- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Erin is a credit card and travel rewards expert at NerdWallet, based in Baltimore, Maryland. She has spent nearly two decades showing readers unique ways to maximize their investments and personal finances. Prior to joining NerdWallet, Erin worked on dozens of newsletters and magazines in the areas of investing, health, business and travel with Agora Publishing. Her love of travel led to a passion for credit card and loyalty rewards to subsidize trips, and she thrives on teaching others how to harness the power of credit card rewards. When she's not writing or editing, Erin is planning her next adventure for her family of four using points and miles. Erin recommends this card as the cornerstone for all travelers looking to build up their rewards portfolio - see it here.

Elina Geller is a former NerdWallet travel writer specializing in airline and hotel loyalty programs and travel insurance. In 2019, Elina founded TheMissMiles, a travel rewards coaching business. Her work has been featured by AwardWallet. She is a certified public accountant with degrees from the London School of Economics and Fordham University.

Mary Flory leads NerdWallet's growing team of assigning editors at large. Before joining NerdWallet's content team, she had spent more than 12 years developing content strategies, managing newsrooms and mentoring writers and editors. Her previous experience includes being an executive editor at the American Marketing Association and an editor at news and feature syndicate Content That Works.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

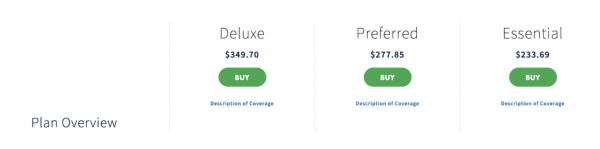

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

What is annual travel insurance?

Coverage options in annual travel insurance plans, how much does annual travel insurance cost, purchasing annual travel insurance, annual travel insurance frequently asked questions, how annual travel insurance works.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Annual travel insurance offers multi-trip coverage for travelers taking several trips over a year.

- Annual travel insurance can be cheaper and more convenient but is less flexible than single trip insurance.

- A 30-year-old US resident can expect to pay between $125 to $700 for annual travel insurance.

The more you travel, the higher your chances are that something goes wrong. Fortunately, coverage is available that can soften the financial blow if you get sick, lose your luggage, or experience some other hiccup while abroad.

While single trip travel insurance can cover one-off trips, frequently travelers may want annual travel insurance, which covers all your trips throughout a year. Read on to learn what annual travel insurance covers, how much you can expect to pay, and when you should buy.

Annual travel insurance, also called multi-trip insurance, is a type of insurance policy that protects you from potential losses on all trips in a 12-month period.

An annual travel insurance plans is more expensive than one single trip policy, but annual travel insurance becomes increasingly cost-effective as you take more trips. Buying annual travel insurance is also more convenient than shopping for travel insurance every time you take a trip. As such, these policies are particularly good for people who travel for work.

While annual travel insurance offers more convenience over single trip policies, you forfeit some flexibility offered in single trip travel insurance. For one, annual travel insurance limits the maximum number of days it will cover in one trip . This threshold varies from provider to provider, but generally it's up to a maximum of 90 days.

"During the coverage period, a traveler can move between countries and remain covered on the same insurance policy," says Rajeev Shrivastava , chief executive officer at VisitorsCoverage , a travel insurance marketplace. "With 30-day coverage, the plan is no longer valid on day 31. The traveler needs to return to their home country, resetting the 30 days and allowing them to resume travel."

Additionally, some annual travel insurance policies only cover trips a certain distance (say, 100 miles) from your residence or farther. Make sure to note these limitations before purchasing your policy — particularly if most of your travel is domestic.

Annual travel insurance coverage varies by plan and provider, but it is generally less comprehensive than a single trip policy.

Annual policies typically include coverage for emergency medical care, medical evacuations, trip delays, and lost or stolen baggage. Most basic plans do not cover trip cancellations (though a few more comprehensive ones do). If you're looking for cancellation reimbursement, you may want to purchase a single-trip plan with cancel for any reason coverage.

Here are just a few things a basic annual travel insurance plan might include:

- Trip cancellation for covered reasons

- Trip interruption

- Trip delays

- Missed connections

- Lost or stolen baggage

- Baggage delay

- Rental car damage or theft

- Emergency medical treatment

- Emergency medical evacuation

- Accidental death and dismemberment

- Repatriation of mortal remains

Limitations and exclusions to annual travel insurance

As we mentioned earlier, annual travel insurance plans are less flexible compared to single trip plans. While this affects how many days are covered in one trip, it'll also limit what you can cover. For one, coverage limits are usually lower throughout the policy.

Most notably, annual travel insurance plans do not offer cancel for any reason coverage . To receive reimbursement for a canceled trip, you must have canceled for a covered reason, such as illness or a disaster at your travel destination.

Depending on your provider, you may be able to add coverage for adventure sports injuries or purchase an adventure sports-specific policy, as these are not covered by standard travel insurance.

