Everything you need to know about cancel for any reason trip protection

In January 2020, my husband and I decided to splurge and book a suite aboard a Celebrity Cruises springtime voyage on the line's Apex ship . The cruise fare wasn't insignificant, so we bought travel insurance — as we usually do for any big trip. We printed out policies from five different companies and carefully reviewed the differences.

We thought about all the things that could go wrong that might stop us from going on this cruise — the death of an elderly relative, a work conflict or a broken leg. At the time, "pandemic" did not make our shortlist. We ultimately purchased a trip insurance package without the pricey "cancel for any reason" add-on (sometimes called CFAR). We thought we'd be just fine.

Of course, the sudden emergence of COVID-19 changed things and, boy, do we wish we'd sprung for the additional CFAR protection.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs — including cancel-for-any reason coverage.

More destinations are reopened to American travelers, and people are booking trips once again. But the coronavirus pandemic isn't over, and there is still some uncertainty about what the rest of this year and 2022 holds. Cancel-for-any-reason trip protection can save you hundreds or even thousands of dollars in a time when flexibility is paramount when booking travel.

If you're not sure what cancel-for-any-reason travel protection is and when you should purchase it, here's everything you need to know.

Visit TPG's coronavirus hub for the latest news and advice.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

What you need to know about travel insurance

Cancel for any reason, also known as CFAR, is a time-sensitive, optional benefit that can be added to some comprehensive travel insurance policies for qualifying travelers. Before we delve into the details, it's useful to understand trip insurance in general. Here are some resources that explain everything you need to know about travel insurance and its benefits, from trip cancellation and interruption coverage to emergency medical to baggage delay. And, we've included some resources that specifically talk about coronavirus as it relates to insurance policies:

- The best travel insurance policies and providers

- When to buy travel insurance versus when to rely on credit card protections

- Will independent travel insurance cover coronavirus? Here's what you should know

- Best credit cards with travel insurance

- What you should know about the trip cancellation and interruption protection offered by select credit cards

- Be careful: Avoiding outbreaks isn't covered by most travel insurance

What is cancel-for-any-reason protection?

While travel insurance policies can offer a range of inclusions (think: medical evacuation, trip cancellation due to foreign or domestic terrorism or damage to your rental car), not every eventuality is included in all insurance policies. For example, some trip insurance plans may offer coverage in the event of employment layoffs, while others do not. Some policies may have robust emergency medical coverage, while competitors don't. That's why it's so important for you to select a plan that meets your specific needs for each trip.

A commonality among insurance policies is their long list of exclusions. For example, my homeowners' insurance clearly states I'm not covered for damage caused by an alien invasion. Yes. Seriously.

When it comes to travel insurance, it's common to see these sorts of incidents excluded from coverage: normal pregnancy, the illness of a pet, suicide (yours or a traveling companion) or any self-inflicted injury, psychological disorders, mountain climbing, bungee-jumping, skydiving, declared (or undeclared) war as well as epidemics and pandemics.

So, under normal circumstances, a travel insurance policy would likely not cover a trip you cancel because you're worried about contracting coronavirus .

That's where a cancel-for-any-reason policy comes into play. This is a time-sensitive add-on you can purchase from some providers when buying specific comprehensive travel insurance plans — as long as you meet certain eligibility requirements. By paying extra for this coverage, you can cancel for any reason under the sun as long as you follow the policies' purchase and cancel stipulations.

When am I eligible to add CFAR protection?

In general, you're only eligible to add CFAR protection to a comprehensive travel insurance policy at the time of purchase — you typically can't purchase the policy and then decide (at a later date) to commit to the CFAR add on. In addition, you'll need to commit to the policy and CFAR protection fairly soon after making your initial trip payment. According to InsureMyTrip.com , typically "a policy must be purchased within 10-21 days of making the initial trip payment to be eligible for CFAR benefits."

Many providers will also require you to insure the entire value of your trip, and additional requirements may apply. As always, it's critical to read through all of the terms before committing to purchasing any travel insurance policy — including CFAR coverage.

How much does cancel-for-any-reason coverage cost?

CFAR coverage is sounding pretty good as a way to hedge bets against the continued uncertainty of the coronavirus pandemic. But, how much are you going to have to dig into your wallet to pay for it? The fee for this add-on is typically calculated as a percentage of the price of the standard insurance policy you select.

Standard comprehensive plans can cost about 4-10% of the total cost of the insured trip, and CFAR can be an additional 40-60% on top of the standard plan (not the cost of the trip).

Consider the following illustrative example for a $5,000 trip with two 50-year-old travelers to Aruba:

- A standard, comprehensive plan might cost around $250 — which is 5% of the total trip cost.

- A comprehensive plan with the CFAR upgrade included might cost around $375 — which is the price of the standard plan ($250) plus an additional 50% ($125).

However, please note that all plan costs can differ based on individual quote details.

Will you get all your money back if you purchase CFAR coverage?

No. Generally speaking, CFAR can reimburse up to 75% of your total insured, prepaid, nonrefundable trip cost. In addition, CFAR typically requires you to cancel your trip no less than two days prior to departure to be eligible for reimbursement.

Check the insurance policy terms carefully to find out how much your refund would be if you invoked the CFAR terms and canceled your insured trip — and be sure to know the deadline for doing so.

Should you buy CFAR coverage?

Whether to travel and what level of insurance to purchase — or not — is always a personal decision. But, TPG has consistently received a lot of reader questions over the past year about what they should do if they have a trip booked or were about to book a trip and now don't know what to do because of the uncertainty of the coronavirus.

"One of the top questions travelers ask is about when to splurge for the CFAR upgrade," says Meghan Walch, a travel insurance expert for InsureMyTrip . "It's important to note that a standard comprehensive policy does not cover fear of travel. That's why we strongly recommend all travelers consider CFAR, if eligible. There is so much uncertainty with the pandemic, travelers are leaning towards maximum flexibility to cancel their trip to receive a percentage of their trip cost back."

If your total trip cost is low, you may decide to forego insurance — or the additional CFAR coverage — and self-insure (i.e., eat the nonrefundable trip costs if you cancel). But, if your vacation is expensive, the additional fee for CFAR may feel like a bargain instead of potentially losing thousands of dollars if you have to cancel nonrefundable reservations.

A few more words of advice

Coronavirus is adding a layer of complexity to decisions travelers must make about going on planned trips and booking future vacations. Here are a few specific scenarios to consider:

What to do if you're about to book a trip but are hesitant because of coronavirus

If you're afraid to commit a large amount of money to a future trip, purchasing a comprehensive travel insurance policy and adding the cancel-for-any-reason coverage option might be the best bet.

"Cancel-for-any-reason is the only way to protect the majority of your trip cost if you would like the flexibility to cancel your trip due to fear of the coronavirus pandemic and variants that are currently spiking," says Walch.

This could also be a great option for immunocompromised travelers. Even a doctor attesting to your inability to travel may not be enough to qualify for reimbursement under a standard, comprehensive plan — but CFAR coverage could help recoup some of your forfeited costs.

