How to claim Ontario's staycation tax credit on your tax return

People in Ontario who vacationed in the province last year can claim the trip on their upcoming tax returns, and here’s how to do it.

Introduced as a temporary, refundable personal income tax credit for 2022 , the Ontario Staycation Tax Credit can be used by families and individuals who went on a leisurely trip somewhere within the province.

Through this credit, Ontarians can claim 20 per cent of their eligible accommodation expenses between Jan. 1 and Dec. 31, 2022.

“If you travelled for work, that wouldn’t count,” H&R Block tax specialist, Yannick Lemay, previously told CTV News Toronto. “We are excluding costs for food, entertainment, gas, and all extra expenses, but anything that goes for accommodation for travel, you can claim.”

Those who are looking to apply for this credit should have the receipts from their accommodation stays, Lemay noted.

“It’s up to $1,000 [for an individual], and it’s a 20 per cent rate credit, so that means Ontarians can get up to $200 back.”

Families and couples can claim up to $2,000 and get a maximum credit of $400.

HOW CAN I CLAIM THE STAYCATION TAX CREDIT?

When it's time to file your Income Tax and Benefit Return for last year, keep your eyes peeled for form ON479 , which lists all of the refundable tax credits Ontarians can specifically claim.

"Many Ontario credits are calculated on this form, and then the total of credits calculated on this form goes onto the T1 returns on your federal tax return. It goes on line 47900," Lemay told CTV News Toronto Friday.

Ontario’s staycation tax credit can be found underneath the Ontario childcare access and relief from expenses (CARE) tax credit.

SO WHAT ELIGIBLE EXPENSES CAN I CLAIM?

Ontarians who stayed at a short-term accommodation for less than a month in province can claim the expenses through the credit – so long as it is a hotel, motel, resort, lodge, bed-and-breakfast, cottage, campground or vacation rental property.

The accommodation must have either been paid by you, or your spouse, partner, or eligible child.

All of the receipts from the eligible expenses must have the location, the date of stay, the name of who purchased the accommodations, and the cost. It should also have the amount of taxes you paid on the stay.

If all these conditions are met, Ontarians can claim the accommodation of one trip or multiple trips, and can be expensed up to $1,000 as an individual or $2,000 as a family.

WHAT CAN’T I CLAIM?

Vacations on boats, trains, or “other vehicles that can be self-propelled,” the province says , aren’t included with the tax credit. Timeshare agreements are also generally not included.

As for travel expenses, Ontarians cannot claim car rentals, fuel, flights, groceries, parking, or tickets purchased to visit location attractions. If the trip was also for school or work, it also cannot be claimed through the staycation tax credit.

Lastly, if the expenses were reimbursed – either by a friend or an employer – the stay cannot be claimed.

May 1 is the deadline for most Canadians to file their tax returns, with June 15 being the deadline for those who are self-employed.

Toronto Top Stories

Feds refuse Toronto's request to decriminalize simple drug possession

Toronto eliminated from PWHL playoffs

Longtime Toronto city councillor Jaye Robinson has died, her office says

Craig Berube named as next head coach of Toronto Maple Leafs

Rays' Tyler Alexander comes within 5 outs of perfect game against Blue Jays

Tampa Bay pitcher Tyler Alexander stellar in 4-3 win over Toronto Blue Jays

Feds offer clarity on rent ruling after Ontario Housing Minister, MPP raise concerns

Toronto police investigating second vandalism incident at north-end synagogue

Ctvnews.ca top stories.

Serial sexual offender linked to unsolved 1970s homicides of four Calgary girls, women

An investigation into unsolved historical homicides from the 1970s has linked the deaths of two girls and two young women in and around Calgary to a now-deceased serial offender.

Woman with liver failure rejected for a transplant after medical review highlights alcohol use

For nearly three months, Amanda Huska has been in an Ontario hospital, part of it on life support, because of severe liver failure. Her history of alcohol use is getting in the way of her only potential treatment: a liver transplant.

$500K-worth of elvers seized at Toronto airport

Fishery and border service officers seized more than 100 kilograms of unauthorized elvers at the Toronto Pearson International Airport on Wednesday.

Toronto has been eliminated from the PWHL playoffs.

Information commissioner faces $700K funding shortfall, says system is 'overwhelmed'

Canada's information commissioner says her office is facing a $700,000 funding shortfall that could impact its ability to investigate complaints about government transparency and accountability.

B.C. man 'attacked suddenly' by adult grizzly near Alberta boundary: RCMP

A B.C. man is recovering from multiple injuries after he was "attacked suddenly" by an adult grizzly bear near Elkford Thursday afternoon.

Backlash over NFL player Harrison Butker's commencement speech has reached a new level

The NFL is distancing itself from controversial comments by Kansas City Chiefs kicker Harrison Butker during a recent commencement address.

Dabney Coleman, actor who specialized in curmudgeons, dies at 92

Dabney Coleman, the mustachioed character actor who specialized in smarmy villains like the chauvinist boss in '9 to 5' and the nasty TV director in 'Tootsie,' has died. He was 92.

The Toronto Maple Leafs have named Craig Berube as their new head coach.

Shopping Trends

The Shopping Trends team is independent of the journalists at CTV News. We may earn a commission when you use our links to shop. Read about us.

Editor's Picks

13 blackout curtains for anyone who needs complete darkness to fall asleep, 17 backyard decor and furniture pieces you need before summer arrives, 20 affordable amazon beauty and skincare products you'll probably repurchase over and over again, 18 budget-friendly products that are bound to come in handy, 17 useful amazon products that deserve to be in your home, 15 of the best towels you can get online, 15 unique father's day gifts they're guaranteed to love, 18 brilliant birthday gifts for the person on your list who is impossible to shop for, 15 birthday gifts that prove good things come in small packages, i tried 7 of the most popular eye creams on amazon canada, and here are my thoughts, our guide to the best beard trimmers in canada in 2024 (and where to get them), 13 inexpensive beauty products that feel luxurious, health & fitness, 12 of the best pickleball sets you can get online right now, our guide to the best bike trailers in canada in 2024 (and where to get them), if you're training for your first marathon, here are the pairs of shoes seasoned runners swear by.

2 men plead guilty in Leonardo Rizzuto attempted murder

Two men pleaded guilty to the 2023 attempted murder of Leonardo Rizzuto, the youngest son of the late reputed Mafia boss Vito Rizzuto.

Quebec cyclist group seeking government funding for new safety campaign

A group promoting the benefits of cycling wants to raise awareness among bike enthusiasts and is taking its message straight to the bike paths, but says it needs funding from the Ministry of Transport.

McGill University to seek second injunction to remove pro-Palestinian encampment

McGill University is not done seeking legal action to remove the pro-Palestinian encampment on its campus, as it said on Friday that it would seek a second injunction to remove protesters from its property.

Evidence of corrosion and concrete delamination in St. Laurent O-Train tunnel: Amilcar

Trains are temporarily skipping the St. Laurent Station along the O-Train line on Friday while crews conduct inspections on the ceiling tiles.

Business owners cast doubts on their future in Ottawa's ByWard Market, Rideau Street, poll shows

More than half of business owners in Ottawa's ByWard Market and on Rideau Street say they are not planning to extend their leases or are uncertain about their future in the popular tourist area.

Workload concerns could prompt call for more bylaw officers in Ottawa

Ottawa's bylaw officers are busy. That's according to data presented this week to the city's Emergency Preparedness and Protective Services Committee.

Northern Ontario

Northern Ont. man jailed 10 days for fishing violations

A Sault Ste. Marie man has been jailed for 10 days for failing to comply with a court order banning him from fishing.

Stumbling impaired driver in the Sault was on wrong side of the road, crashed into a house

A 29-year-old suspect in Sault Ste. Marie has been charged after police received reports this week of an extremely intoxicated person getting into a vehicle.

Impaired driver sentenced to 7 years after double-fatal Cambridge crash

A man who killed two people in a drunk driving crash was sentenced Friday to seven years behind bars.

