- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AAA Travel Insurance Review 2024: Is it Worth the Cost?

Elina Geller is a former NerdWallet travel writer specializing in airline and hotel loyalty programs and travel insurance. In 2019, Elina founded TheMissMiles, a travel rewards coaching business. Her work has been featured by AwardWallet. She is a certified public accountant with degrees from the London School of Economics and Fordham University.

Mary Flory leads NerdWallet's growing team of assigning editors at large. Before joining NerdWallet's content team, she had spent more than 12 years developing content strategies, managing newsrooms and mentoring writers and editors. Her previous experience includes being an executive editor at the American Marketing Association and an editor at news and feature syndicate Content That Works.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does AAA travel insurance cover?

Aaa single-trip plans, aaa annual plans, which aaa travel insurance plan is best for me, can you buy aaa travel insurance online, what isn’t covered by aaa travel insurance, aaa travel insurance, recapped.

- You don't need to be an AAA member.

- Annual or single-trip policies are available.

- Can add on a Rental Car Damage protector plan.

- Cheapest option doesn't include medical coverage.

- CFAR upgrade is only available for higher-cost plans.

Before going on a trip, it's important to give travel insurance some serious thought as it can protect you if anything goes wrong on your vacation. One provider to consider is AAA Travel Insurance.

The company’s policies are administered by Allianz Global Assistance, an insurer that serves 40 million customers in the U.S. and operates in 35 countries. You do not have to be a AAA member to purchase AAA travel insurance.

AAA offers annual or single-trip policies for domestic and international travel. The policies vary by state and travel destination, so the plans available in your home area may differ from the examples shown below. Use AAA's Get A Quote tool to see your specific pricing.

» Learn more: The majority of Americans plan to travel in 2022

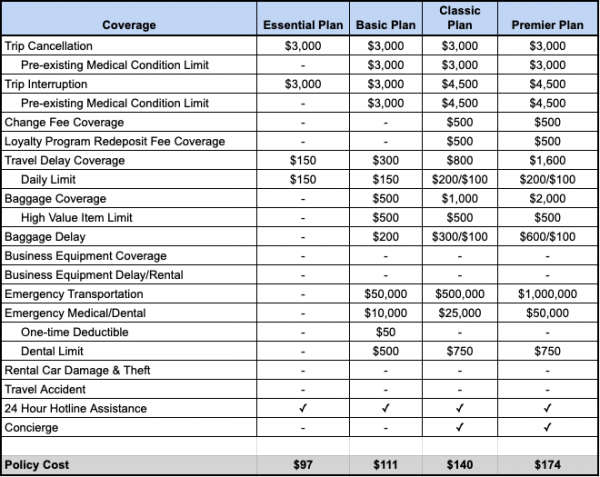

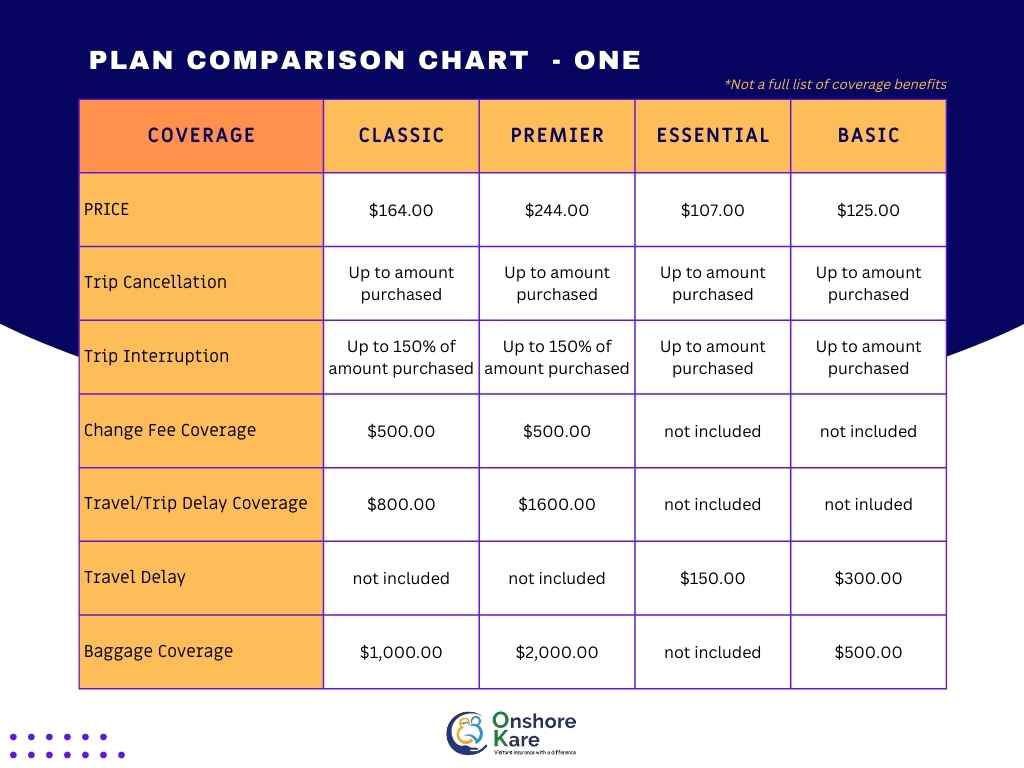

AAA’s single-trip plans are designed for travelers who are leaving their homes, visiting another destination, domestic or international, and returning. To get an idea of which plans are available, we input a sample itinerary of a $3,000, two-week trip to Spain by a 45-year-old from Indiana. For this itinerary, AAA offered four single-trip plans.

* Higher limit requires receipts to be submitted.

AAA single-trip plans cost

The Essential Plan ($97) is ideal for those who just want the basics of trip cancellation and trip interruption insurance and don't need the other protections. This is a good fit for domestic travelers who already have health coverage in the U.S. and don't plan on bringing business equipment.

The Basic Plan ($111) includes all the features of the Essential Plan, along with medical coverage and some increased protections for baggage and travel delays.

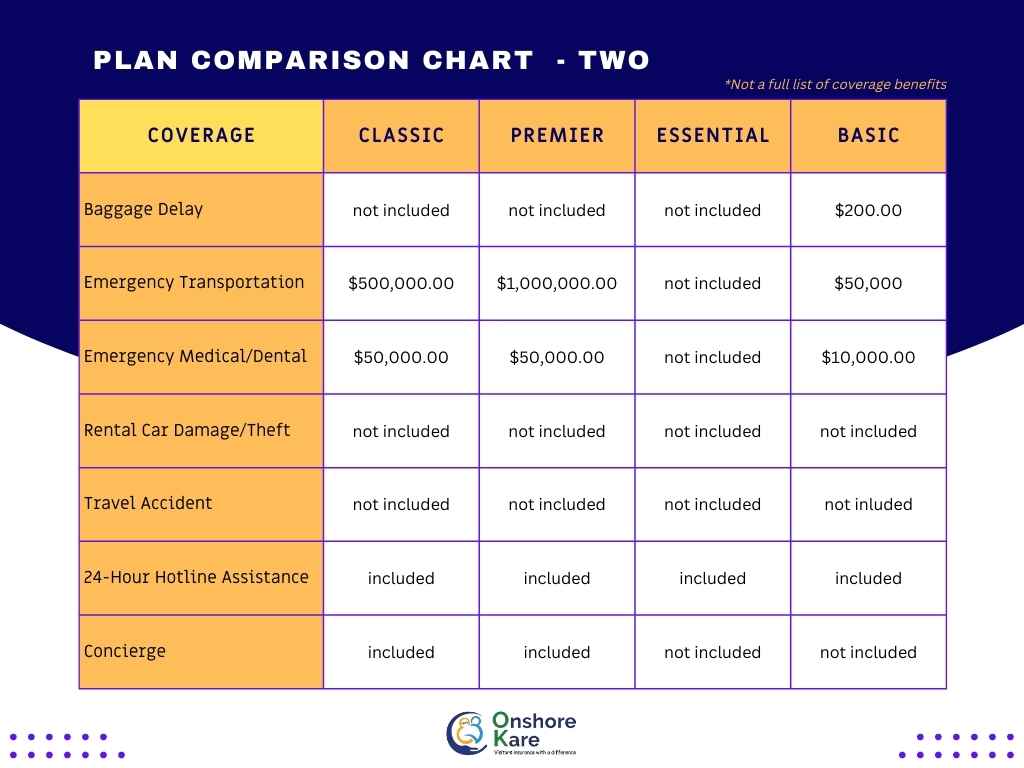

The Classic ($140) and Premier Plans ($174) are nearly identical, but the latter provides double emergency medical coverage, emergency transportation, trip delay and baggage delay limits.

The Classic Plan offers a "cancel for any reason" optional upgrade for $71, which would bring the total to $211.

There is also a Rental Car Damage protector plan for $135, which provides $1,000 of trip interruption and baggage loss coverage and $40,000 of rental car damage and theft benefits. This plan will cover your costs if the rental car is stolen or damaged. In addition, you’ll be reimbursed for the unused portion of your trip and if your bags are lost or damaged. This plan offers an alternative to purchasing coverage at the rental counter.

