Wise Travel Debit Card Review: Fees, Exchange Rates, Limits and How to Use It

There are many things you need to keep track of as a digital nomad, such as visas , travel documents, and accommodation , to name a few.

But one of the most important things to work out is your finances. As a digital nomad, you are likely constantly moving between countries and switching currencies, so having a travel debit card is imperative .

The Wise debit card is an easy financial solution for frequent travelers, digital nomads, and expats . So, what is the fuss about this Wise travel card? How does it work? And most importantly, should you hop on the bandwagon and sign up for it?

I have been using the Wise Travel Card for quite some time now and, in this article, I will give you my honest opinion about it.

What is a Wise Travel Debit Card?

If you travel often, you have probably used or at least heard of Wise (formerly Transfer Wise) .

This UK-based tech company was founded in 2011 by Estonian businessmen Kristo Käärmann and Taavet Hinrikus on the principle of providing fast and fair exchange rates for international transfers without any sneaky fees or below-par exchange rates.

I have been personally using their Wise multi-currency account for years now, and it is still the primary way I transfer money abroad. But, I recently started using the Wise travel card , which added an entirely new dimension to my travels.

Can I Use The Wise Card For Traveling Abroad?

The Wise travel card it's not a credit card and functions pretty much like a regular debit card. You simply add funds to the account and insert, swipe, or tap to pay for items.

The main difference? With Wise, you can hold money in more than 40 different currencies and pay like a local for items in more than 160 countries worldwide without having to worry about hefty fees or markups on conversion rates.

Your Wise Travel Card is connected directly to your Wise account, so you can spend funds from your balances.

Who is the Wise Travel Card for?

Obviously, this is a “travel” card, so its primary purpose is for spending abroad while traveling . That said, you could totally use this for your day-to-day expenses. Traditional banks aren’t really designed to cater to frequent travelers or digital nomads , and the Wise Travel Card fills this gap.

For example, my wages are paid from the US, but I live abroad permanently, so I can easily transfer from my US-based bank to Wise and then simply use my Wise card for most of my daily expenses.

You should consider using the Wise Travel Card if one or more of the following applies to you:

- You frequently transfer funds from another country that uses a different currency.

- You travel internationally often and need a card with low currency conversion fees.

- You often shop online with international retailers that sell their products in a foreign currency.

- You own a business and need a card for international expenses.

- Your current bank card has high currency conversion fees and you want to get away from a traditional bank account

- Your current bank card has high fees for using international ATMs.

Wise Card Features for Traveling Abroad

If you have used a travel prepaid card like Revolut , Chime , or Monzo in the past, you can expect similar features from the Wise Travel Card. Let's see which ones are those:

- Low fees on conversions with the mid-market exchange rate

- Hold, spend, and exchange more than 40 different currencies in your Wise account

- Available to citizens and residents of more than 30 countries , including the UK, Canada, EU, USA, and Australia

- Manage, top up, freeze, and view your card balance in the Wise App

- Use at over 2 million ATMs with free monthly withdrawals up to certain limits.

- Create up to 3 digital virtual cards for free

- Auto currency convert feature to automatically convert your funds at your set rate

- Ability to make Contactless payments

- Connect to most popular eWallets like Google Pay, Apple Pay, and more

- Free spending of any currency you hold in your Wise account

- Biodegradable and eco-friendly card design

Pros and Cons of the Wise Debit Card for Travel

When I first started my digital nomad journey, I quickly came to a rude awakening when I found that my bank was charging exorbitant markups on foreign exchange and fees for ATM withdrawals .

If the same is happening to you, you’ll want to get your hands on this gem of a travel card . But before you sign up, let’s go over some of the upsides and downsides of the Wise Travel Card.

Pros and cons:

What to love about the wise debit card.

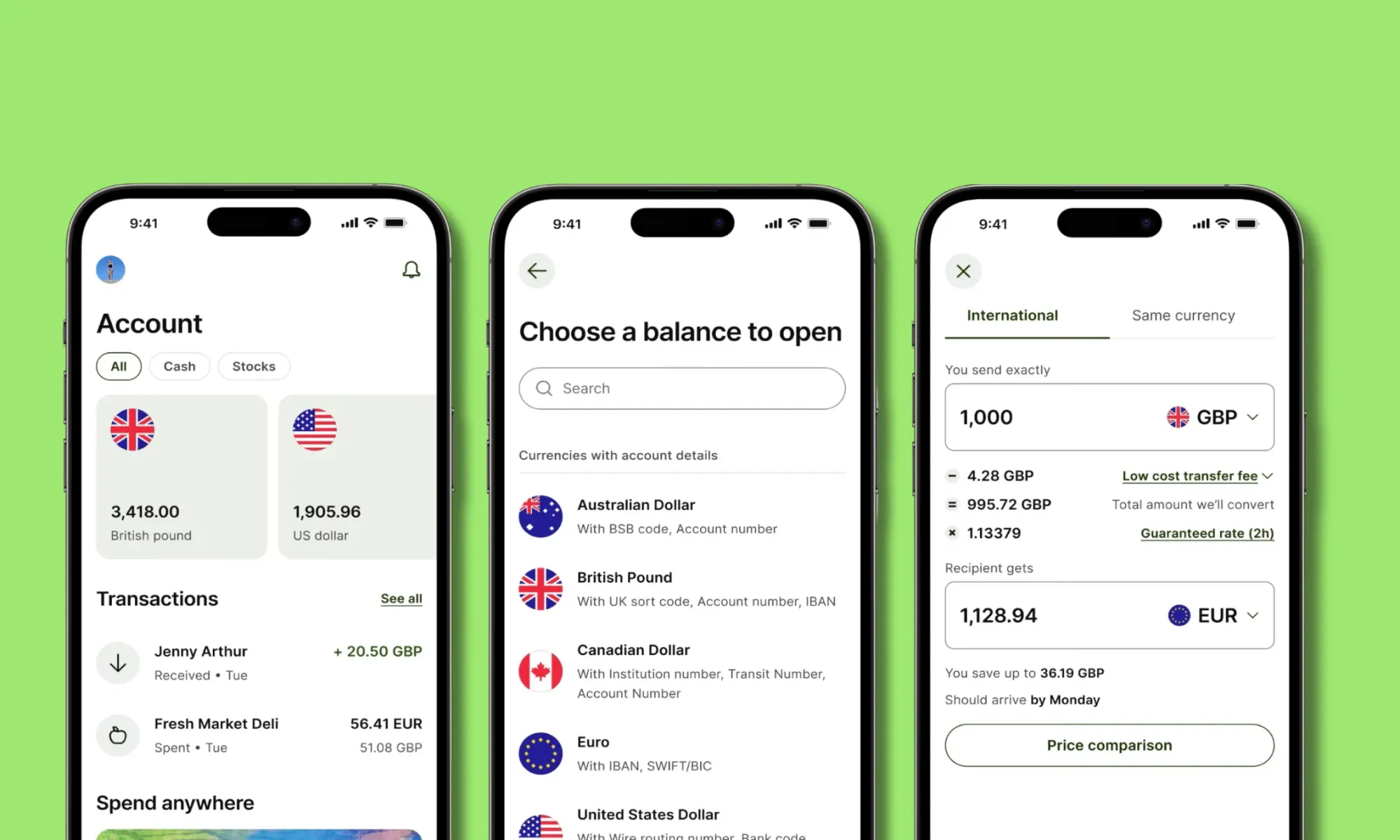

For me, the Wise card's standout features are the app's user-friendliness , the multi-currency account , and the low markup on exchange rates .

Being able to hold more than 40 currencies is a game changer. Transferring funds to different currencies in their app when I travel abroad is super easy. To give you an example, I spend quite a bit of time in Europe, the USA, and New Zealand. And with Wise , I can have separate accounts for USD, EUR, and NZD, which makes my life SO much more manageable when traveling to these countries!

On top of that, while there is a small markup fee on currency exchange, it is extremely minimal compared to other banks I have used .

What Could Be Improved About the Wise Debit Card?

The obvious downsides of the Wise Travel Card lie with ATM withdrawal limits , longer card delivery timeframes , and the lack of a premium option .

I am based in the USA, and my card took more than 2 weeks to arrive. Most digital nomads don’t spend too much time in each place, so this can make it difficult to receive your card initially if you are a frequent traveler .

Also, while card transactions are becoming the norm in many countries, cash is still king in several countries I have traveled to in the past few years. The Wise card is NOT exactly the ideal card for withdrawing cash . You’ll only get two transactions for free , and then you’ll be paying a usage fee as well as a 1.75% to 2% markup . This definitely isn’t a dealbreaker, but I hope Wise will improve this in the future.

What Currencies Can You Use With the Wise Travel Card?

One of the main reasons Wise has kept me on board as a customer all these years is their multi-currency account . This is truly the crown jewel of all of Wise’s features.

You can store 40+ currencies in various wallets in your Wise account , but this doesn’t mean you are limited to spending in those currencies. In fact, you can use the Wise debit card in more than 160+ countries ! If the currency you are spending in doesn’t have a wallet option, the Wise card will simply exchange the money into the payment currency at the time of your purchase .

