How to add or remove your credit card details from Safari on iPhone, iPad, or Mac

In this tutorial, we will show you how to manually add your credit card information to Safari on your iPhone, iPad, or Mac so that you can fill it in quickly to complete online purchases faster. We will also go over how to remove your card details .

Note: We have used the word ‘credit card’ in this article, but the steps and everything else are the same, even if you want to save your debit card information.

Once you save a credit card:

- You don’t have to fill out the card details every time you want to use it.

- It can come in handy when you want to complete a purchase for an item that’s in limited stock or selling quickly. It’s truly helpful when buying new gadgets on launch day, for example.

Related: How to add or change your Apple ID shipping and billing address

Before you begin

- Make sure you have put a password lock on your iPhone, iPad, or Mac.

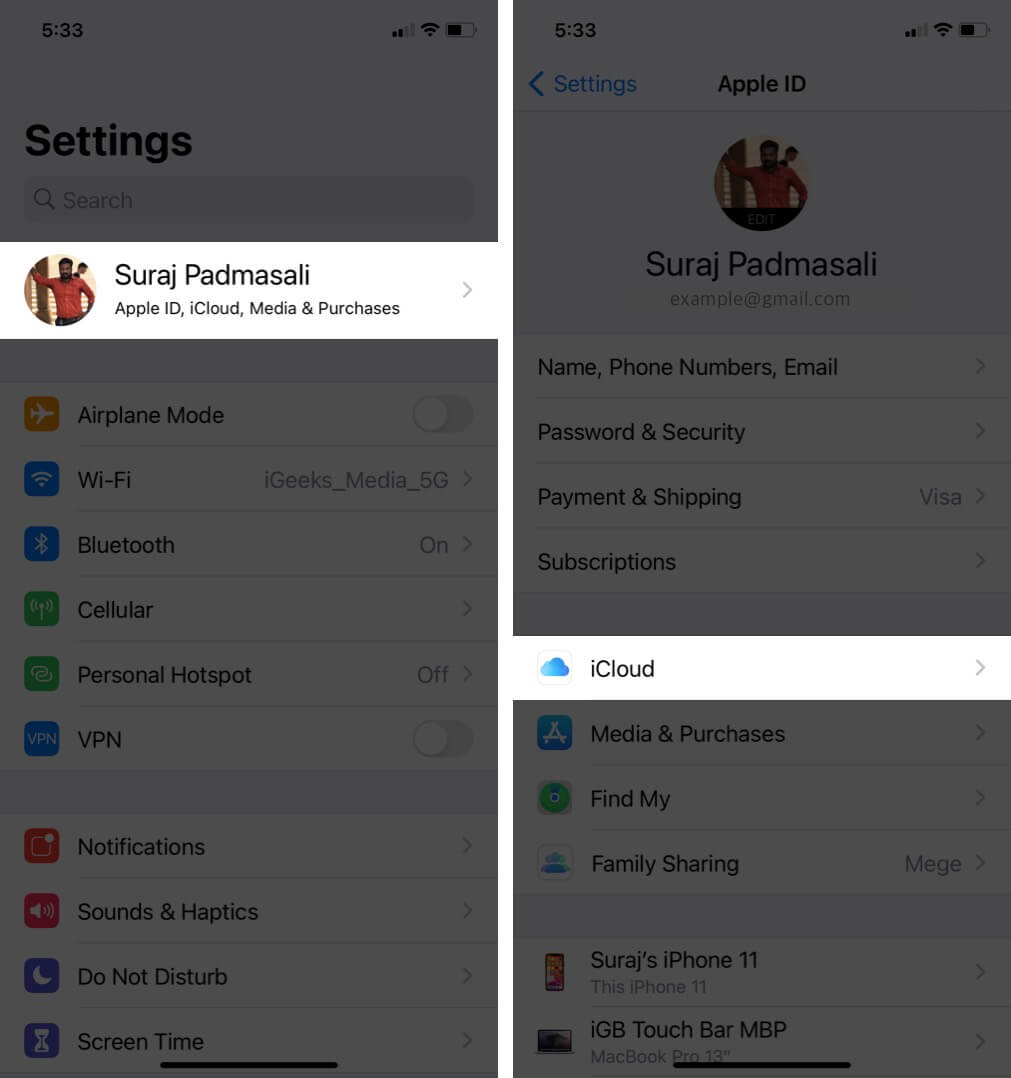

- Make sure iCloud Keychain is set up (iPhone Settings > your name > iCloud > Passwords and Keychain and enable Sync this iPhone).

Save your credit card automatically

When you enter your card details for the first time in Safari on iPhone, iPad, or Mac, you may see an option asking if you would like to save the card details for future use. Simply honor that alert.

If not, you can always save the details manually, which we explain below.

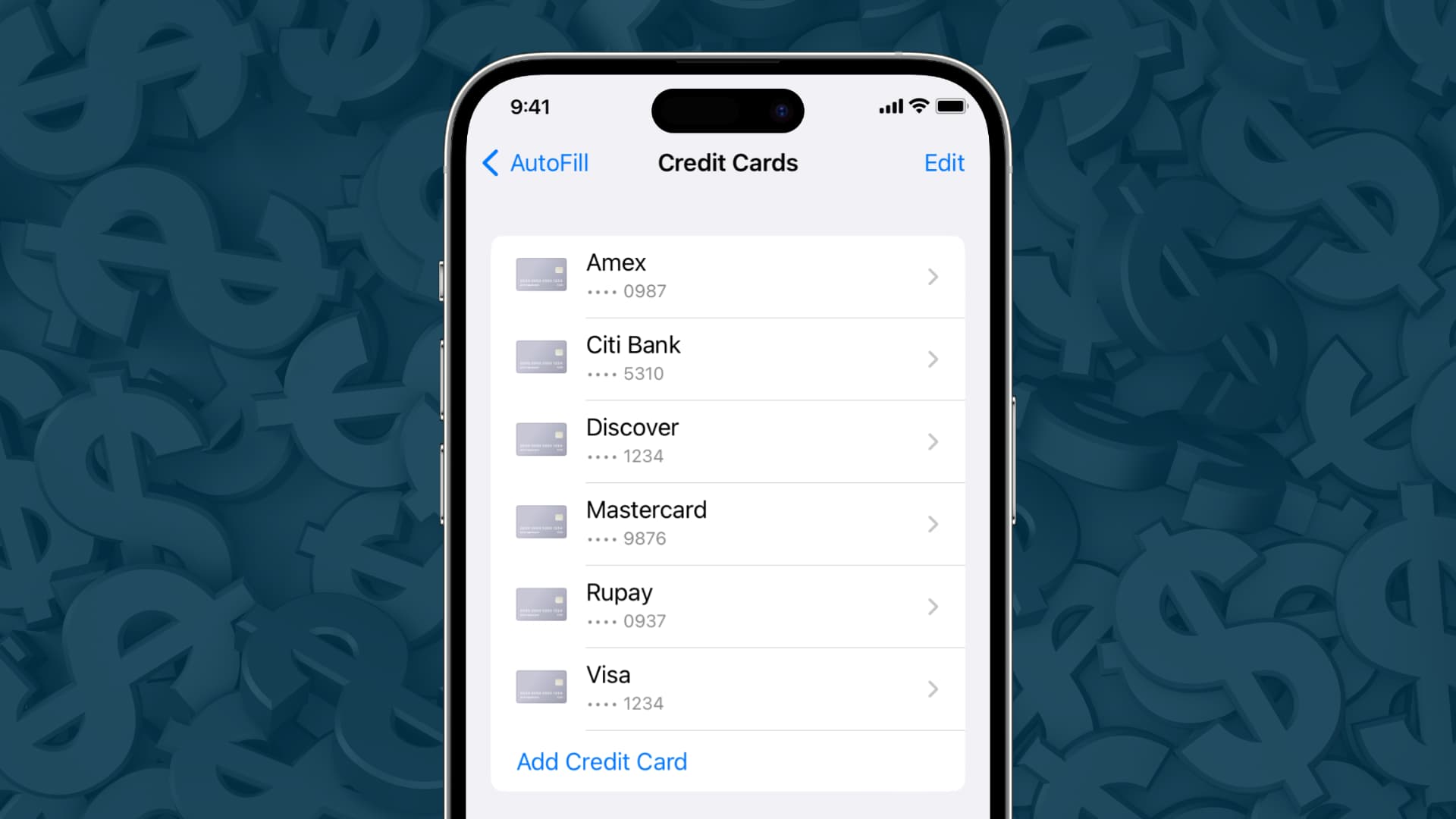

Save credit card details manually for Safari autofill

Thanks to iCloud, any card you save on your iPhone or iPad will automatically appear on your Mac, and vice versa. Here are the steps for both.

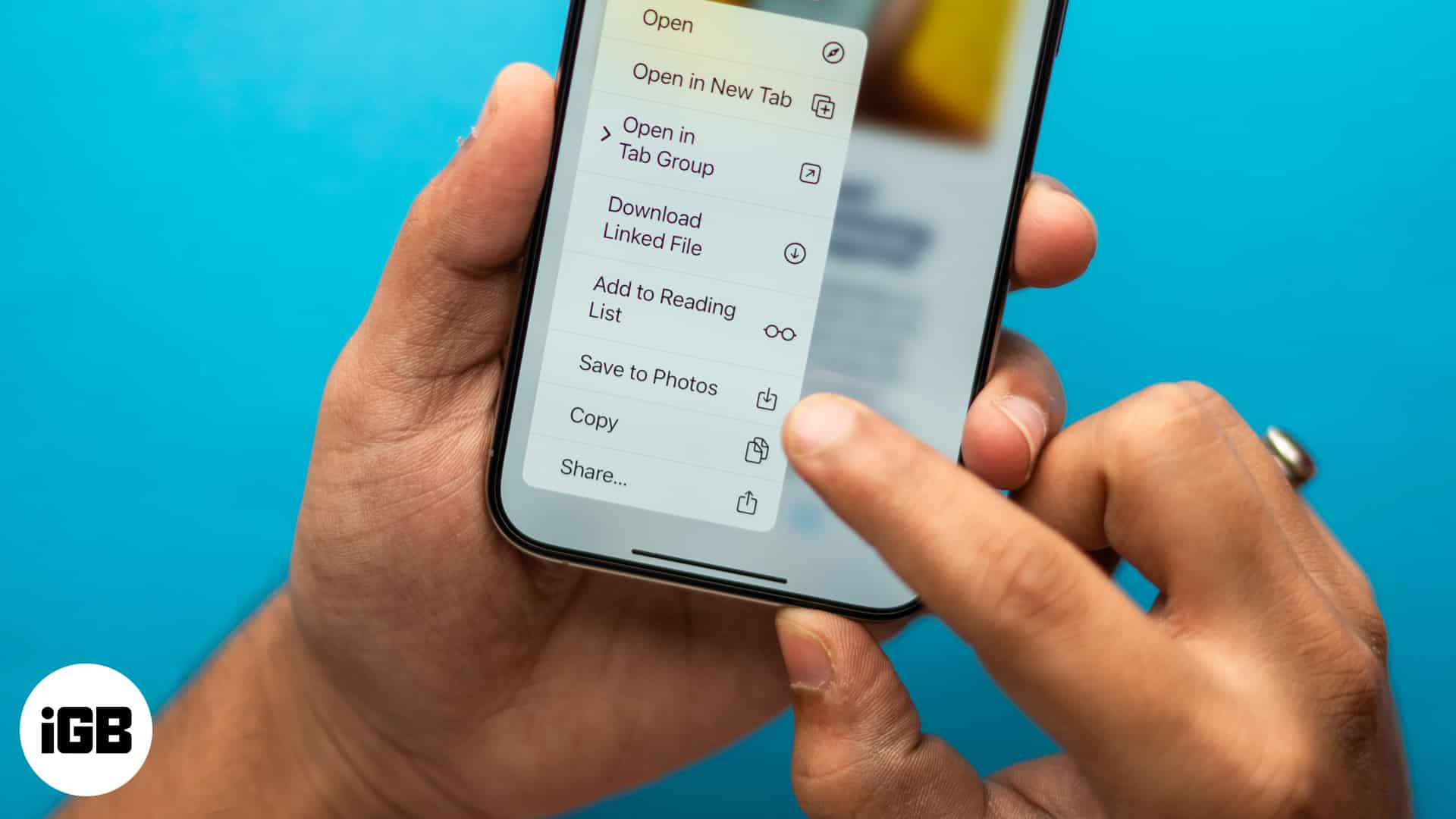

On iPhone or iPad

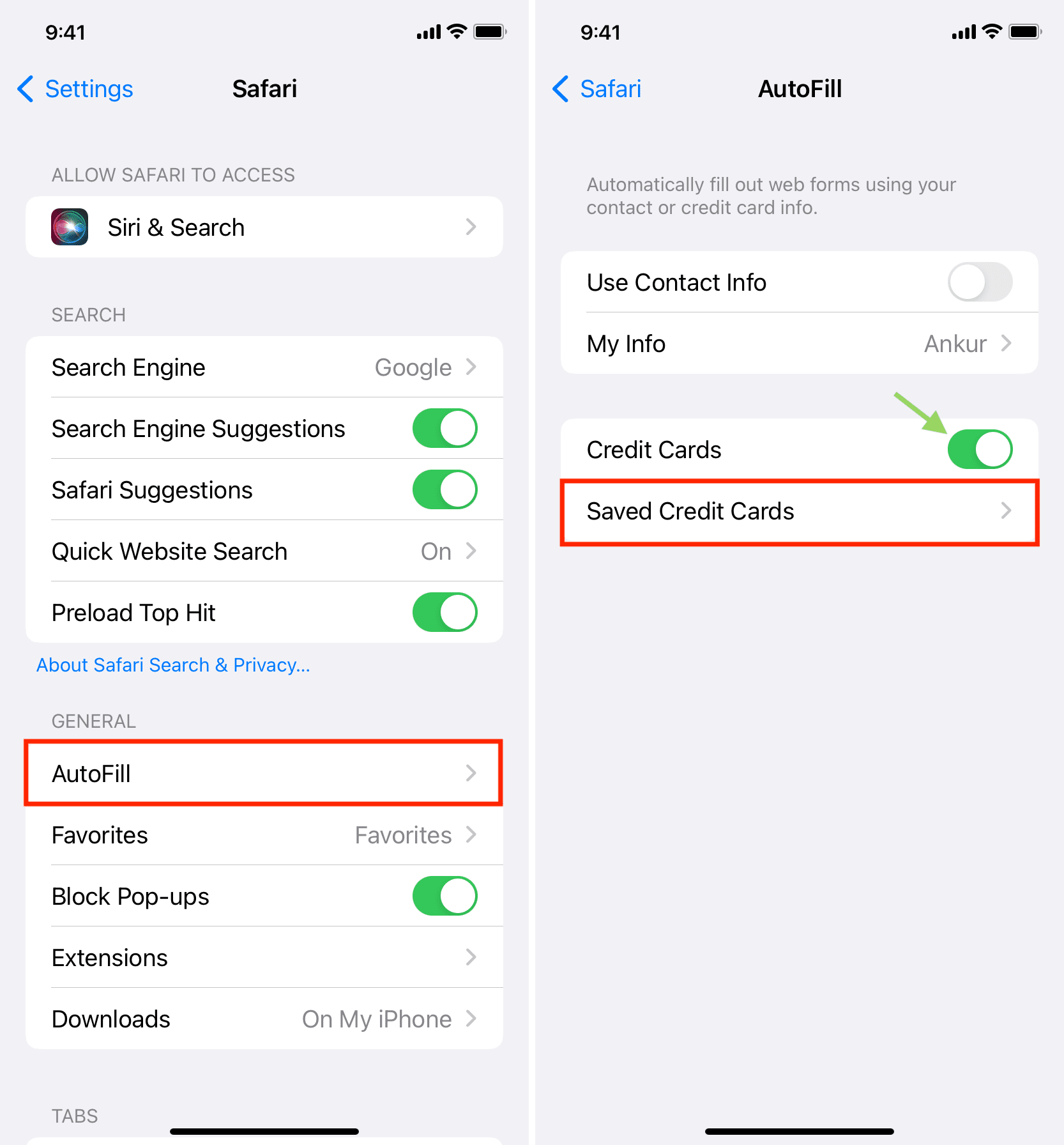

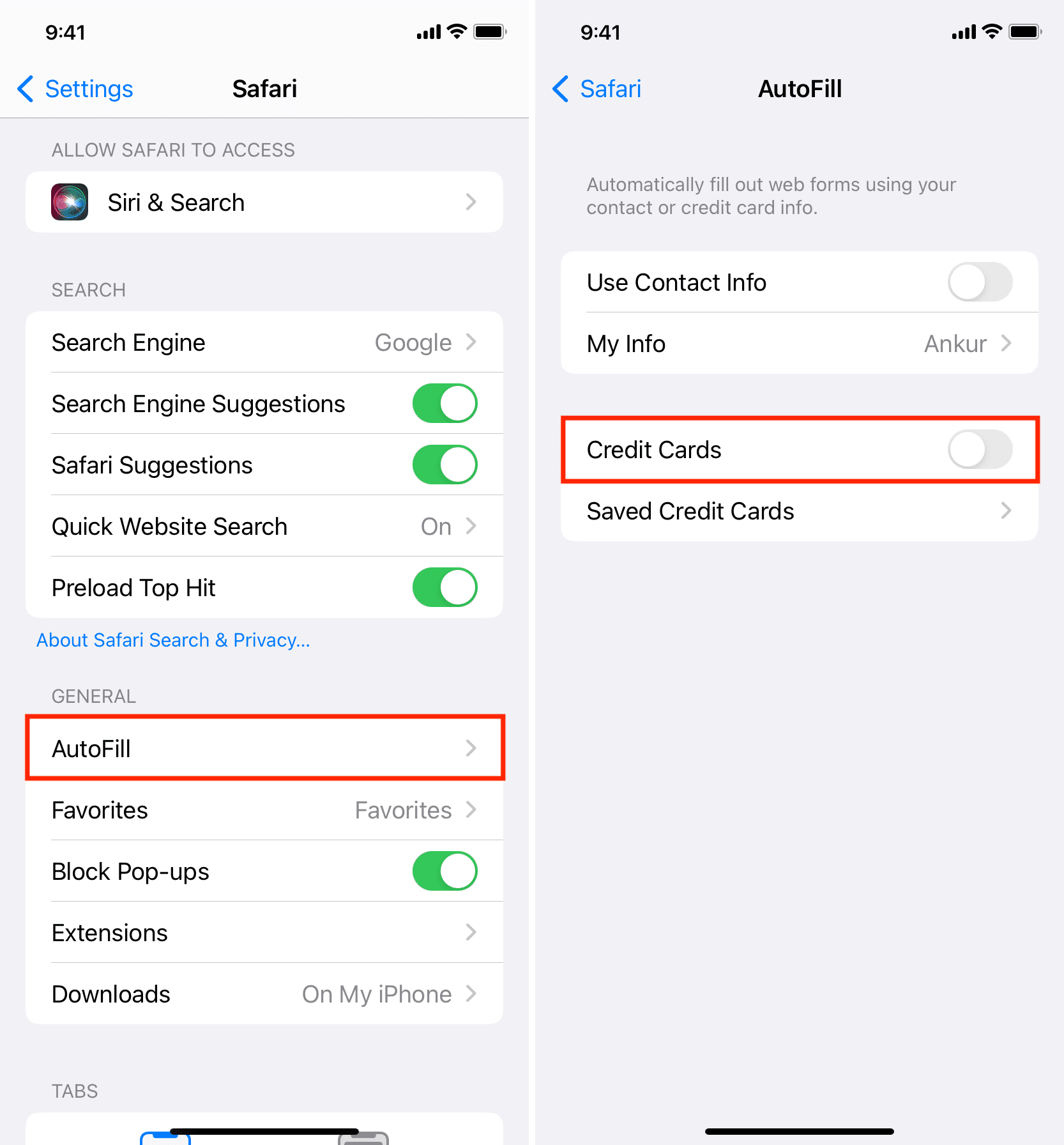

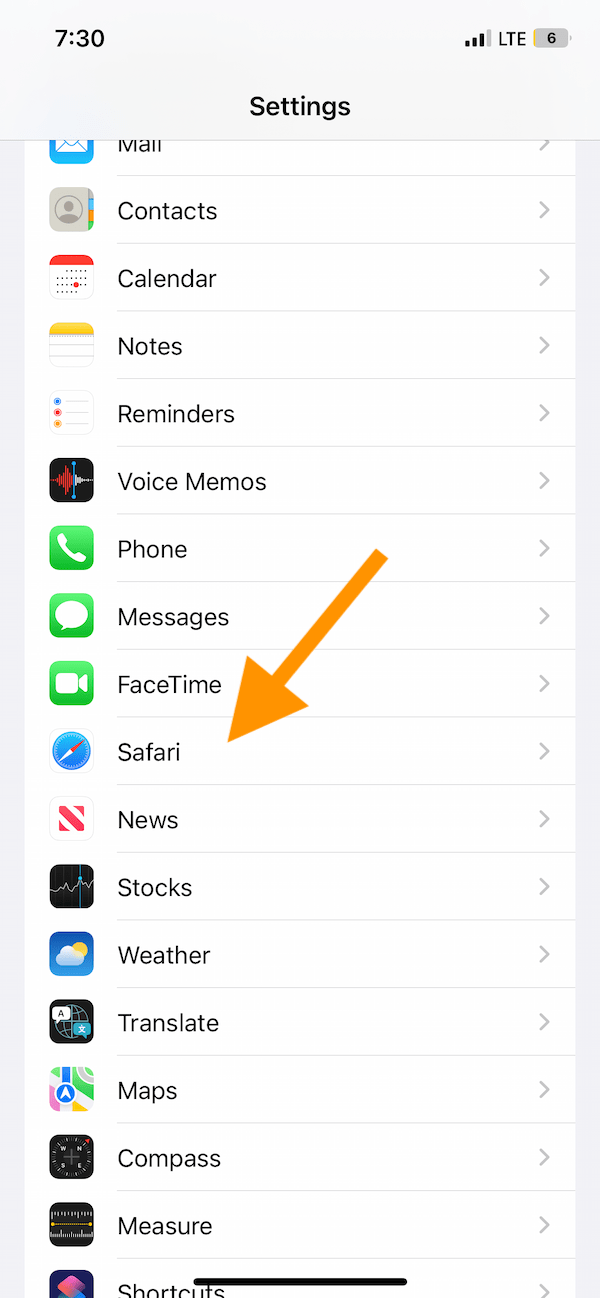

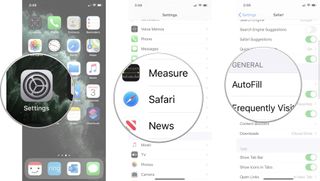

1) Open the Settings app and tap Safari .

