Types of Voucher in Front Office | Hotel

Vouchers is the valuable tool for front office staff. They can help to increase occupancy, boost revenue, and improve guest satisfaction.

In this blog post, we will discuss the different types of vouchers, how they are used in the front office, and the benefits they offer to hotels and guests.

What is the Voucher in Front Office?

Vouchers are a common way for hotels to offer discounts, rewards, or other incentives to guests. In the front office, vouchers can be used to process payments, track inventory, and manage guest stays.

Different types of Voucher used in Front Office in Hotel

Charge voucher

Most common type of voucher. It is used to record a charge to a guest’s folio . Charges can be for room rates, incidentals, or other services.

Correction voucher

Used to correct an error in a guest’s folio. For example, if the wrong room rate was charged, a correction voucher would be used to correct the mistake.

Cash vouchers

Cash vouchers are used to record cash payments made by guests.

Allowance voucher

Allowance voucher is used to give a guest a credit to their folio. Allowances can be given for various reasons, such as a noisy room or a late arrival.

Transfer voucher

Transfer voucher is used to transfer funds between two guest folios. For example, if a guest is moving to a different room, a transfer voucher would be used to move their balance to the new room.

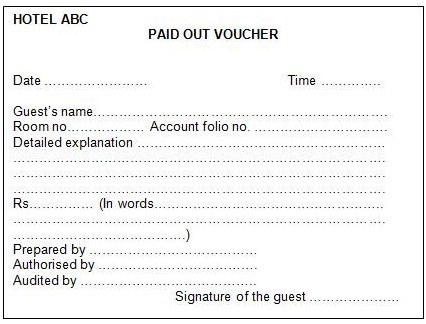

Paid-out voucher

This voucher is used to record a cash payment made by the hotel on behalf of a guest. For example, if a guest pays for a taxi with cash, a paid-out voucher would be used to record the payment.

In addition to these common types of vouchers, there are also a number of other types that may be used by hotels, such as –

Gift voucher

Gift voucher that can be redeemed for goods or services at the hotel.

Complementary voucher

This is a voucher that gives the guest a free item or service.

Marketing voucher

This is a voucher that is used as part of a marketing campaign. For example, a hotel might offer a voucher for a free night’s stay to guests who book through a certain website.

Room Voucher

This voucher is issued to guests upon check-in and contains information about their room type, duration of stay, and any special requests or amenities.

Meal Voucher

Used in hotel or resort settings, meal vouchers are given to guests to avail complimentary meals or discounts at designated dining outlets.

Discount Voucher

These vouchers provide guests with discounts on room rates, food and beverage expenses, or other services offered by the hotel.

Spa/Wellness Voucher

Hotels with spa or wellness facilities may issue vouchers specifically for accessing these services, such as massages, facials, or fitness classes.

Recreation/Activity Voucher

Resorts or hotels offering recreational activities like water sports, golf, or sightseeing tours may provide vouchers that entitle guests to participate in these activities.

Travel Voucher

These vouchers may be issued by travel agencies or hotels as part of a package deal, providing guests with discounts or benefits related to transportation, tours, or other travel-related services.

Uses of voucher in Front Office

Vouchers play an important role in the smooth operation of the front office. By providing accurate and detailed documentation of transactions, vouchers help to ensure that guest accounts are accurate and that the hotel’s financial records are in order.

In addition to their practical uses, vouchers can also be used to track guest spending habits and to identify areas where the hotel can improve its guest services. By analyzing voucher data, the front office can gain valuable insights into the needs of its guests and make changes to its operations accordingly.

Benefits of Voucher in Hotel

Increased accuracy – Help to ensure that all transactions are recorded accurately. This is important for financial reporting and auditing purposes.

Improved efficiency – It can help to streamline the front office process. By tracking all transactions in one place, the staff can quickly and easily see what charges have been made and what payments have been received.

Enhanced customer service – Improve customer service by providing a quick and easy way to resolve billing issues.

Reduced risk of fraud – Vouchers can help to reduce the risk of fraud by providing a paper trail of all transactions.

In this blog post, we have explored the different types of vouchers used in front office. We have seen that vouchers can be used for a variety of purposes, including payment for goods and services, discounts, and promotions. We have also seen that there are many different types of vouchers, each with its own specific purpose.

Finally I think you understand that Vouchers can be a valuable tool for front office staff. They can help to streamline the checkout process, increase customer satisfaction, and boost sales. If you are looking for ways to improve your front office operations, consider using vouchers in your hotel.

LET’S KEEP IN TOUCH!

Check your inbox or spam folder to confirm your subscription.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

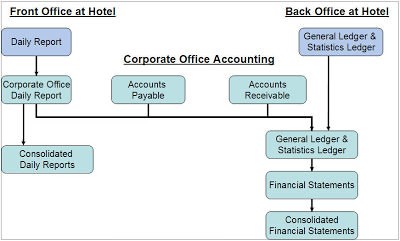

Front Office Accounting

by Prince Kumar

Last updated: 10 July 2023

Table of Contents

Front office accounting system

- Creates and maintains an accurate accounting record for each guest or non guest account.

- Front office accounting system tracks financial transactions through the guest cycle.

- Front office accounting system ensures internal control over cash and non cash transactions.

- Front office accounting system records settlement for all goods and services provided.

There are two types of accounts maintained by front office department with front office accounting system:

- Guest Account

A guest account in front office accounting system is to record of financial transaction between a guest and the hotel. It is created when the guests guarantee their reservations or during registration. The front office usually seeks payment for charges during the departure and settlement stage of the guest cycle.

- Non-Guest Account

A hotel may extend in-house charge privileges to local businesses or agencies as a means of promotion or to groups sponsoring meetings at the hotels. The front office creates non-guest accounts to track these transactions which may also be called house accounts or city accounts.

Front office transactions are charted on account statements called folios. A folio is a statement of all transactions (debits and credits) affecting the balance of a single account. There are basically five types of folios used in front office accounting and maintained with front office accounting system:

- Guest Folios – Accounts assigned to individual guests or guestrooms.

- Master Folios – Accounts assigned to more than one guest or guestroom, usually applicable for group accounts.

- Non-Guest or Semi-Permanent Folios – Accounts assigned to non-guest business or agencies with hotel charge purchase privileges.

- Employee Folios – Accounts assigned to employees with charge purchase privileges.

- Split Folios – Accounts assigned to a guest on his/her request to split his/her charges and payments between two personal folios – one to record expenses to be paid by the sponsoring business company and the other to record personal expenses to be paid by the guest. In this case two folios are created for the same guest.

A voucher details a transaction to be posted to a front office account. There are several types of vouchers used in front office accounting system:

- Charge Voucher – A voucher used to support a charge purchase transaction that takes place somewhere other than the front office.

- Cash Advance Voucher – A voucher used to support cash flow out of the hotel, either directly to or on behalf of the guest.

- Correction Voucher – A voucher used to support the correction of a posting error which is rectified before the close of business on the day the error was made.

- Credit Card Voucher – A form designated by the credit card company to be used for imprinting the credit card and recording the amount charged.

- Transfer Voucher – A voucher used to support a reduction in balance on one folio and an equal increase in balance on another. Transfer vouchers are used for transfers between guest accounts and for transfers from guest accounts to non-guest accounts when they are settled by credit cards.

