JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

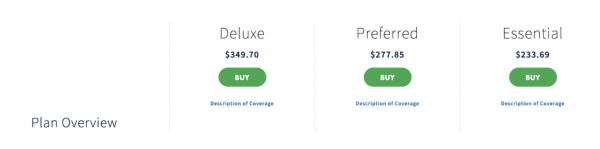

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AIG Travel Guard Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

311 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3221 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1180 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why purchase travel insurance, aig travel guard — coverages and policy options, aig travel guard and covid-19, additional information — aig travel guard, how does aig travel guard compare, the value of travel insurance comparison websites, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Purchasing insurance for your home, auto, or your life, can be complicated and time-consuming if you want to compare coverages and premium costs between companies. Fortunately, the process of purchasing travel insurance is quite simple , and you can secure immediate coverage within minutes.

It all starts with determining the coverages that most important to you, securing a quote, then making sure you’re purchasing from an established, highly-rated company. One such established travel insurance company is AIG Travel Guard .

With over 25 years of experience and high ratings from premier insurance financial rating company A.M. Best , AIG Travel Guard was named the best travel insurance company of 2020 by Forbes . Its Travel Guard Deluxe policy was also given a top 5-star rating by Forbes’ insurance analysts.

We’ll certainly discuss AIG Travel Guard’s policy offerings in our article today but we also want to discuss why you’d want to purchase travel insurance , whether travel insurance covers COVID-19, the process for obtaining a quote, and additional resources to help ensure you’re receiving good value.

Plus, if you’re wondering if you need to purchase travel insurance or whether you might have enough coverage elsewhere, you’ll want to read on.

While the primary reasons for purchasing travel insurance are to protect your economic investment and to cover unexpected additional expenses you might incur due to trip disruptions, purchasing travel insurance has another, more intangible, purpose.

Purchasing travel insurance can provide peace of mind prior to and during your trip as you won’t be worried that an unforeseen event will result in an economic loss. Knowing you have evacuation insurance when you’re traveling to a remote area on safari, for example, could be tremendously reassuring, even if you never use the coverage.

Here are some sample situations where travel insurance may provide coverage:

- Your sister is diagnosed with a life-threatening illness and you must cancel your trip

- You broke your ankle and will not be able to go on your skiing trip

- You become ill and cannot travel

- You or your traveling companion is terminated or involuntarily laid off from your job

- You are summoned to jury duty or other legal action such as requiring you to appear as a witness

If your trip is expensive, complicated, or you need medical coverage while traveling, a travel insurance policy is a must.

Bottom Line: In addition to protecting your trip investment and covering unexpected expenses due to trip disruptions, travel insurance can also provide peace of mind before and during your travels.

There’s probably nothing more boring than listing insurance coverages but it’s important to know the types of coverages you can expect when purchasing an AIG Travel Guard policy.

First, AIG Travel Guard offers 3 policy options for U.S. residents (not including NY residents), 3 separate options for NY residents, and 1 policy for Canadian residents.

- Tr avel Guard Essential

- Travel Guard Preferred

- Travel Guard Deluxe

- Travel Guard Essential Expanded — available to NY residents

- Travel Guard Protect Assist — available to NY residents

- Travel Guard Tour, Cruise, & Travel — available to NY residents

- Gold Trip Cancellation Policy — available to Canadian residents

Coverage options and limits will vary by policy, however, you can expect to find the core and optional coverages listed here.

Core Coverages

Here are the types of coverages you’ll find offered on AIG Travel Guard policies and the applicable coverage limits for each type of policy.

There are also additional coverages that may be included at no extra charge, depending on the policy type selected. Terms and conditions apply.

- 1 child under 17 per covered adult is included for no extra charge

- Pre-existing conditions waiver

- Trip exchange coverage

- Single occupancy fee coverage

- Evacuation for a security reason

- Non-flight accidental and dismemberment insurance

- Worldwide travel and medical assistance services

Optional Coverages for an Additional Fee

You may secure any of the following add-on coverages by paying an additional fee.

- Cancel for Any Reason Insurance — covers trip cancellation for any reason

- Rental vehicle damage — coverage for collision damage when renting a vehicle

- Pet bundle coverage — pet care, medical expenses, and adds pet illness to trip cancellation benefit

- Adventure sports coverage — coverage for higher risk adventure activities

- Increased lodging expense bundle — increases the amount covered under travel inconvenience benefit

- Wedding bundle — coverage when a destination wedding is canceled

- Name a family member bundle — select a traveler to be covered as a family member

Hot Tip: For more information and tips on purchasing travel insurance, start here in our article on travel insurance basics .

Travel insurance , in general, is designed to protect you from financial loss due to unforeseen events that may cause you to cancel your trip, or to cover disruptions that could occur during your journey. It is not meant to cover voluntary trip cancellations due to fear of getting ill.

Voluntary cancellations, including those that are related to the fear of getting ill, are not covered on travel insurance policies. However, there is 1 option for obtaining coverage for voluntarily canceling your trip.

Cancel for Any Reason insurance (CFAR) is an optional coverage that can be added to select travel insurance policies allowing you to cancel your trip for any reason you deem necessary and be covered for partial reimbursement.

AIG Travel Guard offers CFAR coverage as an optional add-on to add to its Preferred and Deluxe plans , with these stipulations:

- Must be purchased within 15 days of the initial trip deposit

- The trip must be canceled more than 48 hours prior to departure

- The full cost of the trip must be insured for at the time of purchase

Cancel for Any Reason insurance does not cover the entire cost of the trip. In this case, to add CFAR insurance to the Deluxe and Preferred plans above, the additional premium would be $53.31 for coverage to cover up to 50% of the trip price. Additional options may be available to cover up to 75% of the cost of your trip.

