- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Chase Ultimate Rewards: How the Program Works

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Chase Ultimate Rewards® is the name of the points program for Chase's rewards credit cards. Among points systems, Chase's program is highly regarded because point values can be relatively high if used strategically to pay for travel.

Here’s what to know about earning and redeeming Chase Ultimate Rewards®.

» MORE: Chase credit cards mobile app review

In this article

Chase Ultimate Rewards®: The basics

How much are Chase Ultimate Rewards® points worth?

Credit cards that earn chase ultimate rewards®, other ways to earn chase ultimate rewards®.

Frequently asked questions and Chase Ultimate Rewards®

Earning Chase Ultimate Rewards points

You earn Chase Ultimate Rewards® points by making purchases with Chase-branded rewards cards — including the Sapphire travel cards, Freedom cash back cards and Ink business cards.

You earn at least 1 point per dollar spent on all purchases, and most (but not all) of these cards give you additional rewards for purchases made in certain categories. ( Jump ahead to see cards that earn Ultimate Rewards® points. ) Additional points are available through sign-up bonuses , targeted offers (e.g. 5 points per dollar at a particular merchant for a limited time) and incentives, such as bonuses for referring new applicants.

Cards issued by Chase with a brand partner — such as United Airlines, Amazon or Marriott — do not earn Ultimate Rewards® points. They earn rewards in the partner's loyalty program.

Chase's "cash-back" credit cards, such as the Chase Freedom Flex℠ , the Chase Freedom Unlimited® and the Ink Business Cash® Credit Card , actually earn Ultimate Rewards® points. With those cards, you just redeem your points for cash back.

The value of a Chase Ultimate Rewards® point varies depending on what you do with it — redeem for cash back, for travel or for something else. Further, when redeeming for travel, point values also depend on which cards you have.

Let's start with cash and cash-like redemption options. Point values for these redemptions are the same regardless of which card you have.

Redeeming Chase Ultimate Rewards points

Chase Ultimate Rewards® points can be exchanged for a range of redemptions, including

Gift cards.

Amazon purchases.

Apple purchases.

You may also be able to redeem for "experiences" — access to special events — if you have an eligible Chase card.

Cash redemptions

Cash back: This can take the form of a credit on your statement or a direct deposit at a rate of 1 cent per point , or 100 points for $1. There is no minimum redemption about.

Gift cards: Most cost the equivalent of 1 cent per point , but Chase often sells specific cards at a discount. For example, a $25 gift card for a specific retailer might cost 2,250 points instead of the full 2,500 points, a value of 1.1 cents per point.

Amazon payment: You can link your eligible Chase card to your Amazon account and use your card's rewards to pay through the Shop With Points program , at a rate of about 0.8 cents per point . That’s the lowest-value redemption option for Chase points and not recommended if you’re trying to maximize the value of your points. You’re better off just taking cash back at a full penny per point and using that money to pay for Amazon purchases.

Apple purchases: Redeem points for Apple merchandise through the Chase Ultimate Rewards® portal for 1 cent per point .

Travel redemptions

There are two ways to use Chase Ultimate Rewards® points for travel:

By booking your travel through Chase and paying for it with your points.

By transferring points to Chase's partner airline and hotel programs.

Booking travel through Chase

Chase has a travel-booking tool with competitive prices. The value you get per point depends on which card you have:

With cash-back cards, booking travel through Chase gets you a value of 1 cent per point . These include the Freedom-branded cards ( Chase Freedom® , Chase Freedom Unlimited® , Chase Freedom Flex℠ ) as well as the Ink Business Cash® Credit Card and the Ink Business Unlimited® Credit Card .

With the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card , booking travel through Chase gets you a value of 1.25 cents per point .

With the Chase Sapphire Reserve® , booking travel through Chase gets you a value of 1.5 cents per point .

Transferring points to Chase travel partners

With the Chase Sapphire Preferred® Card , the Chase Sapphire Reserve® or the Ink Business Preferred® Credit Card , you can transfer your points on a 1:1 basis to about a dozen airline and hotel loyalty programs.

The exact value you get per point depends on which program you transfer to and how you redeem the points within that program, but NerdWallet estimates the overall transfer value at 2.2 cents per point.

Aer Lingus (1:1 ratio).

Air Canada (1:1 ratio).

Air France-KLM (1:1 ratio).

British Airways (1:1 ratio).

Emirates (1:1 ratio).

Iberia (1:1 ratio).

JetBlue (1:1 ratio).

Singapore (1:1 ratio).

Southwest (1:1 ratio).

United (1:1 ratio).

Virgin Atlantic (1:1 ratio).

Hyatt (1:1 ratio).

InterContinental Hotels Group (1:1 ratio).

Marriott (1:1 ratio).

» HOW THEY STACK UP: See how Chase Ultimate Rewards® points compare with other issuer programs on our points and miles valuations page . Or:

See our guide to American Express Membership Rewards .

See our guide to Citi ThankYou Points .

Card-to-card points transfers

Chase Ultimate Rewards® points earned on different cards can be pooled and redeemed together. That allows you to move points to one of the Sapphire cards or the Ink Business Preferred® Credit Card to redeem for outsize value.

For example, if you have the Chase Freedom Flex℠ , you can't redeem for travel at the higher rewards rate — just the usual 1 cent per point. But if you also have the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® , you can transfer your Chase Freedom Flex℠ points to either of those cards and redeem for the higher value (or transfer to a partner airline or hotel).

» MORE: What is the 'Chase trifecta'?

Chase Dining

Chase Dining launched in 2020 as a hub for Chase Sapphire, Freedom and Ink cardmembers. Powered by reservation website Tock, the program allows cardmembers to make reservations at participating restaurants and order takeout. Cardmembers can also redeem points for their food orders.

While all cardmembers earn rewards for purchases made through Chase Dining, cardholders earn an eye-opening rate of 10 points for each $1 spent on Chase Dining purchases.

Chase Experiences

For the Dinner on the Court series, cardmembers got the unique opportunity to walk onto the court and see the Golden State Warriors' championship trophies up close. (Photo by Sally French)

Ever since J.P. Morgan Chase’s 2021 acquisition of the restaurant website The Infatuation, cardholders have gotten increased access to exclusive invitations and unique experiences — many of which are related to dining. That includes events such as the “Dinner on the Court” series, where Chase Sapphire Reserve® cardmembers who bought tickets using either cash or Chase Ultimate Rewards® points got to dine in what was an incredibly-unique dinner experience on the court of San Francisco’s Chase Center, home of the NBA's Golden State Warriors.

Other experiences have included private dinners with celebrity chefs or VIP travel packages to big events such as Formula One races.

Many of these Chase Experiences and Chase Dining events are limited only to people who hold Chase's premium credit cards. For example, only people with the Chase Sapphire Reserve® could book the Dinner on the Court event.

Note: Chase's cash-back credit cards technically earn that cash in the form of Chase Ultimate Rewards®. One point equals 1 cent in those cases.

Chase Sapphire Preferred® Card

5 points per $1 spent on all travel booked through Chase.

3 points per $1 spent on dining (including eligible delivery services and takeout).

3 points per $1 spent on select streaming services.

3 points per $1 spent on online grocery purchases (not including Target, Walmart and wholesale clubs).

2 points per $1 spent on travel not booked through Chase.

1 point per $1 spent on other purchases.

Sign-up bonus: Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

» READ OUR REVIEW of the Chase Sapphire Preferred® Card

Chase Sapphire Reserve®

10 points per $1 spent on Chase Dining purchases.

10 points per $1 spent on hotel stays and car rentals booked through Chase.

5 points per $1 spent on air travel booked through Chase.

3 points per $1 spent on travel and dining not booked with Chase.

Sign-up bonus: Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

» READ OUR REVIEW of the Chase Sapphire Reserve®

Chase Freedom Flex℠

5% cash back on rotating bonus categories, on up to $1,500 spent per quarter (cash back comes in the form of Chase Ultimate Rewards®).

5% cash back on travel purchased through Chase.

3% back at restaurants.

3% back at drugstores.

1% back on all other purchases.

Sign-up bonus: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» READ OUR REVIEW of the Chase Freedom Flex℠

The Chase Freedom Flex℠ replaced the original Chase Freedom® , but holders of the original card were able to keep using it. That card offers the same 5% in rotating categories and 1% elsewhere, but not the bonus rewards on travel, dining and drugstores.

Chase Freedom Unlimited®

1.5% on all other purchases.

Sign-up bonus: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

» READ OUR REVIEW of the Chase Freedom Unlimited®

Ink Business Preferred® Credit Card

3 points per $1 spent on the first $150,000 per year in combined spending on travel and select business categories.

1 point per $1 spent on all other purchases.

Sign-up bonus: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠.

» READ OUR REVIEW of the Ink Business Preferred® Credit Card

Ink Business Cash® Credit Card

5% cash back on office supply store purchases and internet, cable and phone services, on up to $25,000 spent per year combined.

2% back at gas stations and restaurants, on up to $25,000 spent per year combined.