- Travel Agency Voucher – In travel agent guaranteed reservation, the travel agent forwards a voucher to the hotel as proof of payment and guarantees that the prepaid amount will be sent to the hotel when the voucher is returned to the travel agency for payment.

POINTS OF SALE (POS)

The term ‘point of sale’ denotes the location at which goods or services are purchased. Any hotel department that collects revenue for its goods and services is considered a point of sale. The front office accounting system must ensure that all charge purchases at these points of sale are posted to the proper guest or non-guest account. A computerized POS system allows terminals at the points of sale to communicate directly with a front office computer system, and helps front office staff to create a well documented folio statement with a minimum number of errors. Some basic information to be provided by the POS includes the amount of the charge, name of the POS outlet, room number, name of the guest and a brief description of the charge.

A ledger is a summary grouping of accounts. A front office ledger is a collection of front office account folios. There are two types of ledgers in front office accounting system:

- Guest Ledger – It refers to the set of accounts related to the registered hotel guests. It is also known as Transient ledger, Front Office ledger or Rooms ledger.

- City Ledger – Also called the non-guest ledger, it is the collection of non-guest accounts. It can contain credit card payment accounts, direct billing accounts, and accounts of past guests due for collection by the hotel.

ACCOUNTING SYSTEMS

- Non-Automated: Guest folios in a manual system contain a series of columns for listing debit and credit entries accumulated during occupancy. At the end of the business day, each column is totaled and the closing balance is carried forward as the opening balance of the next day.

- Semi-Automated – In this system, transactions are printed to a machine-posted folio.

- Fully Automated – Computerized systems in which POS transactions are automatically updated in the front office accounts.

CREDIT MONITORING

The front office accounting system must monitor guest and non-guest accounts to ensure that they remain within acceptable credit limits.

- Guests who present an acceptable credit card at registration may be extended credit facility equal to the floor limit authorized by the issuing credit card company.

- Guest and non-guest accounts with other approved credit arrangements are subject to limitations established by the front office called house limit .

- The night auditor is mainly responsible for identifying accounts which have reached or exceeded the fixed credit limits. Such accounts are called high risk or high balance accounts. The front office may deny additional charge purchase privileges to such accounts.

- This situation may be resolved by requesting the guest to make a partial payment or requesting the credit card company to authorize additional credit.

FRONT OFFICE ACCOUNTING SYSTEM FORMULA

Transaction postings in the front office conform to a basic accounting formula, which Previous Balance + Debits – Credits = Net Outstanding Balances

INTERNAL CONTROL IN THE FRONT OFFICE

Internal control in the front office involves:

- Tracking transaction documentation

- Verifying account entries and balances

- Identifying vulnerabilities in the accounting system

Auditing is a process of verifying front office accounting records for accuracy. Certain records are maintained to have a control in front office cash:

- FRONT OFFICE CASH SHEET – The front office is responsible for a variety of cash transactions affecting both guest and non-guest accounts. The front office cashiers have to complete a front office cash sheet that lists each receipt or disbursement of cash.

- CASH BANK – A cash bank is the amount of cash assigned to a cashier so that he/she can handle the various transactions that occur during a particular work shift. Cashiers should sign for their bank at the beginning of their shift and only the person who signs should have access to it.

NET CASH RECEIPTS = Amount of Cash, Checks, Vouchers etc in the Cashier’s

Drawer – [Amount of Initial Cash Bank + Paid Outs]

OVERAGES – When the total of cash and checks in a cash drawer is greater than the initial cash bank + net cash receipts

SHORTAGES – When the total of cash and checks in a cash drawer is less than the initial cash bank + net cash receipts.

DUE BACK – A due back occurs when a cashier pays out more than he/she receives i.e. there is not enough cash in the cash drawer to restore the initial cash bank. This may happen when a cashier accepts many checks, or encashes large amount of foreign exchange offered by a guest during shifts. These checks and bills are deposited with other receipts and consequently the front office deposit may be greater than the cashier’s net cash receipts, with the excess due back to the front office cashier’s bank.

- AUDIT CONTROL – Internal auditors should make unannounced visits to the front office cashier’s desk for auditing accounting records as well as conducting spot checks of the cash bank of the cashier on duty. A report should be completed for management and ownership review.

SETTLEMENT OF ACCOUNTS

The collection of payment for outstanding account balances is called account settlement which involves bringing the account balance to zero. An account can be brought to zero balance as a result of a cash payment in full or a transfer to an approved direct billing or credit card account. All guest accounts must be settled at the time of check out.

How useful was this post?

5 star mean very useful & 1 star means not useful at all.

Average rating / 5. Vote count:

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you! 😔

Let us improve this post!

Tell us how we can improve this post?

Syllabus BHM203 (T)

01 Computer Application in Front Office Operation

- Role of information technology in the hospitality industry

- Factors for need of a PMS in the hotel

- Factors for purchase of PMS by the hotel

- Introduction to Fidelio & Amadeus

02 Front Office (accounting)

- Accounting Fundamentals

- Guest and non-guest accounts

- Non-automated – Guest weekly bill, Visitors tabular ledger

- Semi-automated Fully automated

03 Check Out Procedures

- Cash and credit

- Indian currency and foreign currency

- Transfer of guest accounts

- Express check out

04 CONTROL OF CASH AND CREDIT

05 Night Auditing

- Audit procedures (Non-automated, semi-automated and fully automated)

06 Front Office & Guest Safety and Security

- Importance of security systems

- Safe deposit

- Key control

- Emergency situations (Accident, illness, theft, fire, bomb)

- Expressions de politesse et les commander et Expressions d’encouragement

- Reservations (personal and telephonic)

- Reception (Doorman, Bell Boys, Receptionist etc.)

- Cleaning of Room & change of Room etc.

Travel agency front and back office systems

- 1 Classification Categories

- 2 Importance

Almost every travel agency in the world works with a Front Office or Back Office application and in many cases with a single tool that acts both as a Front and Back Office application for the travel agency. The Front part refers to the management and administration tasks and activities that are related to customer. The Back part refers mainly to the accounting related activities of the travel agency sales/purchasing figures.

Classification Categories [ edit | edit source ]

Most travel agencies work with a wide variety of decentralized applications. These applications' usages can be classified into the following categories.

- A website normally considered as a gate way to the upside down

- One or more GDS (Global Distribution Systems)which is used to handle online reservation/booking of mainly Hotel, Flight, Car products from different suppliers

- Retrieve information from the GDS

- Combine the information from the GDS with some extra information such as the customer details, passenger/traveller names etc.

- From here, the system can create travel documents such as travel plans, invoices, credit notes and vouchers

Ideally a Front Office application, it ought to be able to communicate with the GDS and at the same time allow the creation and maintenance of the website as well.

Importance [ edit | edit source ]

A travel agency without a Front or Back Office application is most likely not able to do business effectively. It could easily be compared to two people writing a letter where one uses a type writer and the other uses a computer and a word processing application. With the amount of information handling required within a travel agency, and the tight competition between travel agencies within the local or global market, manual management and administration of these tasks is next to impossible without a tool that combines Front Office and Back Office tasks of a travel agency.

Back Office is the Back-bone of a Travel Agency which is equally important to the Front Office Operations. Travel agencies are working with a strict deadlines from IATA for its payments and other related things. For an IATA/SSI Agent, BSP (Billing and Settlement Plan) will be sending the statement of accounts for each fort-night three or four days after that fortnight. The agent has to make the payment to BSP on or before the 1st day of the next fortnight. If he failed to make the payment or make delay in paying three time in a calendar year, their access to issue the ticket will be revoked automatically. And this fortnight cycle will be continuing through-out the year.

