Monkey Business Images/Shutterstock

Advertiser Disclosure

Citi Double Cash benefits guide

This flat-rate cash back Citi card offers a decent sign-up bonus and numerous redemption options for its rewards

Published: August 29, 2022

Author: Nicole Dieker

Editor: Kaitlyn Tang

Reviewer: Claire Dickey

How we Choose

With the Citi Double Cash, you earn up to 2 percent cash back on every purchase you make and pay off — but what are the card’s other benefits? Read on to learn more about all the card’s perks, including its 0 percent intro APR on balance transfers.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

Citi is an advertising partner

The Citi Double Cash® Card comes with a unique cash back offer — the opportunity to earn an unlimited 1 percent cash back on every purchase, as well as an additional 1 percent back every time you make on-time payments on those purchases. Essentially, you can earn a full 2 percent cash back on every purchase you make and pay off, which provides an incentive for you to pay off your balances as quickly as possible.

But what are the other Citi Double Cash benefits? Let’s take a closer look at the benefits of the Citi Double Cash Card, which include the ability to turn your cash back rewards into Citi ThankYou points and a 0 percent intro APR period on balance transfers.

The Citi Double Cash at a glance

As a flat-rate cash back card , the Citi Double Cash Card provides a unique rewards offer, of up to 2 percent cash back, that helps motivate you to pay off your credit card bill in full. It also gives you 18 months of a 0 percent APR (18.49 percent to 28.49 percent variable APR after) to pay off old debt without accruing interest charges. Eighteen months is a fairly standard time period among balance transfer offers and should be ample time for you to resolve your debt.

- Earning rewards

Flat cash back

The Citi Double Cash Card offers an unlimited 1 percent cash back on all purchases, along with the opportunity to double your cash back when you make on-time payments on those purchases. For cardholders who regularly pay off their balances in full, it’s a straightforward offer, making it easy and effortless to earn up to 2 percent cash back on all your purchases.

Some people may discount the Citi Double Cash as low earning for its simplicity, but don’t count it out too quickly. In fact, compared to its sister card, the Citi Custom Cash℠ Card , another top cash back credit card, the Citi Double Cash earns more cash back in a year for high spenders.

Let’s look at a spend example. If you charge $24,000 in a year on your Citi Double Cash, you would earn $480 in cash back. However, because the Citi Custom Cash Card’s 5 percent category caps out at $500 per billing cycle and all other purchases after that earn 1 percent, $24,000 on the card would also yield $480. Essentially, those who spend annually $24,000 or more will earn more cash back with the Citi Double Cash’s unlimited cash back.

Sign-up bonus

Sometimes lacking one and sometimes offering one, the Citi Double Cash currently boasts a decent welcome offer. New cardholders who spend $1,500 in the first six months will earn $200 in cash back. Considering other welcome bonuses on the market , the $1,500 spending goal is relatively manageable, especially since you have six months to achieve it, which requires you to spend only $250 a month across the six months.

- Redemption options

The Citi Double Cash Card has plenty of redemption options to enjoy the rewards your card earns. Though technically a cash back card, this card actually earns rewards as ThankYou points, which are quite versatile. Every 100 ThankYou points are worth $1 in cash back, and they can be used to book travel through the Citi travel portal, shop online and more.

Note, the card technically earns “basic” ThankYou points , meaning you won’t be able to transfer them to Citi airline or hotel partners.

You can also turn your ThankYou points into cash back redemption methods like statement credits, deposits into checking or savings accounts or mailed checks.

- Balance transfer offer

One of the best Citi Double Cash benefits is its 0 percent intro APR offer — meaning no interest for 18 months on balance transfers, followed by a variable APR of 18.49 percent to 28.49 percent. The card even has an intro balance transfer fee of $5 or 3 percent (whichever is higher) on balance transfers performed in the first four months of opening your account. After that, the fee goes up to $5 or 5 percent, whichever is higher.

For most cardholders who have a little bit of credit debt accumulated from another high-interest card, the Citi Double Cash’s zero-interest offer should be enough time to pay that debt off.

- Other benefits

The Citi Double Cash Card is a no-annual-fee credit card , which also means it doesn’t offer as many benefits and perks as cards that do charge an annual fee.

Nevertheless, the Citi Double Cash does offer a few useful perks, like 24-hour fraud protection and zero liability on authorized charges in case any fraudulent charges are found on your account. As a Citi cardholder, you’ll also have access to Citi Entertainment , which gives you exclusive presale tickets to concerts and sporting events and dinners by renowned chefs.

How to maximize your Citi Double Cash benefits

If you want to maximize your Citi Double Cash rewards, make sure you pay off your credit card balances every month. Remember, you only earn 1 percent cash back on every purchase if you don’t pay off that purchase at the end of the billing cycle, which undermines much of the card’s value. If you make a late credit card payment , you won’t earn the additional 1 percent.

For those with a little bit of credit debt, we recommend transferring your balances to the Citi Double Cash. Since the card lacks a 0 percent intro APR on new purchases, you should work on paying off those balances before charging anything with your new card. And, of course, be sure to meet that $1,500 spend goal within the first six months so that you can earn your sign-up bonus, worth $200. It’s only a good thing that the Citi Double Cash currently offers a welcome bonus, so you should capitalize on it while it lasts.

We also recommend using your rewards as Citi ThankYou points, rather than as cash back. Though redemption options like statement credit and cash back are tempting for their simplicity, the average worth of these is 0.5 cents per point. Instead, we recommend redeeming your ThankYou points for travel on the Citi travel portal or even home mortgage or student loan repayments, as these make points worth 1 cent apiece.

