Do you need to set up travel alerts on your credit cards?

Whether you have two or 22 travel rewards credit cards in your wallet, chances are you enjoy hitting the road. Unfortunately, it can be extremely frustrating when your card gets flagged while traveling, and you're suddenly unable to use it. While it's great when an issuer correctly flags unauthorized account activity as fraudulent, the opposite is true when the issuer inadvertently prevents you from swiping a card.

Thankfully, most major issuers no longer require users to set travel alerts ahead of time.

In this guide, we'll walk through the details for different cards so you know what to expect before your trip.

What is a travel alert?

Before diving into issuer-specific guidelines, let's start with a quick overview of what a travel alert is and why this is important.

Most of today's credit cards have mechanisms to prevent fraud and abuse. When an issuer notices unusual account activity, it may flag it as potentially fraudulent. This happened to me when an unauthorized individual called Chase and inputted the full 16-digit account number of my Chase Freedom Unlimited. I immediately requested a new card, preventing the thief from actually using the compromised card number — a minor inconvenience but not a significant hassle.

However, this protection can also kick in if you try to use a card abroad or in an area of the U.S. that's far from your primary residence. Suppose you've spent months (or even years) swiping a card solely within a specific area and then you suddenly try to use it in another state or country. In that case, this activity might get flagged — and it could be a substantial roadblock to continuing your trip. If you haven't set up your cellphone to work abroad — or if you're in an area with limited service — there may be no quick way to let the issuer know that the purchase is (in fact) valid and authorized.

If you notify the issuer ahead of time, a sudden charge in another part of the country or the world (one that you specifically said you'd be visiting during the given time period) won't be flagged. This allows you to continue swiping your card and — most importantly — keep enjoying your trip.

So, how exactly do you do this? As noted above, many major credit card issuers no longer require proactive travel alerts ahead of time — but let's go through some of the largest ones.

Related: Best credit cards with no foreign transaction fees

How to set American Express travel alerts

Amex doesn't require you to set up travel alerts. In fact, if you log in to your account at AmericanExpress.com, you won't even see this as an option. Here's the rationale, per the issuer's FAQ page on the topic:

We use industry-leading fraud detection capabilities that help us recognize when our card members are traveling, so you don't need to notify us before you travel.

It does suggest that you keep updated contact information on your account and download the Amex app before your trip. However, you shouldn't have any trouble using your cards when traveling.

Applicable cards include: American Express® Gold Card , The Platinum Card® from American Express , Marriott Bonvoy Brilliant® American Express® Card , The Business Platinum® Card from American Express .

How to set Bank of America travel alerts

Like Amex, Bank of America no longer requires travel alerts ahead of time. If you search in the Help & Support center, you'll see the following message:

You no longer need to let us know when you travel. We monitor your accounts and will send automatic alerts if we detect suspicious activity. Should you need us while traveling, call the number on the back of your card anytime.

TIP: It's important that your email address and mobile phone number are up to date on your account profile, so we can notify you quickly about unusual activity.

Note that this applies to both credit and debit cards associated with your Bank of America login, which can be nice if you're planning to withdraw money from an ATM using your debit card.

Applicable cards include : Alaska Airlines Visa Signature® credit card , Bank of America® Premium Rewards® credit card .

How to set Capital One travel alerts

Capital One uses the same approach as American Express — you don't need to set these up in advance. When you log in to your Capital One account and click on the "I Want To…" button, you'll see what appears to be an option to set a travel notification. However, when you click on it, you'll receive the following message:

With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card. That's right! You don't have to tell us when and where you're traveling, inside or outside the United States. Your credit card is 100% covered for fraud while you're traveling and we will alert you if we see anything suspicious.

You're covered by $0 Fraud Liability on unauthorized charges. Remember that none of Capital One's credit cards impose foreign transaction fees for purchases made abroad.

Applicable cards: Capital One Venture X Rewards Credit Card (see rates and fees ), Capital One Venture Rewards Credit Card (see rates and fees ), Capital One SavorOne Cash Rewards Credit Card (see rates and fees ), Capital One Spark Miles for Business (see rates and fees ).

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How to set Chase travel alerts

Chase offers a wide variety of valuable credit cards, including many that you may want to use when traveling. Like previous issuers on the list, you no longer need to proactively set up travel notifications ahead of your trip. When you log in to your Chase account, you'll still see the "Travel notification" option under account services, but here's the message you'll find there:

We've got you covered! With our enhanced security measures:

- You don't need to set up travel notifications anymore.

- We'll send you fraud alerts if we see any possible identity theft.

- We'll alert you if we notice any suspicious behavior on your account.

Applicable cards include: Chase Sapphire Reserve® , Chase Sapphire Preferred Card® , World of Hyatt Credit Card , United℠ Explorer Card , Aeroplan® Credit Card , Ink Business Preferred® Credit Card .

How to set Citi travel alerts

Unlike previous issuers, Citi still allows you to set up travel notifications on your credit cards. Here's how to do so:

BRIAN KELLY/THE POINTS GUY

- Log in to your account at citi.com

- Hover over "Services" at the top, then click on "Travel Services"

- Click on "Add a Travel Notice"

- Select the applicable cardholders, enter your dates, then click "Next"

- Review the details, then click "Confirm"

Note that you don't even need to select the individual destination (or destinations) you're visiting. The only required pieces of information are the cardholders who'll be on the trip (including authorized users ) and the dates of the trip.

Applicable cards include: Citi Strata Premier℠ Card (see rates and fees ), Citi Rewards+® Card (see rates and fees ), Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees ).

What if a travel alert doesn't work?

Unfortunately, even the advanced technology credit card issuers use nowadays isn't guaranteed. There may be certain instances where a legitimate transaction is flagged as potentially fraudulent, especially when traveling. Alternatively, an issuer may require an extra verification step before approving a purchase instead of being declined immediately. This especially applies to many online transactions thanks to 3D card security measures .

This is one reason why it's critical to have updated contact information on file with your card issuers and a working mobile phone when you're outside the country. This ensures that you can complete any verification requests in a timely fashion.

It's also critical to always have at least one backup credit card in your wallet when traveling (or load alternate options into your mobile wallet ). Ideally, this card would be from a different card issuer and work with a different payment network, which minimizes the chance that neither card will work.

Related: Best travel credit cards

Bottom line

From full flights to weather delays to traffic, travel can be stressful — and that's without any financial issues. Fortunately, most major credit card issuers no longer require advance travel notices on your accounts. However, you should still carry at least one backup payment method in case your primary card is declined. It's also critical to have a working phone number to receive email or text notifications when things go wrong.

If you want to maintain your ability to swipe your favorite travel rewards credit cards on your next trip, follow these instructions before you depart.

How to Set Up Credit Card Travel Notifications

Putting a travel notification on your credit card may prevent a major travel headache.

Set Up Credit Card Travel Notifications

Getty Images

Travel notifications prevent a credit card issuer from flagging a purchase you make out of the country as fraudulent.

You might be ready for an upcoming trip, but is your credit card? Depending on your card issuer, you might need to set up a travel notification for your account.

Adding a card travel notification is easy. For most credit cards, you'll follow these steps:

- Call your credit card company, log in to its website or access its app.

- Share your travel dates and locations, if applicable.

- Submit and verify your travel notification.

This will help you avoid potential hassles and embarrassing situations when you're away.

What Are Travel Notifications?