Remembering the ‘perfect storm’ that was 1974 Cambridge flood

The Grand River burst its banks on May 17, 1974 and water spilled onto several city streets - a day Cambridge, and residents, will never forget.

New tech tool used in search for missing Kitchener man

Waterloo regional police used a new tech tool as part of their search for a missing elderly man this week.

London mother sentenced in stabbing death of former Helix guitarist

A London, Ont. mother of five was sentenced to seven years in prison Friday for her part in the stabbing death of Daniel Fawcett, the ex-guitarist for the rock band Helix.

OPP issue warning over 'senior assassin' game involving water guns

Police in Oxford County are warning the public after several recent weapons calls related to a trendy new game popular with teens.

Assault suspect in custody, police believe there may be additional victims

A London man is facing multiple charges after allegedly obtaining sexual services and assaulting a woman earlier this year in a south end hotel room. Police believe there could be additional victims, and have released a photo and name of the accused.

'They're beautiful vessels and we're lucky to have them here': Cruise ship season sailing into Windsor-Essex

The 2024 Great Lakes cruising season in Windsor-Essex is shaping up to be busy, with 30 cruise ships and luxury liners scheduled to dock in Windsor and Leamington.

Two drivers charged after one vehicle passes the other over 150 km/h

Chatham-Kent police have charged two drivers after one passed the other going over 150 kilometres per hour.

Windsor Regional Hospital CEO David Musyj heading to LHSC

Windsor Regional Hospital president and CEO David Musyj is leaving his position in Windsor and heading to London.

City of Barrie highlights bylaws, asking residents to 'be a good neighbour'

The City of Barrie is reminding residents about the importance of adhering to municipal bylaws and the potential repercussions of non-compliance, asking everyone to "be a good neighbour."

'You ruined my childhood,' Innisfil child predator hears from survivors at sentencing hearing

An Innisfil man guilty of sex crimes involving young girls was back in court on Friday as his sentencing hearing got underway with emotional victim impact statements.

Township's photo radar cameras generate over $333,000 in fines in 3 months

Speed cameras in Essa Township have collected a hefty fee since they were first installed three months ago.

UPDATED | Bomb unit removes 'volatile substance' from Winnipeg hospital research centre

The Winnipeg police bomb unit removed a 'volatile substance' from a Winnipeg hospital research centre Friday afternoon, prompting an evacuation.

Cleanup, damage assessment underway after Winnipeg thunderstorm and hail

Winnipeggers were left surveying the damage and cleaning up after a thunderstorm rolled through the city Thursday afternoon.

Southern Manitoba under severe thunderstorm watch

Less than a day after a thunderstorm rolled through Manitoba, bringing hail, heavy winds, and a tornado warning, Environment and Climate Change Canada (ECCC) say a severe thunderstorm is possible on Friday.

Campers issued ticket after Halifax firefighters forced to extinguish fire in Stillwater Lake, N.S.

Two campers have been issued a ticket after Halifax firefighters had to extinguish a fire in Stillwater Lake, N.S., Friday.

Laura Lee Langley named new president of the Atlantic Canada Opportunities Agency

A former high-profile Nova Scotia civil servant has been appointed as head of a well-known federal agency.

Guilty on all charges: Colin Tweedie convicted in hit-and-run death of 10-year-old Cape Breton girl

A judge has found Colin Tweedie guilty on three counts in connection to the death of 10-year-old Talia Forrest on a Cape Breton road on July 11, 2019.

The latest advice for expecting parents? Sign up for child care as soon as you're pregnant

Canada's new $10-a-day child care program is expanding, but there's growing evidence that demand for the program is rising even faster, leaving many parents on the outside looking in.

Study says aquaculture likely driving wild salmon extinction in Newfoundland

A new study shows an Atlantic salmon population in southern Newfoundland is disappearing, and it says nearby aquaculture operations are a likely contributor to the decline.

'Irate male' assaulted Newfoundland officers with block of cheese, police say

Police in Newfoundland say patrol officers were assaulted Thursday by a "very irate male" wielding a block of cheese.

Police searching for black Ford Fusion after road rage incident in Edmonton

Police are looking for three people after a road rage incident in south Edmonton on Friday morning.

Oilers focus on Saturday's game, try to ignore prospect of elimination from playoffs

They're on the verge of being eliminated, but there's only one thing the Edmonton Oilers can do, says their coach: Remain focused.

Alberta Medical Association sounds alarm over lack of available oncologists

The Alberta Medical Association is expressing deep concerns to the provincial government over a lack of oncologists needed to provide cancer care to keep up with population growth.

Pride societies rally against UCP policy proposal for International Day Against Homophobia, Biphobia and Transphobia

Friday was the International Day Against Homophobia, Biphobia and Transphobia and several dozen supporters gathered at a rally in Calgary’s Beltline community to raise awareness of rights and violations.

Sask. Teachers' Federation recommending tentative deal with province to its members

The Saskatchewan Teachers' Federation (STF) and province announced that a tentative agreement had been reached on Friday afternoon, with the STF recommending and endorsing the potential deal to teachers.

'Unequivocally false': Sask. premier says of legislative Speakers' claims of harassment, intimidation

Saskatchewan Premier Scott Moe says claims of intimidation and harassment by legislative Speaker Randy Weekes are 'unequivocally false.'

WEATHER | Windy start to long weekend expected, sun and showers possible

A look at what to expect weather wise in Regina this May long weekend.

Sask. doctor says physicians aren’t being paid correctly under province’s new billing system

A Saskatoon family doctor says the province’s new billing system is a disaster.

'The car was half inside my children's room': Car crashes into Saskatoon apartment building

Firefighters responded to a scene on the 300 Block of Herold Road Friday morning after a car collided with an apartment building.

'Horrible, disastrous consequences': Residents call on government to fix dangerous Metro Vancouver intersection

Two similar crashes involving dump trucks happened in the same New Westminster Intersection in less than a week.

B.C. study tracks breaths of killer whales using stunning drone video

The use of drones has helped researchers track the breathing patterns of killer whales off B.C.'s coast, and the videos offer a stunning glimpse of the majestic creatures diving and surfacing.

Canucks prepare for potential series-clinching Game 6 in Edmonton

The Vancouver Canucks are getting ready for Saturday's potential series clinching Game 6 in Edmonton, following Thursday's blood-pumping late 3-2 win over the Oilers.

Vancouver Island

Police remain tight-lipped one year after crash killed municipal worker near Victoria

One year after an allegedly reckless driver careened into a municipal park east of Victoria, killing a 52-year-old husband and father of two young children, there are few answers about what led to the crash and no criminal charges have been forwarded to prosecutors.

'Unconscionable': B.C. mayor warns against sharing videos of properties destroyed by fire

The mayor of a northeast British Columbia community threatened by wildfires is warning people who stayed behind in the evacuation zone to stay on their properties and not share images of fire destruction on social media.

Stay Connected

Meal expenses can be deducted if your employer requires you to be away for at least 12 consecutive hours from the municipality/metropolitan area of your employer's location where you normally report for work.

Expenses of Railway Employees

Income tax act s. 8(1)(e).

The cost of meals and lodging, for which you have not been reimbursed, and are not entitled to be reimbursed, can be claimed if you meet one of the following two conditions:

How to Claim the Meals and Lodging Expenses

These expenses are claimed on the Canada Revenue Agency (CRA) form TL2 Claim for Meals and Lodging Expenses .

The meals and lodging costs will include GST/HST and any provincial retail sales tax paid. You may be eligible for a refund of the GST/HST included in the costs. See Employee and Partner GST/HST rebate on the GST/HST page.

Line 22900 (line 229 prior to 2019) employment expenses can be entered in the "other deductions" line of the Detailed Canadian Tax and RRSP Savings Calculator .