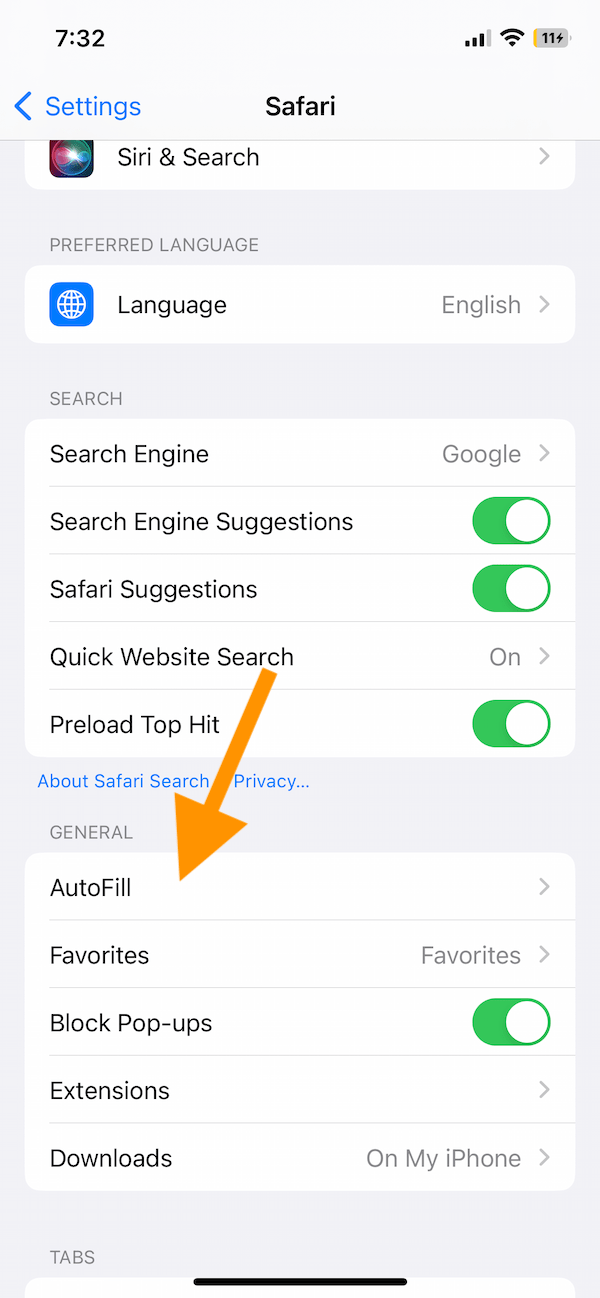

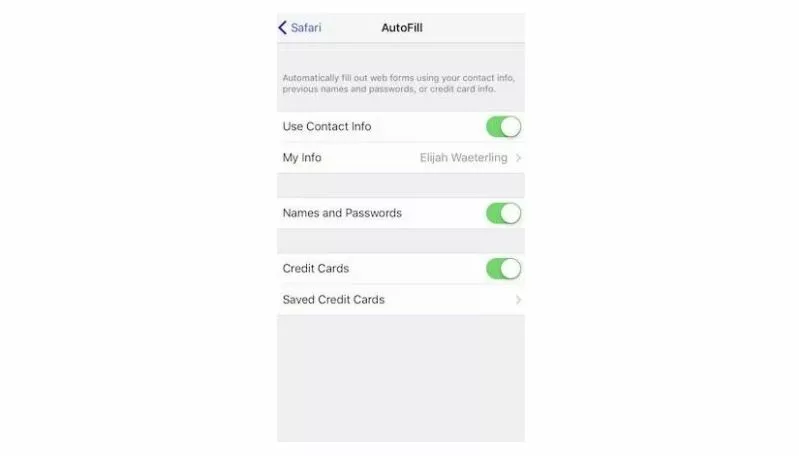

2) Tap AutoFill .

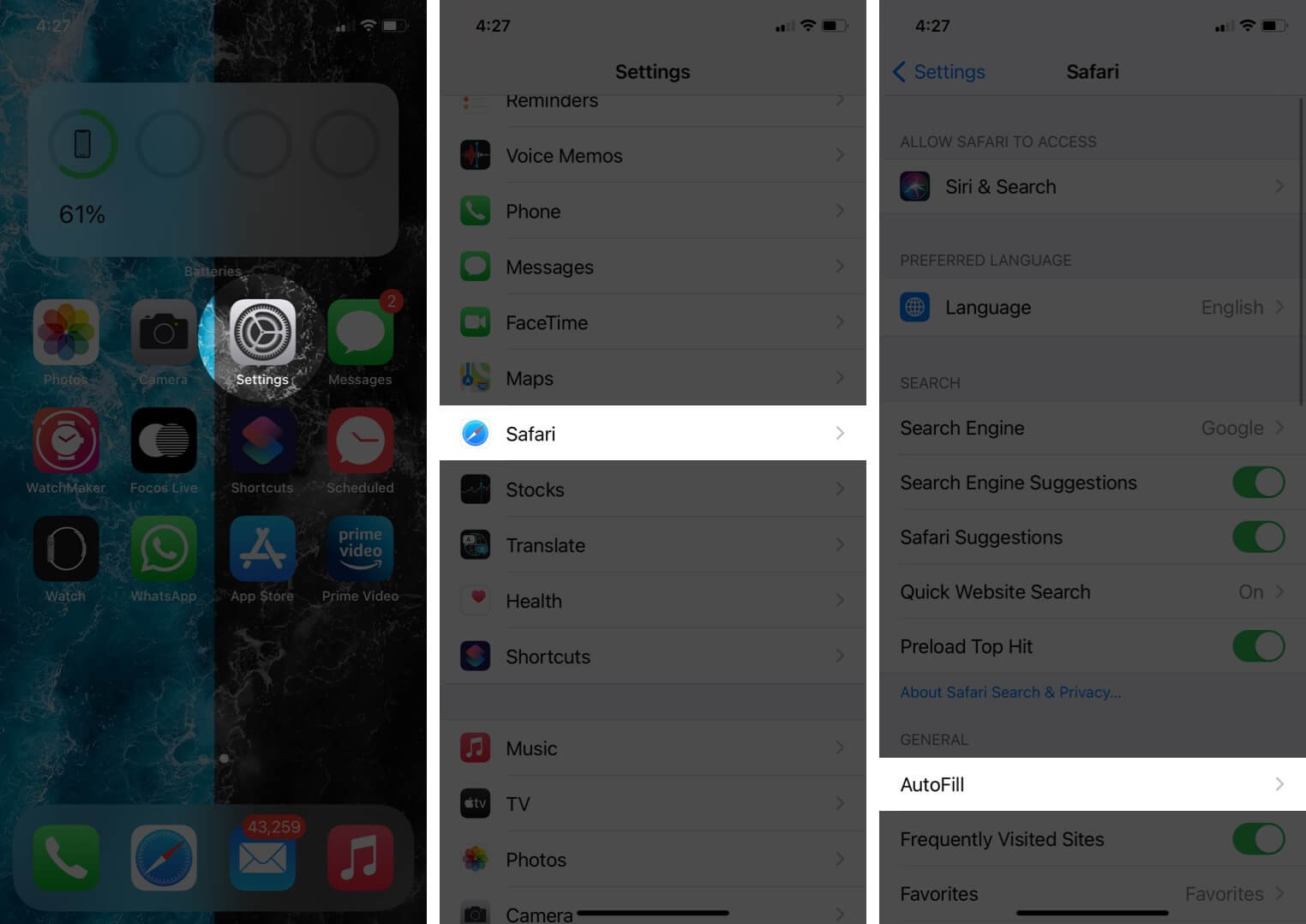

3) Enable the switch for Credit Cards . This will allow your iPhone to autofill your credit card details inside Safari.

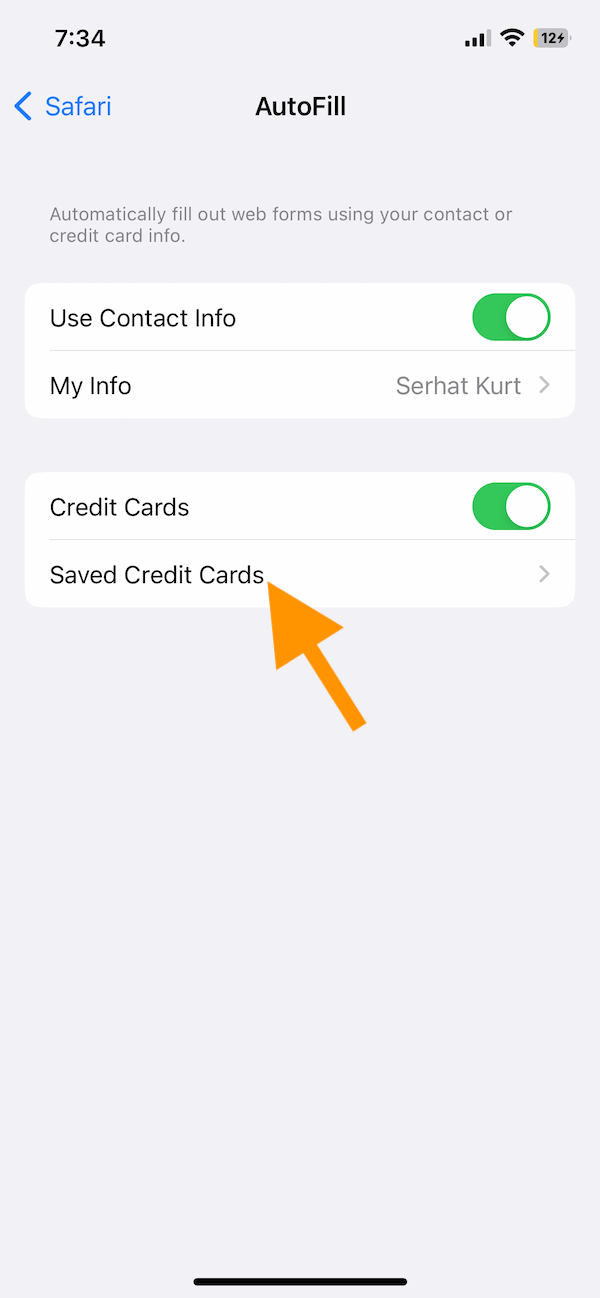

4) Next, tap Saved Credit Cards and authenticate using Face ID or Touch ID.

