- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Annual or Multi-Trip Travel Insurance Works

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does annual travel insurance cover?

Single trip insurance vs. multi-trip travel insurance, how does annual travel insurance work, annual travel insurance plans, is annual travel insurance worth it, caveats to yearly travel insurance, if you're considering multi-trip travel insurance.

Are you hoping to fill your annual calendar with multiple travel adventures? When you’re heading out on a trip, travel insurance may provide peace of mind in case things go awry. It can provide protection in the event of unexpected injury and illness, no matter where you are.

For frequent travelers, sometimes a single-trip travel insurance policy just doesn’t cut it. Let’s take a look at when to buy annual travel insurance, what annual multi-trip insurance is and whether you should invest in this product.

For those who aren’t familiar with travel insurance, it basically works like this: Your personal insurance covers you when you’re at home. Travel insurance does the same when you’re abroad.

There are different levels and kinds of insurance, including those that’ll reimburse you if you have to quarantine, ones that let you cancel for any reason and even policies that cover emergency evacuation services.

Some common types of travel insurance include:

Health insurance .

Lost luggage insurance .

Trip cancellation insurance .

Accidental death insurance .

Rental car insurance .

Trip interruption insurance .

Cancel For Any Reason insurance .

Emergency evacuation insurance .

Most travel insurance policies will offer different levels of coverage for the different types outlined above. In some cases, you can customize your coverage to better meet your needs instead of opting for base-level policy inclusions.

» Learn more: What does travel insurance cover?

Here's a high-level overview of how annual travel insurance policies differ from single trip plans.

Yearly travel insurance works a little bit differently than single-trip insurance. For the most part, you won’t find an annual travel insurance policy that covers extras such as baggage loss or rental car insurance, though you may find some that cover trip interruption and cancellation.

Why is annual travel insurance cheaper than single trip? Multi-trip insurance focuses mainly on medical policies, while single-trip policies can cover a broader range of issues.

In general, annual travel insurance will cover you in the event that you need medical care while traveling overseas. Different policies will have different coverage. Some can include hazardous sports such as skiing and scuba diving, while others will include care in the event you fall ill with COVID-19.

Check whether your medical care is primary or secondary; secondary medical insurance only pays out after other eligible insurances have made their payments.

If you’re looking to be covered for specific needs, be sure to double-check any policy before you decide to purchase it.

» Learn more: How to find the best travel insurance

Purchasing an annual or multi-trip travel insurance plan doesn’t have to be expensive. Of course, you’ll want to get quotes before going forward with any purchase, so it’s best to do your homework ahead of time.

We put in a search for annual travel insurance plans using a 31-year-old traveling from California to Europe among three different policy providers.

1. Nationwide Travel Insurance

Nationwide came in at the cheapest for just $52 for the year, though at that price range it didn’t include trip cancellation or trip interruption insurance.

It was possible to add these in, but it increased the price appropriately. Otherwise, the plan offered $10,000 in emergency medical, $100 for baggage delay, $100 for trip delay and $500 for lost luggage

For our sample itinerary, Allianz offered three different annual travel insurance plans with varying levels of coverage — Executive, Prime and Basic.

The cheapest rang in at $138 for the year but also failed to include trip interruption, while the most expensive option would cost this travel $510.

Allianz’s lowest-cost option (Basic) provided $20,000 in emergency medical and $1,000 for baggage loss, as well as $45,000 for rental car insurance .

3. AIG Travel Guard

AIG Travel Guard returned just one option for multi-trip travel insurance, costing $259 for the year.

However, the increased price seems worth it for the additional coverage, which included $2,500 in trip interruption, $1,500 for trip delay, $500 for missed connections, $2,500 for lost baggage, $1,000 for delayed luggage and $50,000 for emergency medical.

There are a few different questions you’ll want to consider before purchasing travel insurance. This is true whether you’re looking for a single-trip policy or a plan that covers you for an entire year.

How often will you travel?

This is probably the most obvious question you’ll want to answer: How often do you travel? Are you out of town frequently? Do you stay out of the country for longer periods of time?

If you’re someone who goes on one or two vacations per year, for a week or two at a time, it may not be worth purchasing annual travel insurance. Although it’s cheaper than single-trip insurance, the benefits that you’ll receive are reduced accordingly.

What kind of trips are you taking?

How expensive are your trips? What about the chance for illness or accidental injury? Are you certain that you’ll be going on your trip, or is there the chance that you’ll need to cancel?

Multi-trip travel insurance is inherently limited due to its length of coverage. If your trip has a lot of components and opportunities for things to go awry, you may want to consider instead purchasing a single-trip policy.

As we noted above, these types of policies have a much broader area of coverage. This includes options such as cancel for any reason insurance and trip delay insurance.

Do you have any pre-existing conditions?

Pre-existing conditions are those that you have had prior to purchasing insurance. Let’s say that you tore your hamstring last year. After completing a round of physical therapy, you’re doing pretty well, though sometimes you still struggle with pain.

Some annual travel insurance policies will cover acute flare-ups of pre-existing conditions. This means that if your sore hamstring is suddenly aggravated to the point of needing crutches, they will cover the cost of that care.

Some policies do not; they will have a specific clause excluding any pre-existing conditions from your medical care.

» Learn more: What to know about travel insurance for pre-existing conditions

Does your credit card provide travel insurance?

Did you know that many travel credit cards provide complimentary travel insurance? If you book and pay for your trip using your card, you may be eligible for this insurance.

Examples of travel insurance offered by credit cards include:

Rental car insurance.

Emergency medical insurance.

Emergency evacuation insurance.

Trip cancellation insurance.

Trip delay insurance.

» Learn more: The best credit cards for travel insurance benefits

Not all credit card travel insurance coverages are equal; if this is something you’re relying on, you’ll want to carefully examine the policies of the credit card you’re using and the types of coverage it offers.

Cards such as the Chase Sapphire Reserve® offer some of the best complimentary travel insurance on the market.

Chase Sapphire Reserve®

Other cards, such as The Platinum Card® from American Express , also offer a wide range of coverage while you’re traveling. Terms apply.

» Learn more: The best travel credit cards right now

Yearly travel insurance may be a good option for you if you’re often on the road, but keep in mind that there are limits to the product.

For example, many travel insurance plans limit the amount of time you can spend on each trip. This is true for policy provider Heymondo, whose 12-month plan stipulates that your trip duration be less than 60 days.

Other plans may only apply outside the United States. This is the case for GeoBlue , whose travel medical insurance doesn’t cover you when you’re home.

Yes. Depending on the provider, you can purchase multi-trip or an annual travel insurance plan.

The biggest difference with annual travel insurance is it doesn't have as many covered benefits as the individual single-trip plans, as one of the main focuses of annual travel insurance is medical emergencies.

To determine which plan type is right for you, ask yourself questions such as:

How often are you traveling?

Are the trips expensive?

Do you have any credit cards with travel insurance coverage ?

Although cheaper, multi-trip or annual travel insurance are policies that cover multiple trips over a specific time frame. Policies have less coverage than single-trip policies. Generally, single-trip policies have baggage loss or rental car insurance, whereas annual travel insurance does not.

The average cost of a travel insurance policy varies on the coverage provided and the length of the trip. It's typically a percentage of your overall trip cost. On the high end, you can estimate up to 10% of your trip expenses. On the low-to-mid scale, you can estimate 4-8% of your anticipated trip costs.

Yes, you can buy annual or multi-trip travel insurance policies, which can be a good option for extensive trips. Note that these plans differ from single-trip policies in terms of coverage. Annual plans tend to focus on medical emergencies, whereas individual plans offer more robust travel-related coverages (such as baggage or trip delay).