Canada Revenue Agency (CRA) Resources

Revised: March 22, 2024

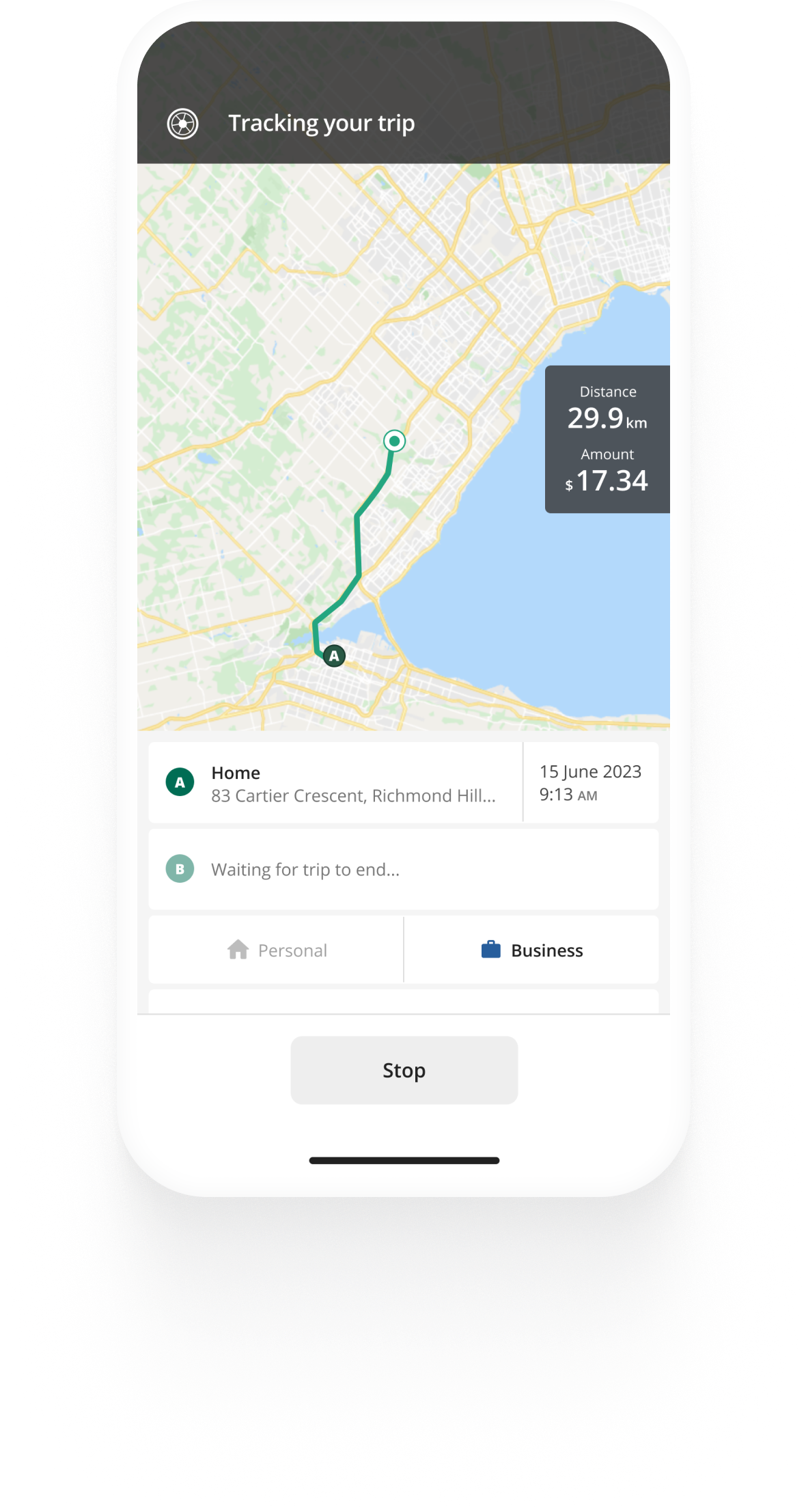

Track mileage automatically

Medical travel in canada, in this article, cra rules on medical travel, medical travel if you travel more than 40 kilometres, medical travel over 80 kilometres in canada and abroad, cra medical travel rates 2023, medical travel rates 2022.

If you need to receive medical care, you may be able to deduct medical travel expenses for your medical mileage. The deductions can represent a big chunk of savings that you can claim at tax time. Here’s an overview of the rules for claiming medical travel from the CRA.

Firstly, you will need proof that you attended the medical service you needed. You can provide receipts for the services you’ve received or a document or letter signed by the provider of the medical service.

You cannot claim medical travel expenses if you travelled less than 40 kilometres in one direction to receive medical attention.

If you travelled more than 40, but less than 80 kilometres one way, you will be able to claim medical travel, and if you travelled more than 80 kilometres, you will be able to claim mileage, as well as accommodation, meal and parking costs.

You will also be able to claim travel expenses if you had to receive medical care outside of Canada.

If a medical practitioner certifies that you needed to be accompanied to receive medical attention, you will be able to claim the expenses of the attendant.

You will only be able to claim medical expenses for which you have not, and will not be reimbursed. If medical reimbursement has been included in your income (ergo, it will be taxed) you will be able to claim your medical travel expenses.

Track business driving with ease

Trusted by millions of drivers

You will be able to claim medical travel from the CRA such as bus, train and taxi fares, and vehicle mileage (if public transportation is not readily available) if you meet the following conditions:

- You were not able to receive the needed medical care near your home

- You took a reasonable and direct route

- It was reasonable for you to travel to a farther destination in order to receive medical attention.

You can claim medical mileage from the CRA by the detailed or simplified method.

If you use the detailed method, you need to keep all receipts of your medical travel expenses in order to claim them. You are able to deduct all qualified public transport fares, and if you travel with your vehicle - all costs of operating and owning it. These include fuel, oil, insurance, maintenance, depreciation and more.

With the simplified method, you will be able to claim a flat medical mileage rate and you won’t need to keep detailed records. However, the CRA may still ask you to provide documentation to support your medical mileage claim, so we recommend keeping a logbook of your medical travel.

If you need to travel more than 80 kilometres in order to receive medical care, you will be able to claim medical expenses such as bus, train and taxi fares, vehicle mileage (if public transportation is not readily available), meals, parking and accommodation if you meet the following conditions:

Again, you can claim medical travel and other expenses by the detailed or simplified method.

The detailed method of claiming medical travel and other expenses requires you to keep all receipts of your accrued expenses, such as for travel, parking (if applicable), meals and accommodation.

The simplified method lets you use a medical mileage rate and a per-meal rate for your expenses. Keep receipts of your accommodation costs, as there are no flat rates. While you don’t need to keep detailed receipts for medical travel and meals, the CRA may ask for documentation to support your mileage expenses claim.

If you claim medical travel with the flat per-kilometre medical rate, note that there are different rates for each Canadian territory.

Use the medical travel rates above to claim your medical travel expenses for 2023.

Are you claiming work-related mileage besides medical travel expenses? See our CRA mileage guide for all the rules on mileage reimbursement and deductions in Canada.

How to automate your mileage logbook

Latest posts

Luxury tax in canada.

- How To Make Car Lease Payments Tax Deductible

- CRA Moving Expenses

Automate your logbook

Related posts, per diem allowance.

In Canada, Per diem often refers to a meal or travel allowance. The CRA doesn’t set fixed rates, so what is a fair rate, and what about tax?

CRA Mileage Rate 2024

The CRA announces 2024 rates for vehicle allowance: From January 1st, 2024, per kilometre rates will increase 2 cents over 2023.

High-end vehicles are subject to luxury tax when they are imported, sold, leased etc. Learn how to calculate it in different scenarios.

Choose your Country or region

How to claim CRA medical travel expenses for 2023

The costs involved with traveling to receive medical attention can be significant when you factor in accommodation, meals, and related expenses.

Find out how to claim your CRA medical travel expenses.

IMPORTANT: All claims related to Medical Travel require documentation provided by the practitioner confirming your attendance (whether this be a receipt for services, or a letter signed by your service provider).

Claiming Mileage

There are two ways to claim transportation costs as a CRA travel medical expense but you have to travel at least 40 kilometers one way to obtain medical service that were not available locally.