Bottom line

The biggest benefit of the Citi Double Cash Card is the opportunity to double your cash back every time you make on-time credit card payments. While you won’t get much in the way of travel perks or similar extra benefits, the ability to earn up to 2 percent cash back on every purchase you pay off is a huge win. And when you add in the Citi Double Cash balance transfer offer, the card becomes a double win.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Nicole Dieker is a freelance writer with a focus on personal finance and habit formation. She spent five years as a writer and editor at The Billfold, a personal finance site where people had honest conversations about money, and she regularly teaches classes on how to build your income as a freelancer.

On this page

- Citi Double Cash at a glance

- How to maximize the benefits

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

Basic ThankYou points: What does that actually mean?

Some Citi credit cards that earn ThankYou points have better redemption options. Combining points from multiple Citi cards can help you maximize the value of your ThankYou points.

Guide to Citi Custom Cash Card's rewards and benefits

The Citi Custom Cash Card offers cash back that adapts to your spending habits. It may be worth a look if you’re interested in flexible rewards.

Earn 60,000 bonus points with the Citi Premier Card

How to get preapproved for a Citi card

How to request a credit limit increase with Citi

How to earn and use Citi ThankYou points

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

Citi Double Cash Card benefits guide

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Credit cards

- • Credit card comparisons

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The Citi Double Cash® Card is an excellent flat-rate rewards card that can earn you 2 percent cash back on all purchases — 1 percent when you make a purchase and 1 percent when you pay it off, with no categories to keep track of.

- If you have high-interest debt, the card's 0 percent intro APR offer on balance transfers for 18 months (variable APR of 19.24 percent to 29.24 percent after) can help you consolidate debt and save money on interest.

- To maximize your card, first understand your financial goals — either to earn straightforward rewards on your spending or consolidating and paying down high-interest debt — to avoid taking on new debt your budget may not be positioned to pay off.

When it comes to earning credit card points, you should understand the different types of rewards credit cards to find the right fit. Some people benefit the most from rewards credit cards that offer different bonus categories, or from travel credit cards that let them earn points good for airfare, hotels and other travel bookings. However, there are also cash back credit cards to consider, including ones that let you earn a flat rate of rewards for each dollar you spend.

The Citi Double Cash® Card * is among the top rewards credit cards in the latter category due to its flat earning rate, yet this card is also popular for consumers who need to consolidate and pay down high-interest debt .

If you want to earn the highest flat rate of cash back you possibly can, or if you need to pay down debt, the Citi Double Cash should be at the top of your list. Read on to learn about the main details of this offer, including the benefits you’ll get if you sign up and if this card is worth it for you.

Citi Double Cash Card benefits

Flat cash back rewards.

Cardholders who sign up for the Citi Double Cash get the chance to earn a total of 2 percent cash back for each dollar they spend — 1 percent back when a purchase is made and another 1 percent when it is paid off. The Citi Double Cash doesn’t charge an annual fee, and there are no limits to the rewards you can earn.

Separately, this card also gives you an introductory 0 percent intro APR on balance transfers for 18 months, followed by a variable APR of 19.24 percent to 29.24 percent based on your creditworthiness. This perk doesn’t necessarily combine well with the rewards aspect of this card, but you can use it to consolidate and pay down high-interest debt from other cards and save money along the way.

0 percent intro APR balance transfer

The Double Cash’s intro APR offer only applies to balance transfers, and not purchases. With that in mind, you should know that purchases you make with your card will accrue interest at the regular variable APR if you carry a balance from month to month.

If you plan to use this card’s intro APR offer to consolidate debt , we suggest not using your card for purchases while you pay off old balances. This will allow you to focus on debt repayment without being enticed by rewards and racking up new balances you can’t afford to pay off.

Balance transfer example

How much money can you save if you transfer a balance to the Citi Double Cash? This all depends on the specifics of your situation. But let’s consider an example.

Let’s say you owe $6,500 in credit card debt at a current APR of 21 percent. You’ve calculated that you can afford to pay $375 a month toward your balance. And at that rate, you could become debt-free in 21 months — although you would pay $1,313 in interest along the way.

If you transferred the $6,500 balance to the Citi Double Cash, you would pay a 3 percent (minimum $5) intro balance transfer fee if completed after four months of account opening. This means you would begin debt repayment with a balance of $6,695. With the same $375 monthly payment, however, you could pay off the entire balance in about 18 months with $0 in interest charges — saving you more than $1,100.

Other protections and benefits

The Citi Double Cash doesn’t have many consumer protections or perks, but there are a few to be aware of. Consider the following benefits and how you might use them when gauging the total value of this offer.

Lost wallet service

If your wallet is lost or stolen, Citi will replace your credit card in a short period of time, usually within 24 hours. Citi can also provide you with emergency cash to spend, provided you have cash advance availability within your credit limit.

Citi Entertainment

The Citi Double Cash can help you gain access to special presale tickets and events that may not be open to the general public. Events available within Citi Entertainment can include concerts, sporting events, culinary experiences and more.

Flexible redemption options

While the Citi Double Cash is a cash back credit card at heart, you have several different options when it comes to redeeming your rewards.

- Cash back or statement credit. You can request a check in the mail for your rewards once your rewards balance is at least $25. You can also request a statement credit to your card when your rewards balance is at least $25, or ask for a credit to a linked Citi checking or savings account (as long as you have used that account to pay your Citi credit card bill at least twice).

- Convert your rewards to Citi ThankYou points. If you have another Citi credit card that earns Citi ThankYou points (or just want to have more options for redeeming your rewards), you can also convert rewards earned with the Citi Double Cash to Citi ThankYou points . You’ll need a minimum of $1 in rewards to make this conversion.

