RBC Avion : How to Use Your RBC Avion Points for Travel Rewards

RBC Avion Rewards Credit Cards

There are several RBC Avion credit cards part of the Avion Rewards program . One of the best is the RBC Avion Visa Infinite Card .

It has excellent insurance, including one for mobile devices, which is rare. In addition, as a welcome offer, it offers a lot of points with little effort.

Other cards that earn Avion Points are:

- RBC Avion Visa Infinite Card

- RBC ION+ Visa Card

- RBC ION Visa Card

- RBC ® Avion ® Visa Infinite Privilege* Card

- RBC Avion Visa Platinum

- RBC Avion Visa Infinite Business Card

- RBC Avion Visa Business Card

With this offer for the RBC Avion Visa Infinite Card, you can earn 35,000 Avion points upon approval and 20,000 bonus points when you spend $5,000 within 6 months of approval.

You can use your Avion Rewards points for travel or redeem them with other loyalty programs such as :

- American Airlines AAdvantage

- British Airways Executive Club (and Qatar Airways Privilege Club)

- Cathay Pacific Asia Miles

- WestJet Rewards

The current welcome offer, for example, gives you the equivalent of 55,000 British Airways Avios or 550 WestJet Dollars .

With the RBC Avion Visa Infinite Card, you earn 1 point per dollar and 1.25 points for travel purchases.

What’s more, you’ll benefit from a wide range of insurances: trip cancellation and interruption insurance, out-of-province or out-of-country emergency medical care insurance, collision and damage insurance for rental vehicles, and mobile device insurance.

How to Use Your Avion Points for Travel Rewards

Use the fixed fare chart for airline tickets.

One way to use your Avion points for travel is with the purchase of an airline ticket. This is the best way to get the most value out of the RBC Avion Rewards program . This is described in detail in this article .

Depending on the destination, 15,000 to 100,000 Avion points are required per ticket.

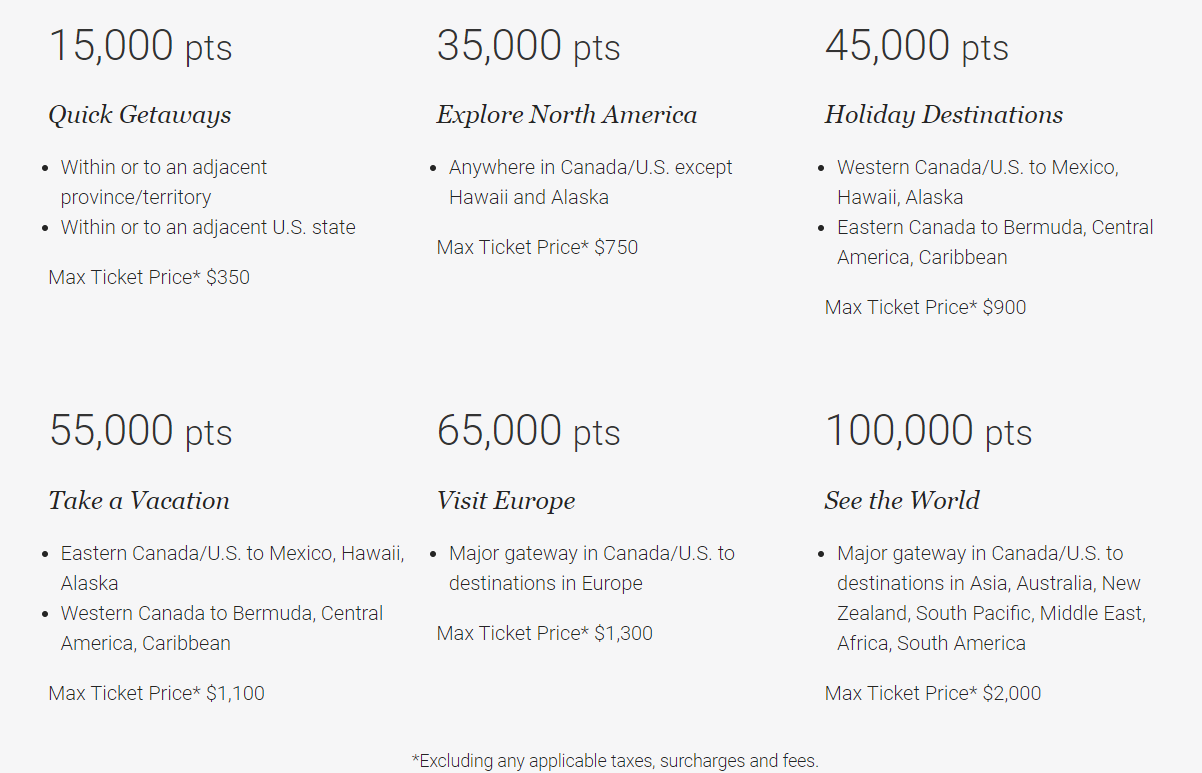

RBC Avion Rewards points can be used to travel anywhere in the world with a round-trip ticket. A one-way trip requires half as many Avion points. Here is the airfare table for a round-trip flight:

On average this equals about 2 cents per Avion point .

Use the Flexible Fare Chart for Airfare

The Flexible Fare Plan uses 100 Avion points for a $1 discount on your airfare. The transaction must be made directly on the Avion Rewards website, using the flight search tool.

For example, with the flat rate fare, 35,000 points will get you a round-trip ticket anywhere in Canada and the U.S., up to a value of $750.

If you choose to purchase that same $750 ticket with the flexible fare structure , you will need 75,000 points. So using the flexible fee schedule would be more of a disadvantage in this case. It’s up to you to make your calculations, depending on the number of points you have banked.

Redeem Avion Points for Any Trip

For even more flexibility, book your hotel, car rental, cruise or airline tickets as you wish on the Avion Rewards site to have your account credited.

Avion credit cardholders can redeem 100 Avion points to deduct $1 from this travel expense. For example, for a night at the hotel that cost $200, 20,000 points are required to bring the balance down to zero.

For ION and ION+ credit card holders, it’s different. They redeem their points using a conversion rate of 172 points = $1.

Buy Gift Cards

There are approximately 250 gift cards to purchase with Avion points. About ten of these geared towards travel. For example, buying a gift card for future stays at Fairmont or Best Western hotels. Or Tim Hortons, for roadtrips !

Generally, the cost is 1 cent per Avion point, so 5,000 points for a $50 gift card .

Uber is different, with 7,000 points for $50.

Transfer to Other Airline Loyalty Programs

Did you know that it is possible to transfer your Avion points to other airline loyalty programs? We explain how in our tutorial on this subject:

Another way of exchanging RBC points in the event of technical problems

Occasionally, the Avion Rewards site may experience technical difficulties or your flight may not appear in the search results.

During that time, call Avion Rewards Customer Service at 1-800-769-2512.

- Get an authorization number to book the flight you want;

- Book your own flight directly on the desired airline’s website;

- Send an e-mail to [email protected] with your authorization number obtained earlier from Customer Service, your name, the number of tickets reserved, proof of ticket purchase and itinerary details.

Avion Rewards will then deduct the required points from your RBC Rewards points account to credit the cost of your airline tickets, according to their fare structure.

Frequently asked questions about the Avion Rewards program

How many avion points are needed for a free airline ticket.

Depending on the destination, 15,000 to 100,000 Avion points are required.

Can I buy a ticket for another person?

Yes , make sure that the person’s personal information is written down perfectly at the time of booking.

What is the definition of a basic Avion Rewards account?

These are the people enrolled in the Value Program , who earn Avion Rewards points.

Where can I redeem my Avion Rewards points for travel?

Go to the site Avion Rewards or click on the Avion Rewards icon in your RBC Direct Banking session. Then go to the Travel section.

All posts by Caroline Tremblay

Suggested Reading

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Living Not So Fabulously

- Decoding Retirement

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

"leave limits behind" with avion rewards: expanded program features available to all canadians, regardless of where they bank.

