UOB Travel Insurance Review 2022: Promo, Covid-19, Complimentary Insurance

UOB travel insurance is something of a hidden gem. When you buy travel insurance, the usual names that come to mind are NTUC , MSIG , FWD and so on.

But in my opinion, UOB travel insurance offers pretty decent coverage – and I’m saying this as someone who is not a fan of UOB at all. This is a pleasant surprise because local banks usually don’t try very hard with their insurance products.

Let’s take a closer look so you can decide if it’s worth your money.

- UOB Travel Insurance: Summary

- UOB Travel Insurance: Coverage

- UOB Travel Insurance Covid-19 Coverage

- UOB Travel Insurance Promo

- UOB Complimentary Travel Insurance

- UOB Travel Insurance: Extreme Sports

- UOB Travel Insurance Claims Review

- Should I buy UOB Travel Insurance?

1. UOB Travel Insurance: Summary

UOB travel insurance is sold under the brand UOB Insure & Travel. It’s actually provided by UOI (United Overseas Insurance) which is UOB’s insurance arm.

This is not to be mixed up with the complimentary travel insurance UOB offers its commercial cardholders. UOB’s InsureTravel is like any other travel insurance provider offering their travel insurance plans for purchase. You don’t have to be an existing UOB customer to buy UOB’s InsureTravel plans.

2. UOB Travel Insurance: Coverage

Two years ago, the UOB travel insurance had only 2 tiers – Essential and Preferred.

Now, UOB InsureTravel comes in 3 tiers:

- Basic Plan (cheapest, lowest coverage)

- Essential Plan

- Preferred Plan (most expensive, highest coverage)

UOB InsureTravel has categorised their insurance premiums into 3 areas for its single-trip plans:

- Area 1 : Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand and Vietnam

- Area 2 : Asia countries excluding Middle East countries, Central Asia countries and Russian Federation. Australia and New Zealand included.

- Area 3 : Anywhere in the world

On the other hand, UOB InsureTravel’s annual plans has categorised their insurance premiums in 2 areas for its annual trip plans:

- Area 4 : ASEAN, Asia countries excluding Middle East countries, Central Asia countries and Russian Federation. Australia and New Zealand are included under Area 4

- Area 5 : Anywhere in the world

UOB InsureTravel’s coverage, claim limits, and key benefits are as follows:

UOB InsureTravel’s plans range from $46 to $123. Even when it’s not discounted, UOB InsureTravel is definitely on the more affordable end of travel insurance plans.

We love a good deal any day of the week but does UOB InsureTravel’s coverage really give you a bang for your buck?

In terms of coverage, UOB travel insurance seems pretty legit. Medical coverage is excellent for its price, travel inconvenience benefits are not the best but still decent, and if you’re using a UOB credit card you also get bonus fraud protection. Even with a Basic plan, the claim limits are pretty high.

Comparison of UOB travel insurance prices vs other travel insurance providers:

Looking at the table above, UOB InsureTravel might not seem like the best in class travel insurance product . However, the thing to note is of the four insurance providers listed, only UOB InsureTravel’s policies include Covid-19 coverage.

Covid-19 coverage has to be purchased as an add-on for FWD and Tiq by Etiqa travel insurance policies. Given that what you pay for UOB InsureTravel’s travel insurance plans also includes Covid-19 coverage, you get your money’s worth in coverage.

Total Premium

FWD Premium

[ Win a Rolex, Samsonite Luggage & More! | MoneySmart Exclusive] • Enjoy 25% off your policy premium • Get S$88 Revolut Cash Award* and an Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply. BONUS: For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw . Stand a chance to score: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Samsonite Robez 68/25 EXP (worth S$550) weekly Increase your chances of winning when you refer friends today. T&Cs apply PLUS, get S$100 Revolut Cash Award when you are the 8th and 88th Successful Applicant each week to sign up for a new Revolut account in our Giveaway. T&Cs apply.

Key Features

Enjoy cashless medical outpatient treatment in Singapore, access to emergency assistance and your travel policy documents through the FWD SG app!

Add on coverage for COVID-19 available for both Single & Annual Trips for travel period of 90 days or less.

Optional add on coverage available when your trip is cancelled for any reason for Single Trips. (To be purchased within 7 days of your initial trip deposit for your trip).

Optional add on coverage available for pre-existing Medical Conditions for Single Trips plans (up to 30 days) with S$50,000 coverage for medical expenses incurred overseas and 50% co-payment for trip cancellation, postponement and more!

.png)

[MoneySmart Exclusive] • Enjoy 40% off your Single Trip policy premium and 60% off Covid-19 add-on for Annual Plans. T&Cs apply • Get S$88 Revolut Cash Award* with every policy purchased. T&Cs apply. PLUS, get S$100 Revolut Cash Award when you are the 8th and 88th Successful Applicant each week to sign up for a new Revolut account in our Giveaway. T&Cs apply. [Etiqa's 10th Year 2024 Grand Draw] Stand a chance to win S$10,000 cash or a Singapore Mint Lunar Dragon 1 gram 999.9 fine gold medallion (worth S$173) with eligible Etiqa/Tiq by Etiqa plans purchased. T&Cs apply.

Comprehensive Covid-19 add-on, protecting you before, during and after your trip

Covers Cruise to Nowhere

Instant claims encashment via PayNow

24-hour worldwide emergency travel support

Get paid upon a 3-hour flight delay, even without submitting a claim

3. UOB Travel Insurance Covid-19 Coverage

Given how affordable UOB’s InsureTravel policies are, it might come as a surprise to you that its plans already include Covid-19 coverage:

UOB InsureTravel’s Covid-19 coverage is also worthy of singing praises. Even the basic plan’s overseas medical expenses coverage limit is $100,000. In comparison, FWD’s Covid-19 coverage will set you back by an additional $20.60-$34.04 for $200,000 in overseas medical expenses.

Given just how pocket-friendly UOB InsureTravel plans are, upgrading to the Preferred plan is still cost competitive with other insurance providers who offer Covid-19 coverage as an add-on.

4. UOB Travel Insurance Promo

We’ve mentioned a fair bit about how affordable and price competitive UOB InsureTravel’s plans are. I don’t know about you, but I really hate buying stuff at full price, especially when I just know there’s going to be a sale just around the corner.

UOB travel insurance is kind of like that. When there’s a promotion, UOB travel insurance can be downright cheap, making it one of the best prices you can get in Singapore. Currently, there’s an ongoing promotion of 30% off on single-trip plans and 10% off on annual plans .

Here are the UOB InsureTravel prices after the 30% discount:

After discount, UOB’s InsureTravel policies certainly give you the best value for money especially considering that it also includes Covid-19 coverage.

You can keep tabs on the latest promotions on the UOB travel insurance page.

5. UOB Complimentary Travel Insurance

If you’re a UOB cardholder, you can qualify for UOB’s complimentary travel insurance if you charge the entire fare of your air ticket to any of the following cards:

- UOB One Credit Card

- UOB EVOL Card

- UOB Absolute Cashback American Express Card

- UOB Visa Signature

- UOB PRVI Miles American Express

- UOB PRVI Miles World Mastercard

- UOB PRVI Miles Visa

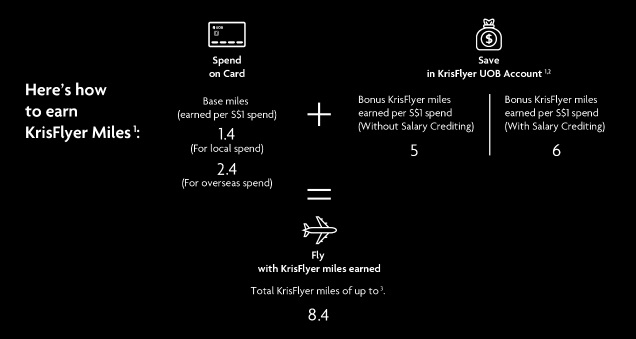

- KrisFlyer UOB Credit Card

Who does love free things? But as the old adage goes, there are no free lunches in the world. The UOB complimentary travel insurance coverage is extremely limited compared to the normal (paid) UOB travel insurance. It’s coverage is limited to the following:

- Personal Accident coverage of $500,000

- Emergency Medical Assistance, Evacuation & Repatriation coverage up to S$50,000 due to an accident or illness (including due to COVID-19 with effect from 1 April 2022)

UOB’s complimentary travel insurance coverage is incredibly bare bones. You’d definitely need to purchase your own travel insurance even if you are a UOB cardholder and qualify for the complimentary coverage.