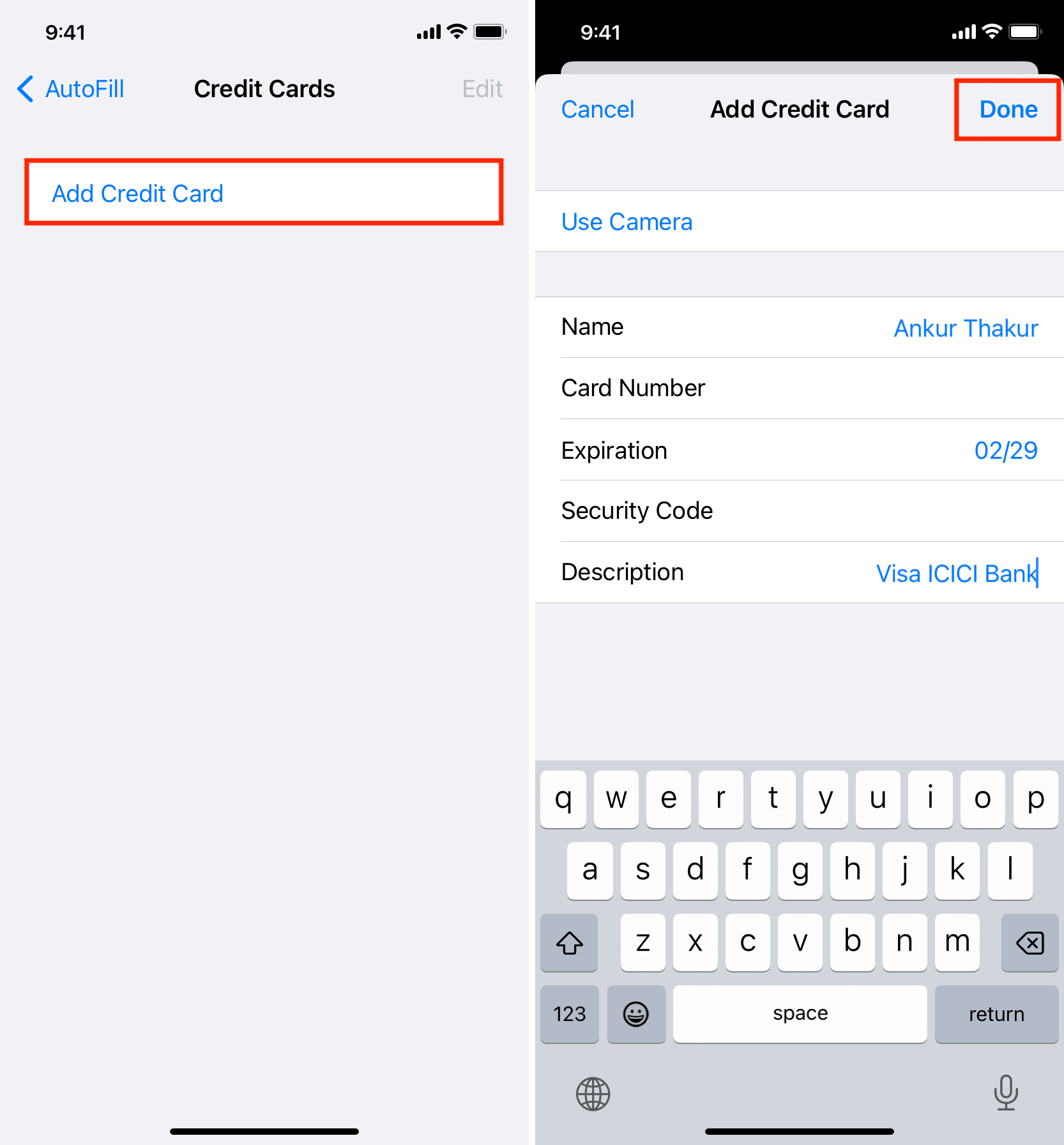

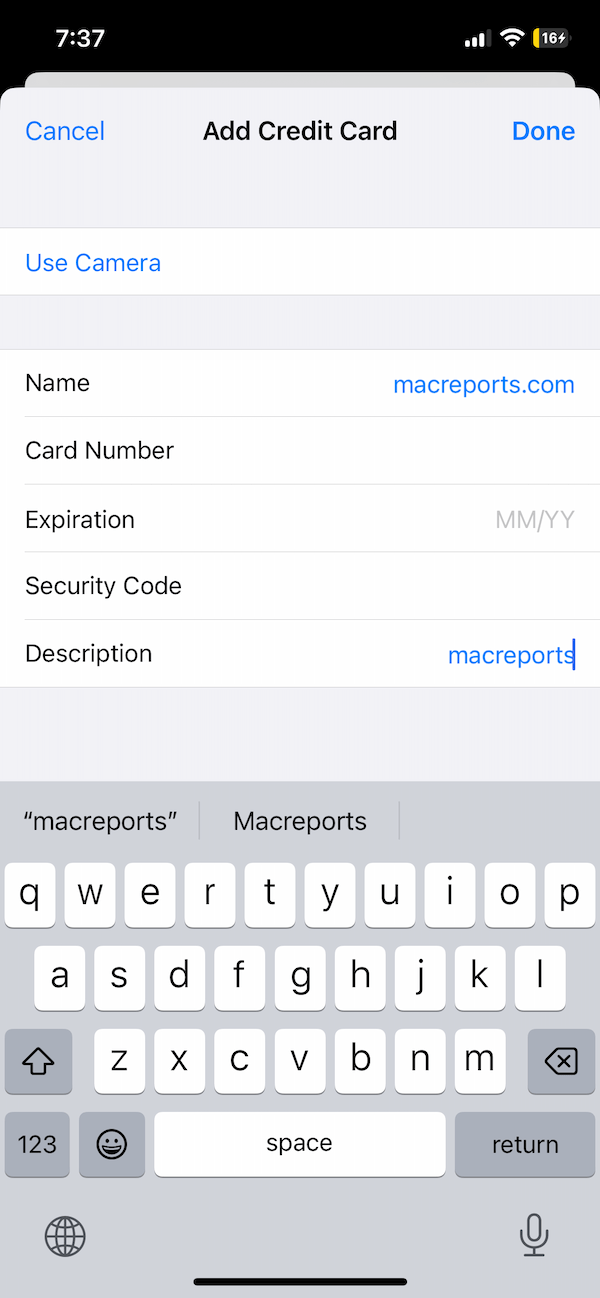

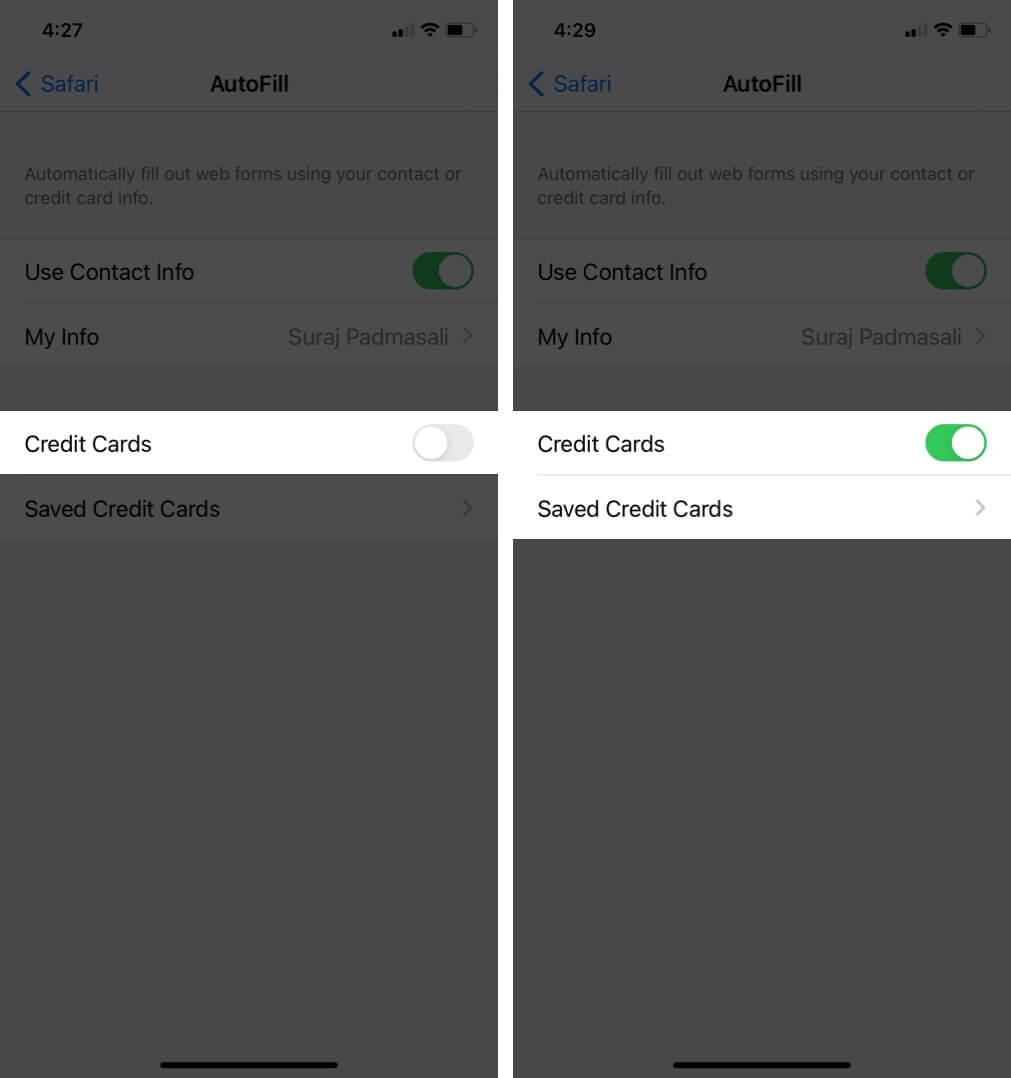

5) Tap Add Credit Card .

6) You can manually enter details like your name, card number, expiration, and security code (CVV).

Or, tap Use Camera and point your iPhone to your credit card. Your iPhone will automatically fill in all or most of the details, like the card number, expiration, and description. In the description, it will read the Visa, Mastercard, or other card provider logo and enter that. You can also change the description to something else, like your bank’s name.

7) With all details filled in, tap Done .

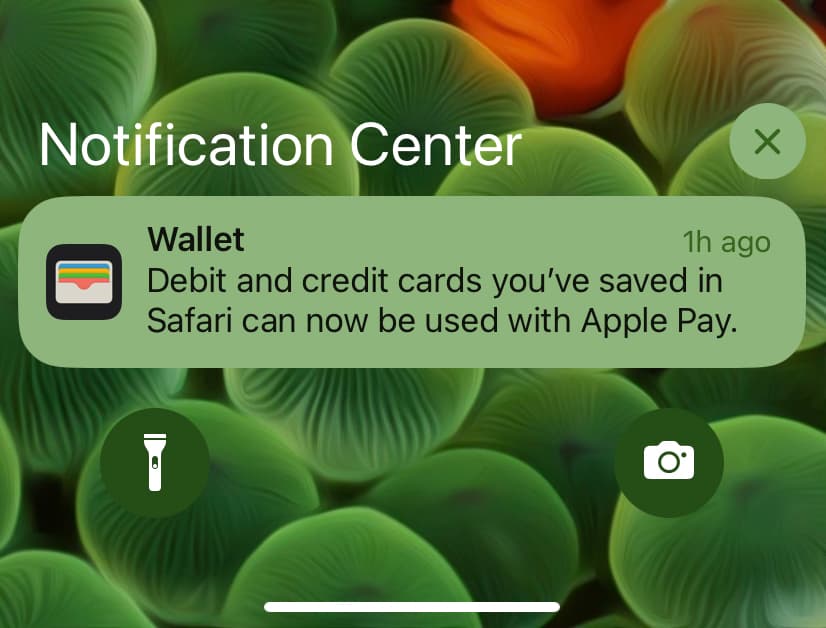

That’s all. You have successfully added your card details to Safari. After this, you may also get a notification from the Wallet app on your iPhone saying, “ Debit and credit cards you’ve saved in Safari can now be used with Apple Pay .” If you have activated Apple Pay , this card is also available for use there. And if you don’t use Apple Pay or are in a country where Apple Pay isn’t supported, then you can safely ignore this notification.

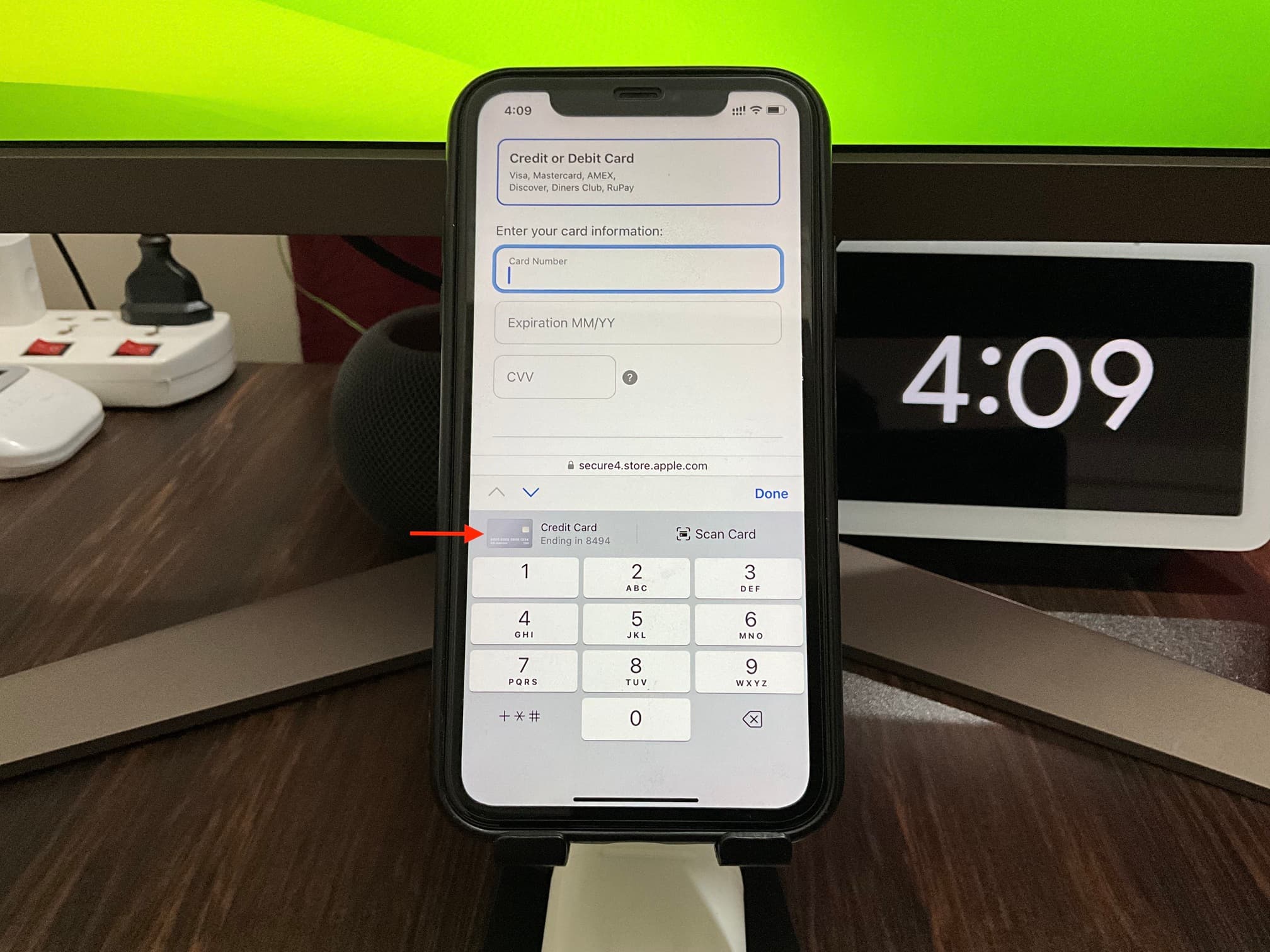

From now, when you’re about to make a payment on a website in Safari and choose the card method, your saved Credit Card details will automatically appear as an autofill option. Just tap it and authenticate with Face ID or Touch ID, and the saved card details will pop right in on the webpage for a faster checkout! Here’s how it looks:

