Rafting Travel Insurance

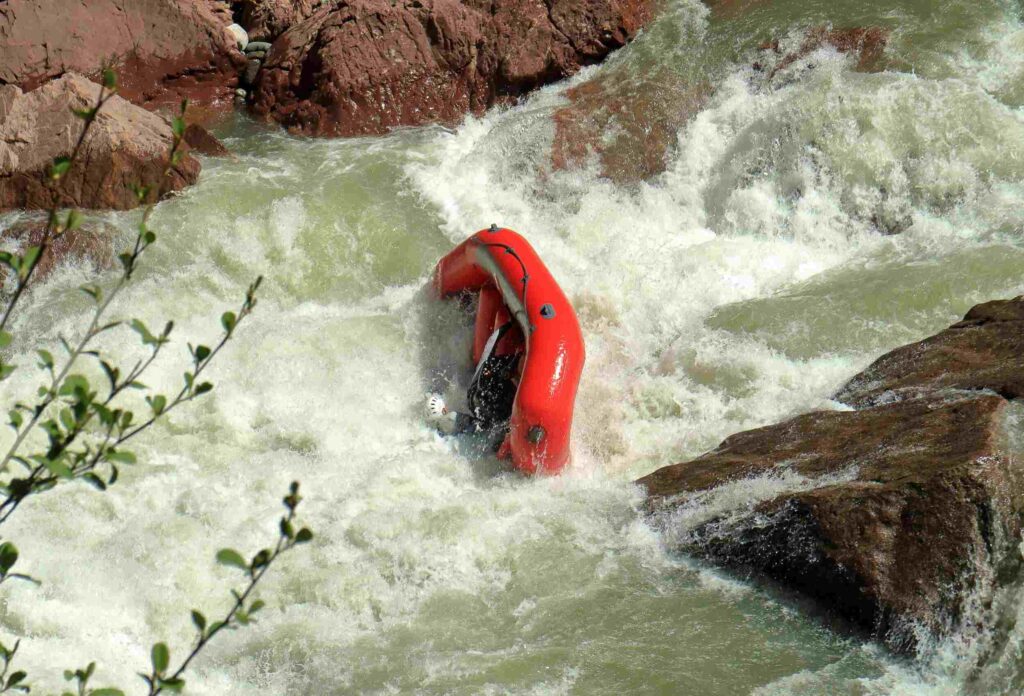

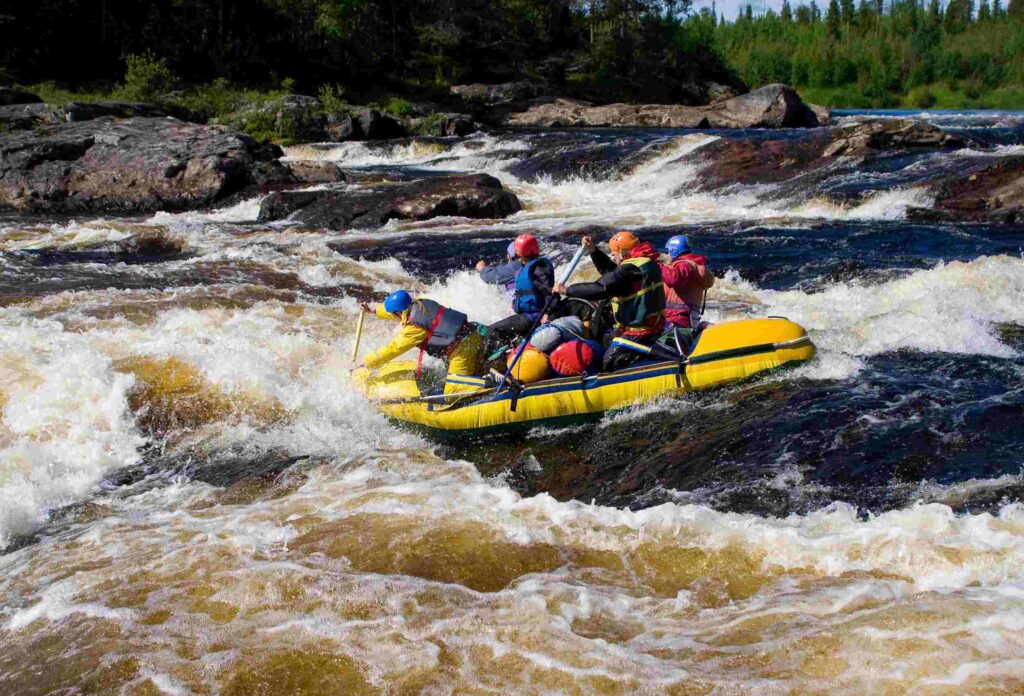

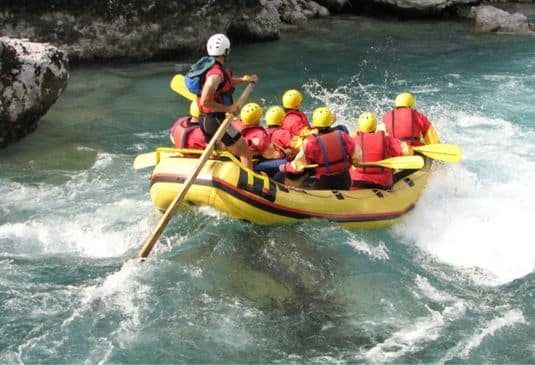

Rafting is floating on rafts or kayaks on mountain rivers with rough currents. This extreme sport allows combining the drive of a high-speed raft with stops on the shore at the campfire. Earlier, this sport was only for professional athletes with a good level of fitness. Now rafting has become popular among tourists. Groups of thrill-seekers go down the safest routes, but the risk of injury remains high. In order to avoid high costs in case of damage, it’s necessary to buy rafting insurance.

Need for Rafting Travel Insurance

It’s necessary to buy an insurance policy for everyone who is planning a rafting trip. Insurance is available for various terms and differs by options and costs included in a policy. It can either cover injuries treatment or all situations on the list of insured events.