Plus, there’s the added trouble of having to sign-up online to qualify for the complimentary travel insurance.

6. UOB Travel Insurance: Extreme Sports Outdoor Adventure

As we’ve seen in the sections above, the UOB travel insurance is actually legit.

However, UOB isn’t the most lenient of insurers when it comes to adventure activities, so UOB travel insurance is not for thrill-seekers who really want to test fate.

Here’s a list of outdoor activities that are covered, taken from the UOI policy wording document which is rather hidden from view. The notable exceptions are activities in which you’re airborne – bungee jumping, skydiving and so on.

If you’re an adventure junkie planning to chase an adrenaline rush while you’re on holiday, the UOB InsureTravel plans are definitely limited in its extreme sports and outdoor adventure coverage. D efinitely consider DirectAsia’s Extreme Sports travel insurance rider as an add-on to your UOB InsureTravel plan. It helps that UOB InsureTravel policies are wallet-friendly to begin with.

7. UOB Travel Insurance Claims Review

UOB travel insurance’s cumbersome claims process that seems to be stuck in time might just be my least favourite thing about UOB InsureTravel. To submit your claim, you have to:

UOB travel insurance claims: Download the claim form from the UOB travel insurance page and email the completed form with supporting documents and receipts. Successful claims will then be credited to your account or the cheque will be sent to you via mail.

The inconvenience aside, UOB does have a 24-hour emergency hotline to tend to your queries anytime of any day. The details are as follows:

Emergency assistance hotline: +65 6222 7737

While there isn’t much fodder online about UOB travel insurance’s claims process, we did find one customer review being less than enthused about a full voicemail box. However, we’d take it with a pinch of salt given that it dates all the way back to 2013.

8. Should I buy UOB travel insurance?

UOB InsureTravel’s travel insurance is one of the most bang-for-buck ones out there – even the mid-tier Essential plan has excellent coverage.

It doesn’t make sense to overpay for your travel insurance unless you’re embarking on a high-stakes trip, like a thrill-seeking adventure. If you have an itinerary that’s heavy on extreme sports and outdoor adventure, you will definitely want to get an add-on that is more niche since UOB InsureTravel’s coverage in that category is greatly limited.

Overall, UOB travel insurance offers very good travel insurance benefits all around, from medical coverage to travel inconveniences that may arise from Covid-19. It’s an added plus that unlike other insurance providers, UOB’s InsureTravel travel insurance plans are inclusive of Covid-19 coverage.

The UOB InsureTravel policy also differentiates itself from other providers with additional benefits that are not common practice. For instance, UOB’s InsureTravel plans extend coverage to compassionate visits by a friend or family member.

On top of that, if you’re a UOB cardholder, you also enjoy the following exclusive benefit:

Looking to buy UOB travel insurance? Compare all Singapore travel insurance policies by price and coverage first .

Related Articles

Travel Insurance Singapore Guide (2023): Must-Knows for Choosing the Best Travel Insurance

Airline Travel Insurance – What does SIA, Scoot, Jetstar travel insurance cover?

Best Travel Insurance Plans in Singapore [content outdated due to Covid]

UOB One Credit Card Review 2024: 10% Rebate, Many Strings Attached

UOB One Credit Card

- Up to 10% cashback

- Cashback for everyday expenses – groceries, Shopee, public transport, etc.

- High petrol savings at SPC and Shell

- Earn bonus interest when paired with UOB One Account

- High minimum spend

- Must hit minimum spend for three consecutive months to qualify for rebates

- Very tight cashback caps

- Low effective cashback rate

Current Promotion

Touted as the “most generous cashback card” in Singapore, the UOB One Credit Card offers up to 10% cashback on eligible transactions.

Compared to other 10% cashback cards, the categories here are also far more accessible. Shopee, Giant, SP utilities, and public transport, for example, likely appear on many of our credit card statements.

But look a bit deeper and you’ll find that there’s a complicated cashback system with this card. That leaves you wondering: just how generous is this card, really?

Read on to find out more about:

- Eligibility & fees

- Cashback, discounts, and other rewards

- How the cashback system works

- How this card compares to others

- Who would benefit most from this card

Eligibility & Fees

There’s no automatic fee waiver past the first year, but most UOB One cardholders have reported being able to call in for a waiver.

Cashback, Discounts, and Other Benefits

Earn extra interest with the uob one account.

The bonus interest UOB advertises is a little misleading: yes, you can earn 3.6% interest, but only on the last S$25,000 of your first S$100,000 in the account. For amounts $75,000 and below, you’ll earn lower interest. All in all, you’ll earn an effective interest of 2.145% on the first S$100,000 in your UOB One Account.

Still, considering the low requirements for the bonus interest, this is still an excellent offer if you’re looking for a savings account + credit card combo. To qualify for maximum interest, you only have to:

- Spend at least S$500 on your UOB One Credit Card

- Credit at least a salary of S$1,600

Both of these sound doable. Other high-interest savings accounts have heavier requirements, like accumulating S$30,000 in eligible transactions (DBS Multiplier) or engaging with multiple products from the bank.

Read also: 5 Best High-Interest Savings Accounts for Singapore

How the Cashback System Works

Most cards have a base cashback rate, and then a minimum spend to meet to unlock the highest cashback.

We wish things were that simple with the UOB One Credit Card. Instead, it has:

- Three tiers of minimum spend

- A minimum requirement of five transactions per month

- A quarterly cashback cap

- Bonus cashback on select categories

- And a base cashback rate of 0.03% (far worse than other cards)

That explains the many complaints we hear about the UOB One cashback system being complex.

Let’s start with the cashback tiers:

The higher the tier, the higher your quarterly cashback cap and rebate percentage. Simple enough so far, right?

Here’s where it becomes a bit of a headache:

- You only reach the cashback tier when you meet the minimum spend for three consecutive months in a quarter. Say you spend $1,000 for the first two months but only $500 for the third: you’ll be at Tier 1, not Tier 2.

- The bonus cashback you get depends on your tier. For example, if you’re only at Tier 1 or 2, you won’t get the extra 1.67% rebate at Shell. You’ll also only get a max of 8.33% cashback at Shopee, Grab, and Dairy Farm merchants.

- Even if you hit Tier 3 and qualify for 10% cashback, you won’t get 10% cashback on all $2,000. Since your quarterly cashback caps out at $200, your max effective cashback is just 3.33% – not quite so “generous” after all.

- Your effective cashback rate drops the more you spend past the minimum. You’ll get optimal rebates if you hit the $500, $1000, or $2000 minimums almost exactly.

For some of us, it’s a lot of effort to track spending for a whole quarter. Just one miscalculation can easily cost you three months of effort.

On top of that, only transactions posted during the statement month count toward that month’s minimum requirement. If, for example, you charge to the card 2 days before the end of the statement month but the merchant only posts the transaction 3 days later, you’re out of luck.

How Does This Card Compare To Others?

Given the effective cashback of 3.33%, it seems like this card is only worth it if you want rebates on categories that your other credit cards don’t offer.

Here’s a quick comparison of the UOB One Credit Card to alternatives:

If you max out every chance you get to earn cashback, the most cashback you’ll be entitled to is around S$66 per month (even if you’re at Tier 3). This makes Maybank Friends and Family Card, OCBC 365, and OCBC Frank Credit Card fair contenders with higher monthly caps.

And none of them require cardholders to meet a quarterly minimum spend.

Maybank Family & Friends Card vs UOB One Credit Card

Maybank’s card is a nice “family-friendly” alternative. It offers you the ability to choose the categories you want rebates in, with many that overlap with UOB One’s high cashback categories.

The S$25 cashback cap per category means you have to spread your spending across five categories to reap the benefits of this card. Still, it offers higher cashback at a lower minimum spend.

OCBC 365 Card vs UOB One Credit Card

OCBC 365 has decent cashback with no cashback cap per category. This allows you more flexibility. If you spend a lot on dining and petrol, this may be your go-to card.

OCBC Frank Card vs UOB One Credit Card

The OCBC Frank Credit Card is great if you don’t usually spend a lot with your card. With only S$600 minimum spend per month, you can still earn more cashback than with the UOB One. However, this card may not be for you if you’re looking for savings on petrol.