A travel notification is essentially a setting you activate on your credit card account. "Basically, you're just telling the credit card issuer you're going to be using the card outside of the normal places you (use it). That way, they don't think someone stole your credit card," says Simon Zhen, research analyst at personal finance website MyBankTracker.com.

If you're on a road trip, you could make a card purchase in one town and then try to shop in another distant location but have your card rejected. Dan Hanks, senior vice president of credit card loyalty and servicing at PNC Bank, says if a transaction appears to be fraudulent, it may be declined, even if it is a legitimate purchase. Purchase location is just one factor credit card companies consider when flagging fraudulent transactions .

"If a customer suddenly starts using a card in a place they've never been, especially in another country, it doesn't mean we'll decline them, but it increases the chance we might stop the transaction if we think it's fraud," Hanks says.

Transactions may be marked as fraudulent and your card deactivated as a precaution, particularly if your issuer can't reach you to confirm them. If you only bring one credit card on your trip, you may have a major problem on your hands. Luckily, setting up a travel notification before you leave is an easy solution.

How to Set Up Travel Notifications

A travel notification usually requires you to provide your planned destinations and trip dates to your credit card issuer. With that information, the issuer has more knowledge to weed out fraudulent transactions from legitimate ones.

You usually have a few options to set up a travel notification. First, you can call the card issuer. "Look on the back of the card, and you can find the phone number to call. You just tell the customer service rep that you'll be traveling," Zhen says. If you prefer digital communication, you can typically set up a travel notification through the credit card company's website or app.

Each credit card company has its own travel notification policies. While many companies allow you to set up travel notifications, others may not need you to tell them about your travel plans. Below are the policies of major credit card issuers:

American Express does not request travel notifications, citing industry-leading fraud detection capabilities.

Bank of America allows you to create a travel notice up to 60 days before your trip, and it can last up to 90 days from the first day of your excursion. With one travel notice, you can set up multiple itineraries for various cards. You must provide Bank of America a contact number for when you're away from home. You can also supply details about where you'll be staying, any planned layovers and other information that may help the company monitor your account for fraud while you're traveling.

According to Barclays , a travel notification is not mandatory, but it could be wise to avoid declined purchases simply because you are traveling abroad or to a different part of the U.S. Contact the bank by phone, or access your account online or with the Barclays app to set up a notification. If you will be traveling for more than 365 days, connect with the bank by phone to set up a notification.

Capital One doesn't need notification of travel plans because of the added security of the bank's chip cards.

Chase lets you set up a travel notification up to a year before your trip. The notification can last up to 90 days. You can apply the notification to multiple cards simultaneously and list multiple destinations.

Citi permits you to add a travel notification up to 180 days before your journey and up to 89 days after your trip begins. You can set the notification for more than one card and report several destinations with one travel notification.

Discover advises setting up a notification before you embark on a trip abroad. Your travel start date can be up to 24 months in the future, and travel notifications can last up to 24 months.

PNC Bank suggests notifying it of the locations and dates of your planned travel to help eliminate phone calls to confirm your account activities. You can create travel notifications up to two years before you depart, and notifications can last up to 30 days. If your travel plans exceed 30 days, you can set up more than one travel alert.

USAA recommends a travel notification to reduce the chance of your card being blocked or flagged for unusual activity. You can set up a notification up to one year before your trip, and the notification will last up to one year from your departure. USAA does not request travel destinations.

U.S. Bank allows you to establish a travel notification for any trip within the next 90 days. Notifications can last up to 90 days. If your travel plans exceed 90 days, you can set up an additional notification at a later date.

Wells Fargo favors notification of when and where you plan to travel. Wells Fargo's travel notifications do not have any time-based restrictions, so you can set up your travel alert for as long as you'll be away and not have to set up subsequent ones.

Overall, setting up a travel notification doesn't have a downside for the customer, Hanks says. Making travel notifications easy to activate is in a credit card company's best interest. And notifications reduce the chance that a real transaction may be classified as fraudulent, which makes everyone happier.

Don't Forget About Debit Cards

"Some people set up a travel notification on a credit card but forget to set one up on their debit card," Zhen says.

While credit cards offer many protections that can be useful when traveling, especially abroad, some people may still plan to use their debit cards. If you do, make sure you set up a travel notification on your debit cards, too, so your purchases on those cards don't get flagged as fraudulent transactions when you're on your next trip.

Tags: credit cards

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

How to Set a Travel Notice for Your Credit Cards

Susan Shain

Susan is a freelance writer who specializes in turning complex financial topics into engaging and accessible articles. She's been writing about personal finance for six years, and was previously the senior writer at The Penny Hoarder and a staff writer at Student Loan Hero. Her personal finance writing has also appeared in publications like MarketWatch and Lifehacker.

When I worked at a ski rental shop in Breckenridge, Colorado, I witnessed many international (and some out-of-state) customers’ credit cards get declined.

Not because their credit limits were too low or because they were purchasing too much — but because they failed to set up travel notifications with their card issuers.

So now, any time I travel to a foreign country, I always set up a travel notice on my credit card beforehand.

Since I travel with the Chase Sapphire Reserve® (Review), I create a Chase travel notice, but you can take this step with most major credit or debit cards. Here’s how.

What Is a Credit Card Travel Notice?

As a way to prevent fraud , your credit card issuer monitors your spending activity. If it notices a suspicious purchase — in an unusually large amount, or from a new location — it may decline the transaction. This could be more likely in countries where fraud is a bigger problem.

Which is why the answer to the question “Should I notify my credit card company when traveling?” is usually yes.

Although you can often get away with shopping in another state without triggering a red flag, international travel is another story.

By notifying your credit card of your travel plans, you’ll reduce the chances of getting your transaction declined in the checkout line — which, trust me, is never fun — and having to call your card issuer to verify your purchases. It’s still possible to have your purchases declined after setting a travel notice, but it’s much less likely.

How to Set Up Travel Notices for 8 Major Credit Card Issuers

Ready to create your first travel alert? While you could call your card issuer, it’s easier to do it online.

Here’s how to set up travel notices with eight different credit card issuers.

When you visit MoneyTips, we want you to know that you can trust what’s in front of you. We are an authoritative source of accurate and relevant financial guidance. When MoneyTips content contains a link to partner or sponsor affiliated content, we’ll clearly indicate where that happens. Any opinions, analyses, reviews or recommendations expressed in our content are of the author alone, and have not been reviewed, approved or otherwise endorsed by the advertiser.

We make every effort to provide up-to-date information; however, we do not guarantee the accuracy of the information presented. Consumers should verify terms and conditions with the institution providing the products. Some articles may contain sponsored content, content about affiliated entities or content about clients in the network. While reasonable efforts are made to maintain accurate information, the information is presented without warranty.

Chase travel notice

Because of the company’s abundant travel perks and partnership with the Visa network — which is widely accepted worldwide — Chase cards are a favorite among globetrotters.

You can create Chase travel notifications up to a year in advance for credit cards, and up to 14 days for debit cards. Your travel dates can span an entire year — if you’re away for longer, you’ll simply have to adjust your dates once you’re on the road. Chase will have your request on file within 24 hours from the time you submit.

To set up Chase travel notifications, you’ll need to log in to your account and click on the credit card you plan to use. Under the “Things you can do” dropdown menu on the right, you’ll see the “Travel notification” option. That will take you to your “Profile & Settings” page, where you’ll be able to create a travel alert.

Insider tip

Depending on the type of Chase account you have, the process may be slightly different for you. In any case, just look for your “Profile & Settings” page, and then look for a button to set a travel notice.