All members can now earn and redeem Avion points, get cash back, access exclusive experiences and more

TORONTO , March 11, 2024 /CNW/ - Avion Rewards , Canada's largest proprietary loyalty program, has launched expanded benefits for its newest membership level, Avion Select, free for all Canadians to join regardless of where they bank. Avion Select members can experience a wide breadth of program features, including up to 40% cash back deals, offers from over 2,400 retailers and brands, the ability to earn Avion points and redeem for virtually anything and much more.

"Accessing value and savings has never been more important for Canadians, and by enabling all of our members to shop, save, earn and redeem, we've created a more inclusive program that offers them limitless choice, freedom and flexibility," said Niranjan Vivekanandan, senior vice president and head, Loyalty & Merchant Solutions, RBC. "By transforming Avion Rewards and expanding the scale and breadth of our program, we're able to deliver an end-to-end loyalty experience that brings everyday value to millions of more Canadians while also increasing reach and access for our retail partners."

Avion Select members can join Avion Rewards and access the following unique features:

Earn points that can be used for virtually anything. Earn cash back and points that can be used for virtually anything, including gift cards, merchandise, travel and more. By linking their payment card, members will earn cash that they can transfer to any Canadian bank account once they've reached savings worth $15 .

Get unique value and savings of up to 40% from over 2,400 retailers and brands. Avion Rewards members can save and access value on everyday purchases from partners including Metro, Petro-Canada, WestJet, DoorDash, Rexall and McDonald's Canada . Members will also benefit from the program's innovative and award-winning shopping companion, Avion Rewards ShopPlus, which eliminates the need to hunt for deals by presenting offers from top brands and more retailers than any other savings platform in Canada.

Access exclusive experiences. Being an Avion Rewards member also means exclusive access to exciting events and contest opportunities, including the chance to win tickets to Taylor Swift | The Eras Tour . As the Official Financial Services Partner and an Official Ticket Access Partner of Taylor Swift | The Eras Tour in Canada, RBC and Avion Rewards are giving away hundreds of tickets leading up to the Canadian leg of the tour.

Access to Avion Rewards Travel. Avion Rewards is one of the largest travel platforms in Canada and members benefit from the program's market-leading "any airline, any flight, any time" travel offering, with no blackout periods or seat restrictions. Avion Select members will now have access to this leading e-travel portal as well as the flexibility to book travel with points, credit cards or both.

To showcase the full breadth of the program and its differentiated benefits, Avion Rewards has just launched " Leave Limits Behind ", a bold new marketing campaign that will run nationally across mainstream media, including TV, digital and social. The campaign highlights the flexibility and choice that is central to Avion Rewards, which millions of members have grown to love and is now available for all Canadians to access and experience.

"With our Leave Limits Behind campaign, we're highlighting the limits that consumers often face with traditional rewards programs, while with Avion Rewards, they can get it all – cash back, points and savings – all in one program," said Carolyn Hynds , vice president, marketing, Avion Rewards. "Through our new campaign, we're bringing this insight to life in a fun and playful way and we're excited for more Canadians to see what Avion Rewards has to offer."

Canadians who hold an eligible RBC product will continue to enjoy even more benefits through the program's two additional tiers: Avion Premium and Avion Elite.

To become an Avion Rewards member, Canadians can simply sign up using their email address. For more information visit avionrewards.com or download the Avion Rewards mobile app .

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 94,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada's biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 17 million clients in Canada , the U.S. and 27 other countries. Learn more at rbc.com .

We are proud to support a broad range of community initiatives through donations, community investments and employee volunteer activities. See how at rbc.com/community-social-impact .

About Avion Rewards

Avion Rewards is an award-winning internationally recognized loyalty and consumer engagement platform that provides Canadians with the flexibility to shop, save, earn and redeem for everyday merchandise, aspirational rewards and experiences. Its exclusive shopping companion, Avion Rewards ShopPlus, enables members to access offers seamlessly, saving them time and money right where they shop online. Additionally, as one of the largest travel providers in Canada , Avion Rewards makes it possible for members to benefit from the program's market-leading "any airline, any flight, any time" travel offering, as well as its flagship Avion credit cards and concierge service. Learn more at avionrewards.com .

SOURCE RBC Royal Bank

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2024/11/c9614.html

The Ultimate Guide to the Avion Rewards Program for Canadians

By Meagen Seatter | Published on 24 Jul 2023

When it comes to credit card reward programs aimed at travellers, Aeroplan is likely the first to pop into most Canadians’ minds. However, the Avion Rewards Program might be more attractive if you primarily travel within Canada. Avion points are easy to collect and redeem for travel rewards, merchandise and more. Members can even transfer their points to other airline loyalty programs.

Avion Rewards are exclusively available to RBC customers, so it’s not as well-known as Aeroplan or Air Miles. Here, we’ll break down how the Avion Rewards Program works, discuss point value, and reveal what kinds of rewards are available to point collectors.

What is the Avion Rewards Program?

The Avion Rewards Program is a reward program owned and operated by the Royal Bank of Canada. It is sometimes referred to as RBC Rewards, an RBC loyalty program previously offered to non-Avion credit cardholders but no longer exists. RBC Rewards was renamed ‘Avion Rewards’ on August 25, 2022.

Cardholders can join Avion Rewards if they hold a select RBC Avion credit card. Travel rewards, discounts at partner retail stores, and using your points to bank with RBC are just a few features that make RBC Avion credit cards a great choice for Canadians, especially those who love to travel.

The program has two tiers; Avion Premium and Avion Elite. RBC ION credit card holders are at the Premium level, while RBC Avion cardholders have access to the Elite level. For this article, we will focus on Avion Elite, which gives members the option of redeeming their points for travel rewards.

How The Avion Rewards Program Works

The major difference between the two tiers is how collectors can redeem their points. Cardholders of either tier can trade Avion Reward points in for WestJet Dollars or Hudson Bay Rewards . Avion Elite Rewards collectors, on the other hand, have access to the Avion Reward Travel Center. Here, members can cash in a set number of points for flights worldwide. Different regions require a different amount of points. For example, a quick trip to an adjacent province or state requires just 15,000 RBC Avion Reward points, while a getaway to a European destination requires 65,000 points. Holidays to far-flung destinations like Australia or the Pacific Islands cost 100,000 points.

Here’s a quick peek at RBC’s Air Travel Redemption Chart:

The number of points required to travel is set by region and covers a maximum base fare only. So, for example, if you want to travel from Alberta to British Columbia, you can cash in 15,000 points for a ticket that costs up to $350, excluding taxes and fees. If a ticket costs more than that, you’ll have to pay out of pocket or cash in more reward points. Also, taxes, surcharges, and other fees charged by the airline that are not included in the exchange rate will have to be paid either out of pocket or you can use the ‘Pay with Points’ option and cash in your Avion Rewards points at an exchange rate of 100 points = $1 CAD.

While on the surface, it may seem like the Avion program doesn’t provide good value (after all, your ticket from Alberta to B.C. costs 15,000 points even if it costs less than $350, too), one major advantage to the program is that it lets collectors travel on any airline, anytime. Unlike other reward programs that blackout peak travel times or place other limits on when you can use your travel rewards, with Avion Rewards, there are no black-out dates or seat or airline restrictions. Plus, rewards aren’t limited to airline tickets; you can use your points like cash to pay for any travel-related expenses, including hotels, car rentals, and even taxes and fees. Points are converted at a ratio of 100 points for $1 CAD. Avion points can also be converted to West Jet Dollars at the same conversion rate.

Are Avion Points Valuable?

The value of Avion Reward points depends on how you use them. If you can find a flight that falls within the sweet spot of Avion’s flight redemption schedule, points hold more value than if you were to convert them to West Jet Dollars or pay with points as cash. The flight redemption schedule can make Avion Reward points incredibly valuable – up to 2.33 cents per point if you can find a ticket that falls within the right price range – it can also have the opposite effect if you can’t find a reasonably priced ticket to where you want to go when you want to travel.