So a very good back office system is a must for its survival

See also [ edit | edit source ]

- School:Tourism

- School:Business

Navigation menu

- Front Office Management Tutorial

- Front Office Management – Home

- Front Office Mnmgt – Introduction

- Front Office Mnmgt – Terminology

- Front Office Mnmgt – Structure

- Ranks & Responsibilities

- Front Office Mnmgt – Reservation

- Front Office – Guest Registration

- Front Office Mnmgt – Accounting

- Front Office – Communication

- Front Office Mnmgt – Night Audit

- Front Office Mnmgt – SOPs

- Front Office Mnmgt – Information Sys

- Front Office Mnmgt Resources

- Front Office Mnmgt - Quick Guide

- Front Office Mnmgt - Resources

- Front Office Mnmgt - Discussion

- Selected Reading

- UPSC IAS Exams Notes

- Developer's Best Practices

- Questions and Answers

- Effective Resume Writing

- HR Interview Questions

- Computer Glossary

Front Office Management - Quick Guide

Front office management - introduction.

Every multi-departmental physical business needs to have a front office or reception to receive the visitors. Front Office Department is the face and as well as the voice of a business. Regardless of the star rating of the hotel or the hotel type, the hotel has a front office as its most visible department. For a business such as hospitality, the front office department comes with an aspect of elevating customer experience with the business.

Front Office department is a common link between the customers and the business. Let us learn more about it.

What is Front Office Department?

It is the one of the many departments of the hotel business which directly interacts with the customers when they first arrive at the hotel. The staff of this department is very visible to the guests.

Front office staff handles the transactions between the hotel and its guests. The staff receives the guests, handles their requests, and strikes the first impression about the hotel into their minds.

Front office department includes −

- Uniformed services

- Front Office Accounting System

- Private Branch Exchange (PBX), a private telephone network used within an organization

Basic Responsibilities of Front Office Department

Following are the most basic responsibilities a front office can handle.

- Creating guest database

- Handling guest accounts

- Coordinating guest service

- Trying to sell a service

- Ensuring guest satisfaction

- Handling in-house communication through PBX

Front Office Operations

There are two categories of Front Office Operations −

Front-House Operations

These operations are visible to the guests of the hotel. The guests can interact and see these operations, hence, the name Front-House operations. Few of these operations include −

- Interacting with the guests to handle request for an accommodation.

- Checking accommodation availability and assigning it to the guest.

- Collecting detail information while guest registration.

- Creating a guest’s account with the FO accounting system.

- Issuing accommodation keys to the guest.

- Settling guest payment at the time of check-out.

Back-House Operations

Front Office staff conducts these operations in the absence of the guests or when the guest’s involvement is not required. These operations involve activities such as −

- Determining the type of guest (fresh/repeat) by checking the database.

- Ensuring preferences of the guest to give a personal touch to the service.

- Maintaining guest’s account with the accounting system.

- Preparing the guest’s bill.

- Collecting the balance amount of guest bills.

- Generating reports.

Guest Cycle in Hotel

Generally, a guest’s interaction with the hotel is divided into the following four sequential phases −

Pre-arrival

It is the stage when the customer is planning to avail an accommodation in the hotel. In this first stage, the customer or the prospective guest enquires about the availability of the desired type of accommodation and its amenities via telephonic call or an e-mail. The customer also tries to find out more information about the hotel by visiting its website.

At the hotel end, the front office accounting system captures the guest’s information such as name, age, contact numbers, probable duration of stay for room reservation and so on.

The front office reception staff receives the guest in the reception. The porters bring in the guest luggage. For the guest with confirmed reservation, the front office clerk hands over a Guest Registration Card (GRC) to the guest and requests the guest to fill in personal information regarding the stay in the hotel. The clerk then registers the guest in the database thereby creating a guest record and a guest account along with it. Later, the clerk hands over a welcome kit and keys of the accommodation. After the procedure of registration, the guest can start occupying the accommodation.

During occupancy, a front office accounting system is responsible for tracking guest charges against his/her purchases from the hotel restaurants, room service, bar, or any outgoing telephone calls made via the hotel’s communication systems. The front office staff is responsible to manage and issue the right keys of the accommodations to the right guests. On guests’ request, the staff also makes arrangement for transportation, babysitting, or local touring while the guest is staying in the hotel.

During guest departure, the front office accounting system ensures payment for goods and services provided. If a guest’s bill is not completely paid, the balance is transferred from guest to non-guest records. When this occurs, collection becomes the responsibility of the back office accounting division.

At the time of guest departure, the front office staff thanks the guest for giving an opportunity to serve and arrange for handling luggage. In addition, if the guest requires airport or other drop service, the front office bell desk fulfils it.

Front Office Management - Terminology

Following are some common terms used in relation to the front office department −

Front Office Management - Structure

Front office area is commonly termed as ‘Reception’, as it is the place where the guests are received when they arrive at the hotel. It is the first point of interaction between the hotel and the guests. Being the prime interface between the hotel services and the guests, the front office is located near the main entrance of the hotel.

The front office structure can be viewed in two ways: the physical setup and the operational structure of the department.

Physical Setup of Front Office

The physical setup includes key-hanging boards, bell desk and guest-mail handling register. The front desk is equipped with various compartments, the computerized property management system, and an in-house communication system.

Positioning the Front Desk

The front desk is where the guests temporarily await to find an accommodation or to clear their bill. Hence, it needs to be positioned appropriately such that the staff and the guests can use them conveniently. The front desk needs to be −

- Positioned at an adequate height and reach.

- An adequately lit-up area.

- Aesthetically furnished.

- Preferably near the hotel lobby and lift.

- Preferably near the sitting area.

- Wide enough to make the staff member communicate with the guests across the desk.

Front Office Communication

The front office staff needs to communicate with the staff of the same as well as all other departments of the hotel. This is termed as internal communication. It mostly relies upon the PBX or IP-PBX system.

When the front office communicates with the potential customers outside the hotel, corporate offices, and other ancillary service providers, then it is an external communication.

Any formal communication outside the hotel is mostly carried out using e-mails and phone calls. For sending coupons or other promotional material, renewing agreements with travel agents or airlines, the front office staff may opt for postal mail.

Operational Structure of Front Office

There are lot of staff working under front office manager. The structure of the front office department changes according to the size of the hotel business, physical size of the hotel, and the hotel management policies. Following is the general structure of the front office department −

Hotel Front Office Sections

Front office department manager heads the team of staff working on various activities and responsibilities in the front office department. Few prominent activities that the front office staff is involved in are −

Reservation − It includes handling request of customers for reserving accommodations.

Reception − It includes receiving the guests according to the highest standards and registering them appropriately. It also includes bidding the guests off.

Guest Services − They are also known as Uniformed Services. It includes personalized guest services such as −

- Handling guest luggage.

- Handling guest mail.

- Delivering newspapers in accommodations.

- Paging the guest inside the hotel (locating the guest in the hotel).

- Arranging for a doctor in emergency.

- Parking guest’s automobiles.

- Arranging for reservations at the places of entertainment outside the hotel.

Accounts − It mainly includes a front office cashier and a Night Auditor. The cashier is responsible for handling guest payments. He typically reports to the accounts manager rather than the front office manager.

