- Travel, Tourism & Hospitality ›

Business Travel

Business travel in the U.S. - statistics & facts

How much does business travel contribute to the u.s. tourism sector, most expensive u.s. business travel destinations, key insights.

Detailed statistics

Business travel spending in the U.S. 2010-2025

Number of business travel jobs in the U.S. 2019-2021

U.S. inbound business travel spending 2020, by source region

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Business Travel Spending

Global business travel spending 2001-2022

Top U.S. travel management partners 2020

Online Travel Market

Leading travel companies worldwide 2022, by sales

Related topics

Recommended.

- Tourism worldwide

- Travel and tourism in the U.S.

- Passenger airlines

- Billionaires around the world

Recommended statistics

- Premium Statistic Global business travel spending 2001-2022

- Basic Statistic G20 nations: business travel spending 2021

- Basic Statistic Share of tourism spending in leading global travel markets 2022, by type

- Premium Statistic Number of business travel jobs in the U.S. 2019-2021

- Premium Statistic Readiness of U.S. travelers to take business trips 2021

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

G20 nations: business travel spending 2021

Expenditure of business tourists in G20 countries in 2021 (in billion U.S. dollars)

Share of tourism spending in leading global travel markets 2022, by type

Distribution of leisure and business travel spending in the leading travel markets worldwide in 2022

Number of jobs supported by business tourism in the United States from 2019 to 2021, by segment (in 1,000s)

Readiness of U.S. travelers to take business trips 2021

Willingness to travel for business purposes in the United States as of October 2021

Volume of business tourism

- Premium Statistic Business travel volume in the U.S. 2010-2021

- Premium Statistic Growth rate of domestic business trips in the U.S. 2017-2026

- Premium Statistic Inbound business tourism volume in the U.S. 2011-2021

- Premium Statistic Main source countries for U.S. inbound business travel 2022

- Premium Statistic Average monthly trips by U.S. business travelers 2022, by type

Business travel volume in the U.S. 2010-2021

Number of trips made by business tourists in the United States from 2010 to 2021, by main destination (in millions)

Growth rate of domestic business trips in the U.S. 2017-2026

Percentage change in the number of trips made by domestic business tourists in the United States from 2017 to 2022, with forecast until 2026

Inbound business tourism volume in the U.S. 2011-2021

Number of business visitor arrivals from overseas to the United States from 2011 to 2021 (in 1,000s)

Main source countries for U.S. inbound business travel 2022

Leading countries of origin for overseas business visitor arrivals in the United States in 2022 (in 1,000s)

Average monthly trips by U.S. business travelers 2022, by type

Expected average number of trips per month by business tourists in the United States as of September 2022, by type

Business travel spending

- Premium Statistic U.S. inbound business travel spending 2010-2021

- Premium Statistic U.S. inbound business travel spending 2020, by source region

- Premium Statistic Main source markets for U.S. inbound business travel spending 2020

- Premium Statistic U.S. outbound business travel spending 2010-2021

- Premium Statistic Main recipient countries of U.S. outbound business travel spending 2020

- Premium Statistic U.S. domestic business travel spending 2019-2026

- Premium Statistic Daily business tourism expenses in the United States 2018-2021

- Premium Statistic Highest-priced U.S. business travel destinations Q4 2022

U.S. inbound business travel spending 2010-2021

Expenditure of international business tourists in the United States from 2010 to 2021 (in billion U.S. dollars)

Expenditure of international business tourists in the United States in 2020, by region of origin (in million U.S. dollars)

Main source markets for U.S. inbound business travel spending 2020

Leading countries for international business tourism in the United States in 2020, by share of total spending

U.S. outbound business travel spending 2010-2021

Expenditure of international business tourists from the United States from 2010 to 2021 (in billion U.S. dollars)

Main recipient countries of U.S. outbound business travel spending 2020

Leading countries of destination for business tourists from the United States in 2020, by share of total spending

U.S. domestic business travel spending 2019-2026

Expenditure of domestic business tourists in the United States from 2019 to 2022, with forecast until 2026 (in billion U.S. dollars)

Daily business tourism expenses in the United States 2018-2021

Average business travel cost in the United States from 4th quarter 2018 to 4th quarter 2021 (in U.S. dollars per day)

Highest-priced U.S. business travel destinations Q4 2022

Most expensive cities for business tourism in the United States in 4th quarter 2022, by average daily cost (in U.S. dollars)

- Premium Statistic Biggest corporate travel spenders in the U.S. 2022, by booked air volume

- Premium Statistic Top U.S. travel management partners 2020

- Premium Statistic Favorite hotel brands for corporate travel during COVID-19 in the United States 2021

- Premium Statistic Predictions on reduction of U.S. corporate travel spend due to green goals 2025

- Premium Statistic Predictions on corporate travel spending in the United States 2022, by destination

Biggest corporate travel spenders in the U.S. 2022, by booked air volume

Leading companies for business travel spending in the United States in 2022, by booked air volume (in million U.S. dollars)

Leading travel management companies in the United States in 2020, by number of top partnerships

Favorite hotel brands for corporate travel during COVID-19 in the United States 2021

Best hotel brands amid the COVID-19 pandemic according to business travel managers in the United States as of September 2021

Predictions on reduction of U.S. corporate travel spend due to green goals 2025

Expected impact of companies' sustainable initiatives on business travel spending in the United States in 2025

Predictions on corporate travel spending in the United States 2022, by destination

Expected change in international business travel spending according to travel managers in the United States in 2022, by region of destination

Bleisure travel

- Premium Statistic Adoption of digital nomads' way of living in the U.S. 2022

- Premium Statistic Major reasons to take bleisure trips for U.S. business travelers 2022

- Premium Statistic Favorite trip length for U.S. bleisure travelers 2022

- Premium Statistic Favorite countries for U.S. Americans to work remotely 2021

- Premium Statistic Most important features at accommodations for U.S. bleisure travelers 2022

Adoption of digital nomads' way of living in the U.S. 2022

Share of employees planning to adopt a digital nomad lifestyle in the United States as of February 2022

Major reasons to take bleisure trips for U.S. business travelers 2022

Main motivating factors to combine business with leisure trips for corporate travelers in the United States as of February 2022

Favorite trip length for U.S. bleisure travelers 2022

Preferred length of stay for trips combining business with leisure activities in the United States as of February 2022

Favorite countries for U.S. Americans to work remotely 2021

Preferred international workation destinations for remote workers from the United States as of December 2021

Most important features at accommodations for U.S. bleisure travelers 2022

Preferred accommodation amenities for bleisure tourists in the United States as of February 2022, by utility score

Travel behavior of remote workers

- Premium Statistic Workation destination choice of remote workers from the U.S. 2021

- Premium Statistic Motivations of U.S. Americans who work remotely to choose workation 2021

- Premium Statistic Duration of workations by U.S. Americans who work remotely 2021

- Premium Statistic Main concerns of U.S. remote workers when picking workation lodging 2021

- Premium Statistic U.S. remote workers' satisfaction with workation experience 2021

Workation destination choice of remote workers from the U.S. 2021

Distribution of remote workers from the United States as of December 2021, by destination type

Motivations of U.S. Americans who work remotely to choose workation 2021

Main reasons to combine work and leisure travel for remote workers from the United States as of December 2021

Duration of workations by U.S. Americans who work remotely 2021

Preferred length of trips involving work and leisure for remote workers from the United States as of December 2021

Main concerns of U.S. remote workers when picking workation lodging 2021

Main considerations to choose an accommodation for work and leisure travel by remote workers from the United States as of December 2021

U.S. remote workers' satisfaction with workation experience 2021

Evaluation of trips involving work and leisure by remote workers from the United States as of December 2021

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Explore Jobs

- Jobs Near Me

- Remote Jobs

- Full Time Jobs

- Part Time Jobs

- Entry Level Jobs

- Work From Home Jobs

Find Specific Jobs

- $15 Per Hour Jobs

- $20 Per Hour Jobs

- Hiring Immediately Jobs

- High School Jobs

- H1b Visa Jobs

Explore Careers

- Business And Financial

- Architecture And Engineering

- Computer And Mathematical

Explore Professions

- What They Do

- Certifications

- Demographics

Best Companies

- Health Care

- Fortune 500

Explore Companies

- CEO And Executies

- Resume Builder

- Career Advice

- Explore Majors

- Questions And Answers

- Interview Questions

25+ Essential Business Travel Statistics [2023]: How Much Do Companies Spend On Business Travel

- Business Travel Statistics

- Small Business Lending Statistics

- B2B Statistics

- How many businesses accept bitcoin

- What percentage of small businesses fail?

