Is the HSBC Global Money Account any good?

Our rating:

With the recent launch of HSBC’s Global Money Account we assess its features and see how it compares to the best travel debit cards for spending abroad, and the best euro account for UK residents .

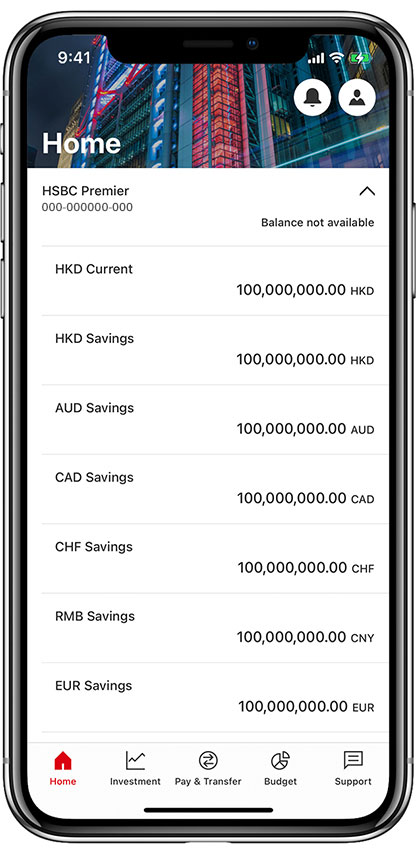

The HSBC Global Money account is a multi-currency current account allowing the holder to send, spend and receive money abroad with no additional fees. Set to rival the likes of Revolut and Wise, the new account launched in October 2022, and is currently available to HSBC customers directly from the banking app.

How much does the Global Money Account cost?

The account is free to hold and there are no fees when making debit card payments, cash withdrawals, or sending money abroad. Delivery of the physical debit card is also free, as are any replacements or reissues.

How do I open a HSBC Global Money Account?

It can be opened within seconds from the HSBC banking app, and as an existing HSBC customer there is no credit check for doing so. Once open, you can allocate your own PIN for the card and add the card to ApplePay and GooglePay immediately. The card issued is a VISA card, so serves making it a nice complement to those with Mastercard’s such as those issued by Starling, or Halifax Clarity.

Unfortunately, the account is only available to existing HSBC current account holders. That doesn’t include First Direct customers (which is a HSBC brand), or those with a basic bank account from HSBC.

If you don’t have a HSBC account, you can instead try HSBC’s new Zing app .

Try HSBC's Zing app instead

HSBC's new Zing money app addresses all the drawbacks of the GMA

Use our link below, and once you spend £5 or more on your Zing Visa card, you'll be given a free £20 bonus.

But hurry, this offer is only available untli 31st May

Which currencies can I hold with the HSBC Global Money Account?

The Global Money Account allows the account hold to hold balances in 18 popular currencies. We’ve added the full list of currencies below.

- GBP – pound sterling

- USD – US dollar

- AUD – Australian dollar

- ZAR – South African rand

- PLN – Polish zloty

- CAD – Canadian dollar

- NZD – New Zealand dollar

- CHF – Swiss franc

- SEK – Swedish krona

- HKD – Hong Kong dollar

- AED – UAE dirham

- CZK – Czech koruna

- NOK – Norwegian krone

- DKK – Danish krone

- SGD – Singapore dollar

- JPY – Japanese yen

- CNH – Chinese yuan renminbi

What are the exchange rates and mark up?

Card transactions use the VISA daily rate for currency conversion. This would apply for example when you are spending in euro but do not hold enough of a euro balance in the account to pay for the item. The bank will then automatically covert from GBP using the VISA daily rate.

When manually converting balances from one currency to another within the account, HSBC will use its own rate. This is based on the interbank exchange rate plus a small mark up. Tests at the time of launch (October 2022) found the HSBC rate to be slightly better than that Wise, Revolut or Finneco across most major currencies.

Subsequently though, customers have found that HSBC’s exchange rates have fallen, and are now often worse than those mentioned above. This is something of a moving target, and your milage may vary.

Weekend premium

A premium of 1% applies when exchanging between currencies while the market is closed. This is typical with multi-currency accounts and the additional mark-up is to protect the banks from large swings in the exchange rate once the exchanges open again.

To put this into perspective, Revolut also applies a 1% surcharge on weekend exchanges across 15 major currencies, and a 2% surcharge on all others. Wise on the other hand continues to use the mid-market rate even at weekends.

We recently reviewed Atlantic Money, a dedicated UK based currency exchange app. It is more limited in terms of the currencies you can exchange, but was consistently cheaper than Wise, Revolut, and HSBC for larger currency conversions (those over £1,200). See our Atlantic Money Review for more.

Can I send and receive payments with the Global Money Account?

Currently you can send payments via the Global Money Account, in any currency you hold. Unfortunately for euro payments these are not SEPA instant payments so may take up to 24 hours before they show up in the recipient’s bank account. That may be subject to change in the future though as recent draft legislation by the EU Commission looks to force payment to providers to offer 24/7 instant payments . Think of it like Faster Payments in the UK.

You can’t receive payments just yet, but it is a feature that is supposedly coming soon, but more than 6 months since the account’s launch, there’s still no sign of it.

What are the HSBC Global Money Account ATM limits?

As ever with multicurrency accounts it’s not all about the foreign exchange rate. Sometimes the various transactional limits can make or break the account. The Global Money account has a daily ATM cash withdrawal limit of £500 (or equivalent foreign currency).

For those that are big cash spenders abroad, that limit beats Starling’s £300 a day, Chase’s £1,500 a month, and Revolut’s measly £200 a month.

International payment limits for transfers are capped at £50,000 or equivalent, so those wishing to make large purchase or transfers for example buying a home abroad, would need some forward planning.

What are the drawbacks and limitations?

The Global Money Account looks like a great travel companion for those with a HSBC account, but it’s not without its drawbacks.

Top ups and transfer not instantly available

Top ups and transfers into the account can take 24 hours before they are ready to use. That could leave you in bind if you run the balance down and forget to top up again before you next need to spend on the card. Whilst this is true with any additional account, banks such as Starling or Monzo that have free foreign spending baked in don’t run into the same issue.

We’d recommend having back up, such as Currensea (see our review) , in case you’re ever caught short.

Currensea acts as a layer on top your HSBC current account. Allowing you to spend in the foreign currency of your choice. It then direct debits your HSBC current account in pounds, to avoid charges. There’s a flat rate of 0.5% (50p per £100), making it much cheaper than using your HSBC current account debit card.

Can’t receive payments

You cannot receive foreign payments into the account. This is a big one for those with links abroad, who’d like an account receive foreign income. HSBC is working on it, but the account has been around for 8 months now, and there’s still no update on this.

Only accessible via the HSBC app

If you prefer to check your balance, reconcile your spending, or manage your account via online banking, then you’re out of luck. HSBC has limited access to the Global Money Account to App users only. There’s also no open banking, which means if use a third party budgeting tool such as Plum, you can’t link your account to it.

Should I get a HSBC Global Money Account?

Whether the HSBC Global Money account is worth it to you, all depends on your current circumstances. If you already bank with HSBC then even if you have a Wise, Revolut, or Finneco account, the Global Money Account could be a worthwhile addition, if only for streamlining the process of moving money around, or for the piece of mind that you’re dealing with a major UK bank with full FSCS protection.

If you aren’t already a HSBC customer, then it doesn’t really make sense to open a current account just to take advantage this Global Money Account, but since HSBC regularly runs current account switching offers , it might make sense for those who are already considering switching. In fact, in some instances it’s required in order to get the switching bonus.

While the exchange rates were some of the best around at launch, they can now be beaten. Added to that, the account is still missing some important features such as receiving foreign payments, and SEPA instant transfers. As such can’t match the likes of Revolut for versatility, or Atlantic Money for one off transfers.

Overall the Global Money Account is a step in the right direction. It will make a massive difference to those who’d normally just use their standard HSBC current account debit card when abroad, and help to retain customers who might otherwise use services from other multi-currency accounts.

Those who aren’t currently HSBC account holders, would be better served by Starling for general holiday spending , or Revolut for regular currency exchanges.

What should I get instead of the HSBCs Global Money account?

HSBC’s own Zing app is an alternative to the Global Money Account. Like the GMA, Zing allows uses to hold multiple different currencies within wallets in the app, and convert between them for low fees. It allows sending foreign payments, and unlike the GMA also accepts incoming foreign payments.

It offers a clean clear interface, and truly transparent pricing, and best yet is open to those without a HSBC current account.

Find out more in our HSBC Zing review

Other alternatives are the well known multi-currency accounts from Revolut (see our review) , and Wise . For those only needing to exchange and send money abroad, then Atlantic Money (see our review) , is a top alternative.

If you have a HSBC Global Money Account we’d love to hear your experience with it? Please comment below.

12 comments on “Is the HSBC Global Money Account any good?”