That brings us to the second, and arguably the most valuable, difference between Avion’s two tiers. Avion Elite members can also trade their Avion Reward points for points with 3 other frequent flyer programs:

- American Airlines AAdvantage

- Cathay Pacific Asia Miles , and

- British Airways

This handy feature greatly expands the range of destinations collectors can visit with Avion Reward Points. That flexibility alone adds value to the program, even if transferring them gives them a lower monetary value than they have using the Avion grid.

Avion points can be traded for British Airways and Cathay Pacific Asia Miles at a ratio of 1:1. The exchange rate for Avion Rewards to AAdvantage points is 10:7. Still, being able to transfer points to a different rewards system is a major advantage of the Avion Rewards Program, especially for Canadian travel hackers looking to stretch the value of a point as far as it can go.

The bottom line is that Avion points can be very valuable when leveraged correctly. However, their value changes depending on where you’re travelling. Long-haul flights within Canada typically yield the greatest return. For shorter flights, the value is almost on par with Avion’s travel purchase exchange rate of 1 cent per point. Collectors must do a little research before booking to get the highest value from their points.

How To Transfer Points

The flexibility to transfer points to other reward programs is one of the best features of the Avion Rewards Program. To complete a transfer, you’ll need to sign in to your RBC Online account. Underneath your account information, click ‘Avion Rewards’, and you’ll be taken to the Avion Rewards page.

At the top of the screen, you’ll see a row of options. Click ‘Transfer,’ and you’ll be shown a list of all of Avion’s available transfer partners. Simply click the program you want to transfer your points to and allow 4 weeks for the transfer to complete.

Ways to Collect Avion Points

The only way to accumulate Avion Reward points is with an RBC Avion credit card. For every $1 charged to your card, you’ll get between 1 and 1.25 Avion Reward points. Qualifying purchases earn extra points, and new cardholders will get bonus points just for being approved. There are 6 Avion Rewards cards available through RBC to choose from, but we’ve compared their best credit cards in the next section. All 3 are currently offering a welcome bonus of 35,000 welcome Avion Reward points.

Top 3 RBC Avion Credit Cards

Rbc avion visa infinite.

The RBC Avion Visa Infinite card earns you 1.25 Avion points per dollar spent on all travel-related purchases and 1 point per dollar spent on everything else. This card is by far the best travel credit card on the list. Although the annual fee of $120 is steep, the features (like 12 types of comprehensive insurance, including travel and mobile phone coverage) are well worth the cost, and it has reasonable income requirements.

RBC Avion Visa Platinum

The RBC Avion Visa Platinum credit card is very similar to the Avion Visa Infinite, but if you don’t make a lot of travel purchases, this one might be a better fit. It also doesn’t have any income requirements, so it’s a good option for part-time or freelance workers. With this card, you’ll earn 1 Avion point for every dollar spent on all purchases.

RBC Avion Visa Infinite Privilege

The RBC Avion Visa Infinite Privilege card has the highest earning potential of the 3, with 1.25 points on all purchases. However, at $400 per year and a minimum income requirement of $100,000, it’s also the most expensive RBC Avion credit card on this list and slightly out of reach for the average Canadian. However, by shelling out for this card, you’ll be rewarded with some lofty perks like a free Priority Pass membership and 6 free airport lounge passes, dedicated parking at Canadian airports, priority service at airport security, and extensive insurance across a range of categories. You’ll also be able to redeem your Avion Reward points for travel expenses at a rate of 100 points = $2 CAD.

Ways to Redeem Avion Reward Points

There are a number of ways to redeem your Avion Reward points, including travel rewards, credits for travel-related expenses, banking, and shopping.

To redeem your points for travel, you’ll first need to sign into your RBC account. Navigate to the Avion Rewards tab to be taken to the Avion Rewards homepage, where you can redeem points for flights, hotels, vacation packages and more. You can also book travel through the Avion Rewards Travel call centre, but a $30 fee applies to all bookings.

If you want to convert your points and redeem them through a different reward program, you’ll need to navigate to the ‘transfer points’ section of the Avion Rewards home page. Follow the prompts to make the transfer to your selected airline program. After the conversion is complete (which can take up to 4 weeks), you’ll redeem points through the airline program’s website.

Avion Elite members can make credit card payments, pay back purchases with points, and use points to pay other eligible bills like the Internet and TV. Points can also be used to send Interac e-transfers, pay down loans and invest with RBC.

Using the Avion Rewards website, app, the RBC Rewards homepage, or the RBC Launch app, you can use your points to purchase products from brands such as Apple, Best Buy, Dyson, and more, either in-person or online. There is also a browser extension called Avion Rewards ShopPlus that automatically searches the web and finds deals suitable for you.

Additionally, you can use your points to purchase gift cards from partner retailers like Amazon, Petro-Canada and Lululemon or donate them for cash value to charities like Ronald McDonald House or the Canadian Olympic Foundation.

Meagen Seatter

Avion Rewards

Avion Rewards is a powerful points program offered by Royal Bank of Canada (RBC) and is easily one of the best loyalty programs among all financial institutions in Canada. These points can be redeemed for travel, gift cards, transferred to frequent flyer programs, and much more.

There are two types of Avion Rewards points that are earned from different families of credit cards:

- RBC Avion Elite points (higher tier)

- RBC Avion Premium points (lower tier)

RBC Avion Elite points can be redeemed for travel and also transferred to all airline partners, while RBC Avion Premium points have more restrictions.

RBC credit cards that earn Avion Elite points will have Avion in their name, such as the RBC Avion Visa Infinite credit card. On the other hand, there are RBC credit cards that earn Avion Premium points such as the RBC ION+ Visa credit card.

Throughout this page, we will use the term “Avion Rewards” to refer to both tiers of points to be consistent. However, we will note any differences between the two sets of points in the relevant sections below.

Earning Avion Rewards Points

There are two main ways in which you can earn points in the Avion Rewards program: credit card welcome bonuses and organic credit card spending.

Credit Card Bonuses

The most effective method to earn Avion Rewards points is through earning the welcome bonus on an Avion Rewards credit card.

The most popular Avion Rewards credit cards are the RBC Avion Visa Infinite card and the RBC Avion Visa Platinum card as they tend to offer the most bonus points and benefits for the lowest annual fee. Both of these cards also earn Avion Elite points, meaning they can easily be transferred to partner frequent flyer programs where you will receive the most value for your points.

The RBC Avion Visa Infinite card earns Avion Elite points and gives cardholders the opportunity to earn 1.25x Avion Elite points on all travel purchases. In 2024, we awarded this card as the Best Flexible Points Travel Credit Card.

Check out our RBC Avion Visa Infinite card review for more details.

Credit card bonuses may also be earned through product switching .

Credit Card Spending

The majority of RBC credit cards that earn Avion Rewards points have a standard earning structure in that a set amount of points are earned for every dollar spent on all everyday purchases with no extra points for spending in specific categories (such as groceries or transportation).

The table below captures all credit cards in Canada that earn Avion Rewards points.

There is one exception as some Avion Rewards credit cards, such as the RBC Avion Visa Infinite card, will earn 1.25 points for travel purchases. On the other hand, the RBC Avion Visa Infinite Business card and the RBC Avion Visa Infinite Privilege card earn 1.25 points on all purchases.

Converting Avion Premium Points to Avion Elite Points

The majority of Avion Rewards earning credit cards earn Avion Elite points, however, both the RBC ION+ Visa card and RBC ION Visa card earn Avion Premium points. These points are much more restrictive when it comes to transferring to frequent flyer programs, as they can only be transferred to WestJet Rewards.