Sign-up bonus: Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

» READ OUR REVIEW of the Ink Business Cash® Credit Card

Ink Business Unlimited® Credit Card

1.5% cash back on all spending.

Sign-up bonus: Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

» READ OUR REVIEW of the Ink Business Unlimited® Credit Card

Online shopping through the Chase Ultimate Rewards® portal with any of these cards will earn extra points or cash back.

You can earn anywhere from 1 to 15 points per dollar spent, depending on the retailer.

» MORE: How to use credit card bonus malls

Chase Ultimate Rewards® points don’t expire as long as your card is open. If you cancel your account, you’ll lose unredeemed points.

Chase Ultimate Rewards® is a points system. You earn at least 1 point for every dollar you spend with a Chase-branded credit card, and most cards earn extra points on purchases in specific categories, such as travel, restaurants or drugstores.

Options for using points include booking travel, getting cash back or — depending on which card you have — transferring them to partner airline or hotel loyalty programs. How much a point is worth depends on how you use it, but you should be able to get at least 1 cent of value per point. You can combine points from multiple cards to maximize your redemption potential.

All Chase-branded rewards credit cards earn Ultimate Rewards® points. Even Chase’s cash-back cards technically earn their rewards as points.

Cards that earn points include the Chase Sapphire Preferred® Card , the Chase Sapphire Reserve® , the Chase Freedom Flex℠ and the Chase Freedom Unlimited® , as well as business credit cards like the Ink Business Cash® Credit Card , the Ink Business Preferred® Credit Card and the Ink Business Unlimited® Credit Card .

Credit cards issued by Chase in partnership with airlines, hotels or retailers do not earn Ultimate Rewards® points. Instead, they earn rewards in the partner’s loyalty program. Examples include Chase’s “co-branded” cards with United and Southwest airlines, with Marriott and Hyatt hotels, and with Amazon and Starbucks.

The value of a Chase Ultimate Rewards® point depends on the card you have and how you redeem. When used for cash back, they’re worth 1 cent apiece. Redeemed for travel booked through Chase, they’re worth 1 to 1.5 cents apiece. When transferred to a partner, they can be worth even more — or even less; it depends on what you do with the points you transfer. Our points and miles valuation page digs deeper on transfer value.

When redeemed for cash back, 10,000 Chase points are worth $100. When redeemed for travel booked through Chase, 10,000 points are worth $150 if you have the Chase Sapphire Reserve® , or $125 with the Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card , or $100 with other Chase cards.

When redeemed for cash back, 100,000 Chase points are worth $1,000. When redeemed for travel booked through Chase, 100,000 points are worth $1,500 if you have the Chase Sapphire Reserve® , or $1,250 with the Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card .

If your Chase card allows transfers, you can transfer them to about a dozen hotel and airline loyalty programs. They include:

Airlines: Aer Lingus, Air France/KLM, British Airways, Emirates, Iberia, JetBlue, Singapore, Southwest, United, Virgin Atlantic

Hotels: Hyatt, InterContinental Hotels Group, Marriott

Chase Ultimate Rewards® points don’t expire as long as your card account is open. If you cancel a card, you’ll lose any unredeemed points on that card.

Cards that earn points include the

, as well as business credit cards like the

The value of a Chase Ultimate Rewards® point depends on the card you have and how you redeem. When used for cash back, they’re worth 1 cent apiece. Redeemed for travel booked through Chase, they’re worth 1 to 1.5 cents apiece. When transferred to a partner, they can be worth even more — or even less; it depends on what you do with the points you transfer. Our

points and miles valuation page

digs deeper on transfer value.

When redeemed for cash back, 10,000 Chase points are worth $100. When redeemed for travel booked through Chase, 10,000 points are worth $150 if you have the

, or $125 with the

, or $100 with other Chase cards.

When redeemed for cash back, 100,000 Chase points are worth $1,000. When redeemed for travel booked through Chase, 100,000 points are worth $1,500 if you have the

, or $1,250 with the

Aer Lingus, Air France/KLM, British Airways, Emirates, Iberia, JetBlue, Singapore, Southwest, United, Virgin Atlantic

Hyatt, InterContinental Hotels Group, Marriott

on Chase's website

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Most links in our content provide compensation to Slickdeals. Applying for and maintaining consumer credit accounts is an important financial decision, with lasting consequences, and requires thought, planning and comparison shopping for the offer that best suits your personal situation. That's why we offer useful tools to evaluate these offers to meet your personal objectives. Be sure to verify all terms and conditions of any credit card before applying.

Search Slickdeals Money

Featured articles.

BrioDirect High-Yield Savings Review: 5.35% APY with No Monthly Fee

Citi Personal Loans Review: No Fees and Generous Rate Discounts

Chase Aeroplan Card Review: 70,000 Bonus Points & Big Travel Benefits

SoFi Checking and Savings Account: Up to $300 Bonus Offer

Get the latest in personal finance news, offers and expert tips.

How to Get 5% Back on Chase Travel with Your Amazon Prime Visa Credit Card

Slickdeals/Amazon

- Share on Twitter

- Share on Facebook

- Share on Email

Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

With travel season fast approaching, Amazon's Prime Visa Credit Card can be a great option if you're looking to earn more rewards on your travel purchases. In addition to offering an unlimited 5% back on Amazon.com and Whole Foods purchases, you can also get an unlimited 5% back on bookings through Chase Travel. Even as a non-Prime member, you're still in an excellent position to reap rewards with 3% back on every flight, hotel stay, and travel-related purchase made through Chase Travel. Whether it's a weekend escape or a grand vacation, your travels just got more rewarding.

Now, let's get into how Prime members can maximize their travel experiences with the Prime Visa Credit Card. Imagine earning an impressive 5% back on all your travel bookings through Chase.

Prime Visa Credit Card

Secure application on Amazon’s site

- Our Rating 3.5/5 How our ratings work Read the review

- APR 19.49% - 27.49% (Variable)

$0 with Prime membership

Get a $100 Amazon Gift Card instantly upon approval exclusively for Prime members

This card is a good fit for consumers who do a lot of shopping at Amazon and Whole Foods because they can earn an unlimited 5% cash back on purchases there. Cardholders also earn some cash back on other purchases, with decent rates for restaurants and gas stations. If you already have or plan to get a Prime membership, using this card could quickly earn you sizable cash back.

- Pros & Cons

With high rewards rates, this card could make up for the required Prime membership fee if you shop a lot at Amazon and Whole Foods. Non-Prime members can qualify for the Prime Visa Credit Card , which is pretty similar but with lower rewards rates.

- No annual fee

- High rewards rates

- Sign-up bonus offer

- Can redeem rewards as soon as the next day

- No foreign transaction fees

- Must have a Prime membership for highest rewards rates

- No intro APR offer

How to Earn 5% Back on Chase Travel with the Prime Visa Credit Card

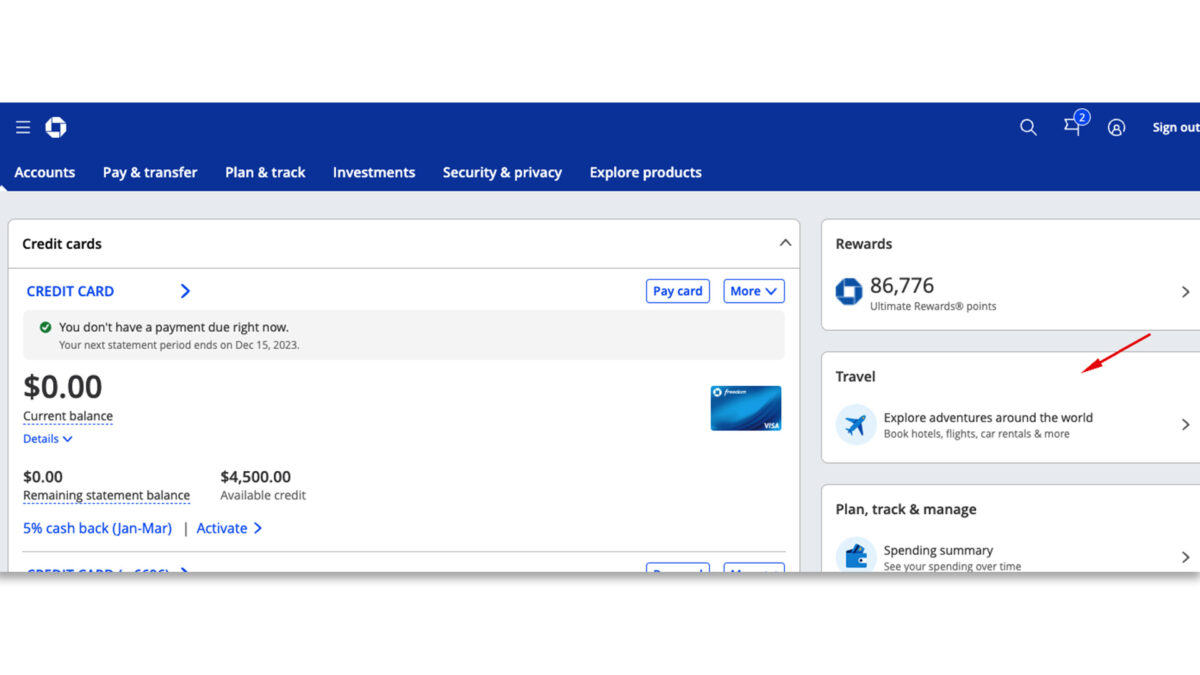

1. sign in to your chase account. click the travel section..

