- Lincoln Navigator

- Lincoln Aviator

- Lincoln Nautilus

- Update My SYNC

- Get Help from a Human

- Find a Retailer Near Me

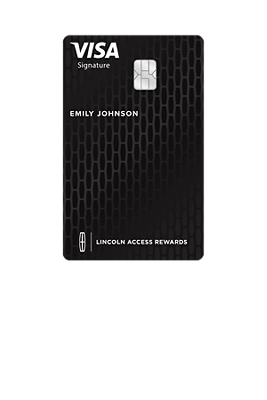

What is the Lincoln Access Rewards™ Visa Card?

The Lincoln Access Rewards Visa card is a new way to earn points and experiences through the Lincoln Access Rewards program.

Benefits include:

- Instant credit for same-day purchasing

- No annual fee

- Points earned on qualifying purchases

- Financing on qualifying purchases

- Early access to Lincoln Access Rewards offerings and anniversary points

- Extended warranty protection

- Travel and emergency assistance

- Zero fraud liability

For more information, visit the Lincoln Access Rewards Website .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Mexico’s Pueblos Mágicos: Visit These 4 Lesser-Known Towns

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Vacations to Mexico don’t have to solely entail sipping on margaritas at an all-inclusive beachside resort or sampling tacos al pastor in Mexico City. For tourists seeking an off-the-beaten-path trip, Mexico’s Ministry of Tourism has curated a list of lesser-known destinations that stand out for their historical significance, natural wonders and local charm. They’re called Pueblos Mágicos (which means magical towns).

The list has grown from four towns in 2001 to now 177 towns. As part of the requirements of the designation, towns must prove they can provide what the government considers “necessary infrastructure to provide visitors with comfort and facilities during their stay.”

In short, towns must make it relatively easy for tourists to get around, book accommodations and find activities to fill a vacation.

Sure, Mexico’s tourist hotspots offer that, too. But these Pueblos Mágicos can offer a unique (and sometimes more budget-friendly) alternative.

These four Pueblos Mágicos are especially worth visiting this year.

(Getty Images)

For serene beauty, head to Bacalar in the southern part of Quintana Roo state. The clear waters of Bacalar Lagoon make for prime swimming.

The area’s boutique, luxury hotel scene has surged. Boca de Agua opened in late 2023 with treehouse-style rooms designed by renowned Mexican architect Frida Escobedo. And in 2023, travel site Afar named local Our Habitas Bacalar, which stands out for its adults-only, A-framed tented rooms, as one of the best resorts in Mexico for that year.

Loreto, located in Baja California Sur, serves as a gateway for whale watching at Bahía de Loreto National Park — particularly in late winter (January through March).

In addition to whales, the area is home to a huge array of diverse wildlife, including more than 170 seabird species and more than 700 fish species.

The town itself is pretty small. According to Mexico’s latest census data, there were only 18,000 residents in 2020. Loreto has maintained its heritage as a fishing village, while also catering to tourists with its locally owned boutique hotels and restaurants.

Despite its size, Loreto has its own airport, offering direct flights from major U.S. cities, including Dallas, Los Angeles, Phoenix and San Francisco. The flight from Los Angeles takes less than two hours, making it an easy trip for Southern California residents.

3. Santa Rosalia

(Photo courtesy of Visit Baja Sur)

Santa Rosalia, which is also located in Baja California Sur, earned its Pueblo Mágico designation in June 2023. Santa Rosalia serves adventure seekers given its beaches for surfing, diving and snorkeling, where you may even spot a fish called a burrito grunt.

If you can’t make it to Paris this year, you may enjoy visiting Santa Rosalia's own piece of possible Eiffel history. Atlas Obscura shares that the town’s main church, Iglesia de Santa Bárbara — which has a unique iron structure — was possibly designed by Alexandre-Gustave Eiffel. Yes, that’s the same Eiffel behind France’s Eiffel Tower.

And that’s not the only French influence in Santa Rosalia. One of the city’s top tourist attractions, El Boleo Bakery, bakes bread using French techniques.

4. San Miguel de Allende

San Miguel de Allende, located in Guanajuato, doesn’t officially have a Pueblos Mágicos designation anymore — but that’s because it got an upgrade. In 2008, it was named a UNESCO World Heritage Site and thus taken off the list.

And it’s only gotten more popular since then, especially with young travelers. According to AmEx Travel data, San Miguel de Allende has experienced a 400% increase in bookings among Gen Zers and millennials. The city earned a spot on the company’s 2024 Trending Destinations list .

Why do people love it? The town is known for its cobblestone streets adorned with candy-colored houses. Much of the city still has baroque architecture, creating a compelling environment for photographers and urban hikers.

Meanwhile, foodies can explore street markets and restaurants, tasting popular local specialties like chiles en nogada (a meat-stuffed poblano chile topped with a walnut-based cream sauce). Art and history buffs will be entertained by its galleries and well-preserved buildings, too.

How to make a Pueblos Mágico trip affordable

Colorful houses line the streets in Guanajuato City, another Pueblo Mágico. (Getty Images)

Going to a Pueblo Mágico isn't necessarily cheap. Getting to more remote towns can be expensive if the airport is far away. Plus, some of these towns are primarily served by boutique, luxury hotels, which can mean higher prices.

Still, there are a few ways to save on a trip to one of these unique destinations.

Hold the right credit card: Since you’re less likely to find the big chain hotels in Mexico’s magic towns, don’t count on redeeming hotel points or cashing in on free night certificates . That said, it’s not impossible to redeem credit card points for boutique hotels through the credit card issuer’s travel portal.

And with some cards, this can be a smart redemption. For example, those who have the Chase Sapphire Reserve® can redeem their Chase Ultimate Rewards points for boutique hotels at a value of 1.5 cents each through Chase’s travel portal. Otherwise, they’re only worth 1 cent when redeemed for cash.

Cash in on statement credits: In that same vein, some travel credit cards let you redeem points for statement credits against travel expenses charged to the card. Sometimes the statement credit automatically kicks in. But if you hold a card that requires you to manually redeem points for travel statement credits, don’t forget that next step.

Credit cards that offer the ability to redeem points as a statement credit after you’ve made a travel purchase include:

on Bank of America's website

on Citibank's application

Redeem points at a rate of 1 cent per mile against travel purchases made within the last 90 days.

Redeem points at a value 1 cent per point toward any purchase (travel or otherwise).Redeem points at a value 1 cent per point toward any purchase (travel or otherwise).

Redeem Citi ThankYou points at a rate of 1 cent each with this card, which earns 1% cash back on all purchases, then another 1% back when you pay them off. Plus, through the end of 2024, cardholders can get 5% cash back on hotel, car rentals and attractions booked through the Citi Travel portal.

Travel during shoulder season: Throughout Mexico, peak season is generally winter as snowbirds flock for warmer weather. Consider visiting during the shoulder seasons — most of spring (aside from spring break) and fall — for better deals.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Best Youth and Student Travel Discount Cards

How to Easily Score Student Discounts as You Travel

Peter Cade/Getty Images

One of the best perks of student travel is having access to thousands of discounts. You'll be able to score cheaper prices on everything from accommodation to flights and entrance fees to tours.

You technically do not have to be a student either. If you're a traveler under the age of 26, you should be eligible for most of the discounts.

And the discounts are not only travel-related, you can have access to discounts on practically everything you can think of. Check out the best card offers out there like the International Student Identity Card, the International Youth Travel Card, the Student Advantage Card, the International Student Exchange Card, and various hostel discount cards.