Multi-trip insurance covers an unlimited number of trips during your coverage period. However, the length of time for your period is going to depend on your specific policy. Many multi-trip plans can be purchased as annual travel insurance, which will cover you up to 365 days.

It’s possible to cancel any insurance policy that you buy, but only during specific periods. This is called the "lookback" or review period. In most states, the lookback period lasts up to 15 days, during which time you can cancel your insurance without penalty.

Do you have any

credit cards with travel insurance coverage

Multi-trip travel insurance can be a cheap, affordable way to make sure you’re covered if you’re a frequent traveler. However, you’ll also want to understand the limitations of year-long policies. Although they can be less expensive than policies that cover a single trip, you can also expect to have less coverage.

Annual travel policies tend to focus more on medical care and — in limited circumstances — trip cancellation or trip interruption. However, if your needs include the ability to cancel your trip for any reason, or extras such as baggage insurance, you may want to consider purchasing a single-trip policy instead.

Finally, if you hold a travel credit card, odds are good that it comes with some form of travel insurance. Check out its guide to benefits to see what types of coverage your card offers, whether it’s emergency medical evacuation or trip delay reimbursement.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Multi-Trip Travel Insurance: One Policy That Covers Every Trip for a Year

Travel's messier than ever, so how'd you like travel insurance you only have to buy annually? Here's what multi-trip insurance is, how it works, and how to tell if it's the economical choice for you.

By Jason Cochran

February 22, 2023

For years you've heard it drilled into your consumer brain: Always buy travel insurance for major trips. But ever since Covid-19 travel restrictions receded, even minor trips may involve big problems.

Airlines and airports are halting operations without warning , political skirmishes are changing the landscape of no-go destinations , and, oh yeah, you could still get sick with Covid when you're scheduled to travel.

Given how unreliable travel has become and how easy it is to get stranded between point A and point B, our new travel insurance advice could very well be simplified to three words: Always have it .

There's actually a type of travel insurance that you only have to buy once a year. Multi-trip insurance will cover you, no matter where you go, for the length of the policy's validity period, which is usually a year.

Buy this type of insurance once, and you'll be covered for all your trips for a full 12 months.

Will I save money using multi-trip insurance?

That's something you have to calculate based on who you are and what your travel habits are.

"The cost of single-trip products are often based on two factors: the age of the traveler and the cost of the trip," said Daniel Durazo of Allianz Travel Insurance , one of the largest players in the business. "So as those factors go up or down, so does the cost of travel insurance."

According to Durazo, single-trip policies often cost between 5% and 10% of the total cost of a trip.

On the other hand, annual multi-trip policies are usually offered at a flat rate, "meaning your cost may not increase with age and trip cost," Durazo said.

Once you possess multi-trip coverage, you don't have to report each trip you take to your insurer, like you do with single-trip policies. You're simply covered for the year, no matter where you go.

All of the insurance industry experts we spoke to estimated that you'd need to take at least three to five trips in a year for the expense of a multi-trip policy to be worth it.

Can I travel all year with a multi-trip policy?

You can take multiple trips, but you can't remain on the road for months at a time. With an annual policy, coverage for each trip will expire after a maximum number of permitted days.

Lynn Pina of Pennsylvania-based GeoBlue , which sells annual travel insurance products, says that "most policies [only] cover trips up to 30 days [apiece]." (However, one of the company's premium products, GeoBlue Trekker, will cover trips lasting up to 70 days.)

After time's up on a trip, travelers on an annual plan will have to return home and then leave again for the clock to reset for the next trip. If you can't get home in between journeys, many insurers will also sell you add-on plans to cover the extra days.

Consequently, multi-trip insurance is better for leisure or business travelers and not designed for expats or long-term backpackers.

How can I compare prices and coverage of single-trip policies vs. multi-trip policies?

You don't have to track down a bunch of insurers to compare prices. That can be done quickly.

There are several one-stop online insurance marketplaces where you can plug in your details to see what numerous companies will offer. InsureMyTrip , Squaremouth , and QuoteWright have all been in business for many years. Check those and you'll be able to survey the major players and compile a thorough list of options.

Those websites can also handle quotes for multi-trip insurance, so you won't have far to go to compare prices and inclusions.

Will multi-trip insurance cover cancellation?

Not automatically. You have to make sure you buy a policy that has trip cancellation coverage. For example, Allianz's most affordable option, AllTrips Basic , will not cover cancellation, but the company's upgraded policies, like AllTrips Premier , do cover cancellation.

If you want the ability to decide unilaterally that you don't want to take a trip you bought, you must ensure that Cancel for Any Reason (called CFAR) coverage is part of your policy. Not all insurance offerings automatically include a CFAR clause.

Some upper-tier multi-trip plans will also cover everyone in your household, even if you travel separately. Maybe you can split costs with family members.

Will multi-trip insurance cover lost luggage?

Multi-trip policies tend to cover baggage loss, but only for a small amount and only for checked baggage.

That might not be a deal-breaker, though, because many credit cards automatically include such protection if you pay for travel with them. You might already have free baggage coverage.

Will multi-trip insurance cover rental car insurance?

That's another thing your credit card may already cover, but many multi-trip policies still throw it in. All of Allianz's annual plans do, and the coverage is good for $45,000 in rental car collision damage.

Will multi-trip insurance cover medical expenses?

Not all annual policies do. Some require Americans to have primary medical insurance back home and will only deal with medical situations that are classified as emergencies.

"The benefits of these plans vary but most typically cover medical expenses, trip interruption, and medical evacuation costs," said Pina of GeoBlue. "Some may even cover preexisting conditions for medical services and medical evacuation."

You just need to seek out the specific medical coverage for your needs.

"If your prepaid costs for an international trip are for items that can be rescheduled [for free], like airline tickets, consider a travel medical plan that provides coverage for medical expenses that will not be covered by your domestic health insurance," said Pina.

Even if your policy offers limited medical inclusions, make sure it at least includes Covid-19 coverage and access to a doctor around the clock via a telehealth service.

How much should I travel in a year to make a multi-trip policy worth the money?

You may also like: Frommer's 8 Great Travel Insurance Providers You may also like: How to Tell If You Need Travel Insurance, Based on the Type of Vacation

- All Regions

- Australia & South Pacific

- Caribbean & Atlantic

- Central & South America

- Middle East & Africa

- North America

- Washington, D.C.

- San Francisco

- New York City

- Los Angeles

- Arts & Culture

- Beach & Water Sports

- Local Experiences

- Food & Drink

- Outdoor & Adventure

- National Parks

- Winter Sports

- Travelers with Disabilities

- Family & Kids

- All Slideshows

- Hotel Deals

- Car Rentals

- Flight Alerts

- Credit Cards & Loyalty Points

- Cruise News

- Entry Requirements & Customs

- Car, Bus, Rail News

- Money & Fees

- Health, Insurance, Security

- Packing & Luggage

- -Arthur Frommer Online

- -Passportable

- Road Trip Guides

- Alaska Made Easy

- Great Vacation Ideas in the U.S.A.

- Best of the Caribbean

- Best of Mexico

- Cruise Inspiration

- Best Places to Go 2024

- Travel More & Spend Less

- Annual Travel Insurance

- Airport Lounges

- Invergordon Cruise Port

- Loch Ness Tour

- Coach Holiday Expert

- Work With Me

- About Melanie

- Editorial Policy

- Privacy Policy

- Cookie Policy

Annual Multi Trip Travel Insurance – What You Need to Know

- 27 February 2024

Heard of annual multi trip travel insurance but not sure how it works?

Well, read on because in this article I will cover everything you need to know.

Links You Might Find Helpful: Get a Quote from Coverwise Directly (It’s Super Quick) Private Half-Day Car Tour to Loch Ness for Up to 3 People Annual Travel Insurance – All You Need to Know

What is Annual Multi Trip Travel Insurance?