The above prices are for a single trip 1-week in length for a traveler of 40 years of age at a cost of $3,000.

AIG Travel Guard policies, even without the CFAR insurance add-on, offer coverage for trip cancellations due to COVID-19 related illness and also medical coverage should a covered traveler become sick with COVID-19 during their travels. Terms and conditions apply.

Bottom Line: While trip cancellation, trip interruption, and emergency medical may offer some coverage for illness, you must purchase Cancel for Any Reason insurance to have coverage for canceling a trip due to the fear of getting ill. AIG Travel Guard offers this coverage on its Deluxe and Preferred plans.

Point-of-Sale Availability — In addition to offering travel insurance package policies directly to the public, AIG Travel Guard offers travel insurance products via several travel providers including airlines and various travel services. You’ll find the option to purchase Travel Guard protection during the checkout process with companies such as United Airlines or Frontier Airlines when purchasing a flight and when making a travel purchase via Costco Travel .

Call for Additional Quotes — While AIG Travel Guard does sell annual multi-trip policies, you must call to request a quote. Adventure sports coverage, medevac coverage, and rental vehicle damage coverage quotes are also available via phone.

15-Day Free Look Period — If you decide, after you have reviewed your purchased policy, that you do not want it, you may receive a full refund.

Cruise Insurance Option — AIG Travel Guard offers cruise insurance that includes cruise diversion and other applicable coverages.

Filing a claim — to initiate a claim, you can either call AIG Travel Guard at 866-478-8222 or access travelguard.com to begin the process. You will need your policy number handy. Once your claim is submitted, you can check the status at claims.travelguard.com/status .

First, know that when purchasing a policy from AIG Travel Guard, you’re buying from a highly-rated established insurance company. Here’s how the company stacks up in relative comparison with other travel insurance companies.

To Other Travel Insurance Companies

Comparing travel insurance policies can be complicated as coverage limits and prices vary widely. We looked at a 1-week trip to Mexico for a traveler 40 years of age and a total trip cost of $3,000 as criteria for obtaining a quote.

AIG Travel Guard’s Preferred plan, which prices out at around $200, aligns with the John Hancock Bronze policy above. Add in CFAR coverage, however, and the comparison costs are closer to AIG Travel Guard’s $254 premium for its Preferred level plan that also includes CFAR.

This 1 example uses the criteria of a specific trip for an individual traveler of a certain age and may not reflect the same relative premium costs as other comparisons.

Your own individual traveler information, the number of travelers, trip length, destination, state of residence, selected coverages, and the total cost of your trip will ultimately determine the premium cost. Our example is just a narrow snapshot comparison.

Bottom Line: Travel insurance policy coverages and costs vary dramatically. To ensure you’re receiving good value, determine the coverages that are most important to you, compare policy options, and purchase from a reliable company.

To Credit Card Travel Insurance

The travel insurance coverages that come complimentary on your credit cards are no substitute for a comprehensive travel insurance policy. With that being said, the coverage that comes with your credit card could be enough to cover some trips.

Here are some examples of trips where you may not need travel insurance and the coverage you have on your credit card could be sufficient.

- The trip consists of only a round trip domestic flight and hotel stay

- The trip is a road trip by car

- The trip does not include any non-refundable trip expenses

- The trip does not have several travel providers involved

- Your health insurance covers you while traveling and you are not worried about having additional medical coverage during your trip

Also, keep in mind that coverage offered on your credit card is generally secondary versus a primary travel insurance policy. This means you must first file a claim with other applicable insurance, including coverage with the airline or travel provider, for example, before the credit card coverage will kick in.

Bottom Line: If you have a significant investment at stake, several travel providers involved, or want medical coverage during your travels, you should purchase a comprehensive travel insurance policy for your trip and not depend on a credit card with travel insurance .

Travel insurance is widely available and competitive. You won’t have trouble purchasing some level of coverage regardless of your situation. Additionally, there are travel insurance comparison websites that make it easy to find a policy that fits and purchase coverage that is effective immediately.

These travel insurance comparison websites are each easy to use, have qualified people to assist, and all feature policies offered only by highly-rated companies.

Travelinsurance.com

- Instant coverage

- Simple format, easy to secure a quote quickly

- Guarantees the best price for the policy you’re purchasing

Squaremouth

- Features 20 companies with nearly 120 different policy options

- Its customer service team is award-winning

- You can access thousands of customer reviews

InsureMyTrip

- Educational content to assist you in understanding coverages

- Features 21 highly-rated companies

- Licensed agents can answer questions and assist with a claim

Bottom Line: Travel insurance comparison websites provide quick easy access to securing a quote, compare several high-rated travel insurance providers at once, and the benefit of receiving immediate coverage.

While airlines and travel providers have made significant changes to cancellation, refund, and exchange policies, it’s still important to consider purchasing travel insurance if you’re uncomfortable with the possibility of losing your trip investment or incurring unexpected expenses during your journey.

In addition, if you need medical insurance coverage during your trip, you won’t find that coverage on a credit card or with the airlines — you’ll need to purchase it.

The fact that AIG Travel Guard does not exclude COVID-19 related claims under certain coverages and offers a Cancel for Any Reason add-on is significant as not every travel insurance company can make that claim.

Also, if you have children traveling with you, you may find good value with AIG Travel Guard having those under 17 included for no extra charge (1 per premium-paying adult).