Cashback aside, the other cards also grant at least two to three years of fee waivers (two years for OCBC cards and three years for Maybank), which means instant savings of S$192.60 to S$385.20. But if you’re confident in getting a waiver for your UOB One Credit Card, then this may not be much of a concern for you.

Downsides of the UOB One Credit Card

Besides the downsides already mentioned, here are a couple other points to note:

1. No Travel Perks

Even though UOB One offers extra cashback on UOB Travel, it comes with a number of exclusions. Oddly, the bonus cashback rate doesn’t apply to online flight bookings. That means you’re left mainly with tour packages, travel insurance, and car rentals.

There are also no travel perks like complimentary lounge access, airport transfers, or free hotel stays. The cashback is the key benefit you’ll get for this card.

2. Cannot Earn UOB UNI$

Unlike other UOB cards like the UOB Lady’s Card, Platinum Visa Card, and Visa Signature Card, this card doesn’t allow you to earn UNI$ to redeem rewards.

Who Would Benefit From This Card?

With the way UOB has redesigned this card, it’s no longer as worthwhile – especially not for those who spend S$2,000 a month.

Instead, we’d recommend this card for:

- Those who already have a UOB One Account and want a credit card to go with it

- Those looking for a card to earn rebates on SP utilities and public transport

- Those who can track their expenses and spend almost exactly $500 on the card each month

UOB One Card

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.sg’s Terms of Use and Privacy Policy

Already have an account? Login

Are you eligible?

- Promotion valid for new-to-UOB cardholders only.

- Charge a min. of S$1,000 in Eligible Transactions per month, for 2 consecutive months

What you need to know

- The Gift is only eligible for the first 200 applicants who sign up during the promotion period

Quick Facts

Get the maximum value by.

Consolidating your daily spend and everyday merchants to maximise cashback

People who don't mind tracking their expenses to get the max cash back

Categories to maximise this card

All categories. Additional cashback on popular merchants like McDonald's, Grab, Cold Storage, Giant, Guardian, 7-Eleven, SimplyGo, Shopee and more

What people use it for

Daily spend and fixed recurring expenses like subscriptions and bills.

You have consistent spending (e.g. S$500 or S$1,000 or S$2,000) and you don't mind tracking your monthly expenses to give you the maximum cash back.

All Details

Key features.

Up to 10% cashback on McDonald's (including McDelivery®)

Up to 10% cashback at Shopee Singapore (excludes ShopeePay)

Up to 10% cashback at DFI Retail Group (Cold Storage, CS Fresh, Giant, Guardian, 7-Eleven & more)

Up to 10% cashback at Grab (including GrabFood, excludes Grab mobile wallet top-ups)

Up to 10% cashback on SimplyGo (bus and train rides)

Up to 10% cashback on UOB Travel

Up to 4.33% cashback on Singapore Power utilities bill.

Up to 3.33% cashback on all retail spend (based on S$500, S$1,000 or S$2,000)

Fuel savings of up to 22.66% at Shell and SPC

Exclusions and T&Cs at uob.com.sg/onetncs

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Petrol Excellent

At SPC Stations, up to 22.66% savings on fuel purchases

At Shell Stations, up to 21.15% savings on fuel purchases

Bill Payment Excellent

Cash back excellent.

Up to 4.33% cashback on Singapore Power utilities bill

Grocery Very Good

Up to 3.33% cashback on other groceries spend (based on S$500, S$1,000 or S$2,000)

Shopping Very Good

Online shopping very good.

Up to 3.33% cashback on all online spend (based on S$500, S$1,000 or S$2,000)

Dining Very Good

Enjoy up to 50% off with UOB dining privileges (e.g. 1-for-1 buffet and more)

Annual Interest Rate and Fees

Minimum income requirements, card association, wireless payment, moneysmart promotions.

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

UOB One Credit Card Review 2024

Pros & cons.

- Up to 10% or 15% cashback on online food delivery, groceries, fast food, online shopping, transport, utilities, petrol and travel

- First year waiver of annual fee available

- S$350 cash credit for first 200 new-to-UOB customers

- Get rewarded with UNI$ points and redeem your UNI$ on UOB TMRW to offset bills and purchases

- Exclusive access to over 13,000 deals on dining, shopping, travel and more, weekly UOB Coupons, dining inspirations within UOB Rewards+

- UOB Complimentary Travel Insurance covers the Cardmember’s spouse and dependent children (if applicable)

- Interest rate of 27.80%, which is higher than other cashback credit cards in the market

- A minimum spend of $1,000 (for 2 consecutive months) is required to qualify for the 15% cashback on spending in selected categories and cash credit (only applicable to new-to-UOB customers)

- Cashback cap of $500 per quarter

- Minimum spend of $500 per month to qualify for the 10% cashback

Compare UOB One Card vs. CIMB World Mastercard vs. HSBC Visa Platinum Card

Find out more about the uob one card in our blog review, uob one card application.

Here are 3 simple steps to apply for the UOB One Card

Apply via MoneySmart’s credit cards page

You may begin your application by clicking on our UOB One card application link. When you choose to apply online via SingPass MyInfo, UOB will pull your identity and income data from SingPass (which is already verified), thus cutting short the processing time. The approval-in-principle page will appear within minutes of submitting your MyInfo.

Provide all documentation required

- NRIC or other identification details

- Latest computerised payslip

- Latest 12 months’ CPF Contribution History Statement

- Latest Income Tax Notice of Assessment (NOA)

Receive your UOB One Card

You’ll be able to activate your UOB One card through UOB TMRW mobile app, and enter a One-Time Password (OTP) after keying in your 6-digit Online Banking PIN to secure all your credit card transactions. Thereafter, it’s ready for you to use on any of your purchases and you can track your cashback rewards and credit card statements with your UOB TMRW mobile app!

Frequently Asked Questions

Are there any fees if i apply for the uob one card, am i eligible for the uob one card.

Travel Insurance

You'll love.

- Hassle-free online buying experience

You'll Need

- To buy Insure & Travel before you leave Singapore

- To be a Singaporean or is a Singapore PR, or Work Permit or Employment pass holder or has a Long Term Visit Pass

Key Benefits

Important information, general exclusions.

- Up to S$300,000 for Personal Accident^

- 50% premium discount for Child travelling with an Insured adult on Single Trip Individual Plan^

- Up to S$15,000 for Loss of Deposit/Cancellation^

- Up to S$2,000 for Baggage Delay^

^The relevant policy terms and conditions apply.

Geographical Areas

Eligibility for cover.

- You must be domiciled in Singapore.

- The Trip must not be for the purpose of seeking medical treatment.

- Insured Person above Age 70 years old is not eligible for Preferred Plan

Family Plan

Maximum enrolment age, other information.

- Age means the age of the Insured or Insured Person on his/her next birthday on the start date of the Period of Insurance stated in the Certificate of Insurance and/or Policy.

- Child means a fully dependent child under the Age of eighteen (18) years or up to twenty- three (23) years who is studying full-time in a recognized institution of higher learning and is not married nor in any employment at the time of purchase of this Certificate of Insurance and/or Policy.

- Male who is serving National Service or waiting for enlistment is not construed as a Child .

- Annual Multi-Tri Individual Plan is not available for Insured Person who is below the Age of 21 years old.

Commencement of Coverage

- All trips must start and end in Singapore.

- Travel Insurance must be purchased before commencement of trip from Singapore.

Maximum Duration of Trip(s)

- Single Trip: Up to 185 days.

- Annual Multi-Trip: Multi-trips, subject to maximum 90 days per Trip.

Premium Discount for Child

calculation of premium, refund and cancellation policy, summary of major exclusions applicable to insure & travel:.

