- Travel, Tourism & Hospitality ›

- Leisure Travel

Online travel market - statistics & facts

How big is the online travel market, what are the leading online travel agencies (otas), what travel products do consumers book online, key insights.

Detailed statistics

Online travel market size worldwide 2017-2028

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Most popular travel and tourism websites worldwide 2024

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Online Travel Market

Market cap of leading online travel companies worldwide 2023

Related topics

Online travel trends.

- Artificial intelligence (AI) use in travel and tourism

- Mobile travel trends

- Digitalization of the travel industry

- Impact of technology on travel and tourism

Online travel companies

- Booking Holdings Inc.

- Expedia Group, Inc.

Trip.com Group

Tripadvisor, travel and tourism worldwide.

- Tourism worldwide

- Travel agency industry

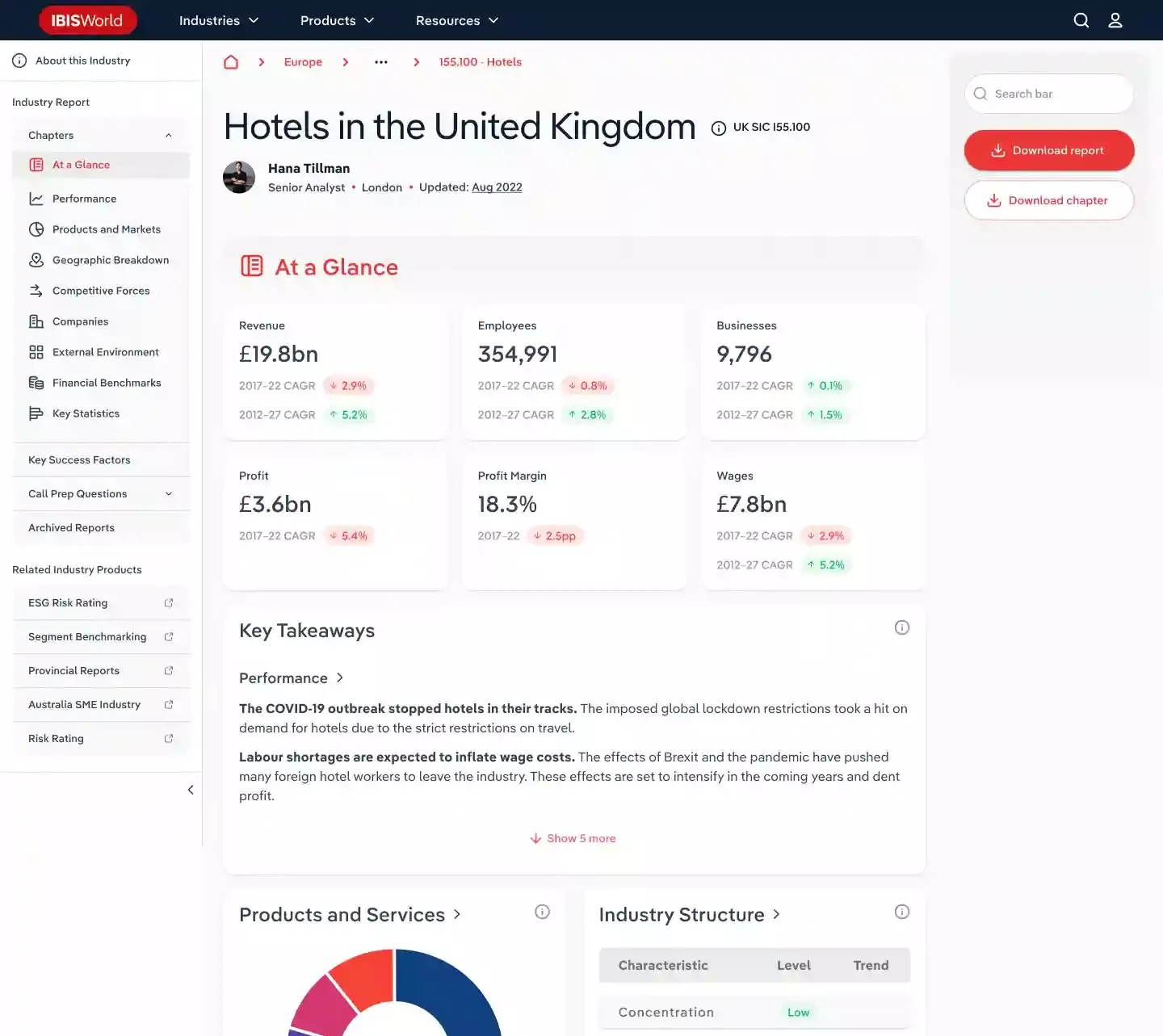

- Hotel industry worldwide

- Cruise industry worldwide

Recommended statistics

Industry overview.

- Premium Statistic Market size of the tourism sector worldwide 2011-2024

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Revenue of the travel apps industry worldwide 2017-2027

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Market size of the tourism sector worldwide 2011-2024

Market size of the tourism sector worldwide from 2011 to 2023, with a forecast for 2024 (in trillion U.S. dollars)

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Revenue of the travel apps industry worldwide 2017-2027

Revenue of the travel apps market worldwide from 2017 to 2027 (in billion U.S. dollars)

Estimated EV/Revenue ratio in the online travel market 2024, by segment

Estimated enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide as of April 2024, by segment

Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Estimated enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide as of April 2024, by segment

Online bookings

- Premium Statistic Travel product online bookings in the U.S. 2023

- Premium Statistic Travel product online bookings in Canada 2023

- Premium Statistic Travel product online bookings in the UK 2023

- Premium Statistic Travel product online bookings in China 2023

- Premium Statistic Travel product online bookings in India 2023

- Premium Statistic Importance to book a trip fully online among travelers worldwide 2023, by generation

Travel product online bookings in the U.S. 2023

Travel product online bookings in the U.S. as of December 2023

Travel product online bookings in Canada 2023

Travel product online bookings in Canada as of December 2023

Travel product online bookings in the UK 2023

Travel product online bookings in the UK as of December 2023

Travel product online bookings in China 2023

Travel product online bookings in China as of December 2023

Travel product online bookings in India 2023

Travel product online bookings in India as of December 2023

Importance to book a trip fully online among travelers worldwide 2023, by generation

Share of travelers who think it is important to be able to book their trip entirely online worldwide as of July 2023, by generation

Market leaders

- Premium Statistic Revenue of leading OTAs worldwide 2019-2022

- Premium Statistic Marketing expenses of leading OTAs worldwide 2019-2022

- Premium Statistic Marketing/revenue ratio of leading OTAs worldwide 2019-2022

- Premium Statistic Number of employees at leading travel companies worldwide 2022

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Premium Statistic Most popular travel and tourism websites worldwide 2024

Revenue of leading OTAs worldwide 2019-2022

Leading online travel agencies (OTAs) worldwide from 2019 to 2022, by revenue (in million U.S. dollars)

Marketing expenses of leading OTAs worldwide 2019-2022

Marketing expenses of leading online travel agencies (OTAs) worldwide from 2019 to 2022 (in million U.S. dollars)

Marketing/revenue ratio of leading OTAs worldwide 2019-2022

Marketing to revenue ratio of leading online travel agencies (OTAs) worldwide from 2019 to 2022

Number of employees at leading travel companies worldwide 2022

Number of employees at selected leading travel companies worldwide in 2022

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Most visited travel and tourism websites worldwide as of April 2024 (in million visits)

Booking Holdings

- Basic Statistic Revenue of Booking Holdings worldwide 2007-2023

- Premium Statistic Number of bookings through Booking Holdings worldwide 2010-2023, by segment

- Premium Statistic Operating income of Booking Holdings worldwide 2007-2023

- Premium Statistic Net income of Booking Holdings worldwide 2007-2023

Revenue of Booking Holdings worldwide 2007-2023

Revenue of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Number of bookings through Booking Holdings worldwide 2010-2023, by segment

Number of bookings through Booking Holdings worldwide from 2010 to 2023, by business segment (in millions)

Operating income of Booking Holdings worldwide 2007-2023

Operating income of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Net income of Booking Holdings worldwide 2007-2023

Net income of Booking Holdings worldwide from 2007 to 2023 (in billion U.S. dollars)

Expedia Group

- Premium Statistic Revenue of Expedia Group, Inc. worldwide 2007-2023

- Premium Statistic Revenue of Expedia Group, Inc. worldwide 2017-2023, by business model

- Premium Statistic Operating income of Expedia Group, Inc. worldwide 2007-2023

- Premium Statistic Net income of Expedia Group, Inc. worldwide 2007-2023

Revenue of Expedia Group, Inc. worldwide 2007-2023

Revenue of Expedia Group, Inc. worldwide from 2007 to 2023 (in billion U.S. dollars)

Revenue of Expedia Group, Inc. worldwide 2017-2023, by business model

Revenue of Expedia Group, Inc. worldwide from 2017 to 2023, by business model (in million U.S. dollars)

