- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Studying abroad? Here are the best international student travel insurance companies

Travel insurance can not only save students money when studying abroad, but many schools also require it..

Studying abroad is a valuable educational and cultural experience and could give you an advantage in the job market after graduation. Buying travel insurance is a way to protect yourself financially while studying abroad.

Many international programs require travel insurance , and some offer it through a predetermined provider. But if you're on the hunt for a comprehensive travel insurance plan on your own, CNBC Select has made it a little easier. We compared dozens of top travel insurance companies for students and narrowed down the five best options that stood out for their strong coverage and affordability . (See our methodology for more information.)

Best student travel insurance

- Best for affordability: AXA Assistance USA Travel Insurance

- Best for medical expenses: USI Affinity Travel Insurance

- Best for trip interruptions: Travel Guard Travel Insurance

- Best for customizable coverage: Allianz Travel Insurance

- Best for students on a budget: Berkshire Hathaway Travel Protection

Best for affordability

Axa assistance usa travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

24/7 assistance available

- Three tiers of plans available

- Highly rated for financial strength

- Cancel for any reason only available on highest-tier coverage

AXA Assistance USA 's most basic plan, the Silver Plan, includes all of the essentials a student will likely need while studying abroad: coverage for emergency medical expenses (up to $25,000 for accident or sickness and up to $100,000 for evacuation), baggage loss (up to $750) trip interruption and trip cancellation.

It's budget-friendly as well and is one of the most affordable yet comprehensive travel insurance plans on the market. If you're interested in higher coverage limits, AXA offers two more premium plans, one of which includes a cancel for any reason (CFAR) option.

[ Jump to more details ]

Best for medical expenses

Usi affinity travel insurance.

USI Affinity has travel medical policies in addition to trip cancellation policies. Travel medical plans include an option for frequent travelers to cover multiple trips. Trip cancellation options include coverage for road trips and group travel.

- Wide variety of plans for both trip cancellation coverage and travel medical insurance

- CFAR only covers up to 70% of non-refundable trip costs

USI Affinity is a good choice for students primarily concerned about potential medical expenses abroad. The company offers only one trip cancellation plan but offers a wide variety of travel medical plans tailored to specific situations.

Best for trip interruptions

Travel guard® travel insurance.

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Students who are concerned about trip interruptions should consider Travel Guard , which offers last-minute coverage. There are three base packages available online, with more options available through a representative. Its most basic plan includes typical coverage for travel medical expenses (up to $15,000 in medical expenses and $150,000 for evacuation), but robust coverage for trip cancellation, trip interruption, baggage theft as well as per-day compensation for trip delays.

Best for customizable coverage

Allianz travel insurance.

10 travel insurance plans make it possible to customize your coverage. For families, Allianz's OneTrip Prime package covers children age 17 and younger when traveling with a parent or grandparent.

- Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents.

- Limited coverage for risky sports

Allianz offers a whopping 10 different travel insurance policies. While many premium insurers offer cancel for any reason coverage that can cover up to 75% of prepaid, non-refundable trip costs, Allianz's Cancel Anytime upgrade can reimburse up to 80% of your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents. If you're planning to be adventurous during your study abroad experience, Allianz has a variety of add-ons to cover rental cars, hazardous sports and more.

Best for students on a budget

Berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

- Wide variety of policies available

- Strong financial strength rating by AM Best

- Cancel for any reason only provides reimbursement for up to 50% of non-refundable trip payments

Berkshire Hathaway Travel Protection is a strong choice for students on a tight budget looking for strong coverage. Its most basic plan (the ExactCare Value plan) earned one of the cheapest quotes reviewed by CNBC Select and includes moderate-limit coverage for everything a student might need while studying internationally.

More on our top travel insurance for studying abroad

AXA's travel insurance offers medical coverage for emergencies and accidents while traveling for up to $250,000. It offers three different plans for travelers starting as low as $16 according to its website.

CFAR coverage available

24/7 assistance?

[ Return to summary ]

USI Affinity offers a number of travel plans, including travel medical plans for those traveling outside of the U.S. Its InterMedical Insurance plan has three levels of medical coverage available ranging from $50,000 to $150,000, and starts at $1.35 per day, according to the company's website.

Travel Guard Travel Insurance

Travel Guard's travel insurance could be a fit for students studying abroad with three levels of coverage. Its travel medical expense coverage can go up to $100,000 with the brand's deluxe plan.

Allianz offers several types of travel insurance for students, including its OneTrip Emergency Medical Plan with up to $50,000 in emergency medical benefits and $250,000 in evacuation benefits. Its OneTrip Prime and Premier plans offer cancellation and trip interruption benefits on top of emergency medical benefits up to $50,000.

Berkshire Hathaway Travel Insurance

Berkshire Hathaway Travel Protection offers several travel insurance plans that could be a fit for student travelers, including its ExactCare Value and ExactCare plans, offering both trip cancellation and interruption coverage in addition to medical coverage.

What does travel insurance cover for studying abroad?

Medical expenses and emergency evacuation.

Stan Sandberg, a co-founder of the online marketplace TravelInsurance.com , said medical coverage is the most important area of coverage for students studying abroad.

Most travel insurance plans, regardless of whether they are designed for students, cover medical expenses incurred abroad. Medical expense coverage can help to cover injuries or illnesses you may incur while abroad. Emergency evacuation coverage generally includes transportation to the nearest adequate facility or transportation home.

Travel medical coverage can exclude some situations that are relevant for students studying abroad — namely, intoxication. "If the individual is either beyond a certain intoxication level or under the influence of illegal substances, those things are very often excluded from coverage," Sandberg said. "So, a student traveling to a country that doesn't have a drinking age, for instance, that would be something to keep in mind."

Because of cultural alienation and homesickness, studying abroad can be an emotionally difficult time for many students. If you are shopping for student travel insurance, you should consider searching for a plan that covers mental health services. Read your travel policy carefully to understand the coverage offered and any requirements for coverage.

If medical expenses are the only cost you wish to insure, then you might instead consider an international health plan, which Sandberg recommends for students on a budget .

Trip cancellation and interruption

If your circumstances change at the last minute, you'll be grateful to have a travel insurance plan with trip cancellation coverage, which will reimburse you for your non-refundable trip costs, like flights and hotels , for covered events.