The bottom line when purchasing travel insurance from AIG Travel Guard is that if you can secure the coverages you need at a price you’re comfortable with and you’ll know you’re completing that transaction with a highly-rated established company.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

Is aig travel guard a good travel insurance company.

AIG Travel Guard is a highly-rated established travel insurance company. It is rated A by the prominent insurance financial rating company A.M. Best and has been in business for over 25 years.

It was also named the best travel insurance company of 2020 by Forbes.

Does AIG Travel Guard cover trip cancellation?

Yes, AIG Travel Guard will cover trip cancellations but only for covered reasons listed in the policy. Examples of situations that may be covered include becoming ill and having to cancel your trip, being called for jury duty or other covered legal obligation, or your home becomes uninhabitable.

Does AIG Travel Guard cover flight cancellations due to COVID?

AIG Travel Guard, like other travel insurance companies, does not cover canceling a flight due to the fear of getting ill. However, if you become ill from COVID-19 and have to cancel your trip, you may have coverage for trip cancellation, trip interruption, or emergency medical if should become ill during your trip.

How do I make a claim with AIG Travel Guard?

You can file a claim with AIG Travel Guard by calling 866-478-8222 Monday through Friday from 7 a.m. to 7 p.m. CST. You can also initiate a claim online at travelguard.com using your policy number and last name.

Once you have submitted a claim, you can check the status of your claim at claims.travelguard.com/status , using your claim number and last name.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- AIG Travel Guard Overview

- AIG Travel Guard Plans

AIG Travel Guard Cost

How to file a claim with aig travel guard, compare aig travel guard, aig travel guard frequently asked questions.

- Why You Should Trust Us

AIG Travel Guard Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

AIG Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits. If you're looking for travel insurance, consider Travel Guard .

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation coverage of up to 100% of the cost, for all three plan levels

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR covers up to 75% of total trip costs (maximum of $112,500 on some plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Medical coverage of up to $500,000 and evacuation of up to $1,000,000 per person

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes COVID coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Above average baggage loss and delay benefits

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical evacuation coverage

- con icon Two crossed lines that form an 'X'. Premiums may run slightly higher than competitors

Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits.

- Trip cancellation coverage for up to 100% of the trip cost

- Trip interruption coverage for up to 150% of the trip cost

- Preexisting medical conditions exclusions waiver must be purchased within 15 days of initial trip payment

- Annual travel insurance plan and Pack N' Go plan (for last-minute trips) available

AIG Travel Guard Travel Insurance Review

AIG Travel Guard is among the best travel insurance companies with impressive coverage limits, even with its basic plan, Travel Guard Essential. It's emergency medical evacuation coverage is particularly high, making Travel Guard a good choice for insuring cruises, as sea to land evacuations are often expensive.

Additionally, Travel Guard's Premium and Deluxe plans offer coverage that many of its competitors don't, such as its travel inconvenience coverage and ancillary evacuation coverage.

That said, Travel Guard is on the pricey side, compared with its competitors. While age is often a factor in your insurance premiums, Travel Guard tends to quote older travelers higher rates than its competitors. However, you often get what you pay for. In Travel Guard's case, you'll find that its coverage justifies its higher rates.

While great coverage is important, it's also crucial that an insurance company has a smooth claims process, which Travel Guard lacks, according to its customer reviews. Across 135 reviews on its Trustpilot page, AIG Travel Guard received an average of 1.2 stars, with 95% of reviewers giving the company one star. Surprisingly, AIG Travel Guard fares even worse with the Better Business Bureau, receiving an average of 1.08 stars out of five across 301 reviews.

Coverage Options Offered by AIG Travel Guard

AIG Travel Guard offers three primary plans: Travel Guard Essential, Travel Guard Preferred, and Travel Guard Deluxe. Each plan has different coverage limits and various types of protection.

Here's a look at what you'll get with each plan:

Depending on the policy you select, there are also additional coverages that my be included at no extra charge, like pre-existing conditions waiver, single occupancy fee coverage, worldwide travel and medical assistance services, and more. Be sure to check each policy closely to see what is and isn't covered.

Each of these plans also include coverage for one child under 17 as long as their travel costs are equal to or under the adult's cost. Additional coverages do not apply to the child.

AIG Travel Guard Pack N' Go Plan

In addition to these three primary plans, Travel Guard offers the Pack N' Go policy along with an Annual plan. This policy is for last-minute travelers who don't need trip cancellation coverage.

This plan includes:

- Trip interruption and trip delay ($200 per day maximum) up to $1,000

- Missed connection up to $500

- Baggage delay up to $200 and baggage coverage up to $1,000

- Medical expenses up to $25,000 and dental expenses up to $500

- Emergency evacuation and repatriation of remains up to $500,000.

AIG Travel Guard Annual Plan

Taking multiple trips throughout the year? Consider the Travel Guard Annual plan instead of purchasing a new policy for each adventure. This plan comes with coverage for:

- Trip interruption coverage up to $2,500

- Trip delay coverag e up to $1,500 ($150 per day maximum)

- Missed connection coverag e up to $500

- Baggage delay coverage up to $1,000 and lost/damaged baggage coverage up to $2,500

- Medical expenses coverage up to $50,000 and dental expenses up to $500

- Emergency evacuation coverage and repatriation of remains up to $500,000

- Accidental death and dismemberment coverage up to $50,000 and security evacuation up to $100,000

Additional Coverage Options from AIG Travel Guard

Like many other travel insurance providers, Travel Guard offers add-ons for an additional cost. These can be selected while you're purchasing your policy.

The availability of these add-ons depends on the policy you're buying. Note also that some are already included in the Preferred and Deluxe plans.