- What percentage of small businesses have a website?

- Hybrid Working Statistics

- Small Business Statistics

- Coworking Statistics

- Online Review Statistics

Research Summary. Whether you’re flying out of town for that important business meeting or simply attending an annual workshop, business travel is an important part of any big company’s protocol. When it comes to business travel, our extensive research shows that:

Business travel in the U.S. from domestic and international travelers amounts to around $387 billion in annual revenue .

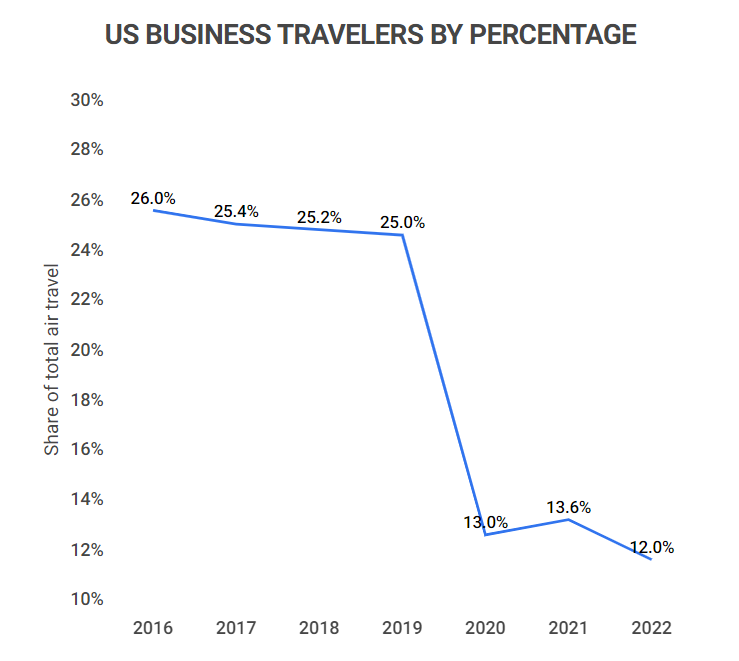

While business trips currently account for roughly 12% of total U.S. air travel , they make up to 75% of airlines’ profits .

At least 35% of U.S. businesses engage in business travel.

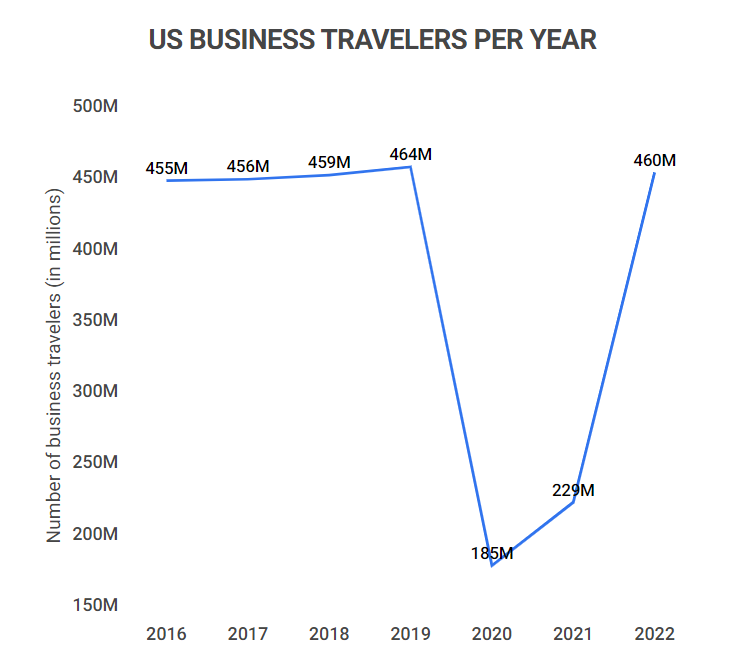

From 2019-2020, the number of business trips taken in the U.S. dropped from 464 million to 185 million .

The average business trip costs Americans $949 in travel fees .

General Business Travel Statistics

Knowing that business travel accounts for up to 75% of air travel revenue, it’s not hard to see why it’s encouraged. In fact, business travel is so lucrative that it even affects the U.S. GDP. Here are the facts:

In 2016 alone, business travel contributed $547 billion to the United States’ total GDP.

That’s around 3% of the total GDP, a number which stayed rather stable until 2020 when the COVID-19 pandemic negatively affected business travel. In reality, these high numbers might never return, as experts predict 36% less business travel post-COVID.

In 2022 business travel accounted for 12% of U.S. air travelers.

In 2022 there were over 460 million business travelers, which is a noticeable increase from 2020’s drop to 185 million. However, both years have had a relatively even share of business travelers (around 12-13%).

Business travel can account for up to 75% of an airline company’s revenue.

This trend can mostly be attributed to the booking of first-class tickets. Instead of saving money on business trips, more and more corporations are looking to provide their travelers with maximum comfort and convenience. While doing so makes the company look better, these decisions are mostly made due to competition.

Business travelers account for as much as 40% of hotel guests.

63% of these travelers are male, and 50% are between 35-54. Further, 56% of these individuals are employed in a professional or managerial position that earns them at least $127,000 per year.

Business Trip Statistics

Now that we know how profitable and common business trips are in the U.S., what does the average business trip look like? Well, according to our extensive research:

The average length of a domestic business trip in the U.S. is three days.

The average length for an international trip is 5-6 days. Overall, these numbers seem to slowly decline over time, with the old average (2016) for international business trips being just over six days.

Roughly 26% of business trips are only one day long.

This is another contributing factor for companies’ high cost of business trips, as same-day flights can wrack up costs. However, this does save the company money elsewhere (lodging, food, etc.).

38% of U.S. business travel is for meetings and events.

ME&I travel ( meetings , events, and incentive travel) amounts to $139.3 billion of all business travel spending, nearly 42% of total business travel spending.

Roughly 1.3 million business trips are taken in the U.S. every day.

A number that took a hit from the 90% reduction in travelers in 2020. While these numbers may not recover to pre-COVID numbers, 2021 has increased.

Business Travel Spending Statistics

As shown, a good percentage of businesses invest in business travel despite the cost. However, you might be surprised to learn just how much business travel costs companies and employees. According to our extensive research:

The average three-day domestic trip costs between $990-$1,293.

While the average international trip costs an average of $2,600 or more. For this reason, business trips need to be especially valuable for the company or employee taking them.

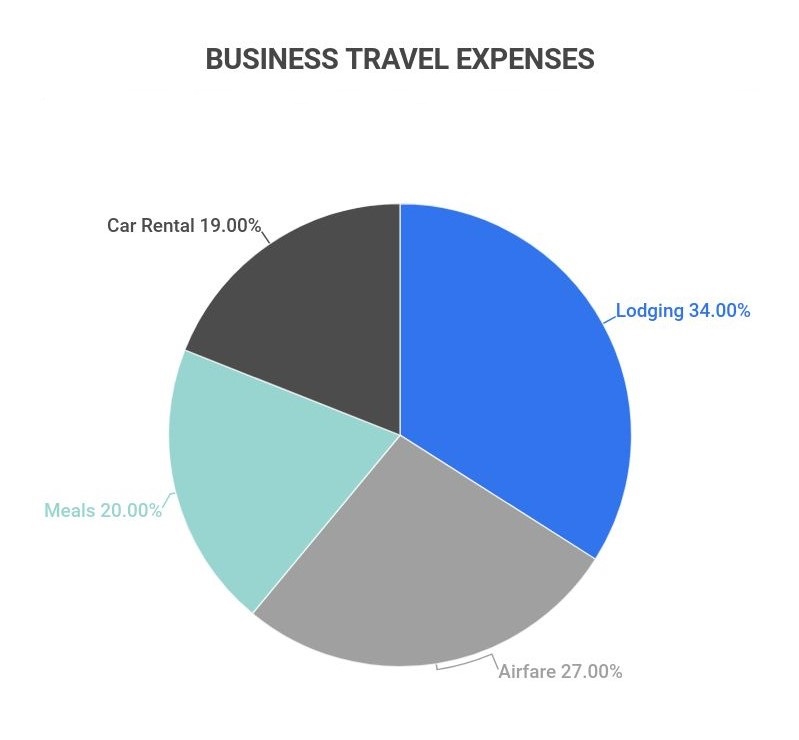

The average company spends 17-27% of its total travel budget on airfare.