Operating income of Expedia Group, Inc. worldwide 2007-2023

Operating income of Expedia Group, Inc. worldwide from 2007 to 2023 (in million U.S. dollars)

Net income of Expedia Group, Inc. worldwide 2007-2023

Net income of Expedia Group, Inc. worldwide from 2007 to 2023 (in million U.S. dollars)

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb revenue worldwide 2019-2023, by region

- Premium Statistic Airbnb operations income worldwide 2017-2023

- Premium Statistic Airbnb net income worldwide 2017-2023

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb revenue worldwide 2019-2023, by region

Revenue of Airbnb worldwide from 2019 to 2023, by region (in billion U.S. dollars)

Airbnb operations income worldwide 2017-2023

Income from operations of Airbnb worldwide from 2017 to 2023 (in million U.S. dollars)

Airbnb net income worldwide 2017-2023

Net income of Airbnb worldwide from 2017 to 2023 (in million U.S. dollars)

- Premium Statistic Total revenue of Trip.com Group 2012-2022

- Premium Statistic Revenue of Trip.com 2012-2022, by product

- Premium Statistic Revenue of Trip.com 2017-2022, by region

- Premium Statistic Net profit of Trip.com 2012-2022

Total revenue of Trip.com Group 2012-2022

Total revenue of Trip.com Group Ltd. in China from 2012 to 2022 (in billion yuan)

Revenue of Trip.com 2012-2022, by product

Revenue of Trip.com Group Ltd. from 2012 to 2022, by product (in million yuan)

Revenue of Trip.com 2017-2022, by region

Revenue of Trip.com Group Ltd. from 2017 to 2022, by region (in million yuan)

Net profit of Trip.com 2012-2022

Net profit of Trip.com Group Ltd. from 2012 to 2022 (in million yuan)

- Premium Statistic Revenue of Tripadvisor worldwide 2008-2023

- Premium Statistic Revenue of Tripadvisor worldwide 2017-2023, by business segment

- Premium Statistic Revenue of Tripadvisor worldwide 2012-2023, by region

- Premium Statistic Operating income of Tripadvisor worldwide 2008-2023

- Premium Statistic Net income of Tripadvisor worldwide 2008-2023

Revenue of Tripadvisor worldwide 2008-2023

Revenue of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Revenue of Tripadvisor worldwide 2017-2023, by business segment

Revenue of Tripadvisor, Inc. worldwide from 2017 to 2023, by business segment (in million U.S. dollars)

Revenue of Tripadvisor worldwide 2012-2023, by region

Revenue of Tripadvisor, Inc. worldwide from 2012 to 2023, by region (in million U.S. dollars)

Operating income of Tripadvisor worldwide 2008-2023

Operating income of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Net income of Tripadvisor worldwide 2008-2023

Net income of Tripadvisor, Inc. worldwide from 2008 to 2023 (in million U.S. dollars)

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Other Reports

Online Travel Market

Online travel market report by service type (transportation, travel accommodation, vacation packages), platform (mobile, desktop), mode of booking (online travel agencies (otas), direct travel suppliers), age group (22-31 years, 32-43 years, 44-56 years, above 56 years), and region 2024-2032.

- Report Description

- Table of Contents

- Methodology

- Request Sample

Market Overview:

The global online travel market size reached US$ 512.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,267.1 Billion by 2032, exhibiting a growth rate (CAGR) of 10.4% during 2024-2032. The e scalating penetration of smart devices, easy access to high-speed internet connectivity, the rising popularity of solo travel, and an increasing number of business travelers are some of the major factors propelling the market.

Online travel refers to the process of planning, booking, and managing travel arrangements using online platforms and websites. It encompasses various aspects of travel, including researching destinations, comparing prices, booking flights, accommodations, car rentals, and other travel-related services through online travel agencies (OTAs) and travel booking websites. It has revolutionized the way people plan and book their trips. It provides travelers with convenient access to a wide range of travel options, allowing them to search and compare different airlines, hotels, and other service providers. These platforms offer user-friendly interfaces, advanced search filters, and real-time availability, making it easier for travelers to find the best deals and make informed decisions.

The widespread availability and adoption of internet and mobile technology will stimulate the growth of the market during the forecast period. Moreover, the convenience of accessing a vast array of travel information, comparing prices, and making bookings online is positively influencing the market growth. Apart from this, the ongoing innovation and the development of user-friendly platforms, advanced search functionalities, and personalized recommendations has catalyzed the market growth. OTAs and travel booking websites have invested in providing seamless and efficient booking experiences, making it easier for travelers to find the best deals and make informed decisions. Furthermore, travelers are appreciating the ability to book their flights, accommodations, and other travel services from the comfort of their homes, and online platforms often offer exclusive deals and discounts, enabling travelers to find affordable options. In line with this, the rising demand for convenience and cost savings has augmented the market growth.

.webp)

Online Travel Market Trends/Drivers:

Increase in Internet and Mobile Penetration

The increasing penetration of the internet and mobile technology has been a significant driver of the market. With more people gaining access to the internet and owning smartphones, the ability to plan and book travel online has become increasingly accessible. Travelers can easily research destinations, compare prices, and make bookings through online platforms, making the process more convenient and efficient. The widespread availability of mobile apps further enhances the accessibility of online travel, allowing travelers to plan and book their trips on the go. Additionally, the integration of online payment systems and secure transaction processes has further facilitated the growth of online travel by providing a seamless and secure booking experience.

Convenience and accessibility

The convenience and accessibility offered by online platforms have transformed the way people plan and book their trips. These platforms provide a one-stop solution, allowing travelers to access a vast array of travel information, options, and services in one place. The ability to browse through numerous airlines, hotels, and travel agencies in a user-friendly interface saves time and effort. Travelers can compare prices, read reviews, and make bookings from the comfort of their homes or while on the go. The 24/7 availability of online platforms means that travelers are no longer restricted by the operating hours of traditional travel agencies. This convenience and accessibility have democratized the travel planning process, empowering travelers to take more control over their itinerary and make informed decisions.

Competitive Pricing and Deals

The competitive nature of the market has resulted in competitive pricing and the availability of attractive deals and discounts. OTAs and booking websites strive to attract customers by offering exclusive promotions, discounted packages, and last-minute deals. The ability to compare prices across multiple platforms allows travelers to find the best available options and secure the most cost-effective deals. The transparency in pricing and the ability to see real-time availability and fluctuations in prices enable travelers to make informed decisions and capitalize on favorable pricing opportunities. The availability of such competitive pricing and deals has made online travel an appealing option for travelers seeking value for their money and cost savings. Moreover, loyalty programs and reward systems offered by these platforms further incentivize travelers to book through their platforms, enhancing customer loyalty and engagement.

Note: Information in the above chart consists of dummy data and is only shown here for representation purpose. Kindly contact us for the actual market size and trends.

To get more information about this market, Request Sample

Online Travel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global online travel market report, along with forecasts at the global, regional and country levels from 2024-2032. Our report has categorized the market based on service type, platform, mode of booking and age group.

Breakup by Service Type:

- Transportation

- Travel Accommodation

- Vacation Packages

Travel accommodation dominates the market

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation and vacation packages. According to the report, travel accommodation represented the largest segment.

The dominance of travel accommodation as the primary service type in the market is driven by several key factors. The widespread presence of online travel platforms has made it easy for travelers to access a range of accommodation options, positively influencing the market growth. These platforms offer a comprehensive inventory of hotels, resorts, vacation rentals, and other types of accommodations, providing travelers with extensive choices and convenience.

Apart from this, the ability to compare prices, read reviews, and view photos of accommodations that empowers travelers to make informed decisions is contributing to the market growth. The user-friendly interfaces of these platforms streamline the booking process, allowing travelers to secure their preferred accommodations quickly and easily. Furthermore, the availability of customer reviews and ratings plays a significant role in driving the dominance of travel accommodation in the market.

Breakup by Platform:

Desktop holds the largest share in the market

A detailed breakup and analysis of the market based on the platform has also been provided in the report. This includes mobile and desktop. According to the report, desktop accounted for the largest market share.

The desktop platform typically involves accessing travel websites through web browsers installed on desktop computers, which offer larger screens, full-sized keyboards, and a mouse or trackpad for navigation. Desktop platforms provide travelers with a robust and comprehensive online experience for researching, planning, and booking their travel arrangements. Desktop computers offer a larger screen size and a more comfortable browsing experience, allowing travelers to easily navigate travel websites, compare options, and view detailed information. Moreover, desktop platforms provide greater processing power and stability, enabling faster loading times and smoother functionality for complex booking processes, thereby accelerating the product adoption rate. Furthermore, desktop platforms are preferred for extensive research and planning, as they provide more screen space and functionality for travelers to explore destinations, read reviews, and make informed decisions. Desktop offers various advantages in terms of screen size, processing power, and research capabilities.

Breakup by Mode of Booking:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

Direct travel suppliers is the most popular mode of booking

A detailed breakup and analysis of the market based on the mode of booking has also been provided in the report. This includes online travel agencies (OTAs) and direct travel suppliers. According to the report, direct travel suppliers accounted for the largest market share.