"Annual travel insurance doesn't cover losses that arise from expected or reasonably foreseeable events," says Daniel Durazo, director of external communications at Allianz Travel Insurance . "If your trips involve high-risk adventure — like skydiving, caving, mountain climbing, or participating in any athletic competition — your annual policy may not cover medical care if you sustain injuries."

Your age, the number of trips you plan to take, where you live, and other factors will figure into the cost of your coverage. For a 30-year-old US resident taking an estimated eight trips per year, all for fewer than 30 days each, annual travel insurance plans cost roughly between $125 and $700 , according to an analysis of plans on travel insurance comparison platform SquareMouth.

For example, under Seven Corner's travel insurance , one of the companies listed in our guide on the best international travel insurance companies for its long-term coverage, a 30-year-old US resident taking trips to eight destinations (including the US) would pay $375.50 for the annual plan with the lowest annual cancellation limit ($2,500) and $648 for the highest ($10,000).

"The per-trip length of coverage is usually a determining factor of the cost," Shrivastava says. "The longer the trip duration, the more expensive the policy can be."

Since annual travel insurance plans cover you for a full year, consider purchasing your policy right before your first trip. Strategic purchase dates could help you stretch your coverage period to cover more travels, but don't ignore the drawbacks of this approach.

First, you could forget. A lot goes into preparing for a trip, so leaving your travel insurance until the last minute could cause it to fall through the cracks. If you do opt to wait, make sure you set an alarm or calendar reminder.

Additionally, if you wait too long, your policy may not cover any pre-existing medical conditions. Some travel insurance companies will only cover pre-existing conditions if you buy your policy within 14 days of making your first trip payment.

As Durazo puts it, "Whether you're choosing an individual or annual policy, the best time to purchase insurance is always at the same time as you book your travel."

Assess your travel needs

Annual travel insurance isn't right for everyone, but if you travel often, it might be a good fit. Before you take out your policy, have an idea of what travels you'll take in the next year, and use the following chart to help guide your decision.

"These plans are ideal for frequent travelers such as business travelers, digital nomads, or other avid travelers," Shrivastava says. "They aren't a fit for travelers who are only taking one or two trips per year or someone looking for a more comprehensive range of benefits."

Yes, many policies include an option to add family members when you buy your policy, though. However, terms will vary depending on the insurance provider.

Some insurers allow you to automatically renew your annual travel insurance when it expires, though you can also wait until you're going on another trip to re-purchase. You can cancel annual travel insurance at any time, but you will only receive a refund if you cancel within your policy's money-back guarantee period and your trip hasn't started yet.

Pre-existing conditions can be covered under an annual travel insurance plan as long as you meet certain requirements. Policies often require that you buy travel insurance within a certain number of days from when you placed a deposit on your trip, usually two to three weeks. Additionally, many travel insurance providers require that your condition is stable.

- Real estate

- Main content

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

SEE FULL REVIEW »

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Find the Right Travel Insurance Plan for You

Whether you're traveling for leisure or business, you'll appreciate the benefits and coverage Allianz Travel Insurance plans can provide. With 24/7 support from our travel professionals around the world, we helped over 70 million people last year to protect themselves from the unpredictable.

OneTrip Prime

AllTrips Executive

OneTrip Rental Car Protector

OneTrip Basic

OneTrip Premier

OneTrip Emergency Medical

OneTrip Cancellation Plus

AllTrips Basic

AllTrips Prime

AllTrips Premier

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

IMAGES

VIDEO

COMMENTS

AIG’s travel insurance program called Travel Guard provides many coverage options if you need to cancel or interrupt your trip.

We've compared 44 UK travel insurance companies and assessed 66 areas of cover for each provider, to help you find the best policy for you

Travel insurance that offers more. Comprehensive cover for holidays and cruises with high levels of cover and quick medical screening.

Annual travel insurance, also called multi-trip insurance, is a type of insurance policy that protects you from potential losses on all trips in a 12-month period. An annual travel insurance plans ...

Tailor your annual travel insurance plan to your needs. Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more. Lowest-tier plans...

Not sure what travel insurance you want? Compare quotes on our most popular plans. Travel Guard offers over 20 products, ranging from our most popular all-inclusive plans, to rental car and flight insurance plans.

Seven Corners is the best senior travel insurance in our analysis. Find out what benefits make top-rated travel insurance plans for seniors stand out.

Discover the affordable and comprehensive travel insurance plans offered by Allianz Global Assistant. Get a Quote and buy online instantly.

Zurich will also acquire AIG Travel's global service centers as part of the deal. The acquisition is expected to result in combined annual gross written premiums of approximately USD 2 billion 1 for the enlarged Cover-More Group. The transaction is expected to result in a reduction of approximately 4ppts in the Swiss Solvency Test (SST) ratio 2.

Compare and quote travel insurance to find the right coverage for your trip. Access the industry's best vacation insurance companies through Progressive travel insurance from InsureMyTrip. You can quote, compare, and buy affordable plans to cover your concerns at a price that fits your budget.