Maximizing the Citi Double Cash Card

If you are thinking of signing up for the Citi Double Cash, we suggest figuring out your goals first. Here are the two strategies to consider once you’re a card member.

Earn rewards on all your purchases

The Citi Double Cash lets you earn one of the best flat rates among all cash back credit cards, and you don’t have to keep track of bonus categories or limits. Use your card for all your spending and regular bills and earn a total of 2 percent cash back for each dollar you spend — 1 percent when you make a purchase and another 1 percent when you pay it off.

Consolidate and pay down high-interest debt

Instead of focusing on rewards, you can use the Citi Double Cash to consolidate and pay down high-interest debt. We suggest transferring as much high-interest debt to this card as you can, then figuring out how to pay off as much as you can within the 18-month introductory period. Remember that any remaining balances you have will begin accruing interest at the regular variable APR after your offer ends.

The bottom line

This guide explains the main perks you can get as a cardholder and the strategies you can use to make the most of this offer. Even so, you should take the time to compare Citi Double Cash Card’s benefits with the perks you get from other rewards credit cards.

If you can’t decide on a single rewards credit card for your wallet, you can also pair up a few cards with different rewards structures and perks. Be sure to research the top credit card combinations before you decide.

Why I love the Citi Double Cash Card

Why the Citi Double Cash card is good for first-time card owners

Why the Citi Double Cash is a great cash back card for paying off debt

Citi Rewards+ Card vs. Citi Double Cash Card

Is the Citi Double Cash Card worth it?

Citi Double Cash Credit Card Review

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

Citi Double Cash Card — Full Review [2024]

Jarrod West

Senior Content Contributor

443 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Senior Editor & Content Contributor

98 Published Articles 692 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Citi Double Cash ® Card

$200 cash back

0% Intro APR for 18 months on balance transfers, then 19.24% - 29.24% Variable

Fair to Excellent (580-850)

Great card for the average spender with no specific focus category; worry-free cash-back earning on everything!

The Citi Double Cash ® Card has long been one of the top cash-back credit cards on the market, and the card now has the ability to earn Citi ThankYou Points!

This means that cardholders of the Double Cash card will now earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. Cash back is earned in the form of ThankYou Points . This means each billing cycle, you will earn 1 ThankYou point per $1 spent on purchases and an additional ThankYou point for every $1 paid on your purchase balance as long as there is a corresponding balance in your Purchase Tracker.

Citi has turned the Double Cash card into a top choice for those who are looking for an everyday, no-fuss credit card.

Card Snapshot

Welcome bonus & info.

- Bonus Offer: Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This offer will be fulfilled as 20,000 ThankYou ® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

- To earn cash back, pay at least the minimum due on time.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Citi Double Cash ® Card Travel Portal Limited Time Offer: Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions, excluding air travel, when booked through the Citi Travel SM portal on ThankYou.com or by calling 1-800-Thankyou and saying “Travel.” Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024.

Card Categories

Credit Card Reviews

- Cash Back Credit Cards

- No Annual Fee Cards

Rewards Center

Citi ThankYou Rewards

Customer Service Number

1-888-248-4226

- Uncapped 2% for every $1 spent (1% when you buy and another 1% when you pay)

- Flexible redemption options

- No annual fee

- No bonus categories

- 3% foreign transaction fees

- Lack of premium travel benefits

Related Articles

Capital One Venture vs Citi Double Cash

The 8 Best 2% Cash-back Credit Cards [2024]

Best 0% Interest Credit Cards

Best Citi Credit Cards

Best Credit Cards for Bills and Utilities

Best Everyday Credit Cards

Citi Transfer Partners

Great card if.

- You want a card with no annual fee

- You prefer a card with a basic earning structure, so you don’t have to memorize bonus categories

Don’t Get If

- You want a card that offers premium travel perks

- You want a card that does not charge foreign transaction fees

- You want a card that offers bonus categories for the things you spend the most on

Double Cash Card — Is It Worth It?

The Double Cash card is an excellent option for those who are looking for a no-annual-fee card that offers a simple but strong earning structure and flexible redemption options.

Since you earn an uncapped 2% back on all purchases (1% at time of purchase and 1% when you pay), without an annual fee, the Citi Double Cash is easily one of the best credit cards for monthly bills and other non-bonused purchases.

Double Cash Card Top Benefits

Introductory apr.

Since the typical user of this card is not spending heavily in any given category, they may want to use this card as a way to float some cash.

- 0% intro APR on balance transfers for 18 months . After that, the variable APR will be 19.24% - 29.24%

There is absolutely no hassle as long as you pay the minimum fee each month (go to the Citibank login right away and set up autopay), allowing you to accrue some quick cash if you need it.

If you’re using the intro APR, just be sure you’ve got a plan to have the cash available by the end of the introductory offer; the APR will be retroactive for anything not paid off by that time.

Other Benefits of the Double Cash Card

While this card is a fairly simple, no-frills card, there are a few more benefits worth mentioning.

First, there is no maximum to the double rewards that you can earn. Whether you spend $1,000 or $100,000 a year, you’ll still earn a total of 2% on all purchases (1% at time of purchase and 1% when you pay).

Plus, your Citi ThankYou Points can be redeemed for cash-back, travel, gift cards, and more.

Double Cash cardholders can transfer their ThankYou Points to Choice Privileges at a 1:1.5 ratio and Wyndham Rewards and JetBlue TrueBlue at a 1:0.8 ratio. But , if you have a premium Citi ThankYou Rewards card like the Citi Premier ® Card or Citi Prestige ® Card , you can pool your points together between the cards and then transfer them to any of the full suite of Citi ThankYou transfer partners.