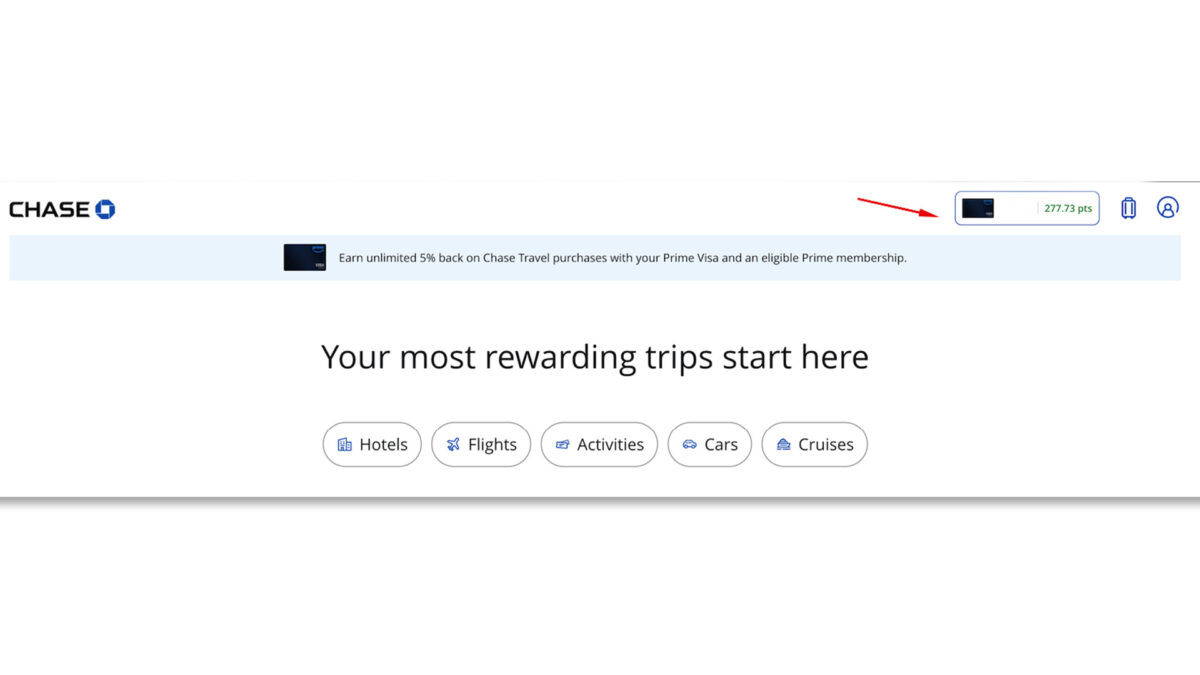

2. Make sure your Prime Visa Credit Card is selected.

If you own multiple Chase credit cards, choose your Prime Visa by tapping the card image in the top right corner.

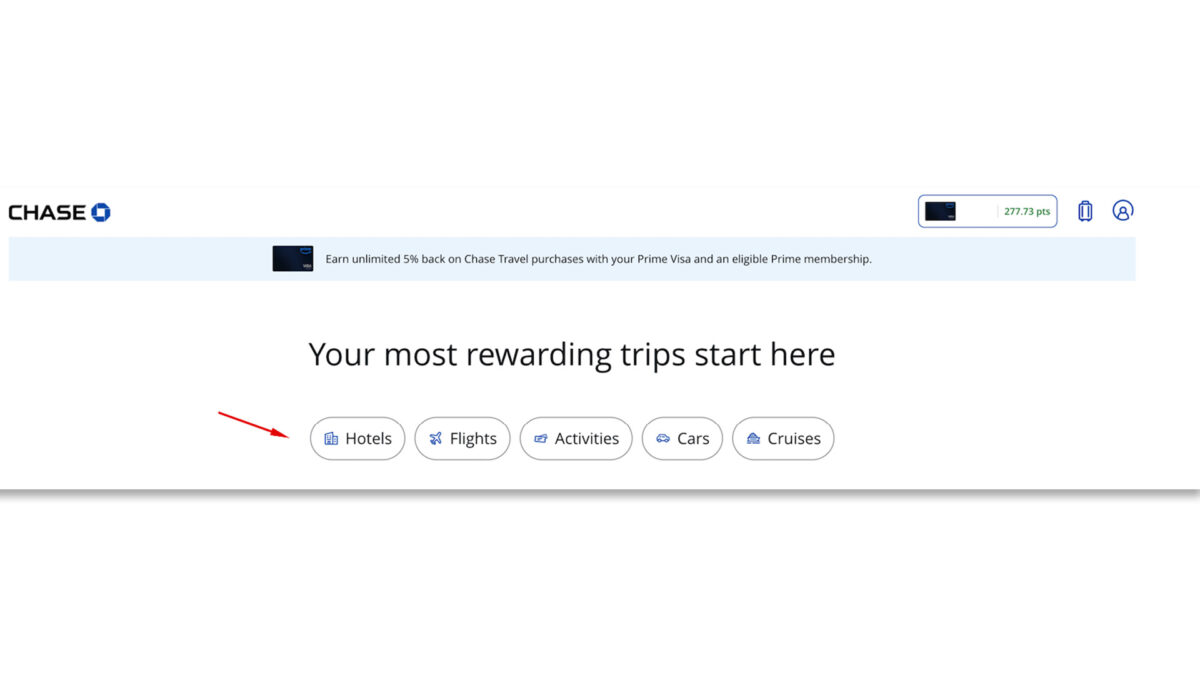

3. Choose your travel booking.

Select what you want to book: hotels, flights, activities, rental cars, or cruises.

To book a hotel, search by destination and refine your choices using filters like price, amenities, ratings, property type, number of bedrooms, and neighborhood.

When booking a flight, adjust your search with filters for cost, airline, flight times, and departure airport. Similar filters are available for activities, rental cars, and cruises.

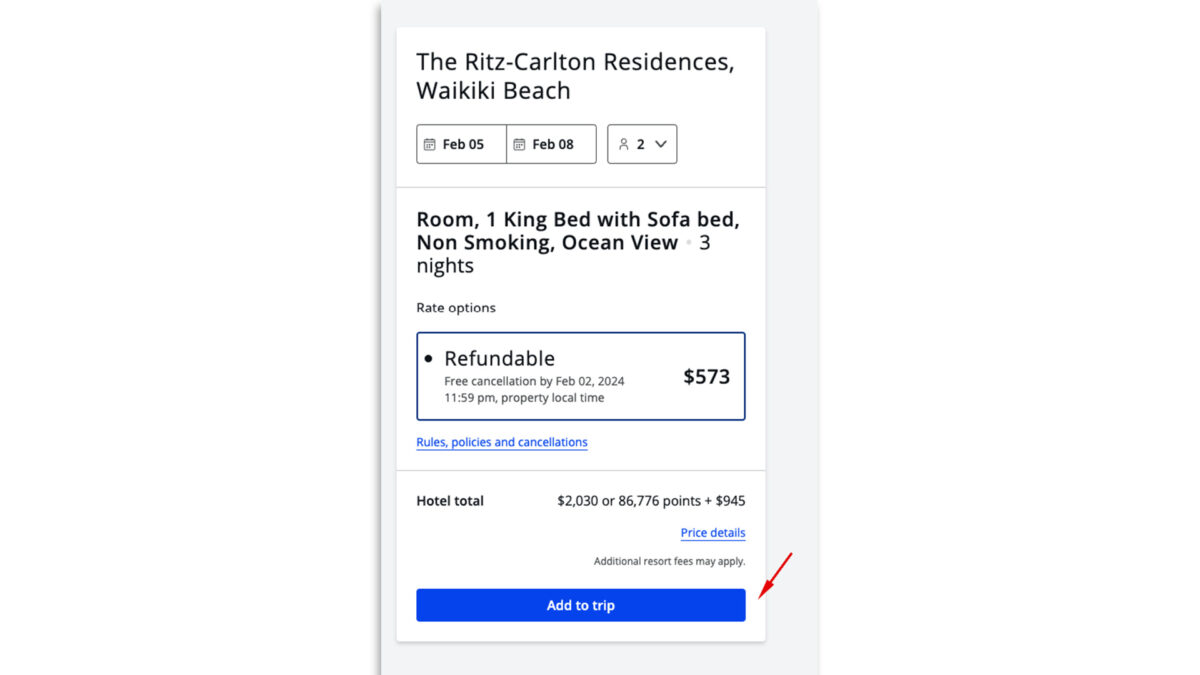

4. Click "Add to trip" to confirm your booking.

Once you're satisfied with your travel selections, confirm your booking by clicking "Add to trip." You can include multiple bookings in your trip cart.