- War and kindred risks and government acts

- Nuclear/Chemical/Biological Terrorism (LSW 1176)

- Nuclear hazards

- Unreasonable care and attention

- Racing, motor sports, mountaineering, flying as a pilot and crew member or other hazardous pursuits and underwater activities except leisure scuba diving under the supervision of a qualified diving instructor

- Self-inflicted injury or illness

- AIDS or AIDS Related Complex

- Alcoholism or drug abuse

- Pre-existing medical conditions

- Pregnancy including childbirth, caesarean operation, abortion, miscarriage (and all complications therefrom) except miscarriage due to accidental bodily injury as provided under Section 3(c) of the Policy contract

- Medical treatment (except as specified) in Singapore

- Non-essential treatment or surgery

- Medical treatment being the specific purpose of the trip

- Failure to notify travel agent/tour operator or provider of transport or accommodation immediately if it is found necessary to cancel or curtail the travel arrangement

- Failure of the Insured Person to check-in according to the itinerary supplied to him

- Strike or industrial action which was in existence at the date of purchase of this insurance

- Normal wear and tear

- Confiscation or detention by customs

- Damage to fragile articles

- Losses not reported to the police within 24 hours at the place of loss

- Baggage losses not reported to the carrier immediately

- Injury to employees or members of the Insured Person's family

- Liability arising out of the use of vehicles, aircraft or watercraft

- Property belonging to or held in trust or in the custody or control of the Insured Person

- Liability directly arising from the Insured Person's specific pursuit of any trade, business or profession

- Liability assumed by the Insured Person by agreement

- Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- UOB One Credit Card: Highest Flat Rate Cashback Card

- Good fit for budgets of at least S$2,000 per month

- Easy cashback on daily spend

- Gives rebates for paying bills

- Doesn't fit inconsistent budgets

For most spenders, there's no better way to maximise cashback than with UOB One Card. Up to 5% flat rebate, boosted to 10% on Dairy Farm, Grab, Shopee & select UOB Travel and 6% on utilities. At this spend level, cardholders can earn up to S$300/quarter, or S$100/month–one of the highest potential earning rates on the market. Lower or inconsistent spenders with budgets as low as S$500/month can also earn a 3.33% cashback. Ultimately, if you’re looking for a convenient card that rewards stable budgets with top rates, there’s no better option than UOB One Card.

UOB One Credit Card Features and Benefits

Our evaluation: great cashback rates for consistent spenders.

We think that one of the best things about UOB One Card is that it earns a pretty high cashback rate on just about any purchase you make with it. Although it does exclude certain types of expenses like bank fees and payment app transactions, most everyday purchases will earn some cashback with UOB One Card. On top of the high base cashback, it also offers many opportunities to boost your rewards by buying from certain merchants.

The UOB One Card is indeed one of the best cashback credit cards in Singapore for those with consistent spending. Offering cash rebates which increase with your total expenditure, it could be a good choice for high and consistent spenders to consider the UOB One Card.

UOB One Card Quarterly Rebate Tiers

The way UOB One Card's rebate scheme works is unique, and it fits best for people whose monthly spending is consistent. Cardholders earn one of three cashback rates based on their lowest monthly spend within a quarter. Those who spend at least S$2,000 each month and charge at least 5 transactions to their card earn the maximum S$300 cashback for that quarter, equal to up to 5% flat cashback on all purchases and S$1,200 in savings over a full year. This makes the card worth considering, given its high cashback

To optimise your cashback from UOB One Card, you must meet two criteria: reach the minimum monthly spend that is closest to your typical budget, and use the card at least 5 times per month. Apart from the quarterly cashback, you can also earn bonus cashback of up to S$100 per month: +5% for Dairy Farm Singapore, Grab, Shopee and select UOB Travel transactions (up to 10% total) and +1% on Singapore Power bills (up to 6% total). All electric bills are eligible for up to 5% rebate.

Regardless of your spend level, UOB One Card also grants additional cashback on the following select merchants:

UOB One Card is not as good if your monthly spending varies a lot or falls too far away from the monthly minimums of S$500, S$1,000 and S$2,000. Because your cashback is based on the lowest monthly spend of the quarter, spending less than these figures reduces your cashback rate.

The closer your lowest monthly spend gets to the next tier, the more cashback you will miss out on until you reach that tier. For instance, spending just S$1 less than S$2,000 in any one month drops a cardholder's rebate from S$300 to S$100 for the whole quarter. The monthly cap on rebates doesn't exist for unlimited cashback cards like American Express True Cashback Card or miles-earning cards like Citi PremierMiles Visa Card .

Ultimately, UOB One Card is best for average consumers with a stable monthly spend of around S$2,000. While the annual fee of S$192.6 is only waived the first year, the rebate potential of UOB One Card offers an easy way to quickly and conveniently recoup the cost. This card is a great fit if you're more concerned with saving money than with miles, rewards, or vouchers.

How the UOB One Credit Card Rewards Program Works

- Every 1 dollar of cashback earned is equal to S$1

- Cash rebate is credited to the cardholder's account 1 month after the end of each quarter

- Cash rebate earned must be used to offset future transactions

- Cash rebate expires 2 calendar years from the quarter in which it was earned

- Cashback is automatically forfeited and is non-transferable when an account is closed

Before You Apply: Caps, Minimums, and Exclusions

While we consider UOB One Card to be stronger than many other credit cards in Singapore, it does carry some limitations that you should keep in mind. First, know that this card's system gives you the cashback in quarterly installments, which means you'll only see the benefit appear in your account four times a year as opposed to every month.

Second, the fixed cashback amounts that you can earn each quarter max out at S$300, which is unlocked by spending S$2,000 and making at least 5 transactions each month. Since there's no added bonus for spending more than that, it's a good idea to start using a different card once you've reached the monthly spend requirement on UOB One Card.

Put together, these terms and conditions mean that UOB One Card is best-suited to people who naturally tend to spend the same amount month after month. Consistent spending will make it easier to hit the monthly spend requirements.

Keep in mind that the following credit card expenditures are ineligible for cash back or rebate with UOB One Card:

Finally, remember that any cashback that you earn using UOB One Card is applied forward: in other words, the cashback only offsets future spending and will not apply as statement credit on the spending that originally generated the cashback. Also, cashback you accumulate expires 2 calendar years after the quarter in which you earn it or immediately when you close your credit card account.

How UOB One Credit Card Compares to Other Cards

Read our comparisons of UOB One Card with other cards and learn what makes each card unique in their own way. We compare and contrast each card to highlight its uniqueness to help you identify the card that you need. In case you would like to compare the rewards value of this card or any other card yourself, go to our RealValue Credit Card Rewards Calculator to compare the cards' rewards, promotions, rates and other unique features.

UOB One Credit Card vs Maybank FC Barcelona Card vs American Express True Cashback Card vs Standard Chartered Unlimited Cashback Credit Card

Maybank FC Barcelona Visa Signature Card , American Express True Cashback Card and Standard Chartered Unlimited Cashback Credit Card are decent alternatives for UOB One Card. These cards provide unlimited cashback of about 1.5% on nearly all purchases without a minimum spend requirement. Given this, these cards may be better than UOB One Card for consumers who spend at least S$6,000 per month. Overall, Maybank FC Barcelona Card stands out for its slightly higher rebate of 1.6% and an easy annual fee waiver, Amex True Cashback Card comes with the renowned customer service, and SC Unlimited Cashback Card offers a 0% instalment payment plan for up to 36 months and doubles as a SimplyGo Card.

Ultimately, UOB One Card benefits average consumers who spend of S$2,000/month, while only the highest spenders can earn greater cashback with Amex True Cashback Card or SC Unlimited Cashback Credit Card.

UOB One Credit Card vs HSBC Advance Credit Card

- Great fit for budgets between S$2,000 and S$8,000/month

- Easy, low-maintenance cashback

- Lacks travel perks

- Doesn't fit highly specialised spend behaviors

HSBC Advance customers can maximise cashback rewards with flat-rate HSBC Advance Credit Card . Banking customers earn 3.5% cashback, 2.5% base rate + 1% bonus rate, for spending at least S$2,000 and depositing a minimum of S$2,000 per month in fresh funds and charging at least five transactions to their account. With this bonus rate, monthly cashback is capped at S$300 (compared to UOB One Card's S$300/quarter), which is S$3,600 per year in savings.

Failing to deposit S$2,000 in fresh funds monthly will result in rate drop to 2.5% when monthly spend is S$2,000 and up, and just 1.5% for monthly spend below S$2.000. The monthly cap is only S$70/month (S$210/quarter vs UOB's S$300), and an annual fee of S$192.60 applies. For customers who cannot deposit fresh funds on a monthly basis to earn the bonus cashback rate, UOB One Card is likely a better alternative.