Direct booking allows travelers to have a direct relationship with the travel supplier, whether it's an airline, hotel, or car rental company. This direct interaction gives travelers more control and the ability to personalize their travel experience, including selecting specific preferences, customizing packages, and accessing loyalty programs or exclusive offers. Moreover, the surging adoption of direct booking as it provides better pricing and deals compared to third-party OTAs is propelling the segment growth. Additionally, the rising use of direct booking as it allows better communication and customer service as travelers can directly contact the travel supplier for any queries, changes, or requests, eliminating the need to navigate through third-party customer service channels, thereby contributing to the segment growth. Furthermore, the rise of online platforms and technology that makes it easier and more convenient for travelers to directly book with travel suppliers is another major growth-inducing factor.

Breakup by Age Group:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

32-43 years dominates the market

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes 22-31, 32-43, 44-56, and above 56 years. According to the report, 32-43 years accounted for the largest market share.

The dominance of the 32-43 years age group in the market is driven by several key factors. This age group represents individuals in their prime working and earning years, typically with more disposable income to spend on travel. They are often at a stage in their lives where they have fewer family responsibilities and greater flexibility to plan and embark on trips. Moreover, the 32-43 years age group is tech-savvy and comfortable with using digital platforms for various activities, including travel planning, and booking, thereby accelerating the product adoption rate. They have grown up alongside the rapid advancement of technology and are accustomed to online transactions and digital communication. Apart from this, Online travel platforms offer a convenient and time-saving solution, allowing them to plan their trips at their own pace and from the comfort of their homes or offices. In addition, the rising preference of this age group for convenience and efficiency in their travel arrangements is contributing to the segment growth.

Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

United States

- South Korea

United Kingdom

- Middle East and Africa

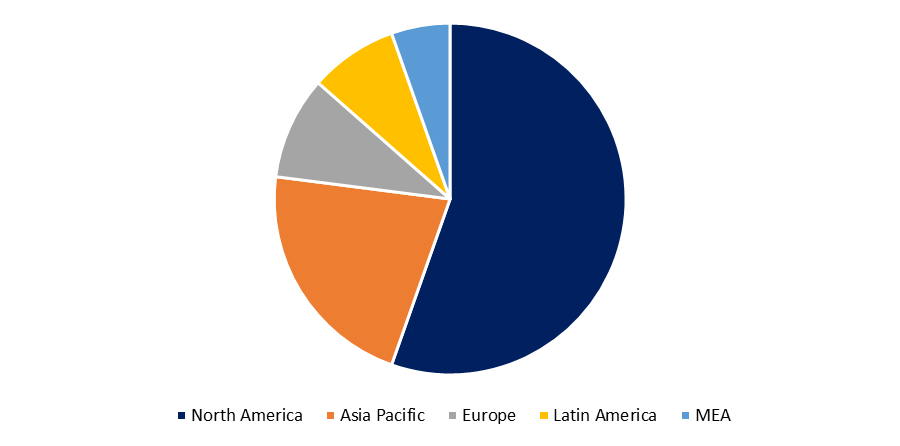

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market.

The dominance of North America as the leading region in the market is driven by several key factors. North America has a highly developed and digitally advanced economy, with a large population of tech-savvy consumers. The region has widespread internet access and a high level of smartphone penetration, making it conducive for online travel activities. Moreover, familiarity and adoption of online platforms for various transactions, including travel bookings, is contributing to the dominance of North America in the market.

Apart from this, North America is home to some of the largest OTAs and travel booking platforms. In addition, these companies offering a wide range of travel services, competitive pricing, and user-friendly interfaces have catalyzed the market growth. The availability of comprehensive travel options, including flights, accommodations, car rentals, and activities, has made North American travelers rely heavily on online platforms for their travel planning and booking needs.

Competitive Landscape:

The market is experiencing a lower-than-anticipated demand compared to pre-pandemic levels however, this is likely to witness a paradigm shift over the next decade with the rise of OTAs, which provide comprehensive platforms for travelers to explore and compare various travel options. Furthermore, online platforms for travel have embraced augmented reality (AR) and virtual reality (VR) to enhance the travel planning experience. With AR, travelers can use their smartphones or wearable devices to virtually explore destinations, visualize hotel rooms or attractions, and even preview menus at restaurants. Additionally, mobile payment options and digital wallets have become widely accepted, allowing travelers to make quick and hassle-free transactions while on the go. We expect the market to witness new entrants, consolidation of portfolios, and increased strategic collaborations among key players to drive healthy competition within the domain.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Expedia Group Inc.

- Fareportal Inc.

- Hostelworld Group plc

- MakeMyTrip Pvt. Ltd.

- priceline.com LLC (Booking Holdings Inc.)

- Thomas Cook India Ltd. (Fairfax Financial Holdings Limited)

- Tripadvisor Inc.

Recent Developments:

- In April 2023, Expedia launched New Feature Powered by ChatGPT to help plan travel. This innovative integration aims to enhance the travel planning experience for Expedia users by providing them with a personalized and conversational approach to trip planning. With this new feature, users can engage in natural language conversations with the ChatGPT system, similar to chatting with a virtual assistant.

- In May 2023, HRS won three sustainability awards at BTN Americas Event by Business Travel News magazine. These accolades acknowledge HRS's comprehensive sustainability program, their role as a green supplier, and their innovative approaches to promoting sustainable travel choices. With these awards, HRS continues to inspire and lead the way in sustainable practices, encouraging positive change across the industry.

- In August 2020, MakeMyTrip launched myPartner platform to assist travel agents in offering enhanced travel booking experiences to travelers. The platform, myPartner, has been designed to provide local travel agents access to one of the widest selections of online travel inventory. While digitizing the day-to-day booking processes of all offline travel agents alike, myPartner has been conceptualized and built to immensely benefit the local travel market beyond metro cities.

Online Travel Market Report Scope:

Key benefits for stakeholders:.

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online travel market from 2018-2032.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global online travel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global online travel market was valued at US$ 512.5 Billion in 2023.

We expect the global online travel market to exhibit a CAGR of 10.4% during 2024-2032.

The expanding travel and tourism industry, along with the rising utilization of online travel agencies across numerous hotels to ensure more visibility and increase their overall sales and profitability, is currently catalyzing the global online travel market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary restrictions on national and international travel activities, thereby limiting the overall demand for online travel.

Based on the service type, the global online travel market has been segmented into transportation, travel accommodation, and vacation packages. Among these, travel accommodation holds the majority of the total market share.

Based on the platform, the global online travel market can be divided into mobile and desktop, where desktop currently exhibits a clear dominance in the market.

Based on the mode of booking, the global online travel market has been categorized into Online Travel Agencies (OTAs) and direct travel suppliers. Currently, direct travel suppliers account for the majority of the global market share.

Based on the age group, the global online travel market can be segregated into 22-31 years, 32-43 years, 44-56 years, and above 56 years. Among these, 32-43 years age group currently holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global online travel market include Expedia Group Inc., Fareportal Inc., Hostelworld Group plc, HRS, Hurb, MakeMyTrip Pvt. Ltd., priceline.com LLC (Booking Holdings Inc.), Thomas Cook India Ltd. (Fairfax Financial Holdings Limited), Tripadvisor Inc., and Yatra.com.

India Dairy Market Report Snapshots Source:

Statistics for the 2022 India Dairy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports.

- India Dairy Market Size Source

- --> India Dairy Market Share Source

- India Dairy Market Trends Source

- India Dairy Companies Source

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-713-2163

Email: [email protected]

Client Testimonials

IMARC made the whole process easy. Everyone I spoke with via email was polite, easy to deal with, kept their promises regarding delivery timelines and were solutions focused. From my first contact, I was grateful for the professionalism shown by the whole IMARC team. I recommend IMARC to all that need timely, affordable information and advice. My experience with IMARC was excellent and I can not fault it.

The IMARC team was very reactive and flexible with regard to our requests. A very good overall experience. We are happy with the work that IMARC has provided, very complete and detailed. It has contributed to our business needs and provided the market visibility that we required

We were very happy with the collaboration between IMARC and Colruyt. Not only were your prices competitive, IMARC was also pretty fast in understanding the scope and our needs for this project. Even though it was not an easy task, performing a market research during the COVID-19 pandemic, you were able to get us the necessary information we needed. The IMARC team was very easy to work with and they showed us that it would go the extra mile if we needed anything extra

Last project executed by your team was as per our expectations. We also would like to associate for more assignments this year. Kudos to your team.

.webp)

We would be happy to reach out to IMARC again, if we need Market Research/Consulting/Consumer Research or any associated service. Overall experience was good, and the data points were quite helpful.

The figures of market study were very close to our assumed figures. The presentation of the study was neat and easy to analyse. The requested details of the study were fulfilled. My overall experience with the IMARC Team was satisfactory.

The overall cost of the services were within our expectations. I was happy to have good communications in a timely manner. It was a great and quick way to have the information I needed.