Example: for trips to and from the hospital, clinic, or doctor’s office.

Record the distance of travel, calculate your mileage according to the province in which you reside. (2021 rates):

Example: 55¢ x 160km = $88.00; you may claim $88.00 as an eligible medical expense.

Vehicle expenses may be claimed as CRA medical travel expenses by submitting gas receipts for the date(s) of travel/service.

Claiming Meals, Accommodations and Parking

In addition to the transportation costs above, you may claim reasonable expenses during your trip for medical attention provided that you had to travel more than 80 kilometers to attend your appointment. The travel costs of one accompanying individual are also allowable, if it is deemed necessary to have a companion.

Meals can be claimed one of two ways: 1. Meal receipts can be submitted for reasonable costs for the patient and one attendant (alcoholic beverages will not be reimbursed) OR 2. A flat rate of $23 per meal may be claimed for the patient and one attendant up to a maximum of $69 per day per person.

Accommodations

Receipts must be enclosed for any reasonable accommodation fees that are being claimed (ie: hotel receipt). Coverage applies to the accommodations ONLY; telephone, movie charges and the like are not eligible for reimbursement.

Receipts must be enclosed for any parking lot fees incurred. Please refer to the CRA medical travel expenses website for further details

A farmer lives in rural Alberta. There is not much in the way of medical services, vision care, or therapeutic care, such as physiotherapy, available in this small town. Consequently, most treatment modalities require travelling to a center that has the appropriate medical facilities. The closest center is 44 kilometers from their home.

On a recent trip, they had chiropractic services performed and managed to visit the dentist for a check-up and teeth cleaning. They were eligible to be reimbursed for the cost of the travel between their home and where the services took place.

In Alberta, that amounts to 53 cents a kilometer – so they were also able to claim $46.64 for travel expenses (there and back). An alternative is to submit gas receipts for the dates of travel service.

On occasion, the same farmer requires a medical service that was only available on a timely basis in a major medical facility in the USA. This service was available in Canada but the wait time was over six months and the inconvenience to our customer as a result of their condition necessitated a faster remedy. They chose the US destination for the service.

As the travel distance now exceeded 80 Kilometers, in addition to the travel costs (economy class air fare), our customer can claim reimbursement for meals, accommodations, parking as well as the costs associated with a companion travelling with the patient if deemed necessary. An eligible travel expense claim of this magnitude represents a significant savings.

How to write off 100% your medical expenses

Are you an incorporated business owner with no arm's length employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with arm's length employees? Discover a tax deductible health and dental plan that has no premiums:

Write off 100% of your medical expenses

Are you an incorporated business owner with no employees? Learn how to use a Health Spending Account to pay for your medical expenses through your corporation:

Do you own a corporation with employees? Discover a tax deductible health and dental plan that has no premiums:

What's in this article

Subscribe to the blog

Discover more.

What is a health care spending account?

Health care spending accounts help business owners save on medical costs by turning after-tax...

By Alden Hui on December 8, 2020

What's covered in a Health Spending Account?

One of the great benefits of a Health Spending Account is the freedom it provides through an ...

By Alden Hui on October 15, 2019

7 Key Health Spending Account Rules that you should know

A Health Spending Account (HSA) is a tax-free benefit which allows small business owners and their...

By Alden Hui on April 25, 2019

This website stores cookies on your computer. To find out more about the cookies we use, see our Privacy Policy .

High Contrast

- Asia Pacific

- Latin America

- North America

- Afghanistan

- Bosnia and Herzegovina

- Cayman Islands

- Channel Islands

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Hong Kong SAR, China

- Ireland (Republic of)

- Ivory Coast

- Macedonia (Republic of North)

- Netherlands

- New Zealand

- Philippines

- Puerto Rico

- Sao Tome & Principe

- Saudi Arabia

- South Africa

- Switzerland

- United Kingdom

- AI, analytics and cloud services

- Audit and assurance

- Business strategy and operations

- Business tax

- Family office

- Financial management

- Global business services

- Managed services and outsourcing

- Mergers and acquisitions

- Private client services

- Restructuring and recovery

- Risk, fraud and cybersecurity

- See all services and capabilities

Strategic technology alliances

- Sage Intacct

- Budget commentary

- Middle market economics

- Supply chain

- The Real Economy

- The Real Economy Blog

- Construction

- Consumer goods

- Financial services

- Food and beverage

- Government and public sector

- Life sciences

- Manufacturing

- Private equity

- Professional services

- Real estate

- Restaurants

- Technology companies

- Financial reporting resources

- Tax regulatory resources

Featured technologies

Platform user insights and resources.

- RSM Technology Blog

- Diversity and inclusion

- Environmental, social, and governance

- Middle market focus

- Our global approach

- RSM alumni connection

- RSM Canada Alliance

- RSM Classic experience

Experience RSM

- Your career at RSM

- Student opportunities

- Experienced professionals

- Executive careers

- Life at RSM

- Rewards and benefits

Spotlight on culture

Work with us.

- Careers in assurance

- Careers in consulting

- Careers in operations

- Careers in tax

- Apply for open roles

Popular Searches

Asset Management

Health Care

Partnersite

Your Recently Viewed Pages

Lorem ipsum

Dolor sit amet

Consectetur adipising

Reimbursements and allowances for remote workers’ travel expenses

This content was originally published in the Canadian Tax Foundations newsletter: Canadian Tax Focus. Republished with permission.

Travel between an employee’s residence and a regular place of employment (RPE) has long been considered by the Canada Revenue Agency (CRA) to be personal travel and not part of the employee’s office or employment duties; therefore, any reimbursement or allowance relating to this travel is a taxable benefit. Conversely, where travel relating to a location other than an RPE is involved, such payments are non-taxable.

But what is an RPE in this era of remote work? A recent technical interpretation provides that a location used for a one-time, multi-day training session for remote workers is not an RPE for those workers (CRA document no. 2022-0936671I7, June 30, 2022); the CRA therefore concludes that the reimbursements and allowances for travelling there are generally non-taxable. However, the CRA notes one exception: allowances for meals (and presumably lodging) are non-taxable only if the rules for a special work site apply.

The CRA generally comments that whether a location is an RPE is a question of fact. CRA document no. 2012-0432671E5 (August 13, 2012) observes that a location could be an RPE even if the employee works there only once or twice a month, but the location might not be an RPE if the employee works there only once or for a few days during the year. In contrast, CRA document no. 2016-0643631E5 (August 17, 2020) declines to offer an opinion on a situation where an employee works at two different locations on alternating weeks. The 2022 technical interpretation takes more definitive positions, which are favourable to the employee.

The 2022 technical interpretation concerns an employer’s plans to hire new employees who reside far from the employer’s offices. The employees may work from home or designate one of the employer’s offices as their place of work, without requiring regular attendance or reserving an onsite workspace. The employer will also provide the necessary equipment for remote work. In addition, the employees will be required to attend a single three-day event during their employment contract for training and team-building activities. For employees who are required to attend, the employer will reimburse reasonable accommodation and transportation costs (bus, train) or provide a per-kilometre motor vehicle allowance. A meal allowance will also be provided.

The CRA concludes that the work location designated in the employment contract is not considered to be an RPE for the new employees. Therefore, reimbursements of travel expenses do not need to be included in their income under paragraph 6(1)(a). Also, reasonable per-kilometre allowances received by employees for the use of their motor vehicle for travel in the course of performing their duties will not be included in their income by virtue of subparagraph 6(1)(b)(vii.1).

The CRA notes that the situation for meal allowances is different. The exemption in subparagraph 6(1)(b)(vii) for reasonable allowances for travel expenses that are not for the use of a motor vehicle requires that the employee be travelling away from the municipality where the employer’s establishment is located. Since the employee’s home is not such an establishment, this condition is not satisfied. However, the CRA notes that the meal allowance could be non-taxable by virtue of subsection 6(6)—special work site. The CRA agrees that the work to be performed (that is, training and team-building activities) is considered temporary in nature and required as part of the employee’s duties. As such, the amounts paid for travel will not be required to be included in their income if all other conditions of the subsection are met. In particular, the employee must be away from home or at the special work site for at least 36 hours and cannot be expected to return home daily from the special work site because of the distance involved.