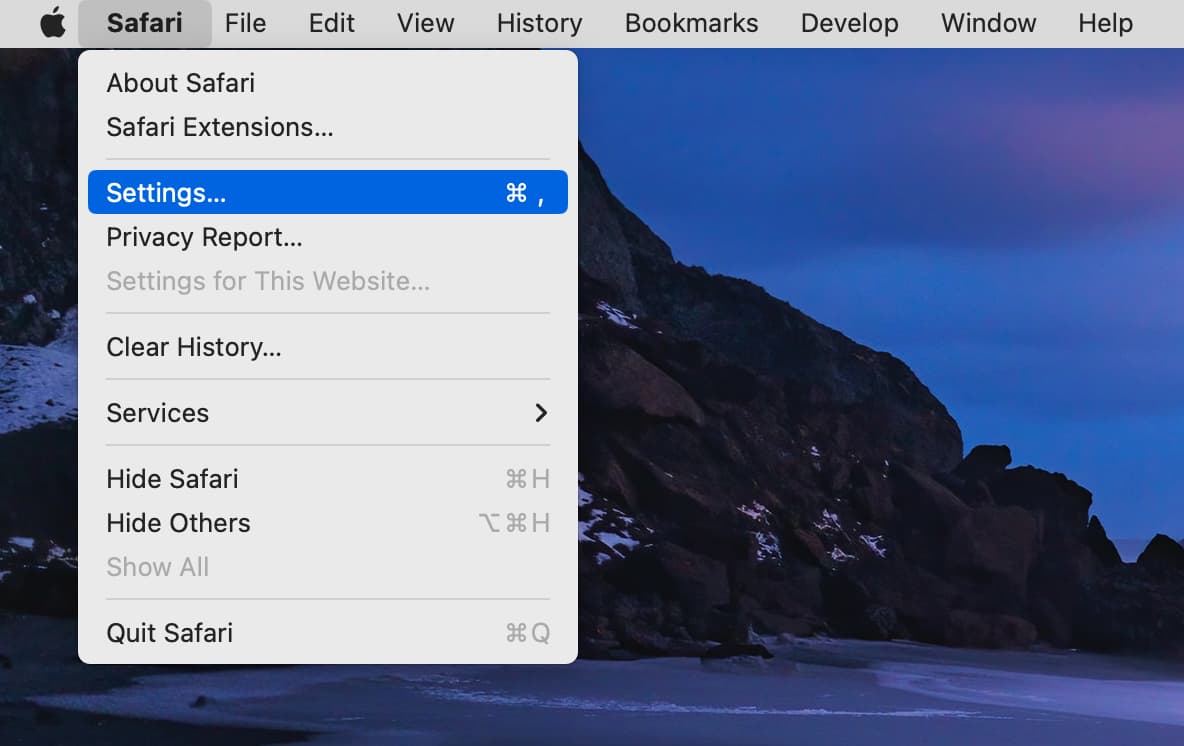

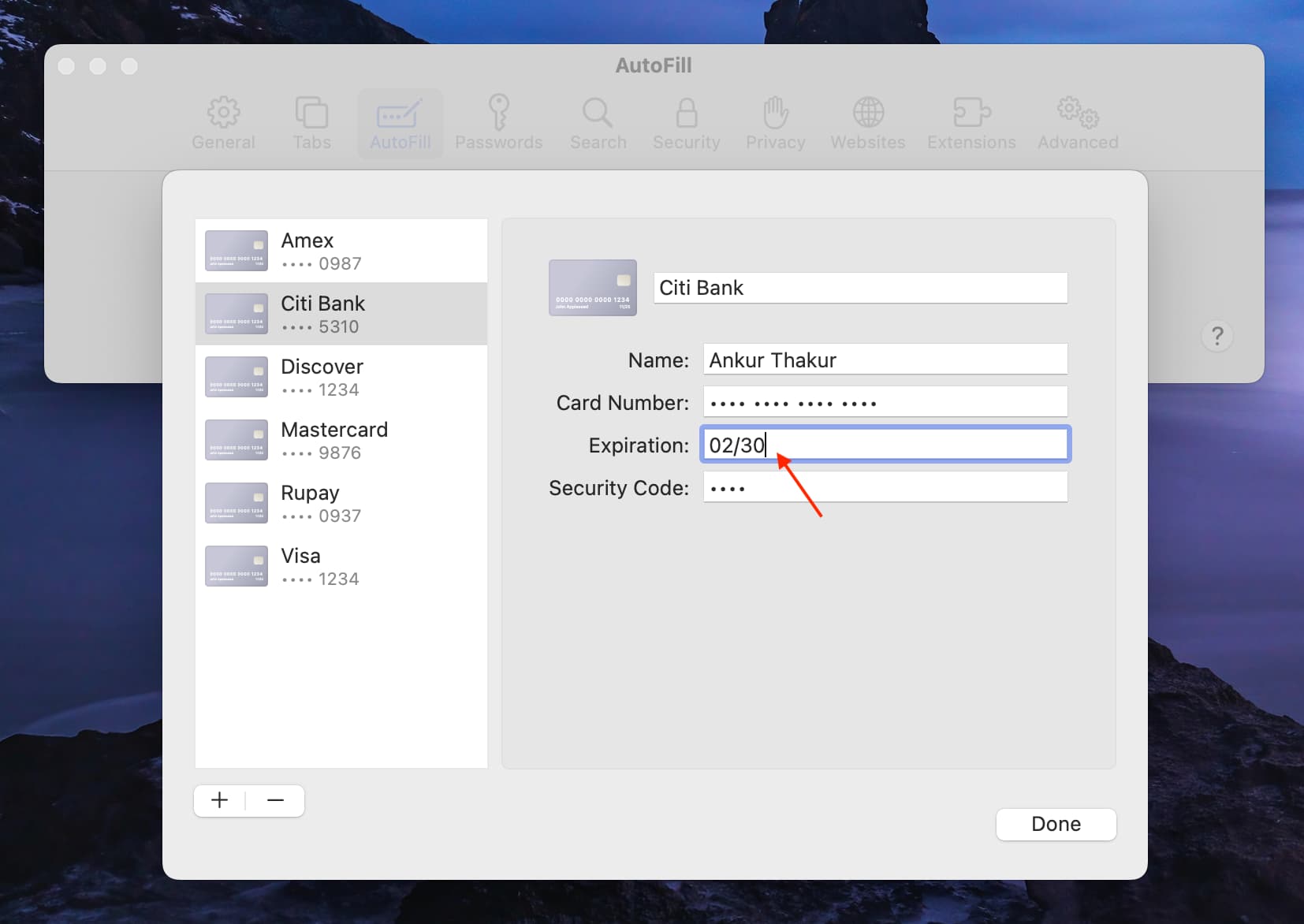

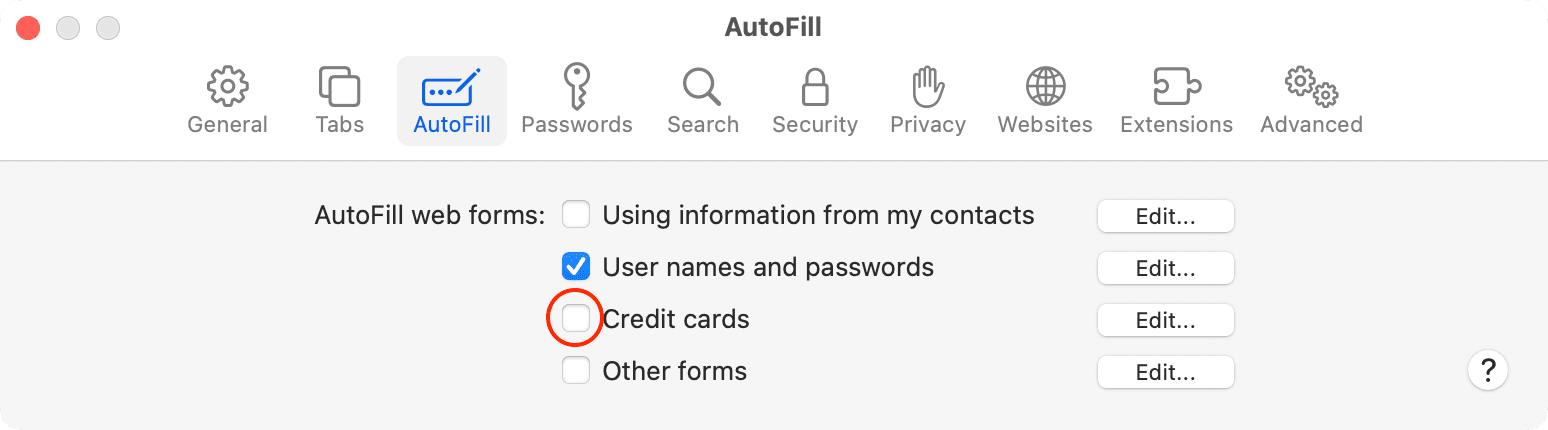

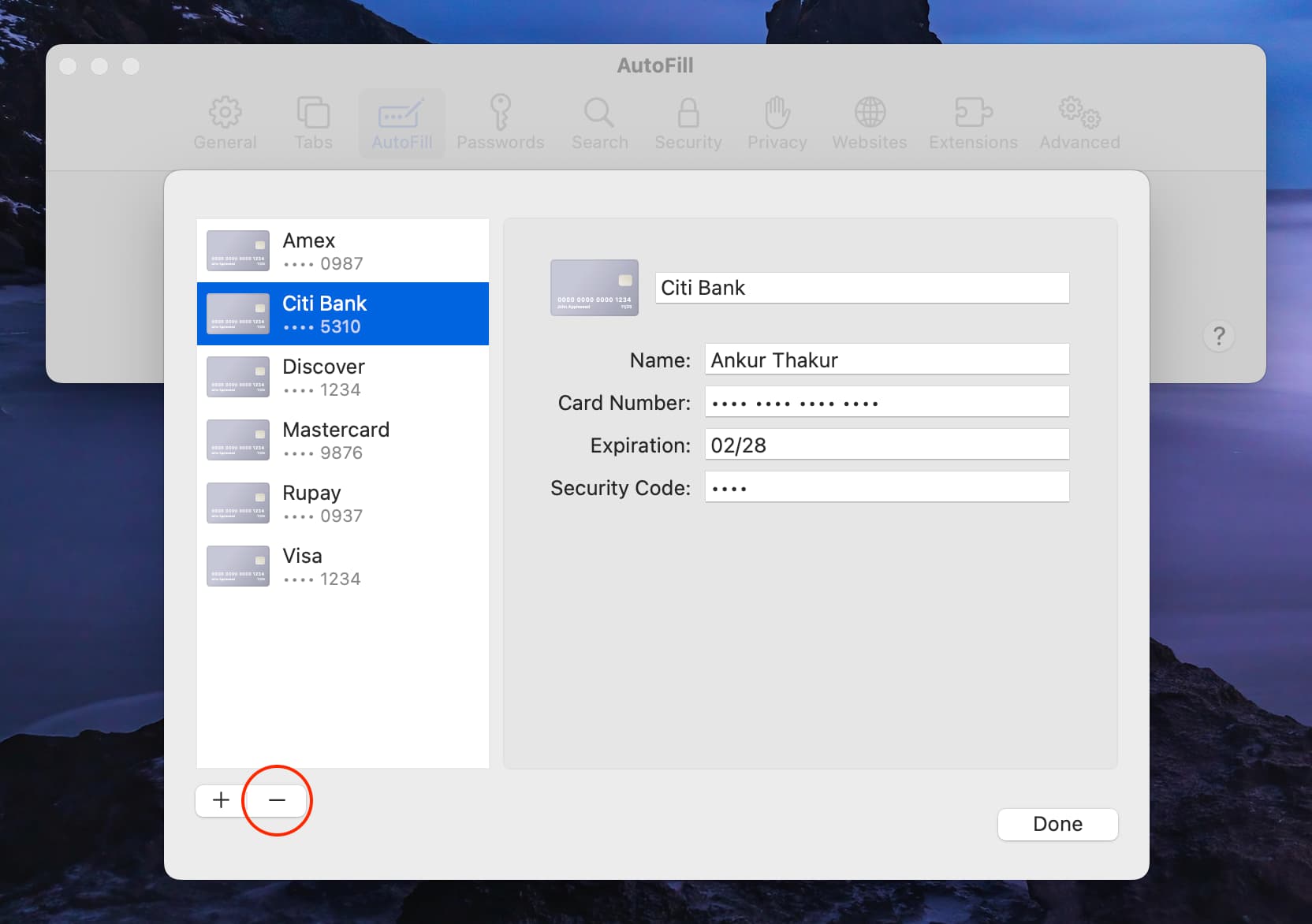

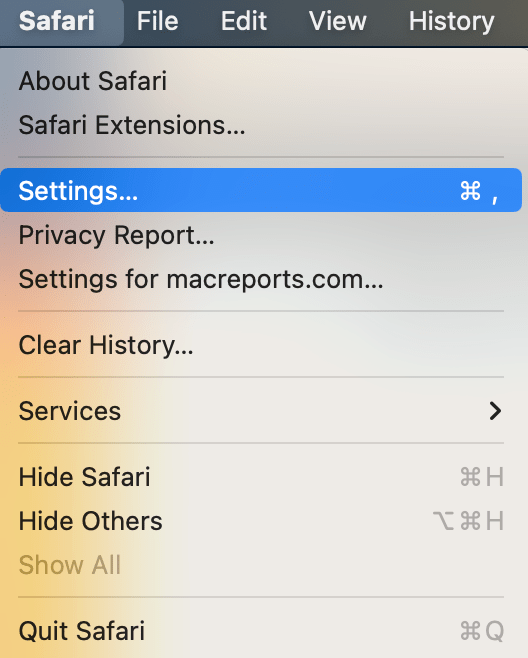

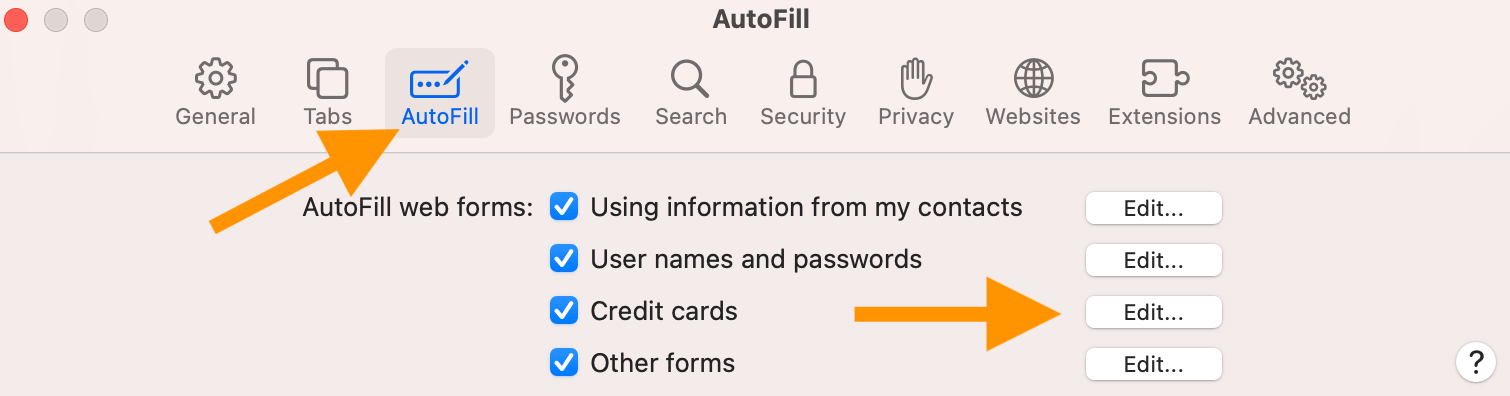

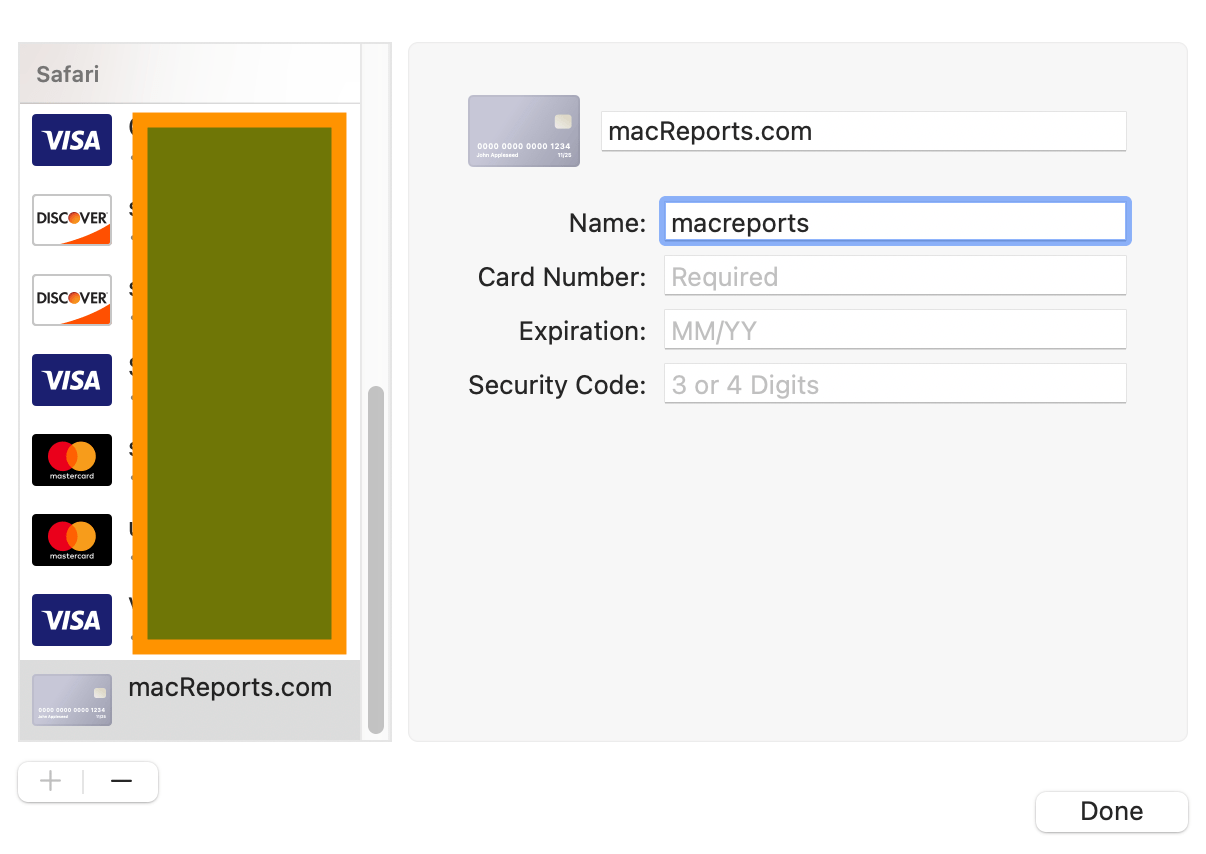

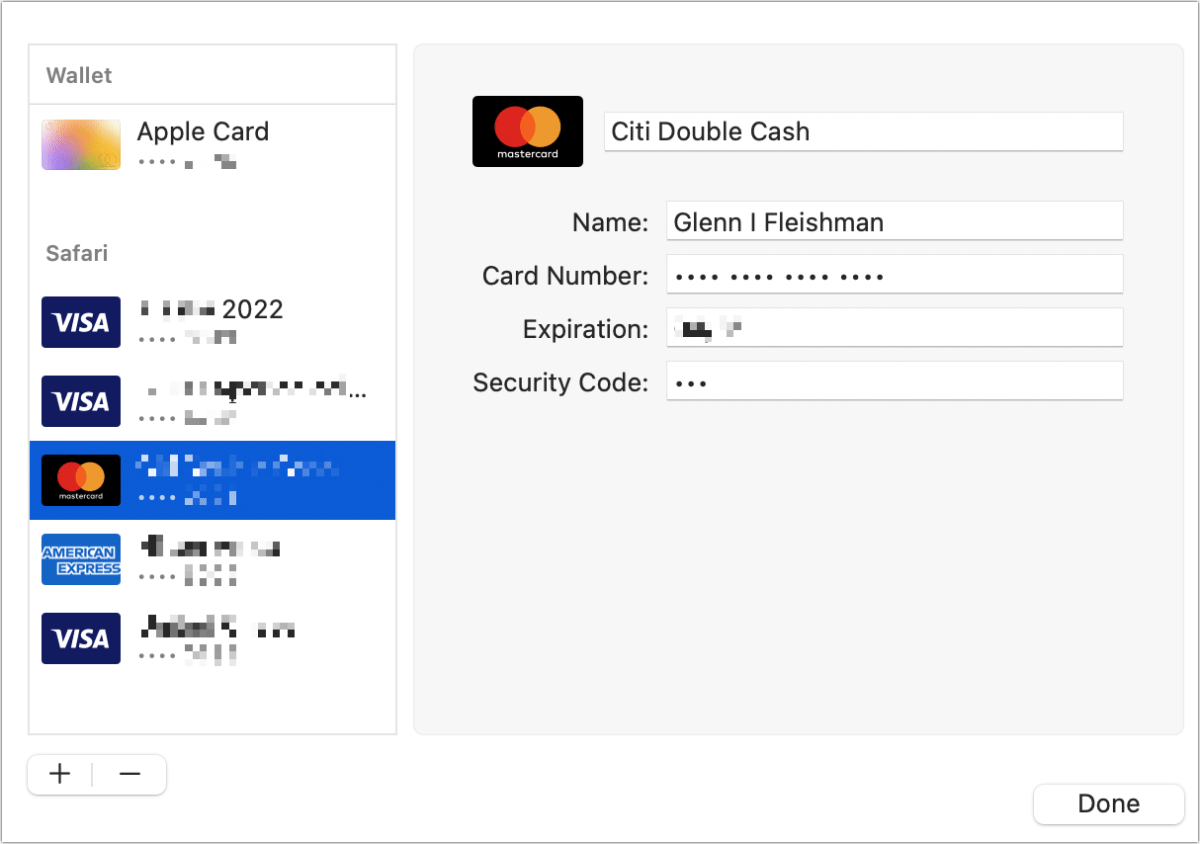

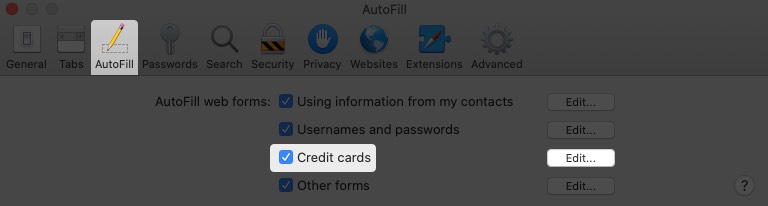

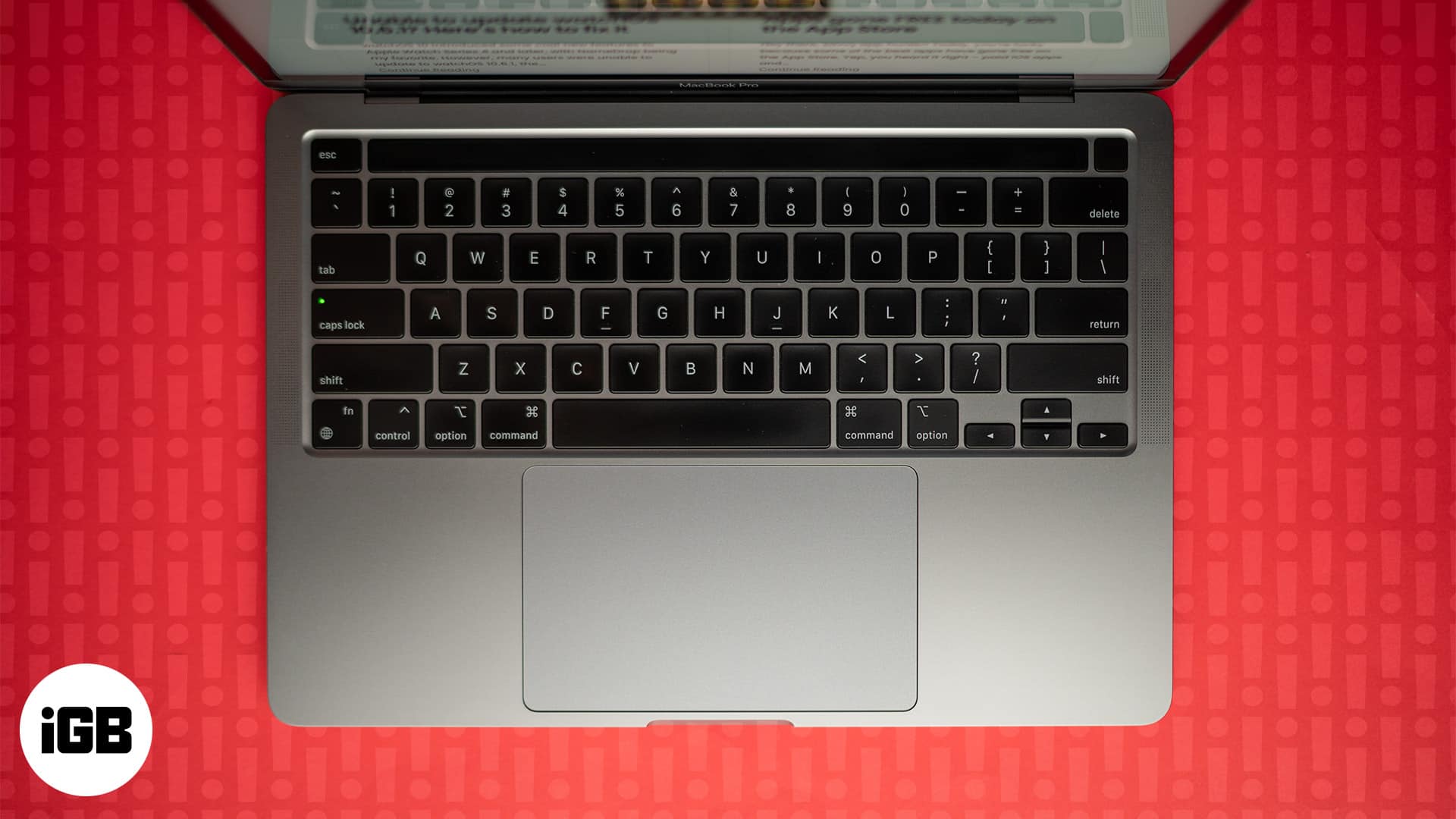

1) Open Safari and click Safari > Settings or Preferences from the top menu bar.

2) Go to the AutoFill section.

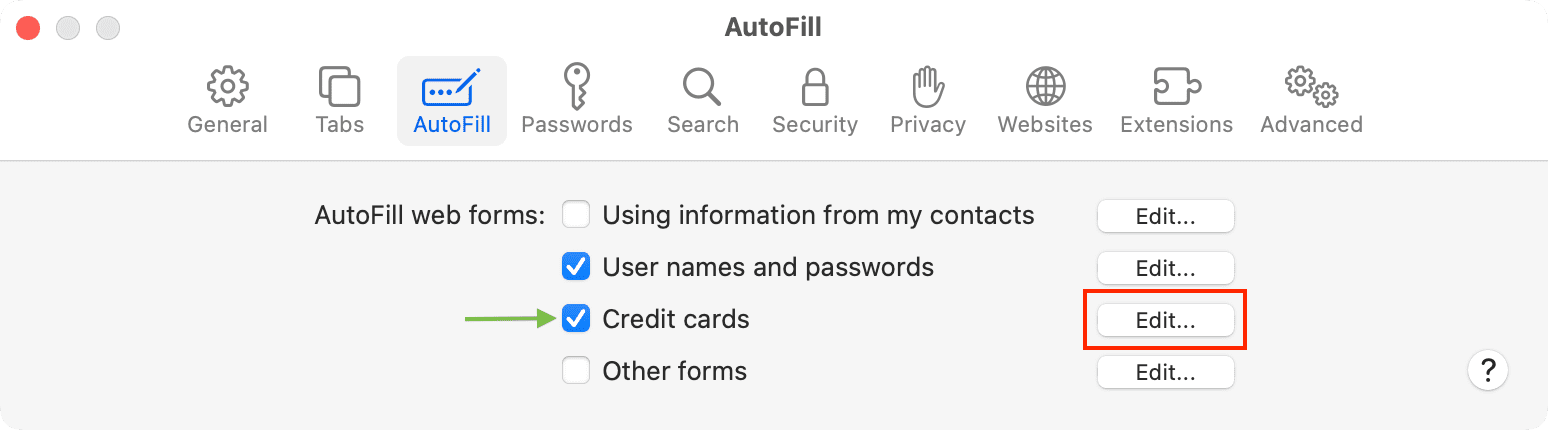

3) Check the Credit cards box to enable autofill.

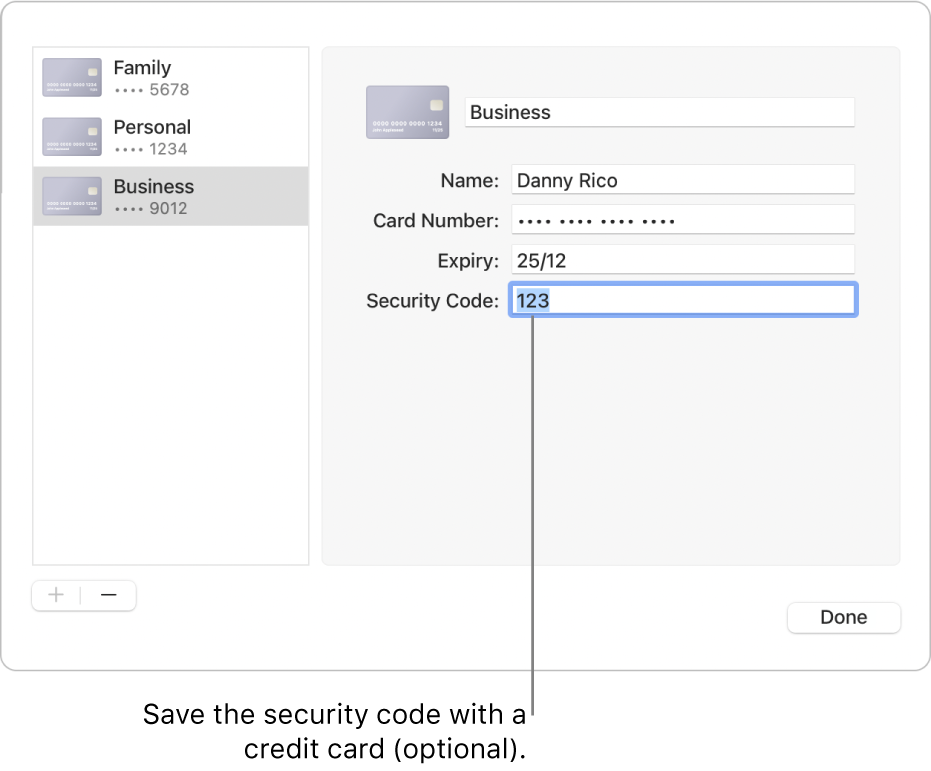

4) Click Edit next to Credit cards and authenticate using Touch ID or your Mac’s password.