For example, I was recently in Guatemala, and, unfortunately, I was not able to store Quetzal (the local currency) in my multi-currency account. But when I bought something, my funds were automatically converted from USD to Quetzal at the mid-market rate (plus 0.5%).

There are also 11 currencies for which you get account details to make bank transfers . This means you can transfer funds in the following currency balances directly from your Wise account to another bank account.

This is a feature of Wise that I use often. If I need to transfer funds from my US bank account to one in another country, I almost always use Wise as a “middleman” in order to avoid unexpected transfer fees .

While you won’t be able to make bank transfers in other currencies, you can hold them in your Wise account and spend with your travel card.

How Does the Wise Card Exactly Work?

As you can see, the Wise Travel Card is a wise decision for any traveler (see what I did there?), but how does it exactly work?

As with any new bank account or credit card, there is a bit of a learning curve when first using your Wise travel card . That said, using this card isn’t rocket science, so you’ll be saving money on exchange fees in no time!

How to Use the Wise Travel Card Abroad

The Wise travel card is specifically designed for spending money outside of your home country, so as you would expect, it is pretty easy to use abroad.

All you need to do is order your card , activate it, create a PIN, add money to your account, and you will be all set to use the card in a different country!

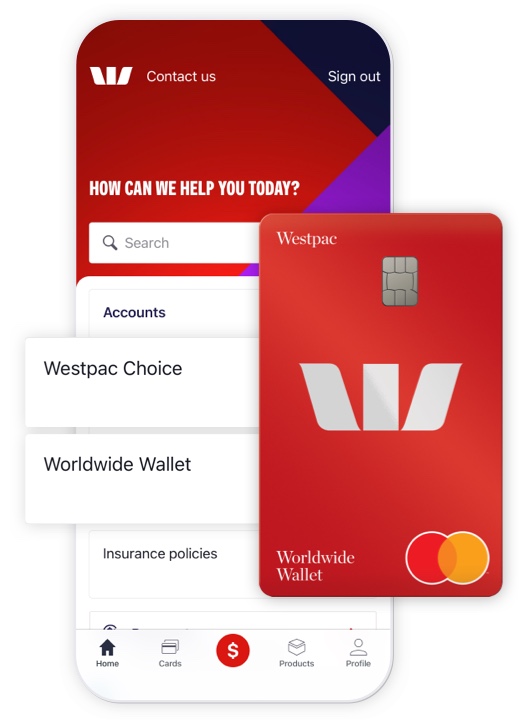

The Wise App

There is nothing more annoying than an app that is built for developers and not for the general public. Your banking and financial app should be easy to navigate and access.

I personally find the Wise app to be extremely user-friendly and intuitive . All features are easy to find, and when navigating through the app, I rarely got stuck or failed to find a setting.

I was easily able to change personal settings, connect bank accounts, exchange money, and send transfers from the app.

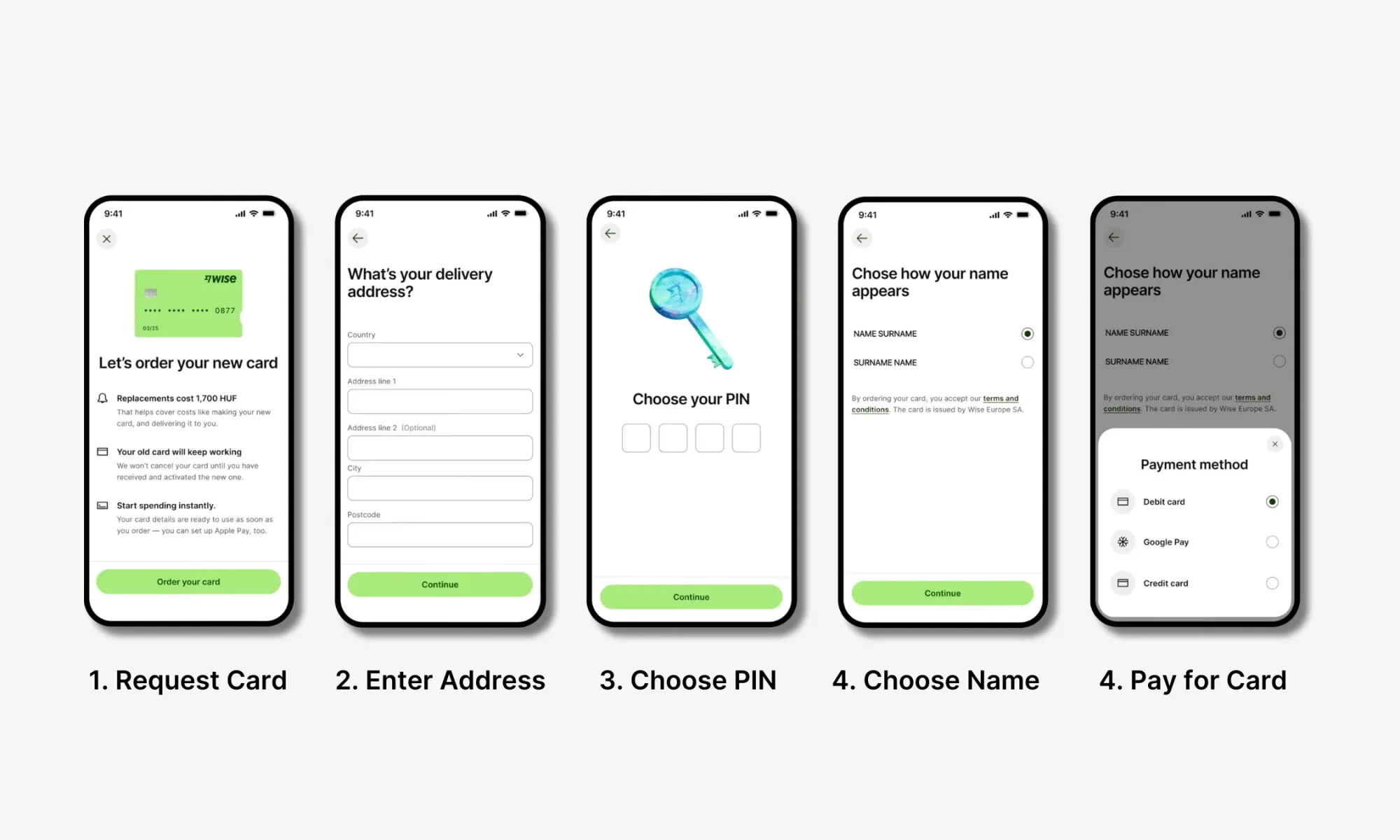

How to Order Your Wise Travel Card

Ordering your Wise Travel Card can take some time (mine took more than 2 weeks to arrive), so I recommend getting on this as soon as possible to ensure you have the card for your next trip!

These are the 3 simple steps you will need to go through:

Step 1: Create a Multi-Currency Account

If you don’t have one already, your first step will be to sign up for a Multi-Currency Account with Wise

Step 2: Start Using Your Virtual Card Immediately

After making an account and verifying your details, you will then be directed to choose a digital/virtual card or a physical card . Digital cards are free and can be added to Google/Apple Pay or used for online payments immediately!

Step 3: Order a Wise Debit Card (Recommended)

If you want instead a physical card, you can do so by clicking on the “Card” tab on the main page and then click on “ Order a Debit Card ”. Physical cards cost a one-off fee of 7 GBP/7 EUR/10 USD , and it will take 7 to 21 business days for the card to arrive, based on your location.

If you'd like to visualise the entire process, watch the instructional video below:

How to Activate Your Wise Card

Once your Wise travel card arrives, it is time to activate it and start spending ! Luckily, for most Wise account holders, you won’t need to take any steps to activate the card, simply make a chip and PIN payment, and the card is ready to go !

Activate Your Wise Card (for US and Japan Customers Only)

As I mentioned above, Wise customers in the USA or Japan must activate the card separately . This isn’t too much of a headache, just don’t forget you need to be in your home country .

Here is a step-by-step breakdown of activating your card if you are a US and Japan customer.

- Log into the Wise app and tap on “ Card ”.

- Then tap on “ Activate Card ”.

- You’ll then be prompted to enter a 6-digit code that you’ll find on your card.

- After entering the code, you’ll create your PIN .

If you'd like to visualise the steps to activate your Wise card for your region, watch the instructional video below:

How to Change the PIN for Your Wise Card

Did you forget your PIN? Don’t worry, it happens to the best of us!

Luckily, if you are a US card holder, you can easily change your PIN in the Wise app :

- Tap on “ Card ” in the Wise app

- Select “ Change PIN ”

- Enter your new PIN 2 times, and you are all set!

If you are a non-US Wise card holder , you cannot change your PIN in the app , unfortunately. Instead, you’ll need to change it using an ATM that supports PIN changes .

My best advice? Choose a PIN you’ll never forget, or keep it written down somewhere secure.

