

- Taiwan, Province of China +886

- Tajikistan +992

- Tanzania +255

- Thailand +66

- Timor-Leste +670

- Trinidad and Tobago +1868

- Tunisia +216

- Turkmenistan +993

- Turks and Caicos Islands +1649

- Tuvalu +688

- Uganda +256

- Ukraine +380

- United Arab Emirates +971

- United Kingdom +44

- United States +1

- Uruguay +598

- Uzbekistan +998

- Vanuatu +678

- Vatican City +379

- Venezuela +58

- Viet Nam +84

- Virgin Islands (British) +1284

- Virgin Islands (U.S.) +1340

- Western Sahara +212

- Zambia +260

- Zimbabwe +263

Indira Gandhi International Airport

Chhatrapati Shivaji International Airport

DEPARTURE DATE

Return Date

Book a round trip to save more

TRAVELLER & CLASS

1 Traveller(s)

(12+ Years)

(2-12 Years)

(0-2 Years)

No Joining fee & Get Annual Benefits worth INR 32000* with your StanChart EaseMyTrip Credit Card

What you get .

- Users under this offer will get attractive discount on Flights, Hotels & Bus booked using Standard Chartered EaseMyTrip Credit Card with EaseMyTrip

How Do You Get It?

- To avail discounts using Standard Chartered EaseMyTrip Credit Card , users have to book flight, bus or hotel for their preferred destination by applying coupon code: EMTSCB

- To apply for Standard Chartered EaseMyTrip Credit Card, click here

- For detailed Terms and conditions of Standard-Chartered EaseMyTrip Credit Card, Know More

- To Download SC mobile App, Click Android & iOS

- Offer is valid only on Flight, Hotel and Bus Bookings.

- This offer is valid for transactions done through only Standard Chartered EaseMyTrip Credit Card.

- This offer is valid once per card per product per month.

- The offer is valid for bookings made on EaseMyTrip's website, Mobile site, Android & iOS App

What Else Do You Need To Know?

- There is no minimum transaction value required to avail the Flights and Hotels Offer.

- The minimum transaction value required to avail the Bus offer is INR 500.

- Convenience fee will be charged as per the applicability.

- This offer is valid on selected flights and hotels only

- The offer can't be clubbed with any other promotional offer.

- Booking with the valid promo codes will be only eligible for this offer.

- In case of partial/full cancellation the offer stands void and discount will be rolled back before processing the refunds.

- Child/infant discount, date or flight change, refund charges, weekend surcharge, blackout period, travel restrictions and/or flight restriction will be also applicable as per the fare rule.

- Changes in flights and dates are allowed with change fees and fare difference.

- Changes in names are not allowed.

Terms & Conditions

- In the event of any misuse or abuse of the offer, EaseMyTrip reserves the right to deny the offer to the customers.

- EaseMyTrip is the sole authority for interpretation of these terms.

- In addition, EaseMyTrip standard booking and privacy policy on www.EaseMyTrip.com shall apply.

- In the event of any dispute, Courts of New Delhi will have jurisdiction.

- EaseMyTrip reserves the right, at any time, without prior notice and liability and without assigning any reason whatsoever, to add/alter/modify/change or vary all of these terms and conditions or to replace, wholly or in part, this offer by another offer, whether similar to this offer or not, or to extend or withdraw it altogether.

- EaseMyTrip shall not be liable for any loss or damage arising due to force majeure.