My questions and concerns were answered in a satisfied way. The costs of the services were within our expectations. My overall experience with the IMARC Team was very good.

I agree the report was timely delivered, meeting the key objectives of the engagement. We had some discussion on the contents, adjustments were made fast and accurate. The response time was minimum in each case. Very good. You have a satisfied customer.

.webp)

We would be happy to reach out to IMARC for more market reports in the future. The response from the account sales manager was very good. I appreciate the timely follow ups and post purchase support from the team. My overall experience with IMARC was good.

IMARC was a good solution for the data points that we really needed and couldn't find elsewhere. The team was easy to work, quick to respond, and flexible to our customization requests.

- Competitive Intelligence and Benchmarking

- Consumer Surveys and Feedback Reports

- Market Entry and Opportunity Assessment

- Pricing and Cost Research

- Procurement Research

- Report Store

- Aerospace and Defense

- Agriculture

- Chemicals and Materials

- Construction and Manufacturing

- Electronics and Semiconductors

- Energy and Mining

- Food and Beverages

- Technology and Media

- Transportation and Logistics

Quick Links

- Press Releases

- Case Studies

- Our Customers

- Become a Publisher

134 N 4th St. Brooklyn, NY 11249, USA

+1-631-791-1145

Level II & III, B-70, Sector 2, Noida, Uttar Pradesh 201301, India

+91-120-433-0800

30 Churchill Place London E14 5EU, UK

+44-753-713-2163

Level II & III, B-70 , Sector 2, Noida, Uttar Pradesh 201301, India

We use cookies, including third-party, for better services. See our Privacy Policy for more. I ACCEPT X

- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Online Travel Market Size, Share, Competitive Landscape and Trend Analysis Report by Service types, Platforms, Mode of Booking ,and Age Group : Global Opportunity Analysis and Industry Forecast, 2022-2031

CG : Travel & Luxury Travel

✷ Report Code: A01415

Tables: 196

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

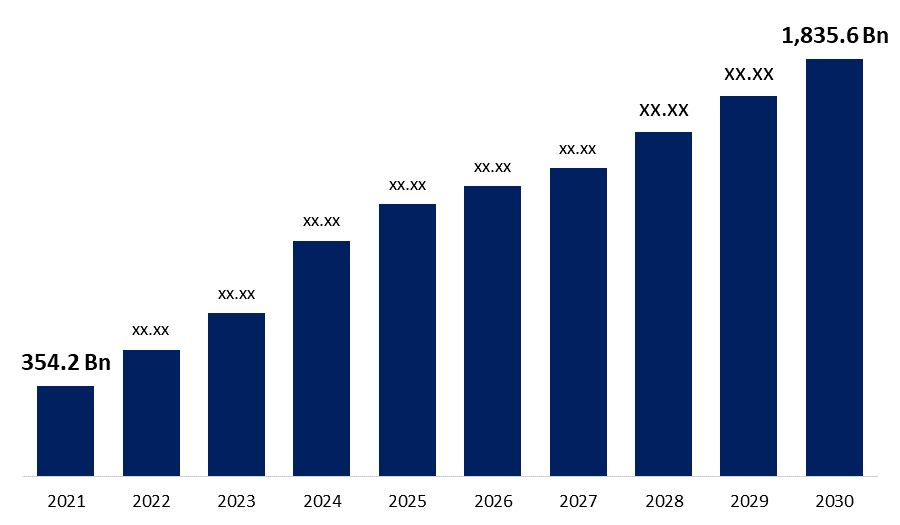

The global online travel market size was valued at $354.2 billion in 2020, and is estimated to reach $1,835.6 billion by 2031, registering a CAGR of 14.8% from 2022 to 2031.

Online travel providers aim to ease travel planning and bookings for travelers. The online travel industry is being pushed by quick and easy flight and hotel bookings, an increase in customer trust in online payment, and the option to compare numerous available travel alternatives.. Market players are extensively offering travel services through mobile websites and apps, as it is one of the most preferred mediums of travel bookings, particularly among the young professionals.

The emergence of internet has led to intense exposure of people to social media sites. People first browse through websites, gather detailed information, and review the required product or service before making a purchase. In addition, social media such as Facebook, Twitter, and travel blogs have become a common medium for people to discuss travel plans. Social media acts as a platform for online travel service providers to advertise their services and special offers for online bookings garnering the online travel market growth during the forecast period.

Transportation segment helds the major share of 41.2% in 2020

Social and political disturbances affect the travel & tourism industry in specific regions. Customers tend to avoid these conflict prone areas even if they get travel services at affordable prices. Government of several nations have also declared instructions for travelers to refrain from traveling to countries affected with epidemics or social/political unrest. This, limits the scope of online travel booking to those countries thereby affecting the sales of the online travel market.

The online travel market segmented into service type, platforms, mode of booking, age group, and region. On the basis of service type, the market is categorized into transportation, travel accommodation, and vacation packages. By platform, it is segmented into mobile and desktop. On the basis of mode of booking, it is segmented into online travel agencies (OTAs) and direct travel suppliers. On the basis of age group, market is segmented into ¬22-31 years¬ 32-43 years¬ 44-56 years¬ and >56 years. Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, UAE, Saudi Arabia, South Africa, and rest of LAMEA).

Desktop segment helds the major share of 69.3% in 2020

According to the online travel market trends, on the basis of service types, the travel accommodation segment was the considerable contributor to the market, with $123.7 billion in 2020, and is estimated to reach $719.5 billion by 2031, at a CAGR of 16.0% during the forecast period. Travelers are increasingly being offered a diverse range of hotel options at reasonable costs by market players.. Customers compare accommodation options at several websites to get the best affordable deal. Travelers choose specialized online accommodation providers such as Airbnb, Inc. and OYO Rooms because they provide a wide range of lodging alternatives.. Thus, above mentioned factors are attributable for the growth of the market through travel accommodation segment.

According to the platforms, the mobile segment was the significant contributor to the market, and is estimated to reach $617.9 billion by 2031, at a CAGR of 15.8% during the forecast period. Increase in usage of mobile and innovative mobile travel apps majorly attribute for the growth of the market through mobile segment. Technology has changed the way people communicate and travel across the globe. With evolving technology and increase in use of mobiles, easy and efficient methods are being developed to make traveling easy and comfortable, thus increasing the growth of travel industry. Mobile travel apps are gradually gaining pace in the market and are preferred by travelers to make their travel arrangements. Thus, increase in usage of the smart phones and growth in digital literacy is likely to proliferate the growth of the online travel market.

Direct Travel Suppliers segment helds the major share of 55.7% in 2020

On the basis of mode of booking, the direct travel suppliers segment was accounted for major share in global online travel market and is expected to sustain its share throughout the forecast period. Direct travel suppliers are the major revenue contributors in the product market. However, this segment witnesses an increase in threat from the growing online travel agencies (OTAs) market share. To remain competitive, airlines such as Lufthansa AG choose to circumvent OTAs by charging additional fees for bookings made through the OTAs.. The online travel industry through direct travel suppliers is developing at a slower rate, because customers are constantly using OTA platforms..

According to the online travel market analysis, on the basis of age group, the 22-31 Years segment was the considerable contributor to the market, with $102.0 billion in 2020, and is estimated to reach $539.2 billion by 2031, at a CAGR of 15.0% during the forecast period. The age group of 22–31 years comprises the young population, which are the early starters in their professional career. When compared to travelers in the older age groups, these travelers are more likely to spend more money on travel and visit new places. These travelers have changed the travel business because of their extensive use of technology, . Smartphones and other mobile devices are largely preferred to make travel arrangements. Furthermore, social media platforms are utilized to evaluate various travel service providers, locations, modes of transportation, and lodging. As a result, the industry is experiencing strong growth in the 22–31 year age group sector..

32 - 43 Years segment helds the major share of 33.6% in 2020

According to the online travel market opportunities, region wise, Asia-pacific gained significant online travel market share and is expected to sustain its share throughout online travel market forecast period. It possesses the highest growth potential in the online travel market, India and China being the most lucrative markets. The growth is attributed to the increase in disposable income, rise in middle-class segment, and greater penetration of internet facilities. Ctrip is the leading player in online travel market in China, whereas MakeMytrip, Yatra, and Cleartrip are the major online travel agencies (OTA) in India.

The players operating in the global online travel industry have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Expedia Group, Inc., Ebury Partners UK Ltd, Fareportal Inc. , Hostelworld.com Limited, Hurb Co S/A, HRS, MakeMyTrip Ltd., Oracle Corporation, Priceline (Booking Holdings Inc.), SABS Travel Technologies, Tavisca Solutions Pvt. Ltd., Thomas Cook India Ltd., travelomatix.com, Trip.com Group, Tripadvisor, Inc., and WEX Inc.

North America region helds the major share of 33.3% in 2020

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the current trends, estimations, and dynamics of the market size from 2020-2031 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size and segmentation assist to determine the prevailing market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the online travel market.