The night auditor performs the duties of front desk reception as well as accounting partly during the night shift. He needs to report to the heads of both departments, front office, and accounting.

Communication − It involves handling communication among various other departments and guests of the hotel.

Ranks and Responsibilities

Let us discuss a few prominent ranks in the front office department and their respective responsibilities −

Reservation Manager

In the context of hotel, the term reservation is used for booking a particular accommodation in the hotel by a guest for a period of time. Reservation section does not directly deal with the guests.

Some important tasks a reservation manager is responsible for are −

- Having knowledge about the reservation systems.

- Providing and updating information on tours, prices, and itineraries.

- Reviewing daily hotel reservations.

- Preparing occupancy forecast.

- Updating travel agent rates in the system.

- Handling correspondence with outside travel agencies.

- Allocating daily tasks to the reservation staff.

- Ensuring special deals with repeat guests, VIPs, or guest groups.

- Training the staff under hand.

Reception Manager

Following are some prominent roles and responsibilities of the reception manager −

Dealing with arrival and departure of the guests.

Welcoming the guests, escorting them to the room, and seeing them off.

Ensuring professional greeting of clients, visitors, and guests.

Coordination with housekeeping department for cleaning rooms.

Filling registration cards for the guests with reserved accommodation or help the guests to fill it up.

Arranging surprise gift for the guests on their special days.

Training of receptionists.

Handling appraisals and performance rewards of the staff.

Reviewing current standards of front office services and procedures, and implementing new practices if required.

Ensuring and Scheduling front office desk staff.

Managing VIP functions and events taking place in the hotel.

Upgrading software if required.

Updating backup database regularly.

Guest Services Manager

The responsibilities of the guest service manager include −

- Handling guest mails, letters, and couriers.

- Ensuring guest messages are delivered at the right time.

- Training the guest service staff such as concierges, bell staff, wallet parking staff, and porters.

- Maintaining guest service suggestion cards and guest complaints.

- Scheduling and appraising guest service staff.

- Ensuring the staff delivers services, accurately and timely.

Night Audit Manager

This manager works during the night hours. The typical responsibilities of a night audit manager are &mnus;

Posting accommodation charges, taxes, and other paid services such as restaurant, Internet charges to each guest's account accurately.

Taking the responsibility as a duty manager for night shift.

Settling guest accounts if required.

Authoring security of the hotel during night shift.

Communication Manager

The communication manager is responsible for −

- Keeping in check all communication facilities such as PBX, facsimile, internet in the hotel.

- Training and scheduling telephone operators in case of large hotels.

- Ensuring immediate delivery of fax to the guests, if required.

- Appraising telephone operators.

- Changing the communication systems to the latest technology for easy use.

Front Office - Staff Qualities and Competencies

Being a part of the service industry, the front office staff needs to have the following qualities and competencies. The front office staff members are required to −

- Understand their respective roles and responsibilities in the hotel and front office as an operation.

- Equip themselves with basic etiquettes and mannerism.

- Possess pleasant, polite, and cordial personality.

- Wear clean and neat uniform with same accessories and footwear.

- Conduct themselves with professionalism, positive attitude, and cooperative nature.

- Possess extraordinary communication skills.

- Be a team player.

- Possess the ability to tackle tricky situations.

Front Office Management - Reservation

Reservation of the hotel accommodation is one of the important responsibilities of the front office department. A potential guest contacts a hotel for availability of the desired type of accommodation and any allied services that the hotel offers. The front office department needs to react to the enquiry of the guests.

For a guest, reservation increases the chances of a better deal for assured accommodation on arrival. For a hotel, reservation can enable a better management of guest experience during usual as well as peak seasons. Reservation procedure varies depending on the size and brand of the hotel and the reservation system employed.

Let us know the details how the front office handles reservations.

Types of Hotel Reservation Systems

An efficient and effective reservation system is what adds to the hotel’s profitability. Following are the most popular reservation systems −

Whitney System of Reservation

It was developed in 1940 by Whitney Paper Corporation from New York, hence the name. This is a conventional manual reservation system the hotels used to follow during pre-computer days in the hotels. It contains the following setup for reservation −

- Slip for request of accommodation reservation

- Whitney slip that records guest name, accommodation type, number, and duration of stay

- Temporary/Permanent arrival slip

- Guest registration card

- Correspondence file

- Bedroom journal that records daily occupancy of the guest with date, guest name, room type, and room number

Let us see how a Whitney slip and the bedroom journal looks like.

Whitney Slip

Bedroom journal.

Though this system proved efficient, it generated a lot of paperwork with occasional scope for errors. The drawbacks were overcome by the central reservation system.

Central Reservation System (CRS)

It is a computerized reservation system that reduces paperwork and can handle large amount of reservation data effortlessly.

In this system, since the guest data and reservation data are stored on the storage disks of the computers, it can be accessed at wish. It is stored in the form of a database of collection of records which can enable searching, adding, removing, or updating any guest related data.

The computerized reservation system not only helps to make guest reservations but also helps to forecast how many accommodations can be reserved in an upcoming time period.

This is how a CRS typically works −

The guests of hotel sales agents call for checking room availability. It is forwarded to the front office reservation staff. The staff finds out details about the requirement and checks the availability of desired accommodation in the database. According to the reservation policies and procedures, the reservation staff member then notifies or suggests the reception about the accommodation availability and takes further appropriate action.

The Role of Internet in Reservation

The Internet has brought a momentum in the hospitality business as well. It facilitates seamless management of a hotel’s offices located at various places and their various departments.

The hotel businesses are actively working on the Internet 24 hours a day, seven days a week. The Internet has simplified complex system of reservations. It enables Online Hotel Management Systems (OHMS) such as Hotelogix to help guests reserve accommodation of their choice fast and conveniently. The guests of the hotel can access rate charts, accommodation availability, check-in and check-out timings, details about the restaurants, and so on, at their own convenience.

Sources of Reservations

People travel for various reasons such as personal as well as for MICE. There are various sources from whom the requests of reservation pour in −

Direct Request from Guests − The prospective guests can approach individually to the hotel for reservation of accommodation mostly when they are single travelers or family travelers.

Request from Travel Agent − They can approach the hotel for booking accommodations for group travelers.

Request from Corporate Agent − An organization can request a hotel to reserve accommodations for their employees, clients, or visitors.

Request from Airlines − The airlines can reserve accommodations for their working staff for routine stay as well as in case of flight cancellations.

Request from Institutions − Various SMERF or NGO institutions request to reserve hotels for sports people, delegations of embassies, or performing-art program groups, workshop groups, and alike who travel to different location.

Managing Reservations

The first step in reserving an accommodation is to check if the requested kind of accommodation is available for selling for a specific period of time. It is done by checking forecast boards or computerized systems.

Accepting Reservation of Accommodation

Reservation of an accommodation is accepted if the desired type of accommodation is available in the hotel for selling. If it is not available during a rush season or if the guest is in urgent need, the staff member suggests for almost similar alternative accommodation by stating its amenities and facilities.

Reservation is accepted in the following cases in conjunction with the availability of the accommodation −

- Is the guest new to the hotel?

- Does the guest have good credentials with the hotel regarding payment and behavior?

- Is the guest a VIP?

Denying Reservation of Accommodation

Denial of reservation directly means loss of revenue. But there are certain situations when the reservation staff turns down the reservation for the guests or agents. The potential causes of denying reservation are −

All accommodations in hotel booked − In such case, the reservation staff refuses the reservation politely and suggests an alternative hotel in the same area or different property of the same owner in a nearby area.

