An official website of the United States government Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Travel plans sometimes change and you may want a refund for a purchased airline ticket or other related services such as baggage or seat fees. This page contains useful information to determine whether you are entitled to a refund for air fare or services related to a scheduled flight.

Am I Entitled to a Refund?

In the following situations, consumers are entitled to a refund of the ticket price and/or associated fees.

- Cancelled Flight – A consumer is entitled to a refund if the airline cancelled a flight, regardless of the reason, and the consumer chooses not to travel.

- DOT has not specifically defined what constitutes a “significant delay.” Whether you are entitled to a refund depends on many factors – including the length of the delay, the length of the flight, and your particular circumstances. DOT determines whether you are entitled to a refund following a significant delay on a case-by-case basis.

- Class of Service Change - A consumer is entitled to a refund if the consumer was involuntarily moved to a lower class of service. For example, if the consumer purchased a first-class ticket and was downgraded to economy class due to an aircraft swap, the consumer is owed the difference in fares.

- Note : In situations where you have purchased an optional service and that amenity either does not work or is not available on the flight, you may need to notify the airline of the problem to receive a refund.

- Airlines may have different policies to determine when a bag is officially lost. Most airlines will declare a bag lost between five and fourteen days after the flight, but this can vary from one airline to another.

- If an airline unreasonably refuses to consider a bag lost after it has been missing for an unreasonable period of time, the airline could be subject to enforcement action by the DOT.

- Learn more about lost, delayed, or damaged baggage .

- Fully refundable ticket - Consumers who purchase fully refundable tickets are entitled to a refund when they do not use the purchased ticket to complete their travel

In the following situations, consumers are not entitled to refunds except under very limited circumstances:

- Non-refundable tickets - Consumers who purchase non-refundable tickets are not entitled to a refund unless the airline makes a promise to provide a refund or the airline cancels a flight or makes a significant schedule change.

- Personal Issue - Consumers who purchase nonrefundable tickets, but are unable to travel for a personal reason, such as being sick or late to the airport, are not entitled to a refund.

- Unsatisfactory Service - A consumer who willingly takes a flight but has a bad experience with the airline or the flight is not entitled to a refund.

- Incidental Expenses – A consumer who incurs incidental expenses such as a rental car, hotel room, or meal due to a significantly delayed or cancelled flight is not entitled to a refund of the incidental expenses.

Note : While airlines are not required to issue a refund for non-refundable tickets, they are free to do so or they may issue a credit or travel voucher for future use on the airline. Airlines must also comply with the promises they make, and in some instances, they may be willing to offer passengers accommodations or other benefits that they are not required to provide. Contact the airline directly to inquire about additional accommodations or benefits.

What if I purchased or reserved my ticket through a travel agent or online travel agency?

- Ticket agents and online travel agencies are required to make “proper” refunds when service cannot be performed as contracted on a flight to, within, or from the United States.

- (i) an airlines cancels or significantly changes a flight;

- (ii) an airline acknowledges that a consumer is entitled to a refunds; and

- (iii) passenger funds are possessed by a ticket agent.

What should I do if I am entitled to a refund and would like to receive one from an airline or ticket agent?

- You should proactively request a refund in writing from an airline or a ticket agent if you believe that you are entitled to a refund.

- If you contact the airline or ticket agent to obtain a required refund and you are refused that refund, you should file a complaint against the airline or ticket agent with the Department at https://secure.dot.gov/air-travel-complaint .

Cancelling a Ticket Reservation or Purchase within 24 hours of Booking

For airline tickets that are purchased at least seven days before a flight’s scheduled departure date and time, airlines are required to either:

allow consumers to cancel their reservation and receive a full refund without a penalty for 24 hours , or

allow consumers to reserve a ticket (place it on hold) at the quoted prices without paying for the ticket for 24 hours .

- Airlines are not required to offer both a hold and a refund option. Check your airline’s policy before purchasing a ticket. However, if an airline accepts a reservation without payment, it must allow the consumer to cancel the reservation within 24 hours without penalty. If an airline requires payment with a reservation, it must allow the consumer to cancel the payment and reservation within 24 hours and receive a full refund.

Although airlines must hold a reservation for 24 hours or provide a refund to consumers at their request within 24 hours of making a reservation, airlines are not required to make changes to a ticket free of charge (for example - change your ticket to a different date or correct a misspelled name on the reservation).

In some cases, instead of paying for a change fee and a potential difference between the original ticket price and the current ticket price, it may be cheaper to request a refund for the ticket and rebook. However, please keep in mind that ticket prices can change quickly.

Does the 24-hour refund/reservation requirement apply to tickets purchased or reserved through a travel agent or online travel agency?

No, the 24-hour refund/reservation requirement for airlines does not apply to tickets booked through online travel agencies, travel agents, or other third-party agents. However, these agents are free to apply the same or similar procedures to provide equivalent or similar customer service.

If you purchased your ticket through an online travel agency (or other agent), you should contact the travel agent directly to obtain a refund before contacting the airline.

How quickly are airlines, travel agents, and online travel agencies required to process a refund?

Airlines and ticket agents are required to make refunds promptly.

For airlines, “prompt” is defined as being within 7 business days if a passenger paid by credit card, and within 20 days if a passenger paid by cash or check.

For ticket agents, prompt is not defined.

This may be addressed in a future DOT rulemaking. More information can be found here:

Airline Ticket Refunds and Consumer Protections

Air Transportation Consumer Protection Requirements for Ticket Agents

DOT Relaunches Air Consumer Website

Tax-Free in the USA for Foreigners and Tourists from Other Countries

- April 7, 2023

Is There a Tax-Free Program in the USA?

According to the U.S. Customs and Border Protection department, the United States Government doesn’t refund sales tax to tourists and foreign visitors .

Even though the USA does not have a tax-free program like Europe, foreigners and tourists can return taxes or buy without taxes by:

- Making a purchase in a state where there is no sales tax

- Making a purchase in a state that has a sales tax refund (or VAT refund)

Tax-Free Shopping in the USA – List of States

By 2023, only five states do not charge VAT on the purchase of goods:

- New Hampshire

Although these states charge other forms of tax instead of VAT, the absence of a sales tax can make shopping more rewarding, especially for out-of-state visitors or tourists.

Everyone (both locals and foreigners) can buy goods without VAT in tax-free states. However, there are two more states, where just foreign tourists, such as people from Mexico, can return sales tax in the USA:

In those states, the program is similar to the European one: buy product and then return sales taxes. With that said, the approach varies per state:

- Louisiana – Shop at a tax-refundable store and show your passport to the cashier. To find out stores where you can shop without taxes, search for the white-red-blue stickers that indicate “Louisiana Tax-Free Shopping”. The seller will provide a tax return voucher that you can exchange for money at the New Orleans airport or downtown Lafayette. You can find out more about Tax-Free in the USA on the official website of the tax refund program .

- Texas – It works similarly, but in addition, a flight ticket or other travel document is also required. In Texas, you can also make a tax refund at the airport or at 14 other locations across the state.

Tax-Free in the USA allows you to save money while shopping in the US by buying goods without taxes or receiving return taxes for purchases that you have already made.