The International Student Identity Card (ISIC)

Full-time students who are 12 years and older can get their hands on an International Student Identity Card to gain discounts on flights, accommodations, shopping, entertainment, and more.

You can get free travel insurance while traveling outside the U.S. through this card (although it is basic), as well as have the opportunity to make inexpensive international phone calls. This is a huge bonus.

The card, which costs about $25, is good through December 31 each year. It is issued by the International Student Travel Confederation and if you are going to go with only one student discount card, this is the one you should get. For $25 a year, you will definitely make your money back and save several hundreds of dollars if you have a few trips planned.

Check out a full list of discounts you'll be eligible for and learn more about how to get an ISIC card.

The International Youth Travel Card (IYTC)

Also issued by the International Student Travel Confederation, the International Youth Travel is a discount card for travelers under 26 who are not enrolled in a school. You get a wide range of youth travel discounts, not quite as many as the ISIC, but it may be worth having if you plan on traveling. It costs $25 a year and comes with free travel insurance as well.

Check out the list of youth travel discounts you can get with IYTC card and learn more about how to get an IYTC card.

The Student Advantage Card

The Student Advantage Card provides student travel, retail, and entertainment discounts for an annual $22 membership fee (you can add up to three additional years of membership for $10 per year).

As for whether it's worth it, it really does depend on how you'll be traveling. You can gain 15 percent off Amtrak and Greyhound fares, and you get booking fees waived if you use HostelWorld. That all sounds great, but you should bear in mind that you can get a Greyhound student discount without the card and that Amtrak gives the same discount to ISIC cardholders. The main bonus, then, is saving on the HostelWorld booking fee. If you're planning a big trip or lots of travel and staying in hostels, dishing out $22 on the Student Advantage Card could be a good deal. If not, get the ISIC instead.

The International Student Exchange Card (ISE)

The $25 ISE card offers many of the same discounts as the ISIC card. Issued to travelers under 26, the card's "youth" version doesn't offer quite as many discounts as the "student" version, issued to enrolled students. Is it worth it for you? You should take a look at the discounts offered, compare them to those offered by the ISIC, and see which of them will be more valuable to you. If both sound great and can offer you great deals independently, then get both. You can buy the mobile-only membership for $9—which cuts out the need for a physical card. Or, you can get a physical ISE card with a SIM card for international calling for $35 (shipping included).

Hostel Discount Cards

Hostel discount cards offer discounts on some hostel bunk nights and a few additional benefits. Some hostel discount cards offer only to waive online booking fees, which may be covered by the Student Advantage Card. Major hostel outfit Hostelling International has a membership card, which can get you a free night stay and other deals.

How to Land Some Serious Student Travel Discounts

Pros and Cons of Discount Bus Travel

Get an ISIC Card

Best Hotel Booking Sites

How to Buy and Use the National Park Pass for Seniors

Can I Get a Senior Discount on Rail Passes?

Youth Discounts on the Eurail Pass

How to Gain Airport Lounge Access

How to Pay for TSA Precheck With Airline Miles

How to Find the Right New York City Gym for You

Tips for Budget Business Travel

5 Ways to Find the Cheapest Train Travel

Should You Book Your Hostels in Advance?

Amsterdam Tourist Discount Cards

How to Find Senior Discounts for Budget Travel

About Single Europe Train Tickets

- Sign in

Bank of America® Travel Rewards Credit Card for Students

We're sorry, this page is temporarily unavailable. We apologize for the inconvenience.

Unavailable

One or more of the cards you chose to compare are not serviced in English.

Continue in English Go back to Spanish

Start building a successful financial future today

while earning unlimited 1.5 points for every $1 you spend on all purchases

Card Details

Unlimited points.

Earn unlimited 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points as long as your account remains open

Low Introductory APR Offer

0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the intro APR offer ends, a Variable APR that's currently 19.24% to 29.24% will apply. 3% † Intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all future balance transfers is 4%.

25,000 online bonus points offer

25,000 online bonus points if you make at least $1,000 in purchases in the first 90 days of your account opening – which can be redeemed for a $250 statement credit toward travel and dining purchases

No annual fee † and no foreign transaction fees †

Enjoy no annual fee and no foreign transaction fees on purchases while earning points to use for statement credit to pay for flights, hotels, vacation packages, cruises, rental cars or baggage fees, and also at restaurants – including takeout

Establish good credit habits

Easily manage your bank accounts and finances online with Online Banking and our award winning Mobile Banking app that help students stay in control of their finances and make payments

FICO ® Score

Now, you can access your FICO ® Score updated monthly for free, within your Mobile Banking app or in Online Banking. Opt-in to receive your score, the key factors affecting your score, and other information that can help you keep your credit healthy.

Interest Rates & Fees Summary †

Introductory apr.

0% for 15 billing cycles

Applies to purchases and to any balance transfers made within 60 days of opening your account

Standard APR

19.24% - 29.24%

Balance Transfer Fee

After the intro balance transfer fee offer ends, the fee for all future balance transfers is 4%.

† Please see Terms and Conditions for rate, fee and other cost information, as well as an explanation of payment allocation. All terms may be subject to change.

Note: minimum payments are applied to lower-interest balances first. Additional payments are applied to higher-interest balances first.

Earn unlimited 1.5 points for every $1 you spend on all purchases everywhere, every time.

No blackout dates or restrictions and points do not expire as long as your account remains open.

Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

Flexibility to redeem points for a statement credit to pay for flights, hotels, vacation packages, cruises, rental cars or baggage fees, and also at restaurants—including takeout.

Additional Benefits

Better money habits ®.

Learning to handle your credit is a big responsibility. A little knowledge can go a long way with Better Money Habits ® Opens in a new window .

Manage your Finances

Manage your money from almost anywhere. From home, the library and everywhere else, help stay in control of your finances with our award winning Mobile Banking app .

Schedule an appointment

Want to talk to someone one-on-one? No problem. We're here with you every step of the way. Set up an appointment at a time and place that works for you.

Security & Features

Stay protected, contactless chip technology, balance connect ® for overdraft protection, paperless statement option, digital wallet technology, online & mobile banking, account alerts.

Now, when you opt-in you can access your FICO ® Score updated monthly for free, within your Mobile Banking app or in Online Banking. FICO ® Score Program . The FICO ® Score Program is for educational purposes and for your non-commercial, personal use. This benefit is available only for primary cardholders with an open and active consumer credit card account who have a FICO ® Score available. The feature is accessible through Online Banking, the Mobile website, and the Mobile Banking app for iPhone and Android devices. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Data connection required. Wireless carrier fees may apply." data-footnote="ADDITIONAL_BENEFITS_FOOTNOTE_07" aria-label="Footnote 5"> Footnote [5] Learn More about Free FICO Credit Score opens in a new window

Priority code: TC038N

Schedule an appointment to apply in person

Connect one on one with a credit card specialist

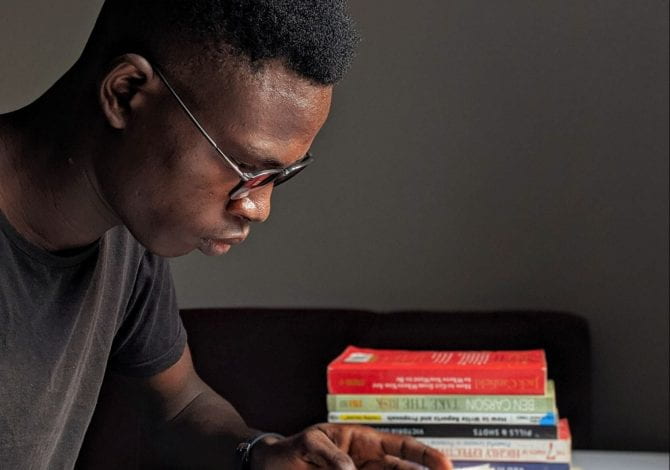

How college students can maximize travel rewards credit cards

Update: Some offers mentioned below are no longer available. View the current offers here .