Requested type of accommodation not available − In such case, the reservation staff suggests an alternate accommodation.

Guest/Agent blacklisted − Some guests or agents are blacklisted due to their history of payment dues against the hotel. In such case, the reservation clerk seeks for reservation manager’s advice.

Finally, the reservation section of the front office prepares the list of the reservations for the day and sends it to the front desk. The list also contains vital information such as if the guest is new or repeat, guest preferences about room location or décor. The rooms are then prepared by housekeeping.

Cancelling a Reservation of Accommodation

This is yet another event when the hotel loses business with a guest. Though the fact is overt loss of revenue, the front office staff must react to it politely and gracefully. The staff member also needs to convey any cancellation charges the guest must pay while cancelling the reservation. Cancellation is done in the following steps −

- Finding out details of the guest and respective reserved accommodation.

- Verifying charges of cancellation, if any.

- Notifying the guest about cancellation charges.

- Cancelling the reservation in the system.

- Updating the system for accommodation availability.

- Confirming the guest about the cancellation.

Generating Reservation Report

Reservation reports are generated for the sake of helping the management find trends and making forecast about business.

The reports typically are of the following types −

- Occupancy report

- Special arrival report

- Revenue forecast report

- Turnaway report

Guest Registration

Guest registration is nothing but recording the guest’s information for official purposes. At the time of reservation, the front office staff asks the guests to enter their personal information on the GRC.

Registration activity is mandatory for both; the guest with reserved accommodation as well as for the walk-in guest. During registration, the guest is required to enter important information on the GRC such as guest name, contact number, purpose of stay at the hotel, and passport and visa details in case of foreign guest. It is the responsibility of the front office staff not to reveal the guest information to unauthorized persons.

Let us learn more about registration.

Pre-registration Procedure

This procedure involves the prospective guests enquiring about the availability of desired type of accommodation. Registration can also be conducted in advance before arrival. It can be done via telephonic conversation in case of frequent guests, VIPs, or group guests.

In case of new walk-in guest, pre-registration is absent as there is no prior interaction between the guest and the hotel. Pre-registration activity accelerates the actual registration process where the desired accommodation is marked as reserved.

Verifying Guest's Identity

Since terror attacks on 9/11, the hotels are mandatorily verifying guests’ identities. The staff verifies guest’s identity first by politely asking the guest’s name. The staff member then requests to show a photo ID such as driving license or a valid identity card from a well-known organization where the guest is working. If the guests are from a foreign country, the staff requests them to show passport. The staff member is authorized to ask any verifying questions politely.

The true copies of the passport or ID card are made to verify the guest’s identity and to prepare guest database.

Registration Card Typical Format

Following is a typical format of a registration card −

Creating Registration Record

When the guests arrive at the hotel, the front desk staff hands over the GRC to the guest to fill up the information. In case of VIPs, the staff enters the information on the card and receives the guest’s signature.

The staff then creates a registration record of the guest, countersigns, attaches the true copies of the passport or other ID cards, and files this set in the guest history file. The guest reservation record is created as a registration record in the software system.

Establishing Payment Method

Guests can pay in advance or at the time of checking-out. Those who have paid in advance are put under Paid-In-Advance (PIA) list. There are various modes of payment out of which a mode that guest prefers is recorded at the time of registration. Following payment methods are available −

- Cash Payment (which also include money order, travelers’ cheque).

- Credit Card/Debit Card Payment (which are accepted only if the cards have not expired).

- Cheque Payment (where post-dated cheques are not accepted).

- Direct Billing.

- Special Payment such as gift card and voucher.

- The guests need to select one of the options of payment at the time of registration.

Assigning an Accommodation

The front office staff assigns an accommodation to the guest only when the registration is complete. The staff member records the accommodation number into the PMS and describes about its positive attributes briefly.

The reservations staff also informs the bell-boy to take the guest luggage.

Issuing Room Keys or Access Code

After the accommodation is assigned, the front office staff gives away the keys or the computerized secret code keys for accessing the accommodation.

It is a general practice to not to speak anything about the room number or the computerized key loudly while giving it to the guest. The bell attendant then assists the guest with luggage handling to the accommodation and explaining the accommodation features. The attendant then gives the keys to the guest, greets for best stay, and leaves the accommodation by closing the door.

Handling Special Requests

If the guest is not satisfied with the accommodation for any unsatisfactory or unpleasant reasons, the bell attendant can bring this to the notice of the front desk staff. In addition, if the guest has special requirements such as a cradle for a baby or hot water bag or a shaving kit and alike, the front office staff is obliged to fulfil the request on time.

Front Office Management - Accounting

Accounting section of any business or organization tracks, records, and manages the financial transactions of the business with its customers and clients. The accounting department handles the financial health and tracks the performance of any business directly. It is helpful for the management to take appropriate decisions.

When it comes to a hotel business, accounting is managing expenses and revenue. It provides a clear information to the guests thereby avoiding any unpleasant surprises to the guests. Let us know more about the accounts section of front office.

What is Front Office Accounting?

It is a systematic process in which the front office accounting staff identifies, records, measures, classifies, verifies, summarizes, interprets, organizes, and communicates financial information for a hotel business.

In the simplest form, a front office account resembles English alphabet ‘Block-T’.

In the domain of front office accounting, the charges are entered on the left side of the ‘T’. They increase the account balance. The payments are entered on the right side of the ‘T’. They decrease the account balance.

Basic Front Office Accounting Formula

Where debit increases the outstanding balance and credit decreases it.

Most of the contemporary hotel businesses employ automated accounting system.

Objectives of Front Office Accounting System

The objectives of accounting system are −

- To handle transactions between the guests and the hotel accurately.

- To track the transactions throughout the guest’s occupancy.

- To monitor the guest’s credit limit.

- To avoid possibility of any fraud.

- To organize and report the transactional information.

Types of Accounts

There are following typical accounts in hotel business dealing with customers −

- Guest Account

- Non-guest or City Account

Management Account

Difference between guest and city account.

Here are some prominent differences between a guest and a city account −

Some hotels allow the managers to entertain the guests’ queries or grievances, or any possibility of acquiring a business deal over a brief interaction with the guests. For example, if a guest has some problem about the hotel policy, the manager calls the guest for interaction over a coffee or a drink and tries to resolve the same. The expenses towards this interaction are then recorded on the management account.

Folios and Types

A folio is a statement of all transaction that has taken place in a single account.

The front office staff records all the transactions between the guest and the hotel on the folio. The folio is opened with zero initial balance. The balance in the folio then increases or decreases depending upon the transactions. At the time of check-out, the folio balance must return to zero on settlement of payment.

Types of Folios

There are following major types of folios −

Guest − Assigned to charge for individual guests.

Master − Assigned charge for group/organization.

Non-guest − Assigned for non-resident guest.

Employee − Assigned for hotel employee to charge against coffee shop privileges.

Postings and Types

The process of recording the entries on the folio is called ‘Posting’ of transactions. There are two basic types of postings −

Credit − They reduce the guest’s outstanding balance. These entries include complete or partial payment, or adjustments against tokens.

Debit − They increase the outstanding balance in the guest account. Debit entries include charges under restaurant, room-service, health center/spa, laundry, telephone, and transportation.