Table of Contents

It’s a travel insurance policy that you buy once a year and it covers you for multiple trips within that year. Generally, there is no limit on the number of trips you can take, although there can be some restrictions on the length of each trip.

Annual Travel Insurance Worldwide Multi Trip

Where Does Annual Multi Trip Travel Insurance Cover?

You choose which parts of the world you will be travelling to when you select your policy. Generally, there are regions to choose from rather than specific countries, for example;

- UK and Europe

- Rest of the world excluding the USA, Canada, and the Caribbean

- Rest of the world including the USA, Canada, and the Caribbean

If you choose UK and Europe and then want to book a trip to the USA you can easily adjust your travel insurance policy by contacting your insurer and advising them.

Annual Multi Trip Travel Insurance

Who Is Covered?

Policies can be purchased for single travellers, multiple travellers and family groups. The travellers named on the policy do not have to travel together to be covered. Children, depending on their age, may need proof that they are travelling with their parent’s consent if travelling on their own.

It’s always best to check the specifics of the travel insurance policy you are interested in so you know the exact details in relation to coverage.

When Does Cover Start?

The policy starts as soon as you buy the policy.

Professional Traveller Top Tip

You may be tempted to leave purchasing your travel insurance until you get close to the date of your first trip. You are better off buying your annual policy before you book your first trip. You are then likely to have some cancellation and abandonment coverage for your trip. The level of coverage will depend on your policy.

Pros of Annual Multi-Trip Travel Insurance

- Buying once a year means you will have some cancellation or abandonment coverage for trips you book during the year.

- Can be cheaper than single-trip travel insurance.

- Gives the same cover for each person named on the policy. If you have £1,000 abandonment cover on the policy, then that applies to each person. Check the specifics of your policy for details.

- This means you can book as many trips as you like and know you are covered.

Cons of Annual Multi-Trip Travel Insurance

- There can be a long time between taking out your insurance and some of your trips. You could buy a policy in January and take a trip in December. This means you need to remember to keep the medical information/health declarations up to date otherwise you could have no coverage.

- There can be a long time between taking out your insurance and some of your trips. This can mean you forget the policy details. Ensure you take a copy of your policy with you and double-check the details before you travel.

Best Annual Multi Trip Travel Insurance

Professional Traveller Recommended Annual Multi-Trip Travel Insurance

I recommend Coverwise for annual multi-trip insurance. It’s what I use and have done for years. Here’s why I recommend them;

- The cover is cost-effective – with an existing health condition my cover is £60 a year

- Covid cover is included

- They cover business travel.

- The amount of coverage can be adjusted depending on your requirements.

Why not get a quick quote now? It’s very easy to do.

If you have more serious health conditions then I recommend Travel Insurance 4 Medical. They are the most cost-effective cover for travellers with medical conditions I have found.

Annual Multi-Trip Travel Insurance Summary

- Annual multi-trip travel insurance is very cost-effective if travelling more than once, and may even be cheaper than single-trip insurance.

- Buying the policy before you book any trips will give you some cancellation coverage.

- It is vital to keep the health declarations up to date to ensure you are fully covered when you travel.

- Business travel cover is ideal for those who travel for work.

Other Articles You Might Like

If you have found this annual multi trip travel insurance article useful you might also like;

7 Things You Need to Know About Travel Insurance

Find more information on my annual travel insurance page.

Further Reading

Best Annual Travel Insurance 2024 [Multi-Trip Insurance]

Home | Travel | Best Annual Travel Insurance 2024 [Multi-Trip Insurance]

When traveling abroad, get a policy from one of the best travel insurance companies . Y ou can get a 5% discount on Heymondo , the only insurance that pays medical bills upfront for you, HERE!

Annual travel insurance is the most convenient option for frequent travelers who want to travel stress-free and save some money at the same time. However, it is not the same as long-term travel insurance , which provides coverage for every day of a long-term trip that can last a year or longer.

Yearly travel insurance covers the multiple, shorter-term trips you take within 365 days so that you don’t have to waste time and money buying travel insurance for each individual trip. It’s not necessarily useful for every traveler, since you won’t need it if you only take a trip or two per year.

In my case, however, there is no doubt that I need annual holiday insurance since I have to travel to South America for work at least once a month, so I can save a ton by buying annual multi-trip travel insurance .

As you can see, I’m a frequent traveler, so eight months ago, I decided to buy multi-trip annual travel insurance and stop spending money on insurance for each individual trip.

If like me, you know that annual travel insurance is the right choice for you, then you shouldn’t settle for any less than the best annual travel insurance 2024 , Heymondo . Not only is Heymondo the best COVID-19 travel insurance , but it is also the only travel insurance annual company that pays travelers’ medical expenses upfront for them instead of making them file a claim.

5% OFF your travel insurance

Keep reading to find out more about what annual travel insurance is, how much travel annual insurance costs, and what different annual holiday insurance plans cover.

- What is annual travel insurance?

- Annual travel insurance price & comparison

Best annual travel insurance plans

- Annual travel insurance coverage

What is annual multi-trip travel insurance and how does it work?

Annual travel insurance is a type of travel insurance that covers each and every one of the trips you take within one year. During that year, you can take as many trips as you like, but there is a maximum number of days you will be covered per trip (30, 45, 60, or 90 days, depending on the annual travel insurance you choose).

The 365 days that your annual travel insurance policy covers will start from the start date of your first trip, so you can easily buy yearly travel insurance as soon as you start planning a trip.

When you leave your home country for your next destination, the day counter is reset, and your covered days start to run out. That doesn’t mean you can’t take a trip that is longer than what is stated in your policy, just that you will only be covered for the number of days specified in your policy.

For example, my Heymondo annual multi-trip insurance covers trips of up to 60 days, but if I travel for 68 days, the last eight won’t be covered by the policy. I would have to come back home and leave again for the maximum days counter to reset to zero.

To make sure you’re covered for all of your trips, every time you use your annual travel insurance coverage, you need to show a supporting document, such as a plane ticket, that proves the start date of your last trip.

However, keep in mind that you don’t have to notify your insurance provider every time you take a trip. You only have to show the proof of departure date when you need assistance from your annual travel insurance company.

Annual travel insurance vs. single trip

So what’s the difference between annual travel insurance vs. single trip insurance ? Annual multi-trip insurance is for people who travel frequently and know they will be traveling multiple times throughout the year. For instance, if you travel nationally or internationally once every two months or more, you should definitely consider multi-trip annual travel insurance .

On the other hand, single trip insurance is travel insurance for one trip at a time. If you know you won’t be traveling much or you only take one trip in a year, you need single trip insurance.

You may also be wondering, why is annual travel insurance cheaper than single trip ? Annual holiday insurance is more affordable for frequent travelers because it is cheaper to buy a 12-month travel insurance policy than it is to buy individual policies for each trip.

Who is multi-trip annual travel insurance for?

The following types of travelers often discover great benefits from purchasing annual travel insurance :

- Travel addicts who travel every chance they get.

- Couples in long-distance relationships who travel often to see each other.

- Sales team members that visit clients from time to time or attend fairs and shows in different countries.

- Athletes participating in international events.

- Members of associations that attend events periodically throughout the year.

- Photographers, international journalists, travel bloggers, and the like.

- International students, ex-pats, or international workers who return home at least every two months.

If you’re an ex-pat or international worker, or are looking for international student insurance , annual travel insurance can save you a lot of money. However, you should keep in mind that you will have to return home from time to time to extend your coverage. It may be more beneficial for you to buy long-term travel insurance instead.

In other words, don’t plan to use yearly travel insurance to take a gap year and travel the world or work abroad and not go home for a long time.

Cost of annual travel insurance

Your yearly travel insurance cost will depend on several factors, including your age, your nationality, the state you live in (if you live in the US), and the number of people who are covered by your annual travel insurance plan .

