Domestic Travel Insurance

Traveling domestically within the United States can be an exciting adventure, but unforeseen circumstances can quickly change all your travel plans. Travel insurance can help ease your mind and provide protection in the event of unexpected emergencies, such as trip cancellations, medical emergencies, or lost or stolen luggage. With reasonable travel protection plans available from AXA, domestic travel is a smart choice for anyone looking for adventure.

Is travel insurance necessary for domestic travel?

Travel insurance for domestic trips is a wise decision, as it provides crucial coverage and protection against unforeseen events that could otherwise spoil your trip. Here are some common benefits of travel insurance for domestic travel:

- Trip Cancellation and Interruption : If your trip is canceled or interrupted due to eligible unforeseen circumstances such as a natural disaster, illness, or death in the family, travel insurance can help provide reimbursement for non-refundable expenses such as flights, hotels and tours.

- Medical Emergencies : If you get sick or injured during your domestic trip, travel insurance can help cover medical expenses such as hospitalization, emergency medical evacuation, and repatriation.

- Travel Delays : If your flight is delayed or canceled, travel insurance can help reimburse for expenses such as meals, accommodations, and transportation until you are able to reach your destination.

- Lost or Stolen Luggage : If your luggage is lost, stolen, or damaged during your domestic trip, travel insurance can help provide reimbursement for the value of your belongings.

GET YOUR FREE QUOTE

Vacation Stories:

Sarah had always been an adventurer, and she was excited to explore the beautiful mountains of Denver, Colorado. She had carefully planned her trip, packed her gear, and set out on her hiking adventure. As she was hiking in a remote area of the mountains, Sarah suddenly slipped and fell, injuring her leg. She tried to continue hiking, but the pain became unbearable. Realizing she needed medical attention, Sarah called her provider and they immediately arranged for her to be airlifted to the nearest hospital. Luckily she had an AXA plan with benefits for the cost of her medical treatment and the emergency transportation, saving her from thousands of dollars in expenses.

Is travel insurance expensive?

A policy usually costs just 3-6% of your trip costs, and the total cost doesn’t go up much for each additional person. 1 Whatever amount of coverage you choose, the knowledge that you are covered in a variety of circumstances is priceless!

Cancel for Any Reason Coverage

If you are concerned about having a trip canceled or interrupted by circumstances outside of those generally covered, “Cancel for Any Reason” coverage may be right for you. Cancel For Any Reason (CFAR) is an optional, add-on benefit that allows you to cancel your trip for any reason, with reimbursement. CFAR is there for when you need to cancel your trip more than 48 hours ahead of time: it can give up to 75% back of your prepaid trip arrangements. CFAR is available exclusively to AXA’s Platinum plan.

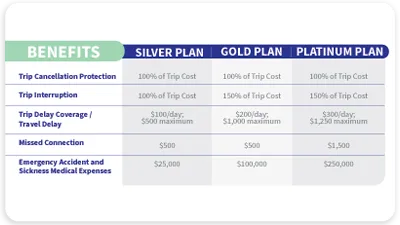

Compare Travel Insurance Plans

Get covered against trip delays, medical emergencies, lost baggage, and more!

Compare Plans

Why choose AXA Travel Insurance for travel within North America?

AXA has been consistently ranked as a reliable insurance company for a decade by global brand-consultancy firm Interbrand. Here are several reasons why travelers trust us with their travel plans:

- Coverage: AXA offers coverage for a range of travel-related incidents, such as trip cancellation, trip interruption, medical emergencies, and lost or stolen luggage.

- 24/7 emergency assistance: Assistance services to help travelers in the event of a medical or travel emergency.

- Easy claims process: AXA has a straightforward and streamlined claims process, making it easy for customers to submit claims and receive reimbursement.

- Global Protection: AXA offers coverage plans that provide customers with reassurance while journeying to destinations accessible to US residents.

- Additional benefits: Depending on the plan chosen, benefits like lost skier days, optional trip cancellation for any reason, optional rental car damage, and identity theft protection coverage can be found in our Gold and Platinum plans.

Can I purchase travel insurance after booking my trip?

Yes, travel insurance can be purchased after booking a trip. However, you must purchase a travel insurance policy at least 24 hours prior to the start of your trip.

Does travel insurance cover COVID?

AXA Travel Protection plans include coverage for COVID related expenses, such as medical treatment, quarantine, and trip cancellation or interruption due to the virus. However, it is essential to carefully review the policy's terms and conditions to understand the specific coverage and exclusions related to COVID.

How to Get a Travel Protection Quote

Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed travel insurance advisors. Monday-Saturday, 8AM-7PM Central Time Also see: Plan Comparison Table | Silver Plan | Gold Plan | Platinum Plan

Need help choosing a plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From medical coverage to trip-cancellation protection, our team of travel experts will help you choose the right coverage.

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Make the most out of your travels. Get AXA Travel Insurance and travel worry free!

You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Travel Insurance

Get a travel insurance quote and protect your next trip

For flight insurance protection:

AirCare Flight Quote

For all-in-one trip insurance protection:

ExactCare Travel Quote

Manage Your Travel And Flight Insurance

Manage your policy online

Need a travel insurance quote?

Existing policyholder?

Why Travel Insurance Matters

Travel insurance provides peace of mind by offering protection against a wide range of travel-related risks. From covering non-refundable trip costs in case of cancellations to providing financial assistance for medical emergencies abroad, a comprehensive travel insurance plan ensures you are prepared for the unexpected.

AirCare Flight Insurance

If you only need to protect your travel costs for a flight, AirCare may be what you need. With affordable coverage for both domestic and international flights, AirCare flight insurance helps you plan with peace of mind.

ExactCare Travel Insurance

If you want to cover your flight and other trip arrangement's ExtraCare can help. An ExactCare Travel Insurance policy can help with the unexpected, such as:

- Trip Cancellations/Interruptions/Delays

- Lost/Stolen travel documents

- Unexpected medical expenses

What's the difference between flight insurance and travel insurance?

Flight insurance is a type of travel insurance that offers specific financial protection for air travel issues. Whereas travel insurance provides coverage for the entire travel experience from trip cancellations to medical emergencies and beyond.