UOB One Credit Card vs UOB EVOL Card

- Easy to use cashback card

- Great for budgets of at least S$600/month

- Rewards all online and mobile spend

- Cashback capped at S$60/mo

UOB EVOL Card is a great fit for young adults looking to maximise cashback on most expenses. Cardholders receive 8% cashback on any purchases made either online or via mobile payment apps like Apple Pay and Google Pay. UOB EVOL Cardholders can also earn cashback after reaching a minimum spend of just S$600, with no quarterly contingencies like the UOB One Card.

However, UOB EVOL Card limits your monthly rewards to S$60, or S$180 per quarter - far lower than the S$300 quarterly rebate on UOB One Card. UOB Evol Card is still a versatile choice for lower budgets concentrated in online purchases and contactless payments, but those who spend at least S$2,000 per month can earn far more from UOB One Card.

Methodology: How We Review Credit Cards

At ValueChampion, we analyse nearly every credit card available in Singapore. Our process involves measuring the value of each card's rewards rates, bonuses, and benefits versus its spending requirements, monthly rewards caps and annual fees.

Most cards earn miles or cashback at rates that change depending on what type of spending your budget includes. Different categories also have different monthly caps on their rewards potential. Some cards also require you spend a minimum amount every month before they earn rewards.

Applying all of these factors to a typical budget allows us to estimate how much the credit card will earn in rewards. Annually recurring fees and bonuses are also considered in our calculation. We use our results to evaluate how effective the card is compared to other options.

To try our calculations for yourself, use our RealValue Rewards Calculator and find out how easy it is to compare the rewards potential of every credit card in Singapore.

- Best Cashback Credit Cards in Singapore 2022

- Best Overall Cashback Credit Cards in Singapore 2022

- GrabPay MasterCard Debit Card: Extend Acceptance of Your GrabPay Wallet and Take Advantage of Complimentary Insurance

Zoryana is a Senior Research Analyst at ValueChampion, who focuses on evaluating credit cards, savings and fixed deposits in Singapore. She holds a BA in Political Science and an MPA in International Finance and Economic Policy, both from Columbia University. Prior to joining ValueChampion, Zoryana worked in treasury management consulting.

Keep up with our news and analysis.

Stay up to date.

Our Top Credit Cards

- Overall Best Credit Cards

- Best Air Miles Credit Cards

- Best Agoda Credit Card Promotions

- Best Expedia Credit Card Promotions

- Best Booking.com Credit Card Promotions

- Best Credit Cards with Klook Promo Codes

- Best Miles Cards with No Annual Fee

- Best Cashback Cards with No Annual Fee

- Best Petrol Credit Cards

- Best Cards for SPC Discounts

- Best Cards for Esso Promotions

- Best Cards for Shell Discounts

- Best Shopping Credit Cards

- Best Student Credit Cards

- Best Credit Cards for Seniors

- Best Expat Credit Cards

- Best Unlimited Cashback Credit Cards

- Best Cards for High Income

- Best Dining Credit Cards

- Best Cards for Food Delivery

- Best Credit Card 1 for 1 Buffet Promotions

- Best Grocery Credit Cards

- Best Entertainment Credit Cards

- Best Credit Cards for TransitLink SimplyGo

- Best EZ-Link Credit Cards

- Best Cards for Insurance

- Medical Credit Cards

- Wedding Credit Cards

- Best Cards for Seniors

Compare Credit Cards by Value

- Rewards Credit Cards

- Cashback Credit Cards

- Petrol Credit Cards

- Travel Credit Cards

Featured Credit Cards

- Citi Cashback Card

- HSBC Visa Platinum Credit Card

- Maybank FC Barcelona Visa Signature Card

- Citi PremierMiles Visa Card

- HSBC Revolution Card

- DBS Altitude Card

Credit Card Basics

- How to Find the Best Rewards Credit Card

- How to Use a Credit Card: Best Practices Explained

- Everything You Need to Know To Optimise Points Redemption

- Guide to the Risks of Credit Card Churning

- Everything to Know about 0% Instal Plans

- Understanding Credit Card APRs & Interest Rates

- Average Interest Rate of Credit Cards

- What Is Credit Card Cash Advance?

- Average Cost of Cash Advance

- What Is a Balance Transfer?

- Repercussions of a Late Payment on Your Credit Card

- Credit Card Minimum Payment: What You Need To Know

- Understanding Credit Cards' Minimum Spend Requirements

- A Basic Guide to Supplementary Credit Cards

- VISA vs MasterCard – Which is better?

- Everything to Know about Foreign Transaction Fees

- Cash vs Credit Cards: Which Is Better To Use When Travelling?

- Cash Back vs Points vs Miles

- Cashback Cards vs Miles Cards

- Guide to Redeeming Miles Credit Card Rewards

- Understanding Caps on Monthly Rewards Earnings

- No Annual Fee Cards vs Fee Cards

- Debit Cards vs Credit Cards

- Common Credit Card Transactions Excluded from Earning Rewards

Featured Credit Card Services

- RentHero vs CardUp

- Youtrip vs. Revolut Digital Wallets

- CardUp Review

- RentHero Review

- Revolut Standard Review

- YouTrip Debit Card Review

Related Articles

- How to Put Your Salary Increment to Good Use

- 10 Best Free-Flow Brunch Buffets in Singapore for All Budgets

- Last-Minute Christmas Shopping Hacks and Gift Ideas For The Procrastinator In All Of Us

- The Best Christmas Dining Specials for a Merry Holiday Season in Singapore (2023)

- 3 Easy Ways to Host Christmas Dinner on a Budget

- Pros and Cons of Contributing to Your Supplementary Retirement Scheme (SRS)

- Everything You Need To Know About Supplementary Retirement Scheme (SRS)

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

- FOR INDIVIDUAL

- PERSONAL BANKING

- WEALTH BANKING

- PRIVILEGE BANKING

- PRIVATE BANK

- UOB REFERRAL

- FOR COMPANIES

- BUSINESS BANKING

- WHOLESALE BANKING

- FOREIGN DIRECT INVESTMENT

- UOB ASEAN INSIGHTS

- INDUSTRY INSIGHTS

- ABOUT IBOR TRANSITION

- CHANGES TO BENCHMARK RATES

- UOB ISLAMIC BANKING

- Islamic Banking

- CORPORATE PROFILE

- STAKEHOLDER RELATIONS

- UOB Digitalisation

- UOB MALAYSIA

- UOB SINGAPORE

- UOB HONG KONG

- UOB INDONESIA

- UOB PHILIPPINES

- UOB THAILAND

- UOB VIETNAM

- UOB PERSONAL INTERNET BANKING

- UOB INFINITY

- Credit Card

- Savings Account

- UOB Chat Assist

- UOB Credit Cards

- Travel Cards

- UOB PRVI Miles Card

UOB PRVI Miles

EARN MILES THE FASTER WAY

Travel Privileges

Daily perks, redeem anything, rates & eligibility.

Up to 5X UNIRinggit on Overseas & Travel Spend

Exclusive Travel Deals

The Travel Insider Inspire. Plan. Book.

For more information, please refer to UOB PRVI Miles Card Terms and Conditions.

50% off Grab Rides

Additional 2,000 UNIRinggit per Month

Redeem miles from over 60 partner airlines

Other Rewards

Lifestyle Products | Gift Vouchers | Airmiles | Service Tax & Annual Fee

Redeem any rewards of your choice from the UOB UNIRinggit Rewards Catalogue

Terms and Conditions

For UOB Credit Card Terms and Conditions, please visit here .

Get up to 5% cashback on your foreign spend with UOB PRVI Miles Card.

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

Is travel insurance worth it?

April 30, 2024 | 2 min read

Planning a trip and wondering if you need a travel insurance policy? Keep reading to learn more about travel insurance to decide whether it’s right for you.

Key takeaways

- Travel insurance can provide financial protection if things go wrong before or during a trip.

- You might get travel insurance to cover potential losses from trip cancellations or delays, lost baggage or medical issues.

- Factoring in details specific to your trip and balancing with existing coverage might help you decide whether travel insurance is right for you.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What does travel insurance do?

Travel insurance is a type of specialized protection that might help protect against financial losses from airline delays, medical issues or other unexpected occurrences. Some travel insurance plans focus on specific things, like lost baggage or health care. Others offer a wide range of benefits under a single plan. It’s a good idea to make sure you understand the terms and conditions, because coverage varies.

When might travel insurance be beneficial?