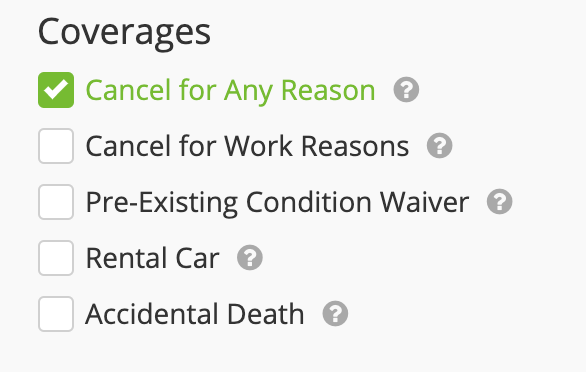

If you're shopping for CFAR, you can use a site like InsureMyTrip.com , and then check the applicable box under the search results:

Doing so will only return policy results that include that type of coverage.

What to do if you booked a trip and have insurance — but your policy doesn't include CFAR clause

If you purchased a comprehensive travel insurance plan for an upcoming trip but didn't add CFAR coverage, just be aware that your options for coronavirus-related cancellations are more limited. While CFAR is the only cancellation option to cover fear of travel due to the coronavirus pandemic, some comprehensive policies still offer coverage for other COVID-19-related concerns. This may include:

- Coverage for common concerns like cancellation due to diagnosed illness before traveling

- Emergency medical care from a doctor or hospital if you become ill while traveling

- Accommodation coverage if quarantined at your destination

Always be sure to review your policy carefully to understand the exclusions — but note that, without CFAR coverage, canceling a trip simply because you're afraid of contracting COVID-19 will likely not result in a successful claim under standard, comprehensive travel insurance plans.

What to do if you booked a trip and have no travel insurance

First, look at when you actually booked the trip. If it was within the last three weeks, you may still be eligible for a comprehensive travel insurance plan with the cancel-for-any-reason add-on. And if not, there may still be more limited policies that provide some coronavirus-related protection — including emergency medical evacuation.

In short, it's critical to begin investigating your travel insurance options as soon as you book (and make an initial payment on) a trip, as this will maximize the number of applicable plans. This is particularly important when it comes to time-sensitive benefits — like CFAR protection.

To explore these options, you can enter your trip details to compare available plans on a site like InsureMyTrip.com .

Bottom line

Having the peace of mind of travel insurance is more important than ever as countries reopen to vaccinated U.S. citizens and people start booking trips once again. With the delta variant now the dominant strain in the U.S., there is still uncertainty ahead for travelers hoping to take trips this year and into next.

In the past, you may have shrugged at the idea of trip insurance, especially the more expensive policies that offer a CFAR add-on. If you don't want the coronavirus pandemic to derail your travel plans but want to be covered if an expensive trip must be postponed or canceled, CFAR may be a great option to consider.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance That Includes Cancel For Any Reason Coverage

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

So you’re organizing a trip and you’re interested in purchasing travel insurance. That makes sense — making plans these days can be pretty stressful. This is one reason that Cancel For Any Reason (CFAR) insurance is so popular.

As the name implies, CFAR allows you to cancel your plans without specifying a covered reason.

We looked at the top Cancel For Any Reason travel insurance companies, comparing their coverage and pricing to find out which was the best. Here’s our shortlist of best options:

Battleface .

USI Affinity Travel Insurance Services .

Seven Corners .

John Hancock .

Travel Insured International .

Factors we considered when picking best Cancel For Any Reason insurance companies

We used these factors when choosing best companies for Cancel For Any Reason insurance:

Types of coverage. Including CFAR, trip delay , baggage loss and emergency medical .

Amount of coverage. Including reimbursements for claims.

Total cost. We checked out the price for each plan compared to what you’ll receive.

Usability . What’s the point in purchasing an insurance plan if you cannot use it? We considered user-friendly websites.

Customizability. We scoured what add-ons were available, such as rental car insurance or sports equipment loss.

An overview of the best Cancel For Any Reason travel insurance

We searched for quotes using Squaremouth for a 46-year-old Texas resident traveling to France for two weeks with a total trip cost of $10,000, including airfare.

When filtering for those providers that offered a Cancel For Any Reason add-on, our list of eligible insurance plans dropped from 103 down to 27.

Note that to purchase Cancel For Any Reason insurance, you’ll need to do so reasonably quickly after putting down your first deposit for your trip. The window to purchase is an average of 14 days after initial purchase, though some plans offer up to three weeks.

The average cost for these basic plans came out to about $635, but there’s a wide variety of coverage levels.

Top Cancel For Any Reason travel insurance options

Here’s a breakdown of the different insurance companies and why they stood out among the best. Note that these plans offer 75% of your total costs back if you cancel your trip.

What makes Battleface a top choice for CFAR insurance:

Absolute cheapest CFAR insurance option.

Also solid second-cheapest plan — the Explorer Plan — includes extras such as trip interruption, emergency medical and travel delay reimbursement.

The Battleface Explorer Plan offers terrific baggage loss, missed connection and travel delay insurance.

For our test trip, two of Battleface’s plans came out significantly cheaper than all the others. The Discovery plan lacked much of anything but CFAR coverage, which is still a decent offering considering it’s just $285.03 and you’ll still receive 75% of your trip costs refunded if you cancel.

What makes GoReady a top choice for CFAR insurance:

Less expensive than average.

Reimburses 150% of expenses in the event of a trip interruption.

Includes financial default coverage.

Offers $50,000 in primary medical insurance.

Our third-best option is GoReady, whose $603 offering is expensive but still costs less than average. With 150% for trip interruption, primary emergency medical and a $50 deductible for care, the GoReady plan offers comprehensive coverage for nearly any situation.

What makes Tin Leg a top choice for CFAR insurance:

Employment layoff is covered if employed for three years.

$500,000 in primary emergency medical.

$500,000 for medical evacuation and repatriation

Tin Leg stands out for its massive medical budget. Although some of its coverage isn’t as good as others, it makes up for it with a combined million dollars in emergency medical and evacuation.

USI Affinity Travel Insurance Services

What makes USI a top choice for CFAR insurance:

No medical deductible.

$250,000 in primary emergency medical.

Includes $15,000 for 24-hour accidental death and dismemberment coverage.

Pre-existing conditions covered.

This plan from USI doesn’t have a single standout feature; instead, it’s a well-rounded plan that provides coverage across a wide range of scenarios, including mandatory evacuations, terrorism and travel delays.

Seven Corners

What makes Seven Corners a top choice for CFAR insurance:

Hurricane warnings covered.

Employer layoff, if employed for one year.

$500 per person for baggage delay after 6 hours.

Seven Corners’ RoundTrip Basic plan is reasonably costly at $768.22 for the trip, but you’ll receive better-than-average coverage.

This includes reimbursement if you get laid off after working somewhere for just one year — other companies have a three-year minimum.

John Hancock

What makes John Hancock a top choice for CFAR insurance:

$1,000 per person for baggage loss; $1,000 specific item limit.

$750 for missed connection after a three-hour delay.

$750 for travel delay after a three-hour delay.

$100,000 for 24-hour AD&D.

John Hancock’s best feature is its reimbursement for travel woes. If you’re delayed, your bags are lost or you end up missing a connection, John Hancock’s plan offers some of the highest coverage around.