What Flight Insurance Covers

AirCare Flight Insurance has a variety of benefits including emergency travel assistance, 24/7/365. Some common flight coverages are:

- Airfare incase flights are cancelled or you miss a connection

- Personal items like lost or delayed luggage

- Flight delays in your departure (at the gate or on the tarmac)

AirCare Quote

What Travel Insurance Covers

ExactCare Travel Insurance offers comprehensive protection tailored to residents of specific states or regions, with benefits that may vary depending on your location. This all-in-one travel protection comes with family friendly pricing and worldwide emergency travel assistance 24/7/365. Common things covered by travel insurance are:

- Trip cancellation or interruption

- Personal items like passports and luggage

- Medical costs like hospital and doctor expenses, medical evacuations, and more

ExactCare quote

Travel Insurance Additional Coverage

Travel insurance optional coverage upgrades vary by plan. They are tailored to meet your specific needs and offer an extra layer of security for unforeseen circumstances. Some popular travel insurance coverage options from GEICO include:

Cancel for Any Reason (CFAR) Coverage: This type of coverage allows travelers to cancel their trip for any reason not covered by standard trip cancellation policies. It typically reimburses a percentage of the prepaid, non-refundable trip costs.

Rental Car Collision Coverage: This optional coverage provides protection against damage to rental vehicles due to collision, theft, or vandalism while traveling.

Baggage Delay or Loss Coverage: This coverage reimburses travelers for essential items, such as clothing and toiletries, lost due to baggage delay or loss.

Pre-existing Medical Condition Coverage: Some travel insurance policies offer coverage for pre-existing medical conditions, which may otherwise be excluded from standard policies. Please note that this coverage can't be purchased as upgrades or add-ons. Please contact our specialist to learn more about this coverage as other restrictions may also apply.

Natural Disaster Coverage: Provides coverage for trip cancellations, interruptions, or delays due to natural disasters such as hurricanes, earthquakes, or floods. Please note that this coverage can't be purchased as upgrades or add-ons. Please contact our specialist to learn more about this coverage as other restrictions may also apply.

Pet Coverage: This optional coverage reimburses travelers for expenses related to pet care if they need to extend their trip due to unforeseen circumstances. It does not provide the same coverage as dedicated pet insurance policies, so be sure to check with your provider for specifics.

Extended Personal Liability Coverage: Offers protection against third-party claims for bodily injury or property damage caused by the traveler while on their trip.

What Travel Insurance Does Not Cover

Your travel insurance is based on the plan you choose. However, travel insurance does not usually cover the following:

- Action and team sports, for example auto racing, pro sports travel, or other extreme sport activities

- Travel to get medical care

- Trip Cancellation because you changed your mind

For more information, please check your policy.

Is travel or trip insurance worth the cost?

Travel insurance can help protect your vacation or trips from unexpected things happening. You can travel without trip insurance but doing so brings greater risk if something goes wrong or you encounter unexpected delays. Flight insurance or trip insurance coverage can include things like flight cancellation, lost luggage, trip cancellation, emergency medical transportation, and more. Learn more about travel insurance and why you should get a travel insurance quote today!

How Much is Travel Insurance?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that can be influenced by several things.

- The cost of the trip

- The length of your trip and destination

- The amount of coverage selected

- The number of travelers covered under the policy

Travel Insurance Worldwide Service and Claims Information.

It's easy to manage your travel insurance..

Berkshire Hathaway Travel Protection (BHTP) has made it easy to manage your travel insurance. You can:

- Visit Berkshire Hathaway Travel Protection's website

- Email [email protected]

Is travel insurance worth it?

Yes. Things happen that are out of your control. Whether it's your flight being cancelled or delayed to a family emergency. Life happens and that's how travel insurance can help. Plan for the unexpected with a travel insurance policy so you can rest easy knowing you're covered.

Travel Insurance FAQs

- What travel insurance plans are available? BHTB offers AirCare (flight only) and 3 main plans: ExactCare Value, ExactCare, and ExactCare Extra. ExactCare Value provides great traveling insurance coverage for budget minded travelers. You can rest easy knowing you're covered for things like trip cancellation, trip interruption, and medical expenses. The main difference is the maximum amount that will be covered. ExactCare and ExactCare Extra's insurance cover the same things as ExactCare Value and add coverage for missed connections and accidental death & dismemberment. The overall amount covered is also increased for each plan respectively.

- Is there travel insurance that can cover my vehicle while traveling to Mexico? Your US auto insurance policy won't cover your vehicle when you drive into Mexico. We're here to help you find the Mexico car insurance you need to insure your car.

- How can I save money on my next trip? No one wants to overpay things. We're here to help. Check out our 5 ways to save your money on your next family vacation.

- Where you're going

- Number of days you're traveling

- Cost of your overall trip

- Coverage you pick

- Number of people covered under your policy and more

- How Can I Get Travel Insurance? To get GEICO travel insurance, visit the GEICO website and navigate to our travel insurance section. There, you can review the different plans available, which include coverage for trip cancellations, medical emergencies, lost luggage, and more. You can get a quote by entering your travel details and personal information.

- When Is It Too Late to Buy Travel Insurance? It's generally too late to buy travel insurance once your trip has started, or a loss has occurred. Most policies must be purchased before departure, with some providers allowing purchases until the day before.

- How Much Travel Insurance Do I Need? The amount of travel insurance you need depends on your trip cost, destination, duration, and personal risk factors, such as your age and health. In general, you should aim for coverage that includes medical expenses, trip cancellations, lost luggage, and emergency evacuation. You may want to consider higher limits for expensive or high-risk destinations.

- How Can I Add Travel Insurance After Booking a Flight? To add travel insurance through GEICO after booking a flight and before travel begins, visit the GEICO website, navigate to our travel insurance section, and apply for coverage. You can also call our dedicated customer service team for assistance.

If you choose to get a rate quote or service your policy online, you will be taken to the Berkshire Hathaway Travel Protection website which is owned by Berkshire Hathaway Specialty Insurance Company, not GEICO. Travel Insurance is underwritten by Berkshire Hathaway Specialty Insurance Company; NAIC #22276. Any information that you provide directly to Berkshire Hathaway Specialty Insurance Company on its website is subject to the privacy policy posted on their website, which you should read before proceeding. GEICO assumes no responsibility for their privacy practices or your use of their website.