» Learn More: Cancel For Any Reason (CFAR) travel insurance explained

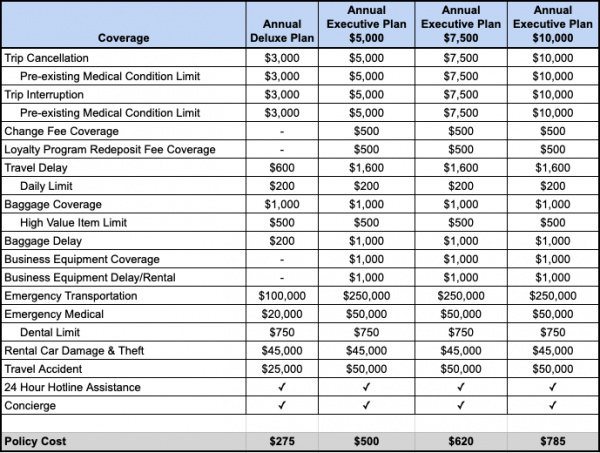

The annual policies provide 365 days of domestic and international coverage and are best suited for those who travel often. To see which plans are available, we input a $15,000 annual travel budget for coverage starting in July 2020 for a 30-year-old from New Hampshire. For this itinerary, AAA is offering four policies, with the three higher-end plans geared toward business travelers.

AAA annual plans cost

The Annual Deluxe Plan ($275) is designed for those who aren’t too concerned with pre-trip cancellation benefits or business equipment protections and are more interested in medical coverage while abroad. If you already have some travel insurance through a credit card, this plan may be sufficient.

The next three Annual Executive Plans ($500-$785) are tiered based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500 or $10,000). All the other protections under the Executive Plans are identical. All three plans include business equipment coverage as well as business equipment rental and delay protections. If you’re traveling for work, these plans may be your best bet.

Although all four of these are annual plans, no individual trip can exceed 45 days. For trips longer than 45 days, Allianz offers an AllTrips Premier plan , which provides coverage for up to 90 days per trip.

» Learn more: What to know before buying travel insurance

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re traveling.

If you have a premium travel card that already provides you with a sufficient level of trip cancellation coverage, you may only need to get a standalone emergency medical policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. Terms apply. Only the Annual Executive Plan ($10,000) has a comparable level of trip cancellation coverage.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like one of the single or annual trip plans, depending on your travel goals.

If you’re a long-term traveler and expect to take many trips, the annual plans will be the most suitable. However, with coverage for each trip capped at 45 days, you’ll want to look at other options if you will be away from home for longer.

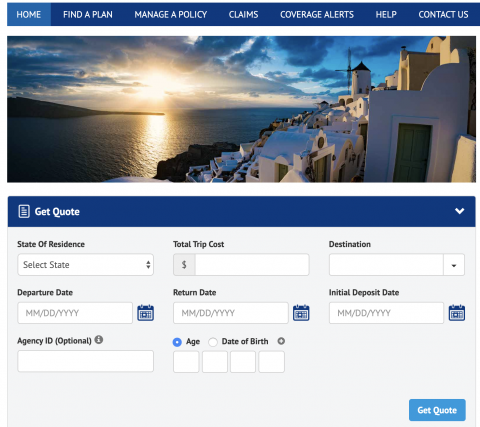

Yes, you can buy AAA Travel Insurance onlince. Head over to Agentmaxonline.com , input your trip details and choose “Get Quote” to see a list of available plans.

Trip insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Will travel insurance cover winter weather woes?

Yes. However, plan choices depend on your state of residence and trip duration. We performed various searches for sample trips and found policies for single trips and annual trips. Single-trip plans are great for travelers who are traveling from their home to a different destination (domestic or international) and then returning. Coverage ends when the traveler returns home. Annual trip plans are designed for those who want to take several trips during a specific period of time, regardless of how many times they return home during the covered period.

The cost of a travel insurance policy depends on many factors , including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit AAA’s travel insurance site and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if travel insurance is worth it .

The cost of a travel insurance policy

depends on many factors

, including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit

AAA’s travel insurance site

and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if

travel insurance is worth it

AAA was found to be one of the best travel insurance companies according to NerdWallet's most recent analysis.

Before shopping for a policy, check to see what coverage you may already have. Some premium credit cards provide travel insurance. If you hold one of these credit cards and the coverage limits are adequate, you may only need a standalone emergency medical insurance policy . However, if your credit card doesn’t cover you sufficiently, a comprehensive travel insurance plan might be the right choice. AAA offers a few plans to pick from, but the choices boil down to annual or single-trip insurance plans.

No matter what type of traveler you are, AAA offers various trip insurance options to choose from. Rates and options vary by state, so be sure to input your information into the online tool.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Travel Advice

- General Information

A Quick & Easy Guide to AAA Travel Insurance

Last Updated: May 24, 2024 May 24, 2024

American Automobile Association — commonly called AAA or Triple A — is probably best known as the organization that provides roadside assistance to its members. However, their members also benefit from AAA’s long standing partnership with Allianz Global Assistance, a leading travel insurance provider .

The good news? You don’t have to be a member to get trip coverage from Triple A, so let’s take a closer look at what you can expect from AAA travel insurance .

What Does Travel Insurance from AAA Cover?

AAA trip insurance coverage options can vary depending on your location and travel destination . The plan you choose also influences what coverage is available. That said, travel insurance from AAA often includes coverage for:

- Trip cancellations

- Trip interruptions

- Travel delays

- Trip changes

- Emergency medical and dental care

- Emergency evacuations

- Baggage loss, theft, damage, or delay

Additionally, AAA travel insurance policies also provide 24-hour assistance to help you with emergencies, ranging from lost passports to ongoing medical monitoring.

Members will also enjoy travel benefits through AAA. These may include:

- Discounts on car rentals and hotels

- Special vacation packages

- A reloadable, prepared credit card

- Assistance with visas, passport photos, and international driving permits

What’s Not Covered by AAA Travel Insurance?

AAA trip insurance policies, like most insurance policies, may exclude coverage for certain perils. For example, your injury likely won’t be covered if it occurred while taking part in criminal or high-risk activities. Intoxication and drug use might also curtail your coverage.

Moreover, your policy may not cover cancellations for some events. This often includes events that were public knowledge when you booked your trip, so check the Coverage Alerts page before you purchase travel insurance from AAA.

Finally, AAA travel insurance only covers named insured — that is, individuals specifically mentioned in the plan. That means your family members or travel companions are only covered if you name them in your policy.

Coverage details can vary, so be sure to review your policy documents before you leave for your trip.

AAA Trip Insurance Plans

AAA offers single-trip insurance plans that depend on your state of residence and destination. Requesting a quote generally returns three plan levels with various coverage options and premiums: TripProtect Deluxe II, TripProtect Select II, and TripProtect Cancel Anytime.

Each of these plans included coverage for:

- Lost document fees.

- Flight changes for covered events.

- Changes to or a missed port of call.

- Required vaccinations.

- Trip cancellations, delays, or interruptions.

- Emergency medical and dental care.

- Emergency transportation.

None of the travel plans covered rental cars, but AAA does offer an add-on to cover that cost if your trip is interrupted as well as the cost of damage or theft of your rental car.

TripProtect Deluxes has the highest coverage limits. However, the TripProtect Cancel Anytime plan is a cancel for any reason policy , which may be attractive for some trip planners.

How to Get AAA Trip Insurance Quotes

Getting a quote from AAA for travel insurance is easy. You simply go to the AAA’s travel insurance page and click the “Get your quote now” button. From there, you enter your state of residence, total trip cost, destination, departure and return dates, initial deposit date, and the ages of every traveler. Once you do this, you’ll receive information about the available plans. Be sure to click the View Plan Comparison button. This will give you a side-by-side comparison coveages and amounts.

How Much Does AAA Travel Insurance Cost?

Your travel insurance premium depends on the cost of your trip and the plan you choose. To give you an idea of what travel insurance from AAA might cost, we plugged in information for a 7-day, $12,000 trip for one traveler leaving from Illinois. Prices ranged between $505 for the TripProtect Select II plan to $704 for the TripProtect Cancel Anytime plan.

The prices for the same trip for a family of three were between $377 and $534.

Frequently Asked Questions About AAA Trip Insurance

Here are answers to some of the more frequently asked questions about travel insurance from AAA.

Does AAA Offer Overseas Travel Insurance?

AAA offers coverage for both domestic and international travel. Cancel for any reason trip insurance may be more difficult or even unavailable or some overseas travel.

Does AAA Cover Flight Cancellation?

AAA can cover flight delays and cancellations. How and when these events are covered depend on your specific policy, but travel insurance from AAA often reimburses you for meals, transportation, and accommodations if a covered event delays your flight for a minimum number of consecutive hours.

Is Allianz Part of AAA?

Allianz has been a travel insurance partner of AAA for over 30 years. The insurer holds an A+ rating from AM Best and has been accredited with the Better Business Bureau since 1991.

Is AAA Travel Insurance Worth It?

Travel insurance is almost always worth the cost, if only because it brings you peace of mind that your vacation is protected should something go wrong. But is travel insurance from AAA worth it? That depends on your particular situation.The best way to decide if travel insurance from AAA is the right coverage for you is to compare policies.

Get quotes from several trip insurance providers, and take a good look at the coverage and cost. When you find the policy that gives you the protection you need at a premium you can afford, you’ve found the right one.

Written by Virginia Hamill

The many travel benefits of being a AAA member

By AAA staff

December 15, 2023

AAA Travel is one of the largest full-service leisure travel agencies in the U.S. and works with over 100 well-known partners worldwide, but you may not realize how many travel benefits are included with a AAA membership.