However, cardholders can easily convert their Avion Premium points to Avion Elite points. All that is required is that a customer holds both an Avion Premium points earning credit card and an Avion Elite points earning credit card at the same time. Cardholders can then transfer their Avion Premium points to their Avion Elite points credit card, such as the RBC Avion Visa Infinite card, to effectively convert them to Avion Elite points.

Utilizing this trick is an easy way to get more out of your Avion Rewards points, as this will unlock the ability to transfer to any of the listed frequent flyer partners.

Redeeming Avion Rewards Points

Avion Rewards is a highly flexible points program and can be redeemed for travel in a variety of ways, as well as redeemed for other types of rewards including financial rewards, merchandise, and gift cards.

As with most bank point programs, travel provides the highest redemption value. Avion Rewards can be redeemed for travel in three ways:

- Air Travel Redemption Schedule (Fixed Travel)

- Flexible Travel Reward

- Transfer to Airline Partners

Air Travel Redemption Schedule (Fixed Travel)

The RBC Air Travel Redemption Schedule provides the greatest value for redeeming Avion Rewards points for flights. However, as the name suggests, there are a few more rules to follow when redeeming your points this way. First of all, you can redeem Avion Rewards for one-way, round trip, and multiple destinations flights.

How many points are required for redemption through the Air Travel Redemption Schedule is fixed and based on the particular destination, according to the chart below. For a given destination, there is a maximum ticket price that the points can be redeemed for – this does not include taxes and fees.

If you exceed the maximum ticket price, you can pay the difference in points at a rate of 100 points = $1 CAD (the flexible travel rate). You can also pay for flight taxes by redeeming your points at this same rate of 100 points = $1 CAD.

There is one other restriction with the Air Travel Redemption Schedule: you must make the booking a minimum of 14 days before the departing flight. Keep this in mind when considering whether to redeem RBC points for flights using this method.

How to Redeem Avion Rewards Points Using the Air Travel Redemption Schedule

To make a flight booking using the Avion Rewards fixed travel program, cardholders will need to access the Avion Rewards Travel portal , which is powered by Expedia.

In order to initiate a flexible travel rewards booking, log into Avion Rewards and click “Travel Home” on the top bar. From there, click on the “Book Travel” button.

This will take you to the Avion Rewards Travel portal page. From here, you will be able to search for flights, hotels, car rentals, and vacation packages. In order to redeem through the fixed travel redemption program, you will need to click on flights.

From here, fill in your desired routing, dates, number of passengers, and ticket class, and click “Search” to generate a list of flights.

Once you can see the list of flights, you will see the total point cost using the fixed travel redemption in addition to the taxes and fees on the ticket. At the top of the screen, you can flip between fixed points pricing and flexible points pricing to determine which is the better deal.

In this case, fixed points pricing has all itineraries at 35,000 Avion Rewards points (as one would expect per the chart above).

On the other hand, if we were to make this booking with flexible rewards, we would be paying at a minimum an additional 21,000 Avion Rewards points. This is where the fixed rewards chart really shines.

Once we go through the portal and select our outbound and inbound flights, we are presented with a page summarizing the flights chosen and the total price. On the right-hand side, you can confirm that you are using the fixed travel redemption method by looking at the total point cost. Since this is an economy roundtrip fare within North America, 35,000 is the correct amount of points. From here, click “Check Out” to complete the rest of the booking process.

For this booking in particular, I was effectively able to redeem 35,000 Avion Rewards for $413 in base fare value (roughly 0.0118 cents per point). Since you can cover up to a $700 base fare with the 35,000 Avion Rewards fixed flight redemption, there is some additional value that could be extracted with the right flight. But if you were just looking to travel to Los Angeles, this is a great value for your points.

It is important to note that any flights that do not qualify for the Air Travel Redemption Schedule will automatically have flexible points pricing applied.

Flexible Travel Rewards

The other way to use Avion Rewards points for travel is through the flexible travel reward chart. This method allows you to redeem your Avion Rewards towards virtually any flight, hotel, car rental, and other travel expenses at a rate of 100 Avion Rewards points = $1 CAD (RBC sometimes refers to this as the “1% rate”).

So for example, 25,000 Avion Rewards points can be redeemed for $250 CAD worth of travel. What makes this method even more flexible is that you can pay for travel using any combination of points and payment via credit card.

In general, you would only want to redeem Avion Rewards points for flights using this method if your flights do not qualify for the Air Travel Rewards Redemption Schedule. Alternatively, you may already have lots of airline points from other programs like Aeroplan and prefer to use your RBC points for a hotel stay, car rental, cruise, or vacation package.

Also of note, holders of the following credit cards actually get a special 2x rate for flexible travel redemptions used towards Business (J) or First Class (F) airline tickets, meaning they can redeem 100 points for $2 CAD:

- RBC Avion Visa Infinite Privilege

- RBC Avion Visa Infinite Business

- RBC Commercial Avion Visa

How to Redeem Avion Rewards Points for Flexible Travel Rewards

Redeeming Avion Rewards for flexible travel rewards can be done entirely through the Avion Rewards Travel portal , which is a search engine powered by Expedia. In order to redeem points through this method, you do need to book through the portal and cannot apply points to a pre-existing booking made elsewhere.

This will take you to the Avion Rewards Travel portal page. From here, you will be able to search for flights, hotels, car rentals, and vacation packages. The process is the same no matter what you are redeeming your Avion Rewards for.

For our how-to, let’s take a look at booking a hotel in Las Vegas for August. Select “Stays” at the top, and select the desired destination, your dates, and the number of travelers. Click “Search”.

Once you search, a variety of hotels will be displayed that meet your travel criteria. You are able to filter or sort if desired to find the perfect hotel to suit your needs. Once you find the hotel you are interested in, click on it to be brought to the hotel-specific page with property details and room types that are available for this booking.

Scroll down and you will see the rooms that are bookable. Once you find the one that you like, click on Reserve to be taken to the payment page.

Once you are on the payment page, this is where you can elect to use your points to pay for the booking through the flexible travel rewards option. You are able to use a portion or all of your points when making a flexible travel booking, however, the default is to use all of your points (or the maximum number of points to pay the booking off completely).

As you update the points and cash payment split, the price summary on the right-hand side of the screen will update. This will give you insight into what you will be paying for this booking when you confirm in addition to any on-property fees (such as a resort fee in Las Vegas).

Once you are happy with the price summary, simply fill in the rest of the details and click “Complete Booking”. Any applicable points will be withdrawn from your account and you will receive an email confirmation of the booking.

Convert Avion Rewards to Airline Partners

If you are pursuing a flight redemption on another airline, you might find value in converting your Avion Rewards points to a specific airline loyalty program. Avion Rewards is partnered with American Airlines AAdvantage, British Airways Executive Club, Cathay Pacific Asia Miles, and WestJet Rewards.

Avion Premium points can only be transferred to WestJet Rewards, whereas Avion Elite points can be transferred to all of the below frequent flyer programs.

You can convert Avion Rewards points at the following rates:

The Avion Rewards program also offers transfer bonuses from time to time. For example, in recent years we have seen promotions that give cardholders an extra 30% British Airways Avios Miles when transferring. This can create some strong value propositions in making dream trips much more accessible, such as redeeming Avios for Qatar Airways Qsuites .

If you hold any of the RBC Avion credit cards, you will be able to transfer to any of the partners listed above. On the other hand, if you hold a card that earns Avion Premium points, you will only be able to transfer your points to WestJet Rewards. (However, you can fix this by either switching the card to an Avion card or by applying for another Avion card and transferring the Rewards+ points to the Avion card).

You can see the current transfer ratios, including any bonus promotions, by viewing our Miles & Points Transfer Partner Tool .

How to Convert Avion Rewards to Airline Partners

To convert your Avion Rewards points to airline partners, go to the ‘Shop Avion Rewards’ portal. You can access this from the account summary page of any of your RBC credit cards.

Then from the Avion Rewards portal home page, select ‘Manage Points’ from the main navigation menu and then ‘Convert Points’ from the submenu.