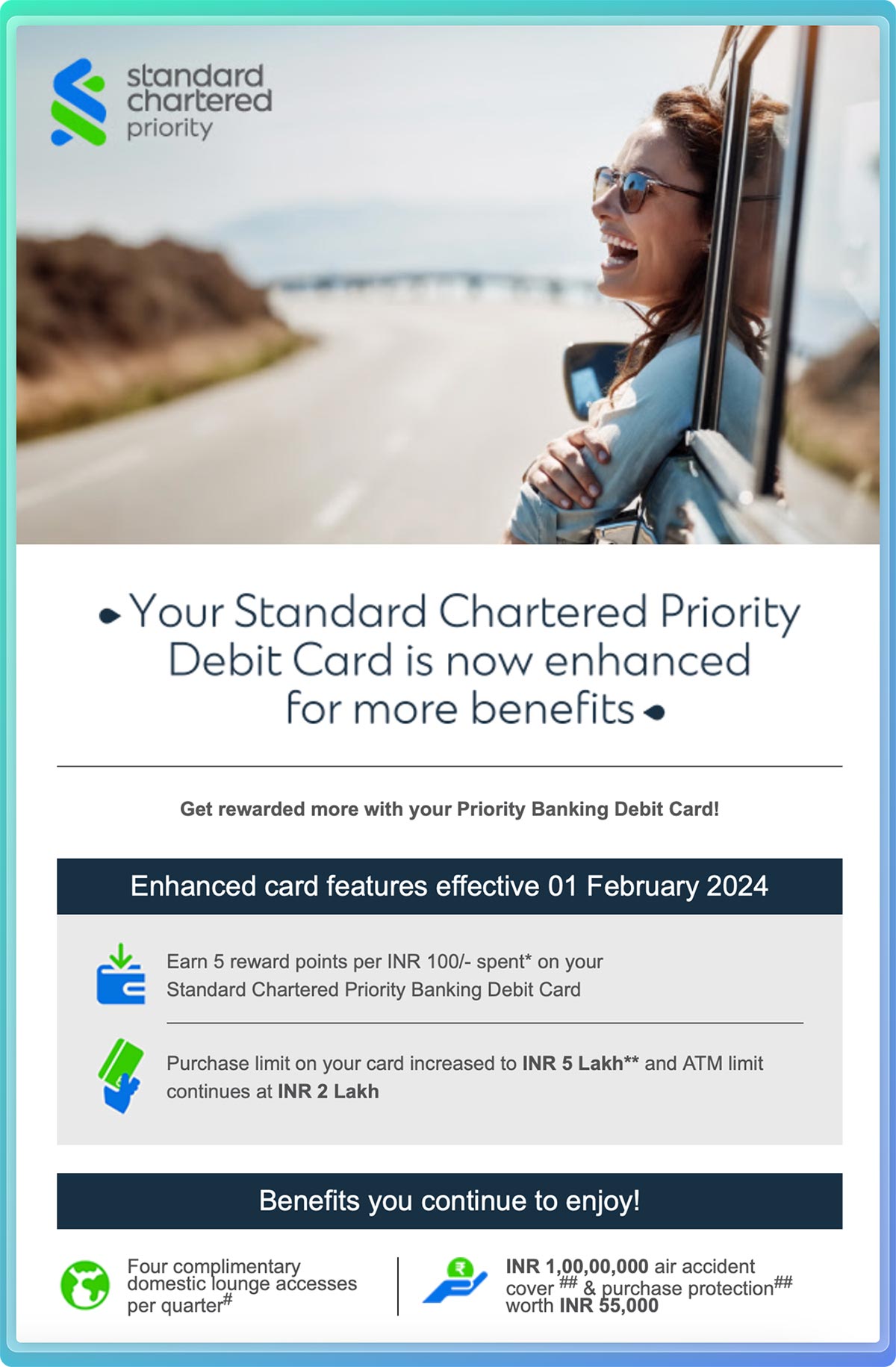

Standard Chartered Priority Infinite Debit Card Review

Standard Chartered provides Priority Banking services in India, a premium banking solution tailored for the affluent customers. As a part of this service, they issue the Standard Chartered Priority Infinite Debit Card with attractive benefits.

Now, the bank has enhanced its features and benefits making it the most rewarding debit card in the country for High Net Worth Individuals (HNIs). Here’s everything you need to know:

Table of Contents

Eligibility

- 5 Point / 100 INR spend (Eff. 1st Feb 2024)

- Reward Rate: 1.25% [1 Point = 0.25 Ps]

- Excluded MCC: Insurance, Education, Government spends and few more.

Just incase if you’re wondering, here’s the email communication on the revision of benefits and the t&c link to excluded MCC list.

For high value spends, even the IDFC First Wealth Debit Card can get you close to 2.5% reward rate however it not only has the capping but also poor reward rate on low spends.