Online Travel Market Report Highlights

Analyst Review

The global online travel market is anticipated to witness robust growth in the emerging market of Asia-Pacific. The growth is attributed to increase in disposable income, rise in middle-class segment, and greater penetration of internet facilities. Business travel has also fueled market growth in Asia-Pacific. Approximately, 90% of corporate travelers in the region own either a smart phone or tablet. More than 50% of these travelers manage their travel through these devices. Companies cater to the needs of travelers through innovative mobile travel apps to gain market share. Apps with various features are being developed to stay connected to travelers throughout their journey and to assist them whenever required. Travel apps offer flexibility to travelers, thus becoming an important differentiating factor for the consumers while choosing a travel company. In addition, customers download hotel and airline apps for quick view and booking status. Thus, proliferation of mobile usage and innovative mobile travel apps are expected to foster the growth of the online travel market in the future.

- Travel Destinations

- Luxury Accommodations

- Travel Packages

- Adventure Travel

- Luxury Travel Experiences

- Travel Planning

- Outdoor Activities

Total Market value of Online Travel report was valued at $354.2 billion in 2020.

14.8% is the CAGR of Online Travel Market

You can request sample from the website (www.alliedmarketresearch.com) or you can call our sales representative on U.S. - Canada toll free - +1-800-792-5285, Int'l : +1-503-894-6022 and for Europe region + 44-845-528-1300.

2022 to 2031 would be forecast period in the market report Market

Expedia Group, Inc., Ebury Partners UK Ltd, Fareportal Inc. , Hostelworld.com Limited, Hurb Co S/A, HRS, MakeMyTrip Ltd., Oracle Corporation, Priceline (Booking Holdings Inc.) and SABS Travel

The online travel market segmented into service type, platforms, mode of booking, age group, and region

India online travel market was valued at $12.4 billion and is expected grow at 21.1% during the forecast period.

By the end of the 2031, Asia-Pacific is expected to dominate the online travel market.

Online travel market was negatively impacted the growth of the market and is expected grow at highest CAGR growth rate after COVID-19 scenario.

Loading Table Of Content...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Online Travel Market

Global Opportunity Analysis and Industry Forecast, 2022-2031

- [email protected]

- +1 9726644514

- +91 9665341414

Adroit Market Research - Industry Insights

Major players profiled in the study include Expedia Group, Ebury Partners UK, Fareportal, Hostelworld Limited, Hurb Co S/A, HRS, MakeMyTrip, Oracle Corporation, Priceline, SABS Travel Technologies, Tavisca Solutions, Thomas Cook India, travelomatix.com, Trip.com Group, Tripadvisor, WEX. among others.

Latest Developments

- Expedia Group just revealed an Open World Technology platform for 2022. Technology is created for partner organisations. The platform is ideal for the agency looking to launch a new online travel business since it includes a comprehensive ecommerce suit, with several blocks including payments, chatbots, services, and fraud detection.

Online Travel Agencies Market Scope

Key Segments in the global Online Travel Market

By Service Type, 2019-2029 (USD Billion)

- Transportation

- Vacation Packages

- Accommodation

By Device Platform, 2019-2029 (USD Billion)

By Payment Modes, 2019-2029 (USD Billion)

- Debit / Credit Card

- Others (Vouchers, Discount Codes)

By Region, 2019-2029 (USD Billion)

North America

- Rest of Europe

Asia Pacific

- Rest of Asia Pacific

South America

- Rest of South America

Middle-East and South Africa

Frequently Asked Questions (FAQ) :

What is the market value of online travel agencies market in 2032, what is the growth rate of online travel agencies market, which are the top companies hold the market share in online travel agencies market.

1. Introduction o Introduction o Market Definition and Scope o Units, Currency, Conversions, and Years Considered o Key Stakeholders o Key Questions Answered 2. Research Methodology o Introduction o Data Capture Sources o Market Size Estimation o Market Forecast o Data Triangulation o Assumptions and Limitations 3. Market Outlook o Introduction o Market Dynamics ? Drivers ? Restraints ? Opportunities ? Challenges o Porter’s Five Forces Analysis o PEST Analysis 4. By Service Type, 2019-2029 (USD Billion) • Transportation • Vacation Packages • Accommodation 5. By Device Platform, 2019-2029 (USD Billion) • Mobile • Desktop 6. By Payment Modes, 2019-2029 (USD Billion) • UPI • E-Wallet • Debit / Credit Card • Others (Vouchers, Discount Codes) 7. Regional Overview, 2019-2029 (USD Billion) North America o U.S o Canada Europe o Germany o France o UK o Rest of Europe Asia Pacific o China o India o Japan o Rest of Asia Pacific South America o Mexico o Dental o Rest of South America Middle-East and South Africa 8. Competitive Landscape o Company Ranking o Market Share Analysis o Strategic Initiatives ? Mergers & Acquisitions ? New Product Launch ? Others 9. Company Profiles • Expedia Group • Ebury Partners UK • Fareportal • Hostelworld Limited • Hurb Co S/A • HRS • MakeMyTrip • Oracle Corporation • Priceline • SABS Travel Technologies • Tavisca Solutions • Thomas Cook India • travelomatix.com • Trip.com Group • Tripadvisor • WEX. 10. Appendix o Primary Research Approach ? Primary Interview Participants ? Primary Interview Summary o Questionnaire o Related Reports ? Published ? Upcoming

Leaving without a Sample Report?

Enter your details and we shall send you a free sample report

Global Online Travel Market by Service type (Transportation, Travel Accommodation, and Vacation Packages), by Platform (Mobile and Desktop), Mode of Booking (Online Travel Agencies (OTAs) and Direct Travel Suppliers); By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

The Global Online Travel Market size was valued at USD 354.2 Bn in 2021. The market is projected to grow USD 1,835.6 Bn in 2030, at a CAGR of 14.8 %. Review sites and travel e-commerce sites make up the majority of the internet travel sector. It provides the convenience of reserving from the comfort of one's own home and frequently entices customers with package deals and cost-cutting choices. As a result, many tourists are opting to book their trips online rather than through traditional brick-and-mortar travel firms. Furthermore, the primary global online travel market is being driven by greater consumer spending power, a government initiative to promote tourism, growing internet and credit card usage, and the creation of new online segments. The increasing penetration of international flight and hotel bookings supplied by online portals such as Booking.com, TripAdvisor.com, .

Get more details on this report -

The emergence of the travel and tourism business, as well as shifting patterns in standard of life, has resulted in a steady increase in the online travel market. The demand for online travels varies depending on the property type and is impacted by factors including location, size, and on-site amenities. The market is likely to be driven by rising disposable income, popularizing weekend culture, the introduction of low-cost airline services, and the developing service industry. The rise in spending power and the style of living are two of the most important factors driving people to luxury resorts. The demand for online travels is also fueled by a city's or country's hosting of sporting events. The development of the market has been hastened by the emergence of online lodging booking services. Marriott International, for example, published a new edition of its mobile app, Marriott Bonvoy, on February 10, 2021, with new features like better booking possibilities, greater personalized experiences, and customizations in earning and redeeming points. As a result, the industry is expected to consolidate due to growing demand for premium services with better booking options.

COVID-19 Analysis

The epidemic of COVID-19 has had a significant influence on the tourism and travel industries. The global implementation of social distancing, stay-at-home, and travel restrictions has stifled the expansion of the online travel industry. According to the American Hotel and Lodging Association 2021 study, hotel occupancy in the United States fell from 66 percent to around 40 percent in 2020, compared to the previous year. As a result of the pandemic, the hotel industry is likely to suffer a severe slowdown; nevertheless, the market is expected to return to its prior growth trajectory in the coming years.

Service Type Outlook

The travel accommodation segment accounted largest market share for the global online travel market in 2020. Market competitors are gradually providing travellers with a varied selection of hotel options at reasonable prices. Customers evaluate lodging options across multiple websites in order to get the most cost-effective option. Because they offer a diverse range of housing options, travelers prefer specialized online accommodation providers such as Airbnb, Inc. and OYO Rooms. As a result, the aforementioned reasons are responsible for the market's rise in the travel accommodation segment. These hotels usually have high-end designer interiors created with cutting-edge technology propels the demand for the growth of the global online travel market.

Global Online Travel Market Report Coverage

Platform Outlook

The mobile segment accounted largest market share for the global online travel market in 2020 owing to the expansion of the market through the mobile sector is mostly due to an increase in mobile usage and the development of novel mobile travel apps. The way people communicate and travel throughout the world has changed as a result of technological advancements. With the advancement of technology and the increased usage of mobile phones, simple and effective techniques are being developed to make travelling simple and comfortable, hence boosting the travel industry's growth. Travelers prefer to make their travel reservations using mobile travel apps, which are gradually gaining traction in the market. As a result, the expansion of the internet travel business is projected to be fueled by an increase in smart phone usage and a rise in digital literacy.