This coverage will not, however, cover any non-refundable costs of your study abroad program, such as tuition, room and board, which are likely to be much more expensive than the flights to and from. So to Sandberg, this coverage is slightly less important for students.

Travel assistance

It's possible that studying abroad will be a student's first time out of the country. Traveling internationally , especially in areas with a language barrier, can be confusing. Many travel insurance plans, and all five policies we chose as our top picks , offer a 24/7 helpline to assist you along your journey.

Lost or stolen baggage

Along with travel assistance, baggage loss and baggage delay coverage are examples of post-departure benefits. Study abroad programs typically last an entire semester or a summer, so you'll likely pack a lot of luggage.

If you're traveling with valuables, you should consider searching for a plan that includes baggage insurance. Sandberg recommends reading the fine print, though, as many plans exclude electronic items in luggage and items above a certain value.

And of course, make sure any policy is worth your money and aligns with your coverage goals before purchasing it. Many travel insurance policies offer free look periods that include time to read over the policy and cancel coverage with a refund.

What is travel insurance for studying abroad?

For students and adults alike, travel insurance is a flexible type of coverage designed to protect you when you're far from home. By purchasing a policy, you can prevent financial hardship related to international medical expenses or travel mishaps like interruptions, delays and lost luggage. Some premium travel insurance plans offer cancel for any reason (CFAR) coverage, which allows you to recoup some of your expenses should you cancel your trip for any reason.

Is travel insurance worth it for studying abroad?

Travel insurance is a wise investment for travelers who will be abroad for a while, including students studying abroad. Most domestic medical plans do not cover international hospital bills, so in case of an emergency, having travel insurance with medical expense coverage could be crucial.

How much does travel insurance cost for students studying abroad?

Travel insurance costs vary depending on the length of the trip, the age of the travelers and the extent of the coverage. You can expect to pay around 4% to 10% of your trip's total cost, according to travel insurance comparison site InsureMyTrip . Keep in mind though that your trip's "total cost" does not include the cost of your study abroad program itself. Most travel insurance companies are only interested in the cost of flights and non-program lodging like hotels. The best way to estimate the cost of insuring your trip is to get quotes from multiple companies.

What is international health insurance?

International health insurance is a health coverage plan that covers your medical expenses anywhere in the world. An international health insurance plan provides very similar medical coverage to that provided by a travel insurance plan.

Do I need travel insurance if my credit card has it already?

Some of the best travel credit cards on the market provide some travel protection. For example, the Chase Sapphire Reserve® card offers trip cancellation and interruption insurance up to $10,000 per covered person up to $20,000 per trip, travel accident insurance, emergency evacuation insurance and coverage for baggage delays and loss. Ask your issuer if your card has any travel protection benefits. If not, or if the coverage is minimal, you should consider purchasing travel insurance from a third party.

Bottom line

Not only is it a smart idea to purchase travel insurance to study abroad, but it is also required by a lot of international programs. With travel insurance, students can worry less about the unexpected and make the most of their experience abroad. If your academic program does not have a pre-existing partnership with a certain provider, then consider using one of these top travel insurance companies for students.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every travel insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best cheap travel insurance.

Our methodology

To determine the best travel insurance companies for students studying abroad, CNBC Select analyzed dozens of U.S. travel insurance companies that come with a wide variety of policies and offer coverage for a number of situations.

When narrowing down the best travel insurance companies, we focused on the coverage available, including the number of plans available, 24/7 assistance availability and cancel for any reason (CFAR) coverage availability. We also considered financial strength ratings from AM Best and Better Business Bureau ratings for customer satisfaction.

To consider costs, we gathered quotes from the top travel insurance companies for four sample trips, which included:

1. A semester-long (January 15 to June 15) study-abroad trip to the United Kingdom:

- $3,000 per person (flights to and from JFK and non-program hotels)

- New York residents

- Traveler aged 20

2. A summer (June 15-August 15) study-abroad trip to Italy:

- $2,000 per person (flights to and from JFK and non-program hotels)

Sample quotes assumed that payments were made on the date of quoting.

Note that the premiums and policy structures advertised for travel insurance companies are subject to fluctuate in accordance with the company's policies.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money . And follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- Here are the best travel credit cards for families Jason Stauffer

- Chase Sapphire Preferred Card vs. Citi Strata Premier: Which is better for you? Jason Stauffer

- Best business credit card sign-up bonuses — get over $1,000 in value Jason Stauffer

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Student Travel

Your first study-abroad trip is an experience you'll never forget, but student travel has its challenges. You've got to stay healthy, be safe and manage your money well. Here's how.

Featured Articles

Share this page.

- {{errorMsgSendSocialEmail}}

Student Travel Insurance Benefits

Study-abroad and student travel programs are an incredible opportunity for... More »

5 Ideas For Study Abroad Alternatives

Most traditional study abroad programs include daytime classes and a home... More »

Travel Insurance for Students

Allianz Global Assistance is there when you can't be. We offer travel insurance plans that... More »

{{articlePreview.snippet}} Read More

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Privacy Policy

Travelers Plans How to Travelers Plans in The World

Student universe travel protection.

Traveling can be one of the most exciting and rewarding experiences of your life. Whether you’re exploring new cultures, trying new foods, or just taking in the beauty of the world around you, there’s nothing quite like the thrill of adventure. However, as much as we all love to travel, there are always risks involved. From cancelled flights to lost luggage to unexpected medical emergencies, there are many things that can go wrong on any trip, no matter how well-planned it may be. That’s why it’s important to consider getting travel insurance, and Student Universe Travel Protection is one of the best options available for students and young travelers.

What is Student Universe Travel Protection?

Student Universe Travel Protection is a comprehensive travel insurance plan designed specifically for students and young travelers. It provides coverage for a wide range of travel risks, including trip cancellation and interruption, emergency medical expenses, and more. It’s available to anyone between the ages of 12 and 40 who is planning a trip of up to 90 days in duration.

Top Reasons to Consider Getting Student Universe Travel Protection

There are many benefits to getting Student Universe Travel Protection, including:

Peace of Mind

Traveling can be stressful, but with travel insurance, you can have peace of mind knowing that you’re protected against unexpected events.

