- Featured Cards Opens Featured cards page in the same window.

- Card Finder Opens card finder page in the same window.

Chase Sapphire ® Credit Cards

Explore premium dining and travel rewards with a Chase Sapphire ® credit card.

Chase Sapphire Preferred ® Credit Card . Links to product page.

Chase Sapphire Preferred ® Credit Card card reviews (7,829 cardmember reviews) Opens overlay

New cardmember offer.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

AT A GLANCE

Premium dining & travel rewards Earn 5x total points on travel purchased through Chase Travel SM , excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel Credit. Earn 3x points on dining at restaurants including eligible delivery services, takeout and dining out. Earn 2x on other travel purchases.

21.49 Min. of (8.50+12.99) and 29.99 %– 28.49 Min. of (8.50+19.99) and 29.99 % variable APR. † Opens pricing and terms in new window

$95 † Opens pricing and terms in new window

Chase Sapphire Reserve ® Credit Card . Links to product page.

Chase Sapphire Reserve ® Credit Card card reviews (4,642 cardmember reviews) Opens overlay

Earn 5x total points on flights and 10x total points on hotels (excluding The Edit SM ) and car rentals when you purchase travel through Chase Travel SM after the first $300 is spent on travel purchases annually.

22.49 Min. of (8.50+13.99) and 29.99 %– 29.49 Min. of (8.50+20.99) and 29.99 % variable APR. † Opens pricing and terms in new window

$550 annual fee † Opens pricing and terms in new window ; $75 for each authorized user † Opens pricing and terms in new window

Compare all Chase Sapphire ® Credit Cards

You're now leaving chase.

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Benefits of the Chase Sapphire Preferred

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Ultra-premium travel rewards cards offer every perk imaginable to soften the blow of their sky-high annual fees. But sometimes you just want a reliable card that provides excellent benefits without the huge price tag.

The Chase Sapphire Preferred® Card is as faithful a travel companion as your well-worn suitcase. In exchange for a $95 annual fee, it offers valuable rewards points, worldwide acceptance and travel protections that can help when that suitcase doesn’t make it to the baggage claim.

Here are the benefits of the Chase Sapphire Preferred® Card .

Travel rewards

1. a generous sign-up bonus.

The issuer phrases the sign-up bonus for the Chase Sapphire Preferred® Card like this: “ Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. ”

2. Bonus earnings on travel, dining, select streaming services and online grocery purchases

With the Chase Sapphire Preferred® Card , you'll earn 3 points per dollar spent on dining out, select streaming services and online grocery purchases (excluding Target, Walmart and wholesale clubs). You'll earn 5 points per dollar on travel purchased through Chase and 2 points per dollar on all other travel. All other spending earns 1 point per dollar.

The travel category is very broad and includes:

Airline purchases.

Hotel stays.

Timeshares.

Rental cars.

Travel agencies and travel sites.

Campgrounds.

Also, through March 2025, you can earn 5 points per dollar spent on Lyft rides.

» MORE: Chase Ultimate Rewards®: How to earn and use them

3. 10% point bonus each year

Each account anniversary, cardmembers will receive bonus points equaling 10% of total purchases that year. So if you spent $25,000, you'd earn an additional 2,500 bonus points.

4. A 25% boost when redeeming for travel via Chase

The perk that makes the Chase Sapphire Preferred® Card such a favorite among travelers is the higher point redemption value when you cash in points for travel through Chase. Instead of the usual penny-per-point rate, you’ll get a value of 1.25 cents each for your points, which can really add up. That's an extra $25 for every $100 worth of points you redeem.

5. A $50 hotel credit

Cardholders can receive a $50 hotel credit each year on reservations booked through Chase. New cardholders will be able to use this credit immediately. Existing cardholders can use this credit after their next account anniversary.

6. Combine points from multiple cards

You can transfer points, for free, among any cards that earn Chase Ultimate Rewards® points, including the Chase Freedom® , Chase Freedom Flex® , the Chase Freedom Unlimited® and the Chase Sapphire Reserve® . You can also transfer points to and from another cardholder in your household, making it possible to create a family pool of points . Not only do you boost your points-earning potential by using multiple cards in the Chase Ultimate Rewards® universe, but transferring points into your Chase Sapphire Preferred® Card account allows you to redeem all points at that higher 1.25-cent rate, instead of the 1-cent rate you’d get with other Chase cards.

» MORE: Complete card details for the Chase Sapphire Preferred

7. Transfer points to airline and hotel partners

If you want to book travel directly through an airline or hotel but need just a few thousand points more in your account to get that free flight or stay, you can transfer Chase Ultimate Rewards® points earned through your Chase Sapphire Preferred® Card to 14 airline and hotel partners at a 1:1 point value. Transfer partners include:

Airlines: Aer Lingus, Air France/KLM, Air Canada, British Airways, Emirates, Iberia, JetBlue, Singapore Airlines, Southwest, United and Virgin Atlantic.