ExactCare is provided through Berkshire Hathaway Global Insurance Services, LLC. ExactCare and AirCare are underwritten by Berkshire Hathaway Specialty Insurance Company. Both coverages are secured through the GEICO Insurance Agency, LLC.

Benefits may vary by jurisdiction. Please contact a representative to confirm availability.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Travel Insurance for Domestic Vacations

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Domestic Travel Insurance: What Does It Cover?

D omestic vacations are generally less expensive than international ones, and your health insurance policy may already cover medical emergencies you experience, even across state lines. So, do you need one of the best travel insurance policies while vacationing in the U.S.? And what would a policy cover during a domestic trip?

In this article, we explain what domestic travel insurance covers to help you determine whether purchasing one of these policies is right for you. Keep reading to find out more.

Table of contents

What does domestic travel insurance cover, domestic travel insurance exclusions, do you need travel insurance for domestic trips, how much is domestic travel insurance, when to buy domestic travel insurance, domestic travel insurance faqs, summary of money’s guide to domestic travel insurance.

While travel insurance is mainly associated with international travel, you can also purchase this type of policy for domestic trips. Coverage options vary by insurance company and plan, yet most travel insurance policies afford the following types of coverage.

- Emergency medical coverage: Reimburses you — up to the policy limit — for medical treatment related to accidents or illnesses you experience during a trip. Coverage generally excludes pre-existing conditions and may be primary or secondary to any existing medical insurance you have that’s in effect at your destination. (Check with your insurer to confirm that coverage.)

- Emergency medical evacuation and repatriation coverage: Covers emergency transportation to the nearest medical facility or back to a hospital close to your home, if medically necessary and recommended by your doctor. It also covers expenses related to transporting your remains to your return destination if you die during the trip.

- Trip cancellation coverage: Refunds you a percentage of pre-paid, non-refundable travel costs — up to a limit — if you cancel or interrupt your trip for eligible reasons. Valid reasons for canceling include natural disasters and the illness or injury of a traveler or their family member.

- Trip interruption coverage: If you must interrupt a trip for a covered reason, travel insurance can reimburse you for the unused portion of the trip and any expenses you incur returning home. Reimbursement is usually capped at 150% of the trip’s cost.

- Travel delay coverage: Trip delay coverage reimburses you up to your policy limits if you experience flight delays and incur additional expenses like meals or lodging. It may also cover airport delays and flight change fees.

- Baggage loss and baggage delay coverage: Refunds you the cost of replacement items (up to a per-item limit) if your luggage is lost or delayed during your trip. You usually have to wait a specified number of hours before filing a claim and provide purchase receipts or a list of items in your luggage. Coverage may also be subject to a deductible.

- 24-hour emergency and travel assistance: Most travel insurers offer worldwide travel assistance services. These include help with replacing lost documents, luggage, prescriptions or medical devices and arranging hotel accommodations and medical transport services.

For more information about these and other coverage options, read our article on what travel insurance covers .

Travel insurance add-ons and benefits for domestic trips

Again, while options vary by company, insurers generally offer add-ons and other benefits that can enhance a base travel insurance policy. These include:

- Rental car collision coverage: Also called collision damage waiver (CDW), this add-on waives policyholders’ financial responsibility (up to a limit) if their rental vehicle is damaged in an accident or collision. When available, this option generally costs extra.

- Cancel for any reason (CFAR) coverage: While standard cancellation coverage reimburses policyholders for cancellations related to specific covered events, cancel for any reason coverage reimburses policyholders for a portion of their trip cost (50% to 75%) if they cancel for any reason whatsoever. This option can increase the policy’s price by as much as 50%.

- Waiver of pre-existing conditions: Travel insurance policies commonly exclude coverage for pre-existing medical conditions. Unless you qualify for a pre-existing conditions waiver at the time of purchase, you won’t be reimbursed for medical expenses related to a condition diagnosed before — even shortly before — your policy’s effective date. Qualifying for this waiver often requires meeting specific criteria, such as being medically fit to travel and insuring the entire trip cost.

- Accidental death and dismemberment (AD&D): This coverage pays out a sum of money if you die, lose a limb or experience vision loss during your trip due to an accident. Depending on the policy, coverage may apply at specific times (while boarding or traveling by plane) or throughout the trip. Some, but not all, policies automatically include this benefit.

Before researching travel insurance for your next trip, keep in mind that some insurers define domestic travel as any trip that takes you over 100 miles from home but is still within the U.S. That means shorter trips may not be eligible for coverage.

Additionally, you may not be covered in all states. Read your policy information thoroughly to understand the coverage exclusions.

According to the NAIC, other common travel insurance exclusions include:

- Pandemics (although some companies cover certain losses related to COVID-19)

- Pre-existing medical conditions (unless you qualify for a pre-existing condition waiver)

- Civil or political unrest at the destination

- Pregnancy and childbirth

- Coverage for high-risk activities (think snowboarding or parasailing)

You don’t necessarily need to purchase a travel insurance plan for a trip within the U.S., especially if your health insurance plan already offers out-of-state or out-of-network coverage.

Additionally, your auto insurance policy generally extends the same coverage and limits to rental vehicles as to the cars you own, so you may not need additional protection. (And rental car companies may not accept a collision damage waiver from a travel insurer as a valid form of coverage.)

Furthermore, some of the best travel credit cards offer benefits that can duplicate or supplement travel insurance coverage. For example, many top-tier credit cards include trip cancellation and interruption coverage and collision damage waivers for rental cars.

Not all credit cards provide these benefits, however, so review your credit card’s benefits guide or contact the issuer for details. You should also verify whether your credit card’s coverage is primary or secondary to other forms of insurance you’re already carrying.

What you’ll pay for a domestic travel insurance policy will depend on factors such as your age (and the age of your travel companions), the insurance company, the plan and coverage options you choose and the total cost of your trip.

Here are some price examples from various insurers for a $4,500 (total) domestic trip for two travelers.

Read our guide to the best travel insurance companies for more information on these and other insurers. And if you’re planning a cruise, check out our top picks for cruise travel insurance .

Generally, it’s best to buy travel insurance soon after making your initial trip payment. That will ensure you qualify for optional benefits such as CFAR coverage and pre-existing condition waivers.