- Medical bundle — Increases coverage amounts for medical expenses and evacuation and adds hospital of choice and additional evacuation benefits.

- Security bundle — Provides various coverages for trip interruption or cancellation due to riot or civil disorder.

- Rental vehicle damage coverage — Reimburses a predetermined amount for physical damage to a rental car in the policy holder's name.

- Cancel for Any Reason Insurance (CFAR) — This is just what it sounds like. Cancel for any reason coverage will reimburse 75% of nonrefundable expenses when you cancel your trip for any reason, up to 48 hours before your scheduled departure. CFAR coverage is only available for Travel Guard's Deluxe and Preferred plans.

- Inconvenience bundle — Offers reimbursement for inconveniences like closed attractions, credit/debit card cancellation, hotel construction, and more.

- Pet bundle coverage — Daily travel benefit for boarding and medical expense coverage for illness or injury of dog or cat. Includes trip cancellation or interruption coverage if the pet is in critical condition or dies within seven days before the departure date.

- Adventure sports bundle — Removes the exclusions for adventure and extreme activities.

- Baggage bundle — Your baggage coverage with AIG becomes primary with increased coverage and baggage delay benefits.

- Wedding bundle — Provides trip cancellation coverage due to wedding cancellation (brides and grooms not covered).

- Name a family member bundle — One person can be named as a Family Member for the purpose of family member-related unforeseen event coverage.

How to Purchase and Manage Your AIG Policy

Getting a quote from AIG Travel Guard is quick and easy. Head to AIG website and enter basic information about the trip you're looking to cover. You'll get an instant quote for the insurance plans available for your trip, so it's easy to compare each option. Be prepared to provide information including:

- Your state of residence

- Date of birth

- The cost of your trip

- Travel dates

- Destination

- Method of travel

We ran a few simulations to offer examples of how much a Travel Guard policy might cost. You'll see that costs usually fall within 5-7% of the total trip cost, depending on the policy tier you choose.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following Travel Guard travel insurance quotes:

- Travel Guard Essential: $86.96

- Travel Guard Preferred: $152.01

- Travel Guard Deluxe: $188.59

Premiums for Travel Guard's various single trip plans are between 2.8% and 6.3%, well within, and even below, the average cost of travel insurance .

A 30-year-old traveler from California is heading to Japan for two weeks, costing $4,000. The Travel Guard travel insurance quotes are:

- Travel Guard Essential: $198.77

- Travel Guard Preferred: $240.39

- Travel Guard Deluxe: $305.04

Premiums for Travel Guard's various single trip plans are between 5% and 7.6%, within the average cost for travel insurance.

A couple of 65-years of age looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following Travel Guard quotes:

- Travel Guard Essential: $471.10

- Travel Guard Preferred: $618.22

- Travel Guard Deluxe: $834.78

Premiums for Travel Guard's various single trip plans are between 7.9% and 13.9%, which is significantly higher than the average cost. That said, travel insurance is often more expensive as you get older.

AIG Travel Guard Annual Plan Cost

Getting a quote for the annual plan requires much less information, only asking for the intended policy start date, your state of residence, and how many people you plan to insure. Quotes from AIG remained at $259 per traveler, regardless of state of residence and number of travelers.

Filing a claim with Travel Guard is a straightforward process. You'll need your policy number and can either go to travelguard.com or call Travel Guard at 866-478-8222 to start the claim. Once submitted, you can check the status of your claim at claims.travelguard.com/status.

See how AIG Travel Guard stacks up against the competition and find the right travel insurance policy for you.

AIG Travel Guard vs. Nationwide Travel Insurance

Nationwide is a household name when it comes to insurance providers and one of the largest and most-recognized insurance providers in the US. Similarly to Travel Guard , Nationwide makes it easy to find coverage by offering just two single-trip plans: the Essential and Prime plan.

In addition, Nationwide offers plans specifically designed for cruises along with annual trip insurance for those who travel a lot throughout the year.

The Nationwide Essential Plan comes with trip cancellation coverage of up to $10,000, up to $250,000 in emergency medical evacuation, up to $150 per day reimbursement for travel delays of 6+ hours, and coverage for delayed or lost baggage.

In comparison, the Travel Guard Essential plan covers trip cancellations with up to $100,0000 in coverage, up to $150,000 in emergency medical evacuation expenses, up to $100 per day ($500 total) for trip delays of 12+ hours, along with lost or delayed baggage coverage.

The high-tier Prime Plan from Nationwide offers even more coverage, including trip cancellation up to $30,000, trip interruption coverage up to 200% of the trip cost (maximum of $60,000), missed connection and itinerary change coverage of $500 each, $250 per day for trip delays of 6+ hours, and up to $1 million in coverage for emergency medical evacuation

AIG's highest-tier Deluxe plan comes with trip cancellation coverage of up to $150,000, up to $1,000,000 in emergency medical evacuation, up to $200 per day ($1,000 maximum) reimbursement for travel delays of 12+ hours, and coverage for delayed or lost baggage.

As you can see, it's hard to compare apples to apples when comparing the two different insurance providers. But it helps to know the specifics of the coverages that matter most to you.

Read our Nationwide travel insurance review here.

AIG Travel Guard vs. Allianz Travel Insurance

With Allianz Travel Insurance , you can choose from 10 different insurance plans to find one that suits your needs. Like Travel Guard , it offers one-off policies for specific trips and an annual travel insurance plan for those who take multiple trips a year. Similar to AIG, too, the different plans offer varying levels of coverage.