You might be surprised to learn that airfare isn’t the most expensive part of business travel. Overall, the average domestic flight is $470, give or take how far away the destination is.

Over 20% of a typical business travel budget goes to food expenses.

That’s even more than flights and can amount to hundreds of dollars in expenses. One of the best ways to avoid this hefty cost is to utilize free hotel breakfasts. After all, never buying breakfast is a great way to cut food expenses.

The most expensive aspect of a business trip is lodging, making up around 34% of total costs.

Hotels make a lot of money from business travelers and the companies who sponsor their trips. This is especially true given the fact that up to 40% of hotel guests are business travelers.

Companies spend roughly $799 per person per day during a business trip.

Business Traveler Statistics

Because only 35% of companies actively partake in business travel, and it can be rather expensive, the demographics of travelers can be rather skewed. According to our research:

At least 50% of business travelers are between 35-54.

Undoubtedly, this abundance of higher ages relates to an employee’s position within the company. Older workers are more likely to have high-level positions . This can also be shown by the fact that 56% of business travelers hold professional or managerial positions that earn at least $127,000 per year.

The average business traveler takes roughly 6.8 trips per year.

And this number is even higher for millennials , who take an average of 7.4 trips per year. In that way, younger generations take more business trips on average (per person) than their older counterparts.

47% of female travelers are traveling on business.

While female business travelers are slightly less common than male travelers, women (on average) tend to enjoy their trips more than their male counterparts. Overall, 45% of women have positive experiences while traveling on business compared to 39% of men.

As of 2021, only 12% of corporate travel representatives feel as though their employees are unwilling to travel.

And with new CDC travel guidelines in 2021, 61% of employees now feel somewhat more comfortable traveling for business.

It takes an average of 38 minutes to complete and correct one expense report.

While it only takes 20 minutes (on average) to complete the expense report , at least 19% of expense reports have errors. Plus, with an average of 1.5 travel expense reports filed per month, that means employees can spend up to an hour filing them each month.

Business Travel Company Policy Statistics

Due to the potentially expensive nature of business travel, it’s no surprise that companies create business travel policies. Here are some stats related to business travel policies:

72% of corporate travel managers haven’t achieved their desired travel policy compliance level.

For the most part, this lack of compliance is due to shortfalls in the traveler ’s experience, fairness and transparency, and not meeting budget requirements.

Only 50% of business travelers follow their company’s travel policy.

In fact, 60% of business travelers don’t even understand their company’s travel policy, making it especially difficult to follow.

81% of business travel is done via personal vehicle.

By contrast, only 16% of business travel is air travel . That means most business travelers travel to their destination by car.

90.6% of corporate travel managers agree that business travel is vital for company growth.

And this sentiment comes from a genuine place, as on average, businesses earn a $2.90 increase in profit for every dollar spent on corporate travel. That equates to an average $9.50 increase in revenue.

Business Travel Trends and Projections

The 2020 height of the COVID-19 pandemic took a major toll on business travel. While business travel has started to recover in 2021, the number of travelers is still around half of what it was pre-COVID. After extensive research, here are the facts about business travel trends:

From 2019-2020, the number of business travelers in the U.S. dropped from 464 million to only 185 million.

From 2010 to 2019, business travelers remained steady between 440 million and 465 million. However, this number dropped drastically in 2020 and then increased to 229 million in 2021.

From 2010-2019, the number of business travelers grew by 4%.

However, the COVID-19 pandemic saw the number of business travelers decrease by 60%, which aligns with other travel declines caused in 2020.

The business travel industry is expected to experience a CAGR of 13.2% between 2021 to 2028.

Luckily, trends seem to show that business travel will start to recover from the COVID-19 pandemic over the next couple of years. Estimates predict that the value of the industry will increase from $695.9 billion in 2020 to $2.1 billion by 2028.

Business Travel FAQ

How many people travel for business annually?

Over 460 million people travel for business annually in the U.S. This is a massive 150% increase from 2020 when there were only 185 million, and similar to 2019’s numbers.

For instance, from 2019-2020, the number of business travelers dropped by 60%. This is mostly due to COVID-19, which affected the travel industry with restrictions and regulations through 2021.

What types of businesses travel the most?

The types of businesses that travel the most are as follows:

Sales Representative

Retail Buyer

Event Planner

Traveling Nurse

International Aid Worker

Civil Servant

Travel Writer

Travel Agent

Flight Attendant

These jobs are all related to or require business travel in one way or another. However, it’s also worth noting that 56% of business travelers hold professional or managerial positions that earn at least $127,000 per year.

How big is the business travel market?

The business travel market is worth an estimated $933 billion as of 2022. From 2020 to 2021, the market rebounded by 14%, from where it had previously dropped to $695 billion. Overall, the business travel market is expected to experience a CAGR of 13.2% between 2021 to 2028.

What percent of travel is business travel?

Approximately 12% of U.S. travel is business travel as of 2022. That number is slightly down from 13.6% in 2021, but half of what it was pre-COVID. For instance, in 2019, business travelers made up at least 25% of all travelers.

How much do companies spend on business travel?

Companies spend over $111.7 billion each year in the U.S. on business travel. Per company, travel costs typically equate to roughly 10% of that company’s annual revenue.

Business travel is an important investment for industries and companies all over the United States. That’s why, despite it costing them between $990-$1,293 per trip, they still choose to send employees on them. In fact, pre-COVID, at least 25% of U.S. travelers were business travelers.

These travelers tend to fall under certain demographics, with at least 50% of business travelers between the ages of 35-54 and 56% of business travelers holding professional or managerial positions that earn at least $127,000 per year.

However, COVID-19 took a heavy toll on the industry. The number of domestic business travelers dropped from 464 million to 185 million (25% to 13%). This job has affected airliners, hotels, the food industry , and more. Luckily, the business travel industry has a CAGR of 13.2% between 2021 and 2028, which indicates at least somewhat of a rebound.

Global Business Travel. “Business Travel Responsible for $547 Billion in U.S. GDP in 2016, Creates Over 7.4 Million Jobs.” Accessed on December 8th, 2021.

Statista. “Number of domestic business and leisure trips in the United States from 2008 to 2019, with a forecast until 2024.” Accessed on December 8th, 2021.

Investopedia. “How Much Airline Revenue Comes From Business Travelers?” Accessed on December 8th, 2021.

AHLA. “Lodging Industry Trends 2015.” Accessed on December 8th, 2021.

Travel Leaders Corporate. “09 Nov Travel Leaders Corporate Releases Q3 Business Travel Trends Data.” Accessed on December 8th, 2021.

U.S. Travel Association. “U.S. Travel Answer Sheet.” Accessed on December 8th, 2021.

Bureau of Transportation. “U.S. Business Travel.” Accessed on December 8th, 2021.

GBTA. “U.S. Business Travel – By The Numbers.” Accessed on December 8th, 2021.

TravelBank. “How Much Should a Business Trip Cost?” Accessed on December 8th, 2021.

JTB. “Important Business Travel Statistics.” Accessed on December 8th, 2021.

Trondent Development Corp. “Business Travel by the Numbers.” Accessed on December 9th, 2021.

GTI Travel. “What do Female Business Travelers do Differently from their Male Counterparts.” Accessed on December 9th, 2021.

Hotel Management. “GBTA poll finds positive momentum for business travel.” Accessed on December 9th, 2021.

SAP Concur. “Save time and money on expense report processing.” Accessed on December 9th, 2021.

TravelPerk. “5 reasons why traveler satisfaction is the key to a successful travel program.” Accessed on December 9th, 2021.

Cision. “Business Travel Market Size to Reach USD 2,001.1 Billion by 2028 at CAGR 13.2% – Valuates Reports.” Accessed on December 9th, 2021.

Certify. “Understanding the average cost of business travel.” Accessed on December 9th, 2021.

Travel jobs statistics

Zippia ’s research team connects data from disparate sources to break down statistics at the job and industry levels. Below you can dig deeper into the data regarding employees who work in travel or browse through Transportation jobs .

Overview | Jobs Salary

Browse Transportation Jobs

How useful was this post?

Click on a star to rate it!