If you don’t know whether to purchase travel insurance coverage in the first place, consider your risks. Travel insurance may make sense if you’re planning an expensive trip and your airfare or hotel bookings are non-refundable. A policy could reimburse you for some of those expenses if you have to cancel or postpone your travel plans at the “last minute.”

That can be especially true when traveling to a destination where weather-related risks are common. For example, if you’re visiting California during peak wildfire season or Florida during hurricane season, travel insurance could offer peace of mind and financial protection against travel disruptions caused by a natural disaster.

Does travel insurance cover domestic flights?

How much is travel insurance, is travel insurance worth it.

If you’re a U.S. resident traveling to other states, domestic travel insurance may be an option worth considering. A comprehensive travel insurance policy for domestic vacations can cost between 3% and 14% of the total cost of your trip, depending on the coverage options you select.

If you’ve booked expensive, non-refundable accommodations, are traveling to a state where natural disasters are common or don’t have health insurance coverage that extends out of state, travel insurance could offer you a measure of financial protection against common travel mishaps — all for a fraction of the cost of your trip.

© Copyright 2024 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

SEE FULL REVIEW »

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Annual Travel Insurance in 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you’re a frequent traveler, annual travel insurance may be something you’ve been considering. Unlike single-trip insurance, annual travel insurance plans can cover you for an entire year, no matter how often you’re on the road.

Let’s look at the best yearly travel insurance companies, why we choose them and the coverage you can expect.

Factors we considered when picking travel insurance companies

We used the following criteria when choosing which companies we thought were best:

Cost . Annual plans can be expensive — depending on the type of coverage you choose — so we wanted ensure that they stayed affordable.

Types of coverage . Travel insurance for annual travelers can be limited in its coverage. We picked the ones with the broadest range of coverage for possible travel disruptions.

Coverage amounts . Annual trip insurance isn’t worth much if your limits are too low. Instead, we wanted plans with reasonable coverage amounts.

Customizability . If your travels take you to different places, you’ll want the ability to customize your plan. The best annual travel insurance plans can provide this.

» Learn more: What does travel insurance cover?

An overview of the best annual travel insurance

We gathered quotes from various travel insurance companies to determine the best annual travel insurance policies. In these examples, we used a year-long trip by a 22-year-old from Alabama. We indicated the main countries of travel as France and Malaysia, and when asked, put the total trip costs at $6,000.

The average cost for an annual travel insurance plan came out to $220. The plans ranged from $138-$386.

Let’s take a closer look at our top recommendations for annual travel insurance.

1. Allianz Travel

What makes Allianz travel insurance great:

Lower than average cost.

Provides health care and travel insurance benefits.

Includes rental car insurance up to $45,000.

Here’s a snippet from our Allianz Travel insurance review :

“AllTrips Basic (annual plan) is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.”

2. Seven Corners

What makes Seven Corners great:

Offers up to $20,000 for acute coverage of pre-existing conditions.

Includes up to $1 million for emergency medical evacuation.

Optional add-on for adventure sport activities.

$0 deductible available.

Here’s a snippet from our Seven Corners review :

“Seven Corners offers one annual policy called Travel Medical Annual Multi-Trip. The policy can be customized depending on how long you plan to be away from home for any one trip. You can travel as much as you like during the 364 days, so long as any one trip doesn’t exceed the option selected — 30, 45 or 60 days.”

What makes IMG great:

Good customizability with medical evacuations and sports coverage.

Low $250 deductible.

Includes coverage for semi-private hospital rooms.

Here’s a snippet from our IMG review:

“Some policies provide emergency medical evacuation coverage, while others skip this benefit entirely. This benefit may be more important to you if you travel to a remote location or engage in physical activity such as trekking.

More comprehensive plans may include other benefits such as assistance with acquiring a new passport, reimbursing reward mile redeposit fees or coverage for pre-existing conditions. If these are something you’re interested in, be sure to check that your policy includes these options.”

4. Trawick International

What makes Trawick International great:

100% coverage for trip cancellation and trip interruption.

Emergency medical evacuation included.

Trip delay reimbursement coverage.

Here’s a snippet from our Trawick International review :

“Trawick International is a comprehensive travel insurance provider that offers trip delay and cancellation insurance, baggage delay coverage, medical coverage and medical evacuation, rental car damage protection, and even COVID-19 coverage among its various policies.

Trawick covers trips for worldwide destinations, including for foreign nationals coming to the U.S.”

What does travel insurance cover?

You’ll find a wide variety of coverage types offered by travel insurance policies. This is true whether you're purchasing a single-trip or annual travel insurance plan. Here are some common types you can expect to find:

Accidental death insurance .

Baggage delay and lost luggage insurance .

Cancel for Any Reason insurance .

Emergency evacuation insurance .

Medical insurance .

Rental car insurance .

Trip cancellation insurance .

Trip delay insurance .

Trip interruption insurance .

How to choose the best annual travel insurance policy

While we’ve highlighted some of the best annual travel insurance companies, the truth is that the best plan for you isn’t going to be the best plan for someone else. If you’re interested in buying annual travel insurance, you’ll want to collect a variety of quotes to see which policy best fits your needs.

This may mean opting for a plan that covers pre-existing conditions or one that specifically includes high-risk activities. Or, if you’re in a country where health care is notoriously expensive, you may want to choose a policy with higher maximums.

Many credit cards come with complimentary travel insurance .

Whatever the case, do your research first and review all the plan details before making your purchase.

» Learn more: How to find the best travel insurance

If you want to buy annual travel insurance

Annual travel insurance can be a great option if you’re often out of town. With such a wide range of policies available, selecting a plan that fits your needs is easy. We’ve done some of the work for you by choosing the best annual travel insurance companies, all of which made the top of the list for their cost, customizability, types of coverage and plan maximums.

Like any travel insurance policy, the cost of your plan is going to vary. Factors that may affect the cost of your annual travel insurance include your age, where you’re going, how long you’ll be traveling, your policy maximums and whether preexisting conditions are included.

Although not all travel insurance providers offer annual travel insurance, many of them do. We’ve gathered together the five best, including Allianz Travel, World Nomads, Seven Corners, IMG and Trawick International.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Travel insurance Compare Our Plans Popular Benefits COVID-19 Benefits International Plans Domestic Plans Comprehensive Insurance Annual Multi-Trip Inbound Plan Cruise Ski & Snowboard Motorcycle & Moped Adventure Activities Seniors Medical Conditions

- Emergency assistance

- Travel alerts Cover-More App

- Manage policy

- Not sure? See full destination list.