If you’re looking for cheap multi-trip insurance , just know that the younger you are and the fewer the people covered by your travel insurance annual plan , the more affordable your 1-year travel insurance worldwide will be .

Annual travel insurance comparison

To generate an annual multi-trip travel insurance comparison , I have used the example of a 30-year-old American citizen from Pennsylvania who is buying an annual travel insurance policy .

Now that you’ve seen an annual travel insurance comparison , I’m sure you’ll understand why I decided to buy Heymondo ’s annual multi-trip insurance : it has some of the highest coverage and maximum number of days per trip, and its price is lower than all the other annual multi-trip insurance plans .

Of course, all of these travel insurance annual plans are some of the best, so below I’ll get into the highlights of each of the best annual travel insurance plans .

1. Heymondo , the best annual travel insurance 2024

In search of the best annual travel insurance 2024 ? Look no further than Heymondo . Their Annual Multi-trip plan is the most affordable travel insurance annual plan but still offers some of the highest coverage and highest annual travel insurance maximum trip length .

The Annual Multitrip plan is available for travelers up to age 69, and travelers can take trips of up to 60 days. Heymondo provides the highest amount of coverage for trip cancellation and baggage loss, and their coverage in all other categories, including COVID-19, is excellent and comprehensive. You can even add Adventure Sports or Electronics coverage if you need it.

Best of all, you will never have to go through the tedious process of filing a claim to get reimbursed for medical expenses. Heymondo pays your medical expenses directly and upfront for you so that you don’t have to wait to get reimbursed.

Speaking of medical expenses, Heymondo’s only drawback is that there is a $100 deductible per claim for medical expenses and baggage loss. That means you will have to pay $100 per medical or baggage claim before Heymondo will start to pay for you.

I think that all of Heymondo’s amazing pros outweigh the cons, that is why this is the policy we have purchased for ourselves. Also, you can save 5% on Heymondo annual travel insurance with the annual travel insurance promo code link below.

2. Allianz , the best multi-trip annual travel insurance for seniors

Allianz is easily one of the best annual travel insurance for seniors since it covers travelers up to the age of 99. Travelers can travel for up to 45 days and still receive yearly travel insurance coverage .

Allianz’s AllTrips Prime plan provides great trip cancellation, trip interruption, and baggage loss coverage. Even better, there is no deductible for medical expenses, so if you get sick or injured, Allianz will cover everything for you.

With that being said, the AllTrips Prime plan offers the lowest amount of emergency medical expense and evacuation and repatriation coverage. It is also the most expensive annual travel insurance plan of the plans I compared. If you want to save money and get similar or better coverage for a lower price, Heymondo is a better option for you.

3. IMG , a cheap annual travel insurance

IMG offers one of the most affordably priced annual travel insurance plans , combined with excellent medical-related coverage. Its Patriot Multi-Trip International plan offers the highest amount of coverage for emergency medical expenses, trip interruption, and evacuation and repatriation.

The Patriot Multi-Trip International plan is intended for travelers under the age of 76 and is highly customizable since you can add Adventure Sports Rider or Evacuation Plus Rider coverage to your plan.

You can also choose between setting 30 days or 45 days as the maximum length for your trips, although choosing 45 days will add about $50 to your annual travel insurance price .

However, since IMG’s travel insurance annual plan offers low baggage coverage and no trip cancellation coverage, it is best for travelers who just want annual multi-trip travel medical insurance . It also has a very high deductible of $250 per covered illness, so that means every time you fall ill, you will have to pay $250 before IMG starts to cover your medical expenses.

If you want a lower deductible, similar coverage for a lower price, and direct medical expense payments, choose Heymondo ’s annual travel insurance plan instead.

4. AIG , the best annual holiday insurance for long trips

If you’re looking to go on longer trips, AIG ’s Travel Guard Annual Travel Plan is perfect for you, since your annual holiday insurance cover will extend to trips of up to 90 days. AIG’s annual travel insurance is also perfect for seniors because there is no age limit for travelers to be able to purchase a plan.

The Travel Guard Annual Travel plan offers solid baggage loss and evacuation and repatriation coverage. There is also no deductible for emergency medical expenses, so you won’t have to pay anything out of pocket to get covered.

Still, a big limitation of AIG’s annual travel insurance plan is the travel-related coverage. The Travel Guard plan offers no trip cancellation coverage and the lowest trip interruption coverage out of all the travel insurance annual plans I compared. Considering how expensive AIG’s yearly travel insurance plan is, particularly compared to its coverage, there’s no question that you’ll get more bang for your buck with a plan like Heymondo ’s.

What does annual travel insurance cover?

Whichever travel insurance annual plan you end up choosing, you need to make sure that you’re getting enough coverage for medical- and travel-related situations. Annual travel insurance coverage should include:

- Emergency medical expenses – medical coverage is an absolute requirement for the best annual holiday insurance. Make sure yours covers important medical expenses such as sudden illness, accidental injury, emergency dental treatment, hospitalization, and prescription drugs.

- Evacuation and repatriation – this type of coverage is crucial if you fall ill in a remote area and need to be transported to a faraway hospital or are so sick that you need to be transported back to your home country for treatment.

- Trip delays, interruptions, and cancellations – any sudden, unexpected event – serious illness, inclement weather, jury duty, unexpected job loss – can interrupt or change your travel plans, but trip delay, interruption, and cancellation coverage ensure that you will still get reimbursed for covered travel costs.

- Lost/damaged/stolen luggage – if anything happens to your belongings while you’re traveling, luggage coverage will allow you to get reimbursed so you can easily buy new toiletries and clothes.

You can also purchase travel annual insurance with sports coverage, cruise coverage, or even electronics coverage if you have more specific coverage needs.

One coverage aspect to note is that it can be more difficult for older travelers to find a multi-trip travel insurance policy since age limits tend to be lower for annual trip insurance than for single trip insurance. If you are an older traveler interested in buying an annual travel insurance plan , make sure to compare the price and coverage of annual travel insurance plans with the price and coverage of single trip insurance plans to see which works best for you.

Is annual travel insurance worth it?

Ultimately, yes, having annual travel insurance is worth it if you travel frequently and want to save time and money on purchasing travel insurance for every trip. If you only take a couple of trips a year, stick to single trip insurance.

For example, imagine that you are a US citizen who is going to take several trips over the next 365 days and buy individual travel insurance plans from Heymondo:

- Indonesia (2 weeks) – $ 70.75

- Iceland (4 days) – $ 26.04

- Spain (1 week) – $ 38.17

- Morocco (3 days) – $ 17.74

- United Kingdom (5 days) – $ 26.04

- Norway (4 days) – $ 26.04

- Brazil (1 week) – $ 38.17

- Mexico (1 week) – $ 38.17

- Argentina (1 week) – $ 38.17

If you paid for these policies individually, it would cost you $319.29.

If you bought an annual travel insurance plan from Heymondo to cover those same trips, you would pay $197.96. In other words, you would have all those trips covered by one policy, and you could take even more trips without paying any other travel insurance fees.

Of course, buying annual travel insurance only works out to be more affordable if you travel frequently enough within a year. Don’t bother buying annual multi-trip holiday insurance if you only plan on traveling once or twice a year.

If you’re still unsure about whether you need annual multi-trip travel insurance , get quotes for single trip insurance for all the trips you will take over the next 365 days and compare that total to your annual holiday insurance quote . If your single trip insurance total is greater than the annual travel insurance price , yearly travel insurance is the best option for you.

Don't miss a 5% discount on your HeyMondo travel insurance

and the only one that pays all your medical bills upfront for you!