Mode of Booking Outlook

The online travel agencies (OTAs) segment accounted largest market share for the global online travel market in 2020. Online travel firms are becoming the most popular method of making reservations around the world. The rise of online travel agencies has been one of the most striking examples of industry and society's digital revolution in the last 25 years. OTAs have evolved into digital marketplaces that provide direct access to a wide range of online travel options for both B2B and B2C consumers. OTAs can be thought of as a cross between an e-commerce platform and a travel agency. Expedia, Booking.com, and Trip.com, among others, have dominated the global online travel business (hotels, airlines, packaged tours, rail and cruises).

Regional Outlook

Asia Pacific dominated largest market share for the global online travel market in 2020 owing to has the most potential for growth in the internet travel business, with India and China being the most profitable areas. The increase in discretionary income, rise in the middle-class section, and increasing penetration of internet facilities are all factors contributing to the expansion. In China, Ctrip is the most popular online travel agency (OTA), whereas in India, MakeMyTrip, Yatra, and Cleartrip are the most popular OTAs.

Europe is anticipated to emerge as the fastest-growing region over the forecast period. This is due to the presence of some of the world's most popular tourist spots. According to the UNWTO's Foreign Tourism Highlights 2019 Edition, Europe accounted for half of all international visitor arrivals in 2018. The survey also reveals that five major European countries are among the top ten destinations based on foreign tourist arrivals in 2018.

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities.

In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market.

Market Segmentation of Global Online travel Market

By Service Type

- Transportation

- Travel Accommodation

- Vacation Packages

By Platform

By Mode of booking

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

Key Players:

- Alibaba Group

- Elong, Inc.

- Tuniu Corporation

- AirGorilla, LLC

- Hays Travel limited

- Airbnb, Inc.

- Yatra Online Private Limited, India

- Trip Advisor Inc.

- MakeMyTrip Limited

- Hostelworld Group PLC (HSW)

- Trivago N.V

- Despegar.com, Corp

- Lastminute.com Group

- Single User: $5150 Access to only 1 person; cannot be shared; cannot be printed

- Multi User: $7150 Access for 2 to 5 users only within same department of one company

- Enterprise User: $9150 Access to a company wide audience; includes subsidiary companies or other companies within a group of companies

Premium Report Details

15% free customization.

Share your Requirements

We Covered in Market

- 24/7 Analyst Support

- Worldwide Clients

- Tailored Insights

- Technology Evolution

- Competitive Intelligence

- Custom Research

- Syndicated Market Research

- Market Snapshot

- Market Segmentation

- Growth Dynamics

- Market Opportunities

- Regulatory Overview

- Innovation & Sustainability

Connect with us

- smartphone USA- +1 303 800 4326

- smartphone APAC- +91 9561448932

- email [email protected]

- email [email protected]

Need help to buy this report?

Online Travel Market Trends and Analysis by Region, Transportation, Accommodation, Travel Intermediation and Segment Forecast to 2030

Access in-depth insight and stay ahead of the market

Published: May 05, 2023 Report Code: GRCBBR00002TT-BB

- Share on Twitter

- Share on LinkedIn

- Share on Facebook

- Share on Threads

- Share via Email

- Report Overview

Key Players

Table of contents.

Accessing the in-depth insight from the ‘Online Travel’ report can help you:

- Make informed decisions about investments, partnerships, and product development

- Identify your competitors positioning to stay ahead in the market

- Identify promising areas, growth trends, segments, and markets to expand your product portfolio or successful investment

- Anticipate expected changes in demand and adjust your business development strategies

- Identify potential areas of disruption

How is our ‘ Online Travel’ report different from other reports in the market?

- The report presents in-depth market sizing and forecast at a segment level for more than 15 countries including historical and forecast analysis for the period 2019-2030 for market assessment

- Detailed segmentation by type – Transportation (Airlines, Car Rental, Others), Travel Accommodation, Travel Intermediation (Online Travel Agencies, Tour Operator Websites, Other Travel Intermediaries)

- Detailed value chain analysis helping businesses identify areas where they can improve their efficiency and effectiveness, reduce costs, and enhance their competitive advantage

- The report offers consumer, industry, and enterprise trends, along with challenging factors impacting the online travel market.

- The growth innovation matrix included in the report, divides the market players in to four categories i.e., flagbearers, contenders, specialists, and experimenters, which will help value chain participants in understanding how competition is performing based on their revenue growth and their R&D efforts

- Competitive profiling and benchmarking of key players in the market to provide deeper understanding of industry competition

We recommend this valuable source of information to anyone involved in:

- Online Travel Agents

- Tour Operators

- Direct Suppliers

- Hotel Groups

- Car Rental Companies

- Technology Companies

- Ancillary Suppliers

- Venture Capital Firms

To Get a Snapshot of the Online Travel Market Report, Download a Free Report Sample

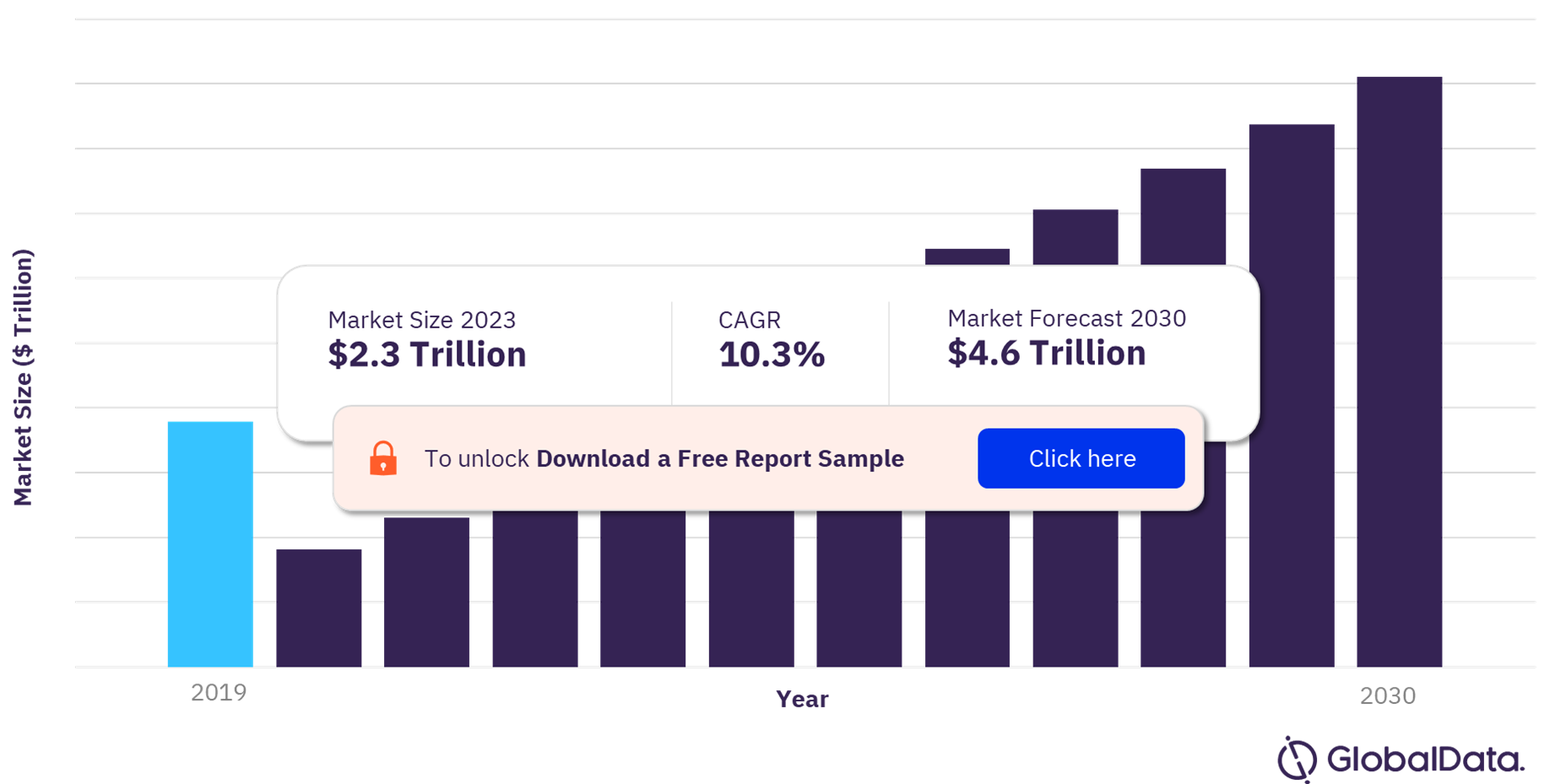

Online Travel Market Overview

The online travel market will be valued at $2.3 trillion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% over the forecast period. The proliferation of mobile devices, improved network connectivity, and rising disposable income are some of the prime factors responsible for the growth of this market. Furthermore, the growing interest of individuals in frequent travel coupled with the emergence of vlogging culture is anticipated to contribute to market growth.

The travel and tourism industry experienced a significant drop in revenue during the pandemic outbreak owing to travel restriction imposed by governments worldwide. This impacted the sales across the online as well as offline channels with the market value of online travel intermediaries and in-store travel intermediaries declining by 60.1% and 63.8% YoY respectively. However, the impact of COVID-19 compelled several consumers to use online services, which is anticipated to benefit and accelerate the uptake of online travel in the future.