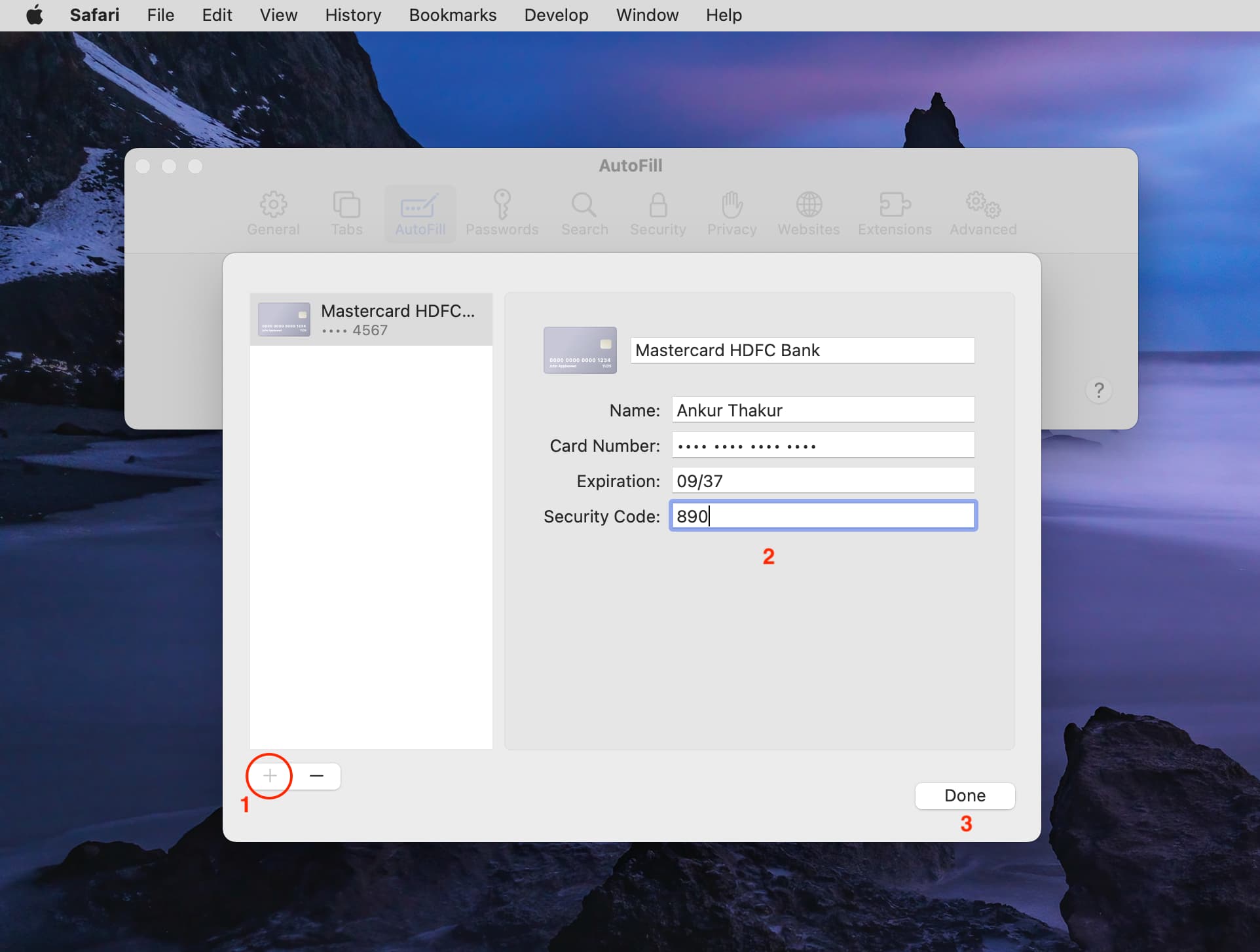

5) Click the plus button (+) from the bottom left.

6) Fill in your credit card details and click Done .

You have successfully saved your card details in Safari on Mac and can use it for swift checkout during purchases.

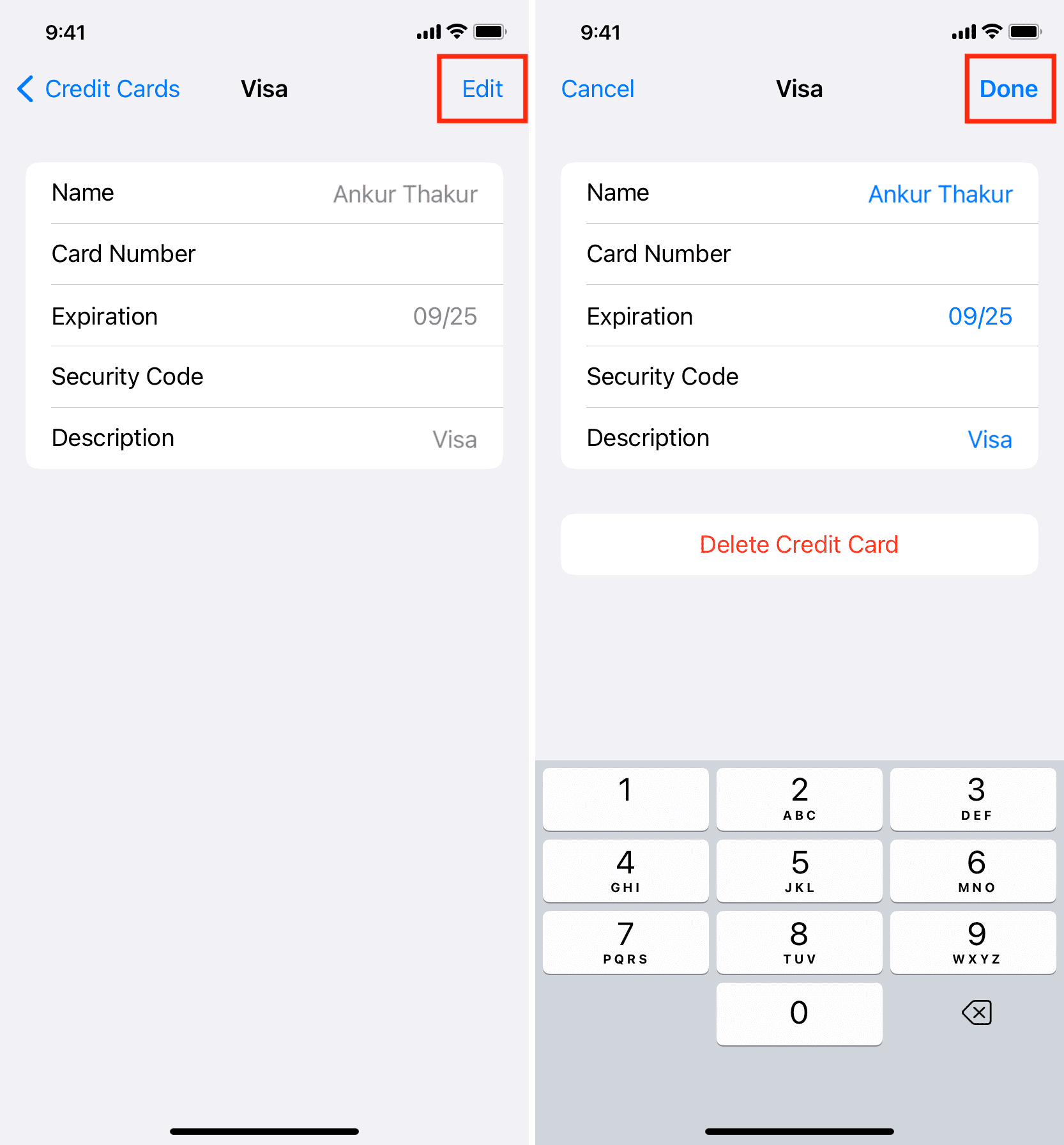

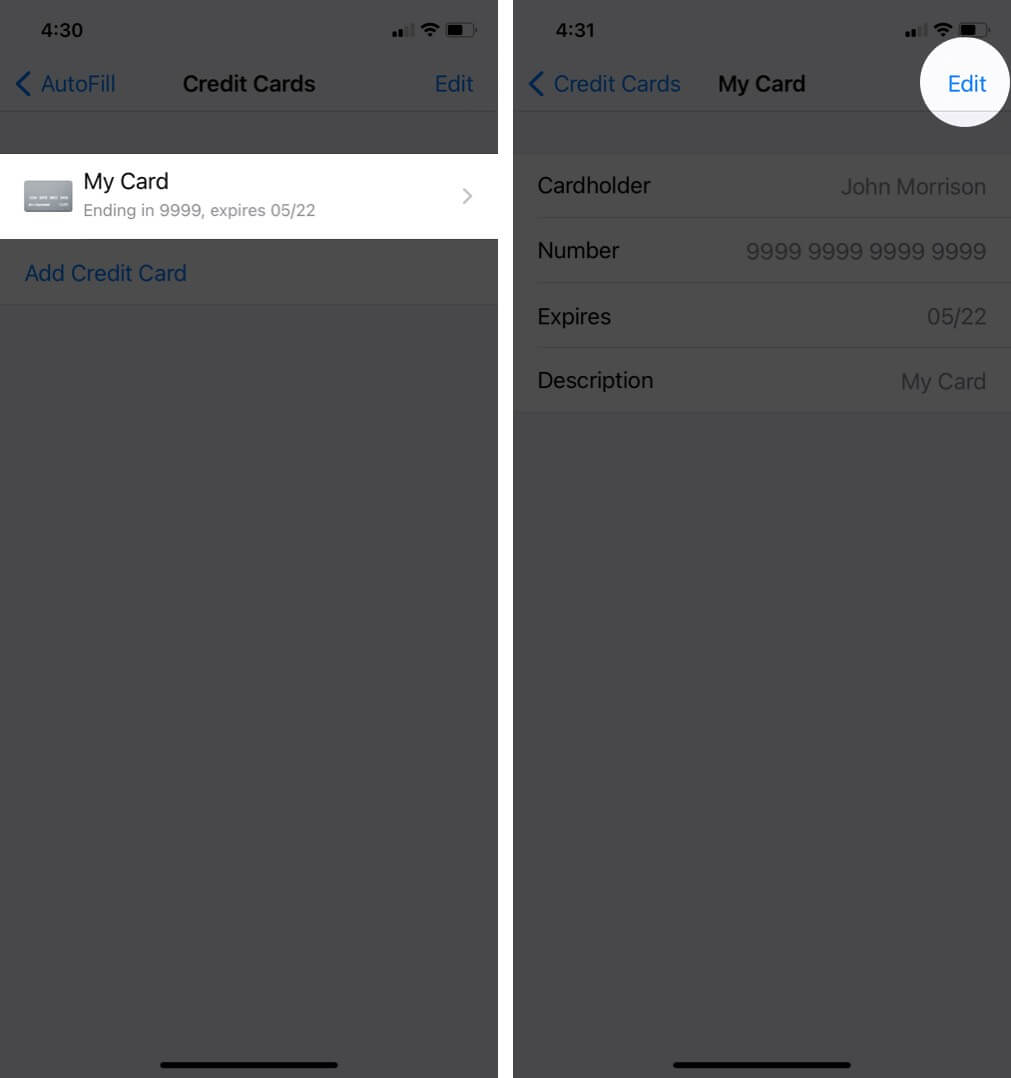

Edit your saved card details

You can easily change the details or description of the saved card. Here’s how:

- Go to the Settings app > Safari > AutoFill .

- Tap Saved Credit Cards .

- Pick the card.

- Make the changes and hit Done .

The new details will soon sync to all your devices via iCloud.

- Launch Safari and go to its settings.

- Click AutoFill .

- Hit Edit next to Credit cards.

- Select a card from the left side.

- Enter the new details and click Done .

Do you have safety concerns?

As per Apple, your card details are encrypted with 256-bit AES encryption during storage and transmission. As a result, your card details can’t be read by Apple.

Still, if you have reservations, you can save your name, card details, and expiration number but leave out the security number (CVV). You can manually fill in the three or four-digit CVV number on the payment page when you’re making a purchase.

Stop credit card autofill in Safari

Follow these steps if you want to temporarily stop seeing your saved credit cards from appearing as an autofill option in Safari when you’re making a payment. Unlike all the other steps in this article, this one is device-specific and applies only to that particular phone or computer.

- Open the Settings app and tap Safari > AutoFill .

- Turn off the switch for Credit Cards , and now you won’t see your saved cards as an autofill option.

- Go to Safari browser and click Safari > Settings or Preferences .

- Uncheck the box for Credit cards .

Delete your saved credit card from Safari autofill

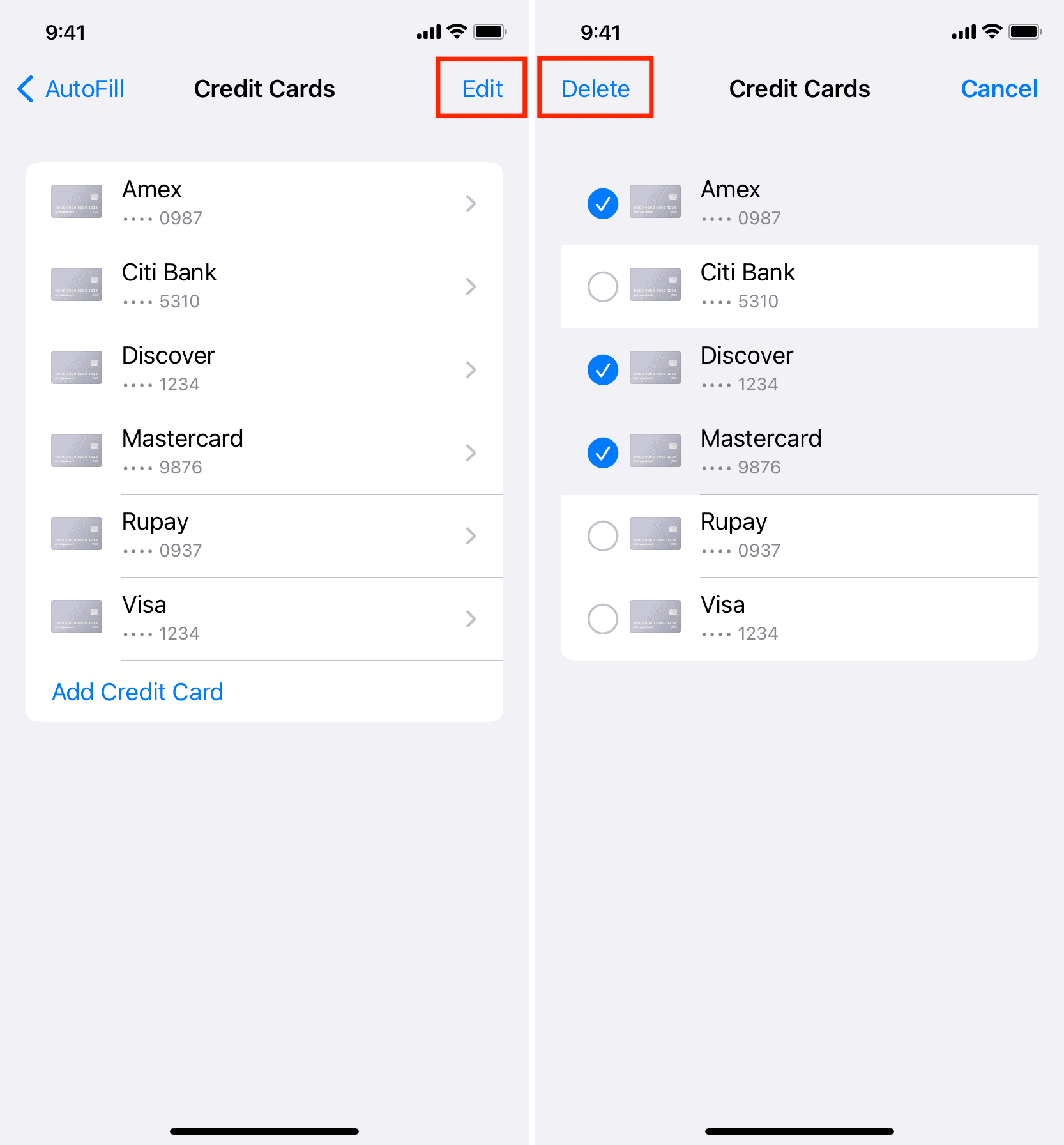

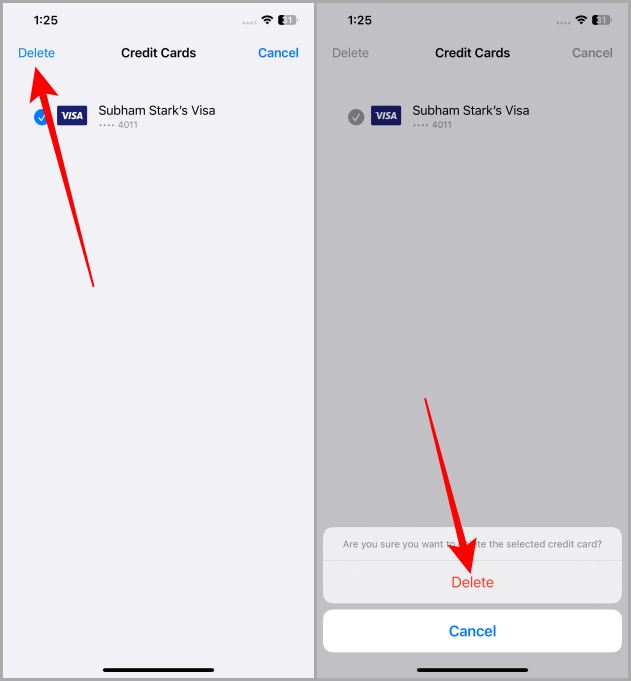

In case you permanently want to remove a saved card from Safari autofill, you can delete it via these steps.

- Open the Settings app and tap Safari .

- Go to AutoFill > Saved Credit Cards .

- Select all the cards you want to delete.

- Finally, tap Delete and confirm.

This card will be deleted from all your Apple devices.

- Open Safari and go to its settings.

- Hit the Edit button next to Credit cards.

- Select a card and hit the minus button (-) to delete it.

- Finally, click Done .

Check out next:

- What is Apple ID balance and how to use it on iPhone, iPad, and Mac

- How to stop name, address, email, and payment autofill suggestions in Safari

- What’s Apple Account card in Wallet? How does it work? How to use it with Apple Pay?

Pocket-lint

How to save, edit, and delete credit cards in autofill on iphone.

Your changes have been saved

Email is sent

Email has already been sent

Please verify your email address.

You’ve reached your account maximum for followed topics.

Key Takeaways

- Autofill on iPhone stores contact and credit card info for convenience.

- You can find, view, and delete saved credit cards in Autofill on iPhone.

- Easily add a new credit card to Autofill on iPhone for online shopping.

The iPhone and Mac have a cool feature called Autofill that you're probably using a lot without even realizing it. It stores your contact and credit card info in Safari, so you don't have to type in all those numbers whenever you shop online. Super convenient, right?