So Standard Chartered’s offering is relatively better for low spends.

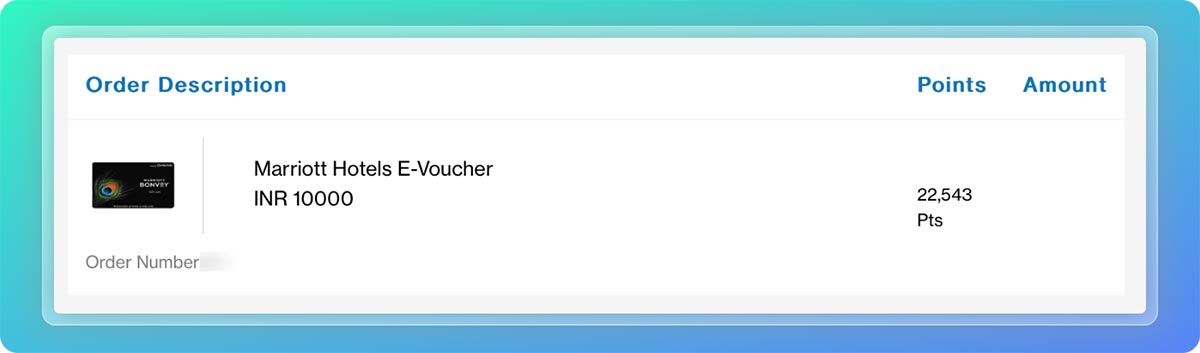

While I’ve personally redeemed for Marriott Hotel eGift Cards, there are other options as well. Here’s a quick look at the options:

- Marriott hotels

- Urban ladder

- Petter England

- Louis Philippe

- Lakme Fashion & few more

- Joining/Annual Fee: Complimentary

- Complimentary airport lounge access: 4 / Qtr (domestic)

- Daily POS limit: 5 Lakhs

- Daily ATM limit: 2 Lakhs

- INR 1,00,00,000 air accident cover

- Purchase protection worth INR 55,000

While the debit card doesn’t have capping on rewards, it does have POS spend limit, which will technical cap the rewards as well, but it’s fair enough for most.

- Total Relationship value: 30 Lakhs (Savings, FD, Investments)

- Salary Credit: 3 Lakhs

- Mortgage: >2 Cr

Customers has to maintain one of the above criteria to get hold of the Priority Banking relationship with Standard Chartered bank.

That said, it is to be noted that the bank also offers Private Banking services for UHNW individuals at ~8 Cr TRV and that comes with a reward rate of 2.5% on a debit card.

Standard Chartered Priority debit card is perhaps the best ever debit card in the country for HNI who want’s to spend a lot on a debit card.

But why would anyone want to spend on a debit card while we can get lot more on a credit card?

Well, some have their own reasons but for most others one may get a Credit Card, perhaps from Standard Chartered itself with their Standard Chartered Ultimate Credit Card that gives 3.3% reward rate on most spends.

Nevertheless, it’s a good sign that the bank is still focusing on their premium cards and I hope someday they come up with a super/ultra premium credit card positioned about the Ultimate Credit Card.

Until then, enjoy the lucrative rewards on the debit card.

Make hay while the sun shines!

Sign up for Weekly Newsletter

Get curated emails every week, so you don't miss any rewards.

Related Posts

20 thoughts on “ Standard Chartered Priority Infinite Debit Card Review ”

Will credit card payment using Priority Infinite Debit Card give reward points?

It used to get and they recently excluded. But now I’m surprised why they haven’t included in the MCC exclusion.

Yet still says the exclusion on the t&c of the debit card landing Page. So only testing it can give the actual answer. Will do sometime and report.

Has anyone tried credit card payments using SC pirority card?

Looks like a good card for wallet loads. Ah but paytm just died.. What are the redemption options?

I usually redeem for Marriott Gift Cards. I used to see Taj and others but not Amazon/Flipkart for sure. Let me update that on article shortly.

It’s no more 0.44 paise per point. Can you check the vouchers section? It shows 40k points for 10k worth of voucher..

Oops, yeah I do see only 25ps point value now unfortunately. Looks like they updated few hrs ago.