This page includes information about the Discover it Cash Back that is not currently available on The Points Guy and may be out of date.

Travel rewards credit cards run the gamut from premium products charging top dollar for benefits like lounge access and Global Entry , to mid-range entries that waive their first year's annual fee, all the way down to cards with no annual fee .

For regular consumers with good credit, the choice can be hard enough. But for college students just starting to manage their personal finances and credit scores , the choices can be that much tougher.

Luckily, the travel credit card marketplace is more diverse than ever, meaning college students have some amazing opportunities to build their credit while reaping rewards at the same time. With some strategy and savvy, college students can make the most of their credit while sticking to a budget and keeping their credit score healthy.

Know your score

You wouldn't dive into a pool without knowing its depth. So why would you start applying for credit cards without knowing your credit score ? Finding out your score will provide you with a benchmark for measuring both your financial health and your progress as you build your credit over the years. It will also make sure your expectations as to which credit cards you are eligible for are realistic.

We often use the terms "credit score" and "FICO score" interchangeably. They are not exactly the same, but they're similar. The three major credit bureaus — Equifax, Experian and TransUnion — all compile their own detailed credit reports, which can vary. A FICO score is your credit score as determined by the Fair Isaac Corporation, and is the score most commonly used by lenders, so it is the most useful to know.

Your FICO score is determined by five key factors:

- Payment history: Whether you pay your bills on time counts for 35% of your score, so it's the most weighted factor. The accounts considered include credit cards, retail accounts, installment loans (like car loans), finance company accounts and mortgage loans.

- Amount of debt: Also known as credit utilization, or the debt-to-credit ratio, this factor is calculated based on how much credit has been extended to you versus how much you are actually using. It is weighted at 30% of your score, so it, too, is very important, and a good reason to keep your balances as low as possible.

- Length of credit history: FICO considers this factor as 15% of your overall credit score. College students just starting out with credit are naturally at a disadvantage, but the longer you hold on to your accounts and keep them in good standing, the more this will be reflected in your score.

- Credit mix: FICO also considers the types of accounts you have open, such as credit cards versus an installment loan. This is weighted at 10% of your score.

- New credit: Also accounting for 10% of your FICO score, lenders want to know how many new accounts you've applied for lately and what the lines of credit extended to you have been. Contrary to popular wisdom , inquiries about new lines of credit will only drop your score minimally and stay on your record for 3-6 months.

Knowing how your financial behavior affects your credit score is of paramount importance, both as you start out with credit and as you mature. A few irresponsible decisions early on can impact your score — and thus your opportunities not only to maximize travel rewards but get a good interest rate on a car loan or mortgage — for years.

How to get your score — for free

Now that you know what goes into your credit score, how do you find out what it is? These days, there are plenty of free ways to do so. More and more credit cards themselves are offering it to cardholders for free as a benefit. However, if you do not have a credit card yet, you still have some good options.

You have to create an account with some basic personal information, but Credit Karma offers free credit reports from both TransUnion and Equifax that you can check anytime.

American Express , Bank of America , Chase Journey , Capital One CreditWise , Citi and Discover Scorecard all offer accountholders and non-customers alike programs through which they can access and monitor their credit scores.

What your score means

Once you find out your score, the numbers break down the following way:

- Over 800: Exceptional credit

- 740-799: Very good, demonstrates you are a dependable borrower

- 670-739: Good, you're an above-average borrower

- 580-669: Fair: A below-average score, though many lenders might still approve your for some loans and credit

- Under 580: Poor, lenders consider you a risky borrower

If you're just starting out with credit, you'll likely be in the middle to lower range somewhere, which means you are eligible for some of the travel rewards cards out there.

Which credit cards are right for you?

Now that you have a handle on your credit, it's time to decide which credit card you're going to get. At TPG, we tend to break down the types of rewards cards down into four categories:

Airline credit cards : Everyone is familiar with these cards, which are associated with a specific carrier, like the Gold Delta SkyMiles® Credit Card from American Express, the United Explorer Card from Chase, or the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®, among many others. Whether this type of credit card is right for you will depend on whether you actually fly a lot, where you fly to and from, and if you take a particular airline more than any other, as well as whether you can maximize perks such as free checked bags and in-flight discounts. Read our picks for best airline credit cards here . The information for the Citi AAdvantage Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Hotel credit cards : If you're a college student, you're more likely to be staying at a hostel or splitting an Airbnb with friends than staying in luxury hotels. But if you are interested in accruing points toward free hotel stays, you could consider a no-annual-fee card that participates in a hotel loyalty program like the Hilton Honors American Express Card (see rates and fees) or the Marriott Bonvoy Brilliant™ American Express® Card. Read our picks for best hotel credit cards here .

Transferable points cards : Transferable points include American Express Membership Rewards , Chase Ultimate Rewards , Capital One miles and Citi ThankYou Rewards , each of which can be redeemed directly for travel through their respective online portals, or transferred to a unique set of travel program partners including both airline frequent-flyer programs and hotel loyalty programs. Though many of the best cards that participate in these points programs — like the Chase Sapphire Preferred Card and the Citi Premier® Card — charge annual fees, there are some that do not, including the Amex EveryDay® Credit Card from American Express. The information for the Amex EveryDay Credit Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Fixed-rate or cash-back cards : Finally, fixed-rate credit cards allow you to accrue points or miles on everyday purchases and then redeem them at a set value (usually 1 cent apiece) toward travel or other purchases. Among the no-annual-fee credit cards that earn these types of points/miles are the Bank of America® Customized Cash Rewards credit card, the Discover it Cash Back, the Capital One Venture Rewards Credit Card, the Wells Fargo Propel American Express® card and the Chase Freedom Unlimited.

The Wells Fargo Propel card is no longer available for new applicants. The information for this card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Best cash back credit cards

One reason to consider the last one in particular is that if you're not going to use your points toward cash-back statement credits anytime soon, you could wait until you get a more premium card such as the Chase Sapphire Preferred later on and then your points will be transferable as well as redeemable at fixed rates.

The other main consideration is which credit card will offer you the most return on your spending. Apart from whether you actually want airline miles, hotel points or cash back, every card's earning structure is different. The Amex EveryDay® Credit Card from American Express, for instance, earns 2x points per dollar at U.S. supermarkets (up to $6,000; then 1x), 1x point per dollar on other purchases and a 20% bonus each statement cycle you make more than 20 purchases with it.

By contrast, with the Discover it Cash Back you can earn 5% cash back on up to $1,500 in purchases made in accordance with Discover's 2019 Cashback Calendar after enrollment, plus 1% cash back on all other purchases. Thinking about your prospective card's earning structure will ensure that you are able to maximize its bonus categories, and thus, your rewards.

Applying for a card

Applying for your first credit card can be daunting — all the more so if you have not already established some credit by being made the authorized user on others individuals' accounts.

If this is your first credit card and you have no established history, don't worry. Several issuers field cards specifically for students looking to build credit. Most notable among them is Discover, which has this handy guide for applying for your first credit card.