But the catch is that it keeps all your old cards, even the expired ones, which can clutter things up. If you're someone who likes to keep things organized, we'll show you how to find and clean up those old cards in your iPhone's Autofill .

How to set up and use Apple Pay across your devices

Apple Pay makes purchases more convenient with just a tap of your iPhone or Apple Watch. You can also checkout online without digging out your wallet.

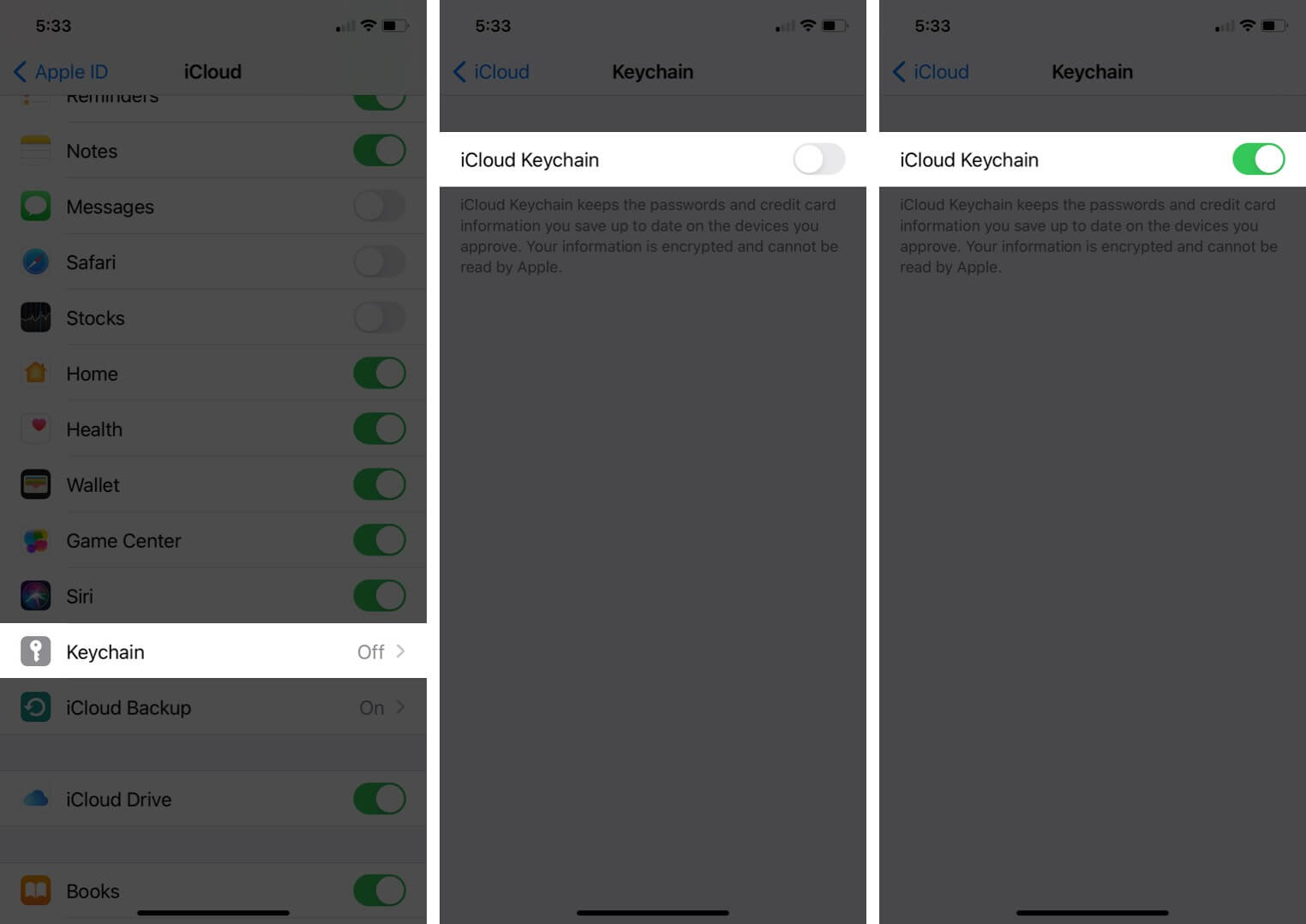

How to find your saved credit cards on iPhone

Finding your saved cards isn't difficult.

Autofill on iPhone is super handy, not just for deleting old cards from Autofill, but also for those times when you don't have your physical cards handy. Like when you need to share your card details for a friend to book a flight for you. You can access all your card info, from the long card number to the expiry date and security code. And you can do all this with no stress about security -- your details are safe behind your iPhone's security features, accessible only to you or someone you've shared your passcode with.

- Open Settings on your iPhone.

- Scroll down to Safari .

- Tap on Autofill under the General section.

- Tap on Saved Credit Cards,

- Authenticate using Touch ID, Face ID or your iPhone passcode.

You'll see a list of your saved credit cards pop up. Tap on any card to view details like the cardholder name , card number , expiration date , security code , and card description . Want to change something? Hit Edit in the top right corner. You can even rename the card description by tapping on a card, hitting Edit , and then tapping the description .

The case for an iPhone 15 Pro

The latest iPhone Pro is impressive, so you'll want to protect it and make it your own with these durable, fun cases.

How to delete your credit card info in Autofill

Do away with it forever.

To delete Autofill info on your iPhone and prevent an expired card from popping up during Safari checkouts, just clear out expired cards. This way, you avoid the hassle of accidentally choosing one and facing a declined payment during your purchase process.

- Tap on Saved Credit Cards .

- Authenticate using Touch ID, Face ID, or your iPhone passcode .

- Tap on Edit in the top right corner.

- Select the credit cards you want to remove or delete.

- Tap on Delete in the top left corner.

- Confirm Delete .

You can also delete a card by tapping on it. Then, hit Edit in the top right corner and select Delete Credit Card to remove it.

Should I buy the iPhone 15 Pro now or wait for the iPhone 16 Pro?

There's no time like right now to buy a new phone, and waiting could mean missing out on great summer deals.

How to add a credit card to Autofill on iPhone

This can be helpful when needing to add a brand new card.

To add a new credit card to your iPhone's Autofill, so it pops up as an option when you're shopping online, just add it once and you're set. Perfect for when you get a new card and want to use it in Safari without having to carry it around all the time.

- Tap on Add Credit Card .

- You can then use your iPhone's camera to scan your card by selecting Use Camera .

- Alternatively, enter the cardholder name, number, expiry, security code, and description manually.

- Tap Done in the top right corner when you've finished.

How to see if someone has read your text message on Android

Read receipts only work if both of you have RCS chats enabled. Here's how to see if someone opened your text on Android.

Q: Why do I have autofill?

Autofill stores your data like name, address, contact details, payment methods, and more. With this feature enabled, you don't need to manually enter the same information over and over again.

Q: What are the disadvantages of autofill?

Hackers can easily access saved passwords and personal information stored in autofill, leaving users vulnerable to identity theft and other forms of cyberattacks.

Q: How to delete saved credit card info on Mac

To delete saved credit card info on a Mac, just follow these steps. It's a good idea to do this to avoid a cluttered list of old cards, which can be a hassle if you accidentally choose an expired one while shopping online, especially in places where Apple Pay isn't an option.

- Open Safari on your Mac.

- Click on the Safari tab in the menu bar at the top of your screen.

- Select Settings .

- Click on the Autofill option at the top of the pop-up box.

- Click on the Edit button next to the Credit Cards box.

- Enter your password.

- A list of your credit cards saved on Autofill will appear.

- Select the credit card you want to remove or delete from Autofill.

- Hold down the shift key to select multiple cards.

- Press the Remove button.

Q: How to add a credit card to Autofill on Mac

To add a credit card to Autofill on your Mac, just go through these steps. It's smart to add your new card as soon as it arrives so it's all set for autofill, making your online shopping smooth and hassle-free.

- Click on the Add button below the list of credit cards.

- Enter the description, card number, cardholder, security code, and expiry by clicking the relevant boxes.

- Click Done .

How to Add, Edit or Remove AutoFill Credit Card Information in Safari

Safari’s AutoFill is a great feature that will fill in certain information for you so that you don’t have to type it over and over again. You can let Safari fill out forms automatically with your saved payment info. This will enable you to quickly navigate and complete online payment forms. For example, if you are using WesternUnion to send money, you can enter your credit card details automatically, meaning Safari will enter the card number, expiration date and security code. Unless you know your credit card number by heart, entering your card details into an online form can be a tedious process if you do this manually. This feature offers not only practicality but also saves time.

You may want to add or modify your credit card details for a variety of reasons. For example, if you have a new Apple Card, you will want to save it to Safari. If there are cards you no longer use, you may want to remove them. Or, if you change your Apple Card number , you would want to update it because the old number would be outdated.

You can add, edit, or delete saved payment information and credit card details in the AutoFill settings. Here is how.

Add, edit or delete AutoFill credit card info in Safari on Mac

- Open Safari on your Mac.

- From the top menu, click on Safari , then Settings (or Preferences if you are running macOS Monterey or earlier). Or press Command – Comma ( , ) together.

- Select the AutoFill tab.

- Click the Edit button next to “Credit cards.”

- The next screen will say, “Credit Cards Are Locked.” Enter your password to unlock it so that you can open the card screen.

- Click the add (+) button to add a new card. Add the details and click Done .

- Click the minus (-) button to remove an existing card. Select a card and click this remove button.

- Select a card, and then you can edit the details such as name, card number, expiration date and security code.

Add, edit or delete AutoFill credit card info in Safari on iPhone or iPad

- Open Settings on your iPhone or iPad.

- Tap on Safari .

- Tap AutoFill under the General section .

- Tap Saved Credit Cards .

- Scroll down and tap Add Credit Card to save a new card. You can click on Use Camera to scan your card and enter the details quickly. You can also use the keyboard to enter it manually.

- Swipe left, and tap Delete to remove a card. You can also tap Edit and select credit cards to remove and tap Delete . This way, you can delete multiple cards at once.

- Tap a card to open its details. Then tap Edit to make changes if needed.

Related articles

- How To View And Download Apple Credit Card PDF Statements

- How To Increase Your Apple Card Credit Limit

- App Store Keeps Asking For Credit Card Info? Fix

Dr. Serhat Kurt worked as a Senior Technology Director specializing in Apple solutions for small and medium-sized educational institutions. He holds a doctoral degree (or doctorate) from the University of Illinois at Urbana / Champaign and a master’s degree from Purdue University. He is a former faculty member. Here is his LinkedIn profile and Google Scholar profile . Email Serhat Kurt .

Similar Posts

How to use remind me later for mail on iphone.

iOS 16 has some cool new features for Mail. In iOS 16, you can unsend emails, schedule an email to be sent later and set reminders for an email. Setting a reminder for…

macOS Monterey: iMovie Not Working, How to Fix

Some users are experiencing iMovie issues after upgrading their computer to macOS Monterey. Some problems include: Unable to open iMovie. Unable to open or play projects. iMovie keeps showing “spinning beach ball loading”…

How to Prevent ‘Now Playing’ on Apple Watch from Opening Automatically

The Now Playing app on Apple Watch can be useful — I use it all the time to control my music on my Bluetooth speaker. However, there are times when you may not…

How to Fix ‘Slack Is Trying to Add a New Helper Tool’

If you have Slack installed on your Mac, you may have run into the problem of having a very annoying and persistent popup asking for permission to add a helper tool. For those…

“APL*ITUNES/BILL”, What Is This?

Do you see a charge that starts with “APL *” (like APL*ITUNES/BILL) in your billing or bank statement? This is an Apple purchase such as iOS or macOS apps, songs, movies, TV shows,…

Messages Keeps Crashing After Updating to macOS Monterey

I had an issue where the Messages app kept crashing when I opened it. Stacey and I wrote several articles on how you can fix various Monterey-related problems. From the users’ emails we…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Categories:

How to Add, Remove, and Update Credit Cards in Safari on iPhone

Are you tired of constantly typing in your credit card information while shopping in Safari on your iPhone? Or are you wondering how to edit or remove the previously saved credit cards in Safari? Either way, your search ends here. Today we’ll share how to add, remove and update credit cards in the Safari browser on an iPhone so that you can enjoy smooth shopping and browsing experience. Let’s dive right into it.

Table of Contents

Add/Save a Credit Card to Safari

Adding a credit card to Safari on your iPhone is effortless. Let’s take a look at the steps to do so.

1. Open the Settings app on your iPhone.

2. Scroll down the Settings and tap on Safari .

3. Tap on AutoFill under the GENERAL section.

4. Now turn on the toggle next to Credit Cards .

5. Tap on Saved Credit Cards .

6. Tap on Add Credit Card to begin.

7. Fill in your credit card information with the help of a keyboard.

8. Once you fill in the information, tap on Done . Now the card will be saved in your Safari AutoFill and you won’t have to type the whole information again and again.

Must Read: How to Add a Website to Home Screen on iOS and Android .

Remove a Saved Credit Card From Safari

If you have any expired cards in your Safari AutoFill and want to get rid of them, then here are the steps to remove a credit card from Safari.

2. Scroll and tap on Safari .

3. Tap on AutoFill .

4. Now tap on Saved Credit Cards .

5. Tap on Edit in the top right corner of the screen.

6. Tap on the circle icon next to the card you want to remove to select it.

7. Tap on Delete near the top left corner of the screen.

8. Again tap on Delete to confirm the deletion of the selected card in Safari browser. And the card will be deleted from your Safari AutoFill.

Also Read: How to Close All Safari Tabs at Once on iPhone .

Update Your Credit Cards in Safari

Updating or editing an existing card in Safari is a no-effort process. Let’s take a look at how to update or edit the existing credit card details in Safari on your iPhone.

1. First, open the Settings app on your iPhone.

2. Scroll down the Settings page and tap on Safari .

3. Now tap on AutoFill .

4. Tap on Saved Credit Cards to view the saved credit cards.

5. Select the credit card that you want to edit or update.

6. Tap on the Edit button near the top right corner of the screen.

7. Once done editing the details of the card, tap on Done to save the updated card details. And the updated card will appear on the next screen. Now you can use this credit card on any website of your choice.

Do More Than Browsing, With Safari

Whether you’re making a one-time purchase on Safari or saving the credit card for future use, managing credit cards on Safari is pretty easy on iPhone. Plus, saving your credit card information in Safari is more convenient than carrying it and typing details every time. The newly introduced Advanced Data Protection feature by Apple also makes sure your saved information is more secure than ever. So, go ahead and enhance your shopping and browsing experience with Safari.

Did you know that Safari has a Reader View (Mode)? Learn how to enable Reader View (Mode) in Safari on iPhone .

Subham is a tech enthusiast and a has knack for writing, he also has a deep love for filmmaking. He is currently working as a full-time Technical writer at TechWiser and his roots are from Samastipur, Bihar.

You may also like

How to stop ios 18 icons from turning..., how to remove or replace camera button from..., 5 pixel 9 ai features i want on..., you can use the apple pencil as a..., how to remove frequently used emojis on iphone..., 7 apple intelligence features everyone needs to use, you can delete verification codes after use automatically..., how to get apple intelligence features on iphone,..., should you buy an iphone 15 or wait..., how to schedule messages to send later on....

- Apple Watch

- Accessories

- Digital Magazine – Subscribe

- Digital Magazine – Info

- Smart Answers

- Back To School

- Apple Watch 2024

- New AirPods

- M4 Mac mini

- 11th-gen iPad

- Best Mac antivirus

- Best Mac VPN

When you purchase through links in our articles, we may earn a small commission. This doesn't affect our editorial independence .

How to access a credit card CVV from Safari via autofill

If you’re like me, you switched to using chipped payment cards and Apple Pay whenever possible for all your in-person, phone order, and online purchases. Apple Pay requires that you enroll credit and debit cards, and the backend infrastructure handles the whole security part for you. Safari for macOS can relay to an iPhone, iPad, or Watch for Apple Pay authorization if the Mac lacks Touch ID (built-in or enabled through a Magic Keyboard with Touch ID).

However, you can also manually enter card information into Safari. In macOS, that’s via Safari > Preferences/Settings > Autofill by clicking Edit next to “Credit cards.” In iOS/iPadOS, go to Settings > Safari > Credit Cards . You provide your name as it appears on the card, its number, its expiration, and the verification code found printed on the card. This information syncs via iCloud Keychain if you have that enabled.

When you use autofill to enter a credit card, Safari draws from its local data store:

- If you enter the verification code (most frequently labeled a CVV or CVC) in Safari’s autofill settings, Safari will fill it if it recognizes the field after you use Touch ID, Face ID, or your device password.

- If you don’t enter it in Safari’s card preferences, you can reserve this as an extra step for yourself–another bar to avoid accidentally spending or give yourself more time!

Some sites do engineer their forms to prevent automatic verification code filling. In that case, you can:

- Look it up on your card to enter.

- Pull it up from a password manager, like 1Password, if you store it there.

- Go to Safari settings (easier on a Mac) and click or tap the Security Code field to reveal the number.

Ask Mac 911

We’ve compiled a list of the questions we get asked most frequently, along with answers and links to columns: read our super FAQ to see if your question is covered. If not, we’re always looking for new problems to solve! Email yours to [email protected] , including screen captures as appropriate and whether you want your full name used. Not every question will be answered, we don’t reply to email, and we cannot provide direct troubleshooting advice.

Author: Glenn Fleishman , Contributor

Glenn Fleishman’s most recent books include Take Control of iOS and iPadOS Privacy and Security, Take Control of Calendar and Reminders, and Take Control of Securing Your Mac. In his spare time, he writes about printing and type history. He’s a senior contributor to Macworld, where he writes Mac 911.

Recent stories by Glenn Fleishman:

- Can you use an old Mac laptop without a battery?

- How to automate cloning your drives on a Mac

- Should you keep your MacBook plugged in when you’re using it?

The Best Gateway for Tech Trends

How to Add, Edit or Remove AutoFill Credit Card Information in Safari

Master safari's autofill: add, edit, and remove credit cards for a smooth checkout..

Table of Contents

Do you know how to Add, Edit or Remove AutoFill Credit Card Information in Safari? This useful tool not only saves you time, but it also makes each deal easier. It keeps your credit card information safe, which makes it easy to buy things on websites that support this function. Safari has tools that make it easy to handle your autofill data, whether you want to add a new card, change information, or get rid of old entries. Safari cares a lot about security, so it uses strong encryption and authentication methods to keep your personal and business information safe. Finding your way around Safari’s autofill settings is easy and will not only save you time but also give you peace of mind. You can feel safe knowing that your credit card information is safe.

Managing your autofill credit card information can make your browsing and shopping experiences a lot better, no matter how long you’ve been using Safari or How to Add, Edit or Remove AutoFill Credit Card Information in Safari. As of now, online deals are easier and faster, so say goodbye to pain. If you want to know more information about this visit Apple Safari Official Website.

What is AutoFill Credit Card Information in Safari

AutoFill Credit Card Information in Safari makes shopping online easier by saving credit card information safely in the browser . Users will no longer have to enter their payment information over and over on different websites thanks to this tool. Instead, Safari fills in the blanks for you during deals, which saves you time and effort. Users only need to enter their credit card information once to use this feature. Safari then encrypts and stores this information safely in its keychain.

AutoFill Credit Card Information makes things easier, but users still need to be careful to keep their private financial information safe. It’s very important to make sure that devices are properly locked down to prevent unauthorized entry. Even though this feature makes the checkout process faster, security should always come first to avoid the risks that come with keeping personal financial information online.

Adding a Credit Card

- Go to Settings > Safari > AutoFill .

- Turn on Credit Cards .

- Tap Saved Credit Cards .

- Tap Add Credit Card .

- Enter your card details or use the camera to scan the information .

- Open Safari .

- Go to Preferences > Autofill .

- Select Credit Card from the left menu .

- Click the + button below the list.

- Enter your card details .

Editing a Credit Card

- Tap the card you want to edit .

- Edit the details and tap Done .

- Select the card you want to edit .

- Edit the details and click Close .