This means. Return value is 1.25% only..but still a up from earlier 0.8%

Yes, fair enough.

Sir, they have reduced the value of the reward points. Until 31st Jan I was getting 15k voucher in 32k(approx points) now I am getting same in 60k points. Can they reduce the value of the reward points without giving any notice? I have 60k points, value has reduced to 50%. Please suggest what should I do.

Unfortunately they’ve done it without notice. You may raise a complaint with bank and if not solved, go for RBI complaint.

Anyone tried cc payment via any means? Does sc provide rewards?

Wallet load is giving points, FYI – tried over Mobikwik.

Hey bro, are you getting any rp for wallet loads from 1st April? How do I connect with you?

Hey, I am not getting rp since 1st April for wallet loading

Hey Utkarsh, even last few days of Mar and Apr month I noticed that points are not credited for Mobikwik, I’ve raised this to Customer care and waiting for the resolution.

Got those rewards, cc had arranged call back and they credited pending rewards, not sure if this would work automatically or I need to raise each month or so.

Uber is gone. Can anyone tell best way to burn points?

For Ultimate though (same collection), used to get 5k Peter England, they had 750 off on 5999, so got to use it better

The lowest of Indian banks is better than this british bank. SC’s tech is worst than the tech ICICI had in 2012. Makeshift website, slow mobile app, and largely untrained staff should be sufficient to not to bank with them. Let aside risk keeping that much amount of money in the hands of a sleeping bank.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Don't subscribe All new comments Replies to my comments Notify me of followup comments via e-mail. You can also subscribe without commenting.

About Contact

Terms of Use

Terms of Use Privacy Policy Advertising Policy

Subscribe to Emails

Love Credit Card Rewards? Then you would love the email newsletters too!

11 Best Debit Cards In India

Introduction

1. icici bank coral paywave international debit card, 2. hdfc bank rupay premium debit card, 3. kotak bank payshopmore international chip debit card, 4. axis bank burgundy debit card, 5. sbi platinum international debit card, 6. idbi visa signature debit card, 7. bank of india rupay platinum debit card, 8. idfc first visa signature debit card, 9. hdfc bank millenia debit card, 10. hsbc premier platinum debit card, 11. standard chartered priority infinite debit card.

Looking to amp up your financial game?

Spice up your wallet with some plastic magic. We’ve curated the Ultimate Top 11 Debit Cards in India that are your passport to a world of benefits. Exceptional rewards, extensive global acceptance, attractive cashbacks, and more are just a swipe away. Dive in now and unleash the high roller in you!

Transform the way you spend, starting today!

ICICI Bank Coral Paywave Card is a Visa Paywave debit card, the most secure card in India. The card offers international transactions for online buyers to maintain their lifestyle and travel.

Bank customers can collect points for online purchases and discounts on merchants’ shops.

Key Features

- Buy 1 Get 1 Movie Tickets: Applicable at Big Cinemas or INOX when booked via BookMyShow.

- Rewards Program: Earn 6 PAYBACK points for every Rs 200 spent.

- Dining Discounts: Avail 15% off on dining at selected Indian restaurants through Culinary Treats Programme.

- Fuel Surcharge Waiver: Enjoy a 2.5% waiver on fuel surcharge at select HPCL outlets on a minimum spend of Rs 401.

- Complimentary Lounge Access: Free access to airport lounges.

If you are interested in this card and want to know more about it –

HDFC Bank RuPay Premium Debit Card is the best for online Indian transactions. It provides a high purchase limit and is suitable for transacting on Indian eCommerce websites. You can also charge this card to interact with sites outside of India.

This card offers many benefits that can make your life easier. It provides a facility to make electronic payments without carrying around cash or using a credit card.

You can withdraw money from participating banks and ATMs.

Finally, the card has many safety features, including fraud protection and 24/7 customer support.

- Utility Bill Cashback: Get 5% cashback on utility bill payments.

- Lounge Access: Enjoy complimentary airport lounge access twice per quarter.

- Café Coffee Day Vouchers: Receive welcome vouchers at Café Coffee Day.

- Discounts on Swiggy & Amazon Pay: Avail 20% off on Fridays.

