Avion Rewards travel

Redeem your points for flights, hotels, car rentals, and more.

How many Avion points do you need to travel?

Rbc avion visa credit card holders.

Choose any airline, any flight, any time. There are no blackout dates or advance booking restrictions, even during peak periods.

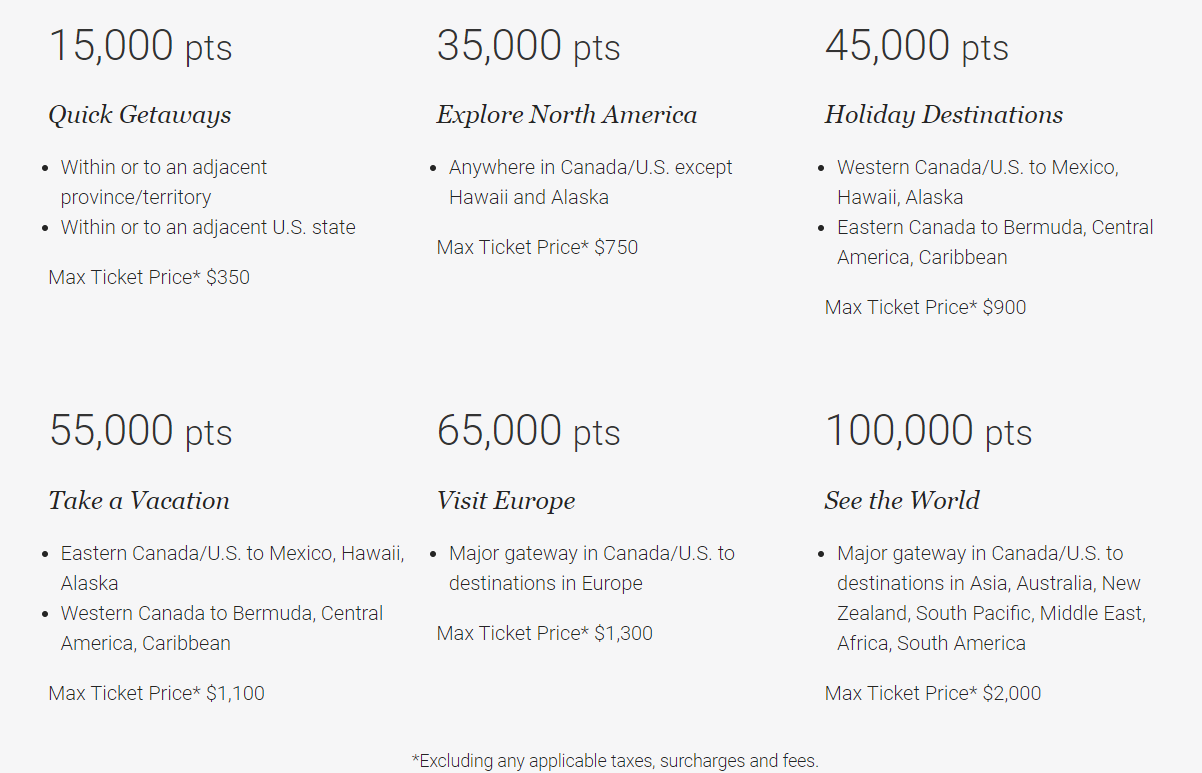

Quick Getaways

- Within or to an adjacent province/territory

- Within or to an adjacent U.S. state

Max Ticket Price* $350

Explore North America

- Anywhere in Canada/U.S. except Hawaii and Alaska

Max Ticket Price* $750

Holiday Destinations

- Western Canada/U.S. to Mexico, Hawaii, Alaska

- Eastern Canada to Bermuda, Central America, Caribbean

Max Ticket Price* $900

Take a Vacation

- Eastern Canada/U.S. to Mexico, Hawaii, Alaska

- Western Canada to Bermuda, Central America, Caribbean

Max Ticket Price* $1,100

Visit Europe

- Major gateway in Canada/U.S. to destinations in Europe

Max Ticket Price* $1,300

100,000 pts

See the World

- Major gateway in Canada/U.S. to destinations in Asia, Australia, New Zealand, South Pacific, Middle East, Africa, South America

Max Ticket Price* $2,000

*Excluding any applicable taxes, surcharges and fees.

Max Ticket Price* $175

Max Ticket Price* $375

Max Ticket Price* $450

Max Ticket Price* $550

Max Ticket Price* $650

Max Ticket Price* $1,000

Avion credit card holders can also redeem for all type of travel, using this simple conversion:

Redeem points using this conversion rate for hotel stays, car rental, cruises, and more. You can also use it for flights when you don’t want to redeem from the Air Travel Redemption Grid above.

Still have questions? Visit our Travel FAQs page

View Legal Disclaimers Hide Legal Disclaimers

Redeeming Avion points for your travel needs is easy

Just use this conversion rate if you’re:

- redeeming for a flight not using the Air Travel Redemption Schedule;

- redeeming for a hotel stay, car rental, cruise or vacation package;

- paying any amount above the maximum dollar value within a category;

- paying taxes, surcharges and fees.

If you are an RBC Avion Visa Infinite Privilege for Private Banking, RBC Avion Visa Infinite Privilege, RBC Avion Visa Infinite Business or RBC Commercial Avion Visa cardholder, you can redeem your points at the rate of 100 points = $2 CAD for first or business class air fare, including paying taxes and surcharges and fees.

Don’t forget, if you’re short a few points, you can always purchase travel by redeeming your points and using your credit card.

For more information, see our Avion Rewards Terms and Conditions .

Eligible Avion Rewards Core Product Account Clients are not eligible to redeem Avion points for travel.

RBC Rewards

RBC Rewards is a powerful points program, and easily one of the best among the big 5 banks in Canada. These points can be redeemed for travel, gift cards, and much more.

There are two types of RBC points that are earned from different families of credit cards:

- RBC Avion Elite points (higher tier)

- RBC Avion Premium points (lower tier)

RBC Avion points can be redeemed for travel and also transferred to other airline partners, while general RBC Rewards points cannot.

RBC credit cards that earn Avion Elite points will have Avion in their name, such as the RBC Avion Visa Infinite credit card. On the other hand, there are RBC credit cards that earn Avion Premium points such as the RBC ION+ Visa credit card.

Throughout this page, we will use the term “RBC Rewards” to refer to both tiers of points to be consistent. However, we will note any differences between the two sets of points in the relevant sections below.

Earning RBC Rewards Points

There are two main ways in which you can earn points in the RBC Rewards program: credit card welcome bonuses and organic credit card spending.

Credit Card Bonuses

The most effective method to earn RBC Rewards points is through earning the welcome bonus on a RBC Rewards credit card. There are many RBC Rewards cards to choose from.

The most popular RBC Rewards credit cards are the RBC Avion Visa Infinite and RBC Avion Visa Platinum credit cards as they tend to offer the most bonus points and benefits for the lowest annual fee.

Credit card bonuses may also be earned through product switching .

Credit Card Spending

The RBC Rewards credit cards have a standard earning structure in that a set amount of RBC Rewards points are earned for every dollar spent on all everyday purchases with no extra points for spending in specific categories (such as groceries or transportation).

There is one exception as some RBC Rewards credit cards, such as the RBC Avion Visa Infinite, will earn 1.25 points for travel purchases, and the RBC Avion Visa Infinite Business/RBC Avion Visa Infinite Privilege cards earn 1.25 points on all purchases.

RBC Rewards Credit Cards

The table below shows the best RBC Rewards earning credit cards available. The RBC Avion Visa Infinite is arguably the strongest card with a very strong current welcome bonus. It also earns 1 point per dollar and 1.25 points for travel purchases.

Redeeming RBC Rewards Points

RBC Rewards is a highly flexible points program and can be redeemed for travel in a variety of ways, as well as redeemed for other types of rewards including financial rewards, merchandise, and gift cards.