Alternatively, if you’re already outside the country, you can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Setting up a travel notice with the Chase bank app

After logging in to the Chase mobile app, tap the profile icon (this should appear as the outline of a person) and select “My settings.” Choose “Travel” within the settings menu and tap “Update” near any credit or debit card products you’ll be taking.

This will allow you to enter the details for your upcoming trip, which can be edited at a later time. Saving this information will successfully set up a travel notice.

Our favorite Chase travel card: While many Chase credit cards are adventure-ready, we’d recommend the Chase Sapphire Preferred® Card for new travelers. Not only does it earn 2X Chase Ultimate Rewards points per dollar on travel, but you’ll also get a great introductory bonus: 60,000 bonus points after spending $4,000 on purchases in the first 3 months. You’ll also earn 5X Ultimate Rewards points per dollar on Lyft rides and travel purchased through Chase Ultimate Rewards. You can transfer the points you earn to a variety of airline and hotel loyalty programs. The Sapphire Preferred has a $95 annual fee.

American Express travel notice

Surprise! You actually can’t create an Amex travel notice.

On its site, the issuer says it uses “industry-leading fraud detection capabilities” that help it recognize when you’re on the road, thereby eliminating the need to create an American Express travel notification.

The issuer does recommend you update your contact information, so it can reach you in case of any complications, and download the Amex app, so you can manage your account on the go.

Note that Amex credit cards aren’t as widely accepted across the globe. If you’re a frequent international traveler, we’d recommend looking for a card with a Visa or Mastercard logo instead because they’re accepted by most merchants.

Our favorite American Express travel card: For its $695 Rates & Fees annual fee, The Platinum Card® from American Express offers a slew of travel perks. They include extensive airport lounge access; 5X Membership Rewards points per dollar on eligible flights and hotels (starting 1/1/21, on up to $500,000 spent per calendar year); and up to $200 in Uber credits per year. Its introductory bonus is Earn 100,000 Membership Rewards® points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu..

Capital One travel notice

As with Amex, there’s no need to set a travel notice for Capital One credit cards.

If you log in and click “Set Travel Notification,” you’ll be greeted by this window:

The issuer, long popular with international travelers for its lack of foreign transaction fees, says: “With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card.”

It notes Capital One will cover you with its $0 fraud liability policy, and will also be on the lookout for any suspicious activity.

Our favorite Capital One travel card: The Capital One Venture Rewards Credit Card is a fantastic, easy-to-use travel rewards card, offering 2X Venture miles per dollar on everything. The introductory bonus is 60,000 bonus miles for spending $3,000 in the first 3 months. It comes with a $95 annual fee.

Bank of America travel notice

Ready to travel with your Bank of America card? Log in to your account, and in the menu at the top right, you’ll see “Help & Support.”

Hover over those words, and a drop-down menu will appear. Click on “Set Travel Notice” — and voila! You’ll be able to add your travel dates and destinations, as well as extra details about your trip, like any planned layovers.

Setting a travel notice with Bank of America.

Bank of America cards allow you to set travel notices up to 60 days in advance, and they can last for up to 90 days. If you’ll be traveling longer than that you’ll need to adjust your travel notice later on.

Our favorite Bank of America travel credit card: If you don’t want to pay an annual fee, the Bank of America® Travel Rewards Credit Card might work for you. You’ll earn 3X points per dollar at the Bank of America travel center and 1.5X points on everything else. After you make $1,000 in purchases in the first 90 days, you’ll earn 25,000 points — enough for a $250 statement credit toward travel purchases.

Citi travel notice

If you have a Citi credit card, the first step is to log in to your account.

Then you should hover over the “Services” button in the menu, and then select “Travel Services.” Next you can select “Manage Travel Notices,” before selecting the card for which you want to set a notice. Unlike some other issuers, you’ll need to set a separate notice for each card you plan to travel with.

Citi advises making sure your contact information is up to date before traveling, and also to download the Citi Mobile App to more easily monitor your account.

Here’s what setting a Citi travel notice looks like:

Setting a travel notice with Citi.

Then, once you fill out your destination and dates and verify your info, you’ll be good to go!

Our favorite Citi travel credit card: The offers a generous 3X ThankYou points per dollar on air travel and at gas stations, restaurants, supermarkets, and hotels. You can earn None. There’s a None annual fee to pay for this card.

Discover travel notice

Although Discover credit cards aren’t the best for traveling internationally, as they aren’t accepted as widely as Visa or Mastercard, you should still set up a travel notice if you bring your Discover card overseas.

You can do this from your online account by selecting “Manage” at the top of your screen, then clicking “Manage Cards” and then “Register Travel.”

Setting a travel notice with Discover.

Our favorite Discover travel card: For a card with no annual fee, the Discover it® Miles isn’t a bad choice. You’ll get 1.5X miles per dollar spent on everything, with double your miles at the end of your first cardholder year.

PNC travel notice

If you have a PNC credit or debit card, the bank recommends you set up a travel notice, explaining: “You typically use your card at local merchants and online, but suddenly you’re buying tapas in Madrid or sushi in Tokyo. This unexpected activity is what triggers the alert. Although less likely, this kind of predicament also can happen when traveling domestically.”

To notify PNC, you can either call the financial institution at 1-888-PNC-BANK or set up an alert online. After logging in to your account, you’ll select: “Customer Service” –> “Account Services” –> “Debit/ATM Card Services” –> “Edit/View Preferences.”

Then, in the bottom right corner of your screen, you’ll see an option to “Notify PNC of Foreign Travel.” After filling it out with your dates, destinations, and phone number, you’ll be ready to go.

Recommended PNC travel credit card: Like the BofA card, the PNC Premier Traveler® Visa Signature® isn’t the best option out there — but it’s fine for PNC loyalists. It offers a 30,000-mile introductory bonus when you spend $3,000 in the first three billing cycles, and 2X miles per dollar spent on everything. Its $85 annual fee is waived the first year.

Wells Fargo travel notice

If you’d like to tell Wells Fargo of your travel plans, you can either call the number on the back of your card, use the bank’s mobile app, or log in to your online account.

If you choose the latter method, you’ll hover over the “Accounts” dropdown menu, then click on “Manage Cards” –> “Manage Travel Plans.” As with the other issuers, you’ll enter your dates and destinations before submitting.

Recommended Wells Fargo travel credit card: There aren’t any Wells Fargo travel cards at the moment.

If you’d prefer a Visa card from Wells Fargo for traveling, consider the Wells Fargo Active Cash℠ Card . It offers 2% cash back on everything you buy, with a solid introductory bonus, but it also has a foreign transaction fee.

4 Things to Consider When Choosing a Travel Credit Card

If you’re looking for another piece of plastic to add to your wallet, here are four things to consider when choosing the best travel rewards credit card:

- Foreign transaction fees: Some credit cards charge a 3% fee for making purchases in a foreign currency. If you plan to travel abroad, make sure your chosen card has no foreign transaction fees.

- Annual fees: Many of the top-tier travel rewards credit cards have hefty annual fees. But before getting scared off, see if the card offers any credits or benifits that offset it. For example, while the Chase Sapphire Reserve® has a $550 annual fee, it also offers a $300 annual travel credit that applies toward flights, car rentals, and even Lyft rides.

- Rewards and perks: One of the most compelling reasons to get a travel credit card is the opportunity to earn points and miles that you can exchange for free travel. So take a look at your potential card’s introductory bonus and earning ability. You should also read the fine print to learn all about its travel perks, which might include airport lounge access or travel insurance.