I am an HSBC customer and opened a Global Money account to pay the deposit on holiday accommodation in the Netherlands. Setting-up the account and using it was simple and my transaction was shown as completed. I was advised the transfer would take up to 3 working days but 13 working days on the money has not arrived in the accommodation provider’s account. I have queried this with HSBC (via telephone banking) 3 times so far and have been told transactions can take time. During my first call 2 weeks ago I was told a referral would be made for my transaction to be traced and this could take up to 5 working days. However, nothing heard so far and I am obviously concerned about what has happened to my money and the fact to secure the accommodation they have to receive my deposit (50% payment). Not sure how this will end but my experience has been a far from happy one.

I’m in the same situation , £1450 has disappeared and I keep getting the same rubbish answers over 4 wks now !!!!!! Very angry sometimes needs to be done asap. There hiding behind call centres

I am an existing HSBC customer. I opened a Global Money account recently to use for withdrawing cash when abroad for daily expenses when on holiday or business. My feedback is based on using it in Australia several weeks ago and the period between opening the account in the UK leading up to first use.

Pros: 1- Simple setting-up of account 2- Easy use as payment or debit card 3- Reasonable daily limit of £500 equivalent in foreign currency cash 4- Wide range of foreign currencies 5- Access through mobile App 6- Exchange in advance within the Global Money account to the target currency is possible 7- Transferring funds out is also easy to separate HSBC currency accounts

Cons: 1- Can only be used outside UK and cannot be used for withdrawing cash in foreign currency in the UK 2- The account requires 24 hours before credited funds in any currency are cleared for use or withdrawal 3- It requires separate HSBC accounts in foreign currencies to credit foreign currency into the Global Money account. 4- Only accessible through the mobile App and is not available on the main HSBC account website on desktops or laptops.

It would certainly be much more appealing if the cons are addressed and resolved. Despite these limitations, the advantages are clear and far outweigh the current negatives. It was easy and simple to use abroad. Based on my personal experience it is certainly better than Monzo, Citibank and Virgin Money comparable current products when used outside the UK.

Opened the global money account and bought USD. Months later I travelled to the US and for all transactions made HSBC charged me with Non-sterling fees when an operator confirmed to me that I can use my debit card as if I was in the UK…. Wouldn’t recommend it

I opened a global acc and transferred money overseas to an account that I have had for a number of years , 4 wks later nothing ? can only talk to a call centre ? no one knows where my money has gone £1450. I had a secure email 2 wks ago saying it was rejected ? and this issue would be sorted no later than 04 /05. nothing !!! I’ve. contacted hsbc and keep getting the same answer , don’t know !!! it’s a terrible set up and once my funds are returned ??? I will close this account for good !!!! Extremely in professional in every way ! Don’t open one !!

Mmm…doesnt look like a good product judging by the comments. I think I will just stick to drawing money out in the UK in euros and putting it in my pocket and traveling.. as I have for the last 30 years and everything has been okay.

This is a great currency wallet, in theory, but it falls short in certain ways. The big one is that, unlike the likes of Revolut, Monzo, Starling, etc, you can’t easily check what you’re spending as there is no push notification. You have to open the app, log in, navigate to the GMA and check in there to see if you’re being charged the correct amount. I don’t ever expect the HSBC app to reach the levels of usability of the newer fintechs, but this is fairly basic.

The other major sticking point is the “HSBC Exchange Rate”… Initially, this seems great, even compared to Revolut. I used it to exchange a large amount of GBP to EUR, but, they try to get you by making their margin much larger if you try to trade any more than £1000 in one go. So, after having traded an amount in £1000 increments, I now find that their rate has decreased by a further 300 bps over what it was initially. For example, if GBPEUR is currently 1.1600, I would be able to buy at around 1.1585. This no longer seems to be the case and the rate I am quoted is around 1.1555. This is a very bad rate indeed! I have already spoken to them about how this rate is supposed to be calculated, but no one at HSBC has the slightest clue, which I guess shouldn’t surprise anyone.

Spoke to HSBC directly about their exchange rate and I can confirm that it is entirely arbitrary and in their discretion to change whenever and however they like. They will actively try to limit your FX trading by increasing their spreads if you try to exchange any amount larger than £1000. Given that you cannot transfer money in yet either, I’d stick with the competitor’s offerings (Revolut or Wise).

I have used a Wise card for years and recently topped up a small amount from my HSBC account and the money never transferred having done so many times in the past. Many phone calls later it was because HSBC had blocked the transfer as ‘suspected’ fraud and it took a lot of convincing HSBC fraud to authorise my transfer. Days later a second top-up was blocked for the same reason and for reasons I still can’t fathom HSBC fraud asked me to visit my local branch to sort matters out. The branch never sorted it it out but I was told about their ‘Global Money’ account and persuaded to open one which I’m evaluating. My point here is that having used Wise for years and done many transfers from my HSBC account when HSBC launch a competitor card for Wise I suddenly start having problems!! Could the issues be connected?

The idea of the account was great. The biggest problem are exchange rates as it seems HSBC was too greedy to keep the promise of “great rates”. In my bank abroad I get Forex rates that can easily be 6-7,% better. I stopped using the account.

On a recent trip to France, the card was refused at several locations, but the amount was still deducted. In some cases it worked the second or third time of trying, but the account later showed that 2 or 3 deductions of the amount had been made, On another occasion the card was refused, so I paid with my credit card. Both accounts were charged. 3 months later, the problem is unresolved. It is very time consumining trying to contact HSBC Global and even then, no answer or offer of repayment.

You get account that promised a lot but typical HSBC style failed to deliver. Issues with card being denied for no reason, delays with credited funds and what renders the account useless are exchange rates. Way worse than any competition offers. The cherry on the cake is useless HSBC customer support that you can’t even get through.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Money in your inbox

Join thousands of like-minded money savers and receive money saving hints, tips, and offers, direct to your inbox.

By entering your email address you agree to our Terms of Use and Privacy Policy and consent to receive emails from from Money Saving Answers.

- Argentina

- Australia

- Brasil

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- New Zealand

- Polska

- Portugal

- România

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

HSBC Everyday Global Account Review

Learn about the HSBC Everyday Global Account in this review to help you decide whether this is the best card to use for your upcoming leisure or business travel

What is the HSBC Everyday Global Account?

The HSBC Everyday Global Account makes bringing cash overseas stress-free and simplifies your overseas purchases at home by allowing you to hold multiple currencies in the single debit account.

- Load and lock in the exchange rate of up to 10 currencies

- No additional overseas transaction or ATM fees

- Withdraw cash from any Visa ATM

The HSBC Everyday Global account bridges the gap between a debit card and a travel prepaid card. You can use your account for everyday buying at home, plus you won't have to worry about carrying lots of cash when you travel.

When you use your HSBC card, you're drawing money directly from your bank account when you make a purchase. It's designed for everyday money transactions and means you're not accumulating debt. And like a prepaid card, you can load the card with a set amount of money in the currencies you need even before you travel overseas.

In fact, you can load up to 10 currencies on your account including AUD, USD, EUR, SGD, NZD, JPY GBP, CAD, HKD and CNY (currency restrictions apply).

What if you want to take out cash while you're travelling? Well, you can without worrying about additional fees - this account comes with no account handling, overseas transaction, or international ATM fees.

If you need a new everyday spending account at home and you travel frequently to multiple overseas destinations, this account offers the convenience and flexibility you might need.

Pros and cons of using the HSBC Everyday Global Account

- Single Account for Multiple Currencies Manage multiple currencies in your one account online or using the HSBC mobile banking app.

- Lock in up-to-the-minute exchange rates Set your exchange rates using HSBC's real-time rates ahead of travel, so you don't have to worry about currency movements. Spend like a local overseas, using the local currency.

- $0 international ATM fees This is a huge benefit if you are travelling often and prefer to take out local cash from an ATM.

- Limited number of currencies. You can only pre-load and hold up to 10 currencies. Saying that, other currencies are still available for ATM cash withdrawals, with funds deducted from your AUD account at the current Visa exchange rate.

- Local Operator ATM fees. HSBC do not charge ATM fees, but local operators may charge extra fees or set limits. Check the ATM before using it.

- Complex FX exchange rates. You are charged two foreign exchange rates either the HSBC rate or the Visa rate in different scenarios.

Why consider the HSBC Everyday Global Account ?

If you're interested in linking your everyday transaction account to a travel card, this appears to be the only one in the market right now. Prepaid travel cards are more expensive, while most debit accounts don't let you hold foreign currency.

Although this account has no account keeping, foreign transaction or international ATM fees, like most banks, there are hidden fees in terms of HSBC's exchange rate margins.

Saying that, if you're good at planning and know your budget, HSBC's real-time exchange rates are slightly better than other banks, so you can lock in a good initial loading rate and save more than other prepaid travel cards. But always double check the rate you've being given against the market rate online - there may be even cheaper travel card options.