Vouchers and Types

Vouchers are detailed documentary evidences for a transaction. It transfers the transaction from its source to the front office. Vouchers are used to notify the front office about guest’s purchases or availing of any service at the hotel.

The following typical vouchers are used in the hotel −

- Cash Receipt Voucher

- Commission Voucher

- Charge Voucher

Petty Cash Voucher

- Allowance Voucher

- Miscellaneous Charge Order (MCO)

- Paid-out Voucher (VPO)

- Transfer voucher

Here are some typical vouchers.

Payment Voucher

Ledger and Types

The ledgers are a group of accounts. There are two ledgers the front office handles −

Guest ledger − A set of all guest accounts currently residing in the hotel.

Non-guest ledger − A set of all unsettled, departed guest accounts.

There are two other types of ledgers used in the hotel. Both types of ledgers are used by back office accounting section as given −

Receivable ledger − The back office accounting staff mails the bills and statements to the guests after their departure without settling the bills and ensures the payments for services provided.

Payable ledger − The staff handles amounts of money paid in advance on behalf of the guest to the hotel for future consumption of goods and services.

Account Settlements

There are various issues regarding account settlement −

Orientation of Account Settlement

By Guest − The guest settles own account by cash/credit card/cheque.

By Organization − The organization settles guest account by transferring money to the hotel account.

Methods of Account Settlement

There are following popular methods of account settlement −

Account Settlement in Local Currency − A guest can pay in terms of a local currency where the payment is not chargeable with conversion fees.

Account Settlement in Foreign Currency − If the guest prefers to pay in foreign currency, the service of payment by the bank is chargeable for around 3% to 6% of the total payable amount.

Account Settlement Using Traveler Check − Travelers’ cheques, the pre-printed cheques in the denominations of major world currencies are a good option to paying by cash.

Debit Card − Use of magnetic cards for payment against account is most common today. Paying by debit cards is as good as paying by cash as the amount of money is instantly transferred from the guest’s bank account into the hotel’s bank account.

In case of credit card settlement, the accounting staff mails the charge vouchers signed by guests to the credit card company; preferably within a specified time. The credit card company then settles the guest account by transferring money against it.

Credit Settlement by Organization − Many national, international, private, or public organizations send their employees or students for attending workshops, seminar, or meetings. Such organizations tie-up with the hotel for paying the bills of their employees on credit. The organizations reserve accommodations depending on the number of room nights (number of rooms × number of nights the representatives are expected to occupy). This is popularly known as account Settlement using Direct Billing.

In direct billing account settlement , the front office staff verifies guest folios and transfers the guest account to non-guest or city account. The hotel’s back-office accounting verifies the guest folios and is responsible to collect the direct billing amount from a direct billing agency such as embassy, university, or organizations.

The accounting section also notifies the guests that if the direct billing agency fails or refuses to pay the charges then the guests need to settle the account by paying them from their pocket.

Combined Account Settlement − A guest can settle account by paying partial amount in cash and remaining amount on credit. The front office staff needs to prepare the supporting document for such kind of payment and hands it over to the back-office accounts.

Front Office Management - Communication

Healthy communication in the organization fosters mutual trust and sense of cooperation among the staff members and the guests as well as between the staff members and the management body. Front office communication with other departments can make or break the guests’ stay at the hotel.

As the front office is responsible to sell the hotel accommodations, it is a major driving force for generating revenue. Hence, communication within and out of front office department needs to be vibrant and positive.

Importance of Front Office Communication

Front office department is responsible for communicating with all other departments in the hotel as well as different sections within the department. To get the front office and back office jobs done successfully, the front office staff members need to communicate with their peers as well as the colleagues and subordinates.

Within the department, the staff of front office communicate with each other to provide the best possible guest services such as reserving accommodations, registering guests, managing guest accounts, handling guest mails, and personalized guest services.

Interdepartmental Communication

Front office interacts with various departments since the guest inquire about reservation through the entire guest cycle up to the guest’s departure.

Here is how front office needs to communicate with the other departments −

Communication with Human Resource − Front Office department is engaged with the HR department to interview, help shortlist them, and select the most eligible employees. It also contacts the HR department for employee training and induction programs, salaries, leaves, dues, and appraisals.

Communication with Accounts − As front office department handles guest accounts with a complete responsibility, the staff needs to often interact with the back-office accounting colleagues regarding payment settlements or dues of guests or non-guests, discount offers, and coupons settlement. It also needs to sort out and get actual status of night auditing with accounts.

Communication with Food and Beverage Department − Since front office department is the one where the guests speak about their food and beverage requirements during reservation, the front office needs to communicate with the food and beverage sections frequently.

It also keeps the track of guest’s purchases from the restaurant, the bar, or coffee shops in the hotel.

It conveys special requests of the guest regarding food and beverage to the F&B department.

It deals, accepts, and reserves banquet inquiries and coordinates them with the respective departments.

Communication with Marketing and Sales Department − Sales and Marketing department highly relies upon front office inputs about the guests. The guest history compiled by the front office department is an excellent source for segmenting the customers, prepare customer-oriented packages, and plan and execute the campaigns.

The front office staff contacts marketing and sales department in case there is a need to prepare electronic marquees or message boards for promotions.

Communication with Housekeeping − The front office staff needs to interact with the housekeeping department on the concerns such as −

Readiness of vacated accommodation for selling.

Security of the accommodation.

Guest’s complaints and requirements about any amenities is initiated at the front desk.

Guest’s requirement of removing soiled dishes or linen from the accommodation.

In addition, the housekeeping department relies upon front office staff for the number of accommodations sold, departures, walk-ins, stay-over guests, and no-shows. Timely distribution of the accommodation sales helps the housekeeping manager to plan employee personal leaves and vacations.

Communication with Banqueting − The front office and banqueting department needs to interact with each other on the concerns such as −

Expected number of guests to attend the banquet.

Showing directions of the venue to the unfamiliar banquet guests.

Posting of daily messages on felt board regarding venue, occasion, hosts and guests.

Settling of the city account against the banquet service for the guest.

Switchboard Operators

A vital link between the prospective guests and the hotel itself is switchboard operator who represents the hotel. When the customers call the hotel, the call first arrives at the switchboard operator.

Using knowledge of the portfolio, tone of speaking, and the command over language the switchboard operator can handle the influx of the calls. The operator represents the competency of the hotel in the market while speaking with the customers. Generally, the switchboard operator greets the guests and transfers their call to appropriate department.

There are two schools of thoughts regarding the area where a switchboard operator should work. Some experts say that they should be visible and some expert advice to assign a separate aloof place for them in the hotel. Today, the task of a switchboard operator for transferring the incoming calls to various departments is computerized and requires less human involvement.

The switchboard operators are informed not to transfer any call to the executive chef or to the banquet manager during busy work hours. Hence, the operator needs to take the message accurately and pass them on to the respective persons on time.

Do's and Don'ts of Hotel Communication

Communication necessarily is about verbal language as well as body language. Here are some common Do’s and Don’ts the front office staff follows while communicating −

Do’s of Hotel Communication

Always present yourself with a warm smile .

Always stand and walk erect which reflects your confidence .

Get hold on to your domain subject. Try to know more about your portfolio . This saves you from the embarrassing situations when you are expected to answer the guests.

Before you start speaking, find out important points about the issue.

Speak in audible voice .

Use simple and correct language .

Use a language that can be understood by everyone.