- Loyalty programs: The majority of hotel chains and airlines have co-branded cards that earn additional rewards when you spend money with them. So if you are loyal to a particular brand, it’s wise to consider the co-branded options. For hotel cards, examples include the IHG® Rewards Club Premier Credit Card, Marriott Bonvoy Boundless™ Credit Card, and The World of Hyatt Credit Card. For airline cards, you can choose from options like the United℠ Explorer Card or Southwest Rapid Rewards® Plus Credit Card.

Whichever card you choose, be sure to set a travel notice before you board your next train or cruise or flight — and then enjoy your vacation free of worries!

You don’t have to stick to “travel credit cards” just because you want to, you know, travel with your credit card. As long as you set up a travel notification when you go, you can use any card you’d like. So, in case they’re a better fit, here are links to the best cash back, balance transfer, and 0% intro APR credit cards.

Share Article

On This Page Jump to Close

You should also check out….

- Customer Service

TD Visa ® Connect Card - Frequently Asked Questions

Expand about the td connect card.

What is the TD Connect Card? How does a TD Connect Card work? What are the benefits of owning a TD Connect Card? Are there any fees associated with the TD Connect Card? What are the load and purchase limits for the TD Connect Card? How do I log into the TD Connect Card website for the first time? Is the TD Connect Card a credit card? How is the TD Connect Card different from a gift card? What should I do if the "Good Thru" date printed on the front of my TD Connect Card has passed? Are there any additional services and benefits that come with my TD Connect Card? What if I have questions regarding my TD Connect Card Account?

What is the TD Connect Card?

The TD Connect Card is a reloadable prepaid card that is safe, convenient and more secure than carrying cash. It works at the grocery store, the pharmacy, and when making purchases online or through your smartphone, anywhere Visa is accepted. With a TD Connect Card you can shop and pay bills online or over the phone. It lets you track purchases, set alerts and limits the amount you can spend to the amount of money on the card. Plus, you can enjoy free access at TD ATMs in the U.S. and Canada.

How does a TD Connect Card work?

The TD Connect Card is easy to fund and use.

Spend with your card: The TD Connect Card can be used for purchases big or small, anywhere Visa is accepted.

- At Retailers: Use your card at the millions of retailers worldwide that accept Visa.

- Online: Use your TD Connect card at any online merchant who accepts Visa as well as with utility, phone, cable and other companies.

- ATMs: Enjoy free access at thousands of TD ATMs in the U.S. and Canada for withdrawals and balance inquiries.

Stay in control of your money: Set up online account alerts on the TD Connect Card website* and keep track of your TD Connect Card account activity and balance 24 hours a day, 7 days a week, 365 days a year.

What are the benefits of owning a TD Connect Card?

- You have access to your funds 24/7. You can load funds onto your card online, at your local TD Bank or by direct deposit from your paycheck, Government benefit checks or tax refunds. You can use your card worldwide, anywhere Visa is accepted – in person, online, over the phone or to make purchases through your smart phone. And you can withdraw funds and check your balance for free at any TD ATM in the U.S. or Canada.

- You control how much money you spend. With a TD Connect Card you decide how much money to load onto your card. It's a built-in budget, just set it and forget it.

- Your money is safe and secure. All funds loaded onto your card are FDIC insured. We will also monitor your card for suspicious activity. And if your card is lost or stolen, you're only responsible for purchases you actually made thanks to Visa's Zero Liability policy. 1

- You won't be charged hidden fees. We won't charge you a fee to talk to us, load funds or make withdrawals at TD ATMs in the U.S. and Canada.

- You decide how often you hear from us. You can select from a choice of multiple alerts as well as track your balance and spending online by visiting the TD Connect Card website* .

Are there any fees associated with the TD Connect Card?

Yes, there are fees associated with the TD Connect Card. If you have a valid TD Bank checking account, the monthly maintenance fee is $2.99. If you do not have a valid TD Bank checking account, the monthly maintenance fee is $5.99. For the full picture of our fees please see the TD Connect Card Account Guide for an easy to follow outline of our services, fees and policies.

What are the load and purchase limits for the TD Connect Card?

After the minimum initial load of $25, there is no minimum reload amount or ongoing minimum balance requirement for the TD Connect Card. The following load and purchase limits apply to the TD Connect Card:

Please see the TD Connect Card Account Guide for an easy to follow outline of our services, fees and policies.

How do I log into the TD Connect Card website for the first time?

Visit the TD Connect Card website * and click Sign In. Enter your TD Connect Card number. Verify your identity by entering the 3-digit security code printed on the back of your card followed by the last four digits of your social security number. You will then be instructed to create a Personal Identification Number (PIN). After logging in, complete your profile by providing your e-mail address, creating a username and selecting your security information.

Is the TD Connect Card a credit card?

No. The TD Connect Card is not a credit card; it is a reloadable prepaid card that you can add funds to when you want. You can only spend the amount of money you have on your card, which helps you to manage your money and eliminates overdraft fees. And we never run a credit check.

How is the TD Connect Card different from a gift card?

The TD Connect Card allows you to continue to add funds to your card. You can not add funds to a gift card and once you use all the funds on the gift card it is no longer valid. Unlike gift cards, you can use a TD Connect Card to withdraw cash at ATMs and branches and get cash back at participating merchants.

What should I do if the "Good Thru" date printed on the front of my TD Connect Card has passed?

The money on your TD Connect Card and in your TD Connect Card account never expires. TD Bank will mail you a new card before the "Good Thru" date passes. If your TD Connect Card has expired and you have not received your new card, please call Customer Service at 1-888-568-7130.

Are there any additional services and benefits that come with my TD Connect Card?

- FREE TD Bank Visa ® Gift Cards

- FREE Check Cashing (TD Bank Checks)

- Money Orders

- Official Checks

What if I have questions regarding my TD Connect Card account?

Account information may be obtained via the TD Connect Card website* . For your convenience the website, automated account information and dedicated Customer Service Representatives at 1-888-568-7130 are available 24 hours a day, 7 days a week. Or you can visit any TD Bank location .

Expand Purchasing a TD Connect Card

How do I purchase a TD Connect Card? Do I need to be a TD Bank Customer to purchase a TD Connect Card? Who can purchase a TD Connect Card? How much does it cost to purchase a TD Connect Card? Can I purchase more than one TD Connect Card? Is a checking account required? Is a credit check required? Can I build my credit rating by using a TD Connect Card?

How do I purchase a TD Connect Card?

Getting a TD Connect Card is easy. Visit any TD Bank location to purchase a TD Connect Card – your TD Connect Card will be issued to you on the spot, with your name printed on it, and will be ready to use as soon as you walk out of the Store. If you are not issued a card on the spot or your card has been replaced, your card will arrive in the mail within 5-7 business days after it's ordered. Once received, you will need to activate your card by visiting the TD Connect Card website* or by calling Customer Service at 1-888-568-7130. Unfortunately, you cannot buy a TD Connect Card online.

Do I need to be a TD Bank Customer to purchase a TD Connect Card?

No. You do not need to be a TD Bank Customer to purchase a TD Connect Card. You may purchase a TD Connect Card at any TD Bank location and load the minimum initial balance of $25 onto the card by cash or check.

Who can purchase a TD Connect Card?

Anyone 18 years of age or older with a valid Social Security number and valid U.S. address can purchase a TD Connect Card by visiting any TD Bank location . At the time of purchase, you must put a minimum initial balance of $25 onto the card by any of the following methods: cash, check or transfer from a TD checking or savings account.