Before rafting, a trainer must check if a tourist has an insurance policy. If there is no insurance, he has no right to allow tourists even to the training. No instructor will risk his reputation and work. So, without insurance, you have no chance of rafting on raging water.

Cases Covered by Rafting Insurance

Unfortunately, rafting is considered an extremely traumatic sport because injuries can lead to different effects. Insurance guarantees payments with:

- slight and medium bodily injuries;

- serious injuries that require long-term treatment and rehabilitation;

- damages resulting in disability;

You can buy rafting insurance at a favorable price in the Sport Travelling company for a trip, a season, or a year. Calculate the cost of a policy individually on the website.

Types of Rafting Insurance

Travelers and professional athletes can buy an insurance policy. Companies offer these types of rafting insurance:

- for a particular sports event;

- for one year coverage;

- for children with 24-hour coverage;

- for competitions abroad;

- single or multi-trip.

Child insurance policy includes coverage for the cost of treatment for injuries got while rafting and accident insurance.

Recommendations for Safe Rafting: 8 Key Tips to Follow

If you’re new to rafting, these tips can help ensure a safe and enjoyable experience. Experienced rafters may also find these tips useful.

Coverage Provided by Rafting Travel Insurance

The standard policy covers expenses abroad related to:

- transportation to a medical facility;

- emergency inpatient or outpatient treatment;

- need for emergency dental care;

- evacuation of an insured person to his/her home country;

- repatriation of human remains.

You may include other types of insurance in the policy for rafting at additional cost.

The price of an insurance package depends on such details:

- traveler’s age;

- trip duration;

- coverage amount;

- extra options.

You can take out and buy a policy in a few minutes at a favorable price from the sportravelling.com company. The process goes online and, as per customer comments and saves money and time.

The insurance price depends on a traveler’s age, trip duration, insurance coverage, and extra options included in a policy.

A valid travel insurance policy may include coverage for injuries received during rafting.

An insurance policy covers transportation to a medical facility, outpatient or inpatient treatment, emergency dental care, evacuation, and repatriation of tourists.

Adventure Travel Hub

Travel Resources for Adventurers

Home » Travel Insurance » Reviews » Best Travel Insurance For White Water Rafting

Best Travel Insurance for White Water Rafting

Written by Antonio Cala

- Affiliate Disclosure

Table of Contents

Embarking on a white water rafting trip is an adrenaline-pumping experience that combines the beauty of nature with the thrill of navigating rapids. However, the unpredictable nature of white water rivers can pose risks, making it essential to be prepared for any scenario.

The right travel insurance is a crucial part of that preparation, providing a safety net against potential mishaps.

In this article, we’ll explore the best travel insurance options for white water rafting enthusiasts, focusing on policies that offer comprehensive coverage for emergency medical care, evacuation, equipment loss, and trip cancellations, ensuring you can ride the rapids with confidence.

For an in-depth analysis of insurance choices tailored for adventure travelers, don’t forget to check out the Ultimate Guide to Adventure Travel Insurance .

Quick Recommendations

If you want some quick recommendations, here is our infographic to help you choose the best insurance for your next white water rafting trip.

White Water Rafting Travel Insurance Overview

Understanding travel insurance for white water rafting.

White water rafting insurance is a specialized type of adventure travel insurance tailored for individuals participating in white water rafting excursions. This insurance is crucial as it offers coverage for medical emergencies, evacuation, and repatriation, which are vital for any rafting adventure. Without such insurance, rafters could be left with substantial medical costs in the case of an accident.

Moreover, this insurance also covers trip cancellations and disruptions, which can lead to significant financial losses. It is important to carefully examine the policy to ensure that it encompasses coverage for the specific white water rafting activities you plan to engage in, providing you with protection as you navigate the rapids.

What Does It Cover?

The majority of insurance policies for white water rafting trips typically provide coverage for the following four categories:

Medical Expenses

Incurring injuries during white water rafting can lead to significant financial repercussions. The cost of medical care can differ widely based on the region, and rafting in secluded spots may result in extra expenses for services like helicopter evacuation and medical repatriation.

Most white water rafting insurance policies include coverage for emergency medical assistance, often with generous limits. Nevertheless, it’s imperative to recognize that the coverage for rescue efforts may come with a cap, potentially lower than the amount covered for medical treatment expenses. It’s always wise to review the details of your policy to grasp the full scope of coverage provided for these types of situations.

Equipment Coverage

Should you face the unfortunate event of your white water rafting gear being damaged, stolen, or lost, white water rafting insurance typically offers coverage that can vary from a small amount to several thousand dollars.

You’ll have the option to file a claim for the costs associated with repairing or replacing your equipment, and potentially for the expenses of renting substitute gear. This coverage guarantees that unforeseen incidents don’t financially burden you and enables you to proceed with your white water rafting trip with as little interruption as possible.

Trip Cancellation or Interruption

If an injury necessitates the cancellation or early termination of your white water rafting trip, white water rafting insurance enables you to claim reimbursement for the parts of the trip that remain unused. The extent of coverage for cancellations varies, often spanning from a nominal amount to several thousand dollars.

This aspect of white water rafting insurance ensures that you can recover a portion of the expenses from your interrupted plans, offering financial support in the face of an unexpected injury.

What Doesn't Cover?

When evaluating specialized travel insurance for white water rafting, it’s important to be aware of the exclusions that could affect your coverage. Some possible exclusions might include:

Unattended equipment: If your white water rafting gear is left unattended and gets stolen, your insurance coverage might be invalidated.

Disregarding travel warnings: If you choose to go white water rafting in a location against the advice of official organizations like the Foreign, Commonwealth, and Development Office, you may find that your insurance will not provide coverage.

Best Travel Insurance Policies for White Water Rafting Trips in 2024

Our Pick For

International Trips + Remote Locations + Any Nationality

Global Rescue

Nationalities: all nationalities are covered.

Pre-existing conditions: Yes.

Seniors Over 65: People aged 65-75 are included in the Individual Plan. Extended Plan memberships are available to those age 75-84 and include all services but are contingent upon completion of a medical form and a physician’s medical verification.