Second, be certain you are applying for the best possible sign-up offer. Bonuses rise and fall all the time, as do the minimum spending requirements. Do your homework and make sure any cards you're thinking of applying for are offering historically good bonuses.

When you are ready to apply, make sure you have all the information necessary, including an accurate estimate of any income, mortgage or lease payments, your current address and your social security number.

One more note if this is your first credit card and you have not had a credit score at all before. It takes three months to generate a VantageScore credit score (this is used by some lenders) and six to generate a FICO score. Wait until you're past that time frame to apply for additional cards, because these applications will count as hard inquiries on your credit score, and any rejections could bring it down.

If you're not approved

It happens to all of us. You apply for the card you think is the perfect fit, only to have your application declined or put into pending status. Don't give up just yet. Credit card issuers have reconsideration phone lines that you can call to argue (politely) the specifics of your application and have it reviewed by a credit specialist.

Treat the agent with respect, have all the information you might need on hand, and be prepared to explain your circumstances and why you need this specific card.

Ideas for meeting minimum spend

If and when you are approved for a credit card, you will likely have to meet a spending requirement in order to qualify for the sign-up bonus. For college students on tight budgets, that might seem intimidating. However, there are ways to accomplish this without racking up debt right off the bat.

Before we jump into them, though, let me just stress again how important it is that you not bite off more than you can chew. Before making purchases on your new card, make certain you can pay them off on time. Otherwise, you'll just be going into debt, hurting your credit score and negating the value of any rewards you might earn.

Related reading: Ten commandments for travel rewards cards

With that out of the way, here are some creative ways to meet your spending requirement (and continue earning rewards beyond it).

Pay for tuition with a credit card: This is often easier said than done . Some institutions completely prohibit you from paying for tuition with a credit card. Others either charge you a convenience fee or partner with payment services that charge a fee (usually around 3%). However, a few colleges will let you pay with a credit card without fees, and in those cases it can be worth it. If you're thinking of doing this, ask your college's accounts department what their policy is to determine whether this might be a good option for you.

Use Plastiq to pay bills: Plastiq is an online bill payment service that basically lets you use your credit card for charges you might not otherwise be able to use a credit card to pay, such as utilities and rent, but also tuition. Plastiq is widely hailed as one of the best of these services since you can pretty much send a payment to any person or business within the U.S. or Canada. To do so, though, you have to pay a 2.5% fee, so do the math and consider whether it's worth it before you commit.

Put your books and supplies on your new card: As the school year starts, chances are you'll have to buy a lot of books, school supplies , and maybe even make a big purchase like a new laptop. As long as you'll be making these purchases anyway, you might as well be earning rewards on them.

Pay for group meals: As long as your friends can pay you back before your statement is due, either with cash or through a free service like PayPal or Venmo, it might be worth putting big group meals on your credit card in order to hit your minimum spending requirement.

Club expenses: Are you part of an on-campus club or group with a budget? Ask if you can put some of the expenses for events or other needs on your card and get reimbursed. This can be a quick and lucrative way to rack up some spending, as long as you can be sure of getting reimbursed in time to make your statement due date.

Gift cards: If you're not going to be able to make the purchases you need to within the spending time frame but coming up with the cash is not an issue, you could always purchase gift cards at a pharmacy or grocery store. Just be sure it's for something you'll actually use.

Related reading: Best credit cards for students and recent graduates

Bottom line

Now that you have the information you need at your fingertips, and strategies for meeting the spending requirements on a new credit card, it's time to figure out which one is best for you. Check out this post on 5 Starter Cards for College Students and Recent Graduates for ideas.

Your credit can help you earn fabulous rewards when it comes to credit cards and travel. Just be sure that you are using your credit responsibly, paying off your bills on time and maximizing the benefits of any card you do decide to carry.

For rates and fees of the Hilton Honors Amex card, click here.

Additional reporting by Sam Lipscomb and Liz Hund.

Cost of Living Support

Support for students during the cost of living crisis.

Advice and discounts

Tips for making your money go further.

While you’re a student, make the most of any discounts you can get and follow these student tips for shopping, cooking and saving money.

Budgeting & money management tips

From tech to food, transport to days out, discounts are one of the best perks of being a student!

I’m going to run through the most important things I learned on my budgeting journey in the hopes of sparing…

A curated playlist of cooking skills by the FoodLinc team.

Every student needs to budget, so here are my tips from first-hand experience.

I understand the necessity of setting a realistic budget and how important it is to follow this and plan out…

Grab some bargains and spruce up your accommodation!

The LinCard

At the University of Lincoln we want to make sure that all our students have great opportunities to support their financial wellbeing and we continually look for ways to do this. We are now delighted to have a totally unique offering for our students and to be launching the LinCard cashback card which is available for free to all our students.

The LinCard is a debit card that allows you to budget your finances but uniquely also allows you to earn cashback when it is used at a number of high street stores including Boots, Asda, Argos, Halfords, Harvester, Primark, The Body Shop and many, many more.

More information is available on the attached leaflet or to sign up for you card simply follow the QR code below. If you have any questions then please email [email protected]

Transport and travel

Public transport is a sustainable way to travel, and, as a student, you can apply for a range of travel cards depending on your travel needs. If you are travelling by train, then you can apply for a Student Railcard for 1/3 off rail fares throughout the UK. For coach travel, the National Express student discount gives 15% off fares.

Course Related Travel Grant:

You can apply for a contribution towards associated travel costs where there is a direct link between the course and the travel, for example, a field trip, conference etc. Students who make these applications are also encouraged to apply for Financial Assistance Funds where appropriate.

The University supports sustainable travel, and you can find more information on bikes and cycle routes below.

Energy saving & sustainability

If you are living in private accommodation, make sure to find out how you will receive the Government’s £400 energy bills discount available to help households this winter.

The Energy Saving Trust also has tips on how to use less gas and electricity, where small changes may be able to save you a lot of money.

Ofwat provide suggestions on how to save water around your home.

If you are living in University-managed accommodation, your utility bills (water, heating and lighting) are included in the cost.

Additional resources

You can buy and collect food that would otherwise go to waste directly from businesses via this app.

Join millions of neighbours all over the world who are using OLIO to share more, care more and waste less.

Save the Student provides free, impartial advice to students on how to make their money go further.

Save money and reduce food waste.

We will be regularly updating this hub with more information and if you have ideas about what we can do to help, or suggestions of other areas for us to explore, please let us know by contacting your Students’ Union at [email protected] or the Student Advice & Support team at [email protected] .

We use cookies to understand how visitors use our website and to improve the user experience. To find out more, see our Cookies Policy .