Hotels: Hyatt, IHG and Marriott Bonvoy.

8. Worldwide acceptance

As a Visa card with no foreign transaction fee, the Chase Sapphire Preferred® Card travels well.

» MORE: NerdWallet review of the Chase Sapphire Preferred

Travel and shopping protections

9. coverage if your trip is canceled or delayed.

Get reimbursed up to $10,000 per person and $20,000 per trip for prepaid, nonrefundable travel expenses if your trip is interrupted by sickness, severe weather or other covered situations. If your travel is delayed by more than 12 hours, or the delay requires you to stay overnight, you’re covered up to $500 per ticket for expenses like meals and a hotel stay.

10. Baggage delay insurance

If your luggage is delayed more than six hours, you can get reimbursed up to $100 a day for five days to cover the cost of new toiletries and clothing.

11. Rental car coverage

Charge the entire car rental to your Chase Sapphire Preferred® Card and get primary insurance coverage for collision and theft in the U.S. and abroad. You must decline the rental company’s insurance to get this coverage.

12. Travel assistance

Get access to legal and medical referrals, or other help as needed if you’re facing an emergency while traveling. The referrals are free, but you’re on the hook for the cost of any services you use.

13. Purchase protections

New purchases are covered for up to 120 days in case of damage or theft, up to $500 per claim and $50,000 per account (perfect for those times when your doorbell camera doesn’t scare package thieves away from your front porch). You’ll also get an extra year added onto the manufacturer’s warranty on eligible warranties of three years or less.

14. Customer service without the wait

There’s no annoying hold music and no need to yell “representative” at your phone over and over. Call the toll-free number on the back of your card and you’ll be connected to a real live human.

Benefits of the Alaska Airlines credit card

Benefits of the American Express Gold Card

Benefits of the American Express Green Card

Benefits of the American Express Platinum Card

Benefits of the Bank of America Travel Rewards card

Benefits of the Capital One Savor cards

Benefits of the Capital One Venture card

Benefits of the Capital One Quicksilver card

Benefits of the Capital One Platinum card

Benefits of the Chase Freedom Flex and Freedom Unlimited cards

Benefits of the Chase Sapphire Preferred Card

Benefits of the Chase Sapphire Reserve card

Benefits of the Citi Costco credit card

Benefits of the Citi Custom Cash Card

Benefits of Citi Double Cash Card

Benefits of Delta Air Lines credit cards

Benefits of the Discover it Cash Back

Benefits of Marriott Bonvoy credit cards

Benefits of Southwest Airlines credit cards

Benefits of United Airlines credit cards

Benefits of the Wells Fargo Active Cash Card

Benefits of the Wells Fargo Autograph

Benefits of the Wells Fargo Autograph Journey

More about the card

NerdWallet review of the Chase Sapphire Preferred® Card

Wells Fargo Autograph Journey℠ Card

Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Chase Sapphire Preferred Card

My Top 5 Travel Redemptions With the Chase Sapphire Preferred [2023]

Stella Shon

Senior Features Editor

125 Published Articles 808 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Senior Editor & Content Contributor

170 Published Articles 797 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![chase sapphire travel deals My Top 5 Travel Redemptions With the Chase Sapphire Preferred [2023]](https://upgradedpoints.com/wp-content/uploads/2023/04/Kailua-Hawaii.jpeg?auto=webp&disable=upscale&width=1200)

Table of Contents

How to earn and redeem points from the chase sapphire preferred card, my top 5 chase sapphire preferred travel redemptions this year, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Recently, the Chase Sapphire Preferred ® Card was offering an elevated 80,000-point welcome offer . While the offer is no longer available, if you were one of the lucky ones to snag this card with the elevated offer, you may be wondering how to best redeem your new stash of Ultimate Rewards points.

In fact, opening the Chase Sapphire Preferred card many years ago is what got me started on this never-ending cycle of earning travel rewards. Combined with the card’s welcome bonus offer and the excellent everyday bonus categories, I’ve stockpiled hundreds of thousands of points over the years.

But how useful are these points, anyway? While award travel is certainly not “free” by any means, redeeming points for flights and hotels has significantly helped to reduce my out-of-pocket costs on trips. In the past, my points have helped me score unbelievable experiences like ziplining through the jungles of Costa Rica and hiking towering waterfalls in Iceland.

Today, I’ll go through the top 5 travel redemptions I’ve made with my Chase Sapphire Preferred Card this year.