AAA Travel offers discounts on rental cars, hotels, vacation packages, passport photos, other exclusive offers, as well as access to AAA Travel Advisors. We look at the many travel benefits of a AAA membership and how you can save on your next vacation by becoming a member.

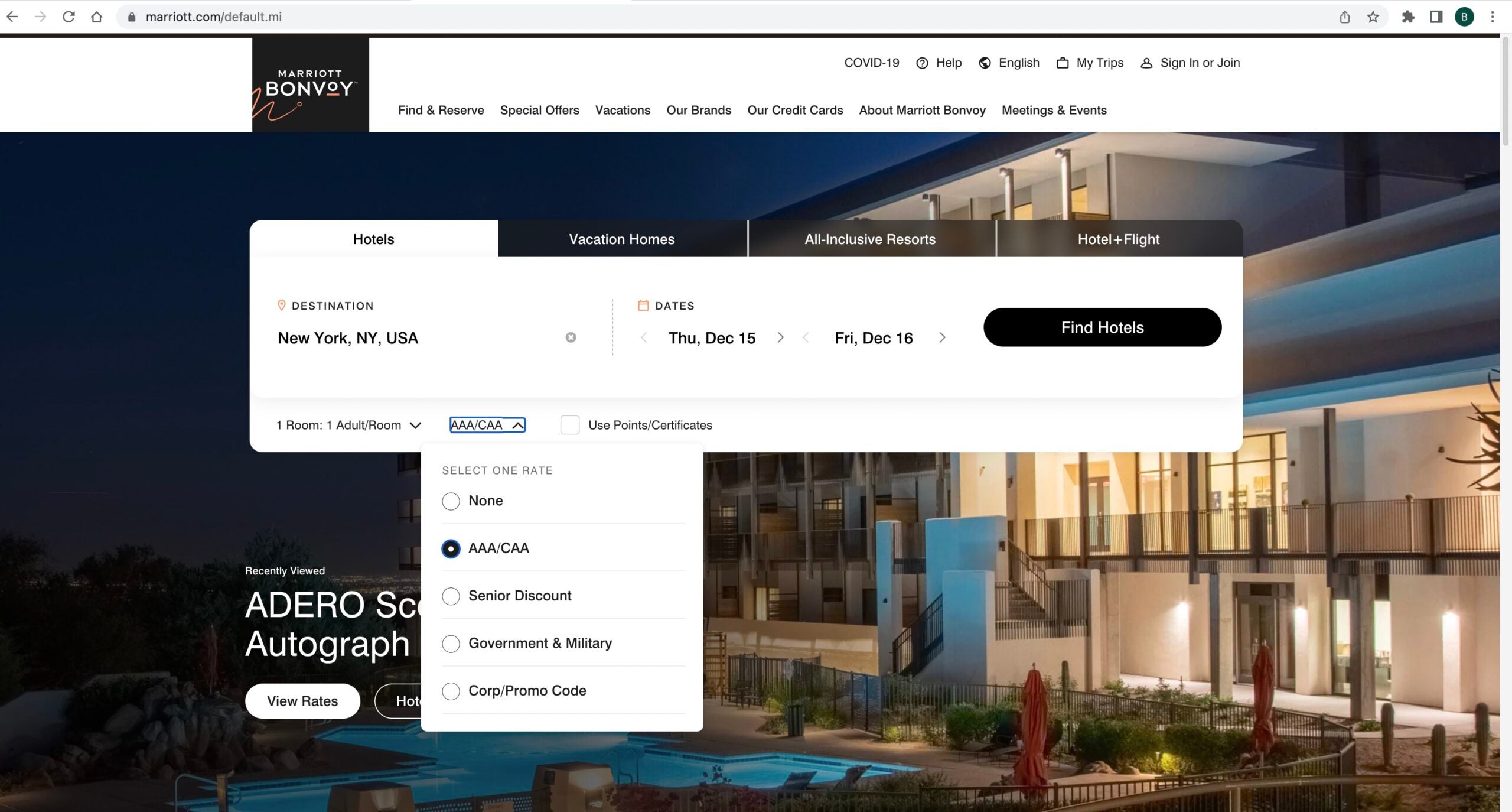

AAA hotel discounts

Whether you’re looking for a last-minute hotel or searching for deals on a future stay, AAA offers members exclusive discounts with hundreds of hotel brands such as Hilton , Hyatt , Marriott , and MGM Resorts .

Members can save 5% or more 1 by booking the exclusive AAA rate and still earn loyalty points at most hotels. Join AAA to unlock savings on everything from a budget hotel stay to suites at all-inclusive resorts in popular destinations such as Mexico and Las Vegas .

AAA rental car discounts

If your vacation includes a rental car , a AAA membership can save you 10% or more on the base rate 2 from Hertz, Dollar, and Thrifty. Members also receive exclusive access to limited-time sales and offers from these major rental car companies to save even more.

On top of those savings, AAA members also receive:

- 10% off fuel purchase options 3

- Free use of a child seat, which could save parents traveling with young children $13.99 a day 3

- Free addition of qualified AAA drivers, a savings of $13.50 daily 3

- No rental fee for young drivers ages 20-24, which is a savings of $29 each day 3

Members can also join Hertz Gold Plus Rewards to earn points and perks like a free rental day. 4

Vacation planning with AAA Travel Advisors

With personalized travel services from a AAA Travel Advisor, a AAA membership makes it easy to plan your dream vacation and save. Travel advisors can help you find member deals that may not be available anywhere else; help you book accommodations, flights, and must-do activities; as well as provide you with invaluable travel insight into a destination. Whether you’re looking to immerse yourself in history and culture, find the perfect beach to relax on, or want to travel like a local, AAA Travel Advisors can customize a vacation just for you.

Working with a AAA Travel Advisor also gives you the added peace of mind of knowing they’ll be there to help before, during, and after your vacation. Members can schedule a phone, virtual, or in-person appointment online by selecting their branch .

AAA travel deals for members

Whether your idea of a perfect vacation includes a cruise , a guided tour, flexible independent travel, a private or small-group tour, or something else, AAA members get deals and discounts on a wide variety of vacation packages , including cruises and tours.

Travel discounts on cruise packages

Join AAA to access year-round discounts; limited-time sales; and perks like onboard credits, in-room gifts, and more on cruise vacations to top destinations like Alaska, Europe, and the Caribbean. Save on packages from well-known cruise lines like Carnival Cruise Line , Celebrity Cruises , Princess Cruises , Royal Caribbean Cruises , Viking , and AmaWaterways River Cruises .

Travel discounts on tour packages

AAA members can get discounts and offers on guided tours from AAA Member Choice Vacations , Alexander + Roberts, Brendan Vacations, Abercrombie & Kent, Insight Vacations, and other top-rated tour providers. With tour packages on every continent, your AAA membership can help you completely immerse yourself in any destination with local guides who can show you authentic experiences.

Discover all the travel benefits of a AAA membership

Join AAA today

Passport photos

If you need to apply for or renew your passport before your vacation, AAA travel benefits include member discounts on passport photos . One of the most common reasons a passport application is denied is because the submitted photo fails to meet the strict government specifications on size, pose, background, and more.

Eliminate the guesswork and help ensure your passport application is approved by getting your passport photos from AAA. Members save at least 30% on a set of 2 passport photos taken at a AAA branch . 5

RushMyPassport

AAA memberships can help you get a visa or passport quickly and save with a 10% discount on expedited passport and visa services from RushMyPassport . 6 Avoid long delays and a trip to the passport office and get your passport application processed in as little as 5 business days once your documents are received. And with a personalized passport application review from RushMyPassport professionals, you can help prevent common mistakes.

AAA Travel resources & services

AAA memberships make travel planning easy with services, discounts, and amenities. Plus, members get peace of mind of knowing AAA is with them every step of the way.

International Driving Permit

Want to drive on your international trip? Requirements vary by destination. Some international countries recognize U.S. driver's licenses, but others require an International Driving Permit (IDP) to drive or even rent a car. Before driving overseas, members can conveniently get an IDP by mail or by visiting a AAA branch .

Travel insurance

A vacation can be a huge expense and Allianz Travel Insurance plans 7 from AAA can help protect you, your loved ones, and your investment. Travel with confidence knowing you have award-winning 24/7 support and protection from Allianz to help you manage any unforeseen issues that may occur before or during your trip. Get coverage for things such as trip cancellation or interruption, emergency medical care, lost luggage, and more.

TSA PreCheck

TSA PreCheck helps travelers save time and hassle at airport checkpoints. AAA partners with IDEMIA, the authorized TSA PreCheck enrollment provider, to offer members convenient TSA PreCheck enrollment events at AAA branches .

AAA Travel resources

AAA can help you get inspiration for your next adventure or spark your curiosity with insightful travel articles and the Traveling With AAA podcast . Plus, with road trip planning guides and maps , travel discounts , and a wealth of other travel resources , a AAA membership makes it easy to discover the world, wherever you want to go.

Become a AAA member to enjoy all the travel benefits and value a membership can provide.