Allianz's most popular single-trip option is the OneTrip Prime plan. This plan offers trip cancellation coverage up to $100,000, trip interruption coverage up to $150,000, emergency medical coverage for $50,000, coverage for baggage loss, theft, or damage up to $1,000, and up to $800 in travel delay coverage.

The most similar plan from Travel Guard is the mid-tier Travel Guard Preferred plan, which which you'll get up to $150,000 in trip cancellation coverage, trip interruption coverage up to $225,000, $50,000 in emergency medical coverage, coverage for baggage loss, theft, or damage up to $1,000, and travel delay coverage of up to $800.

A variety of factors will determine the final cost of any of these travel insurance policies. However, when comparing quotes with the same factors, Allianz tends to be cheaper. Additionally, Travel Guard seems to be more sensitive to the traveler's age. However, it's best to compare quotes using your specific personal and trip details to determine which policy is the best for you.

Read our Allianz travel insurance review here.

AIG Travel Guard vs. Credit Card Travel Insurance

Before purchasing a travel insurance plan, take a look at the coverage offered through your travel rewards credit cards. Some of the basic coverages you're looking for, like rental car insurance, may already be available through credit card travel protection .

The coverage you have on your credit card couple be sufficient if, for example, you're taking a road trip by car and you don't have any non-refundable trip expenses. It could also be enough if your health insurance covers you while you travel and you aren't overly worried about incurring additional medical expenses during your trip.

It's also worth remembering that credit card coverage is usually secondary versus the primary coverage you'd get with a travel insurance policy. Meaning you'll have to file a claim with the other applicable insurance (like through the airline travel provider) before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Depending on the single trip plan you choose, AIG Travel Guard offers $15,000-$100,000 in emergency medical expense coverage.

All three of Travel Guard's single trip policies offer pre-existing condition waivers as long as you purchase your policy within 15 days of your initial trip payment.

Travel Guard is the name used for AIG's travel insurance products, but AIG also offers other insurance products, like AIG Life Insurance .

Your coverage depends on the policy you buy, but all policies will cover (up to a specified limit) trip cancellation, interruption, delay, emergency medical expenses, lost and delayed baggage, and emergency evacuation.

Yes, Travel Guard plans cover trip cancellation and interruption due to illness, injury, or death of a family member. If your trip is delayed or canceled due to inclement weather, that's covered too. AIG Travel Guard's is also among the best CFAR travel insurance companies.

Why You Should Trust Us: How We Reviewed AIG Travel Guard

The policy that's best for you will be the one that offers the right amount and type of coverage, fits your budget, and is easy to use if you ever need it.

In reviewing Travel Guard , we looked at the company's travel insurance offerings and compared them to plans offered by the top travel insurance companies in the space. Factors considered included things like coverage options, claim limits, what's covered, available add-ons, and typical insurance policy costs. We also considered buyer preferences.

Read more about how Business Insider rates insurance providers .

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

AIG Travel Guard

Learn about travel insurance plans offered through AIG Travel Guard and how they compare.

Diverse range of travel insurance plans to choose from

Cancel for any reason (CFAR) coverage available with some plans (conditions apply)

Annual coverage available

Generous limits for emergency medical expenses and medical transportation available

Preexisting medical conditions waiver available (conditions apply)

Low costs for family plans

Essential plan coverage limits may be insufficient

CFAR coverage reimburses at only 50%

What AIG Travel Guard Is Known For

Like many other top travel insurance providers, AIG Travel Guard offers a broad range of plans to cover different types of trips. The company's main coverage options include the basic Essential Plan, the mid-tier Preferred Plan and the top-tier Deluxe Plan, which comes with the highest levels of coverage available.

AIG also offers an annual travel insurance plan that can apply for all trips that an insured individual (or group) takes within a year. Other niche plans from this provider include the Pack 'N Go Plan for last-minute trips, a plan for emergency evacuation and medical transportation, a rental car coverage plan, and an adventure travel insurance plan.

AIG Travel Guard stands out in a few different areas. First, the company offers cancel for any reason (CFAR) coverage as an optional add-on with its Preferred and Deluxe plans. However, this coverage only reimburses up to 50% of prepaid travel expenses, which is lower than other providers. CFAR coverage only applies if travel insurance is purchased within 15 days of making an initial payment on a trip.

AIG Travel Guard also offers a preexisting medical conditions waiver when travelers purchase coverage within 15 days of the initial trip payment. Another standout feature of this company is that its mid- and top-tier plans have high coverage limits for emergency medical expenses and emergency medical evacuation. This emergency evacuation coverage, also called "Medevac," can pay for air evacuation services, transportation to the nearest hospital or clinic, medical transportation to your home country, and more.

AIG Travel Guard Travel Insurance for Individual Trips

AIG Travel Guard plans for individual trips come in three tiers with accelerated levels of coverage and more add-ons available. This lets you tailor your travel insurance coverage to your unique needs, including the type of trip you're taking and the perils you want to protect against the most.

The chart below shows the coverages you can get with each tier.

AIG Travel Guard Pack 'N Go Plan

AIG Travel Guard also offers a last-minute coverage option for consumers who don't need trip cancellation coverage. There is only one available tier for this plan, and it includes the following coverages:

AIG Travel Guard Travel Insurance for Multiple Trips

The company also offers an annual travel insurance plan. This type of coverage can work well for frequent travelers who are always jetting off somewhere new but don't want to purchase an individual plan for every trip. Coverages offered include the following:

AIG Travel Guard Travel Insurance Costs

AIG Travel Insurance costs vary based on the number of travelers in a plan, the age of travelers, the cost of the trip, the tier of coverage selected and other details. We received quotes for several sample trips to give you an idea of how much you might pay.