Trip Duration: Short term policies (7, 14 or 30-days) and long term policies (1 to 5 years) available.

Groups: Individual, family and student plans available.

Situations covered: It covers civil unrest, natural disasters, government evacuation orders and other security emergencies (when purchasing the Security package).

- Pros & Cons

Reasons To Buy

Remote locations coverage. Coverage available for 65-84. Pre-existing conditions accepted. All nationalities accepted.

Reasons To Avoid

The price is a bit higher than other insurance policies. However, no other company provides the same coverage as Global Rescue. It doesn’t cover trip cancellations or delays. It doesn’t cover equipment.

Worldwide field rescue (up to $500,000) in remote or dangerous environments. Global Rescue’s deployable teams are standing by to rescue their members from the point of illness or injury for any serious medical emergency.

Medical Evacuation. Global Rescue’s fully deployable medical teams have unparalleled capabilities to transport our members back to their home hospital of choice from anywhere in the world. This includes global COVID-19 transport.

Medical & Security Advisory Services. Global Rescue’s operations centers are staffed by experienced nurses, paramedics and military special operations veterans. Global Rescue also has partnerships with the Johns Hopkins Emergency Medicine Division of Special Operations, Elite Medical Group and Partners HealthCare, the Harvard Medical School affiliate.

Security Membership. Global Rescue’s teams of military special operations veterans are available to provide advisory, consultation and evacuation services for events like natural disasters, terror attacks and civil unrest when you are in danger.

Destination Reports & Event Alerts. Destination reports for 215 countries and principalities worldwide include entry requirements, COVID-19 travel status and restrictions, detailed health and security assessments and required immunizations. Keep up to date on health and security events worldwide.

My Global Rescue Mobile App. Access Global Rescue services in one location. Browse destination reports and alerts, activate emergency assistance, real-time virtual health visits and keep track of the people you care about with GPS tracking and messaging.

Security Package. Physical extraction when you are in danger of bodily harm. It includes civil unrest, natural disasters, government evacuation orders and other security emergencies.

Global Rescue is the most comprehensive travel protection available worldwide. It has the least restrictions and biggest coverage than any other medical insurance.

It’s a medical-only protection designed for adventure travelers planning to travel internationally or domestically for adventure activities such as white water rafting trips. All nationalities are covered and options for people over 75 are available.

Global Rescue is our preferred option for white water rafting trips worldwide.

Americans + Over 65 + Pre-existing Conditions

Nationalities: Only US citizens and residents are eligible.

Pre-existing conditions: Pre-existing conditions can be covered for Trip Cancellations and Interruptions, as long as you purchase your plan within 14 days of your initial trip deposit, and are medically able to travel when you purchase your plan.

Seniors Over 65: There is no maximum age limit.

Trip Duration: All plans cover trips up to 180 days.

Groups: Insurance policies for solo travelers, couples and families are available.

The prices are very competitive.

Plans are very customizable with plenty of extras available and the option of removing items you don’t need.

Pre-existing medical conditions accepted.

24/7 chat available with the Faye Mobile App

Only available to American residents.

Emergency Medical Expenses: Up to $250,000. If you experience sudden illness or injury in-trip, including COVID-19. We can cover prescription drugs, hospitalization and physician costs.

Emergency Evacuation: Up to $500,000. Coverage of transportation in the case of illness or injury that is acute, severe or life threatening when adequate medical treatment is not available in the immediate area.

Trip Cancellation: Up to 100%. If you need to cancel your trip for covered reasons, including if you get sick, contract COVID-19, or a travel provider goes bankrupt. We can cover flights, hotel bookings, tickets & activities, and quarantine accommodation.

Trip Interruption: Up to 150%. When you must unexpectedly cut your trip short or extend it for covered reasons, including if you contract COVID-19.

Trip Delay: Up to $4,500. Up to $300/day, for delays of more than 6 hours. When you’re stranded in transit due to reasons outside of your control such as flight delay or theft of passport.

Lost or damaged Belongings: Up to $2,000. Reimbursement for lost, stolen, or damaged luggage, including clothing, personal items and professional equipment like a phone or laptop.

Cancel for Any Reason: Up to 75% of Trip Cost. The ability to nix your trip for reasons other than those covered in your plan’s trip cancellation coverage, including fear of contracting COVID-19, as long as you purchase this coverage within 14 days of your initial trip deposit and cancel at least 48 hours in advance of your scheduled departure date.

Pet Care: Up to $2,500 in veterinary expenses & $250 for kenneling. Coverage of veterinary expenses if you take your furry friend along (including pet sickness or injury), or kenneling costs if you arrive back home later than expected.

Adventure & Extreme Sports: Up to $250K (international trips) or $50K (domestic trips) for accidental & sickness expenses. Medical and transportation coverage if you become injured while participating in an adventure or extreme sport, like skydiving, bungee jumping, motocross or free diving.

Faye insurance provides American residents one of the biggest medical coverages on the market at a very competitive price.

There’s no age limit and, with the Adventure & Extreme Sports Protection, you can get coverage for white water rafting.

We recommend Faye for Americans who want a complete travel protection for their white water rafting trip, including high medical coverage, trip protection cancellation & interruption, and baggage coverage.

Non Americans + Budget

World Nomads

Nationalities: Most nationalities can purchase insurance from World Nomads, including residents of the United States, Canada, the United Kingdom, India, Australia, or New Zealand. However, as of the current writing, most European residents are unable to buy a World Nomads policy.

Pre-existing conditions: Not covered.

Seniors Over 65: Travelers aged 70 and over are not covered.

Trip Duration: All plans cover trips up to 365 days.

The price is competitive.

Prices and coverage vary greatly by the country of residence.

Some European nationalities are not covered.

Pre-existing medical conditions not covered

Max age is 70 years old.

Emergency Accident & Sickness Medical Expense: Up to $100,000. Coverage is for medical expenses for emergency treatment of an accidental injury that occurs during the trip. Emergency treatment must be medically necessary and performed during the trip. Refer to the certificate / policy for complete details.