As with most bank point programs, travel provides the highest redemption value. RBC Rewards can be redeemed for travel in three ways:

- Air Travel Redemption Schedule (Fixed Travel)

- Flexible Travel Reward

- Transfer to Airline Partners

Air Travel Redemption Schedule (Fixed Travel)

The RBC Air Travel Redemption Schedule provides the greatest value for redeeming RBC Rewards points for flights. However, as the name suggests, there are a few more rules to follow when redeeming your points this way. First of all, you can redeem RBC Rewards for one-way, round trip, and multiple destinations flights.

How many points are required for redemption through the Air Travel Redemption Schedule is fixed and based on the particular destination, according to the chart below. For a given destination, there is a maximum ticket price that the points can be redeemed for – this does not include taxes and fees.

If you exceed the maximum ticket price, you can pay the difference in points at a rate of 100 points = $1 CAD (the flexible travel rate). You can also pay for flight taxes by redeeming your points at this same rate of 100 points = $1 CAD.

There is one other restriction with the Air Travel Redemption Schedule: you must make the booking a minimum of 14 days before the departing flight. Keep this in mind when considering whether to redeem RBC points for flights using this method.

How to Redeem RBC Rewards Points Using the Air Travel Redemption Schedule

In order to make a flight booking using the RBC Rewards fixed travel program, you will need to go to the RBC Rewards Travel portal , which is powered by Expedia.

In order to initiate a flexible travel rewards booking, log into RBC Rewards and click “Travel Home” on the top bar. From there, click on the “Book Travel” button.

This will take you to the RBC Rewards Travel portal page. From here, you will be able to search for flights, hotels, car rentals, and vacation packages. In order to redeem through the fixed travel redemption program, you will need to click on flights.

From here, fill in your desired routing, dates, number of passengers, and ticket class, and click “Search” to generate a list of flights.

Once you can see the list of flights, you will see the total point cost using the fixed travel redemption in addition to the taxes and fees on the ticket. At the top of the screen, you can flip between fixed points pricing and flexible points pricing to determine which is the better deal.

In this case, fixed points pricing has all itineraries at 35,000 RBC Rewards points (as one would expect per the chart above).

On the other hand, if we were to make this booking with flexible rewards, we would be paying at a minimum an additional 21,000 RBC Rewards points. This is where the fixed rewards chart really shines.

Once we go through the portal and select our outbound and inbound flights, we are presented with a page summarizing the flights chosen and the total price. On the right-hand side, you can confirm that you are using the fixed travel redemption method by looking at the total point cost. Since this is an economy roundtrip fare within North America, 35,000 is the correct amount of points. From here, click “Check Out” to complete the rest of the booking process.

For this booking in particular, I was effectively able to redeem 35,000 RBC Rewards for $413 in base fare value (roughly 0.0118 cents per point). Since you can cover up to a $700 base fare with the 35,000 RBC Rewards fixed flight redemption, there is some additional value that could be extracted with the right flight. But if you were just looking to travel to Los Angeles, this is a great value for your points.

It is important to note that any flights that do not qualify for the Air Travel Redemption Schedule will automatically have flexible points pricing applied.

Flexible Travel Rewards

The other way to use RBC Rewards points for travel is through the flexible travel reward chart. This method allows you to redeem your RBC Rewards towards virtually any flight, hotel, car rental, and other travel expenses at a rate of 100 RBC Rewards points = $1 CAD (RBC sometimes refers to this as the “1% rate”).

So for example, 25,000 RBC Rewards points can be redeemed for $250 CAD worth of travel. What makes this method even more flexible is that you can pay for travel using any combination of points and payment via credit card.

In general, you would only want to redeem RBC Rewards points for flights using this method if your flights do not qualify for the Air Travel Rewards Redemption Schedule. Alternatively, you may already have lots of airline points from other programs like Aeroplan and prefer to use your RBC points for a hotel stay, car rental, cruise, or vacation package.

Also of note, holders of the following credit cards actually get a special 2x rate for flexible travel redemptions used towards Business (J) or First Class (F) airline tickets, meaning they can redeem 100 points for $2 CAD:

- RBC Avion Visa Infinite Privilege

- RBC Avion Visa Infinite Business

- RBC Commercial Avion Visa

How to Redeem RBC Rewards Points for Flexible Travel Rewards

Redeeming RBC Rewards for flexible travel rewards can be done entirely through the RBC Rewards Travel portal , which is a search engine powered by Expedia. In order to redeem points through this method, you do need to book through the portal and cannot apply points to a pre-existing booking made elsewhere.

This will take you to the RBC Rewards Travel portal page. From here, you will be able to search for flights, hotels, car rentals, and vacation packages. The process is the same no matter what you are redeeming your RBC Rewards for.

For our how-to, let’s take a look at booking a hotel in Las Vegas for August. Select “Stays” at the top, and select the desired destination, your dates, and the number of travelers. Click “Search”.

Once you search, a variety of hotels will be displayed that meet your travel criteria. You are able to filter or sort if desired to find the perfect hotel to suit your needs. Once you find the hotel you are interested in, click on it to be brought to the hotel-specific page with property details and room types that are available for this booking.

Scroll down and you will see the rooms that are bookable. Once you find the one that you like, click on Reserve to be taken to the payment page.

Once you are on the payment page, this is where you can elect to use your points to pay for the booking through the flexible travel rewards option. You are able to use a portion or all of your points when making a flexible travel booking, however, the default is to use all of your points (or the maximum number of points to pay the booking off completely).

As you update the points and cash payment split, the price summary on the right-hand side of the screen will update. This will give you insight into what you will be paying for this booking when you confirm in addition to any on-property fees (such as a resort fee in Las Vegas).

Once you are happy with the price summary, simply fill in the rest of the details and click “Complete Booking”. Any applicable points will be withdrawn from your account and you will receive an email confirmation of the booking.

Convert RBC Rewards to Airline Partners

If you are pursuing a flight redemption on another airline, you might find value in converting your RBC Rewards points to a specific airline loyalty program. RBC Rewards is partnered with American Airlines AAdvantage, British Airways Executive Club, Cathay Pacific Asia Miles, and WestJet Rewards.

You can convert RBC Rewards points at the following rates:

The RBC Rewards program also offers transfer bonuses from time to time. For example, in recent years we have seen promotions that give cardholders an extra 30% British Airways Avios Miles when transferring. This can create some strong value propositions in making dream trips much more accessible, such as redeeming Avios for Qatar Airways Qsuites .

If you hold any of the RBC Avion credit cards, you will be able to transfer to any of the partners listed above. On the other hand, if you hold a card that earns Avion Premium points, you will only be able to transfer your points to WestJet Rewards. (However, you can fix this by either switching the card to an Avion card or by applying for another Avion card and transferring the Rewards+ points to the Avion card).

You can see the current transfer ratios, including any bonus promotions, by viewing our Miles & Points Transfer Partner Tool .

How to Convert RBC Rewards to Airline Partners

To convert your RBC Rewards points to airline partners, go to the ‘Shop RBC Rewards’ portal. You can access this from the account summary page of any of your RBC credit cards.

Then from the RBC Rewards portal home page, select ‘Manage Points’ from the main navigation menu and then ‘Convert Points’ from the submenu.

From the next screen, you’ll be prompted to select which loyalty program you would like to transfer to and then the number of points. You will also be prompted to input your membership number for whatever program you are transferring points to, as well as an email address for confirmation (optional).

RBC often offers promotions of 20-25% off on gift card costs for various retailers so there may be value there (which is atypical as for most points programs, redeeming points for gift cards offers terrible value).

The best value is consistently hotels.com or Fairmont as both can be purchased at 1 cent per point without any promotions required. However, there have been previous promotions for hotels.com and Fairmont, in which we have seen up to 25% off.

If you have a Rewards+ earning RBC credit card (not Avion), you can also redeem at 1 cent per point for Amazon.ca gift cards.

Other Redemption Options

RBC Rewards can also be redeemed for merchandise, a statement credit, or financial rewards. These methods are not viable from a value perspective and it is strongly recommended that you do not redeem RBC Rewards using any of these methods as you are effectively throwing money away.