How much does it cost to purchase a TD Connect Card?

There is no fee to purchase a TD Connect Card, but you must put a minimum of $25 on the card at the time of purchase.

Can I purchase more than one TD Connect Card?

No. You may only purchase one TD Connect Card and it must be for you.

Is a checking account required?

No, a checking account is not required to purchase or fund a TD Connect Card.

Is a credit check required?

No, a credit check is not required and will not be performed.

Can I build my credit rating by using a TD Connect Card?

No, the TD Connect Card will not help you build your credit rating. The TD Connect Card is not a credit card, so there are no payments that would be reported to a credit reporting agency.

Expand Funding your TD Connect Card

How do I load money onto my TD Connect Card? Does the TD Connect Card have a minimum or maximum balance requirement? When will funds be available to use? How do I fund my TD Connect Card using my TD Bank debit or credit card? How do I fund my TD Connect Card from my TD Bank checking or savings account? How do I fund my TD Connect Card with cash or a check? What is direct deposit? How do I set up direct deposit? Can I get my Federal tax refund added to my TD Connect Card account? Can I get my Federal tax refund added to my TD Connect Card account if I am filing jointly? Can I get my state tax refund added to my TD Connect Card account? Can I transfer funds from my TD Connect Card to another account?

How do I load money onto my TD Connect Card?

Does the TD Connect Card have a minimum or maximum balance requirement?

After the initial minimum opening amount of $25, there is no minimum re-load amount for adding funds or ongoing minimum balance requirement for the TD Connect Card. The maximum amount you may have on your card at any time is $10,000.

When will funds be available to use?

Funds loaded to the TD Connect Card using a TD Bank debit or credit card or transferred from a TD checking or savings account, or cash deposited at a TD Bank Store, will be available immediately. Funds loaded to a TD Connect Card using direct deposit from another bank will be available the same day we receive the transfer. The first $100 of funds loaded to the TD Connect Card through a check deposit at a TD Bank Store will be available the same day, and any remaining balance will generally be available the next Business Day. This represents our general policy, some restrictions may apply. For specific details, please see the TD Connect Terms & Conditions .

How do I fund my TD Connect Card using my TD Bank debit or credit card?

To fund your TD Connect Card with your TD Bank debit or credit card, go to the TD Connect Card website * and log in to your account. You will need to provide your debit or credit card information and verify your billing address. Funds loaded to your card using a TD Bank debit or credit card will be available the same day the transfer is made.

How do I fund my TD Connect Card from my TD Bank checking or savings account?

To fund your TD Connect Card via a transfer from a TD Bank checking or savings account visit any TD Bank location and request the transfer. Funds loaded to your card via a transfer from a TD Bank checking or savings account will be available the same day the transfer is made. You can avoid going to a TD Bank Store by funding your card online at the TD Connect Card website* using your TD Bank debit or credit card.

How do I fund my TD Connect Card with cash or a check?

To fund your TD Connect Card with cash or check visit any TD Bank location and make a deposit. Funds loaded to your card with cash will be available immediately. The first $100 of funds loaded to the TD Connect Card through a check deposit at a TD Bank Store will be available the same day, and any remaining balance will generally be available the next Business Day. You can avoid going to a TD Bank Store by funding your card online at the TD Connect Card website* using your TD Bank debit or credit card.

What is direct deposit?

Direct deposit is a free electronic transfer of your paycheck, Government benefit check or tax refund that automatically places your check or part of your check into your TD Connect Card account.

How do I set up direct deposit?

To set up a direct deposit, visit the TD Connect Card website* and log in to your account. Here you'll find "Direct Deposit Instructions" as well as your TD Connect Card account and routing numbers. This will map out how to set up a direct deposit and includes the form you will need to complete and give to your employer's payroll department to request direct deposit of your payroll check. You can use this same form to set up a direct deposit of Government benefit checks and tax refunds.

Can I get my Federal tax refund added to my TD Connect Card account?

Yes. You can have your Federal tax refund added to your TD Connect Card account. For more details about tax refunds, please visit the IRS website.

Can I get my Federal tax refund added to my TD Connect Card account if I am filing jointly?

Yes, as long as your Social Security number is listed first on your Federal tax refund and the information on your Federal tax refund, including your full name and Social Security number, matches the information we have on file. If you are filing jointly but your Social Security number is not listed first, or if the information on your Federal tax refund does not match the information we have on file, your Federal tax refund direct deposit will not be posted to your TD Connect Card account.

Can I get my state tax refund added to my TD Connect Card account?

Yes. If your state allows direct deposits to bank accounts, you can have your state tax refunded directly deposited to your TD Connect Card account. Please consult your state for instructions.

Can I transfer funds from my TD Connect Card to another account?

No. Transfers from a TD Connect Card to other accounts or prepaid cards are not available.

Expand Using your TD Connect Card

How do I activate my TD Connect Card? Who can use the TD Connect Card? Can someone else besides the cardholder use the TD Connect Card? Where can I use my TD Connect Card? Do I need a PIN to use my TD Connect Card? Can I use digital wallets with my TD Connect Card? What is the purpose of the chip on my TD Connect Card? When using my TD Connect Card, should I select "credit" or "debit"? Can I withdraw cash with TD Connect Card? How can I be sure of the balance on my TD Connect Card? Can the TD Connect Card be used to make a purchase that is larger than the balance on the card? Can I split my purchase when paying with my TD Connect Card? How can I view where my TD Connect Card was used? Can I get cash back at the register when I am making a purchase with my TD Connect Card? If I need to return a purchase will my TD Connect Card be credited? Can I use my TD Connect Card to pay bills or make payments? Can the TD Connect Card have a negative balance? Can I use my TD Connect Card at a gas station? Will some merchants place a hold on the money in my TD Connect Card account that is more than the actual purchase amount? Does my TD Connect Card expire? How do I close my TD Connect Card?

How do I activate my TD Connect Card?

Your TD Connect Card will be issued to you on the spot 2 at a TD Bank Store, with your name printed on it, and will be ready to use immediately. You will be prompted to create your PIN the first time you visit the TD Connect Card website * or call Customer Service at 1-888-568-1730.

Who can use the TD Connect Card?

Only the person whose name is on the front of the TD Connect Card can use the card. You must be 18 years of age or older to buy and use a TD Connect Card.

Can someone else besides the cardholder use the TD Connect Card?

Absolutely not. You should keep the card and the card number under your control at all times. You should not tell anyone your PIN or card number, and you should not write your PIN on the card.

Where can I use my TD Connect Card?

The TD Connect Card is accepted for purchases wherever Visa is accepted, including online. Enjoy free access at thousands of TD ATMs in the U.S. and Canada.

Do I need a PIN to use my TD Connect Card?

There are two ways to use your TD Connect Card – you can sign for your purchases, or you can enter your PIN. Many times you will automatically be prompted to enter your PIN. If this happens, you can still choose to sign your receipt instead of entering your PIN. You simply need to tell the clerk you want to sign for your purchase and you don't want to use your PIN. Each merchant has their own process to override the PIN to ensure you can sign for your purchases. In some instances, you can sign for your purchases by selecting "credit" instead of "debit" on the terminal before conducting your payment.

What is the purpose of the chip on my TD Connect Card?

The chip embedded on the front of the card provides an additional layer of security when used at a chip-enabled terminal. For convenience, your card still has a magnetic stripe on the back to use at non-chip enabled terminals. You can continue to make purchases wherever Visa is accepted. Learn more about chip technology.