Trip Cancellation and Interruption Coverage

If your trip is cancelled or interrupted for covered reasons such as illness, injury, or severe weather, you can receive reimbursement for non-refundable or unused travel expenses.

Emergency Medical and Dental Coverage

If you experience a medical or dental emergency while traveling, you can receive coverage for emergency medical expenses, including hospitalization, surgery, and more.

Baggage and Personal Effects Coverage

If your baggage or personal items are lost, stolen, or damaged during your trip, you can receive coverage for the value of those items.

24-Hour Assistance Services

If you need assistance while traveling, such as help finding a local doctor or arranging for emergency transportation, you can contact the 24-hour assistance services provided by Student Universe Travel Protection.

How to Get Student Universe Travel Protection

Getting travel insurance through Student Universe Travel Protection is easy. You can purchase it when you book your travel through Student Universe or you can add it to an existing reservation up to 24 hours before your trip. You can choose from several coverage levels to find the one that best meets your needs and budget.

If you’re planning a trip, it’s always a good idea to consider getting travel insurance, and Student Universe Travel Protection is one of the best options available for students and young travelers. With coverage for trip cancellation and interruption, emergency medical expenses, and more, you can enjoy your travels worry-free, knowing that you’re protected against unexpected events. So why not get a quote today and see how easy it can be to travel with peace of mind?

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies (May 2024)

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

The Best Student Travel Insurance Companies of 2024

Companies like Faye, Travelex and Seven Corners can provide affordable options for student travel insurance if you’re planning to travel or study abroad.

with our comparison partner, TravelInsurance.com

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

If you’re a college student planning an international excursion, you may decide to protect your investment with travel insurance. Travel insurance compensates you if you need to cancel your trip for a covered reason, get injured abroad, or lose your luggage or other personal belongings while traveling.

Our top recommended travel insurance provider for college students is Travelex , thanks to its budget-friendly policies and quick applications.

Compare Student Travel Insurance Companies

Our top picks for student travel insurance are Travelex, Faye and Nationwide, which offer a blend of affordability and a range of coverage options.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Top 6 Travel Insurance Companies for Students

Here are our top picks for companies that offer student travel insurance:

- Faye: Our top pick for students

- Travelex: Our pick for affordable plans

- Seven Corners : Our pick for international travelers

- AXA Assistance USA : Our pick for leisure travelers

- Nationwide: Our pick for cruise travel

- Generali Global Assistance: Our pick for emergency assistance

To help you get a better idea of what you might pay for travel insurance as a student, we requested quotes from each of the above providers, as listed in the table below. We collected sample quotes for seven trip types, outlined in our methodology.

Why We Chose Faye

If you’re a digital native, you may enjoy how Faye leverages insurance tech to help you get a policy quickly and file a claim on the go. Benefitting from a digital underwriting process, Faye allows you to view policy options and start comparing quotes in seconds.

Launched in 2022 , Faye may be a newcomer to the travel insurance industry, but its seamless online experience has already earned the company hundreds of positive online customer reviews.

Faye features an all-online quote process with just a handful of questions, enrollment and claims-filing process. You can enroll in coverage and file claims directly through its mobile app, and even be reimbursed on approved claims to your phone’s Faye wallet. Faye also offers real-time alerts and 24/7 customer service before and during your trip.

We recommend Faye to travelers who want a quick, all-online experience that doesn’t require wading through complicated coverage options.

Pros & Cons

Coverage & add-ons.

Faye offers one plan with several optional add-on options.

Optional Add-Ons

- Cancel for any reason (CFAR)

- Rental car damage or theft

- Adventure and extreme sports protection

- Vacation rental damage protection

*Coverage limits and availability may vary by state of residence.

A 30-year-old traveler planning a $4,000, five-day trip to the Bahamas would pay about $187 for travel insurance with Faye. Unlike competitors, this company offers only one policy for international travelers.

We We Chose Travelex

As a student, price may be a main focus when shopping for travel coverage. Travelex is Our pick for families for affordable student travel insurance thanks to its low rates. It offers two policies — the Travel Select and Travel Basic plans — with coverage available from just $30 for most low-value trips. Travel Basic plans include limited coverage but can provide peace of mind for students traveling on a budget.

Each plan also includes access to the company’s 24-hour assistance services, a hotline you can call for help with a variety of travel-related issues, such as medical emergencies and lost passports. Note that you will need to purchase the higher-cost Travel Select to cover a trip longer than 30 days (like a semester abroad).

Coverage & Cost

Add-On Options

Travelex offers the following add-on coverages with its travel insurance plans.

- CFAR coverage: Reimburses you up to 50% for nonrefundable expenses if a trip is canceled for a covered reason.

- Additional medical expense coverage: Extends your emergency medical expense coverage to $500,000 depending on your plan.

- Accidental death and dismemberment (AD&D): Offers your family members up to $25,000 in death benefits if you die or are dismembered while traveling. Coverage excludes airline accidents.

- Adventure sports riders: Travelex’s policies exclude injuries from adventure sports from your emergency medical coverage. This waiver eliminates that exclusion, extending your coverage to sporting accidents.

To help you get an idea of how much you might pay for a travel insurance policy, we requested a few sample quotes directly from Travelex. Browse the table below to learn more about coverage costs.

We We Chose Seven Corners

Seven Corners is a travel insurance provider offering a range of affordable options for students living both in the U.S. and abroad. The Basic and Choice RoundTrip plans will be the most useful for students who are residents of the U.S., providing protections for trip cancellation and interruption, emergency medical expenses, emergency evacuation and repatriation, and lost or stolen baggage.

It’s important to note that the coverage provided by the RoundTrip plan may be subject to certain limits and exclusions, so it’s important to read the policy details carefully and contact Seven Corners with any questions. However, with affordable rates and comprehensive plan inclusions, Seven Corners offers a great policy selection for students.

Seven Corners allows you to enhance travel insurance policies with the following add-ons:

- Cancel for any reason (CFAR) coverage: Extends up to 75% reimbursement for nonrefundable travel expenses. You must add CFAR coverage within 20 days of your initial trip payment deposit.