1 Standard AAA rate discounts are not a lowest price guarantee. Actual discounts may vary, are available at participating hotels around the world and do not apply to all room types. Must present valid AAA/CAA membership card at check-in. Subject to availability and other terms and conditions. Offers subject to change without notice. If you don’t check-in to the hotel on the first day of your reservation and do not alert the hotel in advance, the hotel reserves the right to cancel your reservation and may charge you a penalty. Your credit card will be used to guarantee the reservation. The hotel will charge you directly for room and tax. If you decide not to use your hotel reservation you must cancel it according to the cancellation policy listed or you may be subject to a no-show penalty charged by the hotel. The hotel may require a deposit on confirmed reservations. Deposit amounts can vary from one night to all nights of the stay or another amount required by the hotel. If your hotel requires a deposit, they will charge the credit card provided at time of booking. In the event they are unable to charge the applicable deposit to the credit card provided, your reservation may be canceled.

2 Discounts applies to pay later base rate. Discount will vary depending on date, location, length of rental, car class & other factors. Taxes, fees, and options excluded. AAA Club Discount Code (CDP) must be included in reservation. Benefits available at participating Hertz locations in the U.S;, Canada and Puerto Rico. Twenty-four (24) hour advance reservation required.

3 AAA Club Discount Code (CDP) must be included in reservation. Benefits available at participating Hertz locations in the U.S;, Canada and Puerto Rico. Twenty-four (24) hour advance reservation required. Additional Driver and Young renter must be a AAA member, have a credit card in their own name and meet standard rental qualifications. Child safety seat is subject to availability. Gas savings is only valid when prepaid fuel option is purchased at pickup.

4 HGPR enrollment offer is for AAA members who enroll at AAA.com/Hertzgold or Premier members at AAA.com/Hertzpremier. Valid for new Hertz Gold Plus Rewards (HGPR) members only. Points will be added to HGPR members after first paid Gold rental. At the time of rental, present your AAA membership card.

5 Passport photo fee is subject to change without notice and at any time.

6 Savings applied to RushMyPassport™ service fees only. Government processing fees and shipping fees are paid separately and are not discounted. U.S. Passport and Global Travel Visa services are available online only at AAA .com/RushMyPassport. Some applications may require adjudication at a passport acceptance facility. Terms and conditions apply.

7 Must be 17 and under on plan purchase date and traveling with their parent, grandparent, or legal guardian. Not available on policies issued to Pennsylvania residents. Terms, conditions, and exclusions apply. Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance (AGA) or its affiliates. AGA compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or customerservice@allianzassistance.com .

Guide to Travel Insurance Options for AAA Members

AAA Membership is a smart investment for people taking road trips and needing help in an emergency. If you get stuck by the roadside you can call AAA!

Trip Insurance is a smart investment if you want to protect your trip from any unforeseen events like flight delays, trip cancellations, or trip interruption. If you are in a dire situation overseas you can call the concierge services if provided in your travel coverage.

A Trip Insurance policy also covers travel risks, medical risks, flight disruptions, etc. Having these risks covered adds an extra layer of protection against financial loss.

Medical Emergencies come un-invited. When you travel domestically within the United States your health insurance coverage options may protect you from such medical emergencies. During international travel, your domestic insurance may not protect you overseas, this is where travel insurance comes into play.

Travel insurance can relatively be inexpensive after taking into account how much you will have to pay out of your pocket if something goes wrong during your trip: trip cancellation, accidents, baggage loss, and medical expenses can quickly add up.

If you are still thinking if travel insurance is worth it then see The Top 10 Reasons to Buy Travel Insurance .

As a AAA member, you must be familiar with AAA Insurance, did you know that with AAA Insurance you can also consider buying AAA Travel Insurance?

Let’s get to know what is AAA, and what travel insurance options are they offering. This AAA Travel Insurance Review may help you in evaluating if this is a good option for your next trip.

For Costco Members, we have covered Costco Travel Insurance .

Table of Contents

What is AAA?

AAA (pronounced as ‘Triple A’) stands for American Automobile Association. It is a not-for-profit federation of 32 motor clubs with more than 1,000 offices throughout the United States. Established in 1902 by nine motor clubs with less than 1,500 members, AAA serves more than 61 million members today.

The AAA offers travel services such as hotels, cars, flights, cruises, and travel information, as well as member savings, automotive repair services, insurance, and financial services.

Since its founding, the association has been an advocate for motorists, safer roads and vehicles, better-educated drivers, and the rights of travelers.

Does AAA offer Travel Insurance?

Yes. AAA offers several travel insurance policies through its partnership with Allianz Global Assistance, a world leader in the travel insurance and assistance industry.

Allianz Global Assistance is a part of the Allianz Group. Allianz is of the world’s largest insurers, with 40 million customers in the United States, and operating in 35 countries.

You don’t have to be an AAA member to buy AAA travel insurance.

Note: Travelers who contracted COVID-19 before or during their trip can make use of temporary claim accommodations provided by AAA travel insurance partner Allianz Global Assistance. You can stay informed about the most recent coverage guidelines by consulting your AAA Trip Advisor. Always read the policy document carefully before you purchase travel insurance.

If you need assistance when traveling abroad, the Allianz travel insurance partner’s resources are available through the AAA Mobile app.

If you do have a AAA membership and plan to travel shortly or you are thinking of getting a AAA membership for its benefits, we cover AAA travel insurance options in this blog.

Compare Travel Insurance Plans

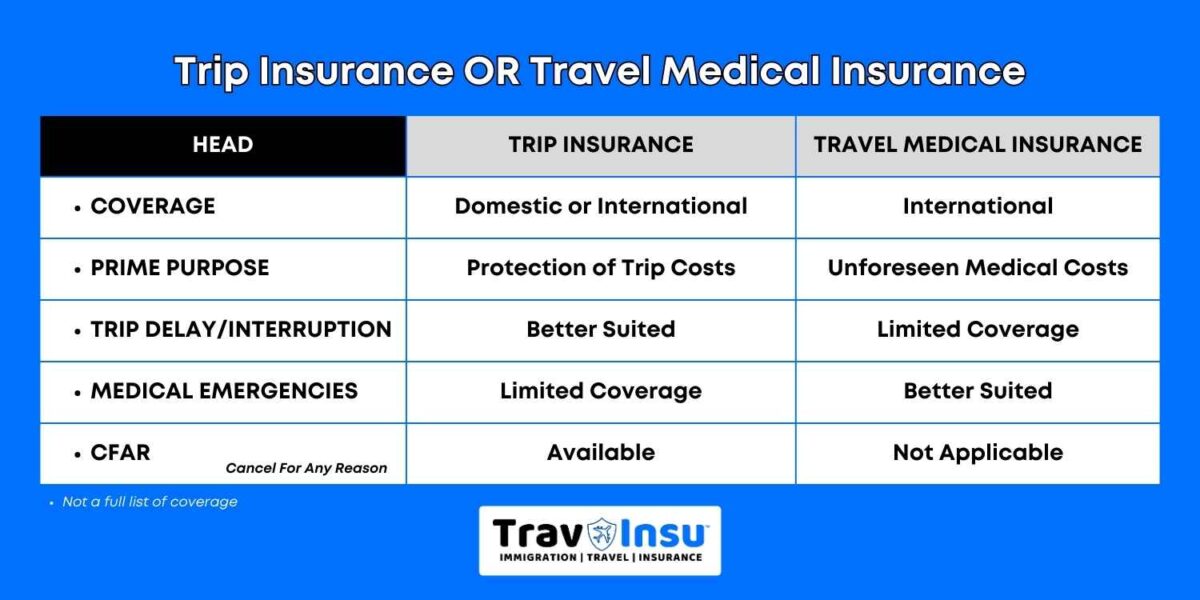

What is the Difference between Trip Insurance and Travel Insurance?

Trip Insurance and Travel Insurance are used interchangeably for buying insurance when you travel, but are these different?

There are some significant differences when it comes to Trip Insurance and Travel Insurance.

For Domestic travelers, Trip Insurance is a more suitable form of coverage option. Trip cancellation coverage and trip interruption coverage really come in handy when you need to use them.

The prime objective of TripInsurance is to offer protection to your financial investment in the Trip Costs, everything else follows.

The prime objective of Travel Insurance is to provide you protection against unforeseen medical expenses when you travel.

Travel Insurance is also known as Travel Medical Coverage or Travel Medical Insurance, it is also popularly known as Visitors’ Insurance.

You can buy either of these coverage options for a single trip or for multiple trips.

Best Travel Insurance Plans:

- Atlas America Insurance

- Safe Travels USA Comprehensive

- Safe Travels USA Cost Saver

- VisitorSecure Fixed Benefit Plan

Guide on How Travel Insurance Works? gives a detailed understanding of the benefits.

If your next trip is a group travel then our article on Travel Insurance for Groups may be of interest to you.

AAA Travel Insurance Plans and Costs

There are two types of AAA Travel Insurance Plans both for domestic and international travel:

- Single Trip Travel Insurance Plans

- Annual Travel Insurance Plans

The policies will differ by US state and the travel destination. So the plans available in your home state vary with other states. An annual plan is better suited for frequent travelers taking multiple trips a year.

Single Trip Plans

AAA’s single-trip plans will provide coverage for one trip where you are leaving home, traveling for a time (a month or less), domestic or international, and then returning home. It doesn’t matter if you go to multiple destinations as long as you leave your home and return home only once, it is considered a single trip.