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.

Jack Flynn is a writer for Zippia. In his professional career he’s written over 100 research papers, articles and blog posts. Some of his most popular published works include his writing about economic terms and research into job classifications. Jack received his BS from Hampshire College.

Recent Job Searches

- Registered Nurse Jobs Resume Location

- Truck Driver Jobs Resume Location

- Call Center Representative Jobs Resume Location

- Customer Service Representative Jobs Resume

- Delivery Driver Jobs Resume Location

- Warehouse Worker Jobs Resume Location

- Account Executive Jobs Resume Location

- Sales Associate Jobs Resume Location

- Licensed Practical Nurse Jobs Resume Location

- Company Driver Jobs Resume

Related posts

25+ Bicycle Industry Statistics [2023]: Bicycle Market Size, Share, Growth, And Trends

15+ U.S. Beverage Industry Statistics [2023]: Refreshing Trends, Facts, And Stats

23 Appointment Scheduling Statistics [2023]: Online Booking Trends

16 Amazing Agile Statistics [2023]: What Companies Use Agile Methodology

- Career Advice >

- English (UK)

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

100+ business travel statistics (some never before released)

?w=50&)

See how to save your company time and money on business travel

How the coronavirus pandemic affected business travel.

?)

Business travel was hit hard by the 2020 health crisis

- International mobility decreased by 65% due to COVID-19 - the lowest rate of travel since the introduction of the Boeing 707 in 1958 which marked the start of the Jet Age ( McKinsey ).

- Following 10 years of predictable growth, the losses sustained by corporate travel in 2020 were 10 times larger than those seen after 9/11 and the 2008 recession ( Global Business Travel Association ).

- It’s estimated the travel industry will lose $820 billion of corporate travel spending due to the coronavirus pandemic ( CNBC ).

- Reduced spending on travel cost the U.S. economy $162 billion in 2020 alone ( U.S. Travel Association ).

- 2020 saw two-thirds of flights put out of action, and 18 airlines declared bankruptcy (McKinsey).

- While business travel was down by 90% at the height of the pandemic, some companies saw work travel return to about 80% of pre-pandemic levels when restrictions eased over the summer (McKinsey).

- In 2020 hotels were at 29% occupancy worldwide, compared with 72% occupancy over the same period in 2019 (McKinsey).

- In 2020 travel managers reported annual travel spending was only 5-15% of the previous year’s totals (McKinsey).

- Research has revealed that, on average, it takes 5 years for airline services to return to normal levels after unexpected events like the pandemic ( IATA ).

Never fear—business travel is bouncing back

- After losses of 52% in 2020, corporate travel is predicted to generate $842 billion in spending in 2021 ( GBTA ).

- 30% of employees would accept roles with a lower salary if the position offered more opportunities to travel ( Booking.com for Business ).

- 64% of workers believe in-person contact is vital for building trust, with 53% stating they have more faith in face-to-face sales situations than online prospectors ( TravelPerk ).

- 53% of survey participants believe their industry requires face-to-face meetings. HR teams, in particular, think that in-person contact is crucial, with 67% of respondents stating their sector would collapse if meetings were forced online ( TravelPerk ).

- Virtual meetings may not reap the best results, with 60% of employees claiming they prepare more for face-to-face meetings than online alternatives ( TravelPerk ).

- For every dollar they spend on business travel, organizations reap an extra $12.50 in revenue ( TravelPerk ).

- The business travel market is expected to recover and hit $829.5 billion by 2027 ( ReportLinker ).

- Almost 100% of corporate travelers enjoy the time they spend traveling for work ( NationalCar.com ).

- 90% of corporate travelers want to carry on taking work trips for the duration of their career ( SavvySleeper ).

- While it’s hard to say for sure when business travel will return to pre-pandemic levels, we’re seeing some interesting domestic recovery trends already. In Europe, domestic travel in Germany was at a low point back in April 2020 at only 8%. However, by September, this reached 71% of pre-pandemic levels! Something similar happened in Spain, where domestic travel was as low as 1% in April and rose to 45% in September when the restrictions were relaxed (TravelPerk proprietary data).

- Business travelers started traveling domestically before international travel resumed. U.S. business travelers are leading the charge at 47% recovery as of January 2021. That’s followed by Spain at 25% domestic recovery, and Germany at 12% (TravelPerk proprietary data).

- Domestic business travel in China is already bouncing back - in fact, only 2% of respondents to this McKinsey report had taken a domestic business trip before May 2020, whereas 25% of respondents had taken one by August of the same year.

- According to our own survey, 50% of companies have implemented new corporate travel policies for the next normal ( TravelPerk ).

- In a 2020 survey, 30% of participants believed their organization would spend 30% of their annual travel budgets on client meetings in 2021, increasing 6% on 2019 spending ( Statista ).

- The proportion of female business travelers is growing. In the USA, 47% of business travelers are now women ( CreditDonkey ).

Is business travel on the increase in your team?

You'll travel a little differently than you did before.

- Over half of business travelers surveyed said that travel restrictions put them off booking arrangements for fear of not having them refunded. More flexible cancellation policies will continue to be key ( GlobalData ).

- Being able to reach providers to change or cancel flights easily (70%)

- Having access to security fast lanes (69%)

- Maintaining social distancing through spacious seating on flights (66%).

- Your travel planning windows will be shorter. You’ll look for tickets and accommodation closer to your departure date than you did before. Data from our own platform reveals that searches for trips less than 6 days away are now almost equal to searches for trips between 7 and 30 days away. Before the coronavirus pandemic, the vast majority of trips were searched for and planned 7 to 30 days in advance ( TravelPerk ).

- Rail travel will boom over air travel and is already leading the path to recovery. Our own data shows that 80% of domestic trips in Germany are being booked on trains ( TravelPerk ). Furthermore, nearly 50% of passengers now find reducing their carbon emissions and sustainability more important than they did before COVID-19 ( GlobalData ).

- Airfares could rise by as much as 54% in a post-pandemic world. This will be due to the growing need to keep planes at a higher standard of cleanliness than before, more contactless solutions, and 24-hour service at airports. Travel managers will therefore need to find ways to optimize their business travel spending and consider savings as a significant part of their company’s travel policy ( BBC ).

Future-proof your corporate travel management

The cost of business travel.

?)

- In 2021 the United States led global spending on corporate travel with a bill of $322.42 billion ( World Bank ).

- The cost of the average American business trip is $1293. While domestic trips average at $990 per itinerary, for international ventures, the number rises to $2525 ( Runzheimer and Expert Market ).

- Domestic flights within the U.S are increasing in cost, with roundtrips averaging around $330 compared to $235 at the start of 2022 ( Travel Pulse ).

- In 2020 the breakdown of spending for business trips was 34% for accommodation, 27% for air tickets, 27% for meal costs, and 19% for car rental ( Travel Pulse ).

- In 2022 the IRS's recommended per diem rate for meals and other incidental costs for US business travelers was set at $59, and the average cost for accommodation was set at $96 per night ( Federal Pay ).

The US is getting expensive, like Switzerland

- In a 2019 survey, New York City took the top spot for the most expensive city for corporate travel, with per diem spending averaging $799. Coming in second was Zurich, with an average spend of $661 per day and closely followed by Washington DC ($621) and Paris ($617) ( ECA International ).

- In Asia, Hong Kong came in first as the most expensive city for business travelers, with the average daily spend coming in at $515 (ECA International).

- Joined only by Paris and Reykjavik, the United States and Switzerland are home to 8 of the world's top 10 most expensive cities for corporate travel. Los Angeles, New York, Washington DC, and San Francisco made the list for the USA, while Geneva, Zurich, Bern, and Basel made up the Swiss contributions ( ECA International ).

- Perhaps unsurprisingly, Geneva was ranked top for most expensive business trip destinations in Europe in 2019, with other Swiss cities also featuring heavily in the top 6 (ECA International).

Further reading recommended:

Tech innovators and unicorns travel differently, disruptive tools, technology and trends.

- The number of Airbnb bookings among tech companies doubled from 2017 to 2018 (TravelPerk).

- Millennial business travelers employed by tech companies prefer non-chain hotels and low-cost air carriers. 85% of them booked low-cost airlines in 2018 (TravelPerk).

- 74% of millennial travelers have stayed in a rental property while on a business trip compared to 38% of Generation X travelers and 20% of baby boomers. 44% of millennials stated they preferred staying in Airbnb-style rentals while traveling for work ( Hipmunk ).