- Stansted Airport

- Luton Airport

- Heathrow Airport

- Gatwick Airport

- Dublin Airport

- London to Stansted

- London to Luton

- Heathrow to Gatwick

- London to Gatwick

- Luton to London

- London Stratford to Stansted

- Manchester Airport

- Bristol Airport

- Birmingham Airport

- Bristol to London

- London to Bristol

- London to Leicester

- Leicester to London

- London to Manchester

- London to Nottingham

- Bournemouth to London

- Glastonbury 2024

- Taylor Swift Eras Tour

- England v Iceland

- Take That in Bristol

- Lost Village 2024

- Foo Fighters in Cardiff

- Boomtown Fair

- Download Festival

- Royal Ascot

- British Grand Prix

- Challenge Cup Final

- NFL in London

- Vehicle types for hire

- Coach hire for school trips

- Coach hire for events & occasions

- Coach hire for business trips

- Coach hire for sporting events

- Coach hire for airport transfers

- Cheap coach tickets

- Buy a Coachcard

- Using a voucher code

- Student offers

- Group offers

- How to book special offers

- Young Person Coachcard

- Senior Coachcard

- Disabled Coachcard

- Travelling with us

- Our coaches

- Sustainability

- Carbon offsetting

- Customer experience

- Onboard safety

- Accessibility

- Exploring on a budget: Free things to do and see

- Affordable things to do by the beach this summer

- 6 things to do in Leeds in a day

- Live service updates

Track your coach

- Explore our route map

- View our timetables

- Ukrainian free travel

- Refunds & amends

- Frequently asked questions

- Luggage & lost property

- Safety & security

- About our tickets

- Flexible travel

- Change & go

- Seat reservation

- Ticket & trip insurance

- London Victoria

- London Golders Green

- All Stations

- Manage my booking

- Destinations

- Why we're No. 1

All Airport Transfers

All Destinations

All Coach Hire Options

- Read our blog

All Help & Advice

Student coach travel

Get going with affordable, high quality travel.

Choose Your Journey

- Use my current location

- Use our Route Map

Outbound date

Select time, outward journey, return date.

Select a return within 3 months of your outward travel.

Return Journey

Children under 14 years of age are not permitted to travel without being accompanied throughout the journey by a responsible person aged 16 years or over. Children aged 14 - 15 years old may travel unaccompanied, as from 5am, arriving at their booked destination no later than 10pm. Unaccompanied children will be asked for proof of age or a signed letter of permission from their parent/guardian. (sms or chat based messages are not permissible)

One infant aged 0-2 travels free when accompanied by an adult with a valid ticket. Additional infants aged 0-2 must be paid for. If you are travelling with more than 1 infant aged 0-2, please book the additional infant as 'Children (3-15).

Do you have a Coachcard?

Get 15% off with UNiDAYS here

Get 15% off with Student Beans here

Get 15% off with Prime Student here

Get 15% off with TOTUM here

Your new favourite way to travel.

- Our commitment to the environment

Travel doesn't have to cost the earth...

Sign up today and pay no booking fees..., right to the heart of the action, head direct to the uk's biggest festivals and events with us..., never travelled with us, find out why we're the nation's favourite coach company....

See where your coach is in real-time and plan your journey...

Start tracking

Find your local stop, plan where you're going & explore different routes...

Explore our maps

Pay in 4 and spread the cost of your journey...

Find out more

We're now on TikTok

Did you know we've joined in the fun on TikTok?

We'll be regularly updating it with plenty of lighthearted videos, showcasing life on board our coaches.

Follow us on TikTok

Join in the conversation on Twitter, Instagram & Facebook

Want to keep up with our comings and goings? Or have a question for our team? Follow us on social media for regular updates, travel tips and nice pictures of a coach or two.

Follow us on Twitter

Visit our Facebook page

Follow us on Instagram

Young Persons Coachcard

Save 1/3 on standard fares for one low yearly price..., find the best places to visit, offers, upcoming events & more....

- "Absolutely brilliant service. Drivers were helpful, friendly and professional."

- "Easy to sort out tickets, great service, will definitely use National Express again in the future."

- "Very professional in maintaining the safety of all passengers."

- "We've never had a coach driver more kind and helpful."

Back to top

Email Sign Up

Subscribe for updates & special offers!

Download Our App!

Book tickets & track your coach anytime, anywhere.

- Career opportunities

- Conditions of carriage

- Cookie policy

- Corporate governance statement

- Gender pay report

- Luggage policy

- Open Return tickets

- Passenger rights

- Privacy Centre

- Rail disruption

- Service updates

- Slavery & human trafficking statement

- Student travel

- Terms & conditions

- Youth promise

Call or get in touch online We are here to help

Coach Tracker

Track your coach in real time

National Express West Midlands

Part of Mobico Group

© Copyright National Express Ltd 2024

Open Return Information

Book your return

Your Open Dated Return is valid for 3 months from your outbound journey. To guarantee your seat on your return you need to confirm your ticket before you travel on www.nationalexpress.com/en/help/tickets/open-returns or call 0371 781 8181.

Open Dated Return Information

If your return date is not yet known, open return tickets provide flexibility. When travelling within the UK, the return journey can be made within 3 months of the outward date of travel. To guarantee your seat on your return journey you need to confirm your ticket before you travel by visiting www.nationalexpress.com/en/help/tickets/open-returns or call us on 03717 81 81 81. Lines open 7 days a week, 8am - 8pm (calls to this number are charged at local rate). Valid on any day throughout the year.

Open returns are not available on European journeys.

Wheelchair accessibility

Accessible coaches.

The majority of stops along the routes listed below are accessible to wheelchair users but are subject to change. Please call us to check the latest situation before booking and at least 36 hours in advance of when you would like to travel.

To see a list of accessible coach routes please visit our Accessibility page.

Assisted Travel Helpline

If you are travelling in a wheelchair or require assistance, please call our helpline before booking and at least 36 hours in advance of when you would like to travel.

03717 81 81 81 - ( option 3) (lines open 8am - 8pm 7 days a week). Calls to this number are charged at local rate.

For more information please visit our Disabled travellers page.

Passengers & Wheelchair accessibility

Passenger descriptions.

Our passenger descriptions are designed to help you choose the right ticket for yourself or your fellow travellers.

Adult (16+) and Children (3-15)

Children under 14 cannot travel alone unless accompanied by an adult (16+). Please note, you may be required to show proof of age at any point during your journey. Failure to do so, may result in the full adult fare being charged.

Children (3-15)

Children under 14 cannot travel alone unless accompanied by a responsible adult (16+).

Disabled Children

Should be booked as Children. If they are travelling in a wheelchair or require assistance, please call our Assisted Travel Helpline.

We strongly recommend that you bring a car seat appropriate to your child's age, but ask you to take responsibility to fit the seat.

Booster Seats

Children aged between approximately 4-11 years old, or up to 150cm tall, may use booster seats. We carry a limited number onboard most coaches.

If travelling with a child, you may be required to show proof of age when buying tickets or at any point during your journey. Failure to do so may result in the child being required to pay the full fare for the journey on that day.

Booster seats

Children aged between approximately 4 years and 11 years or up to 150cm tall may use booster seats, we carry a limited number onboard most coaches along with our comfort fit seat belts.

Disabled children should be booked as children rather than 'Disabled'. If they are travelling in a wheelchair or you wish to book assistance with travel please call our Assisted Travel Helpline before booking and at least 36 hours in advance of when you would like to travel.

You can find a list of accessible coach stops on our Accessibility page .

Please call us 36 hours prior to travelling to check the latest status.

If you are travelling in a wheelchair or require assistance we recommend that you contact us on the following local rate telephone number: 03717 81 81 81 (lines open 8am - 8pm 7 days a week) 36 hours in advance of when you would like to travel.

Adult (26 - 59)

Adult fares are applicable to all passengers aged between of 26 and 59 inclusive.

Child 0 - 12 inclusive

Children aged 12 or under travelling on any European service must be accompanied by an adult aged 18 or over.

Unaccompanied children will not be carried

Young persons (13 - 25)

Children under the age of 16 are not permitted to travel on any European service unless accompanied by an adult aged 18 or over.

Young persons aged 16 or 17 years can travel alone on European services but only if they have a letter of authority from a parent or guardian.