The RBC Rewards merchandise catalog has various products to purchase with points. The value for redeeming points for merchandise varies widely but is generally underwhelming and not recommended. You would be better off redeeming points for a gift card and purchasing the merchandise outright on many occasions.

Points can be redeemed towards a statement credit for your Royal Bank of Canada credit card account. If you were to redeem points through this method, 10,000 RBC Rewards points would be worth a $58 statement credit. It doesn’t take a mathematician to understand the terrible value that this offers.

Finally, RBC Rewards can be redeemed towards RBC financial rewards. This means that if you hold a mortgage, personal loan, or registered account with RBC, you can redeem points to financially fund that account. If you were to use this option, 10,000 RBC Rewards points would be worth $83 in your financial account. Again, not a great value when you can easily redeem points for at least 1 cent per point.

Frequently Asked Questions

As long as you hold an active RBC Rewards or Avion credit card, the points tied to that card will not expire. If you cancel an RBC credit card that still has points remaining, you will have 90 days to either redeem those points or transfer them to another active RBC Rewards or Avion credit card that you hold.

RBC Avion Elite points are RBC Rewards points earned by Avion cardholders. They are a higher tier of points than the basic RBC Avion Premium points and, unlike RBC Rewards, Avion Elite points can be redeemed for travel and also transferred to other airline partner programs.

You can redeem points to redeem for flights through two methods: via the fixed travel award chart or the flexible travel option. The fixed travel award chart allows you to redeem points for round-trip flights to destinations around the world for a set amount of points and up to a certain ticket value. For example, a round-trip economy flight anywhere in North America will always cost you 35,000 RBC Rewards points. The ticket can have a maximum value of $750 CAD. Flexible travel redemptions allow you to redeem points at a rate of 100 RBC Rewards = $1 towards any travel booked through the RBC Rewards travel portal.

Some select flights are not available to book on RBC’s Travel portal. If this is the case, you can instead opt to book the flight yourself and receive statement credit from RBC in exchange for your points. To do this: 1. Navigate to Support from the RBC Travel homepage 2. Select the popular topic “Book with a statement of credit on an Avion flight” 3. Go through the process outlined therein You must call and receive authorization from an RBC travel agent before making the booking. Then you must complete a manual form before you will be credited with statement credit and the appropriate amount of RBC points removed from your account. This method can be used to redeem using the Air Travel Redemption Schedule rates or the 1% flexible travel rate.

Yes, you are able to combine RBC Rewards points between any RBC Rewards credit cards that you hold. When you log into RBC Rewards, click “Transfer Points” and you will be able to choose the account you want to transfer points from and the destination account. You can also quickly combine points between all of your accounts using this feature.

No, you cannot transfer points to a different cardholder.

The value of an RBC Reward point varies, depending on how you choose to redeem them. We recommend using a base value of 1 cent per RBC Reward point when making your redemptions.

The RBC Rewards program team can be contacted via phone at 1-800-769-2512.

Posts about RBC Rewards

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Subscribe to our newsletter .

This site uses Akismet to reduce spam. Learn how your comment data is processed .

5 comments on “ RBC Rewards ”

I just tried the RBC Rewards Travel Portal to see how much a fixed point redemption would cost and it was not as advertised. One person, return trip from Vancouver,BC to LHR leaving Dec 16th and returning Dec 23rd, 2023 would cost 65,000 fixed points (should be worth up to $1,300 excluding tax and fees) plus $935.66 out-of-pocket. I compared this against Expedia and the out-of-pocket trip cost would be $1,140.66 (breakdown is $805.00 in air transportation charges, plus $335.66 for taxes and fees). So, the 65,000 RBC Avion points only saves me $200 in travel costs – this is pathetic! It should have saved me the $805 flight cost! What is going on here; is RBC devaluing their own points? …I ‘m considering changing credit cards if this is the case. Thanks for your advice.

$1300 is the max ticket price, not the guaranteed value. Are you comparing the exact same flight on Expedia and on RBC? The $935 out of pocket seems strangely high but I wonder if its on an airline like BA which have notoriously high taxes and fees. You’d be better off booking a flexible travel redemption and taking $650 off instead.

Personally I find best use of RBC to be transfers to airline partners like BA Avios, Cathay, etc.

Hi Reed. Thanks for your reply. Maybe I’m not quite understanding the ticket price vs guaranteed value. To clarify, the comparison was for the exact same flights, carrier (Air Canada), and dates. Expedia “Air transportation charges” (I assume this is the ticket price portion?) showed as $805 so this was what I expected RBC to cover but they don’t. I did another comparison tonight with different dates (July 6-20, 2024 flying with Iceland Air) and the Expedia cost was $976 for “Air transportation charges” plus $277.96 for “taxes and fees” (total cost $1,253.96). RBC wants 65,000 points plus $621.96. So, out of the total cost of $1,253.96 RBC is only covering the difference of $632 with my 65,000 points (about a 1% points vale); still extremely terrible “value” from RBC. They should cover the $976 flight cost. What am I missing? Can I send you a screenshot? Thanks again.

Yes – I emailed you.

I was not allowed to choose Level of economy flight from basic to the next two levels of economy this is a situation on Air Canada site that allows me to increase my level of comfort

Editorial Disclosure: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities. For complete and current information, please consult the entity's website.

- Find a Branch

- Call 1-800-769-2511

Credit Cards

Earn avion points for every purchase.

With an Avion Rewards credit card, you’ll earn points on every purchase Legal Disclaimer 1 . Redeem them for what matters most to you:

- Book flights, hotel stays, car rentals, and vacation packages

- Shop Apple and Best Buy products, gift cards, and merchandise in the Avion Rewards catalogue

- Put your points towards bill payments, retirement savings, mortgage payments, and other financial products

- Use your points anytime — they never expire Legal Disclaimer 2

What are the Benefits of the Avion Rewards Program?

When you’re approved for a credit card that earns Avion Points, you’ll instantly become an Avion Rewards program member. As a member, you’ll earn points on all your purchases. You can travel the world, get the latest tech, and even make bill payments, all with your points. Plus, members receive exclusive offers, discounts, and experiences, making every day even more rewarding.

Which Credit Cards Earn Avion Points?

Whether you’re a frequent traveller, a small business owner, or a smart budgeter, there’s an Avion Rewards credit card that meets your needs. Discover our most popular Avion Rewards credit cards, or use the card selector to find the right card for you.

FEATURED CREDIT CARDS

Get started with the avion rewards program, ready to earn avion points with a credit card.

Find the best card for you in just 30 seconds

View Legal Disclaimers Hide Legal Disclaimers

{{comparedCards[0].name}}

{{content.addToCompare}}

{{comparedCards[1].name}}

{{comparedCards[2].name}}

Choose your card

Select category:

{{value.name}}

There is no card based on the combined features that you have selected.

How to redeem Avion Rewards points for financial rewards

When logged into RBC Rewards, if you look under the Shop & Redeem menu, you’ll see there’s an option to use your points for RBC financial rewards. Assuming you have financial products with RBC, you can use your points for the following:

- Add to your existing investments

- Mortgage payments

- Repayment to your line of credit.

It takes 12,000 RBC points to get $100 in financial products which gives you a value of .83 cents per point. At first glance that may seem like a lot, but think about the long term. With mortgage and line of credit payments, you’re basically paying off your loan earlier which you immediately save on the interest. If you’re adding to your investments, you can take advantage of compound interest which could make your redemption very valuable in the long run.

If you use your points for a financial reward that’s put towards your RRSP , you could also get a tax break. Putting in your TFSA would allow you to invest with tax free gains. It’s a win-win situation, but you won’t see the reward for many many years.

Redeeming Avion Rewards points for merchandise, statement credits, and charitable donations

The final three redemption options for your RBC Rewards points are merchandise, statement credits, and charitable donations. Although the RBC Rewards merchandise catalogue is quite large and there are some quality products available, the number of additional points required for the value is not worth it at all. I would advise avoiding using your points for merchandise. That said, there are occasionally discounts on merchandise redemptions, so sometimes the transactions aren’t a terrible deal.