Can I use digital wallets with my TD Connect Card?

Yes, your TD Connect Card is eligible for use with digital wallets. Learn more about this convenient way to pay.

When using my TD Connect Card, should I select "credit" or "debit"?

To make a Visa signature transaction, select "credit" when conducting your transaction. You will need to sign the receipt to complete the transaction. To make a PIN transaction, select "debit" when conducting your transaction and then enter your PIN number. Participating merchants will also allow you to get additional cash back from the transaction, if you choose.

Can I withdraw cash with my TD Connect Card?

You will be allowed to withdraw cash at ATMs and to get cash back at participating retailers – many grocery stores, pharmacies and national retailers allow this. You can use any TD ATM in the U.S. and Canada and will not be charged any fees. You can also use any non-TD ATM that accepts Visa, but we will charge you a $3 fee and the bank whose ATM you are using will likely charge you surcharge fees as well. Please see the TD Connect Terms & Conditions or Account Guide for more information on fees. To withdraw cash or view your balance at an ATM, choose the "Checking" option as the account type.

Please note: ATM owners/operators may charge their own fees for ATM transactions and balance inquiries. The amount you can withdraw depends on the available funds in the card account, but you can't take out more than $3,000 per week. Be sure to know your PIN when withdrawing cash at an ATM.

How can I be sure of the balance on my TD Connect Card?

There are a few ways to check your balance. You can check your balance on the TD Connect Card website* , you can visit any TD Bank location , or you can set up the "Daily available balance" account alert and we will send you a daily e-mail and/or text message with your card balance. You can also call Customer Service at 1-888-568-7130.

Can the TD Connect Card be used to make a purchase that is larger than the balance on the card?

You cannot make purchases for amounts larger than the amount of money on your card. Occasionally a merchant will allow a purchase before checking the amount of money on your card. When they do this, it might result in your card having a negative balance. This is not very common, but if it does happen, TD Bank will automatically reduce the difference from the next deposit made to your card. An overdraft fee will not be charged. Keeping track of your balance will help you avoid this.

Can I split my purchase when paying with my TD Connect Card?

If the merchant allows, you may split your purchase and pay with your TD Connect Card and another form of payment.

How can I view where my TD Connect Card was used?

To see where your TD Connect Card was used, log into your account by visiting the TD Connect Card website* . You can also visit any TD Bank location , or set your TD Connect Card up online to receive a text or e-mail alert each time a transaction is made with your TD Connect Card. You may also call Customer Service at 1-888-568-7130.

Can I get cash back at the register when I am making a purchase with my TD Connect Card?

If the merchant supports it, you can get cash back at the register during a PIN-based purchase. Just select the "debit" payment option at the register.

If I need to return a purchase will my TD Connect Card be credited?

Any credit for a returned or exchanged purchase must come from the merchant and is subject to the merchant's policy. It may take up to 7 Business Days after we receive the credit from the merchant to add it back to your TD Connect Card account balance.

Can I use my TD Connect Card to pay bills or make payments?

Yes, your TD Connect Card makes bill payment more convenient. You can use your 16-digit TD Connect Card number to pay bills at merchants that accept Visa online, over the phone or in person.

Can the TD Connect Card have a negative balance?

A negative balance may occur if the final purchase amount the merchant submits to us is greater than the amount we originally authorized, or the merchant processes a transaction without prior authorization. For example, your TD Connect Card has an available balance of $48, you and your friends go out to dinner and your bill comes to $40 which you pay using your TD Connect Card. We authorize the transaction and your card is approved. You sign the merchant copy of the receipt and leave your server a $10 tip forgetting you only have $8 left available to you. The merchant then processes the final purchase amount of $50 and causes your TD Connect Card balance to be negative $2.

Your monthly fee will also deduct from your balance even when your available balance is less than the monthly fee. This is not very common, but if it does happen, TD Bank will automatically reduce the difference from the next deposit made to your card. An overdraft fee will not be charged. Keeping track of your balance will help you avoid this

Can I use my TD Connect Card at a gas station?

Yes. If you would like to use your TD Connect Card at a gas station, we recommend paying inside and specifying the exact amount. Some gas station terminals are set up to automatically preauthorize transactions at the pump for a predetermined amount prior to the purchase (for example, many charge $75) that may exceed the balance on your card and cause your card to be declined. The best way to avoid this is to pay inside by telling the clerk the exact amount you wish to buy before you start pumping.

Will some merchants place a hold on the money in my TD Connect Card account that is more than the actual purchase amount?

- Restaurants: It is customary for restaurants to automatically add 20% to the amount of the bill when authorizing your purchase. For example, you and your friends go out to dinner, your bill not including tip is $15, the merchant may hold an additional 20% to cover any tip you may leave on your TD Connect Card. So instead of the merchant holding $15, they will hold $18. Remember to make sure that the balance on your card is enough to cover the total bill (including the tip) or the purchase may be declined.

- Gas stations (pay at the pump): Gas stations sometimes program the electronic terminal at the pump to seek approval for a set amount that could be in excess of the actual purchase amount. For example, when you swipe your TD Connect Card at a gas station pump, the system doesn't know how much gas you'll purchase. You only pump $20 worth of gas but the system authorizes you for $75. Within a few business days, the merchant will submit the true transaction amount of $20 and the additional $55 being held will be released. To avoid this, simply pre-pay for the gas (for an exact amount) with an attendant inside the station.

Does my TD Connect Card expire?

The money on your TD Connect Card will not expire. However, there is a "Good Thru" date printed on the front of your card. This date is needed by merchants in order to process a transaction. TD Bank will mail you a new card to the address we have on file before your card passes the "Good Thru" date.

How do I close my TD Connect Card?

If you have decided to close your TD Connect Card, please visit any TD Bank location or call Customer Service at 1-888-568-7130. Customer Service Representatives will assist you in closing the card and will reverse any remaining funds in the account to the primary funding account, if one is on file. Otherwise a check will be mailed to you. Funds will be reversed after the account has been closed for 30 days. If you would prefer a check for the remaining funds, you should remove the funding account before you call Customer Service, and advise Customer Service you would like a check for the remaining funds in your TD Connect Card account.

Expand International usage

Can the TD Connect Card be used outside of the U.S.? When traveling outside the U.S., how will I make payments for purchases? Are there any fees for using my TD Connect Card outside the U.S.? --> Can I use a TD Connect Card at a bank outside the U.S. to obtain local currency? Why should I inform TD Bank that I am traveling outside the U.S.? What are the fees for using an ATM outside the U.S.? What do I need to do to make sure my TD Connect Card will work outside the U.S.? How can I get foreign currency for a trip I am taking abroad? Can I order foreign currency online? What precautions should I take to protect my finances when traveling?

Can the TD Connect Card be used outside of the U.S.?

Yes. You can use your TD Connect Card virtually anywhere Visa is accepted. If the purchase is not completed in U.S. dollars, it will be converted or exchanged to U.S. dollars. The exchange rate will be applied either by the network that processes the transaction or the government-mandated rate in effect for the date the network processes the transaction, which may be on a date that is different than when you actually used the card. Terms & Conditions or Account Guide for more information on fees. -->

Please note: Popular tourist and business destinations outside the U.S. have progressed to chip-based cards. This means that on rare occasions magnetic stripe only cards may not work outside the U.S.

When travelling outside the U.S., how will I make payments for purchases?