Removing a Credit Card

- Navigate to Settings .

- Select Safari .

- Go to Autofill .

- Choose Saved Credit Cards .

- Swipe left on the card you want to remove .

- Tap Delete .

- Select the card you want to remove .

- Click the – button below the list .

Benefits of Using AutoFill for Credit Card Information

- Convenience: Because it fills in credit card information quickly on web forms, AutoFill saves you time and effort. This means that credit card numbers, expiration dates, and security codes don’t have to be entered by hand every time an online buy is made.

- Correctness: AutoFill makes sure that credit card information is entered correctly, which lowers the chance of mistakes that could cause transactions to fail or payment handling problems.

- Security: AutoFill saves credit card information safely in Safari’s password manager, which is encrypted and can only be accessed with the passcode or Touch ID/Face ID on the device. This lowers the chance that someone will get into private financial data without permission.

- Protection Against Phishing: AutoFill will only enter your credit card information on real websites where you have already saved it. This helps protect you from scam attacks on fake or harmful websites that try to steal your credit card information.

- Compatibility: AutoFill works perfectly with websites that allow autofill. This means that users have the same experience in all online stores and payment platforms.

- Simplified Checkout Process: AutoFill speeds up the checkout process by filling in credit card information instantly. This means that users can finish their purchases with fewer steps and fewer chances to abandon the cart.

In conclusion, using Safari’s AutoFill tool to organise your credit card information can make shopping online a lot easier and faster. Safari gives you easy-to-use tools to keep your payment information safe and organized on iPhone , iPad and Mac , whether you’re adding new cards, changing current ones, or getting rid of old information. You can make browsing easier and keep your banking information safe by learning how these tools work.

Stay alert and check and update your AutoFill choices often so they fit your needs. This will lower the risk of any possible security threats. Safari’s user-friendly features make it easy to keep track of your credit card information. This lets you browse the web with confidence, knowing that your private information is safe. To stay on top of your online purchases and enjoy a stress-free shopping experience, use Safari’s easy-to-use features.

Question and Answer

You have the option to disable the AutoFill feature in Safari if you do not want the browser to remember your credit card information. You need to navigate to Safari Preferences, select Autofill, and then uncheck the item that is located next to “Credit cards.”

Unquestionably! When you enable iCloud Keychain, the credit card information that you have saved in Safari on your Mac will be synchronized with your iPhone or iPad. This implies that you may use AutoFill for credit cards on all of your Apple devices, which is a very convenient feature.

By utilizing robust encryption, Safari ensures the safety of your credit card information. If you want to safeguard your Mac from potential dangers, you should make sure that it has a robust password and that its security software is up to date.

- How to place a DoorDash Drive order

- How to Add New Skills on Seesaw

- Apple Tips: How to right-click on a Mac

- How to Open a Roth IRA

- How to Add Credit Cards to Safari AutoFill

- How to Remove Credit Card Information

- Debit Card vs Credit Card: which card is right for you?

- (iOS 17) How to Remove Tracking Information from Safari URLs

Clinton Harding

Clinton Harding is the Editor in Charge of Phones at Compsmag. In this role, he covers everything related to mobile devices, including the components that will be used to power your next phone. You can read his perspectives on the current situation of Android phones in his reviews, editorials, and other writings on this site. He has a lot to say on the subject.

Charles Anders

Charles Anders is the go-to person for product coverage at Compsmag and serves as Europe's lead photographer. When he is not putting the newest smartphones through their paces, you can typically find him with a camera in his hand, playing the drums, or chowing down on his stockpile of home-cooked meals.

Leave a Comment Cancel Reply

How to save post on threads: a simple guide, best sneaker resell sites (2024) for sneaker resale, you may also like, how to message a private account on instagram, how to turn off the “sign in with google” prompt on websites, how to get precision drilling bit in skull and bones, how to change google assistant voice on phone or smart speaker, how to get squid tentacles in like a dragon: infinite wealth, how to get s rank in missions in ready or not.

- Help Centre

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Accept Read More

Tips & Tricks

Troubleshooting, how to save credit card info in safari on iphone & ipad.

Did you know that you can save credit card info into Safari to make quick purchases from iPhone or iPad? If you are you tired of filling out your credit card details every time you make an online purchase, this excellent autofill credit card feature is for you as it allows for quick access to credit card payment info in Safari on iPad and iPhone.

Safari, the default web browser that’s included with iOS, ipadOS, and macOS devices, is fully capable of securely storing your credit card information and automatically filling it whenever required for online purchases. The feature works in a similar way to using iCloud Keychain , a feature that autofills login information and passwords upon request. However, for this functionality to work, users need to manually enter their credit card details first.

If you want to try this nifty Safari AutoFill payment info feature on your iOS or iPadOS device, then read on to learn how you can save your credit card information in Safari on both the iPhone & iPad.

Before you go ahead with this procedure, make sure your iPhone or iPad is running at least iOS 12 or later, since this feature isn’t available on older versions. Follow the steps below to learn how to manually input your credit card details for later use with Safari autofill:

That’s really all there is to it, now your credit card info is stored on the iPhone or iPad and ready access through Safari when making online orders or purchases through the web browser.

From now on, whenever you visit a page where you’re asked to type in your credit card details, you could use the Safari AutoFill feature that shows up on your iOS or iPadOS keyboard to automatically fill your name, card number and expiry date. The information is stored encrypted so there’s little security concern, and furthermore you’ll be asked to authenticate the credit card autoFill with Face ID, Touch ID, or passcode, depending on the device you own.

This obviously applies to iPhone, iPad, and iPod touch, but if you own a Mac you’ll be able to take advantage of Safari AutoFill on your macOS machine as well.

Additionally, you can also choose to sync the stored credit card information across all your other macOS, ipadOS, and iOS devices with the help of iCloud Keychain. Using iCloud Keychain for autofill is incredibly useful for owners of multiple devices and is definitely a nice perk of the cloud service. For this to work however, you need to be signed into all the devices using the same Apple ID and make sure Keychain is enabled in the iCloud settings, on any of your devices.

Most of us have multiple credit cards that we use for different purposes. It’s safe to say that you can add all your cards to Safari and access them whenever you like, eliminating the need for constantly having to open your wallet, just to find that one card you want to shop with.

Another saved payment option which is handy to use is Apple Pay, which you can also add cards to for using with Apple Pay compatible payment protocols both on the web, in apps, and with some NFC payment kiosks in stores too.

We hope you managed to add all your credit cards to Safari, for making online purchases a whole lot easier. What do you think about the convenience that Safari AutoFill has to offer? Do you use iCloud Keychain to securely store your credit card info and passwords as well? Let us know your thoughts and opinions in the comments.

Enjoy this tip? Subscribe to our newsletter!

Get more of our great Apple tips, tricks, and important news delivered to your inbox with the OSXDaily newsletter.

You have successfully joined our subscriber list.

Related articles:

- How to Add Credit Cards to Safari AutoFill on Mac

- How to Edit AutoFill Info on iPhone & iPad

- Store Credit Cards Securely in Safari AutoFill on Mac

- How to Delete Specific Chrome Autofill Suggestions

» Comments RSS Feed

Don’t most online retailers that accept credit cards also ask for the 3-digit authentication that is on the reverse side of the card as well?

Yes, often anyway. And so you enter the three digit authentication code, but all credit card info is saved reducing the amount of data you have to input.

Leave a Reply

Name (required)

Mail (will not be published) (required)

Subscribe to OSXDaily

- - Listen to Apple Podcasts on the Web

- - How to Run Llama LLM on Mac, Locally

- - Launch All Apps & Documents Related to a Project with Stapler for Mac

- - How to Recover an Unsaved PowerPoint on Mac

- - How to Uninstall VMWare Fusion on Mac

- - Public Beta 5 of iOS 18, macOS Sequoia, iPadOS 18 Available for Testing

- - MacOS Sequoia 15 Beta 7 Available for Testing

- - iOS 18 Beta 7 Available Now, Could Be Final Beta?

- - Updated Version of iOS 17.6.1 & iPad 17.6.1 Released

iPhone / iPad

- - Beta 2 of iOS 18.1, MacOS Sequoia 15.1, & iPadOS 18.1 Released with Apple Intelligence

- - Beta 6 of iOS 18 & iPadOS Now Available for Testing

- - iOS 17.6.1 & iPad 17.6.1 Released with Bug Fixes

- - MacOS Sequoia 15 Beta 6 Available for Testing

- - chronod on Mac – High CPU Use & Network Access Requests Explained

- - Why Are iPhone Videos Low Quality & Blurry When Sent to Android Users?

- - Fix brew Error “The arm64 architecture is required for this software” on Apple Silicon Mac

About OSXDaily | Contact Us | Privacy Policy | Sitemap

This website is unrelated to Apple Inc

All trademarks and copyrights on this website are property of their respective owners.

© 2024 OS X Daily. All Rights Reserved. Reproduction without explicit permission is prohibited.

How to add your Apple Card to Safari AutoFill on iPhone, iPad, and Mac

Apple Card, just like any credit card, can be added to Safari AutoFill.

More Apple Card guides

Apple Card is a credit card; a MasterCard, to be precise. That means anywhere MasterCard is accepted, so is your Apple Card. It's not exclusive to Apple Pay and you don't need the physical card to buy online. The easiest way to make sure your Apple Card is ready to go when you want to use it online is to let Safari's Autofill feature take care of the rest.

Your Apple Card should automatically appear in Safari's Autofill. But if, for any reason, you need to add it manually, here's how.

How to find your Apple Card account number

How to add apple card to safari autofill on iphone and ipad.

- How to add Apple Card to Safari AutoFill on Mac

Whether you manually add your Apple Card to Safari's AutoFill or just need to find it, you can access your Apple Card account number from within the Wallet app.

- Open the Wallet app on your iPhone.

- Tap your Apple Card .

- Tap the More button in the top-right corner. It looks like three dots.

- Tap Card Information .

- Note the Card Number and Expiration date .

In this section, you'll find your card number, your physical card number, and your device account number. It's important to understand the differences between these three so you know which to use and when.

- Card Number - This is the number that you manually enter in the credit card number field for online payments. It is also the number you will use with Safari AutoFill on Mac and iCloud Keychain on iPhone and iPad.

- Physical Card - This is the last four digits of the card number that appears on receipts when you make a purchase with your physical Apple Card. If you need to return an item to a store in-person, you'll show them this number.

- Device Account Number - This is your Apple Pay number. Any time you use Apple Pay to make a purchase with your Apple Card, this is the last four digits of the card number that is used.

For the purposes of manually adding your Apple Card to Safari Autofill, you'll want the Card Number .

Apple Card should automatically be added to Safari AutoFill, but if it's not there, you can manually add it like any credit card.

Once you've found your Card Number using the steps listed above, follow these steps.

Master your iPhone in minutes

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

- Press and hold the Card Number until Copy appears above it.

- Close the Wallet app .

- Open the Settings app .

- Tap Safari .

- Tap Autofill .

- Tap Saved Credit Cards .

- Tap Add Credit Card .

- Enter your Name .

- Press and hold Number until the option to Paste appears.

- Tap Paste .

- Enter the Expiration date .

Your Apple Card will be listed as an option in AutoFill (but it will just look like the standard MasterCard logo).

How to add Apple Card to iCloud Keychain on Mac

Apple Card should automatically appear in Safari AutoFill on your Mac, but if it's not there, you can manually add it like any credit card.

- Open Safari on your Mac.

- Click Safari in the app menu on the left side of the Menu Bar .

- Click on Preferences .

- Click on AutoFill .

- Enter your administrative password .

- Click Unlock .

- Click Edit next to Credit Cards .

- Click Add .

- Enter the card's description (like Apple Card).

- Enter the Apple Card Number (If you have continuity enabled, you can copy the Card Number on your iPhone and paste it on your Mac).

- Enter the Expiration Date .

- Click Done .

Anything else?

Do you have any questions about adding your Apple Card to iCloud Keychain? Put them in the comments and we'll help you out.

○ Apple Card: Everything you need to know ○ Best Apple Store rewards card ○ Best credit cards with sign up bonuses ○ What to do if you're not approved for Apple Card ○ Is Apple Card worth getting? ○

Lory is a renaissance woman, writing news, reviews, and how-to guides for iMore. She also fancies herself a bit of a rock star in her town and spends too much time reading comic books. If she's not typing away at her keyboard, you can probably find her at Disneyland or watching Star Wars (or both).

Control Center has been supercharged in iOS 18 — here’s how to get the most from it

Apple Maps is getting a ton of new features in iOS 18: Here’s how to use them

Google just showed Apple Intelligence the pitfalls of letting generative AI create artwork

Most Popular

- 2 Twitch is hiking its subscription prices as it tries to claw back Apple's App Store fees from customers

- 3 iPhone 16 launch event will take place on September 10 says top Apple analyst

- 4 Here's every iPhone 16 camera improvement you can expect to see on Apple's newest phone

- 5 macOS Sequoia is set to release at the same time as iOS 18 – in the middle of September

🔥 Get our iOS 17 eBook for FREE!

Add Credit Cards to Safari AutoFill on iPhone, iPad, and Mac

Updated on:

Filling credit card details every time you make an online purchase can be tedious. Under such circumstances, Apple’s AutoFill feature in Safari is a big relief. You can add credit cards to Safari Autofill on iPhone, iPad, and Mac, and you’re free from refilling them for future transactions. Like saved passwords , storing credit cards is easy. Let me show you how!

How to Add Credit Card to Safari AutoFill on iPhone and iPad

- How to Add Credit Card to Safari AutoFill on Mac

How to Use Credit Card Across any Apple Device

How to update or delete stored credit cards to safari autofill.

- Open the Settings app on your iPhone.

- Scroll down and go to the Safari settings.

- Turn on the toggle for Credit Cards.

- To view credit cards, access with Touch or Face ID, or enter the passcode.

- Tap Add Credit Card.

How to Add Credit Cards to Safari AutoFill on Mac

- Open the Safari browser on your Mac.

- Click on its name at the top-left corner.

- Select AutoFill from the Menu.

- Tick the box of Credit Cards.

If you are using multiple Apple devices for online shopping, you can use your saved credit cards across any device with the help of iCloud Keychain. It keeps your credit card details updated and synchronized on all your devices connected with the same Apple ID. Turn on iCloud Keychain on your iPhone with these simple steps.

- Launch the Settings app on your iPhone

- Tap on your Profile Name to view Apple ID, Media & Purchases section.

- Scroll down and tap on Keychain.

In case you want to remove a credit card or edit the details, you can easily update your information. Here we go!

Open the Settings app → Safari → AutoFill → Saved Credit Cards → Tap on the Credit Card → Tap Edit on the top right corner. Tap on Delete Credit Card or Edit the card according to your preferences.

Important Things to Note:

- Don’t save your Credit Card’s CVV and pin to Safari.

- All your details on iCloud Keychain are encrypted and cannot be read by Apple, so you don’t need to worry about synchronizing your credit card on all devices.

Signing Off…

Safari will auto-fill the credit card details every time you’re making a new purchase through any of your Apple devices. But ensure remembering and securing the other two essential things – CVV and card pin. Happy Shopping!!

You may also want to read!

- How to use Touch ID to autofill passwords in Safari on Mac

- Backup iPhone and iPad to iCloud, Mac or Windows PC

- How to Remove Credit Card from Apple Pay

- How to use AutoFill Passwords on iPhone and iPad

Want to read more like this?

Join 15,000+ Apple enthusiast to get the latest news and tips from iGeeksBlog+.

We won’t spam, and you will always be able to unsubscribe.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Similar posts you might also like

Best iPhone cleaner apps in 2024 (Free and Paid)

How to manage downloads in Safari on your iPhone or iPad

Why is my MacBook keyboard not working, and how can I fix it?

Editorial Guide

Review Policy

© 2024 iGeeks Media Private LTD. All rights reserved.

Privacy Policy

How to Set Up AutoFill in Safari on iPhone

If you find yourself typing the same personal data and credit card information over and over again on your iPhone, it's time to set up Safari AutoFill. Setting up AutoFill in Safari on your iPhone saves you time and ensures the accuracy of the information you enter into forms online. We'll walk you through the Autofill setup process.

Related: How to Auto Fill Credit Card Information Using Your iPhone Camera

To set up Safari AutoFill on your iPhone:

- To add a credit card in Safari AutoFill settings, select Saved Credit Cards .

- Enter your passcode, then tap Add Credit Card .

Once you have Use Contact Info and Credit Cards set up, you can fill in any web forms in Safari with your saved information by selecting AutoFill. To learn more about how to customize your Safari experience on your iPhone, sign up for our free Tip of the Day newsletter.

Author Details

Violet cooper.

Violet is a freelance lifestyle writer. She loves spending time with her husband, enjoys going on adventures, and is an Apple enthusiast.

Featured Products

Did you get a new iPad? Protect your investment by putting it in the best case available! Zugu iPad cases offer the best fit and premium features that are custom-designed and meticulously tested. All of their cases have up to 10 adjustable angles that are insanely secure, a protective bumper, air vents, a soft microfiber interior, and an elastic Apple pencil pocket. If you love supporting small businesses and quality products — check out Zugu now , no matter what iPad you have.

Most Popular

How to Tell If Someone Blocked Your Number on iPhone

App Store Missing on iPhone? How To Get It Back

How to Tell If a Dead iPhone Is Charging

How To Find My iPhone From Another iPhone

Step Counter: How To Show Steps on Apple Watch Face

How to Schedule a Text Message on iPhone

How to Refresh AirTag Location Manually & More Often

How To Get an App Back on Your Home Screen

iPhone Notes Disappeared? Recover the App & Lost Notes

How to Find a Lost iPhone That Is Turned Off

How Accurate Is Apple Watch Calories?

How To Put Two Pictures Together on iPhone

Featured articles.

Why Is My iPhone Battery Draining So Fast? 13 Easy Fixes!

Identify Mystery Numbers: How to Find No Caller ID on iPhone

Apple ID Not Active? Here’s the Fix!

How to Cast Apple TV to Chromecast for Easy Viewing

Fix Photos Not Uploading to iCloud Once & for All (iOS 17)

There Was an Error Connecting to the Apple ID Server: Fixed

iPhone Charging but CarPlay Not Working? Here's the Fix!

Check out our sponsors.

- Each email reveals new things you can do with your phone (and other devices) with easy-to-follow screenshots.

- Enter your email to get your first tip immediately!

- Personal Finance

- Managing Wealth

- Small Business

- Corporate & Institutional

- Our Commitments

- Explore Products & Solutions

- Checking Accounts

Debit Cards vs. Credit Cards: Key Differences To Know

Whether you’re making a quick coffee run, putting gas in your car, or buying an item online, there’s a good chance you might use a card to pay for your transaction. Many people have both debit and credit cards in their wallets, but have you ever stopped to think about the difference?

While both are convenient options for making purchases, they each have unique features.

The following guide will explain how each type of card works and discuss important pros and cons so you can make a confident decision regarding which card to use.

Debit Card vs. Credit Card: Key Differences

Debit and credit cards may look nearly identical, but the differences in how they operate can impact your finances. Here’s a quick breakdown of the key variables.

1. Source of Funds

Debit cards link directly to your bank account [1] . When you make a purchase with your debit card, the money is deducted from the account, limiting your spending to your account balance.

With a credit card, each time you make a purchase, you're essentially taking out a small line of credit from the card provider. The provider lends you the money and keeps track of your purchases. They send you a bill in the form of your statement, and you are responsible for paying these purchases back. You may have a minimum payment to make by a specified due date to avoid additional interest charges.

2. Spending Limits

When using a debit card, if you attempt a purchase that exceeds your account balance, your transaction may be declined. If you have overdraft protection, some banks may allow the transaction. However, this often comes with additional fees.

When using a credit card, your credit limit and associated terms of your credit card account will be provided by the card issuer. Exceeding the limit set may cause a declined transaction by the vendor and you could be charged over-limit fees. Check with your credit card issuer for details. Also, note that these actions may impact your credit score.