Some of the situations where it can help to have travel insurance include:

Interruptions and cancellations

Trip delay insurance covers food and lodging expenses if you experience an airline delay. Trip cancellation insurance can reimburse your prepaid costs if an illness forces you to cancel entirely.

Baggage issues

Baggage loss coverage can reimburse you if your luggage is lost, stolen, damaged or delayed.

Medical emergencies

Travel health or medical insurance can cover everything from medication to emergency medical evacuation if you become sick or injured when traveling abroad .

When might travel insurance be unnecessary?

There’s no right or wrong time for travel insurance. It depends on your circumstances. But when deciding whether travel insurance is worth it, you can consider things like:

- Type and length of trip: If the trip’s refundable, you might not need extra protection. And a short or cheap trip might not be worth the cost of coverage.

- Your existing coverage: Check existing policies and agreements. If you have coverage through your health insurance provider, credit card issuer or card network, you may not need more.

Considering travel insurance in a nutshell

Travel insurance can offer peace of mind if anything goes wrong before or during a trip. But it may not always be worth it. If you’re considering travel insurance coverage, looking at your situation, your trip and the terms and conditions of your existing insurance policies could help you determine whether the benefits outweigh the costs.

If you’re interested in getting insurance coverage from a credit card, you can check out the benefits that come with Capital One rewards credit cards .

Related Content

How does travel insurance through capital one cards work.

article | December 14, 2023 | 6 min read

All about booking with Capital One Travel

article | 7 min read

Are travel credit cards worth it?

article | January 9, 2024 | 7 min read

Life Moments

The Travel Insider

Inspire the globetrotter in you with the first one-stop travel portal in Southeast Asia designed by a bank that inspires, helps you plan, and lets you book in one place.

- Compare Accounts

- Deposits Fees & Charges

- Terms and Conditions for Accounts & Services

- Notices, News & Announcements

Skip to higher interest with UOB One Account

Get up to 6% p.a. interest in just two steps. Apply now and get up to S$210 cash! T&Cs apply. Insured up to S$100k by SDIC.

Card Privileges

Card services.

- Compare Cards

- Commercial Cards

- Card Activation

- Overseas Card Use

- Card Application Status

There's a card for everyone. Click here to find out more on the sign-up offers.

Borrow services.

- Home Loan Calculator

- Property Valuation Tool

- Car Loan Instalment Calculator

Balance Transfer

Get instant cash at 0% interest and low processing fees. Select from flexible tenors of 3, 6 or 12 months.

Wealth Insights

Investment solutions, featured solutions.

- Funds Selector

- Fund Updates

- Product Providers

- CPFIS and SRS Corporate Action Information

Wealth on UOB TMRW. Designed around you.

View and manage your portfolio in one place. Invest, insure, and convert FX easily with just a few taps.

General Insurance

Life insurance.

- List of Product Providers

- ATM / Branch Locator

SimpleInsure

Get PRUCancer 360 from just S$3.70 per week. Sign up now and enjoy 35% off your first-year premium. T&Cs apply.

Digital Banking

Personal internet banking, other banking services.

- Forgot Username/Password

- TMRW Guides

- UOB PIB and TMRW FAQs

- E-Payment User Protection Guidelines and FAQs

Meet UOB TMRW, the all-in-one banking app built around you and your needs. Bank. Invest. Reward. Make TMRW yours.

For Individuals

For companies, uob subsidiaries.

- SUSTAINABILITY

- UOB personal internet banking

- UOB INFINITY

- UOBAM invest

- UOB coe open bidding

- UOB kay hian

- UOB rewards

UOB Visa Infinite Metal Card

All style, all substance.

Get up to 80,000 air miles when you apply today.

Get up to 80,000 air miles when you apply today

- New-to-card customers: 80,000 air miles

- Existing-to-card customers: 40,000 air miles

To qualify, simply spend S$4,000 within 30 days from your Card approval date and make full payment of the non-waivable Card Membership Fee of S$654 yearly (inclusive of 9% GST).

Other terms and conditions apply .

Find out more --> Apply now

Bonus Welcome Gifts Promotion Terms and Conditions

This Promotion is valid for customers who have successfully applied for the Card and have their Card approved between 1 January 2024 to 30 June 2024 (both dates inclusive).

You will receive 25,000 air miles (equivalent to UNI$12,500) upon joining or membership renewal, upon full payment of your principal Card annual Membership Fee.

To qualify for the additional 55,000 air miles (equivalent to UNI$27,500) for new-to-card customers or additional 15,000 air miles (equivalent to UNI$7,500) for existing-to-card customers, you are required to charge a minimum of S$4,000 to your UOB Visa Infinite Metal Card within 30 days from your Card approval date. Applicable UNI$ will be awarded two months after the annual Membership Fee is posted.

A new-to-card customer is defined as a customer who does not have any existing principal credit card issued by UOB in Singapore at the time when the application is approved and must not have terminated or cancelled a principal UOB credit card(s) six (6) months prior to 1 January 2024.

Please note that the annual Card Membership Fee of S$654 (inclusive of 9% GST) cannot be waived.

Card application is subject to Bank’s approval.

Presenting you with visions of a lifestyle with endless possibilities

Savour exquisite cuisines of infinite variety

Indulge in dining privileges of up to 30% off at renowned restaurants.

Explore our world’s infinite wonders

Enjoy up to 2.4 air miles per S$1 spent, unlimited airport lounge access worldwide and exclusive privileges at prestigious hotels.

Experience infinitely exceptional service and connections

Revel in unrivalled experiences and gain access to world-class concierge services any time of the day.

Find infinite joy in life’s finest pleasures

Tee off at the region’s best golf courses with complimentary weekday green fees and access an array of curated privileges.

Exclusive Privileges

Exploration.

Infinite Dining NEW!

Enjoy 30% off a la carte food menu

Welcome Gift - Up to 40,000 air miles annually

- Receive 25,000 air miles upon joining or membership renewal 1 .

- With effect from 1 July 2023, get additional 15,000 air miles upon renewal with minimum S$100,000 spend in the membership year 2 .

Unlimited airport lounge access for you and your guest

- Unlimited access for you and a guest at over 1,300 airport lounges worldwide (With effect from 1 June 2023)

- Up to 25% discount at restaurants in airports worldwide

- 5% discount on Limousine and Meet & Greet services

Accelerated Miles On All Spend

- 2.4 air miles per S$1 spent in foreign currency – be it during your travels or shopping online at your favourite sites (with effect from 1 June 2023)

- 1.4 air miles per S$1 spent locally

Enjoy a complimentary welcome drink for you and your guests at a curated list of Michelin-starred and fine dining restaurants

Complimentary GrabGifts Vouchers Monthly

**The $5 GrabGifts Vouchers promotion will end 30 June 2024 .

Receive two complimentary S$5 GrabGifts vouchers monthly via SMS. With GrabGifts voucher, you can pick your preferred gift (Choose from Transport / Food / Mart / Express voucher). Steps to redeem: Open Grab app > Gifts > Tap the Gift icon at the upper right corner > Key in your Gift code > Pick Your Gift (Choice of Grab Transport / Food / Mart / Express voucher) > Apply the Offer before checking out.

Enjoy additional 5% discount, up to 16.6% tax refund and other privileges at Printemps Paris

Enjoy private lounge access, priority entrance and hands-free shopping experience at The Bicester Collection

Enjoy 30% off Afternoon Tea

UOB Travel Concierge

- A dedicated Travel Concierge Manager to assist you with all your travel needs and dining requests prior to your trip

- Earn up to 10 miles # for every S$1 spent with selected travel partners

For all enquiries and reservations, please call (65) 6302 5503 or email [email protected]

Travel Insurance

- Up to US$1,000,000 Travel Personal Accident Insurance for you and your spouse

- Travel inconvenience coverage includes lost baggage, flight delays and missed connections

- Purchase protection* of up to S$10,000 against accidental loss or damage

KrisFlyer UOB Account

Year Long Room Stay Privileges

- 15% off best available rates

- Additional 10% off for Pan Pacific DISCOVERY members

UOB Travel Concierge Luxury Hotel Programme

- Treat yourself to complimentary room upgrades, dining credits, amenities and more at major hotel groups

- Choose your next stay at prestigious properties like Shangri-La; Marriott International; Hyatt and more.