From the next screen, you’ll be prompted to select which loyalty program you would like to transfer to and then the number of points. You will also be prompted to input your membership number for whatever program you are transferring points to, as well as an email address for confirmation (optional).

RBC often offers promotions of 20-25% off on gift card costs for various retailers so there may be value there (which is atypical as for most points programs, redeeming points for gift cards offers terrible value).

The best value is consistently hotels.com or Fairmont as both can be purchased at 1 cent per point without any promotions required. However, there have been previous promotions for hotels.com and Fairmont, in which we have seen up to 25% off.

If you have a Rewards+ earning RBC credit card (not Avion), you can also redeem at 1 cent per point for Amazon.ca gift cards.

Other Redemption Options

Avion Rewards can also be redeemed for merchandise, a statement credit, or financial rewards. These methods are not viable from a value perspective and it is strongly recommended that you do not redeem Avion Rewards using any of these methods as you are effectively throwing money away.

The Avion Rewards merchandise catalog has various products to purchase with points. The value for redeeming points for merchandise varies widely but is generally underwhelming and not recommended. You would be better off redeeming points for a gift card and purchasing the merchandise outright on many occasions.

Points can be redeemed towards a statement credit for your Royal Bank of Canada credit card account. If you were to redeem points through this method, 10,000 Avion Rewards points would be worth a $58 statement credit. It doesn’t take a mathematician to understand the terrible value that this offers.

Finally, Avion Rewards can be redeemed towards RBC financial rewards. This means that if you hold a mortgage, personal loan, or registered account with RBC, you can redeem points to financially fund that account. If you were to use this option, 10,000 Avion Rewards points would be worth $83 in your financial account. Again, not a great value when you can easily redeem points for at least 1 cent per point.

Frequently Asked Questions

As long as you hold an active Avion Rewards or Avion credit card, the points tied to that card will not expire. If you cancel an RBC credit card that still has points remaining, you will have 90 days to either redeem those points or transfer them to another active RBC Rewards or Avion credit card that you hold.

RBC Avion Elite points are Avion Rewards points earned by Avion cardholders. They are a higher tier of points than the basic RBC Avion Premium points and can be redeemed for travel and also transferred to other airline partner programs.

You can redeem points to redeem for flights through two methods: via the fixed travel award chart or the flexible travel option. The fixed travel award chart allows you to redeem points for round-trip flights to destinations around the world for a set amount of points and up to a certain ticket value. For example, a round-trip economy flight anywhere in North America will always cost you 35,000 Avion Rewards points. The ticket can have a maximum value of $750 CAD. Flexible travel redemptions allow you to redeem points at a rate of 100 Avion Rewards = $1 towards any travel booked through the Avion Rewards travel portal.

Some select flights are not available to book on RBC’s Travel portal. If this is the case, you can instead opt to book the flight yourself and receive statement credit from RBC in exchange for your points. To do this: 1. Navigate to Support from the RBC Travel homepage 2. Select the popular topic “Book with a statement of credit on an Avion flight” 3. Go through the process outlined therein You must call and receive authorization from an RBC travel agent before making the booking. Then you must complete a manual form before you will be credited with statement credit and the appropriate amount of RBC points removed from your account. This method can be used to redeem using the Air Travel Redemption Schedule rates or the 1% flexible travel rate.

Yes, you are able to combine Avion Rewards points between any Avion Rewards credit cards that you hold. When you log into Avion Rewards, click “Transfer Points” and you will be able to choose the account you want to transfer points from and the destination account. You can also quickly combine points between all of your accounts using this feature.

Yes, you can combine Avion Rewards points between yourself and your significant other by adding them as a co-applicant to an ION or ION+ credit card. Note that a co-applicant is different than an authorized user.

The value of an Avion Reward point varies, depending on how you choose to redeem them. We recommend using a base value of 1 cent per Avion Rewards point when making your redemptions.

The Avion Rewards program team can be contacted via phone at 1-800-769-2512.

Posts about Avion Rewards

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Subscribe to our newsletter .

This site uses Akismet to reduce spam. Learn how your comment data is processed .

5 comments on “ Avion Rewards ”

I just tried the RBC Rewards Travel Portal to see how much a fixed point redemption would cost and it was not as advertised. One person, return trip from Vancouver,BC to LHR leaving Dec 16th and returning Dec 23rd, 2023 would cost 65,000 fixed points (should be worth up to $1,300 excluding tax and fees) plus $935.66 out-of-pocket. I compared this against Expedia and the out-of-pocket trip cost would be $1,140.66 (breakdown is $805.00 in air transportation charges, plus $335.66 for taxes and fees). So, the 65,000 RBC Avion points only saves me $200 in travel costs – this is pathetic! It should have saved me the $805 flight cost! What is going on here; is RBC devaluing their own points? …I ‘m considering changing credit cards if this is the case. Thanks for your advice.

$1300 is the max ticket price, not the guaranteed value. Are you comparing the exact same flight on Expedia and on RBC? The $935 out of pocket seems strangely high but I wonder if its on an airline like BA which have notoriously high taxes and fees. You’d be better off booking a flexible travel redemption and taking $650 off instead.

Personally I find best use of RBC to be transfers to airline partners like BA Avios, Cathay, etc.

Hi Reed. Thanks for your reply. Maybe I’m not quite understanding the ticket price vs guaranteed value. To clarify, the comparison was for the exact same flights, carrier (Air Canada), and dates. Expedia “Air transportation charges” (I assume this is the ticket price portion?) showed as $805 so this was what I expected RBC to cover but they don’t. I did another comparison tonight with different dates (July 6-20, 2024 flying with Iceland Air) and the Expedia cost was $976 for “Air transportation charges” plus $277.96 for “taxes and fees” (total cost $1,253.96). RBC wants 65,000 points plus $621.96. So, out of the total cost of $1,253.96 RBC is only covering the difference of $632 with my 65,000 points (about a 1% points vale); still extremely terrible “value” from RBC. They should cover the $976 flight cost. What am I missing? Can I send you a screenshot? Thanks again.

Yes – I emailed you.

I was not allowed to choose Level of economy flight from basic to the next two levels of economy this is a situation on Air Canada site that allows me to increase my level of comfort

Editorial Disclosure: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities. For complete and current information, please consult the entity's website.

15 good uses of RBC Avion Rewards points

- Post author: Andrew D'Amours

- Post published: April 27, 2023

- Post category: Travel rewards Canada / Using rewards

- Post comments: 0 Comments

RBC Avion Rewards points are pretty much the only ones among all of Canada’s travel rewards currencies that even try to compete with Amex points in terms of ways to use them for outsized value and transfer partner options (and ease of earning a lot of points). Let’s start with the basics, but we’ll have much more content about this currency!

We’ll look at 15 good uses for those RBC Avion Rewards points.

Basics of RBC Rewards points

The RBC Avion Visa Infinite Card is currently offering its regular welcome bonus. It’s already one of the most popular cards in Canada, as the main card for the country’s largest bank.

Basically, you’ll earn 35,000 RBC Avion Rewards points with no minimum spend requirement to reach, so it’s perfect as a 2 nd card to apply for on the same day as a 1 st one with a minimum spend requirement and a bigger bonus.

You can get this welcome bonus even if you’ve had this card before; that’s the beauty of all cards that aren’t issued by Amex (often there’s a minimum wait period; but not with RBC). And that’s why you can get a literally infinite amount of free rewards to travel more for less! Save your spot for our free webinar on travel rewards for beginners to learn more!

You can read all the details on our RBC Avion Visa Infinite Card page , and on our review (which includes a video presentation if you prefer that format).

We’ll also have a lot more content, tips, and guides on all the major programs (including RBC, Amex, Aeroplan, Avios, Marriott, etc.) very soon.