Domestic travel insurance for Australians

Protect your Australian holiday with domestic travel insurance

Most people know the value of international travel insurance. But did you know it’s just as important to have travel insurance when travelling around Australia?

Whether you’re going on a family holiday to the Gold Coast, going on a hike in Tasmania, or enjoying a long weekend city break in Sydney , a domestic insurance policy may help protect you and your finances should something go wrong.

At Cover-More, we have three Domestic Plans to help cater to all budgets and trip types. Below you’ll find useful information about our domestic travel insurance for Australia and why it’s important. Plus, check out our domestic travel insurance FAQs for extra questions our customers often ask.

Read the PDS and are ready to buy? You can get a quote online or call our friendly team on 1300 72 88 22 to purchase over the phone.

Skip ahead to read:

What is domestic travel insurance?

Do i need travel insurance when travelling in australia, does cover-more have domestic plans.

- Can I add extras to my domestic travel insurance policy?

- Can I buy a domestic Annual Multi-Trip policy?

How do I buy a Cover-More domestic travel insurance policy?

Do cover-more domestic plans include cancellation cover.

- Do domestic travel insurance policies provide medical cover?

Do I need travel insurance for a domestic cruise?

- Am I covered for domestic driving holidays?

- What excess will I pay?

Can I travel in Australia while pregnant?

What is the best domestic plan for senior travellers.

For Australian residents, domestic travel insurance is a type of travel insurance that provides cover for trips taken within Australia.

Depending on the type of policy you buy, most domestic plans for Australia offer coverage for expenses such as lost or damaged luggage and travel documents, rental vehicle insurance excess, additional expenses, amendment or cancellation costs, sporting activities, and winter snow sports.

There are always risks when you travel even on domestic trips. Incidents can happen as easily in Sydney as they can in Singapore, your luggage can become delayed or lost on a flight to Darwin just as they can on a flight to Dublin, and if your child becomes unwell and you need to cancel your trip, it doesn’t matter if you were travelling to Brisbane or to Barcelona.

Travel insurance for Australian trips can help protect you from unexpected mishaps and events outside of your control ruining your trip – and your finances.

While domestic travel insurance does not cover medical expenses in Australia, it provides cover for several other important benefits. For details on what our Cover-More domestic plans cover, view our benefits table below.

Think you can risk travelling in Australia without travel insurance? Here are three claim stories from real-life Cover-More customers who needed the protection of their domestic policy:

- A customer was diagnosed with skin cancer and had to cancel their entire family trip. Amendment and Cancellation claim value: $20,000

- A customer’s rental car was written off after a third-party collision. Rental Car Insurance Excess claim value: $4,000

- An airline lost a customer’s suitcase, and the items were not recoverable. Luggage claim value: $2,500

Find out how affordable cover can be by getting a quote online or call our team on 1300 72 88 22. We can help you find our best domestic travel insurance plan that suits your needs.

At Cover-More, we have three types of domestic plans to allow you to choose the best travel insurance for your trip in Australia:

- Domestic Comprehensive+

- Domestic Comprehensive

- Domestic Basic

Below, you can compare our Domestic Plan benefits and benefit limits:

* Sub-limits apply. Please refer to the PDS for full policy conditions. ~ Cover will not exceed 12 months from onset of the illness, condition, or injury. ^ Cover chosen applies per policy. † Liability collectively for Loss of Income, Disability and Accidental Death is $45,000 on the Comprehensive+ Plan and $30,000 on the Comprehensive Plan. • Item limit applies for any one item, set or pair of items including attached and unattached accessories. You may increase these items limits if You wish. See PDS for full details.

Each domestic travel insurance plan offers different levels of cover, so it’s important to read the PDS to find out what’s best for you, and what you are and aren’t covered for.

Can I add extras to my Cover-More domestic travel insurance policy?

Are you hitting the slopes on your Australian holiday? Or water-skiing on the River Murray? Or maybe you’re planning on motorcycle riding in the countryside?

All our domestic plans allow you to vary your cover by including extra cover for an additional premium. These include cover for:

- Snow or winter sports

- Motorcycle/moped riding

- Adventure activities (beyond those automatically included)

You can add one or more of these options to your cover when you generate a Cover-More quote.

For full details on what each of these options to vary your policy do and don’t cover, read the relevant sections in the PDS .

Can I buy a Cover-More domestic Annual Multi-Trip policy?

Yes, an Annual Multi-Trip policy is available on both our Domestic Comprehensive and Domestic Comprehensive+ plans. (Our Domestic Basic Plan is for Single Trip policies only.)

If you’re a frequent traveller, a domestic annual multi-trip policy for Australia could be handy to have as any trip more than 250 kilometres from your home – or any trip under 250 kilometres if it includes at least one night of paid accommodation with an accommodation provider or supplier – is covered by your domestic policy.

To help find our best domestic travel insurance for you, get a quote online or call us on 1300 72 88 22.

To purchase domestic travel insurance on our website, select “Australia” as your destination under “Where are you going?” in the quote box .

If you’re going on a cruise for two or more nights in Australian waters, select “Domestic Cruise” as your destination to ensure you’re quoted for an international policy that includes cover for medical expenses outside of Australia while on the cruise.

Note: Do not choose “ Australia Inbound ” unless you’re a non-Australian resident visiting Australia.

Continue to fill in the rest of your travel details under “When is your trip?” and “Who is travelling?” and then click ‘Get quote’ to generate a price.

From here, you can select the best domestic travel insurance plan for you, opt for a Single Trip policy (available on all plans) or an Annual Multi-Trip policy (available on our comprehensive plans only), include any options to vary your cover, and advise us of any existing medical conditions you’d like covered before purchasing your policy.

If you need assistance with finding the right plan for you or have questions about cover for an existing medical condition, call us on 1300 72 88 22.

Our Cover-More domestic travel insurance policies can offer coverage in case you need to amend or cancel your trip within Australia for an unexpected reason.

Cancellation cover is not automatically included in our plans, but you can add the amount of cancellation cover that best suits your trip during the quote process. The level of cancellation cover you choose will influence your premium.