Online Travel Market Outlook, 2019-2030 ($ Trillion)

View Sample Report for Additional Insights on Online Travel Market Forecast, Download a Free Report Sample

Online travel booking enables travel and tourism companies to better engage with their customers, which ensures improved customer satisfaction. Furthermore, it helped travel companies and consumers in managing travel bookings while facing uncertainties in terms of travel dates and cancellations during COVID-19 outbreak. This coupled with changing customer demands, compelled travel companies to invest in updating their websites and building travel apps through which travel brands can expand their digital presence and offer various features and discounts, thereby enhancing customer booking experience.

Online travel booking is gaining immense popularity with the younger generation. Millennials and Gen Z are influenced by digitally smart products, owing to which they are expected to look out for advanced booking systems that offer them a personalized experience. As such travel companies are investing in integrating technologies such as artificial intelligence , machine learning , and Big Data to help automate the online travel booking process, which is anticipated to attract young consumers. Travel companies can leverage the traveler analytics generated by Big Data and offer tailored packages, which is expected to help attract more website and app traffic, subsequently contributing to market growth.

Several travel companies are introducing online platforms and applications for travel booking to capitalize on the expansion and automation capabilities it provides to travel companies. However, online platforms are also vulnerable to data breaches, which may pose a challenge to market growth. As reported in 2019 by American Airlines and United Airlines, both companies were compromised with data breachers stealing miles from the 10,000 reward accounts. With a large amount of personal consumer data on the websites, online travel companies are one of the common targets for cyber-attackers. As such, travel companies are investing in integrating advanced cybersecurity solutions in order to mitigate the threat of cyber-attacks and reassure travelers about the safety of their data.

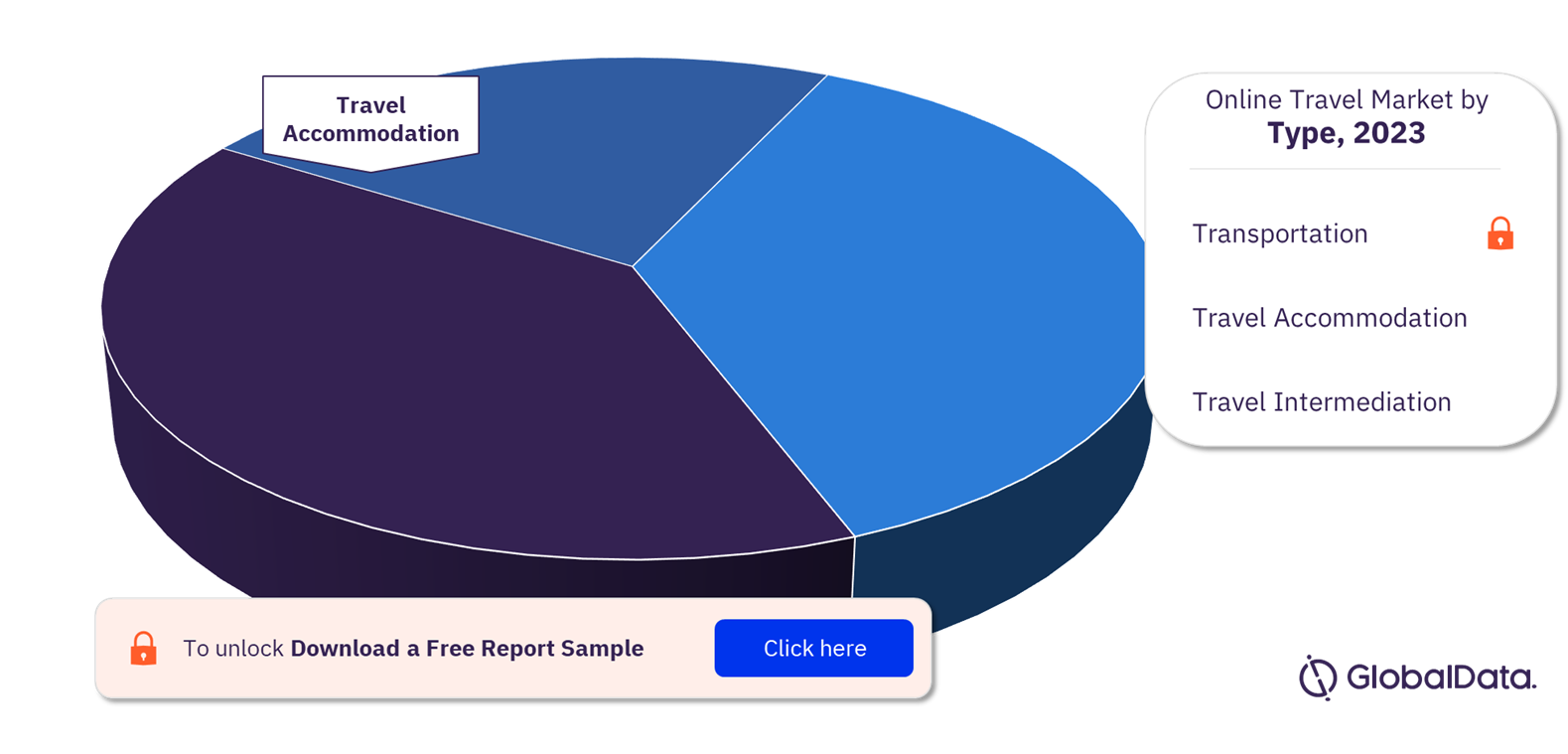

Online Travel Market Segmentation by Type

The online travel type category is broken down into three segments, including transportation, travel accommodation, and travel intermediation. The transportation segment is anticipated to dominate the online travel market in 2023. The increasing amount of online booking for trains, airlines, buses, and cars coupled with rapid urbanization has contributed to the growth of this segment.

Online Travel Market Share by Type, 2023 (%)

Online Travel Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Download a Free Report Sample

The travel accommodation segment is expected to exhibit the fastest growth of more than 10% during the forecast period. Travel companies provide a variety of accommodations nowadays such as homestays, hotel rooms, villas, and more, which enables a consumer to book their preferred options based on the requirements. Additionally, travel companies offer these accommodations in different packages such as honeymoon suites, with meal options, group stays, and others, in order to attract various consumer groups, which is contributing to market growth.

The transportation segment is expected to be followed by travel intermediation segment with second highest market share in 2023. This segment is bifurcated in to three sub-segments, namely, online travel agencies (OTAs), tour operator websites, and other travel intermediaries. OTAs held the significant market share of the travel intermediation segment in the past few years and is expected to retain its dominance over the forecast period. The high market share is attributed to the broad range of services that these agencies provide access to the customer. Travelers can research and book variety of products and services, including flights, hotels, cars, activities, and cruises, among others with the travel suppliers though OTAs, which has fueled the demand for this segment.

Online Travel Market Analysis by Region

The North America region is expected to hold the highest market share in 2023 and is anticipated to continue its strong growth over the forecast period. US is the leading market in the region owing to the high technology penetration across the country. Additionally, early technology adoption and enhanced network connectivity are the factors responsible for market growth in North America. Europe held the second highest market share in the online travel market owing to government initiatives in promoting travel & tourism and favorable business environment across the European countries.