Before we dive into the nitty gritty, let’s first go over how you earn and redeem points on the Chase Sapphire Preferred card. For starters, let’s take a look at what the current welcome offer is:

A fantastic travel card with a great welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

Earning Points

Beyond earning the welcome offer, the Chase Sapphire Preferred card is a rewards powerhouse for many heavy-hitting bonus categories:

- Earns 5x points per $1 on all travel booked via the Chase Travel portal

- Earns 5x points on select Peloton purchases over $250 (through March 31, 2025)

- Earns 5x points on Lyft purchases (through March 31, 2025)

- Earns 3x points per $1 on dining purchases, online grocery purchases, and select streaming services

- Earns 2x points per $1 on all other travel worldwide

- Earns 1x points per $1 on all other eligible purchases

Whether it’s going out to eat, taking Lyft rides around the city, or even paying for my $2.75 subway rides, I’ve been able to earn bonus points on all of my routine purchases.

Redeeming Points

Now when it comes time to redeem points, there are many options to consider on the Chase Travel portal. At first glance, it may seem convenient to cash out your Ultimate Rewards points for gift cards or shopping on Amazon. However, your points aren’t worth very much for either option — just 1 cent or 0.8 cents each, respectively.

The best way to redeem your Ultimate Rewards points is for travel, and there are 2 main ways to do so. The first option is to make new travel bookings (flights, hotels, rental cars, or even cruises) through Chase Travel. If you redeem your points in this fashion, they’re worth 1.25 cents apiece — which is certainly a better value than gift cards or Amazon purchases — but even that method isn’t necessarily the best option.

Instead, we highly recommend that you look toward Chase’s 11 airline and 3 hotel transfer partners . Your points transfer at a 1:1 ratio to these participating loyalty programs, including more familiar faces like Marriott Bonvoy , Southwest Rapid Rewards , or United MileagePlus .

Check out our transfer partner tool calculator to know exactly what your Chase Ultimate Rewards points can get you!

But some of these international airlines that you may have never flown such as Air Canada, Singapore Airlines, and Iberia, offer outstanding value that can’t be ignored. In fact, that’s how we arrived at the value of 2 cents per Ultimate Rewards point when leveraging Chase’s transfer partners. It takes a bit more research and elbow grease, yes, but we’re here to provide these resources at Upgraded Points.

ANA Business Class from New York (JFK) to Tokyo (HND)

Next week, I’ll embark on an exciting 3-week trip to Japan and South Korea. It’s been 5 years since I’ve visited my relatives in South Korea, but this time, I’ll be flying to Asia in style.

Virgin Atlantic has an incredible partnership with Japanese 5-star carrier ANA. If you can find the award space, you can book a one-way, business class flight on the carrier from New York to Tokyo for just 47,500 Virgin Atlantic Flying points. Taxes and fees will run you about $350, but you can’t argue with the value here.

A paid one-way fare would normally cost at least $5,000, so I got almost 10 cents per point by transferring Ultimate Rewards points from my Chase Sapphire Preferred card to Virgin Atlantic Flying Club . (That’s 10x more value than if I had redeemed my Chase points for gift cards!).

Now the challenging part here is finding award availability (which we’ve detailed fully in this guide) . However, there are usually 2 ways to go about it. The first method is to look way out, 330 days to be exact, when ANA first releases seat availability. The other method is the complete opposite — to look very close to the date you’re looking to fly.

I did a combination of the 2, as I originally found and booked the award space about a year ago. But just 3 weeks before flying, I decided that I wanted to change my travel date and also found plenty of award space booked in closely.

All said and done, I’ve seriously upgraded my 14-hour journey to Asia by using just 47,500 Chase Ultimate Rewards points.

ANA First Class from Tokyo (HND) to San Francisco (SFO)

Flying business class to Asia is a bucket-list redemption for many. But did you know you can also use those points to fly first class?

Largely using the same redemption method as above, I’ll be coming home via an ANA flight from Tokyo (HND) to San Francisco (SFO) — in first class. For this ticket, I did book ~330 days out.

Now this ultra-posh ticket would cost closer to $10,000, but I only ended up using 55,000 Virgin Atlantic Flying Club points and paid around $450 in taxes and fees. That’s like getting 17 cents per point in value, which is pretty amazing for Chase Ultimate Rewards points.

Now, redemptions like this seem almost too good to be true, and airlines are always on the hunt to devalue this kind of reward. This did actually happen last month, as Virgin Atlantic raised the award rates for future ANA first class bookings . As such, the same first ticket I booked now requires 72,500 points one-way.

Despite this devaluation, the ability to book first class for less than a six-figure balance of points is still incredible.

2 Nights at Hyatt’s Hana-Maui Resort

Last month, I flew to Oahu to see my college best friend living on the island. Sure, we could have just stayed at her house for the ~10 days I was visiting, but you can’t visit Hawaii without seeing (at least) another island.

Fortunately, my Chase points made this happen. I was able to make a 2-night trip to Maui come to life by booking the Hana-Maui Resort on points. This luxury hotel would have cost $800+ per night , but since it’s part of the World of Hyatt program , I could book it using 30,000 points per night instead.

Plus, Chase’s partnership with World of Hyatt is quite valuable as it’s the absolute best loyalty program for booking hotel nights. In sum, I redeemed 60,000 Chase points to achieve 2.67 cents per point in value. While this may seem like more modest of a value compared to my luxurious lie-flat seats to and from Asia, I still love to redeem my points for hotels — especially with these inflated rates recently.