- Tech travelers break with company policy less than those in the consulting industry. On average, tech companies report 13% of itineraries are not technically compliant with travel policies compared to 16% from consulting firms (TravelPerk).

- European tech companies have unusual travel hubs: Amsterdam, Stockholm, Brighton, Lisbon, and Copenhagen are among their top destinations (TravelPerk).

- When surveyed, 98% of travel managers claim the most significant metrics are policy compliance, traveler experience, and expenditure ( ACTE ).

Why and how business travelers travel

Most corporate travelers travel just once per year, predominantly to visit clients.

- 30% of European corporate travelers fly once per month. 62% travel once per year. 5% travel 21 to 40 times per year ( Fly Aeolus ).

- 44% of European corporate travelers fly to visit with a customer. 32% fly to visit another company office in a different city (Fly Aeolus).

- In the USA, personal cars are used for 81% of business trips ( United States Department of Transportation ).

- Group business travel is more common than you might think. 50% of European corporate business trips are for parties of two or more (Fly Aeolus).

- 26% of European business travelers report a direct connection as the top factor influencing their decision when selecting flights. Other primary considerations were price (19%), convenience with existing schedules (23%), and airport location (20%) (Fly Aeolus).

?)

Business travel industry trends and impact

There’s a push to measure the roi of travel.

- Companies realize $12.50 in incremental revenue for every dollar invested in business travel ( Oxford Economics ).

- An estimated 28% of current business would be lost if business travel were suddenly cut off (Oxford Economics).

- However, only 13% of corporate travel managers actively measure trip success rate and trip ROI ( ACTE ).

Travel management metrics need improving

- 80% of corporate travel managers believe that a standard system of measurement would positively impact corporate travel ( ACTE ).

- 81% of travel managers measure booking statistics like advance bookings, hotel attachment, and booking issues (ACTE) .

- Only 37% of travel managers measure travel engagement (how frequently travelers interact with the TMC or in-house travel manager) (ACTE) .

- 94% of corporate travel managers rely on a TMC or travel agency for reporting (ACTE) .

- Only 61% of corporate travel managers use traveler surveys as part of their travel management metrics. These surveys can help gather data on traveler satisfaction and trip success (ACTE) .

- 4 out of 5 business travel managers believe enacting a system of metrics could benefit their corporate travel program (ACTE) .

Self-booking and mobile bookings are growing

- 59% of U.S. business travelers always book their hotel themselves and 30% usually book their hotel themselves ( Statista ).

- In another survey, 69% of business travelers report that they book travel themselves regardless of the type of booking ( Skift ).

- While desktop bookings still reign supreme, 79% of corporate travelers have completed a business trip booking on their mobile device ( LCT ).

- Business travelers love live chat. 79% of travel industry businesses saw an increase in revenue when they provided live chat (LCT).

Traveler satisfaction and concerns

What travelers want.

- 80% of frequent business travelers feel that they deserve to make time for fun activities during most of their business trips. And fortunately, 79% of them feel that their boss agrees ( NationalCar ).

- 86% of business travelers say that they know how to successfully manage their personal lives while away from home ( NationalCar ).

- 61% of travel managers have a system in place to measure their traveler’s satisfaction ( ACTE ).

- 22% of business travelers would like travel suppliers to remember their personal details for the future ( Accenture ).

- 67% of travelers would like travel companies to make recommendations based on their previous preferences ( Accenture ).

- Over 50% of travelers would appreciate real-time notifications and for airlines to rebook their flights automatically ( International Air Transport Association ).

- Post lockdown, the most significant factor for 70% of business travelers when booking airfares is flexibility. Other key variants are onboard sanitation (63%), flying direct (61%), and hygiene protocols between flights ( Skift Research & McKinsey ).

What business travelers are concerned about

- Flight delays are the leading concern among U.S. business travelers. The second concern is the dreaded middle seat ( Statista ).

- European corporate travelers rank the most tiring aspects of business travel like so: 27% say waiting time is the most tiring while 25% choose no direct flights, 22% say riding to and from the airport, 16% say early departure times or late arrivals and 10% say the flight itself ( Fly Aeolus ).

- What is the number one way to improve the traveler experience? 35% of European corporate travelers report that having to spend less time at the airport is the number one thing they wish they could improve. 23% would like to spend less time on the way to the airport. 26% want better availability of direct flights and the remaining 16% want greater flexibility with their schedule (Fly Aeolus).

?)

Millennial business travel statistics

Millennials are the most frequent business travelers.

- Millennials take an average of 7.4 trips per year ( Skift ).

- Baby boomers take an average of 6.3 trips per year (Skift).

- 75% of millennial business travelers think that traveling for work is a perk ( Hilton Hotels & Reports Survey ).

- 65% of millennial business travelers see it as a status symbol ( Hilton Hotels & Reports Survey ).

- 34% of surveyed employees revealed they have their most innovative ideas while traveling for work. When analyzing the data from 16-24-year-old respondents, this number jumps to 53% ( TravelPerk ).

Most millennials are happy with their ability to self-book...but are they using company approved sites?

- 72% of millennial business travelers are satisfied with their ability to book business travel on a third-party site ( Statista ).

- Hotel bookings are extremely fractured. 28% of millennial business travelers book hotels directly on a hotel’s website. 10% book hotels through an OTA like Expedia. 7% book with a third-party reseller like Kayak. 14% book with a travel agent ( Skift ).

Millennials value free time and leisure time during business travel

- 43% of millennials have extended their business travel trip for leisure ( Statista ).

- 78% of millennials have purposefully carved out personal time during a business trip ( Forbes ).

- 57% of companies have a policy in place for employees who wish to extend their business trip with vacation time ( Forbes ).

- Millennial men are twice as likely to believe they should avoid having fun on a business trip, 41% versus 20% ( NationalCar ).

Business versus leisure travel statistics

Bleisure is climbing.

- Bleisure trips grew 20% from 2016 to 2017 ( Forbes ).

- More than 40% of business trips are extended for leisure purposes ( Expedia ).

- Bleisure travelers are typically frequent business travelers: 32% of bleisure travelers travel for work once or twice per month (Expedia) .

- Business trips for conferences or conventions are the most likely to become bleisure trips. 43% of trips for these types of events will turn into bleisure trips, while 24% of trips for team offsite meetings and 9% of sales trips will be a bleisure trip (Expedia) .

- 84% of bleisure trips that are less than three days take place in one city, while 20% of bleisure trips that are longer than three days take place in more than one city (Expedia) .

- Why do business trips turn into bleisure trips? 66% percent of bleisure travelers say it's because they like the destination and want to explore it. 51% said they turn business trips into bleisure trips based on the proximity to the weekend (Expedia) .

?)

The proportion of business travel spend versus leisure travel spend continues to grow

- Each year, the proportion of business travel spend grows by about .05%. In 2017, the most recent available year, business travel accounted for 30% of all travel spend in the U.S. ( Statista ).

- While business travelers typically make up just 12% of all flyers, they are twice as profitable to airlines because they are loyal and use frequent flier programs, buy amenities like extra legroom, and also book more flights with less notice ( Investopedia ).

First-class travel isn’t affected by the purpose of the trip

- Each year 19% of U.S. travelers will board a first-class flight for leisure. Meanwhile, 20% of US travelers will fly first class for a business trip in the span of one year ( Statista and Statista )

Rogue bookings

Do business travelers comply.

- 60% of companies have a corporate travel policy in place, and 50% of companies allow travelers to book using any method they choose ( Lodging ).

- Hotels are most frequently booked outside of the approved channel. 46% of business travelers have booked hotels on consumer sites because they found a better price (Lodging) .

- 52% of employees feel their organization’s corporate travel policy moderately aligns with the company’s wider culture ( Medium, 2017 ).

- Only 69% of business travelers feel they can comply with their organization’s corporate travel policies ( Lola.com , 2019 ).

- Using a travel management tool can help improve compliance with corporate travel policies. An advanced booking solution can assist organizations in raising their compliance to 100% through powerful automation systems.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

?)

Business Travel and Wellness Survey Results

?)

60+ online travel booking statistics & trends

?)