And unlike other companies, it doesn’t limit missed connection reimbursements to cruises or tours only.

Travel Insured International

What makes Travel Insured International a top choice for CFAR insurance:

$1,000,000 for medical evacuation and repatriation.

$150,000 for non-medical evacuation.

$1,500 for travel delay after three hours.

$500 for baggage delay after three hours.

As our most expensive option, Travel Insured International may be a hard sell. This is especially true if you’re looking for basic CFAR coverage.

However, it’s worth researching as the plan includes high-dollar reimbursements after very short delays, such as $1,500 for a three-hour travel delay.

More resources for travel insurance shoppers

Take a look at these other resources if you’re trying to decide when and where to purchase travel insurance.

Is Cancel For Any Reason travel insurance worth it?

What is travel insurance?

10 credit cards that provide travel insurance .

How to find the best travel insurance .

Trip cancellation insurance explained .

Is travel insurance worth it?

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Search Search Please fill out this field.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

- Personal Finance

Best Cancel for Any Reason Travel Insurance of 2024

See which insurers are the best for affordability, coverage, and more

:max_bytes(150000):strip_icc():format(webp)/eliza1-2c6698e1bd4c402db9efdc0e860c1fc8.jpg)

The best cancel for any reason (CFAR) travel insurance provider is USI Affinity , which offers seven cancel for any reason plans and the cheapest premiums of all the companies we researched. To help you choose the best cancel for any reason travel insurance, we evaluated 18 companies based on 28 criteria. Some of the factors we looked at include the maximum CFAR reimbursement rates (20% of the score), premiums (17.5%), number of policy types available (7.5%), and trip cancellation coverage amounts (5%).

If you’re a frequent traveler, having travel insurance can be valuable. But if you need to cancel a trip, your policy will only refund your prepaid expenses due to certain circumstances. Adding cancel for any reason travel insurance to your policy covers many reasons for canceling that normally are not covered, like last-minute work obligations or safety concerns.

- Best Overall: USI Affinity

- Best Reimbursement Rate: Allianz Travel Insurance

- Most Affordable Premiums for Upgraded Plans: Tin Leg

- Best for Trip Interruption Reimbursement: HTH

- Best for Travel Delay Coverage: Trawick International

All premiums mentioned are based on a $3,500, 10-day trip from Florida to Costa Rica for two same-aged travelers. We gathered quotes for four different ages: 28, 40, 55, and 70.

- Our Top Picks

- USI Affinity

Allianz Travel Insurance

- Trawick International

- See More (2)

- The Bottom Line

Frequently Asked Questions

Methodology, best overall : usi affinity.

With seven cancel for any reason plans available and the cheapest CFAR plan premiums, USI Affinity is our top choice for travelers.

Lowest premiums for CFAR policies

Offers seven CFAR policy options

No pet medical coverage

Kids aren’t covered for free

USI Affinity offered the most CFAR policy options—seven—out of the 18 cancel for any reason travel insurance companies we reviewed.

Additionally, USI Affinity offered the lowest CFAR premium of any company we researched: $121. The company’s highest plan premium was $200, which is also among the lowest rates we found during our research.

CFAR plans from USI Affinity include 75% reimbursement, with a maximum trip cancellation reimbursement of $150,000 for covered events and up to $250,000 in medical coverage per person, per trip.

- Lowest CFAR premium: $121

- Highest CFAR premium: $200

Best Reimbursement Rate : Allianz Travel Insurance

Cancel for any reason travel insurance from Allianz will provide up to 80% reimbursement for non-refundable travel costs.

Maximum reimbursement of 80%

Kids under 17 are covered for free

$200,000 limit for covered cancellations

Low coverage limit for travel delays

Limited coverage for medical expenses

No missed connections coverage

If you spend a lot of money on trips, a CFAR plan from Allianz can be a good choice.

Allianz offers up to 80% reimbursement for eligible travel expenses if you need to cancel for uncovered reasons, which was the highest rate of any of the insurers we analyzed. Additionally, Allianz’s $200,000 trip cancellation coverage (for covered cancellations) was among the highest we found during research.

Although Allianz offers the most coverage for trip reimbursement, its CFAR plans have some limitations worth noting. For example, there’s no coverage for missed connections or pet medical expenses.

Allianz will only provide CFAR insurance if you insure the full cost of your trip within 14 days of making your first trip payment.

- Lowest CFAR premium : $261

- Highest CFAR premium : $315

Most Affordable Premiums for Upgraded Plans : Tin Leg

If you want a cancel for any reason travel insurance policy with the best features and the most coverage, Tin Leg is a great choice because it offers the lowest premiums for its upgraded plans.

Lowest premium for upgraded plans

Up to $500,000 in medical coverage

Doesn’t offer multi-trip coverage

No annual plans

Out of the best CFAR companies on our list, Tin Leg has the lowest premiums for its upgraded CFAR plans. The highest plan premium from Tin Leg is just under $200.

Another thing we like about Tin Leg is that it has the highest amount of coverage for medical expenses. The maximum amount of medical coverage is $500,000 per person, per trip. There were only six insurers we reviewed that offered that much coverage.

Despite the benefits of Tin Leg, this CFAR insurance provider also has some downsides. The plans don’t include pet medical coverage, and kids aren’t covered for free.

Berkshire Hathaway offered a slightly lower premium than Tin Leg for its top-tier plan. However, the company’s overall score was below average and higher than just five of the other 17 companies. Therefore, we kept the insurer out of our rankings.

- Lowest CFAR premium: $145.55

- Highest CFAR premium: $199.50

Best for Trip Interruption Reimbursement : HTH

HTH’s cancel for any reason travel insurance plan reimburses up to 200% of your trip interruption costs, which is the highest reimbursement limit out of the “best” companies we reviewed.

Highest trip interruption reimbursement limit

Plan includes pet medical coverage

Provides up to $500,000 in medical coverage

Only one CFAR plan available

Only reimburses $50,000 for covered cancellations

No multi-trip coverage

HTH only offers one CFAR plan, but it provides excellent coverage, including 200% reimbursement for your trip interruption costs (covered interruptions include 14 scenarios, including sickness and natural disasters). Additionally, the plan includes $500,000 in medical coverage per person, per trip, as well as pet medical expenses coverage. HTH’s CFAR plan provides a maximum reimbursement of 75% for prepaid travel expenses, which is the typical rate.

Thirteen of the 18 companies we analyzed offered a 75% CFAR reimbursement rate.

HTH will only reimburse a maximum of $50,000 in trip cancellation costs for covered events, which is the lowest coverage limit out of the best companies on our list. In addition, it doesn’t offer annual plans, and the one CFAR travel insurance plan available doesn’t cover multiple trips. Additionally, the premium for HTH’s CFAR plan was $301.82, which was around $31 more than the average for top-tier plans and nearly $80 more than the average for low-tier plans.

- Lowest CFAR premium : $301.82

- Highest CFAR premium : $301.82

Best for Travel Delay Coverage : Trawick International

Trawick International’s cancel for any reason travel insurance plans provide $3,000 in travel delay coverage, which is the highest amount of delay coverage out of the companies on this list.