- Rental car damage: Extends coverage to include up to $35,000 in collision coverage for rental cars you use abroad.

- Trip interruption for any reason (IFAR) coverage: Like CFAR coverage, this add-on extends up to a 75% reimbursement if you need to leave your vacation early. You must purchase IFAR coverage within 20 days of your initial trip payment.

To help you get an idea of how much you might pay for a travel insurance policy, we requested a few sample quotes directly from Seven Corners. Browse the table below to learn more about coverage costs.

We We Chose AXA

AXA’s travel insurance policies are comprehensive and provide higher-than-average coverage limits compared to some providers. AXA offers three plan choices — and its most inclusive policy, the Platinum Plan, is ideal for adventure travelers. It includes coverage for lost skiing days, rounds of golf and even up to $1,000 in sports equipment rentals.

Overall, AXA’s plans are highly inclusive and offer a range of benefits. However, pricing is higher than competitors, which can be a particularly large consideration for students.

AXA offers two add-on options.

- CFAR coverage: Provides reimbursements of up to 75% of your trip costs, but you must purchase coverage within 14 days of your initial trip payment.

- Collision coverage: Extends up to $50,000 in collision coverage if you rent a car abroad.

Browse the table below to learn more about what you might pay for an insurance plan with AXA.

We We Chose Nationwide

If you’re a student saving up for a cruise, you probably want to do everything you can to protect your investment. Nationwide is one of the only travel insurance providers to offer policies specifically for cruise vacations. Cruise policies from Nationwide include coverage for all of the following: trip cancellation and interruption, missed connections, itinerary changes, and emergency medical expenses and evacuations.

All Nationwide cruise insurance plans include coverage for weather, work and school-related schedule changes. Coverage even extends to international terrorism that forces you or your cruise liner to cancel. Nationwide also offers standard round-trip insurance plans, which cover all of the standard protections you’d expect from competing insurance providers.

You can add the following optional coverages to Nationwide’s travel plans:

- AD&D: Policies include up to $25,000 in add-on coverage for events that result in AD&D.

- CFAR coverage: Reimburses you for up to 75% of nonrefundable trip expenses.

- Preexisting conditions waiver: Select plans allow you to extend your medical insurance coverage to include preexisting medical conditions present at the time that you apply for coverage.

- Rental car collision coverage: Extends up to $35,000 in rental car collision coverage depending on your plan choice.

Browse the table below to learn more about what you might pay for an insurance plan with Nationwide. Quotes are for standard roundtrip travel insurance policies.

We We Chose Generali

Generali is our top choice for travel insurance that includes 24/7 emergency service — an important consideration if you’re a student traveling abroad for the first time. Generali customers receive access to a 24/7 emergency hotline to contact international travel or telemedicine experts. If you’re traveling to a country where the native language is not English, this can provide peace of mind if you need translation services during an emergency.

Generali’s plans include all the standard coverages one would expect from travel insurance, with three policies available. All policies also include access to emergency transportation, telemedicine assistance and identity theft protection.

You can add the following optional coverages to Generali’s travel insurance plans.

- Rental car damage: You can add up to $25,000 worth of rental car collision coverage on most trips.

- CFAR coverage: Generali allows you to add CFAR coverage to select plans, which provide you with reimbursements of up to 60% for prepaid expenses.

Browse the table below to learn more about what you might pay for an insurance plan with Generali Global Assistance.

What Does Student Travel Insurance Cover?

As a student, most of your money likely goes towards tuition, housing expenses, textbooks and other costs associated with furthering your education. This can make it especially important to protect your financial investments when traveling.

Student travel insurance can provide coverage if you are traveling abroad for educational or cultural purposes. This type of insurance typically covers a range of risks that students may encounter while traveling domestically or abroad, including medical emergencies, trip cancellations or interruptions, lost or stolen luggage, and emergency medical evacuation.

You can purchase travel insurance for a single trip or for multiple trips over a specified period of time. Travel insurance coverage can vary widely depending on your policy details and provider, but if your trip is interrupted or canceled, most plans provide reimbursements for the following nonrefundable expenses:

- Plane tickets

- Reserved car deposits

- Lodging expenses

- Event tickets and excursions you’re unable to use

- Meals, clothing, toiletries and other necessities if your luggage is lost or stolen

- Medical expenses if you are hurt while traveling

While travel insurance is not mandatory for most trips, it can provide peace of mind if you want protection from unexpected trip expenses or disruptions. But keep in mind that travel insurance only provides reimbursements for nonrefundable trip expenses under certain cancellation circumstances — unless you opt for CFAR coverage .

Common Add-Ons

Travel insurance companies commonly allow you to upgrade your plan with add-on coverages. Some of the most common travel insurance add-ons include the following:

- CFAR coverage: Allows you to cancel your trip for any reason and still receive partial reimbursement.

- Rental car coverage: If you’re renting a car abroad, you may need collision coverage. Many travel insurers allow you to add this coverage for an additional cost.

- Umbrella policies: If you’re traveling to a country with particularly high medical expenses, you may want to extend medical coverage using an umbrella rider.

Specific add-on availability will vary by the insurance provider.

Should Students Consider COVID-19 Coverage?

Students may be concerned about whether travel insurance will cover cancellations and interruptions due to COVID-19 . While the specific details of each policy will vary depending on the insurance provider, most travel insurance plans treat COVID-19 as a standard illness when considering reimbursements.

Under the terms of most travel insurance cancellation policies, if you become sick with COVID before traveling and must cancel your trip, you’d be entitled to a reimbursement. Policies may also include medical coverage that extends to a COVID diagnosis you receive abroad. However, plans do not cover trip cancellations due to new COVID-19 outbreaks or strains that develop, nor fear of international travel due to COVID.

How Much Does Student Travel Insurance Cost?

According to our research, the average cost of student travel insurance is $154. However, the total cost of your trip will be the primary factor that influences the price of your travel insurance policy. As the value of your trip increases, so does the expense your insurer will need to cover if you file a claim.

This can make travel insurance cheaper for students who tend to travel on a budget. Medical coverage can also be more affordable for younger travelers, as they are less likely to incur major treatment bills abroad.