Leave a Reply Cancel Reply

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Mobile Menu Overlay

The White House 1600 Pennsylvania Ave NW Washington, DC 20500

FACT SHEET: Biden- Harris Administration Announces Rules to Deliver Automatic Refunds and Protect Consumers from Surprise Junk Fees in Air Travel

Newly finalized rules will mandate automatic, cash refunds for cancelled or significantly delayed flights and save consumers over half a billion dollars every year in airline fees

WASHINGTON – Building on a historic record of expanding consumer protections and standing up for airline passengers, the Biden-Harris Administration announced final rules that require airlines to provide automatic cash refunds to passengers when owed and protect consumers from costly surprise airline fees. These rules will significantly expand consumer protections in air travel, provide passengers an easier pathway to refunds when owed, and save consumers over half a billion dollars every year in hidden and surprise junk fees. The rules are part of the Biden-Harris Administration’s work to lower costs for consumers and take on corporate rip-offs. President Biden signed an Executive Order on Promoting Competition in 2021 that encouraged DOT to take steps to promote fairer, more transparent, and competitive markets. Requiring Automatic Cash Airline Refunds

The first rule requires airlines to promptly provide passengers with automatic cash refunds when owed because their flights are cancelled or significantly changed, their checked bags are significantly delayed, or the ancillary services, like Wi-Fi, they purchased are not provided. Without this rule, consumers have to navigate a patchwork of cumbersome processes to request and receive a refund — searching through airline websites to figure out how to make the request, filling out extra “digital paperwork,” or at times waiting for hours on the phone. Passengers would also receive a travel credit or voucher by default from many airlines instead of getting their money back, so they could not use their refund to rebook on another airline when their flight was changed or cancelled without navigating a cumbersome request process. DOT’s rule makes it simple and straightforward for passengers to receive the money they are owed. The final rule requires refunds to be:

- Automatic: Airlines must automatically issue refunds without passengers having to explicitly request them or jump through hoops.

- Prompt: Airlines and ticket agents must promptly issue refunds within seven business days of refunds becoming due for credit card purchases and 20 calendar days for other payment methods.

- Cash or original form of payment: Airlines and ticket agents must provide refunds in cash or whatever original payment method the individual used to make the purchase, such as credit card or airline miles. Airlines may not substitute vouchers, travel credits, or other forms of compensation unless the passenger affirmatively chooses to accept alternative compensation.

- Full amount: Airlines and ticket agents must provide full refunds of the ticket purchase price, minus the value of any portion of transportation already used. The refunds must include all government-imposed taxes and fees and airline-imposed fees.

Protecting Against Surprise Airline Junk Fees

Secondly, DOT is requiring airlines and ticket agents to tell consumers upfront what fees they charge for checked bags, a carry-on bag, for changing a reservation, or cancelling a reservation. This ensures that consumers can avoid surprise fees when they purchase tickets from airlines or ticket agents, including both brick-and-mortar travel agencies or online travel agencies. The rule will help consumers avoid unneeded or unexpected charges that can increase quickly and add significant cost to what may, at first, look like a cheap ticket. Extra fees, like checked baggage and change fees, have been a growing source of revenue for airlines, while also becoming more complex and confusing for passengers over time. In total, thanks to the final rule, consumers are expected to save over half a billion dollars every year that they are currently overpaying in airline fees. DOT’s rule ensures that consumers have the information they need to better understand the true costs of air travel. Under the final rule, airlines are required to:

- Disclose baggage, change, and cancellation fees upfront : Each fee must be disclosed the first time that fare and schedule information is provided on the airline’s online platform — and cannot be displayed through a hyperlink.

- Explain fee policies before ticket purchase: For each type of baggage, airlines and ticket agents must spell out the weight and dimension limitations that they impose. They must also describe any prohibitions or restrictions on changing or cancelling a flight, along with policies related to differences in fare when switching to a more or less expensive flight.

- Share fee information with third parties : An airline must provide useable, current, and accurate information regarding its baggage, change, and cancellation fees and policies to any company that is required to disclose them to consumers and receives fare, schedule, and availability information from that airline.

- Inform consumers that seats are guaranteed: When offering an advance seat assignment for a fee, airlines and ticket agents must let consumers know that purchasing a seat is not necessary to travel, so consumers can avoid paying unwanted seat selection fees.

- Provide both standard and passenger-specific fee information: Consumers can choose to view passenger-specific fee information based on their participation in the airline’s rewards program, their military status, or the credit card that they use — or they can decide to stay anonymous and get the standard fee information.

- End discount bait-and-switch tactics: The final rule puts an end to the bait-and-switch tactics some airlines use to disguise the true cost of discounted flights. It prohibits airlines from advertising a promotional discount off a low base fare that does not include all mandatory carrier-imposed fees.

DOT’s Historic Record of Consumer Protection Under the Biden-Harris Administration Both of these actions were suggested for consideration by the DOT in the Executive Order on Promoting Competition and build on historic steps the Biden-Harris Administration has already taken to expand consumer protections, promote competition, and protect air travelers. Under the Biden-Harris Administration, DOT has advanced the largest expansion of airline passenger rights, issued the biggest fines against airlines for failing consumers, and returned more money to passengers in refunds and reimbursements than ever before in the Department’s history.

- DOT launched the flightrights.gov dashboard, and now all 10 major U.S. airlines guarantee free rebooking and meals, and nine guarantee hotel accommodations when an airline issue causes a significant delay or cancellation. These are new commitments the airlines added to their customer service plans that DOT can legally ensure they adhere to and are displayed on flightrights.gov.

- Since President Biden took office, DOT has helped return more than $3 billion in refunds and reimbursements owed to airline passengers – including over $600 million to passengers affected by the Southwest Airlines holiday meltdown in 2022.

- DOT has issued over $164 million in penalties against airlines for consumer protection violations. Between 1996 and 2020, DOT collectively issued less than $71 million in penalties against airlines for consumer protection violations.

- DOT recently launched a new partnership with a bipartisan group of state attorneys general to fast-track the review of consumer complaints, hold airlines accountable, and protect the rights of the traveling public.

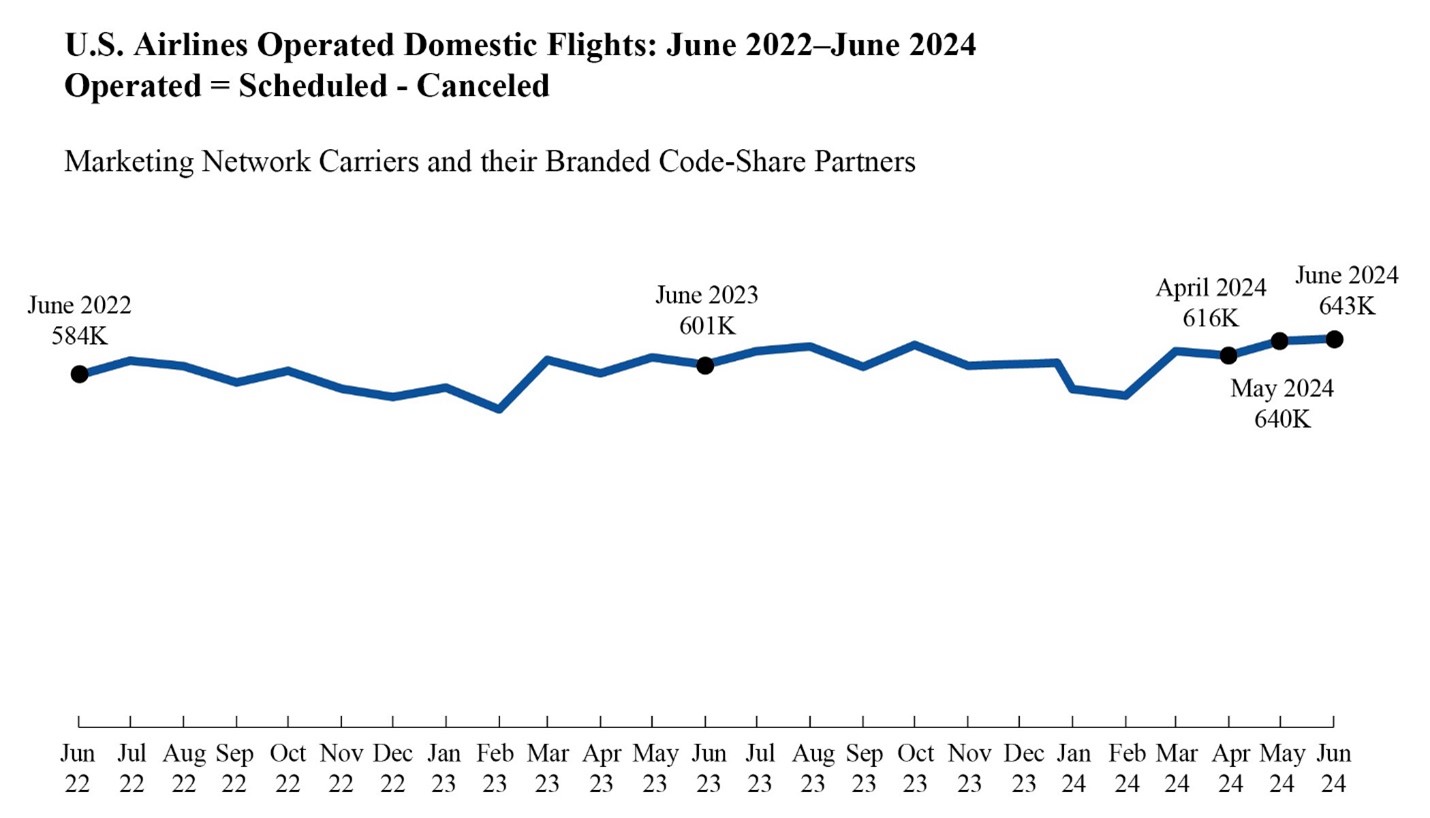

- In 2023, the flight cancellation rate in the U.S. was a record low at under 1.2% — the lowest rate of flight cancellations in over 10 years despite a record amount of air travel