- Personal Accident Cover: Get up to Rs.10 lakh accelerated personal accident death cover.

- Fuel Surcharge Waiver: Enjoy zero fuel surcharge.

Kotak Bank PayShopMore Debit card comes with many customer-oriented features. The debit card is usable at 30 lakh stores around the country for cash-free and convenient shopping.

You can conveniently use it both on mobile apps and through a website.

This card can be used online and offline to make payments, check balances, or withdraw cash.

- High Purchase Limit: Daily purchase limit of Rs 200,000.

- Year-round Offers: Get offers on dining, shopping, travel, etc.

- Accidental Death Cover: Personal accidental death coverage of up to Rs. 5,00,000.

- Purchase Protection: Up to Rs. 50,000 coverage against purchases.

- Lost Card Liability: Coverage of up to Rs. 2,50,000 for lost card.

Axis Bank provides you with the best credit card, superior wealth management and savings options.

It gives the perfect banking experience that includes everything from commercial to personal banking needs.

Axis Bank is here to present you with the Burgundy World Debit Card to offer some of the most exclusive privileges, benefits and advantages not taken by other cards.

- eDGE Loyalty Rewards : Earn 6 eDGE reward points on each international transaction of Rs 200 or more.

- International Transaction Rewards : Gain 2 eDGE points for every international transaction of Rs 200 or above.

- Movie Tickets Offer : Complimentary tickets available via BookMyShow.

- Airport Lounge Access : Gain complimentary access to airport lounges.

- Dining Discounts : Enjoy a minimum 20% discount at partner restaurants through the Dining Delights program.

When looking for a safe and convenient way to manage your finances, look no further than the SBI Platinum International Debit Card. It offers a variety of benefits, including safety and convenience.

The card is issued by one of the world’s leading banks, and it comes with a host of security features to keep your information safe.

Plus, you can use the card to make payments at over 2 million locations worldwide.

So whether you’re looking for a new financial option or want to improve your overall security, the SBI Platinum International Debit Card is a great choice.

- Reward Points : Earn 1 reward point for every Rs 200 spent.

- Activation Bonus : Get 200 bonus points for the first 3 purchase transactions.

- Birthday Benefits : Earn 2X reward points on birthday spends.

- Lounge Access : Complimentary access to airport lounges.

- Global ATM Access : Use the card at all ATMs around the world.

Suppose you’re looking for a reliable, convenient, and affordable method of shopping. In that case, the IDBI Visa Signature Debit Card may be the perfect choice for you.

This card offers a variety of benefits that can make your life easier, including 24/7 customer support, fraud protection, and a wide range of payment options.

Plus, with minimal joining and annual fees, it’s easy to see why many people choose it as their go-to debit card.

- High Cash Withdrawal : Daily cash withdrawal limit of Rs 3,00,000.

- Large Purchase Limit : Daily purchase limit of Rs 5,00,000.

- Loyalty Points : Earn 3 points for every Rs 100 spent.

- Lounge Access : Enjoy 4 complimentary airport lounge visits per quarter.

Suppose you’re looking for a debit card that’s both convenient and user-friendly; the Bank of India RuPay Platinum Debit Card is a great option.

The card has an embedded chip that allows you to make purchases quickly and easily. Additionally, use it at any ATM or merchant that accepts debit cards.

The card has many benefits, including free bank transfers and discounts on travel and entertainment.

If you’re looking for a debit card that’s both convenient and user-friendly, the Bank of India RuPay Platinum Debit Card is a great option.

- ATM Transaction Limit : Daily limit of Rs 50,000 for both domestic and international ATM transactions.

- Lounge Access : Complimentary airport lounge access for 2 visits per quarter.

- POS Transaction Limit : Daily limit of Rs 1,00,000 for domestic and international POS transactions.

After the IDFC bank merger with Capital First, customers have an exciting offer. The new IDFC First savings account comes with their signature Visa debit card.

Suppose you’re looking for a stylish and convenient debit card with various features. In that case, the IDFC First Visa Signature Debit Card is worth considering.

This card offers many benefits that make it a popular choice among consumers. First, it comes with various protections, including fraud monitoring and 24/7 customer support.