Using your points for a statement credit is an even lower value. It takes 17,200 points to get $100 off your statement. That means your points would be worth .58 cents per point. Unless you’re facing financial difficulties, you’re better off redeeming your points for anything else.

RBC Avion points transfer partners

I love programs that let you convert points to other loyalty programs since it adds flexibility and value. Avion Rewards has one of the most extensive and valuable lists of conversion partners when it comes to Canada’s bank travel reward programs. American Express Membership Rewards is better, in my opinion, but RBC Rewards isn’t far behind.

Here is the list of programs you can convert Avion points to, but note that except WestJet Rewards, only Avion cardholders can transfer their points to the following partners:

- WestJet Rewards : 1,000 RBC points = $10 WestJet dollars

- Hudson’s Bay Rewards : 1,000 RBC points = 2,000 HBC Rewards points (worth $10 at Hudson’s Bay)

If you are an Avion cardholder you can also benefit from these conversion options:

- American Airlines : 10,000 RBC points = 7,000 AAdvantage miles

- Cathay Pacific Asia Miles : 10,000 RBC Points = 10,000 Asia Miles

- British Airways : 10,000 RBC points = 10,000 Avios miles

It’s hard to put an exact value on airline miles since there are so many variables, but generally speaking, their value is around a minimum of 1.5¢ per mile for economy tickets. Often you can get double the value if you’re booking in business class. That said, WestJet Rewards uses a dollar system, so they have a fixed value.

It’s a good idea to log into RBC Rewards often since they have many redemption promotions throughout the year, which boost your points’ value. In addition, RBC Rewards had a few transfer bonuses (10% to 30% bonus points) for Westjet, Asia Miles, British Airways Avios Miles, and American Airlines AAdvantage Miles. That meant you got extra value when transferring your points to a partner.

Of particular interest is how you can transfer your points to WestJet dollars. Nothing stops you from holding an RBC Avion card and the RBC WestJet World Elite Mastercard. Both cards come with good sign up bonuses so you could quickly rack up those WestJet dollars. For example, the RBC Avion card typically has a welcome bonus of 15,000 points which can be transferred to WestJet for $150 WestJet dollars. The WestJet RBC World Elite Mastercard’s standard bonus is $250 and a companion voucher. When you combine the two, you’ll have $400 in WestJet dollars without having to spend much. No purchase is required to get the bonus with the Avion card, and you only need one purchase with the WestJet Card.

Do RBC Rewards points expire?

There’s a lot of conflicting information out there about when RBC Rewards points expire. I have confirmed that RBC Avion points don’t expire as long as you have an active eligible RBC Royal Bank credit card. If you cancel your card, you have 90 days to redeem them before losing them. The first-in, first-out rule you may have read about online is an old outdated article. RBC really needs to delete that page. If you’re unsure when your points expire, you could always call customer service to confirm.

How RBC Avion compares to others

RBC Avion Rewards is easily one of the best travel loyalty programs of Canada’s big five banks. There are many reasons why I rank RBC Rewards so high, including:

- No blackout dates

- No minimum number of points to redeem

- A fixed points flight program

- Many transfer partners to convert points to

- Many promotions for redemptions

- Value of points

In my opinion, RBC Rewards is only second to American Express Membership Rewards . American Express holds the first place because RBC Rewards lacks an option to book travel on your own (you can only book through their portal) and because RBC Rewards credit cards don’t really have any increased earn rates which limit how fast you can earn points. You can also read my reviews of CIBC Rewards , BMO Rewards , TD Rewards and Scene+ to see how RBC Rewards compares.

How to earn RBC Avion Rewards

To earn RBC Rewards, you must have a credit card account that earns you RBC Rewards. As you can imagine, the easiest ways to earn points are via credit card sign up bonuses and everyday purchases you make on your RBC Rewards credit card. Currently, there are six personal credit cards and two business credit cards that will earn you RBC Rewards points. To make things a bit complicated, RBC Rewards has two tiers of RBC Rewards points: regular and Avion RBC Rewards points. Points from an Avion account have more redemption options, and these options are the most valuable ones. With this in mind, the RBC Visa Infinite Avion card is arguably the best card to earn Avion points and is one of the best RBC credit cards .

RBC Avion Visa Infinite Card

- $120 annual fee

- 35,000 Avion points on approval

- Earn 1.25 Avion points for every $1 spent on travel purchases

- Earn 1 Avion point per $1 on all other purchases

- Comprehensive travel insurance

- Mobile device insurance up to $1,500

The sign up bonus for new cardholders is typically 15,000 points which isn’t much compared to some of the best travel credit cards in Canada . That said, the RBC Visa Infinite Avion Card often has promotions where the welcome bonus is 25,000 – 35,000 points, and the annual fee for the first year is waived. Whenever a promo like that comes around, it’s worth signing up for the card.

The earn rate of 1.25 points per $1 spent on travel is decent, while the 1 RBC Reward point earned per dollar spent on all other purchases, including bill payments, is pretty common. Here’s something that many people don’t realize. You don’t need to make any purchases to get the bonus. The terms and conditions say you get it after the first statement.

Another little-known trick is that you can switch from the RBC WestJet World Elite Mastercard to the RBC Visa Infinite Avion Card and vice versa. This is useful if you’re not able to maximize your points and want to try something new. That said, be sure to use up your points before you make any changes.

The RBC Visa Infinite Avion Card also provides good travel insurance when travelling outside Canada. Not only do you get travel medical, but you’ll also be covered for trip cancellation/interruption, delayed and lost baggage, hotel/motel burglary and more. Obviously, some exclusions apply, so read the certificate of insurance for complete terms.

Link to your Petro-Points card

RBC has a deal in place with Petro-Canada where you can save 3 cents per litre at Petr-Canada, 20% extra Petro-Points, and 20% extra RBC Rewards points.

To be eligible, you just need to add your Petro-Points number to your RBC online banking account. You would link your Petro-Points card to all of your eligible RBC debit or credit cards.

Final thoughts

Avion Rewards is one of the best bank travel rewards programs . The RBC Visa Infinite Avion card may not give you the best signup bonus or have the highest earn rate, but there’s no denying that once you have the points, they’re easy to use. There are no blackout dates and no minimum points required to make a redemption, so you’ll never run into any issues using your points. If you’re a fan of RBC, check out my RBC InvestEase review and find out how you can reduce your investment management fees.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

97 Comments

Can you explain more on the comprehensive cancellation insurance for traveling? For flight

What I mean is you get travel medical, trip accident, trip cancellation, lost luggage, etc. You cAN READ THE FULL DETAILS HERE.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-infinite-avion/rbc-visa-infinite-avion-certificate-of-insurance.pdf

Barry choi, What about outright flight cancellation by company with no booking possibility ? this happened to me 5 years ago and Avion card could not do anything!

When saying trip cancellation … talking from whom??

What do you mean by company with no booking possibility? With fight cancellation, it only applies to reasons that are outlined in your insurance policy.

When should I pay for a flight as opposed to redeeming points. I want to go to Vancouver – Honolulu -L.A. – Vancouver. Points 45000 plus $266 Cash $960 Plse advise and thx,Lawrence

45,000 Rewards points would be worth $450 + $266 for taxes = $716. Since the value of your redemption via the fixed travel program is $960, you come out ahead using the fixed program.

How much is 28906 rbcrewards point please

10,000 points = $100 so you have $289 at the base value. Your points are worth more if you use the RBC Rewards Air Travel Redemption Schedule

Hi. I have 10500 pts and I purchased my ticket for $2000 whose base fair is $1400. What’s the best way to go with the schedule?

You need 15,000 points to make a claim within or to an adjacent Province/Territory/U.S. State. That fare has a maximum base price of $350 so you can’t use the fixed redemption schedule.

you could just 10,000 points to redeem $100.

Sorry Barry. I have 105000 points. I missed a zero. Can you please update your response?

If you’ve already paid for your ticket, you can’t use the air redemption schedule. Assuming you didn’t 100K points gets you a flight from any major gateway in Canada/U.S. to destinations in Asia, Australia, New Zealand, South Pacific, Middle East, Africa, South America

Hi Barry, thanks for the article and for all the Q&A work as well !!