Coupled with $49 island-hopping flights, I couldn’t have been happier with this redemption — stay tuned for a review coming very soon.

Virgin Atlantic Economy Class from New York (JFK) to London (LHR)

As glamorous as my redemptions have seemed so far, I don’t have an unlimited points stash to use just for business- or first-class flights. I love a good flight deal and am more than happy to fly economy, especially if the flight is under 8 hours or if it’s not a red-eye.

This summer, I’m going on a cruise with a friend out of Barcelona. Because it seems like everyone and their mother is trying to go to Europe this summer, award tickets are scarce.

However, Virgin Atlantic saves the day yet again. The U.K.-based carrier hosts sales several times per year, and back in February, the carrier offered a 30% discount on select award flights . Therefore, I managed to book a flight from New York (JFK) to London (LHR) for just 7,500 Virgin Atlantic Flying Club points and about $150 in taxes and fees.

My same one-way ticket would have cost me at least $700, so I got a terrific 7 cents per point value. Even without the 30% award sale, the same flight would only cost 10,000 Virgin Flying Club points — and there’s lots of award availability at the time of writing.

Iberia Business Class from Madrid (MAD) to New York (JFK)

On the way back, I decided to splurge for an Iberia business class flight from Madrid (MAD). The Spanish flag carrier offers one of the most reasonable award rates for a lie-flat seat to and from Europe: 34,000 Avios (off-peak) or 50,000 Avios (peak).

As I’m flying during the peak summer season, I transferred 50,000 Ultimate Rewards points to Iberia Avios and paid $150 in taxes and fees. The same ticket would have cost me at least $5,000 one-way, which is way too steep for an 8-hour flight. Still, that’s a sizeable value of almost 10 cents per point.

However, you could also stretch your points vastly by redeeming them for economy flights. Iberia is only charging 17,000 Avios one-way in economy for flights to Spain to/from the East Coast, which is another solid redemption to consider.

The total tally clocks in at 220,000 redeemed Ultimate Rewards points this year. That may seem like an eye-popping amount of rewards — but once you factor a stash of 80,000 points and everyday earning opportunities — I guarantee it won’t take you long to creep up with a similar balance of points.

The Chase Sapphire Preferred card is the absolute best place to start if you’ve been longing to book travel using points.

Related Posts

![chase sapphire travel deals Chase Sapphire Preferred Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2020/09/sapphire-preferred.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

The complete guide to Chase Ultimate Rewards

Chase Ultimate Rewards points give you access to some of the best hotel and airline transfer partners in the business, as well as Chase Travel℠ , the issuer's easy-to-use travel portal that allows you to redeem points for a wide variety of bookings, including rental cars, hotels, flights, tours and activities.

Despite increasing competition from American Express Membership Rewards , Citi ThankYou Rewards, Capital One miles and Wells Fargo Go Far Rewards , Chase Ultimate Rewards has maintained its place as one of the most valuable and useful points currencies.

Earn 90,000 bonus points after spending $8,000 in the first three months after account opening with the Ink Business Preferred® Credit Card

If you're ready to get serious about traveling more for less, here's everything you need to know about how to earn and redeem your Chase Ultimate Rewards points.

What are Chase Ultimate Rewards points?

Ultimate Rewards points are the currency of most Chase-branded credit cards . You can earn Chase Ultimate Rewards points for everyday spending on these cards that you can then redeem for a wide range of rewards.

If you're just getting started in the world of travel credit cards, it's typically best to start with Chase products , thanks to the issuer's well-documented 5/24 rule . In short, you generally can't get approved for any Chase cards — including those that earn Ultimate Rewards points — if you've applied for five or more new credit cards across all banks in the past 24 months.

Keep this restriction in mind as you build a strategy to maximize your credit card rewards.

Related: The ultimate guide to credit card application restrictions

How do I earn Chase Ultimate Rewards points?

There are many ways to earn Chase points at rates of 1 to 10 points per dollar spent, depending on the specific Chase credit card you carry.

The first three cards below earn fully transferable Ultimate Rewards points all by themselves, while the remaining four are technically billed as cash-back credit cards .

However, if you have a full Ultimate Rewards points-earning card, you can combine your Chase cash-back rewards in a single account, effectively converting your cash-back rewards into fully transferable points. For this reason, having more than one Chase card can make sense to maximize your earning and redeeming potential.

Here are the seven cards that allow you to earn Chase Ultimate Rewards points.

Chase Sapphire Preferred® Card

Welcome bonus : You'll receive 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That's worth over $750 when redeemed through Chase Travel.