Senior (60 and over)

Passengers aged 60 and over are entitled to receive a small discount on European journeys. On European journeys a 50% discount is given to carers, please call us on 08717 818177 to book.

Please select your passenger type first and then add your coachcards.

We have three different Coachcards available, each offering savings of 1/3 on all of our Standard and Fully Flexible coach fares all year round.

Prices shown include your coachcard discount, your coachcard number will be required during the booking process.

Adult fares are applicable to all passengers aged 2+. Adults under the age of 16 are not permitted to travel alone on any European service unless accompanied by an adult aged 18 or over or they have a letter of authority from a parent or guardian.

Infants 0-1 Inclusive

Children aged under the age of 2, must be accompanied by an adult aged 18 or over. Unaccompanied children will not be carried.

Don't already have a Lincoln Access Rewards™ Visa ® Card?

With the Lincoln Access Rewards Visa ® Card, you’ll earn Lincoln Access Rewards Points on every purchase. Having access to more Points should help to make your Lincoln journey even more rewarding.

Explore all that your credit card account has to offer.

Account features & benefits.

Enjoy the convenience and many benefits your account has to offer.

Online Account Center

Manage your account online to check balances, view transactions, make payments and more.

Account Safety Features

Know your account is protected with Zero Liability 3 , Fraud Monitoring and more.

Tools & Resources

Use tools, get answers and review tips to help you make the most of your account.

Earning Lincoln Access Rewards Points

Turn your everyday purchases into Points. You’ll earn Lincoln Access Rewards Points that can be redeemed toward discounts on Lincoln Purchases like your next Lincoln Vehicle, Lincoln Service and Maintenance, and Lincoln Parts.

Your Points add up fast

Wherever the road leads, your card will help you earn on every purchase from the dealership and gas station to restaurants and parking.

- 5% Back in Points 1 on Lincoln Dealership Purchases

- 3% Back in Points 1 on gas, travel, dining and entertainment purchases

- 1% Back in Points 1 on All Other Purchases

- 10% Back in Points 1 on Lincoln Service ‐ That's 5% Back in Points on Lincoln Dealership Purchases plus 5% Back in Points with Lincoln Access Rewards

Pick up more Points along the road ahead

You’ll earn a $200 Annual Statement Credit 1 when you spend $6,000 in 12 consecutive billing cycles from account opening.

Fully loaded benefits

Your card also comes with Everyday Special Financing with 0% APR 2 for 6 billing cycles from the date of purchase on Lincoln Dealership purchases over $499 . After your 6 billing cycles expire, your APR will then go to the Eligible Purchases Variable APR based on the Prime Rate. See your Rates and Terms Schedule for details.

Your Account, Your Way.

Enjoy convenient access to your accounts 24/7.

Important Information Please see your Rates and Terms schedule for important information on rates, fees, costs, conditions, and limitations. We reserve the right to change your account terms for reasons described in your Cardmember Agreement. Please note you must pay your entire statement balance (with the exception of purchases made with this promotional rate during its promotional rate period) in full by the payment due date each month to avoid being charged interest on new non-promotional purchases from the date those purchases are made. 1 See your Lincoln Access Rewards Visa ® Terms and Conditions for details. Points are not redeemable for cash. Please see the Lincoln Access Rewards Program terms and conditions at LincolnAccessRewards.com for information regarding expiration, redemption, forfeiture and other limitations on Lincoln Access Rewards Points. Must be enrolled in Lincoln Access Rewards. 2 For additional information about Annual Percentage Rates (APRs) fees and other costs, see your Rates and Terms Schedule. 3 Visa's Zero Liability policy covers U.S. issued cards only and does not apply to PIN transactions not processed by Visa or certain commercial card transactions. Cardholder must notify issuer promptly of any unauthorized use. Consult issuer for additional details or visit visa.com/security . FICO and “The score lenders use” are trademarks and/or registered trademarks of Fair Isaac Corporation in the United States and other countries.

Card by FNBO

Student Services

Student visa.

Who needs a Student Visa, how do you apply, what are the financial requirements.

Before You Apply

Do not take advice about any aspect of your Student immigration application from your friends, from online forums or communities, or from anyone else who is not regulated to offer immigration advice. Following bad or misinformed advice from non-professionals can mean your Student immigration application will be refused.

The International Advice Team are the only people who are legally allowed to give Immigration Advice at the University of Lincoln.

If you would like to speak to an International Adviser in confidence please email: [email protected] or call 01522 837080.

Students starting their course from January 2024 will not be able to bring dependants with them unless they are going to be studying on a Postgraduate Research course or a PhD course.

Further information can be found on ukcisa dependants..

Most students from outside the UK beginning a full-time course of six months or longer at the University of Lincoln will require a student visa.

For courses or study periods of less than six months, you may require a Standard Visitor visa instead of a student visa.

Students from the EU, EEA and Switzerland are now included within the Student route and will require a student visa unless they have settled or pre-settled status under the EU Settlement Scheme or another valid right to reside in the UK.

If you are a UK national, UK citizen or permanent resident, or if you already have permission in a different immigration category which permits study, such as a student dependant visa, you may not need to apply for a student visa.

Students from Hong Kong who have a ‘British national (overseas)’ nationality may be eligible for the UK’s new BNO visa. Find out more on the UK government website .

Please contact the International Advice Team for further advice if you are unsure about your immigration options.

How long you can stay and study depends on the length of your course and what study you’ve already completed in the UK.

If you apply for your visa under the new Student Route from the 5 October 2020 there is no limit for time spent studying with Student permission at postgraduate level (RQF level 7) and above.

Studies at Undergraduate level, (RQF level 6), is still subject to the 5 year time limit

Studies below degree level, (RQF level 3, 4 or 5), are subject to a 2 year time limit.

Further guidance can be found on UKCISA showing exactly how long you can stay.

You can apply for Student immigration permission whilst in the UK if you meet ALL of the following three requirements:

1. You can apply in the UK if you are not in the UK on immigration bail, and if you currently have any type of immigration permission except :

• visitor • short-term student • parent of a child student • seasonal worker • domestic worker in a private household • permission outside the Immigration Rules

It is extremely important that you do not apply in the UK if you hold one of the types of immigration permission listed above because the Home Office will treat your application as invalid. This means that they will not consider your application and you will have no right of appeal or administrative review against their decision.

2. The start date of your new course of studies (as stated on your CAS) can be no more than 28 days after the end of your current visa. If the start date is later, you cannot apply in the UK and must leave and apply from your home country.

3. If you currently hold Tier 4 (General) or Student immigration permission, the “Evidence Used” field of your CAS statement must confirm that your new studies show academic progression in order for you to extend in the UK.

You cannot submit your application until you have been issued a CAS by the University of Lincoln.

You will need to make your application online and pay the Immigration Health Surcharge (IHS) fee, biometric enrolment fee and the application fee before being able to complete and submit the application.

* You cannot travel outside the UK before you have a decision on your visa application. If you travel before you receive a decision, your application will be withdrawn, and you must make a new application before being able to return to the UK *

Click here to start your student visa application inside the UK.

As part of your application you will be asked to prove your identity .

If you have previously submitted your biometrics (photograph and fingerprints) to the UKVI before, you may be invited to use the Identity Verification (IDV) app to complete your application. If eligible to use the app, you will be instructed to download this following submitting your application. The app works on most Android and iPhone smartphones and means that the biometrics that you submitted previously will be re-used.