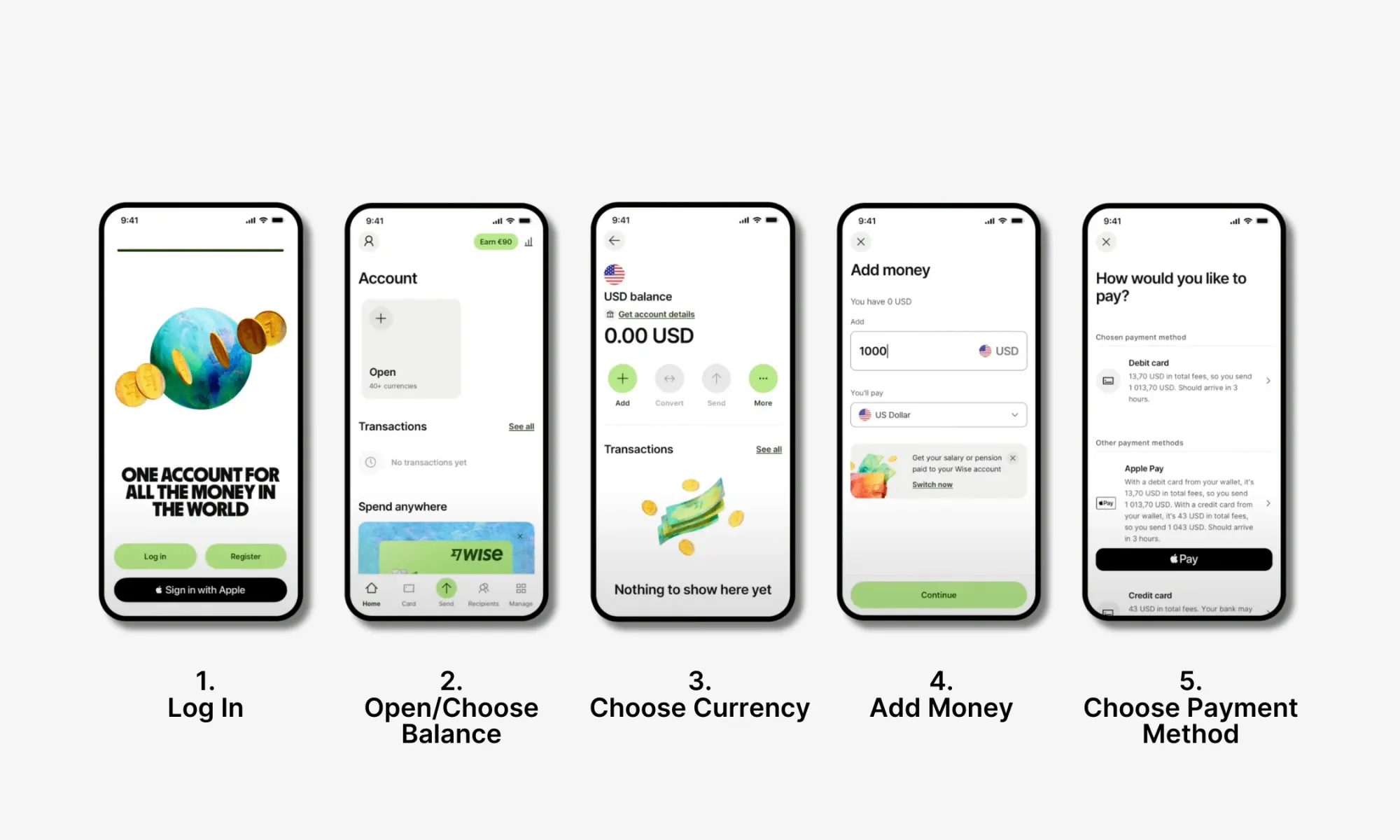

How to Add Money to Your Wise Travel Card

Your Wise travel card is linked to your Wise Multi-Currency account , so you’ll need to top up your Wise account with funds before using the card.

This is a pretty straightforward process:

- Logging into your account

- Choose which currency balance you want to add money to.

- Click “ Add ”.

- Choose which currency you want to use to top up the account.

- Type in the amount of money you want to add.

- Choose your payment method (bank transfer, debit card)

- Confirm the top-up and verify the money arrives in your balance.

Watch the instructional video below to visualise how to top up your Wise balance:

How to Freeze/Unfreeze Your Wise Card

One of the downsides of constant travel is that you put yourself at risk of fraud or losing your card. If you notice potential fraudulent transactions from your Wise card, or you believe your card is lost/stolen, you should freeze your card immediately . This way, you’ll avoid more fraud on your account.

Here are the steps to take to freeze your Wise Travel Card.

- After logging in to your Wise account, tap on “ Card .”

- Then simply click “ Freeze Card ”, or if you want to unfreeze, “ Unfreeze Card .”

- Fill out this transaction dispute form and contact customer support right away. They will be able to help you determine what to do next.

How to Replace a Lost or Stolen Wise Card

If you can confirm that your card has been lost or stolen, you’ll want to cancel the card and then order a new one.

- Log in to your Wise account and click on “ Card .”

- Tap “ Replace Card .”

- You’ll then be prompted to answer why you need a replacement card.

- Wait for the new card to arrive.

How to Use an ATM with Your Wise Travel Card

As mentioned above, ATM withdrawal is not the strongest feature with the Wise card, but you can definitely still use the card to take out cash. Spending with your Wise card is simple since the card can make contactless, chip, and swipe payments and is eligible for Google, Apple, Fitbit, and Garmin Pay. But how do you use an ATM with the Wise card?

Using an ATM with the Wise Travel Card is the same as using any other bank card. Simply insert your card into the machine, enter your PIN, determine how much cash you want to withdraw, and take your cash. Don’t forget to take your card back when you are done (I have made this mistake too many times…).

Wise Card ATM Limits

One of the biggest downsides with the Wise card is that you’ll have limited free ATM withdrawals. For all accounts, you’ll have 2 free ATM withdrawals each month, after which you will be charged an ATM usage fee and a percentage markup on the amount of cash you withdraw.

I use the Wise Travel Card for many of my day-to-day travel expenses, but I use my Charles Schwab Investor Checking account for ATMs. This card not only has a 0% ATM markup, but it also refunds any fees the ATM provider charges. This includes international withdrawals!

Wise Card Delivery Timeframe

Once you order your Wise Travel Card, you can expect it to take between 3 and 21 days to arrive, depending on your location. If you live in Singapore, you’ll get your card SUPER fast. Unfortunately for Americans like me, this isn’t the case.

Wise Travel Card Fees and Exchange Rates

One thing I really love is that using Wise itself is free, and you won’t have to pay an ongoing fee to Wise to use the card. In fact, there isn’t even a Premium account feature, so all users get 100% of the features for free. All this said, there are some charges and exchange rates you should know about before you start using the Wise Travel Card.

Comparison: How Does the Wise Card Holds Up Against Other Travel Cards?

Wise is a leader in the travel account realm, but it still has some major competitors. While all of these different companies vary, they all cater to digital nomads and frequent travelers. The table below will compare some key factors with Wise, Revolut, N26, and Chime.

You may also be interested in:

So, What Travel Card is the Best?

This is a close call and pretty dependent on where you are located. For example, N26 and Chime are awesome choices if you live in the EU or USA (respectively). But, with these options, you can’t hold different currencies like with Revolut and Wise.

For most digital nomads, Wise or Revolut will be the best option. You can hold a huge number of currencies, and they are available to many different nationalities. I have personally used both Wise and Revolut and can say they are both excellent options.

Spending Limits for the Wise Travel Card

The Wise Travel Card has set daily and monthly spending limits for all types of transactions. While these limits won’t be a deal breaker for the vast majority of users, they are still worth noting.

Keep in mind the above limits are for US Wise customers. The amounts will differ slightly for customers based in different regions.

Is It Safe to Use the Wise Travel Card?

Wise is a trusted and safe travel card provider, so you can rest assured that your funds will be protected when using the Wise Travel Card. A licensed and regulated financial institution, your funds are safeguarded in Wise. It is, however, worth noting that since Wise is not considered a bank, it is not FDIC insured. FDIC insures up to $250,000 of bank customer's money, but Wise works a bit differently. Wise safeguards users’ money and is required to ensure all customers have access to all of their funds.

So, is Wise safe to use? Yes, absolutely! We don’t recommend keeping all of your money in Wise, but in general, it is a perfectly secure financial institution.

Additionally, the company uses several security features to protect your data, including HTTPS encryption, a two-step login process, and 24/7 fraud prevention.

What to Do If Your Wise Card Is Lost, Stolen, or Compromised

If you lose your Wise card or suspect it to be stolen or compromised, you’ll need to act quickly to prevent any further fraud. Below, we will go over a step-by-step process for what to do if your card is lost, stolen, or compromised.

- Freeze your card in the Wise app.

- Contact Wise support if you suspect the card to be compromised.

- Cancel the card in the app if you confirm the card is lost or stolen or if fraud charges have been made.

- Order a new card.

- Wait for the new Wise card to arrive.

Bottom Line: Is the Wise Travel Card Worth it?

Time for the 1 million dollar question: Should you get the Wise Travel Card?

If you are a frequent traveler like me and you don’t already have a solid travel card with fair exchange rates, low ATM fees the answer is a resounding yes !