I’m looking at making the switch to Amex. I have 160k reward points I’ve saved up over the years. Looking to cash out or use these points up somehow with the best value. Appears as tho 10,000 points for $100 value is about the best offer from RBC rewards? Also, do you know if these points expire if I got rid of my RBC Avion card?

Yup, 10K points for $100 is indeed the best value. You lose all your points if you cancel your card. Your best bet would be to transfer your points to WestJet Dollars or hotels.com giftcards as they have good value.

I product switched to the RBC British Airways Visa almost 4 months ago. My account has remained in good standing however, I haven’t received the welcome bonus of 15k points yet. I have called RBC multiple times and each time I have been told that BA awards the points but when I speak to BA, they say that RBC needs to award the points. Do you have any idea who should be awarding the points? Thanks in advance for any help you can provide.

In theory, it should be BA that actually issues the points but RBC would have to authorize it.

I would advise escalating the case with RBC first to see if that resolves anything.

If I wish to use my Avion Rewards points to pay off my credit card bill, is it straight 100 points/per every $1?

No, it takes 172 points to claim $1 in statement credit so you’re devaluing your points quite a bit if you were to go that route.

Is this card best to earn miles to book a points first class flight from Vancouver to Tokyo?

I just noticed RBC is offering 50% more points if converted to Avios, does the same offer ever happen with AA points?

The 50% bonus is quite rare. I’ve never seen it with AA.

Is it worth it to convert your Avion points to BA Avios given the 50% bonus on until Dec 15th? I live in Vancouver and typically fly to Hawaii in Winter and Europe in summer. Your insight is much appreciated.

If you plan on using those BA points, then yes, it’s a great deal. That said, I’m not sure which airlines you can use BA Avios points to get you from Vancouver to Hawaii.

Hi, is it worth buying the air Canada gift cards at a 10% discount? Are they easy to use and are there any hidden charges / rules to these we should know about?

Buying the gift cards gives you a guaranteed discount of 10%, but you might get better value if you used your points on the fixed travel program. It’s honestly a personal choice but I imagine you wouldn’t have any issues with using the gift cards. As far as I know there are no additional charges or rules, but read the fine print before you commit.

Do my RBC rewards expire at any point

Not as long as you have a credit card account that earns you RBC Rewards active with them that’s in good standing.

RBC Reward points expire after 3 years on a First In, First out basis.

That is incorrect. If you refer to handbook, the first page states that RBC points don’t expire.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-platinum-avion/rbc-visa-platinum-avion-benefits-guide.pdf

The reference to points expiring after 3 years is old and should have been removed from the website.

my mistake, you are correct. I believe my knowledge was outdated.

I just logged into my RBC Rewards and I see that I have a – 69K point balance. How is it possible to end up with a negative reward points balance?? I have never even used my rewards and forgot that it was even available. Any help would be appreciated.

You’d have to check with RBC about that

Do you think it is worth keeping the RBC Infinite Avion card beyond the first year? Is it worth the $120 per annum annual fee considering that I am also paying fees for amex gold card and BMO cash back card?

Thanks for your insight

Hi Viviene,

I personally wouldn’t keep three credit cards with annual fees. Of the three cards you mentioned, I’d probably drop the BMO cash back card but that’s because I prefer travel points. Who do you bank with? Do they waive the fee for any cards?

I bank with BMO but it’s a joint account and the waiver goes towards my partner’s BMO MC world elite card. I figure the cashback we get each year more than pays for the annual fee.

What does RBC Avion offer that justifies its fee? It seems as if it would take a long time to build up any significant number of points.

Well it’s really for you to decide based on your spending. E.g. if you moved all the spending from your cash back card to the RBC card, you could more in points for flights than what the annual fee would cost you. I think the RBC Rewards fixed flight travel chart offers good value especially if you’re looking at short haul flights. However, that may be redundant since you have the Amex Gold which also has a fixed points program.

How would you compared the two fixed points program? I tend to focus on transferring my Amex points to Avios and haven’t really looked at the Amex fixed points program. I also feel that the Amex Gold has more to offer than the RBC card in terms of travel insurance and flexibility on how to use points. But I may be wrong….

Both programs have their sweet spots. Amex is arguably better since you have more transfer partners. The Amex Gold has a slightly higher earn rate on travel. but RBC Rewards has occasional promos where if you transfer your points to BA, you get 25 or 50% more points.

I do agree that the Gold Amex is a better overall card.

Is there anyway I can browse through options for say a vacation package, that would be qualified for if I had 150000 points? For example my 150000 points would allow me to go to Cayo Largo Cuba, or Puerto Plata Dominican Republic or Cozumel Mexico…you get the idea.

It doesn’t give you an option to search for results based on X points. All really allows you to do is search by price from low to high after you’ve selected a country.

I have always been a fan of the RBC Avion program until today when I tried to change a departing flight and was told that all the flights I chose were “not available” although there were clearly seats for sale on both the airline website AND Expedia. RBC only offered a few very poor flight options. I thought “any flight” meant “any flight”. I have never encountered this before. We ended up buying new flights from the airline after spending over 30 minutes on hold, suffering through a painfully frustrating conversation with an agent and draining the battery on my phone.

I’m going to bail on Avion after learning that they recognize an Air Canada fuel surcharge of 570$ per ticket to europe in a time of extended, sustained low fuel prices. It was going to cost me 1100$= in fees when flights can be purchased outright for just over 1600$.

Value lost due to poor decisions at Avion….. adios!

That’s Air Canada’s fault, not Avion.

How long does it take to convert RBC points into Asia Miles? Is it instantaneous or do you have to wait 6-8weeks?

It usually takes 4-5 days for the transfer to Asia Miles

I have around 200k in avion points. I am trying to figure out the best option for using them as we are moving to Europe for a year. I looked into the flights but almost 1/2 goes to the taxes, etc. I was wondering if it was best to use them while we are there for short trips. So, what would be the best value? (ie rental car, hotels, ?), anything else?

Points for flights to Europe are typically of low value due to the fees. Using them within Europe is also not a good value since you wouldn’t be able to use the fixed travel program. You could use the RBC travel portal when you’re abroad and book points at 10,000 points = $100 in travel.

Alternatively, you could convert your points to WestJet dollars at a 1:1 ratio. On occasion, there are promos where you can convert to hotels.com giftcards which can be a good value.

Hi Barry, we have ~250,000 RBC Avion points and I’m trying to maximize getting to FCO (Rome) this summer from YYZ (Toronto.) We also have 90,000 in Aeroplan.

Traveling with a 15 month old so really wanted to optimize for lie-down seats. But they are pricey. ($8000 for two seats on AC’s direct flights.)

Can you suggest a way to optimize our points to make it work?

Flying from Toronto to Europe is one of the worst redemptions regardless of the program due to high airport taxes. With Aeroplan, you need 110K points for a return business flight so that won’t really work.

For RBC, I don’t think you can use your points for business so that doesn’t really help.

The best value I can think of right now and this is honestly not the greatest solution is to consider transferring your points to WJD. If you have the WestJet World Elite Mastercard, you can use the companion voucher for premium economy. I just booked two flights from YYZ to LGW for $2400. Of course, you would still need to get a flight to Rome and you’d only be redeeming your points at a 1% value.

IMO, you’re better off paying cash for this route and saving your points for later.

Help. We have 175000 Avion points. Looking to use them from YVR to LHR. If I use the points for 3 fares return it looks like another $700 each on top !!!! With Aur Canada. Flights in September are approximately $700 each return. Can you give any advice. I have not checked if BA charges the same.

Flights to Europe are a terrible value due to the high taxes. You’re better off saving your points for a different redemption.

Is it possible to use Avion points to pay for an upgrade on an already booked flight? Is it worth it? Looking at this for a flight from Houston to Auckland on Air New Zealand.

You’d have to call and ask. You definitely can’t do upgrades via the RBC Travel portal.

Is there a time limit to redeem accumulated points? And I wld like to purchase a gift card for electronics?