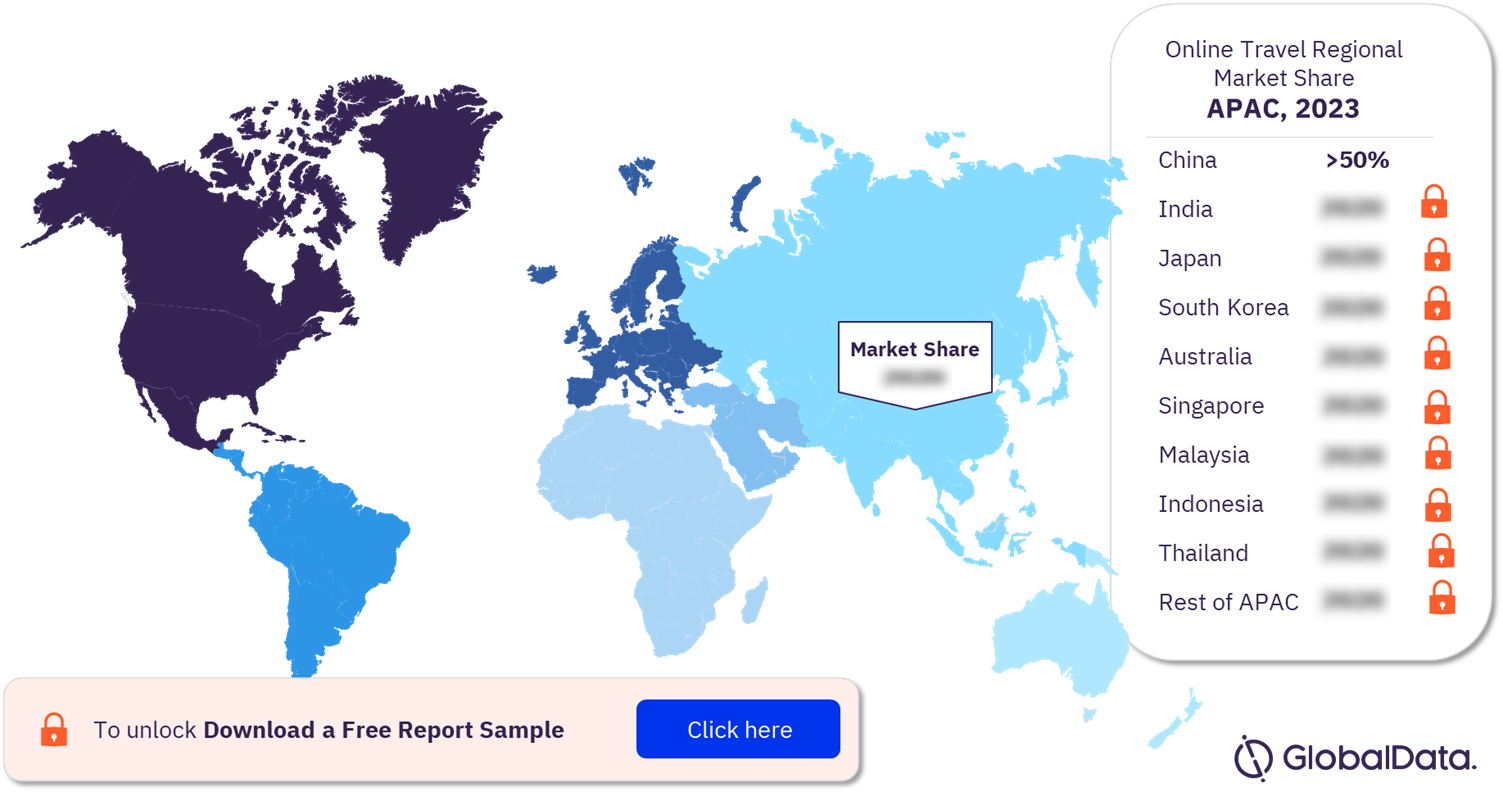

Asia-Pacific Online Travel Market Share by Country, 2023 (%)

View Sample Report for Additional Online Travel Market Insights, Download a Free Report Sample

The Asia Pacific online travel market is expected to register the fastest growth of more than 10% over the forecast period. This growth is attributed to the enhanced network connectivity and rising disposable income across the region. Additionally, the region has significant amount of young tech-savvy population, responsible for the emerging trend of making travel vlogs, which is further anticipated to boost domestic and international travel across the region, thereby fueling market growth.

The South and Central America and the MEA are anticipated to exhibit strong growth over the future owing to government initiatives to promote tourism across the regions. The South and Central American countries offer tourists with natural attractions such as deserts, jungles, and mountains along with different activities in national parks, thereby attracting wildlife enthusiasts, adventure seekers, and hikers.

Furthermore, the countries in this region also offer various culinary experiences from street food to fine dining restaurants. Although, the region has lot to offer to the travel and tourism industry, lack of technological infrastructure may pose a challenge to market growth. Enhancement in technological capabilities such as data centers and telecommunication networks may help travel vendors in expanding online travel booking network across the region, in turn contributing to market growth.

The Middle East has been experiencing a solid growth with the resumption of tourism activities post pandemic. The frequency of online booking has paced up with the emerging trend of escapism travel, which allows people to work from anywhere they want. The last-minute travel bookings are expected to gain momentum with an increased desire to travel among the domestic travelers.

Additionally, with the increasing demand of luxury hotels , total number of 32,621 hotel rooms were under construction in Saudi Arabia in 2022, which bodes well for market growth. This coupled with the robust technological and tourism infrastructure in the region is expected to fuel the market growth.

Online Travel Market – Competitive Landscape

The online travel market is highly competitive market with the presence of several established and small regional players operating in the market. The established companies in the market are focused on merging and acquiring smaller firms in order to expand their business to new regions as well as utilize their technology to enhance online travel booking platforms and enhance user experience.

The market has three types of suppliers, including online travel agencies (OTAs), direct suppliers, and ancillary suppliers. OTAs are currently dominating the market while facing competition from direct suppliers who are indulging in developing their own online travel booking platforms in order to better engage with the customers.

Key players in the online travel market include:

- Booking Holdings Inc

- eDreams ODIGEO SA

- Expedia Group Inc

- Flight Centre Travel Group Ltd

- MakeMyTrip Ltd

- Singapore Airlines Ltd

- The Emirates Group

- Tongcheng Travel Holdings Ltd

- Trainline plc

- com Group Ltd

Other Online Travel Market Vendors Mentioned

TripAdvisor, Uber Technologies Inc, Marriott International, Hilton Worldwide Holdings Inc, Thomas Cook (India) Limited, lastminute.com N.V., Adventure Inc., Tuniu Corporation, Easy Trip Planners Ltd, Yatra Online Inc, and Hostelworld Group PLC, among others.

To Know More About Leading Online Travel Market Players, Download a Free Report Sample

Online Travel Market Research Scope

Online travel market segments and scope.

GlobalData Plc has segmented the online travel market report by type and region:

Online Travel Type Outlook (Revenue, $ Billion 2019-2030)

- Travel Accommodation

- Online Travel Agencies

- Tour Operator Websites

- Other Online Travel Intermediaries

Online Travel Regional Outlook (Revenue, $ Billion 2019-2030)

- North America

- Netherlands

- Switzerland

- Rest of Europe

- Asia-Pacific

- South Korea

- Rest of Asia Pacific

- South and Central America

- Rest of South and Central America

- Middle East and Africa

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Chapter 1 Executive Summary

- Chapter 2 Research Scope and Segmentation

- Chapter 3 Market Overview

- 4.1 Industry Value Chain Analysis

- 4.2 Consumer Trends

- 4.3 Online Travel – Market Challenges Analysis

- 4.4 Online Travel – Market Opportunities Analysis

- 4.5 Industrial Trends

- 4.6 Enterprise Trends

- 4.7 Online Travel – Dashboard Analytics

- 5.1 Global Market Revenue Snapshot

- 5.2.1.1 Global Online Travel Market Estimates and Forecasts, by Type, Transportation, 2019-2030 ($ Billion)

- 5.2.1.2.1 Global Online Travel Market Estimates and Forecasts, by Airlines, 2019-2030 ($ Billion)

- 5.2.1.3.1 Global Online Travel Market Estimates and Forecasts, by Car Rental, 2019-2030 ($ Billion)

- 5.2.1.4.1 Global Online Travel Market Estimates and Forecasts, by Others, 2019-2030 ($ Billion)

- 5.2.2.1 Global Online Travel Market Estimates and Forecasts, by Type, Travel Accommodation, 2019-2030 ($ Billion)

- 5.3.1.1 Global Online Travel Market Estimates and Forecasts, by Type, Travel Intermediation, 2019-2030 ($ Billion)

- 5.3.1.2.1 Global Online Travel Market Estimates and Forecasts, by Online Travel Agencies, 2019-2030 ($ Billion)

- 5.3.1.2.1 Global Online Travel Market Estimates and Forecasts, by Tour Operator Websites, 2019-2030 ($ Billion)

- 5.3.1.4.1 Global Online Travel Market Estimates and Forecasts, by Other Online Travel Intermediaries, 2019-2030 ($ Billion)

- 6.1 Online Travel – Regional Deep Dive

- 6.2.1 North America Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.2.2 North America Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.2.3.1 US Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.2.3.2 US Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.2.4.1 Canada Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.2.4.2 Canada Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.2.5.1 Mexico Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.2.5.2 Mexico Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.1 Europe Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.2 Europe Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.3.1 UK Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.3.2 UK Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.4.1 France Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.4.2 France Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.5.1 Germany Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.5.2 Germany Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.6.1 Netherlands Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.6.2 Netherlands Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.7.1 Italy Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.7.2 Italy Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.8.1 Spain Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.8.2 Spain Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.9.1 Belgium Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.9.2 Belgium Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.10.1 Switzerland Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.10.2 Switzerland Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.11.1 Sweden Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.11.2 Sweden Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.3.12.1 Rest of Europe Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.3.12.2 Rest of Europe Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.1 Asia Pacific Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.2 Asia Pacific Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.3.1 China Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.3.2 China Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.4.1 Japan Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.4.2 Japan Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.5.1 India Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.5.2 India Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.6.1 South Korea Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.6.2 South Korea Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.7.1 Australia Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.7.2 Australia Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.8.1 Singapore Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.8.2 Singapore Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.9.1 Malaysia Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.9.2 Malaysia Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.10.1 Indonesia Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.10.2 Indonesia Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.11.1 Thailand Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.11.2 Thailand Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)

- 6.4.12.1 Rest of Asia Pacific Online Travel Market Estimates & Forecasts, 2019-2030 ($ Billion)

- 6.4.12.2 Rest of Asia Pacific Online Travel Market Estimates & Forecasts, by Type 2019-2030 ($ Billion)