For accurate sample pricing, our team collected quotes for the following trips:

- A 19-year-old taking a 7-day, $4,000 trip to Mexico

- A 21-year-old taking a 5-day, $1,200 cruise in the Bahamas

- A 20-year-old taking a 9-day, $5,000 trip to Italy

- A 22-year-old taking a 2-week, $6,000 trip to France

- A 20-year-old taking a month-long trip to Europe (visiting the UK, Ireland, France, Spain and Greece) costing $8,000

Explore the table below to learn more about how age, trip cost and trip length influence price.

As you can see, trip cost influences the price of travel insurance the most for students.

What Impacts the Cost of Student Travel Insurance?

Several factors can affect the cost of student travel insurance, including:

- Destination: The cost of travel insurance can vary based on where you’re traveling. Some destinations may have higher medical care or evacuation expenses, affecting your premium.

- Length of trip: The length of your trip can affect the cost of travel insurance. The longer your trip, the higher your premium will be.

- Age: The age of the traveler can also impact the cost of travel insurance. Older travelers may have higher premiums due to an increased risk of health issues.

- Preexisting medical conditions: If you have preexisting medical conditions, it can affect the cost of travel insurance. Depending on the severity of your condition, you may need to pay a higher premium.

- Trip cost: More expensive trips will come with higher insurance costs since potential reimbursements depend on the price you paid for the trip.

- Deductible: If you choose a travel insurance plan with a deductible, it can lower your premium. However, you’ll be responsible for paying the deductible before insurance coverage kicks in.

Before you buy travel insurance, it’s important to compare companies carefully and select a plan that offers the coverage you need at a price you can afford. You can also check out our guide to the cheapest travel insurance for more coverage options.

Use the dropdown menu below to select your country of travel for a more in-depth guide on travel insurance for that specific location.

Is Student Travel Insurance Worth It?

Student travel insurance is often affordable, as students are more likely to be younger and insure less expensive trips. Both of these factors make students less likely to need to file a claim, which lowers the price of your insurance premium. If you’re planning a more valuable trip or you’re investing a significant amount of time putting your trip together, it can be worth it to consider travel insurance .

Finding the most affordable student coverage starts by defining your needs. If you are traveling abroad for more than a few weeks to study abroad , be sure to review your visa requirements before buying coverage. Read each company’s policy documentation before you buy, and get a quote from at least three providers to see which offers the best deal for your trip.

Frequently Asked Questions About Student Travel Insurance

Can i get travel insurance for a school trip.

Yes, travel insurance companies do provide insurance coverage for school-sponsored trips. If you’re planning on joining a class trip and have non-refundable expenses, it can be a good idea to consider a travel insurance policy.

Do I need travel insurance to study abroad?

Travel insurance is not usually legally required by international governments for students studying abroad. However, your college or university may have its own requirements you must meet in order to qualify for international study. Consult with your student advisor after selecting a study abroad destination to learn more about travel insurance program requirements.

How can college students afford to travel?

College students can afford to travel by taking trips during off seasons, saving money regularly throughout the year, and by taking advantage of study abroad programs. Students traveling internationally may also want to explore budget accommodations like hostels and low-cost airlines to travel without spending as much money.

What does student travel insurance cover?

Student travel insurance provides coverage for unexpected events that can occur during a trip to other U.S. states or a foreign country. These events may include trip cancellations, trip delays or interruptions, emergency medical bills, lost or stolen luggage, and other unforeseen circumstances.

Do I need student health insurance to travel or study abroad?

While U.S. residents do not legally need health insurance to travel, some schools require students to have health insurance while studying abroad. If your medical coverage does not extend outside your home country, you can purchase travel medical insurance to cover you abroad. While standard travel insurance only covers costs related to medical emergencies, some companies offer specific international health insurance plans for routine healthcare costs and medical treatments while traveling.

Other Insurance Resources From MarketWatch Guides

Discover our top recommendations for the following insurance types to find the providers that best meet your needs.

- Best Pet Insurance Providers

- Cheapest Renters Insurance Providers

- Best Term Life Insurance Providers

- Cheapest Homeowners Insurance Companies

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

Other Travel Insurance Resources

StudentUniverse Review: Are they still reliable for students?

A travel app for students sounds way too good to be true. I've done the research so that you wouldn't have to. Here are their features, pros and cons, and what we really think about the app.

Are you a student? Maybe you're feeling a little swamped with assignments and you're craving some time off?

I totally get it.

But when you're juggling student loans and finances, jetting off to some exotic location might not seem like the most feasible way to kick back. But don't let that burst your travel bubble.

Remember this – traveling on a budget doesn't mean you need to skimp on the quality of your adventure. There's a whole world out there, filled with must-visit spots, stunning sights, and cool places to crash that won't blow your budget.

Trust me 'cus this is coming from personal experience: we've got the inside scoop on a service that can make all this happen.

So, let's spill the beans! Let me show you what I've found about StudentUniverse.

What is StudentUniverse?

StudentUniverse came into existence back in 1999, all thanks to Espen Odegard and Fredrik Carl Stromer. They got their online booking engine up and running by 2000. Now, you might be scratching your head, wondering, "How does StudentUniverse rake in the cash?" Here's the scoop.

StudentUniverse is basically like an online travel agent. Every time a user books a flight, reserves a hotel room, or rents a car via StudentUniverse, they snag a small cut. They also earn a few extra bucks through advertising services they're partnered up with.

And here's a bonus: they've got a handy app called Flights by StudentUniverse, available for both Android and iOS users. How cool is that?

Can Anyone Use StudentUniverse?

Alright, here's the lowdown. StudentUniverse's services are for those 15 and above.

And if you're scratching your head, wondering if you can use StudentUniverse even if you're not a student, well, the answer is no. The deal is, only students from recognized colleges or universities can get in on this action, and your status as a student or faculty member is checked during sign-up.

But don't sweat it if your school isn't listed – just drop them an email, and they'll verify your student status. And yes, high school students, you're included too!

Now, you can use StudentUniverse as a "Guest" and grab deals open to everyone. But, if you're after more goodies like hidden fares, special offers, and promo codes, it's worth creating an account and signing up for a "Basic Membership." The best part? It won't cost you a penny!

How Does StudentUniverse Work?