- DOT is undertaking its first ever industry-wide review of airline privacy practices and its first review of airline loyalty programs

In addition to finalizing the rules to require automatic refunds and protect consumers from surprise fees, DOT is also pursuing rulemakings that would:

- Propose to ban family seating junk fees and guarantee that parents can sit with their children for no extra charge when they fly. Before President Biden and Secretary Buttigieg pressed airlines last year, no airline committed to guaranteeing fee-free family seating. Now, four airlines guarantee fee-free family seating, as the Department is working on its family seating junk fee ban proposal.

- Propose to make passenger compensation and amenities mandatory so that travelers are taken care of when airlines cause flight delays or cancellations.

- Expand the rights for passengers who use wheelchairs and ensure that they can travel safely and with dignity . The comment period on this proposed rule closes on May 13, 2024.

Travelers can learn more about their protections when they fly at FlightRights.gov . Consumers may file an airline complaint with the Department here .

Stay Connected

We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

A Guide to the Department of Transportation's Airline Refund Rules

Here's everything you need to know.

:max_bytes(150000):strip_icc():format(webp)/alison-fox-author-pic-15f25761041b477aaf424ceca6618580.jpg)

Jeff Greenberg/Getty Images

The Department of Transportation (DOT) issued a new rule last week detailing when airlines owe travelers a refund and how they have to pay. But like all good things, it comes with a few caveats.

Under the new rules , all airlines in the United States will now be required to refund travelers for significant changes to their flight, baggage delays, and other instances, but it’s important to know what your options are when it comes to getting your money back.

Travel + Leisure broke down the new rules and what frequent fliers need to know about them before your next trip.

When do airlines need to issue a refund?

Travelers are entitled to automatic refunds when their flights are canceled or significantly changed or if the airline fails to provide an extra service they purchased, like onboard Wi-Fi , seat selection, or inflight entertainment . When it comes to changes, the refund is only available if a traveler has not accepted alternative transportation or travel credits offered.

What constitutes a “significant change?”

As part of the new rule, the DOT has defined a “significant change” as:

- A departure or arrival time that is more than three hours from the original time for domestic flights

- A departure or arrival time that is more than six hours from the original time for international flights

- Changes to the departure or arrival airport

- An increase in the number of connections

- A downgrade to a lower class of service

- A connection at a different airport or flights on different planes that are less accessible or accommodating to a person with a disability

What about delayed bags?

Passengers who file a mishandled baggage report are also now entitled to a refund of the checked bag fee if their bag is not delivered within 12 hours of their domestic flight arriving at the gate, or not delivered within 15 to 30 hours of their international flight arriving at the gate, depending on the length of that flight.

How will travelers receive their refund?

Airlines are now required to automatically issue a refund without a passenger having to request one. Refunds must be issued within seven business days for credit card purchases and within 20 calendar days for other payment methods.

Can you get your money back in cash?

Yes. One of the benefits of this new rule change is airlines can no longer offer a travel voucher — which tends to come with an expiration date — and call it a day. Instead, the refund must be issued in cash or the original form of payment (like a credit card or miles). Airlines can substitute travel vouchers or other forms of compensation if the passenger willingly accepts it.

Airlines must also promptly notify consumers affected by a canceled or significantly changed flight of their right to a refund.

When does the new rule go into effect?

The new rule regarding refunds will take effect on Oct. 28.

Can travelers receive compensation for any other reason?

Yes. Passengers who are unable to travel to, from, or within the U.S. because of a medical issue due to a serious communicable disease are now entitled to a travel credit or voucher. These vouchers must be transferable and valid for at least five years from the date they are issued.

In these instances, travelers may be required to provide evidence of their reason for not traveling.

This new rule will go into effect on April 28, 2025.

Related Articles

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

- At the airport

- International travel

Tax exemptions

Tourism tax refunds.

You may be entitled to a refund of some taxes included in the price of your ticket if you meet the applicable criteria for exemptions and your itinerary involves:

- Travel between the U.S. and Mexico (including travel between Canada and Mexico via the U.S.)

- International travel departing Belize, Colombia or Trinidad and Tobago

- International travel arriving into Colombia

All refund claims must be submitted within 12 months of ticket issuance.

Belize Airport Development Tax (BU) exemptions

- Airline crew on duty

- Belizean citizens with a valid passport, Belizean resident card or a naturalization certificate

- Ministers of government, members of the national assembly, or members of the diplomatic and consular corp

- Military personnel

- Mayors of municipalities

- Official of international organizations

- Caribbean community secretariat personnel traveling on official business

- Minister and officials of other government visiting Belize at the invitation of the Belize government

- Public officers traveling on official business

- Approved scholarship holders leaving Belize to study abroad and sports and cultural groups representing Belize who been accredited by the government.

Belize Airport Departure Tax (FV) exemptions

Belize conservation tax (fu) exemptions.

- Infant under the age of two

- Children under the age of 12

Belize International Security Fee (FW) exemptions

Colombia tourism tax (js) exemptions.

- Passengers arriving to Colombia on international flights and connecting with international flights within 24 hours or less

- Passengers arriving on international flights and connecting with domestic flights or stopping in Colombia for more than 24 hours are NOT exempted.

Colombia Resident Exit Tax (DG) exemptions

- Infants under the age of two

- Children under the age of five

- Government officials

- Non-Colombian residents whose stay does not exceed 60 days in Colombia

- Sports delegations accredited by the national government

- Colombians residents abroad whose stay does not exceed 180 days in Colombia

- Transiting Colombia within 24 hours unless on domestic to international sector transit

- Students with government grants

- Airline staff traveling on duty

Mexico Tourism Tax (UK) exemptions

- Mexican citizen (Passport)

- Resident of Mexico (permanent or temporary) holding a Mexico Visa

- Transit/transfer passenger remaining less than 24 hours in Mexico; passengers stopping over in Mexico aren’t entitled to a refund

Mexico Departure Tax (TUA) (XD) exemptions

- Diplomat (does not include staff or U.S. Embassy in Mexico)

If your travel is not complete and you meet the exception criteria, please contact us for assistance.

- Reservations and ticket changes

If you've completed all travel and think you’re entitled to a refund, please contact Refunds to submit a claim.

Receipts and refunds

Trinidad and Tobago Passenger Service Charge Tax exemptions

- Passengers who are 60 years or above and is a citizen or a resident of Trinidad and Tobago

- Members of the Trinidad Tobago defense force of the armed forces of any country traveling on official duty

- Members of the crew of any aircraft or ship are exempt

- Transiting Trinidad Tobago within 24 hours unless on domestic to international sector transit

- Involuntary rerouting due to technical difficulties, weather conditions or other valid reasons

- Passengers arriving on international flights and connecting with domestic flights or stopping in Trinidad and Tobago for more than 24 hours are not exempted

Need to Change Your Travel Plans Due to Coronavirus? These Are Your Options

The global covid-19 pandemic has canceled many travelers’ upcoming trips. in light of the crisis, numerous airlines, hotels, and tour providers have rolled out more lenient change and cancellation policies—with some now extending those policies into the fall and beyond..