Similar reasoning would presumably apply to allowances for lodging expenses, although this issue was not discussed.

RSM contributors

Get our tax insights in your inbox

Rsm tax professionals stay on top of changing legislation and provide perspective to help you keep your business running smoothly..

THE POWER OF BEING UNDERSTOOD

ASSURANCE | TAX | CONSULTING

- Accessibility plan

- RSM Canada client portals

- Cybersecurity

RSM Canada LLP is a limited liability partnership that provides public accounting services and is the Canadian member firm of RSM International, a global network of independent assurance, tax and consulting firms. RSM Canada Consulting LP is a limited partnership that provides consulting services and is an affiliate of RSM US LLP, a member firm of RSM International. The member firms of RSM International collaborate to provide services to global clients but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmcanada.com/about for more information regarding RSM Canada and RSM International.

©2024 RSM CANADA LLP. All rights reserved.

- Terms of Use

Ontario.ca needs JavaScript to function properly and provide you with a fast, stable experience.

To have a better experience, you need to:

- Go to your browser's settings

- Enable JavaScript

Travel, Meal and Hospitality Expenses Directive

This directive sets out the rules and principles for the reimbursement and payment of travel, meal and hospitality expenses for government employees, appointees, contractors and other designated persons.

This directive has been posted to help you better understand the accountability rules within government and contains references to internal resources and applications used by Ontario government staff.

On this page Skip this page navigation

1.0 purpose.

The purpose of this Directive is:

- to set out rules and principles for the reimbursement and payment of travel, meal and hospitality expenses to ensure fair and reasonable practices

- to provide a framework of accountability to guide the effective oversight of public resources for travel, meal and hospitality expenses

- to set the parameters for the public disclosure of information about expenses

1.1 Application and scope

This Directive sets out the rules for managing travel, meal and hospitality expenses for employees and appointees in:

- provincial agencies

- the Independent Electricity System Operator and Ontario Power Generation Inc. ("organizations")

The Directive also applies to consultants and contractors to ministries or provincial agencies/organizations.

The following definitions apply for the purpose of this Directive:

- Each of the above form part of what is considered government.

- Claimant refers to any person making a claim under the terms of this Directive.

- Approver refers to the person with the authority to make approvals under this Directive.

- Chief Executive Officer (CEO) refers to the head of operations at provincial agencies/organizations.

- Chair refers to the person appointed as the head of a provincial agency/organization and who is accountable to the minister, regardless of whether the title "chair" is used.

- OPS employees refers to employees of ministries or of provincial agencies that are Commission public bodies (that is, employees appointed under section 32 of the Public Service of Ontario Act, 2006 (PSOA) ).

This Directive replaces the Travel, Meal and Hospitality Expenses Directive dated January 1, 2017.

In the event of a conflict or inconsistency, this Directive prevails over a memorandum of understanding (MOU) between a minister and the head of a provincial agency/organization, particularly where the MOU contains less stringent requirements.

This Directive does not prevail over legislation or a collective agreement.

2.0 Principles and best practices

2.1 principles.

- Travel is approved only after other communications options are considered.

- Taxpayer dollars are used prudently and responsibly with a focus on accountability and transparency.

- Expenses for travel, meals and hospitality support government objectives.

- Plans for travel, meals, accommodation and hospitality are necessary and economical with due regard for health and safety.

- Legitimate authorized expenses incurred during the course of government business are reimbursed.

2.2 Best practices

- Prior approval to incur expenses is obtained.

- Corporate travel cards are used for authorized business travel and business-related expenses.

- The government’s vendors of record for travel-related services are used whenever possible.

3.0 Requirements – general

Requirements

- Alcohol cannot be claimed and will not be reimbursed as part of a travel or meal expense.

- Expenses for a group can only be claimed by the most senior person present. An individual cannot claim for expenses incurred by their approver (for example, a director cannot submit their Assistant Deputy Minister’s (ADM) claim for lunch even if they were at the same event).

- Good record-keeping practices must be maintained for verification and audit purposes.

Claimants must

- obtain all appropriate approvals before incurring expenses; if no prior approval was obtained, then a documented explanation must be submitted with the claim

- submit itemized receipts with all claims, except for meal expenses where meal allowances are used (see Section 6.0); credit card slips are insufficient

- In the absence of an itemized receipt, a documented explanation of why the receipt is unavailable and a description itemizing and confirming the expenses must be provided

- submit claims by the end of the quarter following the quarter in which the expense was incurred; if the claim is not submitted within the timeframe, a documented explanation is required

- submit claims for expenses before leaving positions with a ministry or provincial agency/organization

Approvers must

- provide approval only for expenses that were necessarily incurred in the performance of ministry or provincial agency/organization business

- provide approval only for claims that include all appropriate documentation (for example, itemized receipts)

- not approve their own expenses

Note that an overpayment to a claimant is considered to be a debt owing to the government and must be repaid.

4.0 Accountability framework

This Directive sets out the approval authority for incurring travel, meal and hospitality expenses. Approval authority for the reimbursement of expenses is based on the delegation of financial authority established for ministries and provincial agencies/organizations.

In some cases, the level of approval to incur a travel, meal or hospitality expense is identified and also whether the authority can be delegated. In other cases, a requirement is stated (for example, prior approval is required) without identifying an approval level. Where no approval level is identified, ministries and provincial agencies/organizations have the flexibility and discretion to establish their own level and to address possible delegation.

A deputy minister or CEO has the authority to establish additional rules regarding expenses. Any additional rules must be consistent with those laid out in this Directive and be necessary to meet specific operational needs. These rules do not replace any rules in this Directive, nor can they substitute higher rates of reimbursement for kilometres or meals. Additional rules must include the date of approval and must be accessible to everyone covered by the rules.

In addition, a deputy minister or CEO may modify the level of approval upward to a more senior level when authority is assigned to a manager/supervisor or contract manager.

4.1 Managerial discretion

For the purpose of this Directive, managerial discretion is the administrative authority to make decisions and choices with some degree of flexibility, while maintaining compliance with this Directive. There is no discretion to depart from the principles and requirements of this Directive.

All decisions should be taken very carefully. When exercising discretion, the rationale must be documented and filed with the claim.

Approvers are accountable for their decisions, which must be:

- based on good judgment and knowledge of the situation;

- exercised in appropriate circumstances; and

- compliant with the principles and requirements set out in this Directive.

For additional explanation on the exercise of managerial discretion, see the tip sheet on this topic .

When a situation arises, and discretion needs to be exercised, approvers should consider whether the request is:

- able to stand up to scrutiny by the auditors and members of the public;

- properly explained and documented;

- fair and equitable;

- reasonable; and

- appropriate

It is the responsibility of both the approver and the claimant to work out appropriate arrangements which would meet the test of being fair and equitable.

Only Treasury Board/Management Board of Cabinet (TB/MBC) can grant an exemption from all or part of this Directive. Ministries can apply for an exemption by bringing forward a business case to TB/MBC .

4.2 Public disclosure of expenses

Information about expenses must be posted on the appropriate public websites for the following:

- Deputy Ministers

- Associate Deputy Ministers

- Assistant Deputy Ministers

- Positions that carry the same degree of responsibility as those above

- Appointees (every person appointed to the provincial agency/organization by the Lieutenant Governor in Council, the Lieutenant Governor or a minister)

- CEOs (the most senior executive position, regardless of the title)

- Every member of senior management that reports directly to the CEO

The website for public disclosure of expense information for senior managers in ministries is on Ontario.ca . Provincial agencies/organizations can use their own websites for public disclosure.

Information about the procedures for posting on the public websites is found in the public disclosure support material . It includes information on:

- the types of expenses to be disclosed

- the details of each expense to be disclosed

- the frequency of posting

This Directive applies whenever travel is required. For the purpose of this Directive, travel does not refer to a person’s regular commute to work – expenses related to a person’s regular commute are not reimbursable.