Your points don’t expire as long as you have an active RBC credit card that’s in good standing.

I am a bit lost with car rental points… if my rental was $800.00 how many points would I need

That falls under travel so it would cost you 80,000 points.

Barry, Can RBC Avion Visa Infinite cardholders redeem for a Premium Economy class seat instead of Economy class? Thanks!

RBC Rewards is a full service travel agency so you can book premium economy, but it’ll cost you more points. It’s unlikely you’d be able to book premium under the Air Travel Redemption Schedule since the price would exceed the maximum base price.

Barry, RBC Avion Visa Infinite redemption schedule From Canada to Hong Kong: 100,000 points. Maximum ticket price: $2,000.

Normally the Air Canada Premium Economy ticket from Canada to Hong Kong costs close to (less than) $2,000. It’s not worth to redeem Economy class, which is about $1,000 or less. That’s why I would like to know whether I can redeem Premium Economy class or not.

As long as the base ticket price is below $2,000, you should be able to redeem a premium economy flight using your RBC Rewards points.

Hi Barry, I’m totally torn between Scotia Passport and RBC AVion? Which one do you really prefer if we plan on going US visits and Asian Countries as well?

Both cards a bit different. The Scotiabank card is a good all-in-one card since it has no forex fees, but the RBC Avion has a fixed points travel chart which can be of good value. Since you’re based in Canada, Air Canada/Aeroplan cards are good for US travel thanks to the new Buddy Pass. WestJet companion vouchers can also be handy.

Barry, early thanks for answering my question. I am contemplating on utilizing approx. 111,000 Avion points for Best Western gift cards. I presume the gift cards are in Canadian funds? Travel contemplated is in the U.S. once the ban is lifted. How is the difference in currency handled by U.S. based Best Westerns?

The gift cards are only worth it if you’re getting an equal value to your RBC Avion points. E.g. 1,000 points = $10. Yes, the cards would come in CAD. If you use them outside of Canada, you would be subject to the exchange rate at the hotel which will definitely have a markup.

Avion $350 air fare fee for interprovincial travel is useless to many Canadians outside the Upper / Lower Canada belt. Many interprovincial one way tickets are $350 or more. I’ve amassed nearly a million dollars over the years on my Avion card, and travel with my family of 6, using the points. I always have to wait for airlines to post sale prices before I can use the points, because their reward amount is set too low. Its not a cheap card either. I’ve never complained, but its been the same price system for over 10 years. Hello! Inflation!

Paying the taxes on flights is also a bummer. I’ve often just bought sale priced flights with cash, because the Avion rewards taxes where close to half the flight cash amount. Didn’t see the point in wasting them.

How do I book a business class seat? We’d like to go back to Europe next year and want to fly business class. I have over 300,000 points with Avion.

Two years ago we booked two business class seats after transferring points to British Airlines, What a nightmare!

I swore that I’d move to another point card to get better service, connections, etc.

Please help.

RBC has a travel rewards portal where you’d book your flights and then redeem your points.

Aeroplan is a lot easier these days, it’s worth considering switching to a card that earns you Aeroplan points.

We have 215000 points with RBC and travel to Mexico, US and are thinking of going from Edmonton to Amsterdam and returning to Edmonton from Rome. What are the best way to use our points. Is transferring points to Westjet a better deal than buying Westjet gift cards .

To maximize your value, you should use the RBC Air Trave Redemption schedule – https://www.rbcrewards.com/#!/travel/redemptionSchedule

It’ll cost 65,000 points to get to Europe with a max ticket value of $1,300. That works out to 2 cents a point which is double the normal value.

Ad for WJD, it’s a better value to transfer your points directly instead of buying gift cards

Any luck with product switching lately and receiving the welcome bonus of 15,000 points for Avion Infinite?

Darn. Seems to still work for WJ MC. Perhaps makes sense to PS to a no AF card and then cycle back.

I recently “purchased” airline tickets using Avion points. Unfortunately I mistakenly selected the Flexible Points Pricing and as a result ended up using roughly twice as many points as would have been needed under the Fixed Points Pricing. The difference is somewhere around 35,000 points. I requested that Avion reverse this mistake but was advised that it was their policy to not allow such a change. I requested to talk to a manager, but they basically advised that this wasn’t going to happen (they told me it would take 6 weeks). Any advice.

Unfortunately, it’s unlikely they’ll reverse the charges. This happens with all points programs.

Hi Barry… I have over 1 Mil points… and on flight can I upgrade to Exec or 1st Class with my points ?? I don’t see it anywhere when i am looking at the booking … Any ideas. Thanks Mike

In the RBC Avion travel portal, you should be able to choose premium economy or business class seats for your flights.

What are the pros & cons of flex points vs flexible points booking w Avion? How do I know which we should use?

All rbc rewards and avion rewards points can be used on any travel purchase made through the RBC travel portal.

I have been reading your awesome feedback from Avion customers! I recently tried to receive information from the RBC Rewards program call centre and it was horrific – unprofessional and unknowledgeable agents, transferring me first to Expedia and then to Air Canada. They wore me down. I then went online and read reviews on the performance of the program – from what I saw, every customer who had to make a change on their travel booking experienced exactly the frustration I did.. Has this program gone down hill in recent years on their customer service assistance?

The program itself is fine, but I imagine every travel operator is experiencing customer service issues. I guess the real problem is knowing who to call. If you book travel through the Avion travel portal, technically speaking, you will go through them to make changes even if you booked an Air Canada flight.

Hi Barry, I’m unsure whether to use my avion infinite Visa card to pay a Europe bike tour purchase as the surcharge is 4 percent or pay with an e-transfer. The foreign currency rate I’m billed at was 1.49. I look forward to your response. Also, if I pay with an e-transfer will I have any travel protection? Thanks in advance! Barbara

Hey Barbara,

A 4% surcharge is quite a bit. That said, an e-transfer may come with fees too. I personally would just choose what’s cheaper. That said, if you don’t pay with your credit card, you don’t get any protection if you need to cancel your tour for a qualifying reason.

Hi Barry, Thank you for your responses. I really appreciate it! Barbara

Regarding financial rewards, more specifically applying a credit to an existing RBC mortgage: is the cash value going to be considered a lump sum payment or something else? I ask this because the options to pay down a mortgage faster are limited to double-up payments upon each scheduled payment, and one lump sum payment (aka prepayment) of up to 10% of the initial principal per year. I already used my yearly lump sum and I’m concerned that I wouldn’t be allowed to redeem my Avion points towards my mortgage or I may be allowed to do so, but I could be issued a penalty for not following the rules. I couldn’t find anything online about what the value of the points redeemed is considered to be.

Hey Stephanie,

If I had to guess, it would count as a prepayment. You’d have to call them to find out for sure.

Too old to travel. So thinking of using my Avion points to buy RBC merchandise. How can I see what is available if I don’t do any banking transactions on a computer?

You need to go to the RBC Avion website to see what items are available for redemption – https://www.avionrewards.com/index.html

On the web site that I see, the first thing that they want is your Visa number. And that is exactly why we don’t do money matters on line.

Avion Rewards is a credit card rewards program. Using your credit card number is how you log in.

Hello I redeemed 130,000 points for a flights to Barcelona from Toronto and had to cancel. What is the value of these points so that I can make a travel insurance claim

That’s a value of $1,300.

Hi Barry, Thought you might be interested in my experience being transitioned from HSBC World Elite MC to RBC Avion Visa. Since I don’t have anything that spells out the fees, conversion rate, etc. I called the RBC conversion team. They are waiving the $120 annual fee for the first year and that’s it. Although the HSBC card did not charge the 2.5% foreign conversion fee, the RBC card does. The extra points which HSBC gave for travel expenses are likewise not available with the RBC card. It seems to me that if I wanted this card I would be better off applying for it and getting the bonus. Very disappointing.

You should have received paperwork about the details of your new card. HSBC World Elite MC holders being switched the Avion Visa Infinite will still get no FX fees on their card.

You’re correct about losing the travel credit after the first year.