How to use RBC Avion Rewards points

With other RBC cards, the RBC Avion Rewards points you get work differently. So we’ll just focus on the RBC Avion Rewards “Elite” points that are relevant here, as the RBC Avion Visa Infinite Card ‘s welcome bonus is by far the most valuable among RBC cards.

RBC Avion Rewards points can be used as both of the 2 only types of rewards use options that exist: uses that are more valuable (less simple) or uses that are more simple (less valuable).

So we will divide the article into the 4 different ways that RBC Avion points can work:

- Transfer to Avios (12 good uses)

- Transfer to WestJet Rewards and others (1 good use)

- Reward flights with the RBC price chart (1 good use)

- Travel credit to erase almost any travel expense (1 good use)

1. Transfer to Avios (12 good uses)

The Avios program is far from being as simple as the ubiquitous airline rewards program in Canada (the Aeroplan program ), but depending on your travel preferences, it can be very valuable too.

We’ve put together an article that lists 12 good uses of Avios points .

Note that 60,000 RBC Avion points = 60,000 Avios points (1 to 1 transfer rate). The increased welcome bonus on the RBC Avion Visa Infinite Card that is offered regularly gives you those 60,000 points ( sign up to get an alert when it returns).

But usually, RBC has a transfer bonus promo with at least a 30% bonus every year. That means you get 30% more Avios points when transferring RBC points, giving you 30% more free travel! And 30% more value than our Flytrippers Valuation for the RBC Avion Visa Infinite Card ‘s welcome bonus. That’s even more amazing!

This option can give you up to 9 one-way short-distance flights in some countries, or 4 one-way flights to/from Miami from Toronto or Montreal for example.

But with Avios, you’ll have much fewer options compared to Aeroplan. So you’re better off choosing the cards with amazing offers that earn Aeroplan points or American Express points if you want airline rewards (the most valuable type of rewards) but prefer some that are simpler than Avios points.

2. Transfer to WestJet Rewards and others (1 good use)

Okay, there is more than 1 good use with the other airline partner programs, but it’s really a lot rarer that it’s a good value. So we’ll say 1 good use for now: for a sweet spot with other partners.

The 3 other RBC airline program partners are:

- WestJet Rewards (1 to 1 transfer rate)

- Cathay Pacific Asia Miles (1 to 1 transfer rate)

- American Airlines AAdvantage (1 to 0.7 transfer rate)

We’ll discuss it in more detail in our RBC Avion Rewards program guide soon , but the main appeal used to be for those who often fly WestJet. But now, their program is so bad that the RBC points option #4 below is probably more valuable even for WestJet flights.

(The WestJet RBC World Elite Mastercard also has an increased offer and the WestJet RBC Mastercard is a no-fee option, if you really like WestJet — we’ll cover those cards later since the welcome bonus is hundreds of dollars lower than the RBC Avion Visa Infinite Card and the other incredible offers right now !)

The Asia Miles program can be interesting, especially since it is also a transfer partner with the Amex Membership Rewards program and the HSBC Rewards program . So it’s easy to earn many Asia Miles. But it’s a program with sweet spots that are even more specific than Avios, which I’ll cover soon to keep this post shorter today.

Finally, the American AAdvantage program has a much less appealing transfer rate for starters. And the program is not great, as is the case with most US airline programs. That said, I did make my 1 st AAdvantage redemption in 15+ years in the world of travel rewards… and it was literally one of the most valuable redemptions I’ve ever made. I was glad to have RBC Avion points to transfer to AAdvantage!

3. Reward flights with the RBC price chart (1 good use)

We’re now at the first of the 2 uses of RBC points that don’t involve transferring to another program.

I’ll do a separate article for you soon, but basically, the RBC award chart has only one good use: when airline tickets are very expensive in cash .

The thing is the price chart will give you a ticket for a fixed number of points, regardless of the cash price (with a maximum price though).

It’s harder to maximize than airline partner programs, at least for those who don’t normally buy expensive flights. And it’s much more restrictive: you have to book flights only departing from Canada or the USA. However, RBC does allow you to book one-ways at least (compared to the Amex price chart that only allows roundtrips for example).

Here is the full RBC price chart for roundtrip reward flights (directly through the RBC program instead of having to transfer points).

(One-ways simply cost half the amount of points with half the maximum price too!)

So for example, let’s say you use your 60,000 RBC Avion points for 4 roundtrip flights that cost 15,000 points… you could “save” $1400 ($350 x 4)!

That would give a great value of 2.3 ¢ per point (and the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus would be worth $1280 instead of ≈ $780 at our always conservative Flytrippers Valuation).

However, that means you’d be paying for very, very expensive tickets. So it’s just a good use if you were really going to pay a lot of money for those flights (if you didn’t have any flexibility for example). And when the plane ticket’s base fare is as close as possible to the maximum ticket price in the RBC price chart.

When used this way, RBC points only cover the base fare, so not the taxes and some other fees. The maximum ticket price in the price chart is also only for the base fare (the same as the Amex price chart for reward flights ).

Remember that what’s important is not how much you pay out of pocket, but how much you SAVE in total, at least if you know how to do the math and if you want to get the most value with your rewards.

So the RBC price chart can still be interesting if you have to go somewhere and the flights are very expensive. For example, if you are going to a European destination that is very expensive for your dates, that can easily cost $1600, especially if you’re not in Toronto or Montreal (which is sad considering we often spot deals to Europe in the $400s roundtrip).

But then again, like all redemption option of the more lucrative type… certain redemptions are just not good. This time, it’s because of airline surcharges. For example, they’re often high to Europe, making that a bad redemption most of the time.

With 65,000 RBC Avion points (the 5,000 missing after the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus are pretty easy to earn), you could save $1300, a great use on paper. But it’s not a good use if the alternative is a flight to Europe paid with cash that has just a $300 base fare.

To give you an idea, I’ve used airline reward programs for dozens and dozens of flights in the past 10 years, and I have used the bank price charts only once (it was with RBC during the Christmas holidays this year because flights during the holidays are expensive).

I usually don’t buy expensive flights so it’s less beneficial for me. And when I do buy expensive flights, I’m flexible, so airline points are a lot more valuable.

In short, the value you can get with the RBC price chart really depends on your personal situation and how good you are at finding cheap flights. As is always the case in the world of travel, you have to compare!

4. Travel credit to erase any travel expense (1 good use)

Finally, the only option that has a fixed value… isn’t really a good use at all in fact.

It’s a “good” use only if you want to keep it simple and are willing to get a lot less value in return, as so many people are.

Instead of being worth ≈ $780, the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus is worth a flat $480 net if you use it like this. Because as a travel credit, 60,000 RBC Avion points = a $600 credit.

But it’s much simpler: you can apply the points to any travel expense.

It’s always going to be worth 1¢ per point. Any travel use. Very simple.

That’s why the other options are about 50% more valuable… but even $480 for free is pretty good!

With this option, you don’t have to think anything through, you don’t have to maximize anything, you don’t have to take any specific flights… it’s really as simple as it gets.

Well, almost as simple as it gets. There is one restriction: you need to book on the RBC Avion website (you cannot book on other websites as you can with other rewards programs).

If you want to use points for any travel expense, you really shouldn’t “waste” valuable points like RBC Avion points anyway (unless you’re never going to use them for more valuable flight redemptions, in that case of course take the points instead of not taking them).

Instead, use points that cannot give you more value AND can be used by booking on any website! Like Scene+ points (the Scotiabank Gold American Express Card ), BMO Rewards points (the BMO eclipse Visa Infinite Card ), or AIR MILES miles (the BMO AIR MILES World Elite MasterCard ).

Or points that can be used by booking on any website without losing too much value. Like TD Rewards points (the TD First Class Travel Visa Infinite Card ) or HSBC Rewards points (if you already have some).

The RBC Avion Visa Infinite Card is a great option to get points of the more valuable type. These examples may give you a good idea of what you could do with the welcome bonus, while you wait for our more comprehensive guides.