AIG Travel Guard is not accredited by the Better Business Bureau (BBB), and the company also has a low rating with the platform of just 1.08 out of 5 stars. The travel insurance provider has closed 175 customer complaints filed with the BBB in the last 12 months and 791 complaints in the last three years. On Trustpilot, the company has an average star rating of just 1.7 out of 5 stars across 65 reviews on the platform. By contrast, the company has a 4.6 rating on InsureMyTrip. Here's an overview of some positive and negative user reviews that show the experiences of past customers.

Good Customer Service Experience

We bought a TravelGuard policy when we bought airline tickets through Frontier. Only a couple days later Frontier changed our flight times by 13+ hours which would no longer work for our travel plans.

Since it was within the 15 day "review" period TravelGuard fully refunded our premium consistent with their policy quickly and with NO drama.

I was able to talk with TravelGuard customer service with less than a minute of holding. He walked me through the steps to make a written refund request. I heard back from my written request in less than 24 hours. – Sara via Trustpilot

They paid my claim for stolen items when I was in Vegas on an annual travel plan. It did take a few months. The claim amount was three times the premium I originally paid. – Bradley S. via Trustpilot

Travel Guard has been unresponsive and has left me feeling frustrated and disappointed. I booked a trip and purchased trip insurance through Travel Guard. I had to cancel the trip for medical reasons and I filed a claim on January 8, 2024. The information they requested was uploaded on the Travel Guard Portal on January 9, 2024. Forty-eight hours after sending the information, I contacted them to make sure they had all the required information. They confirmed they had all the forms I sent. They told me it would take 10 to 15 business days to review the claim and the insurance adjuster would contact me. It is now February 12th and I have not heard anything from Travel Guard or the adjuster. I have called a few times and keep getting the same run around. I called again today and even asked to speak to a supervisor and was told the supervisor is just going to say the same thing and would not connect me. I paid good money for this trip insurance and am feeling like I was scammed. – William M. via Better Business Bureau

Had to Wait for the Check, But at Least it Came

My husband and I had a flight on Alaskan Airlines from Portland to Tampa, which was canceled because the airlines did not have sufficient staff to operate the flight. We were stuck in Portland for two additional days before we could return home. I thought we would be reimbursed in full, but it turns out, our policy only allowed for a certain amount per person daily. It took a month and a 1/2, but we did receive a check for $600. It wasn't the full amount of two additional days for food, lodging, and rental car, but it was better than nothing. – Clare L. via Trustpilot

Takes two weeks to get response from claims. Then they ask for additional information even though you already sent. Dont get to talk to claims adjusters only email I had to resubmit information again with letter of explanation. Another way to prolong payments. Very flustered with not being able to talk to adjuster. You only talk to a real person when you call in to ask for adjuster. They cant trans the call. Only emails still havent received reimbursement. – Cindy W. via Better Business Bureau

Why Trust U.S. News Travel

Holly Johnson is a travel writer who covers topics like travel insurance, family travel, all-inclusive resorts and cruises. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. Johnson works alongside her husband, Greg, who sells travel insurance through their travel agency, Travel Blue Book .

Read more about AIG Travel Guard in:

- The Best Travel Insurance Companies

- The Best International Travel Insurance

- The Best Vacation Rental Travel Insurance

- The Best Family Travel Insurance

Suggested companies

Allianz partners usa, faye travel insurance, generali travel - usa.

Travel Guard Reviews

In the Money & Insurance category

Visit this website

Company activity See all

Write a review

Reviews 1.7.

Most relevant

They're a scam

You will spend more in notaries than the cost of your ticket if you ever have to use their flight cancellation insurance.

Date of experience : May 02, 2024

Good Customer Service Experience

We bought a TravelGuard policy when we bought airline tickets through Frontier. Only a couple days later Frontier changed our flight times by 13+ hours which would no longer work for our travel plans. Since it was within the 15 day "review" period TravelGuard fully refunded our premium consistent with their policy quickly and with NO drama. I was able to talk with TravelGuard customer service with less than a minute of holding. He walked me through the steps to make a written refund request. I heard back from my written request in less than 24 hours.

Date of experience : December 29, 2022

Had to Wait for the Check, But at Least it Came

My husband and I had a flight on Alaskan Airlines from Portland to Tampa, which was canceled because the airlines did not have sufficient staff to operate the flight. We were stuck in Portland for two additional days before we could return home. I thought we would be reimbursed in full, but it turns out, our policy only allowed for a certain amount per person daily. It took a month and a 1/2, but we did receive a check for $600. It wasn't the full amount of two additional days for food, lodging, and rental car, but it was better than nothing.

Date of experience : May 16, 2022

Horrible : Bought car damage insurance for a recent trip to Italy . Had a minor accident ( dent in bumper ) Rental car company charged me $660 . Submitted claim to Travel guard AIG; refused to pay . Continued to ask for non-existent documents ( police report , Itemized repair bill ) Got the run around for a month . Finally got tired and sued in small claims court . Payed as soon as they got summons and complaint BLANTANT : CONSUMER FRAUD : STAY AWAY

Date of experience : July 21, 2021

Dont buy it

Dont buy it, it's a scam. Purchased as advertised on Orbitz, stated Cancel Trip and with getting money back w/o reason. I canceled and opened a new claim, very complicated process online, forms are not relevant and misleading. Never heard from AIG Travel Guard after submitting a claim. Called within 15 days and customer service was useless.