Why you want it : This is a fantastic all-around travel credit card . It earns points at the following rates:

- 5 points per dollar spent on Lyft (through March 2025)

- 5 points per dollar spent on all travel purchased through Chase Travel

- 3 points per dollar spent on dining , including eligible delivery services, takeout and dining out

- 3 points per dollar spent on select streaming services

- 3 points per dollar spent on online grocery purchases (excluding Target, Walmart and wholesale clubs)

- 2 points per dollar spent on all other travel

- 1 point per dollar spent on all other purchases

The Sapphire Preferred has no foreign transaction fees and comes with many travel perks , including delayed baggage insurance, trip interruption/cancellation insurance and primary car rental insurance .

Annual fee : $95

Application link: Chase Sapphire Preferred® Card

Chase Sapphire Reserve®

Welcome bonus : You'll receive 60,000 points after you spend $4,000 on purchases in the first three months from account opening. That's worth $900 when redeemed through Chase Travel.

Why you want it : Put simply, you want this card for its earning power and its travel perks that can easily cover the annual fee. It accrues the following earnings:

- 10 points per dollar spent on Lyft (through March 2025)

- 10 points per dollar spent on Chase Dining booked through Ultimate Rewards

- 10 points per dollar spent on hotel and car rental purchases through Chase Travel

- 5 points per dollar spent on airline travel booked through Chase Travel

- 3 points per dollar spent on travel not booked through Chase

- 3 points per dollar spent on other dining purchases

- 1 point per dollar spent on all other eligible purchases

Other perks include an easy-to-use annual travel credit worth $300, a fee credit for Global Entry or TSA PreCheck (up to $100 once every four years) and Priority Pass Select lounge access, as well as entry to the growing list of new Sapphire lounges . This is one of the few cards that allows you to use your Priority Pass membership for discounted meals in airport restaurants , though this benefit will no longer be available from July on. Cardholders also get primary car rental coverage, trip interruption/cancellation insurance and other protections .

Annual fee : $550

Application link: Chase Sapphire Reserve®

Ink Business Preferred® Credit Card

Welcome bonus : You'll earn 90,000 points after you spend $8,000 on purchases in the first three months from account opening.

Why you want it : This is one of the best credit cards for small-business owners , earning 3 points per dollar on the first $150,000 spent in combined purchases on travel, shipping, internet, cable and phone services, and advertising made with social media sites and search engines each account anniversary year. You earn 1 point per dollar spent on all other purchases, and points don't expire as long as your account is open.

Application link: Ink Business Preferred® Credit Card

Ink Business Cash® Credit Card

Welcome bonus : Earn up to $750: $350 bonus cash back after you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months from account opening.

Why you want it : Earn 5% cash back on the first $25,000 in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year (then 1%). Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year (then 1%). You can convert these earnings to Ultimate Rewards points if you have one of the three cards above.

Annual fee : $0

Application link: Ink Business Cash® Credit Card

Ink Business Unlimited® Credit Card

Welcome bonus : Earn $900 cash back (which can become 90,000 Ultimate Rewards points) after spending $6,000 on purchases in the first three months from account opening.

Benefits : Earn unlimited 1.5% cash-back rewards on every purchase. These cash-back earnings can be converted to Ultimate Rewards points if you have one of the top three cards listed above, meaning your small business can essentially earn 1.5 points per dollar spent on all charges made with this card.

Application link: Ink Business Unlimited® Credit Card

Chase Freedom Flex®

Welcome bonus : Earn $200 after you spend $500 in the first three months of account opening

Benefits : The card earns 5% back on select bonus categories, which rotate every quarter and apply up to $1,500 in combined spending (activation required). Past bonus categories include gas stations, supermarkets, restaurants, warehouse stores and department stores. You can convert these rewards to valuable Ultimate Rewards points if you have one of the top three cards listed above. Plus, earn 5% on travel purchased through Chase Travel, 3% on dining at restaurants (including takeout and eligible delivery services) and 3% on drugstore purchases.

Application link: Chase Freedom Flex®

Chase Freedom Unlimited®

Welcome bonus : Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year), worth up to $300 cash back.

Benefits : These earnings can be converted to valuable Ultimate Rewards points if you have one of the top three cards listed above. Plus, earn 5% on travel purchased through Chase Travel, 3% cash back on dining at restaurants (including takeout and eligible delivery services) and 3% on drugstore purchases. Earn 1.5% on all other purchases. The card also offers 120-day purchase protection and extended warranty protection .

Application link: Chase Freedom Unlimited®

Other Chase credit cards

Note that there are many other Chase-issued credit cards that aren't listed here, including:

- Those that are no longer available to new applicants, like the Ink Plus and Chase Freedom

- Those that don't fully participate in the Ultimate Rewards program, like the Ink Business Premier® Credit Card , which exclusively offers cash back and doesn't allow rewards to be combined with other cards

- Cobranded products with a partner's loyalty program, like United Airlines cards and Southwest Airlines cards , which don't participate in Ultimate Rewards

Do Chase Ultimate Rewards points expire?