Please refer to the PDS for limits, exclusions, and conditions related to our cancellation cover.

Do domestic travel insurance plans provide medical cover?

No, domestic plans in Australia do not provide medical cover to travellers.

This means we’re unable to cover your medical expenses incurred within Australia if you are an Australian resident or eligible overseas representative. We encourage you to contact Medicare or your private health fund to discuss the medical coverage options available to you while you’re in Australia.

Medicare and private health funds do not cover medical facilities on a cruise ship, so it’s important to consider an international travel insurance plan if you want medical coverage for cruise travel. If you’re going on a domestic cruise, we can provide cover for unforeseen medical expenses while you’re on board. You will need to select “Domestic Cruise” as your destination when generating a quote and answer “Yes” to travelling on a cruise for two or more nights for this to apply.

Cruise holidays are an exciting way to see Australia. If you’re about to set sail on a domestic cruise, we can provide travel insurance cover for a domestic cruise with our international plan options.

Did you know Medicare and/or your private health insurance will not cover the costs of using the medical facilities on a cruise ship, even if it is staying within Australian territorial waters? This means you may be out of pocket if you need to see a doctor unexpectedly while on board.

If you’re a Cover-More travel insurance policyholder and you have told us you are going on a cruise, you can be protected from unexpected expenses related to:

- Cruise cancellation (when you choose a level of cancellation cover to add to your policy)

- Onboard medical and emergency dental

- Ship to shore medical expenses

- Sea sickness cover

Interested in buying cover for your Australian cruise? Select “ Domestic Cruise ” as your destination in the quote box and then answer “Yes” if you are travelling on a cruise for two or more nights.

Does Cover-More provide cover for domestic driving holidays?

If you’re hitting the road for your domestic holiday in Australia, our Cover-More team can help protect your trip whether you’re hiring a rental vehicle or driving your own car.

If you’re a Domestic Comprehensive or Domestic Comprehensive+ policyholder, you’ll receive the below cover:

You’ll find more information on our domestic travel insurance benefits for driving holidays in Australia here, and we strongly encourage you to read the Product Disclosure Statement so you are aware of what is and isn’t included in the plans.

Note: “rental vehicle” means a campervan/motorhome/caravan that does not exceed six tonnes, SUV, sedan, station wagon, hatchback, people mover, coupe, convertible, four-wheel drive or mini bus rented from a licensed motor vehicle rental company, car club company or agency.

What excess do I pay on Cover-More domestic policies?

A $50 excess applies to our Cover-More Domestic Plans.

An excess is the first part of a claim that we will not pay. The excess amount is applied to each separate claimable event.

The excess does not apply to all sections - see the Domestic Plans benefits table in the PDS, which shows the benefits that an excess applies to in the event of a claim.

Check out our dedicated FAQs for domestic travel insurance for more information.

Being pregnant doesn’t necessarily mean you have to stop travelling – especially when you have that babymoon to take! At Cover-More, we can provide limited travel insurance cover for pregnancy up to the 24th week (23 weeks, 6 days).

For more information, read our travel insurance cover for pregnancy page , or call us on 1300 72 88 22 with any questions.

Limits, exclusions, and conditions apply, so please refer to the PDS for full policy conditions before you consider purchasing this product.

^^Conditions apply if you are aware of the pregnancy at the relevant time. For a single trip policy, relevant time means the time of issue of the policy and for an annual multi-trip policy it means the first time at which any part of the relevant trip is paid for or the time at which the policy is issued, whichever occurs last.

Your “golden years” are an ideal time to explore – why not start with Australia?

At Cover-More, our domestic plans have several benefits suitable for seniors if you are younger than 99 years old. Visit our travel insurance benefits for seniors page and our seniors FAQs page for helpful information on how to protect your upcoming domestic trip with Cover-More.

If you’d prefer to speak to someone about our domestic travel insurance options that are suitable for seniors, you can call our friendly team on 1300 72 88 22. Alternatively, you can get a quote online .

Want us to protect your next Aussie holiday?

Find our best domestic travel insurance plan for you today.

- Commercial Motor Vehicle

- Roadside Assistance

- Public Liability

- General Property

- Management Liability

- Small business

- Contractors and tradies

- Retailers insurance

- Healthcare and beauty professionals

- Real estate

- Cafés and restaurants

- NSW stamp duty exemption

- ACT | NT | TAS | WA claims

- NSW forms and resources

- VIC forms and resources

- ACT | NT | TAS | WA forms and resources

- Workplace mental health

- Training & webinars

- Compare Travel Insurance

- Caravan and Trailer

- Cyclone support

- Flood support

- Storm support

- Bushfire support

- Extreme Weather Claims

- Hail support

- Customer counselling program

- Financial hardship

- Scam warning

- Family violence support

- Deceased estates

- Financial institutions

- Insurance brokers

- Partner News Hub

- The Allianz Hub

- Login to My Allianz

- Renew a policy

- Make a payment

- Retrieve a quote

- Retrieve life application

Domestic Travel Insurance

- What's covered

- Why choose us

Additional options

What is allianz domestic travel insurance.

Allianz Domestic Travel Insurance offers cover for a single trip within Australia. It’s designed to cover personal liability, luggage, unexpected trip cancellation, and more. 1 It’s also designed to provide cover for the insurance excess on your rental vehicle if you’re in an accident. 1

Plus, for an additional premium, you might be eligible to add Snow, Cruise and Adventure Packs, increase item limits, and apply for pre-existing medical condition cover. 1 See the Product Disclosure Statement (PDS) for all terms, conditions, exclusions, limits and applicable sub-limits that may apply.

What our Domestic Travel Insurance offers

- Benefits we offer

- What’s not offered

- Optional extras

- Accidental Death 1 If, during the period of cover for your journey:

- a) you’re injured, and due to that injury you die within 12 months of it occurring; or

- b) something you’re travelling on or in disappears, sinks or crashes and your body is not found within 12 months and you’re presumed dead;

we’ll pay the benefit limit payable under the Accidental Death benefit to your estate.