5.1 When travel is a regular part of the job

There are some jobs where frequent travel is a requirement – part of the regular job duties.

On hiring, managers should ensure that staff are aware of the Directive and how it will affect the job. In these situations, approvers should meet with the employee to determine appropriate strategies (for example, pre-approval for frequent or regular travel, when meals can be reimbursed, use of vehicles, etc.).

Ministries and provincial agencies/organizations with jobs that require regular travel need to ensure that the Directive is utilized in a consistent manner so that managers and employees have a common understanding of how the Directive is applied.

5.2 When travel occurs occasionally

In the majority of positions in government, travel occurs irregularly on an as-needed basis; for example, to attend training, meetings, conferences or consultations; representing the government at an event; etc. In some cases, employees will be asked by managers to travel, and in others, the request may come from the employee.

5.3 Approvals for travel

The following charts identify the approval levels for travel footnote 1 [1] for everyone covered by this Directive. In many cases, the authority for approval may be delegated. See below (section 5.4) for information on delegation of authority.

Chart 1: Ministries

Chart 2: Provincial agencies whose employees are appointed under section 32 of the PSOA (Commission public bodies)

Chart 3: Other provincial agencies/organizations whose employees are not appointed under section 32 of the PSOA (includes the Independent Electricity System Operator and Ontario Power Generation Inc. )

Special status for international travel

For some provincial agencies/organizations, the requirement to travel internationally may be considered integral to their business. To ensure that the approvals process does not have an undue negative effect on the ability of the provincial agency/organization to conduct business, these provincial agencies/organizations may have the opportunity to request special status that would allow the chair to approve international travel instead of the positions listed in Chart 2 or 3.

Only TB/MBC can approve special status. Ministries can apply for special status on behalf of their provincial agencies by bringing forward a business case to TB/MBC . If TB/MBC approves special status, the chair may approve international travel or delegate approval authority to the CEO . A provincial agency/organization with special status must report regularly to their ministry, see Appendix A for reporting requirements.

Special status is approved for three years only. If special status continues to be required by the provincial agency/organization, the ministry must reapply to TB/MBC .

Should the business of a provincial agency/organization with special status change significantly during the three years, the ministry must reapply to TB/MBC for special status on behalf of the provincial agency/organization, if appropriate.

For more information on this process and for the approval levels within provincial agencies/ organizations once special status is granted, see Appendix A.

Approval for travel plans

5.4 delegation of authority for travel approvals.

The following chart provides direction on when and how the authority for approving travel requests can be delegated. If delegated, documentation and regular reporting to the position with approval authority is required.

5.5 Before travelling

- Where required, obtain prior documented approval for travel and use the appropriate forms . As a best practice, obtain prior documented approval for any travel. Note that prior approval is required even in situations where expenses are covered by a third party.

- Whenever possible, use the government’s designated vendor of record service providers . OPS employees can access these online booking tools through the Travel Gateway website .

- report any changes to your approver as soon as possible; and

- submit any changes through the travel management company or, if appropriate, an alternate travel agency.

- If you are a ministry employee, information about the rules and applications for the corporate travel card can be found at the Travel Card Services website .

- Others should check with their provincial agency/organization the availability of a corporate travel card.

- Secure travel documents, immunizations, and medications, as appropriate before you travel.

- Inform your approver of any arrangements (for example, accessibility, health, etc.) required during travel.

- choose the most cost-effective accommodation or method of travel;

- use the corporate travel management company to book your method of travel; and

- use the corporate travel card to pay for all travel expenses.

- Loyalty points can be redeemed at the user’s discretion; however, they cannot be redeemed for cash by using the points for business purposes and then submitting a claim for reimbursement.

Travelling outside Canada

If travelling outside Canada, in addition to the obligations set out elsewhere in this Directive, the following rules apply.

Requests for travel outside Canada must include:

- Request for Approval for Travel within Canada and the USA form ; or

- Request for Approval for International Travel form .

- acknowledgement that all appropriate approvals are in place;

- documented rationale demonstrating critical value of travel for government/ organizational priorities and interests, and how the travel will produce a benefit for the province;

- documentation showing detailed itemization of anticipated expenses (note that the lowest cost and most reasonable method of travel must be used); and

- confirmation that a security assessment for physical and cyber risk has been completed for the proposed travel destination.

When planning any travel, consider business continuity (for example, deciding whether senior management or people with specialized knowledge or expertise should travel together).

Security assessment

When travelling outside Canada, including the USA , a prior assessment of physical and cyber security is required. The assessment provides recommendations on safeguards against cyber and physical security threats for individuals travelling internationally.

Information on the requirement for the security assessment is included in the travel forms ( Request for Approval for International Travel form and Request for Travel Outside Ontario – Within Canada and the USA form). Provincial agencies/organizations that do not use the travel forms can contact [email protected] for information.

OPS employees can find information on insurance on Travel Gateway . Others should check with their provincial agency/organization for direction on insurance.

Medical and health insurance

Eligible OPS employees footnote 5 [5] are covered under the employer’s health insurance plans in the event of illness or injury. The cost of additional private medical and health insurance will not be reimbursed for travel within Canada.

Other provincial agency/organization employees, appointees and consultants should speak to their ministry or provincial agency/organization to assess their coverage for medical and health insurance within Canada.

You are responsible for arranging appropriate out-of-country medical insurance. For ministry employees, this cost is reimbursable and can be charged on the corporate travel card.

When purchasing out-of-country medical insurance, it is advised that you also purchase the option that allows for immediate payment of costs at the time of the incident (that is, up-front payment option).

Provincial agency/organization employees, appointees and consultants should speak to their ministry or provincial agency/organization about reimbursement for out-of-country insurance.

Travel accident insurance

Eligible OPS employees have basic insurance for accidental injury or accidental death. Extra insurance may be arranged at the traveller’s expense – it will not be reimbursed.

Other provincial agency/organization employees, appointees and consultants should speak with their ministry or provincial agency/organization to assess their coverage for travel accident insurance.

Vehicle insurance

Rental vehicles, for ministries.

- If you have a corporate travel card you must use it to rent a vehicle and you should decline the collision damage waiver offered by the rental company. The benefits of the corporate travel card include insurance that covers the cost of repairing damage to approved vehicle types rented using the travel card.

- If you do not have a corporate travel card, or you rent a vehicle that is not eligible for coverage under the card, you should purchase the collision damage waiver coverage offered by the rental company. The insurance costs can be claimed as a travel expense. For more information, go to Travel Card Services website .

For provincial agencies/organizations

- Provincial agencies/organizations should check the coverage on any corporate travel cards.

Personal vehicle

If you use your personal vehicle while on government business, the following applies.

- The vehicle must be insured at the vehicle owner’s expense for personal motor vehicle liability.

- It is the driver/owner’s responsibility to ensure that the motor vehicle insurance includes coverage for business use of the vehicle.

- The government will not reimburse the costs of insurance coverage for business use, physical damage or liability.

- The government is not responsible for reimbursing deductible amounts related to insurance coverage.

- In the event of an accident, you will not be permitted to make a claim to the government for any resulting damages.

5.6 Transportation – How to get there

Ministry employees should make travel reservations through the government’s travel management company or book online through the Travel Gateway website .

- Use the government’s travel management company, when booking airfare or making multiple travel arrangements in combination with airfare.

- Use the online booking tools for travel arrangements other than airfare (for example, rail, hotel, rental car).

Provincial agency/organization employees and appointees may call the government’s travel management company directly. Where a provincial agency/organization has an established relationship with an alternative travel agency, it may make reservations with that travel agency as appropriate.

Air travel is permitted when it is the most practical and economical way to travel. Choose the lowest fare available when purchasing a ticket. Travel in business class must have prior approval by the deputy minister or CEO , in limited circumstances such as:

- on international flights

- on flights within Canada and the USA if related to the provision of reasonable accommodation (for example, health reasons)

In some cases, ministry employees may need to use government-owned and charter aircraft. This is managed through the Ministry of Natural Resources and Forestry.