Chase Ultimate Rewards points do not expire, provided you keep at least one card that earns Ultimate Rewards points open.

If you cancel all your Ultimate Rewards cards, you must redeem or transfer your points before closing the last card. Otherwise, you will forfeit the points.

What are Chase Ultimate Rewards points worth?

TPG values Ultimate Rewards points at 2.05 cents apiece . This is largely due to the array of valuable transfer partners like World of Hyatt and United Airlines MileagePlus, as these options give you valuable flexibility in your redemptions.

However, you'll get varying values for Chase points if you pursue other redemption opportunities. For example, Ultimate Rewards points are worth 1.5 cents apiece through Chase Travel for Sapphire Reserve cardholders and 1.25 cents for those with the Sapphire Preferred or Ink Business Preferred. You'll also have access to Chase Pay Yourself Back as a cardholder of any of the above cards, and there are occasionally offers to use Chase points for Apple products or gift cards at an enhanced value.

Finally, Chase points are worth 1 cent apiece if used for simple cash back.

What are the Chase Ultimate Rewards transfer partners?

You can transfer Ultimate Rewards points to 11 airline programs:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

Chase also partners with three hotel programs:

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

All transfer ratios are 1:1 (though there are occasional transfer bonuses ), and you must transfer points in 1,000-point increments.

Options to redeem Ultimate Rewards points

When redeeming Ultimate Rewards points, you have three basic options:

- Fixed-value, non-travel redemptions (e.g., cash back, gift cards, Apple products)

- Fixed-value Chase Travel bookings

- Transfers to travel partners

The "best" option comes down to your travel needs. Points are here to save you money, and you should use them when it suits you.

That being said, you should aim for the highest value whenever possible. Here's a look at all of your options.

Transfer to travel partners

Transferring Ultimate Rewards points to travel partners often can be the most valuable way to redeem your hard-earned points. With 14 transfer partners, you have plenty of options, and you can keep your Chase points in your Ultimate Rewards account until you are ready to transfer them, which provides excellent flexibility. Our favorite sweet spots include:

- Top-tier Hyatt hotels : The World of Hyatt award chart is incredibly inexpensive compared to some competitors. You can book some of the fanciest Park Hyatt properties in the entire portfolio, including the Park Hyatt New York and the Park Hyatt Sydney , for 35,000 points per night during off-peak dates. TPG values Hyatt points at 1.7 cents each, so 35,000 points are worth $595. That's a great deal for hotels that routinely sell for close to $1,000, even when demand is low. There's also great value at the lower end of the Hyatt award chart. Category 1 hotels range from 3,500 to 6,500 points per night, depending on peak, standard and off-peak pricing.

- Iberia flights to Madrid : Round-trip flights from New York's John F. Kennedy International Airport (JFK), Chicago's O'Hare International Airport (ORD) and Boston Logan International Airport (BOS) to Spain's capital will only set you back 34,000 Avios in economy, 51,000 points in premium economy or 68,000 points in business class when you transfer your Chase points to Iberia Plus. Considering that most airlines charge at least 60,000 miles for a one-way business-class award to Europe, you're essentially getting a 50% discount.

- Flights to Hawaii with Alaska Airlines and American Airlines : By transferring your Ultimate Rewards points to British Airways, you can book awards with Oneworld partners American Airlines and Alaska Airlines. As long as your nonstop flight distance is under 3,000 miles each way, you can leverage British Airways' (unpublished) distance-based award chart to fly from any West Coast gateway to Hawaii for only 26,000 Avios round-trip.

- All Nippon Airways flights booked through Virgin Atlantic : For just 145,000 points, you can fly round-trip in first class between the West Coast and Tokyo. Flights from other U.S. gateways only cost an extra 25,000 points (170,000 points round-trip). Business-class redemptions are an even better deal, costing just 90,000 to 95,000 points round-trip, depending on your U.S. departure airport. If possible, you'll want to route through JFK and fly ANA's "The Room" business class , which is only available on select routes.

- Short-haul flights to Canada : Aeroplan stuck to an award chart for partner redemptions but added dynamic pricing for Air Canada flights. As a result, you can often find super-cheap short-haul tickets from the U.S. to Canada. For example, a flight from JFK to Toronto Pearson Airport (YYZ) can be booked for under 6,000 points one-way on many dates.

Book via Chase Travel

You can book through Chase Travel and redeem points for your plane tickets, hotel stays, rental cars or experiences at a fixed cash value per point.

As a Chase Sapphire Preferred or Chase Ink Business Preferred cardholder, each point is worth 1.25 cents. If you have the Chase Sapphire Reserve, your points are worth 1.5 cents each toward travel redemptions in the portal. If you have a Chase Freedom Flex, Ink Business Unlimited Credit Card, Ink Business Cash Credit Card or Chase Freedom Unlimited, all points are worth 1 cent each.