If you are instructed to use the app, you will be asked to take a photo of yourself and your travel documents and upload your mandatory and optional documents using your smartphone. The UK government have provided guidance about uploading evidence as part of the visa application

If eligible to use the app, you will not be required to attend a UKVCAS centre.

If you are not eligible to use the IDV app, you will be directed to Sopra Steria’s website to book an appointment at a UKVCAS service point centre. A combination of free appointments and chargeable appointments are available at all service points across the UK. The only exception to this is if you book an appointment at the Premium Lounge which will always incur a fee.

The earliest you can apply is 6 months before the start date of your course.

Make sure you allow enough time for your application to be processed so that you can arrive in the UK in time for the start of your programme of studies.

Making an Application

Click here to start your student visa application from outside of the uk.

The UK Council for International Student Affairs (UKCISA) has detailed information and links to help you make a Student Visa application from outside of the UK .

The University of Lincoln cannot assist you to complete an application being made outside of the UK but the International Advice Team is happy to answer any questions you may have about the process or sections of the application that you may be unsure about. Please email [email protected] if you require assistance.

A Confirmation of Acceptance for Studies or ‘CAS’ is an electronic document that the University of Lincoln will issue when they make you an unconditional offer. It is stored on a database the Home Office can see.

You cannot make a student visa application without first receiving your CAS.

The University of Lincoln will send you a unique CAS reference number which you will need to enter onto your online Student visa application form. The University should also provide you with the information used to generate your CAS, usually called the ‘CAS statement’. The CAS statement itself is not required for your Student visa application, but it gives you all of the information about your course and Student sponsor (University of Lincoln), and some of the information about money that you need to be able to complete your Student visa application form.

Your application may be refused if there are any discrepancies between the information used by your institution to generate the CAS and the information on your visa application form, so contact the University before you apply if you notice any details which might cause a problem.

If you currently have a Student visa for the UK, or if you previously had one (including a Tier 4 visa), or a pre-Tier 4 student visa, your CAS needs to confirm that you are making academic progress in your studies. For information about this, see the UK government Student and Child Student guidance .

The UK government has introduced restrictions for student dependant visas for courses starting from January 2024. Students studying on a Postgraduate Research course or a PhD course will still be able to bring dependants with them whilst studying.

Your partner and children (‘dependants’) may be able to apply to come to the UK or stay longer in the UK.

You must be one of the following:

- a full-time student on a postgraduate level course (RQF level 7 or above) that lasts 9 months or longer

- a new government-sponsored student on a course that lasts longer than 6 months

- a Doctorate Extension Scheme student

Full time students on an Undergraduate level course (RQF level 6 or below) cannot bring dependants to the UK whilst they are studying.

Your partner and child must each have a certain amount of money available to them. This is in addition to the money you must have to support yourself. (Please see ‘Financial Requirements for a Student Visa application’ below)

The Gov.uk website has further information for students wanting to bring their dependants to the UK whilst they study.

There are 3 payments that have to be made before a visa application can be submitted. These payments are the Immigration Health Surcharge (IHS), the Biometric Enrolment fee and the Visa Application fee.

- You will need to pay a Visa Application fee for each person included on your visa application. The most up to date fee figures can be found on Gov.uk – Student Visa fees

- You will need to pay the Immigration Health Surcharge (IHS) fee for each person included on your visa application. The IHS fee will increase for all applications made on or after the 6th February 2024. The most up to date IHS fees can be found on Gov.uk – IHS fees

- You will need to pay a Biometric Enrolment fee for each person included on your visa application. The most up to date fee figure can be found on Gov.uk – Biometric fees

You will need to provide supporting documents with your Student immigration application. The documents for you will depend on your individual circumstances.

Further information about supporting documents can be found on Gov.uk – Documents you will need

Documents required for all students

- Passport and previous passport(s) or travel document.

- Confirmation of Acceptance for Studies (CAS)

Documents some students may need to provide (depending on your situation)

- Qualifications and English language assessment .

- Evidence of your finances showing you have enough funds to pay your tuition fees and support yourself whilst studying in the UK, unless you are applying in the UK and have held permission to be here for 12 months or longer, or if you are from an exempt country. If you are from an exempt country, you still need to prepare the documents, but only need to provide them if later requested by UKVI.

- Additional evidence if you are showing funds in your parent’s or partner’s account, unless you are applying in the UK and have held permission to be here for 12 months or longer, or if you are from an exempt country. If you are from an exempt country, you still need to prepare the documents, but only need to provide them if later requested by UKVI.

- TB test certificate if applying from overseas and resident in an applicable country

- Official translation of any documents not in English or Welsh.

- ATAS clearance if studying an applicable course.

- Letter of permission from your parents if you are 16 or 17

- Legal documents as evidence of a name change if you have changed your name (an affidavit would NOT be acceptable)

- (you CANNOT apply in a country that you are visiting)

- Current BRP card (if you have one)

- Current up-to-date Police Registration Certificate (if applicable)

- Additional documents if you are planning to bring family members with you as your dependants

- Letter of consent if you are currently in the UK and are financially sponsored by a government or an international scholarship agency or if you have been financially sponsored by a government or international organisation within the last 12 months. The University of Lincoln is not a government or international scholarship agency and so you will not need a letter of consent if you have been sponsored by us.

- Any other documents relevant to your application

The required documents for an application can be original or high quality copy. UKVI reserve the right to see the original documents or contact the issuing authority to verify any documents submitted in support of an application.

There are financial requirements placed on any Student Visa application by the UK Home Office.

You must show that you have enough money to pay the tuition fees for your course and to support yourself and any other people (called dependants) who are included on your visa, unless you’ve been in the UK with a valid visa for at least 12 months on the date of your application.

You will need to provide evidence showing that you have had the required funds for at least 28 consecutive days and the evidence cannot be more than 31 days old when you make your application.

For example; If you submit your application on 1 January 2024, you’d have to show that the funds were in your bank account for at least the 28-day period ending on 1 December 2023.

Further information about financial requirements can be found on the UKCISA website.

Course (Tuition) Fees

You must have enough money to pay for the course fees for the first year of your course, or the entire course if it is less than one year long. If your CAS has been issued for further study on a course that you are already partway through, the ‘first year of study’ means the first year of this new period of study. The Home Office will use the details in your CAS to confirm how much money you need for your course fees.

If you have already paid some or all of your course fees, your CAS will confirm this. If you pay some or all of your course fees after you have received your CAS you do not need to ask for an updated CAS and can use the receipt of payment provided by the University of Lincoln as evidence for the Home Office.

Living Costs (Maintenance)

The Home Office uses fixed amounts, but please bear in mind that these amounts will not reflect your actual living costs whilst studying in the UK.

Further information about actual living costs, including accommodation costs whilst studying in Lincoln can be found on our ‘ Living in the UK ‘ page.

- To study at the University of Lincoln, you will need to show the Home Office that you have £1,023 available for your living costs for each month of your course, up to a maximum of £9,207 for a course lasting nine months or more.

- In addition, you will need to show the Home Office that you have an additional £680 available for the living costs for each dependant for each month of the course, up to a maximum of £6,120 for each dependant for a course lasting nine months or more.

Use the course start and end dates on your CAS to calculate the length of your course and therefore how many months’ maintenance you will need. If the length of your course includes a part of a month, round it up to a full month. For example if your course dates are 30 May until 1 October, this is four months and two days so you would need to show five months’ of funds.