Best Ways To Earn and Redeem Your Citi Points

While you’ll rack up Citi ThankYou Points fast (which is earned as points), there are lots of other great options that help you earn more Citi ThankYou Points , as well.

When it comes time to redeem, the best option goes to those who also hold a premium ThankYou Rewards card like the Citi Premier card or the Citi Prestige card, as they can transfer the points earned from your Double Cash card and have access to the full list of Citi transfer partners .

This will unlock all of the best ways to redeem Citi ThankYou Points , which include using your points to book luxurious first and business class award tickets!

Alternative Card to the Double Cash Card

Chase freedom unlimited ®.

This all-purpose cash-back card offers great bonus categories, including bonus points for every purchase you make!

The Chase Freedom Unlimited ® is easily one of the best cash-back credit cards on the market. There aren’t many no-annual-fee credit cards that offer multiple great bonus categories like 5% back on travel purchased through Chase, 3% back on dining and drugstore purchases, and 1.5% back on all other purchases.

When paired with other Chase cards in the Ultimate Rewards family, you can transfer that cash back into points if you wish – making it one of the most lucrative cards in your wallet.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- 5% back on travel purchased through Chase Travel

- 3% back on dining and drugstore purchases

- 3% foreign transaction fee

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited ® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

- APR: 0% Intro APR for 15 months on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- Foreign Transaction Fees: 3% of each transaction in U.S. dollars

Chase Ultimate Rewards

The Freedom Unlimited card is another compelling no-annual-fee card but earns 5% back on travel through the Chase travel portal , 3% back on dining and drugstore purchases, plus 1.5% cash-back on all other purchases instead of 2%, 1% at the time of purchase and 1% when you pay, offered with the Double Cash card. The Freedom Unlimited card can also earn Chase Ultimate Reward points when paired with a premium Chase card like the Chase Sapphire Preferred ® Card or the Chase Sapphire Reserve ® .

Read more about how these 2 cards compare: Double Cash card vs. Freedom Unlimited card

We’ve compared the Double Cash card to other popular cards:

- Double Cash card vs. Capital One Venture Rewards Credit Card

- Double Cash card vs. Citi Premier ® Card

The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Premier ® Card has expired and the card is no longer open to applicants. The information for the Citi Prestige ® Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Is the double cash card worth it.

The card is a great beginner card for those looking to get started in the credit card points world . Thanks to its uncapped 2% ThankYou Points per $1 on all purchases, flexible redemptions, and no annual fee, it makes a great addition to your wallet.

What is the Double Cash card annual fee?

$0 — there is no annual fee on this card.

What is the Double Cash card foreign transaction fee?

The foreign transaction fee on the card is 3%.

What credit score is needed for the Double Cash card?

There is no specific credit score required to apply for the Double Cash card, nor is there one that will guarantee your approval should you decide to apply. Citi will take your credit score into consideration, along with other factors like your stated income, years of credit history, and the average age of your credit accounts.

But generally speaking, you should feel good about your approval odds on the Double Cash card if your credit score is at least 700 and you have a few years of credit history.

Which card is better: the Chase Freedom Flex℠ Credit Card or the Double Cash card?

Neither card is necessarily better than the other. But some will find one card to be much better suited for them based on their unique needs.

While neither card charges an annual fee, the Freedom Flex card earns 5% back on rotating quarterly categories , 5% back on travel purchased through the Chase travel portal, 3% back on dining and drugstores, and 1% back on all other purchases.

Meanwhile, the Double Cash card does not offer any bonus categories but earns an uncapped 2% back on all purchases.

So, if your spending patterns mainly fall within the bonus categories of the Freedom Flex card, then that would be a much better fit for you. If your spending habits are varied, or you don’t want to be bothered with memorizing different categories, then go with the Double Cash card.

Is the Double Cash card a Visa or Mastercard?

The Double Cash card is a Mastercard and is accepted anywhere in the world that Mastercard is accepted.

Where can I transfer my ThankYou Points earned with the Double Cash card?

If you do not also hold a premium ThankYou Point earning card like the Citi Prestige card or Citi Premier card, then your only transfer partner options will be Choice Privileges at a 1:1.5 ratio and Wyndham Rewards and JetBlue TrueBlue at a 1:0.8 ratio.

If you do pair your Double Cash card with a premium ThankYou Rewards card, you will have access to all of Citi’s transfer partners.

About Jarrod West

Boasting a portfolio of over 20 cards, Jarrod has been an expert in the points and miles space for over 6 years. He earns and redeems over 1 million points per year and his work has been featured in outlets like The New York Times.

Top Credit Card Content

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Buying Guides

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![citi double cash back travel benefits American Express Cash Magnet Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2018/07/American-Express-Cash-Magnet-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

6 ways to maximize the Citi Double Cash Card

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 5:50 a.m. UTC April 1, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Madeleine_Steinbach, Getty Images

Citi is a Blueprint partner.

The Citi Double Cash® Card is one of the best 2% cash-back credit cards on the market, offering an unlimited 2% cash back on purchases — 1% when purchases are made and another 1% when they’re paid off, plus, for a limited time, 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24. But while the card’s rewards structure is straightforward, you still have opportunities to get extra value.

Whether you’re considering applying for the Citi Double Cash Card or you already have it in your wallet, here are six ways you can make the most of the card’s features.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Citi Double Cash® Card

Welcome bonus

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening.This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s take

- No annual fees.

- Introductory APR period on balance transfers.

- Excellent cash-back rewards.

- Charges foreign transaction fees.

- There’s a balance transfer fee.

- Few additional benefits.