AAA offers 4 different Single-Trip Insurance Plans:

- Essential Plan

- Classic Plan

- Premium Plan

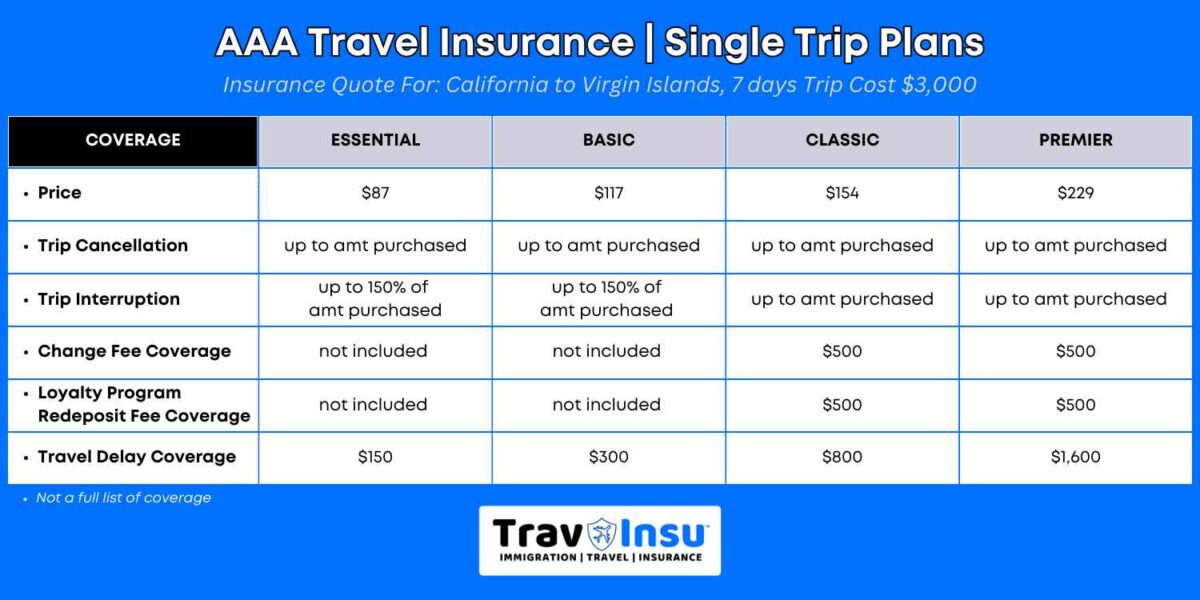

Let’s take a look at the pricing and coverage of each plan for a person aged 43-year-old traveling on a weeklong vacation from California to the Virgin Islands with a total trip cost of $3,000.

The Essential Plan ($87)

- Travel Delay: $150

The Essential Plan is AAA’s lowest-priced plan and hence ideal for the domestic traveler who just wants trip cancellation and trip interruption insurance but does not need other protection or benefits.

It has no medical coverage or evacuation benefits, and no baggage loss coverage.

If you already have health insurance in the U.S. and don’t have the plan to bring business equipment, this is a good travel insurance option.

The Basic Plan ($117)

- Travel Delay: $300

- Baggage Coverage: $500

- Emergency Medical Transportation: $50,000

- Medical Emergency/Dental Coverage: $10,000

The Basic Plan has all the features of the Essential Plan, plus medical coverage and increased coverage for baggage loss/delay and travel delays.

It offers $10k in Emergency Dental and Medical coverage which can be just enough for domestic travel if your health insurance can help out. And the $50k in Emergency Transportation may only be adequate for travel within the USA.

Out-of-state or international travel expenses could add up quickly.

This plan is an affordable option for weekend getaways and overnight trips and may not be sufficient for international destinations.

The Classic Plan ($154)

- Change Fee Coverage: $500

- Loyalty Program Redeposit Fee Coverage: $500

- Travel/Trip Delay: $800

- Baggage Coverage: $1000

- Baggage Delay Coverage: $300

- Emergency Transportation: $500,000

- Emergency Medical/ Dental Coverage: $50,000

The Classic Plan has increased coverage for Emergency Transport, baggage coverage, and travel delays, with additional features from the basic plan.

Another version of the Classic Plan is with RTW ($211.00) with the same benefits except the Medical Emergency/Dental coverage is lower at $25,000.

The Classic plan also offers a “Cancel For Any Reason – CFAR” optional upgrade at an extra cost.

The Premier Plan ($229)

- Travel/Trip Delay: $1600

- Baggage Coverage: $2000

- Baggage Delay Coverage: $600

- Emergency Transportation: $1,000,000

The Premier plan is almost identical to the Classic plan but with 2 times the Emergency Transport, baggage coverage, and limits for trip delays.

This plan is the most expensive since it offers the highest coverage options.

However, it would be beneficial to have higher medical coverage benefits. At least, $100k in medical coverage is preferable since hospitals can often charge an average of $4k per day. $50k in medical coverage will fly past quickly should you have a serious injury.

$1m in Emergency Transportation is extremely high. It is preferable to have more medical coverage instead.

Please Note: Coverage benefits and insurance premiums are subject to change, always check for current information in the plan document.

Annual Plans

The Annual Travel Insurance Plan which is also called Multi-Trip Insurance provides 365 days of domestic and international coverage from the date the policy starts (date the policy is effective).

The plan is designed for frequent travelers, especially business travelers. So if you plan to travel more than once a year, domestically or internationally, it is better to buy a multi-trip policy instead of buying separate travel insurance.

Traveling Domestic? Have you heard of Skiplagged ? Skiplagged is a travel hack used by savvy travelers to save money on their flights.

AAA Travel Insurance offers two different annual travel plans:

- Annual Deluxe

- Annual Executive

The Annual Deluxe Plan

The Annual Deluxe Plan is a good option if you don’t need business equipment protections or pre-trip cancellation benefits. But you want to have medical coverage while you are traveling abroad.

This plan is only sufficient if you already have some travel insurance through a credit card.

- Travel Delay: $600

- Baggage Delay: $200

- Emergency Transportation: $100,000

- Emergency Medical: $20,000

- Rental Car Damage & Theft: $45,000

- Travel Accident: $25,000

The Annual Executive Plan

The next three Annual Executive Plans are tier based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500, or $10,000). All the rest of the features under the Executive Plans are identical.

The three plans include business equipment coverage as well as business equipment rental and delay protections.

- Travel Delay: $1600

- Baggage Delay: $1000

- Business Equipment Coverage: $1000

- Business Equipment Delay/Rental: $1000

- Emergency Medical Transportation: $250,000

- Emergency Medical: $50,000

- Travel Accident: $50,000

If you are traveling for work frequently, these plans may be suitable for you. However, do note that a single trip in these four annual plans cannot exceed 45 days.

Rental Car Damage Protector Plan

This protector plan provides $1,000 of trip interruption and baggage loss coverage and $40,000 of car damage and theft coverage.

If the rental car is stolen or damaged, this protection will cover your expenses. If your baggage gets lost or damaged, you will also be compensated for the period of your trip that was not used. This is an alternative to purchasing car insurance coverage at the rental counter.

Which AAA Travel Insurance plan is the best?

The best AAA Travel insurance plan will depend on what type of coverage you are looking for.

Before shopping for a travel insurance policy, check what coverage you already have. Some premium credit cards offer travel insurance provided the bookings are made using the credit card. If you already have such a credit card and the coverage options are adequate, you may only need a standalone emergency health insurance policy.

For example, the Business Platinum Card from American Express offers $10,000 per trip and $20,000 per year in trip cancellation insurance. The Annual Executive Plan has a comparable level of trip cancellation coverage.

If the coverage provided by your credit card is not enough, or you don’t have credit card coverage, then you should get a comprehensive plan such as single or annual trip plans, depending on your travel needs.

AAA offers a few plans, but your choices will depend on whether you are looking for annual or single-trip insurance plans. And the rates and options will differ by state, so be sure to enter your details correctly when looking for the right plans.

If you are a Senior Traveler, you can get more information from this Senior Travel Insurance Guide .

What is not covered by Travel Insurance?

There are many benefits of buying travel insurance but you have to be aware that your insurer cannot cover you under all circumstances. Always read the policy documents carefully to understand the inclusions, exclusions, limits, and restrictions before you decide on the travel insurance policy.

You will have to pay attention to know exactly what type of coverage you are getting.

Here are some expected exclusions:

- Adventure Sports and Activities : Most travel insurance plans will not have coverage options for adventure sports like skydiving, rafting, mountaineering, bungee jumping, scuba diving, and other types of high-risk sporting activities that are life-threatening. You will be taking part in these activities at your own risk, some high-risk activity coverage may be available as add-on benefits.

- Natural Calamities: Travel insurance usually covers unpredictable natural calamities such as earthquakes, hurricanes, pandemics, etc. But if you bought the travel insurance policy after the event has already taken place or the government released the notice of the calamity, then you will not be eligible to claim for any loss or damage.

- Intentional Behavior: Losses brought on by self-inflicted harm, drug use, intoxication, and criminal activity are not part of the travel insurance coverage options.

It’s important to note that exclusions may differ depending on the policy and where you reside, so it’s always smart to read the fine print to make sure you understand what is and isn’t covered.

Frequently Asked Questions

Yes. AAA offers travel insurance in partnership with Allianz Global Assistance. However, the travel insurance coverage option will depend on your state of residence and the length of your trip. There are various options for single trips and annual trips.