However, as noted previously, if you have multiple cards earning Ultimate Rewards points, you can combine your points into the account with the highest value for Ultimate Rewards bookings. For example, your points earned with the Chase Freedom Flex can be moved to your Sapphire Reserve account, thus increasing their value from 1 to 1.5 cents apiece. This is a generous offer from a credit card program.

If you can find inexpensive airfare via Chase Travel, using your points for these flights can make sense to save cash. In the eyes of the airline, tickets booked this way are essentially the same as paid fares. This means you'll earn elite status credits and redeemable miles. Be careful to avoid basic economy tickets unless you are OK with their restrictions.

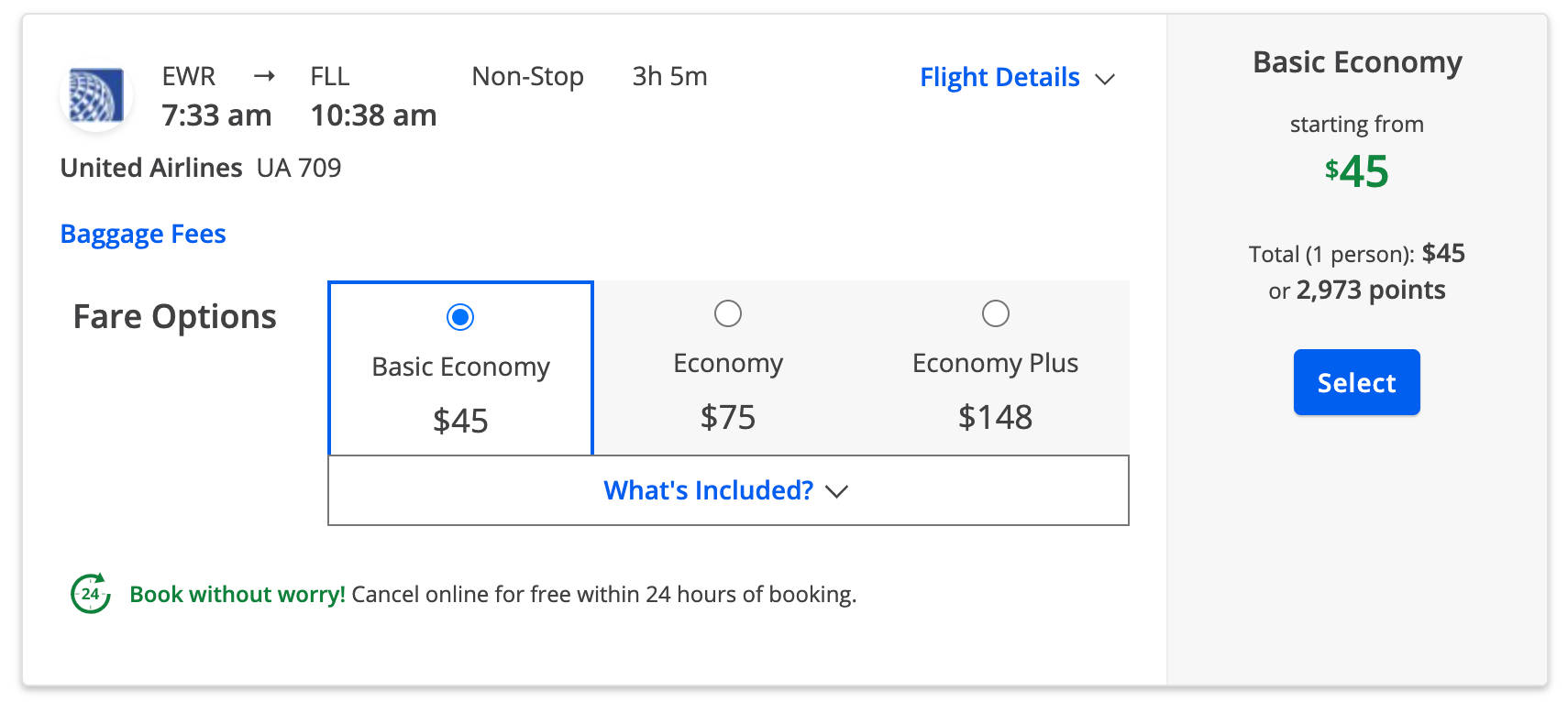

In the case below, spending 2,973 Ultimate Rewards points from a Sapphire Reserve account to fly from Newark Liberty International Airport (EWR) to Fort Lauderdale-Hollywood International Airport (FLL) isn't too shabby.

You might also consider the travel portal option if you only have a handful of Ultimate Rewards points left since Chase lets you redeem points to cover even just a portion of the trip cost. You would then pay the remaining balance with cash.

Finally, this is a decent option for car rentals, non-chain lodging and when cash rates make spending points through transfer partners a bad value. The hotel options are quite varied, though be aware that if you book a hotel that participates in a major loyalty program through Chase, you likely won't earn hotel points, nor will you be able to take advantage of any elite status perks.