Read also: HSBC Review

Benefits of the HSBC Everyday Global Account

- Chip and PIN.

- Additional protection from Visa Zero Liability.

- Emergency card/cash available if stolen/lost.

Convenience

- Easy way to manage, spend and save on multiple currencies.

- No bank account required - set up the everyday debit account & access multiple currencies.

- Contactless payments via Apple Pay and Google Pay.

- Extra card for joint accounts.

- No ATM or foreign purchasing fees.

- Lock in exchange rate by loading funds to foreign currencies and avoid fluctuations.

- Unlimited transactions - no account fee and no minimum balance requirements.

Manage Your Money

- Reload and manage your funds easily online or on mobile phone app.

- Save or keep foreign currency on return for as long as you want.

- Control when you transfer between currencies.

- Unlimited real time currency exchange quotes between 8am Monday and 11.59pm Friday (excluding public & US holidays).

Fees and Limits of the HSBC Everyday Global Account

Transaction limits for hsbc everyday global account.

- Daily transfers and withdrawal limit are set at $10,000 for online transfers and $2,000 for ATM or EFTPOS transactions.

- Maximum load and BPAY/bank transfer amounts are set at $20,000.

- Please note that you may request to increase your transfer and withdrawal limits, however, it will be subject for review and approval.

- Your account will be marked as inactive after 6-months of you not using it.

All prices are in AUD

- Foreign Transaction Fee*: HSBC or VISA exchange rate

- Account Closure: $0

*Foreign currency conversion is charged in different scenarios using HSBC real-time or VISA exchange rates.

Australian Dollar (AUD)*, US Dollars (USD), Euro (EUR), British Pound (GBP), New Zealand Dollars (NZD), Japanese Yen (JPY), Canadian Dollar (CAD), Singapore Dollars (SGD), Hong Kong Dollars (HKD), Chinese Renminbi (RMB)

*Australian Dollar (AUD) is the control or default currency

Extra Tips and Tricks

Understand your exchange rate fees in different situations:, 1. pre-load a supported currency onto your card before travel.

If you decide to pre-load funds onto your card then your AUD* will be converted to any of the 10 supported currencies at the HSBC rate.

2. Exchanging for a supported local currency when you are purchasing

If you don't have local currency on your card while making a local currency purchase, the cash will automatically be taken from your AUD* account and converted at the HSBC rate.

3. Exchanging for a non-supported currency at the time of transacting

If you are transacting in a non-supported currency (one that you don't hold) like Thai Baht, or there are insufficient funds in that currency, then your AUD* will be converted at the Visa rate at the time of the transaction.

*Your AUD account is also known as your 'control currency', 'default currency' or 'main currency'.

Calculate HSBC's foreign currency exchange margin.

Compare HSBC's real-time exchange rate with the current online market rate when you load/reload foreign currencies onto your card. Also keep in mind that the final HSBC exchange rate offered can be different from the rates indicated. From our analysis, HSBC margins are slightly better than other banks.

Always pay using local currency.

Foreign retailers may seem nice by letting you pay in Australian dollars, but they may be hiding some sneaky margins in the exchange rates. With your Everyday Global Account you can spend in the local currency so make sure you do!

Find the cheapest ATMs.

Find out if ATMs charge additional fees and stick to the cheapest ATMs. The best idea is to take out all the cash you need in the one go.

Do everything online.

HSBC charges an extra $2.50 for staff-assisted Telephone Banking and $5.00 for branch withdrawals & transfers so do everything online for free.

How To Apply for the HSBC Everyday Global Account

1. set up your account.

- Set up your HSBC Everyday Global Account online in 5 easy steps or over the phone.

- You need to be 18 years plus and have an Australian residential address. Non-resident apply in-store.

- Make an initial load amount - max AUD$20,000.

2. Card is sent to your address

- Card is sent to your home address as per most debit cards.

3. Register

- Register your card online to manage your account.

4. Transfer Money/Load/Reload

- Transfer money to your account the same as any other debit card.

- Transfer currency from your main AUD account to other currencies, over the phone, online or via the HSBC app.

International payments

You won't be able to use online banking to make international payments from 00:00 to 04:00 BST on Sunday 12 May. This is due to essential maintenance.

Our website doesn't support your browser so please upgrade.

Using your card abroad

Access your money worldwide, including local currency withdrawals and payments

Discover easier worldwide spending and payments when you open an Expat Bank Account.

Use your card worldwide

Enjoy the convenience of using your card wherever you see your card's logo. Fees apply.

- Use in any outlet that displays the Visa or Mastercard logo on your card

- ATM locator to help you find where you're able to use your visa debit or credit card abroad

- Fees apply and non-HSBC cash machines may also charge a fee[@cashwithdrawals]

Security while travelling

If you let us know you're away, we can manage your transactions more effectively while you're on holiday.

- We automatically monitor accounts for unusual foreign transactions

- We look out for possible fraud and declined transactions

- If you have a joint account you both need to notify us. For credit cards, only the primary cardholders needs to give us travel notifications

How to use your card abroad

Overseas usage fees .

Any non sterling transactions (including cash withdrawals) are converted to sterling by using the relevant payment scheme exchange rate applying on the day the conversion is made. We will deduct the payment and related transaction fees from your account once we receive details of the payment from the card scheme, at the latest the next working day.

Cost illustration (Visa)

Cost illustration of making a transaction abroad of EUR 100.00 using the Visa exchange rate on 6 June 2017 of 0.876855 = GBP 87.69 to which will be added the fees appropriate to your card and transaction.

See more information on the rate of exchange Visa used when converting your transaction.

Cost illustration (Mastercard)

Cost illustration of making a non-sterling transaction of EUR 100.00 using the Mastercard exchange rate on 5 June 2017 of 0.875944 = GBP 87.59 to which will be added the fees appropriate to your card and transaction.

See more information on the rate of exchange Mastercard used when converting your transaction.

You receive up to 56 days interest-free credit on credit card purchases if you pay your whole balance in full and on time. Please be aware that interest is charged from the date transactions are applied to your account until payment is received. There is no interest-free period on cash advances. Some cash machine operators may apply a direct charge for withdrawals from their cash machines and this will be advised on-screen at the time of withdrawal. ATM withdrawal limits are applicable.

You can use your card to make non-sterling cash withdrawals from self service machines operated by a third party and agree that the third party will perform the currency conversion for you. The applicable exchange rate, the amount of cash you will receive and the amount in sterling will be shown on the screen. The amount in sterling will be deducted from your account balance when we receive details of the payment from the self service machine operator, at the latest the next working day.

Travelling in the EEA

If you're travelling in the EEA[@eea], see how paying in local currency on your HSBC credit or debit card compares to the European Central Bank (ECB)'s latest foreign exchange rates .

Let us know when you're travelling

Tell us when you're away so we can manage your transactions more effectively.

- Tell us online using our online Live Chat service

- HSBC Premier customers call: +44 1534 616 313

- HSBC Advance customers call: +44 1534 616 212

Just so you know, we may monitor and record your communications with us. This is in the interest of security and to help us continually improve our service.

Start using your card abroad

Already with expat.

If you're already with HSBC Expat, simply activate your card to get started.

New to Expat?

You'll need to apply for an Expat Bank Account.

You might be interested in

Staying safe abroad.

Crisis24 security services offers international risk management for all Expat customers, covering everything from travel safety to identity theft.

Card support

Get help with all your card questions.

Guide to moving abroad

Read our 10-step guide to moving abroad to make sure you've got everything covered.

Additional information

Connect with us.

Please be aware of scammers that pretend to be from HSBC. Scammers may ask you for security codes over the phone or via text messages. They might try to contact you in the same text message thread that has legitimate messages from HSBC. Never share your log on credentials or authorisation codes with anyone, such as codes to register your device for mobile banking, to verify your identity, or to authorise a transaction. Contact us now if you are worried about fraud on your account, or to learn more about common types of fraud or scams.

- Online Banking

- HSBC Invest

Everyday Global Account

We’ve identified scams involving fake fixed income bonds, ESG bonds, and global currency reset products that are being offered to some customers. These are not real offers from HSBC. If you think you may have been the victim of a scam, are worried about fraud on your account, or are unsure about whether you are sending your money to a legitimate destination, please contact us immediately on 02 9005 8220 . You can also find more information on our fraud assistance page .

Easy banking at home and overseas

Our award-winning account makes it simple for you to hold, spend and send up to 10 foreign currencies in one place, with one Visa Debit card. You can also enjoy everyday benefits without any monthly fees.

Why open an Everyday Global Account?

Fee-free banking

No monthly account 1 , transaction or HSBC ATM fees 2

Everyday rewards

Up to 2% cashback 3 for tap and pay transactions under $100

One place, many currencies

Switch between 10 currencies easily on our HSBC Mobile Banking App

Easy money transfers

$0 HSBC fee to send money overseas

Features and benefits

In Australia

While at home in Australia, you can access these global rewards and features every day.