Have any questions about RBC Avion Rewards points? Ask me in the comments below.

Want to be the first to get our free travel rewards course and all our content, sign up for our travel rewards newsletter.

See the deals we spot: Cheap flights

Explore awesome destinations : Travel inspiration

Learn pro tricks : Travel tips

Discover free travel: Travel rewards

Featured image: Beach (photo credit: Nico David)

Share this post to help us help more people travel more for less:

Andrew D'Amours

Leave a reply cancel reply.

Prince of Travel

Prince of Travel is a full-service travel brand with an emphasis on luxury travel.

Get in-depth information on hotel programs and learn more about Prince Collection’s premier brands and vendors.

Credit Cards

Get the latest news, deals, guides, and travel reviews straight to your inbox with a Prince of Travel newsletter subscription.

Join Our Newsletter

Subscribe to the prince of travel newsletter.

You'll receive priority information about the newest luxury properties worldwide, exclusive reservations and deals through Prince of Travel , and unique destinations across the globe.

By providing your email, you agree to the Prince of Travel Privacy Policy

Thank you for subscribing!

Please check your email to confirm your subscription!

Id ea eiusmod magna cupidatat proident commodo tempor sit incididunt. Fugiat aliquip officia exercitation ad culpa ipsum est.

Points Programs

Hotel programs, best credit cards, back to reviews, review: rbc® avion visa infinite†.

In this credit card review, we analyze the features and benefits of the RBC® Avion Visa Infinite†, the flagship card in RBC’s Avion lineup.

Written by Tyler Derksen

Written by {post._embedded?.author[0].name || post.data.author}

On April 18, 2024

Read time 19 mins

RBC’s flagship Avion credit card, the RBC® Avion Visa Infinite† , offers a consistently high welcome bonus, strong insurance, and a flexible points currency, all for a reasonable annual fee. In fact, we’ve ranked the RBC® Avion Visa Infinite† as RBC’s best overall credit card product .

That being said, there are some areas in which the RBC® Avion Visa Infinite† falls behind competitors, which we’ll go over in detail in this review.

What we love: c onsistently strong welcome bonus, flexible points, strong travel and retail insurance.

What we’d change: increase category earning rates, r emove foreign transaction fees, include airport lounge access.

Consistently High Welcome Bonus

One of the most attractive features of the RBC® Avion Visa Infinite† is the consistently high welcome bonus.

The welcome bonus tends to fluctuate between 35,000 and 55,000 Avion (Elite) points, with 55,000 points being the card’s all-time high offer.

Typically, a large portion of the welcome bonus is awarded upon approval or upon making your first purchase, which is an easy way to boost your balance. Sometimes, the entire welcome bonus is awarded upon approval, which is even better.

If there’s a second allotment as part of the welcome bonus structure, it’s usually earned after meeting a reasonable minimum spending requirement of $5,000 or so within the first three-to-six months as a cardholder.

- Earn 35,000 RBC Avion points † upon approval †

- Plus, earn 20,000 bonus Avion points when you spend $5,000 in your first six months †

- Earn 1.25x RBC Avion points † on qualifying travel purchases

- Transfer RBC Avion points to British Airways Executive Club and other frequent flyer programs for premium flights †

- Redeem Avion points for flights with the RBC Air Travel Redemption Schedule †

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120 †

- Supplementary card fee: $50

We value RBC Avion (Elite) points at 2 cents per point. Using this valuation, we estimate that a welcome bonus of 35,000 points would be worth around $700, and a welcome bonus of 55,000 points would be worth around $1,100.

Depending on how you choose to redeem your points, they could be worth more or less than these estimates, and we’ll speak to some of the different redemption options below.

Straightforward Earning Rates

The earning rates on the RBC® Avion Visa Infinite† are quite simple, and are structured as follows:

- Earn 1.25 RBC Avion (Elite) points per dollar spen t on qualifying travel purchases†

- Earn 1 RBC Avion (Elite) point per dollar spent on all other qualifying purchases†

One of the downsides of the RBC® Avion Visa Infinite† is the card’s lack of elevated earning rates on common purchases, such as groceries, gas, and restaurants, which often have category multipliers on other credit cards.

In fact, this is the card’s biggest weakness, since building up your Avion (Elite) balance is a slow-and-steady process, especially if you’re not a big spender.

On the other hand, the baseline earning rate of 1 Avion (Elite) point per dollar spent is on par with the baseline earning rates on comparable cards.

Plus, given the flexible nature of Avion (Elite) points, you can still get a lot of value from collecting Avion (Elite) points, even without accelerated earning rates.

Flexible RBC Avion (Elite) Points

Compared to similar credit cards offered by other banks, redeeming points is where the RBC® Avion Visa Infinite† really shines.

In fact, in Canada, RBC’s Avion (Elite) points is the only rewards currency other than American Express Membership Rewards that offers the ability to transfer points to external partners.

This means that with the RBC® Avion Visa Infinite†, you can transfer Avion (Elite) points earned through the welcome bonus and on daily spending to the following loyalty programs:

- British Airways Executive Club at a 1:1 ratio

- Cathay Pacific Asia Miles at a 1:1 ratio

- American Airlines AAdvantage at a 1:0.7 ratio

- WestJet Rewards at a 100:1 ratio

Plus, RBC often offers transfer bonus promotions throughout the year, during which the transfer ratio is boosted by 10–50%.

By transferring Avion (Elite) points to one of the above airline loyalty programs – ideally when there’s a transfer bonus – you’ll be able to unlock value from a whole range of award flights in economy, premium economy, business class, and even First Class.

If you don’t want to worry about finding award space or navigating loyalty programs, RBC offers an in-house option called the RBC Air Travel Redemption Schedule , which also provides a great return for your points.

With the RBC Air Travel Redemption Schedule, you can redeem Avion (Elite) points for economy flights close to home or around the world and get an elevated value of up to 2.3 cents per point, depending on the route.

Alternatively, if you’re looking for the most straightforward redemption possible, you can also redeem Avion points at a rate of 1 cent per point against any eligible travel expenses charged to your RBC® Avion Visa Infinite†.

Strong Insurance Coverage

Overall, the insurance coverage on the RBC® Avion Visa Infinite† is fairly strong, and it stands out in a few ways compared to competitors.

For example, the emergency medical insurance on the RBC® Avion Visa Infinite† is unlimited in terms of its dollar amount.† This coverage applies for up to 15 days for eligible travellers who are under 65 years old, and for three days for eligible travellers who are 65 years and older.†

Comparatively, other cards usually cap this insurance benefit at $1 million or $2 million in coverage. However, many other cards also have more generous coverage periods and age categories than those offered by the RBC® Avion Visa Infinite†.

A second standout part of the RBC® Avion Visa Infinite† insurance offerings is the purchase security insurance that covers loss or accidental damage for up to 90 days following the purchase of eligible items with your card.†

Notably, this coverage is for up to $50,000 each calendar year,† making the RBC® Avion Visa Infinite† a great choice for larger purchases.

Lastly, the mobile device insurance on the RBC® Avion Visa Infinite† will cover up to $1,500 if your phone is lost, stolen, suffers accidental damage, or experiences mechanical failure for up to two years from the date of purchase.†

This provides you with the reassurance that you won’t be left with out-of-pocket expenses if anything unfortunate happens to a new device that you purchased with your RBC® Avion Visa Infinite†.

What Else Does the Card Offer?

The RBC® Avion Visa Infinite† comes with some other perks and benefits worth highlighting.

For the past few years, RBC has offered the Friday Friend Pass , which gives cardholders a free second lift pass when purchasing a full-price lift pass at many major ski resorts in Canada.†

If you’re able to make use of this benefit, it’s a great feature that can wind up saving you money when you hit the slopes with a friend or family member.

Additionally, on the Avion Rewards dashboard, you’ll also find a series of RBC Offers for earning bonus Avion points or saving you money on travel and experiences.