Enjoy fixed-value, non-travel redemptions

You can redeem Chase points for a statement credit or bank deposit at a flat rate of 1 cent each, and this rate also applies to gift cards and Apple products (outside a limited-time special).

However, with Chase Pay Yourself Back, you can redeem points for cash back at a rate of 1.25 to 1.5 cents each, depending on your card. This redemption rate is valid on statement credits toward rotating purchase categories, such as dining.

Finally, you can also link your eligible Chase cards to your Amazon account and pay for purchases with the Shop With Points program. However, you will only receive a value of around 0.8 cents per Ultimate Rewards point.

As you can see, you'll generally get much better value with the program's transfer partners and Chase Travel bookings. However, we know needs can change, so these non-travel redemptions remain fall-back options.

Bottom line

Chase Ultimate Rewards is one of our favorite credit card programs at TPG. It allows you to start with a credit card offering a large welcome bonus and then enjoy bonus points on many everyday spending categories — like airfare, hotels, dining and groceries. Then, you can choose from a huge range of transfer partners, redeem points for travel directly with Chase or choose cash back.

- Chase Dining SM

- Not a cardmember? Learn more

Explore the world with offers from Sapphire Preferred

All our latest offers – all in one place.

Whether you're craving new restaurants, chances to reconnect with friends and family and even more ways to reward yourself, we have offers to inspire you. Explore what you can do with Sapphire Preferred.

01 DoorDash and Caviar

Doordash and caviar benefit.

From ordering your favorite gourmet takeout to restocking your groceries with a free DashPass membership on both DoorDash and Caviar. You’ll pay a $0 delivery fee and lower service fees on eligible orders for a minimum of one year when you activate by Dec 31, 2027 . * Plus, DoorDash members get up to $10 off a month on non-restaurant DoorDash orders. *

Get started

5x points on Lyft

Earn 5x total points on Lyft rides through March 2025. That's 3x points in addition to the 2x points you already earn on travel. *

See details

Earn 5x total points on Peloton

Work out your way — from HIIT rides to walks and hikes to strength training, and more: Get 5x total points on Peloton equipment and accessory purchases over $150 with a max earn of 25,000 points. Shop Peloton Bikes, Tread, Guide, or Row. Offer ends Mar. 31, 2025. *

Shop Peloton

More ways to get the most from your rewards

Redeem your points for statement credits, gift cards or choose from other flexible ways to make your points work for you.

Get more with gift cards

Choose from a selection of over 175 gift cards from some of your favorite retailers and more.

Redeem points with Pay Yourself Back ®

Redeem your points for statement credits toward purchases made with your ...

Redeem your points for statement credits toward purchases made with your Sapphire Preferred card from the past 90 days. *

Explore the Chase Dining SM program

Redeem your points towards ordering take out or booking prepaid reservations at restaurants ...

Redeem your points toward ordering takeout or booking prepaid reservations at restaurants, wineries, bars and pop-ups across the country.

Shop through Chase ® rewards you for buying from your favorite brands

Shop online with brands you already love. Earn 1x–15x bonus points ...

Shop online with brands you already love. Earn 1x–15x bonus points at more than 450 popular retailers with Shop through Chase. *

Use Pay with Points to boost your purchase power

Use your points to pay for all or part of your purchases ...

Use your points to pay for all or part of your purchases with popular brands like Apple ® and Amazon.com. *

Go further with Chase Sapphire travel benefits

With Sapphire, points are worth more when you redeem for travel through Chase ...

With Sapphire, points are worth more when you redeem for travel through Chase Travel. So let your points take you further and get inspired for your next great adventure.

Earn more. Redeem faster. Go further.

total points on travel purchased through Chase

Annual Chase Ultimate Rewards ® Hotel Credit

points on dining at restaurants worldwide

points on online grocery store purchases

points on select streaming services

anniversary points boost

more value when points are redeemed for travel through Chase

points on other travel and 1x points per $1 spent on all other purchases

There's so much for you

Sapphire Preferred benefits

There’s so much more to make yours—top benefits, offers and experiences for Sapphire Preferred cardmembers.

Chase Dining SM

Cardmembers can enjoy exclusive access to an eclectic list of local restaurants, virtual dining events and other curated culinary content.

Refer-A-Friend

Earn up to 75,000 bonus points per year by referring friends to either Chase Sapphire ® card.

Already a Sapphire Preferred cardmember?

Sign in to view your account, access exclusive content and take advantage of your Sapphire benefits.

Not a Sapphire Preferred cardmember yet?

We’re glad you’re here. Learn more about getting a Sapphire card.

Es posible que esta comunicación contenga información acerca de usted o su cuenta. Si tiene alguna pregunta, por favor, llame al número que aparece en el reverso de su tarjeta.

View the details of the Sapphire Preferred benefits offered on this page.

©2024 JPMorgan Chase & Co. JPMorgan Chase Bank, N.A. Member FDIC

IMAGES

VIDEO