- $0 account 1 , transaction and HSBC ATM fees 2

- 2% cashback for purchases under $100 3

- Track your cashback in our HSBC Mobile Banking App

- Use Visa payWave, Google Pay™ and Apple Pay 4

To find out more about rewards you can earn every day, check out our HSBC Everyday Extras 5 FAQs .

Whilst overseas

Whether you're travelling or shopping online, you can enjoy these unique benefits with an Everyday Global Account.

- $0 overseas ATM fee 2

- $0 international transaction fees

- Our competitive Real Time Exchange Rates 6

- Transfer money online, anywhere in the world with no HSBC transfer fee.

- Currency switching on the HSBC Mobile Banking App

- Buy, transfer, hold and spend the following currencies: AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, and CNY (currency restrictions apply to CNY)

Award-winning everyday account

The HSBC Everyday Global Account is your one account for the world. It has been awarded Canstar’s 5-Star Rating for Outstanding Value – Transaction Account 2021 & 2022, Outstanding Value – Travel Debit Card 2018 - 2023 and Mozo’s Exceptional Everyday Account Award 2021 & 2022.

How to apply for an Everyday Global Account

New to hsbc.

Complete your application online in 5 easy steps today.

You can also apply for a joint account .

If you need additional support with your application, please call us on 1300 131 605 (Monday to Friday, 8:00am to 8:00pm AEST) or visit your local branch .

Already with HSBC?

Apply via online banking or the HSBC Mobile Banking App .

Register for online banking

Apply by phone or branch

- Find your nearest branch

Call us today

Call us on 1300 131 605 from Monday to Friday, 8am to 8pm (AEST)

Upgrade to HSBC Premier 7

Experience premium banking services, complete with your Premier Banking team, no monthly fee needed.

Important information

- Personal Banking Booklet (PDF, 1.50 MB) Personal Banking Booklet (PDF, 1.50 MB) For HSBC personal banking Download

- Transaction and Savings Accounts Terms (PDF, 1.10 MB) Transaction and Savings Accounts Terms (PDF, 1.10 MB) HSBC accounts Download

- Financial Services Guide (PDF, 906 KB) Financial Services Guide (PDF, 906 KB) Download

- User guide with illustrative examples (PDF, 3.9 MB) User guide with illustrative examples (PDF, 3.9 MB) Download

Terms & Conditions

This advertisement provides general advice only and doesn't take into account your objectives, financial situation or needs. Consider the Transaction and Savings Accounts Terms (PDF, 1.10 MB) and Financial Services Guide (PDF, 906 KB) before acquiring this product, available by calling 1300 308 008 , at your local branch or www.hsbc.com.au . Issued by HSBC Bank Australia Limited ABN 48 006 434 162. AFSL 232595.

2. Non-HSBC branded ATMs and HSBC Group ATMs in Argentina, France, Greece, Malta, Mexico and Turkiye may charge an ATM operator fee for withdrawals or balance enquiries at their ATMs.

3. You will earn 2% cashback on eligible purchases under $100 when you tap and pay with Visa payWave, Apple Pay or Google Pay™. This will be paid into your Everyday Global Account with the maximum cashback you can earn being $50 per calendar month. Eligible purchases must be made in Australian Dollars and where the merchant or its financial institution/ payment processor is registered in Australia. Purchases which are excluded for cashback include business, gambling and government transactions (including public transport). For the full exclusion list, refer to the Transaction and Savings Account Terms .

4. Terms and conditions apply to the use of Apple Pay and Google Pay TM .

5. HSBC Everyday Extras is a feature of the HSBC Everyday Global Account. You will be eligible for Everyday Extras if you deposit at least AUD2,000 into your HSBC Everyday Global Account before the last working business day of each calendar month. For more information refer to the Transaction and Savings Accounts Terms.

6. HSBC Real Time Exchange Rates will apply for transfers between HSBC Australia accounts when using HSBC Mobile and Online Banking. For Mobile Banking, HSBC Real Time Exchange Rates will apply for all international transfers.

For Online Banking, HSBC Real Time Exchange Rates will apply for AUD, USD, EUR, GBP, CNY, HKD, CAD, NZD, JPY, CHF, SGD, AED, DKK, MXN, NOK, SAR, SEK, THB and ZAR for international transfers within currency cut-off times .

When the FX market is closed on weekends (that is from the US market closing time on Friday to the Asia market opening time on Monday), the HSBC Real Time Exchange Rate will include additional weekend risk margin for the bank to cover risk of any market volatilities.

The HSBC Real Time Exchange Rate will not apply on currency holidays, on NSW and US public holidays.

For Online Banking, the HSBC Real Time Exchange Rate will not apply to transfers in currencies not listed above and to transfers outside of HSBC Australia entered after currency cut-off times. Instead, the HSBC Daily Exchange Rate , which is set and refreshed every 30 minutes daily from 7:00 AM to 7:00 PM (excluding weekends and NSW public holidays) will apply.

Future dated or recurring international transfers are not available on HSBC Mobile Banking.

For other future dated or recurring transactions via HSBC Mobile and Online Banking, the HSBC Daily Exchange Rate on the future date of the transaction will apply.

HSBC Real Time Exchange Rates will apply for Global Transfers between your HSBC Accounts. For transfers in unsupported currencies using Global Transfers, the receiving country's daily exchange rate will apply and currency cut-off times of the receiving country may also apply. For future dated transactions using Global Transfers, the HSBC Real Time Exchange Rate on the future date of the transaction will apply when the FX market is open.

FX transactions are subject to foreign exchange risk associated with exchange rate movements. HSBC accounts should not be used for speculative FX purposes.

7. Eligibility criteria for HSBC Premier applies and is set out in the HSBC Premier Service Guide

*The HSBC Everyday Global Account was awarded the Canstar 5-Star Rating for Outstanding Value – Transaction Account 2021 & 2022, Outstanding Value – Travel Debit Card 2018 – 2023 and Mozo's Exceptional Everyday Account Award 2021 & 2022.

Our website doesn't support your browser so please upgrade .

Using your card outside the UK

Take your hsbc cards with you.

Heading somewhere nice this year? You can use your HSBC debit and credit cards easily outside the UK, the same way you would at home.

At a glance

- Enjoy flexibility and convenience You can use your debit or credit card at shops, restaurants and cash machines while you’re away. Fees may apply when using your card outside the UK.

- Keep track of your holiday spending Switch on notifications in mobile banking so you know when money goes in or out of your account.

*Fees apply when using your card outside the UK. Please see our frequently asked questions for full details.

Going abroad?

You don't need to notify us. Just make sure your contact details are up to date, so we can get in touch if there's an issue.

Top tip – it pays to go local

If you’re using your card outside the UK in shops, bars or restaurants and are given the choice of paying in pounds or local currency, you could consider choosing local currency.

If you choose to pay in local currency, you’ll avoid dynamic currency conversion fees and in most cases will get a better exchange rate.

Frequently asked questions

How do i choose which cards to take with me .

Using your cards outside the UK, in combination with your travel money , gives you more flexibility when managing your holiday money.

A debit card allows you to withdraw cash at cash machines and pay for purchases plus keep a track of your spending via online, mobile or telephone banking.

Credit cards can be useful when purchasing more expensive items because of your rights under the Consumer Credit Act 1975. However, please note fees and charges apply.

What are the debit card fees outside the UK?

Visa converts transactions into sterling using the Visa Exchange Rate applicable on the day it processes the transaction (the rates are provided by Visa and subject to change). This date may be different to the day on which the transaction took place. Historic exchange rate information is available at www.visaeurope.com .

Where you choose to make the payment / withdrawal in sterling, then HSBC will not make any conversion and this will be done by either the retailer or self-service machine owner. Some cash machine owners may apply an additional charge for withdrawals and this will be advised at the time of the withdrawal.

What are the credit card fees abroad?

When making a payment or withdrawing cash in a foreign currency (non-sterling) you may be asked if you want to pay in Sterling or the local currency. By selecting to pay in the local currency, HSBC will make the conversion using the relevant payment scheme exchange rate applied on the day the conversion is made.

Where you choose to make the payment / withdrawal in sterling, then HSBC will not make any conversion and this will be done by either the retailer or self-service machine owner. Some cash machine owners may apply an additional charge for withdrawals and this will be advised at the time of the withdrawal

How much will I be charged paying in local currency in the European Economic Area (EEA)?

Travelling in the European Economic Area (EEA) ? 1 See how paying in local currency on your HSBC credit or debit card compares to the European Central Bank (ECB)’s latest reference rates .

This shows the percentage difference between the ECB reference rate and your HSBC card rates, depending on how you pay. You can find out more about these fees above.