If you need to talk to your colleague in the presence of guest, talk in a standard language of communication.

Speak only if it is going to be useful to the guests and colleagues. Always speak by maintaining eye contact with the listener.

In case your conversation is interrupted, continue it with a short recap of what has been already discussed.

While you listen, always pay undivided attention to the speaker. Communicate to understand; not to react.

If the guest asks you to arrange for too many things, then repeat them for confirming.

Ask politely if you have missed to hear any point the guest or the colleague is putting forward.

Don’ts of Hotel Communication

Do not use jargon or words such as “hmm-hmm”, “yep”, and alike. Instead, use “perfect”, “absolutely”, and similar words.

Do not speak too fast , too slow, or in too low or high voice.

Do not interrupt the speaker.

Do not speak with the colleagues, if it is not related to the business during working hours.

Do not speak under assumptions.

Do not hastily arrive at the conclusion unless you know.

Do not run around the area of work.

Do not appear harsh with your subordinates.

Do not appear untidy on work.

Essential Attributes of Front Office Staff

Front office communication not only includes verbal or textual communication but also body language of the staff.

Following are some essential attributes the front office staff must have −

- Pleasant, sturdy, and agile personality

- High sense of good conduct and hygiene

- Ability to solve problems and decide quickly

- Salesmanship

- Punctuality

- Knowledge of etiquettes, and manners

- Command over language

- Confident yet polite nature

- Capacity to tackle situations of emergency

- Integrity and honesty

Front Office Management - Night Audit

Auditing is nothing but conducting financial inspection of the organization. For a hotel business, the finance management starts at the front office. Accurate posting of transactions on the guest folios start at the front office, which is further carried to the back-office accounting department. The guest accounts are counterchecked on a daily basis during auditing.

Experts recommend the hotel management team to go through the night audit reports daily to get an insight of the hotel occupancy and finances.

Let us see what night auditing is and details about the same.

What is Night Audit?

It is the process of auditing where the night auditor reviews all financial activities of the hotel that has taken place in one day.

The auditing process for the day is generally conducted at the end of the day during the following night, hence the name ‘Night Audit’. It can be performed by the conventional method of using papers, receipts, vouchers, coupons, and files. But performing audit using modern PMS systems is easy, fast, and efficient.

Basic Activities During Night Audit

The night auditor performs the following steps during night audit activity −

- Posting accommodation and tax charg

- Accumulating guest service charges and payments

- Settling financial activities of various departments

- Settling the account receivables

- Running the trial balance for the day

- Preparing the night audit report

The Need for Night Audit

The objective of night audit is to evaluate the hotel’s financial activities. Night audit not only reviews guest accounts by checking credits and debits but also tracks the credit limits of the guests and tallies projected and actual sales from various departments. Night audit reviews daily cash flow into and out of the hotel’s account.

Night audit has a large significance in hotel business operations. The management body refers night audit report to plan future goals and control the expenses. The managers can react immediately on the acquired information.

Responsibilities of a Night Auditor

Apart from the basic audit activities listed above, the night auditor carries out the following responsibilities −

- Taking over from the last shift.

- Checking-in or checking-out the guests after 11:00 pm at night.

- Registering the guests.

- Allocating accommodations to the newly checked-in guests.

- Settling transactions in the newly created guest accounts.

- Verifying guest folios.

- Verifying room status report.

- Balancing all paperwork with the accounts in the PMS.

- Remaining liable for security of the premises.

- Handling guest accommodation keys.

- Taking backup of the PMS generated reports.

- Preparing lists of expected guest arrivals for the next day.

- Closing financial activities for a day.

- Starting financial activities for the next day.

- Receiving and recording bank deposits.

Types of Night Audit Reports

Today, the PMS helps night auditors to a great extent in auditing and generating accurate reports. Here are some typical reports generated during night audit −

Night Audit Accommodation Report − It gives a snapshot of the days when accommodations are occupied, the days when the accommodations are available, check-ins, check-outs, no-shows, and cancellations. This report can show further details for any of the items listed above.

Night Audit Counter Report − It gives details on cash and credit card receipts and withdrawals.

Night Audit Revenue Report − It delivers information on accommodation revenue, cancellation and no show revenue, and other POS revenue. Revenue generated through various agencies and bodies such as travel agents, corporate organizations, internet booking. etc., is also listed in this report.

Night Audit Tax Report − Contains all the tax information on reservation revenue and other POS revenues such as VAT, luxury tax, and service tax.

Cashier’s report − It is the detailed list of cashier activity of cash influx and out flux, credit cards, and PMS totals. Cashier’s report is very important part of the financial control system of a hotel. The front office manager reviews the night audit and looks for any divergences between the actual amount received and the PMS total.

Manager’s Report − It is a statistical list of previous day’s occupancy. It includes details about available accommodations, occupied accommodations, sold and vacated accommodations, rack-rate, number of guests in the hotel, number of no-shows, and so on.

General Manager’s Report − Each department in the hotel is required to send daily sales report to the front office. Using their information, a departmental total report is generated for the general manager’s assessment. The General Manager determines the profit-generating departments and evaluates the success of sales and marketing.

High Balance Report − This is a detailed report about the guests who have exceeded the credit limit set by the hotel management.

Ledger Balance Summary Report − It displays the opening and closing balances for the Advance Deposit Ledger, Guest Ledger, and City Ledger.

Room Rate Audit Report − It lists all rates that are applied to each guest and the difference from the rack rate with the predetermined rack code.

Balancing Night Reports

Here are some formulae used to balance night audit −

Formula for Balancing Bank Deposit

The formula for balancing bank deposit is −

Formula for Balancing Guest Ledger

The formula for balancing guest ledger is −

Formula for Balancing City Ledger

The formula for balancing city ledger is −

Front Office Management - SOPs

In any business organization, common procedures occur in sequence. They are linear. In addition, some procedures also repeat over a time. The organization needs to find out such linear and repeating procedures to compile them into sets of Standard Operating Procedures (SOPs).

These procedures when compiled step by step, can prove to be an excellent learning material for training the newly joined staff in a short period of time.

Let us learn about a few SOPs followed in the front office department.

SOP for Handling Guest Luggage

This is a procedure followed by the bell desk staff at the time of the guest’s arrival and departure. It goes as follows −

Handling Luggage on Guest Arrival

- As a bellboy look for the new arrival of guest.

- The guest vehicle stops at the hotel entrance.

- Go ahead and open the vehicle door.

- Greet the guest as, "Welcome to (hotel_name), I am (own_name). Do you need any help with your luggage?"

- Help the elderly/disables guests to get out of the vehicle if required.

- Take the luggage in charge and ensure that nothing is left in the vehicle.

- Ask the guest’s name politely as, "May I know your name Sir/Madam?"

- Tag the luggage with the guest name.

- Ask if anything fragile or perishable is in the luggage.

- Add this information on the luggage tag.

- Inform the guest that their luggage is with you.

- Escort the guest to the hotel reception.

- Inform the guest that you will be taking care of their luggage.

- With the other front office staff, find out the accommodation number allotted to the guest.

- Write the accommodation number on the luggage tag.

- Confirm if the guest registration formality is complete.

- If the room is ready, take the luggage to the room by the staff elevator.

- Place the luggage on the luggage rack.

- If the room is not ready, then take the luggage to the store room.

- Record the luggage details into the Daily Luggage Register.

Handling Luggage on Guest Departure

Inform the guest that you are going to guest’s accommodation to collect the luggage.