The Wise Travel Card is one of the best cards for digital nomads and expats, as it allows you to seamlessly spend money, withdraw cash, and transfer funds from anywhere around the globe without having to worry about excessive fees. The best part? After paying a one-time card order fee, your Wise account is completely free to use!

Ready To Save Money Abroad with Wise?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

Heymondo Review: Is It a Good Travel Insurance?

How to beat your post-travel depression: your guide to feeling better, how to create a healthy work-life balance while working remotely.

- Step-By-Step Guide

- Google Flights Guide

- Momondo Guide

- Online Travel Agency Guide

- Southwest Airlines Guide

- Airline Seating Guide

- Train Travel

- Ferry Travel

- Blablacar Guide

- Poparide Guide

- Hitchhiking

- Car Rental Guide

- Ride-Hailing Guide

- Public Transport Guide

- Booking Your Accommodation

- Airbnb & Vrbo Guide

- Hostel Guide

- Couchsurfing Guide

- Coronavirus Travel

- Proof of Onward Travel

- Dual Passport Travel

- Travel Insurance

- Advanced Travel Safety

- Female Traveler Safety

- Best Travel Debit Cards

- Best Travel Credit Cards

- Getting Cash

- Travel-Ready Phones

- Prepaid SIM Cards

- Top Travel Apps

- Packing Guide

- Group Tours

- North America

- Southeast Asia

- Central & South America

- Middle East & North Africa

- Australia & Oceania

- Sub-Saharan Africa

- South & Central Asia

- Cheapest Destinations

- Split-Ticketing

- One-Way Return Tickets

- Hidden-City Ticketing

- More Strategies

- Budget Airline Guide

- Cheap Transportation Guide

- Cheap Accommodation Guide

- Top Budget Travel Tips

- Travel Blog

The Ultimate Guide To The Best Debit Cards For Traveling

This page may contain affiliate links which means I get a small commission, at no extra cost to you, if you make a purchase with them. This helps keep the site running and the travel tips coming! For more info, check out my Privacy Policy & Disclosure .

Having the right debit card for traveling is extremely important as it can mean the difference between:

- A stressful experience because your card doesn’t work in your destination / you blew your budget because you didn’t account for hidden fees most banks charge you.

- Being able to pay for things easily both online as well as in person while also saving hundreds or even thousands of dollars a year on fees that you don’t need to pay.

The second option sounds much better, right?

Well the truth is that most banks will charge you fees for foreign transactions, foreign currency conversions, and foreign ATM withdrawals, and if you only travel once a year, the amount you lose on them might not be that much, but if you travel more often than that, you could be losing hundreds or even thousands of dollars a year on these fees!

In addition, some banks still haven’t caught up to the 21st century and the debit cards that they give you might not even work in other countries because they lack basic functionalities such as a chip & 4-digit number PIN, contactless payments, and Visa or Mastercard integration.

However, there are banks out there that offer no-fee 21st century debit cards that are perfect for traveling. When it comes to finding the right one for you, it depends on where you live.

If your current bank offers a card that has all those functionalities and also none of the fees I mentioned earlier, then great! But most standard banks won’t so you might have to look for a different one.

Luckily for you, I have put together a guide to the best debit cards and bank accounts you can get no matter where you live in the world!

Important information about debit cards:

- Try to limit the amount of payments you make with your debit card since it’s your money that is lost if something happens. Use it to take out cash and use credit cards for payments if you can as they are safer since you aren’t technically paying with your own money when you use a credit card.

- If you do choose to make payments, always choose to pay in the local currency because the exchange rate offered by Visa & Mastercard will always be better than the one offered by foreign merchants. The same goes for ATMs. I go into more detail about this in my Guide to Getting Cash While Traveling .

- If your bank offers this feature, lock your card using the mobile app when you’re not using it to prevent fraud.

- Keep a backup debit card hidden in your luggage in case something happens to your main one and know what to do if your card is lost, stolen, or copied. See #6 in my Guide to Money Management While Traveling for all the steps you should take.

Table of Contents

Best Travel Debit Card in the USA

Charles Schwab Bank

Charles Schwab Bank’s debit card is often recommended by travelers because of its lack of fees and the fact that any fees you have to pay when using any ATM in the world get refunded to you!

This is a feature that not many banks offer so this is why they stand out above the rest. If you’re a US resident, you definitely need to look into getting your hands on this bank account and debit card.

Note: if preventing fraud is a priority and you are looking for a card that has instant notifications for transactions + the ability to freeze & unfreeze your card instantly from the mobile app, check out N26 below .

- No monthly account fees

- No foreign transaction fees

- No foreign currency conversion fees

- No foreign ATM withdrawal fees

- ATM fees imposed by ATMs themselves worldwide get refunded to you by the bank (huge benefit)

- Visa debit card & a US Dollar checking account

- Can sign up online

Eligibility

- You need to be a US resident (with proof of residence) and have a US address (no P.O. boxes) to open an account.

- If you are outside the US when opening an account, you must do it using a VPN or else risk requiring a visit to a branch in person.

- You also have to open a brokerage account with them at the same time to use the checking account. However, it’s free and you don’t even have to touch it if you don’t want to.

Best Travel Debit Card in Canada

While not technically a bank, what STACK offers is the best option for Canadian travelers since there is no Canadian bank that has a similar offering.

Signing up with STACK gets you a free reloadable Canadian Dollar Mastercard that doesn’t have any foreign transaction, currency conversion, or ATM withdrawal fees. You can also fund it quickly and easily with e-transfers. Think of it kinda like a prepaid debit card.

- Sign up using this link and receive $5 for free! (You must click the link with a mobile device to get your $5).

- No foreign transaction fees (max 15 in-person transactions per day)

- No foreign ATM withdrawal fees (max 2 withdrawals per day, max $500 per withdrawal, max $2,000 a month)

- Instant push notifications for any transactions

- Instantly freeze and unfreeze your card anytime from the app

- Contactless Mastercard with a chip & PIN

- Digital wallet compatible

- Easily load the card instantly using e-transfers

- Discounts at certain Canadian retailers

- You need to have a Canadian address (no P.O. boxes) to open an account. You might be able to use a friend’s address.

- It is not available in Quebec (yet). Use a friend’s address in another part of Canada until they offer it in Quebec

Best Travel Debit Card in the UK

Starling Bank

There are a few different options available in the UK, but the absolute best option is Starling Bank thanks to the fact that it doesn’t charge you any fees whatsoever for your travel needs.

Other similar UK banks like Monzo and Monese have limits to the amount of ATM withdrawals you can make, charging you extra fees for going over those limits. This is why Starling Bank stands out as the best choice for UK residents.

- In addition to British Pounds, you can also hold Euros in your account and even make purchases in Euros using the same card

- Contactless Mastercard debit card with a chip & PIN

- You need to have a UK address (no P.O. boxes) to open an account. They may also ask for proof of address information so you might not be able to use a friend’s account.

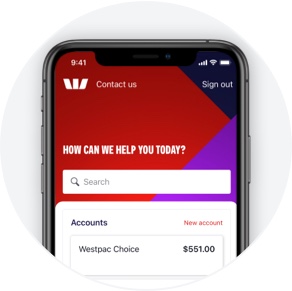

Best Travel Debit Card in Australia

HSBC Everyday Global Account

There are a few decent banking options in Australia, but the HSBC Everyday Global Account takes the cake not only because there are no fees to use it, but also thanks to the fact that it lets you hold a total of 10 different currencies in your account!

You can choose to pre-load your account with a certain currency before traveling or use your main currency and benefit from no foreign currency conversion fees.

- In addition to Australian Dollars, you can hold 9 other currencies in your account: US Dollars, British Pounds, Euros, Hong Kong Dollars, Canadian Dollars, Japanese Yen, New Zealand Dollars, Singapore Dollars, and Chinese Yuan

- Contactless Visa debit card with a chip & PIN

- You need to have an Australian phone number and address (no P.O. boxes) to open an account. If you don’t live in Australia, you might be able to open an account by visiting the nearest HSBC bank to you or by simply using a friend’s phone number and address.

Best Travel Debit Card in Europe

If you live in Europe (or even if you don’t, see below), you gotta go with N26 . They don’t offer completely free accounts, but compared to all the others available, they are the best.

You are able to open a Euro account with N26 in any one of the following countries: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Liechtenstein, Luxembourg, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

Note: they used to be available in the UK, but have left ever since Brexit.

And even if you don’t live in any of those countries, you can ask a friend living in one of them if you can use their address to receive the card, after which you can change the address no problem!

*N26 has also expanded to the US, but Charles Schwab is still the better travel bank account and debit card for Americans to use for the time being unless your priority is fraud prevention, in which case N26 is best since it has instant notifications for transactions + the ability to freeze & unfreeze your card instantly from the mobile app.

- No monthly account fees for the standard account (9.90 EUR for N26 You & 16.90 EUR for N26 Metal)

- Free ATM withdrawals in Euros* (See Eligibility)

- Foreign currency ATM withdrawals come with a 1.7% fee (this fee is waived if you pay for a premium account)

- Free cash withdrawals and deposits at select stores across Germany, Austria, and Italy using their CASH26 feature (deposits over 100 EUR a month get charged a 1.5% fee)

- TransferWise integration for cheaper transfers than most banks

- Online account and customer support also available in Spanish, French, German, & Italian

- Premium accounts come with Travel Insurance, Car Rental Insurance, and even Mobile Phone Theft Insurance!