- Copy Link copied

Travelers the world over are working to cancel or rebook upcoming trips due to the global coronavirus pandemic.

Photo by Sanga Park/Shutterstock

This is a developing story. For up-to-date information on traveling during the coronavirus outbreak, visit the websites of the Centers for Disease Control and Prevention and the World Health Organization.

For travelers who are having to cancel upcoming trips due to the global coronavirus pandemic (and given the unprecedented scope of this international health crisis, we know there are a lot of you), airlines, hotels, and tour operators are offering cancellation and rebooking options that are (rightfully) more generous than what you would expect during non-pandemic times.

Numerous travel companies have considerably relaxed their change and cancellation policies through the summer and into the fall. Many appear to be keen on doing right by travelers who were unknowingly affected by this situation before anyone fully understood its scope and scale, even as they suffer some pretty unfathomable financial losses themselves.

However, if it’s a full refund you’re hoping for, unless the airline, tour operator, or cruise line canceled your trip (and even then it’s not a guarantee), you’re not necessarily going to get one. The U.S. Department of Transportation did recently remind U.S. airlines that they remain obligated to provide refunds to passengers for flights that were canceled by the airlines.

Travelers with existing reservations for trips that are due to take place several months from now may be in limbo for a little while longer as some travel companies wait to decide on what to do about change and cancellation options further out. While those travelers are likely anxious to make a decision one way or another, to just go ahead and cancel or reschedule, there could be some benefits in waiting a bit to see whether some of these policies do in fact end up getting extended (again).

As for what’s on the table right now, here is a roundup of coronavirus-related change and cancellation policies.

Will airlines refund tickets due to coronavirus?

In light of the coronavirus pandemic, airlines have had to cancel thousands of flights due to travel restrictions that have been put in place by various governments (including by the United States ) and due to a drastic drop in demand as large swaths of the population are sheltering in place and practicing social distancing to mitigate the spread of COVID-19.

Given the avalanche of cancellations, airlines have been steering customers toward the option of obtaining a future flight credit—versus a refund—if their flight has been canceled because of the COVID-19 outbreak. But in early April, the U.S. Department of Transportation (DOT) issued a notice to U.S. and foreign airlines reminding them that they remain obligated to provide “a prompt refund to passengers for flights to, within, or from the United States when the carrier cancels the passenger’s scheduled flight or makes a significant schedule change and the passenger chooses not to accept the alternative offered by the carrier.” (Lawmakers in Europe followed suit days later , with Europen Union Transport Commissioner Adina Valean rejecting calls from airlines to relax refund rules.)

The DOT stated that it had been receiving a growing number of complaints and inquiries from ticketed passengers who said they have been denied refunds for flights that were canceled or significantly delayed.

For flights that passengers choose to cancel, the airlines are offering future flight credits, allowing travelers to cancel their ticket and basically set aside that money to be used on a flight at a later date—and thankfully, you don’t have to book that flight now (which is good because it’s impossible to know how this pandemic is going to play out). American and Delta are currently offering that flexibility for flights that were scheduled to depart all the way through the end of September, and United’s flight change waiver now extends to the end of the year.

American Airlines: Any flights booked on American up until May 31, 2020, for travel through September 30, 2020, can be rebooked without change fees for travel that takes place by December 31, 2021; flights booked between March and May 31, 2020, for all future travel can also be canceled and changed without a change fee (while the fees will be waived, you will be charged a fare difference).

The airline is encouraging those who don’t plan to travel anytime soon to simply cancel their flight online and then rebook at a later date. When you’re ready to rebook, call the reservations department and be prepared to give them your 13-digit ticket number and 6-character confirmation number.

If a flight was canceled by American Airlines (either due to travel restrictions or capacity reductions), American said it will send affected passengers an email, and they can either rebook the trip or request a refund for the remaining ticket value and any optional fees.

United Airlines: For a flight booked with United between March 3 and April 30, 2020, you can change it for free—one time—for travel that takes place within the next year. Any flights booked prior to March 3 (regardless of whether they are domestic or international) with original travel dates through May 31, 2020, can be canceled and rebooked for a flight that takes place within 24 months with no change fees. Flights booked prior to March 3 with original travel between June 1 and December 31, 2020, can be canceled and rebooked within 24 months with no change fees but the change or cancellation must be done by April 30, 2020 .

With regards to requests for refunds for canceled flights, United now has an online form that customers can fill out to see if they qualify for a refund. The airline said it could take up to 21 business days to process each request.

Delta Air Lines: Any Delta ticket for domestic or international travel through the end of September can be canceled and rebooked without a fee for travel that takes place up until September 30, 2022. Flights purchased between March 1 and May 31, 2020, can be changed without a fee for travel up to a year from the date of purchase. For flights canceled by Delta, the airline said that passengers will either be issued a future flight credit for the value of the ticket or they can request a refund .

JetBlue: Customers who were due to travel with JetBlue through January 4, 2021, on any flight that is booked by May 31, 2020, can cancel and bank the funds to use for travel up to 24 months from the date the flight credit was issued.

Southwest Airlines: Southwest’s standard refund policies hold, with a few coronavirus-related adjustments. The carrier has tier fares that include refunds (Business Select and Anytime) and a tier fare (Wanna Get Away) that doesn’t include refunds. Those remain the same. But regardless of the type of ticket purchased, it can be canceled sans fee for a future travel credit for up to a year from the original date of purchase. However, if you had travel funds that were set to expire between March 1 and June 30, 2020, those will now expire on June 30, 2021; travel credits from flights canceled for travel that was originally scheduled to take place between March 1 and June 30, 2020, will expire on June 30, 2021.

Alaska Airlines: Alaska flights purchased on or before February 26, 2020, for travel that was originally scheduled to take place March 9 through December 31, 2020, can be canceled, the money set aside in an Alaska account, and the flight rescheduled for anytime up to one year from the original travel date. Any tickets purchased between February 27 and May 31, 2020, for travel anytime through April 30, 2021, can also be changed with no fee for travel up to one year from the original travel date.

British Airways: The U.K. carrier is allowing customers who have booked or who book new flights between March 3 and May 31, 2020, to change those flights for free—and any existing bookings for departures through May 31, 2020, can be changed without a fee as well. Those who would prefer a refund have been asked to call the airline.

Air France: The French airline is offering a travel voucher for flights that were scheduled to depart through July 2, 2020, which will be valid for one year on any Air France, KLM, Delta Air Lines, and Virgin Atlantic flights.

How are Expedia, Priceline, and other online agencies handling coronavirus refunds?

Online travel agencies such as Expedia, Travelocity, Orbitz, and Priceline serve as “middlemen” between travelers and travel suppliers. They have different working relationships with all the suppliers on their sites, which can complicate things a bit.

For instance, Expedia , Orbitz, and Travelocity can help change or cancel reservations for some of the air carriers they sell tickets for, but not all of them. For the ones with which they lack that ability, customers will have to work directly with the airline. But the bottom line is: The airline’s policy will be the policy that customers of Expedia, Orbitz, and Travelocity will have to work with.

Priceline advises its customers that “if your airline does not allow you to cancel or change your flight, we are not able to help you at this time.” The travel booking site offers a very comprehensive contact list, including websites and phone numbers, for all its partner airlines.

On the hotels front, Expedia, Travelocity, and Orbitz are allowing customers to cancel with no penalty all hotel stays through May 31, 2020, that were booked prior to March 19, 2020. For hotel stays after May 31, 2020, Expedia advises customers to check back with the site closer to the departure date.

Coronavirus refunds for hotels and vacation rentals

Hotels have always been pretty flexible when it comes to changing and canceling reservations, but in the wake of the coronavirus pandemic, they are being even more so.