3. Building Credit History

Since a debit card does not involve any borrowing, it does not impact your credit history or credit score. However, credit cards can have a significant impact. When used wisely, they can bolster your credit score, but making late payments or maintaining high balances may bring your score down.

4. Rewards and Benefits

Credit cards often come with rewards programs, offering cash back, travel perks, and other benefits. Typically, you’ll earn rewards in the form of points for every dollar you spend using your credit card and can redeem the points for cash or merchandise. Some credit card rewards programs offer as much as 4% cash back on specific types of purchases, such as gasoline, and have other perks, like cell phone protection policies. Debit cards typically do not offer rewards programs, although some may offer cash back.

5. Security and Fraud Protection

While debit and credit cards prioritize your security, credit cards typically have more robust fraud protection policies. In most instances, you’re not liable for unauthorized transactions as long as you report them promptly.

Debit cards are also secure, but the protection against unauthorized transactions depends on timely reporting. It’s very important that you report unauthorized use immediately.

How Debit Cards Work

Debit cards offer the convenience of cash without having to carry around physical bills. They’re a popular choice for everyday purchases, allowing you to spend responsibly by only using the funds available in your account. Here’s a quick overview of a debit card’s primary features.

Transaction Mechanics

When you make a purchase with your debit card, the retailer’s system checks with your bank to confirm sufficient funds are available. If they are, the amount is immediately reserved or deducted from your account. Some retailers, like gas stations, may hold an initial amount until the final transaction amount is processed.

Spending Limits and Overdraft Fees

Your spending limit with a debit card is determined by the balance in your account. For example, if you have $500 in your account, that’s the amount you can spend unless you have overdraft protection. Some banks or credit unions may set daily spending or withdrawal limits for security reasons.

If you have overdraft coverage, the transaction may go through even if you don’t have enough money in your account, but you could be charged a fee. Without overdraft coverage, your purchase may be declined.

Security Measures

Debit cards come with security features, such as a personal identification number (PIN), which often needs to be entered during a transaction to verify your identity. Some purchases may require a signature, similar to a credit card.

Cash Access

You can typically use your debit card at an automated teller machine (ATM) to withdraw cash from your checking account. You can also get cash back at many retailers when you make a purchase with your debit card [2] .

Lost Card Protocols

If your debit card is lost or stolen, it's crucial to contact your bank immediately. This will allow them to freeze your card and help prevent unauthorized access to your funds. Acting quickly may also limit your liability for unauthorized transactions.

Requirements To Obtain a Debit Card

To get a debit card, you typically need to have a checking account with a bank unless you've purchased a prepaid debit card. There are also often minimum age requirements, although this can vary by institution and account type.

Pros and Cons of Debit Cards

When deciding whether to use a debit card vs. a credit card, there are some important pros and cons to consider.

Pros of using a debit card:

- Real-Time Spend Tracking : Your purchases are typically deducted from your account right away, helping you track your spending in real time.

- No Debt Accumulation : Since you’re using your own money, there’s no risk of accumulating high-interest debt.

- Overdraft Coverage : Banks may offer overdraft coverage, allowing transactions to go through even if you're slightly short on funds, but fees may be assessed.

- No Credit Check Required : Debit cards usually don't require a credit check, making them accessible to those with no credit or a poor credit history.

Cons of using a debit card:

- Doesn’t Build Credit History : Using a debit card won’t help you build or improve your credit score or credit history.

- May Incur Overdraft Fees : If you have overdraft coverage, you could be subject to fees if you spend more than your account balance.

- Potential Hold On Funds : Some vendors, like gas stations, might put holds on a set amount of money when you use your debit card. This could temporarily reduce your available balance.

- Daily Spending Limits : Some banks set daily spending or withdrawal limits, which might be inconvenient for larger purchases.

How Credit Cards Work

Credit cards offer the ability to make purchases and pay for them at a later date, giving you flexibility and the potential to earn rewards. They provide an active line of credit where you choose how much to borrow in real time with a limit. When using a credit card, it’s important to understand the mechanics so you can make the most of their benefits and avoid potential pitfalls. Here are a few important things you need to know.

When you use your credit card, the merchant’s terminal requests authorization from the card issuer. If approved, the amount is reserved against your credit limit. After a day or so, the transaction is finalized, and the amount is added to your statement, awaiting monthly payment [3] .

Spending Limits and Interest Accumulation

Credit cards allow you to borrow money up to a predetermined limit. Since it's a revolving line of credit, as you pay down the account, you can continue to make additional charges if needed. If you exceed the limit, your transaction may be declined, or if the issuer authorizes the additional charges, you may be charged an over-limit fee [4] .

If you don’t pay off your account balance in full each month by the due date, interest charges could be applied. This is calculated based on the annual percentage rate (APR) set by the card issuer.

Credit cards typically come equipped with advanced security features. Many have fraud detection systems that alert you to suspicious activities. Your card provider may reach out to you to verify potentially suspicious transactions. To keep your card safe, avoid giving out personal information that is not already visible on your card. You may also be able to add additional transaction alerts on your card or lock it with an "easy lock" feature, which prevents it from being used until you unlock it again.

Lost or Stolen Credit Card Protocols

It’s important to notify your credit card provider immediately if you lose your card or it’s stolen.

Requirements To Obtain a Credit Card

Applying for a credit card typically involves a credit check. Lenders want to see your credit history and verify your income. If you have less credit history, you may consider a secured credit card. This requires you to put down a deposit, which determines your credit limit [5] .

Pros and Cons of Credit Cards

Credit cards are versatile financial tools. When used responsibly, they can offer a range of benefits, but there are also some potential pitfalls to avoid.

Pros of using a credit card:

- Build Credit History : Regular and responsible credit card use can help you establish credit history. This is vital for securing loans, mortgages, or even some job positions.

- Rewards and Perks : Many credit cards offer rewards programs, cash back, or travel benefits. Some provide extended warranties on purchases, travel insurance, or special discounts.

- Purchase Protection : Credit cards often come with added protections against fraudulent transactions. Some also offer protection against damaged or stolen purchases.

- Emergency Fund : Having a credit card can help you pay for unexpected expenses in emergency situations.

Cons of using a credit card:

- Interest and Debt Accumulation : If you don't pay off the full balance by the due date, you'll incur interest. If not managed responsibly, this can cause you to accumulate high-interest debt.

- Fees : Credit cards may charge annual fees, cash advance fees, and late payment fees.

- Impact on Credit Score : While responsible use can build your credit score, late payments, maxing out your card, or having too many credit inquiries can negatively affect it.

- Complex Terms and Conditions : Credit cards can sometimes have complicated terms and conditions, making it important to carefully review your account agreement.

Debit Cards vs. Credit Cards: Which Is Right for You?

Debit cards are directly linked to your bank account, ensuring you only spend money you actually have. This can help you with budgeting and daily expense tracking. It also allows you to avoid accumulating debt. However, debit cards don’t help you build credit or accumulate rewards.

Credit cards give you the flexibility to buy now and pay later. They can help you build your credit history and may provide a robust rewards program.

However, it's critical to use them responsibly. As quickly as they can help build credit history, they can adversely impact your credit history even faster.

At PNC Bank, our specialists understand that each individual has unique financial needs. We offer a range of debit and credit card options, allowing you to choose a tailored solution. Contact us today to learn more.

- Credit Cards

- Manage Daily Finances

Apply for a checking account today.

Apply for a checking account

with $0 minimum to open online and Low Cash Mode® to help avoid overdrafts.

Important Legal Disclosures and Information

1. Credit Cards, Debit Cards, and Gift Cards, Office of the Comptroller of the Currency, https://www.occ.gov/topics/consumers-and-communities/consumer-protection/credit-cards-debit-cards-and-gift-cards/index-credit-cards-debit-cards-gift-cards.html#

2. Using Debit Cards - What it Is, Consumer.gov, https://consumer.gov/managing-your-money/using-debit-cards

3. Using Credit - What it Is, Consumer.gov, https://consumer.gov/credit-loans-debt/using-credit#what-to-know

4. I went over my credit limit and I was charged an overlimit fee. What can I do?, Aug 28, 2020, Consumer Financial Protection Bureau. https://www.consumerfinance.gov/ask-cfpb/i-went-over-my-credit-limit-and-i-was-charged-an-overlimit-fee-what-can-i-do-en-58/

5. Comparing Credit, Charge, Secured Credit, Debit, or Prepaid Cards, Federal Trade Commission, https://consumer.ftc.gov/articles/comparing-credit-charge-secured-credit-debit-or-prepaid-cards

PNC Bank, National Association Member FDIC .

These articles are for general information purposes only and are not intended to provide legal, tax, accounting or financial advice. PNC urges its customers to do independent research and to consult with financial and legal professionals before making any financial decisions. This site may provide reference to Internet sites as a convenience to our readers. While PNC endeavors to provide resources that are reputable and safe, we cannot be held responsible for the information, products or services obtained on such sites and will not be liable for any damages arising from your access to such sites. The content, accuracy, opinions expressed and links provided by these resources are not investigated, verified, monitored or endorsed by PNC.

- Close

Hi, I am able to update my credit card details after I've completed check-in for my upcoming Disney cruise? Thanks ”

- Useful 1 Useful Please Log In to mark this question useful.

- Save Answer Please Log In to view your saved answers.

Meet the Panelist: Tracie, Florida

Ahoy! Just like Moana, I feel the irresistible call of the sea. I think the best vacation is aboard a Disney Cruise Line ship – thankfully, my family agrees. Whether savoring gelato in Italy, snorkeling in Mexico, or basking in the sea breeze on deck, each destination fills us with memories to last a lifetime. I look forward to helping your family plan a Disney Cruise Line adventure brimming with cherished moments!

Related Video

Related Links

Visit Disney Cruise Line to view exciting itineraries and onboard amenities.

- Disney Cruise Line Planning Tools

- Disney Cruise Line Itineraries

- Disney Dream

Thank a Panelist

Share a message of thanks with the knowledgeable panelist who provided a personalized answer to your disney vacation question..

256 Characters Remaining

Please do not include personal information such as full names and reservation numbers in your message.

- Whom do you want to thank?

- Close Submit

Thanks for submitting your comment!

Didn't find what you were looking for click the ask a question button to open the ask a question dialogue box. if you are not logged in a dialogue box will appear to signin in order to ask a question., to submit your question, please log in now if you have not already done so., ask plandisney, discover the magic of a disney parks family vacation from one of our knowledgeable online panelists..

Please do not include personal information such as full names and reservation numbers in your question.

- Relevant Tags Please select at least one tag related to your question from the choices below.

The menu below has been automatically set to the panelist you were reviewing, however, you can ask anyone on our panel.

- Close Ask a Question Opens the Ask a Question dialog box.

Thanks for submitting your question!

You'll receive an email if your question is answered., please note.

Email communication is the only way we can notify you when your question has been answered. If you choose to opt-out of receiving emails, you will need to return to the site to check if your question has been answered.

Update Browser

For a better experience browsing this website, please download an updated version of Internet Explorer .

Or you can continue browsing without updating.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Social Security Matters

What you can do to protect your personal information.

August 21, 2024 • By Dawn Bystry, Associate Commissioner, Office of Strategic and Digital Communications

Last Updated: August 21, 2024

With various reports of data breaches involving Social Security numbers in the media, we’d like to remind you about the importance of protecting your personal information. Someone illegally using your Social Security number (SSN) and possibly assuming your identity can cause many problems.

What to do if you suspect your Social Security number has been stolen

Identity thieves can use your SSN and other personal information to apply for loans and credit cards and open cellphone and utility accounts in your name. If you believe your information has been stolen and you may be a victim of identity theft, you can:

- Visit IdentityTheft.gov to make a report and get a recovery plan. IdentityTheft.gov is a one-stop resource managed by the Federal Trade Commission, the nation’s consumer protection agency. Or you can call 1-877-IDTHEFT (1-877-438-4338).

- File a police report and keep a copy for your records in case problems arise in the future.

- File an online report with the Internet Crime Complaint Center (IC3) at ic3.gov . Its mission is to receive, develop, and refer cybercrime complaints to law enforcement and regulatory agencies.

- Equifax at 1-800-525-6285.

- Experian at 1-888-397-3742.

- TransUnion at 1-800-680-7289.

- Regularly check your credit report for anything unusual. Free credit reports are available online at AnnualCreditReport.com .

- Contact the IRS to prevent someone else from using your Social Security number to file a tax return to receive your refund. Visit Identity Theft Central or call 1-800-908-4490.

To learn more, read our blog , Protect Yourself from Identity Thieves , and our Identity Theft and Your Social Security Number publication.

What else can you do to protect yourself

Create or sign in to your personal my Social Security account to check for any suspicious activity. If you have not yet applied for benefits:

- You should not find any benefit payment amounts, and you should be able to access your Social Security Statement and view future benefit estimates.

- Review your Statement to verify the accuracy of the earnings posted to your record to make sure no one else is using your Social Security number to work.

If you receive benefits, you can add blocks to your personal my Social Security account:

- The eServices block prevents anyone, including you, from viewing or changing your personal information online.

- The Direct Deposit Fraud Prevention block prevents anyone, including you, from enrolling in direct deposit or changing your address or direct deposit information through my Social Security or a financial institution (via auto-enrollment).

You’ll need to contact us to make changes or remove the blocks.

Other ways to safeguard your information

- Don’t carry your Social Security card with you. Keep it at home in a safe place. Be careful about who you give your number to.

- Change your passwords regularly and use a unique password for each account to prevent hackers from accessing multiple accounts if one password is stolen.

- Add an extra layer of security to your online accounts by using multi-factor authentication, which is a sign-in process that requires a password plus additional information.

- Be wary of scammers pretending to be Social Security employees. If you get a suspicious call, text, or email about a problem with your Social Security number or account, ignore it, hang up, and don’t respond! To report the scam and to learn more, visit Protect Yourself From Scams .

You’ll find more tips at our Fraud Prevention and Reporting page.

Please share this important information with your friends and family and post it on social media.

Did you find this Information helpful?

Tags: data privacy , fraud , scams , Social Security card

About the Author

Dawn Bystry, Associate Commissioner, Office of Strategic and Digital Communications

Deputy Associate Commissioner, Office of Strategic and Digital Communications

Related Articles

Guard your card: protect what’s important to you, social security’s top 5 data privacy resources, 10 ways to protect your personal information, social security’s top 5 scam awareness articles.

August 24, 2024 2:23PM

Like so many others, your process is useless. My PI has been exposed and sold to Dark Web 4 times in the last 2 years. You allow sale of our data as if we were slaves to be bartered?

August 24, 2024 7:41AM

The social security office or US Social Security Administration at location 1871 Rockaway Pkwy, Brooklyn, NY 11236 and phone number 1- 800 772-1213 or 1-866-667-7342 want me to do illegal prostitution with them for my ssi money is why they gave me the worker the Asian worker to ask about my payee money that I need another instead of giving it to me the sole owner. I don’t need a representative

August 25, 2024 1:19AM

this is one of my links that can help that is connect with us or external websites

https://youtu.be/JW3oKZUzC5M?si=HqugNe95x-rmiqpc

August 23, 2024 12:12PM

Why is the onus on ‘We the People’ to fix government mishaps? Private companies should NEVER have been allowed to store ANY critical private data in the first place! This is a complete failure. What are YOU doing to course correct? /We/ didn’t /get/ our data stolen, /YOU/ failed to provide /protection/ from thieving. What is being done about it?

August 23, 2024 4:24AM

These days, it’s important to pay special attention to the security of personal data, as many online platforms offer their services. For example, I’ve recently gotten into gambling and spent a long time choosing a platform with a license and good data protection. I liked low deposit casinos not on Gamstop because, in addition to security, you can try out a large number of games, as low deposits are a great way to do this. I like that you can enjoy the thrilling emotions these games offer without taking too much risk.

August 23, 2024 4:22AM

August 22, 2024 11:14AM

Good Morning, My question is Is there a way I can add a pin or password to my number or maybe put a freeze on my SS number????

August 22, 2024 5:40PM

I like this question.

Leave a Comment

Please review our Comment Policy before leaving a comment. For your safety, please do not post Personally Identifiable Information (such as your Social Security Number, address, phone number, email address, bank account number, or birthdate) on our blog.

Cancel reply

Your email address will not be published. Required fields are marked *

Enter Your Name *

Enter Your Email Address to Comment *

How-To Geek

How to disable and edit safari’s autofill on macos and ios.

Your changes have been saved

Email is sent

Email has already been sent

Please verify your email address.

You’ve reached your account maximum for followed topics.

I Paid for Google's Drive Storage. Here's Why I Don't Regret It

Why it feels like ads are listening to your conversations (when they aren't), google chrome hit by yet another zero-day exploit, update now, quick links, editing or disabling autofill on safari for macos, editing or disabling autofill on safari for ios.

Safari's AutoFill will automatically complete information for contacts, passwords, credit cards and more. Today we're going to discuss how to turn off or edit those AutoFill entries on macOS and iOS.

Whenever any form data is autofilled, Safari highlights them in yellow.

To turn off any or all AutoFill forms in Safari on macOS, first open Safari's preferences from the Safari menu or press Command+, on your keyboard.

In Safari's preferences, click the AutoFill tab You'll see a list of the things Safari can autofill.

Uncheck any items you don't want Safari autofilling, or click "Edit" next to any of the four items to change the actual data Safari has saved. This includes:

- Using info from my contacts : When you start typing any personal information about you, or any other person in your Contacts, into a form (name, address, phone number, etc.), Safari will autofill the blanks.

- User names and passwords : Clicking "Edit" will simply switch to the Passwords tab, which will let you amend any of your login information contained therein.

- Credit cards : This will open a credit card dialog allowing you add or remove payment information. Double-click on an entry to update a credit card's information including the cardholder's name, card number, and expiration date. Before you can edit any sensitive data, you will have to enter your system password.

- Other forms : Click the other forms "Edit" button to edit or remove any or all form data you have saved for a particular website. This is particularly useful if you frequently visit a website with forms you need to fill in time after time with the same information.

Safari on iOS can also fill in form data automatically. To access the AutoFill settings on iOS, open the Settings and tap "Safari".

Next, scroll down to the General options and tap "AutoFill".

In iOS, the options are slightly different than on macOS. You can still turn off your contact information, names and passwords, and credit cards, but there is no option for other forms.

The My Info option will let you choose another contact to use as your device's main contact, or again, you can edit your own contact information so it is up to date.

You can also view, add, remove, and edit any saved credit cards.

You may have noticed, in the previous screenshot, that there isn't any obvious way to edit saved login information. To fix any stored usernames and passwords, tap back to the Safari settings, and then tap "Passwords" right above the AutoFill settings.

Keep in mind that AutoFill will automatically populate any forms on your devices, regardless of who is using them. Thus, you should only lend your devices to people you trust, or simply turn off AutoFill if someone else is going to be using your Mac, iPhone, or iPad.

One final note: user login details and credit cards are stored in your iCloud Keychain ( unless they're not set up to sync to iCloud ), so when you add, delete, or edit either of these items on any one device connected to your iCloud account, the information will be populated to your other devices.

Related: How to Sync Contacts, Reminders, and More with iCloud

That's really all there is to it. Safari's AutoFill settings are simple enough to understand. Now, if you no longer want certain information to automatically populate forms, you can turn it off. Similarly, if the information is incorrect, you can fix it.

- Web Browsers

Watch CBS News

Need to freeze your credit after the Social Security number breach? Here's how.

By Megan Cerullo

Edited By Anne Marie Lee

Updated on: August 19, 2024 / 9:49 AM EDT / CBS News

Freezing your credit is one of the best ways to combat identity theft — and it's free to do. Security experts are advising all Americans to take a few minutes to complete what they deem an essential step in protecting one's credit files in a day and age when cybersecurity breaches are becoming increasingly common.

At the three big credit bureaus, Experian, Equifax and TransUnion, placing a security freeze on your credit file is easy, according to cybersecurity expert David Malicoat. And the recent lawsuit claiming hackers accessed the Social Security numbers of "billions of individuals ," he said, is a good reminder to do so.