For enquiries and reservations, please call UOB Travel Concierge at (65) 6302 5503 or email [email protected] .

Hotel Status Matching

Visa Luxury Hotel Collection

- Room upgrade upon arrival

- Complimentary in-room Wi-Fi

- Complimentary breakfast daily for 2

- US$25 food or beverage credit

- VIP Guest status

- Late check-out upon request

UOB Privilege Banking Services

Auto, Home, Travel and Medical Assistance

Visa Concierge

RMDY Clinic

UOB Medical Concierge

- Telephone medical triage service to direct you to the most suitable medical specialist based on your needs

- Fast track hospital admission arrangements

- Travel arrangements for customers residing overseas

For all enquiries, please call IHH Healthcare at +65 6812 3758 or email: [email protected]

UOB Visa Infinite Payment Facility

- Earn 1 air mile for every S$1 approved

- A one-time administration fee on the approved amount will be charged.

Complimentary weekday green fees with 1 fee paying guest at Sentosa Golf Club

50% off weekday green fees at 50 participating golf clubs across Southeast Asia

Compare accounts.

Indulge in an unforgettable dining event brought to you by two renowned chefs collaborating to create a unique menu each month, limited seats available for a dedicated experience. Visit infinite-dining.com for more details. Also enjoy 15% off at these restaurants and more with your UOB Visa Infinite Metal Card.

- Famous Kitchen

- Famous Palance

- Famous Treasure

- L'Entrecôte @ Duxton

- L'Entrecôte @ Customs House

- Sabio by the Sea

- Spizza @ Jalan Kayu

- Spizza @ Bukit Timah

- Izakaya Yoppi

- Mitsu Sushi Bar

Full list of participating restaurants on infinite-dining.com. Prior reservations are required. Please contact the restaurants directly to make your reservations. Restaurant operating hours may vary, please visit the restaurant website for more information. Terms and conditions apply.

Enjoy 30% off a la carte food bill at these restaurants

Pan Pacific Orchard

Pan Pacific Singapore

- Atrium Lounge

- Hai Tien Lo

- Pacific Emporium

- Poolside Restaurant & Bar

PARKROYAL COLLECTION Marina Bay

- Peach Blossoms

- Peppermint*

- Portman’s Bar

- Skyline Bar

PARKROYAL COLLECTION Pickering

- Lime Restaurant*

PARKROYAL on Beach Road

- Si Chuan Dou Hua Restaurant

PARKROYAL on Kitchener Road

- Si Chuan Dou Hua Restaurant**

For reservations, please call UOB Visa Infinite Concierge at 1800 253 2288.

Valid till 30 June 2025, for dine-in only and restricted to one (1) Card per table. Prior reservation is required to enjoy these privileges. The restaurants reserve the right to not offer the discount if no reservation is made prior. Payment must be made with a UOB Visa Infinite Metal Card. The list of restaurants is subject to change, individual restaurants terms and conditions apply.

Discount is not valid on eve of and on public holidays and special occasions such as Easter Weekend, Mother’s Day, Father’s Day, F1 Weekend and Thanksgiving, and may include other blackout dates determined by the merchant, unless stated otherwise. Discount cannot be used in conjunction with other promotions, offers, privileges, discounts, vouchers, loyalty programmes, and privilege card unless stated otherwise, and is not applicable to service charge and taxes. Discount is not applicable on promotional menus.

*The Promotion is only valid for buffet menu at Edge Pan Pacific Singapore, Peppermint at PARKROYAL COLLECTION Marina Bay, Ginger PARKROYAL on Beach Road, and Lime PARKROYAL COLLECTION Pickering only. All other Promotion at the other participating outlets is only valid for a la carte food menu. Offer is not valid for set menus, promotional menus and/or takeaways.

**Valid till 30 June 2025, for dine-in only and restricted to one (1) Card per table. Offer is not valid for set menus, promotional menus and/or takeaways.

Enjoy 30% off a la carte food menu at these restaurants

Sheraton Towers Singapore Hotel

- The Dining Room

- Li Bai: Valid for dinner from Sundays to Thursdays, for dine-in only

Valid till 30 June 2025, for dine-in and takeaways and restricted to one (1) Card per table. Offer is not valid for set menus and/or promotional menus. Not valid on alcoholic beverages.

Payment must be made with a UOB Visa Infinite Metal Card. The list of restaurants is subject to change. Individual restaurant terms and conditions apply.

Individual merchant terms and conditions apply.

Enjoy these exclusive privileges at The Bicester Collection

- 10% VIP discount

- Hands-free shopping experience

- Private lounge access

For enquiries and arrangements, please call UOB Travel Concierge at (65) 6302 5503 or email [email protected] .

Terms and conditions:

Payment must be made with a UOB Visa Infinite Metal Card. Valid till 31 December 2024. Other terms and conditions may apply. Please check with UOB Travel Concierge for details.

Enjoy these exclusive privileges at Printemps Paris

Physical Shopping

- Exclusive additional 5% discount

- 12% tax refund or 16.6% tax refund if cost of item purchased exceeds €20,000

- Personal Shopper

- Complimentary private transfers from hotel to Printemps

- Complimentary two-way transfer from airport to hotel and hotel to airport, and butler service at airport (Valid with a total spend of €30,000)

Virtual Shopping

- 16.6% tax refund

Enjoy 30% off à la carte food bill at these restaurants

- Li Bai Cantonese Restaurant (Applicable for dinner only, from Sundays to Thursdays)

For reservations, contact UOB Concierge at 1800 253 2288.

Payment must be made with a UOB Visa Infinite Metal Card. Prior reservation is required and subject to availability. The list of restaurants is subject to change. Individual restaurant terms and conditions apply. Discount is not valid on eve of and on public holidays and special occasions such as Easter Weekend, Mother’s Day, Father’s Day, F1 Weekend and Thanksgiving, and may include other blackout dates determined by the merchant, unless stated otherwise. Discount cannot be used in conjunction with other promotions, offers, privileges, discounts, vouchers, loyalty programmes, and privilege card unless stated otherwise, and is not applicable to service charge and taxes. Discount is not applicable on promotional menus. Not valid on alcoholic beverages and Graft8’s wine list.

Enjoy 30% off Afternoon Tea at Republic

The Ritz-Carlton, Millenia Singapore

- Republic: Afternoon Tea

Valid till 30 June 2025, for dine-in only and restricted to one (1) Card per table. Offer is not valid for set menus, promotional menus and/or takeaways.

The Fullerton Hotel Singapore

- Town Restaurant: Lunch on Mondays to Saturdays and Dinner on Mondays to Sundays

- Jade: Lunch on Mondays to Thursdays and Dinner on Mondays to Sundays

The Fullerton Bay Hotel Singapore

- La Brasserie: Lunch on Mondays to Thursdays and Dinner on Mondays to Sundays

- The Landing Point: Lunch and Afternoon Tea

- 30% off dinner buffet food bill at Town Restaurant from Wednesdays to Saturdays

- 30% off Afternoon Tea at The Courtyard from Mondays to Thursdays

Valid till 30 June 2025, for dine-in only and restricted to one (1) Card per table. A maximum of eight (8) customer per bill for all promotions. Offer is not valid for set menus and/or promotional menus. Not valid on alcoholic beverages.

1 Upon full payment of your principal Card annual Membership Fee. UNI$12,500 (equivalent to 25,000 miles) will be awarded two months after the annual Membership Fee is posted. 2 Spend exclusions apply. UNI$7,500 (equivalent to 15,000 miles) will be awarded two months after the Annual Renewal Fee is posted, if you meet the total qualifying spend of S$100,000 and have made full payment of your principal Card renewal Membership Fee.

Accelerated miles on all spend Some transactions are excluded from the awarding of UNI$. For full terms and conditions and details, click here .