Highest amount of travel delay coverage

Five CFAR plan options

Affordable premiums

Plans don’t include pet medical coverage

No free coverage for kids

Free-look period is only 10 days

Trawick International offers the most travel delay coverage out of the 18 CFAR travel insurance companies we evaluated. Plans include a maximum of $3,000 in travel delay coverage in case you need to get a hotel or rent a car due to unexpected travel delays.

Trawick International has five CFAR plans, and the premiums are pretty affordable. The lowest plan premium is $143.14, which is one of the cheapest premiums out of the companies we reviewed. You can also get annual plans and plans with multi-trip coverage.

Keep in mind that Trawick’s free look period is only 10 days, which is shorter than the typical 15-day period other insurers offer.

- Lowest CFAR premium: $143.14

- Highest CFAR premium: $302.94

The Bottom Line

Cancel for any reason travel insurance can be worth the added cost, especially if you travel often or take expensive trips. However, the best CFAR travel insurance company is different for everyone. For instance, if you want the cheapest plan, USI Affinity is a great choice. But if you’re looking for a plan with a high CFAR reimbursement rate, Allianz is the top choice.

What’s the Difference Between Trip Cancellation and Cancel for Any Reason?

Trip cancellation is a standard part of travel insurance that covers the cost of non-refundable travel if you have to cancel a trip for a specific reason, including illness, injury, or death. Cancel for any reason insurance is something you add to a policy to cover cancellations that don’t qualify for trip cancellation. For example, if you have to cancel a trip at the last second because your fear of flying overwhelms you a couple of days before your flight, CFAR allows you to cancel, no questions asked. Another key difference is that trip cancellation insurance typically offers a maximum dollar amount your policy pays out, whereas CFAR reimbursements you a percentage of your non-refundable trip costs.

What Is Cancel for Any Reason Coverage?

Cancel for any reason coverage is a type of insurance coverage you can add to a travel insurance policy that will cover you for cancellation reasons that aren’t covered by your travel insurance. CFAR insurance reimburses you a percentage of your non-refundable travel costs, often 50% to 75%.

How Much Does Cancellation Insurance Cost?

Cancel for any reason insurance can cost you anywhere from 10% to 40% of your travel insurance premium. For example, during our research, we found adding CFAR to a Travel Guard policy that cost $169.29 would add an extra $38.08.

Can You Buy Cancel for Any Reason Insurance After 21 Days?

In most cases, travel insurance companies will require you to buy your CFAR insurance within 14 to 21 days of your first payment for the trip.

Narrowing down the best cancel for any reason travel insurance companies means analyzing aspects of travel insurance that are most important to travelers.

With that in mind, we examined 18 top travel insurance companies across the following 16 categories:

- CFAR reimbursement rate (20% of score) : Companies with higher reimbursement rates for CFAR coverage received the highest scores.

- Premiums (17%) ; We analyzed the highest and lowest premiums offered by a company, weighting the two premiums equally.

- Policy types available (7.5%) : Having a choice of plans to pick from can ensure you aren’t paying for coverage you don’t need. Companies with more options scored higher.

- Free look period length (5%) : A free-look period is an invaluable part of buying insurance. Companies with longer free-look periods received higher scores.

- Pre-existing condition coverage (5%) : Companies that offered medical coverage for pre-existing conditions scored higher than those that didn’t.

- Maximum coverage for emergency transportation (5%) : Evacuation out of a country for medical reasons can be costly, so we scored companies higher if they had higher emergency transportation limits.

- Maximum baggage coverage (5%) : Companies that offer higher coverage limits for lost and damaged baggage score higher.

- Maximum medical coverage (5%) : Medical coverage for injuries you sustain while traveling can offset potentially expensive hospital bills.

- Adventure sports coverage (5%) : Provides coverage if you participate in adventure sports during your trip.

- Sports and activity coverage (5%) : Because vacations typically include new activities or participation in sports, it can be helpful to have travel insurance that covers injuries you sustain during those activities.

- Maximum travel delay coverage (5%) : Travel delay coverage can help you cover the cost of lodging and food if you’re stranded due to, for example, a canceled flight or train ride.

- Maximum trip cancellation coverage (5%) : If you have to cancel a trip for covered reasons (CFAR insurance covers cancellations not otherwise covered by your insurance), a high coverage limit can help offset some or all of your non-refundable trip costs.

- AM Best rating (2.5%) : A high AM Best rating means a company is very likely to pay out a claim in the near future, so companies with higher ratings scored higher.

- Maximum trip interruption reimbursement rate (2.5%) : Companies that offered higher reimbursement amounts in the event of a trip interruption earned higher scores in this category.

- Multi-trip coverage (2.5%) : Avid travelers can benefit from multi-trip coverage, and may be able to save money by booking one insurance package as opposed to a separate policy for each trip.

- No extra charge for a child: (2.5%) : Companies that offered to include at least one child in their CFAR insurance policies received higher scores than those that didn’t.

Oscar Wong / Getty Images

Allianz. “ How the Cancel Anytime Upgrade Works .”

HTH Worldwide Travel Insurance. “ TripProtector Classic Benefits .”

SquareMouth. “ Your Guide to Cancel For Any Reason Travel Insurance .”

:max_bytes(150000):strip_icc():format(webp)/trip-74f2345da73d46dd942e9383b6f1791a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

We'll Be Right Back!

How Does Cancel For Any Reason Travel Insurance Work?

Benefits of choosing cfar insurance, 4 myths about cancel for any reason travel insurance, how much does cancel for any reason travel insurance cost, what is cancel for any reason travel insurance.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Nobody intends to cancel a vacation, business trip, or other travel plans. Unfortunately, life happens as we've all seen. It doesn't matter if it's caused by an unexpected illness, political unrest in your destination country, or something else. If you don't have an effective travel insurance policy , you could lose all your nonrefundable costs. For international or long-trip travelers, this could be thousands of dollars.

Regular travel insurance will cover cancellations as long as the cause falls within guidelines. Unfortunately, this leads to a lot of unexpected denials. People assume travel insurance covers everything only to find out that their family emergency, illness, etc. isn't included. This is where cancel for any reason coverage comes in.

Travel insurance is a type of insurance policy that protects you from various losses that can occur while on a trip. Though most standard policies cover trip cancellation, it's typically limited to specific scenarios — like illness or a natural disaster.

If you add on cancel for any reason (CFAR) coverage, you can cancel for virtually anything as long as you do it within the required timeframe. You typically need to cancel at least two days before the trip is scheduled to start.

"The cancel for any reason benefit means you can nix your trip for reasons other than those specifically covered in your plan," says Jeff Rolander, director of claims at Faye, a travel insurance provider. "Adding CFAR protection to your travel insurance plan helps give you peace of mind knowing you have the ability to cancel your trip if you simply don't feel like going."

Comparing CFAR with Standard Travel Insurance

Standard trip cancellation insurance covers you for specific, predefined reasons, such as illness, injury, or the death of a family member. On the other hand, CFAR insurance provides a broader scope of coverage, allowing you to cancel your trip for any reason that's not listed in the policy. However, CFAR typically comes at a higher premium and usually offers partial reimbursement of your trip cost.