1 European Economic Area where you can pay in currency includes Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Iceland, Ireland, Latvia, Lithuania, Liechtenstein, Luxembourg, Malta, Norway, the Netherlands, Poland, Portugal, Romania, Spain, Slovakia, Slovenia and Sweden.

You might also be interested in

Card abroad vs Travel Money

A guide to the benefits and things to consider of each option.

International payments

Send money quickly and securely using our international payments service.

Global Money

Our new multi-currency mobile account for spending and sending money abroad.

Customer support

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 27 March 2024, new safety measure in the Android version of the HSBC Singapore app will be launched to protect you from malware. Read more on malware scams .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

HSBC Everyday Global Debit Card

What can you do with this debit card.

- Enjoy $0 fee in 10 currencies for your retail purchase and cash withdrawal 1,2

- Manage funds from your Everyday Global Account and convert currencies at your preferred rate online

- Make contactless payments through Visa payWave and withdraw cash at millions of touch points globally

- Make secure purchases with Apple Pay anytime, anywhere

Existing customer with other deposit account

New customer

Win a trip of a lifetime for 2 to the Olympic Games Paris 2024, thanks to Visa

Get up close to the action and stand a chance to win a trip of a lifetime for 2 to the olympic games paris 2024 worth usd26,000 with hsbc visa cards. simply apply, activate and spend with your hsbc visa credit and debit card from 1 march to 15 april 2024 to participate., take a look at the t&cs, more card benefits for your local and global use.

- Go cashless

- Access your funds easily

- Transact securely

- Convert currencies in real time

- Manage cards via mobile app

Make secure purchases in stores, apps and on the web with your iPhone, Apple Watch, iPad and Mac.

Sign or wave to pay for your transactions at over millions of touchpoints globally.

Pay for your local purchases at over 100,000 acceptance points using PIN or tap.

Access to cash

Withdraw cash from HSBC ATMs, HSBC branches, and through the atm5 network (participating banks: Citibank, Maybank, Standard Chartered Bank, Bank of China, and State Bank of India) in Singapore, as well as over a million ATMs on the HSBC and PLUS networks worldwide.

More places to withdraw cash with QuickCash

Get cash from over 600 locations like 7-Eleven, Cold Storage, Guardian and more. No interest or service fee is imposed.

QuickCash Withdrawal limits *

QuickCash allows you to withdraw between S$10 and S$500 (in multiples of S$10) per transaction **

* Cash withdrawal limits are subject to cash availability at Dairy Farm Group of stores in Singapore and other applicable limits set by the Bank, which are subject to change at the Bank’s sole discretion.

** Minimum withdrawal amount of S$10 to a maximum of S$200 at 7-Eleven or a minimum withdrawal amount of S$50 to a maximum of S$300 at Guardian or S$500 at other participating outlets.

Authentication measures

The EMV microchip on your Debit Card authenticates transactions and reduces the chances of fraudulent card usage through skimming of the magnetic stripe.

Verified by Visa One-Time Password

Shop online with peace of mind and safeguard your finances with this added security measure.

While using your Debit Card, you will be informed via an SMS alert+ each time a transaction is performed and approved above your pre-set threshold.

Card protection

In the event of loss or theft of your Debit Card, your card is protected with limited liability.

Real-time fraud monitoring

If any suspicious or unusual card transaction is detected by HSBC, we will notify you immediately.

Make use of your Everyday Global Account now by converting currencies at real-time or at your preferred rate. HSBC offers various options for you to do a currency conversion.

FX Order Watch

Set your own target FX rate to convert funds automatically. Plus, get alerts when your designated FX rate is reached.

GetRate offers you real-time foreign exchange rates before you make a transfer.

Learn more: How to use your travel debit card while overseas

Debit card activation

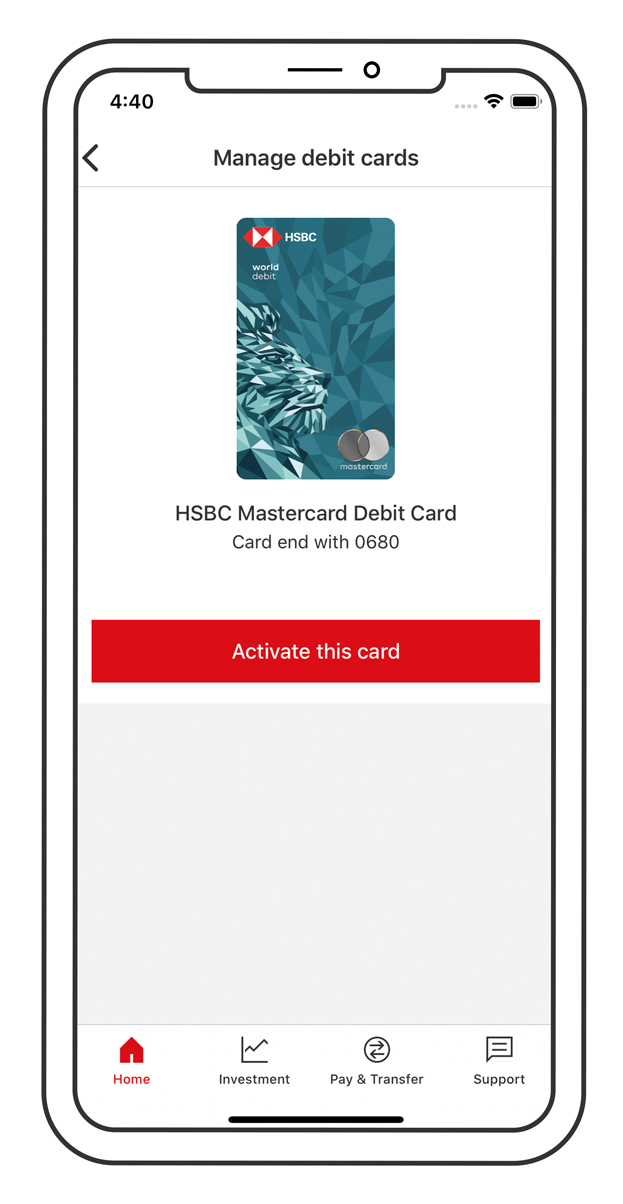

Once you have received your debit card, you can easily activate it through the HSBC Singapore mobile app.

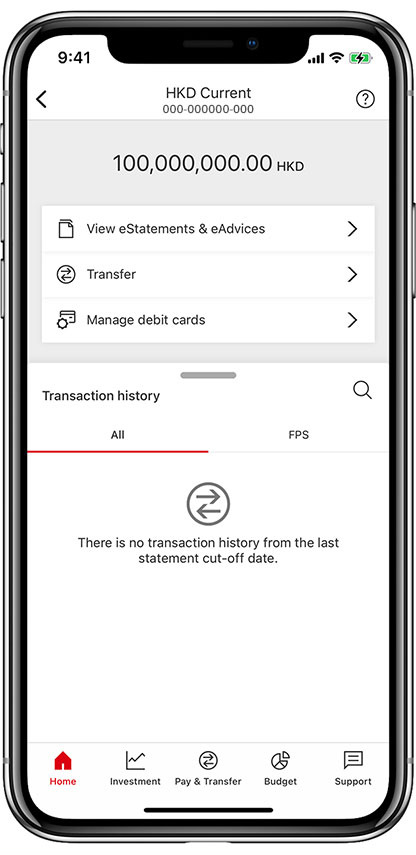

- Log on to the HSBC Singapore mobile app.

- Select account from the 'Home' screen.

- Tap on 'Manage cards'.

- Tap on 'Activate physical card'.

Reset PIN

Easily reset your debit card PIN through the HSBC Singapore mobile app

- Log on to HSBC Singapore mobile app, then select the account linked to your debit card.

- Tap on ‘Manage cards’, then on ‘Set PIN’.

- Enter your new 6-digit PIN and confirm.

You can use your new PIN right away.

For security reasons, set PIN service on HSBC Singapore mobile app will not be available during the cooling off period, ie first 12 hours after you have set up a new Digital Secure Key.

Block/Unblock card

You can temporarily block and unblock your debit card via HSBC Singapore app. This comes in handy if you ever lose your card and want to block it until it's found

- Log on to HSBC Singapore app, then select the account linked to your debit card

- Tap on 'Manage cards'

- To block the card, toggle on 'Block card temporarily'. To unblock the card, toggle off 'Block card temporarily'

Real-time transaction

See information in real time for your debit card transactions on the HSBC Singapore app.

- Log on to HSBC Singapore app, then select the account linked to your debit card.

- Go to 'Transaction history' to see a list of your pending and posted transactions.

Lost, stolen and replace card

Securely report lost or stolen cards and request a replacement instantly through our HSBC Singapore mobile app.

- Tap on ‘Manage cards’, then tap on ‘Report lost or stolen card’.

- Select the card you want to report.

- Tap on confirm.

Go cashless

Access your funds easily , transact securely , convert currencies in real time , manage cards via mobile app , how does this outweigh other cards, ready to apply.