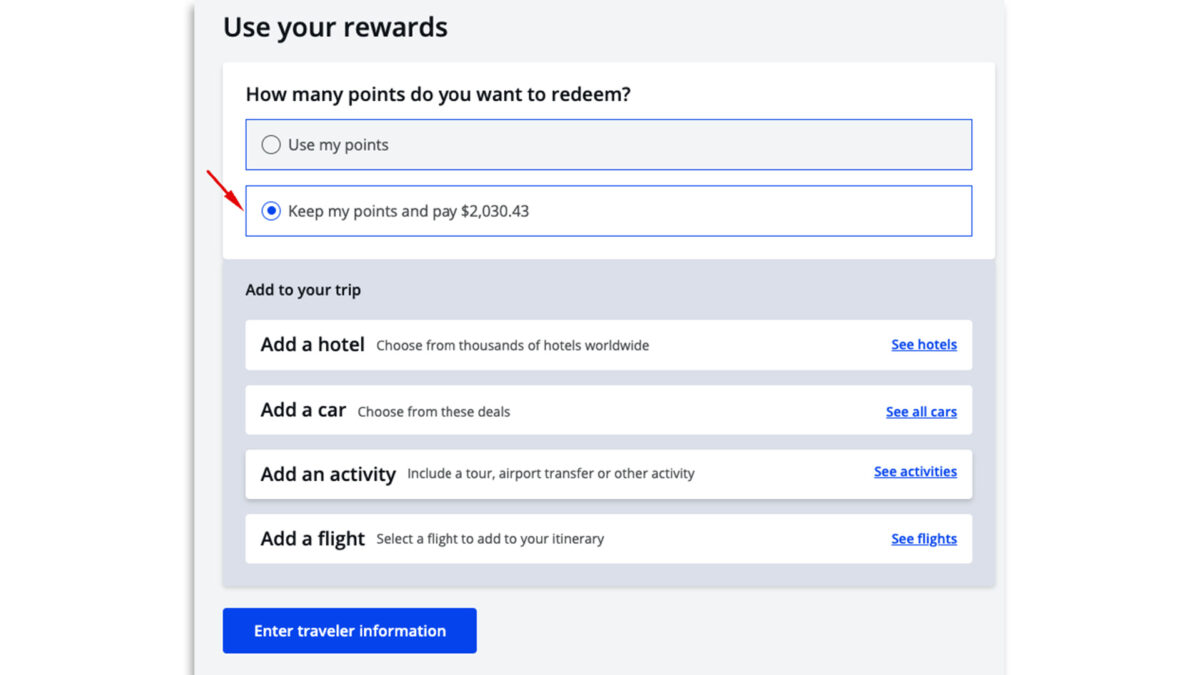

5. Choose your payment option.

If you want to earn 5% back on Chase Travel with your Prime Visa Credit Card, choose the "keep my points and pay" option. Or, you can choose to pay using points.

You can also add additional bookings such as a rental car, hotel, flight, or other travel activity to your booking.

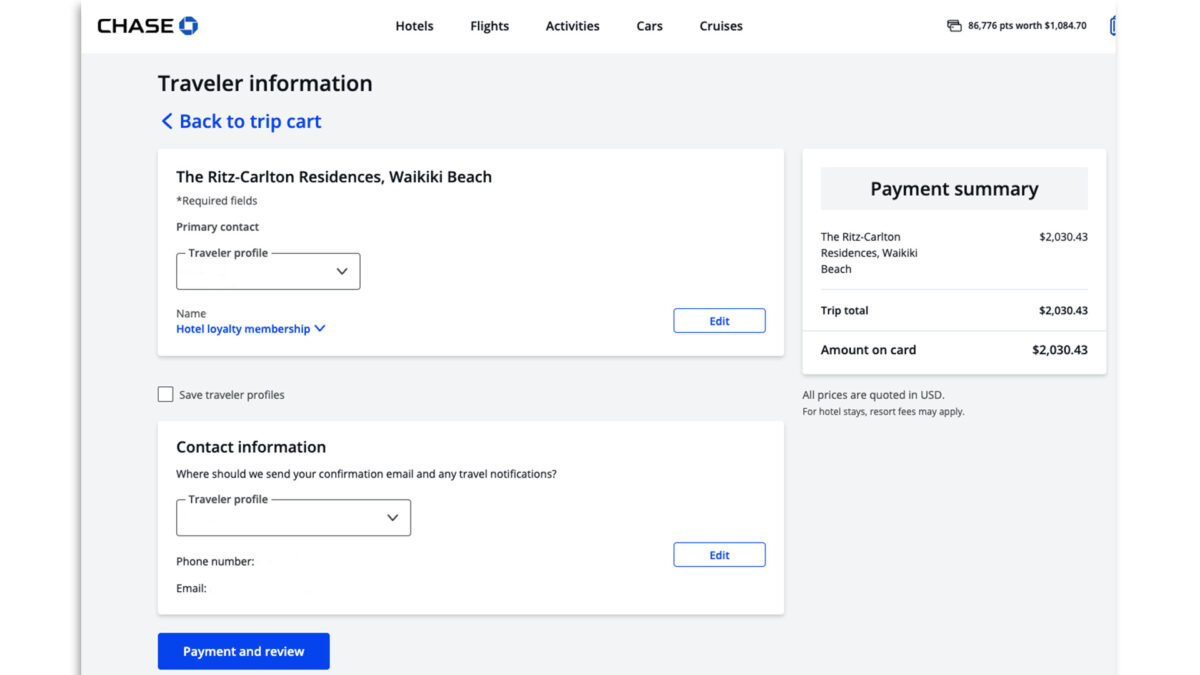

6. Enter your traveler details.

Enter your traveler details, including any applicable loyalty program information.

7. Provide your payment details.

Continue to the payment details and confirm that all the booking information is correct.

8. Complete the booking.

Complete the step to finalize the transaction.

After your billing cycle, you’ll get 5% back in points if you paid with your Prime Visa Credit Card. Each point is equal to one cent. So a $100 flight will earn you 500 points, equal to $5 in cash back.

Recommended Travel Credit Cards

Ryan tronier.

Ryan Tronier is a personal finance expert and writer. His work has been published on NBC, ABC, USATODAY, The Mortgage Reports, Yahoo Finance, MSN, and more. Ryan is the former managing editor of the finance website Sapling, as well as the former personal finance editor at Slickdeals. Find him online at ryantronier.com.

Follow the Money

Get all the latest finance topics and tips delivered straight to your inbox weekly.

Articles Get the latest in personal finance news, offers and expert tips. Dive into more personal finance advice and guides

Amazon’s Prime Visa Credit Card Review: Generous Rewards for Amazon Power Shoppers

Earn an Amazon Gift Card When You Open a Prime Visa Credit Card

The Best 5% Back Credit Cards

Unload Low Gift Card Balances to Amazon for Credits That Don’t Expire

Why I Switched From Travel Rewards to Cash Back

Going for Gold: Robinhood’s New 3% Cash-Back Credit Card

Chase Instacart Mastercard Card Review: 5% Cash Back, Free Year of Instacart+ and $100 Credit

Learn How to Travel for Free: Beginners Guide to Credit Card Travel Rewards

Wells Fargo Autograph Journey℠ Card First Impressions: How Does it Compare?

Costco Anywhere Visa Card Review: A Must-Have for Loyal Costco Shoppers

A Simple Guide to Credit Card Travel Protections

Say Goodbye to Your Starbucks Rewards Visa Card: Chase Announces Transition to New Cards

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

FREEDOM RISE ® GET THE CREDIT, KEEP THE CASH BACK

Start building credit now and get cash back with every purchase.

- Explore Chase Freedom

- Freedom Unlimited

- Freedom Flex

- Freedom Rise

- Learn about credit

1.5% CASH BACK ON EVERYTHING YOU BUY, EVERY DAY

Cash back on everything—so with your new pants, you'll also get 1.5% cash back to put in the pockets.

Say yes to no annual fee

Chase Freedom Rise ® has no annual fee. That's right, no annual fee, ever. None. Nada. Zero. Zilch.

Turn good financial habits into a card upgrade

You will be automatically evaluated each year to upgrade to your first Chase Freedom Unlimited card when:

- Your Freedom Rise account is open and you’ve made a purchase on your Rise card in the past 12 months

- You’ve made all payments on time to all financial lenders in the past 12 months, and none of your Chase accounts are suspended

And say adios to late fees

Get a $25 statement credit when you sign up for automatic payments within the first three months.

Fraud alerts for you

We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card.

WE KNOW APPLYING CAN BE STRESSFUL. WE MADE IT SIMPLE

What to bring.

Get together your Social Security number or ITIN (Individual Taxpayer Identification number), your address, proof of income (like pay stubs or self-employment documents), and your phone number.

What to know

When you apply, you'll be asked about how much you spend on housing or if you want to have anyone else on your card.

Your path to “Approved”

Give yourself a better chance of approval by opening a Chase checking account before you apply and depositing $250.