Emergency dental treatment: Up to $750. Coverage is for emergency dental treatment for accidental injury to sound, natural teeth. The injury and treatment must occur during the trip.

Emergency Evacuation: Up to $500,000. Coverage is for an accidental injury or sickness occurring during the trip that results in your necessary emergency evacuation. An emergency evacuation must be ordered by a physician who certifies that the severity of your accidental injury or sickness warrants your emergency evacuation. Refer to the certificate / policy for complete details.

Trip Cancellation: Up to $10,000. Reimburses for prepaid, non-refundable cancellation charges if you must cancel your trip (after the effective date) due to covered sickness, accidental injury, or death of you, a family member or traveling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike or other covered reasons. Refer to the certificate / policy for complete details.

Trip Interruption: Up to $10,000. Reimburses for prepaid, non-refundable, unused expenses if you must interrupt your trip (after departure) due to a covered sickness, accidental injury, or death of you, a family member or traveling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike, or other covered reasons. Refer to the certificate / policy for complete details.

Trip Delay: Up to $3,000. Coverage is for unused portion of pre-paid accommodation or additional expenses, on a one-time basis, if you are delayed en route to or from the trip for 6 or more hours due to a defined hazard as explained in the certificate / policy.

Baggage & Personal Effects: Up to $3,000. Reimbursement is for loss, theft or damage during the trip to baggage and personal effects (including sporting equipment) owned by you, provided you have taken all reasonable measures to protect, save and recover the property. Per article limit of $500.

Activities covered based on 4 groups. You pay more for higher group. The Explorer plan includes more activities than the Standard Plan. Extreme activities not covered (cave diving, free soloing, etc)

The World Nomads Explorer Plan is a great option if you’re looking for an affordable travel insurance that covers white water rafting activities.

We recommend World Nomads Explorers plan for rafting trips if you are not American or don’t want the full-protection that Faye provides.

Comparison Table

When choosing insurance for your white water rafting trip, the remoteness and accessibility of the rapids you’ll be navigating are crucial factors.

For rafters venturing into remote or hard-to-access rivers, Global Rescue stands out as an excellent option. It is renowned for its exceptional medical evacuation services, which are a cut above other insurance choices.

If your white water rafting excursion takes you to more accessible locations and you’re a US resident, consider Faye . It offers extensive medical coverage, includes pre-existing conditions, has no age limits, and provides protection for rafting activities.

For non-US residents setting off on white water rafting adventures in areas that aren’t extremely remote, the Explorer Plan from World Nomads is a solid pick. It delivers substantial medical coverage and is recognized for its value for money in the travel insurance market.

Other Travel Insurance Reviews

If you would like to read more about insurance options for other type of adventure trips, you can check out our other reviews below:

- Travel Insurance for Ski Trips

- Travel Insurance for Hiking Trips

- Travel Insurance for Mountaineering & High Altitude Trekking

- Travel Insurance for Mountain Bike Holidays

- Travel Insurance for Adventure Cruises

- Travel Insurance for Diving Liveaboards

- Travel Insurance for Adventure Motorcycle Trips

- Travel Insurance for Everest Base Camp Trek

- Travel Insurance for Mount Kilimanjaro Climb

- Travel Insurance for Seniors Over 65

- Travel Insurance for People with Pre-existing Conditions

White Water Rafting Travel Insurance Reviews Online

When doing your research, you might want to read what other publications have to say about the best travel insurance for white water rafting trips.

Here are some of the most popular articles I found interesting.

Rafting Travel Insurance: A Essential Guide – deviantart.com

Whitewater Rafting: 3 Travel Insurance Myths Debunked – tugo.com

About the Author

Antonio was born and raised in Southern Spain, and quit his job in 2013 to travel the world full-time with his wife Amanda for 10 years straight. Their passion for adventure took them to visit 150+ countries.

They cycled 25,000km + from California to Patagonia, sailed over 10,000NM around the Caribbean & Sea of Cortez, rode their motorbikes 30,000 kms+ across West Africa (Spain to South Africa) and visited Antarctica, among many other adventure expeditions. Today, they’re still traveling, currently around the USA with an RV.

Traveling to so many places, remote destinations and by different means taught them a lot about travel insurance, which policies to hold depending on the area and the type of adventure they were doing. Antonio now publishes regular content to help other travelers choose the best travel insurance for adventure trips.

Together, they also run the travel community Summit , the RV site Hitched Up , the boutique accommodation blog Unique Places and the popular newsletter Adventure Fix , where they share their knowledge about the places they’ve visited and the ones still remaining on their list.

Antonio Cala

Co-Founder of Adventure Fix

Privacy Overview

You are our first priority. every time..

We believe everyone should be able to make decisions with confidence. And while our site doesn’t feature every company or travel service available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

- Travel Insurance

- Sports & Activities

Loading Calculator

White Water Kayaking Travel Insurance

If you plan to go on a White Water Kayaking holiday, you should ensure you have a Travel Insurance policy before your trip. To contact us by telephone or email, 0800 043 0020 / 01273 092 757 [email protected] Summary of Cover (per person) Section & Cover Silver Gold Platinum…

Read More..

If you plan to go on a White Water Kayaking holiday, you should ensure you have a Travel Insurance policy before your trip.

To contact us by telephone or email, 0800 043 0020 / 01273 092 757 [email protected]

Summary of Cover (per person)

* Excess payable does vary depending on the claim benefit.

Please read the Policy Wording for the complete list of Benefits.

Healix Insurance Services Ltd, on behalf of Hamilton Insurance DAC, arranges this Travel Insurance policy for Jade Stanley Ltd. Healix Insurance Ltd is registered in England and Wales under No. 5484190 and authorized and regulated by the Financial Conduct Authority under No. 437248. Hamilton Insurance DAC is registered in Ireland No. 484148, authorized by the Central Bank of Ireland, and subject to limited regulation by the Financial Conduct Authority and Prudential Regulation Authority in connection with their UK branch. Jade Stanley Ltd is registered in England and Wales under No. 03570857 and authorized and regulated by the Financial Conduct Authority under No. 306205.