Date of experience : April 26, 2022

🚩🚩🚩🚩 AWFUL SCAM

🚩🚩🚩🚩 Do yourself a favor and DO NOT TRUST THIS COMPANY FOR INSURANCE NEEDS. I'm not even 100% sure they are a real company at this point. Good luck calling to get helpful information, aparently they don't have management?? Or they will call you in 24 hours?? Absolute joke and so disappointing, especially after tragedy 😔

Date of experience : March 10, 2023

Claims handling is nonexistent

Claims handling is nonexistent. Five months after I reported the claim online in November 2022 along with all the booking confirmation, receipts, proof of payment, itinerary, refunds received, etc along with precise details, they’re still sending what appears to be automated emails as though they have not received what I sent. I have asked to speak with the adjuster to no avail and now asking to speak to the claims manager. I have yet to talk to anyone since I reported the claim online. We are now into May.

Date of experience : May 03, 2023

Disreputable company

Disreputable company. Refused to provide a credit after a cruise line cancelled a cruise. Didn't want my money back just a credit for a future trip but they don't seem to recognize the entire counrty is shut down. Not interested in helping out those in need. I can only surmise they'd push back if you ever had a legitimate claim as well. I'd advise looking elsewhere for travel insurance.

Date of experience : April 10, 2020

Cruise interruption for hospitalization

Our Baltic cruise was interrupted when my husband was hospitalized in Norway. After 6 months, some of my husbands bills were reimbursed, but none of mine were. As if I could go on a cruise and leave him in the hospital. The most galling is that Travel Guard does not return calls or communicate with the insured even after repeated calls and emails. NEVER AGAIN!

Date of experience : January 08, 2023

Don't go for the cheap option

My trip was derailed due to airport employee incompetence. Submitted my insurance claim in January, has taken them 4 months to tell me that they will not honor my claim. They list on their website and insurance package what they will help you with, then when you need help with one of these things, they say they can't. Typical of these cheap option insurance companies, make you go back and forth with them only to tell you they won't pay you out. Always find an excuse to keep your money instead of doing what they sell you. Next time, I will pay extra for a better and more reputable company.

Date of experience : May 04, 2023

Our school was to have their graduation…

Our school was to have their graduation grade 8 trip back in May. Due to unfortunate circumstances of covid, the trip was cancelled. The travel company sent the refund request to Travel Guard for our refunds. Since early June, it has been "in processing". Our school administrators have been following up frequently and still no answer when we are to get refunded. So now, administration has asked us parents to start going after the company as well. Is this company that heartless of taking money from thirteen year olds????

Date of experience : September 23, 2020

Don’t buy this!!!!

They ask for an excessive amount of documentation when making a claim that involves getting the airlines to send documents. It is not enough to send boarding passes and proof that was received electronically to show a flight was delayed. I believe they do this to take your money and no pay the claim. I would not go through this headache again and would rather safe my money in the future.

Date of experience : June 02, 2023

Buyer BEWARE! Stay Away!

Purchased insurance in September of 2020 for a cruise in June 2021. Royal Caribbean has cancelled all sailings until further notice. Because it in UNKNOWN on when I will be able to take my cruise I contacted Travel Guard to cancel and refund my premium. Travel Guard refuses to refund any money. After reading several reviews I can see that this company is a scam.They are scamming people every where. Stay away!

Date of experience : May 11, 2021

They paid my claim for stolen items when I was in Vegas on an annual travel plan. It did take a few months. The claim amount was three times the premium I originally paid.

Date of experience : January 27, 2023

Slow and unhelpful

Trying to make a claim due to covid 19 cancellation. They have been slow to even respond to the claim. I bought trip insurance but they are now claiming that the accommodation does not form part of the trip. Which is obviously not true. Expedia sell this dodgy company's products which makes you wonder whose interests they have at heart.

Date of experience : June 30, 2020

Total Nightmare!!

I purchased cancel for any reason which costs extra and is optional - BUT apparently you are not allowed to actually cash it in. I have waited two months to hear anything on this claim and I keep getting asked for info I do not have and just keep getting the run around, if you pay for cancel for ANY reason all you should have to show is that you cancelled the trip. NEVER USE THIS COMPANY!!

Date of experience : April 25, 2022

False Sense of Security

False sense of security. Purchased AIG Travel also known as Travel Guard for a flight to Asia in December before COVID-19 was known. Event that I was attending was canceled due to the coronavirus and quarantines for people returning from Asia were starting in late January. I submitted the lengthy claim form to AIG with documentation. It seems like they're trying to weed out submissions with that process. After several weeks, I received a templated letter that stated my claim was denied. AIG's policy covers very little and the fine print leaves them a lot of room to deny claims. Make sure to review it very carefully or better yet avoid wasting your money with AIG Travel. Instead, purchase flights with airlines that have no rebooking costs or purchase a cancel-for-any-reason policy through another company.

Date of experience : March 05, 2020

Not Keen to Pay

This is the feeling of the first communication you have with AIG, not honest, won't pay. I have an AIG protection policy from CheapTickets as I used to get the protection plan in case of any issues through travelling (flight). This is the first time I got the boarding pass and banned from the boarder's police counter because my name is suspicion with a similar wanted person. I missed the flight and claimed the flight amount with AIG. They have drastic problems that convinced me to write this review. Firstly, they jump to conclusions so that they don't bother themselves to understand the issue so that they responded swiftly that the airline cancelled my flight which is uncovered in AIG policy. The response is ridiculous as I believe it is quite irrelevant to the case. Secondly, when I illustrated the case again much more as they probably have a problem in critically understanding the differences between the procedures in airports, they responded with rejection with no reason. I thought this is an unrespectful way of response and I agreed to close the case to avoid humiliating myself further.