Ready to apply? Come on in.

Our bankers are on standby in your local Chase branch to answer your questions and help you with your application. Let’s get you started on your financial future.

WATCH KEVIN HART SCHOOL DAUGHTER HEAVEN ON CREDIT CARD BASICS

Despite Kevin's wealth, he always stresses the importance of his kids making their own way. Enjoy our series that shows what happens when his daughter Heaven starts looking for her first credit card before going off to college. It’s a family affair that addresses every day financial questions and challenges.

Debit or Credit?

Heaven buys some dorm room basics with her debit card prompting Kevin to tell her the importance of establishing good credit habits

Respect Your Credit Responsibility

Sneaky spending from Heaven sparks a responsibility talk from Kevin

Creating Good Payment Habits

Heaven’s first credit card bill arrives, and Kevin has fatherly advice on how to handle the payment

CREDIT QUESTIONS, ANSWERED

Everything you should know when applying for a credit card online.

What does pre-approved mean for a credit card?

How to activate your new credit card

How to increase your credit limit

CARD BENEFITS THAT MAKE LIFE EASIER

Chase Mobile app ®

Use the app to make payments, deposits, and transfers, check your rewards, manage spending, lock or unlock your card, and more.

Chase Credit Journey

Your credit score is like a snapshot of your credit history. Check it any time with Chase Credit Journey, learn how to improve it, and get alerts if it changes.

Zero Liability Protection

Zero Liability Protection means you won't be held responsible for unauthorized charges made with your card or account information. If you see an unauthorized charge, simply call the number on the back of your card.

Chase Pay Over Time℠

Access more options to pay over time for eligible purchases made on your participating Chase credit card. With Pay Over Time, you can break up eligible purchases you've already made, and, coming soon, at checkout when you shop online at Amazon.com.

REDEEMING IS EASY, TOO

Check out your rewards.

Sign in to the Chase Ultimate Rewards ® Portal to see how much you’ve earned and all the ways you can spend your rewards, including travel.

Redeem for cash

The purest form of cashbacking. Redeem for cash at any time, for any amount, and spend it however you like. It’s your money.

Pay with points

You can use your points to buy gift cards, shop with selected merchants, redeem for dining experiences, or apply them to your card statement.

WANT TO EARN MORE CASH BACK?

Keep up good habits for a year and we’ll automatically upgrade you to the Chase Freedom Unlimited card. With the upgrade, in addition to earning 1.5% cash back on every purchase, you’ll get 3% on dining and drugstores, and 5% on Chase Travel. Plus, the automatic upgrade is easy: Just make a purchase and all your minimum payments on time for your first year.

NOT THE RIGHT CARD FOR YOU? EXPLORE MORE WAYS TO CASHBACK

Freedom unlimited ®️.

Big rewards, ultimate simplicity

Earn big without having to think about it. Freedom Unlimited rewards you automatically with 1.5% cash back on every purchase, 5% on travel purchased through Chase, and 3% on dining, takeout, and drugstores. Redeem for any amount, any time, and use your rewards however you like.

Freedom Flex ®️

Bonus categories, bonus earnings

Freedom Flex lets you shop strategically for bigger rewards. Earn 1% on everything, plus 5% cash back on rotating quarterly bonus categories, 5% on travel, 3% on dining, and 3% on drugstore shopping. And Freedom Flex is easy to use—we’ll remind you when new bonus categories kick in, and once you activate, rewards are automatic.

FREQUENTLY ASKED QUESTIONS

Commonly asked questions about credit, answered for you!

What is a Credit Score?

A credit score is a number from 300 to 850 that tells banks how likely you are to pay your debts on time --the higher the number, the better. It's calculated based on factors like your payment history, amount of debt and the length of time you've held credit in your name.

Without a good credit score, life becomes more complicated. You can have trouble getting a credit card, renting an apartment and buying or leasing a car. Later on in life, it can get in the way of purchasing a home or making other big investments.

Who comes up with the credit score number? Most banks look at three credit bureaus: Equifax ® , Experian ® and TransUnion ® . If you're someone who's never had credit, your credit score is probably pretty low because the credit bureaus don't have any information on you yet. Or, you might not have any record of credit at all. Don't worry, this is normal when you're starting out.

How can you establish credit? One of the best ways is to get a card that's designed for people new to credit, like Freedom Rise ® . If you can't get a credit card on your own, you could ask one of your parents to be a cosigner or make you an authorized user on one of their cards.

Once you've established credit, make sure that you maintain a good credit score. You can keep an eye on it at chase.com/credit .

Improving Credit

A higher credit score lets banks know you're financially responsible. This makes it easier to get approved for a new credit card like Freedom Rise℠, which has no annual fee and lets you earn cash back.

When you're ready to make a big purchase, like a car or home, a good credit score means you'll have a better chance of getting a lower interest rate. The lower the interest rate, the lower your monthly payment.

There are a lot of ways you can improve your score, but here's where you should start.

- Always pay your bills on time. Your payment history is one of the most important factors in your credit score, so consider setting up automatic payments so you don't forget.

- Watch your credit utilization ratio, which is the amount of credit you're using compared to your total credit limit. Pay down any credit cards where you owe more than 30% of your limit. Also, be careful about canceling credit cards because that could reduce your score.

- Check your credit report regularly. Order a free copy of your credit report from each of the three credit bureaus (Equifax ® , Experian ® and TransUnion ® ) at chase.com/credit .

To make all this easier for you, Freedom Rise comes with tools that help you manage your credit—including Chase Credit Journey ® .

How to Apply for a Credit Card Online

If you’ve done your research and found a credit card that’s right for you, the next step is applying. But before you do, make sure you’ve really looked at all your options. Applying for a card is easier than ever, but it’s not quite as effortless as grabbing your phone and tapping a “gimme credit” button. There are a few steps you need to follow so that everything goes smoothly.

Check your credit history

First, make sure there are no credit issues that could get in your way. Order a free copy of your credit report from each of the three credit bureaus (Equifax ® , Experian ® and TransUnion ® ) at chase.com/credit . Banks look at these reports to make sure you’re someone who pays bills on time, doesn’t miss payments and doesn’t already have too many credit cards for your income. If you see a mistake, you can dispute it with the bureaus to get it removed. If the issue is legitimate, the bureaus can give you information on repairing your credit. You should know that if you're new to credit, the bureaus may not have information about you. Don't worry. This is normal for new applicants.

Make sure you’ve picked the right card

Don’t apply for a bunch of credit cards all at once because it will lower your credit score. Instead, choose one that really fits your needs. For example: Freedom Rise ® is a great first credit card. It has no annual fee and lets you earn cash back while you build your credit.

Gather all the information you’ll need

This will save time and prevent you from getting logged out while you run around looking for stuff.

- Your full legal name—the one that’s on your driver's license, passport or other legal documents

- Your Social Security Number (SSN) and/or Individual Taxpayer Identification Number (ITIN)

- Your mailing address where you want to receive your card and statements—this should match the address on your license, ID or other legal documents

- Your gross annual income—your salary before they take out taxes, plus any money you make from side hustles. This can even include funds you regularly receive from someone else, like money your parents give you to help with rent.

- Your employment status—full time, part time, freelance, etc. You may also need to provide your employer's phone number. Or if you are self-employed, a tax document like your federal or state returns.

- Your rent payment amount

- Your phone number—you might get a call for follow-up requests or questions

Before applying online, prevent your personal information from getting in the wrong hands by using a secured Wi-Fi network or your mobile data connection. Also, make sure both your web browser and OS are up to date.

Fill out the forms and apply

Most of the time, you’ll know if you’re approved right away, but sometimes it can take a few days. Once you’re approved, your card should arrive in about 7 to 10 days. When you get it, you’ll need to activate your account before you can start using it.

Remember: If you’re looking for a card that helps you build credit, plus gives you cash back on purchases, check out Freedom Rise.

How to Activate a Credit Card

If you don't activate your card, you won't be able to use it. Good news: It only takes a couple minutes.

Option 1: Give us a call

Look for a sticker on the card with a phone number. When you call, we'll ask a few questions to confirm your identity. Then, you'll be ready to go.

Option 2: Activate online

The sticker on your card also has a site you can visit. Like calling, you'll be asked a few questions to make sure it's really you and then your card will be ready to use immediately.

What happens if you don't activate?

You won't be able to use your card, but your account will still be open. So if you're really not planning on using the card, you might want to cancel it. Keep in mind, this could affect your credit score. If the card isn't right for you and you'd prefer one where you can earn cash back and pay no annual fee, check out the Chase Freedom Rise ® card.

Es posible que esta comunicación contenga información sobre ti y/o de tu cuenta. Si tienes alguna pregunta, por favor, llama al número de teléfono que está al reverso de tu tarjeta.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Student Loans

- Personal Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

The offers on this page are from advertisers who pay us. That may influence which products we write about, but it does not affect what we write about them. Here's an explanation of how we make money.