Related Pages

- Canoeing Travel Insurance | JS Insurance

- Sea Kayaking Travel Insurance | JS Insurance

- White Water Canoeing Travel Insurance | JS Insurance

Travel Insurance Toolkit

- Policy Wording

- Make a Claim

- Authorised and regulated by the Financial Conduct Authority

- Covered by the Financial Services Compensation Scheme

- Secure data encryption

- Become an Affiliate

- Payment Methods

- Privacy Policy

JS Travel Insurance is the trading name of Jade Stanley Limited, 5 Chapel Mews, Waterloo Street,Hove, East Sussex, BN3 1AR, Telephone: 0800 043 0020 . Jade Stanley Ltd is authorised and regulated by the Financial Conduct Authority. FCA Registration number is 306205

Freephone our UK Team

0800 072 6778

Sales & Service

Monday to Friday: 8:30am to 8pm Saturday: 9am to 5:30pm Sunday: 10am to 5:00pm

Monday to Friday: 9am to 7pm Saturday: 9am to 5:30pm

Travel Insurance

Medical travel insurance, seniors travel insurance, europe travel insurance, worldwide travel insurance, coronavirus travel insurance, white water rafting travel insurance.

- Unlimited medical emergency expenses¹

- Up to £10K cancellation cover

- 24/7 emergency medical helpline

Covered 27 million+ travellers

Trusted for 20+ years

24/7 emergency helpline

White water rafting travel insurance

Going white water rafting is an exciting way to spend time exploring nature with friends or even strangers. Depending on the time of year and the complexity of the river it can be quite an adventurous sport so you’ll need adequate travel insurance.

All our travel insurance policies covers over 100 sports and activities , including white or black water rafting adventures up to grade 3. It’s important to note that not all courses are covered and so you’ll need to add extra extreme sports travel insurance to your policy if you’re setting off to ride the hazardous courses of grades 4, 5 or 6.

As always terms and conditions apply, so check the policy wording for full details of these and the other activities we cover.

Why do you need travel insurance for white water rafting?

Whilst incredibly fun, white water rafting can also be a risky activity. Safety equipment issues, slipping overboard or wayward paddles can cause serious injury. It’s important to make sure you have a travel insurance policy that will cover you in the event of an accident or injury. We can have you covered!

What is included with white water rafting insurance?

Provided you’re correctly equipped and rafting on waters no more dangerous than a grade 4 course, you’ll be covered with any of our travel insurance, and also be able to enjoy the following benefits:

- Medical expenses and hospital benefit

- Cancelling and cutting short your holiday

- Abandoning your trip

- Delayed departure

- Accommodation cover

- Personal belongings and baggage

- Personal money, passport and travel documents

- Legal expenses

Please note that while white water rafting can be covered by our policies, you won’t be covered if this is the main purpose of your trip.

White water rafting safety tips

Don’t let an accident ruin the whole holiday; remember a few simple tips and ensure a great time rafting and a happy rest of adventure.

- Make sure to use a qualified and a recognised guide

- Always make sure equipment is fully functional and helmets and flotation devices are worn correctly

- Choose the right travel insurance policy for you, get a quote online or read our policy documents for more information on our travel insurance for white water rafting.

Please note: ‘White water rafting travel insurance’ is a general term for cover included within our standard travel insurance policy. We don’t offer specialist insurance cover for this specific activity. Only white or black water rafting up to grade 3 difficulty are included within our standard travel insurance cover, higher grades require additional coverage with our extreme sports cover .

- Unlimited emergency medical expenses available on Black level policies.

- Based on 2,050 responses, correct as of 22/01/2024

Call us on 01494 484800 Open Mon - Fri | 9:00 - 5:30

Award-Winning, Flexible

RAFTING INSURANCE

- Worldwide Protection for white water rafting

- Cover for Medical Expenses & Repatriation

- Protection for up grade 5 water and above

Buy your specialist Rafting Insurance in minutes

10% OFF ONLINE*

Independent Service Rating based on 4657 verified reviews.

Our White Water Rafting Insurance policy options

Put simply, we offer three different policy options…

1. Travel Insurance

Our Sports Travel Insurance will cover you whilst white water rafting abroad for leisure or competition, and includes cover for medical and repatriation costs, trip cancellation and curtailment, plus more.

2. Travel Insurance Bolt-On

If you have an existing travel insurance policy in place with another provider such as your bank but it does not include cover for white water rafting, we can provide a bolt-on style of protection for your trip.

3. Sports Accident Insurance

Our Sports Accident Insurance is designed to protect you whilst rafting in the UK, whether that be for leisure or competition. The policy provides a range of benefits including personal liability and income protection.

Making claims clearer

AVERAGE PAY OUT

FOR EACH TRAVEL INSURANCE CLAIM**

OF OUR POLICY HOLDERS

NEEDED TO MAKE A CLAIM**

OUR AVERAGE CLAIMS RATING

ACCORDING TO OUR FEEFO SCORE***

Get an instant quote for Rafting Insurance online

Join thousands of sports enthusiasts who choose us every year

Or Call us on 01494 484800

Why choose us

30 years experience.

We have been providing tailored Sports Insurance policies for over 30 years, and today protect more than 57,000 customers a year.

Professional Claims Handling

We work with leading claims handlers to make sure our customers experience a prompt and professional service when making a claim.

Underwritten by Experts

We’re pleased to offer tailored cover from AXA XL, a leading provider of insurance in the sports and leisure industry.

UK Based Customer Service Team

Our highly experienced Sales team are available to help support you with any questions that you might have.

5-Star Customer Service Rating

Thousands of happy customers have awarded us a 5-star customer service score on the independent feedback platform, Feefo.

500+ Sports Covered

Being a specialist in Sports Insurance, we provide cover for over 500 different sports & activities, far more than other providers.

What makes our policy different?

Not all travel insurance providers will cover white water rafting as standard, but we do. We specialise in sports insurance and have done so for over 30 years. Whether you are rafting in the UK or abroad we can protect you and your equipment.