The Avion card is a clear downgrade, I mention a few other options in this article – https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-hsbc-clients-may-not-love-their-new-rbc-credit-cards-but-rbcs-avion/

Thanks Barry. I don’t subscribe to the Globe but I assume you suggested the Scotiabank Passport Visa as an alternative. I don’t want to take up your time with all this but I applied for the Scotia card and it developed into a real mess. I’m still trying to find out what happened, currently waiting to hear back from their Escalated Customer Concern team.

I suggested a few.

The Amex Cobalt for high earn rate, Rogers Mastercard for Costco (if you use Rogers), and Platinum for high end travel benefits. If you want no FX, the Scotiabank card is indeed good, but I like the EQ Bank card cuz it has no fees.

I’ll def check into the EQ card, thanks again.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

Maximizing the Canadian RBC Avion Redemption Schedule For Travel

In a previous post on RBC's Visa Infinite Avion, TPG contributor Ola briefly described the benefits of the Avion Redemption Schedule. In this post, he elaborates on how it works and how to maximize it. The Redemption Schedule is available exclusively to RBC's "Avion" brand card holders.

Air Travel Redemption Schedule

The Redemption Schedule above is taken directly from RBC Rewards, and is classified into different regions mostly based on distance. Each region is assigned a fixed number of points required to travel to it. Flights must originate either from Canada or the US . So you can't use this schedule to go from Europe to Asia for example. There is a maximum ticket price associated with each region and the required RBC Rewards point level. However, RBC Avion is a hybrid points program , so you can also redeem your points for a fixed value of 100 points per $1, if such a redemption makes more sense for your ticket.

Insider Tips For the most part the chart is pretty easy to read, but there are just some points to clarify:

1. The maximum amount of value you can pull from your points in terms of the redemption schedule's maximum ticket value amounts is 2.33 cents .

2. The maximum price in the schedule does not include taxes . Taxes can either be charged to your credit card or paid using 100 points per $1.

3. The schedule applies to roundtrip economy class flights . However, business class tickets can be booked using the maximum amount in the redemption schedule and the difference between the economy and the business class ticket fare paid by charging it to your credit card or using points at the fixed rate of 100 points per $1.

4. Travel to Bermuda, Mexico, Hawaii, Alaska, Central America, and Caribbean has two different "required points" levels depending on where the flight originates. These destinations require less points with a lower maximum price when traveling from Eastern Canada/U.S. and some require less when traveling from Western Canada/U.S. For instance, flying to the Caribbean from Eastern Canada would require 45,000 points, but getting to the same destination would require 55,000 points from Western Canada.

5. The maximum price does not mean that you cannot book a ticket that costs more than the maximum price using your points. If you find a flight that is higher in cost, you can redeem the maximum amount in the chart and pay the rest by credit card or at 100 points per $1 .

6. Make sure to calculate the value of each points redemption. If you find a ticket that costs less than the maximum amount, you want to check if it's less than the value of the required points. The way to do this is by dividing the required point amount by 100. So 15,000 points would equal $150. If the ticket you find costs less than $150, then you should not use the redemption schedule, instead you should redeem using RBC's 100 points per $1 rate.

Maximizing the Redemption Schedule If you're an Avion card holder and want to get the best value for your points for travel using the Redemption Schedule, you should keep three things in mind:

1. Book flights as close as possible to the maximum price level. The closer you get to the maximum amount, the more value each point has. For example, if you're redeeming 100,000 points with a maximum price limit of $2000, and you find a flight that costs $1000, each point will equal 1 cent in value. But if you find a flight that costs $2000, each point will equal 2 cents, that's double the value, quite a difference.

2. If a ticket to your final destination costs less than the maximum amount allowed under the redemption schedule limits, you can add as many stopovers as you want to boost the price until you reach the maximum price. Mind you though that the stopovers may affect the taxes you're paying.

3. Try to find flights with low taxes. Even though flights must be booked through RBC travel, always do your own research and call them at 1-877-636-2870 with the exact flights that you want. Look at different options on different days (if your schedule is flexible) and try to find flights with low taxes and fuel surcharges. One of TPG's answers to a Sunday Reader Question mentions some tips on different airlines and their surcharges. Just remember, your flights must originate from Canada or the US.

Booking Rules Here are the program's rules for booking, changes and cancellations, so keep them in mind because they will affect the cost and value of any awards you book through RBC Avion.

1. Booking has to be done through RBC Rewards travel . Booking by phone costs $30 per passenger per flight. Booking online is free.

2. Booking has to be done 14 days in advance of departure date . If you wish to book less than 14 days in advance, you can only book tickets using the fixed-value rate at 100 points per $1.

3. Tickets are non-refundable , meaning that you will not get a statement credit or points back if you end up having to cancel your trip. However, you will get the monetary value back if you buy cancellation and interruption insurance, if you want to have that option.

4. You can change or cancel tickets for a fee . RBC charges $25 per alteration, per airline ticket, on top of what the actual airline charges for the alteration. If you cancel a ticket without insurance you will get a credit on the airline for what the value of the ticket would have been if you had purchased it, minus the change/alteration fees, that you must use within a year.

5. If you wish to purchase points to reach a redemption threshold, you must have at least half the required amount of points for your destination. There is a minimum of 1,000 and maximum of 15,000 for purchasing points. Every 1,000 points cost $40 (2.5 cents each) plus applicable taxes, so I wouldn't recommend it unless you only need a few thousand to get to a particular award.

Have any more questions about how the RBC Avion Redemption Schedule works? Leave a comment below and I'll get back to you with answers. [card card-name='Premier Rewards Gold Card from American Express ' card-id='22035076' type='javascript' bullet-id='1']

15 good uses of RBC Avion Rewards points

- Post author: Andrew D'Amours

- Post published: April 27, 2023

- Post category: Travel rewards Canada / Using rewards

- Post comments: 0 Comments

RBC Avion Rewards points are pretty much the only ones among all of Canada’s travel rewards currencies that even try to compete with Amex points in terms of ways to use them for outsized value and transfer partner options (and ease of earning a lot of points). Let’s start with the basics, but we’ll have much more content about this currency!

We’ll look at 15 good uses for those RBC Avion Rewards points.

Basics of RBC Rewards points

The RBC Avion Visa Infinite Card is currently offering its regular welcome bonus. It’s already one of the most popular cards in Canada, as the main card for the country’s largest bank.

Basically, you’ll earn 35,000 RBC Avion Rewards points with no minimum spend requirement to reach, so it’s perfect as a 2nd card to apply for on the same day as a 1st one with a minimum spend requirement and a bigger bonus.

You can get this welcome bonus even if you’ve had this card before; that’s the beauty of all cards that aren’t issued by Amex (often there’s a minimum wait period; but not with RBC). And that’s why you can get a literally infinite amount of free rewards to travel more for less! Save your spot for our free webinar on travel rewards for beginners to learn more!

You can read all the details on our RBC Avion Visa Infinite Card page , and on our review (which includes a video presentation if you prefer that format).

We’ll also have a lot more content, tips, and guides on all the major programs (including RBC, Amex, Aeroplan, Avios, Marriott, etc.) very soon.

How to use RBC Avion Rewards points

With other RBC cards, the RBC Avion Rewards points you get work differently. So we’ll just focus on the RBC Avion Rewards “Elite” points that are relevant here, as the RBC Avion Visa Infinite Card ‘s welcome bonus is by far the most valuable among RBC cards.

RBC Avion Rewards points can be used as both of the 2 only types of rewards use options that exist: uses that are more valuable (less simple) or uses that are more simple (less valuable).

So we will divide the article into the 4 different ways that RBC Avion points can work:

- Transfer to Avios (12 good uses)

- Transfer to WestJet Rewards and others (1 good use)

- Reward flights with the RBC price chart (1 good use)

- Travel credit to erase almost any travel expense (1 good use)

1. Transfer to Avios (12 good uses)

The Avios program is far from being as simple as the ubiquitous airline rewards program in Canada (the Aeroplan program ), but depending on your travel preferences, it can be very valuable too.

We’ve put together an article that lists 12 good uses of Avios points .