Life is messy and often unplanned. While many countries are reopening and reducing restrictions, that could change anytime. This is complicated without including family emergencies, illness, and other unexpected complications. Cancel for any reason insurance takes the mystery out of things.

1. CFAR is worth it for any trip, no matter the cost

CFAR increases the cost of travel insurance quite a bit, so it may not be worth it on shorter, less costly trips or ones you're very unlikely to cancel (like a trip to your own wedding, for example).

If you're taking a particularly long or expensive trip, it might be worth it — especially if there's some concern you may need to cancel. If you want the freedom to cancel due to COVID-related concerns, it can also be smart.

"CFAR is worth the money if a traveler has a very specific concern that can't be covered otherwise," Moncrief says. "CFAR proved popular throughout the pandemic as a way for travelers to prepare for the constantly changing travel landscape."

2. CFAR costs a ton of money

While CFAR coverage does make your travel insurance more expensive, you'll still pay around $100 or less in most cases. As you can see in the chart above, the typical CFAR policy costs about $60 to $130 — in addition to your basic travel insurance premium per person.

3. My credit card offers trip cancellation coverage, so CFAR is never worth it

While many credit cards do come with travel benefits, coverage is often limited in scope. The Chase Sapphire Preferred® Card , for example, won't reimburse you for trips canceled due to a "change in plans or financial circumstances." The Platinum Card® from American Express covers cancellations due to injury, sickness, inclement weather, terrorist actions, and other reasons covered by most basic travel insurance plans. Still, in comparison, CFAR offers much wider coverage and protection.

4. You can buy CFAR at any point before your trip begins

You have to purchase CFAR coverage soon after booking your trip. Most companies require you to purchase within 15 to 21 days of putting down an initial deposit. After that point, you will be unable to add CFAR coverage to your policy.

The cost of CFAR travel insurance varies by provider and depends on the age of the travelers, the destination, the duration of the trip, and other details. You can generally expect to pay between 40% to 50% more when adding CFAR coverage.

Here's a look at how much CFAR coverage costs at three different travel insurance providers. These quotes are for a $5,000 weeklong trip to Mexico for one person (30 years old).

How to Purchase CFAR Insurance

Purchasing CFAR insurance involves selecting the right provider and understanding the terms of the policy. It's essential to compare offers and read the fine print to ensure the policy meets your needs.

If you do opt for cancel for any reason coverage, make sure to shop around for your policy. Every provider offers different plans and fees. Comparing at least a few options can help ensure you get the best rate and coverage for your needs.

Cancel For Any Reason (CFAR) insurance allows you to cancel your trip for any reason that is not covered by standard travel insurance. This could include personal reasons like a change in your work schedule, fear of traveling due to a recent event, or simply changing your mind. CFAR usually reimburses a percentage of the non-refundable trip costs, typically around 50-75%, depending on the policy.

CFAR insurance can be worth the additional cost if you desire flexibility and peace of mind. It's particularly valuable if you're investing a significant amount of money into your trip or if you anticipate possible changes or uncertainties leading up to your departure. However, it's essential to weigh the cost against the potential benefits and consider your personal situation, including your risk tolerance and financial capacity.

Generally, you must purchase CFAR insurance within a set period after making your initial trip deposit, often within 14-21 days. However, the specific timeframe can vary depending on the insurance provider. Check the policy details or consult with the insurance provider to understand the time restrictions for purchasing CFAR coverage.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company. Global Assist Hotline Card Members are responsible for the costs charged by third-party service providers. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers. Extended Warranty, Purchase Protection, and Baggage Insurance Plan Underwritten by AMEX Assurance Company. Car Rental Loss & Damage Insurance Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

- Main content

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Guide to Cancel for Any Reason (CFAR) Travel Insurance

Is your next planned trip to an unpredictable destination? Cancel for any reason travel insurance may be the protection you need.

with our comparison partner, Squaremouth

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Roxanne Downer has more than 15 years as a news, finance and lifestyle writer and editor. A graduate of the University of Pennsylvania, she has previously worked at Deutsche Bank, BNY Mellon, Financial Week and MSN Money.

A “cancel for any reason” (CFAR) travel insurance add-on upgrades your travel insurance policy to reimburse you for cancellations outside of the company’s list of covered reasons, such as weather or simply not wanting to travel. However, the CFAR add-on will nearly double the cost of the travel insurance policy.

Based on our research of CFAR availability, cost, and reimbursement percentages and terms, the travel insurance with top-notch CFAR coverage is Faye and Seven Corners. Read on to learn more about how CFAR coverage works, what it covers and more.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

What Is “Cancel For Any Reason” Travel Insurance?

Cancel for any reason travel insurance is an add-on you can purchase to upgrade your standard travel insurance policy. CFAR coverage entitles you to a percentage reimbursement if you need to cancel your vacation, no matter the reason. This is contrary to standard travel insurance policies, which include specific circumstances when you can claim a reimbursement for nonrefundable trip expenses. These are usually limited to a major injury or illness, death in the family, or major political or international events that could make travel unsafe or impossible.

How Does Cancel for Any Reason Travel Insurance Work?

Travel insurance policies are widely available and come in many forms. These policies have become especially popular since the COVID-19 pandemic has made overseas and air travel more unpredictable.

If you want or need to cancel your trip (or even move your scheduled departure date and return date), standard travel insurance policies require that you provide a reason for your trip cancellation. Your reason must match an approved reason listed under their policy rules. Approved cancellation reasons are usually stringent. Some common approved cancellation reasons include the following:

- Acts of terrorism or war in your home country or the country to which you’re traveling

- Death of a family member

- Death of a traveling companion

- Hospitalization

- Jury duty or another type of unforeseen court-ordered appointment

- Military orders or deployment

Your travel insurance provider may require you to submit proof of your claim before you receive reimbursement.

With CFAR travel insurance coverage, you can cancel your trip for reasons not listed as viable and reasonable under the standard travel insurance policy. You can use almost any reason to cancel your travel plans and still get partial reimbursement for prepaid and non-refundable trip costs, provided a few specific criteria.

Perhaps you develop a sudden fear of travel. Maybe your travel companion insists they can no longer make the trip with you. Perhaps you have unexpected medical expenses that take precedence over your trip and need that money back. The optional CFAR upgrade allows you to receive the majority of your money back using the aforementioned reasons or nearly any other reason. In most cases, whatever reason you provide is accepted under CFAR policies, although there are a few exclusions.

Let’s take a look at an example of how you might use CFAR coverage. Say you planned a week-long trip to Bermuda with a total of $2,500 in nonrefundable travel expenses, including your flight and lodging. You lose your job after you book your trip and decide now is not the best time to travel. You decide to cancel your vacation to save money and file a claim with your travel insurance provider.

While this cancellation reason would not usually entitle you to a refund under standard travel insurance coverage, you could request reimbursement with CFAR coverage. In this instance, you would receive a maximum refund up to the percentage outlined in your policy. For example, if you bought a policy with a 70% CFAR reimbursement, in this example, you would get a total refund of $1,750 for your $2,500 vacation.

Can I Get CFAR Coverage At Any Time?