Single-trip plans are the best choice for travelers who are going from their place of residence to another location (whether it’s domestic or international) and then returning. Annual trip plans are made for those who intend to take multiple travels in a year, regardless of how frequently they return home.

Is Travel Insurance included with AAA Membership?

There is no travel insurance be it international travel insurance or domestic travel insurance, included with membership, but you can purchase AAA travel insurance from their website. However, the AAA membership plan offers several benefits as we have discussed.

Does AAA offer International Travel Insurance?

Yes, international travel is covered by AAA’s travel insurance products through their partnership with Allianz Global. To check the plans that are best suited for you, you can visit the AAA travel insurance site and get a quote.

Does AAA provide international benefits?

Many international Motoring Clubs participate in AAA Global Discount Programs. Members of these clubs are eligible to get discounts when traveling internationally thanks to AAA’s international partnerships (attractions, museums, hotels, retail stores, and restaurants).

How much does AAA Travel Insurance cost?

The length of your trip, where you live, the destination you are visiting, your age, and the level of coverage you choose are just a few of the factors that influence how much your AAA Travel Insurance cost will be.

Do all Credit Cards come with Travel Insurance?

Travel insurance is not a given with all credit cards. In some cases, you might be able to pay extra to get policies like emergency medical coverage or trip cancellation and interruption through your credit card provider.

Depending on the card type and the credit card issuer, the credit card can offer a variety of insurance coverage. These are often high-end credit cards that provide travel insurance. You’ll receive information on all of the insurance’s features along with your credit card’s welcome package.

Do Trip Insurance and Travel Medical Insurance cover the same things?

Both trip insurance and travel medical insurance have similarities and distinctions between the two types of coverage. The purpose of trip insurance is to safeguard your financial investment in a trip, whereas travel insurance offers more options for medical coverage.

Does Travel Insurance Offer Coverage for Pre-Existing Medical Conditions ?

Travel insurance is designed to provide coverage for any new sickness or injury, most travel insurance plans do not cover pre-existing conditions. Some plans do offer coverage for the acute onset of pre-existing medical conditions.

Is it worthwhile to purchase Travel Insurance?

Yes, it can give you peace of mind that you will likely be covered financially if something goes wrong while on vacation. Your coverage will be useful in the event of a canceled flight, lost or damaged luggage, or medical attention in an emergency.

Most policies are not very expensive, so it is worth paying the premium to have some financial protection for your trip.

Although it’s never fun to anticipate unforeseen circumstances that can cause your trip to be cut short, think carefully before opting not to get a policy about how much risk you’re ready to accept. This will help you figure out if travel insurance is worth buying.

What is Emergency Medical Evacuation? Can I be sent to my home country during medical evacuation?

In a life-threatening situation, if you need medical evacuation, the cost of medical transportation to the nearest adequate medical facility where you can receive treatment is covered as part of your medical evacuation in an emergency. The medical evacuation generally is only to the nearest medical facility where you can receive treatment. Medical evacuation in an emergency is essential to save your life, read the policy document carefully to understand what circumstances are eligible for evacuation to your home country if your plan provides this benefit.

Is AAA membership worth it?

AAA membership offers a wide range of discounts and benefits. The perks stretch beyond automotive benefits with discounts and offers available for all types of travel including flights, hotels, vacation planning, and much more. Also, AAA offers a variety of insurance products, such as life, home, auto, and AAA travel insurance.

The main downside is that it may not be for everyone. If you are not a frequent traveler who is taking advantage of roadside assistance, emergency services, or travel discounts, the membership fee you are paying can be a waste of money. Also, the discounts are offered only by the AAA partners, so certain auto repair shops, hotels, and car rental services will not be offering discounts to AAA members.

Emergency roadside assistance may also be provided as a value-added service or an add-on at a nominal cost to your vehicle insurance policy do check with your insurance company.

Compare to the other insurers who are providing similar services, AAA insurance offerings tend to be costlier.

Ultimately, the worth of an AAA membership will depend on how frequently you plan to use their services. If you travel extensively and want to feel secure, AAA will provide you with the services you require quickly and affordably.

The Bottom Line

AAA is a great organization and they have a lot to offer. They have partnered with Allianz an insurance company of repute. Allianz is one of the world’s largest insurers and their plans are provided by AAA travel insurance. In the global insurance market, Allianz has one of the highest insurance ratings.

According to our AAA travel insurance review, the plans can be expensive and offer fewer travel medical benefits. We suggest that you shop around to find lower prices with more comprehensive travel insurance coverage. Many different insurers offer cheaper travel insurance with comparable or even greater travel perks.

Share this page:

Related articles.

What Is Deductible In Travel Insurance?

Is Travel Insurance Mandatory For Going To The USA?

INF Elite Travel Insurance For Pre-Existing Conditions

- Popular Articles

What Is Deductible In Travel Insurance?

The World Of USA Coins | Penny Nickel Dime Quarter

Aadhar Card For NRI – Application, Documents, Latest Updates

Visitors Care Insurance Information, Benefits And Eligibility

What Is Acute Onset Of Pre-Existing Conditions

A Complete Atlas America Insurance Review [2024]

Top 10 Busiest Airports In The World – March 2024

TravInsu is here to help you with all your travel insurance needs. If you are planning an international trip or thinking of inviting your parents to visit you in the United States, TravInsu can help.

- Featured Articles

- Immigration

- Privacy Policy

- Disclaimer of Liability

© Copyright 2024. All Rights Reserved. TravInsu

Is AAA membership worth it?

I've been a AAA member for more than 15 years, and I can confidently say that the perks and benefits have come in handy — especially the well-known roadside assistance benefit.

Over the years, AAA has opened up its network to provide vast options and money-saving discounts for travelers beyond roadside assistance.

I'm also partial to the regional magazine AAA produces six times a year; Arizona's is called Via and California's is called Westways. Each issue is full of travel inspiration and valuable tips. AAA even has a travel service you can use to book vacations.

How I've used AAA benefits

Living in Arizona, you can expect that your car battery will not survive more than two years due to the heat. In my case, the two-year timing always seemed to happen in August — the hottest month of the year. I have called AAA on more than one occasion to take advantage of its mobile battery service , and workers have come to my location with a new car battery.

Usually, they will test your current battery power and sell you a new one on the spot if needed. Members receive a $25 discount on batteries purchased during the on-the-spot installation. They even offer a battery warranty, so there's a chance if you purchased your last battery from AAA, your replacement might be free.

It has been a fantastic time saver and more convenient than getting jumper cables and making it to the nearest auto shop. Additionally, AAA membership covers the individual, not just the vehicle. So, you can use your membership for a service call even if you're a passenger in a stalled car.

To request 24/7 roadside assistance , use the AAA online assistance tool, call 800-AAA-HELP (800-222-4357) or you can text HELP to that same phone number and follow the prompts from there.

According to the AAA website, response time varies depending on several factors including time of day, breakdown location, and severity of the issue, and that AAA strives to provide the fastest and most efficient service possible. If you make your request online, you can track the progress of your request and the location of your technician.