- Personal Liability 1,3 If you become legally liable to pay compensation for death or bodily injury to someone else – or physical loss or damage to someone else’s property – as a result of an accident that happens during your journey, we’ll cover you for:

- The compensation (including legal costs) awarded against you

- Any reasonable legal costs incurred by you for settling or defending a claim made against you, providing you have approval in writing from Allianz Global Assistance before incurring these costs

- Luggage, Personal Effects & Valuables 1 Cover is provided for your luggage and personal effects or valuables if, during the period of cover for your journey, they’re stolen, accidentally damaged or permanently lost. See Luggage, Personal Effects & Valuables in the PDS for the exceptions to this cover.

- Luggage & Personal Effects Delay Expenses 1 If you need to buy essential items of clothing or other personal items because items of your luggage and personal effects are delayed, misdirected or misplaced by the carrier for more than 10 consecutive hours during the period of cover, we’ll reimburse you for the reasonable expenses you incur.

- Cancellation 1 If during the period of cover, your journey is cancelled, rescheduled or shortened because of circumstances that weren’t expected or intended by you and are outside your control, we’ll reimburse you:

- The non-refundable portion of unused travel and accommodation arrangements for your journey, that you’ve paid for before cancellation and can’t recover in any other way.

- For the value of frequent flyer points, air miles, loyalty card points, redeemable vouchers or similar schemes lost as a result of cancelling the related services, but only if you can’t recover your loss in any other way.

You can choose different levels of cover when you buy your policy.

- Additional Expenses 1 We’ll reimburse reasonable additional accommodation and travel expenses if you or your travel companion can’t continue your journey or your journey is otherwise disrupted due to any of the events described under the Additional Expenses section in the PDS.

- Travel Delay Expenses 1 If circumstances outside your control result in an unexpected delay to your journey of at least six consecutive hours during the period of cover, we’ll reimburse your reasonable additional meals and accommodation expenses 1 .

- Theft of Cash 1 If cash, banknotes, currency notes, postal orders or money orders are stolen from your person during the period of cover for your journey, we’ll reimburse you up to the amount shown in the Table of Benefits in the PDS.

- Rental Vehicle Excess 1 If your rental vehicle is involved in an accident while it’s being driven by you and you're the nominated driver, or it’s damaged or stolen while in your custody, we’ll pay you the lesser of (up to your benefit limit) 1 :

- the amount specified that you’re liable to pay under the rental vehicle agreement, or

- the property damage for which you’re liable.

If you’re diagnosed by the treating medical adviser as unfit to return your rental vehicle to the nearest depot, we’ll pay the cost of returning the vehicle (up to the applicable benefit limit). Note: This cover only applies if:

- you hire a rental vehicle from a rental company or agency;

- you’re a nominated driver on the rental vehicle agreement; and

- the rental vehicle agreement specifies a maximum amount that you must pay if the rental vehicle is damaged or stolen.

- 1.1 Overseas Emergency Assistance

- 1.2 Overseas Medical & Hospital Expenses

- 1.3 Funeral Expenses

- 1.5 Permanent Disability

- 3.3 Alternative Transport Expenses

- 4.3 Travel Documents, Transaction Cards & Travellers Cheques

- Adventure Pack 1,3 This optional pack is designed to cover a range of more adventurous sports and activities not automatically covered in your policy. For a list of what sports and activities are covered, refer to the activities listed in the PDS. You must be under 75 years at the time of issue of your Certificate of Insurance to buy this optional pack.

- Snow Pack 1,3,4,5 If you’re heading to the snow, this pack is designed to provide cover for you to take part in snow sport activities. Refer to the PDS for a definition of ‘Snow sport activities’ (Our Definitions) and full details of what the Snow Pack covers. You must be under 75 years at the time of issue of your Certificate of Insurance to buy this optional pack.

- Own Snow Sport Equipment if your snow sport equipment is stolen, accidently damaged, lost or delayed

- Snow Sport Equipment Hire

- Snow Sport Pack – to cover non-refundable unused pre-booked and pre-paid ski passes, ski hire, tuition fees or lift passes if you’re injured or become sick during your trip

- Piste Closure

- Bad Weather and Avalanche

- Cruise Pack 1,4,5 This optional pack is designed to provide cover for you to participate in sea and ocean cruising. Refer to the PDS for a definition of ‘ Cruise or Cruising ’ and full details of what the Cruise Pack covers.

- Medical cover while cruising

- Evacuation cover – Ship to Shore

- Cabin Confinement

- Pre-paid Shore Excursion Cancellations

- Formal Cruise Attire Lost or Damaged

- Formal Attire Delayed

- Marine Rescue Diversion

- Increased Items Limits cover 1,6 You can choose a higher item limit for the loss or theft of, or accidental damage to, your luggage and personal effects by buying Increased Items Limits cover, additional to the plan type you choose. You can view the standard items limits cover for luggage and personal effects in the PDS. If you're planning on taking higher value items with you, such as camera equipment, you may want to consider covering them for a higher value.

Why choose us?

Thousands of satisfied customers, network of medical experts, emergency assistance available, we’re an established insurer.

For an additional premium, you may be eligible to add one or more of the following optional covers to provide additional cover for certain activities. For full terms, conditions, limits and exclusions read the PDS.

Snow Pack and Adventure Pack are only available for those aged under 75 at the time of issue of your Certificate of Insurance.

Adventure Pack 3,5

- Cover for 19 more adventurous activities

Snow Pack 3,4,5

- Lost, accidentally damaged or stolen snow sport equipment

- Cover for piste closure

- Bad weather and avalanche cover

Cruise Pack 4,5

- Cancellation cover for pre-paid shore excursions

Increased item limits 1,6

Ready to get started, frequently asked questions.

You may wish to consider Allianz Domestic Travel Insurance for travel within Australia if luggage and personal effects coverage and cancellation coverage are important to you, even when travelling domestically.

Allianz Domestic Travel Insurance includes cover for certain events out of your control such as cancellations and delays caused by inclement weather, which require you to seek alternative flights and/or accommodation. It also includes cover for lost or damaged luggage and personal items you take with you on your trip.

Make sure you read the Product Disclosure Statement (PDS) to see all terms, conditions, exclusions, limits and applicable sub-limits that may apply. As with any financial product, you need to consider your own objectives, financial situation and needs before you buy.

Our Domestic Travel Insurance includes cover for trip cancellation if you or your travel companion are positively diagnosed with COVID-19 2 .

You may also receive a full or partial premium refund if you can’t travel because of unexpected border closures or mandatory quarantine periods due to of COVID-19. Find out more about our COVID-19 benefits and what we offer.