No, you cannot purchase CFAR coverage at any time. Each travel insurance provider institutes its own limitations on how far away from your initial trip deposit you can upgrade to CFAR-level insurance. You typically need to purchase travel insurance between 14 to 21 days from your initial trip payment to qualify to add CFAR coverage. We recommend getting travel insurance quotes sooner rather than later if you’re interested in protecting your trip with a CFAR upgrade.

How Much Does “Cancel For Any Reason” Coverage Cost?

Regular travel insurance costs between 5% and 6% of your total trip cost. In our review, we found the average CFAR upgrade added 90% of the standard premium cost to your total insurance price. This means that in most cases, you can expect your premium to double when you upgrade to CFAR insurance.

To estimate pricing for your CFAR upgrade, we collected quotes for a series of travel insurance policies offered by our top providers. We requested a custom quote for a $5,000 vacation to Canada for a 35-year-old traveler. The table below represents the quotes we received for base plans and how much it would cost to add a CFAR upgrade.

“Cancel for Any Reason” (CFAR) Insurance vs. Standard Travel Insurance

We’ve already mentioned some significant differences between CFAR and standard travel insurance. However, inclusions on CFAR insurance upgrades can vary depending on the company issuing your travel insurance. You should consider the following as you compare CFAR insurance options between providers.

Cost: CFAR travel insurance is always pricier than standard travel insurance. However, it’s not exorbitantly expensive and provides you with a broader range of cancellation flexibility. While CFAR insurance won’t cost more than 150% of regular travel insurance, it can provide much greater peace of mind when exploring abroad, especially in post-pandemic times.

Eligibility Requirements: You cannot purchase CFAR insurance on its own. This insurance is an optional add-on benefit to a standard travel insurance policy. Make sure you’re eligible for CFAR travel insurance by purchasing it no later than three weeks from your original travel insurance plan. Should you need to implement it, use it no fewer than 48 hours before your trip.

Fear of Illness: Standard travel insurance providers do not include fear of illness as a covered reason under most trip cancellation benefit plans. CFAR travel insurance does. The pandemic has changed the travel climate for the foreseeable future, and fear of possible illness is a perfectly acceptable cancellation option when using CFAR insurance. If you’re traveling abroad and think you might need to cancel because you’re at an increased risk of illness, purchasing CFAR insurance can be wise.

Insurance Providers: Some travel insurance companies may not offer CFAR coverage and only offer trip cancellation insurance with restrictions. Be especially mindful of this if you are a New York state resident, where policies are more heavily restricted.

Compare the Best “Cancel For Any Reason” Travel Insurance Providers

Ready to start comparing coverage providers? The table below summarizes our top picks for CFAR travel insurance upgrades.

What Does CFAR Insurance Cover?

CFAR upgrades cover a variety of nonrefundable trip expenses, such as:

- Accommodations: CFAR coverage can reimburse you for nonrefundable hotel or hostel reservations.

- Airfare: If you bought nonrefundable or exchangeable airline seats, CFAR coverage can reimburse you for the cost of tickets.

- Travel arrangements: If you have must cancel prescheduled nonrefundable golf tee times, dinner reservations or rental car costs, CFAR coverage can reimburse you for a percentage of the cost.

- Event and concert tickets: Similar to travel arrangements, CFAR coverage can reimburse you for event tickets you aren’t able to sell or get refunded.

- Lost deposits: Even if you did not put down a full payment for an excursion or event, you can claim a partial refund of lost deposits with a CFAR insurance upgrade.

It’s important to note that CFAR insurance often comes with specific terms and conditions, which can include a deadline for purchasing coverage and a reimbursement requirement to cancel your trip within a specified timeframe. Review your policy documents to learn more about specific items included and excluded from your coverage.

What’s Not Covered by “Cancel for Any Reason” Travel Insurance?

Standard travel insurance policies typically reimburse the total amount of your deposit (or close to it) if you act within the time-sensitive parameters and cancel for the reasons accepted under the policy. On the other hand, CFAR policies will typically offer you between 50% and 75% reimbursement of your deposit or total trip cost if you cancel for reasons not explicitly listed under the terms of the policy.

Additionally, CFAR policies are time-sensitive. You must purchase the CFAR travel insurance add-on within a specific time frame of when you purchased your initial travel insurance policy. The time frame for implementing your CFAR benefits is between one and four weeks (depending on the company) after your initial trip deposit and purchase of standard travel insurance.

Most companies offer CFAR trip cancellation coverage if you cancel your trip within a specific time frame. For travel insurance companies Travelex and Seven Corners, it’s within 48 hours of your scheduled departure date.

CFAR policies don’t cover some circumstances. For example, Seven Corners insists that, should a travel supplier cancel your trip, the responsibility for refunding your trip expenses falls on the operator, not the CFAR insurance policy. So, review the fine print and individual limitations of your policy before you buy travel insurance to be sure you’re getting the benefits you think you are.

Best “Cancel For Any Reason” (CFAR) Travel Insurance

Not every travel insurance provider offers the same level of CFAR coverage. The following are our top picks for travel insurance with CFAR benefits:

- Faye: Our top pick

- Seven Corners Travel Insurance : Our pick for international travelers

- AIG Travel Guard : Our pick for families

- Travelex Insurance : Our pick for budget travelers

- Nationwide Travel Insurance : Our pick for cruise travel

- Trawick International : Our pick for college students

- AXA Assistance USA : Our pick for leisure travelers

- HTH Travel Insurance : Our pick for group travel

- International Medical Group : Our pick for medical coverage

- Generali Global Assistance : Our pick for emergency assistance

- CFAR coverage amount: 75% of trip cost

- Average plan cost : $298

- CFAR upgrade cost : 16%–39% added to premium

Why We Picked Faye

Faye travel insurance is our choice for travelers who prioritize a streamlined, online buying process. With 100% online underwriting and the ability to access quick, general coverage, Faye is a good option for those purchasing travel insurance a few days before their trip. Though Faye only offers one travel insurance policy, it includes CFAR coverage that can reimburse up to 75% of your nonrefundable trip costs.

Faye’s CFAR upgrade is one of the most affordable we reviewed, adding an average of 16% to 39% to your premium cost. Compared to other insurance providers like Trawick, which doubled our quote when we added to CFAR coverage, Faye is a good choice for budget shoppers. However, you can only purchase CFAR coverage within two weeks of your initial trip deposit.

Pros & Cons

Plans and cost breakdown.

Unlike most travel insurance providers, Faye only offers one policy, which includes the following coverages:

- Trip interruption: 150%

- Medical expense: $250,000

- Emergency evacuation and repatriation of remains: $500,000

- Lost baggage: $150

- Trip delay: $4,500 ($300 per day)

- Baggage delay: $200

According to our review, the average Faye customer will pay $298 for an insurance policy.

Seven Corners Travel Insurance

- Average plan cost : $169–$236

- CFAR upgrade cost : 4 0%–42% added to premium

Why We Picked Seven Corners

Seven Corners is our top travel insurance provider for international adventures because of its wide range of coverage options. From annual travel insurance plans to options that offer limited, affordable medical coverage, Seven Corners is known for its inclusive selection of plan offerings. While most coverage providers limit CFAR coverage availability to only the most expensive policy, Seven Corners makes this add-on available with two plan options.