Ascen Aynat

One thought on “ Best Annual Travel Insurance 2024 [Multi-Trip Insurance] ”

Hey there, we are interested to purchase annual multitrip medical emergency travel insurance with specific COVID-19 cover rider. We are seniors, my DOB is April 20, 1946 and my wife’s is October 23, 1950. We reside in Canada and woud like to travel to Costa Rica in October 2020 and to Europe in 2021, if COVID-19 pandemic situation will permit. Your advice would be much appreciated.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Our Bloggers

- Get Travel Insurance

- Travel Tips & Inspiration

- Family Travel

- Food & Culture

- Sustainable Travel

- Outdoor & Adventure

- Senior & Snowbird Travel

- Wellness Travel

- Traveller Stories

- Travel Insurance

- Featured Posts

The Benefits of Multi Trip Annual Travel Insurance

Is multi trip annual insurance right for you.

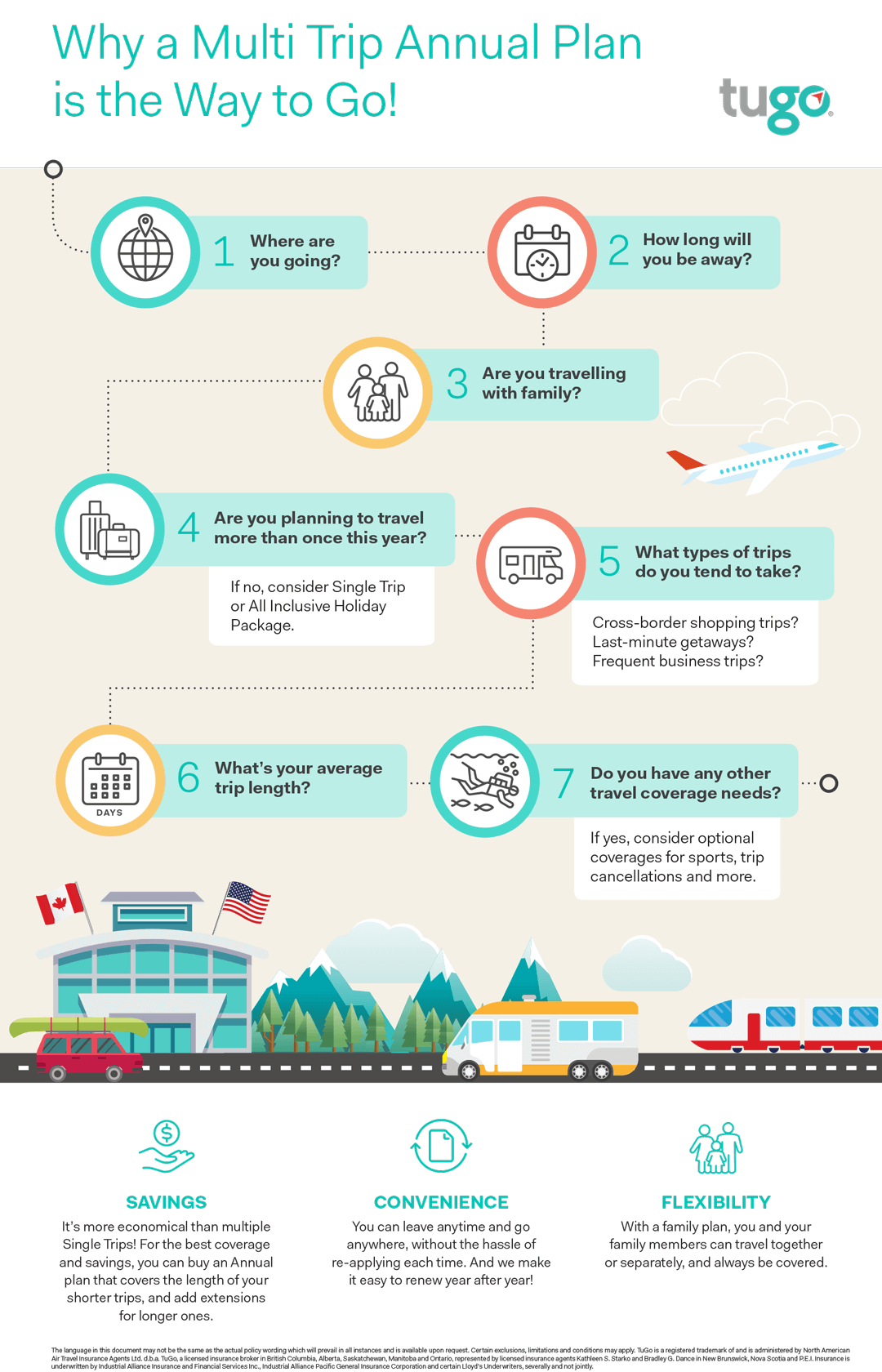

Multi Trip Annual Insurance is designed for those who plan to travel more than once a year. Choosing between a Multi Trip Annual and a Single Trip plan for Emergency Medical Insurance depends on a number of things, such as frequency of travel, length of stay, your destination and other factors. It’s a smart option to benefit from savings, convenience and flexibility, all while getting the type of travel insurance that suits your personal travel needs. Here’s a handy infographic to help you understand that Multi Trip Annual Travel Insurance—though it’s quite a mouthful to say out loud—isn’t as complicated as it might seem!

Take advantage of the savings

Purchasing Multi Trip Annual Insurance is cheaper than buying Single Trip Insurance multiple times in a year. When you think about it, the more times you travel in a year, the more you save on travel insurance per trip! Not only will you save money, you’ll also save time. You won’t need to worry about signing up for travel insurance every time you travel and can instead focus on the fun stuff—planning your itinerary, discovering points of interest or picking out which restaurants to try.

Buy it & forget about it—it’s all about the convenience

We all can get quite busy or—let’s be honest—sometimes downright forgetful. With a Multi Trip Annual plan, you won’t have to worry about remembering to buy travel insurance, since you’ll be covered for a full year. Not only that, but those under 60 can renew their policies year-after-year, hassle-free! Multi Trip Annual Insurance is especially convenient for frequent fliers who travel out of their home province on business, or frequent shoppers who cross the border more than once a year—it’s perfect for short day and weekend trips.

Enjoy flexibility when travelling alone or with your family

Not all trips are created equal! Some trips span just a few days, while others last for weeks. Choose the average length of travel coverage that works best for you—if a trip ends up being longer than planned, simply contact your provider for an extension. Belong to a family of travellers ? Travel as you normally would, together and/or separately. Each family member under the policy will always be covered for that year!

Customize your Multi Trip Annual Plan

The plan you choose will ultimately depend on your destination. Do you want to enjoy unrestricted coverage anywhere in the world? Multi Trip Annual Worldwide plan is your best bet! Are you a domestic business traveller or simply an intrepid explorer of our country? Multi Trip Annual for Travel within Canada plan will suit you. Including additional coverage options to your plan also gives you the freedom to customize your trips even more. Choose from optional coverages including Contact, Adventure or Extreme Sports Coverage , as well as Trip Cancellation & Trip Interruption Insurance.

Questions? Leave your questions in the discussion below. Happy travels, Justin

Ready for your next trip?

Ready for your.

Get the travel insurance you need and the top-quality service you deserve.

We have 7 Partners in Alberta

- ATB Financial

- Belairdirect

- Industrial Alliance

- London Drugs Insurance

- Simpson Group

- Travel Guardian

- Western Financial Group

We have 15 Partners in British Columbia

- Citistar Financial

- Coastal Community Insurance Services

- Hub International - TOS

- Johnston Meier Insurance

- Kootenay Insurance Services

- Megson FitzPatrick Inc.

- RHC Insurance Brokers

- Sussex Insurance

- Vancity Visa

- Western Coast Insurance Services

We have 3 Partners in Manitoba

We have 2 partners in new brunswick, we have 2 partners in nova scotia, we have 1 partners in the northwest territories, we have 9 partners in ontario.