Marriott International: Marriott is allowing all guests at all of its more than 7,300 properties around the world with existing reservations, for any upcoming stay regardless of the date and regardless of whether the original rate had some restrictions, to change or cancel without a charge up to 24 hours prior to arrival—here’s the key thing to note— as long as the change or cancellation is made by June 30, 2020 . For those who make new reservations now through June 30, 2020, they will be allowed to change or cancel at no charge up to 24 hours before arrival, regardless of the date of stay.

Hilton: For guests who have booked stays that were scheduled to begin on or before June 30, 2020, at any of Hilton’s more than 6,100 global properties, the change fee is being waived and the company is offering full refunds for all cancellations (including on reservations described as “non-cancellable”) up to 24 hours before arrival. New reservations booked between now and June 30, 2020, for any future arrival date, can be changed or canceled at no charge up to 24 hours before arrival.

Accor: The 5,000-hotel Accor hasn’t offered much detail on its coronavirus-related change and cancellation policies other than to say that it has advised all of its hotels to adopt flexible change and cancellation conditions for travelers with new or existing bookings through April 30, 2020.

Intercontinental Hotel Group: IHG has waived cancellation fees for existing bookings that were made by April 6, 2020, at all of its hotels the world over for stays through June 30, 2020. It is handling groups and meeting bookings on a case-by-case basis. The company has also developed some new rates and booking options for future travel such as its “book now, pay later” rate, which doesn’t require a deposit and can be canceled up to 24 hours before your stay for bookings made up to September 3, 2020, for travel until December 30, 2020.

Airbnb: Vacation rental powerhouse Airbnb recently issued an updated global change and cancellation policy. Reservations for stays and experiences made on or before March 14, 2020, with a check-in date between March 14, 2020, and May 31, 2020, can be canceled for a full refund by guests, and hosts can cancel without a charge or impact to their Superhost status (and Airbnb will refund all service fees). Reservations made on or before March 14 with a check-in date after May 31, 2020, as well as any reservations made after March 14, 2020, will not be covered unless the guest or host has contracted COVID-19. Otherwise, the host’s standard cancellation policy will apply.

What are tour operators’ policies for coronavirus changes and refunds?

Given the global health crisis that the coronavirus pandemic presents, most reputable tour operators have gone ahead and proactively canceled a good portion of their upcoming itineraries (similar to what the cruise lines did—see below). Here are some examples.

Tauck: Long-time tour provider Tauck has canceled its scheduled tours and cruises through June 30, 2020—and for those tours it will refund the affected guests. For tours that were scheduled to take place between July 1 and July 31, 2020, guests can cancel and receive a future travel credit for any tour in 2020 or 2021 (but airline change fees will not be covered). Standard change policies remain in place for tours scheduled to take place August 1, 2020, and beyond.

Abercrombie & Kent: Luxury tour operator Abercrombie & Kent has temporarily suspended ground operations globally from March 17 to May 31, 2020. A&K is offering guests on those journeys a future tour credit (that will include a 10 percent discount) for any trip for travel that takes place up to December 31, 2021.

Intrepid Travel: Global tour company Intrepid Travel has also suspended its tours through September 30, 2020. For those tours, travelers will receive a 110 percent future tour credit that they can apply toward any itinerary up until September 30, 2022. For tours departing October 1, 2020, and beyond, Intrepid said they are continuing as planned at this point, but that if customers choose to cancel, they can do so and receive a credit for whatever they had paid to be used for travel that takes place by September 30, 2022.

Collette: Family-owned tour operator Collette has canceled all its tours through June 30, 2020, and all affected guests are being offered either a future travel credit or the generous option to receive a refund.

What about cruises?

On March 14, the U.S. Centers for Disease Control and Prevention issued a 30-day “ No Sail Order” for all cruise ships to prevent the spread of COVID-19. As of April 15, 2020, the CDC extended that order, and cruise ship operations (in waters subject to U.S. jurisdiction) have been suspended until July 24, 2020, or until the U.S. Secretary of Health and Human Services declares that coronavirus no longer constitutes a public health emergency, or until and unless the CDC Director rescinds or modifies the order.

Affected customers are being offered anywhere between a 100 percent and 200 percent future cruise credit by the cruise lines.

How travel advisors can help

During a complicated and overwhelming global crisis such as the coronavirus pandemic, a travel advisor can serve as a great ally. While travel advisors can’t force travel suppliers to refund their clients, they typically have stronger relationships with suppliers and thus more sway. They will be better able to help you navigate through the options for changing your trip plans. And as travel professionals (who likely have dealt with numerous crises in the past), they can offer their advice based on their myriad of contacts in the industry and from their own personal experience.

They will also have greater insights into the kinds of trustworthy and reliable travel companies you will want to book your future travel with as we navigate this ever-changing pandemic landscape.

Can travel insurance help you get a refund?

With regard to the current coronavirus crisis, travel insurance providers consider it to be a known event as of January 21, 2020 (or thereabouts, the date can change slightly depending on the provider, but usually falls sometime between January 21 and January 27, 2020). Travel insurance purchased before that date will cover disruptions resulting from the outbreak, but any travel insurance purchased after that date will not.

An exception to that is Cancel for Any Reason (CFAR) coverage , an optional upgrade to a travel insurance policy that covers cancellations for reasons not otherwise covered by a standard travel insurance “such as fear of traveling due to coronavirus or simply not wanting to travel to a country that may be affected,” according to Megan Moncrief, chief marketing officer for travel insurance search and review site Squaremouth.

There are some limitations, however. The CFAR upgrade has to be purchased within 14 to 21 days of making the initial trip deposit and it will reimburse travelers for up to 75 percent of their trip cost—for a price. Cancel for Any Reason coverage typically costs between 5 and 10 percent of the total trip cost.

This story originally appeared on February 24, 2020, and has been updated to reflect current information.

>> Next: How Cancel for Any Reason Travel Insurance Can (and Can’t) Help You

Tired of manually filing sales tax returns? Let TaxJar file for you.

- Sales Tax Compliance Platform

- Real Time Calculations

- Sales Tax Reports

- Nexus Insights

- Filing and Remittance

- Integrations

- Food and Beverage

- Mid-Market Business

- Small Business

- Resource Center

- Sales Tax Fundamentals

- Sales Tax by State

- Sales Tax Calculator

- Product Demo

- Help & Support

- TaxJar & Stripe Tax

- Contact Support

- Contact Sales

Featured resource

Subscribe to our free sales tax newsletter

Resources Blog Calculations

Can US tourists get a sales tax refund when leaving the country?

by TaxJar January 5, 2024

Please note: This blog was originally published in 2021. It’s since been updated for accuracy and comprehensiveness.

I remember traveling in Ireland and a nice shopkeeper reminding me that I could get any VAT I paid as a tourist back before leaving the country. How handy! But that led me to wonder, since the US is so fragmented (what with 46 states and Washington D.C. all administering their own sales tax), does the US do the same thing for tourists when it comes to sales tax?

The short answer is: not really.

But there are some exceptions. Let’s take a look at what tourists from outside the US can expect when it comes to a sales tax refund.

There’s no federal US sales tax

Before we get into the how of sales tax refunds, it is first important to understand the “why.” Unlike Europe, where a nationwide value added tax (VAT) is applied to most transactions, the US allows each state to set their own sales tax rules and laws.

Sales tax is charged at the point of sale and is a percentage of the price of the product. Sales tax is a “consumption tax,” meaning that it is charged for use of the product. That’s why a retailer who is buying a product to resell does not have to pay sales tax while an end user does have to pay sales tax – because they are the one “consuming” the product.

And even if sales tax weren’t a consumption tax, because the US’s sales tax is fragmented among the forty-six different states (and Washington D.C.) that all have a sales tax, there’s no easy or commonsense way for a tourist in the US (especially one who has traveled and made purchases in multiple states) to collect any sales tax paid before leaving the country.

Exceptions to the tourist sales tax refund rule

According to the Sales Tax Institute , there are a few exceptions which allow international tourists to claim sales tax paid. They are:

- Louisiana tax free shopping program – Individuals traveling in the US for less than 90 days and who hold a foreign passport, US Visitor’s Visa and an international transportation ticket to leave the country can apply for a refund on sales tax paid at a few qualifying retailers. Learn more at the Louisiana Tax Free Shopping Program website .