If you are travelling overseas, our Sports Travel Insurance not only includes protection against the usual travel mishaps such as delayed flights and lost baggage, but also includes cover if you were to be injured whilst you were rafting, need search and rescue or repatriation.

When rafting in the UK, our Sports Accident Insurance could be a better policy option for you, with its personal accident and liability cover options.

What is covered?

Our Water Water Rafting Insurance for those rafting in grade 3, grade 4 & 5, and above grade 5 waters. We also cover black water rafting. If you require our Sports Travel Insurance policy for rafting, here are the key benefits:

- Emergency Medical Expenses & Repatriation

- Cancellation & Curtailment

- Personal Liability

- Delayed, lost or stolen baggage

- Lost or damaged Sports Equipment

- Travel Delay, Abandonment and Missed Departure

Frequently Asked Questions

Standard travel insurance policies do not always cover hazardous activities. Our Sports Travel Insurance is specifically designed to cover over 500 sports and activities including white water rafting.

Our Sports Travel Insurance policy provides up to £5,600 worth of equipment cover. This add-on not only protects your own equipment, but also any equipment you hire during your trip. It also covers your rafting equipment in transit to and from your destination.

Yes, our Rafting Travel Insurance can generally be taken out even if you have a medical condition. We can almost always offer cover at no extra cost, but occasionally our underwriters may apply special terms if you subsequently needed to make a claim relating to your condition.

You can purchase our Rafting Insurance online up until 74 years old. Above this age, you would need to call us on 01494 484800 and we will be able to refer your quote to our underwriters. Please note, our quotes are based on your age at the start date of cover.

* 10% online discount applies to our Sports Travel Insurance and Activity TopUp policies only.

** Data relates to Sports Travel Insurance claims from Jan 2023 to Dec 2023 inclusive.

*** Feefo rating relates to Sports Travel Insurance claims review score from Jan 2023 to Dec 2023 inclusive.

Get an instant quote and buy online now!

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Kayaking Insurance

£10m emergency medical expenses - search and rescue included and £2m personal liability standard on ALL policies.

A GUIDE TO OBTAINING A QUOTE and PRE QUOTE INFORMATION - questions answered

please ensure you select the correct activity level for the sports you are insuring and that you insure the full duration of your trip from the UK including departure and return dates on your Snowcard policy - for downhill skiing you will need at least Adventure Plus or Max Adventure for snowboarding

If you have any questions or need guidance on selecting your policy - email [email protected]

N.B. Insurance policies available from this website can only be used by UK, Channel Islands and Isle of Man residents.

Levels of cover

Please start typing your activity in the box below. You are covered for all activities in the level you select and those in lower levels. If you are taking part in multiple activities, make sure you select the highest level that will cover all of your activities.

What is your most extreme activity?

Please check our full activity levels information table - if you cant find a match for your activity - let us know so we can add it.

IMPORTANT - for downhill skiing , you will need at least the Adventure Plus level of cover, do not select Adventure Basic for on and off piste skiing or snowboarding.

If you are taking part in an activity that might be considered out of the ordinary or you are travelling to unusual or remote destinations , please refer full details before proceeding and we will confirm if your trip can be covered.

Annual multi-trip insurance

Cancellation cover (if selected) starts when you book each trip or on the start date entered here and shown on your Insurance Schedule, if this is later. Cover under all other sections of the policy begins when you leave home to go on a trip and ends when you return home from that trip. The start and finish dates of the trip must fall within the 12 month period of insurance. For trips booked during the 12 month period and that start after the end of the 12 month period, we will provide cancellation cover until the policy ends. Please note that annual multi-trip policies can not be purchased more than 2 months in advance of the policy start date and must be purchased in the UK before departure of your first trip. Cancellation cover commences from the policy start date you specify here.

Single trip limits

Winter sports limits on annual multi-trip policies

Single trip policies

You must insure the full duration of your trip and purchase your insurance before departing from the UK. If you have an annual policy with another insurer and you require higher risk cover with Snowcard for a short duration only, we CANNOT help topping up another insurers policy. You must insure your full trip duration with Snowcard for your policy to be valid.

If you select cancellation cover, it takes effect from the date of policy purchase until your departure date. The insurance for personal belongings, equipment and techno pack (if shown on your Insurance Schedule) is only valid if you have insured the whole duration of each individual trip and starts when you depart from the UK. If you have a Snowcard annual multi trip policy at a lower level of cover, you can purchase single trip top up cover (medical and emergency expenses only) at a higher level for short durations.

The age band selected must be that of the person who is the lead insured name or the oldest person in the family or group. If a group member is older than 56+, it will be cheaper for the group if the older traveller is insured seperately. For persons aged over 75 contact https://www.biba.org.uk for advice.

For annual multi trip policies, use the age band applicable on the policy start date. For single trip policies, use the age band applicable on the date of departure.

Please note a family is 1 or 2 adults and up to 4 children up to the age of 18 – a couple is 2 persons married or living together as married – a group is 2 or more persons travelling together on the same holiday.

To insure a minor <18 travelling alone, the parent must register their details but insert the name and age of the child when prompted to enter the name of the person to be insured.

Canoe and Kayaling Travel Insurance

Snowcard offer specialist kayak travel insurance and canoeing travel insurance. As one of the UK’s longest running activity holiday insurers we’ve been providing specialist kayak travel insurance and canoe insurance for over 30 years.

A Snowcard policy is tailor made for water sports travel and we provide specialist cover for a wide range of activities including;

- White water rafting

- Sea and surf kayaking

- Canadian canoeing

- Canoeing on lakes or flat water

- River wilderness expeditions

- White water kayaking (up to grade 5 depending on the cover option you select)

For more information and a complete list of water sports travel insurance activities that we cover please visit our activities covered page .

Why Standard Travel Insurance Including Watersports Is Not Always Suitable

When buying water sports insurance standard insurers will not necessarily cover what they deem to be more hazardous water sports activities, particularly if white water is involved. Many general travel policies like those provided free with bank accounts will only cover the lowest risk sports and limit or exclude cover for search and rescue, personal liability insurance and equipment which are extremely important for any water sports enthusiast.