Getting a handle on how StudentUniverse works is a breeze because the website is super user-friendly and doesn't beat around the bush. When you land on the homepage, you'll spot a search bar that'll hook you up with budget flights, hotels, tours, and car rentals.

Let's say you're hunting for flights – you can pick from the cheapest, fastest, or overall best options out there. You'll key in basics like where you're heading, when you're going, and who's tagging along, but you can also note if your travel dates are set in stone or up for discussion.

Looking for a rental car? Plug in when and where you need it, and if you need a driver and their age. Plus, they've got you covered with the nitty-gritty on the kind of insurance StudentUniverse includes; think Collision Damage Waiver (CDW), Theft Protection, airport charges, local taxes, and road fees.

But wait, there's more! The website also boasts a blog and travel guides to help you make decisions. You can pull ideas for things to do, spots to visit, and places to crash from the blog and travel guides. And don't forget, StudentUniverse isn't just for jet-setters – it's also there for students looking to shake things up and work or study from afar.

When it comes to canceling or changing things up, StudentUniverse's policies largely lean on the service provider you've booked through the site or app. If you're curious about cancellations or changes, it's a smart move to touch base with StudentUniverse early in your trip planning . You can also hunt for these policies under the "My Trips" section of your account.

Things We Like About StudentUniverse

- Student status

Once you register with StudentUniverse, you’re registered as a student. So, the proprietary verification technology used by StudentUniverse guarantees discounts for you for every service you book via them. This student status allows StudentUniverse to get better deals for you from airlines; whereas, direct flight bookings may not offer the same (unless offered by the particular carrier).

- Affordability

StudentUniverse is specifically made for students, in case we didn’t emphasize this enough. Considering the financial situation of many students, the services provided through StudentUniverse come with a discount. If you’re under the age of 26, you can get up to 30% discounts on the services booked through them, making them cheap.

- Extra discounts

Added to this discount, the promo code or the promotional coupon gives you additional discounts on services. These promo codes change now and then. So, it’s wise to keep checking to see if there are new promo codes available. StudentUniverse also claims that each flight booking made through them guarantees a cheaper price than a direct booking via an airline.

Things We Don’t Like About StudentUniverse

StudentUniverse claims that they have really good reviews in terms of the services they provide, and they even give you links to the reviews people have left. The reviews they show you are from a reviews website named ResellerRatings. Most reviews you see of them on that website are positive.

However, if you were to look for reviews of StudentUniverse on a different website, like TripAdvisor, they are mostly negative.

These negative reviews are mostly to do with the StudentUniverse cancellation policy. Most users claim that they have had difficulty in canceling and making changes to their plans, even if they were to do it according to the cancellation policy of StudentUniverse.

Is StudentUniverse Worth It?

If you're the type who's super sure about your travel plans and not looking to make changes or cancellations, then there's a good chance you'll bag a solid deal with StudentUniverse. Some travelers have definitely left positive reviews about their experiences.

On the other hand, if you reckon there might be a chance you'll need to switch things up or cancel your trip altogether, you'll want to get familiar with what other travelers have to say about StudentUniverse's cancellation policy. Because life happens and changes and cancellations can spring up when least expected, it might be smart to check out a few personal stories from other users before you lock in any plans.

Here's to safe and stress-free travels!

My Rating: 4.3/5

- Easy to navigate interface

- Great prices

- Helpful customer service

- High cancellation fees

- At times outdated pricing

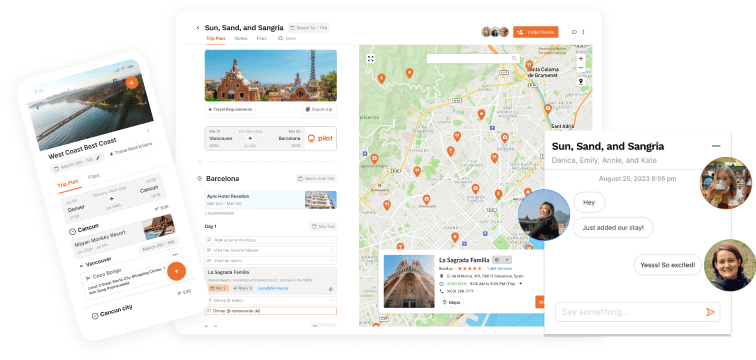

Pilot – Your Ultimate Travel Planner

If you’re planning to travel with your friends or colleagues or any other group of people, Pilot might be able to help you out with it!

Disclosure : Pilot is supported by our community. We may earn a small commission fee with affiliate links on our website. All reviews and recommendations are independent and do not reflect the official view of Pilot.

Satisfy your wanderlust

Get Pilot. The travel planner that takes fun and convenience to a whole other level. Try it out yourself.

Trending Travel Stories

Discover new places and be inspired by stories from our traveller community.

Related Travel Guides

![student universe travel insurance Should You Buy Tickets on Busbud? My honest review [2024]](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0eb0fb86882e4_Busbud_login.png)

Should You Buy Tickets on Busbud? My honest review [2024]

![student universe travel insurance SnapTravel (SuperTravel) Review [2024]: Scam or Bargain?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0eb80ef68855c_Snaptravel%20logo.jpg)

SnapTravel (SuperTravel) Review [2024]: Scam or Bargain?

Going Review (Scott’s Cheap Flights): Worth it in 2024?

Is Scott's Cheap Flights Worth It? Find out if they're for you!

![student universe travel insurance Culture Trip Review [2024]: Reliable travel guide, or nah?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0eb1f3c688ccb_Culture%20Trip%20Logo.png)

Culture Trip Review [2024]: Reliable travel guide, or nah?

Make the most of every trip.

You won’t want to plan trips any other way!

The trip planner that puts everything in one place, making planning your trip easier, quicker, and more fun.

- Helpful Travel Information

Do I need a passport if I'm travelling outside my country?

Simple answer is yes, you do need a passport to leave/get back into Australia. Rules can change on this, so we always recommend you contact your airline directly for these questions. If you are an Australian citizen, we recommend the Department of Foreign Affairs and Trade website as a good source of information. If you are a U.S. citizen, we also recommend the U.S. Department of State website as a good source of information for travel documentation.

Do you offer a travel insurance plan?