Rail travel

Rail travel is permitted when it is the most practical and economical way to travel. Choose the lowest fare available when purchasing a ticket. Travel in business class must have prior approval by the deputy minister or CEO in limited circumstances such as:

- the need to work with a team

- choosing a travel time that allows you to reduce expenditures on meals or accommodation

- accommodation requirements

- health and safety considerations

Road travel

Choosing the appropriate vehicle.

When driving is the most practical, economical way to travel, the following choices are available:

- government vehicle

- rental vehicle

- personal vehicle

The use of any vehicle must be discussed in advance with your approver. Provide and document the rationale for using a particular type of vehicle. The most practical and economical option should be selected.

If you travel regularly as part of your job, arrangements for travelling and the choice of vehicle should be made when you are hired.

Government vehicle

Government vehicles may be available for use in ministries that have a fleet program. Employees should follow the rules approved by their ministry.

Government vehicles can only be used for government business. You can have a passenger in a government vehicle only if the passenger’s travel is related to government business.

Provincial agency/organization employees, appointees and consultants should follow the rules approved by the provincial agency/organization.

Rental vehicle

When renting a vehicle, choose the lowest cost model. Any exceptions must be:

- documented and approved prior to the rental if possible; and

- guided by the principle that the rental vehicle is the most economical and practical size, considering the business purpose, number of occupants, safety (including weather) considerations and any reasonable accommodation requirements.

Luxury and premium vehicles are not permitted.

To avoid higher gasoline charges, refuel your rental car before returning it.

Ministry employees must follow the rules below.

- Use the federal rental car directory to find appropriate companies.

- To ensure that the government, as employer, provides liability coverage when you are renting a vehicle in the province on Ontario government business, you must follow the requirements identified in the car rental section of the Travel Gateway website .

Provincial agency/organization employees, appointees and consultants should follow the rules for renting vehicles approved by the provincial agency/organization.

Car-sharing, through the government’s vendor of record , can be used if a vehicle is needed for a short duration (for example, approximately six hours or less) if:

- car-sharing is available in your area; and

- it is the most practical and economical way to travel.

Using a personal vehicle must be discussed in advance with your approver. The ministry or provincial agency/organization assumes no financial responsibility for personal vehicles.

Employees who have the approval to use a personal vehicle will be reimbursed according to the kilometric reimbursement rates. Employees must keep daily logs of the kilometers used to track the business use.

Accident reporting

All accidents must be reported immediately to local law enforcement authorities and your immediate supervisor. In addition:

- If you are using a government vehicle, advise the ministry’s fleet coordinator and the fleet management vendor of record as well.

- If you are using a rental vehicle, advise the rental car agency and contact the travel card insurance provider to initiate a claim.

- If you are using a personal vehicle, advise your own insurer.

Reimbursement rates

Rates are based on kilometres accumulated from April 1 of each fiscal year. Rates may be established in a collective agreement. If they are not, the rates in this Directive apply.

Expense claims must be submitted with distances calculated in kilometres.

For claimants who can use IFIS/iExpenses, the appropriate rate for reimbursement by kilometre is applied automatically when a claim is submitted electronically through IFIS/iExpenses.

All others should follow their ministry’s or provincial agency/organization’s procedure for claiming kilometre reimbursement.

Accumulated kilometres must be transferred with a claimant when moving within government to another job, ministry or provincial agency/organization.

Reimbursement rates for personal vehicles driven outside Ontario will be at the rates for southern Ontario.

A description of the boundary between northern and southern Ontario can be found in the Q&As document .

Parking and tolls

Reimbursement is provided for necessary and reasonable parking expenses, as well as tolls for bridges, ferries and highways, when driving on government business. Parking costs incurred in the office area as part of a regular commute to work will not be reimbursed. There is no reimbursement for traffic or parking violations.

Taxis and ride-hailing services

Prior approval to use a taxi or ride-hailing service should be obtained whenever possible. Taxis and ride-hailing services may be justified in cases where:

- group travel is more economical than the total cost of having individuals travel separately by public transit or shuttle; or

- there is an unusually tight schedule for meetings.

Taxis and ride-hailing services may not be used to commute to work or home except under exceptional circumstances; for example:

- weather, health or safety conditions indicate it is the best, appropriate option; or

- transport of work-related baggage or parcels is required.

Ride-hailing services can only be used and reimbursed under the following conditions:

- in municipalities where ride-hailing services are regulated and appropriately insured; and

- where a standard (that is, non-premium and single occupancy) service is used.

Use your corporate travel card to pay for any ride-hailing expenses, whenever possible.

Gratuities for taxis and ride-hailing services must be reasonable.

Public transit

Local public transportation including hotel/airport shuttles should be used wherever possible. Program areas should consider purchasing a transit pass or passes, where available and appropriate, for use by employees on work business.

5.7 Accommodation

In the normal conduct of business, reimbursement for overnight accommodation within your office area will be neither authorized nor approved. However, in emergency or highly unusual situations exceptions will be considered. For example:

- You are required to remain close to your office for periods long in excess of (your) standard working hours.

- Your services are deemed necessary (and approved accordingly) for the purposes of emergency or crisis management.

Reimbursement for hotel suites, executive floors or concierge levels is not permitted. Reimbursement will be made for single accommodation in a standard room. To lower the costs of accommodation, consideration should be given to aaccommodation outside of downtown areas. Often, it is more economical and accessible by public transit and other cost-effective means of transportation.

For extended stays at a single location, accommodation must be arranged with prior approval. This will take advantage of lower weekly or monthly rates.

Penalties incurred for non-cancellation of guaranteed hotel reservations are the claimant’s responsibility and may be reimbursed only in an exceptional circumstance.

Use the federal online accommodation directory which provides information on service providers offering government rates. If you do not have access to the directory, use the rules in your workplace.

Private stays with friends or family are acceptable, and a cash payment or gift may be provided to the friends or family:

- A maximum of $30 per night is allowed for accommodation including any meals with friends or family, in lieu of commercial accommodation. Instead of a receipt, you must submit a documented explanation describing the purpose of the trip, identifying the host and the number of days you stayed.

- The $30 value may be given in the form of a small gift (which must be accompanied by a receipt) or by cash or cheque.

5.8 Incidental expenses

Incidental expenses are those types of expenses that are sometimes a necessary part of travel. Some common types of incidental expenses are set out below. Necessary and reasonable incidental expenses that are not specified below may be claimed and reimbursed if you anticipate these expenses and obtain prior approval. Incidental expenses for which prior approval was not obtained require deputy minister/ CEO approval. Approval is subject to managerial discretion.

Visas and immunization

You may be reimbursed for the cost of a visa and/or the cost of immunizations and medications if necessary for international travel.

Laundry and dry cleaning

If travelling on business for five consecutive days or more, reimbursement for laundry and dry cleaning is allowed within reasonable limits. Itemized receipts are required.

You will not be reimbursed for personal or recreational items including toothbrushes, pay-per-view, items from the mini-bar, or hotel valet services.

Communication

With prior approval, you may use your government cell/mobile phone for business purposes when travelling. Speak with your approver to determine what is covered in your cell/mobile phone plan and how your ministry or provincial agency/organization wishes to handle long distance or roaming charges. Note that any use of a mobile phone is subject to a security assessment if travelling outside of Canada (see Section 5.5 above).

Wherever possible, you are expected to use the least expensive means of communication, such as:

- internet enabled calling cards

- internet access through the local provincial government network

Use alternatives to travel whenever possible (for example, audio or video conferencing).

If you are away on government business, reimbursement may be made for:

- reasonable and necessary personal calls home

- reasonable and necessary business calls

- emergency calls

- internet connections and computer access charges

- word processing, faxing, photocopying, and scanning services

- rental and transportation of necessary office equipment

- Dependent care

For the purposes of this Directive, a dependent is a person who resides with the traveler on a full-time basis and relies on the traveler for care (for example, a child or parent).