You can apply for the Everyday Global Account (EGA) and Debit Card with your internet banking access.

Existing EGA customer

Have an EGA but without EGA debit card?

Simply get in touch via:

- HSBC Personal Banking: 1800 4722 669 or (65) 6472 2669 (overseas)

- HSBC Premier: 1800 227 8889 or (65) 6227 8889 (overseas)

- Visit any of our HSBC Singapore branches and your debit card will be mailed to you.

New to HSBC

Leave us your contact details and we will be in touch with you. Otherwise, please visit any HSBC branches islandwide to open your EGA with the Debit Card.

Frequently asked questions

How can i block my debit card via the hsbc singapore app .

Simply log on to the HSBC Singapore app, select 'Account' from home screen, tap on 'Manage cards' and then toggle on 'Block card temporarily' to block the debit card.

How can I unblock my debit card via the HSBC Singapore app?

Simply log on to the HSBC Singapore app, select 'Account' from home screen, tap on 'Manage cards' and then toggle off 'Block card temporarily' to unblock the debit card.

How do I use my new HSBC Everyday Global Debit Card? Is there an annual card fee?

Activate your card prior to your first use and before you travel each time by calling 1800 227 8889 or (65) 6227 8889 if you are overseas, to enjoy the features and benefits of your new HSBC Everyday Global Debit Card.

No, there is no annual card fee. The HSBC Everyday Global Debit Card is extended to you for free.

Do I get to enjoy no FX fee on my overseas purchases and cash withdrawal?

Yes, simply fund your HSBC Everyday Global Account with the foreign currencies that you intend to spend and transact with your HSBC Everyday Global Debit Card. We will deduct the same transacted amount from your account without any FX fee.

Do ensure you are transacting in the supported foreign currencies by checking with the merchant before purchase and maintain sufficient balance in the respective foreign currency to enjoy no FX fee for your purchases and cash withdrawal. Please note that Renminbi (RMB) is not supported for card spends and cash withdrawal.

Can I use my HSBC Everyday Global Debit Card if I have insufficient foreign currency balance?

Yes. We will convert your overseas transaction amount using a prevailing rate that the bank determines and bill you in Singapore dollar currency. However, if you do not have sufficient Singapore dollar balance, we will decline the transaction.

It is recommended that you keep sufficient foreign currency balance to enjoy zero FX fees for your debit card transactions. You may login to HSBC Singapore app to check your balances or transfer funds on the go.

How can I activate my debit card via the HSBC Singapore mobile app?

Simply log on to your HSBC Singapore app, select account from the 'Home' screen, tap on 'Manage cards' and then tap on 'Activate physical card' to complete the activation of the debit card.

What types of debit cards can be activated via the HSBC Singapore mobile app?

All HSBC personal debit cards.

What's a 'pending transaction', as shown in my transaction history?

A 'pending transaction' is a card transaction you authorised on your debit card recently, but which the merchant hasn't submitted to us yet. Your available balance will be 'on hold' for the transaction. If the merchant doesn't submit the pending transaction in 21 days, it will be dropped from the account. For foreign currency transactions, the amount stated is indicative. That means the actual amount charged to your card in Singapore dollars may differ. This is due to a difference in the foreign exchange rate at the time of conversion. Plus, you may be charged an administrative fee for foreign currency transactions.

Where can I see my pending transactions?

You can see your pending transactions via mobile banking. Simply follow these steps:

My debit card has been lost or stolen, what should I do?

Log on to HSBC Singapore app and report your card as lost or stolen immediately.

Follow these steps to report your debit card as lost or stolen:

- Tap on 'Manage cards', then 'Report lost or stolen card'.

Once your debit card has been reported lost or stolen, we'll block it immediately and issue you a replacement card.

If the delivery address reflected on HSBC Singapore app is not correct then please temporarily block your cards on the app and submit your updated address via HSBC Online Banking. After your address has been updated, you can continue to submit the lost/stolen card request on the app. Or, you can call us on 1800-HSBC NOW (4722 669) from Singapore or (65) 64722 669 from overseas.

How do I report my debit card as lost or stolen and order a replacement?

Things you should know.

HSBC debit cards that are issued from 14 December 2020 onwards will not have the NETS FlashPay feature. If you are holding on to an existing HSBC debit card, you may continue to use it. Learn more here .

Fees and charges

- SGD5 if the average daily balance falls below minimum balance of SGD2,000 or its equivalent

- No annual card fee applies

Things to note about card activation and usage

Remember, you need to activate your debit card before you can use it. You can do this by calling 1800-HSBC NOW (1800-4722 669) or (65) 64722 669 if you are overseas. Press '*', then '4' for card activation.

- In some situation, the merchant may process your transaction and bill you in another currency other than the original transaction currency. Please review the currency and billing amount in the merchant's check out section or invoice prior to accepting the transaction.

- If you do not have sufficient foreign currencies to complete the transactions, we will convert at prevailing rate as determined by the bank and bill you in Singapore dollar. Assuming you have charged GBP18,000 to your debit card on 23 Nov 2018 without sufficient balance in your GBP Everyday Global Account, you will be billed indicatively SGD32,455.80 in your SGD Everyday Global Account. This is based on prevailing HSBC Board Exchange Rate of SGD-GBP 1.8031 on 23 Nov 2018.

- There may be a gain or loss when you convert foreign currency. Eligible Customers are advised to make independent judgment with respect to any matter contained herein. The Bank shall not be liable for any delay in effecting such conversion, instruction or transactions.

- Renminbi (RMB) is not available for debit card payment and cash withdrawal. Withdrawals from any RMB Account shall be by way of foreign exchange conversion into non-RMB denominated currency(ies) only.

Useful documents

- Debit Card PIN replacement, Limit change and Account linkage request form (PDF) Debit Card PIN replacement, Limit change and Account linkage request form (PDF) Download

Terms and Conditions

- Everyday Global Activation Terms & Conditions (PDF) Everyday Global Activation Terms & Conditions (PDF) Download

- HSBC Debit Card Cardholder's Agreement (PDF) HSBC Debit Card Cardholder's Agreement (PDF) Download

- Fees and Charges (PDF) Fees and Charges (PDF) Download

1 Applies to successful retail purchase, online shopping and cash withdrawal made via the 10 supported currencies. RMB is not supported for card spend and cash withdrawal. If you do not have sufficient foreign currencies to complete the transactions, we will convert the transaction at a prevailing rate as determined by the bank and bill you in Singapore dollar.

2 HSBC Premier Everyday Global Debit Card Cardholders enjoy $0 HSBC ATM fees for overseas cash withdrawals across all ATMs worldwide.

HSBC Personal Banking Everyday Global Debit Card Cardholders enjoy $0 HSBC ATM fees for overseas cash withdrawal at all HSBC ATMs except in Argentina, France, Brazil, Greece, Malta, Mexico, New Zealand and Turkey.

HSBC Fees apply for cash withdrawals at non HSBC ATMs. Please note that for all customers, fees may be applied by the 3rd party banks for cash withdrawals at non-HSBC ATMs worldwide.

3 This is the indicative foreign exchange rate HSBC uses to convert SGD into GBP via HSBC Singapore app, as of 4 June 2019.

4 Average exchange rate from relevant card scheme associations, with 2.5% administration fee applied.

5 When you apply for more than one SGD current and savings account which includes the Everyday Global Account, only the Everyday Global Debit Card will be issued, and the remaining current and savings accounts opened will be linked as secondary accounts to the Everyday Global Debit Card.

Debit card purchases will be from the primary account linked to your card i.e. the Everyday Global Account. For ATM withdrawals, you can choose between your primary account or any secondary accounts (up to 2 accounts) linked to the card. Secondary accounts can be current or savings accounts. Please note at non HSBC ATMs locally or overseas, if you have linked 2 or more accounts of the same type you may not be able to select the subsequent account, subject to the acquiring bank ATM setup.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Connect with us

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

HSBC Mastercard® Debit Card

Earn up to 20% cash rebate when you spend in Japan/ mainland China!

Get rebate on suica, didi or mainland china alipay with every dollar spent on your hsbc mastercard® debit card terms and conditions apply..

From now on, whether you're shopping at home or travelling abroad, staying in control of your global currencies has never been easier. With a card built around 12 major currencies, you can shop online, make purchases, and withdraw cash at HSBC Group ATMs around the world, with zero fees.

* You need to have an integrated account to apply .

Why you'll want it

Easy access to major currencies, $0 fees for all your purchases, free cash withdrawals worldwide, earn on every purchase.