- Texas private sales tax refunds – Some private companies in Texas will refund the sales tax paid by international visitors who shop at certain stores. This is very limited, and requires the buyer to purchase from a participating store and provide proof such as original receipts, travel documents, flight or transportation numbers and even spend a certain amount of sales tax per store in order to participate.

- Washington non-resident sales tax exemption – The state of Washington provides a sales tax exemption to buyers who make a purchase of an item in Washington but do not intend to use the item in the state of Washington. Learn more about Washington’s non-resident sales tax exemption here .

You can also read more about each program here: “ I am visiting from another country. Can I get a refund of sales tax paid? ”

Diplomatic sales tax exemptions

Diplomats serving in the US, as well as their families and dependents, are not required to pay sales tax. In this case, the diplomat and their contingent are given a sales tax exemption card. According to the US Department of State, “Diplomatic tax exemption cards can generally be used to obtain exemption in person and at point-of-sale from sales taxes and other similarly imposed taxes on purchases of most goods and services, hotel stays, and restaurant meals in the United States.”

These cards must be presented each time the diplomat is required to pay sales tax. The vendor must look up the card’s validity or risk having to pay the unpaid sales tax out of pocket.

You can learn more about the US diplomatic sales tax exemption here .

Watch our product demo

See how TaxJar can simplify your compliance.

Related posts

Calculations

Arizona transaction privilege tax and Arizona use tax

Why five digit zip codes don’t always return correct sales tax rates

Is shipping taxable in Illinois?

Is shipping taxable in West Virginia?

Most popular posts.

2024 sales tax holidays

Resale certificate, how to verify

Sales tax by state: Is SaaS taxable?

by TaxJar February 1, 2024

Sales tax by state: should you charge sales tax on digital products?

Canadian Visitor Tax Refund

The canadian foreign convention and tour incentive program (fctip) , if you've recently come from abroad to visit our beautiful country, you could get back some of the money you spent here thanks to canada's foreign convention and tour incentive program, international tourists or non-residents may be eligible for a tax rebate on the goods and services tax (gst) and/or the harmonized sales tax (hst) paid on select tour package components, foreign convention supplies and exhibitor purchases. .

Who Qualifies for the FCTIP Refund?

- Royal Canadian Mounted Police Non-resident individuals, organizations, businesses or tour operators not registered for the GST/HST, on short-term accommodations and/or camping accommodations included in an eligible tour package.

- Foreign convention sponsors plus convention organizers and exhibitors not registered for the GST/HST, for the GST/HST paid on select services and/or facilities used during the course of conventions held in Canada.

Please note: the FCTIP no longer offers a GST/HST rebate to non-residents for the Canadian accommodation portion of eligible tour packages purchased after March 22, 2017. However, the rebate may still apply to tour packages or accommodations supplied between March 22, 2017 and the end of 2018, if the amount owing for the provision is paid in full prior to January 1, 2018.

A rebate for certain costs related to foreign conventions continues to be available the under the Foreign Convention and Tour Incentive Program.

For more information on the FCTIP: visit the Foreign Convention and Tour Incentive Program (FCTIP) website.

- You must be a non-resident of Canada when the rebate is filed

- You must spend a minimum of $200 Canadian before taxes on a tour package to be eligible for a tax refund (the cost cannot include property and services included in the tour package that are not subject to tax, such as overseas transportation services)

- You must not purchase the eligible tour package for any resale business purposes (except for tour operators in the business of selling tour packages)

- As a certified non-resident tour operator, you must have sold the eligible tour package to another non-resident individual

- You must provide documentation showing proof of eligibility for the rebate

- Of the GST/HST paid on eligible tour packages, 50% of the taxes can be claimed

For detailed information on tour package rebates: visit GST/HST rebate for tour packages.

To download the application form for tour packages: go to GST115 GST/HST Rebate Application for Tour Packages.

- As a foreign sponsor or non-registered organizer, you can make an FCTIP rebate claim for the GST/HST paid on convention facilities and related supplies

- As a foreign exhibitor, you can make an FCTIP rebate claim for the GST/HST paid on the exhibition rental space as well as related supplies that don't include food, drink or catering, when obtained from a GST/HST registrant who is not the convention sponsor

- Of the GST/HST paid on a convention facility, 100% of the taxes can be claimed

- Of the GST/HST paid on convention supplies that don't include food, drink and catering, 100% of the taxes can be claimed

- Of the GST/HST paid on convention supplies related to food, drink and catering, 50% of the taxes can be claimed

- You must provide copies of all supporting documents along with your rebate claim (e.g.: convention schedule, event program, receipts and invoices showing GST/HST payments, hotel bills, proof of exhibition space rental)

For detailed information on foreign convention and non-resident exhibitor rebates: visit GST/HST and QST rebate for sponsors of foreign conventions, organizers of foreign conventions, and non-resident exhibitors.

To download the application form for foreign conventions and non-resident exhibitors: go to GST386 Rebate Application for Conventions.

Contact Information

Prince Edward Island Tax Centre, 275 Pope Road, Summerside PE C1N 6A2, CANADA.

While travelling, be sure to keep all eligible receipts and upon your return home, send in your receipts and completed application, signed and dated.

To check on the status of your FCTIP rebate: call 1-800-959-5525 from within Canada or from the US, and 613-940-8497 from outside Canada and the US.

More GST/HST Rebates

Commercial goods and artistic works exported by a non-resident

Taxable sale of real property by a non-registrant

© VisitorsToCanada.com | Privacy Policy

Can you get a trip refund if the US issues a travel advisory for your destination? Here's what to know

Even if there's a "do not travel" warning, you're likely not entitled to a refund for your flight or resort purchase. but a travel pro shares a suggestion, by susan hogan, news4 consumer investigative reporter • published february 2, 2024 • updated on february 4, 2024 at 9:20 am.

If you’re planning a trip in the next few months, perhaps for spring break, you might be wondering what to do about travel advisories issued for some popular destinations for Americans during the colder months.

The U.S. State Department recently issued travel advisories for both the Bahamas and Jamaica. If you've booked a trip to either location, here's what to know.

📺 Watch News4 now: Stream NBC4 newscasts for free right here, right now.

Travel advisory for Americans planning to go to Jamaica:

On Jan. 23, the State Department issued a Level 3 warning for travel to Jamaica , which suggests that Americans "reconsider travel." This comes after reports of violent crime at all-inclusive resorts and concerns over medical services.

Travel advisory for Americans heading to the Bahamas:

And on Jan. 26, the State Department issued a Level 2 warning for travel to the Bahamas , urging travelers to exercise increased caution. This comes after a security alert posted by the U.S. embassy in Nassau expressed concerns that Americans might be victims of gang violence in the Bahamian capital. There have been 18 reported murders this year, although none involved tourists, state officials say.

Can you get a refund for a trip if there's a travel advisory?

If you want to cancel your trip because of these travel warnings, unfortunately you're probably not entitled to a refund for your flight or resort purchase, even if an advisory is at level 4, which means "do not travel" — unless you got travel insurance or booked refundable trips.

I've spent 20 years studying 100-year-olds—the world's happiest people all share these 15 things in common

FBI: ‘Financial sextortion' of teens is a ‘rapidly escalating threat.' How parents can protect their kids

However, you could contact the airline or resort directly and ask them to work with you.

"If you’re concerned, afraid, and you don’t want to risk anything right now, sometimes the airlines will be flexible," said Clint Henderson, managing editor at The Points Guy . "You’ll see airlines issue travel waivers sometimes."

What to do before international travel:

Before booking any international trips, pay close attention to this map showing State Department-issued travel advisories across the globe.

If you travel to any area where there is an advisory:

- be careful when you’re out at night

- keep a low profile

- be aware of your surroundings

- don’t fight back if you're confronted by robbers

Before you travel, the State Department recommends that you sign up for its Smart Traveler Enrollment Program (STEP ). Through that program, you can:

- get information from the U.S. embassy in your destination about safety conditions

- help the U.S. embassy contact you in an emergency, whether it's a natural disaster, civil unrest or a family emergency

- help family and friends get in touch with you in an emergency

This article tagged under:

- What do I need to know about the Wayfair case and economic nexus?