Note that 60,000 RBC Avion points = 60,000 Avios points (1 to 1 transfer rate). The increased welcome bonus on the RBC Avion Visa Infinite Card that is offered regularly gives you those 60,000 points ( sign up to get an alert when it returns).

But usually, RBC has a transfer bonus promo with at least a 30% bonus every year. That means you get 30% more Avios points when transferring RBC points, giving you 30% more free travel! And 30% more value than our Flytrippers Valuation for the RBC Avion Visa Infinite Card ‘s welcome bonus. That’s even more amazing!

This option can give you up to 9 one-way short-distance flights in some countries, or 4 one-way flights to/from Miami from Toronto or Montreal for example.

But with Avios, you’ll have much fewer options compared to Aeroplan. So you’re better off choosing the cards with amazing offers that earn Aeroplan points or American Express points if you want airline rewards (the most valuable type of rewards) but prefer some that are simpler than Avios points.

2. Transfer to WestJet Rewards and others (1 good use)

Okay, there is more than 1 good use with the other airline partner programs, but it’s really a lot rarer that it’s a good value. So we’ll say 1 good use for now: for a sweet spot with other partners.

The 3 other RBC airline program partners are:

- WestJet Rewards (1 to 1 transfer rate)

- Cathay Pacific Asia Miles (1 to 1 transfer rate)

- American Airlines AAdvantage (1 to 0.7 transfer rate)

We’ll discuss it in more detail in our RBC Avion Rewards program guide soon , but the main appeal used to be for those who often fly WestJet. But now, their program is so bad that the RBC points option #4 below is probably more valuable even for WestJet flights.

(The WestJet RBC World Elite Mastercard also has an increased offer and the WestJet RBC Mastercard is a no-fee option, if you really like WestJet — we’ll cover those cards later since the welcome bonus is hundreds of dollars lower than the RBC Avion Visa Infinite Card and the other incredible offers right now !)

The Asia Miles program can be interesting, especially since it is also a transfer partner with the Amex Membership Rewards program and the HSBC Rewards program . So it’s easy to earn many Asia Miles. But it’s a program with sweet spots that are even more specific than Avios, which I’ll cover soon to keep this post shorter today.

Finally, the American AAdvantage program has a much less appealing transfer rate for starters. And the program is not great, as is the case with most US airline programs. That said, I did make my 1st AAdvantage redemption in 15+ years in the world of travel rewards… and it was literally one of the most valuable redemptions I’ve ever made. I was glad to have RBC Avion points to transfer to AAdvantage!

3. Reward flights with the RBC price chart (1 good use)

We’re now at the first of the 2 uses of RBC points that don’t involve transferring to another program.

I’ll do a separate article for you soon, but basically, the RBC award chart has only one good use: when airline tickets are very expensive in cash .

The thing is the price chart will give you a ticket for a fixed number of points, regardless of the cash price (with a maximum price though).

It’s harder to maximize than airline partner programs, at least for those who don’t normally buy expensive flights. And it’s much more restrictive: you have to book flights only departing from Canada or the USA. However, RBC does allow you to book one-ways at least (compared to the Amex price chart that only allows roundtrips for example).

Here is the full RBC price chart for roundtrip reward flights (directly through the RBC program instead of having to transfer points).

(One-ways simply cost half the amount of points with half the maximum price too!)

So for example, let’s say you use your 60,000 RBC Avion points for 4 roundtrip flights that cost 15,000 points… you could “save” $1400 ($350 x 4)!

That would give a great value of 2.3 ¢ per point (and the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus would be worth $1280 instead of ≈ $780 at our always conservative Flytrippers Valuation).

However, that means you’d be paying for very, very expensive tickets. So it’s just a good use if you were really going to pay a lot of money for those flights (if you didn’t have any flexibility for example). And when the plane ticket’s base fare is as close as possible to the maximum ticket price in the RBC price chart.

When used this way, RBC points only cover the base fare, so not the taxes and some other fees. The maximum ticket price in the price chart is also only for the base fare (the same as the Amex price chart for reward flights ).

Remember that what’s important is not how much you pay out of pocket, but how much you SAVE in total, at least if you know how to do the math and if you want to get the most value with your rewards.

So the RBC price chart can still be interesting if you have to go somewhere and the flights are very expensive. For example, if you are going to a European destination that is very expensive for your dates, that can easily cost $1600, especially if you’re not in Toronto or Montreal (which is sad considering we often spot deals to Europe in the $400s roundtrip).

With 65,000 RBC Avion points (the 5,000 missing after the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus are pretty easy to earn), you could save $1300, a great use on paper. But it’s not a good use if the alternative is a flight to Europe paid with cash that has just a $300 base fare.

To give you an idea, I’ve used airline reward programs for dozens and dozens of flights in the past 10 years, and I have used the bank price charts only once (it was with RBC during the Christmas holidays this year because flights during the holidays are expensive).

I usually don’t buy expensive flights so it’s less beneficial for me. And when I do buy expensive flights, I’m flexible, so airline points are a lot more valuable.

In short, the value you can get with the RBC price chart really depends on your personal situation and how good you are at finding cheap flights. As is always the case in the world of travel, you have to compare!

4. Travel credit to erase any travel expense (1 good use)

Finally, the only option that has a fixed value… isn’t really a good use at all in fact.

It’s a “good” use only if you want to keep it simple and are willing to get a lot less value in return, as so many people are.

Instead of being worth ≈ $780, the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus is worth a flat $480 net if you use it like this. Because as a travel credit, 60,000 RBC Avion points = a $600 credit.

But it’s much simpler: you can apply the points to any travel expense.

It’s always going to be worth 1¢ per point. Any travel use. Very simple.

That’s why the other options are about 50% more valuable… but even $480 for free is pretty good!

With this option, you don’t have to think anything through, you don’t have to maximize anything, you don’t have to take any specific flights… it’s really as simple as it gets.

Well, almost as simple as it gets. There is one restriction: you need to book on the RBC Avion website (you cannot book on other websites as you can with other rewards programs).

If you want to use points for any travel expense, you really shouldn’t “waste” valuable points like RBC Avion points anyway (unless you’re never going to use them for more valuable flight redemptions, in that case of course take the points instead of not taking them).

Instead, use points that cannot give you more value AND can be used by booking on any website! Like Scene+ points (the Scotiabank Gold American Express Card ), BMO Rewards points (the BMO eclipse Visa Infinite Card ), or AIR MILES miles (the BMO AIR MILES World Elite MasterCard ).

Or points that can be used by booking on any website without losing too much value. Like TD Rewards points (the TD First Class Travel Visa Infinite Card ) or HSBC Rewards points (if you already have some).

The RBC Avion Visa Infinite Card is a great option to get points of the more valuable type. These examples may give you a good idea of what you could do with the welcome bonus, while you wait for our more comprehensive guides.

Have any questions about RBC Avion Rewards points? Ask me in the comments below.

Want to be the first to get our free travel rewards course and all our content, sign up for our travel rewards newsletter.

See the deals we spot: Cheap flights

Explore awesome destinations : Travel inspiration

Learn pro tricks : Travel tips

Discover free travel: Travel rewards

Featured image: Beach (photo credit: Nico David)

Share this post to help us help more people travel more for less:

Andrew D'Amours

Leave a reply cancel reply.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Rbc bearings (nyse:rbc) stock performs better than its underlying earnings growth over last five years.

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term RBC Bearings Incorporated ( NYSE:RBC ) shareholders have enjoyed a 100% share price rise over the last half decade, well in excess of the market return of around 76% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 25% in the last year.

Since it's been a strong week for RBC Bearings shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for RBC Bearings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, RBC Bearings managed to grow its earnings per share at 7.7% a year. This EPS growth is lower than the 15% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This optimism is visible in its fairly high P/E ratio of 45.14.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that RBC Bearings has improved its bottom line lately, but is it going to grow revenue? Check if analysts think RBC Bearings will grow revenue in the future.

A Different Perspective

RBC Bearings provided a TSR of 25% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 15% over half a decade It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for RBC Bearings that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.