- The number of free ATM withdrawals in Euros that you get depends on the country you sign up in. Signing up in Austria or Italy gets you unlimited free withdrawals in Euros, whereas signing up in any of the other countries gets you 5 free ATM withdrawals in Euros in Eurozone countries (and only 3 of them if you sign up in Germany), after which they will cost you 2 EUR per withdrawal.

- You need to have an address (no P.O. boxes) in one of the eligible countries to open an account. You can easily use a friend’s address when creating your account to receive the card and then change the address in your account once you get it without any issues. Try to get a friend in Austria or Italy for the unlimited free withdrawals!

Best Travel Debit Card in the Rest of the World

TransferWise Borderless Account

Even if you don’t live in any of the countries I just mentioned or you just want another alternative, you should consider opening a TransferWise Borderless Account.

In addition to super low international transfer fees, you can keep money in more than 50 different currencies in your account as well as have real bank accounts for the USA, UK, Eurozone, Australia, New Zealand, and Poland which also let you receive payments in those currencies like a local!

You also get a contactless Mastercard debit card which you can use to make purchases and take out cash anywhere in the world. Whenever you use that card, if you already have the currency in your account, you don’t get charged any fees and if you don’t have it, you only get charged a small conversion fee, making it a great option for travelers.

Sign up using this link and get a no-fee international transfer of up to £500!

Keep in mind that TransferWise is only able to send cards to residents of Australia, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Hungary, Iceland, Italy, Ireland, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, the Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Singapore, Sweden, Switzerland, the United Kingdom, or the USA (but you can always use a friend’s address to get the card as well).

- Foreign currency conversion fees range from 0.24% – 3.69% depending on the currencies involved, but are typically under 2%

- Free ATM withdrawals up to $250 USD (or your currency’s equivalent) per month if you have the currency you’re withdrawing on your balance. After that, a 2% withdrawal fee will be charged

- Can keep money in 50+ different currencies in your account

- Real bank account details for the USA, UK, Eurozone, Australia, New Zealand, and Poland

- Online account and customer support also available in Mandarin, Spanish, French, Portuguese, German, Italian, Russian, Turkish, Polish, Romanian, and Hungarian.

- You need to have an address (no P.O. boxes) in one of the eligible countries to open an account. You can easily use a friend’s address when creating your account to receive the card and then change the address once you get it without any issues.

- The Mastercard debit card is free, but you need to have a minimum of $20 USD (or the equivalent in another currency) in your account before you can order it unless you’re in Australia, in which case you don’t need a minimum balance to get the card.

And that’s all there is to it!

Having the right debit card while traveling can make a world of difference when it comes to all those annoying fees that most banks charge. Don’t be afraid to get a debit card from more than one bank on this list either! It doesn’t hurt to have the best option for every currency possible.

Let me know in the comments below if this guide helped you find the right debit card for your travels and if there are any similar or better cards or banks in your country, let me know so I can update the list!

And if you want to add a credit card to your wallet as well, check out my Guide to the Best Credit Cards for Traveling .

About The Author

Hi there, I’m Sebastian , founder and creator of Travel Done Simple. Since I turned 20, I have lived in 5 different countries and traveled to over 40 others! You can learn more about me on my About page and find me on social media.

Hi there, I’m Sebastian , founder and creator of Travel Done Simple. Since I turned 20, I have lived in 5 different countries and traveled to over 40 others! You can learn more about me on my About page and find me on social media.

I’m Sebastian , the founder and creator of Travel Done Simple! I was born in Europe and raised in Canada, but I now consider myself to be a citizen of the world. When I’m not busy exploring new destinations, I’m here giving you the best travel tips so you can do the same!

You can learn more about me on my About page and if it’s your first time on my site, start here !

Find Whatever You Need

Latest travel blog posts.

The Best Balkan Trip Itinerary

Life in the Kootenays (BC, Canada)

My Experience In Morocco Feat. That Time I Crashed A Moroccan Baby Shower

Like on facebook.

(And join the official group too!)

Follow on Instagram

Downwithsebster.

Home | About | Contact | Privacy Policy & Disclosure

© 2024 Travel Done Simple - All Rights Reserved

Barclays Travel Wallet Review

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Barclays Travel Wallet is Barclays' very own in-app multi-currency spending tool, and although the concept behind the travel wallet is simple, it's quite unique in our opinion and comes with a few interesting perks that might interest you if you're a frequent traveller.

In this short review, we go through what Barclays Travel Wallet is, how it's different from other travel wallets and cards in the UK, and what its fees and exchange rates are like. Then, we give our verdict on whether we think it's worth it or not, before highlighting a few alternatives instead.

What Monito Likes About Barclays Travel Wallet

- Available to all Barclays current account customers,

- You can set it up in a few taps right from your mobile banking app,

- You simply use your existing Barclays debit card,

- No FX margins for converting leftover currency back to sterling.

What Monito Dislikes About Barclays Travel Wallet

- Exchange rate margins of around 4.6%,

- Balances only available in US dollars and euros,

- Easy to accidentally spend the wrong currency and incur fees.

- 01. What is Barclays Travel Wallet? What makes it different? scroll down

- 02. Is Barclays Travel Wallet really so cheap? scroll down

- 03. How does Barclays Travel Wallet compare to other travel cards? scroll down

- 04. Is Barclays Travel Wallet worth it? Our verdict scroll down

What is Barclays Travel Wallet

When it comes to travel spending, it's easy to think there are two opposed solutions: using your home bank's credit or debit card (the expensive way), or using a third-party travel card like Revolut or Currensea (the more cost-savvy way). However, that's where the Barclays Travel Wallet is different. It lets you use your ordinary debit card and current account to spend abroad and manually convert your pounds sterling into either US dollars or euros right from your Barclays Mobile Banking app.

Barclays Travel Wallet Features

In our opinion, this ease of use is by far the biggest selling point of the Barclays Travel Wallet. Here are the three main features in summary:

- Entirely App-Based: You can set up your Barclays Travel Wallet very quickly and convert sterling right from your bank balance into dollars or euros, even while you're already abroad! This means you don't need to wait to register for and verify a new account with another provider or wait several days for a new debit card to arrive at your door before you travel.

- Use Your Normal Debit Card: Because you don't need to wait for a new special-purpose travel debit card, you can essentially convert your usual debit card into a travel card with Barclays, avoiding the need to wait for a new card to arrive, pay a delivery fee, and have yet another piece of plastic sitting in your wallet!

- Overview and Control: You can use the Barclays Mobile Banking app to keep track of all your transactions (in pounds and in the foreign currency) as well as buy foreign currency at a fixed exchange rate and convert it back to pounds later.

- USD and EUR Only: You can only convert your pound sterling bank balance into US dollars or euros — no other currency is supported yet. This is okay if you're going across the Channel or across the Pond, but it can be a big limitation if you're planning to travel further afield.

How Barclays Travel Wallet Works

Here's a step-by-step overview of how the Barclays Travel Wallet works, assuming you're already a Barclays customer:

- Open your 'Barclays Mobile Banking' app,

- Tap 'Cards' on your home screen,

- Select 'Create a travel wallet',

- Convert pounds to dollars or euros,

- Use your debit card abroad like normal,

- Convert leftover currency back to pounds.

It's worth noting that the last step of converting unused foreign currency back to pounds is important, otherwise you'll be charged 2.99% to pay if you pay in euros or dollars while in the UK! More about that and other fees in the next section.

Barclays Travel Wallet Fees: Are They Any Good?

Using Barclays Travel Wallet to spend your pounds in the Eurozone or the USA is certainly cheaper than using your Barclays debit card directly without the wallet. That's because it allows you to dodge the 2.99% currency conversion fee that's incurred by most Barclays debit card purchases abroad. However, in our opinion, the good deal ends there, because you'll still need to pay the standard Barclays exchange rate to either the US dollar or the euro.

Here's a breakdown of what you are (and are not) charged by Barclays:

Currency Conversion Fees

Barclays Travel Wallet charges no currency conversion fee (allowing you to dodge the standard 2.99% on most Barclays debit cards).

Exchange Rates

The moment you convert your British pounds to dollars or euros, Barclays charges you an exchange rate margin — a type of hidden fee that emerges when you pay the bank's exchange rate while the bank itself uses the mid-market exchange rate (i.e. the 'real' exchange rate you find on Google). To illustrate, here was the mid-market exchange rate for both currencies at the time of writing (7 August 2023 at 11:00 GMT +2):

- GBPEUR: 1.159722

- GBPUSD: 1.2721946

but here were Barclays' exchange rates at the same moment:

- GBPEUR: 1.1061

- GBPUSD: 1.2139

Looking at the difference between these rates, we can see that Barclays charges margins of 4.62% for euros and 4.58% for dollars . While this margin might fluctuate slightly, it's reasonable to assume you'll get a rate between 4% and 5% of the total value of your transaction when converting currencies, which, in our opinion, is very pricey for a travel card.