- What states impose sales/use tax?

- What is Nexus?

- How do I know if I should be collecting tax in a state?

- Can you collect and remit tax for a state even if not required to do so?

- What is the difference between sales tax and use tax?

- Does the Seller Collect Tax for the State It is Located In or the State Where the Customer is Located?

- How do Drop Shipments work for sales tax purposes?

- Didn’t the Internet Tax Freedom Act (ITFA) ban taxes on sales over the Internet?

- Why doesn’t the out-of-state retailer collect the tax?

- If you don’t have nexus and don’t charge sales tax, are you liable if the customer does not pay the tax?

- What is the Streamlined Sales Tax Project (SSTP)?

- What is a resale certificate and who can use one?

- What is an Exemption Certificate and Who Can Use One?

- How are contractors’ purchases taxed?

- Is a sales tax return required even if my tax due is zero?

I am visiting from another country. Can I get a refund of sales taxes paid?

- Do states provide a list of what is and is not taxable in their state?

- I’m making sales over the Internet. Do I have to collect sales tax on all the sales I make?

- What are Sales Tax Holidays and how do they work?

- I Bought a Taxable Item and the Seller Didn’t Charge Sales Tax. Do I Have to Pay the Tax Anyway?

- What is Sales Tax Compliance and How Do I Do It?

- Which Sales Tax Institute course is right for me?

- How do states tax rentals and leases?

- As a US seller, do I need to worry about VAT?

Generally, no refund of sales tax is available if you took possession of the item from the vendor with a given state. In the United States, sales tax is imposed at the point of transfer of title or possession. Therefore, if a non-resident visitor to the United States purchases any taxable items and takes possession of the goods at the retailer’s location, sales tax is due and there is generally no refund of the sales tax paid simply because the goods will be removed from the United States. The United States is different from many other countries that have a VAT structure, where it is more common to get this type of refund.

If the retailer ships the goods out of the United States to the non-resident’s location in another country, then the sales tax is generally not due. However, the retailer must export the goods and the customer cannot take possession of the goods in the United States.

There is an exception to this rule in Louisiana, Texas and Washington.

The city of New Orleans offers a tax-free shopping program – the Louisiana Tax Free Shopping Program – for foreign visitors to the United States. Individuals travelling in the United States for 90 days or less with a foreign passport and/or a current US visitor’s visa and an international transportation ticket can apply for a refund of sales tax paid on qualifying items purchased from New Orleans retailers taking part in the program.

U.S. resident aliens residing in the U.S. and elsewhere, foreign students residing in the U.S., United States citizens living in another country, dual citizens (United States & another country), and visitors in the U.S. for more than 90 days are not eligible for the program.

Refunds are authorized for purchases of material movable property that is permanently removed from the state by the foreign visitor. Purchases of food and beverages that are consumed within the state are not eligible for sales tax refunds. For more information, visit the Louisiana Tax Free Shopping website .

Texas allows international visitors meeting certain requirements to acquire a refund of sales tax paid on their purchases. In Texas, the refund process takes place through private companies. In order to qualify for the refund, the private companies require the purchaser to shop at a participating store, process the refund at one of their specified locations, and produce the following items:

- Purchased merchandise (new and unused). A minimum amount of sales tax per store location may be required.

- Original receipts (no photocopies, duplicates, emails, etc. are accepted)

- Travel documents (such as passport, visa, etc.)

- Flight or transportation information (such as an airline ticket or boarding pass)

Additionally, the items must be purchased within 30 days of the visitor’s departure. The sales tax refund for international visitors is allowed through Texas’s tax statutes for imports/exports and customs brokers.

In Washington state, sales tax does not apply to sales of tangible personal property, digital goods and digital codes to non-residents of the state when:

- the property is for use outside of Washington;

- the purchaser is a resident of a province or territory of Canada or a state, territory or possession of the United States (other than the state of Washington), and that state, possession, territory or province does not impose a sales tax, use tax, value added tax, gross receipts tax on retailing activities or similar generally applicable tax, of 3% or more or, if imposing such a tax, provides an exemption for sales to Washington residents by reason of their residence; and

- the purchaser agrees, when requested, to grant the department of revenue access to such records and other forms of verification at his place of residence as to provide assurance that such purchases are not first used substantially in the state of Washington.

This exemption applies when a non-resident makes a purchase of a taxable good within Washington but the use of the good will occur outside of Washington. Nothing in the provision requires a retailer to make the tax-exempt sale to non-residents (Washington, Sec. 82.08.0273). Sales within designated free trade zones may have an exemption as long as the customer does not take possession of the goods and the retailer has responsibility for export of the goods. For more information, visit the Washington DOR’s webpage .

Washington State has provided guidance on the requirements for a sale to qualify as an export sale exempt from retail sales tax when a customs broker is involved. To qualify as an exempt export sale, a sale must meet one of the following requirements:

- the goods must be delivered to the buyer in another country;

- the goods must be delivered to a carrier who transfers the goods to another country; or

- the goods must be delivered to the buyer at shipside or aboard the buyer’s vessel or other vehicle.

If goods are delivered to an out-of-state buyer’s customs broker in Washington for subsequent delivery to the out-of-state buyer in Washington, the sale is not an exempt export sale. The seller must collect retail sales tax and must pay retailing business and occupation (B&O) tax on the sale.

- Cancellation/Complaint Policy

- Privacy Policy

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock icon ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

What happens if your visa application is rejected

Find out what to do if your visa is denied, and learn if you are eligible for a waiver of grounds of inadmissibility.

When you interview for a visa at a U.S. embassy or consulate, a consular officer decides if they will accept or deny your application. If they deny your application, you have the right to ask:

- Why your visa application was denied

- If you are eligible for a waiver on the grounds of inadmissibility (if the waiver is approved, you may be issued a visa)

Learn more from the Department of State about visa denials , including:

- How to qualify for a visa

- Reasons you might be ineligible for a visa

- If you can reapply for a visa

- How to apply for a waiver on the grounds of inadmissibility

LAST UPDATED: December 8, 2023

Have a question?

Ask a real person any government-related question for free. They will get you the answer or let you know where to find it.

How to get your maximum VAT refund when traveling abroad

While a European vacation is undoubtedly an unforgettable experience, it can be expensive.

That's why savvy travelers have various strategies in place to save money on flights, hotels and rental cars (hopefully by reading some of TPG's great money-saving advice ).

One of the most overlooked ways travelers miss out on saving money is by forgetting to apply for a VAT refund.

VAT is a Value Added Tax . Let's say, for example, you just went on a shopping spree in Rome or splurged on gifts at the El Corte Ingles department store near Las Ramblas in Barcelona. You more than likely paid VAT on your purchases, but the good news is that visitors to the European Union can often get a refund on that tax. Think of it as the traveler's tax break.

Despite the obvious savings that can come with VAT refunds, the amount of money Americans leave on the table each year in unclaimed refunds is estimated to be in the billions. Don't be one of those travelers.

Getting your VAT refund is worth the time and effort it takes, especially if you're traveling within the EU .

The rules surrounding VAT refunds have somewhat changed in recent years, so it's important to read up on the latest rules (including the U.K.'s discontinuation of VAT refunds for international visitors since Brexit). Here's everything you need to know about getting your maximum VAT refund when traveling in Europe.

What is a VAT?

VATs and goods and services taxes (GSTs) are common worldwide; more than 160 countries have them.

In the EU, the VAT is similar to the sales taxes imposed in the U.S., but there are also some big differences. One of the biggest: VAT rates are much higher than those you pay in state and local sales taxes in the U.S.

The EU's minimum standard VAT rate is 15% — far more than the combined state and local sales tax rates you'll find anywhere in the U.S. However, the average standard VAT rate in the EU currently sits around 21%. All EU countries have standard VAT rates above the 15% threshold; Luxembourg has the lowest rate at 16%, and Hungary has the highest at 27%.