It's important not fall into the trap of making price alone the only deciding factor when purchasing Kayak Trip insurance or Canoe insurance

Why Buy Specialist Water Sports Insurance Cover from Snowcard?

Having specialised in activity holiday insurance since 1990 we are one of the UK's longest running specialists insuring adventure holidays. We understand the needs of our clients as adventure travelers and that's why we've developed what we believe to be the best specialist policies with the highest quality and flexible cover designed to respond in an emergency.

Snowcard water sports travel insurance policies provide you with complete freedom and flexibility to tailor your own travel insurance, enabling you to choose your own sums insured for baggage, sports equipment, cancellations, and our unique techno pack option which provides cover for items such as cameras and electronic gadgets. Our canoe insurance and kayak travel insurance can be personalised and tailored to suit your adventure.

No matter where you are in the world you'll also benefit from 24/7 access to specialist claims and assistance services.

How To Buy Canoe and Kayak Holiday Insurance

It really couldn't be easier to get a quote and buy canoeing travel insurance and kayak trip insurance online with Snowcard. Using the form at the top of this page simply enter your trip details for an instant quote, you can then tailor and select your own sums insured.

For single trip and annual multi-trip policies, we offer the following 5 options;

- Adventure basic

- Adventure plus

- Max adventure

- Extreme adventure

- Pro adventure

Each option covers progressively higher risk water sports activities.

If you are in any doubt about which cover option to select, then simply use our convenient 'find my level cover' tool in part 1 above. If you plan on partaking in various water sports activities, then please always ensure that you select the option which will cover your highest risk activity.

Wherever you’re going for peace of mind on your next adventure holiday don’t forget your specialist kayak trip insurance and canoe insurance from Snowcard.

If you would more information about our kayak travel insurance or our canoeing travel insurance then please get in touch with Snowcard by using our contact form or by email .

Enjoy Your Adventure!

Do i need specialist kayaking travel insurance.

If you are planning on kayaking in Europe, then you will need a specialist water sports insurance. Standard travel policies do not cover white water kayaking and canoeing, the additional hazards associated with white water sports need to be covered by an adventure sports specialist.

The best way to prepare for and enjoy your kayaking trip safely is with the right insurance. Snowcard are specialists in all types of mountain and water sports activity travel insurance, and our kayaking insurance policies are amongst the leading policies on the market for over 30 years.

What Does Kayaking Travel Insurance Cover?

Specialist kayaking travel insurance provides you with cover for a range of situations and possibilities including emergency recovery and repatriation, medical costs and ambulance charges in remote mountain regions.

With Snowcard travel insurance, as standard you will receive medical and liability cover, £10 million for emergency medical expenses and £2 million for personal liability. All policies include search and rescue including helicopter air-ambulance. With a Snowcard policy, you can customise your insurance to cover personal belongings, sports equipment, electronics (techno pack), cancellation and travel interruption.

Canoeing Holiday Insurance

see all activities covered

Private Arrival or Departure Transfer: Moscow Airports to City Center

Private Arrival or Departure Transfer: Moscow Airports to City Center (Odintsovo, Russia): Address, Phone Number - Tripadvisor

- (0.28 mi) Tacoc

- (0.88 mi) Iguasu

- (7.12 mi) Hampton by Hilton Moscow Strogino

- (9.87 mi) Radisson Collection Hotel, Moscow

- (8.76 mi) Novotel Moscow City

- (0.28 mi) Tut i Tam

- (0.32 mi) Aiva

- (4.68 mi) Anderson

- (0.77 mi) Sushi Lime

- (0.77 mi) Domcafe

Find cheap flights from Moscow to Seattle

Search hundreds of travel sites at once for deals on flights to seattle.

Save 22% or more Compare multiple travel sites with one search.

Track prices Not ready to book? Create a price alert for when prices drop.

Filter your deals Choose cabin class, free Wi-Fi and more.

Bundle and save Save money when you bundle your flight + hotel.

When to book flights from Moscow to Seattle

Faqs for booking flights from moscow to seattle, do i need a passport to fly between moscow and seattle, which aircraft models fly most regularly from moscow to seattle.

We unfortunately don’t have that data for this specific route.

How does KAYAK find such low prices on flights from Moscow to Seattle?

KAYAK is a travel search engine. That means we look across the web to find the best prices we can find for our users. With over 2 billion flight queries processed yearly, we are able to display a variety of prices and options on flights from Moscow to Seattle.

How does KAYAK's flight Price Forecast tool help me choose the right time to buy my flight ticket from Moscow to Seattle?

KAYAK’s flight Price Forecast tool uses historical data to determine whether the price for a flight to Seattle from Moscow is likely to change within 7 days, so travelers know whether to wait or book now.

What is the Hacker Fare option on flights from Moscow to Seattle?

Hacker Fares allow you to combine one-way tickets in order to save you money over a traditional round-trip ticket. You could then fly to Seattle with an airline and back to Moscow with another airline.

What is KAYAK's "flexible dates" feature and why should I care when looking for a flight from Moscow to Seattle?

Sometimes travel dates aren't set in stone. If your preferred travel dates have some wiggle room, flexible dates will show you all the options when flying to Seattle from Moscow up to 3 days before/after your preferred dates. You can then pick the flights that suit you best.

Book cheap flights from Moscow to Seattle

One-way flight deals, search by stops, flights to seattle, destination:.

Seattle (SEA) United States

Return flight deals:

Seattle - Moscow

Cabin classes:

Browse origins:.

- Flights »

- Worldwide »

Browse destinations:

- United States »

- Washington »

IMAGES

VIDEO

COMMENTS

When you get a travel insurance quote for your kayaking or rafting trip, you need to double-check the Adventure Sports & Activities roster. The following categories have coverage under our plans: Kayaking; Sea kayaking; White water rafting; Black water kayaking (Grades 1-5) International river grades

To secure coverage for a kayaking and rafting trip, you'll need a comprehensive travel insurance plan that also includes adventure sports coverage. Look for a plan taht automatically includes coverage for kayaking as well as white and black water rafting (up to grade 4 rapids). Your travel insurance policy can also include key travel ...