If your trip will consist of snow activities, ocean cruising or adventure activities you may want to consider buying a Snow, Cruise or Adventure Pack 1 .

For an additional premium, these packs will cover additional activities that are not automatically included in our policies.

You must be aged under 75 years at the time the Certificate of Insurance is issued in order to buy the Snow Pack and the Adventure Pack. You won’t have cover under Personal Liability benefit for any claims arising from, or in any way connected with your participation in any of the activities listed as covered adventure activities in the Adventure Pack or your participation in snow sport activities.

Our Snow Pack is designed to cover in certain circumstances, for your snow sport equipment and cost of re-hire as well as coverage for piste closure, bad weather and avalanche closure. This cover is subject to conditions, terms, limits and exclusions which are outlined in the PDS.

The Cruise Pack is designed to cover, subject to the terms of the policy, medical and hospital expenses if you’re injured or become sick on a cruise, ship to shore evacuation if required for emergency medical treatment, plus cover for cabin confinement, pre-paid shore excursion cancellation, marine rescue diversion, and formal attire that has been damaged, lost, stolen or delayed 4 .

Allianz Domestic Travel Insurance automatically includes cover for a wide range of activities such as golf or snorkelling. You can also buy an Adventure Pack if you’re planning on participating in adventure activities such as motorbike riding 1 , moped riding 1 , abseiling, deep sea fishing or zip lining. For full lists of the automatically included activities and the adventure activities covered by the Adventure Pack, see the PDS .

Allianz Domestic Travel Insurance plans are available for travellers of all ages, including senior citizens.

However, some of the additional packs available to buy have age restrictions. You must be aged under 75 years at the time the Certificate of Insurance is issued in order to buy the Snow Pack and the Adventure Pack.

The cost of Domestic Travel Insurance varies. You can get your quote online or over the phone to find out the cost of a Domestic Travel Insurance policy for your trip.

What may influence the cost of your policy are factors such as your age, if there are others listed on your policy like a spouse, partner or dependants, if you buy any additional options such as our Snow, Adventure and Cruise Packs, and any pre-existing medical conditions.

See the “Your Insurance Premium” section of the PDS for a list of factors taken into consideration when calculating your insurance premium.

We're here to help

Give us a call, or send us a message, follow us on, *conditions apply.

- Terms, conditions, exclusions, limits and applicable sub-limits apply. For full details and before making a decision, consider the relevant Product Disclosure Statement (PDS) .

- Policy terms, conditions, limits, exclusions, and sub-limits apply to particular types of losses, premium refunds (full or partial) or claims. This product has a general exclusion, with limited exceptions, against epidemics and pandemics. That means we don’t cover claims that arise from, or are related to, an epidemic or pandemic. However, you’re covered under selected benefits in this product if, during your period of cover, you’re positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, such as COVID-19. Refer to the PDS to see which benefits offer cover in the event you contract a sickness recognised as an epidemic or pandemic, and the terms, conditions, limits and exclusions that apply.

- You won’t have cover under Permanent Disability and Personal Liability benefits for any claims arising from your participation in any of the activities listed under Adventure Pack or your participation in snow sport activities. Refer to the Permanent Disability and Personal Liability sections of the PDS for details.

- Sub-Limits apply. Refer to the Optional Covers – Cruise Pack and Snow Pack Policy Benefits section in the PDS for full details.

- You only have cover for these benefits if the relevant pack has been bought.

- The maximum we’ll pay for all claims combined under the Luggage, Personal Effects & Valuables Benefit is the benefit limit shown in the Table of Benefits in the PDS for the plan you’ve selected, even if you’ve bought Increased Item Limits cover.

- Car Insurance

- CTP Insurance

- Home & Contents Insurance

- Building Insurance

- Landlord Insurance

- Travel Insurance

- Life Insurance

- Caravan Insurance

- Boat Insurance

- Small Business Insurance

- Business Insurance Pack

- Workers' Compensation

- Renewals / Payments

- Manage Your Policy

- Policy Documents

- Customer Support

- How we help

- Sustainability

- Partnerships

- Work with us

Any advice here does not take into account your individual objectives, financial situation or needs. Terms, conditions, exclusions, limits and applicable sub-limits apply. Before making a decision about this insurance, please consider the relevant Product Disclosure Statement (PDS)/Policy Wording and Supplementary PDS (if applicable). Where applicable, the PDS/Policy Wording, Supplementary PDS and Target Market Determination (TMD) for this insurance are available on this website.

Travel Insurance is issued and managed by AWP Australia Pty Ltd ABN 52 097 227 177 AFS Licence No. 245631, trading as Allianz Global Assistance (AGA) as agent of the insurer Allianz Australia Insurance Limited ABN 15 000 122 850 AFS Licence No. 234708 (Allianz). Travel Insurance is underwritten by the insurer Allianz. Terms, conditions, exclusions, limits and applicable sub-limits apply.

We don’t provide advice based on any consideration of your objectives, financial situation or needs. Before making a decision, please consider the Product Disclosure Statement available on this website. If you purchase this insurance, AGA will receive a commission that is a percentage of the premium. Ask us for more details before we provide you with any services on this product.

- Become An Agent

Respect Senior Care Rider: 9152007550 (Missed call)

Help Control COVID-19 New

Get In Touch

Claim Assistance Numbers

Health toll free Number 1800-103-2529

24x7 Roadside Assistance 1800-103-5858

Motor Claim Registration 1800-209-5858

Motor On the Spot 1800-266-6416

Global Travel Helpline +91-124-6174720

Extended Warranty 1800-209-1021

Agri Claims 1800-209-5959

Sales : 1800-209-0144

Service : 1800-209-5858

All transactions, whether they are financial or of any other nature, must be conducted exclusively through our branch offices, our online portals www.bajajallianz.com , our insurance agents or POSPs, or via insurance intermediaries registered with IRDAI who are engaged in solicitation. If you require additional clarification, please write to us at [email protected]

Thank you for visiting our website.

For any assistance please call on 1800-209-0144

Most searched keywords

Two Wheeler Insurance

Health Insurance

Car Insurance

Pet Insurance

- Travel Insurance

Car Insurance Renewal

Family Health Insurance

Car Insurance Calculator