Card details

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

1. Accelerate your cash back with the welcome bonus

Historically, the Citi Double Cash Card hasn’t offered a cash bonus to new cardholders. But in November 2023, the card issuer added a welcome offer to the card.

Now, you’ll earn $200 cash back after spending $1,500 on purchases in the first six months of account opening. That’s a higher spending requirement than similar cash-back bonus offers, but you get twice as long to meet the threshold, which comes out to just $250 in monthly spending over that time.

As you track your progress toward the welcome bonus, make sure to avoid spending more than you would normally just to earn it.

2. Use the card to book travel with Citi

The Double Cash Card typically doesn’t offer bonus rewards categories. However, through December 31, 2024, cardholders can earn an up to 5% cash back when booking hotels, car rentals and attractions through the Citi Travel portal.

3. Pay your balance in full each month

Rewards credit cards make it possible to get value from everyday spending, but carrying a balance can essentially wipe out your rewards by costing you more than you earn.

For example, let’s say you have an average daily balance of $1,000 for a given month and a 24% APR. If you pay off that balance in full, you won’t pay a dime in interest. However, if it takes you three months to pay off the debt, you’ll pay roughly $40 in interest, or double the amount you earned in cash back on the purchases.

4. Use your rewards to book flights with JetBlue

The Citi Double Cash Card is technically a cash-back credit card, but your rewards come in the form of ThankYou® Points.

The Citi ThankYou rewards program allows cardholders to transfer points to several airline and hotel loyalty program partners. If you only have the Double Cash card, you get access to just three of those transfer partners: JetBlue TrueBlue, Choice Privileges and Wyndham Rewards.

If you transfer your points to JetBlue, you’ll get 800 TrueBlue points for every 1,000 ThankYou points you move. That’s below the standard 1:1 transfer ratio you can expect from most travel rewards programs. However, TrueBlue points are worth an average of 1.6 cents apiece, so you can still get more value than you would with cash back.

What can you do with the rewards earned on the Citi Double Cash card? Here’s our complete guide to earning and redeeming Citi ThankYou rewards

5. Pair the card with the Citi Premier® Card * The information for the Citi Premier® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

The Double Cash Card is an excellent choice for your everyday spending. But depending on your spending habits, you could get far more value out of your daily purchases by pairing the Double Cash with the Citi Premier® Card * The information for the Citi Premier® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. .

The Citi Premier Card earns 3 ThankYou® points per $1 at restaurants, supermarkets, gas stations, air travel and hotels and 1 point per $1 on all other purchases.

By using the Citi Premier for its bonus rewards categories and the Double Cash for everything else, you’ll be able to rack up ThankYou points a lot faster. What’s more, the Citi Premier Card gives you full access to the card issuer’s list of transfer partners, plus a better 1:1 transfer ratio with the JetBlue TrueBlue program.

Citi allows you to combine points earned with different ThankYou credit cards, giving you a chance to maximize the rewards you earn with both cards.

Aren’t sure how to book travel through Citi? We’ll explain all about the Citi ThankYou travel portal

6. Pay down high-interest credit card debt

In addition to a welcome bonus, the Citi Double Cash Card also offers an introductory balance transfer offer. New cardholders can get a 0% intro APR on balance transfers for 18 months. After that, the standard variable APR will be 19.24% to 29.24%. An intro balance transfer fee of either $5 or 3%, whichever is greater, applies to transfers completed in the first 4 months. After that, the fee will be 5% of each transfer (minimum $5).

While balance transfer offers typically don’t get the same fanfare as welcome bonuses, a generous offer could give you far more value in the long run.

For example, let’s say that you have a $6,000 balance on a card with a 24% APR. If you were to pay off the debt over 18 months, you’d have a monthly payment of $400.21, and pay roughly $1,203 in interest.

However, if you transferred the balance to the Double Cash Card and paid it off in 18 months, you’d have a monthly payment of $343.33, and your only cost would be the $180 balance transfer fee (3% of each balance transfer; $5 minimum within the first 4 months of account opening) — that’s a savings of $1,023, or more than five times the value of the card’s welcome bonus.

Final verdict

People like the Citi Double Cash for its simplicity, but with the right approach, you can get even more value out of the card than it appears on the surface. If you’re already a Double Cash cardholder, consider how you might use some of these approaches to get even more value in the future.

If you don’t yet have the card, think about your situation and preferences, as well as these strategies, to determine whether the Double Cash Card is right for you.

Read more: How to choose the best cash-back card .

*The information for the Citi Premier® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Ben Luthi is a freelance writer who covers all things personal finance and travel. His work has appeared in dozens of online publications. Ben lives in Salt Lake City with his two children and two cats.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Capital One Venture X benefits guide: Packed with premium perks for a lower fee than its peers

Credit Cards Carissa Rawson

Credit card application rules by issuer

Credit Cards Lee Huffman

Why the Chase Ink Business Unlimited is part of my core credit card setup

Credit Cards Eric Rosenberg

U.S. Bank Business Platinum review 2024: It’s got one job – an intro APR for purchases and balance transfers

Credit Cards Julie Sherrier

How to do a balance transfer with Capital One

Credit Cards Harrison Pierce

Amex Gold vs. Chase Sapphire Reserve

Credit Cards Natasha Etzel

How to avoid interest on a credit card

Credit Cards Sarah Brady

New Citi Strata Premier Card layers on the perks, replaces the Citi Premier Card

How do credit card refunds work?

Credit Cards Tamara Aydinyan

I’m an expat, and here’s why I love my Bank of America Travel Rewards card

Credit Cards Kelly Dilworth

Amex purchase protection benefits guide

Credit Cards Ryan Smith

Limited-time 75K offers on Chase Sapphire Preferred and Sapphire Reserve

Credit card statement balance vs current balance: What’s the difference?