"The VAT is a major income revenue for the tax authorities in Europe," said Britta Eriksson, a VAT expert and CEO of Euro VAT Refund , a Los Angeles-based company that helps companies manage VAT in their overseas operations. "[VAT] represents almost as much as the income tax in terms of revenue for the government."

Many EU countries offer lower VAT rates on certain goods. Sweden, for example, has a standard VAT rate of 25%. However, for some food items, restaurant services and even hotels, a reduced VAT of 12% is offered.

France has reduced the VAT on certain agricultural products and even some cultural events to 5.5%. In other nations, items such as books, newspapers, and bike and shoe repairs receive a reduced VAT rate of only 6%.

As you can see, these "special rates" vary from country to country, so make sure you do your homework before your trip. The EU also exempts some goods and services from VAT; some exemptions include educational services, financial services and medical care.

What are the refund rules?

Prices in the EU always have the VAT included. If you're visiting an EU country, you'll generally have to pay the price of an item, VAT and all, and get your refund after the fact.

There are several requirements to follow to claim your refund. For instance, you must take your new item or items home within three months of the purchase. VAT refunds are not available for large items like cars. EU visitors also cannot get a VAT refund for services like hotel stays and meals.

Some countries require that your purchase exceeds a certain amount to be eligible for a VAT refund. Like the VAT rates, this minimum purchase amount varies from country to country.

For example, in France, the minimum amount is now 100.01 euros (about $107) for the total amount of purchases you buy on the same day in the same shop. In Belgium, the minimum is 50 euros (about $54); in Spain, there is no minimum purchase amount to claim a VAT refund.

One important thing to note is that you can only claim a VAT refund on new items. Your merchandise must be new and still in its packaging when you leave Europe. The goods can't be unpacked, consumed or worn. If you want to claim your refund, you should pack away whatever you purchase and wait until you get home to open it.

Getting your refund

Thousands of European stores do what they can to accommodate tourists seeking refunds and will usually have signs in the window reading "tax-free" or "VAT-free" shop.

As you pay for your item, inform the clerk that you're an EU visitor and intend to get a VAT refund. The store will have some paperwork for you to fill out. Have your passport ready to prove your visitor status. You may also need to show your airline ticket as proof you're leaving Europe in the allotted time in order to claim a VAT refund.

Some stores will refund your VAT, but in most cases, you'll likely have to take your refund forms and get your refund processed elsewhere.

Many stores work with third-party agencies, such as Global Blue or Planet , to process VAT refunds, and these agencies usually have facilities in major cities where you can take your completed forms and get your refund.

When purchasing your items, check to see if your merchant is partnered with these agencies.

On departure day, be sure to take your receipts, the refund forms the shops filled out, the items you bought and all your other travel documents with you to the airport so that you can present everything to customs.

If you're touring multiple EU countries during your trip, you'll complete this process at the last EU country you visit. That means if you visit France and Italy before ending your trip in Spain, you will apply for the VAT refund on your purchases in Spain.

Customs may inspect your purchases, so make sure they're available and not in your checked baggage. Also, make sure the goods are unused and unworn.

If all goes well, the customs office will stamp your refund forms. If either the store or one of the third-party refund agencies has already given you your refund, you'll have to mail this stamped form back to them to prove you left Europe within the mandated three-month period. Otherwise, you risk having your refund canceled and your credit card charged for the VAT you owe.

If you haven't done so already, you can also get your refund at the airport. The big refund agencies have facilities at all the major EU airports, sometimes at a currency exchange. Just show them your stamped customs forms and your passport to get your refund, minus a fee.

No VAT refund in the UK

Before we share some advice on getting your VAT refunds, we want to remind everyone that the U.K. no longer has VAT-free shopping for international tourists. In fact, Great Britain is now the only European country that doesn't offer the savings opportunity for international visitors.

The VAT retail export scheme was eliminated when the U.K. exited the EU in 2021. It resumed briefly before being axed, supposedly for good, in 2022.

Although there's some optimism that VAT refunds could return to Britain in the future — the U.K.'s tourism industry is lobbying for its return — it's not an option for now.

While VAT refunds are no longer available in England, Scotland and Wales, you can still claim refunds if you're visiting Northern Ireland. There are also several exceptions and rules to know; for example, it doesn't apply to services like hotel bills. You can find the list of restrictions here . You should also be aware that some merchants and refund companies in Northern Ireland charge a fee for using tax-free shopping. Still, if you're planning a visit, you could save some money on your shopping.

Tips for maximizing your savings with a VAT refund

Here are some do's and don'ts for getting your VAT refunds.

Research the country

Before your trip, look up the VAT rules for the country you're visiting and check the standard and reduced VAT rates, as well as the minimum purchase points.

As we mentioned earlier, the rates and rules of what qualifies for a VAT refund can vary depending on where you visit, so make sure you're aware before you get there.

Remember that many countries outside the EU also charge a VAT, and their refund policies can differ greatly from what you'll find in Europe.

Research the store

Stores aren't required to provide VAT refund assistance of any kind.

"If you have a store that doesn't have this program, then getting a refund is very complicated," Eriksson warned.

Keep an eye out for stores displaying "tax-free" or "VAT-free" signs. Ask the store employees which third-party agencies they partner with for refunds. Also, ask how they process refunds and what fees they charge. As we noted above, some retailers in some countries may charge a fee to visitors using tax-free shopping.

Allow extra airport time for your refunds

Don't expect to be the only traveler at the airport seeking a VAT refund before heading home. Expect to wait in line for a bit. Plan ahead and give yourself extra time at the airport, as the line can be long.

If you're strapped for time after leaving customs, some agencies will let you drop your stamped forms in one of their mailboxes, and they'll issue your refund later.

Consider shipping your purchases home to avoid VAT entirely

If you don't want to deal with any of this stuff, Eriksson suggests another option.

"You can also have the store ship [your items] to you directly," she said. "Then, they won't charge you VAT."

But there's a catch.

"You still have to pay for the freight," Erikkson added.

Shipping costs from Europe to anywhere in the U.S. can get wildly expensive. So, you have to weigh that shipping cost against the VAT and the time and effort it would take to get your refund to decide if it's worth it.

Make sure the refund is worth the trouble

"If you buy expensive clothing and china, then it's absolutely worth it," Eriksson said.

While many VAT countries have purchase minimums for refunds, in others, any purchase a visitor makes qualifies, no matter how small. So, you should ask yourself if it's worth applying for a VAT refund for that cheap tchotchke you bought as a souvenir.

Bottom line

All this talk of forms, looking for signs, standing in line and getting stamped can take the impulse out of your impulse buy. However, it could save you a lot of money in the long run.

If you pay attention and budget your time wisely, you might get back enough money through VAT refunds to help pay for your next visit across the Atlantic.

Related reading:

- When is the best time to book flights for the cheapest airfare?

- The best airline credit cards

- What exactly are airline miles, anyway?

- 6 real-life strategies you can use when your flight is canceled or delayed

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- What are points and miles worth? TPG's monthly valuations

A blog that gives you insight into international travel and tourism

Featured , How To Series , Tourist Sales Tax Refund

How to claim tax refund in usa for tourist.

- January 15, 2024

Discovering top USA tax free shopping destinations for clothing, electronics, and more is the dream of any tourist visiting the country, while unleashing unbeatable value for money in the process. So, every year visitors from Asia, Europe and the world over travel to the U.S to take advantage of significantly lower prices when shopping in different retail outlets.

Related article : Unveiling 5 Travel Hacks On How To Book Cheap Flights

Related article : Emirates Elevates In-Flight Experience with Expanded Vegan Culinary Choices

To this effect, we will attempt to unlock the secrets which lets tourists become eligible for tax refunds in certain states, such as Texas. Helping you dive into this comprehensive guide for insights on securing tax refunds, including eligibility criteria, essential conditions, and answers to frequently asked questions.

Do you qualify to get a Tax Refund for Shopping in the US at Malls or Online Stores?