While traveling, you can use your TD Connect Card to make purchases or to get cash at an ATM (limits apply) where Visa is accepted. You can also order foreign currency from any TD Bank at least 2 business days prior to leaving for your trip. TD Bank will also buy back any unused foreign currency when you get back from your trip.

Are there any fees for using my TD Connect Card outside the U.S.?

When using your TD Connect Card outside the U.S. you can expect to pay an International Transaction Fee of 3% of the transaction amount. Please see the program Terms & Conditions or Account Guide for more information on fees.

Can I use a TD Connect Card at a bank outside the U.S. to obtain local currency?

You can withdraw local currency using your TD Connect Card at international ATMs accepting Visa cards. To reduce the risk that your card will be declined, be sure you withdraw less than the maximum ATM limit ($3,000/week) to cover conversion rates and ATM surcharge fees. Please see the TD Connect Card Terms & Conditions or Account Guide for more information on limits and fees.

Please note: Due to security risks, use of your TD Connect Card may be restricted in certain countries.

Why should I inform TD Bank that I am traveling outside the U.S.?

To help avoid an interruption in your TD Connect Card service, please let us know of your travel plans. This way we know it's you using your card. Standard limits still apply when traveling in U.S. dollars. Please see the TD Connect Card Terms & Conditions or Account Guide for more information on limits.

What are the fees for using an ATM outside the U.S.?

- Usage fees from the owners of the ATM and ATM network

- Currency exchange fees from Visa

- Non-TD ATM usage fees from TD Bank

- International transaction fees from TD Bank

Please see the TD Connect Card Terms & Conditions or Account Guide for more information on fees.

What do I need to do to make sure my TD Connect Card will work outside the U.S.?

- Call us at 1-888-568-7130 one week in advance to tell us about your travel plans; this lets us know it is you using your card and will help you avoid an interruption in your TD Connect Card service.

- Load the necessary funds to your TD Connect Card.

Standard limits still apply in U.S. dollars when traveling. If you encounter any issues while traveling, please contact us 24/7 at 1-888-568-7130 or call us from outside the U.S. and Canada at 1-215-569-0518.

How can I get foreign currency for a trip I am taking abroad?

You can order foreign currency at any TD Bank and pick up your order in 2 business days.

Can I order foreign currency online?

At this time, we do not offer online ordering for foreign currency. However, you may visit your local TD Bank to place and order and then pick up within 2 business days (limits may apply).

What precautions should I take to protect my finances when traveling?

- Photocopy the front and back of your passport and your TD Connect Card before you leave on your trip. Secure the copies separately from your wallet, passport and cash.

- If you have a secure mobile phone with e-mail access, send the scanned documents to yourself.

- Carry just enough cash to cover incidentals, public transportation and tips.

- Use caution at ATMs and try to use ones located in populated and safe areas.

- Consider obtaining travel insurance before you leave. Depending on the policy, it may cover canceled flights, lost luggage, emergency medical treatment or disaster evacuation.

Expand Website and Personal Identification Number (PIN)

How can I manage my TD Connect Card online? How do I set up online access? What should I do if I forget my Username and/or Password? How do I update my personal information? How do I check my available balance or my transaction history? Can I get information about my TD Connect Card Account via text or e-mail? What are account alerts? How do I set up text message alerts? How do I stop text message alerts? Will I get a paper statement? How do I set or change my Personal Identification Number (PIN)? What if I have forgotten my PIN? What can I do to keep my PIN and Password secure?

How can I manage my TD Connect Card online?

- Balance/ transaction history

- Funding history

- Direct deposit instructions

- Monthly statements

- Profile settings

You will also be able to set up and manage account alerts including daily balance alerts.

How do I set up online access?

Visit the TD Connect Card website* and click Sign In. Enter your TD Connect Card number. Verify your identity by entering the 3-digit security code printed on the back of your card followed by the last four digits of your social security number. You will then be instructed to create a Personal Identification Number (PIN). After logging in, complete your profile by providing your e-mail address, creating a username and selecting your security information.

What should I do if I forget my username and/or password?

If you forget your username you can use your 16 digit card number and password to successfully log in. If you have forgotten your password click "Forgot Password?" then follow the prompts to retrieve or create a new password.

How do I update my personal information?

You can update your name, address or date of birth by visiting us at any TD Bank location . You can also update your address by calling Customer Service at 1-888-751-9000.

How do I check my available balance or my transaction history?

There are a few ways to check your balance and view your transaction history. You can check your balance and view transaction history on the TD Connect Card website* . You can set your TD Connect Card up online to receive a text or e-mail alert with your balance and each time a transaction is made with your TD Connect Card. You can also call Customer Service at 1-888-568-7130.

Your available balance is the amount of money that is on your card that you can spend. The card amount increases when you load funds on the card and decreases when you buy something or use an ATM. Your available balance may not reflect TD Connect Card transactions not yet processed by the merchant for payment (pending transactions).

Can I get information about my TD Connect Card account via text or e-mail?

Yes. You have the ability to set up various e-mail and/or text message alerts.

What are account alerts?

- Daily available balance – The amount of money you have access to on your card; received on a daily basis at approximately 10:00am EST.

- Low balance – You can set up this alert to let you know when the balance on your card reaches any dollar amount. You choose the amount and we will let you know each time your card hits that level.

- Approval of pending transaction – Pending transactions are approved payments that are awaiting confirmation from the merchant. After a few days the transaction will be confirmed and marked as posted. Once the transaction is posted, we will send you an alert letting you know your pending transaction has been approved.

- Declined transactions – Received whenever you perform a transaction that is not allowed. The decline could be due to various reasons. To understand why your purchase was declined, call Customer Service at 1-888-568-7130.

- New funds loaded – Received every time money is loaded to your card by you or by direct deposit.

- Change of card status – Received whenever the status of your card has changed, such as when a replacement card is issued, your card is activated, or your card is being closed.

- Cardholder profile update – Received whenever your profile is updated. For example, we will send you an alert when your password is changed.

How do I set up text message alerts?

You may set up text message alerts by going to the TD Connect Card website * and logging in to your account. After you enter and confirm your text message device number, a validation code will be sent to the number you entered. When you receive the validation code you must enter it online or call Customer Service and provide the code to a representative. Once your device has been validated you can set up any desired alerts. You can also set up alerts by calling Customer Service at 1-888-568-7130.

Note: While TD Bank does not charge a fee for text message alerts your service provider may charge text fees. Please check with your wireless provider for possible fees related to text messages.

How do I stop text message alerts?

If you wish to stop text alerts, text "STOP" to 868472 or 288472.

Will I get a paper statement?

You will not receive a paper statement in the mail. All your transactions are available online on the TD Connect Card website* . If you would like a written history of account transactions, visit any TD Bank or call Customer Service at 1-888-568-7130. A fee will apply. Please see the TD Connect Card Terms & Conditions or Account Guide for more information on fees.

How do I set or change my Personal Identification Number (PIN)?

You will be automatically instructed to create your PIN the first time you call Customer Service or when you first visit the TD Connect Card website* . Your four-digit PIN will allow you to access your account at ATMs and for PIN point-of-sale transactions. You may change or reset your PIN anytime online or by calling Customer Service at 1-888-568-7130.

What can I do to keep my PIN and password secure?

To keep your PIN and password secure do not create an obvious PIN or password like your birthday or a pet's name and never give your PIN or card number to anyone. Change your PIN from time to time and do not write the PIN on your TD Connect Card.