Fortunately, however, this exchange rate margin does not apply when you're converting unused foreign currency back into sterling; only when you're converting sterling into foreign currency in the first place.

ATM Withdrawal Fees

Just like standard currency conversion fees, Barclays Travel Wallet charges no ATM withdrawal fees (which also allows you to dodge the same 2.99% fee that impacts cashpoint withdrawals with most standard Barclays debit cards).

How Does Barclays Travel Wallet Compare?

Barclays Travel Wallet is a rather unique in-app travel solution whose exchange rates are quite high. But how does it compare to other travel card options in the UK? Let's go through a few below:

Starling Bank

If you're open to registering for a new bank account altogether, then Starling Bank should be top of mind. It's a fully-authorised bank in the UK that's well known for its fee-free current account and its complete range of financial services (including overdrafts, loans, joint accounts, spending insights, payment splitting, virtual cards, euro accounts, interest, etc.). We think Starling offers the best online bank in the UK — one we recommend as a complete replacement for an account at a high-street bank like Barclays.

- Trust & Credibility 9.3

- Service & Quality 8.5

- Fees & Exchange Rates 10

- Customer Satisfaction 9.3

- In-Balance Currencies: GBP only

- Foreign Currency Conversion Fee: £0

- Exchange Rate Margin: 0%

- Foreign ATM Fee: 0%

Probably the UK's most famous fintech, there's a good chance you've heard of Revolut . Using its innovative online platform, you'll not only have access to a broad range of financial services, but you'll also be able to take advantage of these services at a comparatively low price (though fair use limits and weekend FX surcharges may apply). However, Revolut is a travel card and not a bank in the UK, meaning we think it's best used as a powerful spending tool next to a main bank account instead of in place of it.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

- In-Balance Currencies: USD, EUR, CAD, SEK, NOK, DKK, CHF, and 25+ others

- Exchange Rate Margin: 0%-2%

Wise isn't a bank in the UK but a money transfer operator that's well-known for offering some of the cheapest international transfers globally. However, money transfers aren't Wise's only speciality — they also offer the Wise Account , a low-cost foreign currency spending account and card product that's best in class for foreign currency spending of all kinds, whether it's holidays overseas, online shopping, or international money transfers.

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

- In-Balance Currencies: USD, EUR, CAD, SEK, NOK, DKK, CHF, and 45+ others

- Foreign Currency Conversion Fee: 0.35% - 2.85%

Is Barclays Travel Wallet Worth It?

All in all, we think the Barclays Travel Wallet is a viable option for Barclays customers travelling abroad. It's comparatively very easy to set up and start using, which is a big plus in our books, plus it lets you use your ordinary debit card instead of ordering a prepaid one and waiting for it to be delivered.

For this reason, we think the Barclays Travel Wallet is best for its convenience , and can help you access foreign currency quickly if you're a Barclays customer travelling to the US or the Eurozone who doesn't have the time to organize another option ahead of your trip.

On the other hand, the high exchange rates of around 4.6% make Barclays a rather expensive travel card compared to leading prepaid debit cards and other travel card options on the UK market, so if saving money is important to you, you can find much better deals elsewhere. We particularly recommend Revolut , whose debit card comes with no monthly fee, very low fees all round for foreign currency spending, and the capability to hold over 30 foreign currency balances in your app-based account.

As we've seen, Barclays Travel Wallet isn't the only kid on the block when it comes to low-cost overseas spending. See how it stacks up against a few of the best travel cards in the UK below:

Check Out These UK Travel Money Guides

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Digital services

Your mobile banking app

Travel wallet

A multi-currency solution at your fingertips, whenever you need it

You can use your debit card to make payments in euros or US dollars and even withdraw currency from your travel wallet, all without incurring any fees. To help you stay on top of your finances you can also get notifications on your wallet balance.

Why should I use it?

Fix your exchange rate before travelling.

Take the worry out of fluctuating exchange rates. Buy your currency at a fixed rate for your travel wallet. If you’re running low, you can top up any time and use your debit card as normal.

Use your debit card abroad

Our travel wallet allows you to use your existing pound sterling debit card like a multi-currency card abroad. It allows you to use the one debit card in both euros and US dollars, you can create a travel wallet for each currency and use the same card to spend from both.

No transaction fees

You can make purchases and withdraw money abroad for free 1 in the local currency once you have added money to your travel wallet.

Keep the change or change it back

You have the choice of swapping any currency remaining in your travel wallet back to British pounds, and move it back into your account. Or, you can keep it for your next trip – your choice.

Stay on top of your money

You can keep on track of your spending by setting up notifications to manage your wallet balance. Or see how much is left and where you have spent it so far by viewing the balance within the app.

Spending abroad is simple with a travel wallet

How to create your travel wallet in the barclays app.

If you haven’t already, you will need to download the Barclays app 2 to create a travel wallet. Once you’ve registered, follow these steps:

1. Log in to the app 2. Tap on ‘Cards’ on the home screen 3. Tap ‘Create a travel wallet’

Terms and conditions apply . You must have a Barclays current account, be at least 18 years old and have a mobile number.

Please note that travel wallet is currently only available to sole account holders. Debit cards linked to a joint account will not see the option to open a travel wallet.

Check your balance, make payments and keep on top of your finances with our app.

Important information

Fee conditions apply. Some UK-based ATMs dispense foreign currency but charge in pounds sterling which is taken from your current account. Return to reference

Restrictions apply, the app may not be available to download and register in all countries. Return to reference

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Best Travel Cards with No Annual Fees [2024 Guide]: Debit & Credit Options

Travel cards are optimized for international use, with extras like ways to hold a foreign currency balance, extra rewards when you spend overseas, or easy ways to avoid foreign transaction fees.

Travel cards can be either debit or credit cards, and may be issued by major banks, card networks, or specialist non-bank alternatives like Wise or Revolut . Whichever you choose, picking a card with no annual fee can mean you get all the perks when you travel, but don’t have to pay ongoing costs.

This guide walks through 5 of the best travel cards with no annual fee for US customers, so you can see if any might fit your specific spending needs.

Key points: Best cards with no annual fees

Here are the cards we’ll investigate in more detail as we dive into the best travel cards with no annual fees:

- Wise Travel Debit Card : Hold 40+ currencies, and spend with the mid-market exchange rate and low fees from 0.43% in 150+ countries

- Revolut Travel Debit Card : Hold 25+ currencies, and pick your account plan to suit your needs and spending pattern – no-fee currency exchange available to fixed plan limits

- Capital One 360 Debit Card: Spend internationally with no foreign transaction fee – and very few fees to worry about overall; network exchange rates apply

- Bank of America Travel Rewards Travel Credit Card: Spend and earn rewards, with no foreign transaction fee and no annual fee

- Discover Travel Credit Card: Travel credit card with no foreign transaction fee and extra perks like reward points that never expire

Go to Wise Go to Revolut

We’ll take a look at each provider more in detail, later.

Are there travel cards with no annual fee?

Yes, you can get travel cards without annual fees, including debit and credit cards. Generally travel cards have some features specific to international use, whether that’s ways to hold a foreign currency balance, no foreign transaction fees, or extra cash back when you spend overseas.

Picking a card with no annual fee – or no monthly fees – means you can use your card as and when you like, with no ongoing costs to cover. This guide looks at both debit and credit cards, including major bank options – and some alternatives you may like to consider, like Wise and Revolut.

Best international travel cards with no annual fees 2023

This guide walks through a selection of no annual fee travel cards from different provider types. We’ve got a couple of smart international debit cards from non-bank providers, plus a debit card from a major bank, and 2 travel credit cards. This gives a great overview into the options available for US customers – let’s start with a head to head comparison, and dive into the detail right after:

*Details correct at time of writing – 7th December 2023

Wise Travel Debit Card

Who is it for? Customers looking for low cost ways to hold, send, spend, and exchange 40+ currencies with a handy, low cost travel debit card

Wise is a specialist provider which has digital account options you can use to hold 40+ currencies and spend internationally with a linked debit card which is accepted globally.

Add money in USD and simply allow the card to make the conversion at the point of transaction, or convert your funds to the currency you need ahead of time. In either case you get the mid-market rate and low, transparent fees – plus some free ATM withdrawals globally every month.

- Hold and exchange 40+ currencies

- Manage your money with just your phone

- Mid-market currency exchange with conversion fees as low as 0.43%

- Spend in 150+ countries

- No ongoing fees or minimum balance

Wise fees: 9 USD card order fee: 1.5 USD + 2% ATM fee once free withdrawals are exhausted; currency exchange from 0.43%

Here’s how to order your Wise card :

- Register a Wise account online or in the Wise app

- Add a currency balance in USD or another supported top up currency

- Tap the Cards tab in the app, and follow the prompts to order your card

- Complete any required verification step

- Pay the one time fee, and your card will be mailed to you

Go to Wise Learn more: Wise card review

Revolut Travel Debit Card

Who is it for? Customers looking for a travel debit card for 25+ currencies, which also comes with extras like accounts for under 18s, and options to upgrade to an account with annual/monthly fees for more perks

Revolut offers various different account options for US customers, including the Standard plan which has no monthly or annual fee. If you’d prefer you can upgrade to an account with monthly costs, which also unlocks extra benefits and higher no fee transaction limits. This gives flexibility to pick the account that suits your spending habits.