- Bruce Murray & Associates

- First Rate Insurance

- R. Battiston

- Travel Insurance Office Inc.

- Travel Secure

We have 3 Partners in Quebec

- Ogilvy Assurances

We have 3 Partners in Saskatchewan

We have 1 partners in the yukon, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

- CEO’s Message

- Social Responsibility

- Canada’s Best Managed

- THIA Bill of Rights

- Contacts Us

- Canadian Residents

- Travel insurance FAQs

- MyFlyt service

- Your Policy

- How to Make a Claim

- What to do in a Medical Emergency

- Claims FAQs

- News & Advisories

- Press Release

- Travel Advisories

- Why Partner With Us

- Licensed Insurance Brokers

- TuGo’s Affiliate Program

- Existing Partners

- Partner Platform

- Partner FAQs

- Affiliate Portal

- Developer Portal

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Plan Your Trip

- Safety & Insurance

Single Trip Vs. Multi-Trip Travel Insurance: Which Is Better?

Published: October 13, 2023

Modified: December 28, 2023

by Federica Schram

- Travel Essentials & Accessories

Introduction

When it comes to travel insurance, there are various options available to protect yourself and your belongings while on the go. Two popular choices are single trip insurance and multi-trip insurance. Understanding the differences between these options can help you make an informed decision based on your specific needs and travel habits.

Single trip travel insurance, as the name suggests, provides coverage for a single trip or vacation. It typically offers comprehensive protection against a range of unexpected events such as trip cancellation or interruption, medical emergencies, lost baggage, and travel delays. This type of insurance is designed to offer peace of mind for a specific journey, whether it’s a weekend getaway or an extended holiday.

On the other hand, multi-trip travel insurance, also known as annual travel insurance or annual multi-trip insurance, is designed for frequent travelers who embark on multiple trips throughout the year. This type of insurance provides coverage for an entire year, allowing travelers to take unlimited trips within a specified time frame. It offers the convenience of not having to purchase separate insurance policies for each trip.

Now that we have a basic understanding of single trip and multi-trip travel insurance, let’s explore the coverage comparison between the two and examine the pros and cons of each option. By weighing these factors, you can determine which type of insurance is better suited to your travel needs and budget. So, let’s dive in and discover the differences between single trip and multi-trip travel insurance.

Definition of Single Trip Travel Insurance

Single trip travel insurance provides coverage for a single journey or vacation. It is designed to protect you against unexpected events that may occur during your trip, ensuring that you have financial security and assistance when you need it most. This type of insurance covers a wide array of risks, including trip cancellation or interruption, medical emergencies, lost baggage, and travel delays.

When you purchase single trip travel insurance, you are essentially buying coverage for a specific period of time, usually from the time of departure until the time of arrival back home. The coverage typically starts on the day you leave your home country and ends on the day of your return. It is important to note that the duration of coverage may vary depending on the policy and the insurance provider.

Single trip travel insurance offers flexibility in terms of trip duration. Whether you are planning a short weekend getaway or an extended holiday, you can choose a policy that suits your needs. The coverage can be tailored based on various factors, such as the destination, the length of the trip, and any specific activities or sports you plan to engage in during your travels.

One of the key advantages of single trip travel insurance is that it allows you to customize your coverage based on your specific requirements. You can choose the level of coverage you need for medical expenses, trip cancellation or interruption, and baggage loss or delay. This flexibility ensures that you are not paying for coverage that you do not need.

While single trip travel insurance provides comprehensive coverage for a specific trip, it does have its limitations. Once your trip is over and you have returned home, the coverage under a single trip policy ends. If you plan to take additional trips within the same year, you will need to purchase separate insurance policies for each trip. This can be a disadvantage for frequent travelers who embark on multiple trips throughout the year.

Now that we have a clear understanding of single trip travel insurance, let’s explore the definition of multi-trip travel insurance and compare the coverage and benefits it offers.

Definition of Multi-Trip Travel Insurance

Multi-trip travel insurance, also known as annual travel insurance or annual multi-trip insurance, is a type of coverage that provides protection for multiple trips within a specific time frame, usually one year. With this insurance, travelers can enjoy the convenience of having continuous coverage for all their trips without the need to purchase separate policies for each journey.

Multi-trip travel insurance is designed for frequent travelers who embark on multiple trips throughout the year, whether for business or leisure. Instead of buying insurance for each trip individually, you can opt for an annual policy that covers all your travels during the specified period. This eliminates the hassle of repetitive insurance purchases and saves you time and effort.

The coverage offered under a multi-trip insurance policy usually includes similar benefits as single trip insurance, such as trip cancellation or interruption, emergency medical expenses, baggage loss or delay, and travel delay. However, the coverage limits and terms may vary among insurance providers, so it’s important to carefully review the policy details.

One of the key advantages of multi-trip travel insurance is cost-effectiveness. If you are a frequent traveler, purchasing individual insurance policies for each trip can significantly add up in terms of premiums. With an annual policy, you pay a single premium that covers multiple trips, potentially saving you money in the long run.

In addition to cost savings, multi-trip travel insurance offers convenience and peace of mind. Once you have the policy in place, you can travel freely without worrying about insurance arrangements for each trip. This is particularly beneficial for business travelers or individuals who have a busy travel schedule throughout the year.

While multi-trip travel insurance provides coverage for multiple trips, there are usually limitations on the duration of each trip. Most policies have a maximum trip duration, which can vary from 30 to 90 days. If you plan to take longer trips, you may need to consider other insurance options or purchase additional coverage for those specific journeys.

Now that we understand the definition and benefits of multi-trip travel insurance, let’s compare the coverage and advantages of single trip and multi-trip insurance to help you make an informed decision based on your travel needs.

Coverage Comparison between Single Trip and Multi-Trip Insurance

When it comes to the coverage provided, there are some key differences between single trip travel insurance and multi-trip travel insurance. Understanding these differences can help you choose the option that best suits your travel needs and preferences.

1. Trip Duration: In terms of trip duration, single trip insurance offers coverage for a specific trip or vacation, typically starting from the time of departure until the time of return. On the other hand, multi-trip insurance covers multiple trips within a specified time frame, usually one year. However, there is usually a limitation on the duration of each trip under a multi-trip policy.

2. Cost: The cost of insurance can vary between single trip and multi-trip options. Generally, single trip insurance tends to be cheaper as you are only paying for coverage for one specific trip. Multi-trip insurance, while more expensive upfront, can be cost-effective for frequent travelers who take multiple trips throughout the year, as it eliminates the need to purchase separate policies for each trip.

3. Frequency of Travel: The frequency of your travels plays a crucial role in determining the type of insurance that is more suitable for you. If you only take one or two trips a year, single trip insurance may suffice. However, if you travel frequently, whether for business or leisure, multi-trip insurance offers the convenience of ongoing coverage for all your trips without the need to repeatedly purchase insurance.

4. Customization: Both single trip and multi-trip insurance policies can be customized based on your specific needs. You have the flexibility to choose the level of coverage for medical expenses, trip cancellation or interruption, and baggage loss or delay. This allows you to tailor the policy to match the activities and destinations of your trips.

5. Coverage Limitations: It’s important to carefully review the terms and conditions of both types of insurance to understand any coverage limitations. For single trip insurance, the coverage ends once you return from your trip. Multi-trip insurance has limitations on the duration of each trip, typically ranging from 30 to 90 days. If you plan to take longer trips, you may need to consider other insurance options.

6. Additional Benefits: Alongside the core coverage, both single trip and multi-trip insurance policies may offer additional benefits. These can include coverage for adventure activities, emergency medical evacuation, rental car insurance, and 24/7 assistance services. It’s important to assess these additional benefits and their relevance to your travel needs when comparing the two options.