Date of experience : January 04, 2020

Disappointed

My wife and I bought AIG (Travel Guard) travel insurance for our Panama Canal Cruise February, 2022. It included the usual Medical, trip return home and trip interruption coverage starting the day of departing our home and back. Unfortunately, during the cruise I got sick with post Covid bacterial double pneumonia and was hospitalized in a Panama City, Panama for a week. On my release, doctor suggested I stay in Panama City for 2-3 more days to recover further before traveling back to the United States. We decided to fly back home the same day of release (although my insurance policy should have covered staying extra days to recover). We wanted to get home and recuperate in my own bed. Because of time of release from hospital, only flight we could get home got us to Nashville airport (our originating airport) around mid-night. Our home is about 2 ½ hours’ drive from the airport. So, we decided to stay the night near Nashville airport and drive home next day. AIG refused to pay for the taxi to the hotel and our night stay at Nashville. The claims adjuster stated that AIG expected us to drive home at midnight. That’s the day I was released from hospital after a week of hospitalization with post Covid double pneumonia. I needed oxygen to fly home, per doctor’s order. Since I was on wheel chair after release from hospital, throughout various legs of our journey till we got to the hotel in Nashville, we tipped the wheelchair helper and luggage porter. AIG refused to pay for any of it, claiming, it was not covered expenses. How can that be not covered when it was medically necessary. Other than that, I have to say, AIG was fair in handling our claim. We have appealed their decision but they rejected our appeal. Iftakhar and stephanie

Date of experience : April 30, 2022

Would give them 0 stars if I could

Would give them 0 stars if I could. Absolute joke of a company that is built entirely on scamming people out of money. Their coverage is laughable, they take months to even look at a claim and then do everything they possibly can to find loopholes to not provide the service you pay for. 13/10 DO NOT recommend ever using this circus of a business.

Date of experience : January 13, 2023

Is this your company?

Claim your profile to access Trustpilot’s free business tools and connect with customers.

- A valid PolicyID must be passed to this page. Please use a link that includes your PolicyID

Service Request

More From Forbes

This romantic hotel in rajasthan belongs on your india travel wish list.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

The main pool at Mihir Garh

“Royal families used to support artists. Now it’s tourism that keeps art and tradition alive,” says Avijit Singh, the director of India’s House of Rohet group of small luxury hotels. He’s speaking about his family’s ancestral home, Rohet Garh, their city hotel in Jodhpur and their most magical tourism endeavor so far, Mihir Garh .

The hotel feels like a primeval fort in remote Rajasthan, the kind of place that’s risen from the sand since forever. But just two decades ago, it existed only as a dream. The site, atop a dune in the windswept Thar Desert, was once a picnic site for guests of Rohet Garh.

When Rohet Garh’s popularity took off, the family realized their desert dream. Their Fortress of the Sun rose with the efforts of more than 100 artisans. They spent more than two years constructing every detail from the murals in the dining room to the mirror-mosaic fireplaces that grace many of the rooms.

The temple courtyard at the entrance

The nine eco-friendly guest rooms are enormous, each around 1,700 square feet, and have unheard-of desert luxuries like plunge pools and open-air Jacuzzis. Their decoration was largely chosen by Avijit’s mother, Thakurani Rashmi Singh, and it leans toward rich colors, opulent dark wood furnishings, carved headboards and elaborately patterned rugs, all produced in the region. The bathrooms, with their curved surfaces and smooth floors and walls, seem to have been fashioned from the sand itself. In fact, it’s a special plaster technique known to only one craftsman in the region.

When Is The Voice Season 25 Finale All About The Star Studded Event

Wayfair outdoor furniture sale the best early memorial day deals this week, echoing nazi germany biden campaign calls out trump s truth social video mentioning unified reich.

The whole thing is a paradox: contemporary comforts in one of the most tradition-bound corners of India, sumptuous accommodations within a barren land, creature comforts in the middle of the wilderness. A cooling dip in the pool as a respite from the relentless afternoon heat, and a cozy snuggle beside the fire as the darkness chills the desert night.

Avijit Singh, whose grandfather led the family into tourism, grew up at Rohet Garh, studied at École Hôtelière de Lausanne in Switzerland and worked for Indian powerhouses like Oberoi and Taj. He returned to the family business with a slew of ideas, including aiming for inclusion in Relais & Châteaux, which Mihir Garj achieved in 2014.

One of the guest suites

Relais & Châteaux prides itself on many things (charm, character, some other C’s), but a clear case of Mihir Garh’s brand compliance is in its cuisine. The kitchen turns out a wide variety of international and Indian dishes. The way to go, of course, is the local fare: traditional Rajasthani delicacies—curries, biriyanis, dals—and family recipes from Avijit’s grandmother. The formal dining room is just a suggestion; guests can also dine in their suites, on the rooftop or anywhere else on the grounds.

While it’s tempting to simply lounge and eat, there’s much to do at Mihir Garh. Its signature excursion is the Village Safari, whose name, I admit, concerned me. I’ve seen too many of the human-petting-zoo products that pass for village tourism in much of the world.

Thankfully, no such thing happens here. The visits, to traditional enclaves with elaborately mustachioed men and red-veiled women, and to rural communities with mud-walled homes and Brahmin villages with the caste’s famous blue buildings, are based on the owners’ personal connections. Guests are invited into homes—of shepherds, Brahmin farmers and weavers—as friends of friends. Tea is shared. Questions are encouraged and answered.

A Village Safari