You can deduct the following from the total amount of money that you need as part of your immigration application:

- money that you have already paid to the University of Lincoln towards your course fees, and

- up to £1,334 that you have already paid to your Student sponsor for your accommodation fees, if you are going to be living in university accommodation.

You cannot deduct any advance payment for any other type of housing, nor can you adjust the amounts if you will have no housing costs (for example if you will be living with a relative free of charge).

Your CAS may include details of any money paid to your institution. If not, you will need to provide a paper receipt confirming how much you have paid towards your course fees and/or your accommodation fees.

When your visa application is approved evidence of your permission to be in the UK will be issued to you as a biometric residence permit (BRP), separate from your passport. A BRP is a plastic card similar to a credit card which contains your personal information, your biometric information (photograph and fingerprints) and states your immigration status and some of your conditions.

Further information can be found on the University of Lincoln’s Biometric Residence Permit (BRP) page.

If you applied for your visa from outside the UK, you’ll need to collect your BRP once you’re in the UK.

You must usually do this before the vignette sticker in your travel document expires or within 10 days of arriving in the UK, whichever is later.

When you are completing your Student Visa application form, you will usually be prompted to choose a location to collect your BRP (biometric residence permit). The form will normally default to the Stonebow Centre Post Office , which is the nearest Post Office to the University of Lincoln campus.

You can enter an “Alternative Address Postcode” to select a different Post Office if the Stonebow branch is not the most convenient Post office branch for you.

You should choose the most convenient Post Office branch for where you are living or studying.

If you want to pick your BRP up from a different Post Office branch once you are in the UK you will need to go online to do this and you will required to pay a fee. Check that the Post Office branch you want to use offers a ‘BRP collection service’.

When your Student immigration permission is granted, you will also be issued with a visa decision letter explaining the student visa conditions. Normally, this letter will also confirm the date and Post Office location where you can collect your BRP. Keep this letter safe for your reference.

If your visa decision letter does not confirm the Post Office where you can collect your BRP, you should check the payment section of your visa application form for the Post Office location. If you do not have a copy of your completed application, you should be able to log in to your UKVI account and access a pdf.

You will need to have a Tuberculosis (TB) test if you are coming to the UK for more than 6 months and you are resident in one of the listed countries on the UK government website.

If your test shows that you don’t have TB, you’ll be given a certificate which is valid for 6 months. You will need to apply for your visa within this 6 month period and include the certificate with your Student application.

You do not need to take a TB test if:

- you are applying for your visa in the UK; or

- you are coming to the UK for less than six months; or

- you lived for at least 6 months in a country where TB screening is not required by the UK, and you’ve been away from that country for no more than 6 months

If you do not need to take a TB test because you have lived for at least 6 months in a country which does not require TB screening, and you have been away from that country for no more than 6 months, then it would be a good idea for you to highlight this in a cover letter and the ‘additional information’ section of the Student immigration application form. You may also wish to provide evidence of your immigration status in the third country (e.g. a residence permit for this country) and evidence about what you were doing in this country (e.g. a letter from your School or Employer in the third country).

For more information about Tuberculosis testing, visit the UK Government website .

The Academic Technology Approval Scheme ( ATAS ) applies to all international students and researchers (apart from exempt nationalities) who are subject to UK immigration control and are intending to study or research at postgraduate level in certain sensitive subjects. If you are applying to study an undergraduate course with an integrated masters year you may also need ATAS clearance.

The subjects and research areas are those where knowledge could be used in programmes to develop Advanced Conventional Military Technology (ACMT), weapons of mass destruction ( WMDs ) or their means of delivery. Researchers and students in these sensitive subjects must apply for an Academic Technology Approval Scheme ( ATAS ) certificate before they can study or start research in the UK.

Students and researchers who are nationals of EU countries, the European Economic Area ( EEA ), Australia, Canada, Japan, New Zealand, Singapore, South Korea, Switzerland or the United States of America do not need an ATAS certificate.

Find out if you need an ATAS certificate

Guidance on how to apply for an ATAS certificate

If you follow this advice guide and the resources it mentions you should be able to make your Student application by yourself. However, if you do feel that you need some help or if you have a specific question about your application, here are your options;

- Contact the University of Lincoln International Advice Team

- The UK Council for International Student Affairs (UKCISA) website contains lots of useful guidance and resources for international students including applying for immigration permission.

Related topics

Life At University

University life can be a fantastic experience, but it also comes with its own challenges, see what support is available here.

Respecting others is a big part of University and staff and students are expected to create a welcoming and inclusive environment.

Academic support

We can help you clarify the University's rules and regulations and what options are available to you.

Health and Wellbeing

Advice on ways to look after yourself, health advice, specific disability advice, and self-help resources.

We use cookies to understand how visitors use our website and to improve the user experience. To find out more, see our Cookies Policy .

Students receiving postcards from all over the world at Lexington elementary school

L EXINGTON, Ky. (WKYT) - When you walk through the halls of Squires Elementary School, you see many flags. Embracing different cultures is something they’re used to.

“So we are calling this our global bulletin board,” said K-5 English Language Teacher Katie Branch. “The idea was to get as many postcards from around the world as possible.”

Students at Squires Elementary School have had their horizons expanded this year. Their postcard collection continues to grow.

“We have six of our seven continents,” said Branch. “We are waiting on Antarctica. It’s supposed to be coming in September. It’s winter there, so they’re not sending a lot of mail. We have all 50 states, and we have over 50 countries.”

The idea behind the postcards is to learn about different cultures and create meaningful conversations.

“We’re a pretty diverse school,” said Branch. “There have been a lot of interesting conversations through the hallway with the students.”

Students in one fourth-grade class decided to take the project even further by writing to different countries.

Ethan Wilson was one of those students. His class wrote to the Philippines.

“I sent it to a museum,” said 4th grade student Ethan Wilson. “We’re in a project trying to collect postcards from as many countries as we can, and we would like a postcard.”

For other students, postcards are a way to show their peers where their family came from.

“It feels like I’m sharing my family but in a different way as a country,” said 1st grade student Abigail Quispe Fuentes.

Abigail Fuentes received cards from her grandparents in Mexico and Peru.

She has loved being able to teach her classmates about what makes each country special.

“For me, it’s the food, the people that are so nice, they talk to me in Spanish, they’re like the same as me,” said Fuentes.

Each card brings new meaning to the world around us.

“We have some that are hand drawn,” said Branch. “We’ve had some places that we’ve reached out to; Liechtenstein also sent us chocolate when they sent us a postcard.”

And a new sense of adventure.

“That’s what I feel right now; I want to travel,” said Fuentes.

And while the school year may be coming to an end, the postcard project is not. They plan to continue the project next year.

If you would like to send a postcard, you can mail it to Squires Elementary School at 3337 Squire Oak Dr, Lexington, KY 40515, Attn: Katie Branch.

Here is the list of countries still needed:

- Burkina Faso

- Central African Republic

- Equatorial Guinea

- Guinea-Bissau

- Ivory Coast

- Sao Tome & Principe

- Sierra Leone

- South Africa

- South Sudan

- Afghanistan

- North Korea

- Philippines

- Saudi Arabia

- Timor-Leste

- Marshall Islands

- Papua New Guinea

- Solomon Islands

- Bosnia and Herzegovina

- North Macedonia

- Vatican City

- North America:

- Antigua and Barbuda

- El Salvador

- Puerto Rico

- Saint Kitts & Nevis

- Saint Lucia

- St. Vincent & Grenadines

- Trinidad & Tobago

- South America:

Watch CBS News