Have an informal conversation with the guest as, "Mr./Ms. (Guest_Name), I hope you enjoyed your stay with us. Do you need an airport transport?"

Collect the luggage from the guest room.

If the guest needs to store the luggage for long term, tag the luggage with the guest name, accommodation number, date and time of collection, contact number, and receive the guest’s signature on long-term luggage request form.

Ensure with the guest that nothing perishable is there in the luggage.

Store the luggage on the designated departure area.

If the guest is leaving the hotel immediately after check-out, then bring the luggage to the lobby.

If a transport vehicle is ready to go then place the luggage in the vehicle.

Request the guest to verify the loaded luggage.

Update the departure luggage movement on the Daily Luggage movement register.

SOP for Handling Reservation Request

The SOP goes as follows −

Pick up the incoming call in three rings.

Greet the guest in the audible voice, introduce yourself, and ask how you can help the guest as, “Good (morning/evening), this is Mr./Ms. own_name, how may I help you?”

Wait for the guest to respond.

The guests say that he/she needs an accommodation in your hotel.

Tell the guest that it’s your pleasure.

Take a new reservation form.

Inform the guest about the types of accommodations in your hotel and their respective charges.

Ask for the guest’s name, contact number, and type of accommodation the guest wants.

Ask for the guest’s dates of arrival and departure.

Check for availability of the accommodation during those dates.

Briefly describe the amenities the hotel provides to its guests.

If the accommodation is available, inform the guest.

If exactly the same kind of accommodation is not available, ask the guest if he/she would care for another type of accommodation.

Note down the guest’s requirements related to the accommodation.

Ask the guest if an airport pickup/drop service is required.

Ask how the guest would settle the bill: by cash, credit, or direct billing.

If the guest prefers by cash or by card, then insist to pay the part of cash in advance against booking charges or credit card details of the guest.

Inform about reservation with the guest name, contact number, accommodation type required, payment method, and confirmation number.

Conclude the conversation as, “Thank you for calling hotel_name, have a nice day!”

SOP for Guest Check-in

- Upon the guest’s arrival, greet the guest.

- Ask the guest for his/her name politely.

- Search the reservation record in the PMS.

- Generate and print a registration card.

- Handover a GRC to the guest for verifying printed details.

- Request the guest to show the ID card from an authorized institute.

- Request to show passport and visa in case of foreigner guest.

- Designation

- Organization

- Business or Residence Address with City and ZIP Code

- Purpose of Visit

- Contact Number in case of Emergency

- Passport Details

- Visa Details

- Inform the guest about any early/late check-out policies.

- Request the guest to sign on the GRC.

- Counter-sign the GRC.

- Update the details on the guest record.

- Create a guest account.

- Prepare copies of driving license/passport and visa.

- Attach them to the GRC and file the entire set.

SOP for Handling Wake up Calls

There are manual and automatic wakeup calls.

Handling Wakeup Call Manually

The guest can request for a wakeup call at the front office directly or by calling from his/her own accommodation.

Ask the guest for a wake-up time and any immediate special request after getting up.

Open the Wakeup Call Register and enter the following information −

Accommodation number

Wakeup date

Wakeup time

Any Special immediate request such as tea/coffee, etc.

Conclude the conversation by greeting the guest again.

Pass the special request for tea/coffee to the room service staff.

At the time of wakeup call, follow the given steps −

Confirm the current time.

Call the guest’s accommodation number on telephone.

Greet the guest as per the time and inform about the current time and the progress on guest’s special request.

Handling Wakeup Call Automatically

Most hotels facilitate their guests to set automatic wakeup call using their phones or televisions. The housekeeper must ensure that the printed instructions about setting an automatic call are kept handy and visible.

The guest can set automatic call which is notified at the PBX system and the PMS system. Even if the guest has set up an automatic call, it is the responsibility of the front office staff to give a manual wakeup call to the guest to avoid any chances of inconvenience.

SOP for Guest Check-out

The process of checking out generally is initiated by the guest. The guest calls up front office and asks to keep the bill ready.

- The guest arrives at the front desk.

- Greet the guest.

- Print a copy of guest folio.

- Hand it over to the guest for verification.

- If there is any discrepancy, assure the guest about its solving.

- Resolve the discrepancy immediately.

- Apologize to the guest for inconvenience.

- From the guest database, ensure the guest’s preference of payment method. Recite it to the guest.

- Settle the guest account.

- Print the receipt and give it to the guest.

- Ask the guest if he/she needs any assistance for luggage.

- Ask the guest if the transport facility to the airport is required.

- Greet the guest for giving an opportunity to serve as, “Hope you enjoyed your stay with us. Thank you. Good (morning/afternoon/night).

SOP for Processing Cancellation Requests

The guests initiate the cancellation of the reserved accommodation. The SOP goes as −

Request for the guest’s full name and reservation number.

Search the guest database for the given name and reservation number.

Recite the guest name, accommodation details and the date of reservation.

Ask the guest if he/she would like to postpone it.

Request the guest for reason behind cancellation.

Record the reason in the PMS.

If the cancellation is being done by a person other than the guest, record the person’s name, contact number, and relation with the guest for information.

Inform the caller about any cancellation charges applicable according to the hotel policies.

Cancel the reservation in the PMS.

Inform the guest about e-mail for cancellation charges. Send the cancellation charges plus cancellation number to the guest by e-mail.

SOP for Controlling Guest Room Keys

The front office staff needs to manage at least two sets of the keys. The number of sets may vary according to the guest policy. Accommodation numbers are not written on the keys, which creates problems when the keys are misplaced within or around the premises.

Giving Accommodation Key to the Guest

Request for the guest’s last name and accommodation number.

Check the information told by the guest against the one recorded in PMS.

If there is any deviation, request the guest to provide photo ID card.

Do not give away the accommodation key without proper authentication.

If the doubt about the guest arises and the guest refuses to cooperate, then inform the front office manager immediately.

If any other superior front office staff member recognizes the guest, then you can give away the duplicate key.

If the guest has lost the key and needs a new one, then ascertain that the guest has lost it.

In the above case, program a new key with the same code.

Present the newly created key to the guest.

You must not issue accommodation keys to any person that claims to be sent by the guest for getting the keys. Yet, you can give them to a non-guest, if the guest has sent the person with a written authority letter addressed to the front office team. In such case, confirm by calling the guest and accompany the non-guest to the accommodation.

Giving Occupied Accommodation’s Key to Staff

The authorized staff on duty is allowed to access the occupied guest accommodation for the purpose of professional work.

For example, the keys can be given for preparing vacated accommodation, laundry staff, mini-bar staff, and bell-boy to take out the guest luggage.

SOP for Turning Away Reservation Request

One thing for sure, always try to solve the guest’s accommodation problem as far as possible. Try selling hotel service by giving options than plainly denying to what the guest wants.

There are a number of reasons why a reservation staff needs to turn down the reservation request. These are few important ones −

- The hotel is fully booked during busy seasons.

- Guest is not interested to reserve after knowing rates.

- The type of accommodation the guest desires is not available.

This is how you turn down a reservation gracefully −

When the guest calls to enquire, answer the call as, “Good (morning, evening), this is own_name from reservations. How may I help you?”

The guest says he/she would like to reserve an accommodation.

Reply as, “Certainly (Sir/Madam). May I request you for your name, mobile number and email ID please?”

The guest tells the same.