Credit Cards Michelle Lambright Black

Check it out: This is what the average household spends on grocery costs per month

Credit Cards Stella Shon

Capital One Quicksilver benefits guide 2024

- Credit Cards

- View All Credit Cards

- See If You're Pre-Selected

- Balance Transfer Credit Cards

- 0% Intro APR Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Travel Credit Cards

- Retail Store Cards

- Small Business Credit Cards

Quick Links

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- Small Business Banking

- Personal Loans

- Overdraft Line of Credit

- Home Lending

- Refinance Your Home

- Use Your Home Equity

- Small Business Lending

- Investing Overview

- Self-Directed Investing

- Guided Investing

- Working with an Advisor

- Wealth Management

- Citigold ® Private Client

- Citi Priority

- Open an Account

Notificación importante

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.

Please be advised that verbal and written communications from Citi may be in English as we may not be able to provide servicing related communications in all languages. These communications may include, but are not limited to, account agreements, statements and disclosures, change in terms or fees; or any servicing of your account. If you need assistance in a language other than English, please contact us as we have language services that may be of assistance to you.

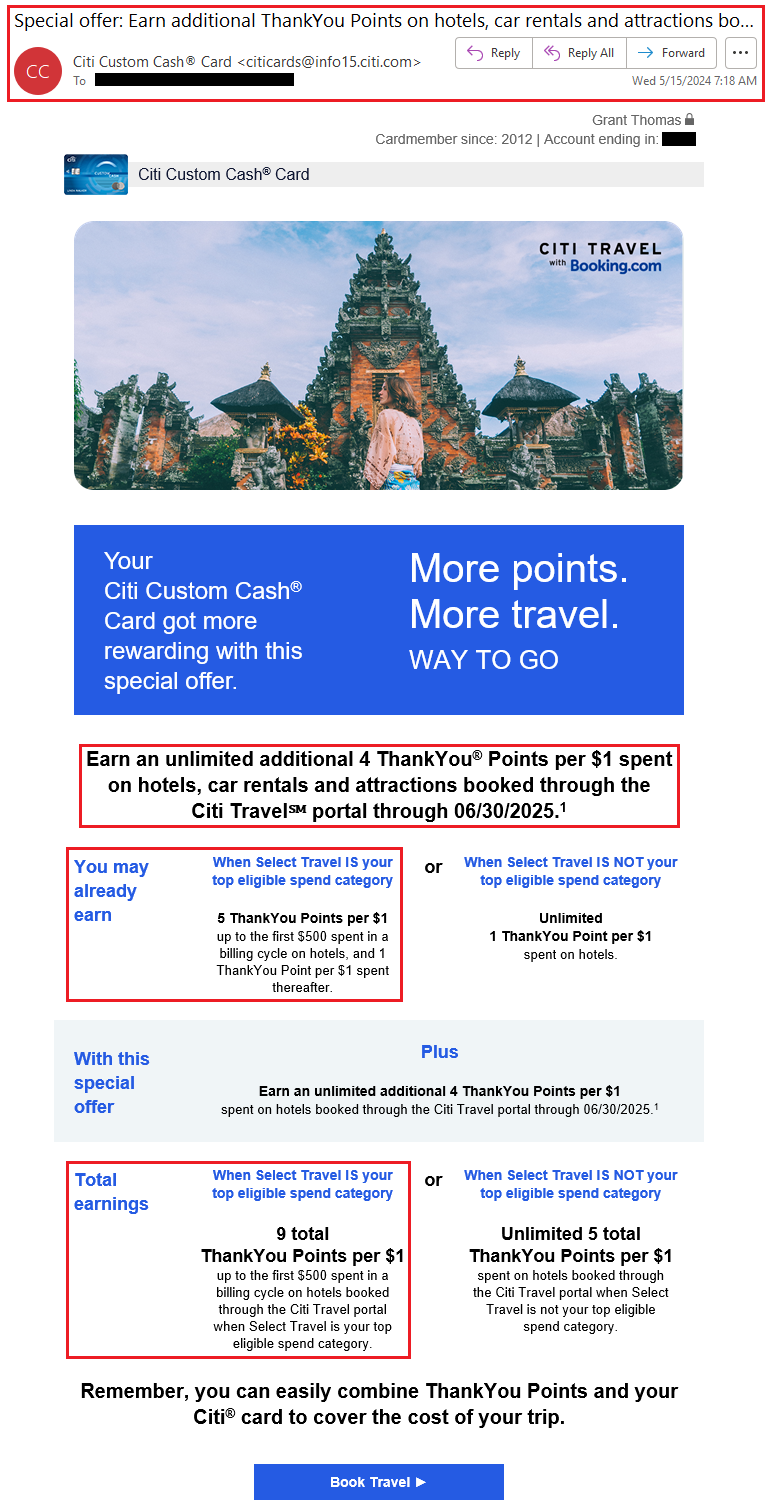

CITI TRAVEL with Booking.com

Introducing citi travel℠: your first stop to your next destination.

Earn ThankYou ® Points when you pay for part, or all, of your trip with your eligible Citi Card through the Citi Travel portal. Plus, you can redeem your points towards even more adventures through the Citi Travel portal. With customizable options and booking right from your Citi Mobile ® App for eligible cardholders, the way to go is now way easier.