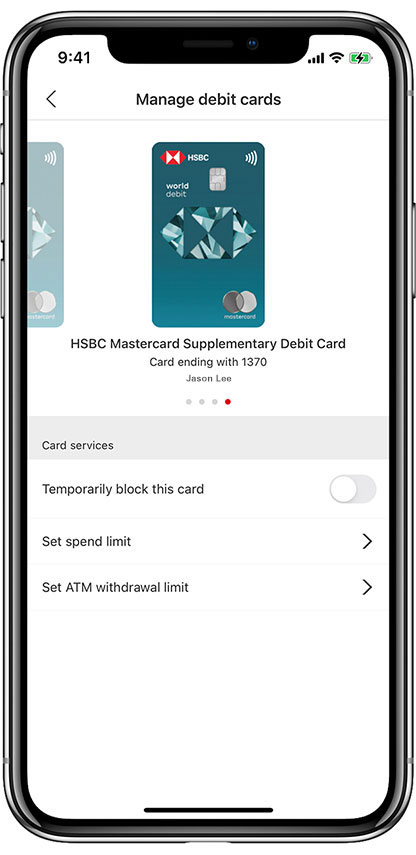

- Supplementary Debit Card for your loved ones A supplementary card gives your loved ones the benefits of multi-currency and fee-free privileges.

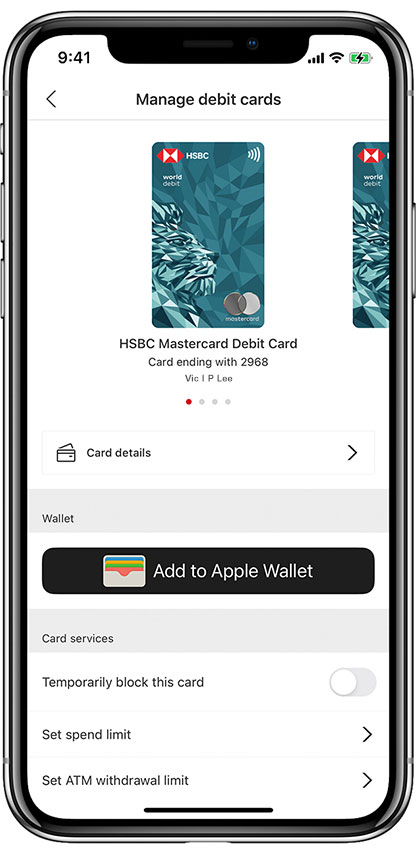

How to get your card ready

Get your card on mobile

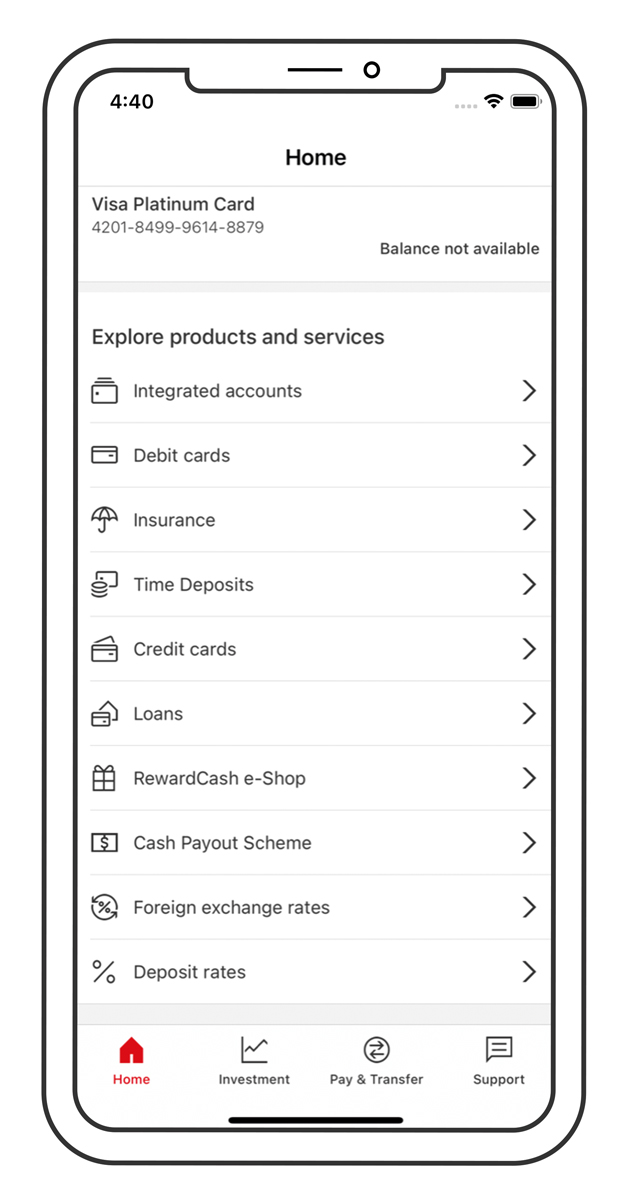

If you're already an integrated account holder, get your debit card application processed instantly on the HSBC HK Mobile Banking app. Simply select "Explore products and services" after you log on to the app.

Alternatively, you're welcome to contact us directly to apply for your card.

Activate your card 3

Once your physical card arrives, you can activate it by entering your card expiration date on the "Manage Debit Cards" page on the HSBC HK Mobile Banking app.

How to receive your card PIN (Personal Identification Number)

You no longer need to wait for your PIN to arrive by mail. Simply call the Interactive Voice Response (IVR) hotline on (852) 3163 0633 and set up your own card PIN after activating your debit card. It’s fast and simple!

Eligibility

Hsbc integrated account holders.

Enjoy all the benefits of having a multi-currency card today.

Not an integrated account holder yet?

If you're opening a new HSBC Premier or HSBC One account, you may request for the HSBC Mastercard® Debit Card at the same time. 1

Apply for an HSBC Premier Account:

- More details

Apply for an HSBC One Account:

Apply for a Supplementary Debit Card for your loved ones

A truly international multi-currency Debit Card for your loved ones, no matter where they go around the world.

- Features & Benefits

- Are you eligible?

- How do I apply?

- Open a supplementary card for your loved ones / children aged 12 or above in a few easy steps on the HSBC HK Mobile Banking app. Supplementary cardholders don't need to visit a branch or hold a bank account

- Provide for the spending needs of your loved ones in any currencies, hassle-free. Simply maintain HKD or respective foreign currency funds in your Integrated Account and your supplementary cardholders can use them directly, with no foreign currency transaction fees

- Worried about over-spending? You can control how much supplementary cardholders spend by setting spending rules via the HSBC HK Mobile Banking app

- Keep updated on supplementary card spending with real-time spend and withdrawal notifications

- Earn 0.4% cash rebates every time your loved ones spend on their supplementary cards

- There are no annual fees, no foreign currency transaction fees, and no ATM cash withdrawal fees when using HSBC Group’s ATMs worldwide

- Apply for up to six supplementary debit cards per principal debit card, if you have a big family

- You must hold an HSBC Mastercard® Debit Card to apply for a supplementary card for your family and friends

- Supplementary card applicants must be aged 12 or above

- Log on to the HSBC HK Mobile Banking app

- Select 'Debit cards' under 'Explore products and services' on the Homepage

- Click on 'Start application'

Remember to have the information and contact details of supplementary cardholders before you apply. These include date of birth, identity document number, mobile phone number and email address.

If your supplementary cardholder does not hold an account with HSBC yet, you need to upload his/her identity document .

Features & Benefits

Are you eligible , how do i apply , what else should i know .

How can I manage my supplementary card through the HSBC HK Mobile Banking app?

Your HSBC Mastercard® Supplementary Debit Card allows you to always stay in control. As a principal cardholder, you can manage supplementary cards from the 'Manage debit cards' page on the HSBC HK Mobile Banking app.

Step 1: Log on to the HSBC HK Mobile Banking app and click on any sub-account of the integrated account with principal card.

Step 2: Click on 'Manage debit cards'.

Step 3: The Mastercard® principal card will be shown.

Step 4: Swipe to the left from the card face to see your supplementary card(s).

What limits can I set for HSBC Mastercard® Supplementary Debit Card?

As a principal cardholder, you can set the following limits:

- Monthly spend limit (covers purchases made via Mastercard® and EPS network)

- Daily local ATM cash withdrawal limit

- Daily overseas ATM cash withdrawal limit

Will my supplementary cardholder know my account balance?

Your privacy matters a lot to us. Supplementary cardholders have access to a limited set of banking / ATM services, and balance enquiries are blocked for them.

What do I do when I receive the supplementary card?

You can follow three simple steps to get started:

- Once you receive the HSBC Mastercard® Supplementary Debit Card, pass it to your supplementary debit cardholder

- Advise your supplementary cardholder to activate the card and set the PIN by calling 3163 0633. A one-time password will be sent to him/her for verification. You will be notified by email and SMS once the activation is successful

- After card activation, you can change the spend and withdrawal limits of the card conveniently via the HSBC HK Mobile Banking app. Just log on > tap on any accounts linked to the card > 'Manage debit cards'. Remember to tell your supplementary cardholder about the limits you set (but just in case you forget, we will also notify the supplementary cardholder every time you change the limit)

What should I know if I am a supplementary cardholder?