Finally, there’s no annual fee associated with this card( for the existing customers at least) and a minimal fee for the new customers post-30 June 2022. This feature makes it an excellent value for those looking to manage their finances responsibly.

- ATM Transaction Limit : Daily limit of Rs 2,00,000 for ATM transactions.

- POS Transaction Limit : Daily limit of Rs 6,00,000 for POS transactions.

- Activation Offer : Enjoy 10% cashback on the 1st transaction of Rs 1,000 or more.

- Lounge Access : Receive two complimentary airport lounge visits per quarter.

A credit card has more benefits when it comes to rewards and types of transactions. Still, there are some situations where we cannot use a credit card, which is when a debit card is helpful. Some debit cards also offer transaction rewards, so look at the Millennia debit card from HDFC Bank.

Suppose you are looking for a debit card with great features and high levels of security. In that case, the HDFC Millenia Debit Card is definitely worth considering. With its rotating zero liability feature, this card provides peace of mind for those worried about being held responsible for unauthorized charges.

The card has many other impressive features, such as online and mobile banking, fraud monitoring, and global reach.

- Annual Discounts : Benefit from discounts up to Rs 4,800 per year.

- Cashback on PayZapp & SmartBuy : Earn 5% cashback points on shopping.

- Online Spends Cashback : Receive 2.5% cashback points on all online purchases.

- Offline Spends & Wallet Reloads : Get 1% cashback points on offline transactions and wallet reloads.

- Lounge Access : Enjoy one complimentary airport lounge visit per quarter.

The HSBC Premier Debit Card is a great way to improve your finances. It has features perfect for those who want to improve their credit score, make more money, and manage their money more efficiently. Plus, the card has a low-interest rate, so you won’t have to worry about paying high-interest rates on your loans.

HSBC is a global company, that provides you with the opportunity to use your debit card in any of the countries where HSBC is present.

The HSBC Premier Platinum debit card would be worth investigating if you’re looking for an exclusive card with a high transaction limit.

- Global Acceptance : Use the card worldwide.

- ATM Withdrawal Limit : Daily limit of Rs 2,50,000 for cash withdrawals.

- Purchase Transaction Limit : Daily limit of Rs 2,50,000 for purchases.

- Dining Privileges : Exclusive dining benefits in Mumbai, Bangalore, Delhi, and Kolkata.

- Concierge Services : 24/7 international assistance.

- Insurance Coverage : Receive up to Rs 5,00,000 in insurance cover.

Suppose you’re looking for a card with excellent value for your money and various extra benefits. In that case, the Standard Chartered Priority Infinite Debit Card is definitely worth considering.

This card is perfect for people who frequently use plastic to make purchases, as it has unlimited borrowing and spending capabilities.

The Standard Chartered Priority Infinite Debit Card should be at the top of your list when looking for an affordable and reliable card. It will give you everything you need.

- Reward Points : Earn 2x points for every Rs 100 spent without any cap.

- Movie Discounts : Save 50% (up to Rs 300) on BookMyShow movie tickets.

- Air Accident Cover : Insurance coverage of Rs 1,00,000 for air accidents.

- Purchase Protection : Protection up to Rs 55,000 on purchases.

Ready to upgrade your wallet and reap the rewards?

Discover the perfect match for your spending habits from our handpicked list of the 11 Best Debit Cards in India . Swipe smarter! Click here and start experiencing exceptional value, unprecedented convenience, and lucrative benefits like never before.

Make your next swipe count!

Please read other interesting blogs:

- Best Airport Lounge Access Debit Cards

- Informative Review: IndusInd Bank Visa Signature Debit Card

- Axis Bank Burgundy Debit Card Review

Can I make an online purchase using a debit card?

They are all contactless debit cards, which allow you to use EMV chips, PIN technology, and NFC. Also, most of these cards have an app that you can use on your smartphone or tablet, which will provide you with a virtual debit card number that is free to access.

Is it safe to use a debit card in India?

In general, debit cards can be a safer option in India as it is less likely for your card details to be stolen than credit cards. However, this is not always the case.

Can I own a debit card without having a bank account?