Yes we do, and we strongly recommend you get it for your student flights! When you book your student flights you'll be offered the chance to say yes to get a travel insurance plan.

How do I book seat assignments and meal requests?

As part of the booking process for student flights, we do request seats for you automatically. For a variety of reasons the airline may not confirm them, so when you receive your e-ticket confirmation, check and see if there are seat numbers listed. If not, or if you wish to change your seats or request a specific meal, we always recommend going to your airline's website directly.

What does the travel insurance plan cover?

The travel insurance plan covers you and your student travel due to covered reasons such as; Sickness, Injury or death of yourself, a Family Member or a Traveling Companion. The Travel Insurance Plan also provides coverage for Trip Cancellation or Interruption due to inclement weather, unforeseen Strikes affecting public transportation, airline Bankruptcy or Default and more.

Policy documents

On this page you can find the policy documents for Student Universe’s products.

Combined Financial Services Guide and Product Disclosure Statement (Combined FSG/PDS)

The Combined FSG/PDS has the full details on a policy including what’s covered and what’s not, limits and conditions. It also has information on how our claims process works. It forms part of the issuing documents you receive when you purchase a policy.

Travel Insurance

Cover-More Distributors Travel Insurance (Integrated) Combined FSG and PDS (effective 29 September 2021)

Cover-More Distributors Domestic Travel Insurance (Integrated) Combined FSG and PDS (effective 29 September 2021)

Target Market Determinations (TMD)

A TMD helps you understand the types of people (called the ‘class of customers’) our insurance policies are designed for, considering their needs, objectives, and financial situations.

From the 5th October 2021, product issuers, under the Corporations Act 2001, are required to have Target Market Determinations for each product they issue to retail clients.

It also describes the events or circumstances where we may need to review the Target Market Determination for a financial product.

Cover-More Distributors Travel Insurance (Integrated) Target Market Determination (effective 29 September 2021)

Cover-More Distributors Domestic Travel Insurance (Integrated) Target Market Determination (effective 29 September 2021)

To obtain a copy of earlier Target Market Determinations for these products, please contact Cover-More on 1300 72 88 22.

Limits, sub-limits, conditions and exclusions apply. Insurance administered by Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713) on behalf of the product issuer, Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507). Any advice is general advice only. Please consider your financial situation, needs and objectives and read the Combined FSG/PDS before deciding to buy this insurance.

How early should I arrive for my flight?

Make sure you have all the information you need for your student flights. Airlines normally recommend arriving 2 hours prior to any domestic flight, 3 hours for any international flight. These times may change however, so we always recommend you ask this question when you call the airline to confirm your flight the day before departure.

Do you have package deals?

We have student flights to pretty much anywhere you want to go, and we have hostels and budget hotels in all of those places, too. You book your student flight and hostel/hotel separately, so that gives you the freedom to choose (and spend) what you want.

How do I get a receipt for my flight?

Before you complete your student travel you may print a receipt for your ticket through our website by logging into My Stuff. Once you've completed your student flights, your itinerary may no longer be available online. If you need a receipt after it is no longer available, please just email this request, and we would be happy to send you a receipt for your student flights. Simply let us know your flight information, and we will get it out to you right away at no charge.

I have questions about baggage. How much can I bring?

Many airlines charge fees for baggage that are not included in the price of your fare.

You can access the baggage policies regarding checked baggage of the operating carrier by clicking the link below and then the airline's name in the table.

The table is for informational purposes only and is subject to change without prior notice from the airlines. We will make every attempt to keep this information up to date. Airlines will charge you for extra bags, or if the weight of an individual bag exceeds their limits, so please check ahead of time with your airline directly for all questions about baggage, weight limitations, and carry-on questions.

What if I'm sick and cannot fly as scheduled?

Please contact us if you are sick and cannot travel as planned.

You MUST cancel or change your student flights by phone with a StudentUniverse agent prior to your scheduled departure time or you will forfeit the value of your ticket. Change/Cancellation fees will apply. If your ticket is non-refundable, most airlines will not make exceptions in any instance.

Plan for the unexpected; purchase travel insurance when you book your flight.

Where can I find my ticket number/confirmation code?

When you receive your confirmation for your student flights, please click on the link which brings you to My Stuff. Under My Stuff you can select your upcoming itinerary and you will see your ticket number, airline reservation code in the airline's system, and your reservation code in our system. Note: the airline reservation code may be the same in both systems, but can also be different.

Which number/code should be used to check my ticket on the airline’s website?

When you receive your e-ticket confirmation, and click on the link, you will see the airline reservation code (which is frequently different than the StudentUniverse reservation code). This code is generated from the airline when you book, and the code you use to look up your flights on their site.

What if I received an email that my flight itinerary changed?

All schedule changes are done by the airline, and most are only a few minutes different than the original flight.

Depending on how big a change is made, some airline schedule changes can require us contacting you to confirm the new flights. If your airline schedule change does not work for you, please call the airline or you can contact us directly.

Need another copy of your student flights?

If you need a copy of your upcoming student flights and you are traveling on an e-ticket, please go to the StudentUniverse homepage , log in, and go to My Stuff. All your upcoming flights will be available there. If for any reason you are not able to access your flights there, please contact us.

FAQ Categories

- Most Popular

- Hotels and Hostels

- Eligibility, Joining, and Website Information

- Flights - Book, Change, or Cancel

Customer Support

+1 949 864 6017

- International Travel Insurance

- Visitor / Immigrant Insurance

- Senior Travel Insurance

- Business Travel Insurance

- Travel Insurance For Schengen Visa

- Student Insurance Plan

- How It Works

- Manage Your Policy

- Book Appointment

- Get A Quote

My Profile Details

Make payment history.

- Student/ Scholar

Student universe how to get a travel insurance plan?

If you are confused about how to get a travel insurance plan, you can consult one of the following ways:

- You can buy a travel insurance company directly in your home country.

- You can buy it on an online platform through international insurance companies offering student travel insurance plans. You can go to their website or download their app to read clearly through the plans they offer, and purchase one.

- You can also buy travel insurance through online travel insurance brokers, which let you compare policies from many providers before choosing one. The dates and locations during which you want to be covered must also be entered.

Similar Questions

What travel insurance does student universe uk offer.