By understanding the coverage comparison between single trip and multi-trip travel insurance, you can make an informed decision based on your travel frequency, trip duration, and budget. Consider your unique needs and preferences to select the option that provides the most comprehensive coverage and peace of mind for your journeys.

Pros and Cons of Single Trip Travel Insurance

Single trip travel insurance offers several advantages and disadvantages that are important to consider when choosing the right insurance option for your specific trip. Let’s explore the pros and cons of single trip travel insurance:

- Comprehensive Coverage: Single trip insurance provides comprehensive coverage for a specific trip or vacation. It typically includes protection against trip cancellation or interruption, medical emergencies, lost baggage, and travel delays.

- Flexibility: With single trip insurance, you have the flexibility to customize the coverage based on your specific needs, such as the destination, trip duration, and planned activities.

- Affordability: Compared to multi-trip insurance, single trip insurance tends to be more affordable, especially if you only take one or two trips per year.

- No Ongoing Commitment: Single trip insurance allows you to purchase coverage for a single journey without any long-term commitment. This is beneficial if you don’t travel frequently and prefer to assess your insurance needs on a trip-by-trip basis.

- Specialized Coverage: Single trip insurance offers the opportunity to add specialized coverage options, such as for adventure activities or pre-existing medical conditions, ensuring that you are adequately protected for your specific travel requirements.

- Limitation to a Single Trip: The primary limitation of single trip insurance is that it provides coverage for a specific journey only. Once your trip is over, so is your coverage. If you plan to take additional trips within the same year, you will need to purchase separate insurance policies for each trip.

- Higher Costs for Frequent Travelers: For individuals who travel frequently, the costs of purchasing single trip insurance for each trip can add up. In such cases, multi-trip insurance may be a more cost-effective option.

- Inconvenience of Repeated Purchases: Buying insurance for each trip individually can be time-consuming and inconvenient. It requires researching and purchasing a new policy before every journey, which can be a hassle, especially for frequent travelers with busy schedules.

- Limited Trip Duration: Some single trip insurance policies have limitations on the duration of each trip. If you plan to take extended trips, you may need to explore other insurance options or purchase additional coverage.

Understanding the pros and cons of single trip travel insurance will help you determine if it is the right choice for your specific travel needs and circumstances. Consider the frequency of your travel, trip duration, budget, and the level of coverage you require to make an informed decision.

Pros and Cons of Multi-Trip Travel Insurance

Multi-trip travel insurance, also known as annual travel insurance, offers several advantages and disadvantages that are worth considering when deciding on the best insurance option for your frequent travels. Let’s explore the pros and cons of multi-trip travel insurance:

- Continuous Coverage: With multi-trip travel insurance, you have ongoing coverage for all your trips within a specified time frame, usually one year. This eliminates the need to purchase separate policies for each trip and provides peace of mind for your frequent travels.

- Cost Savings: For frequent travelers, multi-trip insurance can be more cost-effective compared to purchasing individual insurance policies for each trip. By paying a single premium for the entire year, you may save money in the long run.

- Convenience: Multi-trip insurance offers convenience and time-saving benefits. Once you have the annual policy in place, you can travel freely without the hassle of repeatedly buying insurance before each trip.

- Flexible Trip Duration: While there are limitations on the maximum duration of each trip, multi-trip insurance provides flexibility for trips within the specified timeframe. This is beneficial for individuals who take shorter trips throughout the year.

- Additional Benefits: Many multi-trip insurance policies offer additional benefits, such as coverage for adventure activities, emergency medical evacuation, rental car insurance, and 24/7 assistance services. These extras can enhance your protection and support during your travels.

- Higher Upfront Cost: Compared to single trip insurance, multi-trip insurance tends to have a higher upfront cost. This may deter individuals who do not travel frequently or have a limited travel budget.

- Limited Trip Duration: Most multi-trip insurance policies have limitations on the duration of each trip, often ranging from 30 to 90 days. If you plan to take longer trips, you may need to explore other insurance options or purchase additional coverage.

- Coverage Restrictions: Depending on the policy, multi-trip insurance may have coverage restrictions, such as limitations on certain activities or destinations. It is important to review the policy details to ensure that your travel needs are adequately covered.

- No Customization for Each Trip: With multi-trip insurance, the coverage is standardized for all your trips within the specified time frame. You may not have the same level of flexibility to customize the coverage based on the specific needs of each trip.

- Potential Underutilization: If you do not take advantage of the insurance benefits for a significant portion of the year, you may end up paying for coverage that you do not fully utilize.

Understanding the pros and cons of multi-trip travel insurance will help you determine if it aligns with your frequent travel needs and preferences. Consider the frequency and duration of your trips, your budget, and the level of coverage you require to make an informed decision.

Factors to Consider When Choosing Between Single Trip and Multi-Trip Insurance

When deciding between single trip and multi-trip travel insurance, there are several important factors to consider. Evaluating these factors will help you make an informed decision that best suits your specific travel needs and circumstances. Here are the key factors to consider:

Frequency of Travel: Assess how often you travel within a year. If you only take one or two trips annually, single trip insurance may be the more suitable option. However, if you travel frequently, such as for business or leisure, multi-trip insurance offers the convenience and cost-effectiveness of continuous coverage for all your trips.

Trip Duration: Consider the typical length of your trips. Single trip insurance is ideal for journeys with specific departure and return dates. However, if you often embark on shorter trips within a specified time frame, multi-trip insurance may provide more flexibility.

Budget: Evaluate your budget for travel insurance. Single trip insurance tends to have a lower upfront cost as you only pay for coverage for a specific trip. Multi-trip insurance may have a higher upfront cost, but it can be more cost-effective for frequent travelers who take multiple trips throughout the year.

Customizable Coverage: Determine whether you require the flexibility to customize the coverage for each trip. Single trip insurance allows you to tailor the coverage based on your specific needs, such as the destination, trip duration, and planned activities. With multi-trip insurance, you may have standardized coverage for all your trips within the specified time frame.

Specialized Coverage: Consider if you need specialized coverage for specific activities or destinations. Single trip insurance may allow you to add specialized options based on your unique travel requirements. However, multi-trip insurance may have limitations on certain activities or destinations, so it’s important to review the policy details.

Convenience: Evaluate the level of convenience you desire in insurance arrangements. Single trip insurance requires buying a policy for each trip, which can be time-consuming. In contrast, multi-trip insurance offers the convenience of continuous coverage for all your trips without the need for repetitive purchases.

Additional Benefits: Assess the extra benefits provided by each insurance option. Both single trip and multi-trip insurance may offer additional coverage benefits, such as for adventure activities, emergency medical evacuation, or rental car insurance. Consider which additional benefits are important to you.

By considering these factors, you can weigh the advantages and disadvantages of single trip and multi-trip insurance and choose the option that aligns with your travel habits, preferences, and budget.

When it comes to choosing between single trip and multi-trip travel insurance, there isn’t a one-size-fits-all answer. It ultimately depends on your unique travel habits, preferences, and budget. By considering the key factors discussed, you can make an informed decision that provides the most comprehensive coverage and peace of mind for your journeys.

For occasional travelers who take one or two trips a year, single trip travel insurance offers affordable and customizable coverage for specific journeys. It allows you to tailor the coverage based on your needs, ensuring you have protection against unexpected events during your trip.

On the other hand, frequent travelers who embark on multiple trips throughout the year may find multi-trip travel insurance more advantageous. It provides continuous coverage and cost savings by eliminating the need to purchase separate policies for each trip. The convenience of ongoing protection and additional benefits make it a practical choice for those with busy travel schedules.

Ultimately, the right choice between single trip and multi-trip insurance depends on factors such as the frequency and duration of your trips, your budget, and the level of coverage and customization you require. Evaluating these factors will help you select the option that best meets your specific travel needs.