Seven Corners’ CFAR upgrades were consistently affordable in our review, adding 40% of the cost of your coverage to most sample quotes we received. You can also upgrade to CFAR coverage 20 days after your initial trip payment, which is longer than some competitors. However, this upgrade is only available on single-trip policies and is not offered on a rolling basis for annual plans.

Seven Corners offers two travel insurance policies that allow you to upgrade to CFAR insurance: Trip Protection Basic and Trip Protection Choice. Both options are single-trip plans, with the Basic policy being Seven Corners’ budget option. It includes the following coverages:

- Trip interruption: 100%

- Medical expense: $100,000

- Emergency evacuation and repatriation of remains: $250,000

- Lost baggage: $250

- Trip delay: $600

- Baggage delay: $500

In our review, we found the average Trip Protection Basic policyholder will pay $169 for Basic coverage.

The Trip Protection Choice policy includes more optional coverage than the Basic policy, including a waiver for pre-existing conditions and event ticket registration. This policy also includes extended benefits over the Basic plan, including:

- Medical expense: $500,000

- Emergency evacuation and repatriation of remains: $1 million

- Trip delay: $2,000

- Baggage delay: $2,500

We found that the average Choice policyholder will pay about $236 for travel insurance.

AIG Travel Guard

- CFAR coverage amount: 50% of trip cost

- Average plan cost : $171–$319

- CFAR upgrade cost : 3 1%–38% added to premium

Why We Picked AIG

AIG is our top pick for families looking for more inclusive group coverage because one child under age 17 is included with the purchase of an adult Travel Guard Deluxe plan. This policy also includes the option to add CFAR coverage at a lower rate than most competitors. However, the Deluze policy is not the only option for CFAR travel insurance — you can also upgrade to the lower-cost Preferred plan with the same coverage rates and reimbursement percentage.

While AIG’s CFAR upgrade is more affordable than competitors, it does come with a few limitations. You can only add up to 50% reimbursement, which limits your benefits. You also must purchase the upgrade within 14 days of your initial trip deposit purchase, which is on the lower end of the spectrum compared to other providers.

AIG offers two policy options that support CFAR upgrades: Travel Guard Preferred and Travel Guard Deluxe. The Travel Guard Deluxe plan includes the following coverages:

- Medical expense: $50,000

- Lost baggage: $1,000

- Trip delay: $800 ($200 per day)

- Baggage delay: $300

In our review, we found the average AIG customer could expect to pay about $263 for coverage.

The Travel Guard Deluxe policy is AIG’s more comprehensive single-trip option and includes a wider breadth of coverage than the Deluxe plan. For example, this policy includes coverage for one child under the age of 17 along with adult coverage. It also includes the following policy basics:

- Medical expense: $150,000

- Lost baggage: $2,500

- Trip delay: $1,000 ($200 per day)

Based on quotes we collected, we found that the average AIG customer could expect to pay about $319 for Deluxe-tier coverage.

- CFAR coverage amount: 7 5% of trip cost

- Average plan cost : $176–$248

- CFAR upgrade cost : 71% to 110% added to premium

Why We Picked Travelex

Travelex offers a low-cost choice for travelers looking for a budget policy they can purchase at the last minute. Travelex also allows you to purchase CFAR coverage for up to 20 days from your initial trip payment. CFAR upgrades include 75% reimbursements, which is about average in the travel insurance industry.

In our review, we found that Travelex only offers one policy that supports a CFAR upgrade with its Travel Select plan. This may be disappointing for budget travelers purchasing the low-cost Travel Basic policy, which is offered at a flat rate of $40. CFAR upgrades added between 71% to 110% to the value of our quoted premium.

CFAR coverage is available with the Travel Select policy, which offers the following protections:

- Trip delay: $2,000 ($200 per day)

According to our review, the average Travelex policyholder can expect to pay between $176 and $248 for coverage depending on policy selection.

Nationwide Travel Insurance

- Average plan cost : $132–$219

- CFAR upgrade cost : 85%–120% added to premium

Why We Picked Nationwide

While Nationwide is typically our top recommended provider if you’re taking a cruise vacation, its cruise policies do not include CFAR upgrade options. The company only offers a CFAR add-on with its standard travel insurance plan, the Prime policy. With CFAR coverage, the company will reimburse 75% of your nonrefundable trip costs, which is average in the industry. You can purchase the CFAR upgrade up to 21 days after your initial trip payment, which is about a week longer than most other providers.

The only Nationwide policy that includes the option to add CFAR coverage is the Prime travel insurance plan, which includes the following benefits:

- Trip interruption: 200%

- Trip delay: $2,000 ($250 per day)

- Baggage delay: $600

In our review, we found the average customer choosing Prime travel insurance level coverage from Nationwide can expect to pay $219 .

Trawick International

- CFAR coverage amount: 50%–75% of trip cost

- Average plan cost : $159–$265

- CFAR upgrade cost : 81%–215% added to premium

Why We Picked Trawick

Trawick offers CFAR upgrades with five of its Safe Travels policy options for U.S. residents, which is more than any other provider on our list. Additionally, Trawick is our top choice for college students thanks to its wide range of coverage for student-oriented visas.

While Trawick offers a variety of coverage options, you’ll need to be within 14 days of your initial trip deposit to invest in CFAR upgrades on most policies. Depending on the plan you choose, you may have the option to add between 50% and 75% in reimbursements, which may leave you with less coverage than some competitors. Depending on your selected coverage option, CFAR upgrades may also be prohibitively expensive with Trawick.

Trawick offers CFAR add-on options with a variety of plan options, but three of the most popular include Safe Travels Armor, Safe Travels Voyager and Safe Travels First Class. The Safe Travels Armor policy is Trawick’s most popular policy choice and includes the following coverages:

- Trip delay: $1,000 ($100 per day)

- Baggage delay: $250

The Safe Travels Voyager policy is a more affordable option and includes the following coverages:

- Medical expense: $25,000

- Lost baggage: $300

- Trip delay: $1,000 ($250 per day)

Finally, the Safe Travels First Class policy includes a bit more coverage, including the following options:

- Emergency evacuation and repatriation of remains: $200,000

- Lost baggage: $200

- Trip delay: $1,000 ($150 per day)

Based on quotes we gathered, customers can expect to pay between $159 to $265 for a Trawick travel insurance policy.

AXA Assistance USA

- CFAR coverage amount: 75% of trip cost

- Average plan cost : $188–$274

- CFAR upgrade cost : 118%–170% added to premium

Why We Picked AXA

We selected AXA as our top pick for leisure travelers because of the unique benefits included with its Platinum Plan, such as coverage for lost leisure activities like lost rounds of golf and ski days. The Platinum Plan also includes generous coverages for baggage — and is AXA’s only option that includes CFAR upgrade options.

AXA’s CFAR coverage includes 75% in reimbursements, which meets the industry average. Customers must purchase a CFAR upgrade within 14 days of their initial trip deposit, which is also average compared to competitors. However, CFAR coverage from AXA is more expensive than most competitors — in our review, adding a CFAR upgrade at least doubled the price of our quoted premium.