Like any travel insurance product, student universe UK is also covered all of the following terms:

- Trip Cancellation or Interruption: If you have to cancel or cut short your trip due to unforeseen circumstances, such as illness, injury, or the death of a family member, travel insurance can provide reimbursement for non-refundable trip expenses.

- Medical Expenses: Travel insurance covers medical costs incurred due to illness or injury while traveling. This includes doctor visits, hospitalization, prescription medications, and emergency medical evacuation if needed.

- Baggage and Personal Belongings: If your baggage is lost, stolen, or damaged during your trip, travel insurance can reimburse you for the cost of replacing essential items and belongings.

- Emergency Assistance and Evacuation: If you encounter an emergency situation during your trip, such as a natural disaster or political unrest, travel insurance can help with emergency evacuation and repatriation to your home country.

- Personal Liability: Travel insurance can cover legal expenses and compensation if you are held legally responsible for causing injury to someone or damaging their property during your travels.

- Pre-existing Medical Conditions: Some travel insurance policies offer coverage for pre-existing medical conditions if certain criteria are met.

- 24/7 Assistance: Many travel insurance providers offer round-the-clock assistance services, such as travel advice, medical consultations, and help with lost documents

What does travel insurance on student Universe cost?

Student travel insurance costs vary according to:

- How much protection you desire. You will spend more if you select a health insurance plan with a higher policy maximum. It will cost considerably more if you add coverage for "add-ons" that are optional, like liability.

- The location you are going to. Due to the extremely high cost of healthcare, travel insurance for the US, for instance, is more expensive than in most other nations.

- how long you need to have insurance. It will cost more to purchase travel insurance for a month than for only two weeks.

What is student travel insurance personal liability cover?

Student travel insurance with personal liability cover provides financial protection for students traveling abroad if they are legally responsible for causing injury or property damage to someone else. This coverage also applies to household relatives, so you may be covered if your child accidentally damages your neighbor's property.

Some factors below apply for student travel insurance personal liability:

- Damage to a third party’s property during your careless case.

- Damage to a third party’s vehicle while you are driving.

- Expenses associated with submitting a claim and, if necessary, employing legal counsel; the extent of your plan's coverage will determine these costs.

- Your insurance company will cover the third party's medical bills and any connected expenditures if you are at fault.

- The third-party accidental death benefit depends on the coverage amount in your plan.

- Payment for a third party's lost wages as a result of your negligence, however, is subject to the terms and conditions and policy limits.

Which best student travel insurance?

As an international student, travel insurance is a valuable investment for you. It protects you in unfortunate cases: Cancellation and interruption coverage, lost luggage, medical treatment in case of an illness or accident,...

The best student travel insurance based on your specific needs and circumstances to choose the suitable category. Some factors to consider when selecting a student travel insurance policy: Coverage, medical coverage, pre-existing conditions, destination, duration, additional benefits

You can consider some suppliers that offer student travel insurance: Seven Corners , Travelex Insurance , AXA Assistance USA , Nationwide , Generali Global Assistance .

Besides, you can buy student travel insurance with Travelner . We are proud of providing various categories, 24/07 customer service and suitable pricing policy. Let’s invest student travel insurance to have a peace of mind through study abroad life.

Couldn't find an answer to your question?

Our Customer Success Team of licensed insurance specialists can help. Just click the button below and submit your question. Our experts will typically respond within 48 hours.

Student Insure

Know your plan type, tell us about your trip, trip protection, tell us about your travelers.

Member Portal

Use this link to make changes or to view your member information.

Medical Providers

Locate in-network providers or hospitals near you.

Member Claims

Check claims status, find forms and view your explanation of benefits.

Get ID Card

Click here to view, save and/or print your ID card or policy documents.

Trawick International was founded in 1998. For many years we have provided Student Insurance to Universities, Independent Students and Scholars as well as International Student and Study Abroad insurance plans to students traveling outside of their home country.

After more than a decade of providing these insurance products, Trawick International moved into the travel sector and began offering Travel Insurance plans to clients from around the world.

Today we are pleased to offer a variety of Student Insurance , International Travel Insurance , and Trip Cancellation/Interruption plans. We continue to research ground-breaking products and ideas which meet the needs of travelers everywhere. Trawick strives to offer plans that not only meet those needs but exceed the expectations of our clients.

Our travel insurance programs are designed for those traveling to the USA, individuals traveling abroad, US Citizens who are traveling in the USA and non US citizens traveling from their home country but not visiting the USA. We offer an extensive worldwide network of quality physicians, hospitals and pharmacies. We cover employees, corporations, schools, frequent world travelers, international students, study abroad programs, missionary trips, and just the casual vacation traveler. Our individually customized plans can cover hospital stays, doctor visits, x-rays, prescriptions, ambulance, emergency evacuation, repatriation, flight insurance, trip interruption, trip cancellation, trip delay, and lost baggage.

20 Years Of Trust And Service

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

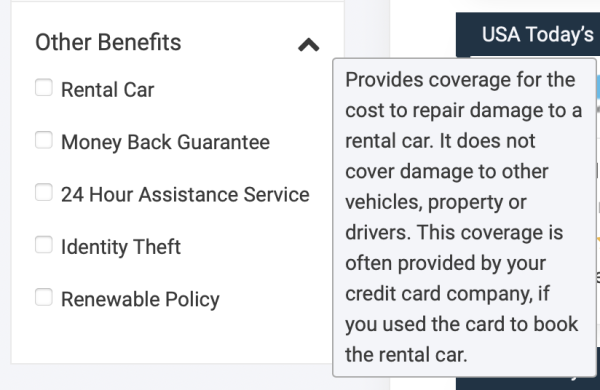

Travel Insurance and Rental Cars: What’s Covered?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you’re planning on renting a car while traveling, you’ll want to make sure that you’re covered with insurance. Most rental car companies offer some coverage at an extra cost, but these options tend to be expensive. But affordable rental car insurance is out there — it just takes some effort to coordinate.

Many general travel insurance policies offer rental car coverage either as part of their standard plans or as an add-on. Plus, you may have a credit card with rental car insurance already included .

Here's a look at how car rental travel insurance works, what it covers and other options for making sure you’re insured while on the road in a rented car.