Prior approval for reimbursement of dependent care expenses is required, as well as a documented explanation of the circumstances. If travel is an expected part of your job duties, there is no reimbursement for dependent care expenses. However, expenses may be reimbursed if the travel requirements of your job or personal circumstances change unexpectedly.

Requests for dependent care expenses may be reimbursed under the following circumstances:

- if travel is occasional or unexpected; and

- if you incur expenses above and beyond your usual costs for dependent care as a direct result of travel.

In these situations, you may be reimbursed for your actual costs up to a daily maximum:

- $75/day/dependent, if you have a caregiver’s receipt

- $35/day/dependent, if you provide a documented explanation

6.1 Reimbursable meals

Reasonable and appropriate meal expenses may be reimbursed. You may incur a meal expense when you are on government business and you:

- are away from the office area (that is, at least 24 km) over a normal meal period; or

- have prior approval for the expense (for example, a business meeting within the office area that must occur over lunch).

Meal expenses will be reimbursed at the established meal allowance rates, regardless of the actual meal costs. A meal allowance rate recognizes that sometimes a meal may be less than the allowance rate, and sometimes more; regardless, the allowance rate is reimbursed. Taxes and gratuities are included in the meal allowance rates. Receipts are not required to be submitted or retained. Meals must be purchased in order to be able to submit a claim for reimbursement. Alcohol cannot be claimed and will not be reimbursed.

In very limited and exceptional circumstances (for example, health or dietary considerations; limited options available) where a meal expense is higher than the meal allowance rate, the actual cost of the meal may be reimbursed. Where these circumstances are anticipated, prior approval is required. Where these circumstances have not been anticipated and prior approval has not been obtained, deputy minister or CEO approval for reimbursement of the expense is required. In any situation where there is a claim for a meal expense higher than the allowance, the claim must be accompanied by an itemized receipt and a documented rationale for exceeding the rate. A credit card slip is not sufficient. Approval is subject to managerial discretion.

There may be situations where an individual pays the meal expenses for a group of individuals. In such cases, the individual may be reimbursed for the total of all meals purchased at the allowance rate for that meal. Group meal expenses can be claimed only:

- by the most senior person present – expenses cannot be claimed by an individual that are incurred by their approver; and

- for individuals covered by this Directive.

The meal allowance rate is for food eaten in a restaurant or for the purchase of prepared food only. Reimbursement for groceries must have prior approval. A receipt and a documented rationale including a breakdown of the actual groceries used for the meals being claimed must be submitted with the claim.

Reimbursement will not be provided for meals consumed at home or included in the cost of transportation, accommodation, seminars or conferences. If you travel as a regular part of your job, your meals will not normally be reimbursed unless you have obtained prior approval.

6.2 Centrally purchased meals (catered)

For meals that are centrally purchased (for example, catering for a working meeting), the maximum amount spent per person should not exceed the established meal allowance rate. As with all corporate purchase card transactions, receipts and appropriate approvals are required.

6.3 Meal rates in Canada

Reimbursement for meal expenses incurred in Canada is subject to the meal allowance rates set out in the chart below. The rates include taxes and gratuities.

These rates should also be used as the maximum amount per person for any centrally purchased meals.

6.4 Meal rates outside of Canada

Federal meal allowance rates are used for meal expenses incurred outside Canada as set out in the appendices of the National Joint Council Travel Directive or successor directive. The rates include taxes and gratuities.

The two relevant appendices are:

- Appendix C – Allowances – Module 2 footnote 6 [6]

- Appendix D – Allowances – Module 4 footnote 7 [7]

The following lists set out when and how to use the appendices.

Travel to USA

- Meal allowance rates are found in Appendix C.

- Rates are the same as the federal rates for Canada, but in US funds.

- Rates include taxes and gratuities.

- Rates do not include incidental expenses.

International travels (outside Canada and the USA )

- Meal allowance rates are found in Appendix D.

- Rates are in the funds identified for each country.

- Rates are dependent on the city rates.

7.0 Hospitality

Hospitality is the provision of food, beverage, accommodation, transportation and other amenities at public expense to people who are not engaged in work for:

- any entity covered by this Directive

- any organization covered by the Broader Public Sector Expenses Directive

Hospitality cannot be offered solely for the benefit of anyone covered by this Directive or the Broader Public Sector Expenses Directive. This means that reimbursement or payment of expenses related to office social events (for example, retirement parties, holiday lunches, etc.) are not permitted.

Hospitality may include hosting or sponsoring planned events, and business interactions (for example, networking meals).

Hospitality may be extended in an economical and consistent manner on behalf of the government under the following circumstances.

- representatives from other governments

- business and industry

- public interest groups

- labour groups

- When the business of a provincial agency/organization includes hospitality

- providing people from national, international, or charitable organizations with an understanding or appreciation of Ontario and the workings of its government

- honouring people for exceptional public service in Ontario

- conducting ceremonies for heads of state, government or guests from the private sector

- Other hospitality as approved by the deputy minister or CEO , providing it conforms to the rules set out in this section of the Directive.

7.1 Planned hospitality events

A government facility should be used if available and appropriate. If not, prior approval from the deputy minister or CEO is required.

Costs should be minimized where possible with due regard for the guests’ status, the size of the party, and the intended business purpose.

- must document and justify the list of government representatives;

- keep the number of government representatives to a minimum, limiting it to those who have a direct involvement in the purpose of the event; and

- may be paid only on authorization by the deputy minister or provincial agency/organization CEO

- may include costs for travel, event tickets or tours

- must be paid directly to the partner

7.2 Hospitality that includes alcohol

Hospitality may include the provision of alcohol:

- at a planned hospitality event

- at a business interaction (for example, networking dinner)

Ministries and hydro organizations are not permitted to incur expenses for alcohol. Reimbursement or payment of alcohol is only permitted for provincial agencies if it is considered to be integral to their business.

The following is required prior to serving alcohol at a planned hospitality event:

- prior documentation with approval from the deputy minister; ministers have no authority to approve (see also special status below for more information)

- completed form on hospitality with the service of alcohol

Reimbursement of alcohol expenses is allowed only when the appropriate approvals are in place. Alcohol must be provided in a responsible manner (for example, food must be served when alcohol is provided). Preference should be given to wine, beer and spirits produced in Ontario.

7.3 Special status for service of alcohol at planned hospitality events

To ensure that the approvals process does not have an undue negative effect on the ability of the agency to conduct business, ministries may request special status on behalf of provincial agencies. Special status would allow the chair to approve the service of alcohol at planned hospitality events instead of the deputy minister.

Only Treasury Board/Management Board of Cabinet ( TB/MBC ) can approve special status. Ministries can apply for special status on behalf of their provincial agency by bringing forward a business case to TB/MBC . If TB/MBC approves special status, the chair may approve the service of alcohol at planned hospitality events or delegate approval authority to the CEO . A provincial agency with special status must report regularly to their ministry; see Appendix A for reporting requirements.

Special status is approved for three years. If special status continues to be required by the provincial agency, the ministry must reapply to TB/MBC on behalf of the provincial agency. Should the business of a provincial agency with special status change significantly during the three years, the ministry must reapply to TB/MBC for special status, if appropriate.

For more information on this process and for the approval levels within agencies once special status is granted, see Appendix A.

7.4 Gift-giving

Appropriate token gifts of appreciation, valued up to $30, may be offered in exchange for gifts of service or expertise to people who are not engaged in work for the government of Ontario, or with any organization covered by the Broader Public Sector Expenses Directive . Gifts valued over $30 must have prior approval.

When the provision of a gift is considered desirable as a matter of custom or protocol, please refer to the following for direction:

- For visiting delegations and other matters of protocol: contact Cabinet Office, Ministry of Intergovernmental Affairs at [email protected]

- For information on working with Indigenous peoples and gift-giving provisions in Ontario: see Gift Etiquette in the Tools for Indigenous relationships and engagement on InsideOPS.

7.5 Documentation for hospitality reimbursement and payment