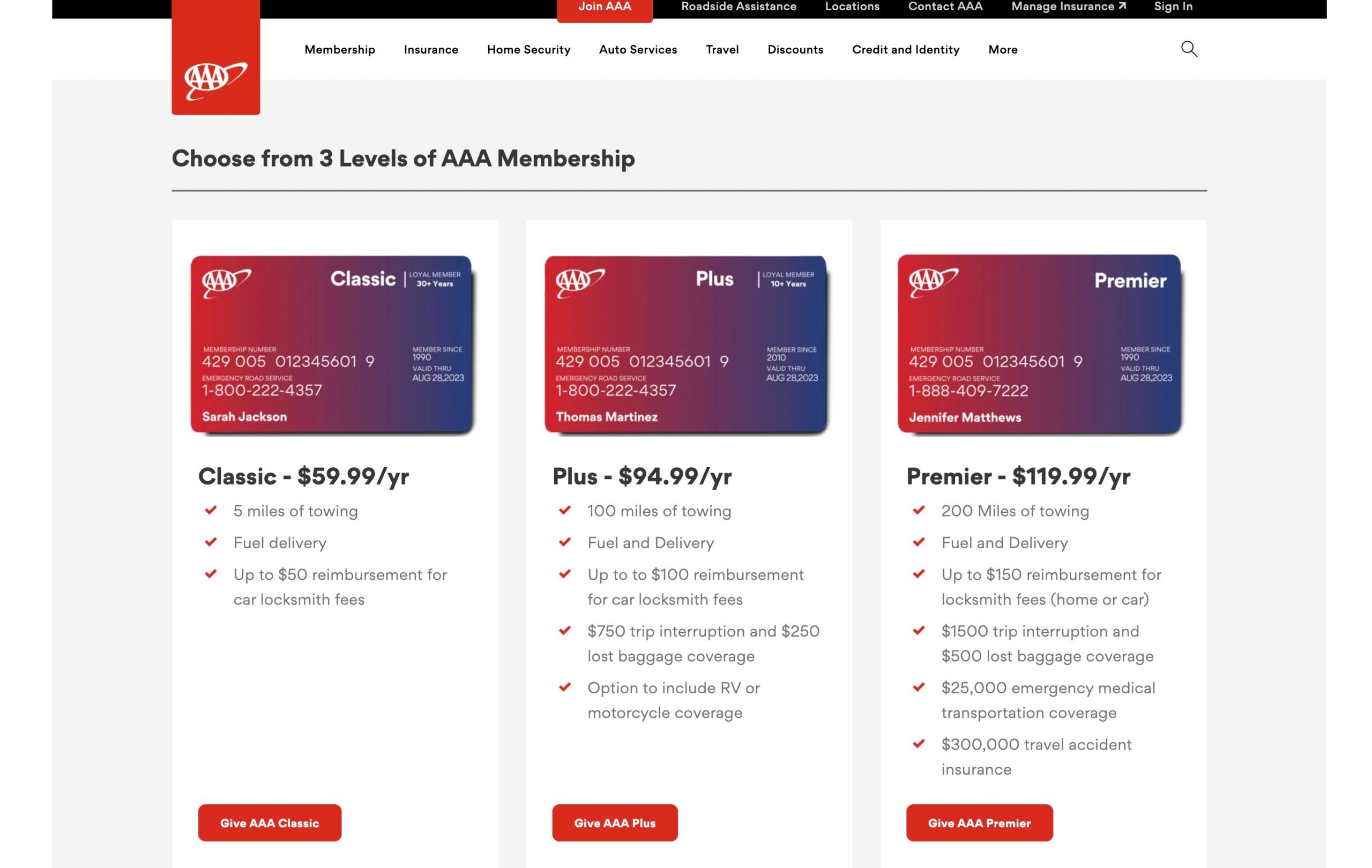

What does AAA membership cost?

Membership rates are determined by the local club and may vary, a AAA spokesperson confirmed. The pricing below is provided as an example and is based on Arizona's current club pricing.

There are three AAA membership levels based on the types of services included.

The entry-level "Classic" membership starts at just $59.99 per year. This basic option allows for 5 miles of towing, fuel delivery and up to a $50 reimbursement for locksmith fees.

The next membership level is called "Plus" and is $94.99 annually. This level will more than pay for itself if you had to use just the locksmith option which is up to $100 reimbursement. This option also includes 100 miles of towing, fuel and delivery, $750 trip interruption, $250 lost baggage coverage and an option to include RV or motorcycle coverage.

The third option, called "Premier" costs $119.99 annually and has upgraded levels of everything in the Plus membership, but also adds $25,000 of emergency medical transportation coverage and $300,000 of travel accident insurance.

Does AAA offer discounts and perks?

AAA can help you save on everything from theme park tickets to car insurance and car repair. AAA membership offers a vast network of discounts and perks when you show your card or make online reservations with certain companies that provide AAA member discounts.

Guide: 6+ unexpected travel discounts to save you money.

A quick look at the AAA merchant list for attractions, zoos, museums and tours reveals discounts for CityPass for some major U.S. cities, Legoland Discovery Centers, Busch Gardens, Six Flags Theme Parks, AMC Theatres and Regal Cinemas, to name a few. You can search by city on the website to narrow down your results.

As I navigated to the AAA website, my Rakuten browser extension popped up and offered me 8% back, so there are ways to stack offers while using your AAA membership.

AAA is a trusted name in the auto industry and not just for its roadside assistance. Auto repair shops can be AAA trust-certified which means as a consumer which means you can access this network and receive discounts on regular automotive service or repairs; the work carries a warranty for 24 months/24,000 miles. You will also get access to priority service and a minimum of 10% off labor costs.

Through AAA Smart Home you can save money on items for your home such as a home security system, smart door locks, energy-efficient thermostats and even home automation.

Many hotel companies offer AAA discounted rates which usually hover around 10% off the best available rate. If you click for rate options, you'll see a AAA rate option on many hotel booking websites.

Another way to utilize AAA perks is for car rentals — many rental companies offer AAA corporate rates which you can find using the AAA travel portal. If you are a renter under 25 , you can rent through Hertz, which specifically honors the AAA discount for younger drivers.

Can I gift AAA membership to a friend or family member?

According to the AAA website, gift memberships are available for purchase in some regions of the country: Northern California, Nevada, Utah, Arizona, Montana, Wyoming and Alaska. If the person you want to gift membership to lives in another region, you can search by zip code to find the local AAA club where they live.

Is AAA worth it?

If you enjoy saving money and getting additional home and travel perks, I recommend checking out AAA to see if it is a program you can benefit from. If you are a T-Mobile customer, see if your plan includes the Coverage Beyond program — this includes AAA membership free for customers (a $60 value).

Related: AAA tests program to allow California users to get Real ID

WhatsApp us

+1-855-652-5565

- Pre-existing Plans

- Trip Insurance

- Cookie Policy (EU)

Get Magik Insurance Services Inc. – OnshoreKare.com License# 0M14328

Contact info

- 35463 Dumbarton Ct, Newark, CA 94560, United States

- +1-855-OK-ALL-OK / +1-855-652-5565

Instive Blog

Travel Insurance for AAA Members – What are the Options?

Whether you have a AAA membership and are looking to travel in the near future or you are possibly considering a AAA membership for its benefits, knowing the travel insurance options AAA insurance provides, is useful.

Travel Planning and Need for Travel Insurance

Travel planning & booking is supposed to be easy with all the digital tools & websites thanks to the internet, but is travel planning really that easy?

Every once in a while, we require a break from all of the planning:

- Flight tickets

- Hotel accommodations

- Rental cars

- Local modes of transportation

- Packing all the luggage

- Meeting family members’ needs and comforts

- Phew…

- You need a break.

Wait a minute, are we forgetting something in the list above? Ah, yes Travel Insurance !!!

It is easy to see how things can be forgotten or overlooked when planning a trip, regardless of whether traveling with family or going with friends, or on a solo trip. In addition, costs can easily spiral out of control before you even realize it.

Getting the right coverage should be prioritized because medical emergencies come uninvited, travel delays occur quite frequently or you may need cancellation insurance in case your travel plans change.

Trip Insurance can be very helpful in protecting your financial investment at the same time also provides medical coverage options during travel.

The AAA Membership benefits

American Automobile Association (AAA) offers some fantastic discounts on a variety of goods and services, including travel insurance coverage options.

They also have travel agents who can assist you in the planning of your next trip and even offer you a variety of discounts on hotels, flights, and other costs associated with the trip.

A very important consideration though is: Do they offer the kind of travel medical insurance that can accommodate all of your specific requirements?

Like Trip Cancellation, Emergency Medical Transportation, Emergency Medical Treatment, Baggage loss coverage, Rental Car Damage, Rental Car Theft, Medical Evacuation, Concierge Services, and more…

Have a Costco membership? See Costco Travel Insurance coverage options

Does AAA offer Travel Insurance?

Yes, AAA offers travel insurance in partnership with Allianz Global Assistance which is an insurance company.

AAA Travel insurance is not an insurance company but the travel insurance plans are extended to AAA members via their partnership with Allianz Global Assistance.

Coverage is available for domestic travel and international travel and you can buy it online without needing a travel agent.

AAA insurance is able to provide customers with four different travel insurance plans.

The AAA insurance plans are:

- Classic plan

- Premiere Plan

- Essential Plan

Each plan provides a different level of coverage options.

Let’s take a look at the pricing and coverage for a person traveling on a weeklong vacation from California to New York with a total trip cost of $5,000.

The rundown of everything that comes included with each plan, beginning with the least expensive option.

AAA Travel Insurance cost & coverage options:

The Essential Plan

The Essential Plan is the most cost-effective and the Premier Plan offers the highest coverage options and is hence priced the most expensive.

Please note that travel insurance plans are subject to changes/edits, refer to the policy document for details before you purchase travel insurance.

Classis Plan

AAA travel insurance also offers a Classis Plan with RTW, we have not included Classic Plan with RTW it in the comparison above but you can check the details on the AAA travel insurance website.

They also offer annual travel plans like an annual deluxe plan, Annual Executive Plan, if you are keen to buy coverage for the year. The annual plan is suitable for someone taking multiple trips in a year, annual plans do have conditions on the number of days per trip limit.

The policy premium and coverage figures

The policy premium and coverage figures are dependent on the location within the United States from where you embark, the available options and prices in each state may vary. You can buy domestic and international coverage from AAA insurance.

For Trip Cancellation and Trip Interruption insurance, there are covered reasons defined in the policy, you need to refer to the policy document to understand all the reasons.

Read more on the Top 5 reasons to get Trip Cancellation Insurance. Please note that Cancel For Any Reason (CFAR) is usually an add-on to the policy at an extra cost.

Now the question that you have to ask yourself is whether or not this level of coverage is sufficient for your requirements.

Those who are thinking about going away for the weekend might want to consider the Basic plan.

If you have private health insurance or health insurance through your employer, you may only need $10,000 for emergency medical and dental care while traveling within the United States.

However, costs incurred outside of the state or internationally might add up to a significant amount. And in the event that you require urgent medical transportation, fifty thousand dollars might not be enough to cover the costs of an international flight and crew.

Premier Plan

Although the Premier Plan does provide more for transportation, it would be more advantageous to have higher benefits for medical coverage.

In the event that you sustain a serious injury, having travel medical coverage for at least $100,000 or more is recommended because hospital care, which costs an average of $3,000 to $5,000 per day, can quickly deplete that amount.

Frequently Asked Questions

Does aaa membership include travel insurance.

The AAA premier membership plan provides several benefits along with an option to purchase travel insurance plans in partnership with Allianz. The membership per see doesn’t provide any travel insurance policy but you can buy AAA travel insurance from their website.