No, debit cards are not meant to be used without a bank account. Many people find the link between a debit card and a bank account helpful for budgeting.

Can we get rewards for spending on debit cards in India?

Some cards offer rewards, but not all of them (please go to the individual card reviews for more details). Some cards might reward you even if you don’t spend every day. Like credit cards, some debit cards might be more rewarding than others.

About The Author

Related Posts

The MasterCard Airport Lounges in India

The Visa Airport Lounges in India

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Start typing and press enter to search

Best Standard Chartered Debit Cards in Hong Kong

Standard Chartered Debit Cards work differently from Credit Card, but they also offer Visa and Mastercards, and can be used in a lot of places in Hong Kong, as well as online payment gateway such as Paypal. Start comparing and applying for Standard Chartered Debit Cards Now!

Looking For The Right Credit Card?

Create a free account, do a 1-min quiz and we'll match you with your perfect card..

- Welcome Offers

- Online Shopping

- Overseas Spending

- Best Credit Cards

- Octopus Card AAVS

- Annual Fee Waiver

- Bill Payment

- Digital Wallets

- Business Card

- Supermarket

- Entertainment

Refine Your Results

Oops no matches found..

We can't find Credit Cards that best match what you're looking for. Try adjusting the filters to refine your search or explore more options.

Disclaimer: At MoneySmart.hk, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. For any discrepancy in product information, please refer to the financial institution’s website for the most updated version. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

FOR INDIVIDUAL

- Personal Banking

- Priority Banking

- Premium Banking

- Saadiq – Islamic Banking

For Companies

- Business Banking

- Digital Banking

- Brunei Darussalam

- Cote d'Ivoire

- Falkland Islands

- Philippines

- Sierra Leone

- South Africa

- South Korea

- United Arab Emirates

- United Kingdom

- United States

- Credit Cards

- Mastercard World Credit Card

Standard Chartered Mastercard World Credit Card

Your ultimate travel partner for making everyday unforgettable with exclusive perks and privileges from around the world

- Apply Now Apply Now

brands across Pakistan with Mastercard Priceless Specials

international airport lounges across the world

Mastercard World Credit Card Features

Enjoy making convenient flight or hotel or get pre-trip information from our dedicated concierge services.

Complimentary access for you to 1000+ airport lounges with access to business facilities and complimentary snacks

Exclusive access to 1000s of experiences and benefits on dining, travel & entertainment in over 40 cities worldwide.

Enjoy 4 free green sessions per month at Karachi Golf Club

Feel at home in the best cities in the world with 10% off OneFineStay apartments when you use the code MCWORLD

Book your next vacation on Booking.com and enjoy 10% money back at 1000s of properties locally and around the world.

You are automatically eligible for Hertz Gold Plus Rewards Five Star, and get upto 15% off car rentals.

Get VIP access and upto 15% off at the most luxurious shopping experience around Europe’s Bicester Village Collection

Shop at the leading luxury fashion platform with 700+ international brands, and get 10% off on using the code MC10MEA.

Udemy is an online learning and teaching marketplace where you can learn anything, on your own schedule.

Get additional savings on purchases at over 300,000 stores across the world’s best brands and enjoy a complementary access with your Saadiq World

Enjoy 10% discount on any international roundtrip airfare with no minimum amount restrictions when you use the promo MCWORLD on checkout

Enjoy an exclusive 10% discount when you book your preferred ride with Rentalcars.com using your SC Mastercard Gold

Eligibility and Documents

Application eligibility.

- You have to be at least 21 years of age if you are salaried OR 25 years of age if you are self employed

- Must have valid and active email ID

- Have a valid Pakistan mobile number

Documents Required

- Income Proof

Frequently Asked Questions

You can withdraw up to 40% of your credit limit in cash. For example, if your credit limit is PKR 100,000 and your withdrawal limit is 40%, then your cash withdrawal limit will be PKR 40,000.

Upon receiving your Standard Chartered Credit Card, simply visit our website or SC Mobile App for card activation, or call our Contact Center at 111-002-002.

The Standard Chartered Mastercard World Credit Card can be used at a vast range of merchant outlets that accept Mastercard Credit Cards all over the world

Important Documents

Useful information.