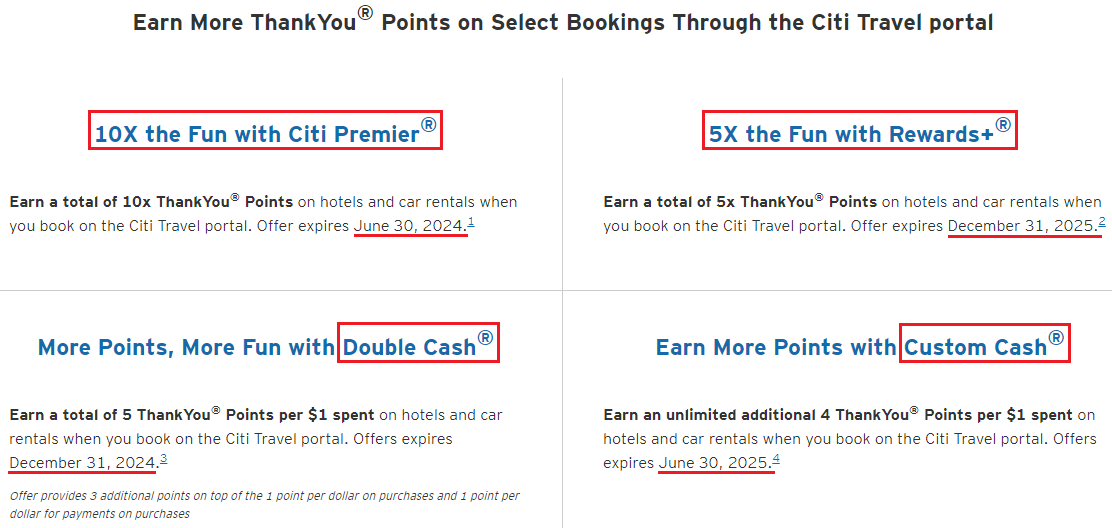

Earn More ThankYou ® Points on Select Bookings Through the Citi Travel portal

10x the fun with citi premier ®.

Earn a total of 10x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. Offer expires June 30, 2024. 1

5X the Fun with Rewards+ ®

Earn a total of 5x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. Offer expires December 31, 2025. 2

More Points, More Fun with Double Cash ®

Earn a total of 5 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires December 31, 2024. 3

Offer provides 3 additional points on top of the 1 point per dollar on purchases and 1 point per dollar for payments on purchases

Earn More Points with Custom Cash ®

Earn an unlimited additional 4 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires June 30, 2025. 4

Additional Citi Travel Portal Benefits

The citi travel portal offers perks to make your travel booking experience easier and more convenient., access to over 1.4 million hotel and resort options, competitive prices when booking flights, hotels, cars and attractions, 24/7 customer service support for your booking needs.

ThankYou ® Cards Make Every Day More Rewarding

It's easy to earn ThankYou ® Points with Citi credit cards. Find the one that helps you earn the most on your daily spending.

Citi Travel: Frequently Asked Questions

What is the citi travel portal.

Citi Travel is a travel booking portal that gives eligible Citi card members access to book flights, hotels, rental cars, and attractions at competitive prices, along with 24/7 customer support. Additionally, when you book through the Citi Travel portal using ThankYou ® rewards cards, you can earn ThankYou ® points on your travel spending which can then be redeemed to be used on your next journey.

How do I book through the Citi Travel portal?

To book through the Citi Travel portal:

- Login into your Citi Mobile App or directly into the Citi Travel portal using your Citi Online User ID and password.

- After that, search for the flights, hotels, car rentals or attractions you want to book and enter the necessary information (such as number of guests or passengers, travel dates, etc.)

- Confirm your booking and choose whether you want to pay with card, points, or a combination of these purchase options.ns.

Can I use any Citi ® card to book through Citi Travel?

All Citi ThankYou ® Rewards Credit Cards

Citi Travel℠ is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

1 Earn a total of 10 ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 (TTY: 711). Offer is valid through 11:59 PM 06/30/2024. You earn 3 ThankYou ® Points per $1 spent on the Citi Travel portal bookings. You will earn an additional 7 bonus ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 (TTY: 711) through 11:59 PM 06/30/2024. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Premier ® Card registered at the Citi Travel portal to earn the bonus points. For bookings made with a combination of points and your Citi Premier ® Card, only the portion paid with your card will earn points. Bonus points will take up to 3 billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

2 Earn a total of 5 ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM 12/31/2025. You earn 1 ThankYou ® Point per $1 spent on the Citi Travel portal bookings. You will earn an additional 4 bonus ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM 12/31/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Rewards+ ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your Citi Rewards+ ® Card, only the portion paid with your card will earn points. Bonus points will take up to 3 billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

3 Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024. You earn 1 ThankYou Point per $1 spent on the Citi Travel portal bookings and an additional 1 ThankYou Point per $1 paid on Eligible Payments (as defined in the Citi ThankYou ® Rewards Terms and Conditions for Citi Double Cash ® Card Accounts) made to your Citi Double Cash card account. You will earn an additional 3 bonus ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM Eastern Time (ET) 12/31/2024. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Double Cash Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi Double Cash card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

4 Earn an additional 4 Thank You Points per $1 spent on hotel, car rental, and attractions excluding air travel through the Citi Travel℠ portal or by calling 1-833-737-1288 (TTY: 711). Offer is valid through 11:59 PM Eastern Time (ET) 6/30/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Custom Cash ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

To provide you with extra security, we may need to ask for more information before you can use the feature you selected.

Just a moment, please...

Get Citibank information on the countries & jurisdictions we serve

You are leaving a Citi Website and going to a third party site. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta. Si necesita ayuda en un idioma distinto al inglés, por favor, comuníquese con nosotros, ya que tenemos servicios de idiomas que podrían serle útiles.