2024 Chase Freedom bonus categories: Get 5% back on Amazon, dining, and more this quarter

Cash-back fans who are willing to strategize their regular spending can get a big annual return from the Chase Freedom Flex® .

In fact, using last year’s rewards categories, we estimate that the average American can earn upwards of $400 cash back with this no-annual-fee card each year, based on consumer spending data from the Bureau of Labor Statistics . But for that, you’ll need to take full advantage of its quarterly bonus categories.

Right now, that includes 5% cash back on purchases at Amazon.com, hotels, and restaurants — as long as you activate by the June 14 deadline.

Here’s more about the Chase Freedom Flex card and how you can get the best value from rotating categories year-round.

In this article:

Chase Freedom Flex details

Freedom Flex bonus calendar

Chase Freedom category activation deadlines

How to maximize current Freedom Flex categories

Pair the Freedom Flex with another Chase card to supercharge your rewards

Annual fee: $0

Welcome offer: Earn $200 after spending $500 within the first three months of account opening

Intro APR: 0% introductory APR for 15 months on new purchases and balance transfers

5% cash back in rotating quarterly categories (up to $1,500 in combined purchases each quarter)

5% cash back on travel booked through Chase Travel

3% cash back on dining

3% cash back at drugstores

1% cash back on all other purchases

More details

To earn 5% on rotating quarterly categories, you must activate the bonus by the quarterly deadline. This card also includes three months of complimentary DashPass by DoorDash with automatic enrollment of nine more months at a 50% discount (activate by Dec. 31, 2024) and 5% cash back on Lyft rides through March 31, 2025.

Plus, get three months of complimentary Instacart+ membership (if activated by July 31, 2024) and earn $10 in quarterly statement credits for Instacart purchases through the same date. Freedom Flex also comes with select travel and purchase protections.

Chase Freedom Flex 5% cash-back calendar

Each quarter, you can earn 5% back in select bonus categories with your Chase Freedom Flex .

Chase only announces new categories shortly before a new quarter starts, so it can be difficult to plan your spending throughout the year. However, we’ve included last year’s full calendar of categories to help you get an idea of what types of categories may come later in the year since they often repeat.

The current categories are in bold:

Remember: For purchases to count toward the 5% bonus category, they must post to your account by the last day of the quarter. That means purchases you make toward a Q2 category on June 30 (the last day of the quarter) may not apply since they can take up to a few days to post as a charge on your statement.

To earn 5% cash-back rewards , you must activate the categories each quarter. These are the dates to keep in mind throughout the year so you never miss an activation:

Q1 January - March: Activate by March 14

Q2 April - June: Activate by June 14

Q3 July - September: Activate by Sept. 14

Q4 October - December: Activate by Dec. 14

While you don’t have to activate until close to the end of each quarter, it’s smart to check your account at the start. You can review the eligible categories for the months ahead and activate them.

If you do wait until the activation deadline, don’t worry. Your 5% rewards will still apply retroactively to qualifying purchases you’ve already made throughout the quarter.

How to activate

Activate the current bonus categories by logging into your Chase account online or through the mobile app. You can also activate in person at a Chase bank branch by calling the number on the back of your card or even while visiting a Chase ATM.

If you’re worried about forgetting quarterly deadlines, consider signing up for email reminders from Chase when it’s time to activate.

How to maximize the current Chase Freedom Flex categories

This quarter, the Chase Freedom Flex 5% categories include purchases at Amazon.com, hotels, and restaurants. Here are some details about each one to help make the most of your spending:

This category includes not only purchases you make online at Amazon.com, but also grocery purchases at Whole Foods. If you have an Amazon membership, now could be a great time to stock up on staples you often buy through the online retailer. And unless you already have a higher-earning grocery rewards credit card in your wallet, you may even want to use Whole Foods as your primary supermarket this quarter.

To get even more specific, everything from Amazon.com and marketplace purchases to Amazon Fresh orders, digital downloads through Amazon, in-store spending at Whole Foods and Whole Foods 365 locations, and WholeFoodsMarket.com purchases are eligible for 5% rewards.

Spending that does not apply includes purchases from international Amazon or Whole Foods sites, from merchants using Amazon Pay, and select other purchases. You also won’t earn 5% rewards when you buy Whole Foods groceries through third parties like Instacart or Shipt.

When you book a hotel stay directly with the hotel brand, you can earn 5% this quarter. This category doesn’t apply to hotels booked elsewhere, such as part of a broader vacation package or through a third-party booking site.

But that’s not all this category has to offer. Earn up to 9% cash back when you book hotel stays through Chase Travel by stacking your bonus rewards categories (base 1% plus 4% quarterly bonus on top of the standard 5% Chase Travel rewards). This applies to prepaid hotel stays you book through the Chase Travel site or by calling the number on your credit card (not including The Luxury Hotel & Resort Collection stays).

Restaurants

You can also stack rewards in this category for a total 7% cash back at restaurants this quarter (base 1% plus 4% quarterly bonus on top of the standard 3% on dining). The dining category includes purchases at any type of restaurant, from fast food or fast casual to fine dining.

There are some cases where your earnings will depend on how the merchant categorizes its purchases, typically for dining purchases outside of a standard restaurant setting. For example, buying food and drinks within a sports stadium or theme park, as well as takeout and delivery services, will only earn bonus rewards if they appear on your statement as a restaurant purchase.

While Chase Freedom Flex is a cash-back credit card , you can also use your rewards for travel redemptions through the Chase Ultimate Rewards portal. Even better, you can combine points with other top Chase credit cards under your same account to maximize your redemptions further.

Chase Sapphire Preferred

For a $95 annual fee, Chase Sapphire Preferred earns 3x points on dining, online grocery purchases (not including Walmart, Target, and wholesale clubs), and select streaming services, plus 2x points on non-Chase travel purchases and 1x points on all non-category purchases.

You can also earn up to $50 in annual statement credits for hotel stays purchased through Chase Travel and 5x points on Chase Travel spending (not including purchases that count toward the hotel credit). Perhaps best of all, you can get a 75,000-point welcome bonus after spending $4,000 within the first three months.

Though it does have some overlapping rewards categories, the Chase Sapphire Preferred makes a great pair with the Freedom Flex because of its 25% redemption boost.

When you redeem your Chase Freedom Flex rewards for travel through Chase, you’ll get 1 cent per point. But Chase Sapphire Preferred rewards are worth 1.25 cents per point when you redeem them through Chase Travel. With both cards in your wallet, you can maximize spending in eligible bonus categories, then pool your points and redeem them using your Sapphire Preferred for maximum redemption value.

There’s another travel perk to combining these cards, too. Sapphire Preferred cardholders have the option to transfer points to Chase’s 14 airline and hotel partners. If you want to transfer your Chase rewards to your United MileagePlus or Marriott Bonvoy account, for example, these cards can make a powerful pair.

Chase Sapphire Reserve

There are many comparable benefits of combining a Chase Sapphire Reserve with the Freedom Flex. But with a $550 annual fee , this option is likely best for frequent travelers looking to boost their travel rewards with cash-back earnings.

The Sapphire Reserve offers up to $300 in annual statement credits toward travel spending — after the credit is maxed out, you’ll earn 10x points on eligible hotels and car rentals through Chase Travel, 5x points on flights through Chase Travel, and 3x points on all other travel. Also earn 10x points on Chase Dining, 3x points on all other dining, and 1x points on all other purchases. The Reserve card has the same limited-time welcome bonus of 75,000 points after spending $4,000 within the first three months.

Learn more about the current Chase Sapphire welcome bonus offers here.

Sapphire Reserve points get a 50% boost when you redeem through Chase Travel — so when you pool your Freedom Flex rewards under your Chase Sapphire Reserve card, you can get up to 1.5 cents per point for travel. You can also transfer Sapphire Reserve points to Chase’s travel partners. With the extra travel benefits, combining these two cards can be a great way to ensure you get maximum travel value from your spending while still keeping the flexibility of rotating bonus categories.

Chase Freedom Unlimited

The Chase Freedom Unlimited is a no-annual-fee cash-back card that’s similar to the Freedom Flex. It earns the same 5% cash back on Chase Travel, plus 3% back on dining and at drugstores. But instead of 5% back in rotating quarterly categories, the Freedom Unlimited earns a flat 1.5% cash back on all other spending.

The Freedom Unlimited’s nontraditional welcome bonus offers a boosted rewards rate over the first year. Each rewards category is worth 1.5% more (on up to the first $20,000 in purchases in the first year) for a potential $300 extra cash back. In other words, you’ll earn 6.5% back on Chase Travel purchases, 4.5% back on dining and at drugstores, and 3% back on all other purchases over your first year until you reach the spending cap.

Learn more: Chase Freedom Unlimited vs. Freedom Flex

Both Freedom cards earn rewards that can be redeemed as points through Chase Travel, so you can pool your points for a bigger redemption. Unlike the Sapphire cards, though, you won’t get any boost on your rewards; they’re worth a standard 1 cent per point. You also can’t access Chase’s transfer partners with the Freedom Flex or Freedom Unlimited .