AXA’s Platinum Plan includes the following standard coverages:

- Lost baggage: $500

- Trip delay: $1,250 ($300 per day)

We collected quotes from the company and found the average AXA customer can expect to pay $274 for Platinum Plan-level coverage.

HTH Travel Insurance

- Average plan cost : $168–$284

- CFAR upgrade cost : 50% added to premium

Why We Picked HTH

HTH is our top choice for group coverage thanks to its premium discounts — when you buy travel insurance as a group, each individual member can save 10% on their coverage. However, if you want to purchase CFAR coverage you will need to opt for the most inclusive and higher-cost TripProtector Preferred policy. Each member must purchase the same coverage when buying as a group, which can make HTH’s CFAR upgrade less beneficial for multiple people.

Based on our research, HTH offers competitively priced CFAR coverage — after collecting a series of quotes, we noticed a consistent increase in premium cost by around 50%. When combined with average premiums and reimbursement rates, HTH is a solid choice for CFAR coverage. If your full group is interested in higher-value coverage and CFAR upgrades, HTH’s discounts could be right for you.

The only plan from HTH that offers the option for CFAR coverage is TripProtector Preferred, which includes the following coverages:

- Trip delay: $2,000 ($500 per day)

- Baggage delay: $400

According to our review, the average HTH policyholder will pay between $168 to $284 for coverage depending on their policy choice.

International Medical Group

- Average plan cost : $95–$356

Why We Picked International Medical Group

Our team recommends the International Medical Group (IMG) for its extensive medical coverage options. With more than 10 individual travel insurance options and medical-only plans, IMG is a strong choice for students and education professionals with visas necessitating medical coverage. However, only one policy option, the iTravelInsured Travel LX plan, includes the choice to add CFAR coverage.

The CFAR upgrade to the iTravelInsured Travel LX plan includes 75% reimbursement, which is average within the industry. We found that IMG’s policy pricing was consistent in terms of adding CFAR coverage, consistently adding 50% of your initial premium to your total cost. While IMG’s higher-than-average premium pricing may negate this benefit in some cases, it is worth considering if you’re looking to combine CFAR coverage with all-inclusive medical protections.

IMG’s only policy that offers a CFAR add-on option is the iTravelInsured Travel LX policy, which includes the following coverages:

- Trip delay: $2,500 ($250 per day)

Our review found the average IMG customer can expect to pay $356 for travel insurance, which is higher than most competitors we reviewed.

Generali Global Assistance

- CFAR coverage amount: 60% of trip cost

- Average plan cost : $211–$322

Why We Picked Generali

Generali is worth considering if you’re planning an adventure to a country where your primary language is not as commonly spoken. All of Generali’s policies include access to 24/7 bilingual travel assistance — which can add peace of mind for those taking their first international trip. Based on our research, Generali also consistently quoted its CFAR upgrade at 50% of the price of the original premium.

While Generali’s CFAR upgrade is more affordable, you must be within 24 hours of your initial trip deposit to add coverage. The company also caps reimbursements at 60% of your total trip cost, which is less than most other providers on our list.

If you’d like to opt into CFAR travel insurance, you’ll need to buy Generali’s most expensive coverage option, the Premium plan, which includes the following basic coverages:

- Trip interruption: 175%

- Lost baggage: $2,000

- Trip delay: $1,000 ($300 per day)

Based on the quotes we gathered, we determined Generali Platinum coverage came at an average premium of $322 .

How We Ranked CFAR Coverage Providers

Most travel insurance providers offer some type of CFAR coverage. We requested quotes from dozens of insurers for policies with CFAR add-ons and compared rates in the following areas to determine our company rankings.

- Percentage reimbursed: Companies with reimbursement rates over 75% received higher ratings, while those offering lower reimbursement percentages ranked lower.

- Cost: CFAR coverage is billed as an add-on to a standard travel insurance premium, not as its own policy. Companies with CFAR add-ons with lower percentage price increases received higher rankings.

- Purchase timeframe: To qualify to purchase CFAR coverage, you’ll need to be within a specific window from your initial trip deposit. This window varies by company, with the average being 14 to 21 days from your initial purchase date. Companies with wider CFAR add-on purchase windows received higher rankings and vice versa.

- Policy availability: Most travel insurance providers that offer CFAR upgrades limit the add-on to higher, more expensive tiers of coverage. Companies with multiple policies offering CFAR add-ons received more points in our review.

Will CFAR Coverage Refund My Whole Trip?

No — even the most generous cancel for any reason coverage will not refund 100% of your trip costs. When you enroll in a travel insurance policy and upgrade to CFAR-inclusive coverage, your travel insurance provider will reimburse you up to a certain percentage if you file a valid claim.

In our review, we found you can expect most CFAR upgrades to offer a 75% reimbursement of trip expenses. As an example, say you planned a trip to Canada with a total of $5,000 in nonrefundable trip expenses. You opted into CFAR coverage, which entitles you to a 75% trip cost reimbursement. In this example, if you needed to cancel your trip for any reason, you’d get a maximum refund of $3,750 — 75% of your total trip cost of $5,000.

How Do I Get “Cancel for Any Reason” Travel Insurance?

If you have experience with travel insurance sites and know what you’re looking for, all you need to do to get CFAR insurance is choose this upgrade when purchasing your plan online. However, if this is new to you, you have several options for buying your first policy.

Begin by comparing some of the major travel insurance providers to see which one suits your needs the best. The options above all have CFAR options, so you can focus on factors like price, medical coverage, medical evacuation , baggage loss benefits , and natural disaster policies of each travel insurance provider as you shop.

Begin by purchasing your travel insurance policy, and add the option for CFAR travel insurance during the checkout process. Paying with a debit or credit card makes this easy, but most travel insurance agencies accept many different forms of payment. Once you sign onto coverage, review your confirmation of benefits, and continue planning your next international adventure.

Is “Cancel For Any Reason” Travel Insurance Worth It?

Given the COVID-19 pandemic’s uncertain nature, travel insurance is a worthwhile investment if you want to recoup the money you’ve spent on a trip you may no longer wish to take. If you believe you may need to cancel your trip for a reason not covered under standard travel insurance policies, purchasing cancel for any reason, insurance is probably worth it. After all, the extra money you’d spend would be far less than the money you’d lose if you opted not to purchase CFAR insurance and canceled your trip for an excluded reason.

Frequently Asked Questions About “Cancel for Any Reason” Travel Insurance

When should i purchase cfar insurance.

For most travel insurance companies, the cut-off for adding on cancel for any reason insurance to your travel insurance plan is between 10 days and three weeks from the date of purchase and varies from company to company. Optimally, you should purchase the optional cancel for any reason add-on when purchasing your standard travel insurance policy.

Does Allianz offer “cancel for any reason” coverage?

No, Allianz does not offer cancel for any reason add-ons to their plans. The only exception is if you need to cancel your trip due to COVID-19-related medical complications. Trip cancellation is covered if you get sick due to the illness and your trip must be canceled or interrupted , and emergency medical care due to contraction of the virus is also covered in most cases.

Does CFAR coverage cover cancellations due to a fear of flying?

Yes. Fear of any travel — whether fear of motion sickness, ocean travel, getting sick, or flying — is included in the coverage cost of cancel for any reason insurance.

What is a good reason to cancel a trip?