As part of our efforts to go green, the following will no longer be included within the Credit Cards welcome pack:

Product Terms and Conditions for your Credit Card which contain all the terms this product is governed by can be found in the “Important Documents” tab above. Product Features Catalogue, details regarding all features and benefits that you can enjoy on your Credit Card are available on this page for your reference. For details, you can find the entire catalogue here.

If you would ever need more help with your Credit Card, please call our 24-hour Client Center at 111-002-002.

- Learn more Learn more

This is to inform that by clicking on the hyperlink, you will be leaving www.sc.com/pk and entering a website operated by other parties:

Such links are only provided on our website for the convenience of the Client and Standard Chartered Bank does not control or endorse such websites, and is not responsible for their contents.

The use of such website is also subject to the terms of use and other terms and guidelines, if any, contained within each such website. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such website, then the terms of use and other terms and guidelines for such website shall prevail.

Thank you for visiting www.sc.com/pk

IMAGES

COMMENTS

From now till 31 July 2024, complete the 3 actions below to earn a total value of HKD300 Klook e-vouchers: Apply for the Standard Chartered Multi-Currency Mastercard Debit Card; and. Spend once with the Multi-Currency Mastercard Debit Card; and. Perform foreign exchange transactions of HKD10,000 equivalent or more. Terms and Conditions apply.

Travel to the corners of the world and discover the true joy of being a global citizen. Trouble free travelling with Standard Chartered Multi-Currency forex card. Avail Insurance cover, duty free shopping, easy refill, instant issuance & more. Apply Now!

Standard Chartered Multi-Currency Mastercard Debit Card offers a 5% cash rebate for all your overseas spending. Exclusive for Priority Private and Priority Banking clients, Standard Chartered's Multi-Currency Mastercard Debit Card is the perfect companion for travellers this summer. With quarantine measures scrapped, travel is officially back on!

Enjoy discount for global flights and hotels with designated Standard Chartered credit cards & Multi-Currency Mastercard debit card on Trip.com! Flights. Enjoy HK$50 off upon spending HK$2,000 or above. Enjoy HK$100 off upon spending HK$4,000 or above. Enjoy HK$150 off upon spending HK$6,000 or above. Enjoy HK$200 off upon spending HK$8,000 or ...

Types of Standard Chartered Debit Card. 1. Platinum Rewards Debit Card. Earn 10 reward points for every Rs. 100 spent on entertainment, groceries, supermarket, telecom and utility bills. Collect up to a maximum of 1, 000 reward points per month. Enjoy higher withdrawal and spending limit of Rs. 2,00,000 per day.

The eligibility conditions for a Standard Chartered debit card may differ based on the card variant. Some debit cards are only intended for a particular group of people, like high-end customers. However, the following basic requirements must be met in order to apply for a Standard Chartered debit card: You must be a resident of India or an NRE.

Dive into digital reading with 67% off* on Magzter GOLD with Standard Chartered credit/debit cards. Know More Know More; Magzter offer. Enjoy 67% off* on a 3-month Magzter GOLD subscription with your Standard Chartered credit/debit card. Term And Condition. Terms and Conditions - Magzter offers

This card's focus on travel-related benefits aligns it closely with the best travel debit card Singapore category, offering a blend of convenience, security, and rewards that cater to the needs of modern travellers. 2. OCBC Yes! ... The Standard Chartered Business Debit Card is an efficient solution for business professionals in Singapore ...

The account will be linked to the Visa Multi-Currency Debit Card, giving clients the ability to create transactions across multiple currencies to use for travel, online shopping, investment, and ...

Here is all you need to know about Standard Chartered Bank Debit Cards. Top Standard Chartered Debit Cards for 2022. The bank offers debit cards for varying individual needs. Hence, it becomes difficult to choose a right credit card. To help you find your ideal match, here are some of the popular Standard Chartered Debit Cards:

You can request a Visa debit card to be linked to any of the following Standard Bank International bank accounts: Visa debit cards are available in GBP, US$, EUR, or AU$ depending on your account's currency. To request a card, please contact us during normal opening hours.