With the overlap in rewards categories and lack of added boost for redemptions, there’s probably fewer benefits to combining the two Freedom cards compared to a Freedom and Sapphire card pair. But if you like earning cash back and want to maximize quarterly categories while still earning a minimum 1.5% back, this could make a solid combination.

This article was edited by Alicia Hahn

Editorial Disclosure: The information in this article has not been reviewed or approved by any advertiser. The details on financial products, including card rates and fees, are accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information. This site doesn't include all currently available offers. Credit score alone does not guarantee or imply approval for any financial product.

How Chase Sapphire travel insurance saved my family over $1,500

Planning a dream vacation is always exciting. But no matter how carefully you plot out the details, sometimes life throws a wrench in the works.

Unfortunately, that's what happened on a recent trip that I took with my family earlier this year. Luckily, my Chase Sapphire Reserve® and its travel protections came to the rescue right when we needed them, saving us over $1,500 all told.

Here's what happened and how we were able to leverage my card's benefits to avoid losing a lot of money.

Planning our dream vacation ... then canceling it

In February, my husband, our son and I were all set for an incredible safari adventure. We were going to stay at the Retreats at Sayari in Tanzania, where lions, cheetahs and elephants are often spotted roaming freely around the area. After that, we planned to end the trip with a few days of relaxation at Mango House Seychelles, LXR Hotels and Resorts — a luxury hotel on the Seychelles' largest island , Mahe.

We had been planning our trip for months, figuring out the logistics and how to save the most money on such a grand journey. We booked our flights using my Chase Sapphire Reserve® card and redeemed some of our Ultimate Rewards points to reduce the cost of the trip.

Redeeming the points directly through Chase Travel℠ at a rate of 1.5 cents apiece completely covered the cost of our three tickets on a Kenya Airways hopper flight from Nairobi to the Seychelles.

We also transferred some of our leftover points to Qatar Airways Avios and used them to book a portion of our trip in the airline's luxurious business-class QSuites ; we paid the balance on the Chase Sapphire Reserve. Despite using points for part of the journey, the out-of-pocket expense was still several thousand dollars.

With everything squared away, we eagerly counted down the months and days until our trip. However, just one day before our departure, our son came down with the flu. Traveling with our sick child was out of the question, especially on a complicated itinerary like this, where we may not be able to seek medical care easily if we needed it.

So, with heavy hearts, we canceled the entire trip. While we managed to get our money and points back for the flights, the airlines hit us with cancellation fees. We had to pay $327 to Kenya Airways and $1,080 for two tickets on Qatar Airways, totaling just over $1,500 in fees. The third Qatar Airways ticket was booked on another card and it was fully refundable, so we didn't have to worry. Still, ouch.

Benefits of Chase Sapphire Reserve's travel insurance

Feeling the sting of those fees, I decided to explore the travel insurance benefits provided by my Chase Sapphire Reserve . This card offers a plethora of protections that many cardholders, myself included, often overlook. But they can come in handy for situations like mine, and that's exactly what they're intended for.

Here are some of the travel protections of the Chase Sapphire Reserve , specifically.

Trip cancellation and interruption insurance

This benefit covers up to $10,000 per person and $20,000 per trip for nonrefundable travel expenses if your trip is canceled or interrupted due to sickness, severe weather and other covered situations. As with any type of insurance, be sure to read the terms and conditions carefully to ensure that your trip and circumstances will be eligible.

Trip delay reimbursement

This covers expenses like meals and lodging if your travel is delayed more than six hours or requires an overnight stay for a covered reason.

Baggage delay insurance

This type of insurance reimburses you for essential purchases such as clothes or toiletries if your baggage is delayed more than six hours.

Lost luggage reimbursement

This protection will reimburse you up to $3,000 per person per covered trip if your luggage is lost or damaged. Note that certain items like electronics and jewelry are not covered.

Travel and emergency assistance services

This service provides legal and medical referrals or other travel assistance when you encounter problems away from home. This service does not cover the cost of these services, but you will have help finding them.

Emergency medical and dental benefit

This benefit reimburses travelers up to $2,500 for medical expenses if you or an immediate family member get sick or injured 100 miles or more from home.

My experience filing a Chase Sapphire travel insurance claim

After brushing up on these benefits, I figured my situation should be eligible for the card's trip interruption and cancellation benefit. I decided to file a claim for the $1,500 in airline cancellation fees.

Filing a trip interruption and cancellation claim with Chase was straightforward in my case, but it required patience, persistence and diligence (and we have had reports of issues dealing with Eclaims from readers in the past).

I used the online form available through the Eclaims Line website . The form asked for detailed information about our trip, including:

- The reason for the cancellation

- Our flight itineraries

- Medical records

- Receipts of expenses

- The airlines' cancellation clauses for our tickets

After submitting my initial claim, I had several back-and-forth calls and emails with Chase; the company requested additional documents and clarifications, such as written proof of the airlines' cancellation policies, documentation of the cancellation fees I had paid and more. While this part of the process was time-consuming, I knew it was important to be thorough and responsive to expedite the approval.

And just remember that there are time limits on when you can submit a claim. With Chase Sapphire Reserve's trip interruption and cancellation insurance, you have to contact Eclaims within 20 days of your trip cancellation to have the chance of being covered.

Finally, after a couple of months of providing the necessary documentation and answering follow-up questions, we received approval for our claim. In the meantime, we covered the cancellation fees by putting them on our Chase Sapphire Reserve.

I started the claim process around Feb. 15. In the first week of May, about 78 days later, $1,507 was directly deposited into our bank account. The relief was immense. Knowing that we had this safety net gave us peace of mind and softened the blow of our canceled trip.

Key takeaways for travelers

Here's what I learned from my experience using the Chase Sapphire Reserve's trip interruption and cancellation coverage and what other travelers should remember in case they ever need to invoke it.

Know your benefits

Familiarize yourself with your credit card's travel protections . Many premium credit cards , like the Chase Sapphire Reserve , come with robust insurance benefits that can save you significant money if things go wrong.

Keep documentation handy

When planning a trip, save all receipts, itineraries and correspondence. This will make filing a claim smoother and ensure you have all the documentation you're likely to need handy.

Be patient and persistent

The claims process can be lengthy and require multiple documentation submissions. Stay organized and respond promptly to any requests from the insurance provider.

Start your claim as soon as possible

If you encounter an issue that your card's travel insurance might cover, file a claim quickly. The potential savings can be substantial, and you don't want to lose out on any money by missing the claim submission time window.

Bottom line

While we were disappointed to miss our safari and Seychelles getaway, the silver lining was discovering just how valuable the Chase Sapphire Reserve's travel insurance can be. It saved us more than $1,500 and provided a safety net that turned a potentially major financial hit into a manageable situation.

So, next time you're booking a trip, consider the peace of mind that comes with knowing a reliable travel insurance policy protects you.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Best family travel credit cards of 2024, unlock award flights, hotel stays and airport lounge access with the top family travel credit cards..

Family travel is a rewarding but complicated endeavor, and every family member you add to the trip increases the cost. However, planning ahead and using the right travel credit card can save you money and make your trips more comfortable.

The best family travel credit cards earn valuable points, miles or cash-back and offer benefits like airport lounge access that the whole family can enjoy. Here are CNBC Select's top picks for families looking to upgrade their next vacation. (See our methodology for more information on how we choose the best travel credit cards for families.)

Best family travel credit cards

- Best for no annual fee: Wells Fargo Autograph℠ Card

- Best for domestic flights: Southwest Rapid Rewards® Priority Credit Card

- Best for lodging: Chase Sapphire Preferred® Card

- Best for airport lounge access: Capital One Venture X Rewards Credit Card (see rates and fees )

- Best for fair credit: Citi Double Cash® Card

Best for no annual fee

Wells fargo autograph℠ card.

Earn unlimited 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans. Plus earn 1X points on other purchases

Welcome bonus

Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

$0 annual fee

0% intro APR for 12 months from account opening on purchases

Regular APR

20.24%, 25.24%, or 29.99% variable APR

Balance transfer fee

Up to 5%, min: $5

Foreign transaction fee

Credit needed.

Excellent/Good

See rates and fees , terms apply.

- No annual fee

- Solid rewards on broad spending categories

- 0% intro APR offer

- Get up to $600 cell phone protection (subject to a $25 deductible)

- Valuable welcome offer

- Access to My Wells Fargo Deals to earn cash back in the form of an account credit when shopping, dining

- No balance transfer offer

Who's this for? The Wells Fargo Autograph℠ Card stands out for those seeking a no-annual-fee travel credit card as it has a long list of 3X bonus categories and earns transferrable points.

Standout benefits: The points earned with this card can be transferred to a growing list of airline and hotel partner programs, including British Airways Executive Club, Avianca LifeMiles and Air France/KLM Flying Blue. Having these various redemption options increases the value of your points as it allows you to take advantage of sweet spots with different programs.

[ Jump to more details ]

Best for domestic flights

Southwest rapid rewards® priority credit card.