Raise a toast in celebration of your meal at these Michelin-starred restaurants. Enjoy priority booking and a complimentary glass of wine per set menu ordered. Participating restaurants:

Enjoy a glass of wine per set menu ordered. Participating restaurants:

Enjoy a glass of wine per main course ordered. Participating restaurants:

To make a reservation at any of the participating restaurants, simply contact your dedicated UOB Visa Infinite Concierge at the following hotlines:

• Local: 1800 253 2288 • Overseas: +65 6253 2288

• Payment must be made with a UOB Visa Infinite Metal Card. • All reservations must be made via UOB Concierge at 1800 253 2288, subject to availability. • Offer is only valid for dinner now till 28 February 2023 for Michelin-starred Restaurants. • Restaurants will offer one complimentary glass of wine per diner per main course or set menu ordered. • Limited to four complimentary glasses of wine per reservation (any additional wine will be paid for by cardmember). • Should the diner prefer another beverage, the restaurant will offer other aperitifs such as champagne, beer, juice or a soft drink. • Offers are not valid on eve of Public Holidays and on Public Holidays, and special occasions such as Easter Weekend, Mother’s Day, Father’s Day, F1 Weekend and Thanksgiving, and may include other blackout dates determined by the merchant, unless stated otherwise. • Offer cannot to be used in conjunction with any other promotions, offers or vouchers. The respective merchants and UOB reserves the right to change the terms and conditions at any time without prior notice.

Complimentary GrabGift vouchers monthly Terms and conditions

- No registration is required. Vouchers will be sent in the form of unique codes to the principal Cardmember via SMS, to the mobile number registered with UOB, on a monthly basis.

- New Cardmembers will receive the codes from the second month of Card approval date (eg. If Card was opened in January 2023, the Cardmember will start to receive the unique promo codes via SMS from February 2023 onwards).

- SMS will be sent by the 20th day of every month.

- Valid on the latest Grab app versions only.

- Once voucher is selected and saved, you will not be able to change the voucher.

- No minimum spend is required to utilise the vouchers.

- Apply the offer before checking out.

- Payment must be made with a UOB Visa Infinite Metal Card.

- Any unused voucher is non-refundable.

- Voucher will be valid until the date stated in the SMS, no extensions will be permitted.

The Airport Companion Program by DragonPass Get started on enjoying your benefit:

- Step 1: Download the Airport Companion App (available on the Apple App Store and Google Play)

- Step 2: Click on “Sign up” to register for the programme

- Step 3: Enter your UOB Visa Infinite Metal Card details for a one-time verification

- Step 4: Complete your personal details for DragonPass account registration

Terms and conditions The principal UOB Visa Infinite Metal Cardmember must enroll and register for a DragonPass digital membership account by downloading the “Airport Companion” application either from Apple Store or Google Play Store (“DragonPass Membership”). Each principal Cardmember is then entitled to unlimited airport lounge visits to any of the participating airport lounges worldwide under the DragonPass Airport Lounge network. For list of lounges, click here . The Principal Cardmember can choose to bring along one accompanying guest to utilise the complimentary airport lounge visit(s), provided always that the guest is a travelling companion. In the event the principal Cardmember would like to bring along more than one accompanying guest, the principal Cardmember can purchase additional airport lounge visits directly from DragonPass by using the “Add Visits” function in the App at US$28 per lounge visit, or at such price as may be determined by DragonPass from time to time. All airport lounge visits are subject to a per person per visit charge. DragonPass may amend the lounge visit prices from time to time without giving prior notice to the Cardmember and the price listed in the App shall prevail. The airport lounge visit will be complimentary for accompanying children under the age of two. For full set of terms and conditions, click here .

*Note: The limit is S$2,000 per single article item/pair or set, up to S$10,000 per purchase and Excess of S$200 for each and every loss. Terms and conditions apply for all abovementioned benefits, please visit uob.com.sg/VI-insurance for details.

- Tian Fu Tea Room

- Spice Brasserie

Valid till 30 June 2025, for dine-in only and restricted to one (1) Card per table. Payment must be made using a UOB Visa Infinite Metal Card. The list of restaurants is subject to change. Individual restaurant terms and conditions apply.

Si Chuan Dou Hua, TOP of UOB Plaza For reservations, contact UOB Concierge at 1800 253 2288. Terms and conditions Payment must be made using a UOB Visa Infinite Metal Card. Privileges are valid till 30 December 2023, for dine-in only and restricted to one (1) Card per table. Discount is not applicable to service charge and taxes. Privilege is not valid on eve of Public Holidays and on Public Holidays, and special occasions such as 15 days of Lunar New Year, Easter Weekend, Mother’s Day, Father’s Day, F1 Weekend and Thanksgiving, and may include other blackout dates determined by the merchant, unless stated otherwise. Privilege cannot be combined with any other promotions, offers or vouchers. Prior reservation is highly recommended and subject to availability. All information is correct at the time of publication. Pan Pacific and PARKROYAL hotels in Singapore Offer not valid for set menus or promotional menus. Maximum of 15 guests. Pan Pacific Hotels Group and UOB reserves the right to change the terms and conditions at any time without prior notice.

20% off total dining bill at PARKROYAL COLLECTION Marina Bay restaurants

- Portman's Bar

For reservations, contact UOB Concierge at 1800 253 2288. Terms and conditions Payment must be made using a UOB Visa Infinite Metal Card. Privileges are valid till 30 December 2023, for dine-in only and restricted to one (1) Card per table. Discount is not applicable to service charge and taxes. Privilege is not valid on eve of Public Holidays and on Public Holidays, and special occasions such as 15 days of Lunar New Year, Easter Weekend, Mother’s Day, Father’s Day, F1 Weekend and Thanksgiving, and may include other blackout dates determined by the merchant, unless stated otherwise. Privilege cannot be combined with any other promotions, offers or vouchers. Prior reservation is highly recommended and subject to availability. All information is correct at the time of publication. Offer not valid for set menus or promotional menus. Maximum of 15 guests. Pan Pacific Hotels Group and UOB reserves the right to change the terms and conditions at any time without prior notice.

Year Long Room Stay Privileges with Pan Pacific Hotels Group Terms and conditions

Valid for bookings and stays till 31 December 2024. All reservations must be made in advance, prior to arrival and is subject to availability. Blackout dates apply. Reservations must be guaranteed with a valid UOB Visa Infinite Metal Card. The same Card must be presented upon check-in and at check-out for payment. Amendment and cancellation is subject to Hotel’s guarantee and cancellation policy. Offer cannot be used in conjunction with other promotions, partner offers and third-party websites. Prevailing taxes and service charges apply. UOB Online Privileges' General Terms and Conditions apply.

Complimentary upgrade to Platinum Card Membership status with Pan Pacific DISCOVERY sign-up. Enjoy unparalleled privileges across 33 hotel brands, 550 hotels and 77 countries with an instant upgrade to Platinum Card Membership status when you sign up as a Pan Pacific DISCOVERY member.

- Early check-in from 9am and late check-out until 3pm, when available

- Guaranteed room availability up to 24 hours prior to arrival, except during blackout dates

- Double room upgrade when available

- Personal choice of local amenity

- 10% off best available rate and members exclusive offers

For enquiries and reservations, please call UOB Travel Concierge at (65) 6302 5503 or email [email protected] . Terms and conditions Privilege is valid only for UOB Visa Infinite Metal Cardmembers. Sign up for a Pan Pacific DISCOVERY member here and call UOB Travel Concierge for fast track upgrade. Pan Pacific DISCOVERY Platinum fast track membership is valid till December 2025 from date of sign-up after which, the member has to accumulate the minimum nights of stay required to maintain the Platinum membership status. Pan Pacific Hotels Group reserves the right to change the terms and conditions at any time without prior notice. Visit uobtravel.com/concierge.html for full terms and conditions for all Hotel Status Matching promotions.

Hertz-International Car Rental Services Terms and conditions Valid for bookings and vehicle pick-ups from now till 31 December 2023 for self-drive rentals on qualifying Affordable Rates (leisure retail rates) at participating locations in Australia, New Zealand, USA, Canada, Europe and Asia. Reservation must be made at least 24 hours prior departure (48 hours for rentals in Asia). Minimum rental days apply. Limited to one offer per rental. Quote CDP# 83181 at time of reservation. For full terms and conditions and details, visit hertzasia.com/visa .

Visa Luxury Hotel Collection Offer is valid at participating properties and privileges are subject to availability. All payment must be with UOB Visa Infinite Metal Card. Best Available Rate applicable. Not applicable on discounted rates or combined with other offer at time of enquiry/booking. Exclude all applicable taxes, services, gratuities and charges. Reservation is subject to availability at time of confirmation. Visa and participating properties reserve the right to vary the terms and conditions of this offer. For full terms and conditions, click here . For updated list of participating properties, please visit visaluxuryhotels.com for details.