Share Your Screen With A Phone Representative

During your call, you may be asked to share your screen for a faster, more efficient experience. If you agree, the phone representative you're speaking with will give you a Service Code to enter below.

If you need assistance from a Citi representative, contact us via chat or phone

You now get World Elite Mastercard perks with the Citi Double Cash card

Update : Some offers mentioned below are no longer available. View the current offers here .

Citi is a TPG advertising partner.

One of the best perks of the Citi® Double Cash Card is, well, double cash back. You get 2% cash-back earnings on all purchases — 1% when you buy and another 1% as you pay — which is pretty tough to beat for a no-annual-fee card .

While fantastic for pure cash back (or ThankYou points with a linked account ), the Double Cash card was otherwise devoid of many perks.

Want more credit card news and travel advice from TPG? Sign up for the TPG daily newsletter.

That list of benefits was sparse and included contactless payment with a chip-enabled card, access to Citi Entertainment , a free ShopRunner membership and access to your FICO Score .

However, Citi has emailed some cardholders -- myself included -- that the Double Cash will be converted to a World Elite Mastercard. And there are several advantages that come with that designation. Note, some cardholders already have a Double Cash that is a World Elite.

Related: Comparing Visa Signature and World Elite Mastercard benefits

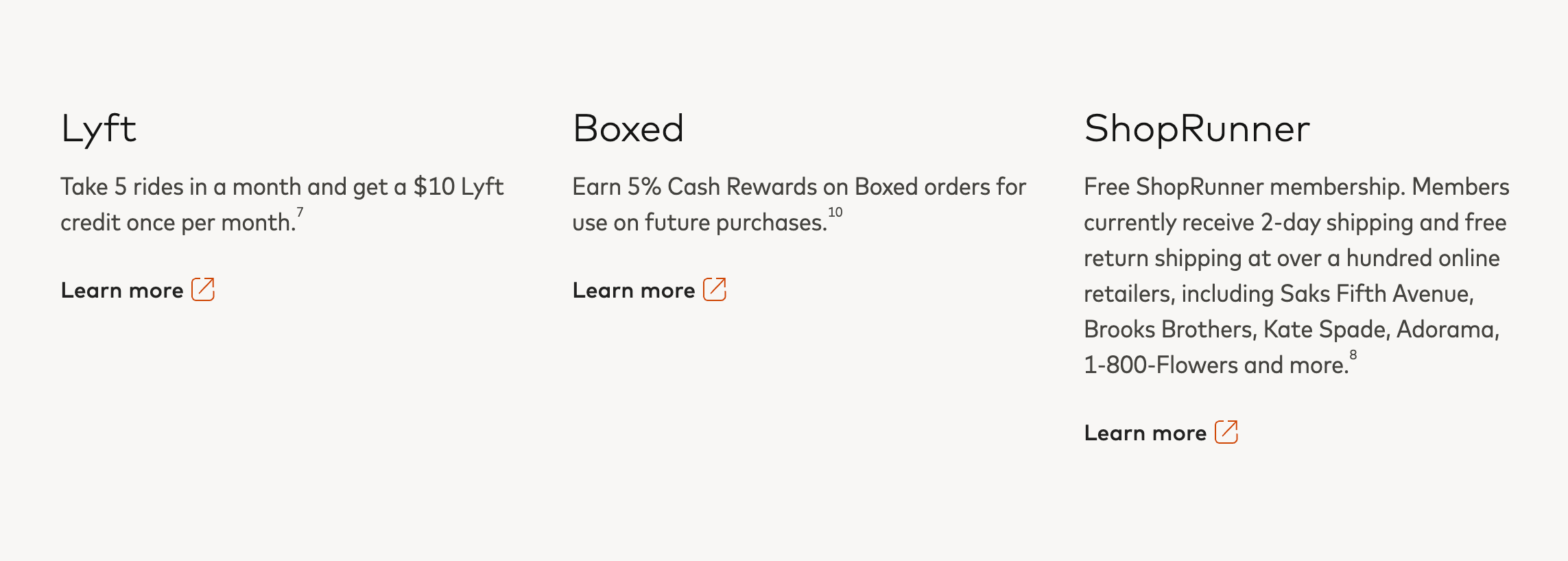

With this change for many Double Cash cardholders, you should now get access to an array of new extras including a Lyft and Boxed benefit.

With Lyft , you can take five rides in a month and get a $10 Lyft credit once per month for World Elite cardholders . With Boxed, you'll earn 5% cash rewards on orders for use on future purchases.

Unfortunately, one of the biggest perks of World Elite Mastercard criteria isn't included on the Citi Double Cash. A Citi spokesperson told TPG that the cell phone protection benefit is not included as part of this update.

However, World Elite cardholders -- including those that have the Double Cash -- do complimentary 24/7 concierge service, a Fandango benefit and more .

Related: Credit cards that cover cellphone loss and damage

With the Double Cash Card, you can convert your cash rewards to ThankYou points and have access to points transfer partners such as JetBlue. If Double Cash cardmembers also have a Citi Premier® Card or Citi Prestige card, they are able to access the full array of Citi's points transfer partners .

You'll earn 2 ThankYou points per dollar spent. Based on TPG's valuation of ThankYou points at 1.7 cents each , this means you can earn a 3.4% return (with the full array of Citi transfer partners).

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

These perks are certainly a welcome addition for those that have a Citi Double Cash card. The benefits should come at no extra cost for current and future cardholders -- great news in a world where sometimes the expectation is fewer perks, not more.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Citi strata premier card replaces citi premier: enjoy travel insurance and other new benefits, in addition to a new name, the card offers new travel protections and bonus rewards categories..

Citi is an advertising partner.