20 Employee retention statistics that might surprise you

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

- SOFTWARE CATEGORIES

- FOR REMOTE WORK

- Research Center

105 Critical Business Travel Statistics: 2024 Spending & Concerns Analysis

Technology may have opened up new ways for individuals to connect, especially in the wake of the COVID-19 pandemic where face-to-face communication can become a health risk. This is why business travel remains important for modern companies. If you want to make the most out of your corporate trips, being knowledgeable about the ins and outs of the industry is important. This is where checking business travel statistics becomes necessary.

In this article, we will be discussing everything from the market size of the business travel industry to the use of budgeting software for corporate travel. Furthermore, we have provided some data on emerging business travel technologies. This way, it would be easier to understand how to manage your company trips better as well as prepare yourself for the shifting demands of the industry.

Business Travel Statistics Table of Contents

- General Business Travel Statistics

- Business Travel Spending Statistics

- Statistics on Business Travel Benefits

- Business Travel Experience Statistics

- Bleisure Statistics

- Statistics on the Modern Business Traveler

- Business Travel Policy Statistics

- Statistics on Business Travel Concerns

- Business Travel Tech Usage Statistics

- Impact of COVID-19 on Business Travel

1. General Business Travel Statistics

Corporate trips may have become more and more prevalent over the years, thanks to the increasingly globalized business landscape. So much so that millions of business travel initiatives are launched each year. However, with the current pandemic, business travel has come to a halt and it is not expected to recover until 2027.

- There are 445 million business trips every year. (Certify, n. d.)

- Business travelers make up 12% of an airline’s passengers, but they represent 75% of the profit. (Investopedia, 2020)

- The global market for business travel is projected to decline by 4.5% in 2021. (ReportLinker, 2020)

- It won’t be until 2027 that the global market for business travel is expected to recover, at which point it is expected to reach US$829.5 billion. (ReportLinker, 2020)

- The global market for business travel is expected to post a CAGR of 3% from 2020 to 2027. (ReportLinker, 2020)

Breakdown of Corporate Travel Across the Globe

Companies across the globe understand how important it is to invest in corporate travel. With companies spending an average of $799 per person per day, the business travel market has surely enjoyed the growth in revenue in the past years. Unfortunately, however, when the pandemic hit, many countries experienced huge losses in business travel spending.

- China lost $404 billion in business travel spend losses due to the COVID-19 pandemic, the biggest amount among member countries of the Global Business Travel Association (GBTA). (GBTA, 2020)

- The second most affected region was Europe, which amassed $190.5 billion in business travel spend losses due to the COVID-19 pandemic. The third most affected region was Asia-Pacific, excluding China, Hong Kong, and Taiwan, with losses amounting to $120.2 billion. (GBTA, 2020)

- The most expensive business travel location in Asia is Hong Kong, with an average cost of $515 per day. (ECA International, 2019)

Business Trips in the US

American companies are one of the top spenders when it comes to business travel. Simply put, many US companies spend to send their employees on domestic and international trips for business purposes. However, much like the rest of the globe, they are also expected to decrease the number of international business trips in the coming years.

- In a survey, 45% of respondents said that their company canceled most international business trips to the U.S. as a result of the pandemic. (GBTA Coronavirus Poll/Statista, 2020)

- U.S. airlines reported a 90% reduction in business travel in Q2 2020. (Spendesk, 2019)

- The reduction in travel spending resulted in a loss of $162 billion for the U.S. economy in 2020. (U.S. Travel Association, 2020)

2. Business Travel Spending Statistics

It’s no secret that corporate travel is expensive. As you’ll see in the data below, companies spend millions of dollars per year on sending their employees on business trips. To ensure steady business travel funding, you should plan and create a budget for it ahead of time, taking into consideration not only accommodation and airfare but also looking into vaccination expenses for employees. This way, they may avoid the risk of contracting coronavirus while they’re traveling. Moreover, you should keep all travel costs in check. For this, you might find that using tools for budgeting can be useful for your company.

- Global business travel decreased by more than half in 2020 to $694 billion. (PhocusWire, 2021)

- Corporate travel spending is expected to lose $820 billion as a result of the pandemic. (CNBC, 2020)

- As of September 2020, China’s number of domestic passengers reached Corporate travel spending 98% of 2019 levels. (Skift, 2020)

- The average daily cost of business travel in the US is $325 per day. (Small Biz Genius, 2021)

- Businesses spend roughly $1,425 for every employee they send on a business trip. (Fyle, 2020)

- Companies spend $111.7 billion on business travel every year. This is an average of $1,286 per work trip. (Travel Pulse, 2020)

- Businesses spend $31.6 billion on international travel. This is an average of $2,600 per person. (Certify)

- The average business travel budget consists of money for lodging (34%), airfare (27%), meals (20%), and car rentals (19%). (Travel Pulse, 2020)

Air Travel Expenditures

If your company is affiliated with businesses located halfway across the globe or on the other side of the country, then spending on air travel is inevitable. So, you should prepare a good chunk of your budget for airfares, especially considering flight tickets and miscellaneous spending at airports are increasingly expensive. You might also want to time your booking so you can get tickets at lower rates.

- The average domestic airfare in the US is $392. (Business Insider, 2019)

- The average cost of coach airfare for international flights is $1216. (Certify)

- Domestic flights in the U.S. are 41% lower on average because of the COVID-19 pandemic. (CNBC, 2020)

- Booking flights 169 to 319 days in advance allows you to fly at the time you prefer and get the seats that you want. (CheapAir, 2018)

- The prime booking window is 21 to 121 days in advance of your preferred flight. The fares are the lowest during this time. (CheapAir, 2018)

- The most costly airports based on lunch, taxi, executive lounge, and parking expenses are London Stansted (£608.29), Amsterdam (£567.35), and London Gatwick (£520.53). (FairFX Blog, 2018)

- The airports that give business travelers the most value for their money based on lunch, taxi, executive lounge, and parking expenses are Barcelona (£236.36), Belfast International (£228.28), and Beijing (£170,03). (FairFX Blog, 2018)

- 70% of corporate travelers said that their most important consideration in booking airline tickets after COVID-19 is flexibility in cancellation and changing ticket conditions. This is followed by special measures to ensure onboard hygiene (63%), availability of direct flights (61%), and sanitation levels of aircraft between flights. (Skift Research & McKinsey, 2020)

Road Transportation Costs

More often than not, business travelers still need to go from one place to another upon reaching their destinations. So, it makes sense for them to spend on road transportation. For domestic trips just outside of the city, this might involve gas money for their personal vehicles. In case they have to go farther away, they will need to allocate a budget for car rental. There might also be those who opt to use ride-sharing applications during the trip, although this may not be as popular an option amid the pandemic.

- Three-fourths of business trips are less than 250 miles from the point of their departure. (U.S. Bureau of Transportation Statistics, 2017)

- Personal cars are often utilized for 81% of business trips. (U.S. Bureau of Transportation Statistics, 2017)

- New demand for road trip travel has led car rental rates in the U.S. to decrease by approximately 15% in 2020. (CheapCarRental, 2020)

- 65% of users stopped using ridesharing services in the U.S. due to the COVID-19 outbreak. (Statista, 2020)

Accommodation and Other Expenses

Business travelers require accommodations that are affordable, secure, and trustworthy. What’s more, staying at a place where they have access to conveniences such as workstations and free WiFi can ensure their productivity while on the go. Plus, with the current pandemic, it is also important to consider what hygiene protocols your intended accommodation implements to ensure the safety of your employees. This is why many companies are willing to spend more on hotel rooms and Airbnb accommodations.

- 40% of hotel guests are business travelers. (American Hotel & Lodging Corporation, 2015)

- In 2020, the average hotel room price dropped significantly by 32% to $186 per night compared to $274 per night in 2019. (NerdWallet, 2020)

- Tech companies prefer Airbnb accommodations. In fact, their bookings have doubled from 2017 to 2018. (TravelPerk)

- In 2018, more than 700,000 businesses utilized Airbnb for Work for their corporate trips. (PhocusWire, 2018)

- For the fiscal year 2020, the IRS has set the per-diem business travel rates for meals and incidental expenses at $71. (Maxwell, Locke & Ritter, 2020)

- When it comes to accommodations, business travelers pay attention to quality (44%), trustworthiness (38%), convenience (40%), quietness (30%), affordability (28%), and coziness (28%). (CWT Research, 2019)

How do businesses spend on travel?

A breakdown of the average corporate trip budget.