What Is Kayak & Whitewater Rafting Insurance? Travel insurance that includes coverage for adventure sports or hazardous activities can provide benefits in the event that you are injured during your activities and require medical care. While a standard travel medical insurance plan typically excludes coverage for injuries related to ...

When you get a travel insurance quote for your kayaking or rafting trip, you need to double-check your policy wording the Adventure Sports & Activities list. Level 1 activities are automatically covered when you buy your policy. You'll need to pay an additional premium to be covered for Level 2 and Level 3 activities such as kayaking outside ...

Up to £6000 Cancellation Cover. The True Traveller is well-known when it comes to arranging travel insurance for adventurous activities, and white water rafting (and Black Water) is one of those sports which is becoming more and more common for people to undertake on their trips, whether on the North Johnson River in Queensland, the Dart in ...

When you get a travel insurance quote for your kayaking or rafting trip, you need to specify the adventure activity in your policy. If you don't, you may not be covered. When you 'choose your options', select your kayaking/rafting activity according to the following activity category: Kayaking: (inland/coastal waters within 3 nautical miles ...

Rafting Travel Insurance. Rafting is floating on rafts or kayaks on mountain rivers with rough currents. This extreme sport allows combining the drive of a high-speed raft with stops on the shore at the campfire. Earlier, this sport was only for professional athletes with a good level of fitness. Now rafting has become popular among tourists.

For kayaking or canoeing at White Water Grades 1-2, this is automatically covered in your pack as standard. However, if you're looking to tackle grade 3 white water, please be aware you will need to pay the appropriate additional premium, and the activity is shown as covered on your policy schedule. Travel insurance cover levels

Discover the best travel insurance for white water rafting trips. Ensure a worry-free rafting experience with the right insurance.

The best travel insurance for adventure sports like whitewater rafting can help provide coverage for: Emergency medical and hospital assistance. Emergency medical evacuation. Theft or damage of protective gear. Pre-paid trip protection in case you have to cancel or postpone your trip. Remember, your travel insurance for whitewater rafting will ...

Kayaking and other white-water sports are usually covered by many travel insurance policies but restrictions could apply, such as a limit on the grade of white water you can navigate, or if it involves sea kayaking. If you're travelling with your kayak, you might want to get it insured separately as your baggage limit might not be sufficient.

If you plan to go on a White Water Kayaking holiday, you should ensure you have a Travel Insurance policy before your trip. To contact us by telephone or email, 0800 043 0020 / 01273 092 757 [email protected] Summary of Cover (per person) Section & Cover Silver Gold Platinum…. Read More..

All our travel insurance policies covers over 100 sports and activities, including white or black water rafting adventures up to grade 3. It's important to note that not all courses are covered and so you'll need to add extra extreme sports travel insurance to your policy if you're setting off to ride the hazardous courses of grades 4, 5 ...

1. Travel Insurance. Our Sports Travel Insurance will cover you whilst white water rafting abroad for leisure or competition, and includes cover for medical and repatriation costs, trip cancellation and curtailment, plus more. 2. Travel Insurance Bolt-On. If you have an existing travel insurance policy in place with another provider such as ...

When you get a travel insurance quote for your kayaking or rafting trip, you need to add your kayaking/rafting adventure activity when prompted to. World Nomads plans for British residents cover the following categories of kayaking and rafting: Kayaking/canoeing: (inland/coastal waters, grades 1-3 only, Sea kayaking/Sea canoeing)

Families leaving on an adventure-oriented trip will need to find a travel insurance policy that covers adventure activities like scuba diving, white water rafting, high-altitude climbing or skiing ...

All aboard the coach trip! Have you been watching Brendan Sheerin on the television? Taking an excited selection of lucky couples on a coach tour of Europe, on a road to Zante or Tenerife and letting you in on the fun?

As one of the UK's longest running activity holiday insurers we've been providing specialist kayak travel insurance and canoe insurance for over 30 years. A Snowcard policy is tailor made for water sports travel and we provide specialist cover for a wide range of activities including; White water rafting. Sea and surf kayaking. Canadian ...

If you find yourself in deep water, we might be able to help: Our travel insurance policies cover white water rafting and black water rafting from grades 1 to 3. Note: Grade 4-6 require varying levels of experience in rafting. See the PDS for details. For most policies (except Domestic policies), we provide medical and hospital assistance, and ...

Travel Insurance for Kayaking and Rafting. Exotic sunsets, the water lapping at your bow; experiences on the water are often the most unforgettable part of any holiday. ... The scale is used for various water sports and activities, such as black and white water rafting, river boarding, white-water canoeing, stand up paddle surfing, and ...

Kuala Lumpur Bird Park Lusail Shooting Club Silver Queen Gondola Pilgrim Monument & Provincetown Museum Water Garden Club Inferno Kemer Nadam Spa Viaport Marina Swarovski Kristallwelten Thompson Point Painting party at Art Bottega - Paint & Wine Studio in Split Ancient Bosnian Pyramid of the Sun 3-Day Private Tour from Amman: Petra, Wadi Rum, Dana, Aqaba, and Dead Sea Experience Friday night ...

British American Tobacco is the market leader in more than 50 countries. Address: 3rd Yamskogo Polya str. 9 | Phone: +7 (495) 974-0555. By the virtue of honesty, efficiency, caution and high spirit, JSC MATUCO joins this potential and challenging field, gradually gaining the trust and favor from our business partners at home and abroad.

What to do in Moscow. 1. Moscow Kremlin: Russia's Must-See. The first stop in Moscow is the Red Square - home to the iconic St. Basil's Cathedral with its multicolored domes, and the gateway to the Kremlin. Just past Lenin's Mausoleum, this fortified citadel was built for royalty. Overlooking the river, it boasts a density of cathedrals and ...

How does KAYAK find such low prices on flights from Moscow to Seattle? KAYAK is a travel search engine. That means we look across the web to find the best prices we can find for our users. With over 2 billion flight queries processed yearly, we are able to display a variety of prices and options on flights from Moscow to Seattle.