Earn 3X points on Southwest® purchases, 2X points on local transit and commuting, including rideshare; 2X points on internet, cable, and phone services; select streaming. 1X points on all other purchases

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

21.49% - 28.49% variable

5%, minimum $5

Foreign transaction fees

Terms apply.

- Southwest upgraded boarding on up to 4 tickets per year

- 7,500 bonus points on each account anniversary

- $75 Southwest annual travel credit

- 4 upgraded boardings per year when available

- $149 annual fee

- No special financing offers

Who's this for? With free checked bags for all passengers and a family-friendly seating policy, Southwest is great for families, and the Southwest Rapid Rewards® Priority Credit Card can help you save on your trips.

Standout benefits: This card can help families earn the Southwest Companion Pass more easily as the points from its welcome bonus count toward the 135,000-point threshold. Cardholders also receive a 10,000-qualifying-point boost every calendar year. The Southwest Companion Pass is valuable for families as it allows you to bring along a guest on any Southwest flight for the cost of taxes and fees.

Best for lodging

Chase sapphire preferred® card.

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

21.49% - 28.49% variable on purchases and balance transfers

Either $5 or 5% of the amount of each transfer, whichever is greater

Read our Chase Sapphire Preferred® Card review .

- Points are worth 25% more when redeemed for travel via Chase Travel℠

- Transfer points to leading frequent travel programs at a 1:1 rate, including: IHG® Rewards Club, Marriott Bonvoy™ and World of Hyatt®

- Travel protections include: auto rental collision damage waiver, baggage delay insurance and trip delay reimbursement

- No fee charged on purchases made outside the U.S.

- $95 annual fee

- No introductory 0% APR

Who's this for? The Chase Sapphire Preferred® Card is an amazing all-around travel card, but can be especially valuable for booking your hotel stays and other lodgings.

Standout benefits: The points earned with this card can help you book everything from an Airbnb to a suite in a luxury hotel. At a minimum, Chase Ultimate® Rewards points are worth one cent for statement credits and gift cards. However, your points are automatically worth 25% more when redeemed through the Chase Travel SM portal and potentially more when transferred to one of Chase's airline or hotel partners.

Best for airport lounge access

Capital one venture x rewards credit card.

Unlimited 2X miles on all eligible purchases, and 5 Miles per dollar on flights and 10 Miles per dollar on hotels and rental cars when booked via Capital One Travel portal

Earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

19.99% - 29.99% variable APR

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Read our Capital One Venture X Rewards Credit Card review.

- Large welcome bonus

- No foreign transaction fees

- Up to $100 statement credits for either Global Entry or TSA PreCheck®

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- High annual fee

- No introductory 0% APR period

Who's this for? The Capital One Venture X Rewards Credit Card is great if you're looking for a premium credit card with easy-to-use benefits.

Standout benefits: This card offers generous airport lounge access, including unlimited access to Capital One Lounges , Priority Pass Lounges and Plaza Premium lounges. You can bring up to two guests to Capital One and Plaza Premium lounges and unlimited guests to Priority Pass Lounges. Better yet, airport lounge access benefits extend to authorized u sers on your card, and you can add up to four for no additional fee.

Best for fair credit

Citi double cash® card.

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

0% for the first 18 months on balance transfers; N/A for purchases

19.24% - 29.24% variable

For balance transfers completed within 4 months of account opening, an intro balance transfer fee of 3% of each transfer ($5 minimum) applies; after that, a balance transfer fee of 5% of each transfer ($5 minimum) applies

Fair/Good/Excellent

Read our Citi Double Cash® Card review.

- 2% cash back on all eligible purchases

- Simple cash-back program that doesn't require activation or spending caps

- One of the longest intro periods for balance transfers at 18 months

- 3% fee charged on purchases made outside the U.S.

- Estimated rewards earned after 1 year: $443

- Estimated rewards earned after 5 years: $2,213

Who's this for? The Citi Double Cash® Card is perfect for families with less-than-perfect credit who don't want to bother with a complicated rewards program.

Standout benefits: Most cash-back credit cards and rewards credit cards earn 1% back or 1X points on purchases that fall outside of special bonus categories. With the Citi Double Cash , you get double the return: 1% cash back when you buy and 1% cash back when you pay. Over time this adds up and there is no limit to how much cash back you can earn.

More on our top credit cards for family travel

The Wells Fargo Autograph℠ Card is a rare no-annual-fee card that earns transferrable travel rewards.

- 3X points at restaurants

- 3X points on travel

- 3X points on gas

- 3X points on transit

- 3X points on popular streaming services

- 3X points on phone plans

- 1X points on all other purchases

Earn 20,000 bonus points after spending $1,000 on purchases with the card in the first three months of account opening.

Notable perks

One of the best features of this card is its ability to transfer points to travel partners. You can transfer Wells Fargo rewards to these airline and hotel programs:

- Aer Lingus AerClub

- Air France/KLM Flying Blue

- Avianca LifeMiles

- British Airways Executive Club

- Iberia Plus

- Choice Hotels

If you prefer simplicity, you can still redeem your points for one cent each for statement credits, gift cards and travel booked through the Wells Fargo rewards site.

When you pay your monthly phone bill with the card, you'll not only earn 3X points but also qualify for cell phone protection . This coverage will reimburse you for up to $600 per claim with a $25 deductible (up to two claims per 12 months). It also has no foreign transaction fee, roadside dispatch, travel and emergency assistance and rental car collision coverage (secondary in the U.S.).

New cardholders also receive an intro 0% APR on purchases for the first 12 months, then a variable 20.24%, 25.24% or 29.99% applies.

[ Return to card summary ]

The Southwest Rapid Rewards® Priority Credit Card is a family-friendly airline card with more than enough benefits to justify its annual fee.

- 3X points on Southwest purchases

- 2X points on hotel and rental cars booked through Southwest

- 2X points on local transit

- 2X points on internet, cable and phone services

Earn 50,000 bonus points after spending $1,000 on purchases in the first three months of account opening.

The points you earn from this card's welcome offer and spending on the card can help you earn a Southwest Companion Pass. On top of that, you also receive a 10,000-qualifying-point boost every calendar year. Anyone pursuing Southwest elite status will appreciate the opportunity to earn 1,500 tier qualifying points (TQPs) for every $5,000 you spend annually with no cap on the number of TQPs you can earn.

Every year, you'll receive two benefits that can offset the annual fee alone: A $75 Southwest travel credit and 7,500 bonus points. Experts value Southwest points at around 1.3 cents per point , which makes the annual bonus points worth roughly $97.50 in Southwest flights.

Every Southwest ticket comes with two free checked bags , no cancellation fees and no change fees, and with this card, you'll get reimbursed for up to four upgraded boardings per year. Southwest doesn't have assigned seats, so upgraded boarding becomes more valuable, especially for families that need to sit together. If you don't want to pack snacks for the trip, you'll receive 25% back on inflight purchases when you use this card.

The Chase Sapphire Preferred® Card is a popular travel rewards card with useful benefits and a lucrative welcome bonus, all for an annual fee under $100 .

- 5X points per dollar on travel purchased through Chase Travel℠

- 5X points per dollar on Lyft rides through Mar. 31, 2025

- 5X points on Peloton equipment and accessory purchases over $150 (through March 31, 2025; max of 25,000 total points)

- 3X points per dollar on dining

- 3X points per dollar on online grocery purchases (excluding Target, Walmart and wholesale clubs).

- 3X points per dollar on select streaming services

- 2X points per dollar on all other travel purchases

- 1X points per dollar on all other purchases

Earn 60,000 bonus points after spending $4,000 on purchases in the first three months from account opening.

The Chase Sapphire Preferred comes with many valuable protections, including primary rental car insurance , trip cancellation and interruption insurance, purchase protection , extended warranty protection and baggage and trip delay insurance. On top of that, you pay no foreign transaction fee and for every card anniversary you'll receive a 10% points bonus based on how many points you earned the previous year.

You'll also have access to several statement credits, including up to $50 hotel credit for bookings you make through Chase's travel site. Cardholders can also register to receive six months of free Instacart+ membership (activate by July 31, 2024) and up to $15 back each quarter for Instacart purchases (through July 2024). You can also enroll to receive a complimentary DashPass membership for a minimum of one year when you activate by December 31, 2024.

Perhaps the best feature of this card is that it unlocks the ability to transfer Chase Ultimate Rewards points to 14 airline and hotel partners. Chase has a long list of valuable partners including United MileagePlus, Southwest Rapid Rewards, Air Canada Aeroplan, World of Hyatt Hyatt and more. You'll also receive a 25% bonus when you pay for travel you book through the Ultimate Rewards site, which means you'll get a value of 1.25 cents per point. Occasionally, Chase offers discounts on gift card redemptions and you may be able to pick up Airbnb gift cards for 1.1 cents per point.

The Capital One Venture X Rewards Credit Card is a top-rated travel credit card offering premium perks for a significantly lower annual fee than luxury cards with similar benefits.

- 10X miles per dollar on hotels and rental cars booked via Capital One Travel portal

- 5X miles per dollar on flights booked via the Capital One Travel portal

- 2X miles on all other eligible purchases