Car rentals

Source: Travel Pulse

Top Budgeting Software

- Freshbooks. This budgeting and accounting software is popular among businesses of all sizes. Learn more about its features like expense tracking, automatic vendor profile creation, sales tax, project overviews, and many more here in our Freshbooks review .

- Sage 50cloud. As a top accounting and budgeting platform, it sports important features such as billing, invoicing, contact management, budgeting, and even forecasting tools. Read about how users leverage this top platform for their business here in our Sage 50cloud review .

- Quickbooks Enterprise. This comprehensive accounting platform is equipped with inventory management, advanced reporting, and FSM to help you budget for projects, operations, or new investments. Learn more about this product in this Quickbooks Enterprise review .

- Xero. This is a popular accounting app designed for freelancers and small businesses. See how its easy-to-use interface is packed with comprehensive and robust features here in our Xero review .

- FreeAgent. This powerful online budgeting and accounting tool sports tax management, invoice management, expense management, and payment gateway integrations. See why freelancers and small businesses love this platform here in our FreeAgent review .

3. Statistics on Business Travel Benefits

Many companies may think that business travel is passé or that it is a waste of money. However, statistics show that this is most certainly not the case. Corporate trips actually allow businesses to foster stronger and more close-knit relationships with potential clients and partners. Thus, they yield a good ROI for their business travel initiatives and even grow their company at a faster pace. In addition, even amid a pandemic, many professionals cite business travel as a job perk.

- 90.6% of corporate travel managers believe that business travel is crucial to company growth. (Skift + TripActions Business Travel Survey, 2019)

- On the other hand, 91.3% of business travelers said that business travel is crucial to company growth. (Skift + TripActions Business Travel Survey, 2019)

- Companies get a $2.90 increase in profit and a $9.50 increase in revenue for every dollar spent on corporate travel. (Certify)

- 79% of employees say that business travel experience has an impact on their overall job satisfaction. (Global Business Travel Association, 2017)

- 83% of employees say that business travel is a job perk. (Stratos Jet Charters, Inc., 2020)

4. Business Travel Experience Statistics

Corporate travelers are consumers. So, in a similar light as your typical shopper, they expect personalized experiences when it comes to traveling. In fact, they are more than willing to provide their preferences and personal information if it means travel agencies and airline companies will provide them with better products and services. In addition to these, modern business travelers also don’t mind paying extra out of their pocket for upgrades on accommodations and transportation.

- Nine in 10 corporate travelers will share their travel preferences for a customized experience. (CWT Research, 2019)

- 65% of travelers are willing to provide additional personal information to accelerate processing at the airport. (International Air Transport Association, 2018)

- 22% of frequent travelers want travel companies to remember their personal data. (Accenture, 2017)

- 67% of modern travelers expect brands to help them make good travel decisions based on previous travel information. (Accenture, 2017)

- 55% of business travelers are willing to pay out of their own pocket to get upgrades for accommodations, car rentals, and airline seats. (AeroLatinNews, 2018)

Improving the Experience of Corporate Travelers

Business travel may not be as prevalent now. But this pause makes it the perfect time to ask, how can you improve the overall business travel experience? Now that we know corporate travel anchors on personalization and convenience, it is important to utilize the available technologies to enhance the travel management process.

Moreover, travel managers should actively measure the satisfaction of business travelers to determine any other points for improvement. To do this, you might want to consider utilizing best-in-class business intelligence platforms or top-rated data analytics software .

- Travelers say that their experience can be improved using real-time and accurate travel notifications (55%) and automatic flight rebooking (53%). (International Air Transport Association, 2019)

- A business travel report revealed that 79% of business travel managers say that partnering with travel management companies can lead to more efficient processes and higher savings. (Egencia, 2018)

- 80% of corporate travel managers say that having a system of measurement can benefit corporate travel initiatives. (ACTE, 2018)

- 98% of corporate travel managers say that the most important metrics to measure are traveler satisfaction, policy compliance, and savings and expenditures. These are followed by booking statistics (96%) and traveler engagement (90%). (ACTE, 2018)

Points for Improvement for Airlines, According to Passengers

5. bleisure statistics.

“Work hard, play hard” is the mantra of modern businessmen and corporate employees. So, before 2020, it was not surprising that employees have made it a point to extend their trip for leisure or, at the very least, allocate time for fun activities during a trip. While this may not be a possibility with the ongoing pandemic, it is certainly a trend that companies should anticipate as travel restrictions and quarantine protocols relax. After all, it will allow your company to reinforce work-life balance for employees.

One thing to note about bleisure, however, is that this may also pose problems for companies when it comes to accountability and productivity. After all, administrators don’t know how their business travelers will spend their time during a trip. In case you feel like this might be an issue for you, you can always opt to use time tracking software solutions. Using these, business travelers may log their productive hours even while away from the office.

- Bleisure trips have increased by 20% between 2016 and 2017. (Forbes, 2018)

- Business travelers enjoy exploring new places and cultures (41%) more than meeting with clients and teams (17%). (Medium, 2017)

- 80% of corporate travelers make sure to squeeze in fun activities while on a business trip. (National Car Rental, 2018)

- Almost half of the corporate trips (40%) are extended for leisure. (Expedia Group, 2016)

Employee Expectations on Bleisure

Nowadays, business travelers are not shy about taking some time off while on a trip. After all, they deserve to have a bit of fun after working long hours out of the office. This is why they expect companies to cover bleisure in their travel policies.

- 82% of travelers expect support from their superiors when taking a break on business trips. (National Car Rental, 2018)

- Employees want their companies to consider bleisure for their travel policy. This means including a budget for extracurriculars (74%) and giving them the option to bring a guest on the trip (38%). Moreover, they want to be provided with the flexibility to extend their trips for leisure (34%) and given a budget for exercise and similar lifestyle activities during the trip (24%). (National Car Rental, 2018)

- 37% said that leisure activities should have an equal length as business activities during a corporate trip. (Expedia Group Media Solutions, 2016)

6. Statistics on the Modern Business Traveler

So, who is the modern corporate traveler? Statistics show that these travelers are mostly college-educated males who are older than 45 years old. They go on trips to attend conferences, build business partnerships, develop their careers, and find investors. Moreover, a handful of them spends a good fraction of their year traveling for business purposes.

- Two-thirds of corporate travelers have a bachelor’s degree. Moreover, they have an average household income of $82,000. (PhocusWire, 2017)

- 60% of business travelers are male. Meanwhile, 50% are older than 45 years old. (PhocusWire, 2017)

- Employees go on business trips to attend conferences (62%), to meet with other companies for business planning (56%), for professional development (44%), to meet with coworkers in a different location (40%), and to pitch new products (30%). (Skift, 2016)

- The top 10% of business travelers spend an average of 88 nights away from their homes per year. (Corporate Traveler, 2017)

- 50% of business travelers from Europe go on trips alone. (Fly Aeolus, 2017)

The Millennial Business Traveler

Millennials are poised to comprise the majority of the workforce in the coming years. So, it only makes sense that we tackle how millennial employees view business travel and how they travel for business.

In the statistics we’ve culled, millennials see being sent on corporate trips as a job perk than an inconvenience. So much so that they even create reasons to travel for business. In fact, as of 2016, this generation has become the most active business travelers.

Another thing that sets them apart from previous generations is that while they prioritize cost-efficiency by avoiding expensive hotels and flights, they have a penchant for bleisure. This means they make it a point to balance each trip for both business and leisure.

- 65% of business travelers who are millennials view corporate trips as a status symbol. (Forbes, 2018)

- 56% of millennials create reasons to go on business trips. Moreover, 69% of them want to extend their trip for leisure. (Forbes, 2018)

- Millennials go on 7.4 trips every year. (Skift, 2016)

- Millennial business travelers in the tech industry prioritize cost-efficiency by opting for non-chain hotels. Also, 85% of them booked budget flights instead of choosing business class seats. (TravelPerk)

- 78% of Millennials intentionally make time for leisure on business trips. (Business Wire, 2016)

Why Do Employees Go On Business Trips?

To attend conferences

To meet with other companies for business planning

For professional development

To meet with coworkers in a different location

To pitch new products

Source: Skift

7. Business Travel Policy Statistics

Business travelers represent your company. So, how they travel must be in line with your business values. This is why it is pertinent to have a corporate travel policy.

With this, you can set standards as to where they should stay, which airlines to pick, what car rentals to choose. It also allows you to set rules around what gifts may be purchased during the trip. In addition, travel policies can serve as a guideline for on-site spending.