What happens if my TD Connect Card is lost or stolen? Will I be responsible for any purchases that are made before I report my TD Connect Card lost or stolen? Are the funds in my TD Connect Card Account FDIC insured? What if I have other questions for TD Bank not related to my TD Connect Card?

What happens if my TD Connect Card is lost or stolen?

Will I be responsible for any purchases that are made before I report my TD Connect Card lost or stolen?

Your TD Connect Card comes with Visa Zero Liability protection 1 , which means that you will not pay for any unauthorized purchases made with your card as long as they are reported promptly by contacting Customer Service at 1-888-568-7130. Certain limitations apply. Please see the TD Connect Card Terms & Conditions for more information on unauthorized purchases.

Are the funds in my TD Connect Card account FDIC insured?

Yes. All TD Connect Card funds are FDIC insured.

What if I have other questions for TD Bank not related to my TD Connect Card?

For other TD Bank inquiries, visit any TD Bank location or call us at 1-888-751-9000.

1 Visa Zero Liability policy covers U.S.-issued cards only and does not apply to ATM transactions, PIN transactions not processed by Visa, or certain commercial card transactions. Cardholders must notify TD Bank promptly of any unauthorized use. 2 Chip cards are not currently available for instant issue. *By clicking on this link you are leaving our website and entering a third-party website over which we have no control.

©2019 Visa U.S.A. Inc.

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Do i need to notify a credit card company when traveling.

If you have planned travel coming up, alerting your credit card issuers about your vacation plans can help to ensure that your charges aren't declined when you arrive. Here's how you can prepare yourself and your credit card for your next trip.

What is a credit card travel notice?

A travel notice is an alert to your credit card issuer that you'll be going on a trip to a different location. By giving this notice in advance, you're letting your credit card company know that you may be making charges from a different state or country.

Why should you notify your credit card company of travel?

Credit card companies check cardholders' accounts for any unusual or suspicious activity when a transaction occurs. If your company sees a charge from a location away from home, your issuer may think this is suspicious activity and decline the charge. If you're visiting a country or location where fraudulent charges occur more often, the chances of your credit card getting declined are higher when you don't alert your credit card issuer about your travel.

Do you need to notify your credit card company?

You're not required to notify your credit card company when you're going away on vacation, but it is highly recommended. By letting your credit card company know where you're going and for how long, your company will know that any card transactions from that location were likely authorized by you. Check with your credit card issuer to see if they have travel notification capabilities.

Traveling outside your city

If you're traveling to an area not far from home, it's unlikely that any credit card charges will be declined, so setting a travel notification may not be a necessity.

Traveling outside your state

As you travel further from home, the chance of charges being declined is higher. If you're visiting another state, you can notify your credit card company that you're going away to avoid any hassles as you travel.

Traveling outside your country

You should definitely consider filing a travel notice for every trip outside your country. If you don't file a travel alert with your card issuer, your credit card may get declined and you might need to contact your credit card company to approve your transactions. If you're in a different country you may have trouble with making an international call, an inconvenience that can prevent you from authorizing your charge and enjoying your trip.

Which credit cards require a travel notice?

Not all credit card companies recommend that you set a travel notice before you go away, including those with EMV chips that may provide added security when you travel. If your credit card doesn't have an EMV chip, you should contact your bank before you leave to make sure your trip goes smoothly.

Multiple credit cards

If you own multiple credit cards, you should set travel notifications for each of the cards you plan to use on vacation. Even if you plan to use one of the cards only in case of emergency, set a travel alert for it just in case.

Risks of not filing a credit card travel notice

If you don't give your credit card issuer a travel notice, the company won't know that you'll be making purchases in a new location. If the company starts to see charges on your credit card from a different state or country, it may flag these transactions as fraud. The credit card issuer may then put your account on hold and prevent you from making any purchases until you can authorize the charges.

Once a credit card is declined, the cardholder has to call the issuer or provide an app verification in order to prove that the purchase made was authorized. You may have difficulties contacting your bank for various reasons, such as if your vacation spot has bad cell service or if you didn't set up international calling for your phone plan. Notifying your credit card company before you leave on vacation will help you avoid this hassle.

How to notify your credit card company of travel

You can notify your credit card issuer about your vacation over the phone, online, through a mobile app or in person. You can also contact your credit card issuer to get a better understanding of how to set a travel notice.

Setting your travel notice online or through a mobile app

Setting your travel notification online or through an app can be easier than speaking with customer service, depending on your preferences. Log into your account on your credit card company's website or app and search for “travel notice" options. If you're unable to find where to set your travel notice, get in contact with your credit card issuer.

Setting your travel notice over the phone or in-person

To set a travel alert for your credit card over the phone, call the number on the back of your card to get in touch with your bank. The customer service line will either let you speak to a representative on the phone or work with an automated system. If you have any questions or concerns about your travel notice, calling your credit card company is a good method to set the notification.

If you want to set your travel notice in person, go to your nearest branch to meet with a representative. Meeting face-to-face gives you the chance to ask any questions you might have.

Chase Sapphire is an official partner of the PGA Championship .

- card travel tips

- credit card benefits

What to read next

Chase sapphire events at miami art week.

Learn about the exclusive events a Chase Sapphire Reserve cardmember can experience at Miami Art Week.

How to choose a credit card to earn travel points

There are many things to consider when choosing a credit card with travel points - how travel points work, how to earn them, and so on. Learn more here.

Should you get a travel credit card that earns points or miles?

Travel credit cards may allow you to earn rewards in the form of points or miles and are redeemable for shopping and travel perks.

Is having access to airport lounges worth it?

Airport lounge access can make your travel arrangements relaxing and comfortable. However, many may question if airport lounge access is actually worth it.

Service Interruption

Interruption de service.

- Customer Service

TD First Class SM Visa ® Signature Credit Card

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

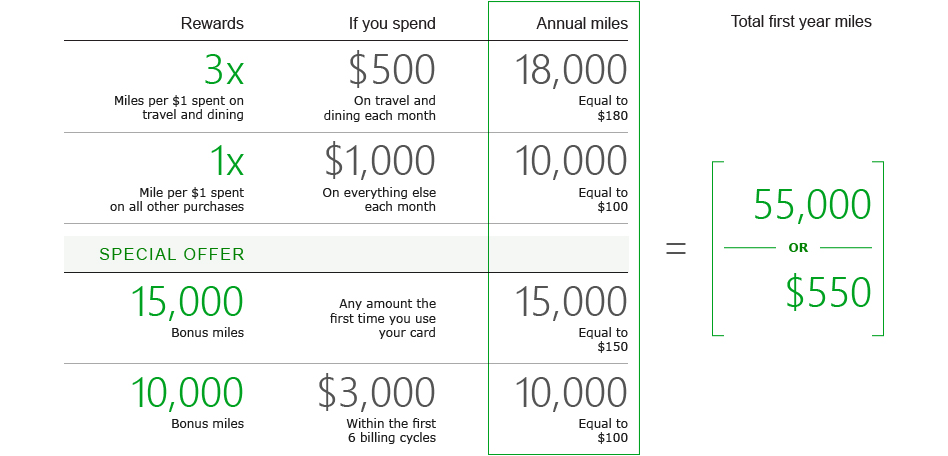

Bonus miles offer.

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

Earn unlimited points with every purchase, and triple the miles on travel

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

- Credit Cards

- TD Platinum Travel Visa Card Review: One of the Best Credit Cards for Expedia Loyalists

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.