Remember to carefully review the terms and conditions, coverage limitations, and benefits offered by different insurance providers. This will ensure that you have a clear understanding of the coverage and can make an informed decision.

Whether you opt for single trip or multi-trip travel insurance, having the right protection in place is essential. It offers financial security, assistance, and peace of mind, allowing you to focus on enjoying your travels without worrying about unexpected mishaps.

Consider your travel habits, evaluate the pros and cons, and choose the type of insurance that aligns with your needs and preferences. This way, you can embark on your journeys with the confidence of knowing you are well-protected, no matter where your travels take you.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

The Comprehensive Guide to Annual Travel Insurance

Who Should Buy Annual Travel Insurance?

Older travelers: Here’s a secret many travelers don’t realize: Annual travel insurance is an especially good deal for people 65 and up. That’s because, unlike single-trip insurance plans, the cost of multi-trip plans is not affected by the traveler’s age. A 71-year-old traveler will pay the same as a 41-year-old traveler.

> Read more: What Factors Affect the Cost of Travel Insurance?

Business travelers: Your friends think your on-the-go life is glamorous. You know the truth: business travel is a grind. The AllTrips Executive plan helps you bounce back when things go wrong by reimbursing your expenses for covered travel delays, misplaced luggage, and even lost or damaged business equipment.

Spontaneous travelers: People with flexible schedules can score savings on last-minute cruises and hotel stays. But travel deals like these often have strict cancellation policies, making travel insurance all the more important. A multi-trip plan automatically protects your trip as soon as you book it.

Road trippers: Because road trips tend to have few pre-paid expenses, people don’t bother to insure them. But travel delays, trip interruptions and medical emergencies can still wreck your plans — what then? An annual travel insurance plan protects you from those unexpected speed bumps.

Budget travelers: If you’re careful with your travel spending, then an AllTrips plan is a must. The expense is minimal, especially if you’re planning several trips. And travel insurance can protect you from unexpected expenses when you’re dealing with a medical emergency, lost bag, travel delay or other mishap.

Parents and grandparents: Did you know you can give an AllTrips plan as a gift ? If your child or grandchild is an avid traveler, an annual insurance plan will accompany them everywhere they go, helping them when things don’t go as planned. You’ll enjoy more peace of mind, too.

Which Benefits Are Included in Annual Travel Insurance?

Every AllTrips plan includes the following benefits:

- Emergency medical benefits , to reimburse you for covered medical expenses in case of a covered illness or injury

- Emergency transportation benefits , in case you require a medically necessary evacuation for a covered illness or injury

- Baggage loss/damage benefits , in case your bags are stolen, or damaged or misplaced by your travel carrier

- Baggage delay benefits to reimburse you for necessary, eligible purchases when your bags are delayed

- Travel delay benefits to reimburse you for eligible meals, accommodations and other covered expenses during a covered delay

- Rental car damage and theft coverage . (Rental car coverage, when purchased as part of an annual plan, is not available for residents of all states.)

- Travel accident benefits, which can pay you for covered losses due to death, loss of limb(s) or sight as a result of a covered travel accident

- Access to 24-Hour Hotline Assistance , so you can get expert help dealing with travel emergencies

- Concierge assistance to help with travel planning and arranging special experiences

Some AllTrips plans also include:

- Trip cancellation benefits , to reimburse your prepaid, non-refundable expenses if you have to cancel your trip due to a covered reason.

- Trip interruption benefits , to reimburse you for the unused, non-refundable portion of your trip and for the increased transportation costs it takes for you to return home due to a covered reason.

- Business equipment coverage, to reimburse the repair, replacement and/or rental of business equipment that has been lost, stolen, damaged or delayed by your common carrier.

- Change fee coverage , to reimburse fees if you change the dates on your airline ticket for a covered reason.

- Loyalty program redeposit fee coverage, which reimburses fees charged for re-depositing loyalty program awards (such as frequent flyer miles) back into your account following a covered trip cancellation or interruption.

What’s the Best Annual Travel Insurance Plan?

Allianz Global Assistance offers four annual travel insurance plans. All of them include our award-winning 24-Hour Assistance services , which can help you find solutions to tough travel problems.

AllTrips Basic is the most economical multi-trip plan offered by Allianz Global Assistance. It includes post-departure benefits to protect you in case of baggage loss/damage/theft, travel delays, covered medical emergencies and more. It does not protect your travel investment with trip cancellation/trip interruption benefits.

AllTrips Prime includes all the benefits (with the same maximum limits) as AllTrips Basic, with the addition of trip cancellation and trip interruption benefits. There’s a limit of $3,000 for trip cancellation and trip interruption per person, per year .

AllTrips Executive can protect business, pleasure and blended trips, with multiple tiers of coverage for trip cancellation and interruption up to $10,000. If your business equipment is lost, stolen, damaged or delayed by an airline or other carriers, this plan can reimburse reasonable costs for equipment rental, replacement and/or repair.

AllTrips Premier can protect your entire household while you’re traveling. It offers four tiers of trip cancellation/trip interruption benefits, up to $15,000 per household, per trip, per year.

> Read more: Which Annual Travel Insurance Plan is Right for You?

Tips for Buying Annual Travel Insurance

An alltrips plan protects trips within a 365-day span (not a calendar year)..

It’s wise to look ahead at your travel plans to make sure your trips will be protected. Your AllTrips plan takes effect at 12:01 a.m. on the day after we receive both your order and full premium payment (or on a future date you choose at the time of purchase). It ends at 11:59 p.m. local time on your coverage end date, unless you are on a trip. If you are on a trip, your coverage will end on the day you arrive at your point of origin or primary residence, or seven days after the coverage end date, whichever is earlier.

Trip cancellation and interruption benefit limits are per person, per year.

This is key! Each benefit in your AllTrips plan has a maximum dollar limit, depending on which plan you choose. For example, AllTrips Prime has a maximum limit of $20,000 in emergency medical benefits per insured person, per trip . So, if you incur $20,000 in emergency medical costs from a car accident while in Romania, and then another $20,000 in emergency medical costs from a hippopotamus attack on a trip to Botswana (bad luck!), both claims could be covered.

Trip cancellation/interruption is different: The maximum limit applies per person, per year . AllTrips Prime’s maximum trip cancellation benefit is $3,000. So, if you file a claim for $2,000 after canceling your Jamaican vacation, you only have $1,000 left to cover any other trip cancellations for the duration of your plan. Keep your total trip costs in mind when you’re choosing a plan.

AllTrips plans can cover losses resulting from pre-existing conditions.

We define a pre-existing medical condition as injury, illness, or medical condition that, within the 120 days prior to and including the policy purchase date:

- Caused a person to seek medical examination, diagnosis, care, or treatment by a doctor;

- Presented symptoms; or

- Required a person to take medication prescribed by a doctor (unless the condition or symptoms are controlled by that prescription, and the prescription has not changed).

With an AllTrips plan, you can be covered for losses due to a pre-existing medical condition if you were a U.S. resident when the policy was purchased and:

a. The trip was purchased during the coverage period; or

b. Your policy was purchased within 14 days of the date of the first trip payment or deposit.

Please read your plan documents for details.

Some trips may not be eligible for travel protection.

While there’s no limit on how many trips you take, most of our AllTrips plans have a 45-day limit on trip length. If you’re planning a longer journey, consider AllTrips Premier , a multi-trip plan that can protect trips up to 90 days, or OneTrip Emergency Medical , a low-cost single-trip plan that can protect trips up to 180 days in length. Also, travel insurance plans do not cover travel with the intent to receive health care or medical treatment of any kind, moving, or commuting to and from work.

Look at your options for protecting the whole family.