All Revolut accounts can hold and exchange 25+ currencies, and come with a linked debit card for global spending. You’ll get mid-market exchange rates to your plan’s limits, then pay a 0.5% fair usage fee. There are also some no fee ATM withdrawals monthly with all accounts.

- Hold and exchange 25+ currencies – all accounts have some no-fee currency conversion every month

- Choose from an account with no monthly or annual fee, or upgrade to an account with ongoing fees if you’d rather

- Get extras like accounts for younger family members and ways to save

- In network ATM withdrawals have no fees; accounts have some no fee out of network withdrawals monthly

Go to Revolut

Revolut fees Standard plans have no monthly fee, Premium plans – 9.99 USD/month, Metal plans – 16.99 USD/month; Some no fee ATM withdrawals monthly, 2% fees after that; Mid-market rate currency exchange to plan limit; fair usage fee of 0.5% after that; 1% out of hours currency conversion fee

Here’s how to order your Revolut card :

- Register a Revolut account in the Revolut app

- Tap Cards, and then Add new

- Complete your mailing details, and your card will be mailed to you

Capital One 360 Debit Card

Who is it for? Customers looking for a low fee checking account with no ongoing charges, and a debit card which has no foreign transaction fees

If you’d prefer a travel card which is linked to a checking account from a major US bank, the Capital One 360 account may appeal. It’s a low fee account, with very few transaction costs and no annual or monthly charge for either the card or the underlying account. You’ll not pay any foreign transaction fee, making this a good option for international use as well as home spending. Some features on this account – such as options to make international payments – may be limited, so it’s important to read through the terms and conditions carefully if you intend to use this as a primary checking account.

- No fuss, low fee checking account from an established bank

- No foreign transaction fee when you’re abroad

- No monthly or annual fee to pay for the account or card

- Get all the options you’d expect from a bank – additional services and products are easily available for existing customers

Capital One 360 Debit Card fees: 30 USD domestic wire fee, where available, international wires cost 30 USD – 40 USD; some fees for checking services apply

Here’s how to order your Capital One card:

- Go to the Capital One website and hit Open Account

- Enter your name, address and SSN

- Add a balance

- Once your balance is cleared and your identity is verified, your account will be opened and you’ll get your account and routing number

Go to Capital One

Bank of America Travel Rewards Card

Who is it for? Customers looking for a no annual fee, no foreign transaction fee credit card with reward options and great global acceptance

The Bank of America Travel Rewards Card offers rewards on spending, which you can trade in for flights, hotel stays, vacation rentals, baggage fees, and at restaurants. There are attractive opening offers – at the time of writing these include extra bonus points for new customers and an initial 0% APR. After any opening offers expire, you’ll pay a variable interest on your spending if you don’t repay your bill in full every period, and as with other credit cards, penalty fees may apply if you miss a payment or don’t pay at least the minimum required amount.

- No annual fee and no foreign transaction fee – making this good for overseas use

- Great offers for new customers, including reduced costs and extra bonus points

- Trade in your rewards flexible, for a good range of treats and practical items

- Relatively low cash advance fees – but still more costly than using a debit card

Bank of America Travel Rewards Card fees: 18.24% – 28.24% variable APR after introductory offer; 3% cash advance fee

Here’s how to order your Bank of America card:

- Go to the Bank of America website and hit Apply now

- Enter your personal and contact information

- Follow the prompts to enter the details needed for eligibility checks

- Once your account is approved, you’ll be sent your card in the mail

Discover Travel Credit Card

Who is it for? Customers looking for a travel credit card with great rewards which have flexible redemption options

Discover doesn’t have foreign transaction fees on any of its cards – but we’ve picked out this one in particular as the reward options can be cashed in for travel credit, or cash to make your foreign travel that bit more luxurious. There’s no annual fee, but it’s worth bearing in mind that the cash advance fees are pretty high so you may decide not to use this card to get cash from an ATM to cut your costs overall. Discover isn’t the most popular global network – so it’s also worth checking if it’s commonly available in your destination.

- No foreign transaction fee and no annual fee to pay

- Good reward options including bonus perks for new customers

- Cash in your rewards for different things, depending on your personal preference

- Get access to your FICO credit score as part of the package

Discover Travel Credit Card fees: 17.24% to 28.24% variable APR after introductory offer; 10 USD or 5% cash advance fee

Here’s how to order your Discover card:

- Go to the Discover website and hit Apply now

Go to Discover

How can you avoid paying an annual fee?

Avoiding annual fees can keep down the costs of your spending overall, and allow you to get a card which you use primarily when you travel, with no extra charges to worry about.

Here are a few tips to help you pick out the right travel card:

- Look out for debit or prepaid cards in particular – as they often don’t have any annual fee

- Read your card’s terms and conditions carefully to make sure you’re not caught out by surprise ongoing costs

- See if you can find a card which waives the annual fee for new customers – this can be a low risk way to see if a travel card suits your needs

- Pick a card from a non-bank alternative like Wise or Revolut which both have account options with no annual or ongoing fees

How do no-annual-fee travel cards work?

A no annual fee travel card allows you to get your card without paying fixed annual, monthly or ongoing charges. You’ll still find some fees apply in most cases – for example, a one time order fee or a card delivery fee, or fees based on how you transact. However, the advantage here is that you can choose a card which only charges you for the specific services you need, so you can use it as and when you need to without having fees to pay when the card is simply sitting at home.

Pros and cons of no annual fee travel cards

- No ongoing charges so just pay the for transactions and services you use

- Cut the costs of international spending

- Cards are convenient and safe to use, at home and abroad

- Travel cards have international benefits, which can include multi-currency balances and no foreign transaction fees

- Cards are available from banks, direct from card networks, and from non-bank alternatives – giving you a great range to choose from

- You may not get all the features and benefits you would with a card which has annual fees

- Transaction fees still apply, which can include cash advance or currency conversion charges

- You’ll need to complete your application for a new card, and wait for it to arrive in most cases – it’s not an instant option

How to get a travel card with no annual fees

Each travel card has its own application process, but in most cases you can order your card online or in an app, and complete all the verification and eligibility checks needed with nothing more than your laptop or phone.

Here’s what you’re likely to need to do to get a travel card with no annual fees:

- Research which card provider might suit your specific needs

- Go to the provider’s app or website and hit Open Account, or Register

- Enter your personal and contact information – usually name, address and SSN

- Complete any verification or eligibility checks needed

- Add a balance if you’re ordering a debit card

- Once everything is checked and approved, your account will be opened and you’ll get all you need to use and manage your card by mail

How to choose the best card for your travel

The right travel card for your needs will depend on how you plan to use it – including how frequently you’ll transact, how often you’ll be transacting overseas, and whether you prefer a debit or credit card. Here are a few things to consider:

If you’ll travel often: Picking a card that lets you hold multi-currency balances – like the Wise or Revolut cards – can reduce the costs of spending in multiple different currencies, without ongoing fees

If you’ll only use your card occasionally: No annual fee cards can be the best bet, particularly debit cards which tend to be cheaper and more flexible overall

If you want to spread the costs of travel: You’ll want to prioritize credit cards, but look carefully at the interest, including any introductory offers which may help you to reduce costs in the short term

If you want to reduce your costs as much as possible: Debit cards are usually cheaper overall than credit cards, and you can’t accidentally spend more than planned or run up an unexpected bill.

Related: Best travel cards without foreign transaction fees

No annual fee travel cards can offer lots of benefits for anyone who travels frequently – but because there are no ongoing costs, they’re also super helpful for people who only occasionally transact internationally. You’ll only pay for the services you need, and many card providers also have ways to upgrade if you find you use your card regularly and would prefer to pay ongoing charges to unlock more benefits.

If you’re thinking of a debit card which has low costs and lets you hold foreign currency balances, check out the Wise Travel Debit Card which is flexible enough to hold and exchange 40+ currencies, and offers mid-market exchange rates and low, transparent fees. Or if you want to spread the costs of travel over a few months, you might prefer a travel credit card like the Bank of America Travel Rewards Card . You’ll earn rewards as you spend, and although there will be interest to pay, this does allow you to pay back your costs gradually if you choose to.

Use this guide to get you started in picking the right no annual fee travel card for your needs.

FAQs: No annual fee travel cards

Why do some cards have annual fees.

Different travel cards are designed for different customer needs. You’ll be able to find some with no annual fees, such as the flexible debit cards from Wise and Revolut – but if you’re a frequent card user you might prefer a card with an annual fee which can also often have extra perks and benefits as part of the package.

Is a travel card with an annual fee worth it?

Whether or not a travel card will be worthwhile for you depends on how often you travel and how you prefer to manage your money. The benefit of a no annual fee card is that you can test it out with little risk – check out the no annual fee options from Wise and Revolut if you want a flexible debit card which has no ongoing costs and low service charges.