However, not every company and business traveler realizes the value of a travel policy. So, many opt not to create one.

If you don’t have one, you might want to find a good travel management software to do it. As an alternative, you may also utilize reliable business process management solutions .

- A business travel market report revealed that 40% of businesses still don’t have a travel policy. (Egencia, 2018)

- 60% of corporate travelers say they don’t understand the need for a company travel policy. (TravelPerk, 2019)

- Companies allow more than half of business travelers to book their trips however they prefer. (Egencia, 2018)

- The factors that have a negative impact on business travel are the lack of formal processes and outdated booking systems. (Medium, 2017)

Corporate Travel Management Problems

Of course, simply having a travel policy is not a surefire way to maximize corporate trips. Its positive effect on your business travel processes depends on how you implement it. As you’ll see in the business travel statistics below, companies with travel policies encounter their fair share of problems.

Many of them have travel policies that are not in line with their company culture. Furthermore, not all of them can manage their policies effectively. Lastly, they have many employees who choose not to comply with the policy they have in place.

- 27% of business travelers say that their company’s travel policy is ill-managed. (Medium, 2017)

- 52% of employees say that their company’s travel policy only moderately aligns with their company culture. (Medium, 2017)

- 69% of business travelers comply with corporate travel policies. (Lola.com, 2019)

- Business travelers often book accommodations out-of-policy because they are not close enough to the destination (37%) or because they found a better hotel within their per diem (37%). (Egencia, 2018)

8. Statistics on Business Travel Concerns

While there may be quite a lot of tools that you can use to optimize the business travel experience, the industry still has a long way to go. What’s more, with the pandemic, corporate travelers today are poised to encounter more obstacles and concerns that may impede them from being the most efficient they can be. For example, many of them still need to deal with delayed flights, long waiting times at the airport, as well as the hassle of lengthy security and safety processes.

- The most common issues that business travelers face are flight delays (65.7%), flight cancellations (31.9%), and paying for travel expenses with a personal credit card (30.5%). These were followed by their company’s tool not having the best booking rates (29.3%) and lack of support in resolving issues while traveling (23%). (Skift + TripActions Business Travel Survey, 2020)

- The most tiring aspects of business travel are the waiting time (27%) and having no direct flights (25%). In addition, travelers feel that the ride to and from the airport (22%), early or late departures/arrivals (16%), and the flight itself (10%) are also exhausting. (Fly Aeolous, 2017)

- The longest waiting times for security screening at US Airports in 2019 are Newark Liberty International, NJ (23.1 minutes), George Bush International, TX (19.8 minutes), Miami International, FL (19.6 minutes), and Baltimore-Washington International (18.2 minutes). (Statista, 2019)

Source: Statista

9. Business Travel Tech Usage Statistics

Corporate travelers are a tech-savvy bunch. They rely heavily on the internet and their smartphones to manage their trips. Moreover, they have quite a knack for learning new technology. As a result, they have high expectations for their companies, travel agencies, airline companies, and similar firms when it comes to innovation.

For example, they want to have access to all-in-one applications that will help them consolidate and accelerate the travel planning process. In addition, they are looking forward to having voice-activated assistants for travel queries. As you’ll see below, these are only a few of the many things that they are expecting from the industry.

- 51% of passengers around the world used a smartphone or other device to check in online. (IATA, 2019)

- 27% of global passengers use an airline app to make last-minute purchases such as an additional bag, upgrade, or lounge access. (IATA, 2019)

- The majority of modern travelers (57%) want to have a single application to manage their planning and booking needs. (Booking.com, 2018)

- 57% of travelers want to have a mobile app that will let them track their luggage in real-time. (Booking.com, 2018)

- 31% of travelers say they like the idea of using voice-activated assistants for their travel queries. (Booking.com, 2018)

FinTech Options for Business Travel

Traveling involves quite a lot of expenditures. Therefore, corporate travelers make a large number of transactions that need to be accounted for after each trip. However, manually tracking spending during a trip can be tedious and prone to errors.

As a result, many travelers are now relying on financial technology, such as expense management software and cashless transactions. These allow them to record their expenditures as they go and make sure that they remain within budget. With these, it is easier for companies to maximize their travel budget down to the last penny.

- It takes an average of 40 hours per month for business travelers to reconcile their expenses and payment data. (Egencia, 2018)

- 66.5% of companies use an online expense reporting platform with a mobile solution. (Business Travel News, 2020)

- In light of the pandemic, 55.7% of corporate travel managers say that contactless payments have become a higher priority for their travel program. (Business Travel News, 2020)

- 51% of corporate travelers believe that all business trip payments will be made via mobile devices in a few years. (Business Travel News Europe, 2017)

The Decline of Ride-Hailing Apps

Ride-sharing apps are undoubtedly cheaper and more convenient alternatives than car rental and chauffeur services. However, with the current pandemic, it seems less and less business travelers are willing to leverage them due to the risk of contracting the virus.

- Ride-hailing companies make up 70.5% of all ground transportation receipts for business trips. (USA Today, 2018)

- Usage of ride-sharing apps like Uber and Lyft dropped between 70% to 80% due to travel reductions brought about by the pandemic. (Forbes, 2020)

- 39% of U.S. consumers who previously used ride-sharing plan to lessen their use of these services. (CarGurus, 2020)

- However, the total number of ride-sharing services are expected to reach 71.3 million users in 2021. (eMarketer, 2020)

Augmented Reality and Virtual Reality Tech

Business travelers, while often trained to deal with unforeseen circumstances, want to come prepared. That is to say; they like visualizing how their travel plans are going to pan out well before the actual trip. To do this, they must familiarize themselves with their destination.

This is where augmented reality (AR) and virtual reality (VR) comes in. These technologies will allow them to get the lay of the land. So, it is easier to map out their itineraries and manage expectations for the trip. For more information about this tech, be sure to check out our list of VR statistics for 2019 .

- Business travel data reveals that 1 in 5 travelers want to use AR so that it is easy to check out their destination before a trip. (Booking.com, 2018)

- 81% of business travelers expect hotels to use virtual, reception-free check-in processes in the future. Meanwhile, 79% predict that using VR tech for accommodations will become the norm in the next 10 years. (Business Travel News Europe, 2017)

Artificial Intelligence

In a similar vein as practically every other industry, business travel is also being reshaped by artificial intelligence (AI). Many travel companies, managers, and corporate travelers rely on this tech to make their trips much more efficient. As you’ll see below, they find this very useful when it comes to monitoring employees as well as finding travel suggestions for planning.

- The majority of corporate travel managers (82%) say that the use of AI for business travel is “very useful” or somewhat useful.” (Skift, 2018)

- 55% of business travelers say they will allow employers to use GPS tracking to monitor their location during out-of-town trips. (Travelport, 2018)

- 41% expect travel brands to use AI to provide them with significant travel suggestions. (Booking.com, 2018)

If you are looking for emerging trends in AI usage, we also have this list of AI statistics that you might find handy.

10. Impact of COVID-19 on Business Travel

With lockdowns and travel restrictions, COVID-19 has turned the business travel sector upside-down. Even as vaccination programs offer a glimmer of hope that business will resume soon, companies still worry about their liabilities for employees who travel without getting vaccinated.

- At the outset of the pandemic, 98% of member countries of the Global Business Travel Association canceled international business tours, while 92% canceled all or most of their business trips. (GlobeNewswire, 2020)

- International business travel experienced a sharp decline of -70% in 2020. (U.S. Travel Association, 2021)

- In a survey, 24% of respondents said that their company is considering returning to domestic travel in one to three months. (Global Business Travel Association, 2020)

- On the other hand, only 6% of respondents said that their company is considering returning to international business travel in one to three months. (Global Business Travel Association, 2020)

- 57% of business travelers are considering taking a trip in the next six months. However, corporate travel and meeting planners are concerned with their liability if employees travel without being vaccinated. (MMGY Global, 2020)

- Only 6% of people miss traveling for business, compared to 48% who miss travel to spend time with loved ones. (Airbnb, 2021)

- Moreover, as of December 2020, 21% of travel managers report that they are not willing to travel for work. (Global Business Travel Association, 2020)

- When the pandemic is over, 36% of people expect to travel less for work compared to pre-COVID conditions. (Airbnb, 2021)

Source: GBTA 2020

What Do These Business Travel Facts Mean for Your Company?