Does AAA cover international travel insurance?

Travel Insurance from Allianz Global provides affordable travel insurance for any traveler from any destination outside the country. This agreement is binding.

Does AAA have international benefits?

Many international Mobility Clubs participate in AAA Global Discount Programs. They’ve partnered across all nations to provide discounts (attractions, museums, hotels, retail stores, and restaurants).

Do all credit cards have travel insurance?

It does not include insurance for travelers. Generally, these are high-end credit cards offering credit card travel insurance. Consult the Benefits Guide on your credit card for more information regarding your travel insurance coverage.

Is the Travel Medical Insurance policy and Trip Insurance Policy the same?

Both offer travel protection and the types of insurance have similarities and differences. Travel Insurance provides more medical coverage options and trip Insurance is designed to protect your financial investment in a Trip. Read more on how Trip Insurance works .

Is AAA Travel Insurance review good?

AAA rating on TrustPilot is 1.5 stars and Allianz is 3.7 stars.

The Benefits of Having OnshoreKare

At OnshoreKare, our objective is to provide you with options that make sense not only for your fundamental travel expenses but also for the specific medical requirements that you have.

It’s simple to think that “I’m healthy, nothing will happen to me” but the truth is that an emergency medical situation can occur without warning to anyone-anytime-anywhere.

Being well-prepared always helps. You might have pre-existing conditions, for which we might have solutions, and we could also provide medical coverage that satisfies the requirements of any country that you are planning to visit.

There are still COVID requirements that must be met in order to enter each country, and these must be adhered to. We are able to assist you in obtaining the appropriate coverage for the duration of your trip.

We at OnshoreKare want to make the process of planning your next trip as simple and stress-free as we possibly can as you get ready to embark on it. If you have any questions, our licensed travel insurance experts are available to help.

Get free no-obligation Insurance Quotes for Trip Insurance coverage

Travel Safe, and Stay Protected!

Not sure what you need ? We’d love to help you plan better.

- +1 - 855-652-5565

Our Company

- Privacy Policy

- Terms of Service

- Visitors Insurance

- Insurance for parents

- Green Card Insurance

- Travel Insurance

- Student Insurance

- Health Insurance

Get in touch

We’re here to listen:

- +1-855-OK-ALL-OK +1-855-652-5565

- icon_f Whatsapp +1 (417) 932-3109

- Licence No:0M14328

© 2024, All Rights Reserved by OnshoreKare

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

How to Calculate Trip Cost for Travel Insurance: The Simple Guide

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Join AAA today Membership gives you access to Roadside Assistance, Deals, Discounts, and more.

- Add Members

- Gift Membership

- Member Benefits Guide

- The Extra Mile

- Renew Expires in 28 days

AAA Visa Signature® Credit Cards

Earn a $100 Statement Credit

After spending $1,000 on your card within 90 days of account opening.

- Advice back All Advice Travel Auto Money Home Life

- Destinations back All Destinations Northeast States Southeast States Central States Western States Mid-Atlantic States National Parks Road Trips International Travel Inspiration

- Connect back All Connect Community Stories Authors & Ambassadors

- Guides back All Guides Doing Your Taxes Protecting Your Valuables Winter Driving Buying and Selling a Car Buying and Selling a Home Getting Organized Home Improvement Improve Your Finances Maintaining Your Car Saving Money Staying Healthy Traveling

- Series back All Series AAA World Garden Road Trips Member News AAA's Take Good Question Car Reviews AAA Traveler Worldwise Foodie Finds Minute Escapes

- Member Benefits

Travel Member Benefits

AAA Travel advisors can provide first-hand knowledge and recommendations you wouldn’t otherwise be able to get on your own. The greatest benefit of using AAA Travel is that as an AAA member, you’ll get access to exclusive member benefits and savings. When you book your next vacation with AAA, receive the following exclusive AAA member benefits and so much more.

- Request A Quote

- Find A Travel Agent

- Frequently Asked Questions

- Call 888-AAA-TRIP

- Why Book with AAA

Car Rentals

Dollar rent a car.

Get up to 15% savings on published retail rates on all car classes in the U.S. and Canada when booked in advance plus other exclusive Member Benefits (including free child safety seat, and extra drivers at no additional cost).

Get up to 20% savings on daily, weekend, weekly and monthly rentals in the U.S. and Canada plus other exclusive Member Benefits (including free child safety seat, extra drivers at no additional cost, and young renter fee waived).

- Additional qualified AAA drivers are FREE

- FREE use of child safety seat, infant or booster seat, a savings of $11.99/day!

- 10% off Hertz's per gallon price for Fuel Purchase Option!

- Triple rewards when you use your AAA Member Rewards Visa

Thrifty Car Rental

Get up to 10% savings on published retail rates in all car classes in the U.S. and Canada when booked in advance plus other exclusive Member Benefits (including free child safety seat, and extra drivers at no additional cost).

Receive 8% savings on published retail rates in all car classes in the U.S. and Canada when booked in advance. Receive 10% daily discount on navigation unit (GPS) at the time of rental pickup.

Terms and conditions for all member benefits: Restrictions apply. Member benefits subject to change. Member benefits may not be combinable with additional offers. See your AAA Travel Agent for full details. Membership card may be required at check-in.

AmaWaterways

Save up to $600 per stateroom, plus receive a welcome gift of a bottle of wine and box of chocolates (Europe Cruises) or $50 per stateroom shipboard credit (Asia, Colombia, Egypt & Africa Cruises). Plus, book select AAA Vacations® sailings and save an additional $200 per stateroom and get up to a $300 shipboard credit per stateroom.

- $Receive up to $300 per stateroom onboard spending credit

- $200 per stateroom savings

Get up to a $150 shipboard credit per stateroom when booking Club Ocean view staterooms or above on select sailings. Plus, book a AAA Vacations® and receive $200 per stateroom onboard credit.

- $200 per stateroom onboard spending credit

Member benefits are made at the discretion of Azamara Club Cruises, based on sailing date and booking window, and may be changed.

Book a Fun Select rate and get up to a $200 onboard credit. Or book a select AAA Vacations® sailing and get a 2-category upgrade, 50% reduced deposit, and up to a $75 shipboard credit per stateroom.

Applicable only with FunSelect Fares and may be capacity controlled.

Celebrity Cruises

Get up to a $175 shipboard credit per stateroom when booking an ocean view stateroom or above. Galapagos departures are excluded.

- Priority check-in on day of embarkation

- Up to $100 per stateroom onboard spending credit

Member benefits are made at the discretion of Celebrity Cruises, based on sailing date and booking window, and may be changed.

Get up to a $900 shipboard credit per stateroom (based on stateroom category and sailing length). For sailings departing now through April 30, 2025, you'll also enjoy enhanced afternoon tea service, and complimentary dining in either of Cunard’s alternative dining restaurants on select sailings.

- Up to $400 per stateroom onboard spending credit

- Enhanced afternoon Tea Service for two

- Complimentary dinner in Kings Court or Lido specialty restaurants (first two guests in stateroom)

Holland America Line

Get a $50 onboard credit per person for the 1st and 2nd guests in your stateroom on select sailings. Plus, book a AAA Vacations® sailing for another $50 onboard credit per person for the 1st and 2nd guests in your stateroom and $50 Denali Dollars per person for first two guests on Alaska Cruisetours Verandah staterooms and above.

- Pinnacle Grill Dinner (for two)

- Canaletto Dinner (for two)

- $50 per person beverage card

Hurtigruten

Get 90 Euro per person onboard credit for all sailing dates except: Hurtigruten Norwegian Coastal Express (300/600 NOK) or MS Santa Cruz II Galápagos sailings ($100.00 USD per person).

- Pre-paid gratuities for first two guests in stateroom

- Wine tasting for first two guests in stateroom

AAA Vacations® amenities only valid in ocean view stateroom or higher.

Oceania Cruises

Receive up to $100 onboard spending credit on all sailings when booked in a verandah category and above. For AAA Vacations sailings, the first two guests in the stateroom also receive free Pre-Paid Gratuities.

Get a $100 shipboard credit per person on all 2024 sailings.

Princess Cruises

Each quarter, book select sailings with reduced deposits and enjoy a complimentary Princess Medallion Clip (first two guests in the stateroom). Book a AAA Vacations® sailing, in a balcony, mini-suite, cabana or suite stateroom, and get up to $150 onboard credit per stateroom and a $50 shore excursion credit per stateroom.

- Dinner for two in a specialty restaurant (first two guests in stateroom)

Regent Seven Seas Cruises

Enjoy up to $200 per suite onboard spending money on select sailings. Or, book AAA Vacations® departures, and get up to $500 onboard credit per suite.

- Complimentary Regent Choice shore excursion

- Private cocktail party

Royal Caribbean International

Members get a complimentary bottle of sparkling wine and a plate of six chocolate covered strawberries delivered to their stateroom prior to departure and up to $100 per stateroom complimentary onboard credit for balcony and above stateroom categories. Plus, book a balcony or above stateroom on any 7-night or longer sailing and get one free 8x10 or digital photo per stateroom.

- Dinner for two in a specialty restaurant on select sailings

- Bottle of sparkling wine delivered to your stateroom

Member benefits are made at the discretion of Royal Caribbean International, based on sailing date and booking window, and may be changed at any time.

Seabourn Cruise Line