- Disclosures

The Best Travel Credit and Debit Cards with No Foreign Transaction Fees (Updated 2022)

No matter where you go or how long you travel, using a credit or debit card with no foreign transaction fees is one of the easiest ways to save money while travelling, period.

Currency exchange booths at airports and banks can be convenient, but a lot of your money goes towards exchange fees (e.g. $10 per exchange) and hidden commissions padded into poor exchange rates (especially the booths advertising “no commissions”). With a bit of research and planning, you can save hundreds , if not thousands of dollars in fees over the long-term!

Credit and debit cards with no foreign transaction fees are the cheapest, easiest ways to get money and make payments overseas. Credit cards are accepted worldwide, and ATMs are internationally networked through the Visa/Plus and Mastercard/Cirrus networks. You enter your PIN and withdraw your cash just like you would at home, while the exchange rates are automatically handled by the banks.

However, some credit and debit cards are better than others! For the majority of cards, banks still try to add commissions and fees to each payment or ATM withdrawal made abroad. Even if you don't travel a lot, these fees add up quickly.

We've rounded up the best credit and debit cards around the world that minimize or eliminate these fees, putting more money back into your adventure funds!

NOTE: These are cards to be used overseas to avoid foreign transaction fees. For the best all around travel points cards, check out the travel rewards cards section of CardRatings , as well as our free guide “ How to Get Free Flights with Travel Credit Cards and Points “!

The best travel credit cards with no foreign transaction fees

Credit cards have various features that can make or break your travel savings. Ideally, these are the features to look for in a credit card:

- Foreign transaction fee of 0%

- Competitive points or cash-back rewards program (at least 1% of the purchase price)

- Extra perks, like free car or travel insurance

Our top U.S. credit cards with no foreign transaction fees

Not only do the Chase Sapphire Preferred and Chase Sapphire Reserve cards have no foreign transaction fees, but they offer major sign-up bonuses that can already cover a free domestic flight. You also earn 2x-3x the points when spending on travel and dining worldwide, making them essential cards for travelling.

Chase Sapphire Preferred® Card

- 60,000 reward points (worth $750 ) after meeting the minimum spend of $4,000 in the first 3 months

- $50 annual Ultimate Rewards Hotel Credit, 5x points for purchases on Chase Ultimate Rewards, 3x points on dining, select streaming services and online groceries, and 2x points on all other travel purchases.

- Points are worth 25% more on airfare, hotels, car rentals, and cruises when booking through Chase Ultimate Rewards (e.g. 60,000 points worth $750 toward travel)

- Includes trip cancellation/interruption insurance, auto rental collision damage waiver, lost luggage insurance and more.

- Can transfer your reward points to leading airline and hotel loyalty programs

- No foreign transaction fees

- Annual fee: $95

Capital One Venture Rewards Credit Card

- 75,000 bonus miles (worth $750 ) once you spend $4,000 in the first 3 months

- Up to $100 credit for Global Entry or TSA PreCheck

- 2 complimentary lounge visits per year to Capital One Lounges or to 100+ Plaza Premium Lounges

- Earn 5x miles on hotels and rental cars booked through Capital One Travel

- Miles don't expire. Book flights, hotels, or transfer points to 10+ travel loyalty programs.

Americans have the cream of the crop when it comes to credit card options, and they're constantly improving. We highly recommend checking out the No Foreign Transaction Fees section on CardRatings.com for up-to-date card comparisons and sign-up bonuses.

Not from the U.S.? Check your country below to see what's best for you!

The best travel debit cards with no foreign transaction fees

These are the ideal features to look for in a debit card:

- Foreign transaction rate of 0%

- International ATM withdrawal fee of $0

- Refund of third-party ATM withdrawal fees (This is rare, but it exists!)

- Competitive points or cash-back rewards program (at least 1% of the purchase price)

Many banks around the world have come together to establish the Global ATM Alliance . If your card belongs to a bank in the alliance, you can make withdrawals from banks at other alliance member ATMs around the world without paying additional fees . Here's our roundup of the best debit cards for travel.

Essential tips for using debit and credit cards while travelling

1. pay using a credit card whenever possible..

Foreign ATMs can still inflate their exchange rates and charge withdrawal fees, but a direct credit card payment only involves the credit card you signed up with in your home country. And with a good points or cashback program, this beats any other method of foreign payment.

Bottom line? Always pay with a credit card, but NEVER withdraw cash from an ATM with one. Credit cards charge interest on cash advances from the moment you withdraw it at the ATM.

2. Never take the option of paying in your own currency

Card terminals at shops and hotels will often detect that your card is from another country and offer to bill you in your home currency. Never choose this option – always pay in the foreign currency! The exchange rate offered will be inflated by the card terminal, so if you’re using one of the credit cards recommended above, you will receive a much better exchange rate.

3. Inform your debit and credit card providers of your travels

Credit and debit cards are frequently being monitored by security departments for suspicious activity. If you're from the U.S. and you make an ATM withdrawal in Thailand when they don’t know you’re overseas, this could appear suspicious to your bank, and your card might be locked the next time you withdraw. Give your bank or credit card provider a call and let them know when and where you’ll be travelling. Take it from us – you do not want to be stuck without cash and a useless card!

4. Obtain at least one debit and credit card on each of the Visa/Plus and MasterCard/Cirrus networks.

Even if you follow the advice in tip #3, it’s possible your card could get locked anyway. On top of that, it’s easy to find yourself in a situation where an ATM accepts only one network and not the other. For example, when we travelled in Japan, the only ATMs we could find that would even accept international cards were at 7-Eleven, and they only worked with cards on the Visa/Plus network. I speak from experience – there’s nothing more stressful than needing more cash and not being able to withdraw it, so be prepared and bring multiple cards on multiple networks .

5. Consider a credit card with included insurance

The jury is still out on whether it's safe to rely on car and travel insurance that is sometimes provided by credit cards, and unfortunately, the only way to know for sure is to file a claim after the accident has happened. If you're concerned about insurance, its best to be safe and purchase it from the car rental company, but if not, you might as well pay with a credit card that offers car insurance and hope for the best if you do end up in an accident. We generally try to use American Express cards when thinking about insurance, as they are managing the insurance on the cards worldwide, whereas Visa/Mastercard insurance is often handled by the card's issuing bank, and may not be as straightforward to redeem.

6. Keep backup cards in your hotel room

If you lose all your credit and debit cards while overseas, you're going to be in quite the pickle. Always keep at least one extra card back at your accommodation in case your main card or entire wallet is lost or stolen while you're out.

7. Bring $100 USD as backup cash

When all else fails, U.S. dollars are the closest thing to a global currency that we have today. It's the most commonly accepted currency, not only at exchange booths, but even at shops and restaurants in other countries. If there are no ATMs in sight or your cards have been stolen, an emergency backup of U.S. dollars will get you out an emergency situation.

Do you have another card recommendation? Know something we don't? Write it in the comments below!

Psssst : for more guides like this, Like Us on Facebook and follow us on Twitter !

Thrifty Nomads has partnered with CardRatings for our coverage of credit card products. Thrifty Nomads and CardRatings may receive a commission from card issuers. Opinions expressed here are author's alone. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Nice! This is really helpful thanks!

Great tips for travelers!

- Pingback: How to Travel Safely in a Foreign Country

- Pingback: The Get-Your-Sh*t-Together List AKA Prepping for Your Backpacking Adventure | petrinatravels

- Pingback: How to Book the Cheapest Flight Possible to Anywhere - Thrifty Nomads

What are the best U.S. debit and credit cards to use overseas?

Just got off a long phone call with HSBC Canada. They are unable to tell me what their card issuer exchange rate surcharge. I had just come back from Mexico and used my HSBC ATM card on a HSBC ATM machine and I calculated the fee to be about 2.1% based on that days interbank rate. Shouldn’t this fee be in the disclosure statements? There was a class action lawsuit I believe many years ago because the credit card companies failed to state their foreign exchange surcharge. From what I’m reading on the Global ATM website is that Visa is involved with the foreign exchange when using an ATM and it states they add a 2.5% foreign exchange fee. You didn’t show this in your nice graphics above. Is it berried in the base exchange rate?

We use Visa Avion, which is good in all categories but I believe they do charge a slight foreign transaction fee. But we have claimed through their default insurance, both car, health, and travel. All minor things, but ya, no issues. The card is not free however, and unless you spend a lot each month or travel frequently it’s not worth it. For us, the points for the business transactions transfer to personal, so it really adds up! (Currently we have more than enough to fly the entire family pretty much anywhere. ) When abroad we usually only use the card for car rental or nicer hotels and of course flights or trains and such (to access insurance benefits one must book the flight etc on that card…) But read the fine print, confirm with the agent. For example, usually to get car insurance you have to wave the rental companies insurance. (This saved us a ton in Africa!) The rental agencies will even phone and confirm if they don’t know the card. These cards were set up for frequent business travelers originally. But read the fine print too, I know our card covers 30 days from home, but you can add insurance to the card for longer trips too. It’s all through RBC, and like any blood sucking corporation there are advantages for the savvy but their ultimate goal is to get you to pay twice for the same thing. Read the fine print, phone your card agent, etc… But we honestly have found the Avion worth it for us because of the company points.