For example, one offer that has popped up before is the opportunity to earn extra Avion points when spending at Canadian Marriott Hotels .

With this type of offer, simply charge your hotel stay to your RBC® Avion Visa Infinite†, and you’ll earn bonus points.

The card also comes with other features that can help you save on some daily purchases.

By linking your RBC® Avion Visa Infinite† to a Petro-Points card, you’ll save 3 cents per litre on gas at Petro-Canada, and you’ll also earn more Petro-Points.†

You’ll also receive a complimentary DoorDash DashPass subscription for 12 months, which gives you $0 delivery fees with DoorDash.†

Alternative Cards to Consider

While the RBC® Avion Visa Infinite† offers a generous welcome bonus and access to flexible RBC Avion (Elite) points, there are other cards worth considering, depending on your priorities.

For example, the American Express Cobalt Card also earns flexible rewards points that can be transferred to even more partners, and its earning rates are much stronger than those of the RBC® Avion Visa Infinite†.

Recall that with the RBC® Avion Visa Infinite†, you’ll only earn 1–1.25 Avion (Elite) points per dollar spent, depending on the purchase.

With the American Express Cobalt Card, you can earn 5 Membership Rewards points per dollar spent on dining and groceries, 3 Membership Rewards points per dollar spent on streaming services, 2 Membership Rewards points per dollar spent on gas, public transit, and travel purchases, and 1 Membership Rewards point per dollar spent on all other purchases.

If you have a high volume of spending in any of the accelerated categories, you’ll wind up with a boosted points balance much faster than making the same purchases on the RBC® Avion Visa Infinite†.

If you’d like to add a card for spending outside of Canada and some complimentary lounge visits, the Scotiabank Passport Visa Infinite Card is a great choice.

While the welcome bonus generally isn’t as high as the RBC® Avion Visa Infinite† and the Scene+ points you earn aren’t transferable to airline or hotel partners, the Scotiabank Passport Visa Infinite Card comes with no foreign transaction fees and six complimentary airport lounge visits per year .

Consider this card as a good alternative if you spend a lot outside of Canada, don’t see yourself transferring points to airline partners, and can make use of the complimentary lounge visits.

The RBC® Avion Visa Infinite† is a great credit card, and has earned our pick as the best overall RBC credit card product .

However, the RBC® Avion Visa Infinite† lags behind the competition in terms of earning points on daily spending given the card’s straightforward earning rates.

Additionally, it’d be nice to see better travel benefits added to the card’s features, such as complimentary airport lounge access and no foreign transaction fees.

That being said, if you’re looking for a travel credit card with a constantly high welcome bonus and flexible points for a reasonable annual fee, the RBC® Avion Visa Infinite† is one of the best.

† Terms and conditions apply. Refer to the RBC website for up-to-date offer terms and conditions.

Share this post

Copied to clipboard!

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Mortgage Renewal

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does a Mortgage Work in Canada?

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- How to Save Money on Your Next Renewal

- First-Time Home Buyer Grants and Assistance Programs

- Types of Houses in Canada

- Types of Mortgages in Canada: Which Is Right for You?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

RBC Avion Visa Infinite Review 2024: Is It Worth It?

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

NerdWallet Rating

NerdWallet CA

- Pros: Petro-Canada fuel discounts, 12 months of free DoorDash deliveries and travel insurance.

- Cons: No airport lounge access, free checked bags or priority airport services.

What our Nerd thinks

“The RBC Avion Visa Infinite Card has some travel-specific perks that will appeal to jet setters and road trippers, but it puts in a decent showing as a general rewards card, too. Overall, I think the card will appeal in equal measure to Canadians who want a rewards program with diverse redemption options and travellers seeking the peace of mind provided by a card with travel insurance.”

CREDIT CARD NERD

Shannon Terrell

The RBC Avion Visa Infinite card offers new cardholders up to 55,000 Avion Points. There are no spending categories to keep track of; cardholders earn one Avion point on all purchases and 1.25 points on eligible travel purchases. However, the card’s $60,000 minimum income requirement and $120 annual fee may be high for some applicants.

RBC Avion Visa Infinite

- Annual Fee $120

- Interest Rates 20.99% / 22.99% 20.99% on purchases, 22.99% on cash advances.

- Rewards Rate 1x-1.25x Points Earn 1.25x Avion points on eligible travel-related purchases and 1x on everything else.

- Intro Offer Up to 55,000 Points Get 35,000 welcome Avion points on approval*. Get an additional 20,000 bonus Avion points when you spend $5,000 or more in qualifying purchases or pre-authorized bill payments within the first 6 months of account opening. Offer ends November 25, 2024.

- Get up to 55,000 Avion points* (a value of up to $1,100†), that’s enough to fly anywhere in North America or the Caribbean!

- Earn 1 Avion point for every dollar you spend* and an extra 25% on eligible travel purchases.

- Avioners can book flights with points on any airline, on any flight, at any time, early or last minute, with no blackout periods or restrictions.

- Avioners earn points that never expire so your points will be waiting for your next adventure.

- Redeem your points for travel and more. Use points for anything from paying bills and paying your card balance to redeeming for Gift Cards and Merchandise at top brands like Apple. The Avion Rewards program gives you the freedom of choice to use your points your way, and helps you make the most as an Avioner.

- Eligible Avion Rewards members can also convert points to other loyalty programs including WestJet dollars, British Airways Avios points and Hudson’s Bay Rewards points.

- Link your RBC card with a Petro-Points membership to instantly save 3₵ per litre on fuel at Petro-Canada stations and earn 20% more Petro-Points and 20% more Avion points.

- Link your RBC card with a Rexall Be Well account and get 50 Be Well points for every $1 spent on eligible products at Rexall. Redeem Be Well points faster for savings in store on eligible purchases where 25,000 Be Well points = $10.

- Get access to RBC offers which provides access to earn points faster at specified brands.

- Extensive insurance including: mobile device insurance, travel insurance (trip cancellation, interruption and emergency medical) and other eligible purchases to protect you and your family.

- Avioners get access to luxury Visa Infinite benefits including first in line for exclusive events, and hotel and dining benefits.

- Avioners no longer need 14-days to book travel using the RBC grid.

- Get $0 delivery fees for 12 months from DoorDash¹⁷ – Add your eligible RBC credit card to your DoorDash account to:

- Get a 12-month complimentary DashPass subscription¹⁸ – a value of almost $120.

- Enjoy unlimited deliveries with $0 delivery fees on orders of $15 or more when you pay with your eligible RBC credit card.

- Corresponding legal references and product terms are available on the RBC website, which will be available and agreed upon in the customer onboarding process.

- Full review

- Customer ratings

- Eligibility

- How to apply

RBC Avion Visa Infinite vs TD First Class Travel Visa Infinite

- Rating methodology

RBC Avion Visa Infinite full review

The RBC Avion Visa Infinite card is one of six personal credit cards from the Royal Bank of Canada that offers Avion points — a loyalty program specific to RBC. You can spend Avion points on a range of products like flights, electronics, investments and more. The company’s Visa Infinite card is among the more expensive of RBC’s personal Avion credit cards.

Benefits of the RBC Avion Visa Infinite card

- 35,000 Avion Points upon approval and 20,000 bonus points when you spend $5,000 in your first 6 months. Apply by Nov. 25, 2024.

- No seat restrictions or blackouts when you book travel using Avion points.

- Free Doordash deliveries for 12 months. (Must activate before Feb. 28, 2025).

- Discounts and additional Avion points available when you rent with Hertz, or link the card to a Petro-Canada card.

Drawbacks of the RBC Avion Visa Infinite card

- Minimum income requirement of $60,000 ($100,000 for household).

- No airport lounge access.

- RBC has low Trustpilot and BBB ratings.

Who should get the RBC Avion Visa Infinite card?

You may want to get the RBC Avion Visa Infinite card if you:

- Want to collect Avion points on all purchases.