Getting Started

- If you hold an HSBC Mastercard® Supplementary Debit Card, you can activate the card and set up the PIN by calling 3163 0633. A one-time password will be sent to your mobile number for verification

- You can then start enjoying the benefits of the fee-free multi-currency spending experience! Remind your principal cardholder to keep sufficient funds in his/her account, just in case

- For your convenience, you can also add the card to your mobile wallet!

Using the card

- You can use the card at any merchants worldwide that accept Mastercard® for purchases or via local EPS network. Please ask your principal cardholder about the limits he/she set for the card before using it

- You can withdraw cash from HSBC Group’s ATM network for free. If you withdraw from non-HSBC Group ATMs, fees may apply. Refer to our tariffs for details. Again, please check what withdrawal limits have been set by the principal cardholder

- Remember – each time you spend or withdraw with the card, we will notify you and the principal cardholder. You will also be notified every time the spending / withdrawal limit set by the principal cardholder is changed. You can find out the remaining monthly spending limit from the spend notification we send you after every transaction

Just in case…

Needing some card services? In most cases, you'll have to ask your principal cardholder. These services include:

- Check card information / status

- Check transaction history

- Replace card

- Change card limits

- Request a new PIN (except first PIN set-up)

- Dispute a transaction

- Change of personal particulars e.g. phone number and email address

- Cancel card

However, you will still be able to raise requests related to the security of your card. They are:

- Activate your card

- Block your card

- Report lost card (you need to ask your principal cardholder for a replacement card request)

Get your card in seconds with the HSBC HK App 2

What else should I know

If you still hold a hsbc jade mastercard® debit card.

Click here to view details

1. You can choose the HSBC Mastercard® Debit Card and/or the HSBC UnionPay ATM Card upon opening your new integrated account.

2. You need to have an integrated account to apply.

- Apple, the Apple logo, iPhone, iPad, iPod touch, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc.

- Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

- QR Code is a registered trademark of Denso Wave Incorporated.

- The screen displays are for reference and illustration purposes only.

- Terms and Conditions apply.

3. By activating this card, you agree to the Debit Card Terms and Conditions and accept the preset daily spending limit as printed on the card mailer. Once the card is activated, if you'd prefer to lower your spending limit, you can adjust it anytime from the 'Manage debit cards' screen on your HSBC HK app or call our hotline as printed on the back of your card.

Risk Disclosure:

- Currency conversion risk - The value of your foreign currency and RMB deposit will be subject to the risk of exchange rate fluctuation. If you choose to convert your foreign currency and RMB deposit to other currencies at an exchange rate that is less favourable than the exchange rate in which you made your original conversion to that foreign currency and RMB, you may suffer loss in principal.

If Your Debit Card Expires While You’re Traveling, Do These 7 Things

T raveling can be an exciting adventure, full of new experiences and memories to cherish. However, it can quickly turn into a stressful situation if you find your debit card has expired. Being far from home without immediate access to your funds can be worrisome, but don’t panic. Here are some important steps to take if your debit card expires while you are on vacation.

Read More: 6 Genius Things All Wealthy People Do With Their Money

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

1. Contact Your Bank Immediately

The moment you realize your debit card has expired, contact your bank or card issuer. Most banks have international toll-free numbers specifically for travelers who have issues with their debit cards. Inform them about your situation and verify your identity. Banks are familiar with handling these situations and can quickly help you find a solution.

2. Request an Emergency Card Replacement

Ask if your bank can expedite a new debit card to your current location. Many banks offer an emergency card replacement service for travelers. While this might come with a fee, it’s worth the peace of mind. Provide a secure and verifiable address, like your hotel, where the card can be delivered.

3. Use Digital Wallet Services

In today’s digital age, accessing your funds without needing the physical debit card is often possible. If your bank supports it, you can add your debit card to a digital wallet like Apple Pay , Google Pay or Samsung Pay. This way, you can continue to make purchases and pay for services with your smartphone or a smartwatch.

4. Explore Wire Transfer Options

If getting a replacement card is not feasible, consider having money wired to you. You can use wire transfer services like Western Union or MoneyGram to receive cash without needing a debit card. You’ll need to provide identification and the transaction details, but it’s a reliable way to access your money.

5. Use Other Cards

Always travel with more than one form of payment. If you have a credit card or another debit card , now is the time to use it. This reduces the inconvenience of having a single expired card and ensures you’re not stranded without access to your funds.

6. Withdraw Funds Through a Partner Bank

Some banks have international partnerships with other banks. In such cases, you might be able to withdraw cash directly from a partner bank’s branch. You’ll need to present your passport and possibly answer security questions, but it’s an effective way to access your money.

7. Precautionary Measures for the Future

To avoid a situation like this in the future, make a note of your card’s expiration date before you leave on vacation. Most banks send out new cards a few weeks before the old one expires, so ensure your address is up-to-date. Additionally, consider setting up travel alerts on your account and inform your bank of your travel plans. That way, you’ll cut down any risk of fraud alerts or blocks issued on your account.

If your debit card stops working while you’re traveling, it can be a hassle, but it’s not a huge disaster. If you act quickly and check out other options, you can still get to your money and have an enjoyable and relaxing time on your trip. Make sure to have a second way to pay ready and the phone number for your bank with you, just in case you need it while you’re on the go.

Editor's note: This article was produced via automated technology and then fine-tuned and verified for accuracy by a member of GOBankingRates' editorial team.

This article originally appeared on GOBankingRates.com : If Your Debit Card Expires While You’re Traveling, Do These 7 Things

HSBC UK says all services are functional after disruption

- Medium Text

Sign up here.

Reporting by Gursimran Kaur in Bengaluru; Editing by Kevin Liffey and Nick Zieminski

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

China's Country Garden repays onshore coupons within grace period

Embattled Chinese property developer Country Garden said in a statement on Saturday it had repaid two onshore bond coupons before the expiry of a five-day grace period, following missed payments last week.

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy

7 steps to adding credit cards to UPI apps

Unified Payments Interface (UPI) has revolutionised the way people make payments. It allows you to use mobile devices to make instant money transfers between bank accounts.

With UPI, you don't need to have the bank account number or Indian Financial System Code (IFSC) of the recipient. Instead, you can simply use their UPI ID to send or receive money. Moreover, you can link multiple bank accounts with a single UPI ID, which makes it a convenient payment option for many people.

How to add your credit card to PhonePe and other UPI apps

If you're using UPI apps like Google Pay, PhonePe or Paytm, you might have noticed that they also offer the option to add a credit card. This is useful when you want to make a payment for a service or product that doesn't accept UPI payments directly. You can make UPI payment from your credit card, then pay off the credit card bill later.

Follow these 7 steps to add a credit card to UPI apps:

- Open the UPI app The first step is to open the UPI app on your smartphone. Depending on the app, you might need to log in using your mobile number, email ID or UPI PIN.

- Go to the Payment Options Find the 'Payment Options' menu once you log in. This might be located in different places depending on the app. For example, in Google Pay, you can find 'Payment Methods' under the Settings menu. In PhonePe, you can find the 'Add Money' option on the dashboard.

- Select Credit Card option In the 'Payment Options', you'll find various payment methods like UPI, debit card, online banking and credit card. Select the 'Credit Card' option to add your credit card details.

- Enter your credit card information Now, you'll be asked to enter your credit card information. This includes the card number, expiration date, CVV and cardholder name. Make sure you enter the correct information. Any mistake will not allow you to add the credit card.

- Verify your credit card Once you enter your credit card information, the UPI app will verify your card details. This process might take a few seconds to a few minutes depending on the app. You might need to authenticate the verification through a one-time password sent to your mobile number or email ID.

- Set up a payment PIN Once your credit card is verified, you'll be prompted to set up a payment PIN. This PIN is a four or six-digit numerical code that you will use every time you make a payment using the credit card on the UPI app. Make sure you set up a strong and unique PIN that you can remember easily.

- Add money to the wallet To set up credit card to UPI transfer, you need to add some money to your wallet. This can be done by selecting the 'Add Money' option in the 'Payment Options' and entering the amount you want to add. You can use various payment methods like UPI, debit card and online banking to add money to your wallet.

Benefits of linking the HSBC Cashback Credit card to UPI

UPI is a convenient and secure online payment method that simplifies tracking your expenses. Adding a credit card to UPI apps is a straightforward process. Once linked, your credit card becomes a viable payment option for services and products that don't directly accept UPI payments.

Additionally, by linking your HSBC Cashback Credit Card for UPI payments, you can enjoy the same rewards and benefits offered by your credit card.

Make sure you keep your payment PIN secure and add money to your wallet to start using your credit card on the UPI app.

You might also be interested in

How does a credit card work?

The differences between a credit card and debit card

Different types of credit cards

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance